Q4 & YEAR END 2018 EARNINGS CALL FEBRUARY 26, 2019

INTRODUCTORY COMMENTS This information is as of the date indicated and, to our knowledge, was timely and accurate when presented. We are under no obligation to update or remove outdated information other than as required by applicable law or regulation. 2

HEADLINES 1. Strong Fourth Quarter Caps a Successful Year 3

HEADLINES 1. Strong Fourth Quarter Caps a Successful Year 2. Investment Spending Regains Momentum 4

HEADLINES 1. Strong Fourth Quarter Caps a Successful Year 2. Investment Spending Regains Momentum 3. Tenant Segments Broadly Strong, New Tenant for CLA Properties 5

HEADLINES 1. Strong Fourth Quarter Caps a Successful Year 2. Investment Spending Regains Momentum 3. Tenant Segments Broadly Strong, New Tenant for CLA Properties 4. Monthly Dividend Increase 6

HEADLINES 1. Strong Fourth Quarter Caps a Successful Year 2. Investment Spending Regains Momentum 3. Tenant Segments Broadly Strong, New Tenant for CLA Properties 4. Monthly Dividend Increase 5. Introducing 2019 Guidance 7

PORTFOLIO UPDATE 8

PORTFOLIO STATISTICS $6.8B+ TOTAL INVESTMENTS 394 PROPERTIES IN SERVICE 99% OCCUPANCY $217M Q4 INVESTMENT SPENDING $572M 2018 INVESTMENT SPENDING 1.92X RENT * Coverage is weighted average for the segments. Theatres and Family Entertainment Centers data is COVERAGE* TTM September 2018. Golf Entertainment Complexes and Other Recreation data is TTM September 2018. Ski Area data is TTM April 2018 and Attractions data is TTM August 2018. Public Charter School data is 9 TTM June 2018, Private school data is TTM June 2018 and Early Childhood Education data is TTM September 2018.

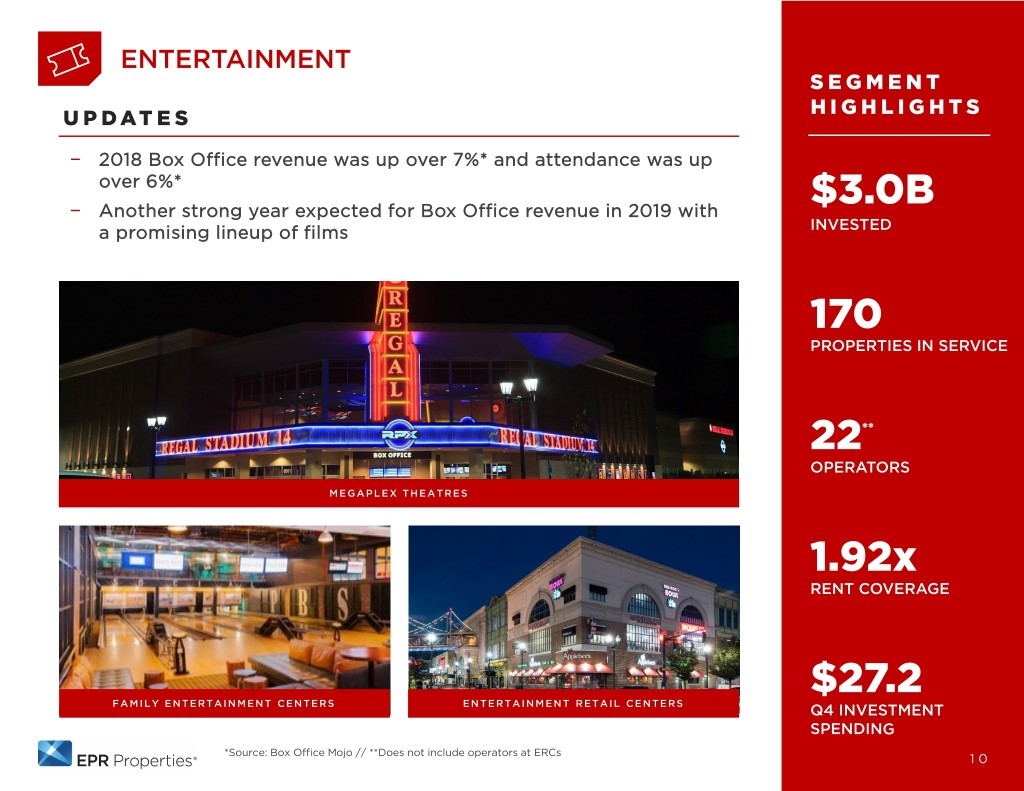

ENTERTAINMENT SEGMENT HIGHLIGHTS UPDATES − 2018 Box Office revenue was up over 7%* and attendance was up over 6%* − Another strong year expected for Box Office revenue in 2019 with $3.0B a promising lineup of films INVESTED 170 PROPERTIES IN SERVICE 22** OPERATORS MEGAPLEX THEATRES 1.92x RENT COVERAGE $27.2 FAMILY ENTERTAINMENT CENTERS ENTERTAINMENT RETAIL CENTERS Q4 INVESTMENT SPENDING *Source: Box Office Mojo // **Does not include operators at ERCs 10

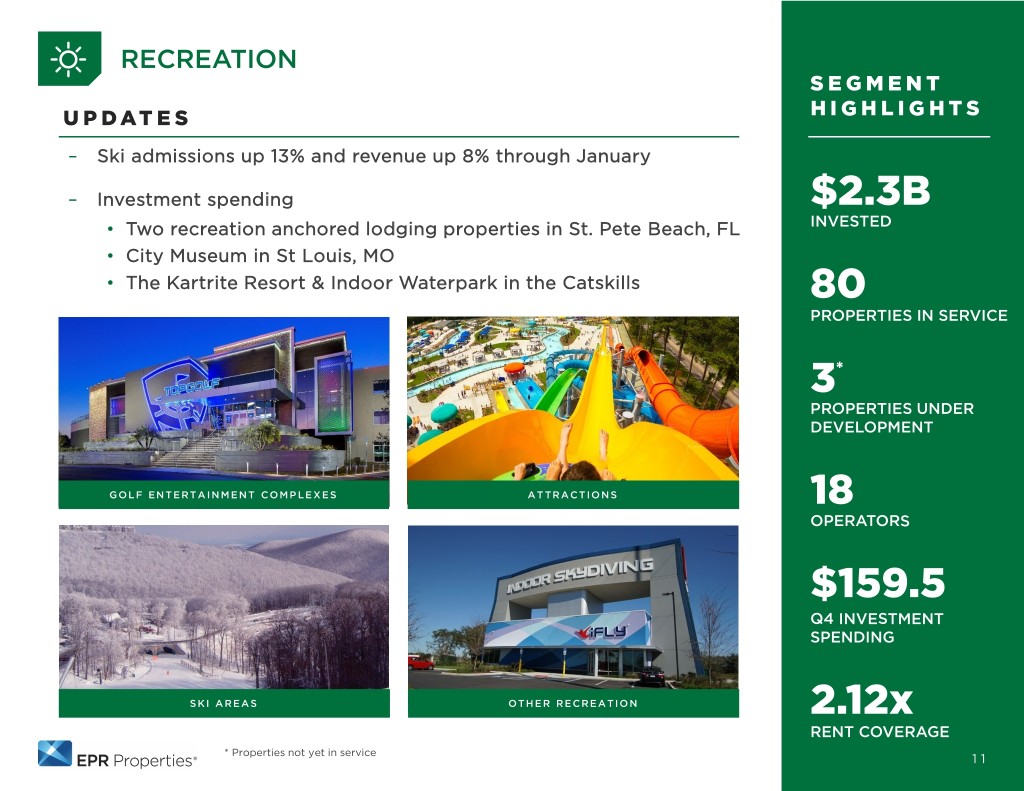

RECREATION SEGMENT UPDATES HIGHLIGHTS – Ski admissions up 13% and revenue up 8% through January – Investment spending $2.3B • Two recreation anchored lodging properties in St. Pete Beach, FL INVESTED • City Museum in St Louis, MO • The Kartrite Resort & Indoor Waterpark in the Catskills 80 PROPERTIES IN SERVICE 3* PROPERTIES UNDER DEVELOPMENT GOLF ENTERTAINMENT COMPLEXES ATTRACTIONS 18 OPERATORS $159.5 Q4 INVESTMENT SPENDING SKI AREAS OTHER RECREATION 2.12x RENT COVERAGE * Properties not yet in service 11

RECREATION OTHER RECREATION- RECREATION ANCHORED LODGING St. Pete Beach Acquisitions Two recreation anchored lodging assets which include – Combined 258 rooms and private beachfront on the Gulf of Mexico – Long history with significant food and beverage contribution Facilities upgrade of $24M planned, will introduce new amenities and drive revenue growth 12

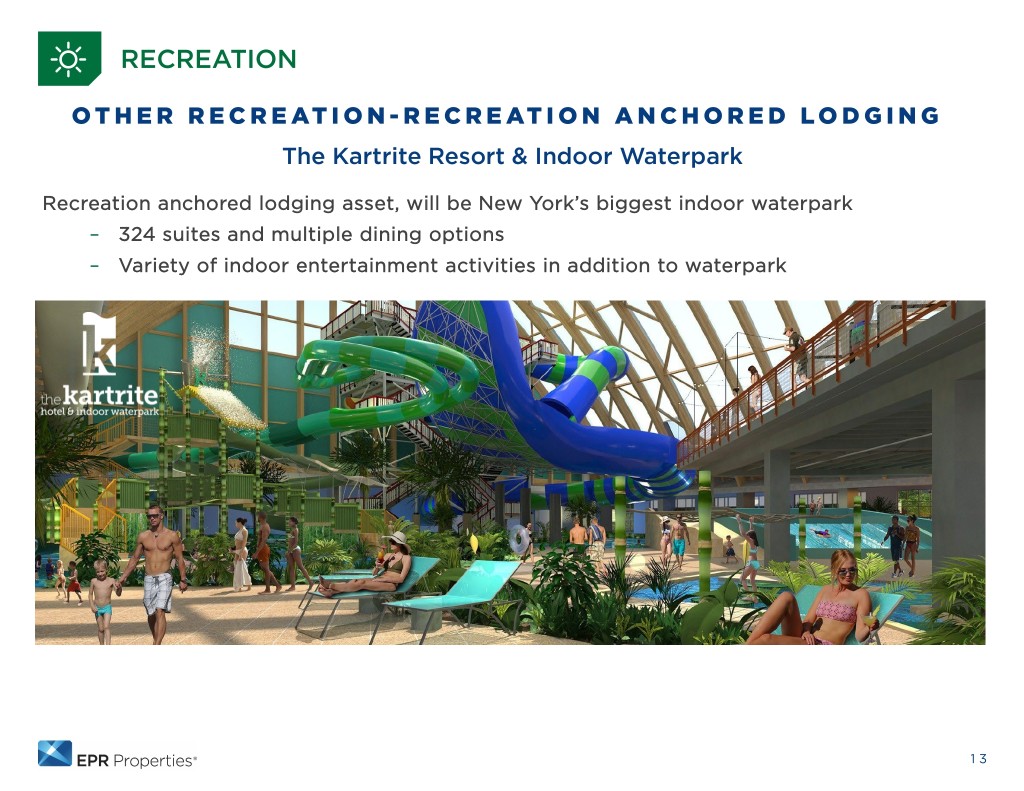

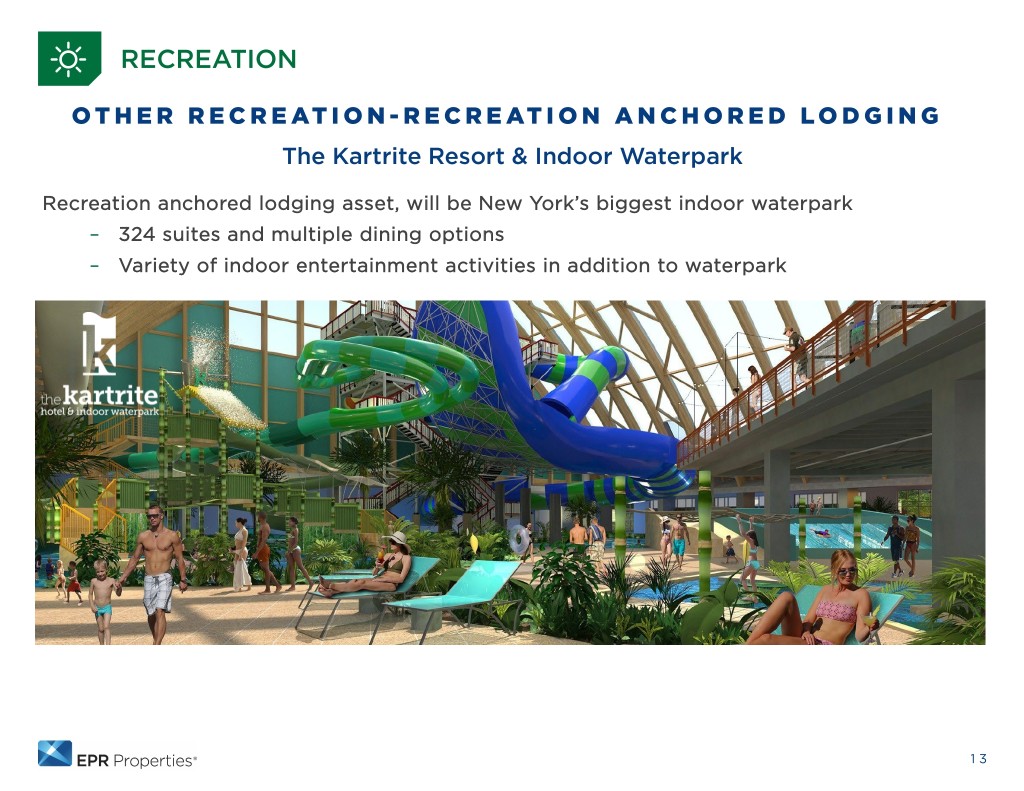

RECREATION OTHER RECREATION- RECREATION ANCHORED LODGING The Kartrite Resort & Indoor Waterpark Recreation anchored lodging asset, will be New York’s biggest indoor waterpark – 324 suites and multiple dining options – Variety of indoor entertainment activities in addition to waterpark 13

RECREATION ATTRACTION City Museum in St. Louis A highly interactive and artistic children’s museum with a 20-year history of delighting guests 14

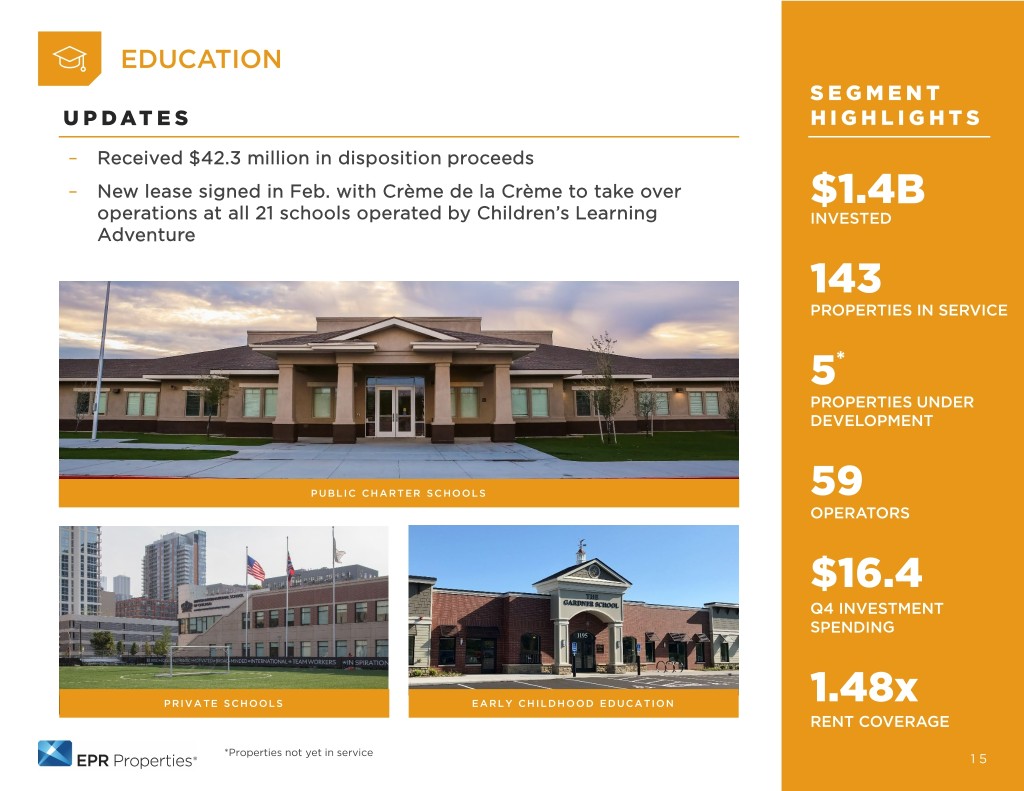

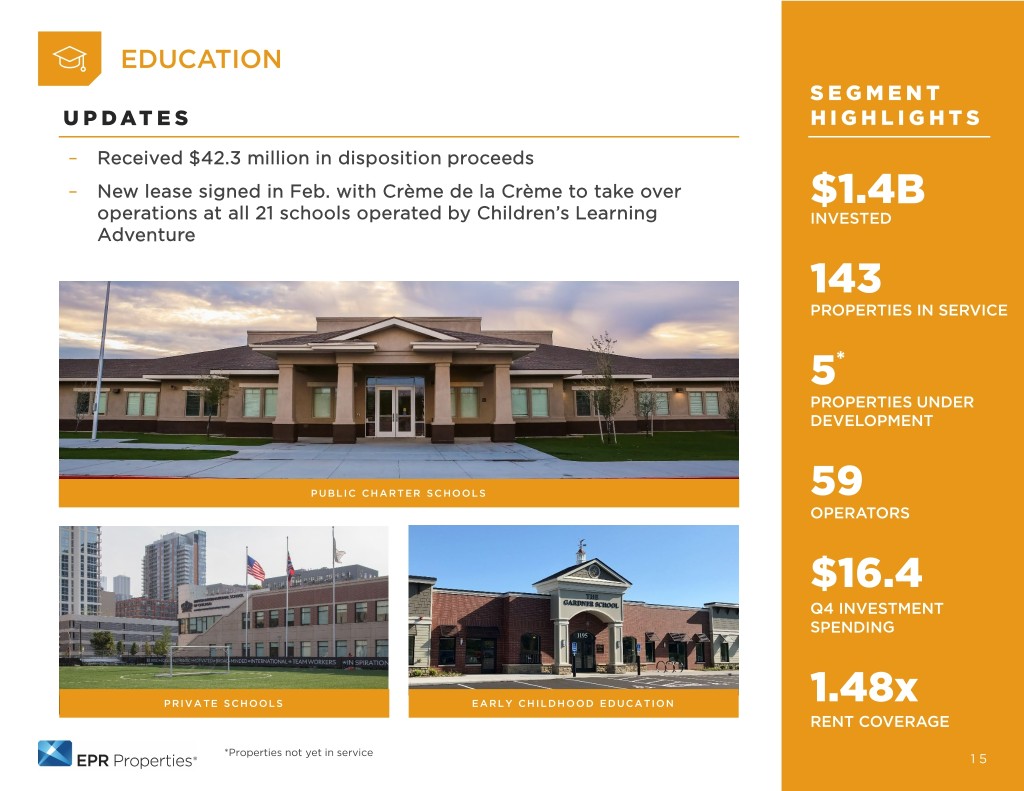

EDUCATION SEGMENT UPDATES HIGHLIGHTS – Received $42.3 million in disposition proceeds – New lease signed in Feb. with Crème de la Crème to take over $1.4B operations at all 21 schools operated by Children’s Learning INVESTED Adventure 143 PROPERTIES IN SERVICE 5* PROPERTIES UNDER DEVELOPMENT PUBLIC CHARTER SCHOOLS 59 OPERATORS $16.4 Q4 INVESTMENT SPENDING PRIVATE SCHOOLS EARLY CHILDHOOD EDUCATION 1.48x RENT COVERAGE *Properties not yet in service 15

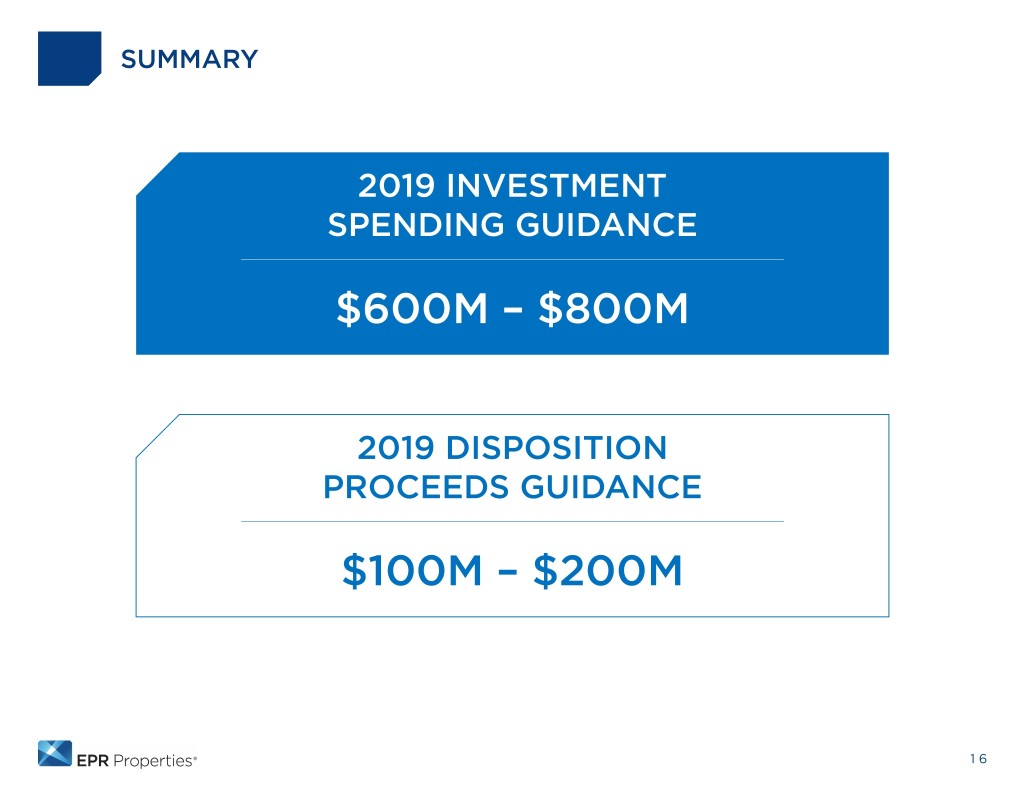

SUMMARY 2019 INVESTMENT SPENDING GUIDANCE $600M – $800M 2019 DISPOSITION PROCEEDS GUIDANCE $100M – $200M 16

FINANCIAL REVIEW 17

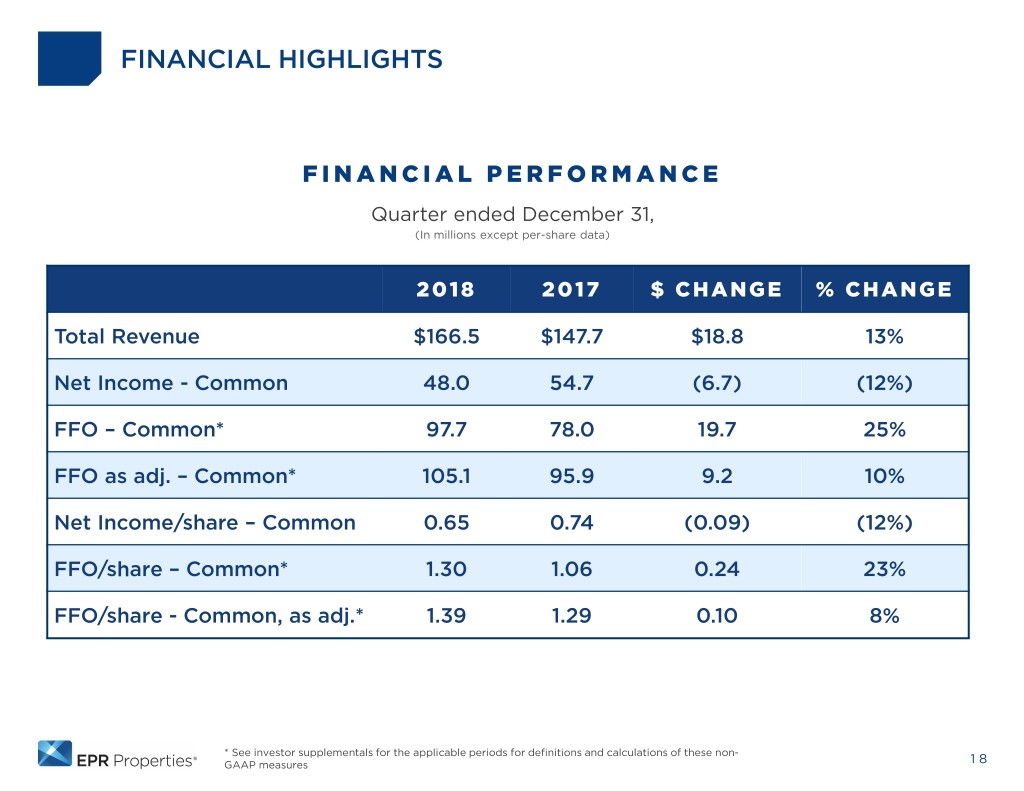

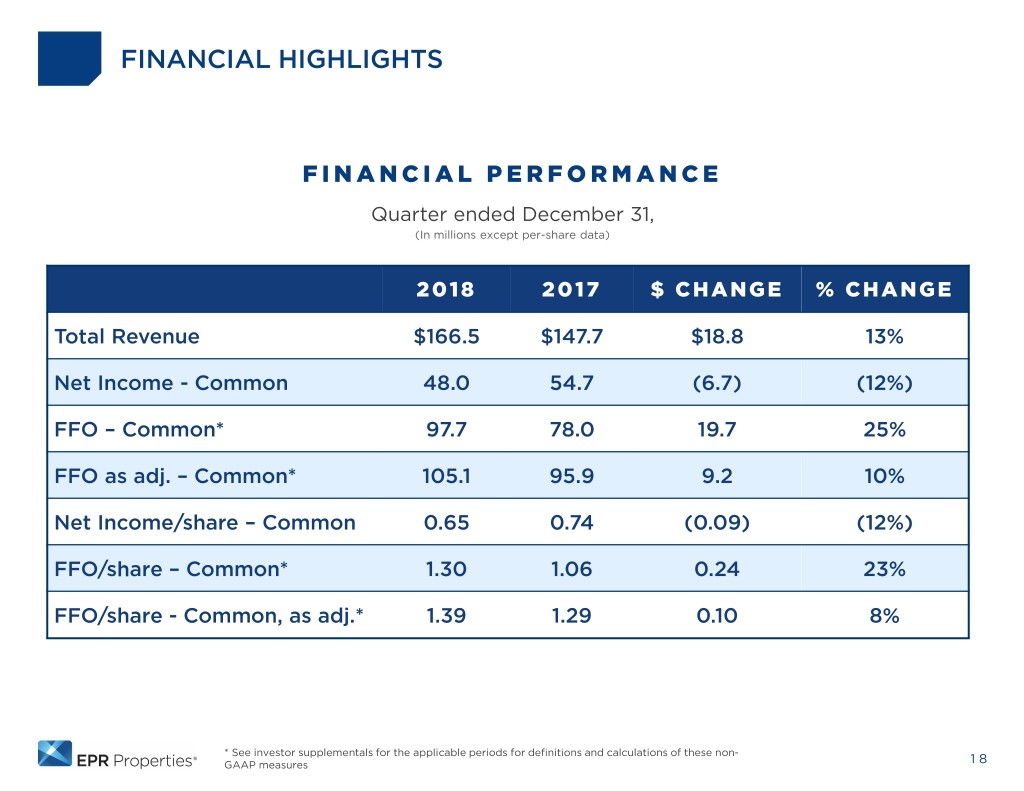

FINANCIAL HIGHLIGHTS FINANCIAL PERFORMANCE Quarter ended December 31, (In millions except per-share data) 2018 2017 $ CHANGE % CHANGE Total Revenue $166.5 $147.7 $18.8 13% Net Income - Common 48.0 54.7 (6.7) (12%) FFO – Common* 97.7 78.0 19.7 25% FFO as adj. – Common* 105.1 95.9 9.2 10% Net Income/share – Common 0.65 0.74 (0.09) (12%) FFO/share – Common* 1.30 1.06 0.24 23% FFO/share - Common, as adj.* 1.39 1.29 0.10 8% * See investor supplementals for the applicable periods for definitions and calculations of these non- GAAP measures 18

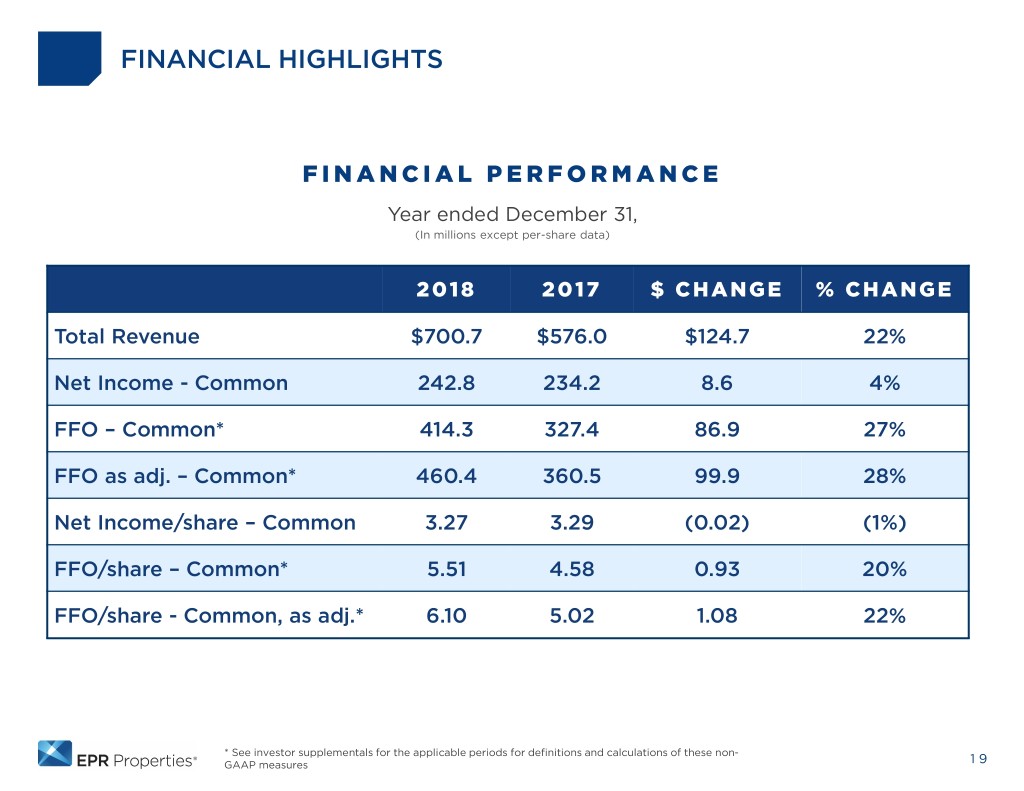

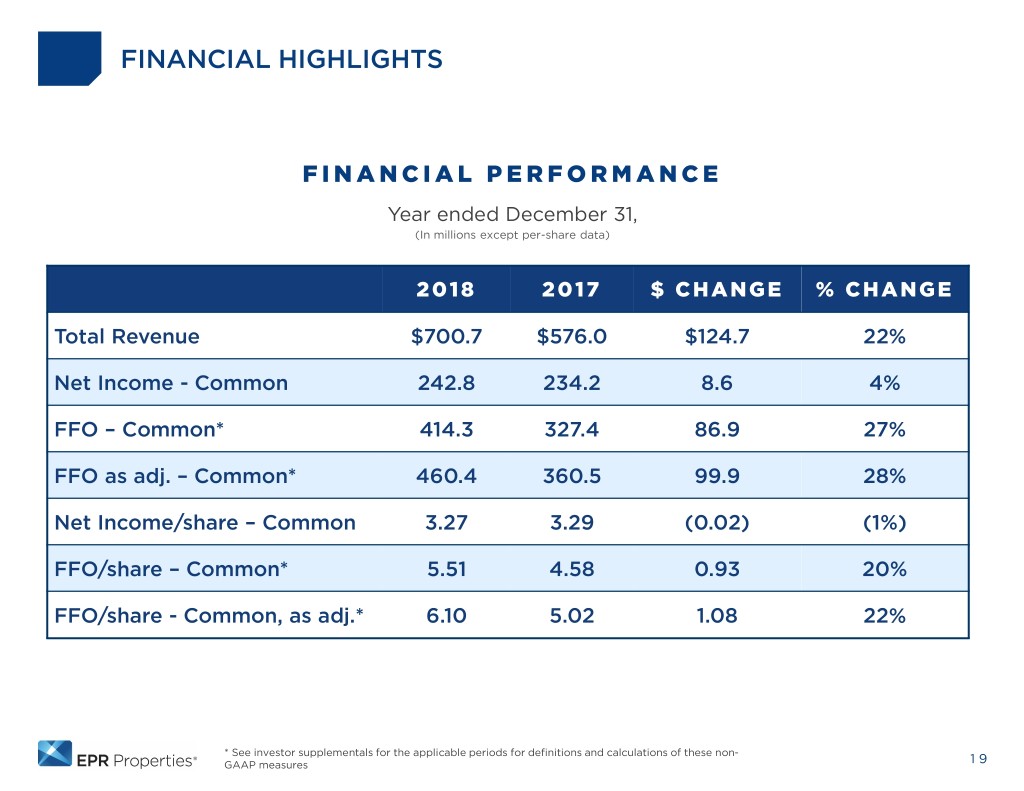

FINANCIAL HIGHLIGHTS FINANCIAL PERFORMANCE Year ended December 31, (In millions except per-share data) 2018 2017 $ CHANGE % CHANGE Total Revenue $700.7 $576.0 $124.7 22% Net Income - Common 242.8 234.2 8.6 4% FFO – Common* 414.3 327.4 86.9 27% FFO as adj. – Common* 460.4 360.5 99.9 28% Net Income/share – Common 3.27 3.29 (0.02) (1%) FFO/share – Common* 5.51 4.58 0.93 20% FFO/share - Common, as adj.* 6.10 5.02 1.08 22% * See investor supplementals for the applicable periods for definitions and calculations of these non- GAAP measures 19

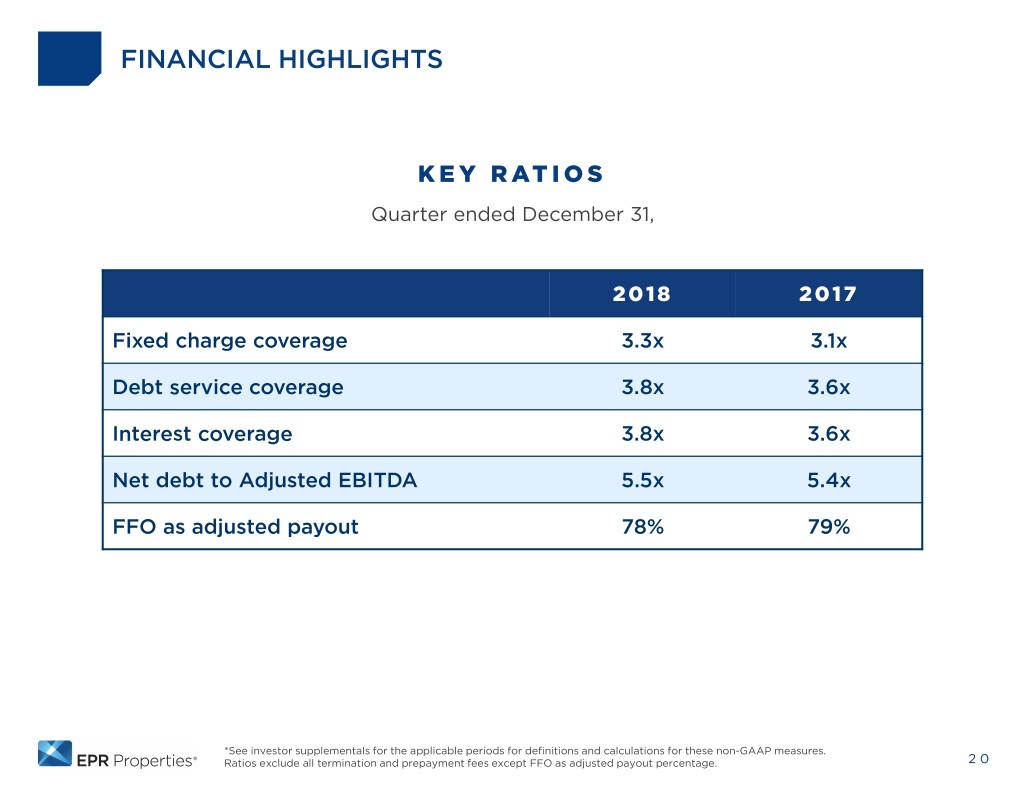

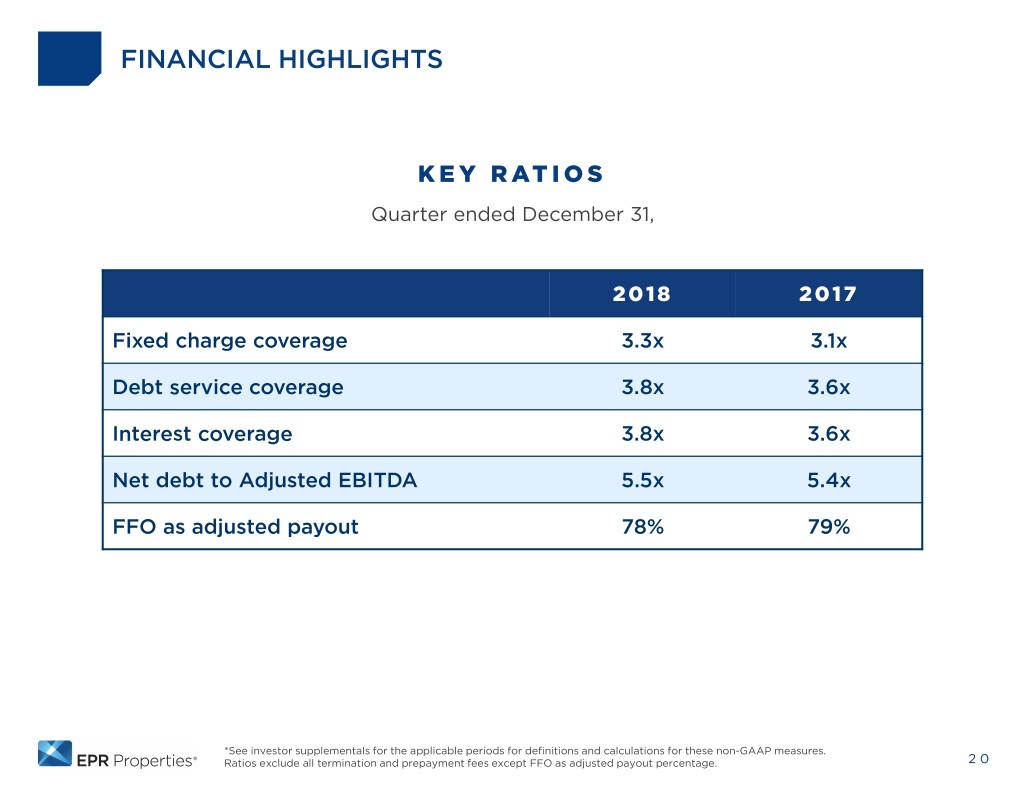

FINANCIAL HIGHLIGHTS KEY RATIOS Quarter ended December 31, 2018 2017 Fixed charge coverage 3.3x 3.1x Debt service coverage 3.8x 3.6x Interest coverage 3.8x 3.6x Net debt to Adjusted EBITDA 5.5x 5.4x FFO as adjusted payout 78% 79% *See investor supplementals for the applicable periods for definitions and calculations for these non-GAAP measures. Ratios exclude all termination and prepayment fees except FFO as adjusted payout percentage. 20

CAPITAL MARKETS & LIQUIDITY UPDATE 21

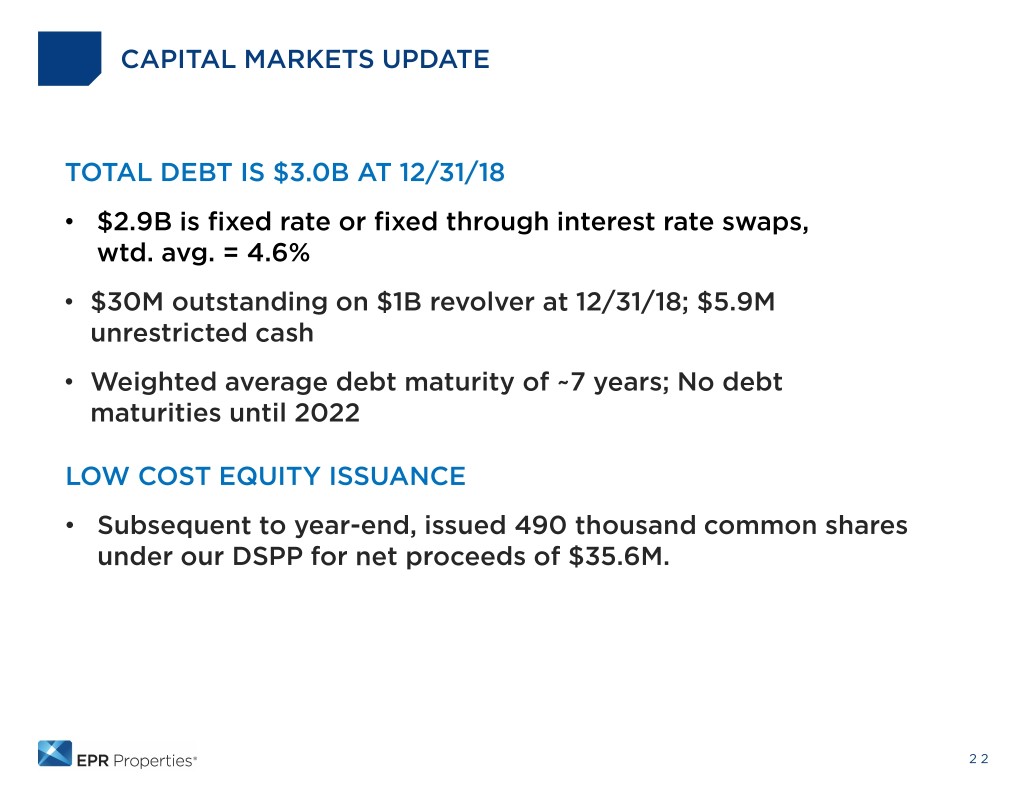

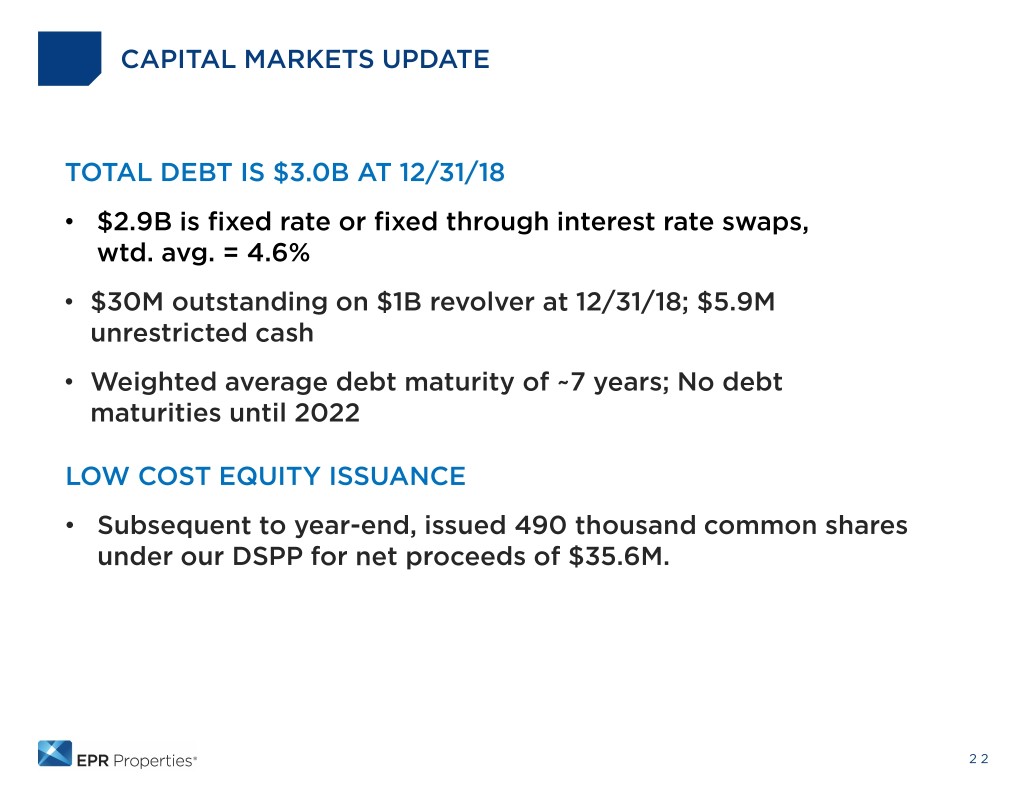

CAPITAL MARKETS UPDATE TOTAL DEBT IS $3.0B AT 12/31/18 • $2.9B is fixed rate or fixed through interest rate swaps, wtd. avg. = 4.6% • $30M outstanding on $1B revolver at 12/31/18; $5.9M unrestricted cash • Weighted average debt maturity of ~7 years; No debt maturities until 2022 LOW COST EQUITY ISSUANCE • Subsequent to year-end, issued 490 thousand common shares under our DSPP for net proceeds of $35.6M. 22

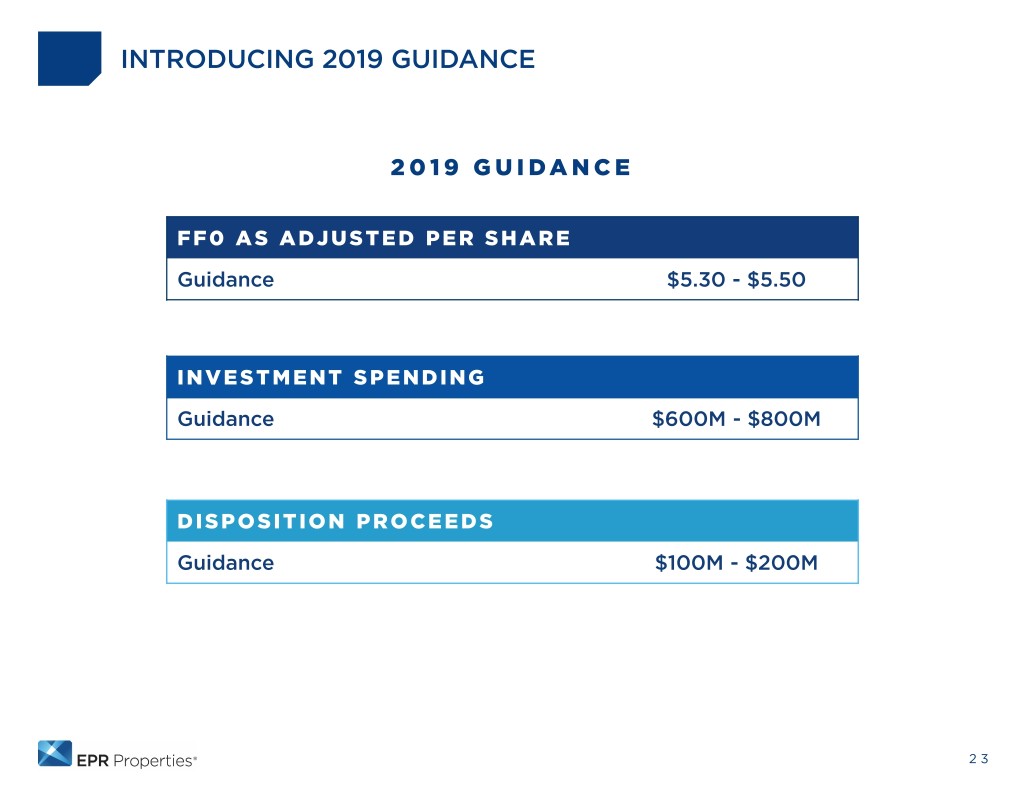

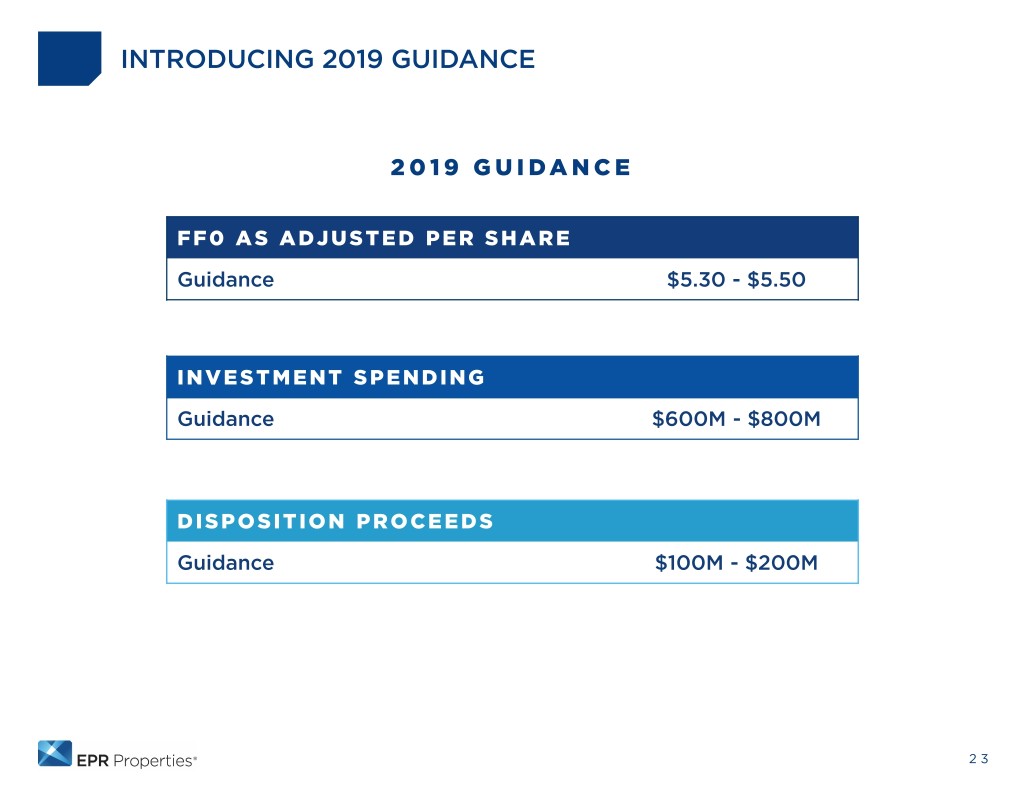

INTRODUCING 2019 GUIDANCE 2019 GUIDANCE FF0 AS ADJUSTED PER SHARE Guidance $5.30 - $5.50 INVESTMENT SPENDING Guidance $600M - $800M DISPOSITION PROCEEDS Guidance $100M - $200M 23

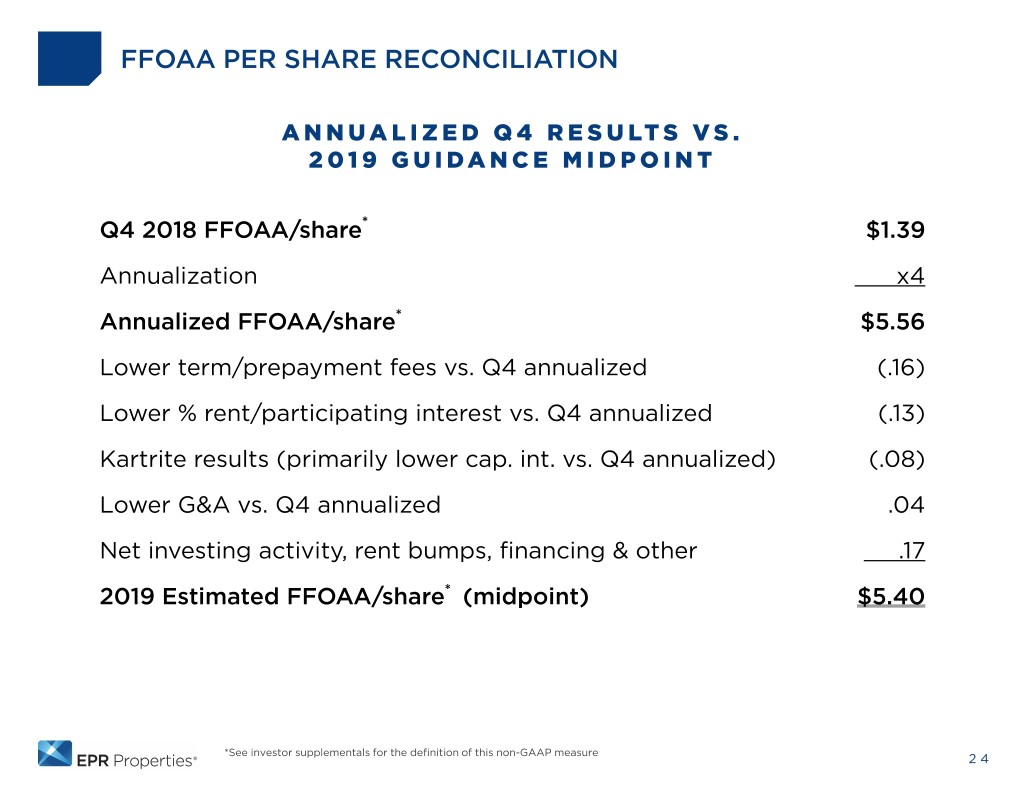

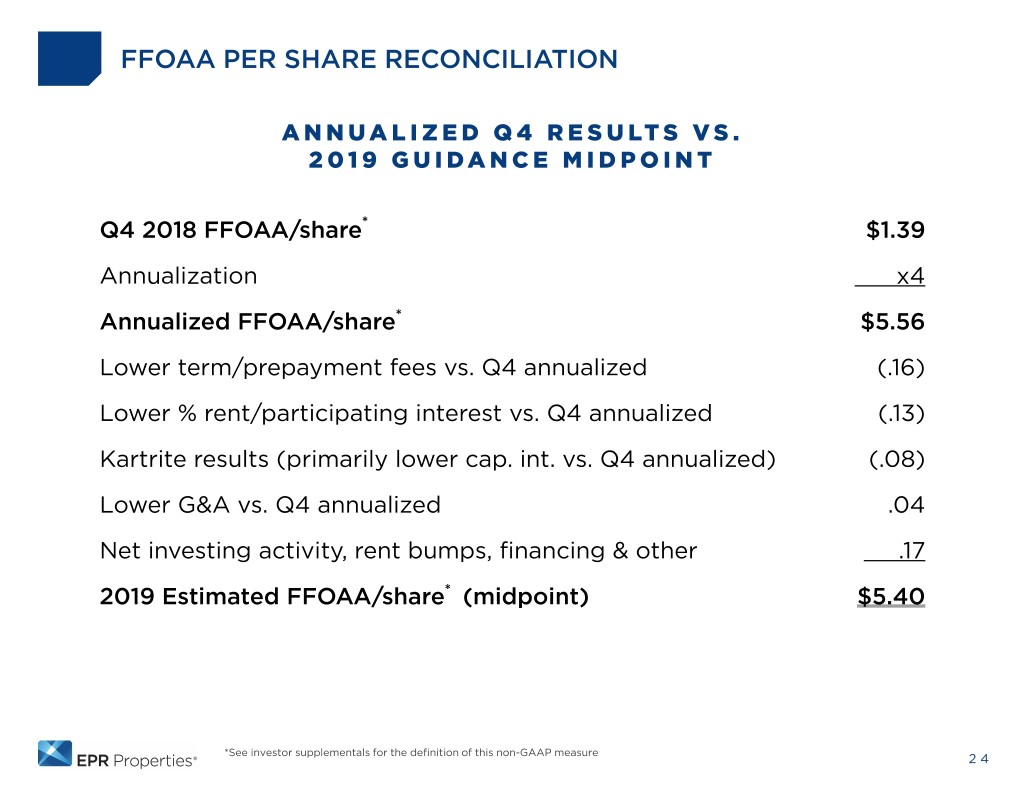

FFOAA PER SHARE RECONCILIATION ANNUALIZED Q4 RESULTS VS. 2019 GUIDANCE MIDPOINT Q4 2018 FFOAA/share* $1.39 Annualization x4 Annualized FFOAA/share* $5.56 Lower term/prepayment fees vs. Q4 annualized (.16) Lower % rent/participating interest vs. Q4 annualized (.13) Kartrite results (primarily lower cap. int. vs. Q4 annualized) (.08) Lower G&A vs. Q4 annualized .04 Net investing activity, rent bumps, financing & other .17 2019 Estimated FFOAA/share* (midpoint) $5.40 *See investor supplementals for the definition of this non-GAAP measure 24

CLOSING COMMENTS 25

EPR Properties 909 Walnut Street, Suite 200 Kansas City, MO 64106 www.eprkc.com 816-472-1700 info@eprkc.com