|

Exhibit 99.1

|

Investor Presentation

May 2015

Cira Centre, 2929 Arch Street, 17th Floor, Philadelphia, PA 19104 | 215.243.9000 | rait.com

Forward Looking Statements, Non- GAAP Financial Measures & Securities Offering Disclaimers

This document and the related presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about: RAIT Financial Trust’s (“RAIT”) plans, objectives, expectations and intentions with respect to future operations; projected dividends, net income (loss) allocable to common shares and adjustments thereto, cash available for distribution (“CAD”), and weighted average shares outstanding; and other statements that are not historical facts.

Forward-looking statements are sometimes identified by the words “project,” “assume,” “may”, “will”, “should”, “potential”, “predict”, “continue”, “guide”, or other similar words or expressions. These forward-looking statements are based upon the current beliefs and expectations of RAIT’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally not within RAIT’s control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. RAIT does not guarantee that the assumptions underlying such forward looking statements are free from errors. Actual results may differ materially from the anticipated results discussed in these forward-looking statements.

The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: whether dilution from our outstanding convertible senior notes or warrants or equity compensation will occur; whether we will be able to achieve our assumed loan originations, property acquisitions, gains on property sales, growth in rental revenue and levels of loan repayments; the timing and amount of investments, repayments and asset sales and capital raised; our ability to use leverage; changes in the expected yield of investments and the overall conditions in commercial real estate and the economy generally; and the risk factors and other disclosure contained in filings by RAIT with the Securities and Exchange Commission (“SEC”), including, without limitation, RAIT’s most recent annual and quarterly reports filed with SEC. RAIT’s SEC filings are available on RAIT’s website at www.rait.com.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. All subsequent written and oral forward-looking statements attributable to RAIT or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this document and the related presentation. Except to the extent required by applicable law or regulation, RAIT undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events.

This document and the related presentation may contain non-U.S. generally accepted accounting principles (“GAAP”) financial measures. A reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measure is included in this document and/or RAIT’s most recent annual and quarterly reports.

This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of RAIT or Independence Realty Trust, Inc. (“IRT”), a RAIT consolidated and managed multifamily equity REIT. Any disclosure in this presentation of the proposed business combination between IRT and Trade Street Residential does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval.

2

About RAIT

RAIT Financial Trust (“RAIT”) (NYSE: RAS), is a multi-strategy

commercial real estate company that utilizes a vertically integrated

platform focused on lending, owning and managing commercial real

estate assets nationwide.

IPO – January 1998

Scalable, “in-house”, commercial real estate platform with over 775

employees (includes property management)

RAIT is organized as an internally-managed REIT with $4.6 billion of

assets under management

Offices - Philadelphia, New York, Chicago, Charlotte

Quarterly common dividend of $0.18 or $0.72 annually representing

11.1% yield(1)

Seasoned executive team with strong real estate experience

1) Based on a $6.50 stock price as of May 19, 2015.

3

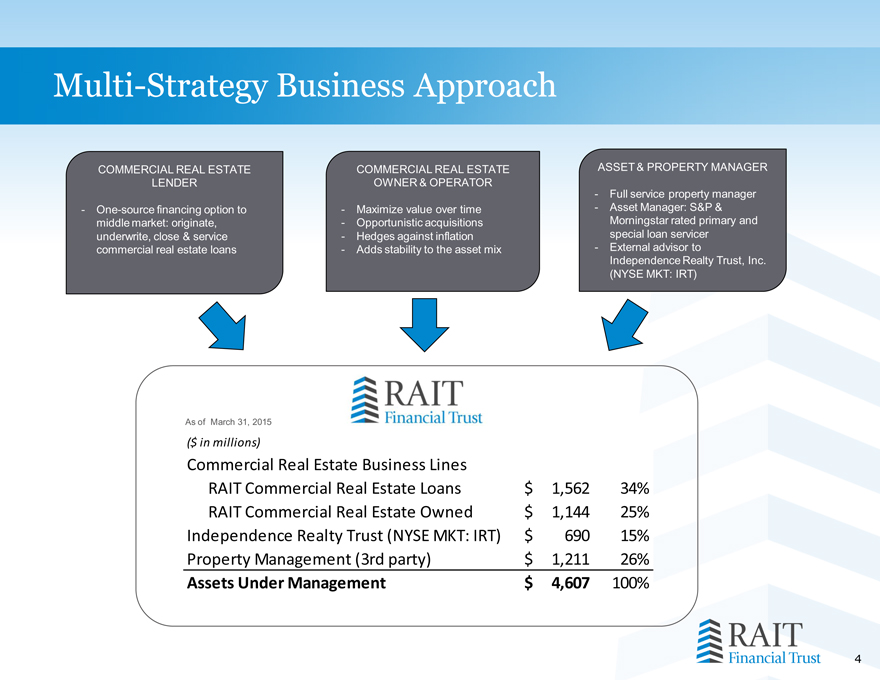

Multi-Strategy Business Approach

COMMERCIAL REAL ESTATE COMMERCIAL REAL ESTATE ASSET & PROPERTY MANAGER LENDER OWNER & OPERATOR

- Full service property manager

- One-source financing option to - Maximize value over time - Asset Manager: S&P & middle market: originate, - Opportunistic acquisitions Morningstar rated primary and underwrite, close & service - Hedges against inflation special loan servicer commercial real estate loans - Adds stability to the asset mix - External advisor to Independence Realty Trust, Inc.

(NYSE MKT: IRT)

As of March 31, 2015

($ in millions)

Commercial Real Estate Business Lines

RAIT Commercial Real Estate Loans $ 1,562 34% RAIT Commercial Real Estate Owned $ 1,144 25% Independence Realty Trust (NYSE MKT: IRT) $ 690 15% Property Management (3rd party) $ 1,211 26%

Assets Under Management $ 4,607 100%

4

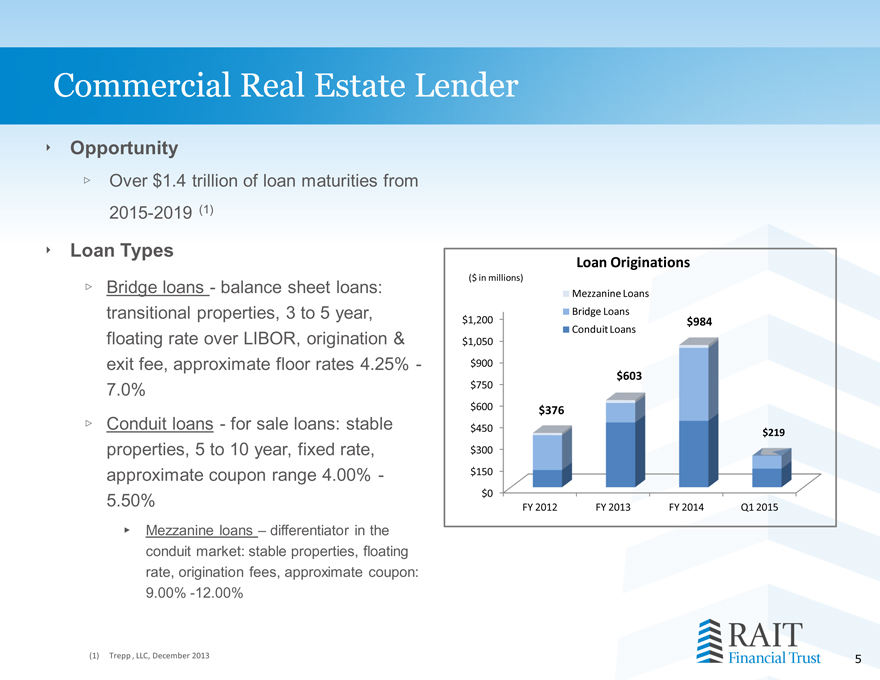

Commercial Real Estate Lender

Opportunity

Over $1.4 trillion of loan maturities from 2015-2019 (1)

Loan Types

Bridge loans - balance sheet loans: transitional properties, 3 to 5 year, floating rate over LIBOR, origination & exit fee, approximate floor rates 4.25% -

7.0%

Conduit loans - for sale loans: stable properties, 5 to 10 year, fixed rate, approximate coupon range 4.00%—

5.50%

Mezzanine loans – differentiator in the conduit market: stable properties, floating rate, origination fees, approximate coupon:

9.00% -12.00%

(1) Trepp , LLC, December 2013

Loan Originations

($ in millions)

Mezzanine Loans

Bridge Loans

$1,200 $984

Conduit Loans

$1,050

$900

$603

$750

$600 $376

$450 $219

$300

$150

$0

FY 2012 FY 2013 FY 2014 Q1 2015

5

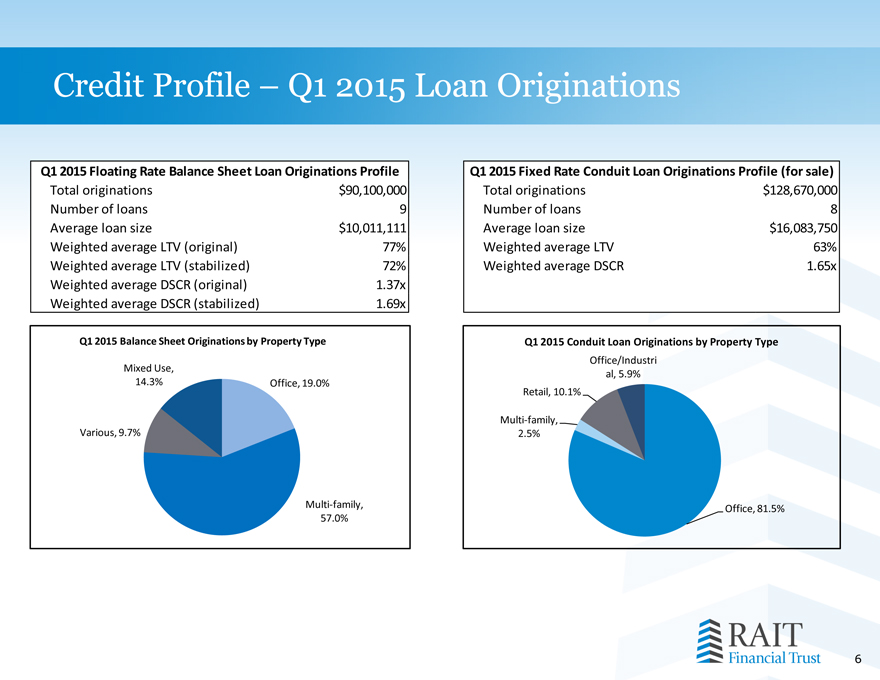

Credit Profile – Q1 2015 Loan Originations

Q1 2015 Floating Rate Balance Sheet Loan Originations Profile

Total originations $ 90,100,000

Number of loans 9

Average loan size $ 10,011,111

Weighted average LTV (original) 77%

Weighted average LTV (stabilized) 72%

Weighted average DSCR (original) 1.37x

Weighted average DSCR (stabilized) 1.69x

Q1 2015 Balance Sheet Originations by Property Type

Mixed Use,

14.3% Office, 19.0%

Various, 9.7%

Multi-family,

57.0%

Q1 2015 Fixed Rate Conduit Loan Originations Profile (for sale)

Total originations $128,670,000

Number of loans 8

Average loan size $16,083,750

Weighted average LTV 63%

Weighted average DSCR 1.65x

Q1 2015 Conduit Loan Originations by Property Type

Office/Industrial, 5.9%

Retail, 10.1%

Multi-family,

2.5%

Office, 81.5%

6

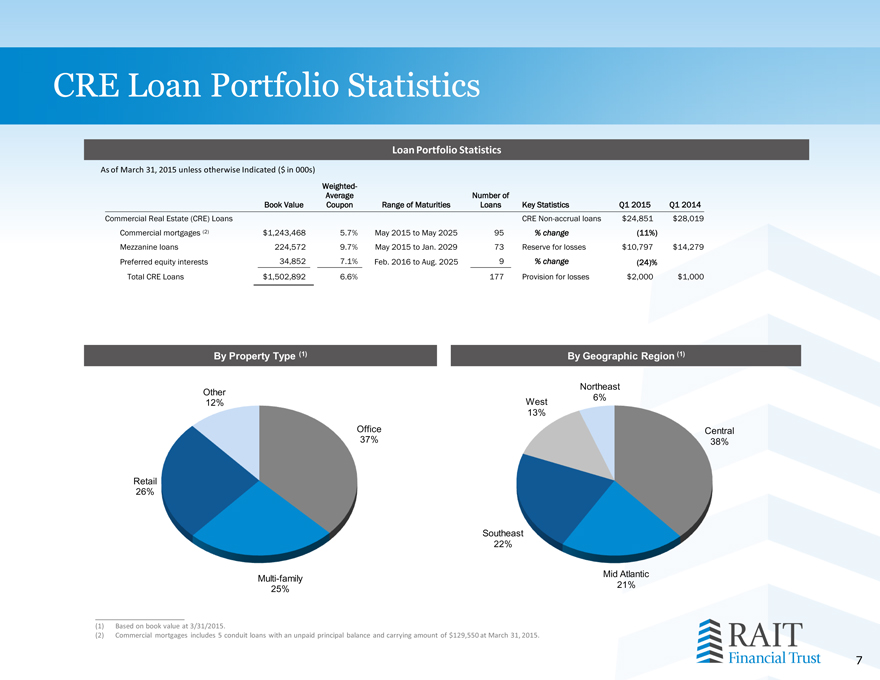

CRE Loan Portfolio Statistics

Loan Portfolio Statistics

As of March 31, 2015 unless otherwise Indicated ($ in 000s)

Weighted-

Average Number of

Book Value Coupon Range of Maturities Loans Key Statistics Q1 2015 Q1 2014

Commercial Real Estate (CRE) Loans CRE Non-accrual loans $24,851 $28,019

Commercial mortgages (2) $1,243,468 5.7% May 2015 to May 2025 95 % change (11%)

Mezzanine loans 224,572 9.7% May 2015 to Jan. 2029 73 Reserve for losses $10,797 $14,279

Preferred equity interests 34,852 7.1% Feb. 2016 to Aug. 2025 9 % change (24)%

Total CRE Loans $1,502,892 6.6% 177 Provision for losses $2,000 $1,000

By Property Type (1) By Geographic Region (1)

Northeast

Other 12% West 6%

13%

Office Central

37% 38%

Retail

26%

Southeast

22%

Multi-family Mid Atlantic

25% 21%

(1) Based on book value at 3/31/2015.

(2) Commercial mortgages includes 5 conduit loans with an unpaid principal balance and carrying amount of $129,550 at March 31, 2015.

7

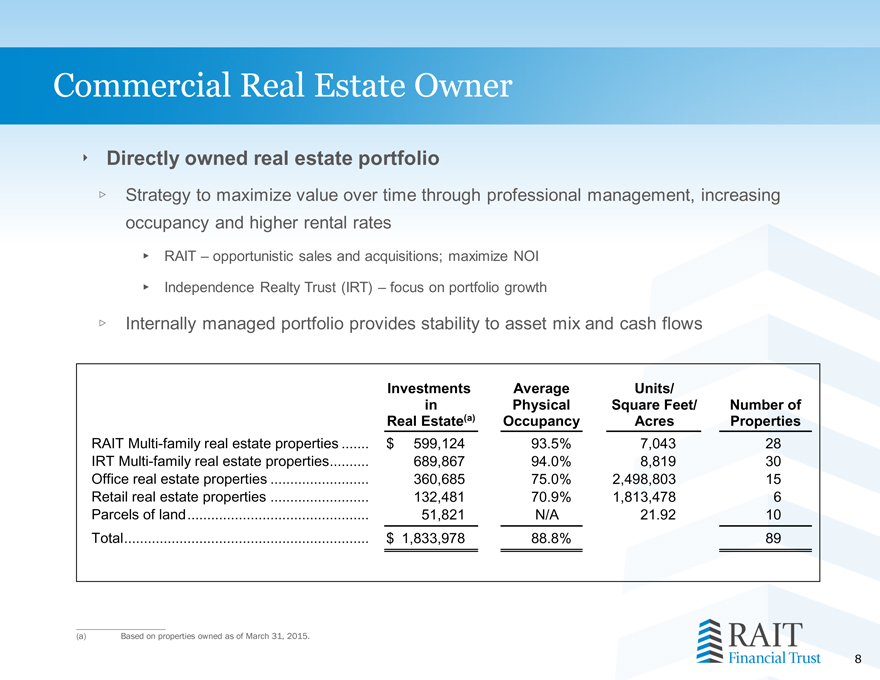

Commercial Real Estate Owner

Directly owned real estate portfolio

Strategy to maximize value over time through professional management, increasing occupancy and higher rental rates

RAIT – opportunistic sales and acquisitions; maximize NOI

Independence Realty Trust (IRT) – focus on portfolio growth

Internally managed portfolio provides stability to asset mix and cash flows

Investments Average Units/

in Physical Square Feet/ Number of

Real Estate(a) Occupancy Acres Properties

RAIT Multi-family real estate properties $ 599,124 93.5% 7,043 28

IRT Multi-family real estate properties 689,867 94.0% 8,819 30

Office real estate properties 360,685 75.0% 2,498,803 15

Retail real estate properties 132,481 70.9% 1,813,478 6

Parcels of land 51,821 N/A 21.92 10

Total $ 1,833,978 88.8% 89

(a) Based on properties owned as of March 31, 2015.

8

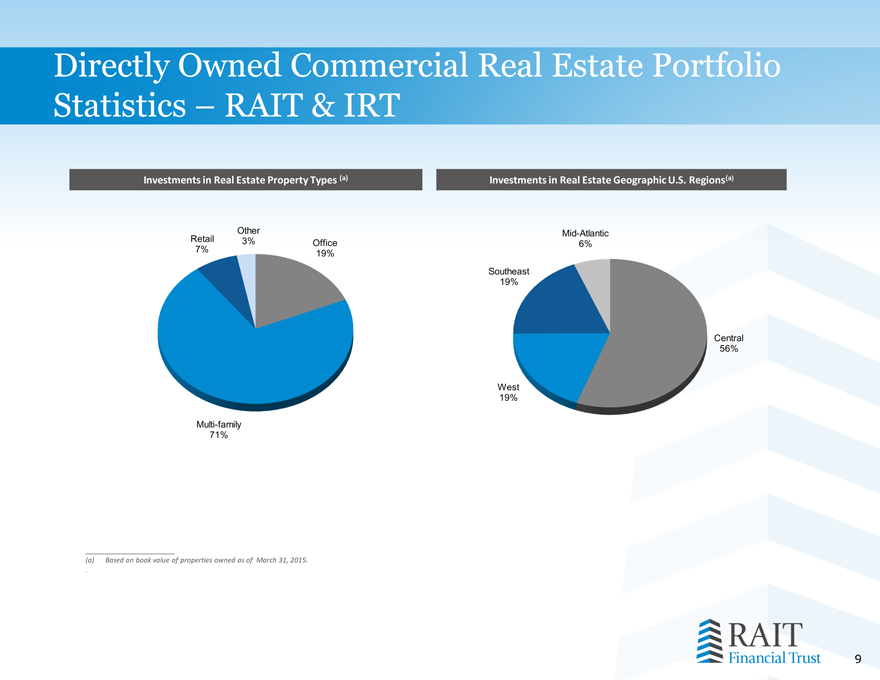

Directly Owned Commercial Real Estate Portfolio Statistics – RAIT & IRT

Investments in Real Estate Property Types (a) Investments in Real Estate Geographic U.S. Regions(a)

Other Mid-Atlantic

Retail 3% Office 6%

7% 19%

Southeast

19%

Central

56%

West

19%

Multi-family

71%

(a) Based on book value of properties owned as of March 31, 2015.

.9

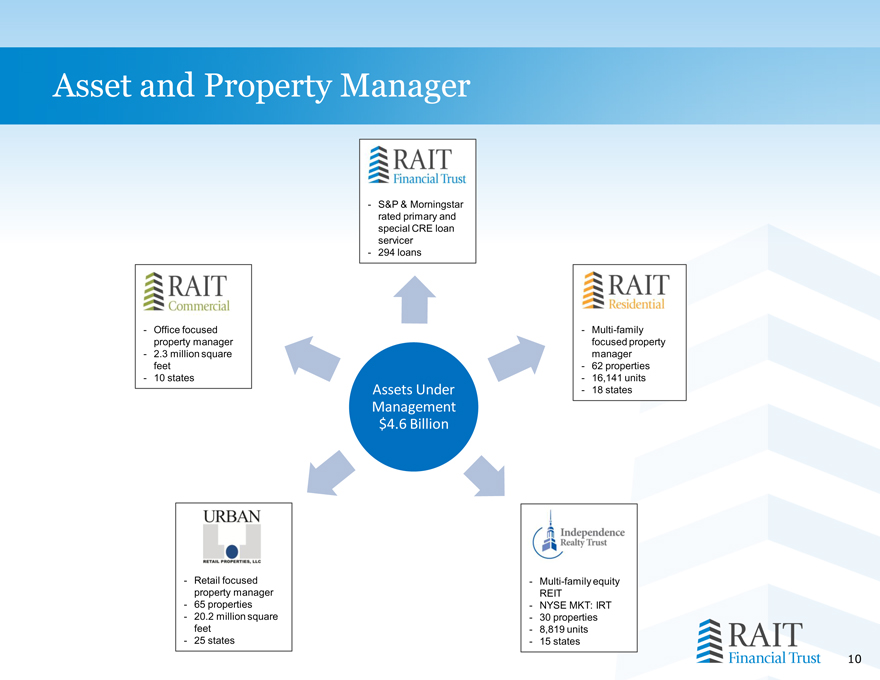

Asset and Property Manager

- S&P & Morningstar

rated primary and

special CRE loan

servicer

- 294 loans

- Office focused - Multi-family

property manager focused property

- 2.3 million square manager

feet - 62 properties

- 10 states - 16,141 units

Assets Under - 18 states

Management

$4.6 Billion

- Retail focused - Multi-family equity

property manager REIT

- 65 properties - NYSE MKT: IRT

- 20.2 million square - 30 properties

feet - 8,819 units

- 25 states - 15 states

10

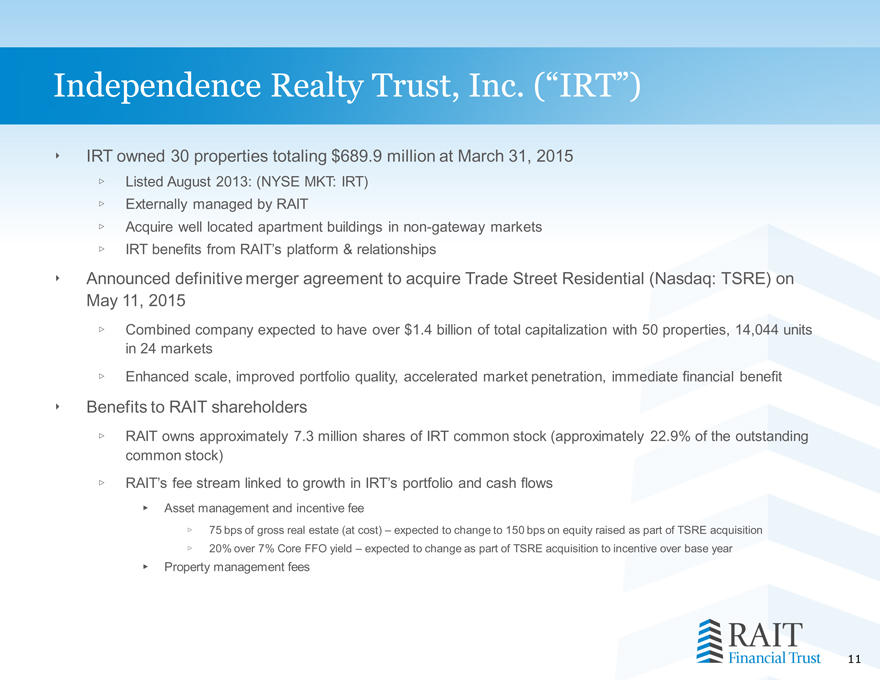

Independence Realty Trust, Inc. (“IRT”)

IRT owned 30 properties totaling $689.9 million at March 31, 2015

Listed August 2013: (NYSE MKT: IRT)

Externally managed by RAIT

Acquire well located apartment buildings in non-gateway markets

IRT benefits from RAIT’s platform & relationships

Announced definitive merger agreement to acquire Trade Street Residential (Nasdaq: TSRE) on

May 11, 2015

Combined company expected to have over $1.4 billion of total capitalization with 50 properties, 14,044 units

in 24 markets

Enhanced scale, improved portfolio quality, accelerated market penetration, immediate financial benefit

Benefits to RAIT shareholders

RAIT owns approximately 7.3 million shares of IRT common stock (approximately 22.9% of the outstanding

common stock)

RAIT’s fee stream linked to growth in IRT’s portfolio and cash flows

Asset management and incentive fee

75 bps of gross real estate (at cost) – expected to change to 150 bps on equity raised as part of TSRE acquisition

20% over 7% Core FFO yield – expected to change as part of TSRE acquisition to incentive over base year

Property management fees

11

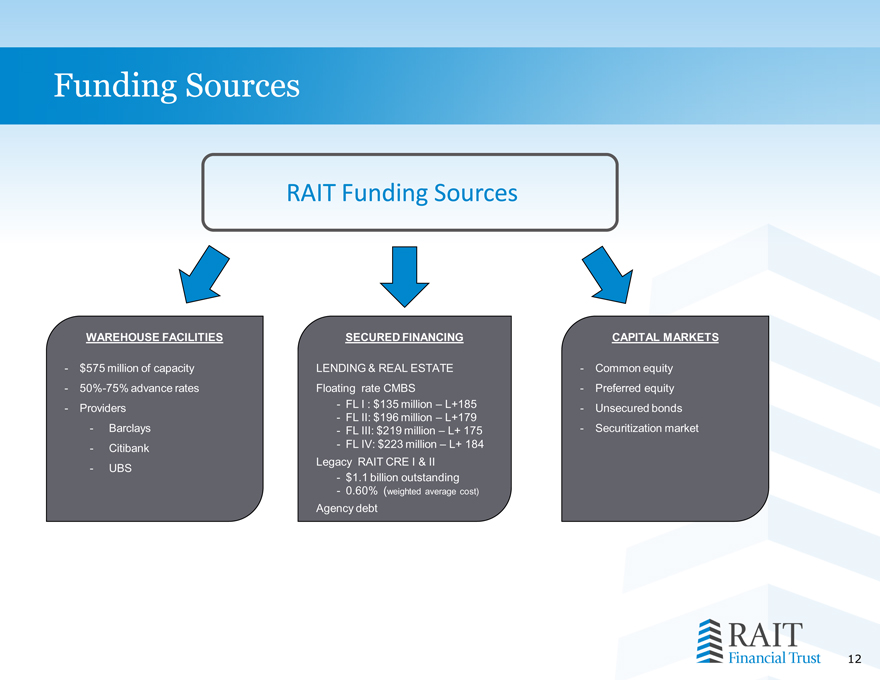

Funding Sources

RAIT Funding Sources

WAREHOUSE FACILITIES SECURED FINANCING CAPITAL MARKETS

- $575 million of capacity LENDING & REAL ESTATE - Common equity

- 50%-75% advance rates Floating rate CMBS - Preferred equity

- Providers - FL I : $135 million – L+185 - Unsecured bonds

- FL II: $196 million – L+179

- Barclays - FL III: $219 million – L+ 175 - Securitization market

- Citibank - FL IV: $223 million – L+ 184 Legacy RAIT CRE I & II

- UBS

- $1.1 billion outstanding

- 0.60% (w eighted average cost)

Agency debt

12

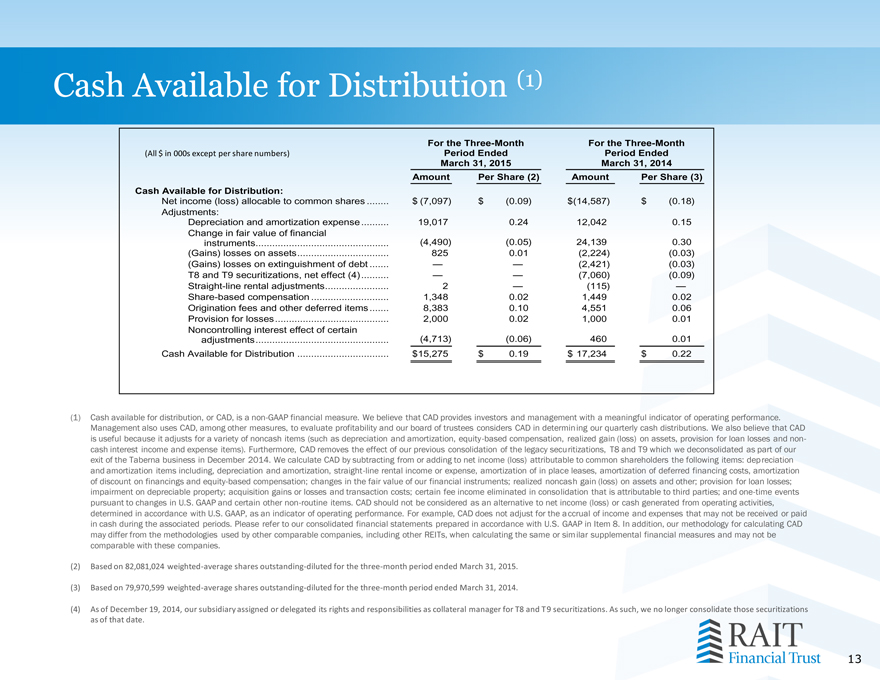

Cash Available for Distribution (1)

For the Three-Month For the Three-Month

(All $ in 000s except per share numbers) Period Ended Period Ended

March 31, 2015 March 31, 2014

Amount Per Share (2) Amount Per Share (3)

Cash Available for Distribution:

Net income (loss) allocable to common shares $ (7,097) $ (0.09) $(14,587) $ (0.18)

Adjustments:

Depreciation and amortization expense 19,017 0.24 12,042 0.15

Change in fair value of financial

instruments (4,490) (0.05) 24,139 0.30

(Gains) losses on assets 825 0.01 (2,224) (0.03)

(Gains) losses on extinguishment of debt — — (2,421) (0.03)

T8 and T9 securitizations, net effect (4) — — (7,060) (0.09)

Straight-line rental adjustments 2 — (115) —

Share-based compensation 1,348 0.02 1,449 0.02

Origination fees and other deferred items 8,383 0.10 4,551 0.06

Provision for losses 2,000 0.02 1,000 0.01

Noncontrolling interest effect of certain

adjustments (4,713) (0.06) 460 0.01

Cash Available for Distribution $15,275 $ 0.19 $ 17,234 $ 0.22

(1) Cash available for distribution, or CAD, is a non-GAAP financial measure. We believe that CAD provides investors and management with a meaningful indicator of operating performance. Management also uses CAD, among other measures, to evaluate profitability and our board of trustees considers CAD in determining our quarterly cash distributions. We also believe that CAD is useful because it adjusts for a variety of noncash items (such as depreciation and amortization, equity-based compensation, realized gain (loss) on assets, provision for loan losses and non-cash interest income and expense items). Furthermore, CAD removes the effect of our previous consolidation of the legacy securitizations, T8 and T9 which we deconsolidated as part of our exit of the Taberna business in December 2014. We calculate CAD by subtracting from or adding to net income (loss) attributable to common shareholders the following items: depreciation and amortization items including, depreciation and amortization, straight-line rental income or expense, amortization of in place leases, amortization of deferred financing costs, amortization of discount on financings and equity-based compensation; changes in the fair value of our financial instruments; realized noncash gain (loss) on assets and other; provision for loan losses; impairment on depreciable property; acquisition gains or losses and transaction costs; certain fee income eliminated in consolidation that is attributable to third parties; and one-time events pursuant to changes in U.S. GAAP and certain other non-routine items. CAD should not be considered as an alternative to net income (loss) or cash generated from operating activities, determined in accordance with U.S. GAAP, as an indicator of operating performance. For example, CAD does not adjust for the accrual of income and expenses that may not be received or paid in cash during the associated periods. Please refer to our consolidated financial statements prepared in accordance with U.S. GAAP in Item 8. In addition, our methodology for calculating CAD may differ from the methodologies used by other comparable companies, including other REITs, when calculating the same or similar supplemental financial measures and may not be comparable with these companies.

(2) Based on 82,081,024 weighted-average shares outstanding-diluted for the three-month period ended March 31, 2015.

(3) Based on 79,970,599 weighted-average shares outstanding-diluted for the three-month period ended March 31, 2014.

(4) As of December 19, 2014, our subsidiary assigned or delegated its rights and responsibilities as collateral manager for T8 and T9 securitizations. As such, we no longer consolidate those securitizations as of that date.

13

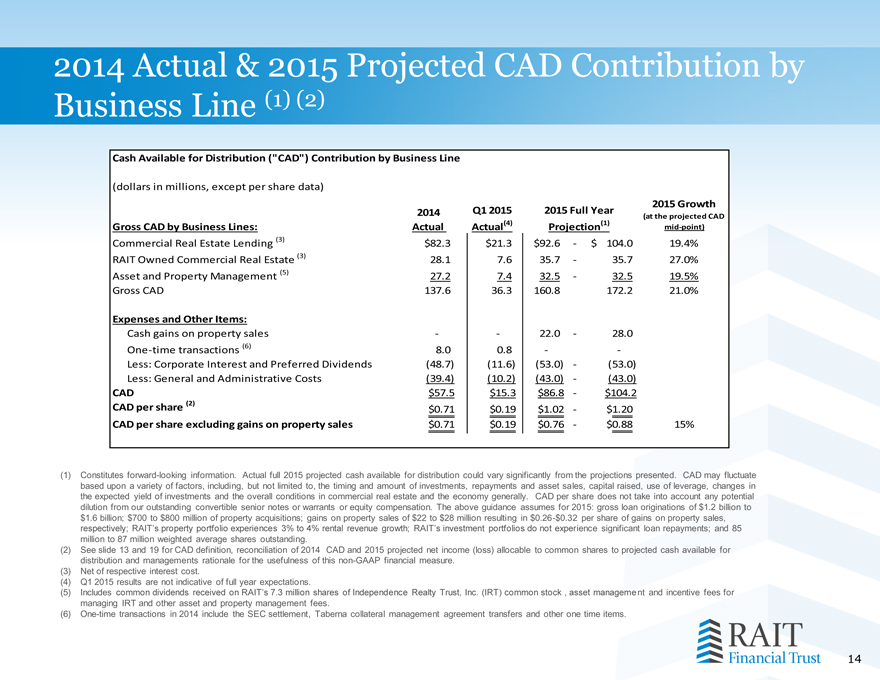

2014 Actual & 2015 Projected CAD Contribution by Business Line (1) (2)

Cash Available for Distribution (“CAD”) Contribution by Business Line

(dollars in millions, except per share data)

2015 Growth

2014 Q1 2015 2015 Full Year (at the projected CAD

Gross CAD by Business Lines: Actual Actual(4) Projection(1) mid-point)

Commercial Real Estate Lending (3) $82.3 $21.3 $92.6 — $ 104.0 19.4%

RAIT Owned Commercial Real Estate (3) 28.1 7.6 35.7 — 35.7 27.0%

Asset and Property Management (5) 27.2 7.4 32.5 — 32.5 19.5%

Gross CAD 137.6 36.3 160.8 172.2 21.0%

Expenses and Other Items:

Cash gains on property sales —— 22.0 — 28.0

One-time transactions (6) 8.0 0.8 — —

Less: Corporate Interest and Preferred Dividends (48.7) (11.6) (53.0) — (53.0)

Less: General and Administrative Costs (39.4) (10.2) (43.0) — (43.0)

CAD $57.5 $15.3 $86.8 — $104.2

CAD per share (2) $0.71 $0.19 $1.02 — $1.20

CAD per share excluding gains on property sales $0.71 $0.19 $0.76 — $0.88 15%

(1) Constitutes forward-looking information. Actual full 2015 projected cash available for distribution could vary significantly from the projections presented. CAD may fluctuate based upon a variety of factors, including, but not limited to, the timing and amount of investments, repayments and asset sales, capital raised, use of leverage, changes in the expected yield of investments and the overall conditions in commercial real estate and the economy generally. CAD per share does not take into account any potential dilution from our outstanding convertible senior notes or w arrants or equity compensation. The above guidance assumes for 2015: gross loan originations of $1.2 billion to

$1.6 billion; $700 to $800 million of property acquisitions; gains on property sales of $22 to $28 million resulting in $0.26-$0.32 per share of gains on property sales, respectively; RAIT’s property portfolio experiences 3% to 4% rental revenue grow th; RAIT’s investment portfolios do not experience significant loan repayments; and 85 million to 87 million w eighted average shares outstanding.

(2) See slide 13 and 19 for CAD definition, reconciliation of 2014 CAD and 2015 projected net income (loss) allocable to common shares to projected cash available for distribution and managements rationale for the usefulness of this non-GAAP financial measure.

(3) Net of respective interest cost.

(4) Q1 2015 results are not indicative of full year expectations.

(5) Includes common dividends received on RAIT’s 7.3 million shares of Independence Realty Trust, Inc. (IRT) common stock , asset management and incentive fees for managing IRT and other asset and property management fees.

(6) One-time transactions in 2014 include the SEC settlement, Taberna collateral management agreement transfers and other one time items.

14

RAIT Highlights & Goals

Growth & stability through a multi-strategy approach

Utilize RAIT’s core, integrated, real estate platform and management expertise to maximize shareholder value by investing in and growing RAIT’s core business lines and expand RAIT’s assets under management.

Focus on growth in RAIT’s core businesses

Commercial real estate lending

Commercial real estate ownership

Asset and property management

Opportunistic property sales

Target a mid-teen CAD return

15

Appendix

16

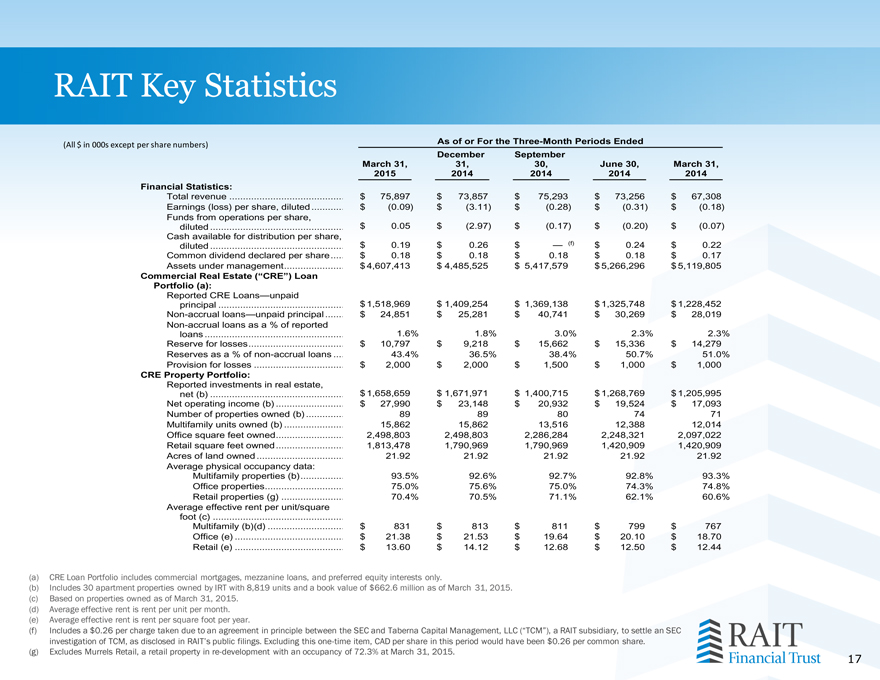

RAIT Key Statistics

(All $ in 000s except per share numbers) As of or For the Three-Month Periods Ended

December September

March 31, 31, 30, June 30, March 31,

2015 2014 2014 2014 2014

Financial Statistics:

Total revenue $ 75,897 $ 73,857 $ 75,293 $ 73,256 $ 67,308

Earnings (loss) per share, diluted $ (0.09) $ (3.11) $ (0.28) $ (0.31) $ (0.18)

Funds from operations per share,

diluted $ 0.05 $ (2.97) $ (0.17) $ (0.20) $ (0.07)

Cash available for distribution per share,

diluted $ 0.19 $ 0.26 $ — (f) $ 0.24 $ 0.22

Common dividend declared per share $ 0.18 $ 0.18 $ 0.18 $ 0.18 $ 0.17

Assets under management $ 4,607,413 $ 4,485,525 $ 5,417,579 $ 5,266,296 $ 5,119,805

Commercial Real Estate (“CRE”) Loan

Portfolio (a):

Reported CRE Loans—unpaid

principal $ 1,518,969 $ 1,409,254 $ 1,369,138 $ 1,325,748 $ 1,228,452

Non-accrual loans—unpaid principal $ 24,851 $ 25,281 $ 40,741 $ 30,269 $ 28,019

Non-accrual loans as a % of reported

loans 1.6% 1.8% 3.0% 2.3% 2.3%

Reserve for losses $ 10,797 $ 9,218 $ 15,662 $ 15,336 $ 14,279

Reserves as a % of non-accrual loans 43.4% 36.5% 38.4% 50.7% 51.0%

Provision for losses $ 2,000 $ 2,000 $ 1,500 $ 1,000 $ 1,000

CRE Property Portfolio:

Reported investments in real estate,

net (b) $ 1,658,659 $ 1,671,971 $ 1,400,715 $ 1,268,769 $ 1,205,995

Net operating income (b) $ 27,990 $ 23,148 $ 20,932 $ 19,524 $ 17,093

Number of properties owned (b) 89 89 80 74 71

Multifamily units owned (b) 15,862 15,862 13,516 12,388 12,014

Office square feet owned 2,498,803 2,498,803 2,286,284 2,248,321 2,097,022

Retail square feet owned 1,813,478 1,790,969 1,790,969 1,420,909 1,420,909

Acres of land owned 21.92 21.92 21.92 21.92 21.92

Average physical occupancy data:

Multifamily properties (b) 93.5% 92.6% 92.7% 92.8% 93.3%

Office properties 75.0% 75.6% 75.0% 74.3% 74.8%

Retail properties (g) 70.4% 70.5% 71.1% 62.1% 60.6%

Average effective rent per unit/square

foot (c)

Multifamily (b)(d) $ 831 $ 813 $ 811 $ 799 $ 767

Office (e) $ 21.38 $ 21.53 $ 19.64 $ 20.10 $ 18.70

Retail (e) $ 13.60 $ 14.12 $ 12.68 $ 12.50 $ 12.44

(a) CRE Loan Portfolio includes commercial mortgages, mezzanine loans, and preferred equity interests only.

(b) Includes 30 apartment properties owned by IRT with 8,819 units and a book value of $662.6 million as of March 31, 2015. (c) Based on properties owned as of March 31, 2015.

(d) Average effective rent is rent per unit per month. (e) Average effective rent is rent per square foot per year.

(f) Includes a $0.26 per charge taken due to an agreement in principle between the SEC and Taberna Capital Management, LLC (“TCM”), a RAIT subsidiary, to settle an SEC investigation of TCM, as disclosed in RAIT’s public filings. Excluding this one-time item, CAD per share in this period would have been $0.26 per common share.

(g) Excludes Murrels Retail, a retail property in re-development with an occupancy of 72.3% at March 31, 2015.

17

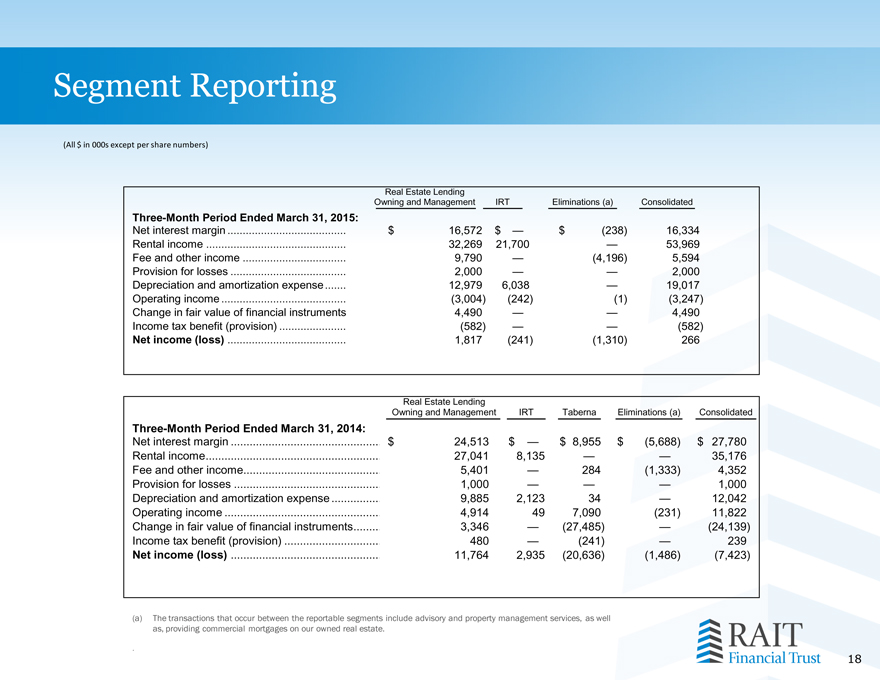

Segment Reporting

(All $ in 000s except per share numbers)

Real Estate Lending

Owning and Management IRT Eliminations (a) Consolidated

Three-Month Period Ended March 31, 2015:

Net interest margin $ 16,572 $ — $ (238) 16,334

Rental income 32,269 21,700 — 53,969

Fee and other income 9,790 — (4,196) 5,594

Provision for losses 2,000 — — 2,000

Depreciation and amortization expense 12,979 6,038 — 19,017

Operating income (3,004) (242) (1) (3,247)

Change in fair value of financial instruments 4,490 — — 4,490

Income tax benefit (provision) (582) — — (582)

Net income (loss) 1,817 (241) (1,310) 266

Real Estate Lending

Owning and Management IRT Taberna Eliminations (a) Consolidated

Three-Month Period Ended March 31, 2014:

Net interest margin $ 24,513 $ — $ 8,955 $ (5,688) $ 27,780

Rental income 27,041 8,135 — — 35,176

Fee and other income 5,401 — 284 (1,333) 4,352

Provision for losses 1,000 — — — 1,000

Depreciation and amortization expense 9,885 2,123 34 — 12,042

Operating income 4,914 49 7,090 (231) 11,822

Change in fair value of financial instruments 3,346 — (27,485) — (24,139)

Income tax benefit (provision) 480 — (241) — 239

Net income (loss) 11,764 2,935 (20,636) (1,486) (7,423)

(a) The transactions that occur between the reportable segments include advisory and property management services, as well

as, providing commercial mortgages on our owned real estate.

.

18

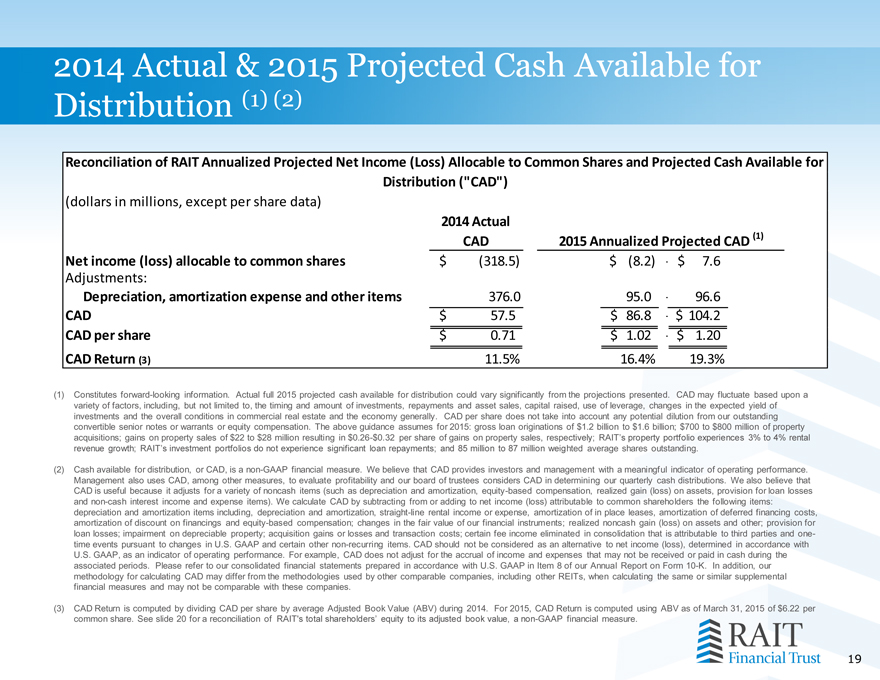

2014 Actual & 2015 Projected Cash Available for Distribution (1) (2)

Reconciliation of RAIT Annualized Projected Net Income (Loss) Allocable to Common Shares and Projected Cash Available for

Distribution (“CAD”)

(dollars in millions, except per share data)

2014 Actual

CAD 2015 Annualized Projected CAD (1)

Net income (loss) allocable to common shares $ (318.5) $ (8.2) $ 7.6

Adjustments:

Depreciation, amortization expense and other items 376.0 95.0 96.6

CAD $ 57.5 $ 86.8 $ 104.2

CAD per share $ 0.71 $ 1.02 $ 1.20

CAD Return (3) 11.5% 16.4% 19.3%

(1) Constitutes forward-looking information. Actual full 2015 projected cash available for distribution could vary significantly from the projections presented. CAD may fluctuate based upon a variety of factors, including, but not limited to, the timing and amount of investments, repayments and asset sales, capital raised, use of leverage, changes in the expected yield of investments and the overall conditions in commercial real estate and the economy generally. CAD per share does not take into account any potential dilution from our outstanding convertible senior notes or w arrants or equity compensation. The above guidance assumes for 2015: gross loan originations of $1.2 billion to $1.6 billion; $700 to $800 million of property acquisitions; gains on property sales of $22 to $28 million resulting in $0.26-$0.32 per share of gains on property sales, respectively; RAIT’s property portfolio experiences 3% to 4% rental revenue grow th; RAIT’s investment portfolios do not experience significant loan repayments; and 85 million to 87 million w eighted average shares outstanding.

(2) Cash available for distribution, or CAD, is a non-GAAP financial measure. We believe that CAD provides investors and management w ith a meaningful indicator of operating performance. Management also uses CAD, among other measures, to evaluate profitability and our board of trustees considers CAD in determining our quarterly cash distributions. We also believe that CAD is useful because it adjusts for a variety of noncash items (such as depreciation and amortization, equity-based compensation, realized gain (loss) on assets, provision for loan losses and non-cash interest income and expense items). We calculate CAD by subtracting from or adding to net income (loss) attributable to common shareholders the follow ing items: depreciation and amortization items including, depreciation and amortization, straight-line rental income or expense, amortization of in place leases, amortization of deferred financing costs, amortization of discount on financings and equity-based compensation; changes in the fair value of our financial instruments; realized noncash gain (loss) on assets and other; provision for loan losses; impairment on depreciable property; acquisition gains or losses and transaction costs; certain fee income eliminated in consolidation that is attributable to third parties and onetime events pursuant to changes in U.S. GAAP and certain other non-recurring items. CAD should not be considered as an alternative to net income (loss), determined in accordance with U.S. GAAP, as an indicator of operating performance. For example, CAD does not adjust for the accrual of income and expenses that may not be received or paid in cash during the associated periods. Please refer to our consolidated financial statements prepared in accordance with U.S. GAAP in Item 8 of our Annual Report on Form 10-K. In addition, our methodology for calculating CAD may differ from the methodologies used by other comparable companies, including other REITs, w hen calculating the same or similar supplemental financial measures and may not be comparable w ith these companies.

(3) CAD Return is computed by dividing CAD per share by average Adjusted Book Value (ABV) during 2014. For 2015, CAD Return is computed using ABV as of March 31, 2015 of $6.22 per common share. See slide 20 for a reconciliation of RAIT’s total shareholders’ equity to its adjusted book value, a non-GAAP financial measure.

19

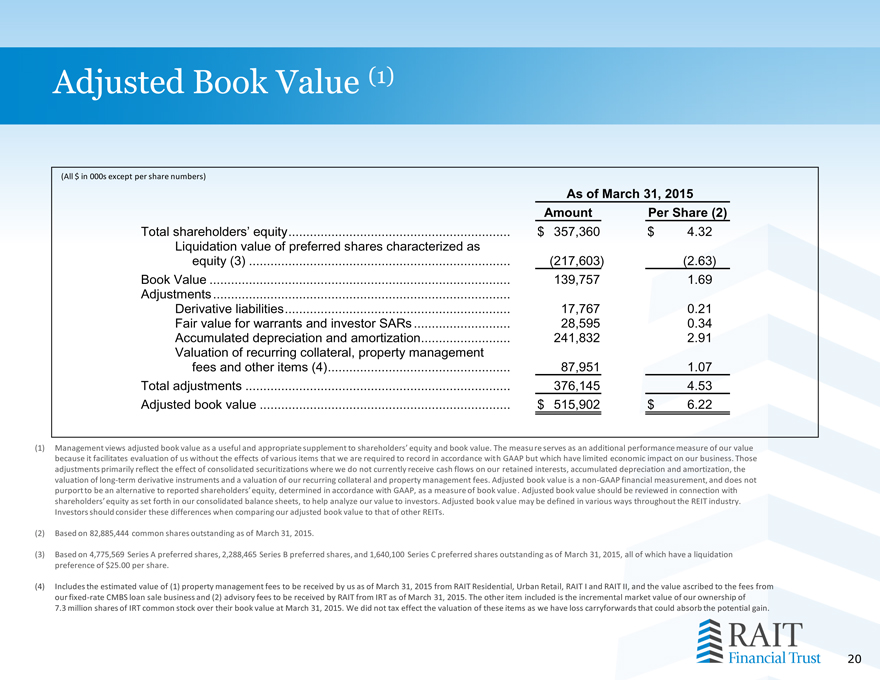

Adjusted Book Value (1)

(All $ in 000s except per share numbers)

As of March 31, 2015

Amount Per Share (2)

Total shareholders’ equity $ 357,360 $ 4.32

Liquidation value of preferred shares characterized as

equity (3) (217,603) (2.63)

Book Value 139,757 1.69

Adjustments

Derivative liabilities 17,767 0.21

Fair value for warrants and investor SARs 28,595 0.34

Accumulated depreciation and amortization 241,832 2.91

Valuation of recurring collateral, property management

fees and other items (4) 87,951 1.07

Total adjustments 376,145 4.53

Adjusted book value $ 515,902 $ 6.22

(1) Management views adjusted book value as a useful and appropriate supplement to shareholders’ equity and book value. The measure serves as an additional performance measure of our value because it facilitates evaluation of us without the effects of various items that we are required to record in accordance with GAAP but which have limited economic impact on our business. Those adjustments primarily reflect the effect of consolidated securitizations where we do not currently receive cash flows on our retained interests, accumulated depreciation and amortization, the valuation of long-term derivative instruments and a valuation of our recurring collateral and property management fees. Adjusted book value is a non-GAAP financial measurement, and does not purport to be an alternative to reported shareholders’ equity, determined in accordance with GAAP, as a measure of book value. Adjusted book value should be reviewed in connection with shareholders’ equity as set forth in our consolidated balance sheets, to help analyze our value to investors. Adjusted book value may be defined in various ways throughout the REIT industry.

Investors should consider these differences when comparing our adjusted book value to that of other REITs.

(2) Based on 82,885,444 common shares outstanding as of March 31, 2015.

(3) Based on 4,775,569 Series A preferred shares, 2,288,465 Series B preferred shares, and 1,640,100 Series C preferred shares outstanding as of March 31, 2015, all of which have a liquidation preference of $25.00 per share.

(4) Includes the estimated value of (1) property management fees to be received by us as of March 31, 2015 from RAIT Residential, Urban Retail, RAIT I and RAIT II, and the value ascribed to the fees from our fixed-rate CMBS loan sale business and (2) advisory fees to be received by RAIT from IRT as of March 31, 2015. The other item included is the incremental market value of our ownership of 7.3 million shares of IRT common stock over their book value at March 31, 2015. We did not tax effect the valuation of these items as we have loss carryforwards that could absorb the potential gain.

20