Unofficial Translation

Part 1 – Description of General Developments in the

Company’s Business

The Board of Directors of Tefron Ltd. is pleased to present the Description of the Company's Business as of December 31, 2010, which reviews the Company's Description and the development of its business in 2010 (hereinafter "The Report Period"). The Report was prepared in accordance with the Securities Regulations (Periodic and Immediate Reports), 5730 – 1970. The financial data included in the report are in dollars, unless stated otherwise. The data in this report, stated to be correct at the Report Date, are updated to March 15, 2011.

The nature of the information in this periodic report, including a description of material transactions, was examined from the Company's point of view, and in some cases the description was expanded so as to give a comprehensive picture of the topic described.

All parts of this periodic report should be read together.

For convenience, in this periodic report the following abbreviations have the meanings appearing alongside them:

| Dollar: | The US dollar; |

| TASE: | The Tel Aviv Stock Exchange Ltd.; |

| Tefron: | Tefron Ltd.; |

| Hi-Tex: | Hi-Tex Founded by Tefron Ltd., a private company registered in Israel, wholly-owned by Tefron; |

| Macro: | Macro Clothing Ltd., a private company registered in Israel, wholly-owned (100%) by Tefron; |

| Al Mesira: | Al Mesira Textile Company Ltd., a private company registered in Jordan, wholly-owned (100%) by Tefron through Tefron USA Inc.; |

| Tefron USA: | Tefron USA Inc., a private company registered in Delaware, wholly-owned (100%) by Tefron US Holding Inc., which is wholly-owned by the Company; |

| Nouvelle: | Intimes Nouvelle Seamless Inc. A private company incorporated in Canada, owned by the Lieberman family |

| Nouvelle Seamless USA: | Nouvelle Seamless USA Inc., a private company registered in the state of Delaware USA, wholly owned (100%) by Nouvelle; |

| The Group / the Company/ the Corporation: | Tefron, Hi-Tex, Macro, Tefron USA, Al Mesira, Tefron HK, Tefron UK; |

| The Companies Law: | The Companies Law, 5759 – 1999; |

| The Securities Law: | The Securities Law, 5728 – 1968; |

| The Company’s ordinary shares: | The Company's ordinary shares with a nominal value of NIS 10 each after reverse stock split; |

| The Income Tax Ordinance: | The Income Tax Ordinance (New Version), 5721 – 1961; |

NIS : | New Shekel; |

| Norfet: | Norfet Limited Partnership; |

| NYSE or the New York Stock Exchange: | New York Stock Exchange, the New York Stock Exchange in the United States; |

| OTC: | OTC Bulletin Board in the United States. |

| 1.3. | The Corporation's operations and description of its business development |

Tefron was incorporated in Israel in 1977 as a private company under the Companies Ordinance [New Version], 5243 – 1983, and its operations are managed and controlled from Israel. The Company's production operations are conducted in plants located in Israel, Jordan, and the Far East. The Company focuses on the development, production, marketing and sales of intimate apparel, active-wear, swimwear and beachwear sold worldwide by such name-brand marketers as: Victoria's Secret, Wal-Mart, Calvin Klein, GAP, Patagonia, Reebok, Hanes Brands Industries, TJ.Maxx and other brands well-known in the USA and in Europe. The Company's products include active-wear, bras, undershirts, intimate apparel, shirts, leotards, body shapers, nightclothes, socks, leggings, swimsuits, beachwear and accessories, including active-wear and lingerie. The Company uses its advanced production capabilities to supply its customers with competitively priced fashionable and trendy products in its field of operations.

On December 30, 2010 the Company closed the deal to purchase Nouvelle's operations in the women's intimate apparel field manufactured with seamless technology. A total of $5,813,000 was also invested in the Company by various investors.

On December 24, 2010 the Company signed an amendment to the Bank Agreement for the provision of an additional five (5) million US dollars credit, part of the Company's preparations for closing the deal with the investors.

The amendment follows an agreement the Company signed with the banks on March 2, 2010 to restructure the credit facilities provided to it by the banks (hereinafter: "the Bank Agreement"). As part of the Bank Agreement, the Company raised four (4) million dollars gross in March 2010 with a rights offering and a supplementary private placement to Norfet and companies on its behalf (hereinafter: "Norfet”)

During Q1 2010, the Company initiated its turnaround plan to restore the Company to profitability. For more information, see 1.3.8 below.

Arrangements with the Company's lending banks and capital raising

On March 2, 2010 the Company signed an agreement with the three banks with which the Company is connected through financing agreements (Bank Leumi le-Israel, Bank Discount le-Israel, and Bank Hapoalim) that regulates the Company's conduct vis-à-vis the banks, including a restructuring of the credit the banks had provided the Company (hereinafter: “the Bank Agreement”). As part of the Bank Agreement the Company undertook, inter alia, to make a rights offering and/or a private placement of shares in which an additional amount of not less than 4 million dollars would be invested in the Company’s equity capital. For more information see the Company’s immediate reports of January 6, 2010 (ref: 2010-01-346200) and March 3, 2010 (ref: 2010-01-401277).

After Norfet Limited Partnership notified the Company that it could not participate in the rights offering because of regulatory restrictions, the Company chose to raise said sum through a combination of a rights offering and a supplementary private placement to Norfet, with Norfet undertaking to invest in the Company against the private placement of shares, an amount that would bring the total amount raised in the rights offering and the private placement to Norfet to four (4) million dollars.

In February 2010 the General Meeting of the Company’s shareholders accordingly approved the private placement of the Company’s shares to Norfet (hereinafter: "the Private Placement") for $3.8 a share (the same price as for a share in the rights offering) provided that Norfet's percentage holding immediately after the Private Placement would not exceed 45% of the Company's issued and paid-up share capital (for more information see the Company's immediate reports of February 11, 2010 (ref: 2010-01-381624) and February 24, 2010 (ref: 2010-01-393966)).

The Company also published a shelf prospectus and a prospectus for a rights offering in Israel as well as a prospectus for a rights offering in the US, under which the Company’s shareholders1 were offered up to 1,578,975 of the Company’s ordinary shares for $3.8 a share.

1 Excluding: a) Norfet, FIMI Opportunity Fund Limited Partnership and FIMI Israel Opportunity Fund Limited Partnership that undertook not to exercise and not to sell the rights given to them and in return took a share in the above private placement; and (b) Tefron Holdings (98) Ltd. that also undertook not to exercise and not to sell the rights given to it.

The Company raised a total of $US2,867T from shareholders in the rights offering against an allocation of 754,384 of the Company's ordinary shares.

The Company raised an additional $1,133T from the private placement, received from Mivtach Shamir Holdings Ltd. (one of the partners in Norfet) and Ta-Top Limited Partnership (a sister company of Norfet) in equal proportion against an allocation of 149,124 of the Company's ordinary shares to each, such on completion of the rights offering and the Private Placement, each held 4.7% of the Company's issued and paid up share capital. Immediately on completion of the rights offering and the Private Placement, Norfet, Mivtach Shamir Holdings Ltd. and Ta-Top Limited Partnership together held 24% of the Company's issued and paid up share capital.

Overall, the Company raised four (4) million dollars gross in the rights offering and the Private Placement.

On December 24, 2010 the Company signed an amendment to the Bank Agreement, for the provision of an additional five (5) million dollars credit, part of the Company's preparations for closing the deal with the investors. For more information see the Company's immediate report of December 26, 2010 (ref: 2010-01-729861).

On December 29, 2010, a special meeting of the Company's shareholders approved the deal in which, inter alia, the Company acquired the operations of Nouvelle's women's intimate apparel field, manufactured with seamless technology, against a private placement to Nouvelle of 600,000 of the Company's ordinary shares, which immediately after the allocation were 9.2% of the Company's issued and paid up share capital and the voting rights in it (7.9% with full dilution). $US5,813,000 was also invested in the Company by: (i) Litef Holdings Inc. (hereinafter "Nouvelle Investors"); ii) Mivtach Shamir Holdings Ltd (hereinafter "Mivtach Shamir"); (iii) Zilkha Partners, L.P; (iv) Fima Trust; and (v) Rimon Investments Master Fund L.P. (hereinafter jointly: "the Investors" and "the Deal" respectively).

On December 30, 2010 the Deal was closed and the Company accordingly allocated the Company's ordinary shares to the Investors constituting 51.5% of the Company's issued and paid up share capital and the voting rights in it (50.4% with full dilution) against $US5,813,000 that was transferred to the Company. See Note 18 to the Financial Statements, Part C of this Report and see the Company’s immediate report of December 23, 2010 (ref: 2010-01-728055) concerning the calling of a general meeting of the Company’s shareholders on the agenda of which was, inter alia, the acquisition of the Nouvelle operations and an investment of $5.8M in the Company. Said immediate report is included in this periodic report by way of a reference.

| 1.3.2. | Fields of operations and product lines |

The Company has two main fields of operations that comprise accounting segments:

The seamless field:2 in this field, the Company develops, designs, manufactures, markets and sells seamless products with unique characteristics that support the activities for which they are intended, as intimate apparel, upper garments, and active-wear for women and men. manufactured using advanced technology.

The Cut & Sew field: in this field the Group develops, designs, manufactures and sells intimate apparel, swimsuits and active-wear manufactured using a Cut & Sew method. The work process using this method includes production in a number of stations (knitting, cutting, dyeing, and sewing).

The Company's products are designed and developed primarily in Israel and manufactured in the Company's plant in Israel and Jordan, or with sub-contractors in Israel, Jordan and the Far East – according to product type and complexity of production. As a result of changes in the business environment, including continuing erosion of prices and stiffening competition, the Company is relocating its non high-tech manufacturing operations as far as possible to countries outside of Israel where manufacturing costs, including labor costs, are lower. Thus most of the sewing of intimate apparel and active-wear is now done in Jordan. For the last three years the Company has been manufacturing traditional products of no special production complexity through sub-contractors in the Far East, including India, China and Vietnam. The Company manufactures its swimwear and beachwear through sub-contractors, mainly in China and Cambodia.

The Company has three production lines: active-wear, intimate apparel products, and swim and beachwear. The intimate apparel and active-wear product lines are partly Cut & Sew field and partly seamless. The swimwear product lines are Cut & Sew only.

| 1.3.3. | The Group has long-term relationships with most of its customers, some of which have a significant market share in certain clothing categories in the countries in which they operate. The Group's marketing strategy is based on its ability to offer its customers full product planning, development and production services, including inter alia. the design, development and manufacture of products tailored to the specific requirements of each client, using advanced production technologies and providing production capacity for supplying a wide range of products. However, due to the global economic crisis and the operating difficulties, as explained in 1.3.8 below, the Company is coping with a significant reduction in the level of orders from a number of important clients to which it has supplied its products for a number of years. The Company is making a great effort to maintain its relationships with these customers and increase the level of orders. |

2 Seamless products are manufactured using technologies that allow by one continuous knitting action to knit almost the entire garment from the appropriate yarn, after which the product is dyed and finished and undergoes a reduced amount of sewing.

| 1.3.4. | The Company's innovativeness and uniqueness are reflected in special production technologies in each of its fields of operations, in the development of new products made from high quality and innovative cloth and from special yarn developed by the Company, including performance supporting yarn. For more information about the unique technology the Company uses in each of its fields of operations and the Company's competitive advantage in each, see 3.6 and 3.15 below, respectively. |

| 1.3.5. | Listing for trading on the NYSE and TASE |

In 1997 an initial public offering of the Company's shares was made on NYSE, the Company went public and its shares were listed for trading. In September 2005, the Company listed its shares for trading on the TASE, parallel to the trading of its shares on the NYSE.

On December 22, 2008, the Company's shares were delisted from trading on the New York Stock Exchange due to non-compliance with NYSE maintenance rules, and from the beginning of 2009 the Company shares started trading on the OTCBB3. Accordingly, as from March 1, 2009, the Company reports according to Chapter F of the Securities Law, and this concurrently with reporting in accordance with the reporting obligations under the U.S. Security Exchange Act of 1934 relating to a Foreign Private Issuer whose securities are held by the public. Since the delisting of the Company's shares on the NYSE, the Company is no longer subject to the directives of the NYSE.

| 1.3.6. | Milestones in the Company's operations |

In 1990 the Company first marketed its body sized cotton intimate apparel with applicated elastics.

In 1997 Hi-Tex was established, wholly-owned by Tefron, and the Group started production on its seamless products.

During 1999 Tefron acquired full ownership of an American company whose name was later changed to Tefron USA Inc. (hereinafter: "Tefron USA"), which is engaged in the production of seamless products and medical clothing products.

In 2001 the Company began a major transfer of the sewing operations of its various products to Jordan.

During 2002 the Company reorganized Tefron USA including a spin-off of the health textile products division, and established a business partnership with a strategic investor in the field of health textile products - AlbaHealth Inc. (hereinafter: "AlbaHealth"). In addition, in 2002 the Company began to consolidate the seamless production operations of Tefron USA with the production operations of Hi-Tex in Israel, a process which was completed in the second quarter of 2003.

3 The OTCBB (Over The Counter Bulletin Board)is an electronic quotations system that displays quotes, prices and trading volumes of securities traded over the counter in real time and not in one of the stock exchanges in the U.S.

In 2003 the Company acquired Macro Ltd. which manufactures, develops, markets and sells swimwear and beachwear.

In 2003 the Company began implementing a strategy to increase the number of its product lines, including its active-wear products in order to expand the range of products it has on offer, and thus expand its customer base.

In 2004 the Company based part of its marketing operations on operations directed at customers in the active-wear field and launched the Sports Innovation Division to expand the Company's customer base in sports products, active-wear and performance product marketing.

In 2004 the Company also contracted with Norfet and Leber Partners L.P (hereinafter: "Leber") and raised $20M from them in a private placement. On December 22, 2005, Leber stopped being an interested party in the Company. As of the date of this report, the Company does not know of any contacts between Leber and any of the interested parties in the Company.

In 2006 Tefron USA sold its holdings in AlbaHealth to AlbaHealth (held by a third party unconnected with the Company). The Company received $11.75M in payment. For more information see 4.15 below (Material agreements).

On December 18, 2008, the Company published a proxy statement in which were proposed, inter alia, a reverse stock split of the Company's shares in the ratio 10:1 and a 40% increase in the Company’s registered capital. The Company's general meeting, convened on February 22, 2009, approved the reverse stock split of the Company's capital and it was implemented.

In 2008 there was a significant deterioration in the Company's financial results due. inter alia. to the global economic crisis and its repercussions. The Company therefore decided to implement a comprehensive turnaround plan in 2009 as described in 1.3.8 below.

In Q1 2010 the Company began to implement its turnaround plan as described in 1.3.8 below. On March 2, 2010 the Company signed an agreement with its three financing banks on a restructuring of the credit facilities provided to it by the banks and the injection of capital into the Company.

In March 2010 the Company raised four (4) million dollars gross in a rights offering to the public and a supplementary private placement to Mivtach Shamir Holdings Ltd. and Ta-Top Limited Partnership, companies on Norfet's behalf. For details see 1.5.1 and 1.5.2 below.

On December 24, 2010 the Company signed an amendment to the Bank Agreement for the provision of an additional five (5) million US dollars credit, part of the Company's preparations for closing the deal with the investors. See Note 13 to the Financial Statements, Part C of this Report.

On December 30, 2010 the Company closed deal to acquire the operations of Nouvelle's women's intimate apparel field, manufactured with seamless technology, against a private placement to Nouvelle of 600,000 of the Company's ordinary shares. $5,813,000 was also invested in the Company by various investors. See 1.5.3 below.

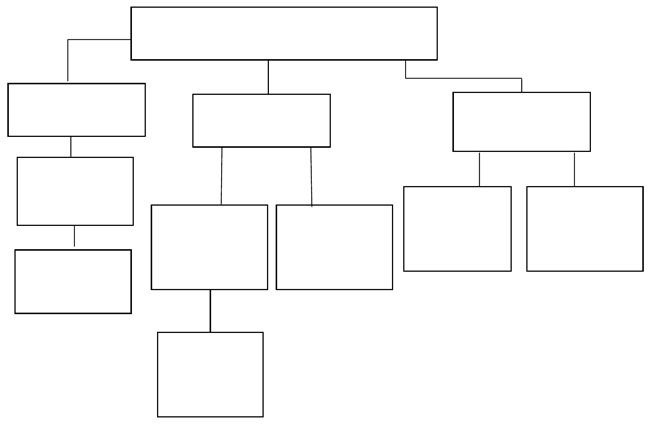

| 1.3.7. | Structure of the Company's holdings in the material subsidiaries on December 31, 2010: |

Flowchart of holdings

Following is a flowchart of the Company's holdings structure:

Dong Guang Macro Clothing Limited

Tefron Holdings (98) Ltd.

Hi-Tex Founded by Tefron Ltd.

El Masira Textile Company Ltd.

| 1.3.8. | Changes in the Corporation's business |

In Q1 2010, the Company began to implement a turnaround plan with a view to restoring the Company to profitability. The turnaround plan included recruiting a new CEO, new management members and key personnel, establishing professional teams in the key fields described below, setting precise operational and commercial targets leading to an improvement in the Company’s performance which as a consequence, restores customers’ faith, regular follow-up of progress in all fields of operations, and raising capital to finance the Company’s operations (hereinafter: "the Turnaround Plan"). The turnaround plan continued at full throttle throughout 2010, and the Company estimates that the full effect of its implementation will be felt from Q1 2011. The Company also estimates that the overall contribution of the turnaround plan, after neutralizing the effect of the reduction in the volume of operations, was in excess of $10M in 2010.

The Turnaround plan includes the following main elements:

| a. | A substantial improvement in lead times for customers’ orders by putting an emphasis on planning, administrative focusing on customer targets, dealing with main root problems with product quality and operational bottlenecks. Since the end of Q2 2010 the Company has been measuring a high and consistent level of meeting lead times for supply to customers of more than 95%. This is compared to an average percentage of 60% in meeting lead times in 2009. |

| b. | Further dealing with and reducing the level of production waste, including quality waste and logistic waste. The measures taken also include the analysis and identification of root problems in knitting, fixation, dyeing and sewing, improvement in quality control in the early production stages, measuring and managing waste at production floor level and in the various work stations, as well as improvement and optimization of quantity planning to reduce logistical waste. Since the end of Q2 2010 the Company has been measuring 40% less waste in production compared with 2008 and 2009. |

| c. | Efficiency measures on the Company's production floor by improving efficiency and output levels mainly at the knitting and sewing stages. The efficiency measures include assessment and incentives for employees on the production lines according to relevant indexes and targets, changes in work processes, including streamlining and reducing the workforce, training employees, and increasing control over the production process. The Company measured a 20% improvement in efficiency in the second half of 2010 compared with the 2009 average. The Company also significantly reduced its payroll in 2010. |

| d. | Reducing acquisition costs, mainly of raw materials, finishing and ancillary materials by identifying additional alternative suppliers, mainly in South-East Asia, increasing competition among suppliers, and by developing products with cheaper substitute raw materials. Attention will also be paid to shipping, transportation and dispatch which are a significant component of the Company’s costs. |

| e. | Savings and efficiencies in the general and administrative items. In an effort to make said savings and efficiencies the Company signed an agreement with the owner of the property the factory occupies in Teradyon in Misgav under which, inter alia, the Company vacated some of the buildings and signed a new lease agreement for the remainder, as stated in 4.5 below. The agreement with the owner and the vacating of the Company’s headquarters building in Misgav led to annual savings of more than NIS 4M. The Company is also looking into all the expenses items and reducing them as far as possible. |

| f. | Examining and improving the costing process and the product and customer mix to prevent selling price erosion, discontinuing sales to overseas customers that make a negative contribution to the Company, and discontinuing the manufacture of products that are not profitable for the Company. |

| g. | Recruiting key personnel in the textile and clothing field in order to expand the Company's know-how basis. As part of this process, Mr. Amit Meridor was recruited as the Company's CEO. Mr. Amit Meridor brings with him decades of management experience, 15 years of which were in the textile company Nilit Ltd., a manufacturer of high quality yarn and fibers. For additional details of Mr. Amit Meridor and the terms of his employment, see the Company's Immediate Report of January 31, 2010 (Ref. No. 2010-01-361179) and of January 23, 2010 (Ref. No: 2010-01-362682) included in this report by way of reference. Moreover, on 5 July 2010, Mr. Arnon Tiberg was appointed to the post of Chairman of the Board. Mr. Tiberg has many years of proven managerial experience in different companies in the economy including a textile company in the Company’s field of operations. A new member of the management staff with a background in the field in which the Company operates and other key personnel were also added to the Company’s ranks during the year. |

| h. | Restructuring of the Company’s debt to the banks. For details of the agreements between the Company and its financing banks on the restructuring of the credit facilities and the additional credit, see note 13 to the Financial Statements, Part C of this Report. . |

| i. | Raising four (4) million dollars gross for the Company in a rights offering and a supplementary private placement during March 2010. |

| j. | Closing the deal to acquire Nouvelle's operations in the women's intimate apparel field manufactured with seamless technology and investment of US$5,813,000 in the Company by various investors. |

The information on the turnaround plan, including the Company’s intention to return to profitability, reduce levels of waste, improve lead times in the supply of its products, reduce acquisition costs, and save general and administrative expenses is forward-looking information as defined in the Securities Law. Forward-looking information is information about the future that is uncertain, based on existing information or estimates, including the Company’s intentions or estimates on the date of publication of this Report or that is not dependent solely on the Company. This information, in whole or in part, may not be realized or realized differently inter alia for the following reasons: fluctuations in market conditions, competition, restrictions on the financing sources at the Company's disposal, difficulties implementing the plan, a drop in demand and customers' orders, erosion of the exchange rate of the dollar against other currencies, increases in raw material costs, an inflexible structure of Company expenses, and such like.

The turnaround plan mentioned above was implemented after the Company carried out an efficiency plan at the beginning of 2009 in view of the Company’s financial results inter alia because of the global financial crisis and operational difficulties the Company encountered.

The operational difficulties mentioned above were due to the transition to manufacturing a wide variety of new and complex products ordered by customers in smaller production batches than previously. As a result of these operational difficulties, there were increases in production costs and in the product waste level. Another result of the operational difficulties were delays in delivering the products to the customers. To reduce these delays the Company air freighted some of the orders to customers instead of sending them by sea, which led to a significant increase in the Company’s shipping expenses.

The operational difficulties came about and intensified gradually. They are a result of a gradual change in the behavior of a market becoming increasingly more demanding, for both more complex products and more precise production. The difficulties and lack of customer tolerance increased during 2009 as a result of the global crisis, which began in the U.S where most of the Company's markets are located.

The efficiency plan that the Company carried out in 2009 included:

| (1) | Efficiency in the production and control set-up by concentrating a number of production sites in fewer and larger production facilities. For this purpose, the Company stopped working with a number of small sewing workshops in Jordan and instead started working mainly with one large sewing workshop constructed in Jordan by a sub-contractor specially for this purpose. As of the date of this Report, the Company has completed the processes of concentrating these production sites. |

| (2) | The Company does a substantial part of its sewing work in Jordan through a self owned sewing facilities and through sub-contractors, due to the low wage costs in Jordan compared with Israel. To work with the sub-contractors, the Company leases them sewing machines it owns. This method of operation is a necessity in Jordan where the investments budget is lower than customary in the western world and does not permit the setting up of large plants without foreign investors such as the Company. Furthermore, the Company has tax advantages as a result of production in Jordan in the tax-free trading zone which is exempt from customs duties under the trading agreements with the U.S. and Europe. |

| (3) | The Company is examining the possibility of transferring another part of its manufacturing operations to countries where labor costs are low. Thus the Company published that it was negotiating with third parties to set up a joint venture in Egypt to manufacture products for the Company’s customers (for more information see the Company’s immediate report of June 15, 2009, reference No.: 2009-01-142995). The considerations weighed by the Company when it came to examine the operations in Egypt were (1) low costs of setting up and operating the manufacturing infrastructure; (2) low tax rates; (3) rates of duty and free trade agreements with the U.S. which is a key market for the Company;(4) low labor costs; and (5) strategic partnerships for setting up and managing operations. The Company cannot guarantee that its customers will not try to manufacture the Company's products through third parties, including by directly contacting subcontractors who are currently employed by the Company. Due to the resignation of the Company's CEO in November 2009 and developments with the banks, contacts between the parties were discontinued. |

| (4) | Improvement in the extent of use of the Company’s knitting capacity through a new arrangement of the machinery on the production floor and realignment of part of the human resources facilities on the production floor. |

| (5) | Reduction in the Company’s knitting costs by cutting wages across the board by up to 15% (which has been done) and efforts by the acquisitions department to reduce raw material costs. |

| (6) | Changes in development processes (to respond to production demands at the development stage) so that products in the development stages are processed through the production department to ensure their production feasibility. |

| (7) | Installing an advanced system of quality assurance with precise feedback for the production process. |

| (8) | Reduction of time lost between the various production stages. As part of this procedure, in Q2 2009 the Company brought back most of the pressing machines from Jordan to Israel. This step saved the transportation time needed for sending products to be pressed in Jordan and returning them to Israel for dyeing. The Company also keeps available, as far as possible, a basic yarn inventory, which contributes significantly to savings in yarn production and supply times. This reduction means shorter lead times for the customer. |

| (9) | Reduction in production waste levels through tighter control procedures, adjusting production-floor workforce and the return of the pressing machines from Jordan as stated in sub-clause 8 above. These steps mean greater control of the process which translates into a decrease in waste. |

| (10) | 15% reduction in Company’s manpower . |

| (11) | In addition, at the end of 2008 the Company closed its dyeing plant in Israel which had provided part of the dyeing operations of the Cut & Sew division. The number of cuts dyed in the dyeing factory was a small part of the Company's overall product dyeing operations. The Company transferred all its dyeing operations to sub-contractors in Israel with whom the Company has intensive and long-term commercial connections – including: Negev Textile (1987) Ltd. |

To characterize the difficulties, from the development stage to the supply stage of the Company's various products and control the efficiency measures, the Company uses a number of indexes which include inter alia: (1) utilization indexes for the knitting and sewing processes; (2) percentages of waste in production; (3) measurement of lead times from order date to delivery date to the customer; and (4) levels of inventory being processed. All the above indexes showed improvement in 2009.

The Company had completed the implementation of its 2009 efficiency plan by the end of Q2 2009 which led to significant cost savings in 2009.

Transfer of operations from the Company to Hi-Tex – In order to streamline Company's management, its operations, and its interface with its customers and suppliers, in January 2009 the Group concentrated all the active-wear and intimate apparel operations in Hi-Tex and left the swimwear operations in Macro Ltd. For that end, the Company transferred 71% of its assets to Hi-Tex against an allocation of additional shares in Hi-Tex, pursuant to Section 104 of the Income Tax Ordinance. Since January 2009, contracts with all the Company's customers and most of its suppliers, in connection with intimate apparel and active-wear have been with Hi-Tex only – compared with the previous situation in which customers and suppliers had to make separate contracts with the Company and Hi-Tex. As of the date of this Report, the Company is managing the operations of Hi-Tex, Macro and the other companies in the Group, with most of the assets and liabilities held by Hi-Tex and Macro, all of whose shares are owned by the Company

| 1.4. | Fields of operations |

The Company has two fields of operation reported as business segments in its consolidated financial statements as at December 31, 2010: (a) The seamless field of operations; (b) The Cut & Sew field of operations (hereinafter jointly: "Fields of Operation"). Following is a short description of each of these fields of operation:

| 1.4.1. | The seamless knitting field |

In this field, the Company designs, develops, manufactures, markets and sells seamless intimate apparel and active-wear for women and men, for customers in the U.S., Canada, Europe and the Far East.

| 1.4.2. | The Cut & Sew field |

In this field, the Company designs, develops, manufactures, markets and sells intimate apparel and active-wear for men, women and children, mainly to large retail chains in the U.S., and companies with leading brands in the U.S. In this field the Company also designs, develops, manufactures, markets and sells swimwear and beachwear to retail chains and companies with leading brands in the U.S., Europe and Israel.

| 1.5. | Investments in the Corporation's capital and transactions in its shares |

In March 2010 and on December 30, 2010, as part of the arrangement with the Company's banks, the Company raised capital as follows:

| 1.5.1. | An allocation to the Company's shareholders4 of up to 1,578,975 of the Company's ordinary shares for $3.8 per share The shares were offered such that every shareholder holding 1.406 ordinary shares of the Company was entitled to 1 rights unit. 754,384 rights to purchase 754,384 ordinary shares were actually exercised in the rights offering and the Company raised a total of $2,867T from its shareholders. |

| 1.5.2. | An extraordinary private placement to Mivtach Shamir Holdings Ltd. (one of the partners in Norfet) and Ta-Top Limited Partnership (a sister company of Norfet) for $3.80 a share (the same price as the share in the rights offering) (hereinafter: "the Private Placement"). With the private placement, the Company raised an additional $1,133T from Mivtach Shamir Holdings Ltd. and Ta-Top Limited Partnership in equal proportions, against an allocation of 149,124 of the Company's ordinary shares to each, such that on completion of the rights offering and the Private Placement, each held 4.7% of the Company's issued and paid up share capital. Immediately on completion of the rights offering and the Private Placement, Norfet, Mivtach Shamir Holdings Ltd. and Ta-Top Limited Partnership together held 24% of the Company's issued and paid up share capital. |

| 1.5.3. | On December 30, 2010, the Company's completed the deal in which, inter alia, it acquired the operations of Nouvelle's women's intimate apparel field,5 manufactured with seamless technology, against a private placement to Nouvelle of 600,000 of the Company's ordinary shares, which immediately after the allocation were 9.2% of the Company's issued and paid up share capital and the voting rights in it (7.9% with full dilution). $US5,813,000 was also invested in the Company by: (i) Litef Holdings Inc.6 ; (ii) Mivtach Shamir Holdings Ltd;7 (iii) Zilkha Partners, L.P.; (iv) Fima Trust; and (v) Rimon Investments Master Fund L.P. On closing the deal, the Company allocated the Company's ordinary shares to the Investors constituting 51.5% of the Company's issued and paid up share capital and the voting rights in it (50.4% with full dilution) against $US5,813,000 that was transferred to the Company. |

4 See footnote 1 above.

5 To the best of the Company's knowledge, the shareholders in Nouvelle are and Yyad Holdings Ltd. and Manufacture de Bas Culottes Lamour Inc., in equal parts. To the best of the Company's knowledge, the shares of Yyad Holdings Ltd. are held in whole by Mr Willy Lieberman (who at the reporting date serves as Senior Vice President of Nouvelle), and the shares of Manufacture de Bas Culottes Lamour Inc. are held as follows: (i) 75% by Aaron Lieberman in trust by the Aharon Lieberman Family and through his holdings in Litef Holdings Inc.; (ii) 25% is held by the late Sam Lieberman in trust by the Sam Lieberman Family and through Sam Lieberman’s holdings in Samlieb Holdings Inc. To the best of the Company's knowledge, Aaron Lieberman and the late Sam Lieberman were brothers and Willy Lieberman is the son of the ate Sam Lieberman

6 To the best of the Company’s knowledge, Litef Holdings Inc. is a private company incorporated in Canada controlled by Mr. Martin Lieberman (one of Nouvelle’s shareholders).

7 To the best of the Company’s knowledge, the parties at interest in Mivtach Shamir Holdings Ltd. are as follows: Mr. Meir Shamir holds 33.67% of the voting rights and equity rights in Mivtach Shamir Holdings Ltd. (33.15% with full dilution)with full dilution 33,15%), Ofer Glaser holds 10.81% of the voting rights and equity rights in the company (10.64% with full dilution), Leon Recanati holds 8.42% of the voting rights and equity rights in the company (8.29% with full dilution), the Clal Group holds 13.34% of the voting rights and equity rights (13.19% with full dilution), Ashtrom Properties Ltd. holds 11.65% of the voting rights and equity rights (11.47% with full dilution), and the Menorah Group holds 9.14% of the voting rights and equity rights (8.99% with full dilution). According to a report of the holdings of interested parties in Mivtach Shamir Holdings Ltd. at March 28, 2011, Mivtach Shamir Holdings Ltd. is controlled by Meir Shamir (33.67) and Ashtrom Properties Ltd. (11.67%) that have an agreement between them concerning the selection of directors, a right of first refusal, and a right to participate. Ashtrom Properties Ltd. is a public company whose shares are traded on the TASE and information about which is published publicly.

For more information about the investments in the Corporation’s capital see Note 18 to the Financial Statements, Part C of this report and see the Company’s immediate report of December 23, 2010 (ref: 2010-01-728055) concerning the calling of a general meeting of the Company’s shareholders on the agenda of which was inter alia the approval of the deal to acquire the Nouvelle operations and the investment of $5.8M in the Company. Said immediate report is included in this periodic report by way of reference.

| 1.6. | Dividend distribution |

| 1.6.1. | Dividends declared and distributed by the Company's in the past two years: |

In May 2008 the Company made a permitted dividend distribution of $8,0008 thousand in cash. As at December 31, 2009, the Company does not have a distributable balance of profits.

| 1.6.2. | External restrictions on the Corporation's ability to distribute a dividend |

In accordance with the provisions of the arrangement between the Company and the financing banks, the Company undertook that as long as certain loans the banks are to provide for have not been repaid in full, it will not pay and not undertake to pay, in any shape or form whatsoever, dividends to its shareholders or to controlling shareholders in it and/or to a family member of any of them and/or to companies or corporations in which the shareholders are parties at interest and/or to any third party replacing any of the above or on their behalf without the prior written consent of the banks, apart from making said payments between the Company, Macro and Hi-Tex.

| 1.6.3. | Dividend distribution policy |

As of the date of submitting this Report, the Company does not have a dividend distribution policy.

Part 2 – Other information

| 2.1. | Financial information about the Company's fields of operation |

The Company has two fields of operation: The seamless field and the Cut & Sew field, reported as operational segments in the Company’s consolidated Financial Statements as at December 31, 2010 (see also Note 22 to the Financial Statements as at December 31, 2010:

Following are the Company's consolidated financial data by fields of operations, in $1,000s (for more information see Note 22 to the Company's financial statements – Part C of this Report):

| 2010 | | | |

| $1,000s | Seamless field | Cut & Sew field | Consolidated |

1. | Revenues from externals | 52,850 | 33,194 | 86,044 |

| 2. | Fixed costs | 30,524 | 14,498 | 45,022 |

| Variable costs | 38,587 | 25,100 | 63,687 |

| 3. | Loss from standard operations | (16,278) | (6,528) | (22,806) |

| 4 | Total assets and liabilities, net at December 31, 2010 | 26,539 | 9,371 | 35,910 |

| 2009 | | | |

| $1,000s | Seamless field | Cut & Sew field | Consolidated |

1. | Revenues from externals | 62,306 | 53,232 | 115,538 |

| 2. | Fixed costs | 30,902 | 13,059 | 43,961 |

| Variable costs | 44,601 | 47,902 | 92,503 |

| 3. | Loss from standard operations | (13,197) | (7,729) | (20,926) |

| 4 | Total assets and liabilities, net at December 31, 2009 | 39,262 | 7,733 | 46,995 |

| 2008 | | | |

| $1,000s | Seamless field | Cut & Sew field | Consolidated |

1. | Revenues from externals | 86,265 | 87,564 | 173,829 |

| 2. | Fixed costs | 39,527 | 12,180 | 51,707 |

| Variable costs | 62,542 | 78,808 | 141,350 |

| 3. | Loss from standard operations | (15,804) | (3,424) | (19,228) |

| 4 | Total assets and liabilities, net at December 31, 2008 | 58,291 | 5,454 | 63,745 |

The allocation of joint costs between fixed costs and variable costs is made according to the ratio of sales and the ratio of production in Israel.

Following are the Company's consolidated financial data on the breakdown of revenues and expenses according to functional currencies:

| | | $1,000s | |

| | | 2010 | | | 2009 | | | 2008 | |

| Dollar | | | 75,230 | | | | 101,402 | | | | 137,992 | |

| Euro | | | 6,472 | | | | 6,884 | | | | 28,038 | |

| NIS | | | 2,413 | | | | 5,335 | | | | 4,551 | |

| Other | | | 1,929 | | | | 1,917 | | | | 3,248 | |

| Total | | | 86,044 | | | | 115,538 | | | | 173,829 | |

Following are the Company's consolidated financial data on the breakdown of revenues and expenses according to manufacturing locations:

| | | $1,000s | |

| | | 2010 | | | 2009 | | | 2008 | |

| The Far East | | | 28,257 | | | | 39,926 | | | | 46,352 | |

| Jordan and Israel | | | 57,787 | | | | 75,612 | | | | 127,477 | |

| Total | | | 86,044 | | | | 115,538 | | | | 173,829 | |

Following are the Company's consolidated financial data on the breakdown of revenues and expenses according to sales destinations:

| | | $1,000s | |

| | | 2010 | | | 2009 | | | 2008 | |

| North America | | | 72,754 | | | | 97,975 | | | | 137,992 | |

| Europe | | | 10,443 | | | | 11,259 | | | | 28,038 | |

| Israel | | | 2,413 | | | | 5,335 | | | | 3,851 | |

| Other | | | 434 | | | | 969 | | | | 3,948 | |

| Total | | | 86,044 | | | | 115,538 | | | | 173,829 | |

| 2.2. | Nature of adjustments in the consolidated statement |

There are no transactions between related companies operating in different fields of operations.

| 2.3. | Developments in the financial data |

Explanations of developments in the financial data are presented in 2.1 above; and for additional main data, see section 3 in the Directors' Report, Part B of this Report.

| 2.4. | General environment and the effects of external factors on the Corporation's operations |

The Group is exposed to trends, events and developments in world clothing and the world economy which are likely to have an effect on the Group's operations and on those of its competitors, as described below.

| 2.4.1. | Economic situation in target markets and production locations |

The global financial crisis and the slowdown in activities in the real economy, which occurred in 2008, resulted inter alia in serious damage to global financial markets, in declines and extreme fluctuations in the stock exchanges worldwide and in Israel, in a worsening of the credit crisis, a decline in the value of assets held by the public, and a significant slowdown and uncertainty in economic activities. As a result, various economies in the world, including the U.S. and many European countries, went into recession and there were indications of a recession in Israel as well.

Commencing Q2 2009, there was a modest recovery which gained strength in most fields of the Israeli economy. Various world markets are experiencing a similar recovery and there is a definite global trend of recovery in real operations.

From the beginning of 2010 the economic recovery has continued in most of the world's financial and real markets, especially in emerging economies and in Israel, but the repercussions of the 2008 financial crisis are still being felt, including fluctuations in securities and currency rates against the background of uncertainty with regard to the ability of some European countries to service their debt, the ability of the United States to reduce its unemployment rate, the slow recovery of the American real-estate market, and how developing countries (particularly China) are dealing with growing inflation due to the steep rises in commodity prices worldwide. A positive trend was recorded in the domestic financial market in 2010.

The economic situation and recession in the company's target markets could have an effect on consumers consumption patterns in the Company's fields of operation and on consumption volume.

The economic situation also increases risk levels inherent in the operations of all the Company’s business partners – customers, subcontractors (including a significant subcontractor in the dyeing field), and suppliers – and the risk that they will become insolvent. The Company is exposed to non-payment by its customers if they get into payment difficulties even after the Company has supplied the orders it received from customers, mostly without the customers providing any payment guarantees. The Company’s suppliers and subcontractors are also liable to get into financial difficulties and consequently the Company may be forced to find alternative suppliers or subcontractors without sufficient notice. As a result the Company may fall behind in supplying its products to its customers. Risks associated with the economic situation globally, in Israel, in the target markets, and in the world as a whole may affect the Company’s sales volumes, its ability to supply orders to customers and to operate its full production setup.

The Company strives to balance the distribution of the financial burden and commercial risk between itself and its suppliers and customers by making similar demands of its suppliers to those made by its customers.

Changes in the availability of financing sources worldwide, inter alia due to the global crisis described above, may affect the Company's cash flows. The Company is currently having to finance production and supply to customers for a period of 150 days (from date of payment of raw material requirements and financing the production process until the date of collection from the customer). To allow the Company broad scope in its activities while maintaining its ability to deal with fluctuations in its cash flow, the Company needs financing sources that are available to it at any time. For details of the bank and extra-bank sources of finance available to the Company, see section 5 of the Directors' Report, Part B of this Report.

| 2.4.3. | Changes in forex rates and inflation levels |

Fluctuations in forex rates of the various currencies have a significant effect on the results of the Company's operation, mainly in view of the fact that the company's sales are made mostly to the U.S. in dollars whereas a large part of its expenses are in NIS. In 2010 the Company recorded $75.2M of sales in U.S. dollars (87.4% of the Company's overall sales in that period) and the shekel expenses for salaries and raw material purchases were equivalent to $32M. To limit the Company's exposure to fluctuations in forex rate between the various currencies, the Company takes action from time to time to protect against exposure to losses resulting from changes in the forex rates of the shekel-dollar and euro-dollar.

| 2.4.4. | Increasing competition worldwide |

The clothing field is intrinsically competitive and the Company has to cope with falling prices and competing manufacturers’ production and supply capacity. Most of the competition from other manufacturers in the clothing field comes from cutting production costs, reducing lead times, design, product quality, and efficient supply of the product to the customer. Due to the fact that production costs depend to a large extent on manpower costs, in the last few years most of the production in the field was done in countries with low labor costs. The Company is competing with manufacturers of intimate apparel, active wear and swimwear, many of whom have a lower cost base, longer operational experience, wider customer base, closer geographical propinquity to customers, and greater financial sources than the Company. Increased competition, direct or indirect, can reduce the Company’s revenues and its profitability by exerting pressure to cut prices, costing it market share, and other factors.

In addition, the Company's Far East competitors have established relationships with the Company's customers, leading to price erosion in some of the Company's Cut & Sew products and a reduction in the volume of sales of these products. In March 2010 the Company's Board made a decision to discontinue manufacturing operations in the cut & sew field in Israel; manufacturing operations in this field are continuing in countries in the Far East.

Therefore products, in which production processes are labor intensive and not based on the Company’s unique technology, and in which the Company has no relative advantage over Far East competitors, are being manufactured almost exclusively by subcontractors in the Far East and Jordan. The Company regularly examines the possibility of transferring an additional part of the manufacturing operations to countries with low labor costs.

In technology intensive fields the Company is developing and renewing in order to maintain its position as a world leader in the Seamless field, but it cannot guarantee that its competitors will not equip themselves with machinery similar to what the Company has and catch up with the Company’s development rate in that area, too.

A worsening of the economic situation also increases price competition as a result of manufacturer’s and marketers’ willingness to cut their inventory levels, also by selling inventory at lower prices.

For more information about competition in the Company's fields of operations see 3.6 below on competition in the seamless field and 3.15 on competition in the cut & sew field.

| 2.4.5. | Changes in fashion and consumer preferences |

The clothing field is prone to changes in consumer preferences and fashion. The Company develops, designs and manufactures products according to how the Company and its customers understand consumers’ tastes and the price they will be willing to pay for the Company’s products. If the Company does not correctly predict consumers’ tastes and their preferences, the Company’s customers may reduce the volume of their orders from the Company or the prices at which they will agree to purchase the Company's products.

| 2.4.6. | Changes in raw material costs |

The Company’s cost base is affected by fluctuations in raw material prices. The Company uses cotton yarn in the manufacture of its products, affected by world cotton prices, and Spandex yarn, various polymer yarn, and elastic, affected by fluctuations in world oil prices. The Company’s financial results, as a manufacturer of clothing products, are significantly affected by the prices of raw materials and their availability. The Company has no significant influence on fluctuations in raw material prices, apart from exploiting opportunities to purchase raw materials at attractive prices on certain occasions.

| 2.4.7. | Increases in the cost of purchasing finished products from manufacturers in the Far East and in labor costs of contractors in the Far East and Jordan |

In the last few years there have been increases in the cost of purchasing finished clothing products from subcontractors in the Far East and Jordan, due mainly to increases in the prices of raw materials, cloth and ancillary materials as well as an increase in wage costs and costs surrounding production in these countries, and to the strengthening of local currencies against the U.S. dollar. Some of the products the Company sells are purchased and manufactured by subcontractors and from its factories in the Far and Middle East (Jordan), and are therefore affected by these price increases.

| 2.4.8. | Changes in world free trade agreements that may lead to changes in tariff and quota regulations in the Company’s main target market countries |

Commencing January 2009 quotas on textile imports into the U.S. and the European Union were removed. The removal of import quotas increased competition in these markets and causes further erosion of the selling prices of the Company's products and consequently further erosion of its profitability. It also cancelled out the considerable advantage the Company had over some of its competitors. In the past, competitors from Far East countries were limited in the amounts they could export to the U.S. and Europe. This gave countries to which no such limitations applied, such as Israel, an advantage in the supply of surplus demand beyond the quota restrictions. It should be emphasized that even after the removal of these quotas there was still a levy of 7.6% to 32% on imports into the U.S. and the European Union from countries that had no free trade agreements, with the precise levy determined according to the type of product imported and the exporting country.

Despite the levies on imports into the U.S. and the E.U. as stated above, the Company, together with other companies in the clothing field, takes advantage of the free trade agreements between Israel and the U.S., Canada, the E.U. and the European Free Trade Association (EFTA). The trade agreements allow the Company and other companies in the clothing field to sell products manufactured in Israel to the U.S., Canada, E.U. and EFTA member countries free of tax. The U.S. extended the concessions under the U.S. – Israel free trade agreement to goods processed in the free trade zone in Jordan and therefore the Company can also export tax-free the Company's products which are partly manufactured (sewing) in Jordan.

Some countries, also with free trade agreements with the U.S., Canada and the E.U., are a manufacturing source for the Company's competitors – whether because they have lower labor costs or the costs of transporting products from them are lower and their lead times are shorter. Other competitors in countries with no such free trade agreement are exposed to the payment of levies on imports to the U.S. and/or the E.U. In general, products manufactured in China and other countries in the Far East are not exempt from levies. If other countries sign free trade agreements with the U.S. and/or the E.U. and this leads to a reduction/abolition of duties on imports from these countries then competition in the field will increase.

The Company’s knitting factories are located in an industrial zone in Misgav, Israel, and therefore the situation on the country's northern border could impact the operations of the Company's factories there. Moreover, all the Company's sewing is done in Jordan, with the Company’s products being transferred from Israel to Jordan and back. Therefore, the security situation between Israel and Arab countries in general and the Palestinians in particular could affect the Company's ability to work freely and comfortably in Jordan. In January 2011 demonstrations erupted in Egypt and in other Arab countries calling for regime change. The current uncertainty in connection with the future of regimes in the Arab world in general and in Jordan where the Company operates in particular, increases the concerns about the future of Jordan’s relationship with Israel and consequently with companies associated with Israel such as the Company.

Part 3 – Description of the Company’s Business by Fields of

Operation

Following is a description of the Company’s fields of operations: The seamless field and the Cut & Sew field.

The seamless field

| 3.1. | General information about the seamless field of operations |

In this field, the Company develops, designs, manufactures, markets and sells seamless products with unique characteristics that support the activities for which they are intended as intimate apparel, upper garments, and active-wear for women and men.

The Company's development and design operations in the seamless field are conducted in its factory in the Teradyon Industrial Zone, Misgav, Israel. Its production is done by the Group's workers and subcontractors in Jordan and Israel. Marketing and sales are handled by the Group's employees in the U.S,, Europe and Israel.

The Company is making a great effort to expand its operations in this field in which the Company has an advantage over its competitors both because of the great number of Santoni machines it has and because of the unique technologies the Company uses in this production. The Santoni machines are sophisticated sewing machines that manufacture an almost complete product from yarn. The products, planned in detail and divided up according to the various features of each of the garment’s areas, are knitted in their entirety by the Santoni machines.

Based on its experience in the relevant markets, the Company estimates the size of the wholesale market for seamless knitted products among customers in the categories in which the Company operates at 2 billion dollars annually.

For more information about the operations the Company acquired from Nouvelle in the seamless field see the Company’s immediate report of December 23, 2010 (ref: 2010-01-728055) to which is attached inter alia the following documents: (a) an outline of Nouvelle’s operations (Appendix A of said report); (b) Nouvelle’s consolidated and audited financial statements for the 12 calendar month period ending June 30, 2010 and Nouvelle’s summarized and reviewed consolidated financial statements for the three calendar month period ending September 30, 2010, both drafted according to the International Financial Reporting Standards (IFRS) (Appendix B1 to B4 of said report); (c) the Directors’ Report on the state of Nouvelle’s affairs for the 3 calendar month period ending June 30, 2010, and the Directors’ Report on the state of Nouvelle’s affairs for the 3 calendar month period ending September 30, 2010 (Appendix C1 to C4 of said report). Said immediate report is included in this periodic report by way of reference.

| 3.1.1. | Changes in the volume of operations in the field and their profitability – seamless field |

Sales in this field were 15.2% down in 2010 in comparison with 2009 mainly due to: (1) The "Ultimate" project, a production line for Nike of mainly sportswear tops, for which no follow-up orders have been placed since Q2 2009; and (2) a drop in sales of intimate apparel products to two customers that ended their contracts with the Company during 2009.

Despite the drop in sales and in the wake of the success of the turnaround plan, the Company improved its direct profitability in this field. The successful parts of the plan that led to the improvement in profitability are those concerned with production floor efficiency, a reduction in waste during the production process, and a shortening of lead times to customers that also led to a substantial decrease in the use of air freight as a means of delivery. The Company estimates that in financial terms, the success of the recovery plan translated into more than $10M saved on operations expenses in 2010. For more information on the recovery plan see 1.3.8 above.

At the end of 2008 and the beginning of 2009 the Company put together an action plan that included efficiency measures to align its volume of operations and expenses with the anticipated sales volume as described in 1.3.8 above.

The information on the effect of the global recession is forward-looking information as defined in the Securities Law. Forward-looking information is information about the future that is uncertain, based on existing information or estimates, including the Company’s intentions or estimates on the date of publication of this Report or that is not dependent solely on the Company. This information, in whole or in part, may not be realized or realized differently inter alia for the following reasons: Changes in forex rates of the dollar against other currencies, the global crisis, changes in the requirements of the relevant market, changes in competition, and such like.

| 3.1.2. | Market developments in the field of operations and changes in the characteristics of its customers - seamless field |

The target market for the Company's products in the seamless field are mainly in the U.S. and the changes in the financial state of this market were reflected in the last period of recession by a drop in consumption, constant pressure to reduce prices, and demand for shorter lead times. These changes have a negative effect on the Company's sales volume. For more information about the Company's sales according to geographic targets see Note 22c to the Company's Financial Statements as at December 31, 2010.

Furthermore, the clothing industry is subject to changes in fashion preferences and fashion trends. These changes lead to: (a) The shorter lead times required by customers; (b) An increase in the number of product collections required: and (c) A reduction in the extent of production runs. These trends in consumption patterns make operations and manufacturing difficult and force the Company to adapt the management of the production setup to the ever changing trends.

Despite the improvement in the seamless field operations during 1020 and as part of the recovery plan as stated in 1.3.8 above, the Company began to face and is still facing operational difficulties that impact its profitability. The Company closely and constantly examines the manufacturing setup as a whole so as to identify specific and systemic failures.

| 3.1.3. | Critical success factors in the field of operations and changes in them – the seamless field |

The Company considers that there are a number of factors on which its success in the field depends, the main ones being:

| 3.1.3.1. | Managing long-term relationships with customers; |

| 3.1.3.2. | Investing resources in operating the field and in quality management of it, to enable the Company to capitalize on its technological advantage and its innovative ability thanks to which it is considered a world leader in its field. |

| 3.1.3.3. | Investing resources in the design and development departments together with constant focus on local and global developments in the intimate apparel and sportswear fields and on the changes of customers and consumers' tastes and preferences, as well as in the development and design of fashionable collections and advanced and innovative products, in order to maintain the Company's competitive edge. |

| 3.1.3.4. | Adapting products to changing fashion demands and to the needs of the relevant customers and consumers while remaining constantly innovative. |

| 3.1.3.5. | Having an effective marketing setup that allows for the development of strong relationships with existing customers, for new customers to be contacted in new and existing markets, and for relationships with them to be soundly based and nurtured. |

| 3.1.3.6. | Making sure to have a wide range of suppliers that make quality raw materials, including those developed specially by the Company and/or for it. |

| 3.1.3.7. | Being meticulous about production quality and quality control of products in accordance with the specifications and requirements of the Company and its customers. |

| 3.1.3.8. | Exploiting the Company’s scale advantage both in the volumes of purchase orders from its customers and the number of items ordered of each manufactured design, which help to cut production costs. |

| 3.1.3.9. | An efficient operating setup and supply chain that provide full support for sales requirements and keeping to lead times that have shortened in the last few years. |

| 3.1.3.10. | Continuing to develop and improve production technologies in order to maintain the Company’s competitive edge in this field. |

The Company considers that these success factors have become doubly important in view of changes in the business environment which are evident in increased competition, selling price erosion, and shorter lead times.

| 3.1.4. | The main entry barriers of the field of operations and changes in them – seamless field |

The Company considers the main entry barriers to the field of operations are:

| 3.1.4.1. | Technological know-how, advanced machinery, advanced production methods, and the ability to develop raw materials, cloth and advanced products; |

| 3.1.4.2. | Familiarity with and understanding of the demands of the fashion market and the tastes of the end consumer; |

| 3.1.4.3. | Stable and long-term relationships with the major customers (the world’s leading marketers and brands); |

| 3.1.4.4. | Stable and reliable production capacity, with competitive prices and good quality; |

| 3.1.4.5. | Innovation in the development and design of fashion and performance products; |

| 3.1.4.6. | Meeting customers’ demands of: Compliance, quality and standards; |

| 3.1.5. | Alternatives for products in the field of operations and changes in them – seamless field |

There are alternatives to the Company’s products in this field of operations, both from wholesalers and manufacturers who market products similar in design to those of the Company, and sometimes even of their quality, even if they are not seamless products. Thus, for example, there are manufacturers that use the heat gluing technology or sew various parts of the product. The Company strives to bolster and maintain the advantage its products have over the alternative products by differentiating itself through being remarkable for innovation, design, knitting, the quality of the knitted cloth, the elasticity of the product, and the ability to plan and manufacture using a computer to produce customers' products with great precision.

Seamless technology enables the Company to knit products based on precision computer work according the design specification. These products are flexible, with patterns and textures built into cloth, boasting rich colors and advanced design. The Company's ability to translate the designer's language into machine language is considered as the most advanced in the world. Nevertheless, the Company has many competitors in its field of operations and generally does not have exclusivity with its customers.

| 3.1.6. | The structure in competition in the field and the changes it is undergoing - the seamless field |

In recent years, the clothing field in general has continued to be characterized by fierce competition and a decline in production costs and prices to the consumer as a result of the transfer of a considerable part of production to sub-contractors in the Far East. In the seamless field, however, the Company is one of the global leaders and therefore, as long as the Company succeeds in supplying leading products of good quality with competitive lead times and prices, it can enjoy a significant competitive edge. But as each of these conditions is breached, the Company's customers are liable to prefer to buy alternative products from different manufacturers in the Cut & Sew field and waive the level of innovation and quality in the seamless products.

For more information about competition in the Company's seamless field of operations see 3.6 below.

| 3.2. | Products and services – the seamless field |

| 3.2.1. | The main products and services – the seamless field |

In the intimate apparel field, the Company develops and provides production services for women's and men's intimate apparel, undershirts, tops, bras, body shapers and additional products. In the active-wear field the Company develops and provides production services for tops, pants and jackets worn mainly as a first layer on the body. The main market for the Company's intimate apparel products and active-wear is in America, although it is working to expand its sales in this field in Europe and Israel.

There is growing demand for active-wear products for women, for body shapers and for professional sports products (products with a high performance level). Some of these products have already been sold in the markets, mainly in the U.S., and some are in the development stage.

| 3.3. | Breakdown of revenues and profitability of products and services – seamless field |

Following are data on the breakdown of revenues from products and services in the years 2008, 2009 and 2010:

| | | Intimate apparel | | | Active wear | |

In million dollars | | 2010 | | | 2009 | | | 2008 | | | 2010 | | | 2009 | | | 2008 | |

| Revenues | | | 44.5 | | | | 45.0 | | | | 57.7 | | | | 8.4 | | | | 17.3 | | | | 28.6 | |

| Percentage of the Company’s total revenues | | | 51.7 | % | | | 38.9 | % | | | 33.2 | % | | | 9.7 | % | | | 15.0 | % | | | 16.4 | % |

It should be mentioned that in the seamless field of operations, there is a difference between the Company's percentage profit from the sale of active wear products and intimate apparel products, and that in 2010 the difference between the profit percentages, on average, was from 0% to 10% in favor of the active wear products. As a rule, the more innovative and intricate the Company's products are, more efforts the Company has to invest in development before putting them into production. These products are more attractive in markets and they face proportionally less competition. Some of the Company's customers can get higher prices and the Company's profit margins on these products is higher than the profit margins on basic products which are less innovative and intricate.

On the other hand, the less innovative the products are in fabric composition, design and complexity (such as basic intimate apparel), the more the customer attaches a greater importance on a competitive price for the product. In most cases this customer will be in the mass markets. In these products, Company profitability is low and global competition is mainly against manufacturers from the Far East.

| 3.4. | Customers – seamless field |

| 3.4.1. | Among the Company's customers in the seamless field of operations are some of the marketers of the world’s leading brands that purchase most of their advanced products in the active wear and intimate apparel from the Company. |

| 3.4.2. | The Company’s major customers in the field of operations are: |

| 3.4.3. | Victoria's Secret - Sales to this customer in the seamless field were $31.8M (60.1% of total sales in the seamless field) compared with $28.3M in 2009 (45.4% of total sales in the seamless field); i.e. an increase of 14.7% in sales to the customer out of the Company's total sales in the seamless field during the Report period. |

Total sales to that customer in all the Company's fields of operations were 38.7% of total consolidated sales in 2010 and 32.7% of total consolidated sales in 2009. i.e. an increase of 6.0% in sales to the customer out of the Company's total sales during the Report period.

Most of the increase in sales to this customer in 2010 was due to an increase on orders in the "Pink" category as a result of the success in selling the product and expanding sales points in the U.S.

The Company has been manufacturing intimate apparel products for Victoria's Secret since 1991. The Company has no exclusivity in the production of intimate apparel products for Victoria's Secret. For more information about the nature of the contract, see 3.4.3 below.

| 3.4.3.1. | Calvin Klein - Sales to this customer in the seamless field were $5.4M (about 10.2% of total sales in the seamless field) in 2010 compared with $4.4M in 2009 (7.1% of total sales in the seamless field); i.e. an increase of 3.1% in sales to the customer out of the Company's total sales in the seamless field during the Report period. |

Total sales to this customer in all of the Company's fields of operations were 9.4% of total consolidated sales in 2010 compared with 6.2% of total consolidated sales in 2009; an increase of 3.2% in sales to the customer out of the Company’s total sales in the report period.

Most of the increase in sales to this customer in 2010 is for projects following an expansion of its distribution channels.

| 3.4.3.2. | For the breakdown of sales according to geographic areas, see Note 22c to the Company's Financial Statements as of December 31, 2010, part C of this Report. |

| 3.4.4. | Nature and characteristics of contracts with the Group's major customers – seamless field |

The Group has long-term relationships with its customers. The relationships between the Group and its main customers, including Calvin Klein and Victoria's Secret are generally arranged in a standard general agreement drawn up by the customers unilaterally and in the customers' purchase orders from the Group. The agreement is not for a fixed period and does not give the Company exclusivity. The general agreement includes general provisions applying to all the customers' suppliers, concerning the customer's relationship with the Group, including basic conditions for performing the work, product quality conditions, meeting material legal provisions, product quality warranty, responsibility for supplying on time, provisions relating to second and third quality, protection of the customer's intellectual property rights, fines for quality problems, delays in supply, etc. The general agreement does not include provisions of a contract with a specific supplier, such as agreement periods or quantities ordered and are not specific to any particular supplier.

The terms of payment on which the Company's major customers pay are between 30 to 60 days from the date of supply and the issue of the invoice.

Delivery dates to customers are stated in the purchase orders and they change from order to order.

The Company's contracts with its customers in the purchase orders are carried out on the basis of developing a project, a series of products or a product, according to customer demand or on the Company's initiative. The work process with the customer generally starts a number of months prior to the date on which the finished goods should reach the shop's shelves. In the initial stage of the process, the product is developed based on the customer's ideas, its remarks or questions, or on the Company's initiative which the customer chooses to adopt. In the next stage, the Company prepares sample products until the customer gives it final approval. After completing the product file, it is sent for production in the Company's factories. At the end of the production stage, the products are sent as directed by the customer and according to the required timetable. The distribution of products to the customer's various stores is generally done by the customer.

| 3.4.5. | Dependence on a single customer – seamless field |

The Company considers that a significant reduction in the level of sales to any of its major customers is likely to impact the financial results in the seamless field as well as the consolidated financial results.

| 3.5. | Order backlog – seamless field |

The Company's sales are based on specific orders received by the Company. The Company begins the production process soon after receiving such orders.

Due to the structure of the field and the contracting method characterized by ad-hoc orders, the Company has an order backlog for relatively short periods of 3 to 5 months. In the Company's opinion, the order backlog does not therefore give a complete indication of the level of orders as they actually will be during the year.

Following are details of the breakdown of the Company's order backlog for the following quarters, in which the recognition of income (in thousands of dollars) is expected in the seamless field of operations:

| | | | | | | | | | Order backlog at Dec. 31, 2009 | |

| | Order backlog at March 15, 2011 | | | | Order backlog at Dec. 31, 2010 | | | | Actual | | | | Expected | |

| Q1 2010 | - | | | | - | | | | 11,424 | | | | 11,507 | |

| Q2 2010 | - | | | | - | | | | 12,139 | | | | 2,850 | |

| Total 2010 | - | | | | - | | | | 23,563 | | | | 14,357 | |

| | |

| Q1 2011 (*) | 20,206 | | | | 16,986 | | | | - | | | | - | |

| Q2 2011 | 17,184 | | | | 6,892 | | | | - | | | | - | |

| Q3 2011 | 3,438 | | | | - | | | | - | | | | - | |

| Q4 2011 | | | | | - | | | | - | | | | - | |

| 2012 | | | | | - | | | | - | | | | - | |