Grace’s financial statements display income statement activity and balance sheet amounts on a net basis, reflecting the contractual interdependency of policy assets and liabilities.

In January 2005, Grace surrendered and terminated most of these life insurance policies and received approximately $14.8 million of net cash value from the termination. As a result of the termination, gross cash value of the policies was reduced by approximately $381 million and policy loans of approximately $365 million were satisfied. Grace’s insurance benefits in force was reduced by approximately $2 billion. See Note 14 for a discussion of a settlement agreement with the Internal Revenue Service (‘‘IRS’’) with respect to tax contingencies related to these life insurance policies and the tax consequences of terminating such policies.

Interest payments amounted to $2.3 million in 2005, $2.1 million in 2004, and $4.2 million in 2003.

currency risk related to euro denominated intercompany loans due to a U.S. subsidiary of Grace. In 2005 the Company extended the remaining portion of these forward currency contracts (see Note 6 for further information).

Fair Value of Debt and Other Financial Instruments – At December 31, 2005, the fair value of Grace’s debt payable within one year not subject to compromise approximated the recorded value of $2.3 million. Fair value is determined based on expected future cash flows (discounted at market interest rates), quotes from financial institutions and other appropriate valuation methodologies. At December 31, 2005, the recorded values of other financial instruments such as cash, short-term investments, trade receivables and payables and short-term debt approximated their fair values, based on the short-term maturities and floating rate characteristics of these instruments. Grace’s bank debt subject to compromise is trading at approximately par value plus recorded accrued interest and, accordingly, is considered reflected at fair value.

Credit Risk – Trade receivables potentially subject Grace to credit risk. Concentrations of credit to customers in the petroleum and construction industries represent the greatest exposure. Grace’s credit evaluation policies, relatively short collection terms and history of minimal credit losses mitigate credit risk exposures. Grace does not generally require collateral for its trade accounts receivable, but may require a bank letter of credit in certain instances, particularly when selling to customers in cash restricted countries.

|  |

| 14. | Commitments and Contingent Liabilities |

Asbestos-Related Liability – See Note 3

Environmental Remediation – Grace is subject to loss contingencies resulting from extensive and evolving federal, state, local and foreign environmental laws and regulations relating to the generation, storage, handling, discharge and disposition of hazardous wastes and other materials. Grace accrues for anticipated costs associated with investigative and remediation efforts where an assessment has indicated that a probable liability has been incurred and the cost can be reasonably estimated. These accruals do not take into account any discounting for the time value of money.

Grace’s environmental liabilities are reassessed whenever circumstances become better defined or remediation efforts and their costs can be better estimated. These liabilities are evaluated based on currently available information, including the progress of remedial investigation at each site, the current status of discussions with regulatory authorities regarding the method and extent of remediation at each site, existing technology, prior experience in contaminated site remediation and the apportionment of costs among potentially responsible parties. Grace expects that the funding of environmental remediation activities will be affected by the Chapter 11 proceedings.

At December 31, 2005, Grace’s estimated liability for environmental investigative and remediation costs totaled $342.0 million, as compared with $345.0 million at December 31, 2004. The amount is based on funding and/or remediation agreements in place and Grace’s best estimate of its cost for sites not subject to a formal remediation plan. Grace’s estimated environmental liabilities are included in ‘‘liabilities subject to compromise.’’

For the years ended December 31, 2005 and 2004, Grace recorded pre-tax charges of $25.0 million and $21.6 million, respectively, for environmental matters. Of the pre-tax charges in 2005 and 2004, $22.3 million and $20.0 million, respectively, were in connection with a cost recovery lawsuit brought by the U.S. government relating to Grace’s former vermiculite mining activities near Libby, Montana, and Grace’s evaluation of probable remediation costs at vermiculite processing sites currently or formerly operated by Grace, as described below. The remainder of the pre-tax charges were primarily attributable to the ongoing review of recorded environmental liabilities.

Net cash expenditures charged against previously established reserves for the years ended December 31, 2005, 2004 and 2003 were $28.0 million, $9.0 million, and $11.2 million, respectively. The increase in spending for 2005 was primarily due to a $21.4 million payment made in settlement of remediation liability at a formerly owned site.

Vermiculite Related Matters

From 1963 until 1992, Grace conducted vermiculite mining and related activities near Libby, Montana. Previous owners had conducted similar activities at the Libby site since the 1920s. The mined vermiculite ore contained varying amounts of asbestos as an impurity, almost all of which was removed during processing. Expanded vermiculite was used in products such as fireproofing, insulation and potting soil.

EPA Lawsuit – In November 1999, Region 8 of the Environmental Protection Agency (‘‘EPA’’) began an investigation into alleged excessive levels of asbestos-related disease in the Libby population related to these former mining activities. This investigation led the EPA to undertake additional investigative activity and to carry out response actions in and around Libby. On March 30, 2001, the EPA filed a lawsuit in U.S. District Court for the District of Montana, Missoula Division (United States v. W. R. Grace & Company et al.) under the Comprehensive Environmental Response, Compensation and Liability Act for the recovery of costs allegedly incurred by the United States in response to the release or threatened release of asbestos in the Libby, Montana area relating to such former mining activities. These costs include cleaning and/or demolition of contaminated buildings, excavation and removal of contaminated soil, health screening of Libby residents and former mine workers, and investigation and monitoring costs. In this action, the EPA

F-29

also sought a declaration of Grace’s liability that would be binding in future actions to recover further response costs.

In December 2002, the District Court granted the United States’ motion for partial summary judgment on a number of issues that limited Grace’s ability to challenge the EPA’s response actions. In January 2003, a trial was held on the remainder of the issues, which primarily involved the reasonableness and adequacy of documentation of the EPA’s cost recovery claims through December 31, 2001. On August 28, 2003, the District Court issued a ruling in favor of the United States that requires Grace to reimburse the government for $54.5 million (plus interest) in costs expended through December 2001, and for all appropriate future costs to complete the clean-up. The Ninth Circuit Court of Appeals upheld the District Court’s rulings. Grace intends to appeal this case to the U.S. Supreme Court.

Grace’s total estimated liability for vermiculite-related remediation at December 31, 2005 and December 31, 2004 was $226.2 million and $204.2 million, respectively. The estimate does not include the cost to clean-up the Grace-owned mine site at Libby, which is not currently estimable. Grace’s estimate of costs is based on public comments regarding the EPA’s spending plans, discussions of spending forecasts with EPA representatives, analysis of other information made available from the EPA, and evaluation of probable remediation costs at vermiculite processing sites. However, the EPA’s cost estimates have increased regularly and substantially over the course of this clean-up. Consequently, as the EPA’s spending on these matters increases, Grace’s liability for remediation will increase.

Montana Criminal Proceeding – On February 7, 2005, the United States Department of Justice announced the unsealing of a 10-count grand jury indictment against Grace and seven current or former senior level employees (United States of America v. W. R. Grace & Co. et al) relating to Grace’s former vermiculite mining and processing activities in Libby, Montana. Two of the counts have since been dismissed. The indictment accuses the defendants of (1) conspiracy to violate environmental laws and obstruct federal agency proceedings; (2) violations of the federal Clean Air Act; and (3) obstruction of justice. The U.S. District Court for the District of Montana has entered a scheduling order setting a trial date of September 11, 2006.

Grace purchased the Libby mine in 1963 and operated it until 1990; vermiculite processing activities continued until 1992. The grand jury charges that the conspiracy took place from 1976 to 2002 and also charges that the alleged endangerment to the areas surrounding Libby continues to the present day. According to the U.S. Department of Justice, Grace could be subject to fines in an amount equal to twice the after-tax profit earned from its Libby operations or twice the alleged loss suffered by Libby victims, plus additional amounts for restitution to victims. The indictment alleges that such after tax profits were $140 million. Grace has categorically denied any criminal wrongdoing and intends to vigorously defend itself at trial.

The U.S. Bankruptcy Court previously granted Grace's request to advance legal and defense costs to the employees, subject to a reimbursement obligation if it is later determined that the employees did not meet the standards for indemnification set forth under the appropriate state corporate law. For the year ended December 31, 2005, total expense for Grace and the employees was $20.0 million, which is included in selling, general and administrative expenses.

Grace is unable to assess whether the indictment, or any conviction resulting therefrom, will have a material adverse effect on the results of operations or financial condition of Grace or affect Grace's bankruptcy proceedings. However, Grace expects legal fees for this matter could range from $7 million to $10 million per quarter through the trial date. Such costs will be expensed as incurred.

New Jersey Lawsuit – On June 1, 2005, the New Jersey Department of Environmental Protection (‘‘DEP’’) filed a lawsuit against Grace and two former employees seeking civil penalties for alleged misrepresentations and false statements made in a Preliminary Assessment/Site Investigation Report and Negative Declarations submitted by Grace to the DEP in 1995 pursuant to the New Jersey Industrial Site Recovery Act. Grace submitted the Report, which was prepared by an independent environmental consultant, in connection with the closing of Grace’s former plant in Hamilton Township, New Jersey. Grace is also aware that the State of New Jersey and U.S. Department of Justice each are conducting criminal investigations related to Grace’s former operations of such plant.

Grace purchased the Hamilton plant assets in 1963 and ceased operations in 1994. During the operating period, Grace produced spray-on fire protection products and vermiculite-based products at this plant. The current property owners are conducting remediation activities as directed by the EPA. The property owners and the EPA have filed proofs of claim against Grace in the amount of approximately $4 million with respect to the Hamilton plant site.

Grace is unable at this time to assess the effect of this lawsuit or the pending criminal investigations on Grace’s results of operations, cash flows, or liquidity, or on its bankruptcy proceeding.

Non-Vermiculite Related Matters

At December 31, 2005 and 2004, Grace’s estimated liability for remediation of sites not related to its former vermiculite mining and processing activities was $115.8 million and $140.8 million, respectively. This liability relates to Grace’s current and former operations, including its share of liability for off-site disposal at facilities where it has been identified as

F-30

a potentially responsible party. The decrease in the liability in 2005 was primarily due to a $21.4 million Bankruptcy Court approved payment made in settlement of remediation liability at a formerly owned site. During the fourth quarter of 2005, Grace recorded a net $2.7 million increase to its estimated environmental liability for non-vermiculite related sites as a result of settlement discussions with the EPA related to certain sites, and investigation of environmental conditions at a current operating plant. During the fourth quarter of 2004, Grace recorded a $1.6 million increase to its estimated environmental liability for non-vermiculite related sites in connection with the investigation of environmental conditions at a current operating plant. Grace’s estimated liability is based upon an evaluation of claims for which sufficient information was available. As Grace receives new information and continues its claims evaluation process, its estimated liability may change materially.

Contingent Rentals – Grace is the named tenant or guarantor with respect to leases entered into by previously divested businesses. These leases, some of which extend through the year 2017, have future minimum lease payments aggregating $91.3 million, and are fully offset by anticipated future minimum rental income from existing tenants and subtenants. In addition, Grace is liable for other expenses (primarily property taxes) relating to the above leases; these expenses are paid by current tenants and subtenants. Certain of the rental income and other expenses are payable by tenants and subtenants that have filed for bankruptcy protection or are otherwise experiencing financial difficulties. Grace believes that any loss from these lease obligations would be immaterial. Grace has rejected certain of these leases as permitted by the Bankruptcy Code, the financial impacts of which are insignificant.

Tax Matters – On May 19, 2005, Grace received a revised examination report (the ‘‘1993-1996 Examination Report’’) from the Internal Revenue Service (the ‘‘IRS’’) for the 1993-1996 tax periods asserting, in the aggregate, approximately $77.3 million of proposed tax adjustments, plus accrued interest. The most significant issue addressed in the 1993-1996 Examination Report concerns corporate-owned life insurance (‘‘COLI’’) policies, as discussed below. Grace reached an agreement with the IRS with respect to all proposed tax adjustments in the Examination Report with the exception of approximately $7.0 million of proposed adjustments relating to research and development credits. On April 14, 2005, Grace made a $90 million payment to the IRS with respect to federal taxes and accrued interest for the 1993-1996 tax periods, consistent with the revised Examination Report. On June 17, 2005, Grace filed its protest with respect to the R&D matter with the IRS Office of Appeals and on December 7, 2005 Grace received an acknowledgment from that office that the matter is under consideration at IRS Appeals.

With respect to COLI, in 1988 and 1990, Grace acquired COLI policies and funded policy premiums in part using loans secured against policy cash surrender value. Grace claimed a total of approximately $258 million in deductions attributable to interest accrued on such loans through the 1998 tax year, after which such deductions were no longer permitted by law. On January 20, 2005, Grace terminated the COLI policies and Grace, Fresenius, Sealed Air and the IRS entered into a COLI Closing Agreement. Under the COLI Closing Agreement, the government allowed 20% of the aggregate amount of the COLI interest deductions and Grace owed federal income tax and interest with respect to the remaining 80% of the COLI interest deductions disallowed. The federal tax liability resulting from the COLI settlement is approximately $57.5 million, $10.4 million of which was paid in 2000 in connection with the 1990-1992 tax audit, and $30.8 million of which was paid in the April 14, 2005 payment in connection with the 1993-1996 federal tax audit discussed above. The remaining approximately $16.3 million of additional tax liability will be satisfied in connection with the 1997 and 1998 federal tax audits, which are still under examination by the IRS. The COLI Closing Agreement also provides that, with respect to the termination of the COLI policies, Grace will include 20% of the gain realized in taxable income, with the government exempting 80% of such gain from tax. As a result of the termination, Grace received $14.8 million in cash proceeds and will report income for tax purposes of approximately $60 million in 2005. It is anticipated that Grace will apply its net operating loss carryforwards to offset the taxable income generated from terminating the COLI policies, although alternative minimum taxes may apply.

As a consequence of having finally determined federal tax adjustments for the 1990-1996 tax periods, Grace became liable for additional state taxes plus interest accrued thereon. Grace’s estimate for state taxes and interest to be paid for these years is approximately $18.3 million, of which it has already paid approximately $6.3 million. The remainder is expected to be paid in accordance with Grace’s bankruptcy proceedings.

Grace’s federal tax returns covering 1997 and later years are either under examination by the IRS or open for future examination. In connection with the years 1997 – 2001 that are currently under examination, Grace reached agreement with the IRS on a number of issues. After taking all issues into consideration, Grace reduced its recorded liabilities in 2005 by $13.5 million. Grace believes that the remaining recorded tax liability is adequate to cover the impact of probable tax return adjustments at December 31, 2005.

The IRS has assessed additional federal income tax withholding and Federal Insurance Contributions Act taxes plus interest and related penalties for calendar years 1993 through 1998 against a Grace subsidiary that formerly operated a temporary staffing business for nurses and other

F-31

health care personnel. The assessments, aggregating $61.9 million, were made in connection with a meal and incidental expense per diem plan for traveling health care personnel, which was in effect through 1999, the year in which Grace sold the business. (The statute of limitations has expired with respect to 1999.) The IRS contends that certain per diem reimbursements should have been treated as wages subject to employment taxes and federal income tax withholding. Grace contends that its per diem and expense allowance plans were in accordance with statutory and regulatory requirements, as well as other published guidance from the IRS. Grace has a right to indemnification from its former partner in the business for approximately 36% of any tax liability (including interest thereon) for the period from July 1996 through December 1998. The matter is currently pending in the United States Court of Claims. Grace has tentatively agreed with the Department of Justice and IRS on a settlement amount and certain other terms that would resolve the matter. The preliminary settlement is subject to the execution of written closing agreements with the IRS and a written settlement agreement with the Department of Justice, and to Bankruptcy Court approval.

Purchase Commitments – Grace engages in purchase commitments to minimize the volatility of major components of direct manufacturing costs including natural gas, certain metals, asphalt, amines and other materials. Such commitments are for quantities that Grace fully expects to use in its normal operations.

Guarantees and Indemnification Obligations – Grace is a party to many contracts containing guarantees and indemnification obligations. These contracts primarily consist of:

|  |

| • | Contracts providing for the sale of a former business unit or product line in which Grace has agreed to indemnify the buyer against liabilities arising prior to the closing of the transaction, including environmental liabilities. These liabilities are included in ‘‘liabilities subject to compromise’’ in the Consolidated Balance Sheets; |

|  |

| • | Guarantees of real property lease obligations of third parties, typically arising out of (a) leases entered into by former subsidiaries of Grace, or (b) the assignment or sublease of a lease by Grace to a third party. These obligations are included in ‘‘liabilities subject to compromise’’ in the Consolidated Balance Sheets; |

|  |

| • | Licenses of intellectual property by Grace to third parties in which Grace has agreed to indemnify the licensee against third party infringement claims; |

|  |

| • | Contracts entered into with third party consultants, independent contractors, and other service providers in which Grace has agreed to indemnify such parties against certain liabilities in connection with their performance. Based on historical experience and the likelihood that such parties will ever make a claim against Grace, such indemnification obligations are immaterial; and |

|  |

| • | Product warranties with respect to certain products sold to customers in the ordinary course of business. These warranties typically provide that product will conform to specifications. Grace generally does not establish a liability for product warranty based on a percentage of sales or other formula. Grace accrues a warranty liability on a transaction-specific basis depending on the individual facts and circumstances related to each sale. Both the liability and annual expense related to product warranties are immaterial to the Consolidated Financial Statements. |

Financial Assurances – Financial assurances have been established for a variety of purposes, including insurance and environmental matters, asbestos settlements and appeals, trade-related commitments and other matters. At December 31, 2005, Grace had gross financial assurances issued and outstanding of $257.8 million, comprised of $135.1 million of surety bonds issued by various insurance companies, and $122.7 million of standby letters of credit and other financial assurances issued by various banks.

Accounting for Contingencies – Although the outcome of each of the matters discussed above cannot be predicted with certainty, Grace has assessed its risk and has made accounting estimates as required under U.S. generally accepted accounting principles. As a result of the Filing, claims related to certain of the items discussed above will be addressed as part of Grace’s Chapter 11 proceedings. Accruals recorded for such contingencies have been included in ‘‘liabilities subject to compromise’’ on the accompanying Consolidated Balance Sheets. The amounts of these liabilities as ultimately determined through the Chapter 11 proceedings could be materially different from amounts recorded at December 31, 2005.

|  |

| 15. | Shareholders' Equity (Deficit) |

Under its Certificate of Incorporation, the Company is authorized to issue 300,000,000 shares of common stock, $0.01 par value. Of the common stock unissued at December 31, 2005, 7,093,646 shares were reserved for issuance pursuant to stock options and other stock incentives. The Company has not paid a dividend on its common stock since 1998. The Company is not permitted to pay dividends on its common stock while it is in bankruptcy. The Certificate of Incorporation also authorizes 53,000,000 shares of preferred stock, $0.01 par value, none of which has been issued. Of the total, 3,000,000 shares have been designated as Series A Junior Participating Preferred Stock and are

F-32

reserved for issuance in connection with the Company’s Preferred Stock Purchase Rights (‘‘Rights’’). A Right trades together with each outstanding share of common stock and entitles the holder to purchase one one-hundredth of a share of Series A Junior Participating Preferred Stock under certain circumstances and subject to certain conditions. The Rights are not and will not become exercisable unless and until certain events occur, and at no time will the Rights have any voting power.

|  |

| 16. | Earnings (Loss) Per Share |

The following table shows a reconciliation of the numerators and denominators used in calculating basic and diluted earnings (loss) per share.

Stock options that could potentially dilute basic earnings (loss) per share (that were excluded from the computation of diluted earnings (loss) per share because their exercise prices were greater than the average market price of the common shares) averaged approximately 6.8 million in 2005, 8.1 million in 2004, and 9.4 million in 2003. As a result of the 2004 and 2003 net losses, approximately 300,000 and 100,000, respectively, of employee compensation-related shares issuable under stock options also were excluded from the diluted loss per share calculation because their effect would have been antidilutive.

|  |

| 17. | Stock Incentive Plans |

Each stock option granted under the Company’s stock incentive plans has an exercise price equal to the fair market value of the Company’s common stock on the date of grant. Options become exercisable at the time or times determined by the Compensation Committee of the Company’s Board of Directors and may have terms of up to ten years and one month.

The following table sets forth information relating to such options during 2005, 2004 and 2003:

|  |  |  |  |  |  |  |  |  |  |

| Stock Option Activity |  | 2005 |

| |  | Number of

Shares |  | Average

Exercise

Price |

| Balance at beginning of year |  | | 7,691,580 | |  | $ | 12.92 | |

| Options exercised |  | | (526,475 | ) |  | | 5.92 | |

| Options terminated or cancelled |  | | (71,459 | ) |  | | 14.19 | |

| Balance at end of year |  | | 7,093,646 | |  | | 13.42 | |

| Exercisable at end of year |  | | 7,093,646 | |  | $ | 13.42 | |

| |  | 2004 |

| Balance at beginning of year |  | | 9,582,784 | |  | $ | 12.02 | |

| Options exercised |  | | (781,657 | ) |  | | 5.43 | |

| Options terminated or cancelled |  | | (1,109,547 | ) |  | | 10.41 | |

| Balance at end of year |  | | 7,691,580 | |  | | 12.92 | |

| Exercisable at end of year |  | | 7,691,580 | |  | $ | 12.92 | |

| |  | 2003 |

| Balance at beginning of year |  | | 10,440,417 | |  | $ | 11.94 | |

| Options exercised |  | | (15,831 | ) |  | | 2.40 | |

| Options terminated or cancelled |  | | (841,802 | ) |  | | 11.24 | |

| Balance at end of year |  | | 9,582,784 | |  | | 12.02 | |

| Exercisable at end of year |  | | 9,227,438 | |  | $ | 12.39 | |

|

Currently outstanding options expire on various dates through September 2011. At December 31, 2005, 4,768,707 shares were available for additional stock option or restricted stock grants. The following is a summary of stock options outstanding at December 31, 2005:

Stock Options Outstanding

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Exercise Price Range |  | Number

Outstanding |  | Weighted-

Average

Remaining

Contractual

Life

(Years) |  | Weighted-

Average

Exercise

Price |  | Number

Exercisable |  | Weighted-

Average

Exercise

Price |

| $1-$8 |  | | 695,813 | |  | 6.00 |  | $ | 2.66 | |  | | 695,813 | |  | $ | 2.66 | |

| $8-$13 |  | | 2,484,974 | |  | 2.88 |  | | 12.33 | |  | | 2,484,974 | |  | | 12.33 | |

| $13-$18 |  | | 2,547,959 | |  | 4.60 |  | | 14.19 | |  | | 2,547,959 | |  | | 14.19 | |

| $18-$21 |  | | 1,364,900 | |  | 3.02 |  | | 19.47 | |  | | 1,364,900 | |  | | 19.47 | |

| |  | | 7,093,646 | |  | 3.83 |  | | 13.42 | |  | | 7,093,646 | |  | | 13.42 | |

|

F-33

|  |

| 18. | Pension Plans and Other Postretirement Benefits Plans |

Pension Plans – Grace maintains defined benefit pension plans covering employees of certain units who meet age and service requirements. Benefits are generally based on final average salary and years of service. Grace funds its U.S. qualified pension plans (‘‘U.S. qualified pension plans’’) in accordance with U.S. federal laws and regulations. Non-U.S. pension plans (‘‘non-U.S. pension plans’’) are funded under a variety of methods, as required under local laws and customs.

Grace also provides, through nonqualified plans, supplemental pension benefits in excess of U.S. qualified pension plan limits imposed by federal tax law. These plans cover officers and higher-level employees and serve to increase the combined pension amount to the level that they otherwise would have received under the U.S. qualified pension plans in the absence of such limits. The nonqualified plans are unfunded and Grace pays the costs of benefits as they are incurred.

At the December 31, 2005 measurement date for Grace’s defined benefit pension plans (the ‘‘Plans’’), the accumulated benefit obligation (‘‘ABO’’) was approximately $1,386 million as measured under U.S. generally accepted accounting principles. At December 31, 2005, Grace’s recorded pension liability for underfunded plans was $533.9 million ($447.5 million included in liabilities not subject to compromise and $86.4 million related to supplemental pension benefits, included in ‘‘liabilities subject to compromise’’). The recorded liability reflects 1) the shortfall between dedicated assets and the ABO of underfunded plans ($321.4 million); and 2) the ABO of pay-as-you-go plans ($212.5 million).

Postretirement Benefits Other Than Pensions – Grace provides postretirement health care and life insurance benefits (referred to as other post-employment benefits or ‘‘OPEB’’) for retired employees of certain U.S. business units and certain divested units. The postretirement medical plan provides various levels of benefits to employees hired before 1991 and who retire from Grace after age 55 with at least 10 years of service. These plans are unfunded and Grace pays a portion of the costs of benefits under these plans as they are incurred. Grace applies SFAS No. 106, ‘‘Employers’ Accounting for Postretirement Benefits Other Than Pensions,’’ which requires that the future costs of postretirement health care and life insurance benefits be accrued over the employees’ years of service.

Retirees and beneficiaries covered by the postretirement medical plan are required to contribute a minimum of 40% of the calculated premium for that coverage. During 2002, per capita costs under the retiree medical plans exceeded caps on the amount Grace was required to contribute under a 1993 amendment to the plan. As a result, for 2003 and future years, retirees will bear 100% of any increase in premium costs.

For 2005 measurement purposes, per capita costs, before retiree contributions, were assumed to initially increase at a rate of 10.5%. The rate is assumed to decrease gradually to 5.0% through 2010 and remain at that level thereafter. A one percentage point increase or decrease in assumed health care medical cost trend rates would have a negligible impact on Grace’s postretirement benefit obligations.

In December 2003, President George W. Bush signed the Medicare Prescription Drug, Improvement and Modernization Act of 2003 (the ‘‘Act’’) into law. The Act introduces a prescription drug benefit under Medicare (‘‘Medicare Part D’’) as well as a federal subsidy to companies that provide a benefit that is at least actuarially equivalent (as defined in the Act) to Medicare Part D. On January 21, 2005, the Center for Medicare and Medicaid Services released the final regulations implementing the Act. Grace has determined that the prescription drug benefit under its postretirement health care plan is actuarially equivalent to the Medicare Part D benefit. Therefore, the accumulated postretirement benefit obligation (APBO) was remeasured as of January 21, 2005 to reflect the amount associated with the federal subsidy. The APBO was reduced by approximately $14.6 million and the net periodic benefit cost for 2005 was reduced by approximately $1.9 million due to the effect of the federal subsidy.

Analysis of Plan Accounting and Funded Status – The following table summarizes the changes in benefit obligations and fair value of retirement plan assets during 2005 and 2004 (Grace uses a December 31 measurement date for the majority of its plans):

F-34

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Change in Financial Status of Retirement Plans

(In millions) |  | |  | Pension |  | Other

Post-Retirement

Plans |

| |  | U.S. |  | Non-U.S. |  | Total |  | |

| |  | 2005 |  | 2004 |  | 2005 |  | 2004 |  | 2005 |  | 2004 |  | 2005 |  | 2004 |

| Change in Projected Benefit Obligation (PBO) |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Benefit obligation at beginning of year |  | | | |  | $ | 1,079.6 | |  | $ | 918.1 | |  | $ | 360.9 | |  | $ | 293.9 | |  | $ | 1,440.5 | |  | $ | 1,212.0 | |  | $ | 115.0 | |  | $ | 127.0 | |

| Service cost |  | | | |  | | 16.4 | |  | | 14.1 | |  | | 6.9 | |  | | 6.3 | |  | | 23.3 | |  | | 20.4 | |  | | 0.5 | |  | | 0.5 | |

| Interest cost |  | | | |  | | 57.9 | |  | | 59.5 | |  | | 17.1 | |  | | 16.4 | |  | | 75.0 | |  | | 75.9 | |  | | 4.9 | |  | | 6.6 | |

| Plan participants’ contributions |  | | | |  | | — | |  | | — | |  | | 0.8 | |  | | 0.8 | |  | | 0.8 | |  | | 0.8 | |  | | — | |  | | — | |

| Amendments |  | | | |  | | 2.9 | |  | | — | |  | | — | |  | | — | |  | | 2.9 | |  | | — | |  | | — | |  | | — | |

| Curtailments/settlements recognized |  | | | |  | | (0.3 | ) |  | | — | |  | | 2.3 | |  | | — | |  | | 2.0 | |  | | — | |  | | — | |  | | — | |

| Acquisitions |  | | | |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |

| Change in discount rates and other assumptions |  | | | |  | | 29.1 | |  | | 162.1 | |  | | 30.3 | |  | | 29.1 | |  | | 59.4 | |  | | 191.2 | |  | | (19.9 | ) |  | | (6.6 | ) |

| Benefits paid |  | | | |  | | (91.4 | ) |  | | (74.2 | ) |  | | (14.7 | ) |  | | (14.4 | ) |  | | (106.1 | ) |  | | (88.6 | ) |  | | (11.9 | ) |  | | (12.5 | ) |

| Currency exchange translation adjustments |  | | | |  | | — | |  | | — | |  | | (39.3 | ) |  | | 28.8 | |  | | (39.3 | ) |  | | 28.8 | |  | | — | |  | | — | |

| Benefit obligation at end of year |  | | | |  | $ | 1,094.2 | |  | $ | 1,079.6 | |  | $ | 364.3 | |  | $ | 360.9 | |  | $ | 1,458.5 | |  | $ | 1,440.5 | |  | $ | 88.6 | |  | $ | 115.0 | |

| Change in Plan Assets |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Fair value of plan assets at beginning of year |  | | | |  | $ | 665.7 | |  | $ | 658.1 | |  | $ | 225.7 | |  | $ | 193.2 | |  | $ | 891.4 | |  | $ | 851.3 | |  | $ | — | |  | $ | — | |

| Actual return on plan assets |  | | | |  | | 36.2 | |  | | 57.6 | |  | | 34.1 | |  | | 18.9 | |  | | 70.3 | |  | | 76.5 | |  | | — | |  | | — | |

| Employer contributions |  | | | |  | | 35.0 | |  | | 24.2 | |  | | 12.7 | |  | | 9.1 | |  | | 47.7 | |  | | 33.3 | |  | | 11.9 | |  | | 12.5 | |

| Acquisitions |  | | | |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |

| Plan participants’ contributions |  | | | |  | | — | |  | | — | |  | | 0.8 | |  | | 0.8 | |  | | 0.8 | |  | | 0.8 | |  | | — | |  | | — | |

| Benefits paid |  | | | |  | | (91.4 | ) |  | | (74.2 | ) |  | | (14.7 | ) |  | | (14.4 | ) |  | | (106.1 | ) |  | | (88.6 | ) |  | | (11.9 | ) |  | | (12.5 | ) |

| Currency exchange translation adjustments |  | | | |  | | — | |  | | — | |  | | (21.5 | ) |  | | 18.1 | |  | | (21.5 | ) |  | | 18.1 | |  | | — | |  | | — | |

| Fair value of plan assets at end of year |  | | | |  | $ | 645.5 | |  | $ | 665.7 | |  | $ | 237.1 | |  | $ | 225.7 | |  | $ | 882.6 | |  | $ | 891.4 | |  | $ | — | |  | $ | — | |

| Funded status (PBO basis) |  | | | |  | $ | (448.7 | ) |  | $ | (413.9 | ) |  | $ | (127.2 | ) |  | $ | (135.2 | ) |  | $ | (575.9 | ) |  | $ | (549.1 | ) |  | $ | (88.6 | ) |  | $ | (115.0 | ) |

| Unrecognized transition obligation |  | | | |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |  | | — | |

| Unrecognized actuarial loss |  | | | |  | | 581.1 | |  | | 561.0 | |  | | 125.7 | |  | | 136.7 | |  | | 706.8 | |  | | 697.7 | |  | | 24.5 | |  | | 46.1 | |

| Unrecognized prior service cost (benefit) |  | | | |  | | 12.6 | |  | | 15.2 | |  | | 2.2 | |  | | 3.2 | |  | | 14.8 | |  | | 18.4 | |  | | (37.2 | ) |  | | (50.0 | ) |

| Net amount recognized |  | | | |  | $ | 145.0 | |  | $ | 162.3 | |  | $ | 0.7 | |  | $ | 4.7 | |  | $ | 145.7 | |  | $ | 167.0 | |  | $ | (101.3 | ) |  | $ | (118.9 | ) |

| Amounts recognized in the Consolidated Balance Sheet consist of: |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Deferred pension costs |  | | | |  | $ | 3.4 | |  | $ | 2.9 | |  | $ | 105.4 | |  | $ | 116.6 | |  | $ | 108.8 | |  | $ | 119.5 | |  | $ | — | |  | $ | — | |

| Pension obligation |  | | | |  | | (407.8 | ) |  | | (371.0 | ) |  | | (126.1 | ) |  | | (131.3 | ) |  | | (533.9 | ) |  | | (502.3 | ) |  | | (101.3 | ) |  | | (118.9 | ) |

| Intangible asset |  | | | |  | | 12.7 | |  | | 15.3 | |  | | — | |  | | — | |  | | 12.7 | |  | | 15.3 | |  | | N/A | |  | | N/A | |

| Accumulated other comprehensive loss |  | | | |  | | 536.7 | |  | | 515.1 | |  | | 21.4 | |  | | 19.4 | |  | | 558.1 | |  | | 534.5 | |  | | N/A | |  | | N/A | |

| Net amount recognized |  | | | |  | $ | 145.0 | |  | $ | 162.3 | |  | $ | 0.7 | |  | $ | 4.7 | |  | $ | 145.7 | |  | $ | 167.0 | |  | $ | (101.3 | ) |  | $ | (118.9 | ) |

| Increase (Decrease) in Minimum Liability Included in Other Comprehensive Income (Loss) |  | | | |  | $ | 21.6 | |  | $ | 116.9 | |  | $ | 2.0 | |  | $ | 9.2 | |  | | NM | |  | | NM | |  | | NM | |  | | NM | |

| Weighted Average Assumptions Used to Determine Benefit Obligations as of December 31 |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |  | | | |

| Discount rate |  | | | |  | | 5.50 | % |  | 5.50% |  | 4.66% |  | 5.11% |  | | NM | |  | | NM | |  | | 5.50 | % |  | | 5.50 | % |

| Rate of compensation increase |  | | | |  | | 4.25 | % |  | 4.25% |  | 3.42% |  | 3.51% |  | | NM | |  | | NM | |  | | NM | |  | | NM | |

| Weighted Average Assumptions Used to Determine Net Periodic Benefit Cost (Income) for Years Ended December 31 |  | U.S. |  | | | |  | |  | |  | |  | | | |  | | | |  | | | |  | | | |

| 2006 |

| Discount rate |  | 5.50% |  | | 5.50 | % |  | 6.25% |  | 5.11% |  | 5.52% |  | | NM | |  | | NM | |  | | 5.50 | % |  | 6.25% |

| Expected return on plan assets |  | 8.00% |  | | 8.00 | % |  | 8.00% |  | 7.21% |  | 7.27% |  | | NM | |  | | NM | |  | | NM | |  | NM |

| Rate of compensation increase |  | 4.25% |  | | 4.25 | % |  | 4.25% |  | 3.51% |  | 3.50% |  | | NM | |  | | NM | |  | | NM | |  | NM |

|

|  |

| NM — Not meaningful |

|  |

| N/A — Not applicable |

F-35

|  |

| (1) | Plans intended to be advance-funded. |

|  |

| (2) | Plans intended to be pay-as-you-go. |

F-36

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Estimated Expected Future Benefit Payments Reflecting

Future Service and Medicare Subsidy Receipts for the

Fiscal Year(s) Ending

(In millions) |  | Pension Plans |  | Other Postretirement Plans |  | Total |

| U.S. |  | Non-U.S. |  | Benefit

Payments |  | Medicare

Subsidy

Receipts |

Benefit

Payments |  | Benefit

Payments |

| 2006 |  | $ | 81.5 | |  | $ | 14.7 | |  | $ | 9.7 | |  | $ | (3.7 | ) |  | $ | 102.2 | |

| 2007 |  | | 71.6 | |  | | 15.2 | |  | | 9.3 | |  | | (3.9 | ) |  | | 92.2 | |

| 2008 |  | | 72.1 | |  | | 16.4 | |  | | 9.0 | |  | | (4.1 | ) |  | | 93.4 | |

| 2009 |  | | 73.2 | |  | | 17.1 | |  | | 8.7 | |  | | (4.1 | ) |  | | 94.9 | |

| 2010 |  | | 74.5 | |  | | 18.3 | |  | | 8.5 | |  | | — | |  | | 101.3 | |

| 2011-2015 |  | $ | 395.7 | |  | $ | 102.2 | |  | $ | 38.9 | |  | $ | — | |  | $ | 536.8 | |

|

Discount Rate Assumption – The assumed discount rate for pension plans reflects the market rates for high-quality corporate bonds currently available. The assumed discount rate is determined at the annual measurement date of December 31 and is subject to change each year based on changes in the overall market interest rates. For 2005 and 2004, the assumed discount rate for the U.S. qualified pension plans was selected by the Company, in consultation with its independent actuaries, based on a yield curve constructed from a portfolio of high quality bonds for which the timing and amount of cash outflows approximate the estimated payouts of the plan.

For 2003 and prior years, the assumed discount rate for the U.S. qualified pension plans was determined based on a comparison of historical spreads between the Company's selected discount rates and various benchmark interest rates (Moody’s Corporate Aa Bond, 30-year Treasury Bond, PBGC Immediate Rate, etc.) over the past several years. The average of these spreads was then applied to the year-end benchmark interest rates.

As of December 31, 2005, the United Kingdom pension plan and German pension plans combined represented 87% of the benefit obligation of the non-U.S. pension plans. The assumed discount rates for these pension plans were selected by the Company, in consultation with its independent actuaries, based on yield curves constructed from a portfolio of Sterling and Euro denominated high quality bonds for which the timing and amount of cash outflows approximate the estimated payouts of the plans. The assumed discount rates for the remaining non-U.S. pension plans were determined based on the nature of the liabilities, local economic environments and available bond indices.

For 2004 and prior years, the Company, in consultation with its independent actuaries, set the assumed discount rates used for the non-U.S. pension plans based on the nature of the liabilities, local economic environments and available bond indices.

Investment Guidelines for Advance-Funded Pension Plans –The target allocation of investment assets for 2006, the actual allocation at December 31, 2005 and 2004, and the expected long-term rate of return by asset category for Grace’s U.S. qualified pension plans are as follows:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

U.S. Qualified Pension Plans

Asset Category |  | Target

Allocation |  | Percentage of Plan

Assets December 31, |  | Weighted-Average

Expected Long-Term

Rate of Return |

| 2006 |  | 2005 |  | 2004 |  | 2005 |

| U.S. equity securities |  | 45% |  | 44% |  | 45% |  | 4.46 |

| Non-U.S. equity securities |  | 15% |  | 15% |  | 16% |  | 0.76 |

| Short-term debt securities |  | 10% |  | 14% |  | 13% |  | 0.60 |

| Intermediate-term debt securities |  | 30% |  | 27% |  | 26% |  | 2.18 |

| Total |  | 100% |  | 100% |  | 100% |  | 8.00 |

|

The investment goal for the U.S. qualified pension plans, subject to advance funding, is to earn a long-term rate of return consistent with the related cash flow profile of the underlying benefit obligation.

The U.S. qualified pension plans have assets managed by five investment managers under investment guidelines summarized as follows:

F-37

|  |

| • | For debt securities: single issuers are limited to 5% of the portfolio's market value (with the exception of U.S. government and agency securities); the average credit quality of the portfolio shall be at least A rated; no more than 20% of the market value of the portfolio shall be invested in non-dollar denominated bonds; and privately placed securities are limited to no more than 50% of the portfolio's market value. |

|  |

| • | For U.S. equity securities: the portfolio is entirely passively managed through investment in the Dow Jones Wilshire 5000 index fund, which is invested primarily in equity securities with the objective of approximating as closely as possible the capitalization weighted total rate of return of the entire U.S. market for publicly traded securities. |

|  |

| • | For non-U.S. equity securities: no individual security shall represent more than 5% of the portfolio's market value at any time; investment in U.S. common stock securities is prohibited (with the exception of American Depository Receipts) and emerging market securities may represent up to 30% of the total portfolio's market value. Currency futures and forward contracts may be held for the sole purpose of hedging existing currency risk in the portfolio. |

For 2006, the expected long-term rate of return on assets for the U.S. qualified pension plans is 8.0% (also 8.0% in 2005). Average annual returns over one, two, three, five, ten and fifteen-year periods were 6.36%, 8.08%, 12.71%, 3.76%, 7.25%, and 8.16%, respectively. Negative returns across broad categories of U.S. equity securities in 2000, 2001 and 2002 caused lower returns in periods greater than three years.

Non-U.S. pension plans accounted for approximately 27% and 25% of total global pension assets at December 31, 2005 and 2004, respectively. Each of these plans, where applicable, follow local requirements and regulations. Some of the local requirements include the establishment of a local pension committee, a formal statement of investment policy and procedures, and routine valuations by plan actuaries.

The target allocation of investment assets for non-U.S. pension plans varies depending on the investment goals of the individual plans. The plan assets of the United Kingdom pension plan represent approximately 83% and 84% of the total non-U.S. pension plan assets at December 31, 2005 and 2004, respectively.

The target allocation of investment assets for 2006, the actual allocation at December 31, 2005 and 2004, and the expected long-term rate of return by asset category for Grace’s United Kingdom pension plan are as follows:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

United Kingdom Pension Plans

Asset Category |  | Target

Allocation |  | Percentage of Plan Assets

December 31, |  | Weighted-Average

Expected Long-Term

Rate of Return |

| 2006 |  | 2005 |  | 2004 |  | 2005 |

| U.K. equity securities |  | 30% |  | 30% |  | 30% |  | 2.55 |

| Non-U.K. equity securities |  | 20% |  | 21% |  | 21% |  | 2.00 |

| U.K. gilts |  | 20% |  | 20% |  | 20% |  | 0.90 |

| U.K. corporate bonds |  | 30% |  | 29% |  | 29% |  | 1.55 |

| Total |  | 100% |  | 100% |  | 100% |  | 7.00 |

|

The plan assets of the Canadian pension plans represent approximately 6% of the total non-U.S. pension plan assets at December 31, 2005 and 2004. The target allocation of investment assets for 2006, the actual allocation at December 31, 2005 and 2004, and the expected long-term rate of return by asset category for Grace’s Canadian pension plans are as follows:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Canadian Pension Plans

Asset Category |  | Target

Allocation |  | Percentage of Plan Assets

December 31, |  | Weighted-Average

Expected Long-Term

Rate of Return |

| 2006 |  | 2005 |  | 2004 |  | 2005 |

| Equity securities |  | 55% |  | 59% |  | 58% |  | 5.50 |

| Bonds |  | 45% |  | 41% |  | 42% |  | 2.50 |

| Total |  | 100% |  | 100% |  | 100% |  | 8.00 |

|

The plan assets of the other country plans represent approximately 11% and 10% in the aggregate (with no country representing more than 3% individually) of total non-U.S. pension plan assets at December 31, 2005 and 2004, respectively.

F-38

Plan Contributions and Funding – Subject to the approval of the Bankruptcy Court, it is Grace’s intention to satisfy its obligations under the Plans and to comply with all of the requirements of the Employee Retirement Income Security Act of 1974. On June 22, 2005, Grace obtained Bankruptcy Court approval to fund minimum required payments of approximately $46 million for the period from July 2005 through June 2006. In that regard, Grace contributed approximately $15 million in July 2005, approximately $9 million in October 2005 and approximately $9 million in January 2006, to the trusts that hold assets of the Plans. However, there can be no assurance that the Bankruptcy Court will continue to approve arrangements to satisfy the funding needs of the Plans. Based on the Plan’s status as of December 31, 2005, Grace’s ERISA obligations for 2006, 2007, and 2008 would be approximately $93 million, $61 million, and $41 million, respectively.

Contributions to non-U.S. pension plans are not subject to Bankruptcy Court approval and Grace intends to fund such plans based on actuarial and trustee recommendations. Grace expects to contribute approximately $13 million to its non-U.S. pension plans and $6 million to its other postretirement plans in 2006.

Grace plans to pay benefits as they become due under virtually all pay-as-you-go plans and to maintain compliance with federal funding laws for its U.S. qualified pension plans.

19. Operating Segment Information

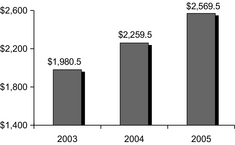

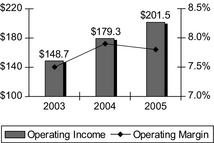

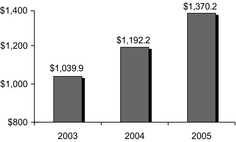

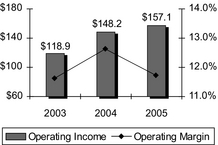

Grace is a global producer of specialty chemicals and materials. It generates revenues from two operating segments: Grace Davison, which includes silica− and alumina-based catalysts and materials used in a wide range of industrial applications; and Grace Performance Chemicals, which includes specialty chemicals and materials used in commercial and residential construction and in rigid food and beverage packaging. Intersegment sales, eliminated in consolidation, are not material. The table below presents information related to Grace’s operating segments for 2005, 2004, and 2003. Only those corporate expenses directly related to the segment are allocated for reporting purposes. All remaining corporate items are reported separately and labeled as such.

F-39

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Operating Segment Data

(In millions) |  | 2005 |  | 2004 |  | 2003 |

| Net Sales |  | | | |  | | | |  | | | |

| Grace Davison |  | $ | 1,370.2 | |  | $ | 1,192.2 | |  | $ | 1,039.9 | |

| Grace Performance Chemicals |  | | 1,199.3 | |  | | 1,067.7 | |  | | 940.6 | |

| Total |  | $ | 2,569.5 | |  | $ | 2,259.9 | |  | $ | 1,980.5 | |

Pre-tax Operating

Income |  | | | |  | | | |  | | | |

| Grace Davison |  | $ | 157.1 | |  | $ | 148.2 | |  | $ | 118.9 | |

| Grace Performance Chemicals |  | | 151.1 | |  | | 131.8 | |  | | 107.9 | |

| Total |  | $ | 308.2 | |  | $ | 280.0 | |  | $ | 226.8 | |

Depreciation and

Amortization |  | | | |  | | | |  | | | |

| Grace Davison |  | $ | 76.0 | |  | $ | 74.6 | |  | $ | 67.6 | |

| Grace Performance Chemicals |  | | 33.7 | |  | | 32.0 | |  | | 33.1 | |

| Total |  | $ | 109.7 | |  | $ | 106.6 | |  | $ | 100.7 | |

| Capital Expenditures |  | | | |  | | | |  | | | |

| Grace Davison |  | $ | 48.8 | |  | $ | 43.4 | |  | $ | $68.1 | |

| Grace Performance Chemicals |  | | 25.6 | |  | | 17.8 | |  | | 16.5 | |

| Total |  | $ | 74.4 | |  | $ | 61.2 | |  | $ | 84.6 | |

| Total Assets |  | | | |  | | | |  | | | |

| Grace Davison |  | $ | 869.0 | |  | $ | 890.9 | |  | $ | $797.1 | |

| Grace Performance Chemicals |  | | 665.6 | |  | | 674.5 | |  | | 609.2 | |

| Total |  | $ | 1,534.6 | |  | $ | 1,565.4 | |  | $ | 1,406.3 | |

|

F-40

The following table presents information related to the geographic areas in which Grace operated in 2005, 2004 and 2003.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Geographic Area Data

(In millions) |  | 2005 |  | 2004 |  | 2003 |

| Net Sales |  | | | |  | | | |  | | | |

| United States |  | $ | 945.4 | |  | $ | 873.2 | |  | $ | 804.3 | |

| Canada and Puerto Rico |  | | 141.7 | |  | | 105.8 | |  | | 78.9 | |

| Total North America |  | | 1,087.1 | |  | | 979.0 | |  | | 883.2 | |

| Germany |  | | 121.0 | |  | | 111.6 | |  | | 92.2 | |

Europe, other than

Germany |  | | 815.1 | |  | | 704.1 | |  | | 584.7 | |

| Total Europe |  | | 936.1 | |  | | 815.7 | |  | | 676.9 | |

| Asia Pacific |  | | 403.2 | |  | | 349.2 | |  | | 312.7 | |

| Latin America |  | | 143.1 | |  | | 116.0 | |  | | 107.7 | |

| Total |  | $ | 2,569.5 | |  | $ | 2,259.9 | |  | $ | 1,980.5 | |

| Properties and Equipment, net |  | | | |  | | | |  | | | |

| United States |  | $ | 348.2 | |  | $ | 364.6 | |  | $ | 386.4 | |

| Canada and Puerto Rico |  | | 18.9 | |  | | 19.0 | |  | | 19.4 | |

| Total North America |  | | 367.1 | |  | | 383.6 | |  | | 405.8 | |

| Germany |  | | 104.6 | |  | | 126.2 | |  | | 120.7 | |

Europe, other than

Germany |  | | 63.6 | |  | | 77.0 | |  | | 72.3 | |

| Total Europe |  | | 168.2 | |  | | 203.2 | |  | | 193.0 | |

| Asia Pacific |  | | 41.3 | |  | | 46.7 | |  | | 46.8 | |

| Latin America |  | | 13.1 | |  | | 11.8 | |  | | 11.0 | |

| Total |  | $ | 589.7 | |  | $ | 645.3 | |  | $ | 656.6 | |

| Goodwill and Other Assets |  | | | |  | | | |  | | | |

| United States |  | $ | 155.9 | |  | $ | 147.2 | |  | $ | 113.0 | |

| Canada and Puerto Rico |  | | 18.9 | |  | | 19.2 | |  | | 4.1 | |

| Total North America |  | | 174.8 | |  | | 166.4 | |  | | 117.1 | |

| Germany |  | | 41.5 | |  | | 50.6 | |  | | 48.0 | |

Europe, other than

Germany |  | | 139.3 | |  | | 157.4 | |  | | 146.6 | |

| Total Europe |  | | 180.8 | |  | | 208.0 | |  | | 194.6 | |

| Asia Pacific |  | | 13.3 | |  | | 13.4 | |  | | 13.6 | |

| Latin America |  | | 16.3 | |  | | 13.9 | |  | | 16.1 | |

| Total |  | $ | 385.2 | |  | $ | 401.7 | |  | $ | 341.4 | |

|

Cash value of life insurance policies, net of policy loans and asbestos-related insurance are held entirely in the U.S.

Pre-tax operating income, depreciation and amortization, capital expenditures and total assets for Grace’s operating segments are reconciled below to amounts presented in the Consolidated Financial Statements.

F-41

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Reconciliation of Operating Segment Data to Financial Statements

(In millions) |  | 2005 |  | 2004 |  | 2003 |

| Pre-tax operating income – operating segments |  | $ | 308.2 | |  | $ | 280.0 | |  | $ | 226.8 | |

| Minority interest |  | | 21.1 | |  | | 8.7 | |  | | (1.2 | ) |

| Gain (loss) on sale of investments and disposal of assets |  | | (1.8 | ) |  | | (0.8 | ) |  | | (1.5 | ) |

Provision for environmental

remediation |  | | (25.0 | ) |  | | (21.6 | ) |  | | (142.5 | ) |

| Provision for asbestos-related litigation, net |  | | — | |  | | (476.6 | ) |  | | (30.0 | ) |

| Net gain from litigation settlement |  | | — | |  | | 51.2 | |  | | — | |

| Interest expense and related financing costs |  | | (55.3 | ) |  | | (111.1 | ) |  | | (15.6 | ) |

| Corporate costs |  | | (106.7 | ) |  | | (100.7 | ) |  | | (78.1 | ) |

| Other, net |  | | 0.1 | |  | | (6.2 | ) |  | | (11.8 | ) |

| Income (loss) from operations before Chapter 11 expenses, income taxes, and minority interest |  | $ | 140.6 | |  | $ | (377.1 | ) |  | $ | (53.9 | ) |

Depreciation and amortization

—operating segments |  | $ | 109.7 | |  | $ | 106.6 | |  | $ | 100.7 | |

| —corporate |  | | 4.3 | |  | | 2.2 | |  | | 2.2 | |

| Total depreciation and amortization |  | $ | 114.0 | |  | $ | 108.8 | |  | $ | 102.9 | |

Capital Expenditures

—operating segments |  | $ | 74.4 | |  | $ | 61.2 | |  | $ | 84.6 | |

| —corporate |  | | 6.5 | |  | | 1.7 | |  | | 1.8 | |

| Total capital expenditures |  | $ | 80.9 | |  | $ | 62.9 | |  | $ | 86.4 | |

Total assets

—operating segments |  | $ | 1,534.6 | |  | $ | 1,565.4 | |  | $ | 1,406.3 | |

| —corporate |  | | 276.7 | |  | | 279.4 | |  | | 272.4 | |

| Cash and equivalents |  | | 474.7 | |  | | 510.4 | |  | | 309.2 | |

| Asbestos-related insurance |  | | 500.0 | |  | | 500.0 | |  | | 269.4 | |

| Deferred tax assets |  | | 731.2 | |  | | 683.7 | |  | | 618.0 | |

| Total assets |  | $ | 3,517.2 | |  | $ | 3,538.9 | |  | $ | 2,875.3 | |

|

Minority interest primarily pertains to Advanced Refining Technologies LLC (‘‘ART’’), a joint venture between Grace and Chevron Products Company where Grace has a 55% economic interest.

Corporate costs include expenses of corporate headquarters functions incurred in support of core operations, such as corporate financial and legal services, human resources management, communications and regulatory affairs. This item also includes certain pension and postretirement benefits, including the amortization of deferred costs, that are considered a core operating expense but not allocated to operating segments.

F-42

|  |

| 20. | Quarterly Summary and Statistical Information (Unaudited) |

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Quarterly Summary and Statistical Information (Unaudited)

(In millions, except per share) |  | March 31 |  | June 30 |  | September 30 |  | December 31(1) |

| 2005 |  | | | |  | | | |  | | | |  | | | |

| Net sales |  | $ | 603.2 | |  | $ | 676.5 | |  | $ | 653.4 | |  | $ | 636.4 | |

| Cost of goods sold |  | | 392.7 | |  | | 439.7 | |  | | 426.0 | |  | | 431.4 | |

| Net income (loss) |  | | 3.1 | |  | | 32.7 | |  | | 32.1 | |  | | (0.6 | ) |

| Net income (loss) per share: (2) |  | | | |  | | | |  | | | |  | | | |

| Basic earnings (loss) per share: |  | | | |  | | | |  | | | |  | | | |

| Net income (loss) |  | $ | 0.05 | |  | $ | 0.49 | |  | $ | 0.48 | |  | $ | (0.01 | ) |

| Diluted earnings (loss) per share: |  | | | |  | | | |  | | | |  | | | |

| Net income (loss) |  | | 0.05 | |  | | 0.49 | |  | | 0.48 | |  | | (0.01 | ) |

| Market price of common stock: (3) |  | | | |  | | | |  | | | |  | | | |

| High |  | $ | 13.79 | |  | $ | 11.59 | |  | $ | 11.72 | |  | $ | 10.47 | |

| Low |  | | 8.49 | |  | | 7.11 | |  | | 7.32 | |  | | 6.75 | |

| Close |  | | 8.52 | |  | | 7.79 | |  | | 8.95 | |  | | 9.40 | |

| 2004 |  | | | |  | | | |  | | | |  | | | |

| Net sales |  | $ | 518.5 | |  | $ | 572.4 | |  | $ | 579.9 | |  | $ | 589.1 | |

| Cost of goods sold |  | | 331.2 | |  | | 357.2 | |  | | 361.3 | |  | | 381.8 | |

| Net income (loss) |  | | 15.8 | |  | | 21.3 | |  | | 48.0 | |  | | (487.4 | ) |

| Net income (loss) per share: (2) |  | | | |  | | | |  | | | |  | | | |

| Basic earnings (loss) per share: |  | | | |  | | | |  | | | |  | | | |

| Net income (loss) |  | $ | 0.24 | |  | $ | 0.32 | |  | $ | 0.73 | |  | $ | (7.36 | ) |

| Diluted earnings (loss) per share: |  | | | |  | | | |  | | | |  | | | |

| Net income (loss) |  | | 0.24 | |  | | 0.32 | |  | | 0.72 | |  | | (7.36 | ) |

| Market price of common stock: (3) |  | | | |  | | | |  | | | |  | | | |

| High |  | $ | 3.70 | |  | $ | 6.50 | |  | $ | 9.53 | |  | $ | 14.95 | |

| Low |  | | 2.55 | |  | | 2.51 | |  | | 5.26 | |  | | 9.34 | |

| Close |  | | 3.12 | |  | | 6.20 | |  | | 9.45 | |  | | 13.61 | |

|

|  |

| (1) | Fourth quarter 2005 net loss contains a provision for environmental remediation of $25.0 million. Fourth quarter 2004 net loss includes a $714.8 million pre-tax charge to adjust Grace’s recorded asbestos-related liability to the maximum amount permitted as a condition precedent under Grace’s proposed plan of reorganization (the ‘‘Plan’’); a pre-tax credit for expected insurance recovery related to asbestos liabilities of $238.2 million; a $94.1 million pre-tax charge to increase the interest to which general unsecured creditors would be entitled under the Plan; a $151.7 million pre-tax credit for net income tax benefits related to the above items; and an $82.0 million tax liability on the expected taxable distributions from foreign subsidiaries to fund the Plan. |

|  |

| (2) | Per share results for the four quarters may differ from full-year per share results, as a separate computation of the weighted average number of shares outstanding is made for each quarter presented. |

|  |

| (3) | Principal market: New York Stock Exchange. |

F-43

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Financial Summary(1)

(In millions, except per share amounts) |  | 2005 |  | 2004 |  | 2003 |  | 2002 |  | 2001 |

| Statement of Operations |  | | | |  | | | |  | | | |  | | | |  | | | |

| Net sales |  | $ | 2,569.5 | |  | $ | 2,259.9 | |  | $ | 1,980.5 | |  | $ | 1,819.7 | |  | $ | 1,722.9 | |

| Income (loss) from continuing operations before Chapter 11 expenses, income taxes, and minority interest (2) |  | | 140.6 | |  | | (377.1 | ) |  | | (53.9 | ) |  | | 92.4 | |  | | 161.7 | |

| Minority interest in consolidated entities |  | | (21.1 | ) |  | | (8.7 | ) |  | | 1.2 | |  | | (2.2 | ) |  | | (3.7 | ) |

| Net income (loss) (2) |  | | 67.3 | |  | | (402.3 | ) |  | | (55.2 | ) |  | | 22.1 | |  | | 78.6 | |

| Financial Position |  | | | |  | | | |  | | | |  | | | |  | | | |

| Cash and cash equivalents |  | $ | 474.7 | |  | $ | 510.4 | |  | $ | 309.2 | |  | $ | 283.6 | |  | $ | 191.9 | |

| Current assets |  | | 1,253.6 | |  | | 1,228.5 | |  | | 930.0 | |  | | 830.3 | |  | | 741.3 | |

| Current liabilities |  | | 377.1 | |  | | 372.2 | |  | | 247.5 | |  | | 239.5 | |  | | 231.2 | |

| Properties and equipment, net |  | | 589.7 | |  | | 645.3 | |  | | 656.6 | |  | | 622.2 | |  | | 590.3 | |

| Total assets |  | | 3,517.2 | |  | | 3,538.9 | |  | | 2,875.3 | |  | | 2,691.7 | |  | | 2,521.1 | |

| Total liabilities |  | | 4,112.5 | |  | | 4,160.7 | |  | | 3,039.1 | |  | | 2,913.9 | |  | | 2,662.8 | |

| Liabilities subject to compromise (a subset of total liabilities) |  | | 3,155.1 | |  | | 3,207.7 | |  | | 2,452.3 | |  | | 2,334.7 | |  | | 2,311.5 | |

| Shareholders' equity (deficit) |  | | (595.3 | ) |  | | (621.8 | ) |  | | (163.8 | ) |  | | (222.2 | ) |  | | (141.7 | ) |

| Cash Flow |  | | | |  | | | |  | | | |  | | | |  | | | |

| Operating activities |  | $ | 54.2 | |  | $ | 313.0 | |  | $ | 110.8 | |  | $ | 195.5 | |  | $ | 14.6 | |

| Investing activities |  | | (64.8 | ) |  | | (125.6 | ) |  | | (109.1 | ) |  | | (110.7 | ) |  | | (131.4 | ) |

| Financing activities |  | | (10.1 | ) |  | | (0.7 | ) |  | | (4.7 | ) |  | | (9.2 | ) |  | | 123.7 | |

| Net cash flow |  | | (35.7 | ) |  | | 201.2 | |  | | 25.6 | |  | | 91.7 | |  | | — | |

| Data Per Common Share (Diluted) |  | | | |  | | | |  | | | |  | | | |  | | | |

| Net income (loss) (2) |  | $ | 1.00 | |  | $ | (6.11 | ) |  | $ | (0.84 | ) |  | $ | 0.34 | |  | $ | 1.20 | |

| Average common diluted shares outstanding (thousands) |  | | 67,300 | |  | | 65,800 | |  | | 65,500 | |  | | 65,500 | |  | | 65,400 | |

| Other Statistics |  | | | |  | | | |  | | | |  | | | |  | | | |

| Capital expenditures |  | $ | 80.9 | |  | $ | 62.9 | |  | $ | 86.4 | |  | $ | 91.1 | |  | $ | 62.9 | |

| Common stock price range |  | $ | 6.75-13.79 | |  | $ | 2.51-14.95 | |  | $ | 1.48-5.52 | |  | $ | 0.99-3.75 | |  | $ | 1.31-4.38 | |

| Common shareholders of record |  | | 9,883 | |  | | 10,275 | |  | | 10,734 | |  | | 11,187 | |  | | 11,643 | |

| Number of employees (approximately) |  | | 6,400 | |  | | 6,500 | |  | | 6,300 | |  | | 6,400 | |  | | 6,400 | |

|

|  |

| (1) | Certain prior-year amounts have been reclassified to conform to the 2005 presentation. |

|  |

| (2) | Amounts in 2005 contain a provision for environmental remediation of $25.0 million. Amounts in 2004 reflect the following adjustments: a $714.8 million pre-tax charge to increase Grace’s recorded asbestos-related liability to the maximum amount permitted as a condition precedent under Grace’s Plan of Reorganization (the ‘‘Plan’’); a pre-tax credit for expected insurance recovery related to asbestos liabilities of $238.2 million; a $94.1 million pre-tax charge to increase the interest to which general unsecured creditors would be entitled under the Plan; a $151.7 million pre-tax credit for net income tax benefits related to the above items; and an $82.0 million tax liability on the expected taxable distributions from foreign subsidiaries to fund the Plan. Amounts in 2003 contain a provision for environmental remediation of $142.5 million and a provision for asbestos-related claims of $30.0 million. Amounts in 2002 contain a provision for environmental remediation of $70.7 million. |

F-44

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Financial Summary for December 31, 2005

Following is a summary analysis of key financial measures of our performance for the year ended December 31, 2005 compared with the prior year.

|  |

| • | Net income for each period has been primarily affected by: 1) the results of our businesses – which is categorized as ‘‘core operations’’; and 2) the impact of legal contingencies and other nonoperating liabilities – which is categorized as ‘‘noncore activities’’. |

|  |

| • | Net income for the year ended December 31, 2005 was $67.3 million, compared with a net loss in 2004 of $402.3 million. Net income for 2005 included interest accruals of $50.6 million ($32.9 million after tax) on prepetition liabilities and a $25.0 million ($16.3 million after tax) charge for environmental remediation. It also included income from insurance carriers of $44.5 million ($28.9 million after tax) for losses related to pre-chapter 11 asbestos and environmental claims. The net loss in 2004 included a $476.6 million pre-tax charge ($309.8 million after tax) to adjust our liability for asbestos-related litigation, net of insurance, as reflected in our proposed plan of reorganization, and a $94.1 million pre-tax charge ($61.2 million after tax) to adjust interest accruals on pre-petition obligations to the rates reflected in the plan. |

|  |

| • | Sales increased 13.7% for the year ended December 31, 2005 primarily as a result of higher sales volume in all geographic regions, improved product mix and selling price increases in response to cost inflation. |

|  |

| • | Pre-tax income from core operations increased 12.4% for the year ended December 31, 2005, due to higher sales, favorable currency exchange rates, and acquisitions. Pretax income was negatively impacted by raw material and utility inflation that was partially offset by increased selling prices and productivity. |

|  |

| • | Pre-tax operating income of our Grace Performance Chemicals operating segment increased 14.6% for the year ended December 31, 2005 reflecting higher sales volume, and positive results from productivity and cost containment initiatives, partially offset by raw material cost inflation. |

|  |

| • | Pre-tax operating income of our Grace Davison operating segment increased 6.0% for the year ended December 31, 2005 reflecting higher sales from both volume and mix factors, improved productivity over 2004 and selling price increases that partially offset higher raw material and natural gas costs. |

|  |

| • | Operating cash flow was $54.2 million and $313.0 million for the years ended December 31, 2005 and 2004, respectively. The 2005 cash flow reflects an increase in working capital in response to higher sales as well as bankruptcy court-approved payments aggregating $119.7 million to resolve U.S. federal tax return audits and an environmental contingency at a formerly owned site. |

We are attempting to resolve noncore liabilities and contingencies through our Chapter 11 proceeding. Our noncore liabilities include asbestos-related litigation, environmental remediation, tax disputes and business litigation. Our operating statements include periodic adjustments to account for changes in estimates of such liabilities and developments in our Chapter 11 proceeding. These liabilities and contingencies may result in continued volatility in net income in the future.

Effect of Hurricanes Katrina and Rita

On August 29, 2005, Hurricane Katrina made landfall in Louisiana, Mississippi and Alabama, causing widespread wind and water damage. Katrina caused shutdowns of several refineries in the affected area, including a number of customers that regularly use our Grace Davison fluid catalytic cracking, or FCC, catalysts, and also disrupted other business operations and construction activity. The shutdowns and disruptions negatively affected our sales, and the damage to infrastructure in the affected area increased sales and distribution costs of our FCC catalyst products business for the remainder of 2005. We did not incur property damage losses as a result of Hurricane Katrina. Business interruption impacts from Hurricane Katrina were below our insurance deductible.

On September 25, 2005, Hurricane Rita made landfall in Louisiana and Texas, also causing widespread wind and water damage and further disrupting refinery and other business operations and construction activity. Our Grace Davison production facility for refining catalysts in Lake Charles, Louisiana is located in an area that was particularly hard-hit by Rita. Our Lake Charles facility was shut down for two weeks but returned to full production before the end of October. We were able to supply our customers during the shutdown, but incurred increased production and distribution costs by supplying products from our other catalyst plants. We also incurred additional expenses to support our displaced workers in Lake Charles during the storm’s aftermath. Our energy and raw material costs were driven higher as a result of both hurricanes.

We incurred property damage losses at our Lake Charles facility and business interruption costs throughout North America as a result of Hurricane Rita. Property damage and

F-45

cleanup at our Lake Charles facility was less than the deductible of our insurance policy. Business interruption impacts from Hurricane Rita were approximately $7.1 million for which we reached agreement for approximately $2.7 million from our insurance carrier after deductibles, which is included in other (income) expense.

Description of Core Business

We are engaged in specialty chemicals and specialty materials businesses on a worldwide basis through our two operating segments:

Grace Davison includes:

|  |

| • | catalysts and chemical additives used by petroleum refiners, including fluid catalytic cracking, or FCC, catalysts, that help to ‘‘crack’’ the hydrocarbon chain in distilled crude oil to produce transportation fuels, such as gasoline and diesel fuels, and other petroleum-based products, and FCC additives used to reduce sulfur in gasoline, maximize propylene production from refinery FCC units, and reduce emissions of sulfur oxides, nitrogen oxides and carbon monoxide from refinery FCC units |

|  |

| • | hydroprocessing catalysts used by petroleum refiners in process reactors to upgrade heavy oils into lighter, more useful products by removing impurities such as nitrogen, sulfur and heavy metals, allowing less expensive feedstocks to be used in the petroleum refining process |

|  |

| • | specialty catalysts, including polyolefin catalysts and catalyst supports that are essential components in the manufacture of polyethylene and polypropylene resins, and other chemical catalysts used in a variety of industrial, environmental and consumer applications |

|  |

| • | silica-based and silica-alumina-based engineered materials used in: |

|  |  |

| • | industrial markets, such as coatings, plastics and rubber, precision investment casting, refractory, insulating glass windows, desiccants, and gas and liquids purification |

|  |  |

| • | consumer applications, such as food products, toothpaste, pharmaceutical and personal care products, and the processing of edible oils and beverages |

|  |  |

| • | digital media coatings on ink jet papers |

|  |

| • | silica-based materials and chromatography columns, instruments, consumables and accessories used in life and analytical sciences applications |

We conduct our hydroprocessing catalyst business through Advanced Refining Technologies, LLC, or ART, our joint venture with Chevron Products Company. We report 100% of the revenues of our ART joint venture, but only receive 55% of the income after the minority interest.

Key external factors for our FCC catalysts and hydroprocessing catalysts are the economics of the petroleum refining industry, specifically the impacts of demand for transportation fuels and petrochemical products, and crude oil supply.

Sales of our other three Grace Davison product groups are affected by general economic conditions including the underlying growth rate of targeted end-use applications.

Grace Performance Chemicals, or GPC, includes:

|  |

| • | Construction materials and systems, including concrete admixtures and fibers used to improve the durability and working properties of concrete, additives used in cement processing to improve energy efficiency and enhance the characteristics of finished cement, waterproofing materials used in commercial and residential construction and renovation to protect buildings from water penetration, and fireproofing materials used to protect buildings from structural failure in the event of fire |

|  |

| • | Packaging technologies, primarily specialty sealants and coatings used in rigid food and beverage packages, including can and closure sealants used to seal and enhance the shelf life of can and bottle contents, and coatings for cans and closures that prevent metal corrosion, protect package contents from the influence of metal and ensure proper adhesion of sealing compounds |

Construction products sales are affected by non-residential construction activity and, to a lesser extent, residential construction activity, which both tend to lag the general economy in both decline and recovery. Waterproofing products sales are also significantly affected by residential renovation activity. A significant portion of our sales of construction products are in the U.S., so it is most dependent on the level of U.S. construction activity.

Our packaging technologies sales are affected by general economic conditions globally as well as an ongoing shift in demand from metal and glass to plastic packaging for foods and beverages. This shift is causing a decline in can sealant usage, but provides opportunities for closure sealants and other products for plastic packaging.

Global scope – We operate our business on a global scale with more than 60% of our revenue and 40% of our operating property outside the United States. Our business is conducted in more than 40 countries and in more than 20 currencies. Our operating segments are managed on a global basis, serving global markets, with currency fluctuations in relation to the U.S. dollar affecting reported earnings, net assets and cash flows.

F-46

The table below shows the sales of our operating segments as a percentage of our total sales.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Percentage of Total Grace Sales |  | 2005 |  | 2004 |  | 2003 |

| Grace Davison |  | | 53.3 | % |  | | 52.8 | % |  | | 52.5 | % |

| Grace Performance Chemicals |  | | 46.7 | % |  | | 47.2 | % |  | | 47.5 | % |

| Total |  | | 100.0 | % |  | | 100.0 | % |  | | 100.0 | % |

| Grace U.S. |  | | 36.8 | % |  | | 38.6 | % |  | | 40.6 | % |

| Grace non-U.S. |  | | 63.2 | % |  | | 61.4 | % |  | | 59.4 | % |

| Total |  | | 100.0 | % |  | | 100.0 | % |  | | 100.0 | % |

|

Voluntary Bankruptcy Filing

In response to a sharply increasing number of asbestos-related personal injury claims, on April 2, 2001, Grace and 61 of our United States subsidiaries and affiliates, including W. R. Grace & Co. – Conn., filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware. Our non-U.S. subsidiaries and certain of our U.S. subsidiaries were not included in the Chapter 11 filing.

Under Chapter 11, we have continued to operate as debtors-in-possession under court protection from creditors and claimants, while using the Chapter 11 process to develop and implement a plan for addressing the asbestos-related claims. Since the Chapter 11 filing, all motions necessary to conduct normal business activities have been approved by the bankruptcy court.

On January 13, 2005, we filed an amended plan of reorganization and related documents with the bankruptcy court. The plan of reorganization is supported by committees representing general unsecured creditors and equity holders, but is not supported by committees representing asbestos personal injury claimants and asbestos property damage claimants. Under the terms of the plan of reorganization, a trust would be established to which all pending and future asbestos-related claims would be channeled for resolution. The plan of reorganization can become effective only after a vote of eligible creditors and with the approval of the bankruptcy court and the U.S. District Court for the District of Delaware. See ‘‘Plan of Reorganization’’ below for more information.

Critical Accounting Estimates