Exhibit 99.1

Ore Pharmaceuticals A Pharmaceutical Asset Management Company 1 September, 2009

Disclaimer This presentation contains “forward-looking statements,” as such term is used in the Securities Exchange Act of 1934, as amended. Such forward-looking statements include our ability to identify strategies for making its businesses successful and the impact of such strategies on our business and financial performance and on shareholder value. Forward-looking statements typically include the words “expect,” “anticipate,” “believe,” “estimate,” “intend,” “may,” “will,” and similar expressions as they relate to Ore Pharmaceuticals or its management. Forward-looking statements are based on our current expectations and assumptions, which are subject to risks and uncertainties. They are not guarantees of our future performance or results. Our actual performance and results could differ materially from what we project in forward-looking statements for a variety of reasons and circumstances, including particularly risks and uncertainties that may affect the Company’s operations, financial condition and financial results and that are discussed in detail in the our Annual Report on Form 10-K and our other subsequent filings with the Securities and Exchange Commission. They include, but are not limited to: whether the compounds we develop will be commercially viable; whether we will be able to begin to generate sufficient new revenue from licensing or other transactions early enough to support our operations and continuing compound development; whether there will be valid claims for indemnification from the buyers of our Genomics Assets; whether there will be claims from the landlords of the leased properties we have assigned, the buyer of our Preclinical Division or the assignee of our Cambridge facility lease, that we would be required to pay as guarantors of such leases; whether we will be able to collect amounts due under the terms of promissory notes from the buyers of our Genomics Assets and molecular diagnostic business; whether we will be able to manage our existing cash adequately and whether we will have access to financing on sufficiently favorable terms to maintain our businesses and effect our strategies; whether we will be able to maintain our NASDAQ listing; whether we will be able to attract and retain qualified personnel for our business; and potential negative effects on our operations and financial results from workforce reductions and the transformation of our business. Stockholders may obtain a free copy of any documents filed by the Company with the SEC at the SEC’s web site at www.sec.gov or through the Company’s web site at www.orepharma.com. Ore Pharmaceuticals Inc. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. 2

Corporate Overview • Publicly-listed pharmaceutical asset management company (NASDAQ: ORXE) • Offices in Cambridge, MA • Turnaround situation • New, highly-motivated management team • Four attractive clinical-stage pharmaceutical assets under “incubation” • $8.4M in cash and notes receivable as of 6/30/09 – Sufficient to fund operations through late 2010 at expected burn • Clean and transparent capital structure • $324M tax loss carry-forward as of 12/31/2008 • $3.3M market cap as of 9/8/09 3

The Opportunity • Pharmaceuticals is an attractive business – Relatively inelastic demand – Favorable demographic trends – High barriers to entry • Traditional biotech model of drug discovery & development is flawed – Public investors are no longer interested in funding research – Investment capital often deployed on non value-enhancing activities (e.g., The Opportunity corporate overhead) – Management, shareholder incentives often misaligned • Current environment offers an extraordinary opportunity to capture highquality pharmaceutical assets on favorable terms – Major pharmaceutical companies rationalizing portfolios – Smaller discovery/development companies lack capital Key Issue – How to manage and finance acquisition and development in today’s environment? 4

What We Do • Asset management approach – Risk-adjusted ROI drives decisions • Strategy: – Acquire/in-license diversified portfolio of promising, undervalued pharmaceutical assets in disease areas that are: • A priority for pharmaceutical companies • Associated with rapid and low-cost demonstration of therapeutic value – Use minimally-dilutive third-party financing to develop assets – Enhance asset value via targeted development – Monetize investment to maximize ROI • Focus: – Targeted development of clinical-stage compounds – Value-added development of mature pharmaceutical brands – Special or opportunistic investment situations that meet our ROI criteria • Goal: create a stable, profitable business based on: – Program management fees and/or structuring fees – Substantial profit interests in successful projects 5

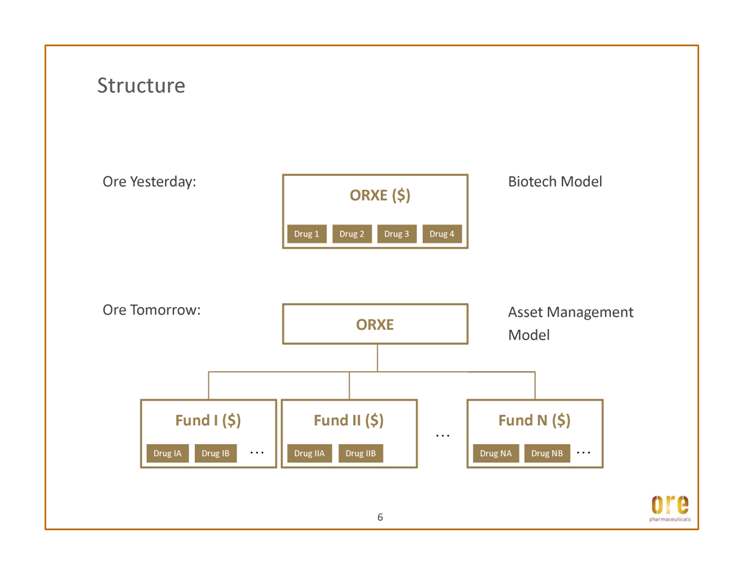

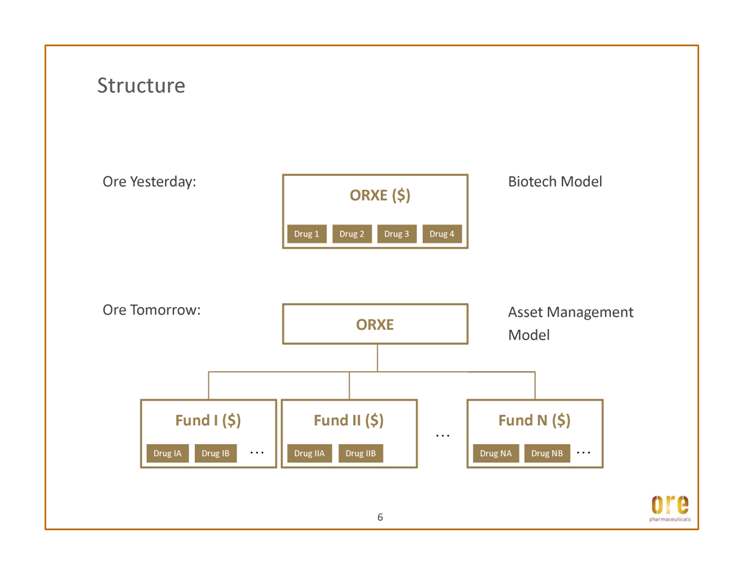

Structure Ore Yesterday: ORXE ($) Biotech Model 6 Ore Tomorrow: ORXE Fund I ($) … Fund II ($) … … Fund N ($) … Drug NA Drug NB Asset Management Model

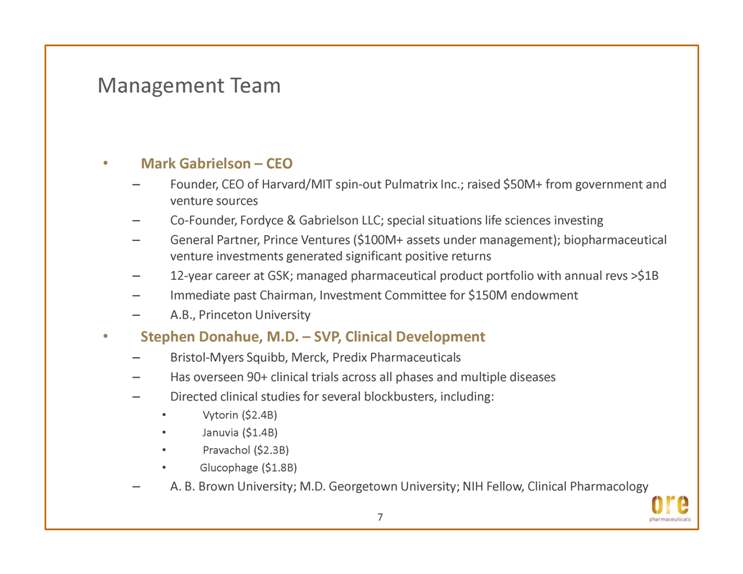

Management Team • Mark Gabrielson – CEO – Founder, CEO of Harvard/MIT spin-out Pulmatrix Inc.; raised $50M+ from government and venture sources – Co-Founder, Fordyce & Gabrielson LLC; special situations life sciences investing – General Partner, Prince Ventures ($100M+ assets under management); biopharmaceutical venture investments generated significant positive returns – 12-year career at GSK; managed pharmaceutical product portfolio with annual revs >$1B – Immediate past Chairman, Investment Committee for $150M endowment – A.B., Princeton University • Stephen Donahue, M.D. – SVP, Clinical Development – Bristol-Myers Squibb, Merck, Predix Pharmaceuticals – Has overseen 90+ clinical trials across all phases and multiple diseases – Directed clinical studies for several blockbusters, including: • Vytorin ($2.4B) • Januvia ($1.4B) • Pravachol ($2.3B) • Glucophage ($1.8B) – A. B. Brown University; M.D. Georgetown University; NIH Fellow, Clinical Pharmacology 7

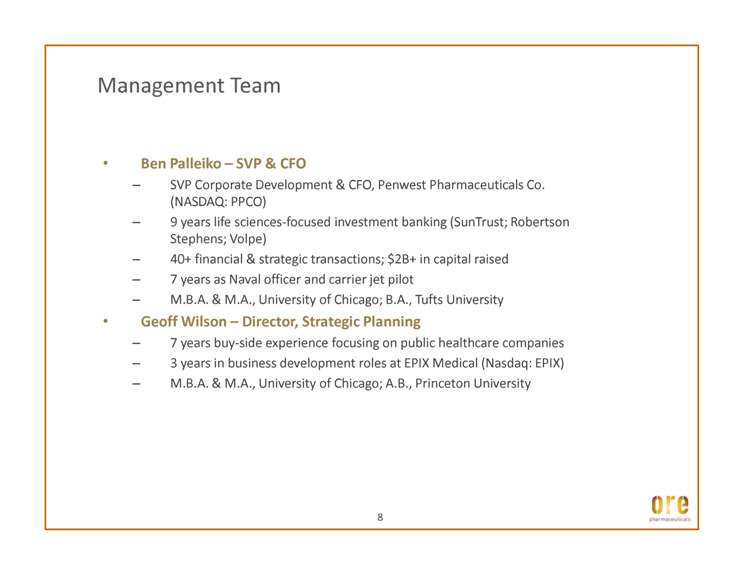

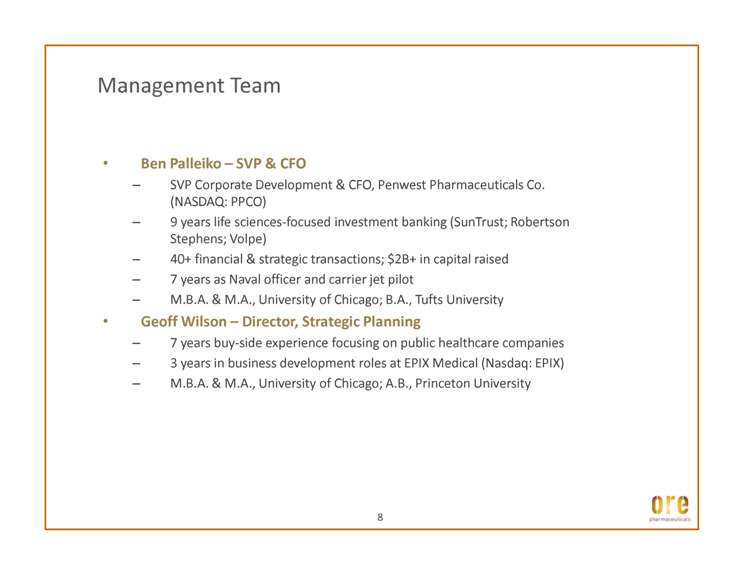

• Ben Palleiko – SVP & CFO – SVP Corporate Development & CFO, Penwest Pharmaceuticals Co. (NASDAQ: PPCO) – 9 years life sciences-focused investment banking (SunTrust; Robertson Stephens; Volpe) – 40+ financial & strategic transactions; $2B+ in capital raised – 7 years as Naval officer and carrier jet pilot Management Team – M.B.A. & M.A., University of Chicago; B.A., Tufts University • Geoff Wilson – Director, Strategic Planning – 7 years buy-side experience focusing on public healthcare companies – 3 years in business development roles at EPIX Medical (Nasdaq: EPIX) – M.B.A. & M.A., University of Chicago; A.B., Princeton University 8

• James W. Fordyce – Director – Director since August 2009 – Current Managing Partner of MEDNA Partners LLC – General Partner, Prince Ventures; notable venture investments included Genentech, Applied Biosystems, Centocor, and Regeneron – Chairman Emeritus of the Board of Directors of the Albert and Mary Lasker Foundation • Mark J. Gabrielson – President & CEO Board of Directors • G. Anthony Gorry, Ph.D. – Director – Director since January 1997 – Friedkin Professor of Management & Professor of Computer Science, Rice University • J. Stark Thompson, Ph.D. – Chairman – Director since February 2002; Chairman since November 2004 – Former President & CEO of Life Technologies, Inc. • David L. Urdal, Ph.D. – Director – Director since April 2007 – Senior Vice President & Chief Scientific Officer, Dendreon Corp. 9

Core Activities Goal: To identify and in-license promising compounds for little or no up-front capital commitment Ore approach: Improve likelihood of Goal: To source external funding for compound development Goal: To establish robust clinical proof-of-concept as quickly and inexpensively as possible Ore approach: Goal: To monetize successful programs to the fullest extent possible Ore approach: Structure funding vehicles Ore approach: Structure compound sales success by focusing on compounds with: • Prior clinical evidence of safety/tolerability • Prior clinical or preclinical evidence of efficacy in target indication • Clear demand from pharmaceutical companies Focus on high-need indications with welldefined clinical endpoints and predictive animal models. Evaluate alternative dosing and/or novel combinations. Utilize low-cost/highquality geographies for clinical trials whenever possible. to allocate bulk of risk and reward to direct investors, with Ore and its shareholders retaining significant participation in successful programs. and out-licensing deals to maximize expected value. Likely targets include major pharmaceutical companies and mid-tier specialty pharmaceutical companies. 10 Combining an investor mindset with biopharmaceutical development expertise Current

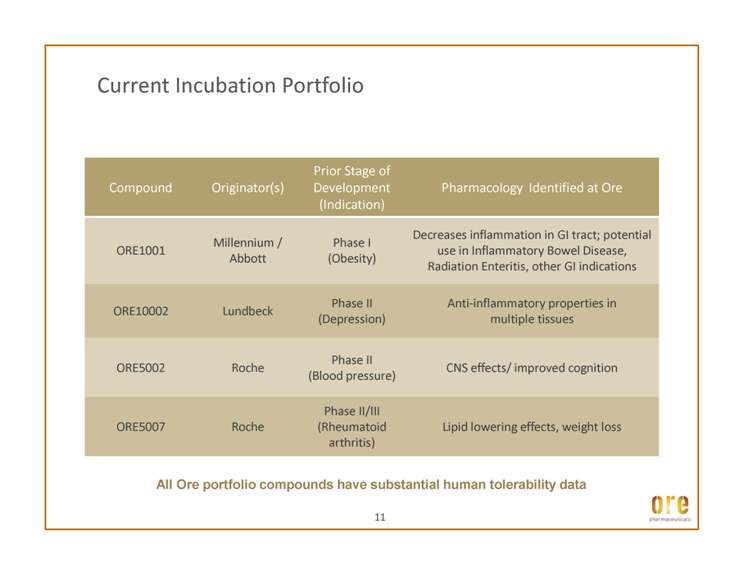

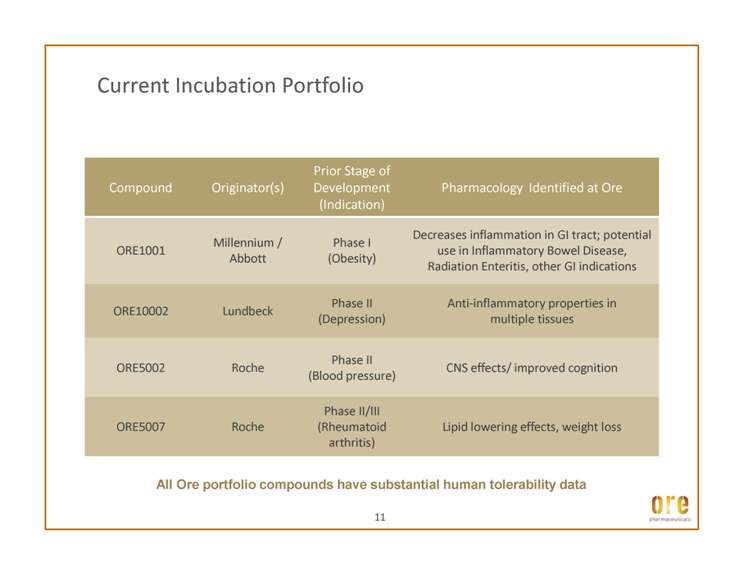

Current Incubation Portfolio Millennium / Abbott Phase I (Obesity) Decreases inflammation in GI tract; potential use in Inflammatory Bowel Disease, Radiation Enteritis, other GI indications All Ore portfolio compounds have substantial human tolerability data ORE10002 Lundbeck Phase II (Depression) Anti-inflammatory properties in multiple tissues ORE5002 Roche Phase II (Blood pressure) CNS effects/ improved cognition ORE5007 Roche Phase II/III (Rheumatoid arthritis) Lipid lowering effects, weight loss

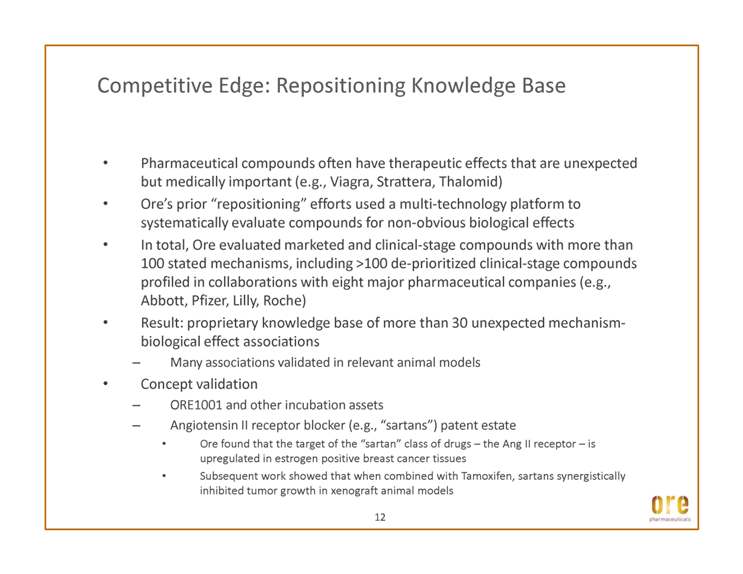

Competitive Edge: Repositioning Knowledge Base • Pharmaceutical compounds often have therapeutic effects that are unexpected but medically important (e.g., Viagra, Strattera, Thalomid) • Ore’s prior “repositioning” efforts used a multi-technology platform to systematically evaluate compounds for non-obvious biological effects • In total, Ore evaluated marketed and clinical-stage compounds with more than 100 stated mechanisms, including >100 de-prioritized clinical-stage compounds profiled in collaborations with eight major pharmaceutical companies (e.g., Abbott, Pfizer, Lilly, Roche) • Result: proprietary knowledge base of more than 30 unexpected mechanismbiological effect associations – Many associations validated in relevant animal models • Concept validation – ORE1001 and other incubation assets – Angiotensin II receptor blocker (e.g., “sartans”) patent estate • Ore found that the target of the “sartan” class of drugs – the Ang II receptor – is upregulated in estrogen positive breast cancer tissues • Subsequent work showed that when combined with Tamoxifen, sartans synergistically inhibited tumor growth in xenograft animal models 12

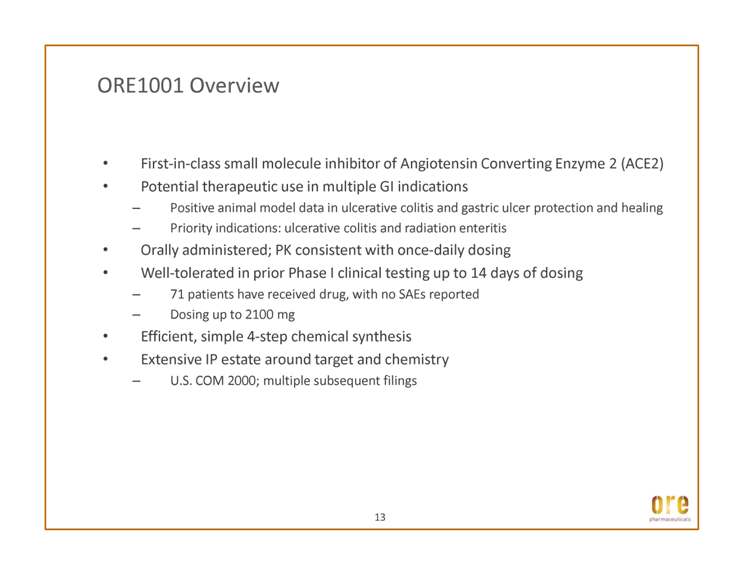

ORE1001 Overview • First-in-class small molecule inhibitor of Angiotensin Converting Enzyme 2 (ACE2) • Potential therapeutic use in multiple GI indications – Positive animal model data in ulcerative colitis and gastric ulcer protection and healing – Priority indications: ulcerative colitis and radiation enteritis • Orally administered; PK consistent with once-daily dosing • Well-tolerated in prior Phase I clinical testing up to 14 days of dosing – 71 patients have received drug, with no SAEs reported – Dosing up to 2100 mg • Efficient, simple 4-step chemical synthesis • Extensive IP estate around target and chemistry – U.S. COM 2000; multiple subsequent filings 13

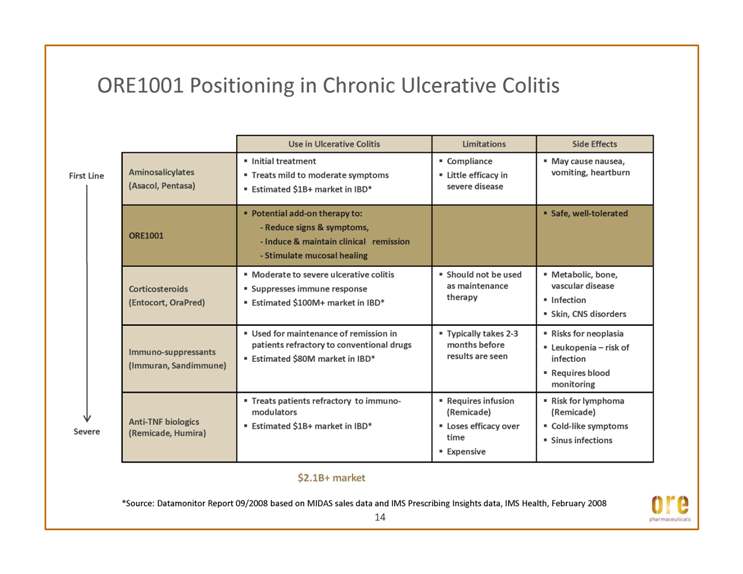

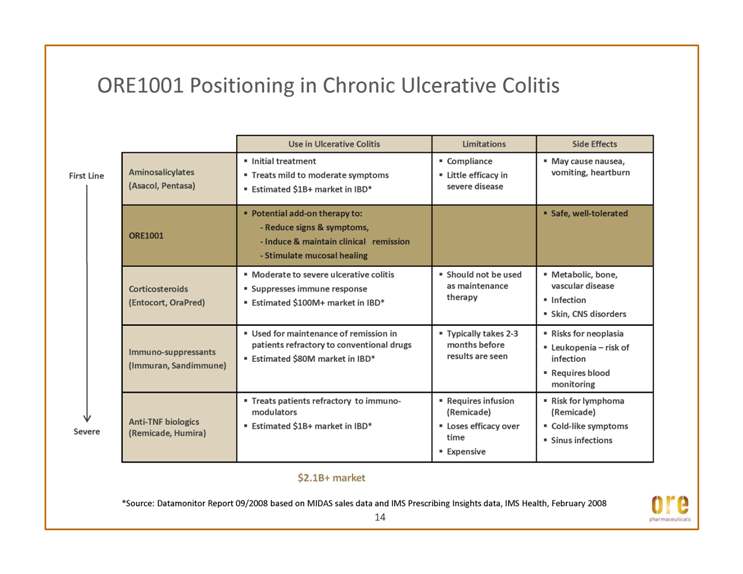

ORE1001 Positioning in Chronic Ulcerative Colitis Use in Ulcerative Colitis Limitations Side Effects Aminosalicylates (Asacol, Pentasa) _ Initial treatment _ Treats mild to moderate symptoms _ Estimated $1B+ market in IBD* _ Compliance _ Little efficacy in severe disease _ May cause nausea, vomiting, heartburn ORE1001 _ Potential add-on therapy to: - Reduce signs & symptoms, - Induce & maintain clinical remission - Stimulate mucosal healing _ Safe, well-tolerated Corticosteroids _ Moderate to severe ulcerative colitis _ Suppresses immune response _ Should not be used as maintenance _ Metabolic, bone, vascular disease First Line (Entocort, OraPred) _ Estimated $100M+ market in IBD* therapy _ Infection _ Skin, CNS disorders Immuno-suppressants (Immuran, Sandimmune) _ Used for maintenance of remission in patients refractory to conventional drugs _ Estimated $80M market in IBD* _ Typically takes 2-3 months before results are seen _ Risks for neoplasia _ Leukopenia – risk of infection _ Requires blood monitoring Anti-TNF biologics (Remicade, Humira) _ Treats patients refractory to immunomodulators _ Estimated $1B+ market in IBD* _ Requires infusion (Remicade) _ Loses efficacy over time _ Expensive _ Risk for lymphoma (Remicade) _ Cold-like symptoms _ Sinus infections Severe *Source: Datamonitor Report 09/2008 based on MIDAS sales data and IMS Prescribing Insights data, IMS Health, February 2008 14 $2.1B+ market

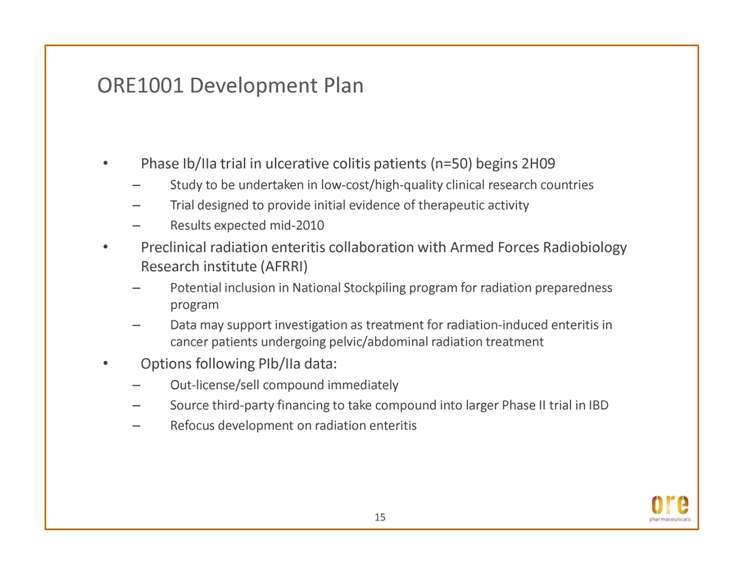

• Phase Ib/IIa trial in ulcerative colitis patients (n=50) begins 2H09 – Study to be undertaken in low-cost/high-quality clinical research countries – Trial designed to provide initial evidence of therapeutic activity – Results expected mid-2010 • Preclinical radiation enteritis collaboration with Armed Forces Radiobiology Research institute (AFRRI) – Potential inclusion in National Stockpiling program for radiation preparedness ORE1001 Development Plan program – Data may support investigation as treatment for radiation-induced enteritis in cancer patients undergoing pelvic/abdominal radiation treatment • Options following PIb/IIa data: – Out-license/sell compound immediately – Source third-party financing to take compound into larger Phase II trial in IBD – Refocus development on radiation enteritis 15

• Differentiated, ROI-driven approach • Substantial clinical development capability • Incubating four promising clinical-stage compounds • Restructuring to an asset management business model • Repositioning knowledge base provides competitive edge in identifying additional undervalued assets Experienced, capable management team Summary • • Favorable risk/return profile given current valuation – $3.3M market cap as of 9/8/2009 16

Appendix 1: ORE1001 A promising new therapeutic candidate for Inflammatory Bowel Disease

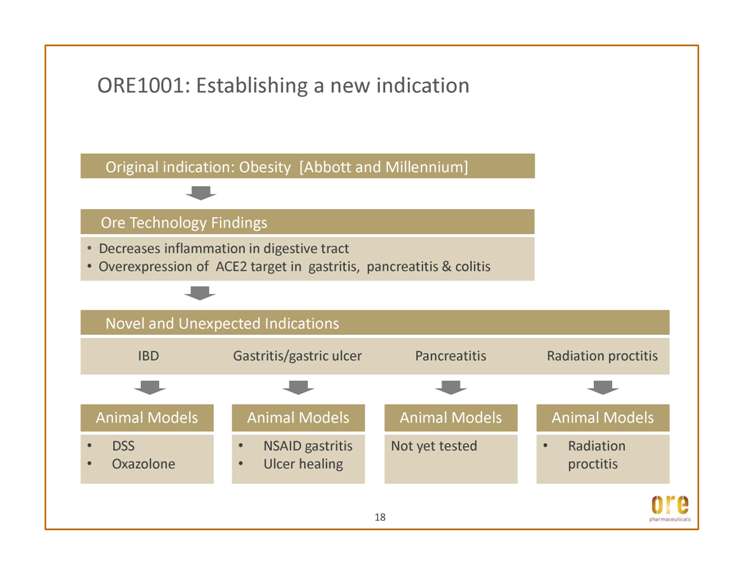

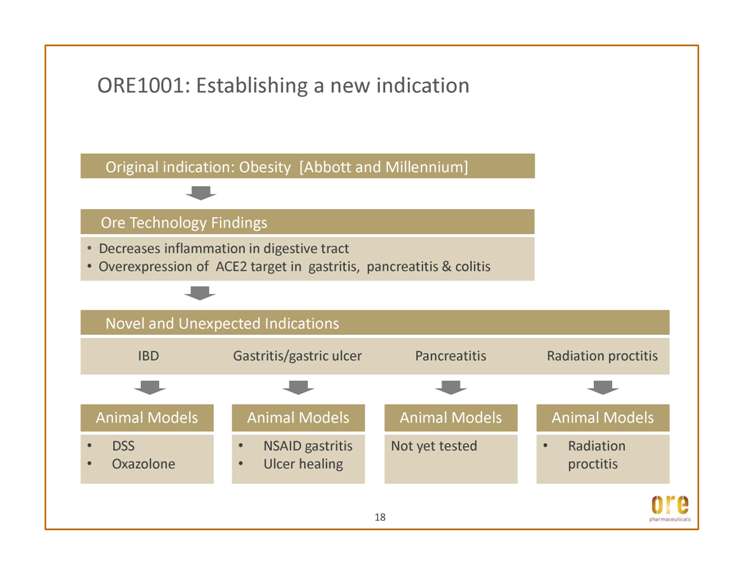

ORE1001: Establishing a new indication • Decreases inflammation in digestive tract • Overexpression of ACE2 target in gastritis, pancreatitis & colitis • DSS • Oxazolone IBD Gastritis/gastric ulcer Pancreatitis Radiation proctitis • NSAID gastritis • Ulcer healing Not yet tested • Radiation proctitis 18

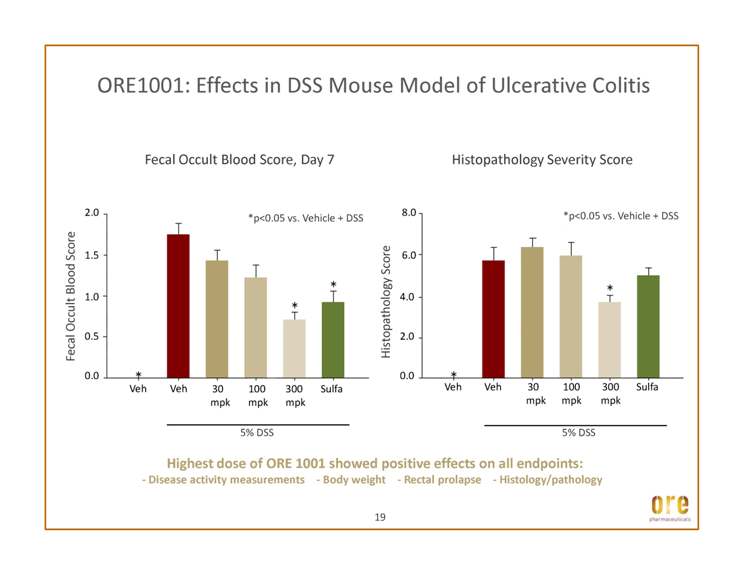

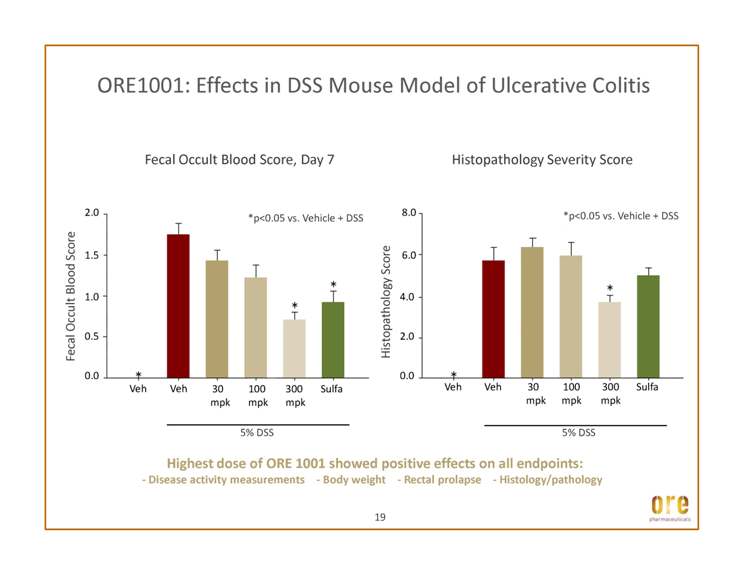

ORE1001: Effects in DSS Mouse Model of Ulcerative Colitis Histopathology Score 8.0 Fecal Occult Blood Score 2.0 Fecal Occult Blood Score, Day 7 Histopathology Severity Score 6.0 1.5 *p<0.05 vs. Vehicle + DSS *p<0.05 vs. Vehicle + DSS 19 0.0 2.0 4.0 Veh Veh 30 mpk 100 mpk 300 mpk Sulfa 5% DSS 0.0 0.5 1.0 Veh Veh 30 mpk 100 mpk 300 mpk Sulfa 5% DSS Highest dose of ORE 1001 showed positive effects on all endpoints: - Disease activity measurements - Body weight - Rectal prolapse - Histology/pathology

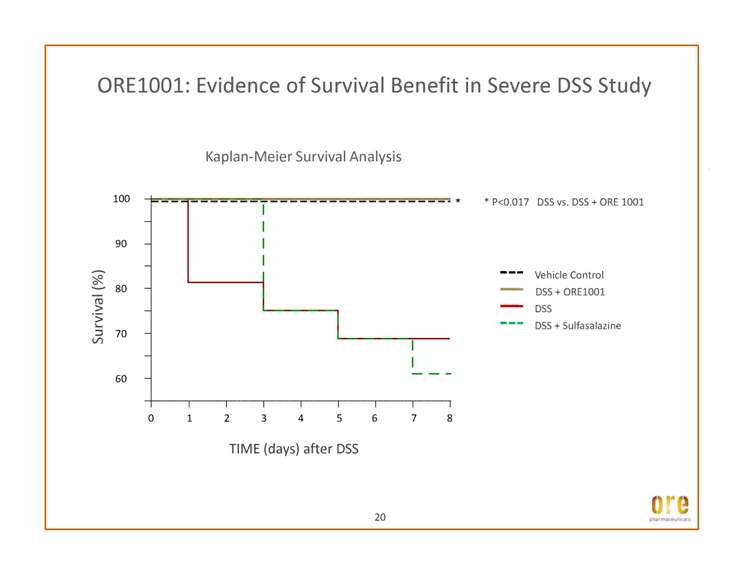

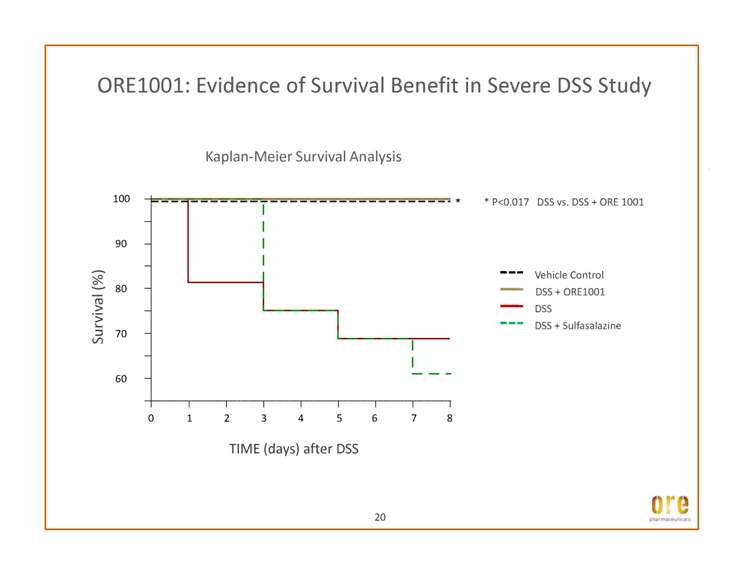

ORE1001: Evidence of Survival Benefit in Severe DSS Study * P<0.017 DSS vs. DSS + ORE 1001 Vehicle Control DSS + ORE1001 80 90 100 * Survival (%) Kaplan-Meier Survival Analysis DSS DSS + Sulfasalazine 0 1 2 3 4 5 6 7 8 60 70 TIME (days) after DSS

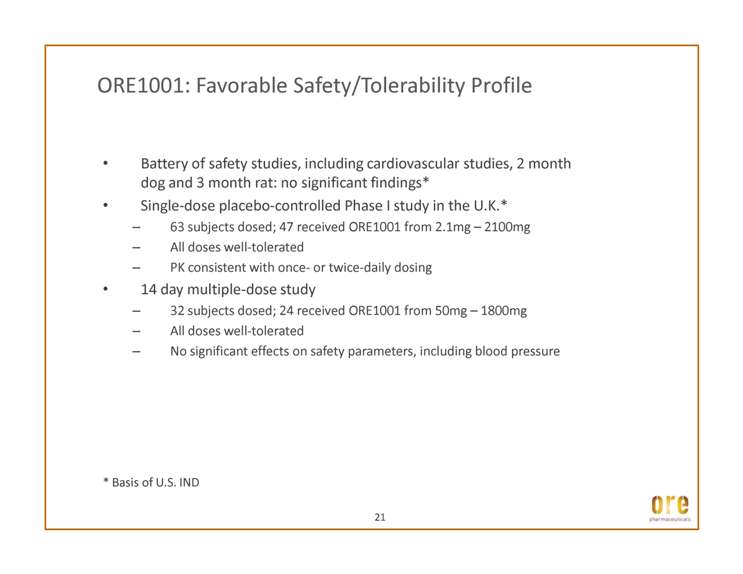

ORE1001: Favorable Safety/Tolerability Profile • Battery of safety studies, including cardiovascular studies, 2 month dog and 3 month rat: no significant findings* • Single-dose placebo-controlled Phase I study in the U.K.* – 63 subjects dosed; 47 received ORE1001 from 2.1mg – 2100mg – All doses well-tolerated – PK consistent with once- or twice-daily dosing • 14 day multiple-dose study – 32 subjects dosed; 24 received ORE1001 from 50mg – 1800mg – All doses well-tolerated – No significant effects on safety parameters, including blood pressure * Basis of U.S. IND 21

Where to Find Additional Information about the Potential Reorganization of Ore Pharmaceuticals On September 2, 2009, Ore Pharmaceuticals Inc. (the “Company”) filed a registration statement with the SEC on Form S-4/A that includes a definitive proxy statement/prospectus and other relevant materials regarding a proposed reorganization of the Company in which the Company would become a wholly owned subsidiary of Ore Pharmaceutical Holdings Inc., a newly formed Delaware corporation (“Holdings”), and each share of the Company’s common stock would be exchanged for one share of common stock of Holdings. Stockholders are urged to read the definitive proxy statement/prospectus and any other relevant materials filed with the SEC because they contain, or will contain, important information about the Company and the proposed reorganization. The definitive proxy statement/prospectus is being sent to Company stockholders seeking their approval of the reorganization. Stockholders and potential investors may obtain a free copy of the definitive proxy statement/prospectus, as well as other documents filed by the Company with the SEC at the SEC’s web site at www.sec.gov or through the Company’s web site as www.orepharma.com. The definitive proxy statement/prospectus and the Company’s other SEC filings also may be obtained for free from the Company by directing a request to: Ore Pharmaceuticals Inc., 610 Professional Drive, Suite 101, Gaithersburg, Maryland 20879, Attention: Corporate Secretary, telephone: 240-361-4400. Stockholders and potential investors are urged to read the definitive proxy statement/prospectus and other relevant materials relating to the reorganization before voting or making any investment decision with respect to the reorganization or the Company. The Company, its directors, executive officers and certain members of management and employees may be considered “participants in the solicitation” of proxies from the Company’s stockholders in connection with the transaction. Information regarding such persons and a description of their interests in the transaction is contained in the proxy statement/prospectus and the Company’s Annual Reports on Form 10-K and Form 10-K/A filed with the SEC. Additional information regarding the interests of those persons may be obtained by reading the definitive proxy statement/ prospects.