UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

LOGILITY, INC.

(Name of Registrant as specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

LOGILITY, INC.

470 East Paces Ferry Road

Atlanta, Georgia 30305

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO THE STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Logility, Inc. (the “Company”) will be held at the offices of the Company, 470 East Paces Ferry Road, N.E., Atlanta, Georgia, on Tuesday, August 19, 2003 at 11:00 a.m. for the following purposes:

| | 1. | To elect two directors of the Company for a term to expire at the 2006 annual meeting of stockholders. |

| | 2. | To consider and transact such other business as may properly come before the meeting. |

Only stockholders of record of the Company at the close of business on July 11, 2003 will be entitled to vote at the meeting.

Stockholders are requested to vote, date, sign and mail their proxies in the form enclosed even though they plan to attend the meeting. If stockholders are present at the meeting, their proxies may be withdrawn, and they may vote personally on all matters brought before the meeting, as described more fully in the enclosed Proxy Statement.

BY ORDER OF THE BOARD OF DIRECTORS

James R. McGuone,

Secretary

July 30, 2003

IMPORTANT

We encourage you to attend the stockholders’ meeting. In order that there may be a proper representation at the meeting, each stockholder is requested to return his or her proxy in the enclosed envelope, which requires no postage if mailed in the United States. Attention by stockholders to this request will reduce the Company’s expense in soliciting proxies.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

OF LOGILITY, INC.

TO BE HELD AT

LOGILITY, INC.

470 EAST PACES FERRY ROAD, N.E.

ATLANTA, GEORGIA 30305

ON AUGUST 19, 2003

This Proxy Statement is furnished to the stockholders by the Board of Directors of Logility, Inc., 470 East Paces Ferry Road, N.E., Atlanta, Georgia 30305 (the “Company”), in connection with the solicitation of proxies by the Board of Directors for use at the Annual Meeting of Stockholders on Tuesday, August 19, 2003 at 11:00 a.m., and at any adjournment or adjournments thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. This Proxy Statement and accompanying proxy card and Notice of Annual Meeting are first being mailed to stockholders on or about July 30, 2003.

If the enclosed form of proxy is properly executed and returned, the shares represented thereby will be voted in accordance with its terms. If no choices are specified, the proxy will be voted:

| | FOR—Election | of Frederick E. Cooper and Parker H. Petit as Directors for terms ending with the 2006 Annual Meeting of Stockholders and until their successors are elected and qualified. |

In addition, a properly executed and returned proxy card gives the authority to vote in accordance with the proxy-holders’ best judgment on such other business as may properly come before the meeting or any adjournment thereof. A stockholder giving a proxy pursuant to this solicitation may revoke that proxy, either in writing furnished to the Secretary of the Company prior to the meeting or personally by attending the meeting, insofar as the holders of the proxy have not exercised the proxy at the meeting and the stockholder attending the meeting informs the Secretary of the Company of his or her intent to revoke the proxy.

VOTING SECURITIES

Record Date and Voting of Securities

The Board of Directors has fixed the close of business on July 11, 2003 as the record date for determining the holders of common stock entitled to notice of and to vote at the meeting. On July 11, 2003, the Company had outstanding and entitled to vote a total of 13,120,524 shares of Common Stock, no par value (“Common Stock”).

Each outstanding share of Common Stock is entitled to one vote per share on all matters to come before the meeting. The affirmative vote of a majority of the shares represented at the meeting is necessary for election of directors. Any other matter submitted to the meeting also must be approved or ratified by the affirmative vote of a majority of the shares represented at the meeting. One-third of the outstanding shares of Common Stock will represent a quorum at the meeting.

Security Ownership

Five Percent Stockholders. The only persons known by the Company to own beneficially more than 5% of the outstanding shares of Common Stock of the Company are those set forth below. This information is as of June 30, 2003. Except as disclosed in the notes to the table, each person has sole voting and investment power with respect to the entire number of shares shown as beneficially owned by that person.

Name and Address of Beneficial Owner

| | Shares Beneficially Owned

| | | Percent(1)

| |

American Software, Inc. | | 11,300,000 | | | 86.0 | % |

470 East Paces Ferry Road, N.E. | | | | | | |

Atlanta, Georgia 30305 | | | | | | |

James C. Edenfield | | 11,300,000 | (2) | | 86.0 | % |

c/o American Software, Inc. | | | | | | |

470 East Paces Ferry Road, N.E. | | | | | | |

Atlanta, Georgia 30305 | | | | | | |

| (1) | Based on a total of 13,116,374 shares outstanding. |

| (2) | Consists solely of shares held by American Software, Inc. Mr. Edenfield owns or has the option to acquire within 60 days approximately 2.4% of the outstanding Class A Common Shares and owns approximately 55.9% of the outstanding Class B Common Shares of American Software. Under the American Software articles of incorporation, the holders of Class B Common Shares, as a class, have the right to elect a majority of the board of directors of American Software. Accordingly, Mr. Edenfield may be deemed to share beneficial ownership of the Common Stock of the Company held by American Software. |

Directors and Executive Officers. The following table shows the shares of Common Stock beneficially owned, as of June 30, 2003, by each present director and nominee for director, by each executive officer named in the Summary Compensation Table and by all directors and executive officers of the Company as a group. The statements as to securities beneficially owned are based upon information provided by the person(s) concerned. Except as disclosed in the notes to the table, each person has sole voting and investment power with respect to the entire number of shares shown as beneficially owned by that person.

Name of Beneficial Owner or Description of Group

| | Shares of Common Stock Beneficially Owned

| | | Percent(1)

| |

Frederick E. Cooper | | 17,000 | (2) | | 0.1 | % |

H. Allan Dow | | 71,221 | (3) | | 0.5 | % |

James C. Edenfield | | 11,300,000 | (4) | | 86.0 | % |

J. Michael Edenfield | | 184,000 | (5) | | 1.4 | % |

Vincent C. Klinges | | 8,250 | (6) | | 0.1 | % |

Parker H. Petit | | 27,000 | (7) | | 0.2 | % |

Donald L. Thomas | | 25,050 | (2) | | 0.2 | % |

John A. White | | 26,500 | (7) | | 0.2 | % |

All Directors and Executive Officers as a Group (Eight Persons) | | 11,659,021 | (8) | | 87.4 | % |

| (1) | Based on a total of 13,116,374 shares outstanding, plus any shares issuable pursuant to options held by the person or group in question that may be exercised within 60 days. |

| (2) | Consists of shares subject to options exercisable within 60 days. |

| (3) | Includes 22,500 shares subject to options exercisable within 60 days. |

| (4) | Consists solely of shares held by American Software, Inc. Mr. Edenfield owns or has the option to acquire within 60 days approximately 2.4% of the outstanding Class A Common Shares and owns approximately |

2

| | 55.9% of the outstanding Class B Common Shares of American Software. Under the American Software articles of incorporation, the holders of Class B Common Shares, as a class, have the right to elect a majority of the board of directors of American Software. Accordingly, Mr. Edenfield may be deemed to share beneficial ownership of the Common Stock of the Company held by American Software. |

| (5) | Includes 105,000 shares subject to options exercisable within 60 days. |

| (6) | Includes 3,750 shares subject to options exercisable within 60 days. |

| (7) | Includes 24,000 shares subject to options exercisable within 60 days. |

| (8) | Includes 221,300 shares subject to options exercisable within 60 days. Also includes 11,300,000 shares held by American Software, Inc., the beneficial ownership of which is attributable to James C. Edenfield, as discussed in footnote (4). |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 (the “Exchange Act”) requires the Company’s executive officers and directors, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission (the “Commission”). Officers, directors and holders of more than 10% of the Common Stock of the Company are required under regulations promulgated by the Commission to furnish the Company with copies of all Section 16(a) forms they file.

Based upon a review by the Company of filings made under Section 16(a) of the Exchange Act and representations from its directors and officers, all of the reports required to be filed during fiscal 2003 were filed on a timely basis, except that the Company inadvertently filed on behalf of its outside directors the report of the October 31, 2002 stock option grants eight days after they were required to be filed.

ELECTION OF DIRECTORS

AND INFORMATION REGARDING DIRECTORS

The Company’s Bylaws, as amended, provide that directors shall be divided into three classes, with staggered three-year terms. The term of two of the present directors, Frederick E. Cooper and Parker H. Petit, will expire at the Annual Meeting of Stockholders in 2003. The Board of Directors has nominated Messrs. Cooper and Petit for terms expiring at the Annual Meeting of Stockholders in 2006 and until their successors are elected and qualified.

The following information is provided concerning the nominees for election as directors:

Frederick E. Cooper, age 61, has been Chairman of Cooper Capital, LLC, a private investment firm that he founded. Prior to joining Cooper Capital, Mr. Cooper was Chairman and Chief Executive Officer of CooperSmith, Inc., a producer and distributor of baked goods, which was sold to The Earthgrains Company in January 1998. Prior thereto, Mr. Cooper served for 16 years with Flowers Industries, Inc., a Fortune 500 food company, holding the positions of President and Vice Chairman and Executive Vice President and General Counsel. He currently serves as a director of Matria Healthcare, Inc. Mr. Cooper earned his B.A. in 1964 from Washington & Lee University and his J.D. in 1967 from the University of Georgia School of Law. Mr. Cooper first became a director of the Company in 1999.

Parker H. Petit, age 63, was the founder of Healthdyne, Inc. and served as its Chairman and Chief Executive Officer from 1970 to March 1996. Healthdyne spun off two of its subsidiaries to its shareholders, Healthdyne Technologies (Nasdaq: HDTC) and Healthdyne Information Enterprises (Nasdaq: HDIE) in 1995. Subsequently, its remaining subsidiary, Healthdyne Maternity Management, was merged with Tokos Medical

3

Corporation to form Matria Healthcare, Inc. (Nasdaq: MATR) in 1996. Since 1996, Mr. Petit has served as Chairman, President and CEO of Matria Healthcare, a provider of specialized home healthcare services. Mr. Petit also serves as a member of the Board of Directors of Intelligent Systems Corporation. He is also a director of the Georgia Research Alliance, a coalition of government and industry leaders formed to encourage development of high technology business in Georgia, and has been elected to the Georgia Technology Hall of Fame. Mr. Petit first became a director of the Company in 1997.

If either of these nominees becomes unwilling or unable to serve, which is not expected, the proxies will be voted for a substitute person to be designated by the Board of Directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT THE STOCKHOLDERS OF THE COMPANY VOTE “FOR” THE PROPOSAL TO ELECT FREDERICK E. COOPER AND PARKER H. PETIT AS DIRECTORS OF THE COMPANY TO HOLD OFFICE UNTIL THE 2006 ANNUAL MEETING OF STOCKHOLDERS AND UNTIL THEIR SUCCESSORS ARE ELECTED AND QUALIFIED.

The following directors were elected in 2001 and their present terms expire with the Annual Meeting of Stockholders in 2004:

J. Michael Edenfield, age 45, has served as President and Chief Executive Officer of the Company since January 1997. He also serves as a director of INSIGHT, Inc., in which the Company owns a minority interest. Until the Company’s initial public offering in October 1997, he served as Chief Operating Officer of American Software, Inc., a position he had held since June 1994. Mr. Edenfield has served as Executive Vice President of American Software from June 1994 to the present, and has been a Director of American Software, Inc. since 2001. Prior to June 1994, Mr. Edenfield served in the following positions with American Software USA, Inc.: Senior Vice President of North American Sales and Marketing from July 1993 to June 1994, Senior Vice President of North American Sales from August 1992 to July 1993, Group Vice President from May 1991 to August 1992 and Regional Vice President from May 1987 to May 1991. Mr. Edenfield holds a Bachelor of Industrial Management degree from the Georgia Institute of Technology. Mr. Edenfield is the son of James C. Edenfield, Chairman of the Board of Directors of the Company. Mr. Edenfield first became a director of the Company in 1997.

Dr. John A. White, age 63, is Chancellor of the University of Arkansas. From July 1991 to July 1997, Dr. White served as Dean of Engineering at Georgia Institute of Technology, having been a member of the faculty since 1975. From July 1988 to September 1991, he served as Assistant Director of the National Science Foundation in Washington, D.C. Dr. White is a member of the Board of Directors of Eastman Chemical Company, J.B. Hunt Transport Services, Inc., Motorola, Inc. and Russell Corporation. He is a member of the National Science Board and the National Academy of Engineering, a past President of the Institute of Industrial Engineers and past Chairman of the American Association of Engineering Societies. Dr. White founded SysteCon, a logistics consulting firm, and served as its Chairman and Chief Executive Officer until its acquisition by Coopers and Lybrand. Dr. White received a B.S.I.E. degree from the University of Arkansas, an M.S.I.E. degree from Virginia Polytechnic Institute and State University and a Ph.D. from Ohio State University. Dr. White first became a director of the Company in 1997.

The following director was elected in 2002 and his present term expires with the Annual Meeting of Stockholders in 2005:

James C. Edenfield,age 68, has served as Chairman of the Board of Directors of the Company since January 1997. He is a co-founder of American Software, where he has served as Chief Executive Officer and Director since 1971. Prior to founding American Software, Mr. Edenfield held several executive positions at, and was a director of, Management Science America, Inc., an applications software development and sales company. He holds a Bachelor of Industrial Engineering degree from the Georgia Institute of Technology. Mr. Edenfield first became a director of the Company in 1997.

4

From May 1, 2002 through April 30, 2003, the Board of Directors held four meetings. No director of the Company attended fewer than 75% of the total meetings of the Board of Directors and committee meetings on which such Board member served and was eligible to attend during this period.

The Board of Directors has an Audit Committee, which presently consists of Dr. John A. White (Chairman), Mr. Frederick E. Cooper, and Mr. Parker H. Petit. The Audit Committee held two meetings during fiscal 2003. Nasdaq Stock Market has adopted rules regarding the composition and function of audit committees for listed companies. Those rules require audit committees to be composed of not less than three members who are “independent,” as that term is defined in the rules. The Audit Committee complies with those requirements.

The Company’s Audit Committee Charter outlines the composition requirements of the Audit Committee as described above, as well as its duties and responsibilities. The primary responsibility of the Audit Committee is to provide assistance to the Company in connection with the financial reporting process. The functions of the Audit Committee include making an annual recommendation of independent public accountants to the Company, reviewing the scope and results of the independent public accountants’ audit, monitoring the adequacy of the Company’s accounting, financial and operating controls, reviewing from time to time the Company’s periodic financial statements and other financial reports with management and with the independent auditors, pre-approving audit services and permitted non-audit services and related fees, and reviewing with management and the independent auditors the financial statements to be included in the Company’s annual report.

The Company has a Stock Option Committee, consisting of Messrs. James C. Edenfield and J. Michael Edenfield. During fiscal 2003, this Committee met or acted by written consent on two occasions. The functions of this Committee are to consider the grant of stock options under the 1997 Stock Plan to employees other than directors and executive officers and establish the terms of those options, as well as to construe and interpret the Plan and to adopt rules in connection therewith.

The Company has a Compensation Committee, consisting of Mr. Frederick E. Cooper (Chairman) and Mr. Parker H. Petit, described below in “Certain Information Regarding Executive Officers and Directors—Report on Executive Compensation.” Among other functions, the Compensation Committee members act as the Special Stock Option Committee under the 1997 Stock Plan, with authority to grant stock options to Executive Officers and establish the terms of those options, as well as to construe and interpret the 1997 Stock Plan and adopt rules in connection therewith. The Compensation Committee held two meetings and acted by unanimous written consent on one other occasion during fiscal 2003.

The Board has no nominating committee or any other committee performing similar functions.

5

CERTAIN INFORMATION REGARDING EXECUTIVE OFFICERS AND DIRECTORS

Executive Compensation

The following table provides certain summary information concerning compensation paid or accrued by the Company to or on behalf of the Company’s Chief Executive Officer and the three other executive officers of the Company (determined as of April 30, 2003) whose annual compensation exceeded $100,000 during fiscal 2003 (referred to herein as the “named executive officers”), for the fiscal years ended April 30, 2003, 2002 and 2001:

SUMMARY COMPENSATION TABLE

Name and Principal Position

| | Fiscal Year

| | Annual Salary ($)

| | Bonus or Other Annual Compensation ($)

| | Long-Term Compensation Awards/Number of Option Shares Granted

| | | All Other Compensation ($)(1)

| |

J. Michael Edenfield | | 2003 | | 259,200 | | 143,667 | | 20,000 | (3) | | 2,040 | (4) |

President and Chief Executive | | 2002 | | 259,200 | | 100,205 | | 20,000 | (5) | | 2,040 | (4) |

Officer(2) | | 2001 | | 259,200 | | -0- | | -0- | (6) | | 4,690 | (4) |

| | | | | |

H. Allan Dow | | 2003 | | 180,000 | | 63,957 | | 20,000 | (3) | | 2,650 | |

Executive Vice President of | | 2002 | | 180,000 | | 50,276 | | 20,000 | (5) | | 2,650 | |

Sales and Marketing(7) | | 2001 | | 105,000 | | 25,000 | | 25,000 | (6) | | 2,650 | |

| | | | | |

Vincent C. Klinges | | 2003 | | 150,000 | | -0- | | -0- | (3) | | -0- | |

Chief Financial Officer(8) | | 2002 | | 150,000 | | 64,351 | | -0- | (5) | | 1,688 | (9) |

| | | 2001 | | 150,000 | | -0- | | -0- | (6) | | 2,650 | |

| | | | | |

Donald L. Thomas | | 2003 | | 145,000 | | 10,491 | | 5,000 | (3) | | 2,040 | (4) |

Vice President, | | 2002 | | 145,000 | | 23,508 | | 5,000 | (5) | | 2,040 | (4) |

Customer Service | | 2001 | | 145,000 | | -0- | | -0- | (6) | | 2,040 | (4) |

| (1) | The aggregate amount of perquisites and other personal benefits, securities or property given to each named executive officer, valued on the basis of aggregate incremental cost to the Company, was less than either $50,000 or 10% of the total annual salary and bonus for that executive officer during each of these years. Except as otherwise indicated, amounts shown in this column represent the matching payment amount by the Company into the officer’s 401(k) Plan account. |

| (2) | James C. Edenfield, Chairman of the Board of Directors, is the father of J. Michael Edenfield. |

| (3) | Excludes options granted by American Software in the following amounts: Mr. Edenfield—130,000 shares; Mr. Thomas—5,000 shares; Mr. Dow—45,000 shares; and Mr. Klinges—65,000 shares. |

| (4) | This amount includes $2,040 reimbursed to the officer for medical insurance coverage through the Company paid by him. |

| (5) | Excludes options granted by American Software in the following amounts: Mr. Edenfield—130,000 shares; Mr. Thomas—5,000 shares; Mr. Dow—30,000 shares; and Mr. Klinges—65,000 shares. |

| (6) | Excludes options granted by American Software in the following amounts: Mr. Edenfield—130,000 shares; Mr. Thomas—20,000 shares; Mr. Dow—75,000 shares; and Mr. Klinges—65,000 shares. |

| (7) | Mr. Dow joined the Company effective September 26, 2000. |

| (8) | Mr. Klinges also serves as Chief Financial Officer of American Software. Of Mr. Klinges’ salary compensation in fiscal 2003, 2002 and 2001, $102,000 was paid by American Software. Sixty-eight percent of his bonus compensation and 401(k) matching payments were paid by American Software during each of these years. |

6

Summary of Logility Stock Plan

The 1997 Stock Plan (the “Plan”) was adopted by the Board of Directors, approved by the sole stockholder of the Company in August 1997 and amended by the stockholders of the Company at the 1998 Annual Meeting. Up to 1,200,000 shares of Common Stock (subject to adjustment in the event of stock splits and other similar events) may be issued pursuant to stock options granted under the Plan. Up to 300,000 stock appreciation right (“SAR”) units may be granted under the Plan, each SAR unit being equivalent to the appreciation in the market value of one share of Common Stock.

The authorization of up to 1,200,000 shares for stock option grants is subject to the limitation, as set forth in the Plan, that stock options may be granted only if, following the exercise of those options, American Software would retain the 80% stock ownership percentage it requires to retain the Company as a member of American Software’s consolidated group for federal and state income tax purposes. Of the 1,200,000 authorized option shares, as of June 30, 2003, 61,539 shares have been purchased pursuant to the exercise of stock options and 764,744 shares were subject to outstanding options, leaving 373,717 shares available for new options. As of June 30, 2003, based on the number of outstanding shares held by American Software, the Company could grant up to 243,882 additional option shares under the 80% limitation described above. The Company has not granted any SARs under the Plan.

Purpose of Plan. The purpose of the Plan is to attract and retain the best available talent and encourage the highest level of performance by officers, employees, directors, advisors and consultants, and to provide them with incentives to put forth maximum efforts for the success of the Company’s business.

Automatic Option Grants to Nonemployee Directors. Under the terms of the Plan, each independent, nonemployee director automatically receives an option to purchase 2,000 shares of Common Stock upon his or her election to the Board. Each non-employee director also automatically receives an option to purchase an additional 1,000 shares on the last day of each fiscal quarter. The exercise price of each option is equal to the fair market value of the Common Stock on the date the option is granted.

Administration. The Plan is administered by the Board of Directors and by the Stock Option Committee and the Special Stock Option Committee. The Special Stock Option Committee, composed of nonemployee directors, is responsible for the administration and granting of stock options and SARs to executive officers of the Company. The Stock Option Committee, consisting of other directors of the Company, is responsible for the administration and granting of stock options and SARs (collectively, “Awards”) to other employees and eligible persons. The Stock Option Committee is composed of James C. Edenfield and J. Michael Edenfield. The Special Stock Option Committee is composed of Parker H. Petit and Frederick E. Cooper.

Eligibility. All employees (123 persons as of June 30, 2003) and Directors of the Company are eligible to participate in the Plan. In addition, advisors and consultants to the Company may be eligible for Award grants if deemed appropriate by the Stock Option Committee.

Exercise Price of Stock Options and SARs. The exercise price per share of any stock option granted under the Plan is set in each case by the respective Committee. For incentive stock options granted under the Plan, the exercise price must be at least 100% of the fair market value of Common Stock on the date of grant (at least 110% for options granted to 10% stockholders). For nonqualified stock options granted the Plan, the exercise price may be less than the fair market value per share of Common Stock on the date upon which the option is granted. The base price of a SAR unit granted under the Plan must be at least 100% of the fair market value of the Common Stock on the date of grant. As of the close of business on June 30, 2003, the market value of the Common Stock was $4.59 per share.

Terms and Exercisability of Options and SARs. Options granted pursuant to the Plan generally expire on the tenth anniversary of the grant date. Any SARs granted under the Plan would expire not later than the fifth

7

anniversary of the date of grant. Awards granted pursuant to the Plan generally become exercisable in equal portions over a four-year period (other than formula options granted to non-employee directors, which vest immediately upon grant).

Death, Disability, Retirement or Termination of Employment. Following a participant’s termination of employment, Awards held by such person pursuant to the Plan are generally exercisable only with respect to the portions thereof in which the participant is then vested. Under the Plan, upon termination of employment, stock options remain exercisable for 90 days, or twelve months if termination results from death or disability, but in any event not beyond the original option term. Any SARs would be deemed to be exercised automatically upon termination of employment, to the extent vested.

Change of Control. The stock option agreements and SAR agreements (if any SARs are granted) provide that in the event of a Change in Control (as defined in the Plan) of the Company, or a threatened Change in Control of the Company as determined by the Board of Directors, outstanding Awards will automatically become fully exercisable, subject to the right of the individual Award holder to accept a substitute stock option or similar equity right from the surviving entity in the Change of Control transaction.

American Software Option Plans. As long as the Company remains a majority-owned subsidiary of American Software, officers and other employees of the Company will be eligible to receive grants of stock options under American Software’s stock option plan. The grant of such options, if any, will be entirely within the discretion of the respective committees of the American Software Board of Directors. James C. Edenfield, a Director of the Company, serves on one of the committees of the American Software Board that has authority over the American Software stock option plan.

Termination. The Plan terminates in August 2007, unless sooner terminated by the Board of Directors. Except as expressly contemplated by the terms of the Plan, no amendment, discontinuance or termination of the Plan will have any effect on options or SARs outstanding thereunder at the time of termination.

8

Stock Option Grants

The following table sets forth information with respect to stock options granted pursuant to the Plan during fiscal 2003 to each of the Company’s directors and to the named executive officers.

OPTION GRANTS IN LAST FISCAL YEAR

| | | INDIVIDUAL GRANTS

| | Potential Realized Value At Assumed Annual Rates of Stock Price Appreciation for Option Term(2) 5% 10% ($)

|

Name

| | Number of Options Granted(1)

| | | Percent of Total Options Granted to Employees

and Directors in Fiscal 2003

| | | Exercise or Base Price (Per Share) ($)

| | Expiration Date

| |

J. Michael Edenfield | | 20,000 130,000 | (3) | | 25.32 14.36 | % %(3) | | 2.55 3.12 | | 12/04/12 06/27/12 | | 32,074/81,281 255,080/646,422 |

| | | | | |

Frederick E. Cooper | | 1,000 1,000 1,000 1,000 | | | 1.27 1.27 1.27 1.27 | % % % % | | 2.10 2.22 2.86 3.30 | | 07/31/12 10/31/12 01/31/13 04/30/13 | | 1,321/3,347 1,396/3,538 1,799/4,558 2,075/5,259 |

| | | | | |

H. Allan Dow | | 20,000 45,000 | (3) | | 25.32 4.97 | % %(3) | | 2.55 2.96 | | 12/04/12 09/04/12 | | 32,074/81,281 83,769/212,286 |

| | | | | |

Vincent C. Klinges | | 65,000 | (3) | | 7.18 | %(3) | | 3.12 | | 06/27/12 | | 127,540/323,211 |

| | | | | |

Parker H. Petit | | 1,000 1,000 1,000 1,000 | | | 1.27 1.27 1.27 1.27 | % % % % | | 2.10 2.22 2.86 3.30 | | 07/31/12 10/31/12 01/31/13 04/30/13 | | 1,321/3,347 1,396/3,538 1,799/4,558 2,075/5,259 |

| | | | | |

Donald L. Thomas | | 5,000 5,000 | (3) | | 6.33 0.55 | % %(3) | | 2.55 2.96 | | 12/04/12 09/04/12 | | 8,018/20,320 9,308/23,587 |

| | | | | |

John A. White | | 1,000 1,000 1,000 1,000 | | | 1.27 1.27 1.27 1.27 | % % % % | | 2.10 2.22 2.86 3.30 | | 07/31/12 10/31/12 01/31/13 04/30/13 | | 1,321/3,347 1,396/3,538 1,799/4,558 2,075/5,259 |

| (1) | Such options may not be exercised earlier than one year after the date of grant. Options vest ratably over a period of four years. |

| (2) | These amounts represent certain assumed rates of appreciation only. Actual gains, if any, on stock option exercises are dependent on the future performance of the Company’s or American Software’s common stock, as the case may be, and overall market conditions. The amounts reflected in this table may not necessarily be achieved. |

| (3) | These grants were grants of American Software stock options and the percentage and fair market value information for those option grants relate to American Software stock options and American Software Class A Common Stock. |

9

Stock Option Exercises and Outstanding Options

The following table contains information, with respect to (i) the number of stock options exercised during the last fiscal year, and the values realized in respect thereof, by the named executive officers, and (ii) the number of stock options and the value of said stock options held by the named executive officers as of April 30, 2003.

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options Exercisable/Unexercisable

| | | Value of Unexercised In-the-Money Options Exercisable/Unexercisable (1) ($)

|

J. Michael Edenfield | | – – | | – – | | 17,500/47,500 319,750/316,250 | (2) | | 6,875/21,875 257,481/260,744 |

H. Allan Dow | | – – | | – – | | 17,500/47,500 45,000/105,000 | (2) | | 6,875/21,875 81,825/144,225 |

Vincent C. Klinges | | – – | | – – | | 3,750/1,250 123,750/161,250 | (2) | | -0-/-0- 91,833/132,478 |

Donald L. Thomas | | – – | | – – | | 22,800/11,000 34,250/18,750 | (2) | | 4,286/3,750 11,150/10,975 |

| (1) | The market price of the Company’s Common Stock on April 30, 2003 was $3.30. The market price of American Software’s Class A Common Stock on April 30, 2003 was $3.70. |

| (2) | These relate to stock options granted by American Software. Values are based in part on the market price of American Software Class A Common Stock. |

Employment Agreements

The Compensation Committee and the Chief Executive Officer of the Company, J. Michael Edenfield, have established that for fiscal 2004 he will receive a base salary of $259,200 and a bonus targeted at $240,000 if the Company meets an operating earnings target. The amount of the bonus may be lower or higher than that amount, depending on the degree to which the Company meets or exceeds that target. Mr. Edenfield’s bonus plan and other compensation terms are described in greater detail under the heading “Report on Executive Compensation,” below.

None of the executive officers of the Company has entered into an employment agreement with the Company. Each of the executive officers, however, will be entitled to incentive compensation based on individualized fiscal year performance standards.

Director Compensation

During fiscal 2003, the Company compensated Directors who were not employed by the Company or its affiliates at the rate of $5,000 per annum, plus $1,000 for each meeting of the Board of Directors and $600 for each meeting of any committee of the Board that they attended.

Directors are eligible to receive stock option grants under the Plan. Under the terms of the Plan, Directors who are not employed by the Company automatically receive stock option grants of 2,000 shares each upon his initial election and additional 1000-share grants at the last day of each fiscal quarter thereafter, with exercise prices equal to the market price on those respective dates. These options become fully exercisable at the time of grant and expire ten years thereafter. They do not terminate if the Director ceases to serve on the Board of the Company. Under this program, Mr. Cooper, Mr. Petit and Dr. White each received options to purchase an aggregate of 4,000 shares in fiscal 2003.

10

Compensation Committee Interlocks and Insider Participation

The following persons served as members of the Compensation Committee of the Board of Directors during fiscal 2003: Frederick E. Cooper, Chairman, and Parker H. Petit. Neither of the members of the Compensation Committee was an officer or employee of the Company or had any relationship with the Company requiring disclosure under Securities and Exchange Commission regulations.

Report on Executive Compensation

The following is the report of the Compensation Committee of the Board of Directors of Logility, Inc. for the fiscal year ended April 30, 2003.

Meetings. During fiscal year 2003, the Compensation Committee met on two occasions formally, acted by written consent on one occasion and conferred informally a number of times among the members of the Committee and with management and the other members of the Board of Directors concerning the authority and responsibilities of the Committee.

Executive Compensation Philosophy. The Committee believes that a compensation program which enables the Company to attract and retain outstanding executives has assisted and will continue to assist the Company in meeting its long-range objectives, thereby serving the interests of the Company’s stockholders. The compensation program of the Company is designed to achieve the following objectives:

| | • | Provide compensation opportunities that are competitive with those of companies of a similar size within the same industry. |

| | • | Create a strong connection between the executive’s compensation and the Company’s annual and long-term financial performance. |

| | • | Include above-average elements of financial risk through performance-based incentive compensation that offers an opportunity for above-average financial reward to the executives. |

Compensation of Chief Executive Officer. The Compensation Committee has the responsibility and authority to review and establish compensation for the Chief Executive Officer of the Company, including his participation in the Logility 1997 Stock Plan and the re-evaluation and negotiation of the terms of his employment. Following discussions with the Chief Executive Officer, J. Michael Edenfield, the Committee and Mr. Edenfield have established that for fiscal 2004 he will receive a base salary of $259,200, which is unchanged from fiscal 2003, and a bonus targeted at $240,000 if the Company achieves the annual bonus targeted level of operating earnings as set forth in his compensation plan. The amount of the bonus could be higher or lower than the targeted bonus amount, varying directly depending on the degree to which the target is met or exceeded. The targeted bonus is increased from the $200,000 targeted bonus in fiscal 2003.

The Committee’s selection of this basis for incentive compensation reflects its belief that a substantial portion of the Chief Executive Officer’s compensation should be tied to operating earnings. By leaving the salary component unchanged and increasing the targeted bonus, the Committee is placing even greater weight on the incentive component.

The Committee believes Mr. Edenfield continues to be paid a reasonable salary in light of salaries paid to chief executives of other companies of similar size operating in the software industry. His salary has not changed since fiscal 2000. The Committee believes also that Mr. Edenfield’s targeted bonus for fiscal 2004 is based upon challenging but achievable financial goals that align his interests directly with those of the Company’s stockholders.

The Chief Executive Officer’s cash compensation from the Company in fiscal 2003, both salary and bonus, was determined under the terms of an incentive compensation arrangement established by the Compensation

11

Committee effective at the beginning of fiscal 2003. Based on the Company’s results in fiscal 2003, Mr. Edenfield received a bonus for that fiscal year of $143,667, or 72% of his targeted bonus.

During fiscal 2003, this Committee granted to Mr. Edenfield options to purchase 20,000 shares of the Company, at an exercise price of $2.55 per share. In fiscal 2003 he also was granted an option to purchase 130,000 shares of American Software at an exercise price of $3.12 per share. Stock option grants under the American Software stock option plan are determined by the committee responsible for that plan and not by this Committee.

Any further participation by the Chief Executive Officer in the Logility Stock Plan during fiscal 2004 will be determined in the discretion of this Committee based upon its authority to grant options as the Special Stock Option Committee under that Plan.

Other Executive Officers. The Compensation Committee has responsibility for the review of compensation of other executive officers of the Company and consults with the Chief Executive Officer as he structures their compensation plans. The Committee understands that it is the policy of the Company, which is supported by the Committee, to base a substantial portion of executive officer compensation upon the achievement of Company-wide or divisional goals, relating in some cases to revenue generation, in some cases to total annual earnings, as well as other factors. The bonus plans for each of the most highly compensated executive officers reflect this approach. Because Vincent C. Klinges, the Chief Financial Officer of the Company, also serves as Chief Financial Officer of American Software, his compensation plan will continue to be established by American Software. Mr. Klinges’ compensation is allocated between the two companies in connection with the general allocation of expenses between the companies relating to shared financial and other services.

The Compensation Committee has direct and exclusive authority over the granting of stock options to executive officers of the Company by acting as the Special Stock Option Committee under the Logility Stock Plan. In addition, the Compensation Committee assists the Chief Executive Officer in evaluating and consulting on executive compensation plans, which are customized for each executive officer. The Committee uses stock option grants under the Plan as both a motivating and a compensating factor. Because the performance of executive officers can substantially influence performance of the entire enterprise, the Committee believes that grants of stock options and carefully structured incentive compensation plans can create greater incentives for improving Company performance. The Compensation Committee believes these incentives also may positively influence the market price for Company stock in both the near and long term.

During fiscal 2003, the Compensation Committee formally and informally considered the exercise of its authority under the Plan to grant options to executive officers of the Company. The term and size of the options granted to the executive officers were intended and calculated by the Compensation Committee to reward those officers for their prior performance, to serve as incentive for promotion of Company profitability and other long-term objectives, as well as to maintain their overall compensation at competitive levels. Thus, the option grants reflect both a retrospective and prospective approach to executive compensation.

During fiscal 2004, the Compensation Committee will continue to consult with the Chief Executive Officer with respect to executive officer compensation packages, including salaries, bonuses and fringe benefits, and will make decisions regarding stock option grants, to ensure that compensation is appropriately related to individual and Company performance as well as competitive compensation standards and other relevant criteria. The Compensation Committee will continue its investigation of compensation arrangements in peer group companies as guides for future consultations with the Chief Executive Officer.

Limitations on Deductibility of Executive Compensation. Since 1994, the Omnibus Budget Reconciliation Act of 1993 has limited the deductibility of executive compensation paid by publicly held corporations to $1 million per employee, subject to various exceptions, including compensation based on performance goals. The deductibility limitation does not apply to compensation based on performance goals where (1) the performance

12

goals are established by a compensation committee which is comprised solely of two or more outside directors; (2) the material terms are disclosed to shareholders and approved by majority vote of the shareholders eligible to vote thereon before the compensation is paid; and (3) before the compensation is paid, the compensation committee certifies that the performance goals and other material terms have been satisfied. The Company has not adopted a policy with respect to deductibility of compensation since no executive officer currently receives, or has previously received, taxable income in excess of $1 million per year from the Company. The Compensation Committee will monitor compensation levels closely, particularly in areas of incentive compensation. As revenues and income of the Company grow, incentive compensation also can be expected to increase and it may become necessary to adopt a long-term incentive compensation plan in compliance with the foregoing criteria.

By the Compensation Committee:

Frederick E. Cooper, Chairman

Parker H. Petit

Audit Committee Report

The following is the Audit Committee Report of the Board of Directors of Logility, Inc. for the fiscal year ended April 30, 2003.

The Board of Directors has adopted, at its May 2003 meeting, a revised Charter for the Audit Committee. A copy of the revised Charter is attached to this Proxy Statement as Exhibit A. As set forth in that Charter, the Audit Committee’s job is one of oversight. It is not the duty of the Audit Committee to prepare the Company’s financial statements, to plan or conduct audits, or to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles. The Company’s management is responsible for preparing the Company’s financial statements and for maintaining internal controls. The independent auditors are responsible for auditing the financial statements and for expressing an opinion as to whether those audited financial statements fairly present the financial position, results of operations, and cash flows to the Company in conformity with generally accepted accounting principles.

In fulfilling its responsibilities with respect to the fiscal year 2003 audit, the Audit Committee: (1) reviewed and discussed the audited financial statements for the fiscal year ended April 30, 2003 with Company management and KPMG LLP (“KPMG”), the Company’s independent auditors; (2) discussed with KPMG the matters required to be discussed by Statement on Auditing Standards No. 61 relating to the conduct of the audit; and (3) received written disclosures and the letter from KPMG regarding its independence as required by Independence Standards Board No. 1. The Audit Committee discussed with KPMG the independence of KPMG from the Company.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in the Corporation’s Annual Report on Form 10-K for the fiscal year ended April 30, 2003 for filing with the Securities and Exchange Commission.

The rules of the National Association of Securities Dealers require audit committees to be composed of not less than three members who are “independent,” as that term is defined in the rules. The Audit Committee believes that its members meet the definition of “independent” set forth in those rules.

By the Audit Committee:

John A. White, Chairman

Frederick E. Cooper

Parker H. Petit

13

RELATIONSHIP WITH AMERICAN SOFTWARE AND CERTAIN TRANSACTIONS

The Company and American Software have entered into various agreements (the “Intercompany Agreements”), including a Services Agreement, a Facilities Agreement, a Marketing License Agreement and a Tax Sharing Agreement. These Agreements and the other Intercompany Agreements are further described in the Company’s Annual Report on Form 10-K for the fiscal year ended April 30, 2003, filed with the Securities and Exchange Commission. In fiscal 2003, the Company paid the following amounts to American Software under the terms of the Intercompany Agreements: Services Agreement—$1,190,000; Facilities Agreement—$469,000; and Marketing License Agreement—$102,000. Under the Tax Sharing Agreement, the Company was not allocated any federal, state and local taxes for fiscal 2003.

As a result of the various transactions between the Company and American Software, amounts payable to and receivable from American Software arise from time to time. At April 30, 2003, there was a payable to American Software from the Company in the amount of $1,972,000.

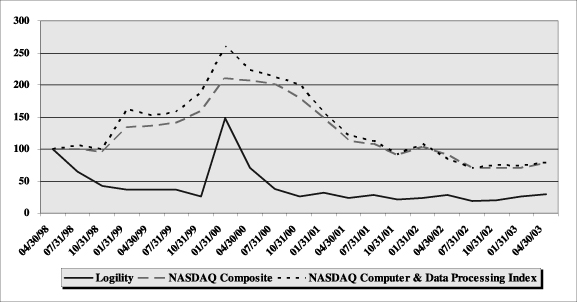

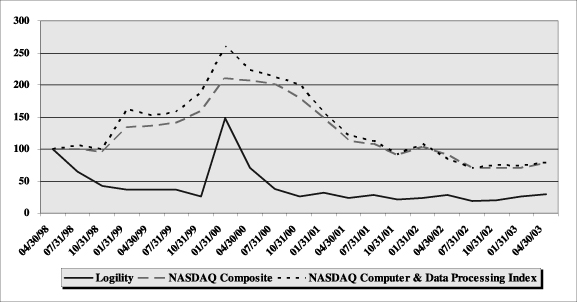

STOCK PRICE PERFORMANCE GRAPH

The graph below reflects the cumulative stockholder return on the Company’s shares compared to the return of the Nasdaq Composite Index and a peer group index on a monthly basis. The graph reflects the investment of $100 on April 30, 1998 in the Company’s stock, the Nasdaq Stock Market—U.S. Companies (“Nasdaq Composite Index”) and in a published industry peer group index. The peer group index is the Nasdaq Computer and Data Processing Index, which is different from the peer group index used in the Company’s 2002 Proxy Statement, the Robertson Stephens Hi-Tech Index – Software Group. This change resulted from the discontinuance of the Robertson Stephens Index.

14

INDEPENDENT AUDITORS

General

During the fiscal year ended April 30, 2003, the Company engaged KPMG LLP (“KPMG”) to provide certain audit services, including the audit of the annual financial statements, a review of the quarterly financial data furnished by the Company to the SEC for the quarters ended July 31, 2002, October 31, 2002 and January 31, 2003, services performed in connection with filing this Proxy Statement and the Annual Report on Form 10-K by the Company with the SEC, attendance at meetings with the Audit Committee and consultation on matters relating to accounting, tax and financial reporting. KPMG has acted as independent certified public accountants for the Company since 1997. Neither KPMG nor any of its associates has any relationship to the Company or any of its subsidiaries except in its capacity as independent certified public accountants.

The Company expects that representatives of KPMG will attend the Annual Meeting of Shareholders. These representatives will be available to respond to appropriate questions raised orally and will be given the opportunity to make a statement if they so desire. The Audit Committee has recommended to the full Board that the Company employ KPMG as its independent auditors for the fiscal year ending April 30, 2004. The annual meeting of the Board of Directors is scheduled to be held immediately before the Annual Meeting of Stockholders.

Audit Fees and All Other Fees

The aggregate fees billed to the Company by KPMG during fiscal 2003 and fiscal 2002 are summarized below.

Audit Fees

Fees for audit services totaled approximately $140,000 in fiscal 2003 and approximately $125,000 in fiscal 2002, including fees associated with the annual audit and the reviews of the Company’s quarterly reports on Form 10-Q.

Audit Related Fees

Fees for audit related services totaled approximately $2,000 in both fiscal 2003 and fiscal 2002.

Tax Fees

Fees for tax services, including tax compliance, tax advice and tax planning, totaled approximately $10,250 in fiscal 2003 and $4,500 in fiscal 2002.

All Other Fees

The Company’s independent auditors did not receive fees for other services not described above in fiscal 2003 or in fiscal 2002.

The Audit Committee considered the compatibility of the non-audit services performed by and fees paid to KPMG in fiscal 2003 and the proposed non-audit services and proposed fees for fiscal 2004 and determined that such services and fees are compatible with the independent status of such auditors. During fiscal 2003, KPMG did not utilize any leased personnel in connection with the audit.

In accordance with the rules of Nasdaq and the SEC, the Audit Committee has the authority to pre-approve all independent audit engagement fees and terms and pre-approve all permitted non-audit engagements (including the fees and terms thereof) to be performed for the Company by the independent auditors.

15

STOCKHOLDER PROPOSALS

Proposals of stockholders intended to be presented at the 2004 Annual Meeting of Stockholders must be forwarded in writing and received at the principal executive offices of the Company no later than April 1, 2004 directed to the attention of the Secretary, to be considered for inclusion in the Company’s proxy statement for that Annual Meeting. Any such proposals must comply in all respects with the rules and regulations of the Securities and Exchange Commission.

OTHER MATTERS

As of the date of this Proxy Statement, the Board of Directors does not intend to present, and has not been informed that any other person intends to present, any matter for action at the Annual Meeting other than those specifically referred to in this Proxy Statement. If other matters properly come before the meeting, it is intended that the holders of the proxies will act in respect thereto in accordance with their best judgment.

The cost of this solicitation of proxies will be borne by the Company. In addition to solicitation by mail, employees of the Company may solicit proxies by telephone, in writing or in person. The Company may request brokerage houses, nominees, custodians and fiduciaries to forward soliciting material to the beneficial owners of stock held of record and will reimburse such persons for any reasonable expense in forwarding the material.

Copies of the 2003 Annual Report of the Company are being mailed to stockholders together with this Proxy Statement, proxy card and Notice of Annual Meeting of Stockholders. Additional copies may be obtained from Pat McManus, 470 East Paces Ferry Road, N.E., Atlanta, Georgia 30305.

A COPY OF THE COMPANY’S ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED APRIL 30, 2003, AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, WILL BE FURNISHED WITHOUT CHARGE TO STOCKHOLDERS BENEFICIALLY OR OF RECORD AT THE CLOSE OF BUSINESS ON JULY 11, 2003 ON REQUEST TO PAT McMANUS, 470 EAST PACES FERRY ROAD, N.E., ATLANTA, GEORGIA 30305.

By Order of the Board of Directors,

James R. McGuone, Secretary

Atlanta, Georgia

July 30, 2003

16

EXHIBIT A

LOGILITY, INC.

AUDIT COMMITTEE CHARTER

(Amended effective May 20, 2003)

I. Organization and Composition.

There shall be an Audit Committee (the “Committee”) selected by the Board of Directors (the “Board”) that shall be composed of not less than three members of the Board. Subject to the right of the Board to elect one member who is not independent to the extent permitted by the listing requirements of Nasdaq, each member of the Committee shall be (1) determined by the Board to be “independent” of Company management under the listing requirements of Nasdaq and Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules promulgated thereunder by the Securities and Exchange Commission (“SEC”) implementing Section 301 of the Sarbanes-Oxley Act of 2002 (as amended, “Sarbanes-Oxley Act”), and (2) free from any relationship to the Company that, in the opinion of the Board, would interfere with the exercise of his or her independent judgment as a member of the Committee. All Committee members, either at the time of their appointment to the Committee or within a reasonable time thereafter, must be able to read and understand fundamental financial statements, including the Company’s balance sheet, income statement, and cash flow statement. At least one Committee member must have past employment experience in finance or accounting, requisite professional certification in accounting or any other comparable experience or background.

II. Statement of Policy.

The Audit Committee shall provide assistance to the Board of Directors in fulfilling its oversight responsibility to the shareholders, potential shareholders, the investment community and others relating to the Company’s financial statements and the financial reporting process, the systems of internal accounting and financial controls, the internal audit function, the annual independent audit of the Company’s financial statements, the independent auditor’s qualifications and independence, and the legal compliance and ethics programs as established by management and the Board. In so doing, it is the responsibility of the Committee to maintain free and open communication between the Committee, independent auditor, the internal accountants and management of the Company. In discharging its oversight role, the Committee is empowered to investigate any matter brought to its attention, with full access to all books, records, facilities, and personnel of the Company and the power to retain outside counsel or other experts for this purpose. The independent auditor’s ultimate accountability shall be to the Board of Directors and the Committee, as representatives of the shareholders. These shareholder representatives’ ultimate authority and responsibility shall be to select, evaluate and, where appropriate, replace the independent auditor.

III. Responsibilities and Processes.

(A) Primary Responsibilities. The primary responsibility of the Audit Committee is to oversee the Company’s financial reporting process on behalf of the Board and report the results of the Committee’s activities to the Board. Management is responsible for preparing the Company’s financial statements and the independent auditors are responsible for auditing those financial statements. In carrying out its responsibilities, the Committee believes its policies and procedures should remain flexible in order to best react to changing conditions and circumstances. The Committee should take the appropriate actions to set the overall corporate “tone” for quality financial reporting, sound business risk practices and ethical behavior.

The following are the principal recurring processes of the Audit Committee in carrying out its oversight responsibilities. These processes are a guide and may be supplemented by the Committee or the Board as it deems appropriate:

| | (1) | The Audit Committee shall recommend annually to the Board of Directors the accounting firm to be selected by the Board to act as independent auditors of the Company, who shall be accountable to the |

A-1

| | Board and the Committee as representatives of the Company’s shareholders. The Committee shall have authority to evaluate and replace the independent auditors if appropriate. In accordance with the rules of Nasdaq and Section 10A(i) of the Exchange Act, the Committee shall have the authority to pre-approve all independent audit engagement fees and terms and pre-approve all permitted non-audit engagements (including the fees and terms thereof) to be performed for the Company by the independent auditors, subject to thede minimus exceptions for non-audit services described in Section 10A(i)(1)(B) of the Exchange Act which are approved by the Committee prior to the completion of the audit. The Committee shall discuss with the auditors their independence from management and the Company and the matters included in the written disclosures required by the Independence Standards Board. |

| | (2) | The Committee, in its discretion, may appoint and delegate to one or more members of the Committee who are independent directors the authority to grant the pre-approvals of the Committee described in the preceding paragraph. |

| | (3) | The Committee shall receive and evaluate from the independent auditor reports on critical accounting policies and practices, alternative treatments and material communications with management as required by Section 10A(k) of the Exchange Act. |

| | (4) | The Committee shall discuss with both the Company’s internal accountants and the independent auditors the overall scope and plans for all audits, including the adequacy of staffing and compensation. Also, the Committee shall discuss with management, the internal accountants, and the independent auditors the adequacy and effectiveness of the accounting and financial controls, including the Company’s system to monitor and manage business risk, and legal and ethical compliance programs. Further, the Committee shall meet separately with the internal accountants and the independent auditors, with and without management present, to discuss the results of their examinations. |

| | (5) | The Committee shall from time to time review the periodic financial statements and other financial reports of the Company with management, and with the independent auditors. The Chair of the Committee may represent the entire Committee for the purposes of any such review. The Committee shall also discuss matters required to be communicated to the Company by the independent auditors under generally accepted auditing standards. |

| | (6) | The Committee shall review with management and the independent auditors the financial statements to be included in the Company’s Annual Report on Form 10-K (or the annual report to shareholders if distributed prior to the filing of Form 10-K), including their judgment about the quality, not just acceptability, of accounting principles, the reasonableness of significant judgments, and the clarity of the disclosures in the financial statements. Also, the Committee shall discuss the results of the annual audit and any other matters required to be communicated to the Committee by the independent auditors under generally accepted auditing standards. The Committee shall prepare the “Audit Committee Report” required by SEC regulations to be included in the Company’s annual proxy statement. |

| | (7) | The Committee shall have the authority, to the extent it deems necessary or appropriate, to retain independent legal, accounting or other consultants to advise the Committee. The Company shall provide for appropriate funding, as determined by the Committee, for payment of compensation to the independent auditor for the purpose of rendering or issuing an audit report and to any advisors or consultants employed by the Committee pursuant to Section 10A(m) of the Exchange Act. |

| | (8) | The Committee shall review and reassess the adequacy of this Charter at least on an annual basis. |

(B)Additional Authority. The Committee, to the extent it deems necessary or appropriate, may:

| | (1) | Obtain from the independent auditor an assurance of compliance with Section 10A of the Exchange Act with respect to auditor disclosure of corporate fraud. |

A-2

| | (2) | Discuss with management and the independent auditor any matters that the Committee deems relevant, including matters as to which such discussions may be required by applicable Statements on Auditing Standards, such as Numbers 61 and 90 relating to the Company’s financial statements, or the Sarbanes-Oxley Act. |

| | (3) | Review and evaluate the experience and qualifications of the lead partner of the independent auditor team and confirm that the independent auditor is taking proper steps to assure that the lead audit partner of the independent auditor and the audit partner responsible for reviewing the audit are rotated at least every five years. |

While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits. Management has responsibility for the preparation, presentation, completeness and integrity of the financial statements and for the appropriate use of accounting principles and reporting policies. The independent auditor is responsible for auditing the financial statements, expressing an opinion thereon in accordance with GAAP, and complying with all applicable law.

A-3

Ú FOLD AND DETACH HERE Ú

LOGILITY, INC.

PROXY SOLICITED BY THE BOARD OF DIRECTORS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD

AUGUST 19, 2003 AT 11:00 A. M.

470 EAST PACES FERRY ROAD, N.E.

ATLANTA, GEORGIA

FOR HOLDERS OF COMMON SHARES

The undersigned hereby appoints James C. Edenfield and J. Michael Edenfield, or either of them, attorneys and proxies, each with full power of substitution to vote, in the absence of the other, all Common Shares of LOGILITY, INC. held by the undersigned and entitled to vote at the Annual Meeting of Stockholders to be held on August 19, 2003 and at any adjournment or adjournments thereof, in the transaction of such business as may properly come before the meeting, and particularly the proposal stated below, all in accordance with and as more fully described in the accompanying Proxy Statement.

It is understood that this proxy may be revoked at any time insofar as it has not been exercised and that the shares may be voted in person if the undersigned attends the meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE FOLLOWING PROPOSAL:

Election of Directors. Two Directors to be elected.

Nominee:

| | |

| Frederick E. Cooper | | ¨ FOR | | ¨ WITHHOLD AUTHORITY |

| | |

| Parker H. Petit | | ¨ FOR | | ¨ WITHHOLD AUTHORITY |

Ú FOLD AND DETACH HERE Ú

THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED AS DIRECTED BY THE UNDERSIGNED STOCKHOLDER ON THE REVERSE OF THIS PROXY CARD, OR IF NO DIRECTION IS GIVEN, THEY WILL BE VOTED FOR THE ABOVE PROPOSAL. IN THEIR DISCRETION, THE PROXYHOLDERS ARE AUTHORIZED TO VOTE UPON SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING.

| IMPORTANT: | | Please sign this Proxy exactly as your name or names appear hereon. If shares are held jointly, signatures should include both names. Executors, administrators, trustees, guardians and others signing in a representative capacity should please give their full titles. |

Pleasevote, sign, date and return this proxy card

promptly, using the enclosed envelope. Dated: , 2003 |