Exhibit 99.1

NOTICE OF 2011 ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

AND

MANAGEMENT PROXY CIRCULAR

FEBRUARY 24, 2011

COMPTON PETROLEUM CORPORATION

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual and special meeting (the “Meeting”) of the shareholders of Compton Petroleum Corporation (the “Corporation”) will be held in the ENMAX Ballroom, Calgary Chamber of Commerce, Fourth Floor, 517 Centre Street South, Calgary, Alberta, Canada on Tuesday, May 10, 2011, at 3:30 p.m. (Calgary time), for the purposes of:

| • | receiving the financial statements for the year ended December 31, 2010, together with the auditors’ report thereon; |

| • | electing a board of directors to serve until the next annual meeting of shareholders or until their successors are duly elected or appointed; |

| • | appointing Grant Thornton LLP, Chartered Accountants, as auditors and authorizing the directors of the Corporation to fix the auditors’ remuneration; |

| • | approving the ability of the Corporation to issue up to 1,924,992 Common Shares of the Corporation in partial satisfaction of amounts owing to the officers of the Corporation under certain employment arrangements that are described in the accompanying Management Proxy Circular; |

| • | approving the ability of the Corporation to issue up to 1,875,000 Common Shares of the Corporation to the independent directors of the Corporation in partial payment of Director’s fees under a deferred share unit plan described in the accompanying Management Proxy Circular; and |

| • | transacting such other business as may properly be brought before the Meeting, or any adjournment or adjournments thereof. |

Details of all matters proposed to be put before the Meeting are set forth in the accompanying Management Proxy Circular.

Holders of record of Common Shares of the Corporation at the close of business on March 25, 2011 will be entitled to vote at the Meeting.

| | | By Order of the Board of Directors, (Signed) Leland Corbett Corporate Secretary Calgary, Alberta, Canada |

| | | February 24, 2011 |

If you are unable to be present at the Meeting, PLEASE COMPLETE AND RETURN THE ACCOMPANYING FORM OF PROXY in the envelope provided for that purpose. Proxies must be received at the registered office of the transfer agent of the Company, Computershare Trust Company of Canada, c/o Service Delivery, 100 University Avenue, 9th Floor, Toronto, Ontario, Canada, M5J 2Y1, not later than 48 hours (excluding Saturdays, Sundays, and holidays) prior to the time of the Meeting, or any adjournment or adjournments thereof, in order for such proxy to be used at the Meeting or any adjournment or adjournments thereof.

COMPTON PETROLEUM CORPORATION

MANAGEMENT PROXY CIRCULAR

| BUSINESS OF THE MEETING | | | 1 | |

Financial Statements | | | 1 | |

Election of Directors | | | 1 | |

Appointment and Remuneration of Auditors | | | 6 | |

Issuance of Retention Shares | | | 7 | |

Deferred Share Unit Plan | | | 8 | |

| PROXY INFORMATION | | | 10 | |

Solicitation of Proxies | | | 10 | |

Appointment of Proxyholders and Revocation of Proxies | | | 11 | |

Voting of Common Shares - Advice to Beneficial Holders of Securities | | | 11 | |

Exercise of Discretion by Proxyholders | | | 11 | |

Voting Shares and Principal Holders Thereof | | | 12 | |

| EXECUTIVE AND DIRECTOR COMPENSATION | | | 12 | |

Compensation Discussion and Analysis | | | 12 | |

Compensation of Executive Officers | | | 12 | |

Performance Graph | | | 19 | |

Option Based Awards During 2010 | | | 20 | |

Summary Compensation Table | | | 20 | |

Termination and Change of Control Benefits | | | 24 | |

Compensation of Directors | | | 25 | |

Director Compensation Table | | | 26 | |

Incentive Plan Awards - Directors | | | 27 | |

Directors’ and Officers’ Insurance | | | 29 | |

Director Retirement Policy | | | 29 | |

| OTHER INFORMATION | | | 29 | |

Indebtedness to the Corporation | | | 29 | |

Interest of Certain Persons or Companies in Matters to be Acted Upon | | | 29 | |

Interest of Informed Persons in Material Transactions | | | 30 | |

| STATEMENT OF CORPORATE GOVERNANCE PRACTICES | | | 30 | |

Canadian Corporate Governance Requirements | | | 30 | |

U.S. Corporate Governance Requirements | | | 30 | |

| ADDITIONAL INFORMATION | | | 31 | |

Availability of Information | | | 31 | |

Communicating with the Board | | | 31 | |

| SCHEDULE A DSU PLAN | | | 33 | |

| SCHEDULE B NI 58-101 CORPORATE GOVERNANCE DISCLOSURE | | | 38 | |

| SCHEDULE C BOARD OF DIRECTORS CHARTER | | | 50 | |

COMPTON PETROLEUM CORPORATION

MANAGEMENT PROXY CIRCULAR

BUSINESS OF THE MEETING

This Management Proxy Circular (the “Proxy Circular”) is furnished in connection with the solicitation of proxies by and on behalf of the management (the “Management”) of Compton Petroleum Corporation (“Compton” or the “Corporation”) for use at the annual and special meeting (the “Meeting”) of the shareholders of the Corporation (the “Shareholders”) for the purposes set out in the accompanying notice of the Meeting, or any adjournment or adjournments thereof. The Meeting is to be held in the ENMAX Ballroom, Calgary Chamber of Commerce, Fourth Floor, 517 Centre Street South, Calgary, Alberta, Canada on Tuesday May 10, 2011, at 3:30 p.m. (Calgary time).

Unless otherwise stated, the information contained in this Proxy Circular is as of February 24, 2010.

As set forth in the accompanying notice of the Meeting, the business to be conducted at the Meeting consists of annual and special business that the Corporation is required to conduct, including:

| • | tabling the Corporation’s 2010 Annual Report and financial statements; |

| • | the election of directors (“Directors”) of the Corporation; |

| • | the appointment of auditors; |

| • | approving the ability of the Corporation to issue up to 1,924,992 Common Shares of the Corporation in partial satisfaction of amounts owing to the officers of the Corporation under certain employment arrangements; and |

| • | approving the ability of the Corporation to issue up to 1,875,000 Common Shares of the Corporation to the independent Directors of the Corporation in partial payment of Director’s fees under a deferred share unit plan. |

Financial Statements

The consolidated financial statements of Compton for the year ended December 31, 2010, and the report of the auditors thereon, will be placed before the Meeting. The consolidated financial statements form part of the 2010 Annual Report of the Corporation. Additional copies of the 2010 Annual Report may be obtained from Compton’s Corporate Secretary upon request and copies will be available at the Meeting.

Election of Directors

Role of the Corporate Governance, Human Resources and Compensation Committee

The Corporate Governance, Human Resources and Compensation Committee (the “Governance Committee”), acting under its mandate as the nominating committee, is responsible for identifying and recommending candidates to the Board of Directors of the Corporation (the “Board”) for election and re-election by the Shareholders. The Board has adopted independence standards that derive from applicable Canadian and United States securities laws and the New York Stock Exchange corporate governance rules. Based upon such standards, all members of the Governance Committee are independent.

Nomination Process

The Governance Committee also establishes general criteria for the election and re-election of Directors. In this regard, the Governance Committee considers the desired complement of Directors’ skills and characteristics based on broad categories, such as leadership, functional capabilities, market knowledge, and prior experience. The process is reviewed annually to reflect the current needs of the Board and strategic priorities of the Corporation. The Board also conducts a self-assessment and Board effectiveness review by each Director, which assists in identifying candidates for the Board.

Majority Voting Policy

In 2007, the Board approved a Majority Voting Policy. In an uncontested election, any nominee for Director who is an incumbent Director (an “Incumbent”) and who receives a greater number of votes “withheld” from his election than votes “for” such election (a “Majority Withheld Vote”), excluding abstentions, shall promptly tender his resignation to the Board, following certification of the Shareholder vote. If a non-Incumbent nominee receives a Majority Withheld Vote, the individual will not become a Director and will not serve on the Board in any capacity.

The Governance Committee will make a recommendation to the Board as to whether to accept the resignation, or whether other action should be taken. The Board, taking into account the Governance Committee’s recommendation, will publicly disclose through a press release, its decision regarding the resignation and the rationale behind the decision, within 90 days from the date of the receipt of the resignation.

In determining whether to accept the resignation of an Incumbent, the Governance Committee and the Board may consider any factors they determine appropriate and relevant, but in any event, will accept the resignation absent a compelling reason to reject it. Compelling reasons for not accepting a resignation might include, among other things and without limitation; (i) any stated reasons why Shareholders voted against the Incumbent; (ii) the Incumbent was the target of a “vote no” campaign on an illegitimate basis, such as racial discrimination or on the basis of misinformation; (iii) any alternatives for addressing the reason for the Majority Withheld Vote; (iv) loss of the Incumbent would cause the Board to have less than a majority of independent Directors; (v) loss of the Incumbent would cause the Corporation to fail to satisfy stock exchange listing or regulatory requirements; or (vi) loss of the Incumbent would result in a default or breach under any loan covenants or other contractual arrangements.

An Incumbent who tenders his or her resignation will not participate in the recommendation of the Governance Committee or the decision of the Board with respect to his resignation. If the resignation is not accepted by the Board, such Incumbent will continue to serve with full responsibilities and powers until the next annual meeting of the Shareholders. If the Board accepts an Incumbent’s resignation, or if a non-Incumbent nominee for Director is not elected, then the Board, in its sole discretion, may fill any resulting vacancy pursuant to the Corporation’s articles and by-laws.

If the Governance Committee does not have a quorum because multiple Directors have tendered their resignations, and is unable to make a recommendation regarding a resignation, then the remaining disinterested members of the full Board shall act on the resignations without a recommendation from the Governance Committee. If all Directors are unsuccessful Incumbents, the Incumbent Board will nominate a new slate of Directors and, within 180 days after the date of the Meeting, hold a special meeting of the Shareholders to elect a new Board. In such circumstances, the Incumbent Board will continue to serve until new Directors are elected and qualified.

Contested elections, in which there are more nominees than Directors to be elected, will continue to use the plurality standard and nominees who receive the highest number of votes will be elected.

Nominees

The articles of the Corporation stipulate that the Board shall consist of a minimum of one and a maximum of eleven Directors. The Board currently consists of eight Directors and the Governance Committee has proposed that the seven persons named below, all of whom are Directors as at the date of this Proxy Circular, should serve as nominees for election as Directors to continue in office until the next succeeding annual meeting of the Shareholders or until their successors are duly elected or appointed.

All of the proposed nominees (Messrs. Allan, Belich, Fitzpatrick, Granger, Hurtubise, Koop and Shimmerlik) were duly elected as Directors at the annual meeting of Shareholders held on May 12, 2010. Mr. Smith has advised the Corporation that he does not intend to stand for re-election as a Director.

The nominees for election as Directors of Compton are:

| | J. Stephens Allan | | R. Bradley Hurtubise |

| | Mel F. Belich | | Irvine J. Koop |

| | David Fitzpatrick | | Warren M. Shimmerlik |

| | Tim Granger | | |

The persons proposed for nomination are, in the opinion of the Governance Committee and the Board, well qualified to act as Directors for the ensuing year. Each nominee has established his eligibility and willingness to serve as a Director if elected.

The persons named in the accompanying form of proxy as proxyholders are either officers (“Officers”) or Directors of Compton and intend to vote at the Meeting FOR the election of the nominees whose names are set forth above, unless specifically instructed on the form of proxy to withhold such vote. The election of Directors will be decided by a majority of the votes cast at the meeting by Shareholders present, in person, or by proxy. The Board and Management unanimously recommend that Shareholders vote in favour of each of the above named nominees.

Set forth below is biographical and other information with respect to each of the seven nominees for election as Director, including principal occupation, business or employment for the past five years or more, and the common shares (“Common Shares”) of the Corporation and stock options to acquire Common Shares (“Options”) held as at February 24, 2010. In addition, the table lists other companies with whom each nominee is currently serving as a Director. Each of the nominees has served as a Director since the year he first became a Director and was elected to his present term of office by a vote of the Shareholders at a meeting of Shareholders held on May 12, 2010.

Mel F. Belich, Q.C. Calgary, AB, Canada | Mel Belich, 63, is the Chairman of Compton. Mr. Belich is the former Chairman and President of each of Enbridge International Inc., and Enbridge Technology Inc., and a former Director of numerous Enbridge affiliates, including those in Europe and Latin America. Mr. Belich joined Enbridge Inc., an energy pipeline company, in 1994 after 20 years of service with a major Canadian law firm, where he held a series of senior management and counsel positions. He was appointed Queen’s Counsel in 1996. Mr. Belich is a member of the Institute of Corporate Directors, and his other activities include serving as a Director of the Calgary Airport Authority, an Honorary Director with the Van Horne Institute for Regulatory Affairs, Director and past President of Ducks Unlimited Canada, and past Chairman of the Canadian Association for the World Petroleum Council. Compton Board Details: • Independent • Director since 1993 • Areas of expertise: corporate governance, corporate law, regulatory affairs, international business, and oil and gas transmission • Attendance at meetings in 2010: 15/15 (100%) • Chairman of the Board of Directors since 2001 • Ex officio voting member all Board Committees, including the Corporate Governance, Human Resources and Compensation Committee; the Reserves, Operations and Environmental, Health & Safety Committee; and the Audit, Finance and Risk Committee • Meets share ownership guidelines Common shares owned: 2,504,616 ($1.1 million) (1) Options: 209,300 |

Tim S. Granger, P.Eng. Calgary, AB, Canada | Tim Granger, 53, is the President and Chief Executive Officer of Compton. Mr. Granger has more than 27 years of experience in the petroleum industry, which includes extensive experience in exploitation and production operations. Most recently, Mr. Granger held the office of Vice President and Chief Operating Officer at Paramount Energy Trust, a natural gas royalty energy trust, and prior to that was Managing Director of TAQA North, an oil and gas exploration company, following the acquisition of PrimeWest Energy Trust by TAQA in January of 2008. Mr. Granger had served as the Chief Operating Officer of PrimeWest Energy Trust, an oil and gas royalty trust, since 1999. Mr. Granger is a member of the Association of Petroleum Engineers, Geologists and Geophysicists of Alberta. Compton Board Details: • Non-independent due to Mr. Granger’s position as President and Chief Executive Officer with the Corporation • Director since 2009 • Area of expertise: management and operation of exploration and production companies • Attendance at meetings in 2010: 15/15 (100%) • Ex officio non-voting member of the Corporate Governance, Human Resources and Compensation Committee; the Reserves, Operations and Environmental, Health & Safety Committee; and the Audit, Finance and Risk Committee • Meets share ownership guidelines - in transition(2): Common shares owned: 467,933 ($205,891) (1) Options: 1,331,000 |

J. Stephens Allan, FCA, ICD.D., Calgary, AB, Canada | Steve Allan, 66, is a consultant to RSM Richter LLP, one of the largest independent accounting, business advisory, and consulting firms in Canada. Mr. Allan has 40 years of experience as a Chartered Accountant, which includes extensive experience in complex corporate finance matters. He was awarded an FCA in 1992. Mr. Allan is the past Chairman of the Board of the Calgary Exhibition & Stampede. He has served as a Director of the Calgary Foundation and University Technologies Inc. He is currently a Director of the McMahon Stadium Society and the Calgary Stampede Foundation and was a member of the Committee to End Homelessness in Calgary. Mr. Allan is Chairman of the Canadian Tourism Commission and was formerly Chairman of the Independent Review Committee for the Citadel Group of Funds. He is a past President of the Institute of Chartered Accountants of Alberta and the Rotary Club of Calgary, as well as a past Director of the Alberta Insolvency Practitioner’s Association and the Institute of Management Consultants of Alberta. Mr. Allan has also served as a Governor of the Canadian Institute of Chartered Accountants. He is a member of the Institute of Corporate Directors. Compton Board Details: • Independent • Director since 2007 • Areas of expertise: corporate governance and finance • Attendance at meetings in 2010: 12/15 (80%) • Chairman of the Audit, Finance and Risk Committee • Member of the Corporate Governance, Human Resources and Compensation Committee • Meets share ownership guidelines - in transition(2): Common shares owned: 51,250 ($22,550) (1) Options: 189,300 |

David M. Fitzpatrick, P. Eng., C. Dir. Calgary, AB, Canada | David Fitzpatrick, 52, is an independent businessman and prior thereto served as President, CEO and Director of Shiningbank Energy Ltd. from 1996 to 2007 (acquired by PrimeWest Energy Trust), an oil and gas company. Mr. Fitzpatrick has served as a Director of each of PrimeWest Energy Trust, Shiningbank Energy Income Fund, Platform Energy Ltd., Fairquest Energy Ltd., Enerchem International Inc., Eagle Energy Trust, Pinecrest Energy Ltd. and Twin Butte Energy Ltd., each an oil and gas company or trust. Mr. Fizpatrick is a member of the Association of Petroleum Engineers, Geologists and Geophysicists of Alberta, the Society of Petroleum Engineers and is a Chartered Director. Compton Board Details: • Independent • Director since 2009 • Areas of expertise: engineering and production • Attendance at meetings in 2010: 15/15 (100%) • Member of the Reserves, Operations and Environmental, Health & Safety Committee • Meets share ownership guidelines - in transition(2): Common shares owned: 100,000 ($44,000) (1) Options: 224,300 |

R. Bradley Hurtubise B. Comm., MBA, CFA Calgary, AB, Canada | R. Bradley Hurtubise, 52, is President, Chief Executive Officer and a Director of Eaglewood Energy Inc. an international oil and gas company. Prior thereto he was Executive Managing Director, Investment Banking at Tristone Capital Inc. and Executive Managing Director and Head of the Calgary office of BMO Nesbitt Burns. Mr. Hurtubise is currently on the Board of Directors of Ithaca Energy Inc., Direct Cash Payments Inc. and serves on the Advisory Board of Marsh Canada. Compton Board Details: • Independent • Director since 2009 • Areas of expertise: finance • Attendance at meetings in 2010: 12/15 (80%) • Member of the Audit, Finance and Risk Committee • Meets share ownership guidelines - in transition(2): Common shares owned: 51,400 ($22,616) (1) Options: 224,300 |

Irvine J. Koop, P.Eng. Calgary, AB, Canada | Irv Koop, 64, is an independent businessman and prior thereto was the Chairman and Chief Executive Officer of IKO Resources Inc., a petroleum consulting firm. Mr. Koop was the Executive Vice President and President and Chief Executive Officer, Pipelines and Midstream, of Westcoast Energy Inc., an energy products and services company (acquired by Duke Energy Company), and was the former President and CEO of Numac Energy, an oil and gas company (acquired by Anderson Exploration). Mr. Koop is a member of the Association of Petroleum Engineers, Geologists, and Geophysicists of Alberta, and the Canadian Institute of Mining and Minerals. Mr. Koop is also a Director and Chairman of NAL Energy Corporation, a public oil and gas company, and past chair of the Canadian Association of Petroleum Producers (CAPP) and Canadian Energy Research Institute. Compton Board Details: • Independent • Director since 1996 • Areas of expertise: engineering, and midstream and pipeline transmission • Attendance at meetings in 2010: 15/15 (100%) • Chairman of the Corporate Governance, Human Resources and Compensation Committee • Member of the Reserves, Operations and Environmental, Health & Safety Committee • Meets share ownership guidelines: Common shares owned: 587,000 ($258,280) (1) Options: 209,300 |

Warren M. Shimmerlik Bedford, NY, United States | Warren M. Shimmerlik, 62, is an independent businessman. Prior thereto, Mr. Shimmerlik was a Member and Principal of COSCO Capital Management LLC, a private equity intermediary and from 1990 to 2004 President of Shimmerlik Corporate Communications, Inc., an investor relations firm. He spent nearly two decades as a Wall Street Energy Analyst holding senior positions at Merrill Lynch & Company, L.F. Rothschild Unterberg Towbin and County NatWest Securities USA. Compton Board Details: • Independent • Director since 2009 • Area of expertise: finance • Attendance at meetings in 2010: 15/15 (100%) • Member of the Audit, Finance and Risk Committee • Meets share ownership guidelines - in transition(2): Common shares owned: 53,600 ($23,584) (1) Options: 224,300 |

| (1) | Share ownership value based on TSX closing stock price of $0.44 on December 31, 2010. |

| (2) | Share ownership guidelines were revised and instituted in September 2009; Directors have a five-year compliance period so are currently in a transition period (see “Executive and Director Compensation - Incentive Plan Awards - Executive Share Ownership and Guidelines” and “Director Share Ownership and Guidelines”). |

Appointment and Remuneration of Auditors

Grant Thornton LLP, Chartered Accountants, (“Grant Thornton”) will be nominated for re-appointment as the Corporation’s auditors to hold office until the next succeeding annual meeting of Shareholders, at such remuneration as may be fixed by the Board upon the recommendations of the Audit, Finance and Risk Committee. Representatives of Grant Thornton will be present at the Meeting and will have an opportunity to make a statement if they wish to do so. They will also be available to respond to Shareholders’ questions. Grant Thornton has been the auditors of the Corporation since 1993. The Audit, Finance and Risk Committee has recommended to the Board and to Shareholders, the nomination of Grant Thornton as the Corporation’s auditors. The appointment of the auditors will be decided by a majority of the votes cast at the Meeting by Shareholders present in person or by proxy. The Board and Management unanimously recommend that Shareholders vote in favour of the re-appointment of Grant Thornton as the Corporation’s auditors.

Annual Information Form and Audit Fees

The Corporation has included in its Annual Information Form in the section entitled “Audit, Finance and Risk Committee Information,” certain prescribed information in respect of Audit, Finance and Risk Committee matters and audit fees.

The aggregate amounts billed by Grant Thornton LLP to the Corporation with respect to fees payable for audit and audit-related engagements (including separate audits of subsidiary entities, financings, and regulatory reporting requirements), tax, and other services in the fiscal years ended December 31, 2010 and 2009 were as follows:

| Type of Service | Fiscal 2010 | Fiscal 2009 |

| Financial statement and internal controls audit | $ 754,218 | $ 1,030,849 |

| Audit related | 125,007 | 51,636 |

| Tax | 22,601 | 21,945 |

| Other non-audit | 151,543 | 137,000 |

| Total | $ 1,053,369 | $ 1,241,430 |

Financial statement audit fees in fiscal 2010 and 2009 include those charged in respect of the annual financial statement audit as well as those charged for the quarterly review of the financial statements. Fees charged in 2010 and 2009 for the audit of internal controls relate to requirements under the United States Sarbanes-Oxley Act of 2002 and similar Canadian regulatory compliance.

Audit related fees include services performed to translate the annual and quarterly financial statements into French as well as the reimbursement of the pro-rata share of annual fees charged to each audit firm by the Canadian Public Accountability Board.

Tax services performed by Grant Thornton outside of normal audit procedures during 2010 related to debt restructuring and the preparation and filing of the annual returns. Other non-audit fees relate to services provided during the issue of offering documents as well as the preparation of a scoping, planning and implementation document to support the Corporation’s transition to International Financial Reporting Standards (“IFRS”) on January 1, 2011.

The Audit, Finance and Risk Committee of the Corporation considered the fees and determined that they were reasonable and do not affect the independence of the Corporation’s auditors. Further, such Committee determined that in order to ensure the continued independence of the auditors, only limited non-audit related services would be provided to the Corporation by Grant Thornton and in such case, only with the prior approval of the Audit, Finance and Risk Committee. The Committee has pre-approved the retention of Grant Thornton to provide miscellaneous, minor, non-audit services in circumstances where it is not feasible or practical to convene a meeting of the Audit, Finance and Risk Committee, subject to an aggregate limit of $25,000 per quarter.

Issuance of Retention Shares

In January 2011, the Corporation significantly revised the compensation arrangements that it has with each of Tim Granger, President and Chief Executive Officer, David Horn, Vice President, Business Development and Land, and Shannon Ouellette, Chief Operating Officer. Effective February 28, 2011, the Corporation entered into a new compensation arrangement with Theresa Kosek in her newly appointed position as Vice President, Finance and Chief Financial Officer. Each of Mr. Granger, Mr. Horn, Ms. Ouellette and Ms. Kosek are an “Executive” and collectively, the “Executives”. These new compensation arrangements are described in the section entitled “Executive and Director Compensation - Compensation Discussion and Analysis”. Part of those new compensation arrangements consists of a long-term retention plan award (the “LTRP Awards”), effective February 15, 2011, of $570,000 to Mr. Granger, $290,000 to Mr. Horn, $390,000 to Ms. Ouellette and $290,000 to Ms. Kosek.

The terms of the LTRP Award for each Executive provide that one-third of the amount of the LTRP Award for that Executive will be paid to that Executive on each of February 15, 2012, 2013 and 2014, as long as the Executive remains an employee in good standing on each such date. In the event an Executive is terminated with cause or resigns prior to each vesting period, that Executive will forfeit his or her LTRP Award. In the event of a change of control of the Corporation, any unvested portion of the LTRP Award will vest.

Subject to regulatory and disinterested shareholder approval, the Corporation has agreed to pay one-half of the LTRP Awards to the Executives in the form of Common Shares of the Corporation (“Retention Shares”). The number of Retention Shares to be delivered to each Executive would be equal to the quotient obtained by dividing 50% of the LTIP Award payable to that Executive by the volume weighted average trading price of the Common Shares on the Toronto Stock Exchange (the “TSX”) for the five consecutive trading days immediately preceding the date of the Meeting (such price being the “Reference Price”). For example, if the Reference Price is $0.44 per share and the required approvals are obtained, then the cash and number of Retention Shares that the Corporation would deliver to the Executives on each of the applicable payment dates would be as follows:

| | Tim Granger | | $95,000 and 215,909 Retention Shares |

| | David Horn | | $48,333 and 109,848 Retention Shares |

| | Shannon Ouellette | | $65,000 and 147,727 Retention Shares |

| | Theresa Kosek | | $48,333 and 109,848 Retention Shares |

Using this example, a total of 1,749,996 Retention Shares would be issued under the LTRP Awards to the four Executives. The number of Retention Shares to be issued under the LTRP Awards will vary, depending on the Reference Price; however, the Corporation will not issue more than 1,924,992 Retention Shares (which as at February 24, 2011 represent 0.7% of the issued and outstanding Common Shares) to the Executives under the LTRP Awards (which corresponds to a Reference Price of $0.44 per share). In this case Mr. Granger would be eligible to receive up to 712,500 Common Shares (which as at February 24, 2011 represents 0.3% of the issued and outstanding Common Shares), Mr. Horn would be eligible to receive up to 362,496 Common Shares (which as at February 24, 2011 represents 0.1% of the issued and outstanding Common Shares), Ms. Ouellette would be eligible to receive up to 487,500 Common Shares (which as at February 24, 2011 represents 0.2% of the issued and outstanding Common Shares) and Ms. Kosek would be eligible to receive up to 362,496 Common Shares (which as at February 24, 2011 represents 0.1% of the issued and outstanding Common Shares). To the extent that the number of Retention Shares to be delivered to the Executives would otherwise exceed that maximum, or the required approvals are not obtained, the Corporation will deliver cash to the Executives in an amount required to satisfy the LTRP Awards. In the event that disinterested Shareholder approval of the issuance of the Retention Shares is not obtained, each Executive will be paid on vesting their entire LTRP Award in cash.

The LTRP Awards have been recommended by the Governance Committee and approved by the Board. The Governance Committee’s review process included a broad discussion and analysis of the compensation arrangements for the Executives. The Governance Committee and the Board have determined that the LTRP Awards are in the best interests of the Corporation in that they will allow the Corporation to conserve its financial resources (if paid in Common Shares) while further aligning the interests of the Executives with those of the Shareholders.

The TSX has conditionally approved the issuance of the Retention Shares subject to disinterested Shareholder approval. Because the Executives are insiders of the Corporation, the TSX requires the Corporation to obtain disinterested shareholder approval of the issuance of the Retention Shares. Accordingly, at the Meeting, disinterested Shareholders will be asked to approve the issuance of the Retention Shares by an ordinary resolution (the “Retention Share Resolution”).

Recommendation of the Board

The Board has determined that the issuance of the Retention Shares is in the best interests of the Corporation and the Shareholders. The Board unanimously recommends that the disinterested Shareholders vote in favour of the issuance of the Retention Shares.

Unless specified in a form of proxy that the Common Shares represented by the proxy shall be voted against the Retention Share Resolution, it is the intention of the persons designated in the enclosed form of proxy to vote for the Retention Share Resolution.

Retention Share Resolution

“RESOLVED THAT the award of up to 712,500 Common Shares to Tim Granger, 362,496 Common Shares to David Horn, 487,500 Common Shares to Shannon Ouellette and 362,496 Common Shares to Theresa Kosek, in each case to be issued to such individuals in increments no greater than one-third of such awards on each of February 15, 2012, 2013 and 2014, be and the same is hereby approved, ratified and confirmed and that any Officer or Director of the Corporation is authorized, in the name and on behalf of the Corporation, to do all such things and execute all such documents as may be necessary or advisable to implement this resolution.”.

Deferred Share Unit Plan

At the Meeting, Shareholders will be asked to ratify and approve the ability of the Corporation to issue up to 1,875,000 Common Shares to the independent Directors of the Corporation under a deferred share unit plan of the Corporation (the “DSU Plan”). The Board approved the adoption of the DSU Plan effective January 27, 2011 for the purpose of providing an alternative form of compensation to the independent Directors of the Corporation.

Under the DSU Plan, each independent Director will be awarded deferred share units (“DSUs”) effective on the date of each annual general meeting of the Shareholders, beginning with the date of the Meeting. The notional amount of each DSU award to each independent Director will be $35,000 ($40,000 for the Chair of the Board of Directors). The notional number of Common Shares represented by each DSU award (the “DSU Notional Shares”) will be the quotient obtained by dividing the notional amount of the DSU award by the volume weighted average trading price of the Common Shares on the TSX for the five consecutive trading days immediately preceding the date of the award (such price being the “DSU Reference Price”). At the time an independent Director to whom DSUs have been granted under the DSU Plan ceases to be a director of the Corporation for any reason, including without limitation disability, death, retirement or resignation (other than a resignation or other termination as a result of or following misconduct or a fraudulent act as described below), that Director will be paid an amount (payable in Common Shares or cash, at the option of the Corporation) equal to the value of the DSU Notional Shares corresponding to all DSU awards previously received by that Director, based on the volume weighted average trading price of the Common Shares on the TSX for the five consecutive trading days immediately preceding the date on which that Director ceases to be a director of the Corporation. This form of compensation will enable the independent Directors to participate in any increase in the value of the Common Shares and will promote a greater alignment of interests among independent Directors and the Shareholders.

If an independent Director ceases to be a director of the Corporation as a result of or following any misconduct or fraudulent act by that Director, he or she will not be eligible to receive any future DSUs and will forfeit all rights to any DSUs granted prior to the date in respect of which that Director ceases to be a director of the Corporation.

Subject to regulatory and shareholder approval, the Corporation will have the option to satisfy any obligation to pay an amount to a departing independent Director in respect of the DSUs held by that Director by delivering Common Shares equal in number to the number of DSU Notional Shares corresponding to all DSU awards previously received by that Director.

Under the DSU Plan, the aggregate number of Common Shares that may be reserved for issuance pursuant to DSUs at any given time shall not exceed 1,875,000 Common Shares.

The Corporation will not issue Common Shares under the DSU Plan to any Director where such issuance would result in: (a) the total number of Common Shares issuable at any time under the DSU Plan to insiders, or when combined with all other Common Shares issuable to insiders under any other equity compensation arrangements then in place, exceeding 10% of the total number of issued and outstanding equity securities of the Corporation on a non-diluted basis; or (b) the total number of Common Shares that may be issued to insiders during any 12-month period under the DSU Plan, or when combined with all other Common Shares issued to insiders under any other equity compensation arrangements then in place, exceeding 10% of the total number of issued and outstanding equity securities of the Corporation on a non-diluted basis. If the Corporation is precluded from issuing Common Shares (corresponding to DSU Notional Shares) to a Director, the Corporation will pay to that Director cash in an amount as described above.

The Board may at any time and from time to time, without Shareholder approval, amend any provision of the DSU Plan, including, without limitation:

| | (a) | to make amendments of a “housekeeping” nature, including amendments to the DSU Plan or a DSU necessary to comply with applicable law or the requirements of any regulatory authority or stock exchange and any amendment to the DSU Plan or a DSU to correct any ambiguity, defective provision or error or omission therein; |

| | (b) | to amend the vesting, redemption or payment provisions of the DSU Plan or any DSUs; or |

| | (c) | any other amendment that does not require Shareholder approval under applicable laws or the rules and policies of the TSX; |

provided, however, that:

| | (d) | no such amendments of the DSU Plan may be made without the consent of the affected participant in the DSU Plan if such amendment would adversely affect the rights of such participant under the DSU Plan for DSUs previously granted; and |

| | (e) | Shareholder approval shall be obtained in accordance with the rules and policies of the TSX for any amendment to the amendment provisions of the DSU Plan. |

| Appropriate adjustments to the number of DSUs outstanding under the DSU Plan shall be made to give effect to stock dividends, subdivisions, consolidations, reclassifications or similar changes to the Common Shares or other relevant changes in the capital structure of the Corporation. Notwithstanding the foregoing, any transaction (including a take-over bid, merger, arrangement or similar business combination) which results in the exchange of the Common Shares for cash or securities of another issuer (or a combination thereof) shall result in the termination of the DSU Plan and shall entitle each independent Director to whom DSUs have been granted under the DSU Plan to be paid an amount equal to the value of the DSU Notional Shares corresponding to all DSU awards previously received by that Director, based on the volume weighted average trading price of the Common Shares on the TSX for the immediately preceding five consecutive trading days. |

| The rights and interests of an independent Director in respect of the DSUs granted to that Director shall not be transferable or assignable other than by the will or the laws of succession to the legal representative of that Director or, subject to applicable law, to a dependant or relation, including without limitation a spouse, of that Director. |

A copy of the DSU Plan is attached hereto as Schedule “A”. The TSX has accepted the DSU Plan and has conditionally approved the issuance of up to 1,875,000 Common Shares (which corresponds to an estimated three years’ worth of DSU awards using a DSU Reference Price of $0.44 per share) in connection with the DSU Plan, subject to Shareholder approval. Accordingly, at the Meeting, Shareholders will be asked to approve the issuance of Common Shares in connection with the DSU Plan by an ordinary resolution (the “DSU Share Resolution”).

Recommendation of the Board

The Board has determined that the adoption of the DSU Plan and the issuance of Common Shares in connection with the DSU Plan are in the best interests of the Corporation and the Shareholders. The Board unanimously recommends that Shareholders vote in favour of the DSU Share Resolution.

Unless specified in a form of proxy that the Common Shares represented by the proxy shall be voted against the DSU Share Resolution, it is the intention of the persons designated in the enclosed form of proxy to vote for the DSU Share Resolution.

DSU Share Resolution

“RESOLVED THAT the issuance of up to 1,875,000 Common Shares in connection with the Deferred Share Unit Plan as described in the proxy information circular of the Corporation dated February 24, 2011 substantially in the form attached to the proxy information circular as Schedule “A” be and the same is hereby approved, ratified and confirmed and that any Officer or Director of the Corporation is authorized, in the name and on behalf of the Corporation, to do all such things and execute all such documents as may be necessary or advisable to implement this resolution.”

PROXY INFORMATION

Solicitation of Proxies

This Proxy Circular, which is being mailed to Shareholders on or about April 8, 2011, is furnished in connection with the solicitation by and on behalf of Management of proxies to be used at the Meeting to be held on Tuesday, May 10, 2011 at the time and place and for the purposes set forth in the accompanying notice of the Meeting, or any adjournment or adjournments thereof. The solicitation will be made primarily by mail but may also be made by telephone or other means of telecommunication by Officers, Directors, or employees of the Corporation. The cost of the solicitation will be borne by the Corporation.

Appointment of Proxyholders and Revocation of Proxies

A Shareholder has the right to appoint as proxyholder any person, other than the Directors or Officers of the Corporation named in the accompanying form of proxy, to attend and vote at the Meeting in the Shareholder’s place, and may do so by inserting the name of such other person, who need not be a Shareholder, in the blank space provided in the form of proxy or by completing another proper form of proxy.

In order for proxies to be recognized at the Meeting or any adjournment or adjournments thereof, the completed forms of proxy must be received at the registered office of the Corporation’s transfer agent, Computershare Trust Company of Canada, c/o Service Delivery, 100 University Avenue, 9th Floor, Toronto, Ontario, Canada, M5J 2Y1, not later than 48 hours (excluding Saturdays, Sundays, and holidays) preceding the Meeting or any adjournment or adjournments thereof.

A proxy is revocable. The giving of a proxy will not affect the right of a Shareholder to attend and vote in person at the Meeting. A Shareholder, or his attorney authorized in writing, who executed a form of proxy may revoke it in any manner permitted by law, including by depositing an instrument of revocation in writing at the Corporation’s registered office, located at Suite 4300, 888 - 3rd Street S.W., Calgary, Alberta, Canada, T2P 5C5, Attention: Corporate Secretary, at any time up to and including the day prior to the Meeting or any adjournment or adjournments thereof, or with the chairman of the Meeting on the day of the Meeting, or any adjournment or adjournments thereof, but prior to the use of the proxy at the Meeting, or any adjournment or adjournments thereof.

Voting of Common Shares - Advice to Beneficial Holders of Securities

The information set forth in this section is of significant importance to those Shareholders who hold Common Shares through brokers and their nominees and not in their own name. Shareholders who do not hold their Common Shares in their own name (referred to in this Proxy Circular as “Beneficial Shareholders”) should note that only proxies deposited by Shareholders whose names appear on the records of the Corporation as the registered holders of the Common Shares can be recognized and acted upon at the Meeting. If Common Shares are listed in an account statement provided to a Shareholder by a broker, then in almost all cases, those shares will not be registered under the name of the Shareholder on the records of the Corporation. Such shares will more likely be registered under the name of the Shareholder’s broker or an agent of that broker. Shares held by brokers or their nominees can only be voted for, or withheld from voting, or voted against any resolution upon the instructions of the Beneficial Shareholder. Without specific instructions, brokers and nominees are prohibited from voting shares for their clients.

Applicable regulatory policy requires intermediaries and brokers to seek voting instructions from Beneficial Shareholders in advance of Shareholders’ meetings. Every intermediary and broker has its own mailing procedures and provides its own return instructions, which should be carefully followed by Beneficial Shareholders in order to ensure that their Common Shares are voted at the Meeting. Often, the form of proxy supplied to a Beneficial Shareholder by his/her broker is identical to the form of the proxy provided to registered Shareholders; however, its purpose is limited to instructing the registered Shareholder how to vote on behalf of the Beneficial Shareholder. A Beneficial Shareholder receiving a proxy from an intermediary cannot use that proxy to vote shares directly at the Meeting, rather the proxy must be returned to the intermediary well in advance of the Meeting in order to have the shares voted.

Exercise of Discretion by Proxyholders

The persons whose names are printed on the accompanying form of proxy as proxyholders, who are either Officers or Directors of the Corporation, will on a show of hands or any ballot that may be called for, vote for, withhold from voting, or vote against the shares in respect of which they are appointed in accordance with the direction of the Shareholder appointing them. If no choice is specified by the Shareholder, then such shares will be voted FOR the election of the nominees for each of the Directors, as set forth under the heading “Business of the Meeting - Election of Directors,”, FOR the appointment of Grant Thornton as the Corporation’s auditors, as set forth under the heading “Business of the Meeting - Appointment and Remuneration of Auditors”, FOR the issue of up to 1,924,992 Common Shares, as set forth under the heading “Business of the Meeting - Issuance of Retention Shares”, and FOR the issue of up to 1,875,000 Common Shares, as set forth under the heading “Business of the Meeting - Deferred Share Unit Plan.”

The form of proxy accompanying this Proxy Circular confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the notice of the Meeting accompanying this Proxy Circular and with respect to other matters which may properly come before the Meeting. As at the date hereof, Management knows of no such amendment, variation, or other matter to come before the Meeting. If any such amendment, variation, or other matter that is not now known should properly come before the Meeting, then the persons named in the form of proxy will vote on such matters in accordance with their best judgment with respect to the shares represented by such proxy.

Voting Shares and Principal Holders Thereof

The by-laws of the Corporation provide that every question submitted to any meeting of Shareholders, with the exception of the election of Directors, shall be decided on a show of hands unless a ballot is duly demanded by a Shareholder or proxyholder either before or on the declaration of the result of any vote by a show of hands. Upon a show of hands, every Shareholder present in person shall have one vote. If a ballot is taken, then each Shareholder present in person or represented by proxy, is entitled to one vote for each Common Share registered in his name as at the close of business on March 25, 2011, being the record date (the “Record Date”) fixed by the Board for the determination of the registered Shareholders who are entitled to receive the notice of the Meeting accompanying this Proxy Circular. If a Shareholder transfers the ownership of any of the Shareholder’s Common Shares after the Record Date, then the transferee will be entitled to vote at the Meeting if the transferee produces properly endorsed share certificates or otherwise establishes proof of ownership of the shares and demands, not later than 10 days before the Meeting, that the transferee’s name be included in the list of Shareholders entitled to vote. This list of Shareholders will be available for inspection after the Record Date during usual business hours at the Calgary office of the Corporation’s transfer agent, Computershare Trust Company of Canada, Suite 600, 530-8th Avenue S.W., Calgary, Alberta, Canada, T2P 3S8, and at the Meeting.

Directors receiving the majority of votes cast (number of shares voted “for’’ a Director must exceed the number of votes “withheld” from that Director) will be elected as a Director. If the number of nominees exceeds the number of Directors to be elected, the Directors shall be elected by a plurality of the shares present in person or by proxy at any such meeting and entitled to vote on the election of Directors. Shares not present at the meeting and shares voting “withheld” have no effect on the election of Directors. See “Election of Directors - Majority Voting Policy.”

As at February 24, 2011, there were 263,579,701 Common Shares outstanding. Each Common Share carries the right to one vote on any matter properly coming before the Meeting. The Common Shares are Compton’s only outstanding class of shares. To the knowledge of the Directors and Officers, there are no person as of February 24, 2011, who beneficially owns, or controls or directs, directly or indirectly, more than 10% of the issued and outstanding Common Shares.

EXECUTIVE AND DIRECTOR COMPENSATION

Compensation Discussion and Analysis

Compensation of Executive Officers

Composition of the Governance Committee

The Board has delegated to the Governance Committee responsibility for the oversight, review, and approval of Compton’s compensation policies. During 2010, the Governance Committee was composed of the following three independent Directors, Messrs. Koop (Chair), Allan, and Smith, as well as one ex officio voting independent Director, Mr. Belich, and one ex officio non-voting non-independent Director, Mr. Granger, each of whom have significant executive and managerial experience in industry and are well qualified to determine and implement the compensation policies of the Corporation. The compensation of the Executives of the Corporation, including the President and Chief Executive Officer, is recommended for approval to the Board of Directors by the members of the Governance Committee.

Objectives of Compensation Program

The primary objective of the Corporation’s executive compensation program is to attract, motivate, develop, and retain outstanding individuals. In determining the level of compensation paid to named executive officers (each a “NEO”)1, the Governance Committee annually considers several factors including: the NEO’s overall experience, responsibility and performance; the compensation levels of similar executive positions in the Canadian oil and gas industry in which the Corporation competes; and the necessity to retain key personnel and Compton’s overall performance and achievement of its corporate objectives. More specifically, the Governance Committee considers for each NEO: the individual’s performance in comparison to defined individual goals and objectives and how this performance compares to other members of the Management team; specific corporate operating statistics and performance ratios; Compton’s financial objectives; the individual’s ability to perform to internal budget projections and expectations; and plans for future exploration, development and acquisition activities.

The Corporation’s compensation program is designed to reward for services provided and to serve as an incentive for NEOs to implement the Corporation’s short-term and long-term strategic goals that are intended to maximize Shareholder value.

Elements of Compensation Program

As discussed in further detail below, the term “total compensation” refers to all of the elements of compensation disclosed in the “Summary of Compensation Table”, specifically: base salary, share-based awards, option based awards, non-equity incentive awards, and other compensation, such as benefits and the Corporation’s Employee Savings Plan.

The term “total direct compensation” represents the combined value of fixed compensation and performance-based variable compensation, but excludes other compensation such as benefits and the Employee Savings Plan. The elements of total direct compensation include base salary, annual incentives in the form of a cash bonus, and long-term incentives in the form of stock options and long-term retention plans. In 2009, the Corporation adopted a pay-for-performance philosophy for all employees, including the NEOs, whereby actual awards are directly linked to Compton’s results. Total direct compensation targets the fiftieth percentile of market comparables, advancing to the seventy-fifth percentile if corporate and individual performance warrants.

Base Salary

The primary element of the Corporation’s compensation program is base salary, which is a fixed portion of total direct compensation. The Corporation’s view is that base salary is a necessary element to attract and retain qualified executive officers through income certainty. Base salaries for NEOs are reviewed annually and are recommended for approval to the Board of Directors by the Governance Committee. The base salaries of Executives, including that of the Chief Executive Officer (“CEO”), target a range between the fiftieth and seventy-fifth percentile indicated in the below mentioned market comparison surveys, which consider compensation for similar roles and levels of responsibility within comparable companies.

1 A named executive officer means each of the following individuals: a CEO, a CFO, each of the three most highly compensated executive officers, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000 and each individual who would be an NEO but for the fact that the individual was not an executive officer nor acting in a similar capacity at the end of that financial year.

The Board has determined that Officers’ base salaries for 2011 will be reduced in consideration of the current market environment and the reduction in corporate size over the last two years. As a result, the Officers’ salaries are reduced as follows:

| | 2010 Base Salary | 2011 Base Salary |

| Tim Granger | $ 400,000 | $ 200,000 |

| David Horn | $ 225,000 | $ 200,000 |

| Shannon Ouellette | $ 250,000 | $ 200,000 |

As such, the Executives’ 2011 compensation will be lower as a result of being benchmarked to a revised peer group of smaller companies. The newly appointed Vice President, Finance and Chief Financial Officer of the Corporation, Ms. Theresa Kosek, will also receive a base salary of $200,000 in 2011.

Annual Incentive Plans

Annual incentive plans are an element of compensation designed to reflect achievement of both corporate and individual goals and objectives. The Corporation’s annual incentive plan is a short-term incentive intended to reward each employee and NEO based on overall corporate company performance, as measured through financial and non-financial terms, as well as individual contribution to Compton’s results, measured against goals and objectives that are determined at the beginning of each year.

In setting goals and objectives for Officers, weightings are given to individual performance measures and to corporate goals and objectives that are formed, in part, from benchmarking studies. If certain performance levels are achieved, a bonus is payable. The target short-term incentive award for the CEO is set at 40% of annual base salary, with an opportunity to earn a maximum bonus award of up to 80% for exceptional performance. As part of its deliberations regarding bonus awards for 2010, the Board weighted corporate performance at 80% and the individual performance of the CEO at 20%. The target short-term incentive award for a NEO (other than the CEO) is set at 30% of annual base salary, with an opportunity to earn a maximum bonus award of up to 60% for exceptional performance. As part of its deliberations, the Board weighted corporate performance at 70%, and the individual performance of the NEO (other than the CEO) at 30%.

Compton’s Executives were evaluated against the following corporate performance criteria for 2010:

| Corporate Performance Criteria (70% - 80% of assessment) | Weighting |

| Production | 20% |

| Operational cost | 15% |

| Administrative expenses | 5% |

| Capital efficiency | 20% |

| Relative shareholder return | 20% |

| Board discretion | 20% |

| Total corporate performance goals | 100% |

| | |

Targets, weightings and measures are intended to be guidelines, allowing for Board discretion. Based on the criteria set out above and the achievement of corporate and individual goals (both financial and non-financial), the Board determined that the awards of Annual Incentive Bonuses, as set out in “Compensation of Executive Officers - Summary Compensation Table” were appropriate, based on the fact that the majority of 2010 corporate and individual goals were materially met or exceeded as outlined in the table below. The Governance Committee also assessed bonus amounts relative to Compton’s peer group in ensuring that the amount is consistent with targeted total direct compensation.

| 2010 Goals & Objectives | Guidance | Results |

| Average daily production (boe/d) | 16,000 - 16,500 | 17,402 |

| Administrative expenses ($ millions) | $25 - $27 | $22.7 |

| Operating costs ($ millions) | $80 - $85 | $66.1 |

| Cash flow ($ millions) | $40 - $50 | $54.4 |

Capital expenditures(1) ($ millions) | $60 - $70 | $46.3 |

| | As at Dec. 31, 2009 | As at Dec. 31, 2010 |

Reduce debt level: Total bank debt & term notes ($ millions) | $568.9 | $382.8 |

Relative shareholder return(2) Q4 level relative to peers | 1% | (53%) |

| (1) | Capital expenditures were to be adjusted according to cash flow generated from operations and other sources; as Management’s strategy of living within cash flow was maintained, the Board viewed that the performance measure was met. |

| (2) | Compton’s share price was negatively impacted by continued low natural gas prices, which was outside of Management’s control; in its assessment, the Board took into consideration factors within Management’s control that were met, such as production levels and expenses. |

Compton met or exceeded its targets on average daily production, administrative expenses, operating costs and reduction of corporate debt. The Corporation measures its cash flow guidance on adjusted cash flow, which adjusts the cash flow amount (as stated on the ‘Consolidated Statements of Cash Flow’ contained in the annual financial statements for 2010) for realized foreign exchange losses and asset retirement expenditures. The Corporation exceeded this target as well after adjustment for one-time items such as the impact of the termination of office lease costs.

Capital expenditures, before acquisitions and dispositions in December 2010, were $13.7 million lower than guidance due to Management’s strategy of living within cash flow. In addition, equipment delays in the latter part of the year moved some expenditures into 2011.

In evaluating the NEOs, the Governance Committee came to the following conclusions:

For his accomplishments in 2010, the Board granted Mr. Cassidy a short-term incentive award totalling 30% of his 2010 annual base salary, meeting the target of 30%. Mr. Junghans exceeded targeted performance for 2010 and was granted a short-term incentive award equal to 35.4% of his annual base salary. The targeted percentage was 30%.

In 2010, Ms. Ouellette successfully developed a cohesive team, which was supportive of the corporate objectives. Under Ms. Ouellette’s leadership, operational performance related to operational costs, annual production, development and environmental, health and safety results all exceeded expectations and 2010 performance targets. Ms. Ouellette was compensated accordingly, receiving a short-term incentive award of 60%. The target was 30% of her 2010 annual base salary.

Mr. Horn led a number of corporate and asset divestment processes in 2010. Under his leadership, the land business unit continued to improve land records and strengthen processes. Mr. Horn is a strong ambassador for the Corporation, working effectively with external stakeholders. Mr. Horn's contributions exceeded the performance targets established for 2010. The target for Mr. Horn's short-term incentive award was 30% of his base salary. Given that his performance exceeded targets, Mr. Horn was compensated with a short-term incentive award equalling 55.5% of his 2010 annual base salary.

Mr. Granger's 2010 performance was measured by his accomplishments against six operational, financial and market corporate performance measures as well as individual goals and objectives. His overall performance rating and compensation was weighted 80% to corporate performance and 20% to attainment of individual goals. In 2010, Mr. Granger led his team in successfully executing a plan that saw a significant reduction in operating and administrative costs, reduced debt levels and increased the efficiency of Compton’s capital expenditure program. A continuation of low natural gas prices resulted in these significant achievements not being fully reflected in the Corporation’s share price. The Committee also deemed Mr. Granger’s compensation to be appropriate relative to the compensation of other executive officers and Chief Executive Officers of Compton’s peer group. The Board approved a short-term incentive award commensurate with 40% of Mr. Granger's 2010 base salary. The target percentage was 40%.

In consideration of the current market environment and the reduction in corporate size over the last two years, the Executives’ 2011 compensation will be lower as a result of being benchmarked to a revised peer group of smaller companies.

Option Based Awards

Long-term incentive compensation may be provided through the granting of stock options under the Corporation’s Stock Option Plan. Awards of Options are intended to increase the pay-at-risk component for executives and to align their interests with the interests of the Shareholders. The following guidelines have been endorsed by the Board, recognizing that the Governance Committee has flexibility and uses discretion to determine the size of each award, taking into account all relevant circumstances including the value of Compton’s Option awards in comparison with its peer group and other components of the compensation previously received by the Officer. Each Officer (with the exception of the CEO) may be granted 75% of base salary for meeting annual targets, with the opportunity to earn a maximum of 150% of base salary for exceptional corporate and individual performance. The target for the CEO is 100% of base salary, with an established maximum of 200%. Due to a continued low natural gas commodity price environment, no option-based awards were granted to Officers for 2010 performance.

Restricted Share Units

In 2008, the Corporation’s RSU plan (the “RSU Plan”) was substituted for the Stock Option Plan in the compensation of executives. RSU awards, like options, are intended to increase the pay-at-risk component for executives and to align their interests with the interests of the Shareholders. The size of the RSU award to individual executives is determined by considering individual performance, level of responsibility, authority and overall importance to the Corporation and the degree to which each executive’s potential and contribution will be critical to the long-term success of Compton. The Governance Committee has flexibility in the determination of the size of the award and takes into account all relevant circumstances, including the value of Compton’s RSU awards in comparison with its competitors and other components of the compensation previously received by the Executive, including prior Option grants. There were no RSUs granted in 2009 or 2010.

Compensation Consultant and Benchmarking

Management retained the services of Mercer (Canada) Ltd. (“Mercer”), an independent consulting firm, to provide expertise and advice on staffing levels in 2010. The fees paid to Mercer for these services were $15,750.

In 2009, the Governance Committee retained the services of Towers Perrin Inc. (“Towers Perrin”), an independent consulting firm, to provide expertise and advice on change-of-control practices. The fees paid to Towers Perrin for these services were $1,289. The services of another independent consulting firm, Hugessen Consulting Inc. (“Hugessen”), was also retained to provide expertise and advice on director, executive and staff compensation programs, incentive program plan design and compensation strategy. The fees paid to Hugessen for services to the Governance Committee were approximately $164,000.

The performance of each independent consulting firm is reviewed, and engagement is approved annually by the Governance Committee. No fees were paid to Towers Perrin or Hugessen for any services in 2008 or 2010.

Compensation that is market competitive is an important objective of the executive compensation program. The NEO’s compensation is established by the Governance Committee with reference to comparable Canadian-based energy companies by benchmarking to compensation surveys conducted by independent expert consulting firms, including Mercer. In each instance, compensation data collected from a peer group serves as a guideline to the Governance Committee.

In 2010, the Governance Committee benchmarked executive base salaries, along with short-term and long-term incentive award ranges, to a peer group of the following 11 domestic intermediate producers:

| | Anderson Energy Ltd. | | Fairbourne Energy Ltd. |

| | Angle Energy Inc. | | Galleon Energy Inc. |

| | Bellatrix Exploration Ltd. | | Peyto Exploration and Development Corp. |

| | Birchcliff Energy Ltd. | | Storm Exploration |

| | Chinook Energy Inc. | | Vero Energy Inc. |

| | Crew Energy Inc. | | |

This peer group was reviewed by the Governance Committee, which considered valuation measures such as market capitalization, natural-gas weighting and production in selecting the members of the peer group.

To ensure sufficient data was available to accurately benchmark executive base salaries and total direct compensation, Compton also referenced the 2010 Mercer Total Compensations Survey for the Energy Sector as part of a broader peer group.

Compensation of the President and Chief Executive Officer

The components of total direct compensation of the CEO are the same as those which apply to other Executives of Compton, namely base salary, short-term incentive award, long-term incentive award, RSUs and other compensation, such as benefits and the Corporation’s Employee Savings Plan (as defined below).

The CEO’s compensation is established with reference to comparable companies and after giving consideration to his performance in relation to targets, goals and objectives established at the beginning of each year. In determining comparables, Compton considered the above referenced industry compensation surveys including the 2010 Mercer Total Compensation Survey for the Energy Sector. On an annual basis, the Governance Committee reviews the CEO’s performance and makes recommendations to the Board regarding the CEO’s compensation.

In the determination of the CEO’s total direct compensation for 2010, the Board considered the achievement of corporate and individual objectives and goals of both a financial and non-financial nature. The CEO’s individual objectives mirrored those of the Corporation, with a focus on increasing Shareholder confidence through: the delivery of financial and operational budgets; the refinement of systems, processes and policies; the implementation of recapitalization initiatives; and the development of subsequent growth strategies.

Mr. Granger’s total compensation for 2010 was $1.2 million (which included base salary, option based awards, annual incentive award, and certain other compensation as detailed in the Summary Compensation Table below). As at December 31, 2010, Mr. Granger held 467,933 common shares, having a value of $205,891 (see “Executive Share Ownership and Guidelines”).

New Executive Employment Arrangements

Compton successfully executed a number of significant restructuring transactions and other steps in 2009 and 2010 in response to deteriorating natural gas prices. These included an equity offering, the sale of a five percent gross overriding royalty, other asset sales, the recapitalization of the senior notes and significant reductions in operating, and general and administrative costs. However, continued weak natural gas prices have continued to place pressure on Compton’s balance sheet, its capital expenditure program and its share price. Among other things, this has led Compton to implement substantial reductions in its staff complement, as well as retention arrangements for its executive and key staff.

In January and February 2011, Compton undertook further changes intended to reduce its general and administrative costs, including substantial additional reductions in staff, the departure of two executives, a restructuring of the compensation arrangements for the remaining executives and entering into a new compensation agreement with Theresa Kosek in her newly appointed position as Vice President, Finance and Chief Financial Officer. The compensation arrangements for the remaining executives and Ms. Kosek include new employment agreements (the “New Employment Agreements”) with each of Tim Granger, Shannon Ouellette, David Horn and Theresa Kosek. Under the New Employment Agreements:

| • | the base salary of each of the remaining executives was reduced to $200,000 per year, and Ms. Kosek was awarded a base salary of $200,000 per year; |

| • | in lieu of being issued stock options for 2011, the remaining executives were awarded LTRP Awards of $570,000 for Mr. Granger, $390,000 for Ms. Ouellette, $290,000 for Mr. Horn and $290,000 for Ms. Kosek, one-third of which is payable on each of February 15, 2012, 2013 and 2014 provided the executive continues to be employed with Compton at the applicable time of payment. Subject to shareholder approval, the Corporation may pay up to half of these amounts in Common Shares. See “Business of the Meeting - Issuance of Retention Shares”; |

| • | previously awarded retention benefits amounting to $1,200,000 for Mr. Granger, $562,500 for Ms. Ouellette and $506,250 for Mr. Horn were restructured such that half of those awards would be payable on January 15, 2012 and the remaining half would be payable on January 15, 2013 provided the executive continues to be employed with Compton at the applicable time of payment; |

| • | the severance amounts payable under the previous employment agreements of the remaining executives as a result of the reductions in base salary ($1,360,000 for Mr. Granger, $637,500 for Ms. Ouellette and $556,875 for Mr. Horn) would be structured such that half of those amounts were paid on January 14, 2011 and the remaining half would be payable January 14, 2012 provided the executive has not resigned or been terminated for cause prior to that time; and |

| • | in recognition of the payment of severance amounts under the previous employment agreements, the remaining executives will not be entitled to any severance amount in respect of their base salary or incentive bonus payments if they are terminated or a change of control occurs prior to January 1, 2013. See “Executive and Director Compensation - Termination and Change of Control Benefits”. |

The Governance Committee and the Board believe that the compensation arrangements under the New Employment Agreements are in the best interests of the Corporation in that they appropriately incentivize a very capable management team to remain with the Corporation and position a smaller and more focused Corporation for growth with a recovery in natural gas prices. At this time, the Board intends to revert to the Stock Option Plan as the principal method of long-term incentive compensation for the Directors, Officers and employees of the Corporation for years following 2011. At the appropriate time, the Board will reconsider the efficacy of the Stock Option Plan.

In addition to the foregoing, the Board also reduced the compensation payable to the Directors, as discussed in further detail under “Executive and Director Compensation - Compensation of Directors”.

Submitted on behalf of the Governance Committee:

| Irvine J. Koop (Chair) | Jeffrey T. Smith |

| J. Stephens Allan | Mel F. Belich (ex officio, voting member) |

Performance Graph

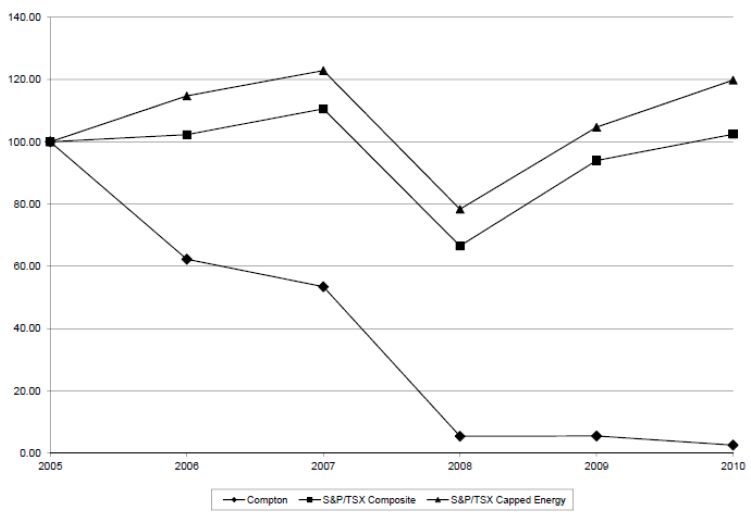

The following performance graph and chart compares the cumulative total Shareholder return for $100 invested in Common Shares for the period commencing on December 31, 2005, and ending on December 31, 2010, with the cumulative total return from a similar investment in the Standard & Poor’s/ TSX Composite Total Return Index (“S&P/TSX Composite”) and the TSX Capped Energy Index (“TSX Capped Energy”) for such period.

Cumulative Value of $100 invested on December 31, 2005

| As at December 31, | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

| Compton | $100.00 | $62.28 | $53.45 | $5.44 | $5.50 | $2.57 |

| S&P/TSX Composite | $100.00 | $114.74 | $122.90 | $78.35 | $104.69 | $119.82 |

| TSX Capped Energy | $100.00 | $102.30 | $110.59 | $66.55 | $93.98 | $102.42 |

Total shareholder return was impacted from 2008 to 2010 by a number of factors, including: the termination of the corporate sales process in 2008; depressed natural gas prices; high debt levels; reduced capital expenditure programs resulting in production declines; and the general state of the economy.

As noted above, the Governance Committee considers a number of factors and performance elements when determining compensation for the Officers. Although total shareholder return is one performance measure that is reviewed, it is not the only consideration in executive compensation deliberations. As a result, a direct correlation between total shareholder return over a given period and executive compensation levels is not anticipated. It should be noted that executive compensation was amended in 2011 to reflect some of these factors, including base salary reductions for 2011.

Option Based Awards During 2010

No options were granted in 2010.

Summary Compensation Table

The following table sets forth the compensation for the Corporation’s NEOs for the financial year ended December 31, 2010:

Name and Principal Position | Year | Salary ($) | Share Based Awards ($)(1) | Share Based Long-Term Incentive Plan Awards ($)(2) | Non-Cash Option- Based Awards ($)(3) | Non-equity incentive plan compensation ($) | Pension Value ($) | All Other Compensation ($)(4)(5)(6) | Total Compensation ($) |

| Annual Incentive Plans | Long-Term Incentive Plans(2) |

Tim Granger President and Chief Executive Officer | 2010 2009 | 400,000 374,359 | - - | 285,000 - | - 801,026 | 160,000 240,000 | 285,000 - | - - | 73,807 61,479 | 1,203,807 1,476,867 |

Mr. C.W. Leigh Cassidy(7) Vice President Finance and Chief Financial Officer | 2010 2009 | 275,000 187,564 | - - | - - | - 349,255 | 82,500 125,000 | - - | - - | 61,856 37,786 | 419,356 699,605 |

David B. Horn(8) Vice President Business Development and Land | 2010 2009 | 225,000 139,038 | - - | 145,000 - | - 300,748 | 125,000 100,000 | 145,000 - | - - | 56,540 32,654 | 696,540 572,440 |

Marc R. Junghans(9) Vice President Exploration | 2010 2009 2008 | 254,000 254,000 294,000 | - - 15,852 | - - - | - 352,785 - | 90,000 90,000 50,000 | - - - | - - - | 74,738 130,199 365,375 | 418,738 826,984 725,227 |

Shannon Ouellette(10) Chief Operating Officer | 2010 2009 | 250,000 141,186 | - - | 195,000 - | - 351,499 | 150,000 90,000 | 195,000 - | - - | 59,464 131,160 | 849,464 713,845 |

| (1) | See “Executive and Director Compensation - Restricted Share Unit Plan” for a description of the RSU Plan (as defined herein). No RSUs were granted as part of 2009 or 2010 compensation. For 2008, RSU values were calculated using the methodology identified in Section 3870 of the CICA Handbook (accounting fair value), which the Board determined to be the methodology which most accurately reflects the valuation of the RSU grants. The grant date fair value of the RSU grants (without using the methodology identified in Section 3870 of the CICA Handbook) would be $3,029,400 based on the five day weighted average TSX closing price of Compton’s shares prior to the date of grant, which is a theoretical value calculated at the date of grant. Realized values are determined when the incentives are payable to the NEO. The RSUs vest as to one-third of the RSUs granted on each of the first anniversary, second anniversary and the third anniversary less one day of the date of grant. |