Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act and the rules of the SEC require our directors, certain officers and beneficial owners of more than 10% of our outstanding common stock to file reports of their ownership and changes in ownership of our common stock with the SEC. Based solely on our review of the copies of such forms received by us and upon written representations of the Reporting Persons received by us, we believe that, except for the late filings set out herewith, there has been compliance with all Section 16(a) filing requirements applicable to such Reporting Persons with respect to the fiscal year ended December 31, 2021:

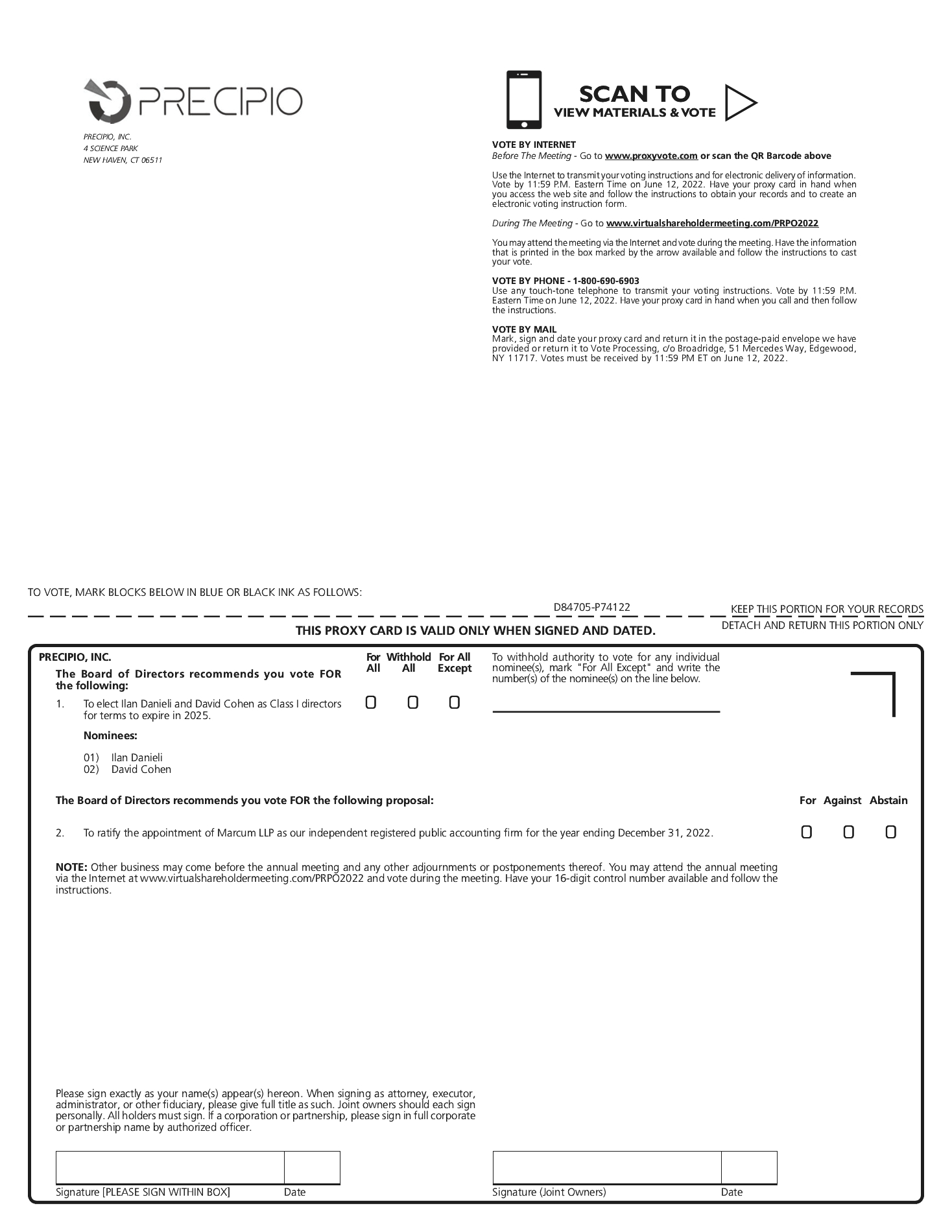

Mr. Cohen filed late two Form 4s in respect of the sale of a total of 110,140 shares of the Company. On May 27, 2021, Mr. Cohen sold 40,178 shares of the Company and on June 10, 2021 Mr. Cohen sold 69,962 shares of the Company. Both sales were completed through a brokerage account. The sales were made pursuant to Rule 144. Upon review of the filings conducted by the Company’s in-house compliance team, we noted that Mr. Cohen did not file Form 4s in respect of the aforementioned sales. On review of the matter it was evident that the brokerage firm failed to file these forms on Mr. Cohen’s behalf. Immediately upon finding out the status, Mr. Cohen filed the Form 4s on August 3, 2021 to reflect the sales.

Mr. Danieli filed a late Form 4, on December 10, 2021, eight days subsequent to the date required to file the Form 4 to report an acquisition of stock pursuant to 10b5-1 plan which was acquired on behalf of Mr. Danieli’s account by the brokerage firm entrusted to carry out the purchases made on December 1, 2021. The late reporting was due to failure by the brokerage firm to inform Mr. Danieli of the acquisition.

Culture and Human Capital Management

Recruiting, developing and engaging our workforce is critical to executing our strategy and achieving business success. The board oversees and is regularly updated on the company’s leadership development and talent management strategies designed to recruit, develop and retain business leaders who can drive the Company’s growth objectives and build long-term stockholder value. Our board is continuously focused on culture and human capital management priorities for promoting a safe, inclusive and respectful work environment, where employees across our entire workforce feel empowered to speak on issues important to them, inspired to act ethically and with integrity and raise concerns and encouraged to implement new and innovative ideas in the best interests of the business.

The board is keenly interested in ensuring that the Company maintains and promotes a culture that fosters the values, behaviors and attributes necessary to advance the Company’s business strategy and purpose. To foster employee engagement and commitment, we follow a robust process to listen to employees, take action and measure our progress with on-going employee conversations, transparent communications and employee engagement surveys. The Board receives regular updates on matters of employee culture and engagement.

Related Person Transactions

There have been no transactions since January 1, 2020 to which we have been a participant in which the amount involved exceeded or will exceed $120,000 or one percent of the average of our total assets at year-end for the last two completed fiscal years, and in which any of our directors, executive officers or holders of more than 5% of our capital stock, or any members of their immediate family, had or will have a direct or indirect material interest, other than compensation arrangements which are described under “Executive Compensation” and “Director Compensation,” and other than the transactions described below.

As disclosed in the Company’s Form 8-K filed on April 23, 2018 and amended on April 26, 2018, on April 20, 2018, the Company entered into a securities purchase agreement (the “2018 Note Agreement”) with certain investors (the “April 2018 Investors”), pursuant to which the Company would issue up to approximately (i) $3,296,703 in Senior Secured Convertible Promissory Notes with an interest rate of 8% per annum and an original issue discount of 9% (the “ Bridge Notes”) and (ii) warrants in an amount equal to the number of shares of common stock issuable upon conversion of the Bridge Notes based on the conversion price at the time of issuance (the “Convertible Debt Transaction”). Some of the warrants were issued with a one-year term and some with a five-year term.

As previously disclosed in our 2021 Proxy Statement filed on Form DEF 14A with the SEC on April 29, 2021, since April 2018, we amended the terms of the Bridge Notes and warrants issued in connection therewith. In connection with this transaction, a member of our board of directors, Mr. David S. Cohen was issued an aggregate of $439,560 in principal of the Bridge Notes and issued warrants to purchase 74,539 shares of our common stock. The Bridge Notes issued to Mr. Cohen have been converted into 744,840 shares of common stock. See “SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT” for more information related to Mr. Cohen’s ownership of our securities.