SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ý | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| For the fiscal year ended September 30, 2007 |

| | |

| o | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-15789

STRATUS SERVICES GROUP, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | | 22-3499261 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| 149 Avenue at the Common, Suite 3, Shrewsbury, New Jersey 07702 |

| (Address of principal executive offices) |

| | | |

| (732) 866-0300 |

| (Registrant’s telephone number, including area code) |

| | | |

Securities registered under Section 12(b) of the Exchange Act: Not Applicable |

| | | |

| Securities registered under Section 12(g) of the Exchange Act: |

| Common Stock, $.04 par value |

| (Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý.

Indicate by check mark whether the registrant has (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý.

The aggregate market value of the voting and non-voting common equity held by non-affiliates, computed by reference to the last sale price of such stock as reported by the OTC Bulletin Board, as of December 31, 2007, was $751,851 based upon 53,703,615 shares held by non-affiliates.

The number of shares of Common Stock, $.04 par value, outstanding as of December 31, 2007 was 69,568,617.

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These statements relate to future economic performance, plans and objectives of management for future operations and projections of revenue and other financial items that are based on the beliefs of our management, as well as assumptions made by, and information currently available to, our management. The words “expect”, “estimate”, “anticipate”, “believe”, “intend”, and similar expressions are intended to identify forward-looking statements. Such statements involve assumptions, uncertainties and risks. If one or more of these risks or uncertainties materialize or underlying assumptions prove incorrect, actual outcomes may vary materially from those anticipated, estimated or expected. Among the key factors that may have a direct bearing on our expected operating results, performance or financial condition are economic conditions facing the information technology staffing industry generally; uncertainties related to the job market and our ability to attract qualified candidates; uncertainties associated with our brief operating history; our ability to raise additional capital; our ability to achieve and manage growth; our ability to attract and retain qualified personnel; our ability to develop new services; our ability to open new offices; general economic conditions; the continued cooperation of our creditors; our ability to diversify our client base; and other factors discussed in Item 1A of this Annual Report under the caption “Risk Factors” and from time to time in our filings with the Securities and Exchange Commission. These factors are not intended to represent a complete list of all risks and uncertainties inherent in our business. The following discussion and analysis should be read in conjunction with the Financial Statements and notes appearing elsewhere in this Annual Report.

In this Annual Report on Form 10-K, references to “Stratus”, “the Company”, “we”, “us” and “our” refer to Stratus Services Group, Inc. and, unless the context otherwise requires, Stratus Technology Services, LLC, and Green-Tech Assets, LLC, each a 51% owned joint venture of Stratus Services Group, Inc.

FORM 10-K

STRATUS SERVICES GROUP, INC.

Form 10-K for the Fiscal Year Ended September 30, 2006

Table of Contents

| | PAGE |

| | 4 |

ITEM 1A. | RISK FACTORS | 8 |

| | 11 |

| | 11 |

| | 11 |

| | | |

| | |

| | 12 |

| | 13 |

| | 13 |

| | 21 |

| | 22 |

| | 22 |

ITEM 9A. | CONTROLS AND PROCEDURES | 22 |

| | | |

| | |

| | 23 |

| | 24 |

| SECURITIES OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 30 |

| | 32 |

| PRINCIPAL ACCOUNTING FEES AND SERVICES | 32 |

| | | |

| | |

| | 33 |

| | | |

| INDEX TO FINANCIAL STATEMENTS | F-1 |

General

We provide information technology (“IT”) staffing services through Stratus Technology Services, LLC (“STS”), a 51% owned subsidiary, and technology asset disposition services through Green-Tech Assets, LLC, which is also a 51% owned subsidiary. Until December 2005, we were a national business services company engaged in providing outsourced labor and operational resources and temporary staffing services. We were incorporated in Delaware in March 1997 and began operations in August 1997 with the purchase of certain assets of Royalpar Industries, Inc. and its subsidiaries. This purchase provided us with a foundation to become a national provider of comprehensive staffing services.

In order to reduce workers’ compensation costs, we began, during the fiscal year ended September 30, 2004, to outsource payroll and related functions for our temporary employees and certain in-house personnel to ALS, LLC, a Florida limited liability company (“ALS”). As a result of this arrangement, all of our field personnel and temporary employees that we placed with our clients became employees of ALS during the fiscal year ended September 30, 2005.

In December 2005, we completed a series of asset sale transactions pursuant to which we sold substantially all of the assets that we used to conduct our staffing services business (the “Asset Sales”). As a result of the Asset Sales, we ceased conducting active staffing services operations for clients other than IT staffing solutions through STS.

STS provides IT staffing solutions to Fortune 1000, middle market and emerging companies. STS offers expertise in a wide variety of technology practices and disciplines ranging from networking professionals to internet development specialists and application programmers.

In August 2007, our newly formed 51% owned subsidiary, Transworld Assets, LLC, acquired substantially all of the assets used by Green-Tech Assets, Inc. and its affiliate, CC Laurel, Inc. in their technology asset disposal business. Following the transaction, we changed the name of Transworld Assets, LLC to Green-Tech Assets, LLC (“Green-Tech”).

Between September 1997 and December 2004, we completed ten acquisitions of staffing businesses, representing thirty offices in seven states. In March 2002, we sold our Engineering Division and in fiscal 2003 we sold the assets of eight of our offices located in Nevada, New Jersey, Florida and Colorado. In addition to the Asset Sales, we sold the assets of six of our northern California offices in June 2005 and in October 2005, we sold the assets of one of our New Jersey offices.

We are headquartered at 149 Avenue of the Common, Suite 3, Shrewsbury, New Jersey 07702 and our telephone number is (732) 866-0300. We maintain a presence on the Internet with our website at www.stratusservices.com, an informational site designed to give prospective customers and employees additional information regarding our operations.

Financial Information About Industry Segments

We disclose segment information in accordance with SFAS NO. 131, “Disclosure about Segments of an Enterprise and Related Information.” During the fiscal year ended September 30, 2007, we operated in two business segments: IT staffing solutions and technology asset disposition services following our acquisition of the Green-Tech business.

IT Staffing Solutions

We provide IT staffing services through our affiliate, STS. STS was formed in November 2000 as a 50/50 joint venture between us and Fusion Business Services, LLC, a New Jersey based technology project management firm, to consolidate and manage the company-wide technology services business into a single entity focused on establishing market share in the IT market for staffing services. We acquired an additional 1% interest in STS in February 2007. See “Part III-Item 13 Certain Relationships and Related Party Transactions”. STS markets its services to client companies seeking staff for project staffing, system maintenance, upgrades, conversions, installations, relocations, etc. STS provides broad-based professionals in such disciplines as finance, pharmaceuticals, manufacturing and media which include such job specifications as Desktop Support Administrators, Server Engineers, Programmers, Mainframe IS Programmers, System Analysts, Software Engineers and Programmer Analysts. In addition, STS, through its roster of professionals, can initiate and manage turnkey IT projects and provide outsourced IT support on a twenty-four hour, seven day per week basis. STS’ IT staffing solutions services are generally provided on a time-and-materials basis, meaning that STS bills its clients for the number of hours worked in providing services to the client. Hourly bill rates are typically determined based on the level of skill and experience of the consultants assigned and the supply and demand in the current market for those qualifications. Alternatively, the bill rates for some assignments are based on a mark-up over compensation and other direct and indirect costs.

Assignments can range from 30 days to over a year, with an average duration of 4 months. STS maintains a variable cost model in which it compensates most of its consultants only for those hours that it bills to its clients. The consultants who perform IT services for its clients consist of independent contractors and subcontractors. As a result of the sale of our staffing services business, we expect to focus primarily on the development of the STS IT staffing solutions business in fiscal 2006.

Technology Asset Disposition Services

General

Since August 2007, we have provided technology asset disposition services through our 51% owned subsidiary, Green-Tech. Green-Tech is a technology risk management company that provides complete, creative asset disposal and disposition solutions for Fortune 1000 and other companies. Green-Tech’s services include:

| · | technology asset disposition services; |

| · | data security protection; and |

| · | asset auditing and tracking. |

Green-Tech’s integrated legal, financial and insurance program is designed to provide liability protection against all environmental, software license infringement and security risks relating to the retirement of technology assets.

The Industry

In response to growing environmental and data security challenges facing businesses, information technology asset disposal services are being increasingly used in companies around the world. The recycling of desktops, notebooks personal computers, monitors, consumer electronics and all other electronic products and systems has become a growing business as a result of data security and environmental liability concerns. According to IDC, a subsidiary of Intelligence Data Group which provides market intelligence advisory services to the IT industry, approximately 35.3% of United States companies use a third party disposal service for the disposition of their technology assets. Companies use third party providers for their data security expertise and their ability to provide a certificate of compliance to protect against business, legal and environmental risks. In light of the potentially damaging impact on the environment that disposal of technology assets presents, companies are utilizing third party technology disposal providers to facilitate compliance with regulatory requirements and minimize environmental liability.

Technology Disposal and Risk Management

In providing its technology disposal services, Green-Tech utilizes the following four phase process:

| · | Risk Identification– Green-Tech assesses the client needs and identifies the risks that the client faces in disposing of its technology assets |

| · | Risk Analysis– The risks identified by Green-Tech and their potential impact on the client are analyzed and designated as either high, medium or low risk |

| · | Risk Planning– After analyzing the possible impact of the identified risks, Green-Tech develops step-by-step action plans outlining potential options on a worst case scenario basis |

| · | Risk Tracking – Green-Tech monitors “trigger events” that indicate that a risk is about to become a reality |

| · | Risk Control – Green-Tech takes the steps to minimize the adverse consequences of a risk scenario. |

Green-Tech provides quotes to clients on a per project basis and offers menu servicing designed to respond to simple as well as complex solutions processes.

Asset Recycling

Green-Tech utilizes new collection and processing technology to recycle a vast array of materials including commercial office paper, aluminum, electronic scrap, metals, organics and post-industrial plastics when a decision has been made to dispose of technology and other assets. Green-Tech partners with ISO 9001 and 14001 vendors who guarantee a zero landfill process where all materials are reused.

Through its relationship with a national insurer, Green-Tech provides environmental liability insurance to its clients who are named as additional insureds on Green-Tech’s insurance policies.

Data Security Protection

Retired technology assets can be sources of security breaches if the data they store is not properly removed prior to retirement. According to a study conducted by IDC, security concerns are the primary motivation for companies to use a third party information technology-asset disposal vendor. In addition to concerns about breaches of security and the risk of confidential data being used improperly, companies are now subject to a variety of laws and regulations which impose privacy requirements or mandate the protection of personal data, such as the Sarbanes-Oxley Act of 2002, the Gramm-Leach-Billey Act, Fair Credit Reporting Act, and the USA Patriot Act. As a result, companies need to ensure that data stored on its systems is fully secured or destroyed.

Green-Tech eliminates data security risks by utilizing U.S. Department of Defense certified data destruction technologies. Green-Tech’s 2000 full overwrite processes completely sanitize hard drives before their final disposition is determined. Hard drives that cannot be tested are physically destroyed and recycled to insure that no data breaches occur.

Asset Auditing and Tracking

As part of its asset audit and tracking services, Green-Tech maintains a comprehensive data base of serial numbers, asset tags and model number identification details for all technology assets it processes. Retired assets are registered, evaluated and routed for other services. The process is fully documented through the final disposition or redeployment of the asset. Green-Tech’s comprehensive data base enable clients to demonstrate that their technology assets have been disposed of in a manner that complies with all regulatory requirements.

Resale of Technology Assets

In addition to generating revenues from services to its clients, Green-Tech obtains additional revenues from sales of refurbished and/or working equipment collected from customers. Sales are generally conducted through on-line auction sites such as E-Bay.

Competitive Business Conditions

IT Staffing. STS operates in a highly competitive and fragmented industry. There are relatively few barriers to entry into its markets, and the IT staffing industry is served by thousands of competitors, many of which are small, local operations. There are also numerous large national and international competitors that directly compete with us, including TEKsystems, Inc., Ajilon Consulting, MPS Group, Inc., Kforce Inc., Spherion Corporation, CDI Corp., Computer Horizons Corp. and Analysts International Corp. Many of STS’ competitors may have greater marketing and financial resources than STS.

The competitive factors in obtaining and retaining clients include, among others, an understanding of client-specific job requirements, the ability to provide appropriately skilled information technology consultants in a timely manner, the monitoring of job performance quality and the price of services. The primary competitive factors in obtaining qualified candidates for temporary IT assignments are wages, the technologies that will be utilized, the challenges that an assignment presents and the types of clients and industries that will be serviced.

Technology Asset Disposition. The technology asset disposal industry is highly competitive and fragmented. Green-Tech competes on a local, regional and national level with a small number of major firms and many smaller companies. Green-Tech competes primarily on the uniqueness, quality and design of its services platform. Certain of Green-Tech’s competitors have greater name recognition and financial resources than Green-Tech. Green-Tech may also face competition from potential new entrants into the technology asset disposal industry or increased competition from existing competitors that may attempt to develop the ability to offer the full range of services offered by Green-Tech. Green-Tech believes that competition is based primarily on the ability to deliver solutions that meet a client’s requirements and, to a lesser extent, on price. Green-Tech’s competitors include Intechra, Redemtech and large electronics companies such as IBM, Dell and Sony. There can be no assurance that Green-Tech will be able to compete successfully in the future against existing or potential competitors.

Sales and Marketing

Due to monetary constraints our marketing has been limited. For the most part our information technology revenues sales have been generated by our internal sales forces located in our New Jersey and Florida offices. Recently we expanded our sales force in both the West and Mid-West regions of the United States. We generate sales for our technology asset disposal service business through our internal sales force and through third-party sales representatives. Our marketing strategy includes the cross-selling of both information technology services and technology asset disposal services.

Customers

STS and Green-Tech provide services to customers throughout the United States. During the year ended September 30, 2007, one STS customer represented 34% of STS’ revenues. During the period from August 2, 2007 (the date we acquired Green-Tech’s business) through September 30, 2007, two customers represented 37% and 16% of Green-Tech’s revenues, respectively. A loss of any of these customers could have a material adverse effect on our business.

Governmental Regulation

Staffing services firms, including IT staffing firms, are generally subject to one or more of the following types of government regulation: (1) regulation of the employer/employee relationship between a firm and its temporary employees; and (2) registration, licensing, record keeping and reporting requirements. Staffing services firms are the legal employers of their temporary workers. Therefore, laws regulating the employer/employee relationship, such as tax withholding and reporting, social security or retirement, anti-discrimination and workers’ compensation, govern these firms. State mandated workers’ compensation and unemployment insurance premiums have increased in recent years and have directly increased our cost of services. In addition, the extent and type of health insurance benefits that employers are required to provide employees have been the subject of intense scrutiny and debate in recent years at both the national and state level. Proposals have been made to mandate that employers provide health insurance benefits to staffing employees, and some states could impose sales tax, or raise sales tax rates on staffing services. Further increases in such premiums or rates, or the introduction of new regulatory provisions, could substantially raise the costs associated with hiring and employing staffing employees.

Certain states have enacted laws that govern the activities of “Professional Employer Organizations,” which generally provide payroll administration, risk management and benefits administration to client companies. These laws vary from state to state and generally impose licensing or registration requirements for Professional Employer Organizations and provide for monitoring of the fiscal responsibility of these organizations. We believe that Stratus is not a Professional Employer Organization and not subject to the laws that govern such organizations; however, the definition of “Professional Employer Organization” varies from state to state and in some states the term is broadly defined. If we are determined to be a Professional Employer Organization, we can give no assurance that we will be able to satisfy licensing requirements or other applicable regulations. In addition, we can give no assurance that the states in which we operate will not adopt licensing or other regulations affecting companies that provide commercial and professional staffing services.

Green-Tech’s operations are subject to numerous Federal and state statutes and regulations which govern the handling, transportation and disposition of hazardous materials, including cathode ray tubes and other components of and materials included in the technology assets handled, recycled and disposed of by Green-Tech.

Trademarks

We have not obtained federal registration of any of the trademarks we currently use or previously used in our business, including our slogan, name or logo or the slogan, name or logo of STS or Green-Tech. Currently, we are asserting Common Law protection for these slogans, names and logos by holding the marks out to the public as the property of Stratus, STS or Green-Tech, as the case may be. However, no assurance can be given that this Common Law assertion will be effective to prevent others from using any of our marks concurrently or in other locations. In the event someone asserts ownership to a mark, we may incur legal costs to enforce any unauthorized use of the marks or defend ourselves against any claims.

Employees

As of September 30, 2007, we were employing 87 total employees. Of that amount, 42 were billable employees on assignments. In addition, as of September 30, 2007, we had 23 consultants on assignment.

STS recruits its consultants through both centralized and decentralized recruiting programs. Its recruiters use its internal proprietary database, the Internet, local and national advertisements and trade shows.

This Form 10-K contains forward-looking statements concerning our future programs, products, expenses, revenue, liquidity and cash needs as well as our plans and strategies. These forward-looking statements are based on current expectations and the Company assumes no obligation to update this information. Numerous factors could cause actual results to differ significantly from the results described in these forward-looking statements, including the following risk factors.

We have disposed of a substantial portion of our assets and have significantly reduced the scope and changed the nature of our operations.

In December 2005, we completed a series of transactions pursuant to which we sold substantially all of the assets used to conduct our staffing services business, other than the IT staffing solutions business that we conduct through our 51% owned joint venture, STS. In August 2007, we entered the technology asset disposition business through our acquisition of Green-Tech’s business.

The sale of our staffing operations may subject us to claims of third parties.

We completed the Asset Sales with a view toward avoiding a foreclosure action by our lender and maximizing our prospects of reducing our indebtedness to creditors, including our lender, and the possibility of preserving value for our shareholders. In light of the exigent circumstances surrounding the Asset Sales, formal corporate procedures typically required in connection with these types of transactions were not adhered to. As a result, no assurance can be given that creditors and/or shareholders will not assert claims against us related to the Asset Sales.

We have limited liquid resources and a history of net losses.

Our auditors have qualified their opinion on our financial statements for the year ended September 30, 2006, with a qualification which raises substantial doubt about our ability to continue as a going concern. Our ability to continue in business depends upon the continued cooperation of our creditors, our ability to generate sufficient cash flow to meet our continuing obligations on a timely basis and our ability to obtain additional financing. Current liabilities at September 30, 2007 were $9,787,281 and current assets were $1,749,528. The difference of $8,037,753 is a working capital deficit, which is primarily the result of losses incurred during the previous four years. At September 30, 2007, we owed $1,434,058 under promissory notes that are past due or due upon demand, as well as $300,000 that was due in January 2005 in connection with the redemption of our Series A Preferred Stock. In addition, approximately $3.1 million of payroll taxes, including interest and penalties, was delinquent. We can give no assurance that we will raise sufficient capital to eliminate our working capital deficit or that our creditors will not seek to enforce their remedies against us, which could include the imposition of insolvency proceedings.

We may not be able to successfully integrate or manage the operations of Green-Tech

If we are unable to successfully manage and integrate the technology asset disposition operations of Green-Tech which we acquired in August 2007, our financial condition and operating results may suffer. We have no prior experience in the technology asset disposition industry and are heavily dependent on the personnel who joined us when we acquired the Green-Tech business.

Fluctuations in the general economy could have an adverse impact on our business.

Demand for IT staffing services is significantly affected by the general level of economic activity and unemployment in the United States. Companies use temporary staffing services to manage personnel costs and staffing needs. When economic activity increases, temporary employees are often added before full-time employees are hired. However, as economic activity slows, many companies reduce their utilization of temporary employees before releasing full-time employees. In addition, we may experience less demand for the services we provide through STS and more competitive pricing pressure during periods of economic downturn. Therefore, any significant economic downturn could have a material adverse effect on our business, results of operations, cash flows or financial condition.

We may be unable to achieve and manage our growth.

Our ability to achieve growth will depend on a number of factors, including: the strength of demand for IT solutions consultants and technology asset disposition services in our markets; the availability of capital to fund acquisitions; the ability to maintain or increase profit margins despite pricing pressures; and existing and emerging competition. We must also adapt our infrastructure and systems to accommodate growth and recruit and train additional qualified personnel. Should an economic slowdown or a recession continue for an extended period, competition for customers in the IT staffing solutions and technology asset disposition industries would increase and may adversely impact management’s allocation of our resources and result in declining revenues.

We rely heavily on executive management and could be adversely affected if our executive management team was not available.

We are highly dependent on our senior executives, including Joseph J. Raymond, our Chairman, CEO and President since September 1, 1997, and Michael A. Maltzman, Executive Vice President and Chief Financial Officer who has been serving in that capacity since September 1, 1997. We entered into an employment agreement with Mr. Raymond effective September 1, 1997, for continuing employment until he chooses to retire or until his death and that agreement remains in effect as written. In April 2005, we entered into a new employment agreement with Mr. Maltzman which expires in April 2008. The loss of the services of either Mr. Raymond or Mr. Maltzman could have a material adverse effect on our business, results of operations, cash flows or financial condition.

We rely heavily on our management information systems and our business would suffer if our systems fail or cannot be upgraded or replaced on a timely basis.

We believe our management information systems are instrumental to the success of our operations. Our business depends on our ability to store, retrieve, process and manage significant amounts of data. We continually evaluate the quality, functionality and performance of our systems in an effort to ensure that these systems meet our operational needs. We have, in the past, encountered delays in implementing, upgrading or enhancing systems and may, in the future, experience delays or increased costs. There can be no assurance that we will meet anticipated completion dates for system replacements, upgrades or enhancements that such work will be competed in the cost-effective manner, or that such replacements, upgrades and enhancements will support our future growth or provide significant gains in efficiency. The failure of the replacements, upgrades and enhancements to meet these expected goals could result in increased system costs and could have a material adverse effect on our business, results of operations, cash flows or financial condition.

Our financial results will suffer if we lose any of our significant customers.

Certain of our engagements to provide services to its customers are of a non-exclusive, short-term nature and subject to termination by the customer with little or no notice. The loss of any of our significant customers could have an adverse effect on our business, results of operations, cash flows or financial condition. We are also subject to credit risks associated with our trade receivables. Should any principal customers default on their large receivables, our business results of operations, cash flows or financial condition could be adversely affected.

We have experienced significant fluctuations in our operating results and anticipate that these fluctuations may continue.

Fluctuations in our operating results could have a material adverse effect on the price of our common stock. Operating results may fluctuate due to a number of factors, including the demand for our services, the level of competition within our markets, our ability control costs and expand operations, the timing and integration of acquisitions and the availability of qualified IT consultants. In addition, our results of operations could be, and have in the past been, adversely affected by severe weather conditions. Moreover, our results of operations have also historically been subject to seasonal fluctuations and this seasonality may continue in the future.

We compete in highly competitive markets with limited barriers to entry and significant pricing pressures and we may not be able to continue to successfully compete.

Both the U.S. IT staffing services and technology asset disposition markets are highly competitive and fragmented. Through STS, we compete in national, regional and local markets with full-service and specialized staffing agencies, systems integrators, computer systems consultants, search firms and other providers of staffing services. Green-Tech competes with a small number of large firms and many smaller companies. A majority of our competitors are significantly larger than we are and have greater marketing and financial resources than us. In addition, there are relative few barriers to entry into our markets and we have faced, and expect to continue to face, competition from new entrants into our markets. We expect that the level of competition will remain high in the future, which could limit our ability to maintain or increase our market share or maintain or increase gross margins, either of which could have a material adverse effect on our financial condition and results of operations. In addition, from time to time we experience significant pressure from our clients to reduce price levels, and during these periods we may face increased competitive pricing pressures. Competition may also affect our ability to recruit the personnel necessary to fill the needs of STS’ clients. We also face the risk that certain of STS’ current and prospective clients will decide to provide similar services internally. We may not be able to continue to successfully compete.

Our profitability will suffer if STS is not able to maintain current levels of billable hours and bill rates and control its costs.

Our profit margin, and therefore our profitability, is largely dependent on the number of hours billed for STS’ services, the rates it charges for these services and the pay rate of its consultants. Accordingly, if we are unable to maintain these amounts at

current levels, our profit margin and our profitability will suffer. The rates STS charges for its services are affected by a number of considerations, including:

| Ÿ | its clients’ perception of our ability to add value through our services; |

| Ÿ | competition, including pricing policies of its competitors; and |

| Ÿ | general economic conditions. |

The number of billable hours is affected by various factors, including the following:

| Ÿ | the demand for IT staffing services; |

| Ÿ | the quality and scope of its services; |

| Ÿ | seasonal trends, primarily as a result of holidays, vacations and inclement weather; |

| Ÿ | the number of billing days in any period; |

| Ÿ | the ability to transition consultants from completed assignments to new engagements; |

| Ÿ | the ability to forecast demand for services and thereby maintain an appropriately balanced and sized workforce; and |

| Ÿ | the ability to manage consultant turnover. |

STS’ pay rates are affected primarily by the supply of and demand for skilled U.S.-based consultants. During periods when demand for consultants exceeds the supply, pay rates may increase.

STS may be unable to attract and retain qualified billable consultants, which could have an adverse effect on its business, financial condition and results of operations.

STS’ operations depend on its ability to attract and retain the services of qualified billable consultants who possess the technical skills and experience necessary to meet its clients’ specific needs. STS must continually evaluate, upgrade and supplement our staff in each of our markets to keep pace with changing client needs and technologies and to fill new positions. The IT staffing industry in particular has high turnover rates and is affected by the supply of and demand for IT professionals. This has resulted in intense competition for IT professionals, and we expect such competition to continue. Customers may also hire STS’ consultants, which increases our turnover rate. The failure to attract and retain the services of personnel, or an increase in the turnover rate among STS employees, could have a material adverse effect on IT staffing business, operating results or financial condition. If a supply of qualified consultants, particularly IT professionals, is not available in sufficient numbers or on economic terms that are, or will continue to be, acceptable to us, our business, operating results or financial condition could be materially adversely affected.

We may be subject to claims as a result of actions taken by our temporary staffing personnel.

Actions taken by our temporary staffing employees could subject us to significant liability. Providers of temporary staffing services place people in the workplaces of other businesses. An inherent risk of such activity includes possible claims of errors and omissions, discrimination or harassment, theft of customer property, misappropriation of funds, misuse of customers’ proprietary information, employment of undocumented workers, other criminal activity or torts, claims under health and safety regulations and other claims. There can be no assurance that we will not be subject to these types of claims, which may result in negative publicity and our payment of monetary damages or fines, which, if substantial, could have a material adverse effect on our business, results of operations, cash flows or financial condition.

Short sales of our common stock could place downward pressure on the price of our common stock.

Selling stockholders and others may engage in short sales of our common stock. Short sales could place downward pressure on the price of our common stock.

Regulatory and legal uncertainties could harm our business.

The implementation of unfavorable governmental regulations or unfavorable interpretations of existing regulations by courts or regulatory bodies could require us to incur significant compliance costs, cause the development of the affected markets to become impractical or otherwise adversely affect our financial performance. If we are determined to be a “Professional Employer Organization,” we cannot assure you that we will be able to satisfy licensing requirements or other applicable regulations. Certain states have enacted laws which govern the activities of Professional Employer Organizations, which generally provide payroll administration, risk management and benefits administration to client companies. These laws vary from state to state and generally impose licensing or registration requirements for Professional Employer Organizations and provide for monitoring of the fiscal responsibility of these organizations. We believe that Stratus is not a Professional Employer Organization and not subject to the laws which govern such organizations; however, the definition of Professional Employer Organization varies from state to state and in

some states the term is broadly defined. In addition, we can give no assurance that the states in which we operate will not adopt licensing or other regulations affecting companies which provide commercial and professional staffing services.

Green-Tech is subject to numerous Federal and state laws and regulations pertaining to the handling, transport and disposition of hazardous materials, as well as laws pertaining to safeguarding personal data which may be embedded in the technology assets recycled and disposed of by Green-Tech. Any failure to comply with these laws could subject Green-Tech to liability.

We own no real property. We lease approximately 3,000 square feet in a professional office building in Shrewsbury, New Jersey as our and STS’ corporate headquarters. That facility houses all of our centralized corporate functions, including the Executive management team, payroll processing, accounting, human resources and legal departments. Our lease expires on May 31, 2011. In addition, STS maintains a branch office in Winter Park, Florida under a month to month lease and Green-Tech leases approximately 20,000 square feet of office and warehouse space in Providence, Rhode Island under a month-to-month lease. We believe that our facilities are generally adequate for our needs and we do not anticipate any difficulty in replacing such facilities or locating additional facilities, if needed.

We are currently a party to the following actions:

Tymatt Associates, LLC v. Stratus Services Group, Inc. On October 15, 2007, Tymatt Associates, LLC (“Tymatt”) filed suit against us for breach of contract in the Supreme Court of the State of New York, County of New York, seeking damages of $300,000 plus accrued interest at a rate of 18% per annum from January 31, 2005, as well as costs and expenses, including accountant’s fees and attorney’s fees, in connection with our failure to either pay to Tymatt the sum of $250,000 or to deliver to Tymatt a number of shares of Stratus common stock with a value of $250,000 by January 31, 2005 as required by the terms of a redemption agreement pertaining to our Series A Preferred Stock. We have been in discussions with Tymatt in an attempt to resolve this matter; however, no assurance can be given that we will be able to resolve this matter on terms that are satisfactory to us.

TeamOne Personnel Solutions, LLC vs. Stratus Services Group, Inc. On October 19, 2007, TeamOne Personnel Solutions, LLC (“TeamOne”) filed a Request for Entry of Default and Court Judgment in the amount of $157,004 in the Superior Court of California, County of Solano. TeamOne had filed in July 2007 suit seeking enforcement of an acceleration provision of a promissory note (the “Note”) executed by us in favor of TeamOne on March 2, 2005 in the principal amount of $160,000. We have been discussions with TeamOne to arrange for a deferred payment schedule for the amount owed; however, no assurance can be given that TeamOne will agree to deferring payment and will not seek to enforce its judgment.

In re APX Holdings, LLC, et al. In August 2007, the Trustee in a Chapter 7 bankruptcy proceeding in the United States Bankruptcy Court for the Central District of California involving APX Holding, LLC, one of our former customers, brought an action against us and several other parties, including our former lender and ALS, seeking to recover $860,184 of preference payments that were allegedly made by APX and its affiliates. We believe that the maximum amount of payments received by us which could be considered recoverable preference payments is approximately $23,000. As a result, we are vigorously defending this action.

Temporary Services Insurance Ltd. V. Stratus Services Group, Inc., ALS, LLC, U.S. Temps, Inc., et al. In September 2007, Temporary Services Insurance Ltd. (“TSIL”) instituted an action in the United States District Court, Middle District of Florida, Orlando Division, against us, ALS, certain principals and affiliates of ALS, and certain other parties alleging that we participated in a fraudulent scheme to obtain workers compensation insurance through TSIL at a cost substantially lower than the cost of workers compensation insurance that we could have otherwise obtained through our own carriers. In its complaint, TSIL, which seeks unspecified damages, alleges that ALS failed to disclose certain outsourcing agreements with its clients, including the outsourcing agreements between us and ALS, that the employees provided by ALS to perform services for us and our clients were actually our employees, and that we were unjustly enriched by ALS’ misrepresentations and failure to disclose material facts pertaining to its relationship with us. We intend to vigorously defend this matter.

We are involved, from time to time, in other routine litigation arising in the ordinary course of business. We do not believe that any other currently pending litigation will have a material adverse effect on our financial position or results of operations.

| SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

During the fourth quarter of fiscal 2007, no matter was submitted to a vote of security holders through the solicitation of proxies or otherwise.

| MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES. |

Our common stock was delisted from the Nasdaq SmallCap Market and is currently trading on the NASD OTC Bulletin Board under the symbol “SSVG.OB”. There were approximately 100 holders of record of common stock as of December 31, 2007. This number does not include the number of shareholders whose shares were held in “nominee” or “street name”. The table below sets forth, for the periods indicated, the high and low sales prices of our common stock as reported by the NASD OTC Bulletin Board.

| Fiscal Year 2006 | High | Low |

| Quarter Ended December 31, 2005 | 0.07 | 0.01 |

| Quarter Ended March 31, 2006 | 0.02 | 0.01 |

| Quarter Ended June 30, 2006 | 0.05 | 0.02 |

| Quarter Ended September 30, 2006 | 0.05 | 0.01 |

| Fiscal Year 2007 | High | Low |

| Quarter Ended December 31, 2006 | 0.02 | 0.01 |

| Quarter Ended March 31, 2007 | 0.02 | 0.01 |

| Quarter Ended June 30, 2007 | 0.02 | 0.01 |

| Quarter Ended September 30, 2007 | 0.10 | 0.01 |

On December 31, 2007, the closing price of our common stock as reported by the NASD OTC Bulletin Board was $.014 per share. We have never paid cash dividends on our common stock and we intend to retain earnings, if any, to finance future operations and expansion. Any future payment of dividends on our common stock will depend upon our financial condition, capital requirements and earnings as well as other factors that the Board of Directors deems relevant.

See “Part III, Item 12, Security Ownership of Certain Beneficial Owners and Management” for information regarding securities authorized for issuance under equity compensation plans.

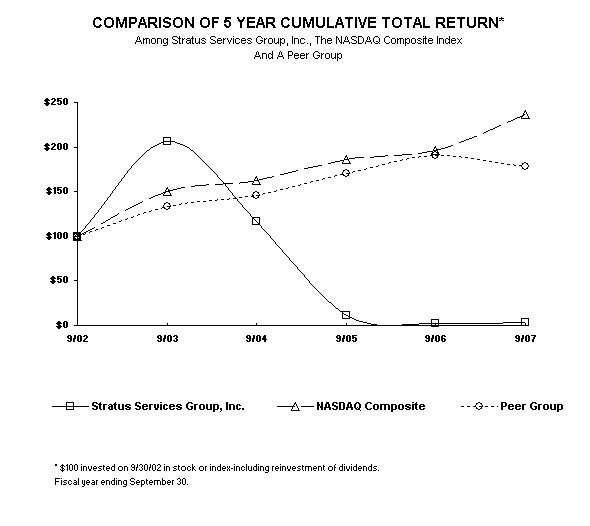

PERFORMANCE GRAPH

Set forth below is a performance graph which compares the percentage change in the cumulative total stockholder return on our Common Stock for the period from September 30, 2002 to September 30, 2007, with the cumulative total return over the same period on the Nasdaq Composite Index and a peer group over the same period (assuming the investment of $100 in the Company’s Common Stock, the Nasdaq Market Index and the peer group index on September 30, 2002 and that all dividends were reinvested).

| | 9/30/02 | 9/30/03 | 9/30/04 | 9/30/05 | 9/30/06 | 9/30/07 |

Stratus Services Group, Inc. | 100.00 | 206.67 | 116.67 | 10.83 | 2.00 | 3.92 |

| NASDAQ Composite | 100.00 | 150.59 | 162.76 | 185.69 | 196.70 | 236.91 |

Peer Group (1) | 100.00 | 133.32 | 145.47 | 170.20 | 190.62 | 178.59 |

(1) Consists of the following companies:

| Adecco SA | Comsys It Partners Inc. | Monster Worldwide Inc. |

| Administaff Inc. | Cross Country Healthcare Inc. | MPS Group Inc. |

| Allied Healthcare International Inc. | General Employees Ents | National Technical Systems Inc. |

| AMN Healthcare Services Inc. | Gevity HR Inc. | On Assignment Inc. |

| Analysts International | Heidrick Struggles International | RCM Technologies Inc. |

| ATC Healthcare Inc. | Hudson Highland Group Inc. | Resources Connection Inc. |

| Barrett Business Services Inc. | Kelly Services Inc. | Robert Half International |

| Butler International | Kforce Inc. | Spherion Corp. |

| CDI Corp. | Korn Ferry International | Teamstaff Inc. |

| Comforce Corp. | Labor Ready Inc. | Techteam Global Inc. |

| Computer Horizons Corp. | Manpower Inc. | Volt Information Science Inc. |

| Computer Task Group Inc. | Medical Staffing Network Holdings | Westaff Inc. |

(In thousands except per share)

The selected financial data that follows should be read in conjunction with our financial statements and the related notes thereto and Management’s Discussion and Analysis of Financial Condition and Results of Operations appearing elsewhere in this report.

| | Year Ended September 30, |

| | 2007 | 2006 | 2005 | | 2004 | | 2003 | |

| | | | | | | | | |

| Income statement data: | | | | | | | | |

| Revenues | $ 8,210 | $ 5,131 | $ 4,521 | | $ 1.150 | (1) | $ — | (1) |

| Gross profit | 2,492 | 1,526 | 1,318 | | 384 | | — | |

| Operating (loss) from continuing operations | (479) | (1,556) | (3,960) | | (3,055) | | (2,464) | |

| Net (loss) from continuing operations | (677) | (2,055) | (634) | | (1,834) | | (2,707) | |

| Net (loss) from continuing operations attributable to common stockholders | (719) | (2,097) | (676) | | (7,148) | | (4,337) | |

| | | | | | | | | |

| Per share data: | | | | | | | | |

| Net (loss) from continuing operations attributable to common stockholders – basic | $ (.01) | $ (.05) | $ (.04) | | $ (.94) | | $ (.25) | |

| Net (loss) from continuing operations attributable to common stockholders – diluted | $ (.01) | $ (.05) | $ (.04) | | $ (.94) | | $ (.25) | |

| Cash dividends declared | ¾ | ¾ | ¾ | | ¾ | | ¾ | |

| | | | | | | | | |

| | Year Ended September 30, |

| | 2007 | 2006 | 2005 | | 2004 | | 2003 | |

| | | | | | | | | |

| Balance sheet data: | | | | | | | | |

| Net working capital (deficiency) | $(8,038) | $(7,339) | $(9,161) | | $(16,267) | | $(7,979) | |

| Long-term obligations, including current portion | 2,323 | 1,457 | 858 | | 2,649 | | 4,001 | |

| Put option liability | — | — | — | | 673 | | 823 | |

| Warrant liability | — | — | 2 | | 5,266 | | — | |

| Minority Interest in Subsidiaries | 547 | 41 | 22 | | — | | — | |

| Redeemable convertible preferred stock | — | — | 2,218 | | 2,218 | | 3,810 | |

| Stockholders’ equity (deficiency) | (7,780) | (8,055) | (9,876) | | (9,773) | | (4,915) | |

| Total assets | 3,805 | 2,015 | 18,798 | | 27,907 | | 25,151 | |

(1) Prior to the third quarter of fiscal 2004, we accounted for our investment in STS, then a 50%-owned joint venture, under the equity method. Accordingly, the financial statements did not include the accounts of the joint venture until beginning with the third quarter of fiscal 2004 when the accounts of the joint venture were included in the consolidated financial statements.

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. |

Introduction

From inception until December 2005, we provided a wide range of staffing services and productivity consulting services associated with such staffing services nationally through a network of offices located throughout the United States. In December 2005, we completed a series of asset sale transactions pursuant to which we sold our staffing operations. As a result of such sales, we no longer actively conduct any staffing services business, other than IT staffing solutions services conducted through our 51% owned joint venture, STS. In August 2007, we entered the technology asset disposition business through our acquisition of the operations now conducted by our 51% subsidiary, Green-Tech.

Critical Accounting Policies and Estimates

The following accounting policies are considered by us to be “critical” because of the judgments and uncertainties affecting the application of these policies and because of the likelihood that materially different amounts would be reported under different conditions or using different assumptions.

Revenue Recognition

We recognize revenue from our staffing services as the services are performed by our workforce. Our customers are generally billed bi-weekly. At balance sheet dates, there are accruals for unbilled receivables and related compensation costs. We also provide permanent placement services. Fees for placements are recognized at the time the candidate commences employment. We guarantee our permanent placements for 60-90 days. In the event a candidate is not retained for the guarantee period, we will provide a suitable replacement candidate. In the event a replacement candidate cannot be located, we will provide a refund to the client. An allowance for refunds, based on our historical experience, is recorded in the financial statements. Revenues are recorded on a gross basis as a component of revenues. We recognize revenues from our technology asset disposal business when the services are rendered or when the product has been delivered so long as there is an agreed upon price and collection of the revenue is reasonably assured.

Allowance for Doubtful Accounts Receivable

We provide customary credit terms to our customers and generally do not require collateral. We perform ongoing credit evaluations of the financial condition of our customers and maintain an allowance for doubtful accounts receivable based upon historical collection experience and expected collectibility of accounts. As of September 30, 2007, we had recorded an allowance for doubtful accounts of approximately $200,000. The actual bad debts may differ from estimates and the difference could be significant.

Goodwill and Other Intangible Assets

We follow Financial Accounting Standards N. 142 (SFAS No. 142), “Goodwill and Other Intangible Assets”. Under SFAS No. 142, goodwill and indefinite lived intangible assets are no longer amortized but are reviewed at least annually for impairment. SFAS No. 142 prescribes a two-phase process for impairment testing of goodwill. The first phase screens for impairment; while the second phase (if necessary), measures the impairment. Factors included in the impairment analysis include expected revenue and EBITDA growth rates, working capital needs, discount rates and earnings multiples. These assumptions are based on management’s best estimate of the current and expected economic environment.

Valuation Allowance Against Deferred Income Tax Assets

Deferred tax assets and liabilities are determined based on differences between the financial reporting and tax bases of assets and liabilities, and are measured using the enacted tax rates and laws that are expected to be in effect when the differences reverse. We have recorded a valuation allowance of approximately $9.3 million to offset the entire balance of the deferred tax asset as of September 30, 2007. The valuation allowance was recorded as a result of the losses incurred by us and our belief that it is more likely than not that we will be unable to recover the net deferred tax assets.

Results of Operations

Discontinued Operations/Acquisition or Disposition of Assets

Effective as of June 5, 2005, we sold substantially all of the tangible and intangible assets, excluding accounts receivable of our six Northern California offices to ALS, a related party (see Note 15 to the Consolidated Financial Statements).

The purchase price was $3,315,719, which represented the balance due by us to ALS as of the close of business on May 3, 2005, less $600,000. Accordingly, $3,315,719 due to ALS as of the date of the sale was deemed paid and cancelled. In addition, all amounts due to us from ALS as of the date of sale were deemed paid in full. Such amounts aggregating $376,394 were comprised of a note receivable ($122,849), accounts receivable ($50,000) and other receivables ($203,545). ALS and our then lender also entered into a transaction pursuant to which ALS contributed $600,000 in exchange for a junior participation interest in amounts borrowed under our line of credit. ALS agreed to pay to us $600,000 as contingent purchase price. We agreed that this amount would be paid to us or offset against balances due by us to ALS, when ALS was repaid the junior participation interest and all other amounts due by us to ALS were paid in full. All amounts owed by ALS to us and by us to ALS under this agreement were satisfied in connection with our Asset Sale Transaction with ALS that was completed in December 2005.

In connection with the June 2005 transaction, we and ALS entered into a non-compete and non-solicitation agreement pursuant to which we agreed not to compete with ALS with the customers of and in the geographic area of the Northern California offices, and ALS agreed not to compete with us with respect to certain customers and accounts, including, accounts serviced by our remaining offices, for a period of two years.

The sale resulted in a gain of $2,239,108, computed as follows:

| | |

| Sales price – cancellation of accounts payable – related parties | $3,315,719 |

| | |

| Less costs of sale: | |

Write-off of amounts due from ALS | (376,394) |

Other costs (including $75,000 to a related party) | (322,952) |

| | |

Balance | 2,616,373 |

Net assets sold | 377,265 |

Gain | $2,239,108 |

In December 2005, we completed the following series of transactions pursuant to which we sold substantially all of our assets used to conduct our staffing services business, other than the IT staffing solutions business that is conducted through our 51% owned joint venture, STS:

| (a) | On December 2, 2005, we completed the sale, effective as of November 21, 2005, of substantially all of the tangible and intangible assets, excluding accounts receivable, of several of our offices located in the Western half of the United States (the “ALS Purchased Assets”) to ALS. The offices sold were the following: Chino, California; Colton, California; Los Angeles, California; Los Nietos, California; Ontario, California; Santa Fe Springs, California and the Phoenix, Arizona branches and the Dallas Morning News Account (the “Western Offices”). Pursuant to the terms of an Asset Purchase Agreement between us and ALS dated December 2, 2005 (the “ALS Asset Purchase Agreement”), the purchase price for the ALS Purchased Assets was paid or is payable as follows: |

| • | $250,000 was paid over the 60 days following December 2, 2005, for our documented cash flow requirements, all of which is payable at a rate no faster than $125,000 per 30 days; |

| • | $1,000,000 payable by ALS is being paid directly to certain taxing authorities to reduce our tax obligations; and |

| • | $3,537,000 which was paid by means of the cancellation of all net indebtedness owed by us to ALS outstanding as of the close of business on December 2, 2005. |

| In addition to the foregoing amounts, ALS also assumed our obligation to pay $798,626 due under a certain promissory note issued by us to Provisional Employment Solutions, Inc. As a result of the sale of the ALS Purchased Assets to ALS, all sums due and owing to ALS by us were deemed paid in full and no further obligations remain. |

In connection with the transaction, we entered into Non-Compete and Non-Solicitation Agreements with ALS pursuant to which we agreed not to compete with ALS with the customers of and in the geographic area of the Western Offices, and ALS agreed not to compete with us with respect to certain customers and accounts, including, accounts serviced by our remaining offices, for a period of two years.

| (b) | On December 5, 2005, we completed the sale, effective as of November 28, 2005 (the “AI Effective Date”), of substantially all of the tangible and intangible assets, excluding accounts receivable and other certain items, as described below, of three of our California offices (the “AI Purchased Assets”) to Accountabilities, Inc. (“AI”) The offices sold were the following: Culver City, California; Lawndale, California and Orange, California (the “Other California Offices”). Pursuant to the terms of an Asset Purchase Agreement between the Company and AI dated December 5, 2005 (the “AI Asset Purchase Agreement”), AI has agreed to pay to us an earnout amount equal to two percent of the sales of the Other California Offices for the first twelve month period after the AI Effective Date; one percent of the sales of the Other California Offices for the second twelve month period after the AI Effective Date; and one percent of the sales of the Other California Offices for the third twelve month period from the AI Effective Date. In addition, a Demand Subordinated Promissory Note between us and AI dated September 15, 2005 which had an outstanding principal balance of $125,000 at the time of closing was deemed paid and marked canceled. |

Certain assets held by the Other California Offices were excluded from the sale, including cash and cash equivalents, accounts receivable, and our rights to receive payments from any source.

In connection with the AI transaction, we entered into Non-Compete and Non-Solicitation Agreements with AI pursuant to which we agreed not to compete with AI with the customers of and in the geographic area of the Other California Offices, and AI agreed not to

compete with us with respect to certain customers and accounts, including, accounts serviced by our remaining offices, for a period of three years.

| (c) | On December 7, 2005, we completed the sale, effective as of November 28, 2005 (the “SOP Effective Date”), of substantially all of the tangible and intangible assets, excluding accounts receivable and other assets as described below, of several of our Northeastern offices (the “SOP Purchased Assets”) to Source One Personnel, Inc. (“SOP”). The offices sold were the following: Cherry Hill, New Jersey; New Brunswick, New Jersey; Mount Royal/Paulsboro, New Jersey (soon to be Woodbury Heights, New Jersey); Pennsauken, New Jersey; Norristown, Pennsylvania; Fairless Hills, Pennsylvania; New Castle Delaware and the former Freehold, New Jersey profit center (the “NJ/PA/DE Offices”). The assets of Deer Park, New York, Leominster, Massachusetts, Lowell, Massachusetts and Athol, Massachusetts (the “Earn Out Offices”) were also purchased (collectively the “NJ/PA/DE Offices” and the “Earn Out Offices” shall be referred to as the “Purchased Offices”). In addition to the foregoing, the SOP Purchased Assets also included substantially all of the tangible and intangible assets, excluding accounts receivable and other assets as described below, used by us in the operation of our business at certain facilities of certain customers including the following: the Setco facility in Cranbury New Jersey, the Record facility in Hackensack, New Jersey, the UPS-MI (formerly RMX) facility in Long Island, New York, the UPS-MI (formerly RMX) facility in the State of Connecticut, the UPS-MI (formerly RMX) facility in the State of Ohio, the APX facility in Clifton, New Jersey (the “Earn Out On-Site Business”) and the Burlington Coat Factory in Burlington, New Jersey, the Burlington Coat Factory facility in Edgewater Park, New Jersey and the UPS-MI (formerly RMX) facility in Paulsboro, New Jersey (the foregoing business and the “Earn-Out On-Site Businesses” shall be referred to herein collectively as the “On-Site Businesses”). Pursuant to the SOP Asset Purchase Agreement between us and SOP dated December 7, 2005 (the “SOP Asset Purchase Agreement”), the purchase price for the SOP Purchased Assets was paid or payable as follows (the “SOP Purchase Price”): |

| · | An aggregate of $974,031 of indebtedness owed by us to SOP (i) under certain promissory notes previously issued by us to SOP and (ii) in connection with a put right previously exercised by SOP with respect to 400,000 shares of our common stock was cancelled. |

| · | SOP is required to make the following earn out payments to us during the three year period commencing on the SOP Effective Date (the “Earn Out Period”): |

| · | Two percent of sales (excluding taxes on sales) from the Earn Out Offices and the Earn Out On-Site Businesses for the initial twelve months of the Earn Out Period. |

| · | One percent of sales (excluding taxes on sales) from the Earn Out Offices and the Earn Out On-Site Businesses for the second twelve months of the Earn Out Period. |

| · | One percent of sales (excluding taxes on sales) from the Earn Out Offices and the Earn Out On-Site Businesses for the third twelve months of the Earn Out Period. |

Certain assets held by the Purchased Offices were excluded from the sale, including cash and cash equivalents, accounts receivable, our rights to receive payments from any source.

In connection with the SOP transaction, we entered into Non-Compete and Non-Solicitation Agreements with SOP pursuant to which we agreed not to compete with SOP with respect to the business acquired from us by SOP for a period of two years.

| (d) | On December 7, 2005 (the “Closing Date”), we completed the sale of substantially all of the tangible and intangible assets, excluding cash and cash equivalents, of two of our California branch offices (the “TES Purchased Assets”) to Tri-State Employment Service, Inc. (“TES”). The offices sold were the following: Bellflower, California and West Covina, California (the “California Branch Offices”). Pursuant to the terms of an Asset Purchase Agreement between the Registrant and TES dated December 7, 2005 (the “TES Asset Purchase Agreement”), TES has agreed to pay to us as follows: |

| · | two percent of sales of the California Branch Offices to existing clients for the first twelve month period after the Closing Date; |

| · | one percent of sales of the California Branch Offices to existing clients for the second twelve month period after the Closing Date; and |

| · | one percent of sales of the California Branch Offices to existing clients for the third twelve month period after the Closing Date. |

For purposes of calculating the amount owed by TES to us, in no event shall the aggregate annual sales to such clients exceed $25,000,000.

On the Closing Date, TES made a payment of $1,972,521 to our lender and acquired the lender’s rights to certain of our accounts receivable that collateralize our obligation to the lender. As a result of this transaction, our obligations to the lender were reduced by $1,972,521.

In connection with the TES transaction, we entered into Non-Compete and Non-Solicitation Agreements pursuant to which we agreed not to compete with TES with the customers of and in the geographic area of the California Branch Offices, and TES agreed not to compete with Stratus with respect to certain customers and accounts, including, accounts serviced by Stratus’ remaining offices, for a period of three years.

The foregoing transactions resulted in a $3,804,047 net gain on sale of discontinued operations which is summarized as follows:

| Sold to: | | | |

| ALS | $ | 4,340,459 | |

| AI | | (10,013 | ) |

| SOP | | (190,879 | ) |

| TES | | (275,520 | ) |

| | 3,864,047 | |

| | | |

| Other costs of sales | | (60,000 | ) |

| Gain on sale of discontinued operations | $ | 3,804,047 | |

The above gain includes earnout payments of $721,466.

Continuing Operations

Year Ended September 30, 2007 Compared to Year Ended September 30, 2006

Revenues. Revenues increased 60.0% to $8,209,564 for the year ended September 30, 2007 from $5,131,081 for the year ended September 30, 2006. Approximately $595,000 of the increase was attributable to the acquisition of our technology asset disposition operations in August 2007. Excluding the acquisition, revenues increased 48.4%. This increase was primarily a result of an increase in billable hours and permanent placements and expansion of our customer base.

Gross Profit. Gross profit increased 63.3% to $2,492,267 for the year ended September 30, 2007 from $1,525,837 for the year ended September 30, 2006. Approximately $197,000 of the increase was attributable to the acquisition in August 2007. Excluding the acquisition, gross profits increased 50.4%, primarily as a result of increased revenues. Gross profit as a percentage of revenues, exclusive of the gross profit attributable to the acquisition, increased to 30.1% for the year ended September 30, 2007 from 29.7% for the year ended September 30, 2006, primarily as a result of increased permanent placements.

Selling, General and Administrative Expenses. Selling, General and Administrative expenses (“SG&A”) decreased 3.6% to $2,971,755 for the year ended September 30, 2007 from $3,082,139 for the year ended September 30, 2006. Exclusive of approximately $195,000 attributable to the acquisition in August 2007, SG&A decreased 6.3%. SG&A as a percentage of revenues decreased to 36.2% for the year ended September 30, 2007 from 60.1% for the year ended September 30, 2006.

As a result of the Asset Sales completed in December 2005, we began reducing our corporate overhead structure to be more in line with the remaining revenues. These reductions were completed in February 2006.

Interest Expense. Interest expense decreased 48.9% to $246,342 for the year ended September 30, 2007 from $481,762 for the year ended September 30, 2006. Interest expense as a percentage of revenues decreased to 3.0% for the year ended September 30, 2007 from 9.4% for the year ended September 30, 2006. Interest expense in the year ended September 30, 2006 includes $100,000 of the principal amount of the Convertible Note issued in exchange for our Series I Preferred Stock that was attributable to the settlement of our obligation to pay certain advisory fees and dividend payments under the terms of the Series I Preferred Stock (see Note 14 to the Consolidated Financial Statements).

Gain on Change in Fair Value of Warrants. We recognized a non-cash gain as a result of the decrease in the fair value of certain warrants accounted for as a derivative liability of $-0- and $2,135 in the years ended September 30, 2007 and 2006, respectively.

Minority interest in net (income) loss of consolidated subsidiaries. The minority interest in net loss of consolidated subsidiaries for the years ended September 30, 2007 and 2006 represents the minority venturers’ proportionate share of the net loss of our consolidated subsidiaries.

Net (Loss) Attributable to Common Stockholders from Continuing Operations. As a result of the foregoing, we had a net (loss) attributable to common stockholders of $(718,782), for the year ended September 30, 2007 compared to a net (loss) attributable to common stockholders of $(2,097,372) for the year ended September 30, 2006.

Year Ended September 30, 2006 Compared to the Year Ended September 30, 2005

Revenues. Revenues increased 13.5% to $5,131,081 for the year ended September 30, 2006 from $4,520,643 for year ended September 30, 2005. This increase was primarily a result of an increase in billable hours.

Gross Profit. Gross profit increased 15.8% to $1,525,837 for the year ended September 30, 2006 from $1,317,927 for the year ended September 30, 2005, primarily as a result of increased revenues.. Gross profit as a percentage of revenues increased to 29.7% for the year ended September 30, 2006 from 29.2% for the year ended September 30, 2005, primarily as a result of increased permanent placements.

Selling, General and Administrative Expenses. SG&A decreased 41.6% to $3,082,139 for the year ended September 30, 2006 from $5,278,186 for the year ended September 30, 2005. SG&A expenses as a percentage of revenues decreased to 60.1% for the year ended September 30, 2006 from 116.8% for the year ended September 30, 2005.

As a result of the Asset Sales completed in December 2005, we began reducing our corporate overhead structure to be more in line with the remaining revenues. These reductions were completed in February 2006.

Interest Expense. Interest expense decreased 74.6% to $481,762 for the year ended September 30, 2006 from $1,895,283 for the year ended September 30, 2005. Interest expense as a percentage of revenues decreased to 9.4% for the year ended September 30, 2006 from 41.9% for the year ended September 30, 2005. Included in interest for the year ended September 30, 2005 was $217,750, which had to be paid to the holder of the Series I Preferred Stock and an advisory fee of $217,750 which was paid in connection with the extension of the redemption date of the Series I Preferred Stock.

Gain on Change in Fair Value of Warrants. We recognized a non-cash gain as a result of the decrease in the fair value of certain warrants accounted for as a derivative liability of $2,135 and $5,263,854 in the years ended September 30, 2006 and 2005, respectively.

Minority interest in net (income) loss of consolidated subsidiaries. The minority interest in net income of consolidated subsidiaries for the years ended September 30, 2006 and 2005 represents the minority venturer’s proportionate share of the net income of STS.

Net (Loss) Attributable to Common Stockholders From Continuing Operations. As a result of the foregoing, we had a net (loss) attributable to common stockholders of $(2,097,342) for the year ended September 30, 2006 compared to a net (loss) attributable to common stockholders of $(676,194) for the year ended September 30, 2005.

Liquidity and Capital Resources

Cash flows have not been segregated between continuing operations and discontinued operations in the accompanying condensed consolidated statements of cash flows. Cash provided to us from discontinued operations (included in the consolidated cash flow discussions below) during the years ended September 30, 2007, 2006 and 2005 was comprised of the following:

| | Year Ended September 30, | |

| | 2007 | 2006 | 2005 | | | |

| Cash provided by (used in) operating activities | $ | (759,184) | $ 7,955,991 | $ 6,886,346 | | | |

| Cash provided by (used in) investing activities | | 1,017,203 | 1,316,953 | (289,217) | | | |

| Cash used in financing activities | | - | (7,969,175) | (3,012,326) | | | |

| Net | $ | 258,019 | $ 1,303,769 | $ 3,584,803 | | | |

Although there is no assurance we will continue to receive earnout payments in connection with discontinued operations, we estimate that we will receive approximately $20,000 per month, through November 2008.

At September 30, 2007, we had limited liquid resources. Current liabilities were $9,787,281 and current assets were $1,749,528. The difference of $8,037,753 is a working capital deficit, which is primarily the result of losses incurred during the last several years. The financial statements do not include any adjustments to reflect the possible future effect on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the outcome of this uncertainty.

Our continuation of existence is dependent upon the continued cooperation of our creditors, our ability to generate sufficient cash flow to meet our continuing obligations on a timely basis, to fund the operating and capital needs, and to obtain additional financing as may be necessary.

We have taken steps to revise and reduce our operating requirements, which we believe will be sufficient to assure continued operations and implementation of our plans. The steps included closing branches that are not profitable, reductions in staffing and other selling, general and administrative expenses, and, most significantly, the Asset Sale transactions that were completed in December 2005. We continue to pursue other sources of equity or long-term debt financings. We also continue to negotiate payment plans and other accommodations with our creditors. We believe that the cash flow from operations and earnout payments to which we are entitled in connection with the Asset Sales will provide us with sufficient cash flow to support our operations in the next twelve months provided that we continue to receive cooperation and accommodations from our creditors. No assurance can be given that our creditors will not seek to pursue all remedies available to them, which could result in a voluntary or involuntary bankruptcy proceeding.

Net cash provided by (used in) operating activities was $(1,162,054) and $6,743,565 in the years ended September 30, 2007 and 2006, respectively.

Net cash provided by (used in) investing activities was $(207,440) and $(1,300,241) in the years ended September 30, 2007 and 2006, respectively. Net cash used for the acquisition in 2007 was $1,192,643. Net cash received in connection with the sale of discontinued operations was $1,017,203 and $1,329,999 in the years ended September 30, 2007 and 2006, respectively. Such amounts were comprised of earnout payments in 2007 and included earnout payments of $676,763 in 2006. Cash used for capital expenditures was $32,000 and $36,367 in the years ended September 30, 2007 and 2006, respectively.

Net cash provided by (used in) financing activities was $1,429,462 and $(7,999,709) in the years ended September 30, 2007 and 2006, respectively. We had net proceeds (repayments) of $45,620 and $(6,362,218) under our lines of credit in the years ended September 30, 2007 and 2006, respectively. Net short-term loan proceeds (repayments) were $36,879 and $(29,975) in the years ended September 30, 2007 and 2006, respectively. During the year ended September 30, 2007, our Chief Executive Officer loaned $100,000 to us which was repaid during the year ended September 30, 2007. Payments of notes payable-acquisitions was $11,337 and $77,783 in the years ended September 30, 2007 and 2006, respectively. We paid $1,515,000 in the year ended September 30, 2006, against a note payable to Pinnacle Partners, LP, a related party. During the year ended September 30, 2007, we received net proceeds of $1,348,925 from the minority investors in Green-Tech Assets, LLC of which $675,000 is represented by notes payable and the balance is contributed equity. Our principal uses of cash are to fund temporary employee payroll expense and employer related payroll taxes, investment in capital equipment, expansion of services offered, workers’ compensation, general liability and other insurance coverages and debt service.