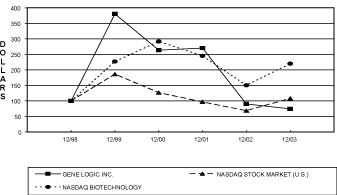

As part of the proxy statement disclosure requirements mandated by the Securities and Exchange Commission, the Company is required to provide a comparison of the cumulative total stockholder return on its Common Stock with that of a broad equity market index and either a published industry index or a company-constructed peer group index. The following graph compares the performance of the Company’s Common Stock for the periods indicated with the performance of the Nasdaq Stock Market (U.S.) Index and the Nasdaq Biotechnology Index. The comparison assumes $100 was invested on December 31, 1998 in the Company’s Common Stock and in each of the foregoing indices and assumes the reinvestment of all dividends.

CERTAIN TRANSACTIONS

During April 1999, the Company issued a promissory note in the amount of $150,000 to Dr. Dolginow, an executive officer of the Company, to offset tax liabilities for unrealized capital gains resulting from stock option exercises. The secured promissory note bore interest of 5.25%. Dr. Dolginow’s note was required to be repaid in four equal annual installments together with accrued interest. The outstanding balance on this loan, including unpaid interest, was repaid in full in April 2003.

Prior to July 2001, the Company had a Flow-thru ChipTM technology, which comprised a microarray platform designed to provide higher chip throughput than that of commercially available alternatives. The Company never realized any income from the development of this technology before July 2001. Because the Company decided that this technology was not part of its core business, management concluded that this business opportunity could best be developed through a separate entity with access to independent capital sources and dedicated management. Accordingly, in July 2001, the Company transferred the assets and rights related to the Flow-thru ChipTM technology to a separate company, MetriGenix, Inc. (“MetriGenix”), in exchange for shares of MetriGenix Class A common stock. MetriGenix also completed a $15 million equity financing. Upon completion of the financing, the Company owned approximately 54% and a group of investors owned approximately 46%, of MetriGenix’s outstanding stock. The investors included several Oxford investment limited partnerships (which purchased 47% of the preferred stock) and a Burrill investment limited partnership (which purchased 27% of the preferred stock), in which Mr. Dimmler, a director of the Company, was, at the time, an indirect affiliate. Dr. Brennan, a director of the Company and, then, of MetriGenix, was then (and until April 2003) one of several general partners in the general partner of each of the Oxford investment limited partnerships. The Company and the investors entered into a stockholders’ agreement, which contained certain restrictions on transfer of MetriGenix stock, provisions regarding certain matters of corporate governance (including provisions that provide the investors with veto rights with respect to all significant aspects of MetriGenix’s operations and with majority representation on the Board of Directors), approval rights with respect to related party transactions and informational requirements.

From July 2001 to November 2003, the Company subleased space to MetriGenix and provided various administrative services which varied from time to time, for monthly fees which were intended to reimburse the Company for costs incurred by the Company in providing such subleased space and administrative services. MetriGenix paid fees totaling $678,000, $793,000 and $256,000 for the years 2003, 2002 and 2001, respectively. The Company also entered into a GeneExpress® database subscription with MetriGenix, amended in 2002 to limit the subscription to the BioExpressTM database and extend access through 2005. Under the terms of the amended license, MetriGenix was not required to pay any license fees until the Company’s percentage of ownership of MetriGenix was reduced below 15% or MetriGenix completed an initial public offering yielding at least $10 million, resulting in significant potential savings to MetriGenix compared to a standard, arms’ length, fee-bearing commercial arrangement.

Neither the Company nor the investors had any funding obligations with respect to MetriGenix. In 2002, MetriGenix began to seek additional financing, with little success, due in large part to the existing conditions in the capital markets for biotechnology companies. To enable MetriGenix to continue to operate during its search for funding, in 2003 certain existing investors provided MetriGenix bridge debt financing of $2.3 million, including $1.4 million provided by Oxford affiliates.

MetriGenix continued to seek financing and to consider available strategic alternatives throughout most of 2003. In November 2003, concluding that further additional financing was not available from either existing or third party investors, MetriGenix sold substantially all of its assets for cash to an unrelated privately held company (the “Buyer”). The cash proceeds of the sale were sufficient to satisfy MetriGenix’s then known liabilities in amounts settled upon by MetriGenix with its creditors, and to fund the winding down of that company. Among the liabilities compromised and paid were approximately $1,050,000 in outstanding bridge debt (of which approximately $700,000 was paid to Oxford affiliates) and approximately $373,000 to the Company in satisfaction of past due amounts for rent and services. As a result of the sale of MetriGenix, the holders of preferred stock in MetriGenix received no further consideration with respect to, or return on, their equity in MetriGenix. As additional consideration for the sale of MetriGenix, the Company agreed to an assignment of the BioExpressTM database subscription, for which it received stock of Buyer. Mr. Gessler, the Chief Executive Officer of the Company, also was appointed a director of Buyer.

19

In connection with the formation of MetriGenix, Messrs. Gessler and Rohrer and Drs. Brennan and Dolginow (all executive officers of the Company except Dr. Brennan who is a director of the Company) purchased, respectively, 125,000, 100,000, 100,000 and 20,000 restricted shares of common stock of MetriGenix at a purchase price of $0.30 per share. The shares vested over three years, subject to earlier vesting in the case of certain events such as a change of control or an initial public offering of stock. The Company loaned Dr. Dolginow and Mr. Rohrer $6,000 and $30,000, respectively, to fund the purchases, in exchange for promissory notes due August 2008 or earlier under certain circumstances, bearing interest at 5.64%, with full recourse against the borrowers and secured by a pledge of the stock. MetriGenix was entitled to repurchase unvested shares in certain circumstances and the shares were subject to certain restrictions on transfer. In connection with the sale of the assets of MetriGenix, these loans became due and payable and the Company foreclosed on the pledged shares of MetriGenix common stock in satisfaction of the full amounts of principal and interest then due from Mr. Rohrer and Dr. Dolginow of $34,003 and $6,801, respectively. The shares were transferred by the Company to Buyer in exchange for additional shares of preferred stock of Buyer. Mr. Gessler also sold his stock in MetriGenix to Buyer in exchange for approximately 0.2% of the preferred stock of Buyer.

While all of the transactions noted above in this section were considered by the Company to be on terms which were fair and reasonable taking into account existing relationships, such transactions were not necessarily on terms the Company would have made available to unrelated third parties.

In 2003, the Company derived 1.5% of the Company’s total revenue from agreements with customers in which various limited partnerships affiliated with Oxford Biosciences Partners are investors. Dr. Brennan, a director of the Company, was a former partner of Oxford Biosciences Partners, through which he had certain limited direct and indirect equity interests in each of these customers, which were portfolio companies of funds with which Oxford Biosciences Partners was affiliated. During the second quarter of 2003, for reasons completely unrelated to Gene Logic, Dr. Brennan ceased to be a partner of Oxford Biosciences Partners. Presently, Dr. Brennan retains only a minor, passive interest in the investment partnerships affiliated with such Oxford-related customers. The agreements with Oxford-related customers are on terms no more favorable than those available to other third-party customers.

The Company has entered into indemnity agreements with certain officers and all directors which provide, among other things, that the Company will indemnify such officer or director, under the circumstances and to the extent provided for therein, for expenses (including attorney fees), witness fees, damages, judgments, fines and settlements he may be required to pay in actions or proceedings to which he is or may be made a party by reason of his position as a director, officer or other agent of ours, and otherwise to the full extent permitted under Delaware law and the Company’s Amended and Restated Bylaws.

OTHER MATTERS

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

GENE LOGIC INC.

Gaithersburg, Maryland

April 26, 2004

A copy of the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission for the year ended December 31, 2003 is available without charge upon written request to: Corporate Communications, Gene Logic Inc., 610 Professional Drive, Gaithersburg, Maryland 20879.

| (1) | | This section is not “soliciting material,” is not deemed filed with the SEC and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing. |

20

EXHIBIT A

Amended and Restated as of March 12, 2004

AUDIT COMMITTEE CHARTER

GENE LOGIC INC.

PURPOSE AND POLICY

The purpose of the Audit Committee is to represent and assist the Board of Directors in its general oversight of the Company’s accounting and financial reporting processes, audits of the financial statements, and internal control and audit functions. Management is responsible for (a) the preparation, presentation and integrity of the Company’s financial statements; (b) accounting and financial reporting principles; and (c) the Company’s internal controls and procedures designed to promote compliance with accounting standards and applicable laws and regulations. The Company’s independent auditing firm is responsible for performing an independent audit of the consolidated financial statements in accordance with generally accepted auditing standards.

The Audit Committee members are not professional accountants or auditors and their functions are not intended to duplicate or to certify the activities of management and the independent auditor, nor can the Committee certify that the independent auditor is “independent” under applicable rules. The Audit Committee serves a board level oversight role to oversee the relationship with the independent auditor, as set forth in this charter, and provide advice, counsel and general direction, as it deems appropriate, to management and the auditors on the basis of the information it receives, discussions with the auditor, and the experience of the Committee’s members in business, financial and accounting matters.

COMPOSITION AND ORGANIZATION

The members and the chairman of the Audit Committee will be appointed each year by the Board and shall serve at the pleasure of the Board and for such term or terms as the Board may determine. The Audit Committee shall comprise at least three directors determined by the Board of Directors to meet the applicable independence and financial literacy requirements of The NASDAQ Stock Market, Inc. (“NASDAQ”) and applicable federal law. At least one member of the Committee should be an “audit committee financial expert” as defined under applicable law and regulations.

Appointment to the Committee, including the designation of the Chair of the Committee and the designation of any Committee members as “audit committee financial experts”, shall be made on an annual basis by the full Board upon recommendation of the Nominating Committee.

The Committee shall meet at least quarterly and otherwise at such times and places as the Audit Committee shall determine. The Audit Committee shall meet in executive session with the independent auditor and management periodically. The Committee shall maintain minutes of each meeting and provide them to all members of the Board, and shall report on matters considered at Committee meetings to the Board at the next quarterly Board meeting. The Chairman of the Audit Committee is to be contacted directly by the independent auditor (1) to review items of a sensitive nature that can impact the accuracy of financial reporting or (2) to discuss significant issues relative to the overall Board responsibility that have been communicated to management but, in their judgment, may warrant follow-up by the Audit Committee.

The operation of the Audit Committee shall be subject to the Bylaws of the Company as in effect from time to time and Section 141 of the Delaware General Company Law.

RESPONSIBILITIES

The Audit Committee:

| • | | Is directly responsible for the appointment, replacement, compensation, and oversight of the work of the independent auditor, including resolution of disagreements between management and the auditor regarding |

A-1

| | | final reporting for the purpose of preparing or issuing an audit report or related work. The independent auditor shall report directly to the Audit Committee. With respect to the independent auditors, the Committee shall: |

| | (a) annually appoint the independent auditors |

| | (b) establish policies and procedures for the review and pre-approval by the Committee of all auditing services and permissible non-audit services (including the fees and terms thereof) to be performed by the independent auditor, with exceptions provided for within specified limits under certain circumstances as described by law, and shall review and approve the audit scope and fees and terms of engagement of the independent auditor, consistent with the Committee’s policies |

| | (c) at least annually receive from the independent auditors a formal written statement describing: the auditors’ internal quality-control procedures; any material issues raised by the most recent internal quality-control review, or peer review, of the auditors, or by any inquiry or investigation by governmental or professional authorities, within the preceding 5 years, respecting one or more independent audits carried out by the auditors, and any steps taken to deal with any such issues; and (to assess the auditors’ independence) all relationships between the auditors and the Company, including each non-audit service provided to the Company, and the matters set forth in Independence Standards Board No. 1 and discuss with the auditors any disclosed relationships or services that may impact the quality of the audit services or the auditors’ objectivity and independence |

| | (d) review and evaluate the qualifications, performance and independence of the independent auditor and of the auditors’ lead partner, taking into account the opinions of management |

| | (e) discuss with management the timing and process for implementing the rotation of the lead audit partner and the reviewing partner and consider whether there should be a regular rotation of the audit firm itself |

| • | | Reviews with management and the independent auditor the annual financial statements and quarterly financial statements and other financial reporting matters, including: |

| | (a) the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” |

| | (b) significant transactions which are not a normal part of the Company’s operations |

| | (c) the selection, application and disclosures of critical accounting policies, any major issues regarding accounting principles and financial statement presentations, including any significant changes in the company’s selection or application of accounting principles |

| | (d) significant adjustments proposed by the independent auditors, including any such adjustments not made |

| | (e) analyses prepared by management and/or the independent auditors setting forth significant financial reporting issues and judgments made in connection with the preparation of the financial statements, including analyses of the effects of alternative GAAP methods on the financial statements |

| | (f) the effect of any regulatory and accounting initiatives, as well as off-balance sheet structures on the company’s financial statements |

| | (g) the matters required to be discussed with the independent auditors by Statement of Auditing Standards No. 61, “Communications With Audit Committees” including the quality, not just the acceptability, of the accounting principles and underlying estimates used in the audited financial statements |

| | (h) any difficulties encountered by the independent auditors in the course of the audit work, including any restriction on the scope of their activities or on access to requested information, and any significant disagreements with management |

| | (i) instances where management has obtained second opinions from other auditors, any accounting adjustments that were noted or proposed by the auditors but were “passed” (as immaterial or otherwise), and any communications between the audit team and the auditors’ national office regarding auditing or accounting issues presented by the engagement |

A-2

| | (j) any management or internal control letter issued, or proposed to be issued, by the independent auditors and management’s response thereto |

| | (k) discussion of earnings press releases, as well as the types of financial information and earnings guidance (if any) provided to analysts |

| | (m) discussion of guidelines and policies governing the process by which senior management assesses and manages the Company’s exposure to financial risk, and the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures |

| • | | Discusses with management and the independent auditor quarterly earnings press releases, including the interim financial information and any financial forecasting included therein |

| • | | Reviews and has prior-approval authority for related-party transactions (as defined in the relevant NASDAQ requirements) |

| • | | Reviews and discusses with management each year, subject to quarterly monitoring as to effectiveness: |

| | (a) the adequacy and effectiveness of the Company’s internal controls (including any significant deficiencies and significant changes in internal controls reported to the Committee by the independent auditor or management); |

| | (b) the Company’s internal audit procedures; |

| | (c) any significant internal fraud issues and |

| | (d) the adequacy and effectiveness of the Company’s disclosures controls and procedures, and management reports thereon. |

| • | | Reviews matters related to the corporate compliance activities of the Company. |

| • | | Establishes and implements procedures for the receipts, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. |

| • | | Approves the Audit Committee Report required by the rules of the Securities and Exchange Commission to be included in the Company’s Annual Report of Form 10-K. |

| • | | When appropriate, designates one or more of its members to perform certain of its duties on its behalf, subject to such reporting to or ratification by the Committee as the Committee shall direct. |

PERFORMANCE EVALUATION

The Committee shall produce and provide to the Board an annual performance evaluation of the Committee, which evaluation shall compare the performance of the Committee with the requirements of this charter. The performance evaluation shall also recommend to the Board any improvements to the Committee’s charter deemed necessary or desirable by the Committee. The performance evaluation shall be conducted in such manner as the Committee deems appropriate, and may be a written or oral report.

DELEGATION TO SUBCOMMITTEE

The Committee may, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee consisting of one or more members of the Committee.

RESOURCES AND AUTHORITY

The Committee shall have the resources and authority appropriate to discharge its duties and responsibilities, including the authority to select, retain, terminate, and approve the fees and other retention terms of independent counsel and other advisors, including outside auditors for special audits, reviews and other procedures, as it deems appropriate, without seeking the approval of the Board or management.

A-3

| | Please

Mark Here

for Address

Change or

Comments | £ |

| | SEE REVERSE SIDE |

| MANAGEMENT RECOMMENDS A VOTE FOR PROPOSAL 1. | | |

| | | | MANAGEMENT RECOMMENDS A VOTE FOR PROPOSAL 2. |

| Proposal 1: | To elect two directors to hold office until the 2007

Annual Meeting of Stockholders. | | |

| | | | | | | | | | | | | FOR | | AGAINST | | ABSTAIN |

| | £ | | FOR all nominees listed

below (except as marked

to the contrary below) | | £ | | WITHHOLD AUTHORITY

to vote for the nominees

listed below | | Proposal 2: | To ratify selection of Ernst & Young LLP as

independent auditors of the Company for its

year ending December 31, 2004. | | £ | | £ | | £ |

Nominees:

01 Jules Blake, Ph.D. and 02 Michael J. Brennan, M.D., Ph.D.

TO WITHHOLD AUTHORITY TO VOTE FOR ANY NOMINEE(S) WRITE SUCH

NOMINEE(S)’ NAME(S) OR NUMBER(S) BELOW.

|

| |

| | | | Dated: | | , 2004 |

| | | |

| |

| | | | Signature |

| | | | | | |

| | | | Signature if held jointly |

| | | | | | |

| PLEASE VOTE, DATE AND PROMPTLY RETURN THIS PROXY IN THE ENCLOSED RETURN ENVELOPE WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES. | | | Please sign exactly as your name appears hereon. If the stock is registered in the names of two or more persons, each should sign. Executors, administrators, trustees, guardians and attorneys-in-fact should add their titles. If signer is a corporation, please give full corporate name and have a duly authorized officer sign, stating title. If signer is a partnership, please sign in partnership name by authorized person. |

| | | | | | |

Vote by Telephone or Mail

24 Hours a Day, 7 Days a Week

Telephone voting is available through 11:59 PM Eastern Time

the day prior to annual meeting day.

Telephone vote authorizes the named proxies to vote your shares in the same manner

as if you marked, signed and returned your proxy card.

Telephone

1-800-435-6710 Use any touch-tone telephone to vote your proxy. Have your proxy card in hand when you call. | OR | Mail

Mark, sign and date

your proxy card

and

return it in the

enclosed postage-paid

envelope.

|

If you vote your proxy by telephone,

you do NOT need to mail back your proxy card.

| | GENE LOGIC INC. PROXY SOLICITED BY THE BOARD OF DIRECTORS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 3, 2004 The undersigned hereby appoints Mark D. Gessler and Philip L. Rohrer, Jr., and each of them, as attorneys and proxies of the undersigned, with full power of substitution, to vote all of the shares of stock of GENE LOGIC INC. which the undersigned may be entitled to vote at the Annual Meeting of Stockholders of GENE LOGIC INC. to be held at the Company’s executive offices, 610 Professional Drive, Gaithersburg, Maryland 20879, on Thursday, June 3, 2004 at 3:00 p.m. local time, and at any and all postponements, continuations and adjournments thereof, with all powers that the undersigned would possess if personally present, upon and in respect of the following matters and in accordance with the following instructions, with discretionary authority as to any and all other matters that may properly come before the meeting. UNLESS A CONTRARY DIRECTION IS INDICATED, THIS PROXY WILL BE VOTED FOR ALL NOMINEES LISTED IN PROPOSAL 1, AND FOR PROPOSAL 2, AS MORE SPECIFICALLY DESCRIBED IN THE PROXY STATEMENT. IF SPECIFIC INSTRUCTIONS ARE INDICATED, THIS PROXY WILL BE VOTED IN ACCORDANCE THEREWITH. MANAGEMENT RECOMMENDS A VOTE FOR THE NOMINEES FOR DIRECTOR LISTED ON THE OTHER SIDE AND FOR PROPOSAL 2. (CONTINUED AND TO BE SIGNED ON OTHER SIDE.) | |

| | Address Change/Comments (Mark the corresponding box on the reverse side) | |

| |

| |