Industrias Bachoco, S.A.B. de C.V.,

Form 20-F for Fiscal Year Ended December 31, 2007

Filed June 30, 2008

File No. 001-33030

Dear Ms. Cvrkel:

Industrias Bachoco, S.A.B. de C.V., (the “Company”) has received the Staff’s comment letter dated September 11, 2008 concerning the above-referenced filing on Form 20-F. On behalf of the Company, we advise you as follows regarding your comments as noted below:

SEC Comment No. 1.

Item 3. Selected Financial Data, page 1

1. Please revise future filings to include disclosures of the Company’s net revenues and operating income as determined in accordance with US GAAP for all periods presented.

Response to Comment No. 1.

The Company will include net revenues and operating income in accordance with US GAAP for all periods presented in its future fillings.

SEC Comment No. 2.

Risk Factors, page 4

2. Reference is made to your disclosure on page 8 which states that certain members of the Robinson Bours family hold the power to elect a majority of the members of your Board of Directors and have the power to determine the outcome of certain other actions requiring the approval of your stockholders. We also note that the Robinson Bours family has established two Mexican trusts which they control and hold 82.75% of the 600,000,000 shares outstanding as of December 31, 2007. In this regard, please revise Note 19 in future filings to disclose the existence of this control arrangement. Refer to the requirements of paragraph 2 of SFAS No. 57.

Response to Comment No. 2.

The Company will revise its future 20-F filings, including this disclosure to conform to the requirements of paragraph 2 of SFAS No.57.

SEC Comment No. 3.

Item 5. Operating and Financial Review and Prospects, page 25

Acquisitions and Dispositions, page 29

3. We note from your disclosure on page 30 during fiscal 2007 you reached an agreement with certain Grupo Libra for the leasing of their facilities which included breeders and chicken farms, along with a slaughter plant, and a processing center. In addition, you acquired all of Grupo Libra’s working capital and brands. We also note during December 2007, you reached an agreement with Grupo Agra which also provides for the leasing of their facilities, a processing plant, distribution centers and the Agra brands, and that you also acquired all their working capital. In this regard, please explain to us in detail how you accounted for such acquisitions within your financial statements under Mexican Financial Reporting Standards and under U.S. GAAP. Your response should include, but not be limited to, the accounting treatment of leases of the facilities and brands, and whether the acquisition of working capital was considered a business acquisition which should be accounted for under purchase accounting. If differences exist between your home country financial reporting standards and U.S. GAAP, please explain to us such differences and tell us how such differences have been accounted for within your Item 18 reconciliation. Please revise Note 19 in future filings to include all disclosures required under paragraphs 51-53 of SFAS No. 141, where applicable. We may have further comment upon receipt of your response.

Response to Comment No. 3.

In 2007, the Company decided to expand its chicken business market in the northeastern Mexico by leasing some facilities in such region. Following is an overview of these transactions.

Libra

In February 2007, Bachoco entered into a lease agreement with Grupo Libra. The contract consisted of the leasing of 29 chicken farms, 8 poultry breeder farms, 3 egg incubator plants, 1 chicken processing plant, 2 packing plants and 1 feed mill plant, all for a term of five years, which can be renewed for an additional period of five years, (at Bachoco’s discretion). The fixed annual leasing payment is Ps. 28,200 thousand. Additionally, Bachoco acquired the existing inventories at the starting date of the lease (it was referred to as “working capital” in the 20-F form), which were physically in existence in the facilities (such raw material, incubational eggs, live chicken in farms, balanced feed in farms, spare parts and finished products). The purchase price and fair value of the inventories was Ps. 52,400 thousand. Grupo Libra had already stopped using its brands of these products prior to the agreement with Bachoco and therefore the rights of certain brands were also transferred to Bachoco. For future filings the Company will clarify that the estimate fair value of the brands were negligible, given that such brands had been used only in a limited local market and had very limited use. For Bachoco, the value and the driver of the transaction was the acquisition of the inventories and the access to additional production facilities; the brands were not at all a significant factor in the economics of the transaction.

Agra

In December 2007, Bachoco entered into a lease agreement with Grupo Agra consisting of 2 laying hens’ farms and a distribution center for a term of five years, which can be renewed for an additional period of five years, (at Bachoco’s discretion.) The fixed annual leasing payment amounts to Ps. 10,800 thousand. Additionally, Bachoco acquired the existing inventories at the starting date of the lease (it was also referred to as “working capital” in the 20-F), which were physically in existence in the facilities (raw materials, laying hens in farms, balanced feed in farms and finished products). The purchase price and fair value of the inventories was Ps.1, 683 thousand. Grupo Agra stopped operating those brands prior to the agreement with Bachoco and therefore, Grupo Agra granted a license to use certain brands for a term of five years, which can be renewed for an additional period of five years, at Bachoco’s discretion. For future flings the Company will clarify that the estimated brands fair value was negligible because, similarly to the Libra transaction above, the brands had been used only in a limited local market in a specific area and had very limited use. For Bachoco, the value and the driver of the transaction was the acquisition of the inventories and the access to additional production facilities; the brand was not at all significant factor in the economics of the transaction.

We respectfully inform the staff that the production of these properties subject to these two transactions in 2007, represent less than 1.0% of the sales of the Company.

The Company analyzed both transactions to determine whether these agreements should be considered as business acquisitions, under SFAS141.

Per the terms of the agreements, Bachoco did not acquire any employees, customer base or production techniques. For these and other reasons, Bachoco concluded that the transactions did not qualify as a business in accordance with EITF 98-3 (paragraph 6) and therefore were not deemed to be business combinations, in accordance with FAS 141. Both transactions were accounted for as asset acquisitions. The accounting is the same for Mexican GAAP. The FAS 141 disclosure requirements in paragraph 51-53 therefore do not apply to these transactions.

Additionally, the Company analyzed the appropriate accounting treatment related to leases as described in FASB 13 and concluded that the transactions were operating leases and did not qualify as capital leases because there is no transfer of ownership of the property to Bachoco by the end of the lease term, the lease does not contain an option to purchase the leased property at a bargain price, the lease term is not equal or greater than 75% of the estimated economic life of the leased property and the present value of rental and other minimum lease payment is not equal to or exceed 90% of the fair value of the leased property. The Company concluded that they were operating leases under both Mexican Financial Reporting Standards and US GAAP. The lease commitments were appropriately included in footnote No. 10 to the financial statements.

Notes to the Consolidated Financial Statements

SEC Comment No. 4.

Note 11. Other taxes payable and other accruals, page F-25

4. Please explain to us and in your footnote disclose the nature of the accruals related to IMSS, SAR and INFONAVIT of Ps. 49,491 and 56,476 as of December 31, 2006 and 2007, respectively.

Response to Comment No. 4.

The IMSS (Instituto Mexicano del Seguro Social), SAR (Sistema de Ahorro para el Retiro) and INFONAVIT (Instituto del Fondo Nacional de la Vivienda para los Trabajadores) are all public institutions managed by the Mexican government. The amounts the Company contributes to these funds that do not represent employee’s withholding are expended in the income statement. The amounts included in note 11 are detailed as follows:

| - | IMSS (a Government health care institution): contributions are made by the Company and by its employees in accordance with applicable regulations. The Company is required to pay this contribution on monthly basis, along with the Company’s own contribution to the social security fund. |

| - | SAR (a Government institution for employee retirement savings): Contributions are made by the Company based on applicable regulations as a percentage of salary. The Company has a duty to pay these contributions to the government every two months. |

| - | INFONAVIT (a Government institution that provides mortgages to employees): The Company is required to make contributions to this entity based on approximately 5% of the employee’s salaries, subject to certain limits. The Company has a duty to pay these contributions every two months. |

SEC Comment No. 5.

Note 15. Income Tax Asset Tax and Flat-Rate Business Tax, page F-29

(e) Deferred Income Tax, page F-3l

5. We note the disclosure in the reconciliation of your statutory tax rate to your effective tax rate for 2006, that the increase in the tax rate from 16% to 19% in 2007 impacted your 2006 effective tax rate by 22.27%. We also note from the discussion on page 35 that this change in tax rate for 2007 resulted in a debit of Ps 336.4 million to income, reflected in deferred taxes in 2006. Please tell us and explain in the notes to your financial statements in future filings why a change in the tax rate to 19% in 2007 impacted the Company’s effective tax rate, and resulted in the Ps.336.4 million during 2006. As part of your response, please explain why you believe the treatment used was appropriate for both Mexican and US GAAP purposes. We may have further comment upon receipt of your response.

Response to Comment No. 5.

The change in the tax rate from 16% to 19% was published by the Mexican authorities on December 27, 2006. The effect on the deferred taxes was recognized in the 2006 financial statements because the tax rate of 19% was the one to be used to calculate the tax once the effects that cause the deferred tax materialized.

This treatment was applied in accordance with the D-4 bulletin under Mexican GAAP as well as with SFAS No.109, paragraph 27 under US GAAP. Both of them established that the effects in deferred tax due to a change in the tax rate should be included in the period in which it is issued.

The Company will explain this matter in the notes to its financial statements in future filings.

SEC Comment No. 6.

Note 16. Other ordinary income, page F-32

6. We note from the disclosure in Note 16 that you have reflected sales and related costs of sales associated with waste animals, raw materials, by-products and others in “other ordinary income, expense, net” for Mexican GAAP purposes. Please tell us in further detail the specific nature, type and amounts of sales and costs of sales comprising these line items reflected in Note 16 to your financial statements. Also, as part of your response, please explain how these sales and costs of sales are reflected in your financial statements for US GAAP purposes and explain why you believe the treatment used is appropriate. Your response should clearly explain why such sales and cost of sales are not included as part of regular sales and costs of sales for US GAAP purposes.

Response to Comment No. 6.

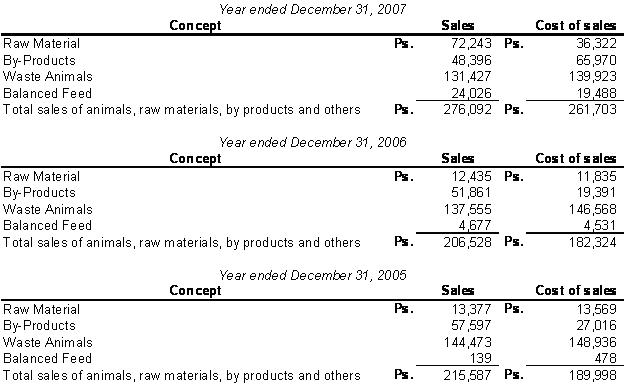

The Company’s detailed sales associated with waste animals, raw materials, by-products and other included in Note 16 are disclosed in “Other Income” as allowed by Mexican Financial Reporting Standards since these transactions are not the core business of the reporting entity. These amounts were not reclassified as revenues for US GAAP purposes because the Company does not deem the effect to be material to the financial statements. The Company will continue to monitor this and will revise future filings when such amounts become material

The detail is as follows:

| - | Raw Material: mainly included one time sale of wheat. |

| - | By-Products: this category includes mainly sales of scrap iron, and waste of grains, among others. |

| - | Waste Animals, mainly includes swine (grand parent stock), and other biological assets. |

| - | Balanced Feed: mainly caused by an unusual sale of feed, outside our regular commercial practices. |

These sales are all considered a component of “other ordinary income, expense net “for Mexican GAAP purposes.

In thousand of constant Mexican pesos.

The Company believes the amounts are immaterial because they represent approximately 1.5% of revenues for 2007 (1.3% and 1.4% for 2006 and 2005, respectively); 1.8% of cost of sales for 2007 (1.5% and 1.7% for 2006 and 2005, respectively) and less than 1.0% of gross profit for 2007, 2006 and 2005.

SEC Comment No. 7.

Note 19. Differences Between Mexican FRS and United States Generally Acceptable Accounting Principles, page F-38

7. Please revise Note 19 in future filings to include disclosures regarding revenues from transactions with external customers which amount to 10% or more of your revenues for each year an income statement is presented. Refer to paragraph 39 of SFAS No. 131. Also, for any accounts receivable balance from a single customer which represents 10% of more of total accounts receivable as of the balance sheet date, you are required to disclose such information for each year a balance sheet is presented.

Response to Comment No. 7.

The Company has considered paragraph 39 of SFAS No.131 and will take into account your observations in future filings.

SEC Comment No. 8.

8. Please revise your disclosure in future filings to include the amount of goodwill allocated to each reportable segment in accordance with paragraph 45 of SFAS No. 142.

Response to Comment No. 8.

As requested, the Company will revise its disclosure in future filings to include the amount of goodwill allocated to each reportable segment in accordance with paragraph 45 of SFAS No.142.

SEC Comment No. 9.

9. Please tell us and revise future filings to disclose any non-cash investing or financing activities of the Company for each year a statement of cash flows is presented.

Response to Comment No. 9.

The Company confirms that it does not have any non-cash investing or non-cash financing activities. The Company will disclose for each year a statement of cash flows is presented any such activities in future filings if it performs these types of transactions.

SEC Comment No. 10.

10. In future filings, please revise to also disclose the fair value of your long-term debt arrangements as of each balance sheet date presented and the methods used to determine the fair values of your long-term debt arrangements. Refer to the disclosure requirements outlined in paragraph 10 of SFAS No.107.

Response to Comment No. 10.

In future filings, the Company will disclose the fair value of its long-term debt arrangements as of each balance sheet date presented and the methods used to determine the fair values of its long-term debt arrangements, in accordance with the disclosure requirements outlined in paragraph 10 of SFAS No. 107.

******

In accordance with the requests at the end of your letter, the Company hereby acknowledges that it is responsible for the adequacy and accuracy of the disclosure in its filing; staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

If you have any questions or wish to discuss any matters relating to the foregoing, please contact me at 212-848-5009, or Mr. Daniel Salazar Ferrer of the Company at 011-52-461-618-3555.

| Very truly yours, | ||

| | | |

| /s/ Antonia E. Stolper | ||

cc: Jean Yu - Staff Accountant - Division of Corporation Finance

Cristóbal Mondragón Fragoso - Chief Executive Officer - Industrias Bachoco S.A.B. de C.V.

Daniel Salazar Ferrer - Chief Financial Officer - Industrias Bachoco S.A.B. de C.V.