UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant o Filed by a Party other than the Registrant þ

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| þ | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

RESPONSE GENETICS, INC.

(Name of the Registrant as Specified In Its Charter)

TOM R. DEMEESTER

RAJ MAHESHWARI

ROBERT J. MAJTELES

MICHAEL J. TILLMAN

RICHARD VAN DEN BROEK

DAVID M. WURZER

DAVID B. SABLE

AUSTIN W. MARXE

AWM INVESTMENT COMPANY

L.S. ADVISERS, LLC

MGP ADVISERS LIMITED PARTNERSHIP

SPECIAL SITUATIONS CAYMAN FUND, L.P.

SPECIAL SITUATIONS FUND III QP, L.P.

SPECIAL SITUATIONS LIFE SCIENCES FUND, L.P.

(Name(s) of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| |

| | (1) | Title of each class of securities to which transaction applies: N/A |

| | (2) | Aggregate number of securities to which transaction applies: N/A |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | N/A |

| | (4) | Proposed maximum aggregate value of transaction: N/A |

| | (5) | Total fee paid: N/A |

| |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | (1) | Amount Previously Paid: N/A |

| | (2) | Form. Schedule or Registration Statement No.: N/A |

| | (3) | Filing Party: N/A |

| | (4) | Date Filed: N/A |

Special Situations Fund III QP, L.P.

Special Situations Cayman Fund, L.P.

Special Situations Life Sciences Fund, L.P.

527 Madison Avenue

Suite 2600

New York, NY 10022

August 24, 2010

Dear Fellow Response Genetics Shareholder:

We are writing to you as a shareholder of Response Genetics, Inc. You have probably received our materials and WHITE proxy card related to the 2010 Annual Meeting of the company’s shareholders, which meeting has been scheduled to take place on September 21, 2010.

You may be aware that our investment firm owns 3,350,174 of the company’s shares or over 18%, and is Response Genetics’ second largest shareholder. We are leading an initiative to elect a new independent board of directors. Collectively, we believe that our nominees have substantial industry expertise and significant stock ownership, so their interests are aligned with yours. They would bring an independent perspective that we believe is lacking and that would help to focus the Board on the best interests of shareholders like you.

Our Goal Is Not To Take Over Or Run Response Genetics.

Rather, we want the company to have the type of independent, value-added board of directors that it needs to thrive in the high-growth molecular diagnostics sector.

While we believe that the current Board is a significant liability to the company’s growth, we also believe that Kathleen Danenberg, the company’s chief executive, is a valuable asset to the company. Her core strengths, including managing research and development, maintaining relationships within the academic and medical communities and with key opinion leaders and continuing her work as a liaison between the sales force and physicians, need to be supplemented at a director level with skills in financing, negotiation of strategic agreements and in general company management. In our opinion, too much management and board responsibility has been left solely with Ms. Danenberg.

Why Are We Proposing New Directors?

It is important for you as a shareholder to understand why we have nominated an opposition slate. In our view, the molecular diagnostics industry is changing rapidly, providing competitive, regulatory, development and financial challenges that can overwhelm even those companies, like Response Genetics, that are well-positioned by virtue of ability and good products. We believe that success in this sector requires a combination of technical knowledge and expertise, knowledge of and relationships in the capital markets, and strategic vision to identify and take advantage of industry alliances. Response Genetics has been successful in developing products, communicating with oncologists to identify their needs, establishing relationships within the physician community, and running an effective laboratory operation. Sadly, we do not believe that these skills have been mirrored by the success of the business. Having observed the company for several years, meeting with management numerous times, and having spoken with each Board member as well as with analysts, members of the sales force and customers, we have concluded that the company has received insufficient input from its Board of Directors, and that the current Board lacks sufficient experience and expertise in the life science industries and in emerging growth companies to serve the company adequately. We believe that the deficiencies on the Board are reflected in the stock’s performance and have seriously harmed the value of your and our investment in the company.

PLEASE VOTE THE ENCLOSED WHITE PROXY CARD TODAY. DISCARD ANY GOLD CARD YOU RECEIVE. YOUR VOTE IS IMPORTANT.

Among the reasons that led us to take the serious step of looking to restructure the Board are the following:

We Were Asked To Do So By Existing Directors

We have shared our concerns about Ms. Danenberg’s responsibilities and the current Board with all of the directors including Michael Serruya and David Smith, two of the company’s nominees, and Dr. Tom DeMeester, one of our nominees and the company’s current chairman. Those three directors have also informed us that in their opinions the current Board does not provide meaningful direction and functions in a reactive manner. In fact, Messrs. Serruya and Smith approached us early this year to become involved to shake up and to do something about the Board. They had lost confidence in the current Board to make the right decisions and to effect the necessary changes to guide the company forward. Ironically, our further investigation of the Board indicated to us that Messrs. Serruya and Smith were part of the problem.

The Board Has Suffered From Significant Turnover

The company’s current slate of nominees contains none of the physicians or scientists who have served on the board since the beginning of 2009. Of the five legacy board members that make up a majority of the company’s slate only one, Kirk Calhoun, has experience as director of a healthcare company other than Response Genetics. Two other members of the management board slate, Michael Serruya and David Smith, have no relevant experience of any kind. Moreover, in 2010 alone, two other directors, Dr. David R. Gandara and Mr. Hubertus Spierings, both resigned as directors and Dr. Edith Mitchell, who was elected to replace Dr. Gandara in 2010, is not even included in the company’s current slate of nominees. In addition, when vacancies have occurred on the Response Board, we believe Ms. Danenberg has sought to fill those vacancies with directors who are friendly to her, despite their lack of relevant industry experience or expertise.

The Board Has Shown A Pattern Of Poor Decision Making

We believe that the Board has demonstrated a pattern of last-minute, poor and disorganized decision-making, and a lack of strategic thinking. In February 2009, with the company running out of cash, we approached it with a financing offer. Despite the company’s precarious financial position, we found no plans in place to maintain the company’s solvency. At that time we also offered to advise the Board on future financing plans and a longer term strategy. The Board did not accept our offer, nor are we aware of the Board engaging any adviser to assist it in such matters. Most recently, in March 2010, the company sold 3,005,349 shares of its common stock in a private placement at $1.31 per share. Before this offering, we argued strenuously to the Board and to Ms. Danenberg that the timing of the sale would be significantly dilutive to existing investors and not in the best interests of the company. We also requested of the Board cash-flow analyses that would justify the raising of capital at that time with the correlative dilution. No analyses were ever provided to us, nor do we know whether any analyses were ever prepared. We were offered the opportunity to invest in this round of financing, but declined as we believed that it was not in the company’s best interests. Now, less than six months later, we further question the wisdom of proceeding with this dilutive offering, An offering today would impose less than nearly half the dilution that selling shares at $1.31 caused.

The Board Needs To Be Reduced To Function More Effectively

We feel that a six person board is an optimal size. Since the current board is composed of eight directors, we needed to nominate eight to our slate. In the event that our nominees are all elected as directors, we expect that the Board of Directors will reduce its size to six individuals and that the two nominees affiliated with our fund - Mr. Marxe and Dr. Sable - will step down.

The Board Has Turned Down Our Settlement Offers

The company would have you believe that it is already pointed in the right direction and that the current Board can be trusted to select the best and most qualified candidates to serve you. Simply put, we do not have any such confidence, which is why we have pushed in settlement discussions for half of the Board to be comprised of our nominees, in order to ensure that real change for your benefit will occur. For some reason not known to us, the current Board is unwilling to accept our suggestion. You should know that in prior settlement overtures to us, the company was also unwilling to even identify for us which incumbent directors would remain on the Board.

Stock Price Underperformance

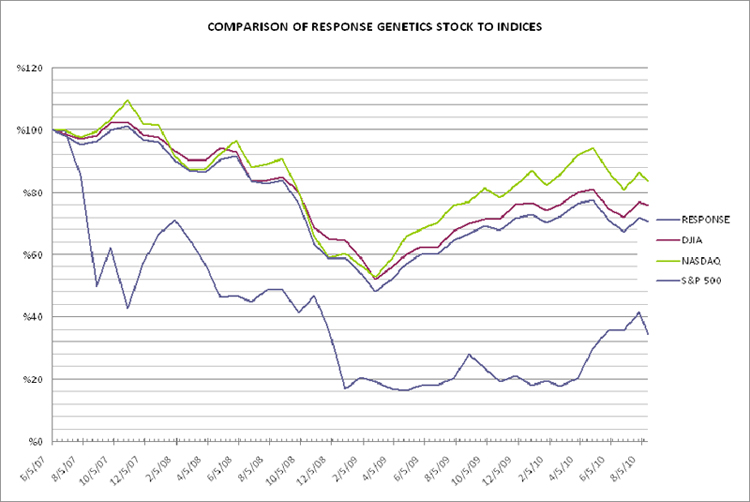

Since the company’s IPO in June 2007 when we made our largest investment, the company’s stock has lost over 65% of its value. For that same period, as reflected on the below graph, the Dow Jones Industrial Average declined approximately 24%, the NASDAQ Composite declined approximately 16%, and the Standard & Poor 500 declined approximately 30%. From the IPO price of $7.00 per share, the stock has struggled to stay above $2.00 for nearly the past two years, and we believe that its current improvement to approximately $2.50 per share as of today, takes into account the market’s reaction to our nominating a new slate of directors.

Messrs. Serruya and Smith

As discussed above, Michael Serruya and David Smith have no relevant experience when it comes to medical diagnostic companies or even more broadly healthcare companies. In fact, we believe that much of their experience is in the ice cream business, specifically with a company named CoolBrands International, a Canadian public company that has not had recent operations. Canadian Business Online’s 2006 annual ranking of the best and worst boards of Canadian public companies based on independence, accountability, share performance and disclosure, ranked CoolBrands second to last. According to a Globe and Mail article from March 30, 2007 entitled “The incredible shrinking ice cream company,” in similar rankings by The Globe and Mail in 2003 and 2004, CoolBrands’ board finished last. According to that same article, the Serruya and Smith families maintained control of CoolBrands through the creation of multiple voting shares (10 votes per share) notwithstanding that they owned less than 15% of the total equity. We think that individuals with such a corporate governance history have no place being directors of your company.

Look at Our Slate

Our goal in forming an alternate slate was to give Ms. Danenberg and her team a Board loaded with relevant, value-added experience on public boards and experience in the molecular diagnostics industry. Every one of our unaffiliated nominees has extensive experience in these areas.

| | · | Tom DeMeester is the emeritus professor and prior chairman of the department of surgery at USC-LA County Medical Center and a founder and current chair of the Response Genetics board. |

| | · | Raj Maheshwari has served as a board member of Akela Pharmaceuticals and has extensive contacts within the molecular diagnostics industry. |

| | · | Robert Majteles has served as a board member of World Heart Corporation, and is the director of the Entrepreneurship Program at the Berkeley Center for Law, Business and the Economy. |

| | · | Michael Tillman served as president and chief executive of Roche Diagnostics North America, chairman of the boards of Roche Diagnostics Asia Pacific Pte. Ltd. and Roche Diagnostics Shanghai Ltd., China. |

| | · | Richard van den Broek serves on the boards of Pharmaxis Ltd. and Pharmacyclics, Inc., public life sciences companies in Australia and the United States. He has extensive knowledge of healthcare company financing and deal structuring. |

| | · | David Wurzer served as executive vice president, treasurer and chief financial officer of Curagen Corporation and held comparable positions at Value Health, Inc, and served at a director of 454 Life Sciences, when it was acquired by Roche Diagnostics. |

In contrast, the majority of management’s board slate consists of legacy members, two of whom bring no relevant expertise or experience to the Board, and three new members who were approved by the same individuals responsible for determining the composition of the current board.

Response Genetics has tremendous potential to grow as a company and to benefit patients, company employees and shareholders. Our goal is to assist the company by ensuring that an experienced, competent and professional Board of Directors is in place to provide the oversight and assistance needed to succeed in a rapidly-changing and volatile segment of healthcare.

WE NEED YOU TO VOTE FOR THE NEW DIRECTORS TO PROTECT YOUR INVESTMENT

In order to cast your vote for our slate of new directors, you can simply complete the enclosed WHITE card and return it as instructed.

We appreciate your support, and if you need assistance or have any questions, please call our Proxy Solicitor, The Altman Group, Inc., toll-free at (877) 297-1745 or collect at (201) 806-7300.

| | Sincerely, SPECIAL SITUATIONS FUND III QP, L.P. SPECIAL SITUATIONS CAYMAN FUND, L.P. SPECIAL SITUATIONS LIFE SCIENCES FUND, L.P.

By:

Austin W. Marxe General Partner |

ADDITIONAL INFORMATION

SSF filed a definitive proxy statement with the Securities and Exchange Commission (the “SEC”) on August 16, 2010. In addition, we may file additional other solicitation materials regarding this proxy solicitation. RESPONSE GENETIC’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT BECAUSE IT CONTAINS IMPORTANT INFORMATION. THE PROXY STATEMENT AND OTHER SOLICITATION MATERIALS ARE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV AND AT OUR SITE AT RGDX_ALT_SLATE.INVESTORROOM.COM.

SSF PARTICIPANT INFORMATION

INFORMATION REGARDING THE IDENTITY OF THE PERSONS WHO MAY, UNDER SEC RULES, BE DEEMED TO BE PARTICIPANTS IN THE SOLICITATION OF SHAREHOLDERS AND THEIR INTERESTS ARE SET FORTH IN THE DEFINITIVE PROXY STATEMENT THAT WAS FILED BY SSF WITH THE SEC.