Use these links to rapidly review the document

W. R. GRACE & CO. AND SUBSIDIARIES Table of Contents

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| | |

ý |

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended September 30, 2009 |

OR |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-13953

|

W. R. GRACE & CO.

| | |

| Delaware | | 65-0773649 |

| (State of Incorporation) | | (I.R.S. Employer Identification No.) |

7500 Grace Drive

Columbia, Maryland 21044

(410) 531-4000

(Address and phone number of principal executive offices)

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer ý | | Accelerated filer o | | Non-accelerated filer o

(Do not check if a smaller

reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date.

| | |

| Class | | Outstanding at October 31, 2009 |

|---|

| Common Stock, $0.01 par value per share | | 72,236,518 shares |

Table of Contents

W. R. GRACE & CO. AND SUBSIDIARIES

Table of Contents

| | | | | | | | |

Part I. | | Financial Information | | |

| | Item 1. | | Financial Statements (unaudited) | | 1 |

| | | | Report of Independent Registered Public Accounting Firm | | 2 |

| | | | Consolidated Statements of Operations | | 3 |

| | | | Consolidated Statements of Cash Flows | | 4 |

| | | | Consolidated Balance Sheets | | 5 |

| | | | Consolidated Statements of Equity (Deficit) | | 6 |

| | | | Consolidated Statements of Comprehensive Income | | 7 |

| | | | Notes to Consolidated Financial Statements | | |

| | | | 1. | | Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies | | 8 |

| | | | 2. | | Chapter 11—Related Information | | 12 |

| | | | 3. | | Asbestos-Related Litigation | | 26 |

| | | | 4. | | Life Insurance | | 30 |

| | | | 5. | | Inventories | | 31 |

| | | | 6. | | Debt | | 32 |

| | | | 7. | | Fair Value Measurements | | 32 |

| | | | 8. | | Income Taxes | | 37 |

| | | | 9. | | Pension Plans and Other Postretirement Benefit Plans | | 39 |

| | | | 10. | | Other Balance Sheet Accounts | | 42 |

| | | | 11. | | Commitments and Contingent Liabilities | | 42 |

| | | | 12. | | Restructuring Expenses | | 45 |

| | | | 13. | | Product Line Sales | | 46 |

| | | | 14. | | Other (Income) Expense, net | | 47 |

| | | | 15. | | Comprehensive Income (Loss) | | 47 |

| | | | 16. | | Earnings Per Share | | 50 |

| | | | 17. | | Operating Segment Information | | 50 |

| | | | 18. | | Noncontrolling Interests in Consolidated Entities | | 53 |

| | Item 2. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 54 |

| | Item 3. | | Quantitative and Qualitative Disclosures About Market Risk | | 79 |

| | Item 4. | | Controls and Procedures | | 79 |

Part II. | | Other Information | | |

| | Item 1. | | Legal Proceedings | | 81 |

| | Item 1A. | | Risk Factors | | 81 |

| | Item 6. | | Exhibits | | 82 |

Unless the context otherwise indicates, in this Report the terms "Grace," "we," "us," "our" or "the company" mean W. R. Grace & Co. and/or its consolidated subsidiaries and affiliates. Unless otherwise indicated, the contents of websites mentioned in this report are not incorporated by reference or otherwise made a part of this Report. Grace®, the Grace® logo and, except as otherwise indicated, the other product names used in the text of this report are trademarks, service marks, and/or trade names of operating units of W. R. Grace & Co. or its affiliates and/or subsidiaries.

Table of Contents

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Review by Independent Registered Public Accounting Firm

With respect to the interim consolidated financial statements included in this Quarterly Report on Form 10-Q for the quarter ended September 30, 2009, PricewaterhouseCoopers LLP, the company's independent registered public accounting firm, has applied limited procedures in accordance with professional standards for a review of such information. Their report on the interim consolidated financial statements, which follows, states that they did not audit and they do not express an opinion on the unaudited interim financial statements. Accordingly, the degree of reliance on their report on the unaudited interim financial statements should be restricted in light of the limited nature of the review procedures applied. This report is not considered a "report" within the meaning of Sections 7 and 11 of the Securities Act of 1933, and, therefore, the independent accountants' liability under Section 11 does not extend to it.

1

Table of Contents

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of W. R. Grace & Co.:

We have reviewed the accompanying consolidated balance sheet of W. R. Grace & Co. and its subsidiaries as of September 30, 2009, and the related consolidated statements of operations, equity (deficit), and comprehensive income (loss) for the three-month and nine-month periods ended September 30, 2009 and 2008 and the consolidated statements of cash flows for the nine-month periods ended September 30, 2009 and 2008. These interim financial statements are the responsibility of the Company's management.

We conducted our review in accordance with the standards of the Public Company Accounting Oversight Board (United States). A review of interim financial information consists principally of applying analytical procedures and making inquiries of persons responsible for financial and accounting matters. It is substantially less in scope than an audit conducted in accordance with the standards of the Public Company Accounting Oversight Board (United States), the objective of which is the expression of an opinion regarding the financial statements taken as a whole. Accordingly, we do not express such an opinion.

Based on our review, we are not aware of any material modifications that should be made to the accompanying interim consolidated financial statements for them to be in conformity with accounting principles generally accepted in the United States of America.

The accompanying interim consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Notes 1 and 2 to the interim consolidated financial statements, on April 2, 2001, the Company and substantially all of its domestic subsidiaries voluntarily filed for protection under Chapter 11 of the United States Bankruptcy Code, which raises substantial doubt about the Company's ability to continue as a going concern in its present form. Management's intentions with respect to this matter are also described in Notes 1 and 2. The accompanying interim consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We previously audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheet as of December 31, 2008, and the related consolidated statements of operations, equity (deficit), comprehensive income (loss), and of cash flows for the year then ended (not presented herein), and in our report dated February 27, 2009, we expressed an unqualified opinion on those consolidated financial statements with an explanatory paragraph relating to the Company's ability to continue as a going concern. As discussed in Note 1 to the accompanying consolidated financial statements, the Company changed its method of accounting for noncontrolling interests. The accompanying December 31, 2008 consolidated balance sheet reflects this change.

PricewaterhouseCoopers LLP

McLean, Virginia

November 6, 2009

2

Table of Contents

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Operations (unaudited)

(In millions, except per share amounts)

| | | | | | | | | | | | | | |

| | Three Months

Ended

September 30, | | Nine Months

Ended

September 30, | |

|---|

| | 2009 | | 2008 | | 2009 | | 2008 | |

|---|

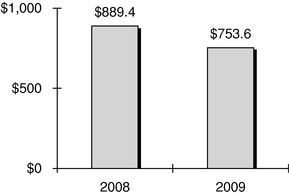

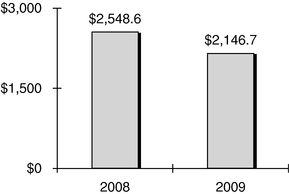

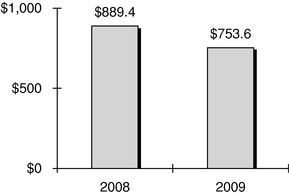

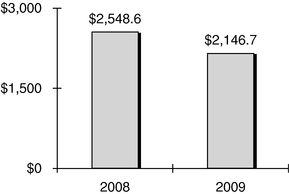

Net sales | | $ | 753.6 | | $ | 889.4 | | $ | 2,146.7 | | $ | 2,548.6 | |

Cost of goods sold | | | 491.1 | | | 630.8 | | | 1,470.6 | | | 1,774.0 | |

| | | | | | | | | | |

Gross profit | | | 262.5 | | | 258.6 | | | 676.1 | | | 774.6 | |

Selling, general and administrative expenses | | |

136.7 | | |

150.7 | | |

425.8 | | |

441.7 | |

Restructuring expenses | | | 1.9 | | | — | | | 26.9 | | | 5.2 | |

Gain on sales of product lines | | | (22.2 | ) | | — | | | (22.2 | ) | | — | |

Research and development expenses | | | 16.6 | | | 20.5 | | | 52.8 | | | 63.4 | |

Defined benefit pension expense | | | 21.5 | | | 14.1 | | | 63.9 | | | 42.4 | |

Interest expense and related financing costs | | | 9.7 | | | 13.2 | | | 28.5 | | | 42.8 | |

Provision for environmental remediation | | | 0.4 | | | 2.9 | | | 1.1 | | | 8.8 | |

Chapter 11 expenses, net of interest income | | | 18.4 | | | 12.0 | | | 36.4 | | | 48.4 | |

Other (income) expense, net | | | 5.1 | | | 17.1 | | | 11.2 | | | (6.5 | ) |

| | | | | | | | | | |

| | | 188.1 | | | 230.5 | | | 624.4 | | | 646.2 | |

| | | | | | | | | | |

Income before income taxes | | | 74.4 | | | 28.1 | | | 51.7 | | | 128.4 | |

Benefit from (provision for) income taxes | | | (23.6 | ) | | 4.3 | | | (17.0 | ) | | (38.9 | ) |

| | | | | | | | | | |

Net income | | | 50.8 | | | 32.4 | | | 34.7 | | | 89.5 | |

Less: Net income attributable to noncontrolling interests | | | (6.4 | ) | | (4.1 | ) | | (9.9 | ) | | (11.4 | ) |

| | | | | | | | | | |

Net income attributable to W. R. Grace & Co. shareholders | | $ | 44.4 | | $ | 28.3 | | $ | 24.8 | | $ | 78.1 | |

| | | | | | | | | | |

Earnings Per Share Attributable to W. R. Grace & Co. Shareholders | | | | | | | | | | | | | |

Basic earnings per share: | | | | | | | | | | | | | |

| | Net income | | $ | 0.61 | | $ | 0.39 | | $ | 0.34 | | $ | 1.08 | |

| | Weighted average number of basic shares | | | 72.2 | | | 72.2 | | | 72.2 | | | 72.0 | |

Diluted earnings per share: | | | | | | | | | | | | | |

| | Net income | | $ | 0.61 | | $ | 0.39 | | $ | 0.34 | | $ | 1.07 | |

| | Weighted average number of diluted shares | | | 72.9 | | | 72.8 | | | 72.3 | | | 72.7 | |

The Notes to Consolidated Financial Statements are an integral part of these statements.

3

Table of Contents

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Cash Flows (unaudited)

(In millions)

| | | | | | | | |

| | Nine Months

Ended

September 30, | |

|---|

| | 2009 | | 2008 | |

|---|

OPERATING ACTIVITIES | | | | | | | |

Net income | | $ | 34.7 | | $ | 89.5 | |

Reconciliation to net cash provided by (used for) operating activities: | | | | | | | |

| | Depreciation and amortization | | | 84.5 | | | 90.8 | |

| | Chapter 11 expenses, net of interest income | | | 36.4 | | | 48.4 | |

| | Provision for income taxes | | | 17.0 | | | 38.9 | |

| | Income taxes paid, net of refunds | | | (8.1 | ) | | (44.3 | ) |

| | Interest accrued on pre-petition liabilities subject to compromise | | | 26.9 | | | 38.8 | |

| | Net (gain) loss on sales of product lines and disposals of assets | | | (25.2 | ) | | 0.3 | |

| | Restructuring expenses | | | 26.9 | | | 5.2 | |

| | Defined benefit pension expense | | | 63.9 | | | 42.4 | |

| | Payments under defined benefit pension arrangements | | | (42.5 | ) | | (57.4 | ) |

| | Payments under postretirement benefit plans | | | (1.5 | ) | | (4.7 | ) |

| | Net income from life insurance policies | | | (1.2 | ) | | (2.0 | ) |

| | Provision for uncollectible receivables | | | 2.9 | | | 0.8 | |

| | Provision for environmental remediation | | | 1.1 | | | 8.8 | |

| | Expenditures for environmental remediation | | | (5.8 | ) | | (3.3 | ) |

| | Expenditures for retained obligations of divested businesses | | | — | | | (0.1 | ) |

Changes in assets and liabilities, excluding effect of businesses acquired/divested and foreign currency translation: | | | | | | | |

Working capital items (trade accounts receivable, inventories and accounts payable) | | | 99.5 | | | (85.9 | ) |

Other accruals and non-cash items | | | (29.1 | ) | | (30.0 | ) |

| | | | | | |

Net cash provided by operating activities before Chapter 11 expenses and settlements | | | 280.4 | | | 136.2 | |

Cash paid to resolve contingencies subject to Chapter 11 | | | — | | | (252.0 | ) |

Chapter 11 expenses paid | | | (34.9 | ) | | (52.9 | ) |

| | | | | | |

Net cash provided by (used for) operating activities | | | 245.5 | | | (168.7 | ) |

| | | | | | |

INVESTING ACTIVITIES | | | | | | | |

Capital expenditures | | | (53.6 | ) | | (93.1 | ) |

Proceeds from sales of investment securities | | | 17.7 | | | 61.5 | |

Purchases of equity investments | | | (1.5 | ) | | (3.0 | ) |

Proceeds from termination of life insurance policies | | | 68.8 | | | 8.1 | |

Net investment in life insurance policies | | | (0.6 | ) | | (0.2 | ) |

Proceeds from disposals of assets | | | 8.0 | | | 2.8 | |

Proceeds from sales of product lines | | | 26.7 | | | — | |

| | | | | | |

Net cash provided by (used for) investing activities | | | 65.5 | | | (23.9 | ) |

| | | | | | |

FINANCING ACTIVITIES | | | | | | | |

Dividends paid to noncontrolling interests in consolidated entities | | | (14.3 | ) | | (13.3 | ) |

Proceeds from life insurance policy loans | | | — | | | 40.0 | |

Net (repayments) borrowings under credit arrangements | | | (4.8 | ) | | 1.5 | |

Fees paid under debtor-in-possession credit facility | | | (1.4 | ) | | (1.6 | ) |

Proceeds from exercise of stock options | | | 0.6 | | | 9.6 | |

| | | | | | |

Net cash provided by (used for) financing activities | | | (19.9 | ) | | 36.2 | |

| | | | | | |

Effect of currency exchange rate changes on cash and cash equivalents | | | 14.2 | | | 1.1 | |

| | | | | | |

Increase (decrease) in cash and cash equivalents | | | 305.3 | | | (155.3 | ) |

Cash and cash equivalents, beginning of period | | | 460.1 | | | 480.5 | |

| | | | | | |

Cash and cash equivalents, end of period | | $ | 765.4 | | $ | 325.2 | |

| | | | | | |

The Notes to Consolidated Financial Statements are an integral part of these statements.

4

Table of Contents

W. R. Grace & Co. and Subsidiaries

Consolidated Balance Sheets (unaudited)

(In millions, except par value and shares)

| | | | | | | | |

| | September 30,

2009 | | December 31,

2008 | |

|---|

ASSETS | | | | | | | |

Current Assets | | | | | | | |

Cash and cash equivalents | | $ | 765.4 | | $ | 460.1 | |

Investment securities | | | 4.8 | | | 21.6 | |

Cash value of life insurance policies, net of policy loans | | | — | | | 67.2 | |

Trade accounts receivable, less allowance of $6.4 (2008—$5.0) | | | 442.1 | | | 462.6 | |

Inventories | | | 261.2 | | | 354.8 | |

Deferred income taxes | | | 42.5 | | | 45.8 | |

Other current assets | | | 75.3 | | | 86.1 | |

| | | | | | |

| | Total Current Assets | | | 1,591.3 | | | 1,498.2 | |

Properties and equipment, net of accumulated depreciation and amortization of $1,611.7 (2008—$1,545.3) | | | 686.6 | | | 710.6 | |

Goodwill | | | 120.2 | | | 117.1 | |

Deferred income taxes | | | 880.4 | | | 851.7 | |

Asbestos-related insurance | | | 500.0 | | | 500.0 | |

Overfunded defined benefit pension plans | | | 33.9 | | | 48.6 | |

Other assets | | | 124.4 | | | 149.3 | |

| | | | | | |

| | Total Assets | | $ | 3,936.8 | | $ | 3,875.5 | |

| | | | | | |

LIABILITIES AND EQUITY (DEFICIT) | | | | | | | |

Liabilities Not Subject to Compromise | | | | | | | |

Current Liabilities | | | | | | | |

Debt payable within one year | | $ | 6.6 | | $ | 11.2 | |

Accounts payable | | | 177.6 | | | 207.6 | |

Other current liabilities | | | 312.0 | | | 314.3 | |

| | | | | | |

| | Total Current Liabilities | | | 496.2 | | | 533.1 | |

Debt payable after one year | | | 0.4 | | | 0.6 | |

Deferred income taxes | | | 5.8 | | | 7.1 | |

Underfunded defined benefit pension plans | | | 397.6 | | | 392.3 | |

Unfunded pay-as-you-go defined benefit pension plans | | | 153.7 | | | 136.7 | |

Other liabilities | | | 42.2 | | | 46.6 | |

| | | | | | |

| | Total Liabilities Not Subject to Compromise | | | 1,095.9 | | | 1,116.4 | |

Liabilities Subject to Compromise—Note 2 | | | | | | | |

Pre-petition bank debt plus accrued interest | | | 843.7 | | | 823.5 | |

Drawn letters of credit plus accrued interest | | | 30.9 | | | 30.0 | |

Income tax contingencies | | | 123.9 | | | 121.0 | |

Asbestos-related contingencies | | | 1,700.0 | | | 1,700.0 | |

Environmental contingencies | | | 147.5 | | | 152.2 | |

Postretirement benefits | | | 181.1 | | | 169.7 | |

Other liabilities and accrued interest | | | 126.1 | | | 116.5 | |

| | | | | | |

| | Total Liabilities Subject to Compromise | | | 3,153.2 | | | 3,112.9 | |

| | | | | | |

| | Total Liabilities | | | 4,249.1 | | | 4,229.3 | |

| | | | | | |

Commitments and Contingencies | | | | | | | |

Equity (Deficit) | | | | | | | |

Common stock issued, par value $0.01; 300,000,000 shares authorized; outstanding: 2009—72,220,768 (2008—72,157,518) | | | 0.8 | | | 0.8 | |

Paid-in capital | | | 441.6 | | | 436.6 | |

Accumulated deficit | | | (221.8 | ) | | (246.6 | ) |

Treasury stock, at cost: shares: 2009—4,758,992; (2008—4,822,242) | | | (56.6 | ) | | (57.4 | ) |

Accumulated other comprehensive income (loss) | | | (544.5 | ) | | (560.3 | ) |

| | | | | | |

| | Total W. R. Grace & Co. Shareholders' Equity (Deficit) | | | (380.5 | ) | | (426.9 | ) |

Noncontrolling interests in consolidated entities | | | 68.2 | | | 73.1 | |

| | | | | | |

| | Total Equity (Deficit) | | | (312.3 | ) | | (353.8 | ) |

| | | | | | |

| | Total Liabilities and Equity (Deficit) | | $ | 3,936.8 | | $ | 3,875.5 | |

| | | | | | |

The Notes to Consolidated Financial Statements are an integral part of these statements.

5

Table of Contents

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Equity (Deficit) (unaudited)

(In millions)

| | | | | | | | | | | | | | | | | | | |

| | Common

Stock

and

Paid-in

Capital | | Accumulated

Deficit | | Treasury

Stock | | Accumulated

Other

Comprehensive

Income (Loss) | | Noncontrolling

Interests | | Total

Equity

(Deficit) | |

|---|

Balance, June 30, 2009 | | $ | 440.5 | | $ | (266.2 | ) | $ | (57.4 | ) | $ | (531.7 | ) | $ | 63.1 | | $ | (351.7 | ) |

Net income | | | — | | | 44.4 | | | — | | | — | | | 6.4 | | | 50.8 | |

Stock plan activity | | | 1.9 | | | — | | | 0.8 | | | — | | | — | | | 2.7 | |

Other comprehensive loss | | | — | | | — | | | — | | | (12.8 | ) | | (0.7 | ) | | (13.5 | ) |

Dividends paid | | | — | | | — | | | — | | | — | | | (0.6 | ) | | (0.6 | ) |

| | | | | | | | | | | | | | |

Balance, September 30, 2009 | | $ | 442.4 | | $ | (221.8 | ) | $ | (56.6 | ) | $ | (544.5 | ) | $ | 68.2 | | $ | (312.3 | ) |

| | | | | | | | | | | | | | |

Balance, December 31, 2008 | | $ | 437.4 | | $ | (246.6 | ) | $ | (57.4 | ) | $ | (560.3 | ) | $ | 73.1 | | $ | (353.8 | ) |

Net income | | | — | | | 24.8 | | | — | | | — | | | 9.9 | | | 34.7 | |

Stock plan activity | | | 5.0 | | | — | | | 0.8 | | | — | | | — | | | 5.8 | |

Other comprehensive income (loss) | | | — | | | — | | | — | | | 15.8 | | | (0.5 | ) | | 15.3 | |

Dividends paid | | | — | | | — | | | — | | | — | | | (14.3 | ) | | (14.3 | ) |

| | | | | | | | | | | | | | |

Balance, September 30, 2009 | | $ | 442.4 | | $ | (221.8 | ) | $ | (56.6 | ) | $ | (544.5 | ) | $ | 68.2 | | $ | (312.3 | ) |

| | | | | | | | | | | | | | |

The Notes to Consolidated Financial Statements are an integral part of these statements.

6

Table of Contents

W. R. Grace & Co. and Subsidiaries

Consolidated Statements of Comprehensive Income (unaudited)

(In millions)

| | | | | | | | | | | | | |

| | Three Months

Ended

September 30, | | Nine Months

Ended

September 30, | |

|---|

| | 2009 | | 2008 | | 2009 | | 2008 | |

|---|

Net income | | $ | 50.8 | | $ | 32.4 | | $ | 34.7 | | $ | 89.5 | |

| | | | | | | | | | |

Other comprehensive income (loss): | | | | | | | | | | | | | |

Foreign currency translation adjustments | | | 10.9 | | | (1.8 | ) | | 30.1 | | | (4.4 | ) |

Gain (loss) from hedging activities, net of income taxes | | | 2.8 | | | (7.5 | ) | | 5.3 | | | (3.5 | ) |

Defined benefit pension and other postretirement plans, net of income taxes | | | (26.7 | ) | | 20.2 | | | (20.6 | ) | | 21.1 | |

Unrealized holding gain on available-for-sale securities | | | 0.2 | | | — | | | 1.0 | | | — | |

| | | | | | | | | | |

Total other comprehensive income (loss) attributable to W. R. Grace & Co. shareholders | | | (12.8 | ) | | 10.9 | | | 15.8 | | | 13.2 | |

Total other comprehensive loss attributable to noncontrolling interests | | | (0.7 | ) | | (0.9 | ) | | (0.5 | ) | | (1.6 | ) |

| | | | | | | | | | |

Total other comprehensive income (loss) | | | (13.5 | ) | | 10.0 | | | 15.3 | | | 11.6 | |

| | | | | | | | | | |

Comprehensive income | | $ | 37.3 | | $ | 42.4 | | $ | 50.0 | | $ | 101.1 | |

| | | | | | | | | | |

The Notes to Consolidated Financial Statements are an integral part of these statements.

7

Table of Contents

Notes to Consolidated Financial Statements

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies

W. R. Grace & Co., through its subsidiaries, is engaged in specialty chemicals and specialty materials businesses on a worldwide basis through two operating segments: Grace Davison, which includes specialty catalysts and materials used in a wide range of energy, refining, consumer, industrial, packaging and life sciences applications; and Grace Construction Products, which includes specialty chemicals and materials used in commercial, infrastructure and residential construction.

W. R. Grace & Co. conducts substantially all of its business through a direct, wholly-owned subsidiary, W. R. Grace & Co.-Conn. ("Grace-Conn."). Grace-Conn. owns substantially all of the assets, properties and rights of W. R. Grace & Co. on a consolidated basis, either directly or through subsidiaries.

As used in these notes, the term "Company" refers to W. R. Grace & Co. The term "Grace" refers to the Company and/or one or more of its subsidiaries and, in certain cases, their respective predecessors.

Voluntary Bankruptcy Filing During 2000 and the first quarter of 2001, Grace experienced several adverse developments in its asbestos-related litigation, including: a significant increase in personal injury claims, higher than expected costs to resolve personal injury and certain property damage claims, and class action lawsuits alleging damages from Zonolite Attic Insulation ("ZAI"), a former Grace attic insulation product.

After a thorough review of these developments, Grace's Board of Directors concluded that a federal court-supervised bankruptcy process provided the best forum available to achieve fairness in resolving these claims and on April 2, 2001 (the "Filing Date"), Grace and 61 of its United States subsidiaries and affiliates, including Grace-Conn. (collectively, the "Debtors"), filed voluntary petitions for reorganization (the "Filing") under Chapter 11 of the United States Bankruptcy Code ("Chapter 11") in the United States Bankruptcy Court for the District of Delaware (the "Bankruptcy Court"). The cases were consolidated and are being jointly administered under case number 01-01139 (the "Chapter 11 Cases"). Grace's non-U.S. subsidiaries and certain of its U.S. subsidiaries were not included in the Filing.

Under Chapter 11, the Debtors have continued to operate their businesses as debtors-in-possession under court protection from creditors and claimants, while using the Chapter 11 process to develop and implement a plan for addressing the asbestos-related claims. Since the Filing, all motions necessary to conduct normal business activities have been approved by the Bankruptcy Court. (See Note 2 for Chapter 11—Related Information.)

Basis of Presentation The interim Consolidated Financial Statements presented herein are unaudited and should be read in conjunction with the Consolidated Financial Statements presented in the Company's 2008 Annual Report on Form 10-K. Such interim Consolidated Financial Statements reflect all adjustments that, in the opinion of management, are necessary for a fair presentation of the results of the interim periods presented; all such adjustments are of a normal recurring nature except for the impacts of adopting new accounting standards as discussed below. Potential accounting adjustments discovered during normal reporting and accounting processes are evaluated on the basis of materiality, both individually and in the aggregate, and are recorded in the accounting period discovered, unless a restatement of a prior period is necessary. All significant intercompany accounts and transactions have been eliminated.

8

Table of Contents

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

The results of operations for the nine-month interim period ended September 30, 2009 are not necessarily indicative of the results of operations for the year ending December 31, 2009.

Reclassifications Certain amounts in prior years' Consolidated Financial Statements have been reclassified to conform to the 2009 presentation. Such reclassifications have not materially affected previously reported amounts in the Consolidated Financial Statements.

Use of Estimates The preparation of financial statements in conformity with U.S. Generally Accepted Accounting Principles ("U.S. GAAP") requires management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the Consolidated Financial Statements, and the reported amounts of revenues and expenses for the periods presented. Actual amounts could differ from those estimates, and the differences could be material. Changes in estimates are recorded in the period identified. Grace's accounting measurements that are most affected by management's estimates of future events are:

- •

- Contingent liabilities, which depend on an assessment of the probability of loss and an estimate of ultimate resolution cost, such as asbestos-related matters (see Notes 2 and 3), environmental remediation (see Note 11), income taxes (see Note 8), and litigation (see Note 11);

- •

- Pension and postretirement liabilities that depend on assumptions regarding participant life spans, future inflation, discount rates and total returns on invested funds (see Note 9); and

- •

- Realization values of net deferred tax assets and insurance receivables, which depend on projections of future income and cash flows and assessments of insurance coverage and insurer solvency.

The accuracy of management's estimates may be materially affected by the uncertainties arising under Grace's Chapter 11 proceeding.

Effect of New Accounting Standards—In June 2009, the Financial Accounting Standards Board ("FASB") issued FASB Accounting Standards Codification ("ASC") No. 105 and the Hierarchy of Generally Accepted Accounting Principles, which is effective for financial statements issued for interim and annual periods ending after September 15, 2009. The Codification does not change current U.S. GAAP, but is intended to simplify user access by providing all of the authoritative literature related to a particular topic in one place, and as of the effective date, all existing accounting standard documents were superseded. Grace has included the references to the Codification, as appropriate, in this Form 10-Q.

In June 2009, the FASB issued SFAS No. 167, "Amendments to FASB Interpretation No. 46(R)." The objective of this Statement is to improve financial reporting by enterprises involved with variable interest entities. The Statement is effective as of the beginning of each reporting entity's first annual reporting period that begins after November 15, 2009, for interim periods within that first annual reporting period, and for interim and annual reporting periods thereafter. Grace will adopt this standard for 2010 and does not expect it to have a material effect on the Consolidated Financial Statements.

In May 2009, the FASB issued SFAS No. 165, "Subsequent Events", which was subsequently codified as ASC 855. The objective of this Statement is to establish general standards of accounting

9

Table of Contents

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

for and disclosure of events that occur after the balance sheet date but before financial statements are issued or are available to be issued. This Statement is effective for interim or annual financial periods ending after June 15, 2009, and accordingly, Grace has adopted this Standard. ASC 855 requires that public entities evaluate subsequent events through the date that the financial statements are issued. We have evaluated subsequent events through the time of filing these financial statements with the SEC on November 6, 2009.

In April 2009, the FASB issued FASB Staff Position ("FSP") No. FAS 107-1 and APB 28-1, "Interim Disclosures about Fair Value of Financial Instruments", which was subsequently codified as ASC 825. ASC 825 amends FASB Statement No. 107 (subsequently codified ASC 825),Disclosures about Fair Value of Financial Instruments, to require disclosures about fair value of financial instruments for interim reporting periods of publicly traded companies as well as for annual financial statements. ASC 825 also amends APB Opinion No. 28 (subsequently codified as ASC 270),Interim Financial Reporting, to require those disclosures in summarized financial information at interim reporting periods. ASC 825 is effective for interim reporting periods ending after June 15, 2009, and accordingly, Grace has adopted this standard.

In April 2009, the FASB issued FSP No. FAS 115-2 and FAS 124-2, "Recognition and Presentation of Other-Than-Temporary Impairments", which was subsequently codified as ASC 320. ASC 320 changed the method for determining whether an other-than-temporary impairment exists for debt securities and the amount of an impairment charge to be recorded in earnings. ASC 320 is effective for interim and annual periods ending after June 15, 2009 and accordingly, Grace has adopted this standard. This standard has not had a material effect on the Consolidated Financial Statements.

In January 2009, the FASB Emerging Issues Task Force ("EITF") issued EITF 99-20-1, "Amendments to the Impairment Guidance of EITF Issue No. 99-20", which was subsequently codified as ASC 325. The objective of ASC 325 is to achieve more consistent determination of whether an other-than-temporary impairment has occurred, and to retain and emphasize the objective of an other-than-temporary impairment assessment and the related disclosure requirements in FASB Statement No. 115,Accounting for Certain Investments in Debt and Equity Securities, which was subsequently codified as ASC 320, and other related guidance. This standard is effective for interim and annual reporting periods ending after December 15, 2008, and applies prospectively. Grace has adopted ASC 325 in 2009.

In December 2007, the FASB issued SFAS No. 141(R), "Business Combinations", which was subsequently codified as ASC 805. ASC 805 requires the acquirer in a business combination to recognize the assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree at the acquisition date, measured at their fair values as of that date, with acquisition-related costs recognized separately from the acquisition. In March 2009, the FASB issued FSP No. FAS 141(R)-1, "Accounting for Assets Acquired and Liabilities Assumed in a Business Combination That Arise from Contingencies", which was subsequently codified as ASC 805. This standard addresses application issues on initial recognition and measurement, subsequent measurement and accounting, and disclosure of assets and liabilities arising from contingencies in a business combination. This standard is effective for assets or liabilities arising from contingencies in business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008. Grace has adopted this standard in 2009.

10

Table of Contents

Notes to Consolidated Financial Statements (Continued)

1. Basis of Presentation and Summary of Significant Accounting and Financial Reporting Policies (Continued)

In December 2008, the FASB issued FSP No. FAS 132(R)-1 "Disclosures about Postretirement Benefit Plan Assets" which was subsequently codified as ASC 718. This standard amends FASB Statement No. 132 (revised 2003),Employers' Disclosures about Pensions and Other Postretirement Benefits, which was subsequently codified as ASC 230, to provide guidance on an employer's disclosures about plan assets of a defined benefit pension or other postretirement plan. ASC 718 shall be effective for fiscal years ending after December 15, 2009. Grace will adopt these disclosure requirements for its 2009 Annual Report on Form 10-K.

In April 2008, the FASB issued FSP No. FAS 142-3 "Determination of the Useful Life of Intangible Assets", which was subsequently codified as ASC 350. This standard will improve the consistency between the useful life of a recognized intangible asset under ASC 350 and the period of expected cash flows used to measure the fair value of the asset under ASC 805, and other U.S. GAAP. This standard is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. Grace has adopted this standard, and it did not materially impact the Consolidated Financial Statements.

In March 2008, the FASB issued SFAS No. 161, "Disclosures about Derivative Instruments and Hedging Activities—an amendment of FASB Statement No. 133", which was subsequently codified as ASC 815. This standard expands the current disclosure framework by requiring entities to provide qualitative disclosures about the objectives and strategies for using derivatives, quantitative data about the fair value of and gains and losses on derivative contracts, and details of credit-risk-related contingent features in their hedged positions. ASC 815 is effective for fiscal years beginning after November 15, 2008 and interim periods within those fiscal years. Grace has adopted these disclosure requirements.

In December 2007, the FASB issued SFAS No. 160, "Noncontrolling Interests in Consolidated Financial Statements"' which was subsequently codified as ASC 810. ASC 810 establishes new accounting and reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. ASC 810 is effective for fiscal years beginning on or after December 15, 2008. Grace has adopted this standard, and has modified its Consolidated Financial Statements where applicable.

In September 2006, the FASB issued SFAS No. 157, "Fair Value Measurements", which was subsequently codified as ASC 820. ASC 820 defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements. In February 2008, the FASB delayed the effective date of ASC 820 for all non-financial assets and non-financial liabilities, except for items that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least annually), until fiscal years beginning after November 15, 2008. Grace adopted ASC 820 in the first quarter of 2008, and the adoption for Grace's financial assets and liabilities did not have a material impact on its Consolidated Financial Statements. In April 2009, the FASB issued FSP No. FAS 157-4 "Determining Fair Value When the Volume and Level of Activity for the Asset or Liability Have Significantly Decreased and Identifying Transactions That Are Not Orderly", which was subsequently codified as ASC 820. This standard provides additional guidance and expands on the factors that should be considered in estimating fair value when there has been a significant decrease in market activity for a financial asset. This standard is effective for interim and annual periods ending after June 15, 2009, with early adoption permitted for periods ending after March 15, 2009. Grace has adopted this standard, and it has not had a material impact on its Consolidated Financial Statements. See Note 7 for further discussion of ASC 820.

11

Table of Contents

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11—Related Information

Official Parties to Grace's Chapter 11 Cases Three creditors' committees, two representing asbestos claimants, the Official Committee of Asbestos Personal Injury Claimants (the "PI Committee") and the Official Committee of Asbestos Property Damage Claimants (the "PD Committee"), and the third representing other unsecured creditors, and the Official Committee of Equity Security Holders (the "Equity Committee"), have been appointed in the Chapter 11 Cases. These committees, a legal representative of future asbestos personal injury claimants (the "PI FCR") and a legal representative of future asbestos property damage claimants (the "PD FCR"), have the right to be heard on all matters that come before the Bankruptcy Court and have important roles in the Chapter 11 Cases. The Debtors are required to bear certain costs and expenses of the committees and the representatives of future asbestos claimants, including those of their counsel and financial advisors.

As discussed below, the Debtors, the Equity Committee, the PI Committee and the PI FCR have filed a joint plan of reorganization, subsequently amended, with the Bankruptcy Court that is designed to address all pending and future asbestos-related claims and all other pre-petition claims as outlined therein. The committee representing general unsecured creditors, the PD Committee and the PD FCR are not co-proponents of this joint plan.

Plans of Reorganization On November 13, 2004, Grace filed a proposed plan of reorganization, as well as several associated documents, including a disclosure statement, trust distribution procedures, exhibits and other supporting documents, with the Bankruptcy Court. On January 13, 2005, Grace filed an amended plan of reorganization (the "Prior Plan") and related documents to address certain objections of creditors and other interested parties. At the time it was filed, the Prior Plan was supported by the committee representing general unsecured creditors and the Equity Committee, but was not supported by the PI Committee, the PD Committee or the PI FCR. At the time of filing of the Prior Plan, the PD FCR had not been appointed.

On July 26, 2007, the Bankruptcy Court terminated Grace's exclusive rights to propose a plan of reorganization and solicit votes thereon. As a result of the termination of these rights, any party-in-interest may propose a competing plan of reorganization. On November 5, 2007, the PI Committee and the PI FCR filed a proposed plan of reorganization (the "PI Plan") with the Bankruptcy Court.

On April 6, 2008, the Debtors reached an agreement in principle with the PI Committee, the PI FCR, and the Equity Committee designed to resolve all present and future asbestos-related personal injury claims (the "PI Settlement").

Prior to the PI Settlement, the Bankruptcy Court entered a case management order for estimating liability for pending and future asbestos personal injury claims. A trial for estimating liability for such claims began in January 2008 but was suspended in April 2008 as a result of the PI Settlement.

As contemplated by the PI Settlement, on September 19, 2008, the Debtors, supported by the Equity Committee, the PI Committee and the PI FCR, as co-proponents, filed a joint plan of reorganization with the Bankruptcy Court to reflect the terms of the PI Settlement.

On October 17, 2008, the Ontario Superior Court of Justice, in the Grace Canada, Inc. proceeding pending under the Companies' Creditors Arrangement Act, approved an agreement (the "Minutes of Settlement"), entered into by the Company, Grace Canada, Inc. and legal representatives of Canadian ZAI property damage claimants on September 2, 2008, that would settle

12

Table of Contents

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11—Related Information (Continued)

all Canadian ZAI property damage claims and demands. Under the Minutes of Settlement, all Canadian ZAI property damage claims and demands would be paid through a separate Canadian ZAI property damage claims fund of CDN$6.5 million. The Minutes of Settlement are subject to the confirmation and effectiveness of the Joint Plan (as defined below). The Minutes of Settlement provide that if the Bankruptcy Court does not issue a confirmation order with respect to the Joint Plan by October 31, 2009, the Minutes of Settlement will terminate. The parties are discussing the terms of a possible extension.

On November 21, 2008, the Debtors reached an agreement in principle (the "ZAI PD Term Sheet") with the Putative Class Counsel to the U.S. ZAI claimants, the PD FCR, and the Equity Committee designed to resolve all present and future U.S. ZAI property damage claims and demands.

As contemplated by the PI Settlement and the ZAI PD Term Sheet, the Debtors, supported by the Equity Committee, the PI Committee and the PI FCR, as co-proponents, amended the joint plan of reorganization and several associated documents, including a disclosure statement, trust distribution procedures, exhibits and other supporting documents on December 18, 2008, February 3, 2009 and February 27, 2009 through filings with the Bankruptcy Court. The Debtors and co-proponents filed technical modifications to the Joint Plan and certain exhibits on September 4, 2009 and October 12, 2009. The joint plan of reorganization (as amended and modified through October 12, 2009, the "Joint Plan") is designed to address all pending and future asbestos-related claims and all other pre-petition claims as outlined therein. The Joint Plan supersedes the Prior Plan and the PI Plan. The committee representing general unsecured creditors, the PD Committee and the PD FCR are not co-proponents of the Joint Plan.

Under the Joint Plan, two asbestos trusts would be established under Section 524(g) of the Bankruptcy Code. All asbestos-related personal injury claims would be channeled for resolution to one asbestos trust (the "PI Trust") and all asbestos-related property damage claims, including U.S and Canadian ZAI property damage claims, would be channeled to a separate asbestos trust (the "PD Trust").

Any plan of reorganization, including the Joint Plan and any plan of reorganization that may be filed in the future by a party-in-interest, will become effective only after a vote of eligible creditors and with the approval of the Bankruptcy Court and the U.S. District Court for the District of Delaware. On March 9, 2009, the Bankruptcy Court approved the disclosure statement associated with the Joint Plan. On March 31, 2009, Grace distributed the Joint Plan, exhibits and disclosure statement along with voting materials to all creditors entitled to vote on the Joint Plan. The Bankruptcy Court required all creditors eligible to vote on the Joint Plan to submit their votes, and all parties-in-interest who object to the Joint Plan to submit their objections, by May 20, 2009. All classes of creditors entitled to vote accepted the Joint Plan. The class of general unsecured creditors, who voted on a provisional basis pending a determination by the Bankruptcy Court as to whether the class is impaired and therefore entitled to a vote, voted to reject the Joint Plan. The objections filed generally relate to demands for interest at rates higher than provided for in the Joint Plan, assertions that the Joint Plan may impair insurers' contractual rights, assertions that the Joint Plan discriminates against Libby, Montana personal injury claimants and the classification and treatment of claims under the Joint Plan. Grace believes that the Joint Plan complies with the requirements for confirmation under the Bankruptcy Code and Grace intends to vigorously defend the Joint Plan against these and all other objections. If certain objections were resolved adversely to Grace and the other Joint Plan proponents, or if rulings by the Bankruptcy Court resolving certain

13

Table of Contents

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11—Related Information (Continued)

objections favorably to the Joint Plan proponents were appealed, certain conditions to the Joint Plan, including for example, payments pursuant to the Sealed Air Settlement (as defined below) and the Fresenius Settlement (as defined below), might not be satisfied and potential lenders might not be willing to provide the new financing that Grace seeks to fund the Joint Plan. The resolution of these objections and any related appeals could have a material effect on the terms and timing of Grace's emergence from Chapter 11. Hearings to determine whether the Bankruptcy Court will approve the Joint Plan were held on June 22-23, 2009, September 8-17, 2009, and October 13-14, 2009. The parties will submit post-hearing briefs in November and December 2009. Closing arguments on confirmation of the Joint Plan are scheduled for January 4-5, 2010.

The Joint Plan assumes that Cryovac, Inc. ("Cryovac"), a wholly-owned subsidiary of Sealed Air Corporation ("Sealed Air"), will fund the PI Trust and the PD Trust with an aggregate of: (i) $512.5 million in cash (plus interest at 5.5% compounded annually from December 21, 2002); and (ii) 18 million shares (reflecting a two-for-one stock split) of common stock of Sealed Air, pursuant to the terms of a settlement agreement resolving asbestos-related, successor liability and fraudulent transfer claims against Sealed Air and Cryovac, as further described below (the "Sealed Air Settlement"). The value of the Sealed Air Settlement changes daily with the accrual of interest and the trading value of Sealed Air common stock. The Joint Plan also assumes that Fresenius AG ("Fresenius") will fund the PI Trust and the PD Trust with an aggregate of $115.0 million pursuant to the terms of a settlement agreement resolving asbestos-related, successor liability and fraudulent transfer claims against Fresenius, as further described below (the "Fresenius Settlement"). The Sealed Air Settlement and the Fresenius Settlement have been approved by the Bankruptcy Court, but remain subject to the fulfillment of specified conditions.

The Joint Plan is designed to address all pending and future asbestos-related claims and demands and all other pre-petition claims as outlined respectively therein. However, it is possible that the Joint Plan will not be confirmed by the Bankruptcy Court, or become effective if it is confirmed. If the Joint Plan is not confirmed by the Bankruptcy Court or the U.S. District Court for the District of Delaware or does not become effective, the Debtors would expect to resume the estimation trial, which was suspended in April 2008 due to the PI Settlement, to determine the amount of its asbestos-related liabilities. Under those circumstances, a different plan of reorganization may ultimately be confirmed and become effective. Under that effective plan of reorganization, the interests of holders of Company common stock could be substantially diluted or cancelled. The value of Company common stock following the effective date of any plan of reorganization and the extent of any recovery by non-asbestos-related creditors would depend principally on the amount of Debtors' asbestos-related liability under such effective plan of reorganization.

Joint Plan of Reorganization Under the terms of the Joint Plan, claims under the Chapter 11 Cases would be satisfied as follows:

Asbestos-Related Personal Injury Claims

All pending and future asbestos-related personal injury claims and demands ("PI Claims") would be channeled to the PI Trust for resolution. The PI Trust would use specified trust distribution procedures to satisfy allowed PI Claims.

14

Table of Contents

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11—Related Information (Continued)

The PI Trust would be funded with:

- •

- $250 million in cash plus interest thereon from January 1, 2009 to the effective date of the Joint Plan to be paid by Grace;

- •

- Cash in the amount of the PD Initial Payment (as described below) and the ZAI Initial Payment (as described below) to be paid by Grace;

- •

- A warrant to acquire 10 million shares of Company common stock at an exercise price of $17.00 per share, expiring one year from the effective date of the Joint Plan;

- •

- Rights to all proceeds under all of the Debtors' insurance policies that are available for payment of PI Claims;

- •

- Cash in the amount of $512.5 million plus interest thereon from December 21, 2002 to the effective date of the Joint Plan at a rate of 5.5% per annum reduced by the amount of Cryovac's contribution to the PD Initial Payment and the ZAI Initial Payment (as described below) and 18 million shares of Sealed Air common stock to be paid by Cryovac pursuant to the Sealed Air Settlement;

- •

- Cash in the amount of $115 million to be paid by Fresenius pursuant to the Fresenius Settlement reduced by the amount of Fresenius' contribution to the PD Initial Payment and ZAI Initial Payment (as described below); and

- •

- Deferred payments by Grace-Conn. of $110 million per year for five years beginning in 2019, and $100 million per year for 10 years beginning in 2024, that would be subordinate to any bank debt or bonds outstanding, guaranteed by the Company and secured by the Company's obligation to issue 50.1% of its outstanding common stock (measured as of the effective date of the Joint Plan) to the PI Trust in the event of default.

Asbestos-Related Property Damage Claims

All pending and future asbestos-related property damage claims and demands ("PD Claims") would be channeled to the PD Trust for resolution. The PD Trust would contribute CDN$6.5 million to a separate Canadian ZAI PD Claims fund through which Canadian ZAI PD Claims would be resolved. The PD Trust would generally resolve U.S. ZAI PD Claims that qualify for payment by paying 55% of the claimed amount, but in no event would the PD Trust pay more per claim than 55% of $7,500 (as adjusted for the increase in inflation each year after the fifth anniversary of the effective date of the Joint Plan). The PD Trust would satisfy other allowed PD Claims pursuant to specified trust distribution procedures with cash payments in the allowed settlement amount. Unresolved PD Claims and future PD claims would be litigated pursuant to procedures to be approved by the Bankruptcy Court and, to the extent such claims were determined to be allowed claims, would be paid in cash by the PD Trust in the amount determined by the Bankruptcy Court.

The PD Trust would contain two accounts, the PD account and the ZAI PD account. U.S. ZAI PD Claims would be paid from the ZAI PD account and other PD Claims would be paid from the PD account. The separate Canadian ZAI PD Claims would be paid by a separate fund established in Canada. Each account would have a separate trustee and the assets of the accounts would not be commingled. The two accounts would be funded as follows:

15

Table of Contents

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11—Related Information (Continued)

The PD account would be funded with:

- •

- Approximately $147 million in cash plus cash in the amount of the estimated first six months of PD Trust expenses, to be paid by Cryovac and Fresenius (the "PD Initial Payment"), and CDN$6.5 million in cash to be paid by Grace pursuant to the Minutes of Settlement.

- •

- A Grace obligation (the "PD Obligation") providing for a payment to the PD Trust every six months in the amount of the non-ZAI PD Claims allowed during the preceding six months plus interest and, except for the first six months, the amount of PD Trust expenses for the preceding six months. The aggregate amount to be paid under the PD Obligation would not be capped.

The ZAI account would be funded as follows (the "ZAI Assets"):

- •

- $30 million in cash plus interest from April 1, 2009 to the effective date, to be paid by Cryovac and Fresenius (the "ZAI Initial Payment").

- •

- $30 million in cash on the third anniversary of the effective date of the Joint Plan, to be paid by Grace.

- •

- A Grace obligation providing for the payment of up to 10 contingent deferred payments of $8 million per year during the 20-year period beginning on the fifth anniversary of the effective date of the Joint Plan, with each such payment due only if the ZAI Assets fall below $10 million during the preceding year.

All payments to the PD Trust that were not to be paid on the effective date of the Joint Plan would be secured by the Company's obligation to issue 50.1% of its outstanding common stock (measured as of the effective date of the Joint Plan) to the PD Trust in the event of default. Grace would have the right to conduct annual audits of the books, records and claim processing procedures of the PD Trust.

Other Claims

All allowed administrative claims would be paid in cash and all allowed priority claims would be paid in cash with interest. Secured claims would be paid in cash with interest or by reinstatement. Allowed general unsecured claims would be paid in cash, including any post-petition interest as follows: (i) for holders of pre-petition bank credit facilities, post-petition interest at the rate of 6.09% from the Filing Date through December 31, 2005 and thereafter at floating prime, in each case compounded quarterly; and (ii) for all other unsecured claims that are not subject to a settlement agreement providing otherwise, interest at 4.19% from the Filing Date, compounded annually, or if pursuant to an existing contract, interest at the non-default contract rate. The general unsecured creditors that hold pre-petition bank debt have asserted that they are entitled to post-petition interest at the default rate specified under the terms of the underlying credit agreements which, if paid, would be materially greater than that reflected above. Grace has asserted that such creditors are not entitled to interest at the default rate and has requested the Bankruptcy Court to determine the appropriate rate at which interest would be payable. Unsecured employee-related claims such as pension, retirement medical obligations and workers compensation claims, would be reinstated.

16

Table of Contents

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11—Related Information (Continued)

Effect on Company Common Stock

The Joint Plan assumes that Company common stock will remain outstanding at the effective date of the Joint Plan, but that the interests of existing shareholders would be subject to dilution by additional shares of Company common stock issued under the warrant or in the event of default in respect of the deferred payment obligations to the PI Trust or the PD Trust under the Company's security obligation. In order to preserve significant tax benefits which are subject to elimination or limitation in the event of a change in control (as defined by the Internal Revenue Code) of Grace, the Joint Plan provides that under certain circumstances, the Board of Directors would have the authority to impose restrictions on the transfer of Grace stock with respect to certain 5% shareholders. These restrictions will generally not limit the ability of a person that holds less than 5% of Grace stock after emergence to either buy or sell stock on the open market. In addition, the Bankruptcy Court has approved trading restrictions on Grace common stock until the effective date of a plan of reorganization. These restrictions prohibit (without the consent of Grace) a person from acquiring more than 4.75% of the outstanding Grace common stock or, for any person already holding more than 4.75%, from increasing such person's holdings. This summary of the stock transfer restrictions does not purport to be complete and is qualified in its entirety by reference to the order of the Bankruptcy Court, which has been filed with the SEC.

Claims Filings The Bankruptcy Court established a bar date of March 31, 2003 for claims of general unsecured creditors, PD Claims (other than ZAI PD Claims) and medical monitoring claims related to asbestos. The bar date did not apply to PI Claims or claims related to ZAI PD Claims.

Approximately 14,900 proofs of claim were filed by the March 31, 2003 bar date. Of these claims, approximately 9,400 were non-asbestos related, approximately 4,300 were PD Claims, and approximately 1,000 were for medical monitoring. The medical monitoring claims were made by individuals who allege exposure to asbestos through Grace's products or operations. Under the Joint Plan, these claims would be channeled to the PI Trust for resolution. In addition, approximately 800 proofs of claim were filed after the bar date.

Approximately 7,000 of the non-asbestos related claims involve claims by employees or former employees for future retirement benefits such as pension and retiree medical coverage. Grace views most of these claims as contingent and has proposed to retain such benefits under the Joint Plan. The remaining non-asbestos claims include claims for payment of goods and services, taxes, product warranties, principal and interest under pre-petition credit facilities, amounts due under leases and other contracts, leases and other executory contracts rejected in the Chapter 11 Cases, environmental remediation, pending non-asbestos-related litigation, and non-asbestos-related personal injury. Claims for indemnification or contribution to actual or potential codefendants in asbestos-related and other litigation were also filed.

The Debtors analyzed the claims filed pursuant to the March 31, 2003 bar date and found that many are duplicates, represent the same claim filed against more than one of the Debtors, lack any supporting documentation, or provide insufficient supporting documentation. As of October 30, 2009, of the approximately 4,300 non-ZAI PD Claims filed, approximately 375 claims have been resolved, approximately 3,890 claims have been expunged, reclassified by the Debtors or withdrawn by claimants, leaving approximately 35 claims to be addressed through the property damage case management order approved by the Bankruptcy Court and/or the Joint Plan or another plan of reorganization. The claims remaining to be addressed include 16 asbestos property damage claims that had been expunged by a bankruptcy court order that was reversed by an order of the District

17

Table of Contents

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11—Related Information (Continued)

Court of Delaware on September 29, 2009. As of September 30, 2009, of the approximately 3,290 non-asbestos claims filed, approximately 1,900 have been expunged or withdrawn by claimants, approximately 1,170 have been resolved, and an additional approximately 220 claims are to be addressed through the claim objection process and the dispute resolution procedures approved by the Bankruptcy Court.

Additionally, by order dated June 17, 2008, the Bankruptcy Court established October 31, 2008 as the bar date for ZAI PD Claims related to property located in the U.S. As of September 30, 2009, approximately 19,260 US ZAI PD Claims have been filed. In addition, on October 21, 2008, the Bankruptcy Court entered an order establishing August 31, 2009 as the bar date for ZAI PD Claims related to property located in Canada. As of September 30, 2009, approximately 13,890 Canadian ZAI PD Claims have been filed. The Joint Plan provides for the channeling of US ZAI PD Claims and Canadian ZAI PD Claims to the Asbestos PD Trust created under the Joint Plan, and the subsequent transfer of Canadian ZAI PD Claims to a Canadian fund. No bar date has been set for personal injury claims related to ZAI. The Joint Plan provides that ZAI PI Claims would be channeled to the Asbestos PI Trust created under the Joint Plan.

Grace is continuing to analyze and review unresolved claims in relation to the Joint Plan. Grace believes that its recorded liabilities for claims subject to the March 31, 2003 bar date represent a reasonable estimate of the ultimate allowable amount for claims that are not in dispute or have been submitted with sufficient information to both evaluate the merit and estimate the value of the claim. The PD Claims are considered as part of Grace's overall asbestos liability and are being accounted for in accordance with the conditions precedent under the Prior Plan, as described in Note 3.

Debt Capital All of the Debtors' pre-petition debt is in default due to the Filing. The accompanying Consolidated Balance Sheets reflect the classification of the Debtors' pre-petition debt within "liabilities subject to compromise."

The Debtors have entered into a debtor-in-possession post-petition loan and security agreement, or DIP facility, with a syndicate of lenders that, as amended effective April 1, 2008, provides for up to $165 million of revolving loans and face amount of letters of credit. The DIP facility is secured by a priority lien on substantially all assets of the Debtors with the exclusion of the capital stock of non-U.S. subsidiaries, and bears interest based on LIBOR. The term of the DIP facility ends on the earlier of April 1, 2010 or the Debtors' emergence from Chapter 11.

Accounting Impact The accompanying Consolidated Financial Statements have been prepared in accordance with FASB Accounting Standards Codification 852 ("ASC 852"), "Financial Reporting by Entities in Reorganization Under the Bankruptcy Code. ASC 852 requires that financial statements of debtors-in-possession be prepared on a going concern basis, which contemplates continuity of operations, realization of assets and liquidation of liabilities in the ordinary course of business. However, as a result of the Filing, the realization of certain of the Debtors' assets and the liquidation of certain of the Debtors' liabilities are subject to significant uncertainty. While operating as debtors-in-possession, the Debtors may sell or otherwise dispose of assets and liquidate or settle liabilities for amounts other than those reflected in the Consolidated Financial Statements. Further, the ultimate plan of reorganization could materially change the amounts and classifications reported in the Consolidated Financial Statements.

Pursuant to ASC 852, Grace's pre-petition and future liabilities that are subject to compromise are required to be reported separately on the balance sheet at an estimate of the amount that will

18

Table of Contents

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11—Related Information (Continued)

ultimately be allowed by the Bankruptcy Court. As of September 30, 2009, such pre-petition liabilities include fixed obligations (such as debt and contractual commitments), as well as estimates of costs related to contingent liabilities (such as asbestos-related litigation, environmental remediation, and other claims). Obligations of Grace subsidiaries not covered by the Filing continue to be classified on the Consolidated Balance Sheets based upon maturity dates or the expected dates of payment. ASC 852 also requires separate reporting of certain expenses, realized gains and losses, and provisions for losses related to the Filing as reorganization items. Grace presents reorganization items as "Chapter 11 expenses, net of interest income," a separate caption in its Consolidated Statements of Operations.

As discussed in Note 3, Grace has not adjusted its accounting for asbestos-related liabilities to reflect the Joint Plan.

Grace has not recorded the benefit of any assets that may be available to fund asbestos-related and other liabilities under the Fresenius Settlement and the Sealed Air Settlement, as such agreements are subject to conditions, which, although expected to be met, have not been satisfied and confirmed by the Bankruptcy Court and, under the Joint Plan, these assets would be transferred to the PI Trust and the PD Trust. The estimated fair value available under the Fresenius Settlement and the Sealed Air Settlement as measured at September 30, 2009, was $1,205.1 million comprised of $115.0 million in cash from Fresenius and $1,090.1 million in cash and stock from Cryovac under the Joint Plan. Payments under the Sealed Air Settlement will be made directly to the PI Trust and the PD Trust by Cryovac.

Grace's Consolidated Balance Sheets separately identify the liabilities that are "subject to compromise" as a result of the Chapter 11 proceedings. In Grace's case, "liabilities subject to compromise" represent both pre-petition and future liabilities as determined under U.S. GAAP. Changes to pre-petition liabilities subsequent to the Filing Date reflect: (1) cash payments under approved court orders; (2) the terms of the Prior Plan, as discussed above and in Note 3, including the accrual of interest on pre-petition debt and other fixed obligations; (3) accruals for employee-related programs; and (4) changes in estimates related to other pre-petition contingent liabilities. The accounting for the asbestos-related liability component of "liabilities subject to compromise" is described in Note 3.

19

Table of Contents

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11—Related Information (Continued)

Components of liabilities subject to compromise are as follows:

| | | | | | | |

(In millions) | | September 30,

2009 | | December 31,

2008 | |

|---|

Pre-petition bank debt plus accrued interest | | $ | 843.7 | | $ | 823.5 | |

Drawn letters of credit plus accrued interest | | | 30.9 | | | 30.0 | |

Asbestos-related contingencies | | | 1,700.0 | | | 1,700.0 | |

Income tax contingencies(1) | | | 123.9 | | | 121.0 | |

Environmental contingencies | | | 147.5 | | | 152.2 | |

Postretirement benefits other than pension | | | 77.4 | | | 73.2 | |

Unfunded special pension arrangements | | | 115.3 | | | 106.0 | |

Retained obligations of divested businesses | | | 31.1 | | | 29.8 | |

Accounts payable | | | 31.2 | | | 31.2 | |

Other accrued liabilities | | | 63.8 | | | 55.5 | |

Reclassification to current liabilities(2) | | | (11.6 | ) | | (9.5 | ) |

| | | | | | |

Total Liabilities Subject to Compromise | | $ | 3,153.2 | | $ | 3,112.9 | |

| | | | | | |

- (1)

- Amounts are net of expected refunds of $0.8 million for each of the periods ending September 30, 2009 and December 31, 2008.

- (2)

- As of September 30, 2009 and December 31, 2008, approximately $11.6 million and $9.5 million, respectively, of certain pension and postretirement benefit obligations subject to compromise have been presented in other current liabilities in the Consolidated Balance Sheets in accordance with ASC 715.

Note that the unfunded special pension arrangements reflected above exclude non-U.S. pension plans and qualified U.S. pension plans that became underfunded subsequent to the Filing. Contributions to qualified U.S. pension plans are subject to Bankruptcy Court approval.

20

Table of Contents

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11—Related Information (Continued)

Change in Liabilities Subject to Compromise

The following table is a reconciliation of the changes in pre-filing date liability balances for the period from the Filing Date through September 30, 2009.

| | | | |

(In millions) (Unaudited) | | Cumulative

Since Filing | |

|---|

Balance, Filing Date April 2, 2001 | | $ | 2,366.0 | |

Cash disbursements and/or reclassifications under Bankruptcy Court orders: | | | | |

Payment of environmental settlement liability—including Libby (see Note 11) | | | (252.0 | ) |

Freight and distribution order | | | (5.7 | ) |

Trade accounts payable order | | | (9.1 | ) |

Resolution of contingencies subject to Chapter 11 | | | (130.0 | ) |

Other court orders including employee wages and benefits, sales and use tax, and customer programs | | | (365.8 | ) |

Expense/(income) items: | | | | |

Interest on pre-petition liabilities | | | 423.7 | |

Employee-related accruals | | | 87.9 | |

Provision for asbestos-related contingencies | | | 744.8 | |

Provision for environmental contingencies | | | 328.3 | |

Provision for income tax contingencies | | | 2.4 | |

Balance sheet reclassifications | | | (37.3 | ) |

| | | | |

Balance, end of period | | $ | 3,153.2 | |

| | | | |

Additional liabilities subject to compromise may arise due to the rejection of executory contracts or unexpired leases, or as a result of the Bankruptcy Court's allowance of contingent or disputed claims.

For the holders of pre-petition bank credit facilities, beginning January 1, 2006, Grace agreed to pay interest on pre-petition bank debt at the prime rate, adjusted for periodic changes, and compounded quarterly. The effective rates for the nine months ended September 30, 2009 and 2008 were 3.25% and 5.43%, respectively. From the Filing Date through December 31, 2005, Grace accrued interest on pre-petition bank debt at a negotiated fixed annual rate of 6.09%, compounded quarterly. The general unsecured creditors that hold pre-petition bank credit facilities have asserted that they are entitled to post-petition interest at the default rate specified under the terms of the underlying credit agreements which, if paid, would be materially greater than that reflected above. Grace has asserted that such creditors are not entitled to interest at the default rate and has requested the Bankruptcy Court to determine the appropriate rate at which interest would be payable.

For the holders of claims who, but for the Filing, would be entitled under a contract or otherwise to accrue or be paid interest on such claim in a non-default (or non-overdue payment) situation under applicable non-bankruptcy law, Grace accrues interest at the rate provided in the contract between the Grace entity and the claimant or such rate as may otherwise apply under applicable non-bankruptcy law.

21

Table of Contents

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11—Related Information (Continued)

For all other holders of allowed general unsecured claims, Grace accrues interest at a rate of 4.19% per annum, compounded annually, unless otherwise negotiated during the claim settlement process.

Chapter 11 Expenses

| | | | | | | | | | | | | |

| | Three Months

Ended

September 30, | | Nine Months

Ended

September 30, | |

|---|

(In millions) | | 2009 | | 2008 | | 2009 | | 2008 | |

|---|

Legal and financial advisory fees | | $ | 18.4 | | $ | 12.0 | | $ | 36.5 | | $ | 50.0 | |

Interest income | | | — | | | — | | | (0.1 | ) | | (1.6 | ) |

| | | | | | | | | | |

Chapter 11 expenses, net of interest income | | $ | 18.4 | | $ | 12.0 | | $ | 36.4 | | $ | 48.4 | |

| | | | | | | | | | |

Pursuant to ASC 852, interest income earned on the Debtors' cash balances must be offset against Chapter 11 expenses.

22

Table of Contents

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11—Related Information (Continued)

Condensed financial information of the Debtors

W. R. Grace & Co.—Chapter 11 Filing Entities

Debtor-in-Possession Statements of Operations

| | | | | | | |

| | Nine Months

Ended

September 30, | |

|---|

(In millions) (Unaudited) | | 2009 | | 2008 | |

|---|

Net sales, including intercompany | | $ | 1,058.4 | | $ | 1,194.8 | |

| | | | | | |

Cost of goods sold, including intercompany, exclusive of depreciation and amortization shown separately below | | | 751.9 | | | 870.9 | |

Selling general and administrative expenses | | | 229.4 | | | 222.8 | |

Restructuring expenses | | | 12.1 | | | 2.9 | |

Gain on sales of product lines | | | (22.2 | ) | | — | |

Research and development expenses | | | 26.9 | | | 33.3 | |

Depreciation and amortization | | | 41.5 | | | 43.2 | |

Defined benefit pension expense | | | 52.1 | | | 28.0 | |

Interest expense and related financing costs | | | 27.7 | | | 42.2 | |

Other income, net | | | (48.8 | ) | | (68.7 | ) |

Provision for environmental remediation | | | 1.1 | | | 8.8 | |

Chapter 11 expenses, net of interest income | | | 36.4 | | | 48.4 | |

| | | | | | |

| | | 1,108.1 | | | 1,231.8 | |

| | | | | | |

Loss before income taxes and equity in net income of non-filing entities | | | (49.7 | ) | | (37.0 | ) |

Benefit from (provision for) income taxes | | | 7.6 | | | (11.8 | ) |

| | | | | | |

Loss before equity in net income of non-filing entities | | | (42.1 | ) | | (48.8 | ) |

Equity in net income of non-filing entities | | | 66.9 | | | 126.9 | |

| | | | | | |

Net income | | $ | 24.8 | | $ | 78.1 | |

| | | | | | |

23

Table of Contents

Notes to Consolidated Financial Statements (Continued)

2. Chapter 11—Related Information (Continued)

W. R. Grace & Co.—Chapter 11 Filing Entities

Debtor-in-Possession Statements of Cash Flows

| | | | | | | | |

| | Nine Months

Ended

September 30, | |

|---|

(In millions) (Unaudited) | | 2009 | | 2008 | |

|---|

Operating Activities | | | | | | | |

| | Net income | | $ | 24.8 | | $ | 78.1 | |

Reconciliation to net cash provided by (used for) operating activities: | | | | | | | |

| | Chapter 11 expenses, net of interest income | | | 36.4 | | | 48.4 | |

| | (Benefit from) provision for income taxes | | | (7.6 | ) | | 11.8 | |

| | Equity in net income of non-filing entities | | | (66.9 | ) | | (126.9 | ) |

| | Depreciation and amortization | | | 41.5 | | | 43.2 | |

| | Interest on pre-petition liabilities subject to compromise | | | 26.9 | | | 38.8 | |

| | Provision for environmental remediation | | | 1.1 | | | 8.8 | |

| | Other non-cash items, net | | | (26.4 | ) | | (1.7 | ) |

| | Contributions to defined benefit pension plans | | | (33.0 | ) | | (47.1 | ) |

| | Cash paid to resolve contingencies subject to Chapter 11 | | | — | | | (252.0 | ) |

| | Chapter 11 expenses paid | | | (34.9 | ) | | (52.9 | ) |

| | Restructuring expenses | | | 12.1 | | | — | |

| | Changes in other assets and liabilities, excluding the effect of businesses acquired/divested | | | 68.2 | | | (39.9 | ) |

| | | | | | |

Net cash provided by (used for) operating activities | | | 42.2 | | | (291.4 | ) |

| | | | | | |

Investing Activities | | | | | | | |

| | Capital expenditures | | | (30.0 | ) | | (52.0 | ) |

| | Loan repayments and other | | | 148.5 | | | 208.3 | |

| | | | | | |

Net cash provided by investing activities | | | 118.5 | | | 156.3 | |

| | | | | | |

Net cash provided by (used for) financing activities | | | (0.8 | ) | | 48.0 | |

| | | | | | |

Net increase (decrease) in cash and cash equivalents | | | 159.9 | | | (87.1 | ) |