quality problems for our product lines could cause us to delay or cease shipments of products, or recall products, thus impairing our revenue or cost targets. In addition, while we seek to limit our liability as a result of product failures or defects through warranty and other limitations, if one of our products fails then a customer could suffer a significant loss and seek to hold us responsible for that loss.

To assure the availability of our products to our customers, we outsource the manufacturing of components prior to the receipt of purchase orders from customers based on their forecasts of their product needs and internal product sales revenue forecasts. However, these forecasts do not represent binding purchase commitments and we do not recognize revenue for such products until the product is shipped to the customer. As a result, we incur inventory and manufacturing costs in advance of anticipated revenue. As demand for our products may not materialize, this product delivery method subjects us to increased risks of high inventory carrying costs, obsolescence and excess, and may increase our operating costs. In addition, we may from time to time make design changes to our products, which could lead to obsolescence of inventory.

At current sales levels we purchase several component parts from sole source and limited source suppliers. As a result, if our suppliers receive excess demand for their products, we may receive a low priority for order fulfillment as large volume customers will receive priority. If we are delayed in acquiring components for our products, the manufacture and shipment of our products also will be delayed. We are, however, continuing to enter into long-term agreements with our sole suppliers and other key suppliers, when available, using a rolling sales volume forecast to stabilize component availability. Lead times for ordering materials and components vary significantly and depend on factors such as specific supplier requirements, contract terms, the extensive production time required and current market demand for such components. Some of these delays may be substantial. As a result, we purchase several components in large quantities to protect our ability to deliver finished products. If we overestimate our component requirements, we may have excess inventory, which will increase our costs. If we underestimate our component requirements, we will have inadequate inventory, which will delay our manufacturing and render us unable to deliver products to customers on scheduled delivery dates. If we are unable to obtain a component from a supplier or if the price of a component has increased substantially, we may be required to manufacture the component internally, which will result in delays. Manufacturing delays could negatively impact our ability to sell our products and could damage our customer relationships.

We believe our future success will depend in large part upon our ability to attract and retain highly skilled managerial, engineering and sales and marketing personnel. There is a limited supply of skilled employees in the power quality marketplace. The decline in our stock price has resulted in a substantial number of “underwater” options, which may cause certain of our employees to seek employment elsewhere as a result of this decreased financial incentive. If we are unable to retain the personnel we currently employ, or if we are unable to quickly replace departing employees, our operations and new product development may suffer.

The markets for power quality and power reliability are intensely competitive. There are many companies engaged in all areas of traditional and alternative UPS and backup systems in the United States and abroad, including, among others, major electric and specialized electronics firms, as well as universities, research institutions and foreign government-sponsored companies. There are many companies that are developing flywheel-based energy storage systems and flywheel-based power quality systems. We also compete indirectly with companies that are developing other types of power technologies, such as superconducting magnetic energy storage, ultra-capacitors and dynamic voltage restorers.

Many of our current and potential competitors have longer operating histories, significantly greater resources, broader name recognition and a larger customer base than we have. As a result, these competitors may have greater credibility with our existing and potential customers. They also may be able to adopt more aggressive pricing policies and devote greater resources to the development, promotion and sale of their products than we can to ours, which would allow them to respond more quickly than us to new or emerging technologies or changes in customer requirements. In addition, some of our current and potential competitors have established supplier or joint development relationships with our current or potential customers. These competitors may be able to leverage their existing relationships to discourage these customers from purchasing products from us or to persuade them to replace our products with their products. Increased competition could decrease our prices, reduce our sales, lower our margins, or decrease our market share. These and other competitive pressures could prevent us from competing successfully against current or future competitors and could materially harm our business.

If we are unable to protect our intellectual property, we may be unable to compete.

Our products rely on our proprietary technology, and we expect that future technological advancements made by us will be critical to sustain market acceptance of our products. Therefore, we believe that the protection of our intellectual property rights is, and will continue to be, important to the success of our business. We rely on a combination of patent, copyright, trademark and trade secret laws and restrictions on disclosure to protect our intellectual property rights. We also enter into confidentiality or license agreements with our employees, consultants and business partners and control access to and distribution of our software, documentation and other proprietary information. Despite these efforts, unauthorized parties may attempt to copy or otherwise obtain and use our products or technology. Monitoring unauthorized use of our products is difficult, and we cannot be certain that the steps we have taken will prevent unauthorized use of our technology, particularly in foreign countries where applicable laws may not protect our proprietary rights as fully as in the United States. In addition, the measures we undertake may not be sufficient to adequately protect our proprietary technology and may not preclude competitors from independently developing products with functionality or features similar to those of our products.

Our efforts to protect our intellectual property may cause us to become involved in costly and lengthy litigation, which could seriously harm our business.

In recent years, there has been significant litigation in the United States involving patents, trademarks and other intellectual property rights. For example, we were recently named in a lawsuit, along with Joe Pinkerton, our chairman and chief executive officer, alleging the misappropriation of trade secrets that we describe in further detail in “Legal Proceedings” in Item 3 of Part I below. We may become involved in additional litigation in the future to protect our intellectual property or defend allegations of infringement asserted by others. Legal proceedings, including the current lawsuit in which we are named as a defendant, could subject us to significant liability for damages or invalidate our intellectual property rights. Any litigation, regardless of its outcome, would likely be time consuming and expensive to resolve and would divert management’s time and attention. Any potential intellectual property litigation also could force us to take specific actions, including:

• cease selling our products that use the challenged intellectual property;

• obtain from the owner of the infringed intellectual property right a license to sell or use the relevant technology or trademark, which license may not be available on reasonable terms, or at all; or

• redesign those products that use infringing intellectual property or cease to use an infringing trademark.

Any acquisitions we make could disrupt our business and harm our financial condition.

Although we are not currently negotiating any material business or technology acquisitions, as part of our growth strategy, we intend to review opportunities to acquire other businesses or technologies that would complement our current products, expand the breadth of our markets or enhance our technical capabilities. We have no experience in making acquisitions. Acquisitions entail a number of risks that could materially and adversely affect our business and operating results, including:

• problems integrating the acquired operations, technologies or products with our existing business and products;

• potential disruption of our ongoing business and distraction of our management;

• difficulties in retaining business relationships with suppliers and customers of the acquired companies;

• difficulties in coordinating and integrating overall business strategies, sales and marketing, and research and development efforts;

• the maintenance of corporate cultures, controls, procedures and policies;

• risks associated with entering markets in which we lack prior experience; and

• potential loss of key employees.

We may require substantial additional funds in the future to finance our product development and commercialization plans.

Our product development and commercialization schedule could be delayed if we are unable to fund our research and development activities or the development of our manufacturing capabilities with our revenue, cash on hand and proceeds from our initial public offering. We expect that our current cash and investments, together with our other available sources of working capital, will be sufficient to fund development activities for at least 24 months. However, unforeseen delays or difficulties in these activities could increase costs and exhaust our resources prior to the full commercialization of our products under development. We do not know whether we will be able to secure additional funding, or funding on terms acceptable to us, to continue our operations as planned. If financing is not available, we may be required to reduce, delay or eliminate certain activities or to license or sell to others some of our proprietary technology.

Provisions in our charter documents and of Delaware law, and provisions in our agreements with Caterpillar, could prevent, delay or impede a change in control of our company and may depress the market price of our common stock.

Provisions of our certificate of incorporation and bylaws could have the effect of discouraging, delaying or preventing a merger or acquisition that a stockholder may consider favorable. Additionally, in December of 2001 our board of directors approved a stockholder rights plan, which would require a potential acquiror to negotiate directly with our board of directors regarding any planned acquisition. We also are subject to the anti-takeover laws of the State of Delaware, which may further discourage, delay or prevent someone from acquiring or merging with us. In addition, our agreement with Caterpillar for the distribution of CleanSource UPS provides that Caterpillar may terminate the agreement in the event we are acquired or undergo a change in control. The possible loss of our most significant customer could be a significant deterrent to possible acquirers and may substantially limit the number of possible acquirers. All of these factors may decrease the likelihood that we would be acquired, which may depress the market price of our common stock.

Our stock price may be volatile.

From January 1, 2001 through December 31, 2002, the market price of our common stock has fluctuated between $1.10 and $31.50 per share. The market price of our common stock can be expected to fluctuate significantly in response to numerous factors, some of which are beyond our control, including the following:

• actual or anticipated fluctuations in our operating results;

• changes in financial estimates by securities analysts or our failure to perform in line with such estimates;

• changes in market valuations of other technology companies, particularly those that sell products used in power quality systems;

• announcements by us or our competitors of significant technical innovations, acquisitions, strategic partnerships, joint ventures or capital commitments;

• introduction of technologies or product enhancements that reduce the need for flywheel energy storage systems;

• loss of one or more key OEM customers;

• inability to expand our distribution channels; and

• departures of key personnel.

ITEM 2. Properties.

As of December 31, 2002, our corporate headquarters facility, which houses our administrative, engineering, information systems, marketing, sales and service and support groups, consists of approximately 48,896 square feet in Austin, Texas. We lease our corporate headquarters facility pursuant to a lease agreement that expires in March 2003. Our manufacturing facility of approximately 127,000 square feet is also located in Austin, Texas. The total monthly lease payments due under all our facility leases are approximately $134,000. Our total monthly lease space will decrease by 26,746 square feet and lease payments to approximately $97,000 when we complete the consolidation of our sales, marketing, service, advanced development and administrative organizations into our manufacturing facility, which we anticipate will be completed by the end of our first fiscal quarter of 2003.

ITEM 3. Legal Proceedings.

On March 25, 2002, we, along with Joseph F. Pinkerton, III, our chairman and chief executive officer, Pinkerton Generator, Inc. (a corporation in which Mr. Pinkerton was an officer, director and the primary shareholder), and Caterpillar Inc. were named as defendants in a complaint filed in Michigan state court in the Circuit Court for the County of Wayne. The plaintiffs, Magnex Corporation, Enigma Corporation and Bergeron Corporation, and their individual principals, are seeking damages for: alleged breach of a joint venture agreement dated June 23, 1989, which was entered into by and among Pinkerton Generator, Inc., Magnex Corp. and Enigma Corp.; breach of fiduciary duties; misappropriation of trade secrets; and the commission of other torts relating to this joint venture. Neither Active Power nor any of its predecessors in interest was a party to the joint venture agreement. A First Amended Complaint was filed on April 16, 2002. We were not served with the Original Complaint and Amended Complaint until April 19, 2002.

In January 2003, Active Power, and the other defendants, have sought the removal of this case to the United States District Court for the Eastern District of Michigan. The plaintiffs have since sought to remand the case back to Michigan state court in the Circuit Court for the County of Wayne; however, the judge has not yet ruled on this motion as of March 7, 2003. Both Mr. Pinkerton and we believe the claims have no merit, deny the allegations in the complaint and intend to defend ourselves vigorously. This proceeding is in the discovery phase, and we are therefore unable to determine the ultimate outcome of this claim at this time.

ITEM 4. Submission of Matters to a Vote of Security Holders.

We did not submit any matters to the vote of our stockholders during the fourth quarter of fiscal 2002.

PART II

ITEM 5. Market for Registrant’s Common Equity and Related Stockholder Matters.

Our common stock has been quoted on the Nasdaq National Market under the symbol “ACPW” since our initial public offering on August 7, 2000. Prior to our initial public offering, there had been no public market for our common stock. The following table lists the high and low per share closing sales price for our common stock as reported by the Nasdaq National Market for the periods indicated:

| | High | | Low | |

| |

| |

| |

| | | | | |

Fiscal Year Ended December 31, 2002 | | | | | |

| | | | | |

First Quarter | | $ | 7.40 | | $ | 3.58 | |

Second Quarter | | $ | 5.14 | | $ | 3.43 | |

Third Quarter | | $ | 3.45 | | $ | 1.10 | |

Fourth Quarter | | $ | 2.27 | | $ | 1.35 | |

| | | | | |

Fiscal Year Ended December 31, 2001 | | | | | |

| | | | | |

First Quarter | | $ | 29.06 | | $ | 17.13 | |

Second Quarter | | $ | 29.95 | | $ | 15.50 | |

Third Quarter | | $ | 16.17 | | $ | 4.00 | |

Fourth Quarter | | $ | 6.87 | | $ | 4.64 | |

As of March 3, 2003, there were 41,833,344 shares of our common stock outstanding held by 523 stockholders of record.

We have never declared or paid cash dividends on our capital stock. We currently intend to retain any earnings for use in our business and do not anticipate paying any cash dividends in the foreseeable future. Future dividends, if any, will be determined by our board of directors.

During 2002, we issued an aggregate of 768,894 shares of our common stock pursuant to exercises of stock options that were granted prior to August 7, 2000 with exercise prices ranging from $0.07 to $1.85 per share. These issuances were deemed exempt from registration under Section 5 of the Securities Act of 1933 in reliance upon Rule 701 thereunder and appropriate legends were affixed to the share certificates issued in each such transaction.

ITEM 6. Selected Financial Data.

The following tables set forth our selected financial data. The data for the three years ended December 31, 2002, 2001, and 2000 have been derived from the audited financial statements appearing elsewhere in this document. The data for the years ended December 31, 1999 and 1998 have been derived from audited financial statements not appearing in this document. You should read the selected financial data set forth below in conjunction with our financial statements and the notes thereto, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and other financial information appearing elsewhere in this document.

Results of Operations:

| | Year ended December 31, | |

| |

| |

| | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | |

| |

| |

| |

| |

| |

| |

| | (In thousands, except per share data) | |

Revenues: | | | | | | | | | | | |

Product revenue | | $ | 9,469 | | $ | 21,562 | | $ | 4,872 | | $ | 1,047 | | $ | 915 | |

Development contract | | 4,000 | | 1,000 | | — | | 5,000 | | — | |

| |

| |

| |

| |

| |

| |

Total revenue | | $ | 13,469 | | $ | 22,562 | | $ | 4,872 | | $ | 6,047 | | $ | 915 | |

| | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | |

Cost of product revenue | | 15,264 | | 25,796 | | 7,966 | | 3,006 | | 1,238 | |

Cost of development contract | | 3,219 | | 283 | | — | | 2,935 | | — | |

Research, development and engineering | | 10,696 | | 14,930 | | 9,864 | | 1,506 | | 4,045 | |

Selling, general & administrative | | 12,184 | | 11,684 | | 6,205 | | 3,972 | | 1,925 | |

Restructuring expenses | | 1,586 | | — | | — | | — | | — | |

Amortization of deferred stock compensation | | 1,239 | | 4,003 | | 6,692 | | 1,631 | | — | |

| |

| |

| |

| |

| |

| |

Total operating expenses | | 44,187 | | 56,696 | | 30,727 | | 13,050 | | 7,208 | |

| |

| |

| |

| |

| |

| |

Operating loss | | (30,718 | ) | (34,134 | ) | (25,855 | ) | (7,003 | ) | (6,294 | ) |

Interest income/expense, net | | 3,093 | | 6,190 | | 4,363 | | 421 | | 305 | |

Change in fair value of warrants with redemption rights | | — | | — | | (1,562 | ) | (3,614 | ) | — | |

Other income (expense) | | 2 | | (18 | ) | (50 | ) | 8 | | 10 | |

| |

| |

| |

| |

| |

| |

Net loss | | $ | (27,623 | ) | $ | (27,962 | ) | $ | (23,104 | ) | $ | (10,188 | ) | $ | (5,979 | ) |

Preferred stock dividends, accretion, & conversion | | — | | — | | 19,079 | | 29,660 | | 2,789 | |

Net loss to common stockholders | | $ | (27,623 | ) | $ | (27,962 | ) | $ | (42,183 | ) | $ | (39,848 | ) | $ | (8,767 | ) |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

Net loss per share, basic & diluted | | $ | (0.67 | ) | $ | (0.70 | ) | $ | (1.92 | ) | $ | (3.98 | ) | $ | (0.90 | ) |

Shares used in computing net loss per share, basic & diluted | | 41,247,404 | | 39,781,031 | | 21,928,874 | | 10,009,554 | | 9,789,407 | |

| | | | | | | | | | | |

Balance Sheet Data:

| | As of December 31, | |

| |

| |

| | 2002 | | 2001 | | 2000 | | 1999 | | 1998 | |

| |

| |

| |

| |

| |

| |

| | (thousands) | |

Cash, cash equivalents and investments | | $ | 90,044 | | $ | 112,105 | | $ | 146,209 | | $ | 26,265 | | $ | 7,536 | |

Working capital | | 67,455 | | 83,060 | | 136,972 | | 26,394 | | 8,008 | |

Total assets | | 110,773 | | 139,376 | | 156,132 | | 28,366 | | 9,734 | |

Long-term obligations, less current portion | | — | | — | | — | | — | | 55 | |

Redeemable convertible preferred stock | | — | | — | | — | | 54,235 | | 24,575 | |

Total stockholders’ equity | | | 106,660 | | | 131,730 | | | 152,389 | | | (30,338 | ) | | (15,524 | |

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion should be read in conjunction with the financial statements appearing elsewhere in this Form 10-K. This report contains forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, that involve risks and uncertainties. The important factors which could cause actual results to differ materially include, but are not limited to, the potential for significant losses to continue; inability to accurately predict revenue and budget for expenses for future periods; fluctuations in revenue and operating results; overall market performance; a slowing global economy, particularly in the primary markets served by our products, and continued decreases and/or delays in capital spending; limited product lines; inability to manufacture products of the quality necessary to be accepted in the power quality market; inability to expand our distribution channels; inability to manage new and existing product distribution relationships; our current dependence on our relationship with Caterpillar; inability to successfully integrate new OEM channel partners; competition; delays in research and development; inability to increase sales volumes to fully utilize our increased manufacturing capacity; inventory risks; risks of delay or poor execution from a variety of sources; limited resources; dependence upon key personnel; inability to protect our intellectual property rights, including the possibility of an adverse outcome in the litigation in which we are currently engaged; potential future acquisitions; and the volatility of our stock price regardless of our actual financial performance. The discussion below addresses some of these factors. Additional risks and uncertainties that we are unaware of or that we currently deem immaterial also may become important factors that affect us.

Overview

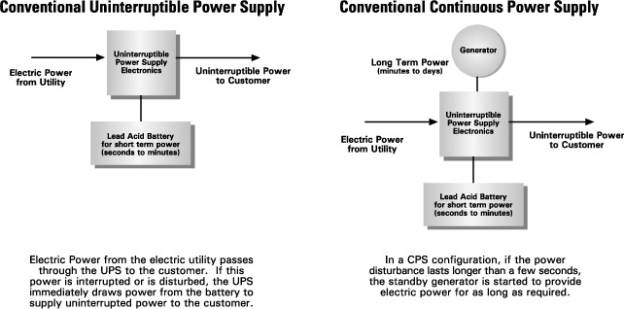

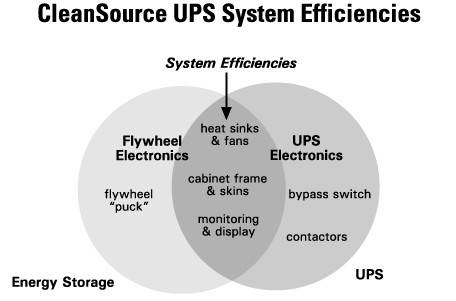

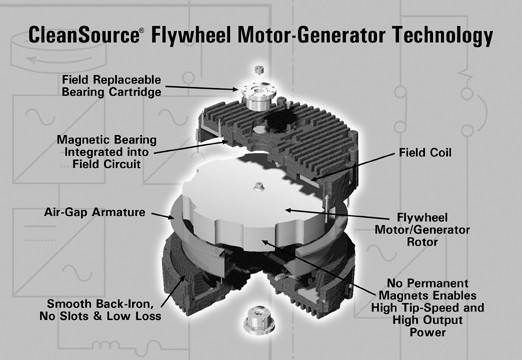

We design, manufacture and market power quality products that provide the consistent, reliable electric power required by today’s digital economy. We believe that we are the first company to commercialize a flywheel energy storage system that provides a highly reliable, low-cost and non-toxic replacement for the lead-acid batteries used in conventional power quality installations. Leveraging our expertise in this technology we have developed a battery-free uninterruptible power supply (UPS). We currently sell our CleanSource UPS through Caterpillar under the Caterpillar brand name, Cat® UPS. We have also developed a battery-free DC system that is compatible with all major UPS brands, CleanSource2 DC. We sell our CleanSource2 DC products primarily through Powerware, for whom we are an original equipment manufacturer, or OEM. We intend to distribute many of our products through a variety of channels including our existing OEMs and through independent power quality representatives to maximize market coverage and penetration. Our products are sold for use in the facilities of companies across many different industries that all share a critical need for reliable, high-quality power, such as broadcasters, hospitals, credit card processing centers, semiconductor manufacturers, pharmaceutical manufacturers, plastic manufacturers, data centers and electric utilities. Sales have been spread across many different countries from all regions of the world.

Since 1996, we have focused our efforts and financial resources primarily on the design and development of our CleanSource® line of power quality products and on establishing effective distribution channels to market our products (CleanSource2 DC and CleanSource UPS). As of December 31, 2002, we had generated an accumulated deficit of $108.3 million and expect to continue to sustain operating losses for the next several quarters. Prior to our initial public offering, we funded our operations primarily through sales of shares of our preferred stock, which have resulted in gross proceeds of approximately $42.6 million. Based on the current spending levels and expectations in our current business plan, we believe the proceeds from our August 2000 initial public offering, approximately $138.4 million net of commissions and issuance costs, cash balances on hand prior to August 2000, and cash from product revenue and development contracts will be sufficient to meet our capital requirements through at least the next 24 months. Our cash and investments position at December 31, 2002 was $90.0 million.

Since our inception, a small number of customers have accounted for the majority of our annual sales. In 2002, 2001 and 2000, our business level with Caterpillar and its dealer network accounted for 81%, 87% and 96%, respectively, of our revenue. In 2002, sales to Powerware constituted 12% of our total revenue. We expect to continue to be dependent on a few OEM customers, primarily Caterpillar, for the majority of our sales at least through 2003.

Critical Accounting Policies and Estimates

The preparation of financial statements and accompanying notes in conformity with generally accepted accounting principles requires that we make estimates and assumptions that affect the amounts reported. Changes in the facts and circumstances could have a significant impact on the resulting financial statements. We believe the following critical accounting policies affect our more complex judgments and estimates. We also have other policies that we consider to be key accounting policies, such as our policies for revenue recognition; however, these policies do not meet the definition of critical accounting estimates because they do not generally require us to make estimates or judgments that are difficult or subjective.

Allowance for Doubtful Accounts

We estimate an allowance for doubtful accounts based on factors related to the credit risk of each customer. Because to date we have sold to a limited number of large customers (e.g., Caterpillar Inc. and Powerware), credit losses have been minimal. As we integrate additional distribution channels into our business, and begin selling our products to smaller, less established customers, the risk of credit losses may increase. If the financial condition of our customers were to deteriorate, resulting in an impairment of their ability to make payments, additional allowances may be required.

Inventories

We state inventories at the lower of cost or market. If actual future demand or market conditions are less favorable than those projected by management, or if product design changes result in excess or obsolete components beyond current expectations, additional inventory write-downs may be required. We evaluate our inventory reserves on a quarterly basis.

Accrued Warranty Liability

We provide for the estimated cost of product warranties at the time revenue is recognized. While we engage in product quality programs and processes, our warranty obligation is affected by product failure rates, material usage and service delivery costs incurred in correcting a product failure. Should actual product failure rates, material usage or service delivery costs differ from our estimates, revisions to the estimated warranty liability may be required. We evaluate the reasonableness of our warranty accrual levels on a quarterly basis.

Marketing Programs Accrual

We have engaged in a marketing program with Caterpillar aimed at increasing the number of dedicated UPS salespeople employed by the Caterpillar dealers. As part of that program, we have agreed, under certain circumstances, to offset some of the first-year expenses of this program. We estimate our liabilities under this program and accrue based on our expected payout. We continually monitor the progress of the program, and based on the success of the dedicated UPS salespeople our actual payments may differ from our estimates.

Results of Operations

Comparison of 2002, 2001, and 2000

Product revenue. Product revenue primarily consists of sales of our CleanSource power quality products. Sales decreased $12.1 million, or 56%, to $9.5 million in 2002 from $21.6 million in 2001. Sales increased $16.7 million, or 343%, to $21.6 million in 2001 from $4.9 million in 2000. We believe the decrease in revenue and units shipped in 2002 was primarily attributable to a significant reduction in the market for capital equipment due, in large part, to the overall economic slowdown that has taken place in the United States and globally. In addition, during the first nine months of 2001 we benefited from several inventory-stocking orders by two Caterpillar dealers of approximately 145 units, or $7.5 million. Stocking levels at these two Caterpillar dealers has declined modestly to approximately 120 units by the end of 2002. Since the third quarter of 2001, substantially all of our sales have been to our OEM customers for specifically identified end users. Although Active Power has no obligations to its OEM customers for the products that they hold, a significant reduction in our OEM customers’ product levels would negatively impact our future sales. The average selling price of our base products has remained relatively flat for the last two years and will vary depending on the level of options purchased by the customer. During 2002 we sold 164

of our quarter megawatt flywheel units as compared with 382 units in 2001. The 2001 increase over 2000 revenues was attributable to a growing market acceptance of our products and ramp up in the sales of our CleanSource UPS product line, with initial sales of this new product line beginning in the fourth quarter of 1999. During 2001 we sold 382, including the stocking orders noted above, of our quarter-megawatt flywheel units as compared with 118 units in 2000.

Development contract revenue. Development contract revenue primarily consists of funding paid us by Caterpillar. In 1999, we entered into an agreement with Caterpillar to develop the Cat UPS. As part of that agreement Caterpillar provided $5 million in funding for the successful completion of several development milestones. In September 2001 we signed an extension to our development agreement with Caterpillar to expand the Cat UPS product line. The extension called for an additional $5.0 million in funding upon successful completion of certain development milestones. In December 2001, we completed the first milestone and collected $1.0 million and in 2002 we completed the remaining four milestones and collected $4.0 million. We do not currently have any additional development agreements in place that will result in development funding in 2003.

Cost of product revenue. Cost of product revenue includes the cost of component parts of our products that are sourced from suppliers, personnel, equipment and other costs associated with our assembly and test operations, shipping costs, and the costs of manufacturing support functions such as logistics and quality assurance. Cost of goods sold decreased $10.5 million, or 41%, to $15.3 million in 2002 from $25.8 million in 2001. Cost of goods sold increased $17.8 million, or 223%, to $25.8 million in 2001 from $8.0 million in 2000. The decrease in 2002 was primarily due to the lower sales activity in 2002 compared to the same period of 2001. During 2001, we significantly expanded our manufacturing capacity by increasing our manufacturing facilities, in anticipation of future demand for our products. This has increased our fixed manufacturing expense base, which will adversely impact our gross margins until production volumes increase enough to cover the added costs of this increased manufacturing capacity. While our variable product margin (sales less materials and direct labor) was positive in 2002, our overall product margin was negative due, in large part, to the underutilization of our indirect manufacturing costs. Over time, we believe gross margins should improve if we can increase product volumes, thereby achieving greater economies of scale in production and in purchasing component parts, and introduce additional engineering design savings. We have also taken additional steps to scale back direct and indirect manufacturing capacity and spending levels given current market conditions that we believe should result in additional product margin improvements in 2003, such as a 30% reduction in manufacturing staffing levels implemented in October of 2002. The 2001 increase over 2000 was primarily attributable to increases in the volume of product sold and an increase in our manufacturing capacity to support an increase in sales volume and an anticipated further increase in demand for our products. Although the absolute dollar amounts of our cost of goods sold increased significantly from 2000 to 2001, we achieved substantial improvements in our gross margin as a percentage of sales. These improvements were a result of supplier cost reductions associated with higher volume, changes in our supplier base, engineering design savings, and leverage gained from higher production volumes.

Cost of development contract. Cost of development contract primarily consists of engineering expenses incurred in relation to the joint development process with Caterpillar, through which we receive development funding. In 2002, we incurred $3.2 million in development contract expenses, while in 2001 we incurred $283,000. We had no development contract expenses in 2000. The margins we achieve in our development funding activities can vary considerably depending on the difficulty of each development milestone, the level of contract development we purchase from third parties, and level of materials purchased.

Research and development. Research and development expense primarily consists of compensation and related costs of employees engaged in research, development and engineering activities, third party consulting and development activities, as well as an allocated portion of our occupancy costs. Research and development expense decreased $4.2 million, or 28%, to $10.7 million in 2002 from $14.9 million in 2001. Research and development expense increased $5.0 million, or 51%, to $14.9 million in 2001 from $9.9 million in 2000. The decrease in research and development expense in 2002 was driven primarily by two principal factors. The first factor was a significant reduction in development spending on a low power telecom product. Although many of the internal resources committed to this effort have been redirected to other new product initiatives, such as our high power UPS product line extension, the amount of research and development services we purchased from third parties was significantly reduced, thereby reducing our overall spending levels. The second factor was the separation of costs associated with the development of our high power UPS product line extension. These costs, including significant material costs, have been separated from R&D and recorded as a separate line on the income statement, called “cost of development contract” (see above). We believe that research and development expenses will increase modestly in

the first half of 2003, as personnel and overhead costs assigned to cost of development contracts are reabsorbed into the research and development expense. Over time we expect the shift in our development efforts from our high power 1200 kVA UPS to lower power products will reduce our project related cost and, in turn, lower our R&D spending level. The increase in research and development expense in 2001 compared to 2000 was primarily due to an increase in the number and scope of our product development activities, including our UPS product line extension, CleanSource2 DC and low power telecom products.

Selling, general and administrative. Selling, general and administrative expense is primarily comprised of compensation and related costs for sales, service, marketing and administrative personnel, selling and marketing expenses, professional fees and product warranty and bad debt costs. Selling, general and administrative expense increased approximately $0.5 million, or 4%, to $12.2 million in 2002 from $11.7 million in 2001. Selling, general and administrative expense increased approximately $5.5 million, or 88%, to $11.7 million in 2001 from $6.2 million in 2000. The increase in selling, general and administrative expense in 2002 was principally due to an increase of personnel in sales, service and marketing to support sales in our distribution channels. We believe that selling, general and administrative expense will increase in future periods due primarily to higher warranty costs, sales commissions and marketing promotion associated with anticipated future sales growth, additional channel development and an anticipated increase in directors and officers insurance premiums, but should decrease as a percent of sales if future sales growth occurs. The increase of 2001 expenses over 2000 were principally due to increased personnel in our sales, service and marketing organizations to support our main OEM channel partner’s sales and service ramp up of the Cat UPS product line and due to higher administrative expenses associated with becoming a public company.

Restructuring expense. In December 2002 we incurred a restructuring charge of $1.6 million related to the consolidation of leased facility space and the impairment of associated leasehold improvements. The majority of this charge, $1.4 million, is a non-cash asset impairment of certain leasehold improvements and equipment in our engineering lab space. The remainder of the restructuring charge was accrued for future obligations, including restoration and cleanup, associated with the leased space we will be vacating as part of our consolidation early in 2003. We did not have restructuring expenses in 2001 or 2000.

Amortization of deferred stock compensation. Deferred stock compensation is a non-cash expense that reflects the difference between the exercise price of option grants to employees and the estimated fair value determined subsequently by us of our common stock at the date of grant. Since our initial public offering, all stock option grants have had an exercise price equal to the fair market value on that grant date. We are amortizing deferred stock compensation as an operating expense over the vesting periods of the applicable options, which resulted in amortization expense of $1.2 million, $4.0 million and $6.7 million in 2002, 2001 and 2000, respectively. We expect the amortization expense to continue to decrease throughout 2003 and disappear by early 2004 as the options for which we are amortizing this expense become fully vested, and to a smaller extent as some employees to whom these options were granted leave the company and any unvested options are canceled.

Interest income/expense. Interest income net of interest expense decreased $3.1 million, or 50%, to $3.1 million in 2002 from approximately $6.2 million in 2001. Interest income net of interest expense increased $1.8 million, or 42%, to $6.2 million in 2001 from approximately $4.4 million in 2000. The increase in 2001 over 2000 was principally due a higher post-IPO cash balance for an entire year as compared to the five months of 2000 with a post-IPO cash increase. The decrease in 2002 from 2001 is attributable to two factors. First, there was a decrease in our average cash and investments balance in 2002 of $101.1 million compared to an average cash and investments balance of $129.2 million in 2001. Second, the average rate of return on our investments dropped significantly from 6% the first quarter of 2001 to 3% in the fourth quarter in 2002, as interest rates in the financial markets have declined significantly over the past two years.

Change in fair value of warrants. Due to the redemption feature of warrants we had outstanding until the initial public offering, we recorded a liability associated with the fair value of the warrants on the balance sheet and recorded changes in fair value of the warrants in earnings. We calculated the fair value of the warrants using a Black-Scholes pricing model. In 2000 the fair value of the underlying common stock increased substantially, resulting in an increase in the warrant value and corresponding non-cash expense. No such expenses were incurred in 2001 or 2002.

Preferred stock dividends, accretion and conversion. We recorded non-cash charges of $19.1 million in 2000 associated with our redeemable preferred stock to reflect dividend rights and accretion to redemption value. In 1999,

we issued Series E convertible preferred stock at a price lower than the subsequently determined fair market value by the board of directors totaling a $22.0 million discount. All of our preferred stock was converted to common at August 8, 2000, the date of our initial public offering.

Income Tax Expense. As of December 31, 2002, our accumulated net operating loss carryforward was $96.0 million and our research and development credit carryforwards were approximately $1.5 million. We anticipate that all of this loss carryforward amount will remain available for offset against any future tax liabilities that we may incur; however, because of uncertainty regarding our ability to use these carryforwards, we have established a valuation allowance for the full amount of our deferred tax assets.

Liquidity and Capital Resources

Our principal sources of liquidity as of December 31, 2002 consisted of $90.0 million of cash and investments. We have primarily funded our operations through our initial public offering in August 2000, resulting in net proceeds of $138.4 million, sales of shares of our preferred stock, which have resulted in gross proceeds of approximately $42.6 million, as well as $10 million in development funding received from Caterpillar since 1999. Cash used in operating activities in 2002 was $22.6 million, a $0.2 million decrease from the $22.8 million used in 2001. Cash used in operating activities in 2001 was $22.8 million, a $7.5 million increase from the $15.3 million used in 2000. The cash usage in 2002 was principally focused on product development of our higher power product platform, the expansion of our existing UPS product line and product cost reduction. In addition, we continued to fund manufacturing operations and sales and marketing activities both to support current revenue and position the company for future sales growth. In 2001, the cash usage was primarily attributable to the expansion of our manufacturing operations and sales activities, product development activities on our CleanSource UPS and DC2 product lines, as well as an increase in our inventory levels to support both actual and anticipated revenue growth over 2000.

Capital expenditures were approximately $788,000, $15.2 million and $4.4 million in 2002, 2001 and 2000, respectively. In 2002 our expenditures were principally for the upgrade of our engineering test capabilities, as well as improvements to our information technology equipment and software capabilities. Our expenditures in 2001 were primarily attributable to the increase in our manufacturing capacity, including several new product test lines and leasehold improvements for our new manufacturing facility. Capital spending in 2000 was primarily related to expanding our engineering lab’s test capacity and capability, test equipment, market demonstration units, and general computer and office equipment. We expect to spend $1.0 to $2.0 million in 2003 on the consolidation of our advanced development, sales and marketing, and administrative groups into our manufacturing facility, as well as additional engineering lab equipment, demonstration units, and general computer equipment and software for manufacturing, engineering and administrative purposes.

We believe our existing cash and investments balances at December 31, 2002 will be sufficient to meet our capital requirements through at least the next 24 months, although we might elect to seek additional funding prior to that time. Beyond the next 24 months, our capital requirements will depend on many factors, including the rate of sales growth, the market acceptance of our products, the timing and level of development funding, the rate of expansion of our sales and marketing activities, the rate of expansion of our manufacturing processes, and the timing and extent of research and development projects. Although we are not a party to any agreement or letter of intent with respect to a potential acquisition or merger, we may enter into acquisitions or strategic arrangements in the future, which could also require us to seek additional equity or debt financing.

Recent Accounting Pronouncements

In August 2001, the FASB issued SFAS No. 144, ACCOUNTING FOR THE IMPAIRMENT OR DISPOSAL OF LONG-LIVED ASSETS, which supersedes SFAS No. 121, ACCOUNTING FOR THE IMPAIRMENT OF LONG-LIVED ASSETS AND FOR LONG-LIVED ASSETS TO BE DISPOSED OF; however, it retains the fundamental provisions of that statement related to the recognition and measurement of the impairment of long-lived assets to be “held and used.” In addition, the Statement provides more guidance on estimating cash flows when performing a recoverability test, requires that a long-lived asset to be disposed of other than by sale be classified as “held and used” until it is disposed of, and establishes more restrictive criteria to classify an asset as “held for sale.” We adopted SFAS No. 144 on January 1, 2002, but the adoption did not have a material impact on our results of operations or financial position.

In June 2002 the FASB issued SFAS No. 146, ACCOUNTING FOR COSTS ASSOCIATED WITH EXIT OR DISPOSAL ACTIVITIES. SFAS No. 146 requires companies to recognize costs associated with exit or disposal activities when they are incurred rather than at the date of commitment to an exit or disposal plan. This statement is effective for exit or disposal activities initiated after December 31, 2002. We do not believe that the adoption of SFAS No. 146 will have a material impact on our financial statements.

In December 2002, FASB issued SFAS No. 148, ACCOUNTING FOR STOCK-BASED COMPENSATION - TRANSITION AND DISCLOSURE, AN AMENDMENT OF FASB STATEMENT NO. 123. This Statement amends FASB Statement No. 123, ACCOUNTING FOR STOCK-BASED COMPENSATION, to provide alternative methods of transition for an entity that voluntarily changes to the fair value based method of accounting for stock-based employee compensation. It also amends the disclosure provisions of that Statement to require prominent disclosure about the effects on reported net income of an entity’s accounting policy decisions with respect to stock-based employee compensation. Finally, this Statement amends APB Opinion No. 28, INTERIM FINANCIAL REPORTING, to require disclosure about those effects in interim financial information. Since we are continuing to account for stock-based compensation according to APB 25, our adoption of SFAS No. 148 requires us to provide prominent disclosures about the effects of FAS 123 on reported income and will require us to disclose these affects in the interim financial statements as well.

ITEM 7A. Quantitative and Qualitative Disclosures About Market Risk.

Our interest income is sensitive to changes in the general level of U.S. interest rates, particularly since the majority of our investments are in cash and long-term instruments in marketable securities. We believe that our investment policy is conservative, both in terms of the average maturity of investments that we allow and in terms of the credit quality of the investments we hold. We estimate that a 1% decrease in market interest rates would decrease our interest income by $900,000. Because of the short-term nature of the majority of our investments, we do not believe a 1% decline in interest rates would have a material effect on their fair value.

We invest our cash in a variety of financial instruments, including bank time deposits, and taxable variable rate and fixed rate obligations of corporations, municipalities, and local, state and national government entities and agencies. These investments are denominated in U.S. dollars.

ITEM 8. Financial Statements and Supplementary Data.

The information required by this item is included in Part IV, Item 15(a)(1) and are presented beginning on Page F-1.

ITEM 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

PART III

ITEM 10. Directors and Executive Officers of the Registrant.

The following table sets forth certain biographical information concerning our current executive officers:

Name | | Age | | Position(s) |

| | | | |

Joseph F. Pinkerton, III | | 39 | | Chairman of the Board, President and Chief Executive Officer |

| | | | |

David S. Gino | | 45 | | Chief Operating Officer, Vice President of Finance, Chief Financial Officer and Secretary |

| | | | |

James A. Balthazar | | 49 | | Vice President of Sales and Marketing |

Joseph F. Pinkerton, III, our founder, has served as our Chief Executive Officer, President and director since August 1992. He was elected Chairman of the Board in December 2001. Mr. Pinkerton formed our company in 1992 as Magnetic Bearing Technologies, Inc. Prior to founding Active Power, Pinkerton was a principal with Fundamental Research Company (FRC), in Walled Lake, Michigan. While at FRC, Pinkerton completed two joint research projects with the University of Texas at Austin and was awarded a patent for a novel electrical generator. Mr. Pinkerton received a Bachelor of Arts degree in Physics from Albion College, Albion, MI in association with Columbia University, New York, N.Y.

David S. Gino has served as Chief Financial Officer, Vice President of Finance and Secretary since December 1999. In December 2001, he took on the additional role of Chief Operating Officer. From August 1995 to November 1999, Mr. Gino was the Chief Financial Officer and Executive Vice President of Finance of DuPont Photomasks, Inc. (DPI), a publicly-traded semiconductor component manufacturer. Prior to joining DPI, Mr. Gino held a number of financial and business management positions with The DuPont Company’s semiconductor materials, imaging systems and printing and publishing businesses. Mr. Gino holds a Bachelor of Arts degree in economics from the University of California at Santa Barbara and an M.B.A. from the University of Phoenix.

James A. Balthazar has served as our Vice President of Marketing since October 1996. In February 2002, Mr. Balthazar was promoted to Vice President of Sales and Marketing. Mr. Balthazar is responsible for worldwide sales, service and marketing activities at Active Power, including market development, channel development and product marketing activities. Prior to joining Active Power, Mr. Balthazar held various management positions, including Vice President of Marketing, during his 12-year tenure at Convex Computer Corporation, a public supercomputer manufacturer in Richardson, Texas. Mr. Balthazar has a Bachelor of Science degree from the University of Maryland, College Park and a M.S. in theoretical and applied mechanics from Cornell University, Ithaca, New York.

Further information required by this Item is incorporated by reference to our Proxy Statement under the sections captioned “Matters to be Considered at Annual Meeting—Proposal One: Election of Directors” and “Compliance with Section 16(a) of the Securities Exchange Act of 1934.”

ITEM 11. Executive Compensation.

The information required by this Item is incorporated by reference to our Proxy Statement under the sections captioned “Executive Compensation and Other Information” and “Certain Transactions.”

ITEM 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The information required by this Item is incorporated by reference to our Proxy Statement under the section captioned “Ownership of Securities.”

Equity Compensation Plan Information

The following table provides information as of December 31, 2002 with respect to shares of our common stock that may be issued under our existing equity compensation plans.

| | A | | B | | C | |

| |

| |

| |

| |

Plan Category | | Number of Securities to be

Issued Upon Exercise of

Outstanding Options | | Weighted Average

Exercise Price of

Outstanding Options | | Number of Securities Remaining

Available for Future Issuance

Under Equity Compensation

Plans (Excluding Securities

Reflected in Column A | |

| |

| |

| |

| |

Equity Compensation Plans Approved by Shareholders (1) | | | 3,618,418 | (2) | $ | 7.27 | | | 2,918,222 | (3) |

| | | | | | | |

Equity Compensation Plans Not Approved by Shareholders | | — | | — | | — | |

| |

| |

| |

| |

| | | | | | | |

Total | | | 3,618,418 | | $ | 7.27 | | | 2,918,222 | |

______________

(1) Consists of the 2000 Stock Incentive Plan and the 2000 Employee Stock Purchase Plan.

(2) Excludes purchase rights accruing under the Company’s 2000 Employee Stock Purchase Plan which has a stockholder approved reserve of 1,478,449 shares. Under the 2000 Employee Stock Purchase Plan, each eligible employee may purchase up to 5,400 shares of Common Stock at semi-annual intervals on the last U.S. business day of January and July each year at a purchase price per share equal to 85% of the lower of (i) the closing selling price per share of Common Stock on the employee’s entry date into the two-year offering period in which that semi-annual purchase date occurs or (ii) the closing selling price per share on the semi-annual purchase date.

(3) Consists of shares available for future issuance under the 2000 Employee Stock Purchase Plan and the 2000 Stock Incentive Plan. As of December 31, 2002, an aggregate of 1,168,979 shares of Common Stock were available for issuance under the 2000 Employee Stock Purchase Plan and 1,749,243 shares of Common Stock were available for issuance under the 2000 Stock Incentive Plan.

ITEM 13. Certain Relationships and Related Transactions.

The information required by this Item is incorporated by reference to our Proxy Statement under the section captioned “Certain Transactions.”

ITEM 14. Controls and Procedures.

We performed an evaluation under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of our disclosure controls and procedures. Based on their evaluation, our management, including our Chief Executive Officer and Chief Financial Officer, concluded the Company’s disclosure controls and procedures (as defined in Rule 13a-14(c) under the Securities Exchange Act of 1934) are effective as of December 31, 2002 to ensure that information required to be disclosed by us in the reports filed or submitted by us under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms. There have been no significant changes in our internal controls or other factors that could significantly affect internal controls subsequent to December 31, 2002.

PART IV

ITEM 15. Exhibits, Financial Statement Schedules, and Reports on Form 8-K.

(a) The following documents are filed as part of this Form 10-K:

1. Financial Statements. The following financial statements of Active Power, Inc. are filed as a part of this Form 10-K on the pages indicated:

2. Schedules.

All schedules have been omitted since the information required by the schedule is not applicable, or is not present in amounts sufficient to require submission of the schedule, or because the information required is included in the Financial Statements and notes thereto.

3. Exhibits.

Exhibit

Number | Description |

| |

3.1* | Amended and Restated Certificate of Incorporation (filed as Exhibit 3.1 to Active Power’s IPO Registration Statement on Form S-l (SEC File No. 333-36946) (the ‘‘IPO Registration Statement’’) |

| |

3.2* | Amended and Restated Bylaws (filed as Exhibit 3.2 to the IPO Registration Statement) |

| |

4.1* | Specimen certificate for shares of Common Stock (filed as Exhibit 4.1 to the IPO Registration Statement) |

| |

4.2* | Rights Agreement, dated as of December 13, 2001, between the Active Power and Equiserve Trust N.A., which includes the form of Certificate of Designation for the Series A Junior Participating Preferred Stock as Exhibit A, the form of Rights Certificate as Exhibit B and the Summary of Rights to Purchase Series A Preferred Stock as Exhibit C (filed as Exhibit 4.1 to Active Power’s Current Report on Form 8-K dated December 13, 2001). |

| |

10.1* | Form of Indemnity Agreement (filed as Exhibit 10.1 to the IPO Registration Statement) |

| |

10.2* | Active Power, Inc. 2000 Stock Incentive Plan (filed as Exhibit 10.2 to the IPO Registration Statement) |

| |

10.3* | Active Power, Inc. 2000 Employee Stock Purchase Plan (filed as Exhibit 10.3 to the IPO Registration Statement) |

| |

10.4* | Second Amended and Restated Investors’ Rights Agreement by and between Active Power, Inc. and certain of its stockholders (filed as Exhibit 10.4 to the IPO Registration Statement) |

| |

10.6+* | Phase II Development and Phase III Feasibility Agreement by and between Active Power, Inc. and Caterpillar Inc. (filed as Exhibit 10.6 to the IPO Registration Statement) |

| |

10.7* | Credit Terms and Conditions by and between Active Power, Inc. and Imperial Bank (filed as Exhibit 10.7 to the IPO Registration Statement) |

| |

10.8* | Security and Loan Agreement by and between Active Power, Inc. and Imperial Bank (filed as Exhibit 10.8 to the IPO Registration Statement) |

| |

10.9* | Lease Agreement by and between Active Power, Inc. and Braker Phase III, Ltd. (filed as Exhibit 10.9 to the IPO Registration Statement) |

| |

l0.l0* | First Amendment to Lease Agreement by and between Active Power, Inc. and Braker Phase III, Ltd. (filed as Exhibit 10.10 to the IPO Registration Statement) |

| |

10.11* | Second Amendment to Lease Agreement by and between Active Power, Inc. and Braker Phase III, Ltd. (filed as Exhibit 10.11 to the IPO Registration Statement) |

| |

10.12* | Third Amendment to Lease Agreement by and between Active Power, Inc. and Braker Phase III, Ltd. (filed as Exhibit 10.12 to the IPO Registration Statement) |

| |

10.13* | Fourth Amendment to Lease Agreement by and between Active Power, Inc. and Metropolitan Life Insurance Company (filed as Exhibit 10.13 to the IPO Registration Statement) |

| |

10.14* | Fifth Amendment to Lease Agreement by and between Active Power, Inc. and Metropolitan Life Insurance Company (filed as Exhibit 10.14 to the IPO Registration Statement) |

| |

10.15* | Sublease Agreement by and between Active Power, Inc. and Video Associates Laboratories, Inc. (filed as Exhibit 10.15 to the IPO Registration Statement) |

| |

10.16* | Employee offer letter (including severance arrangements) from Active Power, Inc. to David S. Gino (filed as Exhibit 10.16 to the IPO Registration Statement) |

| |

10.17* | Lease Agreement by and between Active Power, Inc. and BC12 99, Ltd. (filed as Exhibit 10.17 to Active Power’s Annual Report on Form 10-K for the fiscal year ended December 31, 2000) |

| |

10.18* | Sixth Amendment to Lease Agreement by and between Active Power, Inc. and Metropolitan Life Insurance Company (filed as Exhibit 10.18 to the Active Power’s Annual Report on Form 10-K dated March 16, 2001 (the “2000 10-K”)) |

| |

10.19* | Seventh Amendment to Lease Agreement by and between Active Power, Inc. and Metropolitan Life Insurance Company (filed as Exhibit 10.19 to the 2000 10-K) |

| |

10.20*+ | Distributor Agreement by and between Active Power and Powerware Corporation dated October 28, 2001 (filed as Exhibit 10.20 to the Active Power’s Quarterly Report on Form 10-Q dated November 9, 2001 (the November 2001 10-Q) |

| |

10.21*+ | Master Sourcing Agreement by and between Active Power and General Electric Company (through its Digital Energy business unit) dated July 13, 2001 (filed as Exhibit 10.21 to the November 2001 10-Q) |

| |

10.22+ | Phase II & Phase III Purchase Agreement by and between Active Power, Inc. and Caterpillar Inc. dated as of September 1, 2001 |

| |

10.23+ | Phase III Product Development Agreement by and between Active Power, Inc. and Caterpillar Inc. dated as of September 1, 2001 |

| |

23.1 | Consent of Ernst & Young LLP |

| |

24.1 | Power of Attorney, pursuant to which amendments to this Form 10-K may be filed, is included on the signature page contained in Part IV of this Form 10-K |

| |

99.1 | Certification of Chief Executive Officer pursuant to Section 906 of Sarbanes-Oxley Act of 2002 |

| |

99.2 | Certification of Chief Financial Officer pursuant to Section 906 of Sarbanes-Oxley Act of 2002 |

______________

* Incorporated by reference to the indicated filing.

+ Portions of this exhibit have been omitted pursuant to a confidential treatment previously granted.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | ACTIVE POWER, INC. |

| | By: |

/s/ JOSEPH F. PINKERTON, III

|

| | |

|

| | | Joseph F. Pinkerton, III, |

| | | Chairman of the Board and

Chief Executive Officer |

Power of Attorney

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby severally constitutes and appoints, Joseph F. Pinkerton, III and David S. Gino, and each or any of them, his true and lawful attorney-in-fact and agent, each with the power of substitution and resubstitution, for him in any and all capacities, to sign any and all amendments to this Annual Report on Form 10-K and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, hereby ratifying and confirming all that each said attorney-in-fact and agent, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

Name | | Title | | Date |

| | | | |

/s/ JOSEPH F. PINKERTON, III | | Chairman of the Board and

Chief Executive Officer

(principal executive officer) | | March 7, 2003 |

|

Joseph F. Pinkerton |

| | | | |

/s/ DAVID S. GINO | | Chief Operating Officer and

Chief Financial Officer

(principal financial and accounting officer) | | March 7, 2003 |

|

David S. Gino |

| | | | |

/s/ RICHARD E. ANDERSON | | Director | | March 7, 2003 |

|

Richard E. Anderson |

| | | | |

/s/ RODNEY S. BOND | | Director | | March 7, 2003 |

|

Rodney S. Bond |

| | | | |

/s/ BENJAMIN L. SCOTT | | Director | | March 7, 2003 |

|

Benjamin L. Scott |

| | | | |

/s/ JAN H. LINDELOW | | Director | | March 7, 2003 |

|

Jan H. Lindelow |

| | | | |

/s/ TERRENCE L. ROCK | | Director | | March 7, 2003 |

|

Terrence L. Rock |

Chief Executive Officer Certification

I, Joseph F. Pinkerton III, President and Chief Executive Officer of Active Power, Inc., certify that:

1. I have reviewed this Annual Report on Form 10-K of Active Power, Inc. (the “Registrant”);

2. Based on my knowledge, this Annual Report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this Annual Report;

3. Based on my knowledge, the financial statements, and other financial information included in this Annual Report, fairly present in all material respects the financial condition, results of operations and cash flows of the Registrant as of, and for, the periods presented in this Annual Report;

4. The Registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-14 and 15d-14) for the Registrant and have:

a) designed such disclosure controls and procedures to ensure that material information relating to the Registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this Annual Report is being prepared;

b) evaluated the effectiveness of the Registrant’s disclosure controls and procedures as of a date within 90 days prior to the filing date of this Annual Report (the “Evaluation Date”); and

c) presented in this Annual Report our conclusions about the effectiveness of the disclosure controls and procedures based on our evaluation as of the Evaluation Date;

5. The Registrant’s other certifying officer and I have disclosed, based on our most recent evaluation, to the Registrant’s auditors and the audit committee of Registrant’s board of directors (or persons performing the equivalent functions):

a) all significant deficiencies in the design or operation of internal controls which could adversely affect the Registrant’s ability to record, process, summarize and report financial data and have identified for the Registrant’s auditors any material weaknesses in internal controls; and

b) any fraud, whether or not material, that involved management or other employees who have a significant role in the Registrant’s internal controls; and

6. The Registrant’s other certifying officer and I have indicated in this Annual Report whether there were significant changes in internal controls or in other factors that could significantly affect internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses.

| Dated: March 7, 2003 | | | |

| /s/ Joseph F. Pinkerton, III | | |

|

|

| | | |

| Joseph F. Pinkerton, III

Chairman of the Board and Chief Executive Officer

(Principal Executive Officer) | | | |

Chief Financial Officer Certification

I, David S. Gino, Vice President, Chief Operating Officer and Chief Financial Officer of Active Power, Inc., certify that:

1. I have reviewed this Annual Report on Form 10-K of Active Power, Inc. (the “Registrant”);

2. Based on my knowledge, this Annual Report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this Annual Report;

3. Based on my knowledge, the financial statements, and other financial information included in this Annual Report, fairly present in all material respects the financial condition, results of operations and cash flows of the Registrant as of, and for, the periods presented in this Annual Report;

4. The Registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-14 and 15d-14) for the Registrant and have:

a) designed such disclosure controls and procedures to ensure that material information relating to the Registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this Annual Report is being prepared;

b) evaluated the effectiveness of the Registrant’s disclosure controls and procedures as of a date within 90 days prior to the filing date of this Annual Report (the “Evaluation Date”); and

c) presented in this Annual Report our conclusions about the effectiveness of the disclosure controls and procedures based on our evaluation as of the Evaluation Date;

5. The Registrant’s other certifying officer and I have disclosed, based on our most recent evaluation, to the Registrant’s auditors and the audit committee of Registrant’s board of directors (or persons performing the equivalent functions):

a) all significant deficiencies in the design or operation of internal controls which could adversely affect the Registrant’s ability to record, process, summarize and report financial data and have identified for the Registrant’s auditors any material weaknesses in internal controls; and

b) any fraud, whether or not material, that involved management or other employees who have a significant role in the Registrant’s internal controls; and

6. The Registrant’s other certifying officer and I have indicated in this Annual Report whether there were significant changes in internal controls or in other factors that could significantly affect internal controls subsequent to the date of our most recent evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses.

| Dated: March 7, 2003 | | | |

| /s/ David S. Gino | | |

|

|

| | | |

| David S. Gino

Vice President, Chief Operating Officer and Chief Financial Officer

(Principal Financial and Accounting Officer) | | | |

REPORT OF INDEPENDENT AUDITORS

The Board of Directors

Active Power, Inc.

We have audited the accompanying balance sheets of Active Power, Inc. (the Company) as of December 31, 2002 and 2001, and the related statements of operations, stockholders’ equity and cash flows for each of the three years in the period ended December 31, 2002. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Active Power, Inc. at December 31, 2002 and 2001, and the results of its operations and its cash flows for each of the three years in the period ended December 31, 2002, in conformity with accounting principles generally accepted in the United States.

| | | |

| | | /s/ Ernst & Young LLP |

Austin, Texas

January 15, 2003 | | | |

ACTIVE POWER, INC.

BALANCE SHEETS

(Thousands, except per share amounts)

| | December 31, | |

| |

| |

| | 2002 | | 2001 | |

| |

| |

| |

| | | | | |

ASSETS | | | | | |

| | | | | |

Current assets: | | | | | |

Cash and cash equivalents | | $ | 62,934 | | $ | 80,401 | |

Accounts receivable, net | | 1,510 | | 1,723 | |

Inventories | | 6,511 | | 7,869 | |

Prepaid expenses and other | | 613 | | 714 | |

| |

| |

| |

Total current assets | | 71,568 | | 90,707 | |

Property and equipment, net | | 12,095 | | 16,965 | |

Investments in marketable securities | | 27,110 | | 31,704 | |

| |

| |

| |

Total assets | | $ | 110,773 | | $ | 139,376 | |

| |

|

| |

|

| |

| | | | | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | |

| | | | | |

Current liabilities: | | | | | |

Accounts payable | | $ | 352 | | $ | 4,530 | |

Accrued expenses | | 3,761 | | 3,116 | |

| |

| |

| |

Total liabilities | | 4,113 | | 7,646 | |

Stockholders’ equity: | | | | | |

Common Stock - $.001 par value; 400,000 shares authorized; 41,637 and 40,647 shares issued and outstanding in 2002 and 2001, respectively | | 42 | | 41 | |

Treasury stock, at cost; 35 shares | | (2 | ) | (2 | ) |

Deferred stock compensation | | (198 | ) | (2,575 | ) |

Additional paid-in capital | | 214,548 | | 214,637 | |

Accumulated deficit | | (108,315 | ) | (80,692 | ) |

Other accumulated comprehensive income | | 585 | | 321 | |

| |

| |

| |

Total stockholders’ equity | | 106,660 | | 131,730 | |

| |

| |

| |

Total liabilities and stockholders’ equity | | $ | 110,773 | | $ | 139,376 | |

| |

|

| |

|

| |

See accompanying notes.

ACTIVE POWER, INC.

STATEMENTS OF OPERATIONS

(Thousands, except per share amounts)

| | Year ended December 31, | |

| |

| |

| | 2002 | | 2001 | | 2000 | |

| |

| |

| |

| |

Revenues: | | | | | | | |

Product revenue | | $ | 9,469 | | $ | 21,562 | | $ | 4,872 | |

Development contract | | 4,000 | | 1,000 | | — | |

| |

| |

| |

| |

Total revenue | | 13,469 | | 22,562 | | 4,872 | |

Operating expenses: | | | | | | | |

Cost of product revenue (excludes deferred stock compensation amortization of $133 in 2002 and $466 in 2001) | | 15,263 | | 25,796 | | 7,966 | |

Cost of development contract | | 3,219 | | 283 | | — | |

Research and development (excludes deferred stock compensation amortization of $383 in 2002 and $1,030 in 2001) | | 10,696 | | 14,930 | | 9,864 | |

Selling, general & administrative (excludes deferred stock compensation amortization of $723 in 2002 and $2,507 in 2001) | | 12,184 | | 11,684 | | 6,205 | |

Restructuring expenses | | 1,586 | | — | | — | |

Amortization of deferred stock compensation | | 1,239 | | 4,003 | | 6,692 | |

| |

| |

| |

| |

Total operating expenses | | 44,187 | | 56,696 | | 30,727 | |

| |

| |

| |

| |

Operating loss | | (30,718 | ) | (34,134 | ) | (25,855 | ) |

Interest income | | 3,093 | | 6,190 | | 4,365 | |

Interest expense | | — | | — | | (2 | ) |

Change in fair value of warrants with redemption rights | | — | | — | | (1,562 | ) |

Other income (expense) | | 2 | | (18 | ) | (50 | ) |

| |

| |

| |

| |

Net loss | | (27,623 | ) | (27,962 | ) | (23,104 | ) |

Cumulative undeclared dividends on preferred stock | | — | | — | | (2,053 | ) |

Accretion on redeemable convertible preferred stock to redemption amounts | | — | | — | | (17,026 | ) |

| |

| |

| |

| |

Net loss to common stockholders | | $ | (27,623 | ) | $ | (27,962 | ) | $ | (42,183 | ) |

| |

|

| |

|

| |

|

| |

Net loss per share, basic & diluted | | $ | (0.67 | ) | $ | (0.70 | ) | $ | (1.92 | ) |

Shares used in computing net loss per share, basic & diluted | | 41,247 | | 39,781 | | 21,928 | |

| | | | | | | |

Comprehensive loss: | | | | | | | |

Net loss | | $ | (27,623 | ) | $ | (27,962 | ) | $ | (23,104 | ) |

Unrealized gain on investments in marketable securities | | 264 | | 321 | | — | |

| |

| |

| |

| |

Comprehensive loss | | $ | (27,359 | ) | $ | (27,641 | ) | $ | (23,104 | ) |

| |

|

| |

|

| |

|

| |

See accompanying notes.

ACTIVE POWER, INC.

STATEMENTS OF STOCKHOLDERS’ EQUITY

(Thousands)

| | 1992

Preferred Stock | | Common Stock | | Treasury Stock | | | | | | | | | | | |

| |

| |

| |

| | | | | | | | | | | |

| | Number

of Shares | | Par

Value | | Number

of Shares | | Par

Value | | Number

of Shares | | At

Cost | | Deferred

Stock

Compensation | | Additional

Paid-In

Capital | | Accumulated

Deficit | | Other

Accumulated

Comprehensive

Income | | Total

Stockholders’

Equity | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |