Credit Suisse Basic Materials Conference September 10, 2019

Disclaimer Statement Regarding Safe Harbor For Forward-Looking Statements This presentation contains forward-looking statements, that is, information related to future, not past, events. Such statements generally include the words “believes,” “plans,” “intends,” “targets,” “will,” “expects,” “suggests,” “anticipates,” “outlook,” “continues,” or similar expressions. Forward-looking statements include, without limitation, expected financial positions; results of operations; cash flows; financing plans; business strategy; operating plans; capital and other expenditures; competitive positions; growth opportunities for existing products; benefits from new technology and cost reduction initiatives, plans and objectives; and markets for securities. For these statements, Grace claims the protections of the safe harbor for forward-looking statements contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. Like other businesses, Grace is subject to risks and uncertainties that could cause its actual results to differ materially from its projections or that could cause other forward-looking statements to prove incorrect. Factors that could cause actual results to differ materially from those contained in the forward-looking statements include, without limitation: risks related to foreign operations, especially in emerging regions; the costs and availability of raw materials, energy and transportation; the effectiveness of its research and development and growth investments; acquisitions and divestitures of assets and businesses; developments affecting Grace’s outstanding indebtedness; developments affecting Grace's pension obligations; legacy matters (including product, environmental, and other legacy liabilities) relating to past activities of Grace; its legal and environmental proceedings; environmental compliance costs; the inability to establish or maintain certain business relationships; the inability to hire or retain key personnel; natural disasters such as storms and floods, and force majeure events; changes in tax laws and regulations; international trade disputes, tariffs and sanctions; the potential effects of cyberattacks; and those additional factors set forth in Grace's most recent Annual Report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, which have been filed with the Securities and Exchange Commission and are readily available on the Internet at www.sec.gov. Reported results should not be considered as an indication of future performance. Readers are cautioned not to place undue reliance on Grace's projections and forward-looking statements, which speak only as of the dates those projections and statements are made. Grace undertakes no obligation to release publicly any revision to the projections and forward-looking statements contained in this announcement, or to update them to reflect events or circumstances occurring after the date of this presentation. Non-GAAP Financial Terms In this presentation, Grace presents financial information in accordance with U.S. generally accepted accounting principles (U.S. GAAP), as well as the non-GAAP financial information described in the Appendix. Grace believes that this non-GAAP financial information provides useful supplemental information about the performance of its businesses, improves period-to-period comparability and provides clarity on the information management uses to evaluate the performance of its businesses. In the Appendix, Grace has provided reconciliations of these non-GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP. These non-GAAP financial measures should not be considered as a substitute for financial measures calculated in accordance with U.S. GAAP, and the financial results calculated in accordance with U.S. GAAP and reconciliations from those results should be evaluated carefully. 2019 W. R. Grace & Co. | 2

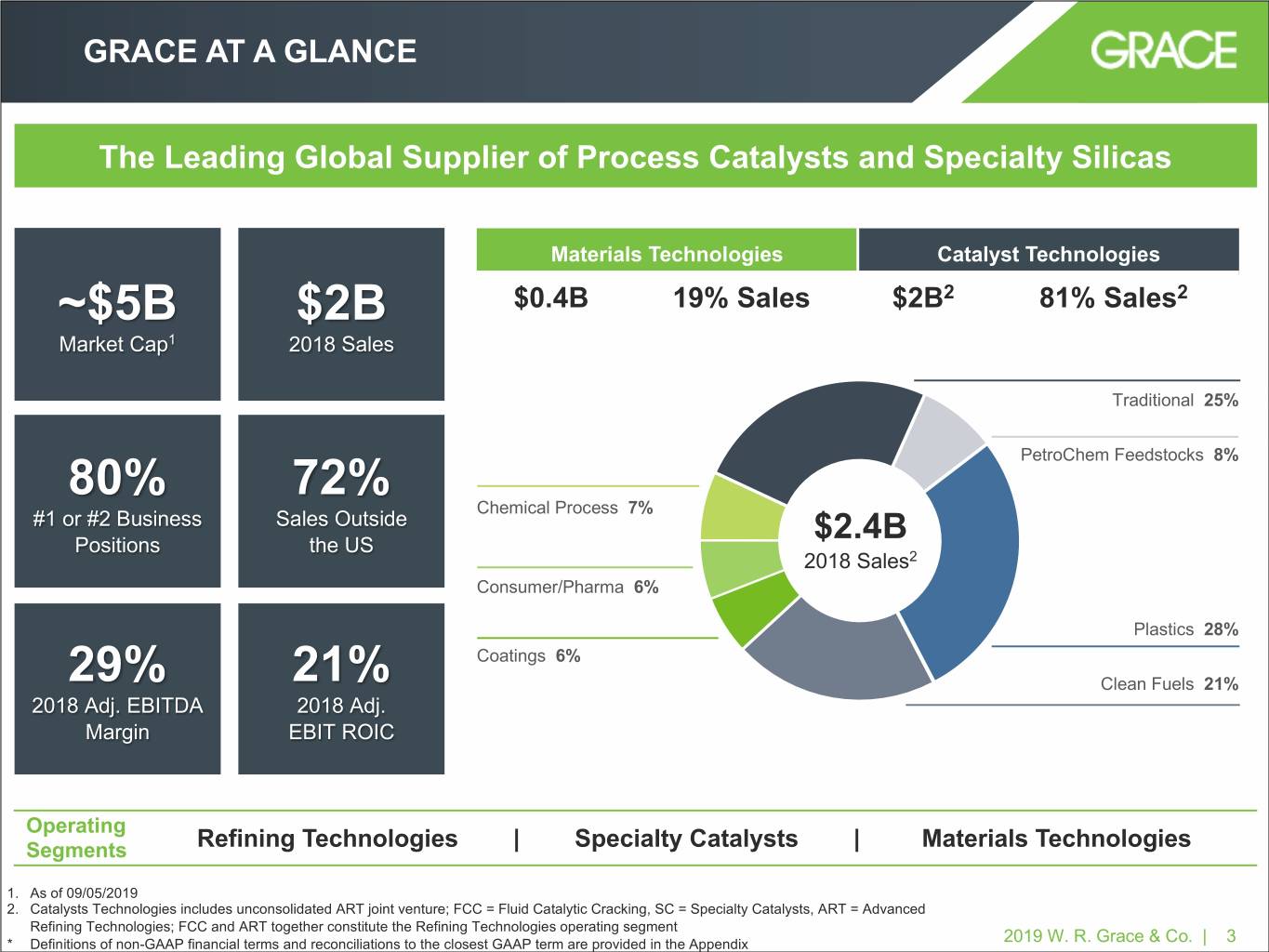

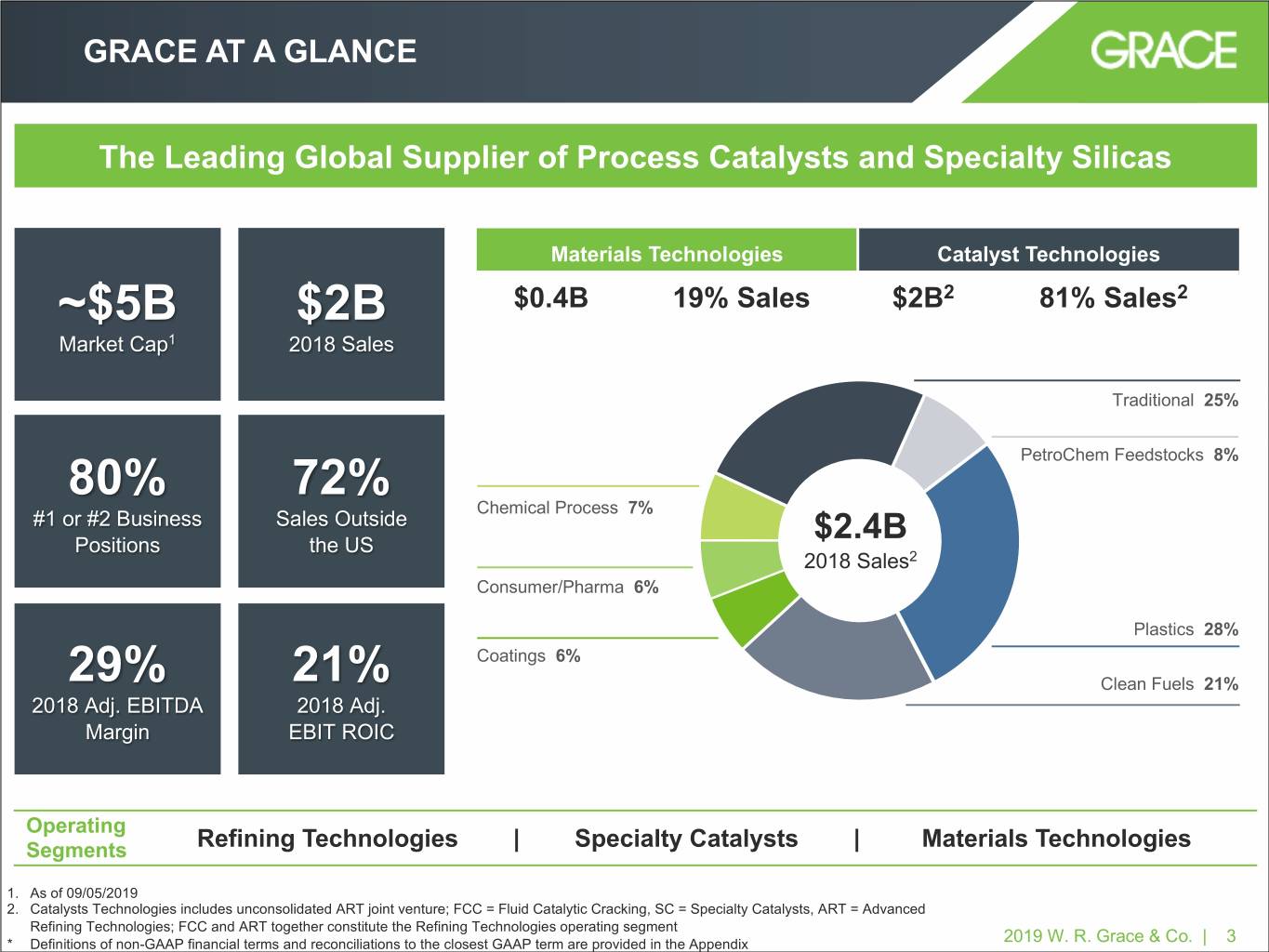

GRACE AT A GLANCE The Leading Global Supplier of Process Catalysts and Specialty Silicas Materials Technologies Catalyst Technologies ~$5B $2B $0.4B 19% Sales $2B2 81% Sales2 Market Cap1 2018 Sales Traditional 25% 80% 72% PetroChem Feedstocks 8% Chemical Process 7% #1 or #2 Business Sales Outside $2.4B Positions the US 2018 Sales2 Consumer/Pharma 6% Plastics 28% Coatings 6% 29% 21% Clean Fuels 21% 2018 Adj. EBITDA 2018 Adj. Margin EBIT ROIC Operating Segments Refining Technologies | Specialty Catalysts | Materials Technologies 1. As of 09/05/2019 2. Catalysts Technologies includes unconsolidated ART joint venture; FCC = Fluid Catalytic Cracking, SC = Specialty Catalysts, ART = Advanced Refining Technologies; FCC and ART together constitute the Refining Technologies operating segment * Definitions of non-GAAP financial terms and reconciliations to the closest GAAP term are provided in the Appendix 2019 W. R. Grace & Co. | 3

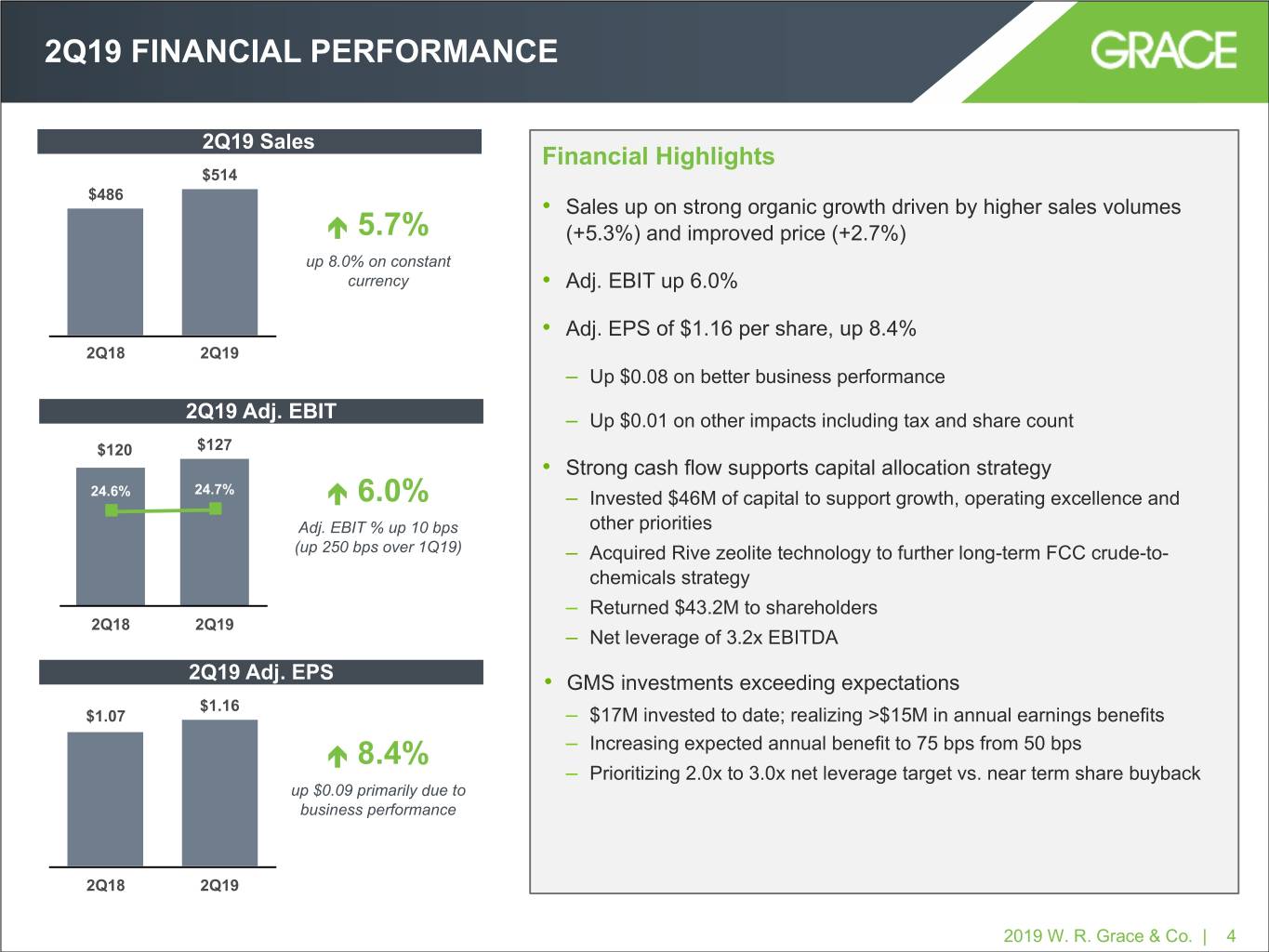

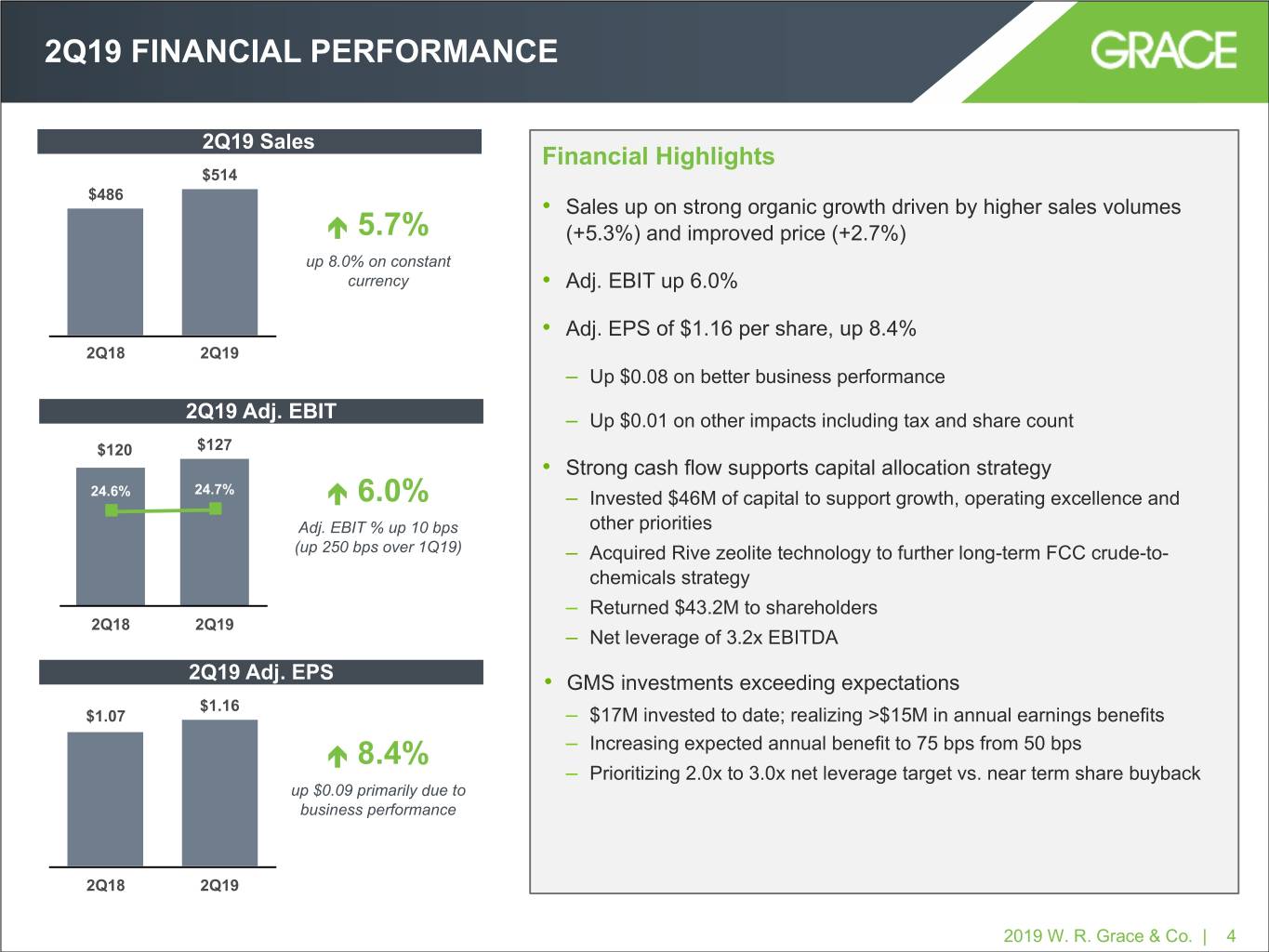

2Q19 FINANCIAL PERFORMANCE 2Q19 Sales Financial Highlights $514 $486 • Sales up on strong organic growth driven by higher sales volumes é 5.7% (+5.3%) and improved price (+2.7%) up 8.0% on constant currency • Adj. EBIT up 6.0% • Adj. EPS of $1.16 per share, up 8.4% 2Q18 2Q19 – Up $0.08 on better business performance 2Q19 Adj. EBIT – Up $0.01 on other impacts including tax and share count $120 $127 $120.00 29.00% • Strong cash flow supports capital allocation strategy 27.00% $100.00 24.6% 24.7% é 6.0% 25.00% – Invested $46M of capital to support growth, operating excellence and $80.00 23.00% Adj. EBIT % up 10 bps other priorities $60.00 21.00% (up 250 bps over 1Q19) $40.00 – Acquired Rive zeolite technology to further long-term FCC crude-to- 19.00% $20.00 17.00% chemicals strategy $0.00 15.00% – Returned $43.2M to shareholders 2Q18 2Q19 – Net leverage of 3.2x EBITDA 2Q19 Adj. EPS • GMS investments exceeding expectations $1.16 $1.07 – $17M invested to date; realizing >$15M in annual earnings benefits – Increasing expected annual benefit to 75 bps from 50 bps é 8.4% – Prioritizing 2.0x to 3.0x net leverage target vs. near term share buyback up $0.09 primarily due to business performance 2Q18 2Q19 2019 W. R. Grace & Co. | 4

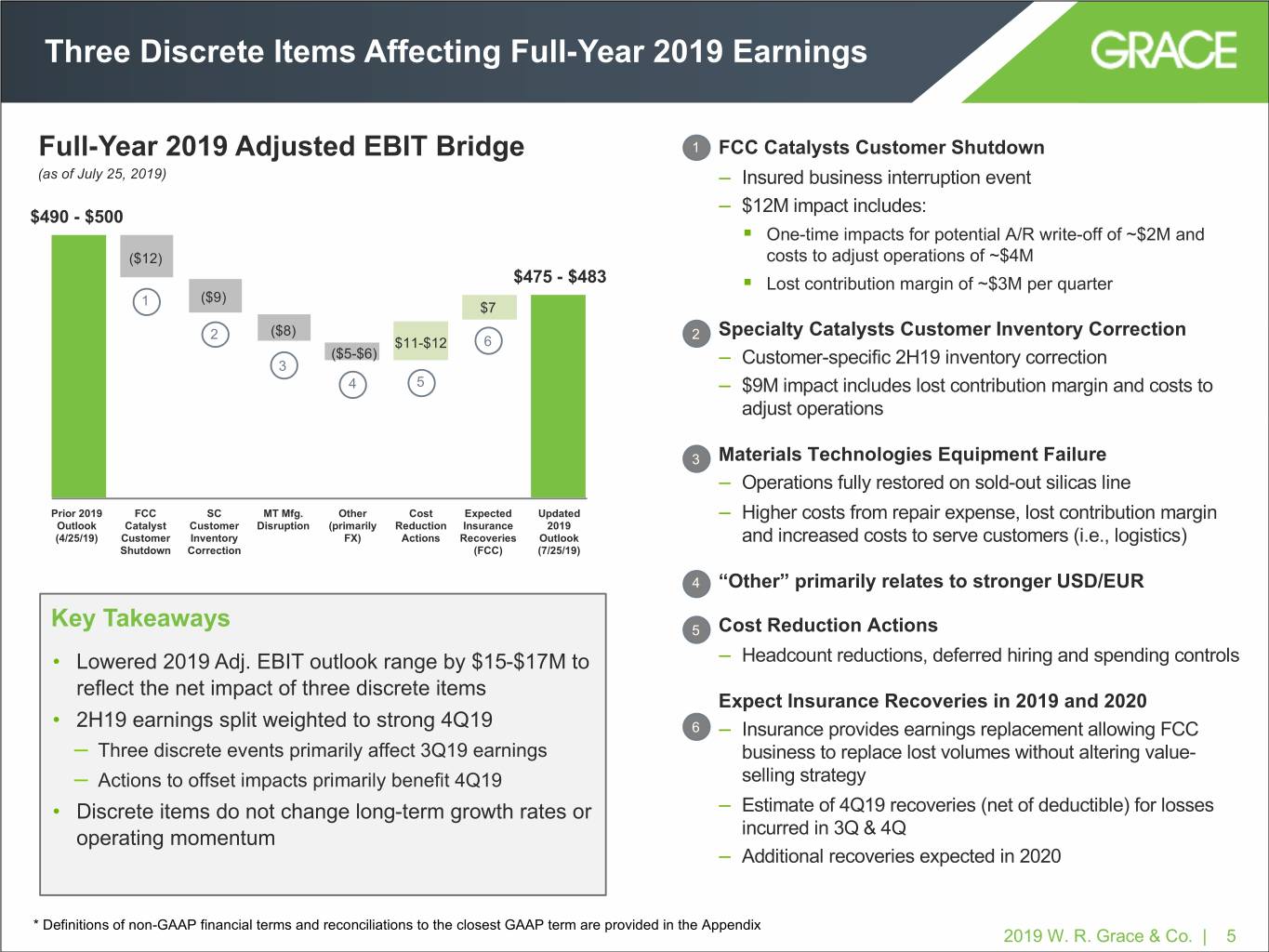

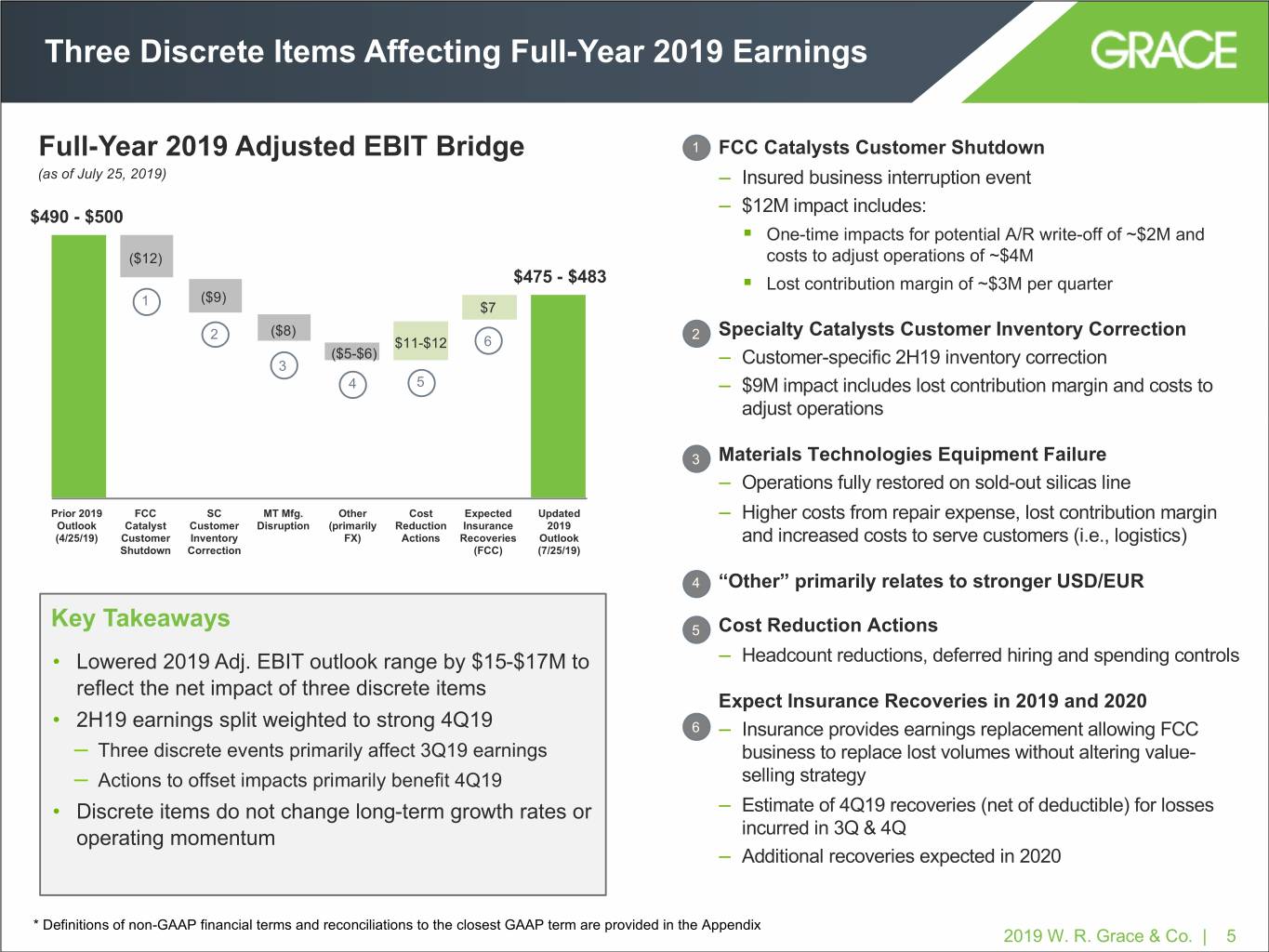

Three Discrete Items Affecting Full-Year 2019 Earnings Full-Year 2019 Adjusted EBIT Bridge 1 FCC Catalysts Customer Shutdown (as of July 25, 2019) – Insured business interruption event – $12M impact includes: $490 - $500 § One-time impacts for potential A/R write-off of ~$2M and ($12) costs to adjust operations of ~$4M $475 - $483 § Lost contribution margin of ~$3M per quarter ($9) 1 $7 2 ($8) 2 Specialty Catalysts Customer Inventory Correction $11-$12 6 ($5-$6) 3 – Customer-specific 2H19 inventory correction 4 5 – $9M impact includes lost contribution margin and costs to adjust operations 3 Materials Technologies Equipment Failure – Operations fully restored on sold-out silicas line Prior 2019 FCC SC MT Mfg. Other Cost Expected Updated – Higher costs from repair expense, lost contribution margin Outlook Catalyst Customer Disruption (primarily Reduction Insurance 2019 (4/25/19) Customer Inventory FX) Actions Recoveries Outlook and increased costs to serve customers (i.e., logistics) Shutdown Correction (FCC) (7/25/19) 4 “Other” primarily relates to stronger USD/EUR Key Takeaways 5 Cost Reduction Actions • Lowered 2019 Adj. EBIT outlook range by $15-$17M to – Headcount reductions, deferred hiring and spending controls reflect the net impact of three discrete items Expect Insurance Recoveries in 2019 and 2020 • 2H19 earnings split weighted to strong 4Q19 6 – Insurance provides earnings replacement allowing FCC – Three discrete events primarily affect 3Q19 earnings business to replace lost volumes without altering value- – Actions to offset impacts primarily benefit 4Q19 selling strategy • Discrete items do not change long-term growth rates or – Estimate of 4Q19 recoveries (net of deductible) for losses operating momentum incurred in 3Q & 4Q – Additional recoveries expected in 2020 * Definitions of non-GAAP financial terms and reconciliations to the closest GAAP term are provided in the Appendix 2019 W. R. Grace & Co. | 5

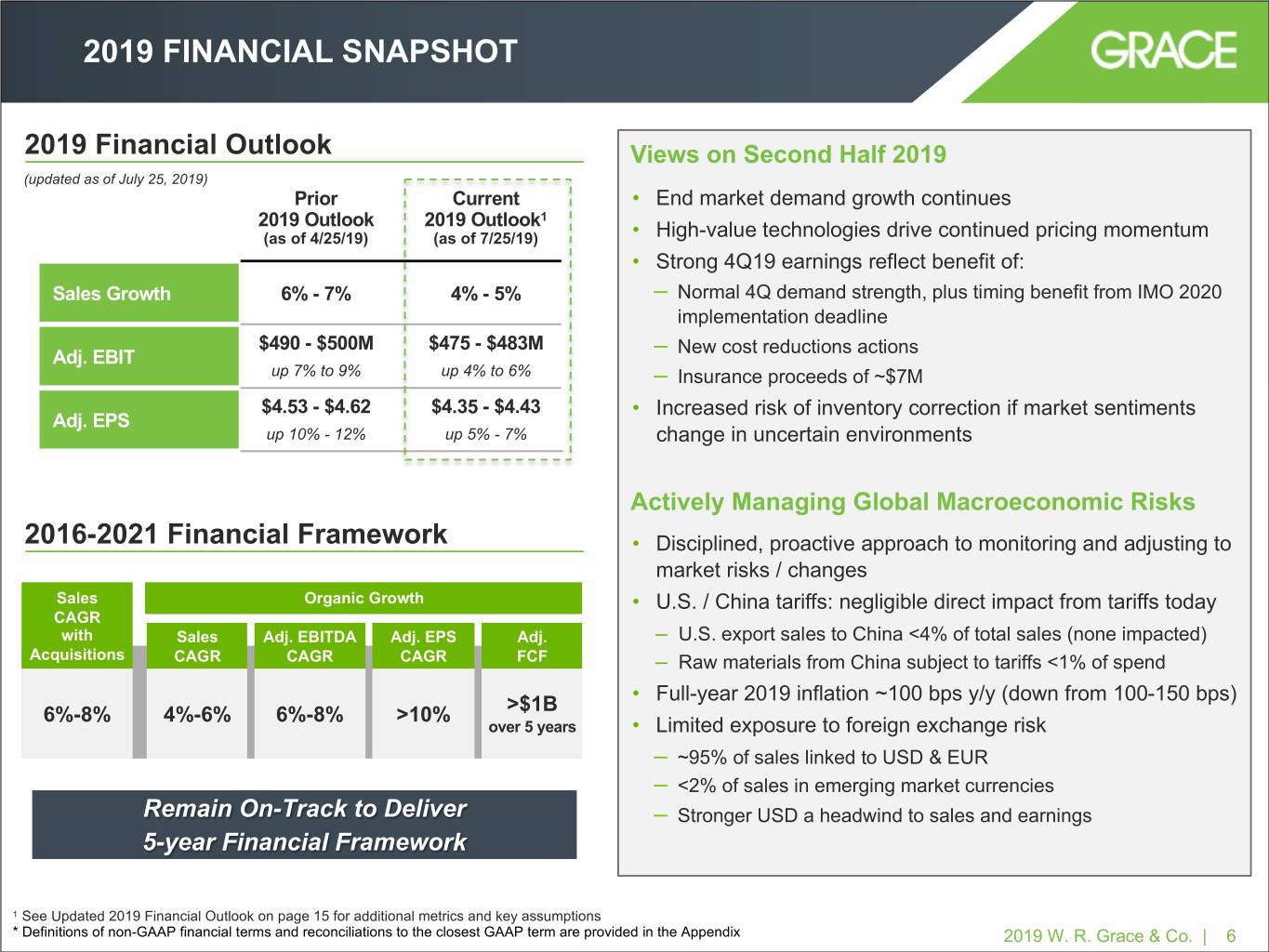

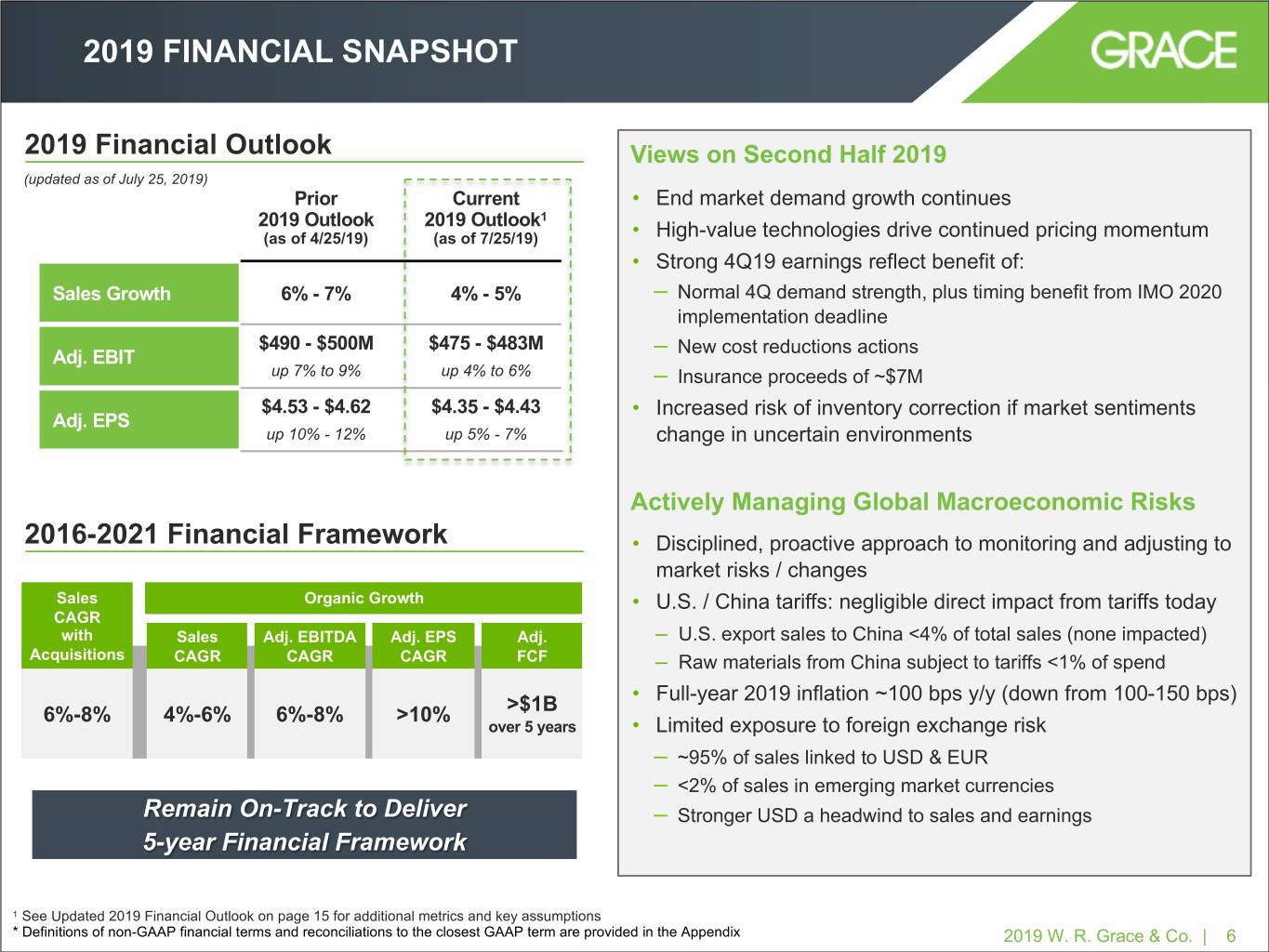

2019 FINANCIAL SNAPSHOT 2019 Financial Outlook Views on Second Half 2019 (updated as of July 25, 2019) Prior Current • End market demand growth continues 2019 Outlook 2019 Outlook1 (as of 4/25/19) (as of 7/25/19) • High-value technologies drive continued pricing momentum • Strong 4Q19 earnings reflect benefit of: Sales Growth 6% - 7% 4% - 5% – Normal 4Q demand strength, plus timing benefit from IMO 2020 implementation deadline $490 - $500M $475 - $483M New cost reductions actions Adj. EBIT – up 7% to 9% up 4% to 6% – Insurance proceeds of ~$7M $4.53 - $4.62 $4.35 - $4.43 • Increased risk of inventory correction if market sentiments Adj. EPS up 10% - 12% up 5% - 7% change in uncertain environments Actively Managing Global Macroeconomic Risks 2016-2021 Financial Framework • Disciplined, proactive approach to monitoring and adjusting to market risks / changes Sales Organic Growth • U.S. / China tariffs: negligible direct impact from tariffs today CAGR with Sales Adj. EBITDA Adj. EPS Adj. – U.S. export sales to China <4% of total sales (none impacted) Acquisitions CAGR CAGR CAGR FCF – Raw materials from China subject to tariffs <1% of spend • Full-year 2019 inflation ~100 bps y/y (down from 100-150 bps) 6%-8% 4%-6% 6%-8% >10% >$1B over 5 years • Limited exposure to foreign exchange risk – ~95% of sales linked to USD & EUR – <2% of sales in emerging market currencies Remain On-Track to Deliver – Stronger USD a headwind to sales and earnings 5-year Financial Framework 1 See Updated 2019 Financial Outlook on page 15 for additional metrics and key assumptions * Definitions of non-GAAP financial terms and reconciliations to the closest GAAP term are provided in the Appendix 2019 W. R. Grace & Co. | 6

COMPELLING INVESTMENT THESIS 1 • Strong strategic positions in high-value markets Enduring Growth • Increasing demand for high-performance plastics, petrochemical feedstocks, and clean transportation fuels; rising living standards and growing middle class incomes Drivers • Growing global focus on stricter environmental standards, improving health and wellness and sustainability 2 • Comprehensive framework to improve profitability; Significant runway for value creation Delivering Value • Commercial excellence and customer-driven innovation reinforce and extend our through the Grace competitive advantages Value Model • Differentiated capabilities and strategies enable above market sales growth rates • Operating excellence delivers productivity and efficiencies in our operations 3 • High-return investments in growth capacity, technology and operating excellence Investing to Extend Our accelerates sales and earnings growth Competitive Advantages • Balanced and disciplined capital allocation strategy drives strong investment returns 4 • 4-6% organic sales growth CAGR Clear Path to Deliver • >10% Adj. EPS growth 2016-2021 • Strong free cash flow available for acquisitions and return to shareholders Financial Framework • Framework reflects targeted investments to accelerate growth across our portfolio • Long-term outlook reinforces investment thesis Strategy, Operating Discipline, and Leadership Team in Place to Create Value 2019 W. R. Grace & Co. | 7

OUR STRATEGY FOR PROFITABLE GROWTH… 1 2 Invest to accelerate Invest in great people growth and extend our to strengthen our competitive advantages high-performance culture 3 4 Execute the Acquire to build our Grace Value Model technology and manufacturing to drive operating excellence capabilities for our customers …Investing in Our Businesses 2019 W. R. Grace & Co. | 8

LONG-TERM GROWTH SUPPORTED BY ENDURING MACRO TRENDS AND LEADING MARKET POSITIONS GLOBAL MACRO TRENDS Rising Living Standards Regulation / Health & Wellness 4-6% ~4% 5-7% 5-8% Annual Global Plastics Annual Global Middle Class Annual Hydroprocessing Annual Consumer/Pharma MARKET Demand Growth Consumption Growth Catalysts Demand Growth Demand Growth GROWTH 1 DRIVERS + Demand for plastics and petrochemical feedstocks + Demand for cleaner fuels and heavy oil upgrading + Growth in household disposable incomes + Stricter environmental standards + Global sustainability focus + Increased focus on health and wellness Investing in innovation, technical service and operations to deliver high-value products to help our customers: VALUE + Develop new and reformulated products to meet increasing end-consumer demand CREATION OPPORTUNITY + Address changing consumer demands and preferences, and regulatory and environmental standards + Improve efficiency of their manufacturing to reduce raw material, energy and water usage, and harmful emissions Leading Positions in High-Value Segments 2016 – 2021 Financial Framework ENABLE § FCC catalysts LONG-TERM, § Hydroprocessing catalysts 80% § Hydrocracking catalysts 4-6% 6-8% >10% PROFITABLE of Sales in § Polyolefin catalysts #1 Organic Sales Adj. EBITDA Adj. EPS GROWTH segments where § Independent PP process we are #1 or #2 technology licensing Growth CAGR CAGR CAGR § Specialty silica gel 1. Source: See W.R. Grace Investor Day Presentation, March 2, 2018 for market growth rates. 2019 W. R. Grace & Co. | 9

HIGH-VALUE END MARKETS TIED TO POSITIVE, LONG- TERM TRENDS Long-Term 2018 Sales Key Growth Drivers Customers / Applications Growth1 Global, regional and national petrochemical + Demand for plastics companies Applications include: Specialty + Increasing population § Non-phthalate plastics $661M HSD + Rising living standards § Packaging for food safety and preservation Catalysts 2018 Sales Expected Growth § High pressure pipe for clean water distribution + Growth in middle class § Geomembranes for erosion protection incomes § Light-weighting components to improve fuel efficiency § Medical devices to improve health and safety $802M LSD + Demand for cleaner Global, national (state-owned) and independent 2018 Sales Expected Growth transportation fuels refining companies Refining Technologies Applications include: + Increasing energy Refining § Environmentally compliant transportation fuels consumption Technologies § Petrochemical feedstocks $498M HSD + Demand for § Upgrading low-value oil (resid) petrochemical feedstocks 2018 Sales Expected Growth § Cleaner burning fuels for emissions control ART JV Consumer/Pharma + Rising living standards § Pharmaceutical intermediates, excipients, and product + Growing middle class additives promote health and well-being incomes Coatings Materials $469M MSD § Functional additives for matting and corrosion + Increased focus on Technologies 2018 Sales Expected Growth resistance in industrial and consumer coatings health and wellness Chemical Process + Stricter regulatory § Environmental catalysts for emissions control environment § Adsorbents for natural gas and petrochemical processes and biofuels 1. Source: See W.R. Grace Investor Day Presentation, March 2, 2018. 2019 W. R. Grace & Co. | 10

OUR PRODUCTS CONTRIBUTE TO OUR CUSTOMERS’ SUSTAINABILITY OBJECTIVES 2018 Sales Examples of Grace Products and Benefits • High-performing PP catalysts for lightweighting auto parts to improve fuel economy Improving our customers’ • Custom single-site PE catalysts for downgauging packaging to reduce products1 ~$0.1B plastics requirements • Silicas for tires to reduce rolling resistance and improve fuel economy • Zeolites for dual pane windows to reduce energy use • Advanced FCC catalysts to reduce raw material and energy Improving our customers’ requirements process1 ~$0.5B • Advanced silica gel for filtration to reduce water use and waste • Hydroprocessing catalysts to meet cleaner fuels standards Enabling our customers to (e.g., IMO 2020) meet stricter ~$0.3B • Additives to reduce SOx and NOx emissions from refinery operations environmental standards • Colloidal silicas for vehicle emission control devices Enabling our customers to • Non-phthalate PP catalysts for safer packaging and household items reformulate their products ~$0.1B • Silicas for anti-corrosive coatings that are heavy-metal free to meet consumer demand • Silicas for high performance paints with low-VOCs 2018 Sales directly contribute to sustainability ~$1.0B ~38% objectives 1. Represents revenues aligned to SASB Chemicals Sustainability Accounting Standards definition of products designed for use-phase resource efficiency, including improving energy efficiency, eliminating/lowering emissions, reducing raw materials consumption, increasing product longevity, and/or reducing water consumption. 2019 W. R. Grace & Co. | 11

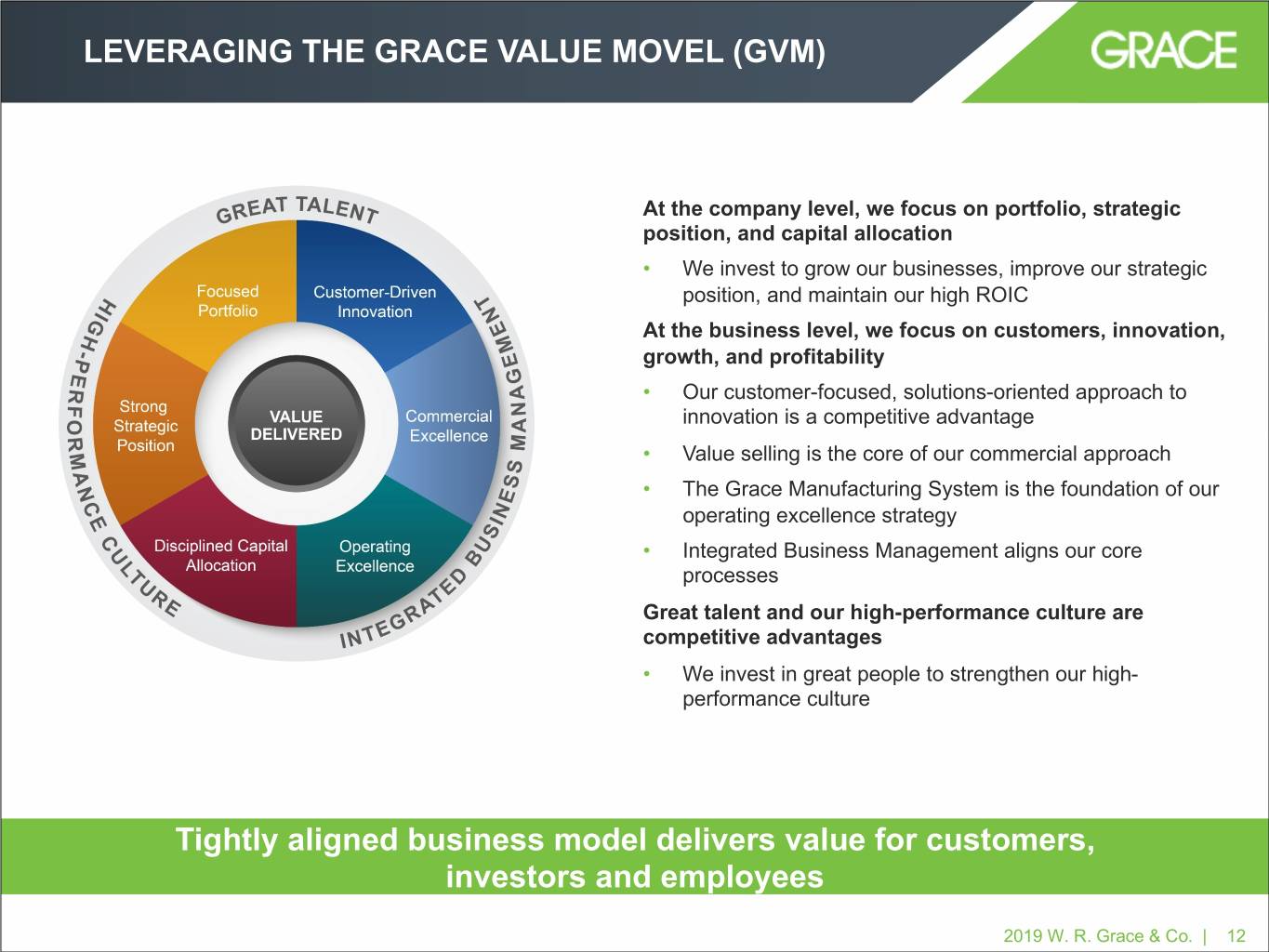

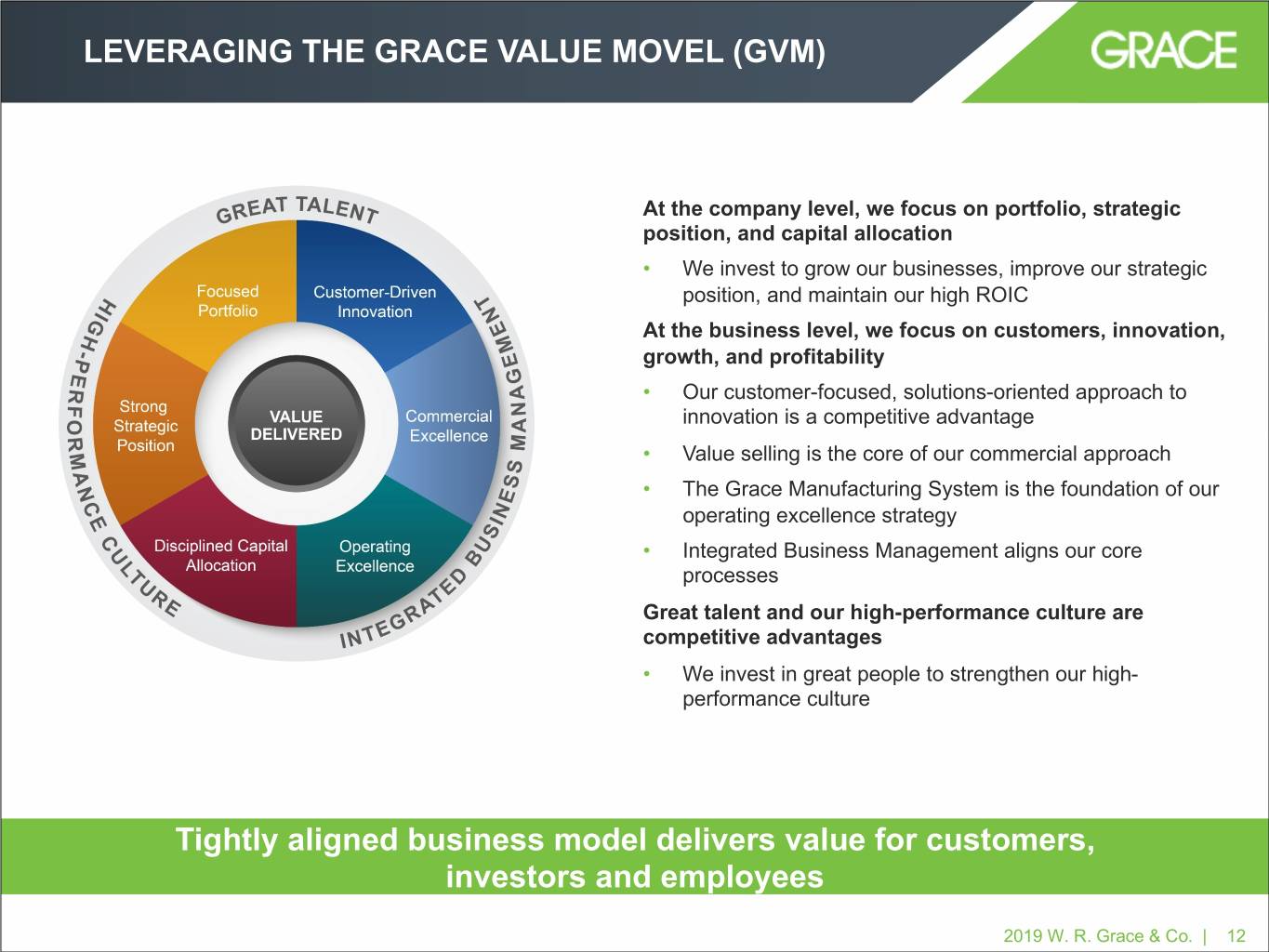

LEVERAGING THE GRACE VALUE MOVEL (GVM) At the company level, we focus on portfolio, strategic position, and capital allocation • We invest to grow our businesses, improve our strategic position, and maintain our high ROIC At the business level, we focus on customers, innovation, growth, and profitability • Our customer-focused, solutions-oriented approach to innovation is a competitive advantage • Value selling is the core of our commercial approach • The Grace Manufacturing System is the foundation of our operating excellence strategy • Integrated Business Management aligns our core processes Great talent and our high-performance culture are competitive advantages • We invest in great people to strengthen our high- performance culture Tightly aligned business model delivers value for customers, investors and employees 2019 W. R. Grace & Co. | 12

CAPITAL ALLOCATION UPDATE 2Q19 Capital Allocation INVEST IN GROWTH • Capex and R&D investments to accelerate organic growth and extend our competitive advantages 2x - 3x • Strategic growth and productivity investments typically Target generate 20-30% IRR • Invested $46M to support growth, operating excellence and other priorities (~70% in strategic capital) BASF Albemarle Rive Acquisition Acquisition Acquisition PURSUE STRATEGIC ACQUISITIONS (3Q16) (2Q18) (2Q19) • Bolt-on acquisitions – Acquired Rive Technology • Acquisitions typically return > 20% IRR RETURN CASH TO SHAREHOLDERS • Dividends and share repurchases • Returned $43.2 million dollars to shareholders – $25.0 million Share repurchases – $18.2 million Dividends Strong Balance Sheet and Cash Generation Support Capital Allocation Plan * Definitions of non-GAAP financial terms and reconciliations to the closest GAAP term are provided in the Appendix 2019 W. R. Grace & Co. | 13

UPDATED 2019 FINANCIAL OUTLOOK 2019 Full-Year Outlook 2019 Outlook 2019 Outlook (as of 4/25/19) (as of 7/25/19) Key Assumptions - Lower sales reflects impact of three discrete items Sales Growth 6% - 7% 4% - 5% - Moderate FX headwind continuing in 2H19 $490 - $500M $475 - $483M Adj. EBIT - $15 to $17 million impact of three discrete items up 7% to 9% up 4% to 6% - Inflation of ~1.0%, down from 1.0% - 1.5% - Moderate FX headwind continuing in 2H19 $4.53 - $4.62 $4.35 - $4.43 Adj. EPS - Interest Expense of $81 - $83M (no change) up 10% - 12% up 5% - 7% - Reflecting increased investment to support growth and productivity Adj. FCF $235 - $250M $235 - $250M (no change) - $200 - $210M of capital investment in 2019 (no change) Depreciation & $105 - $110M ~$105M Amortization Adj. Effective Tax Rate 26% - 27% 26% - 27% - Low cash tax rate to 2026 (no change) Adj. Cash Tax Rate 12% - 15% 12% - 15% * Definitions of non-GAAP financial terms and reconciliations to the closest GAAP term are provided in the Appendix 2019 W. R. Grace & Co. | 14

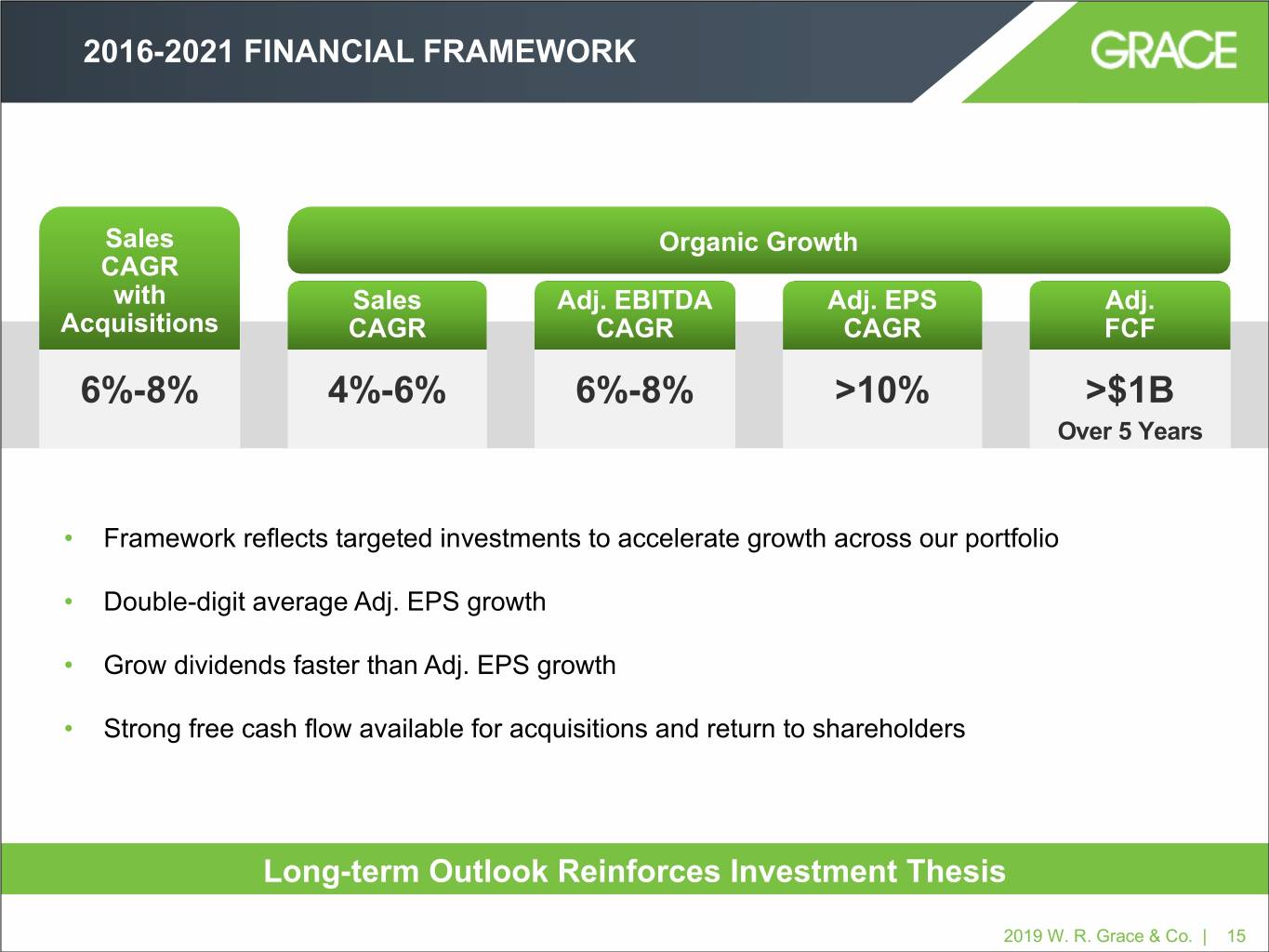

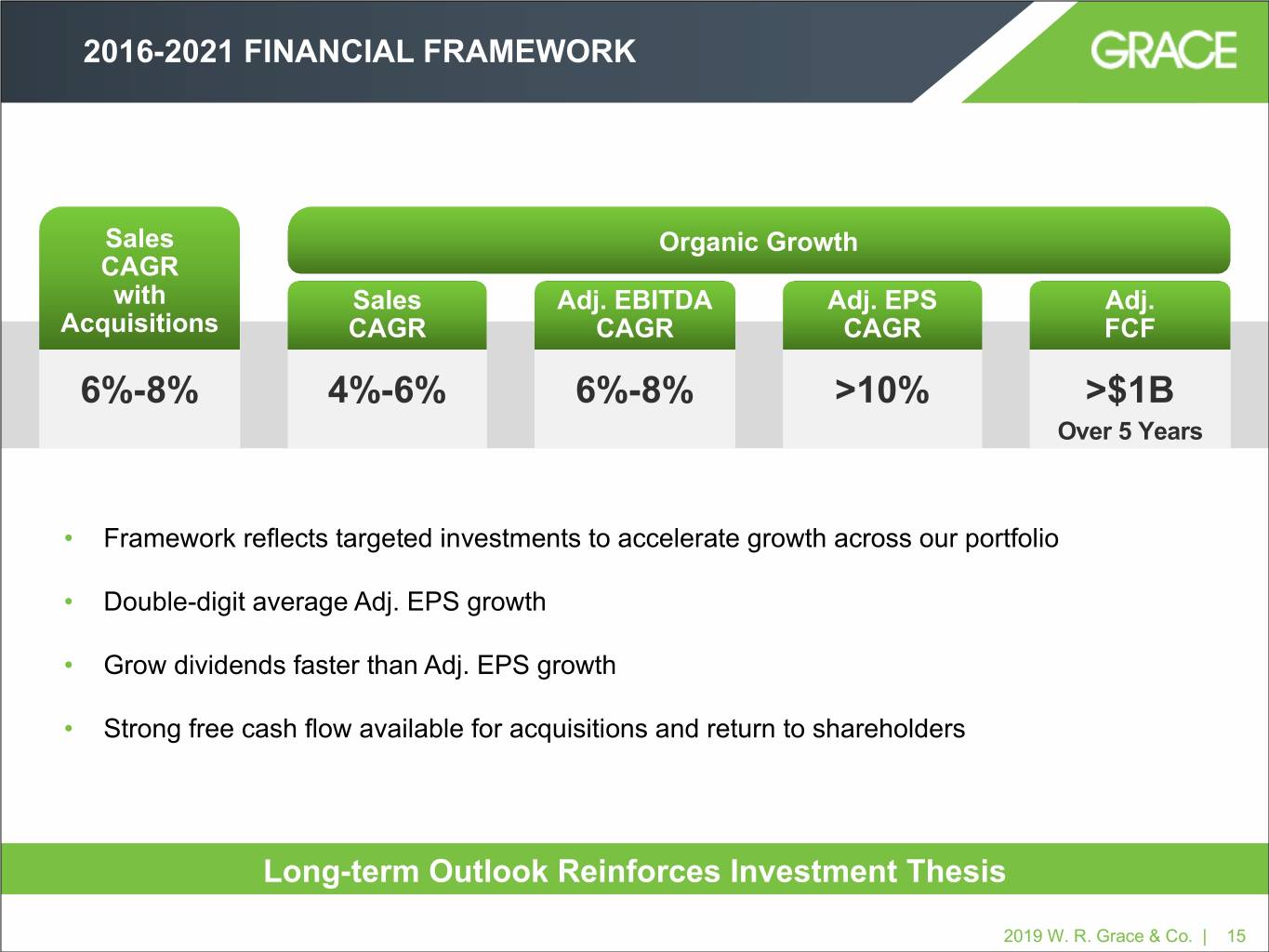

2016-2021 FINANCIAL FRAMEWORK Sales Organic Growth CAGR with Sales Adj. EBITDA Adj. EPS Adj. Acquisitions CAGR CAGR CAGR FCF 6%-8% 4%-6% 6%-8% >10% >$1B Over 5 Years • Framework reflects targeted investments to accelerate growth across our portfolio • Double-digit average Adj. EPS growth • Grow dividends faster than Adj. EPS growth • Strong free cash flow available for acquisitions and return to shareholders Long-term Outlook Reinforces Investment Thesis 2019 W. R. Grace & Co. | 15

KEY TAKEAWAYS Strong strategic position; well-positioned for growth Grace Value Model focused on creating value Investing in operating excellence; long runway of opportunity Attractive financial framework for growth, earnings and cash 2019 W. R. Grace & Co. | 16

Supplemental Information 17

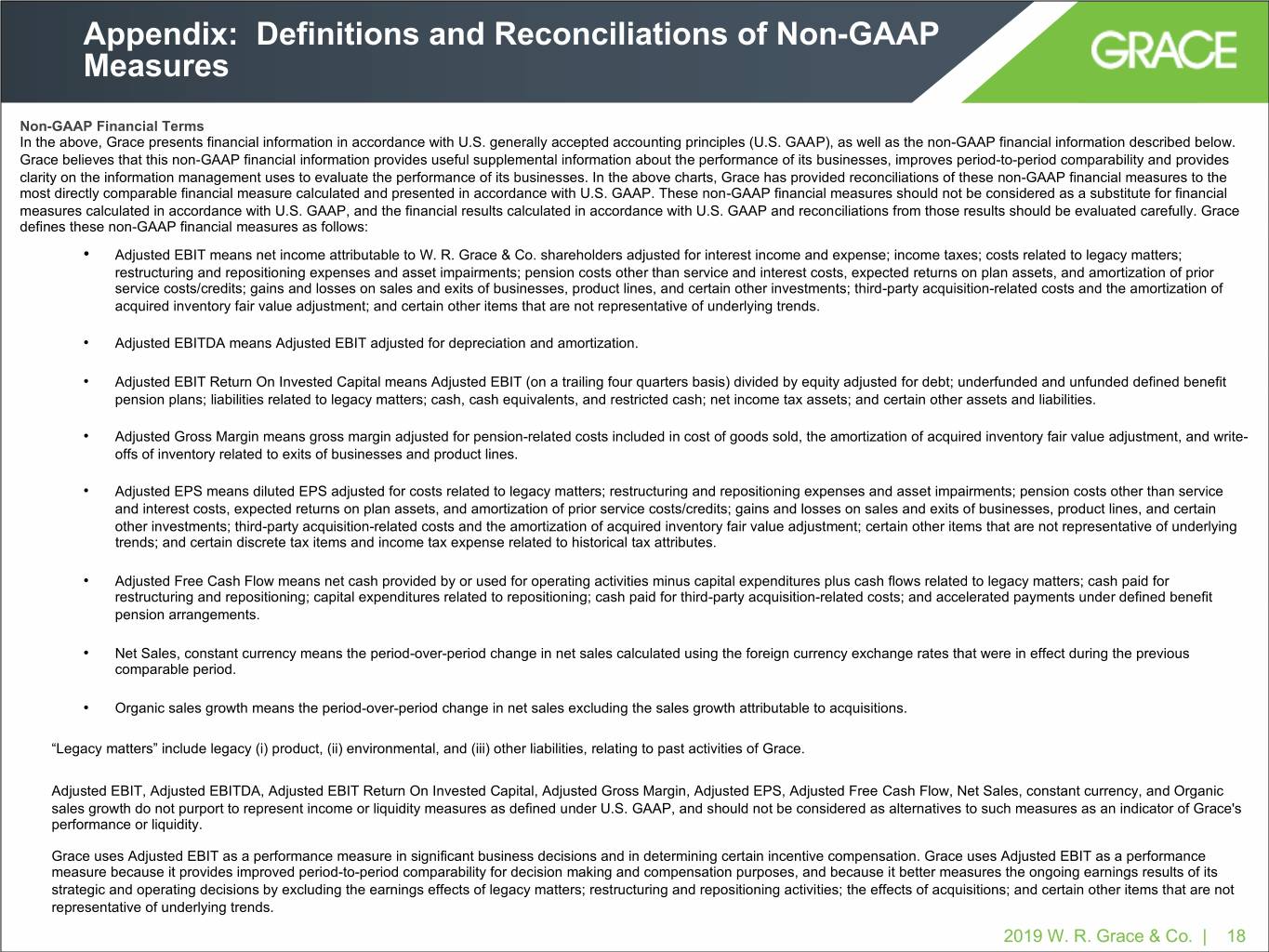

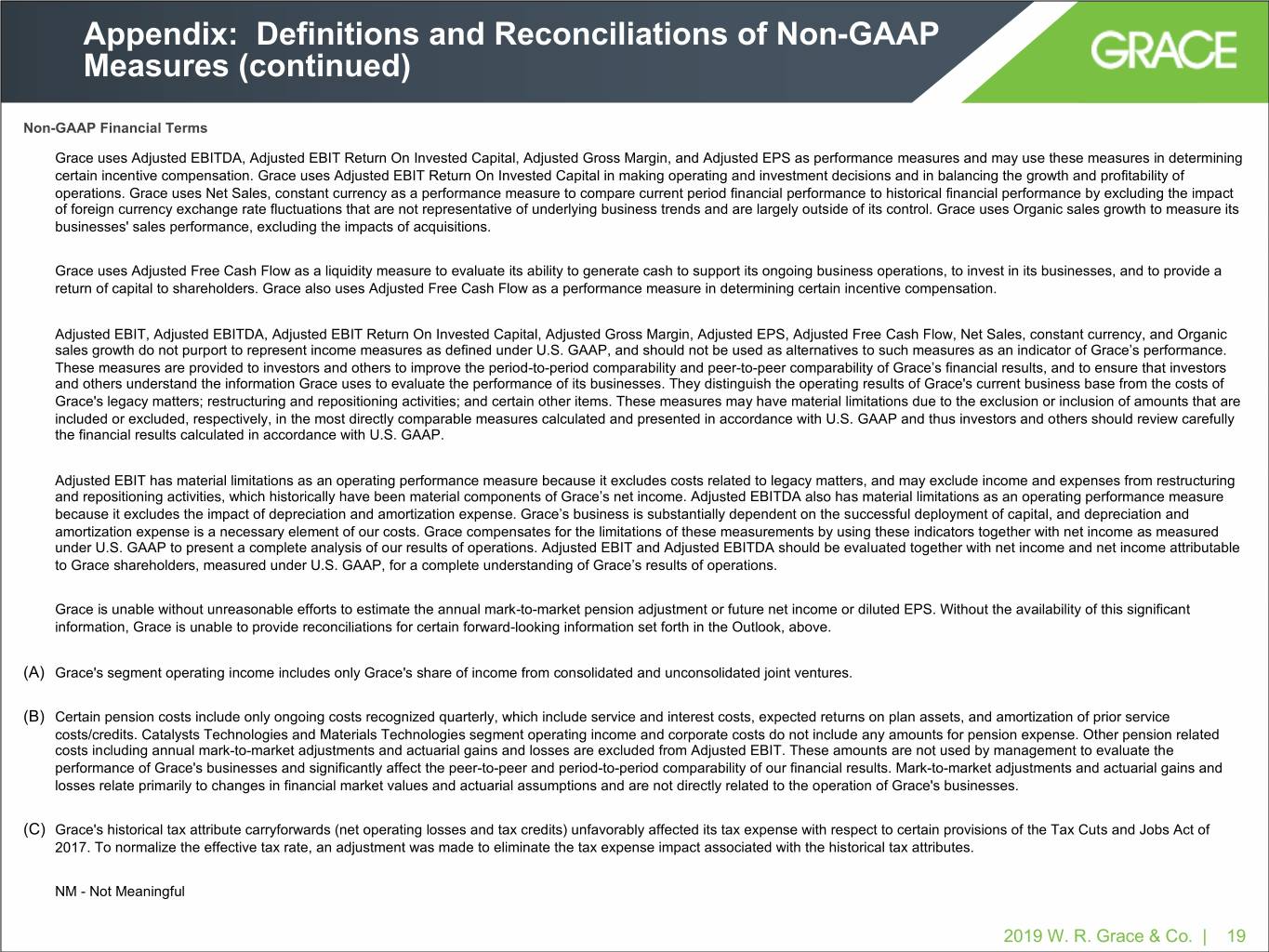

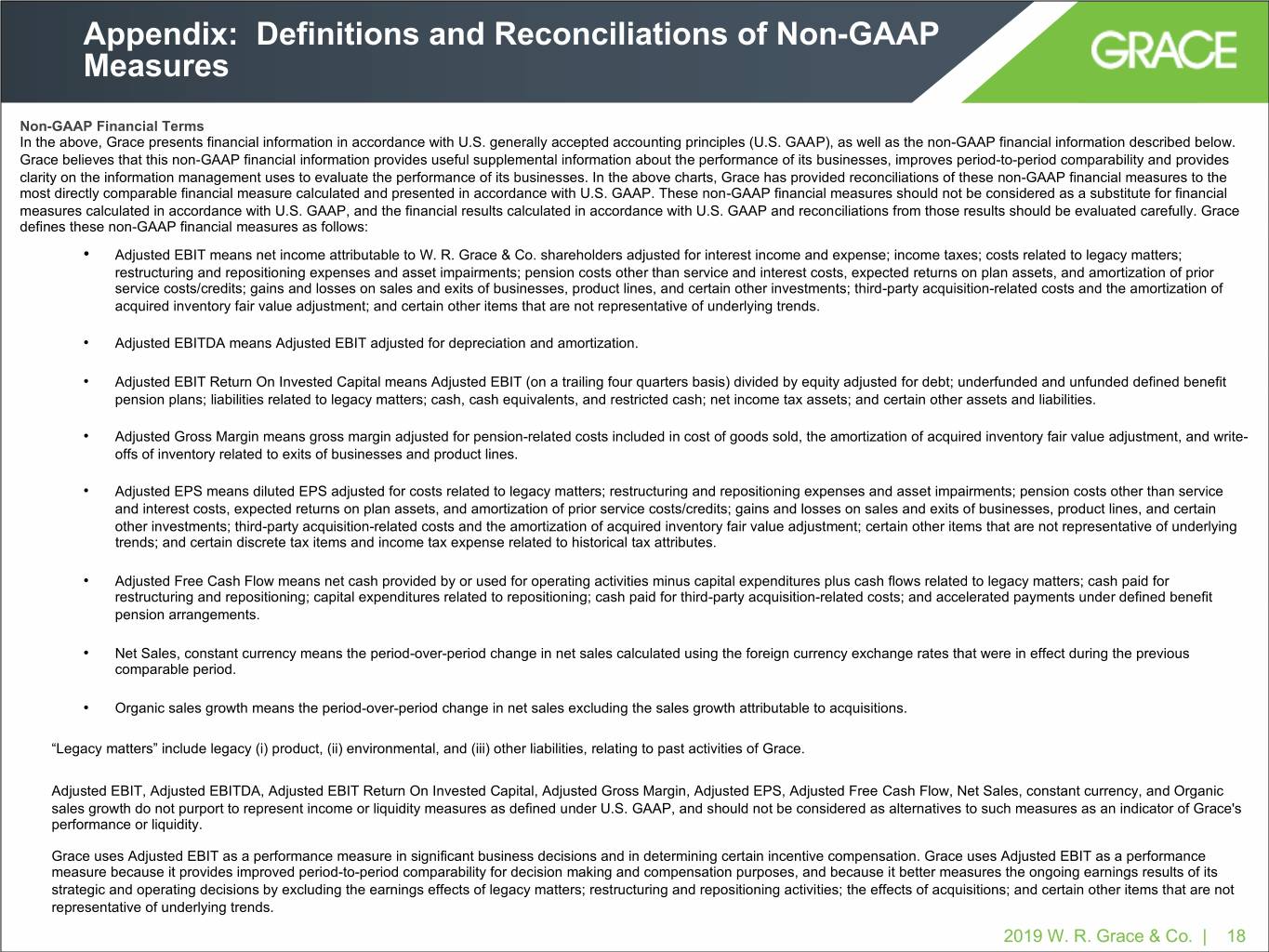

Appendix: Definitions and Reconciliations of Non-GAAP Measures Non-GAAP Financial Terms In the above, Grace presents financial information in accordance with U.S. generally accepted accounting principles (U.S. GAAP), as well as the non-GAAP financial information described below. Grace believes that this non-GAAP financial information provides useful supplemental information about the performance of its businesses, improves period-to-period comparability and provides clarity on the information management uses to evaluate the performance of its businesses. In the above charts, Grace has provided reconciliations of these non-GAAP financial measures to the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP. These non-GAAP financial measures should not be considered as a substitute for financial measures calculated in accordance with U.S. GAAP, and the financial results calculated in accordance with U.S. GAAP and reconciliations from those results should be evaluated carefully. Grace defines these non-GAAP financial measures as follows: • Adjusted EBIT means net income attributable to W. R. Grace & Co. shareholders adjusted for interest income and expense; income taxes; costs related to legacy matters; restructuring and repositioning expenses and asset impairments; pension costs other than service and interest costs, expected returns on plan assets, and amortization of prior service costs/credits; gains and losses on sales and exits of businesses, product lines, and certain other investments; third-party acquisition-related costs and the amortization of acquired inventory fair value adjustment; and certain other items that are not representative of underlying trends. • Adjusted EBITDA means Adjusted EBIT adjusted for depreciation and amortization. • Adjusted EBIT Return On Invested Capital means Adjusted EBIT (on a trailing four quarters basis) divided by equity adjusted for debt; underfunded and unfunded defined benefit pension plans; liabilities related to legacy matters; cash, cash equivalents, and restricted cash; net income tax assets; and certain other assets and liabilities. • Adjusted Gross Margin means gross margin adjusted for pension-related costs included in cost of goods sold, the amortization of acquired inventory fair value adjustment, and write- offs of inventory related to exits of businesses and product lines. • Adjusted EPS means diluted EPS adjusted for costs related to legacy matters; restructuring and repositioning expenses and asset impairments; pension costs other than service and interest costs, expected returns on plan assets, and amortization of prior service costs/credits; gains and losses on sales and exits of businesses, product lines, and certain other investments; third-party acquisition-related costs and the amortization of acquired inventory fair value adjustment; certain other items that are not representative of underlying trends; and certain discrete tax items and income tax expense related to historical tax attributes. • Adjusted Free Cash Flow means net cash provided by or used for operating activities minus capital expenditures plus cash flows related to legacy matters; cash paid for restructuring and repositioning; capital expenditures related to repositioning; cash paid for third-party acquisition-related costs; and accelerated payments under defined benefit pension arrangements. • Net Sales, constant currency means the period-over-period change in net sales calculated using the foreign currency exchange rates that were in effect during the previous comparable period. • Organic sales growth means the period-over-period change in net sales excluding the sales growth attributable to acquisitions. “Legacy matters” include legacy (i) product, (ii) environmental, and (iii) other liabilities, relating to past activities of Grace. Adjusted EBIT, Adjusted EBITDA, Adjusted EBIT Return On Invested Capital, Adjusted Gross Margin, Adjusted EPS, Adjusted Free Cash Flow, Net Sales, constant currency, and Organic sales growth do not purport to represent income or liquidity measures as defined under U.S. GAAP, and should not be considered as alternatives to such measures as an indicator of Grace's performance or liquidity. Grace uses Adjusted EBIT as a performance measure in significant business decisions and in determining certain incentive compensation. Grace uses Adjusted EBIT as a performance measure because it provides improved period-to-period comparability for decision making and compensation purposes, and because it better measures the ongoing earnings results of its strategic and operating decisions by excluding the earnings effects of legacy matters; restructuring and repositioning activities; the effects of acquisitions; and certain other items that are not representative of underlying trends. 2019 W. R. Grace & Co. | 18

Appendix: Definitions and Reconciliations of Non-GAAP Measures (continued) Non-GAAP Financial Terms Grace uses Adjusted EBITDA, Adjusted EBIT Return On Invested Capital, Adjusted Gross Margin, and Adjusted EPS as performance measures and may use these measures in determining certain incentive compensation. Grace uses Adjusted EBIT Return On Invested Capital in making operating and investment decisions and in balancing the growth and profitability of operations. Grace uses Net Sales, constant currency as a performance measure to compare current period financial performance to historical financial performance by excluding the impact of foreign currency exchange rate fluctuations that are not representative of underlying business trends and are largely outside of its control. Grace uses Organic sales growth to measure its businesses' sales performance, excluding the impacts of acquisitions. Grace uses Adjusted Free Cash Flow as a liquidity measure to evaluate its ability to generate cash to support its ongoing business operations, to invest in its businesses, and to provide a return of capital to shareholders. Grace also uses Adjusted Free Cash Flow as a performance measure in determining certain incentive compensation. Adjusted EBIT, Adjusted EBITDA, Adjusted EBIT Return On Invested Capital, Adjusted Gross Margin, Adjusted EPS, Adjusted Free Cash Flow, Net Sales, constant currency, and Organic sales growth do not purport to represent income measures as defined under U.S. GAAP, and should not be used as alternatives to such measures as an indicator of Grace’s performance. These measures are provided to investors and others to improve the period-to-period comparability and peer-to-peer comparability of Grace’s financial results, and to ensure that investors and others understand the information Grace uses to evaluate the performance of its businesses. They distinguish the operating results of Grace's current business base from the costs of Grace's legacy matters; restructuring and repositioning activities; and certain other items. These measures may have material limitations due to the exclusion or inclusion of amounts that are included or excluded, respectively, in the most directly comparable measures calculated and presented in accordance with U.S. GAAP and thus investors and others should review carefully the financial results calculated in accordance with U.S. GAAP. Adjusted EBIT has material limitations as an operating performance measure because it excludes costs related to legacy matters, and may exclude income and expenses from restructuring and repositioning activities, which historically have been material components of Grace’s net income. Adjusted EBITDA also has material limitations as an operating performance measure because it excludes the impact of depreciation and amortization expense. Grace’s business is substantially dependent on the successful deployment of capital, and depreciation and amortization expense is a necessary element of our costs. Grace compensates for the limitations of these measurements by using these indicators together with net income as measured under U.S. GAAP to present a complete analysis of our results of operations. Adjusted EBIT and Adjusted EBITDA should be evaluated together with net income and net income attributable to Grace shareholders, measured under U.S. GAAP, for a complete understanding of Grace’s results of operations. Grace is unable without unreasonable efforts to estimate the annual mark-to-market pension adjustment or future net income or diluted EPS. Without the availability of this significant information, Grace is unable to provide reconciliations for certain forward-looking information set forth in the Outlook, above. (A) Grace's segment operating income includes only Grace's share of income from consolidated and unconsolidated joint ventures. (B) Certain pension costs include only ongoing costs recognized quarterly, which include service and interest costs, expected returns on plan assets, and amortization of prior service costs/credits. Catalysts Technologies and Materials Technologies segment operating income and corporate costs do not include any amounts for pension expense. Other pension related costs including annual mark-to-market adjustments and actuarial gains and losses are excluded from Adjusted EBIT. These amounts are not used by management to evaluate the performance of Grace's businesses and significantly affect the peer-to-peer and period-to-period comparability of our financial results. Mark-to-market adjustments and actuarial gains and losses relate primarily to changes in financial market values and actuarial assumptions and are not directly related to the operation of Grace's businesses. (C) Grace's historical tax attribute carryforwards (net operating losses and tax credits) unfavorably affected its tax expense with respect to certain provisions of the Tax Cuts and Jobs Act of 2017. To normalize the effective tax rate, an adjustment was made to eliminate the tax expense impact associated with the historical tax attributes. NM - Not Meaningful 2019 W. R. Grace & Co. | 19

Appendix: Reconciliation of Non-GAAP Financial Measures (continued) Adjusted EBIT by Operating Segment: 2018 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Catalysts Technologies segment operating income $ 440.5 $ 92.1 $ 113.7 $ 119.5 $ 115.2 $ 101.4 $ 125.2 Materials Technologies segment operating income 105.6 24.1 29.6 26.6 25.3 24.0 24.1 Corporate costs (73.5) (16.6) (19.8) (19.7) (17.4) (16.2) (18.0) Certain pension costs(B) (15.9) (3.8) (4.0) (3.8) (4.3) (4.8) (4.6) Adjusted EBIT 456.7 95.8 119.5 122.6 118.8 104.4 126.7 Costs related to legacy matters (82.3) (2.0) (2.2) (74.6) (3.5) (46.9) (1.5) Restructuring and repositioning expenses (46.4) (5.6) (18.8) (8.4) (13.6) (2.3) (6.4) Write-off of MTO inventory — — — — — — (3.6) Third-party acquisition-related costs (7.3) (0.9) (5.8) (0.5) (0.1) (0.3) (1.0) Amortization of acquired inventory fair value adjustment (6.9) — (4.6) (2.3) — — — Pension MTM adjustment and other related costs, net 15.2 — — — 15.2 — — Loss on early extinguishment of debt (4.8) — (4.8) — — — — Interest expense, net (78.5) (18.9) (19.5) (20.0) (20.1) (19.3) (19.2) (Provision for) benefit from income taxes (78.1) (24.8) (25.0) (0.7) (27.6) (10.9) (18.8) Net income (loss) attributable to W. R. Grace & Co. shareholders $ 167.6 $ 43.6 $ 38.8 $ 16.1 $ 69.1 $ 24.7 $ 76.2 2019 W. R. Grace & Co. | 20

Appendix: Reconciliation of Non-GAAP Financial Measures (continued) Adjusted Free Cash Flow: YTD 2Q 2019 YTD 2Q 2018 Net cash provided by (used for) operating activities 144.9 119.0 Cash paid for capital expenditures (101.5) (90.8) Free Cash Flow 43.4 28.2 Cash paid for legacy matters 7.8 12.6 Cash paid for restructuring 6.3 5.1 Cash paid for repositioning 10.0 11.2 Cash paid for third-party acquisition-related costs 0.6 3.0 Accelerated defined benefit pension plan contributions — 50.0 Adjusted Free Cash Flow $ 68.1 $ 110.1 Four Quarters Ended June 30, Calculation of Adjusted EBIT Return On Invested Capital (trailing four quarters): 2019 2018 Net income (loss) attributable to W. R. Grace & Co. shareholders $ 186.1 $ 6.8 Adjusted EBIT 472.5 438.5 Total equity 387.3 294.9 Reconciliation to Invested Capital: Total debt 1,983.0 1,986.6 Underfunded and unfunded defined benefit pension plans 433.9 452.2 Liabilities related to legacy matters 165.5 61.5 Cash, cash equivalents, and restricted cash (159.9) (132.8) Net income tax assets (502.1) (515.5) Other 18.7 14.4 Adjusted Invested Capital $ 2,326.4 $ 2,161.3 Return on equity 48.1% 2.3% Adjusted EBIT Return On Invested Capital 20.3% 20.3% 2019 W. R. Grace & Co. | 21

Appendix: Reconciliation of Non-GAAP Financial Measures (continued) Three Months Ended June 30, 2019 2018 (In millions, except per share amounts) Pre-Tax Tax Effect After Tax Per Share Pre-Tax Tax Effect After Tax Per Share Diluted earnings per share $ 1.14 $ 0.58 Restructuring and repositioning expenses $ 6.4 $ 1.1 $ 5.3 0.08 $ 18.8 $ 4.6 $ 14.2 0.21 Costs related to legacy matters 1.5 0.4 1.1 0.02 2.2 0.6 1.6 0.02 Write-off of MTO inventory 3.6 — 3.6 0.05 — — — — Third-party acquisition-related costs 1.0 0.3 0.7 0.01 5.8 1.3 4.5 0.07 Amortization of acquired inventory fair value adjustment — — — — 4.6 1.1 3.5 0.05 Loss on early extinguishment of debt — — — — 4.8 1.1 3.7 0.05 Income tax expense related to historical tax attributes (2.3) 2.3 0.03 (4.7) 4.7 0.07 Discrete tax items 11.3 (11.3) (0.17) (1.1) 1.1 0.02 Adjusted EPS $ 1.16 $ 1.07 Six months ended June 30, 2019 2018 (In millions, except per share amounts) Pre-Tax Tax Effect After Tax Per Share Pre-Tax Tax Effect After Tax Per Share Diluted earnings per share $ 1.51 $ 1.22 Restructuring and repositioning expenses $ 8.7 $ 1.6 $ 7.1 0.11 $ 24.4 $ 5.7 $ 18.7 0.28 Costs related to legacy matters 48.4 13.2 35.2 0.53 4.2 1.0 3.2 0.05 Write-off of MTO inventory 3.6 — 3.6 0.05 — — — — Third-party acquisition-related costs 1.3 0.4 0.9 0.01 6.7 1.6 5.1 0.08 Amortization of acquired inventory fair value adjustment — — — — 4.6 1.1 3.5 0.05 Loss on early extinguishment of debt — — — — 4.8 1.1 3.7 0.05 Income tax expense related to historical tax attributes (2.3) 2.3 0.03 (9.4) 9.4 0.14 Discrete tax items 10.3 (10.3) (0.15) (1.1) 1.1 0.02 Adjusted EPS $ 2.09 $ 1.89 2019 W. R. Grace & Co. | 22