Q3 2019 EARNINGS CALL OCTOBER 30, 2019

INTRODUCTORY COMMENTS This information is as of the date indicated and, to our knowledge, was timely and accurate when presented. We are under no obligation to update or remove outdated information other than as required by applicable law or regulation. 2

HEADLINES 1. Strong Quarter Anchored by Continued Demand For Experiential Assets 3

HEADLINES 1. Strong Quarter Anchored by Continued Demand For Experiential Assets 2. Record Low Bond Yield and Spread 4

HEADLINES 1. Strong Quarter Anchored by Continued Demand For Experiential Assets 2. Record Low Bond Yield and Spread 3. Well-Positioned Balance Sheet with Ample Capacity 5

HEADLINES 1. Strong Quarter Anchored by Continued Demand For Experiential Assets 2. Record Low Bond Yield and Spread 3. Well Positioned Balance Sheet with Ample Capacity 4. Increasing Earnings and Investment Spending Guidance 6

PORTFOLIO UPDATE 7

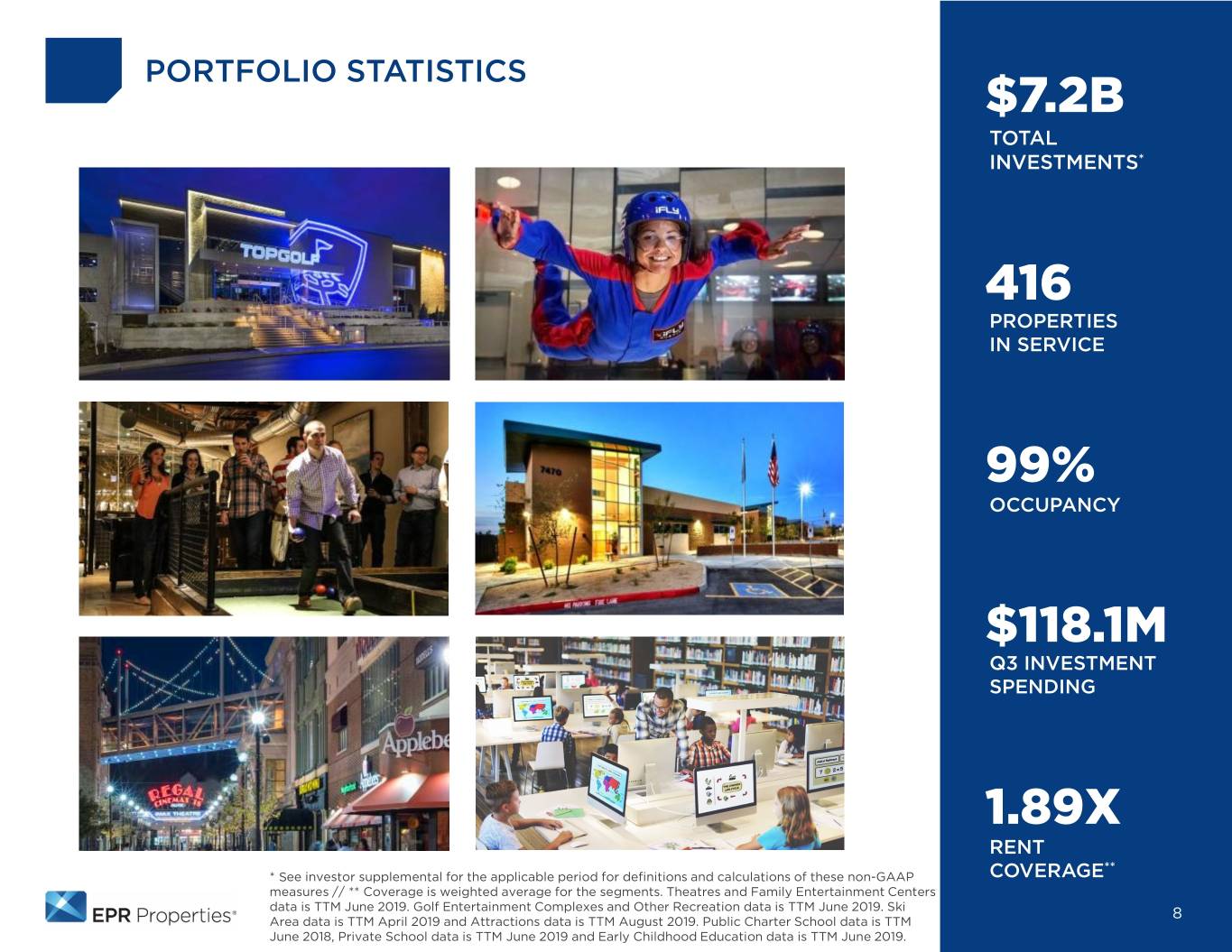

PORTFOLIO STATISTICS $7.2B TOTAL INVESTMENTS* 416 PROPERTIES IN SERVICE 99% OCCUPANCY $118.1M Q3 INVESTMENT SPENDING 1.89X RENT ** * See investor supplemental for the applicable period for definitions and calculations of these non-GAAP COVERAGE measures // ** Coverage is weighted average for the segments. Theatres and Family Entertainment Centers data is TTM June 2019. Golf Entertainment Complexes and Other Recreation data is TTM June 2019. Ski 8 Area data is TTM April 2019 and Attractions data is TTM August 2019. Public Charter School data is TTM June 2018, Private School data is TTM June 2019 and Early Childhood Education data is TTM June 2019.

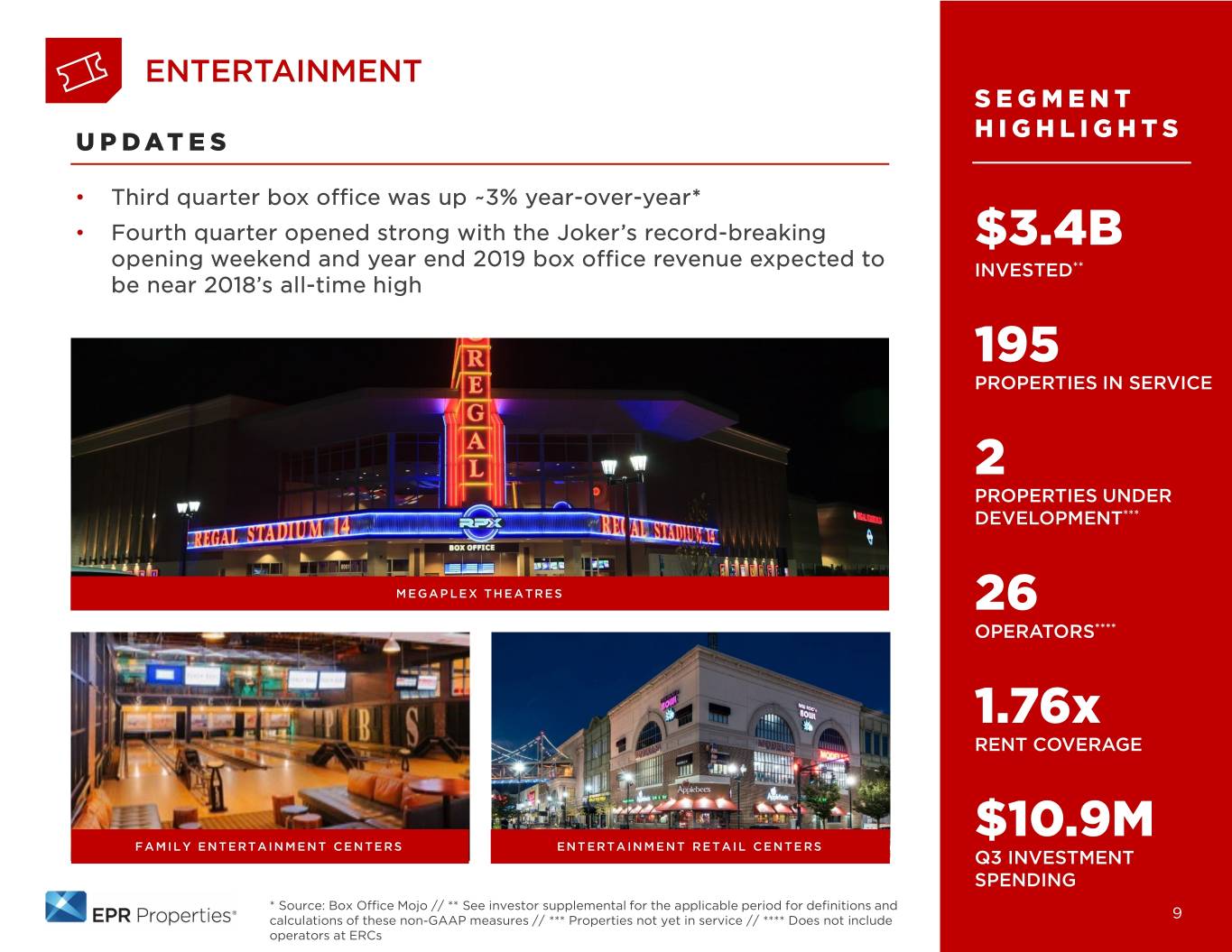

ENTERTAINMENT SEGMENT HIGHLIGHTS UPDATES • Third quarter box office was up ~3% year-over-year* • Fourth quarter opened strong with the Joker’s record-breaking $3.4B opening weekend and year end 2019 box office revenue expected to INVESTED** be near 2018’s all-time high 195 PROPERTIES IN SERVICE 2 PROPERTIES UNDER DEVELOPMENT*** MEGAPLEX THEATRES 26 OPERATORS**** 1.76x RENT COVERAGE $10.9M FAMILY ENTERTAINMENT CENTERS ENTERTAINMENT RETAIL CENTERS Q3 INVESTMENT SPENDING * Source: Box Office Mojo // ** See investor supplemental for the applicable period for definitions and calculations of these non-GAAP measures // *** Properties not yet in service // **** Does not include 9 operators at ERCs

RECREATION SEGMENT UPDATES HIGHLIGHTS • Attractions portfolio visits up 4% and revenue up 7% through August over the three-year average $2.3B • Financed Margaritaville Nashville Hotel in Nashville’s SoBro district, INVESTED* one of the country’s hottest experiential destinations • Vail Resorts closed on Peak Resorts acquisition, becoming our 5th largest customer 83 PROPERTIES IN SERVICE 19 OPERATORS GOLF ENTERTAINMENT COMPLEXES ATTRACTIONS 2.28x RENT COVERAGE $89.6M SKI AREAS OTHER RECREATION Q3 INVESTMENT SPENDING * See investor supplemental for the applicable period for definitions and calculations of these non-GAAP measures 10

EDUCATION SEGMENT UPDATES HIGHLIGHTS • Received $104 million in disposition proceeds Excellent progress on Crème de la Crème transition, 17 completed and $1.3B • * remaining 4 anticipated in fourth quarter INVESTED 137 PROPERTIES IN SERVICE 55 OPERATORS PUBLIC CHARTER SCHOOLS 1.51x RENT COVERAGE PRIVATE SCHOOLS EARLY CHILDHOOD EDUCATION $17.6M Q3 INVESTMENT SPENDING * See investor supplemental for the applicable period for definitions and calculations of these non-GAAP measures 11

FINANCIAL REVIEW 12

FINANCIAL HIGHLIGHTS FINANCIAL PERFORMANCE Quarter ended September 30, (In millions except per-share data) 2019 2018 $ CHANGE % CHANGE Total Revenue $184.9 $176.4 $8.5 5% Net Income - Common 28.0 85.8 (57.8) (67%) FFO – Common* 59.1 116.5 (57.4) (49%) FFO as adj. – Common* 115.3 119.6 (4.3) (4%) Net Income/share – Common 0.36 1.15 (0.79) (69%) FFO/share – Common* 0.76 1.54 (0.78) (51%) FFO/share - Common, as adj.* 1.46 1.58 (0.12) (8%) * See investor supplementals for the applicable periods for definitions and calculations of these non- GAAP measures 13

FINANCIAL HIGHLIGHTS KEY RATIOS * Quarter ended September 30, 2019 2018 Net debt to Adjusted EBITDA 5.2x 5.3x Fixed charge coverage 3.3x 3.3x Debt service coverage 3.8x 3.8x Net debt to gross assets (book) 40% 42% Net debt to gross assets (market) 32% 35% FFO as adjusted payout 77% 68% * See investor supplementals for the applicable periods for definitions and calculations for these non-GAAP measures. Net debt to Adjusted EBITDA and coverage ratios exclude all termination and prepayment fees. 14

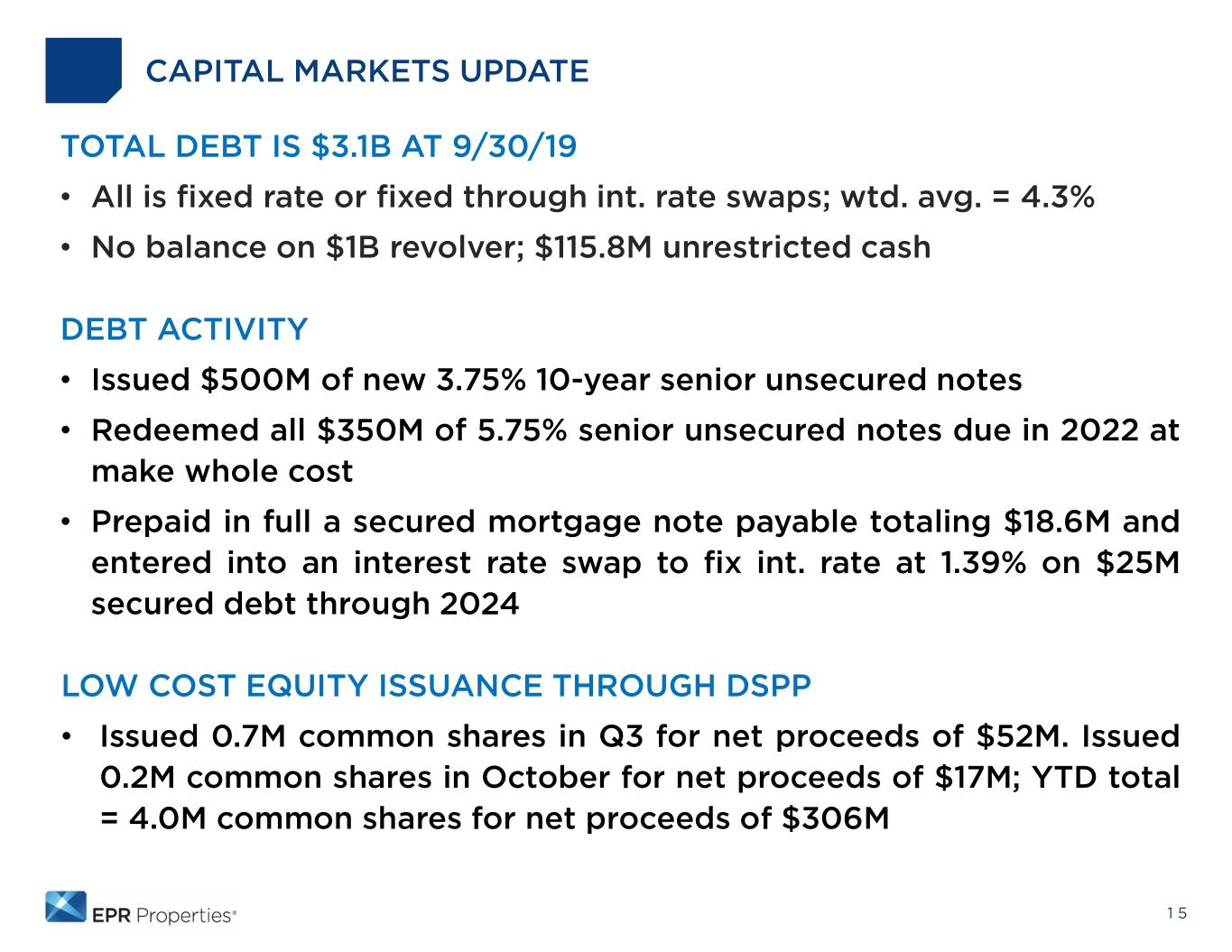

CAPITAL MARKETS UPDATE TOTAL DEBT IS $3.1B AT 9/30/19 • All is fixed rate or fixed through int. rate swaps; wtd. avg. = 4.3% • No balance on $1B revolver; $115.8M unrestricted cash DEBT ACTIVITY • Issued $500M of new 3.75% 10-year senior unsecured notes • Redeemed all $350M of 5.75% senior unsecured notes due in 2022 at make whole cost • Prepaid in full a secured mortgage note payable totaling $18.6M and entered into an interest rate swap to fix int. rate at 1.39% on $25M secured debt through 2024 LOW COST EQUITY ISSUANCE THROUGH DSPP • Issued 0.7M common shares in Q3 for net proceeds of $52M. Issued 0.2M common shares in October for net proceeds of $17M; YTD total = 4.0M common shares for net proceeds of $306M 15

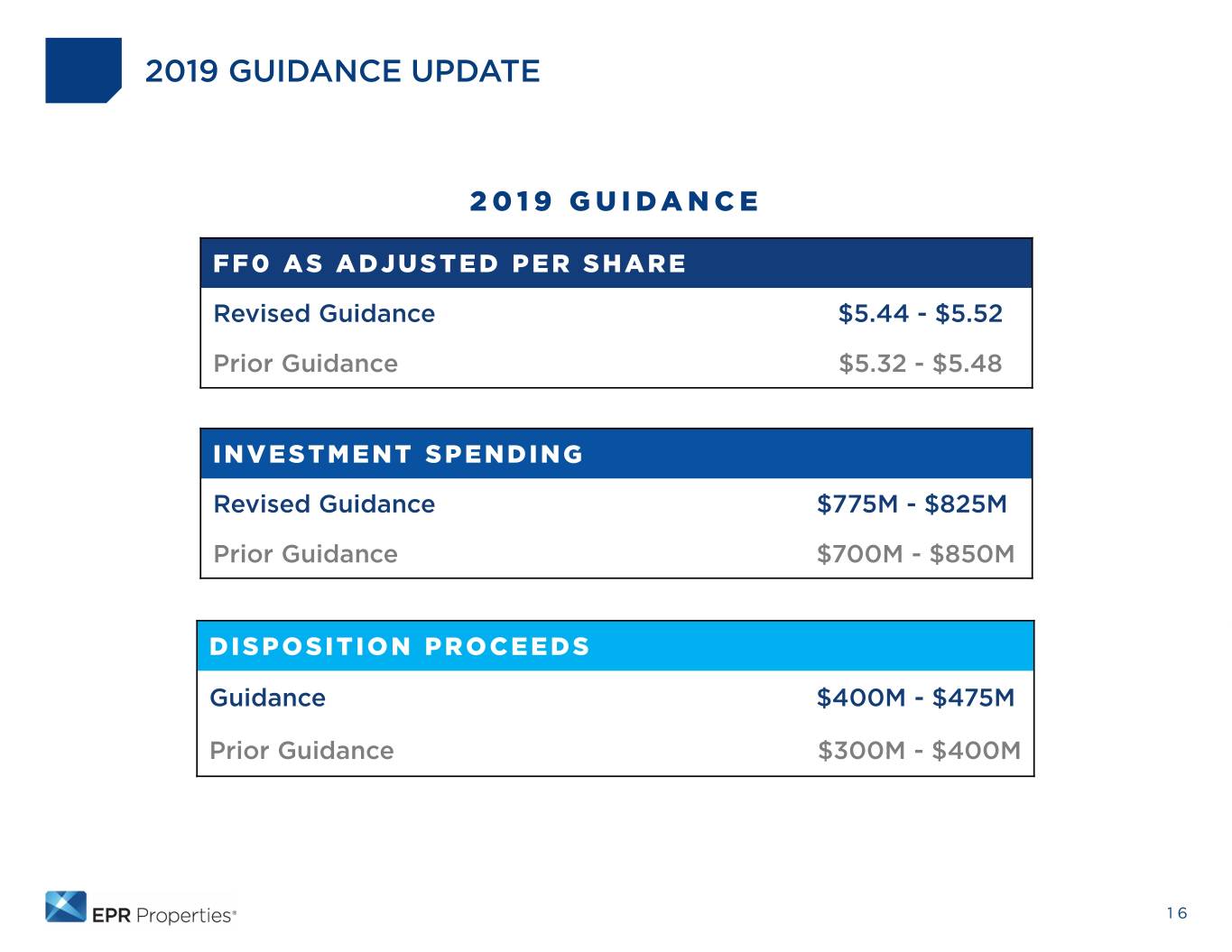

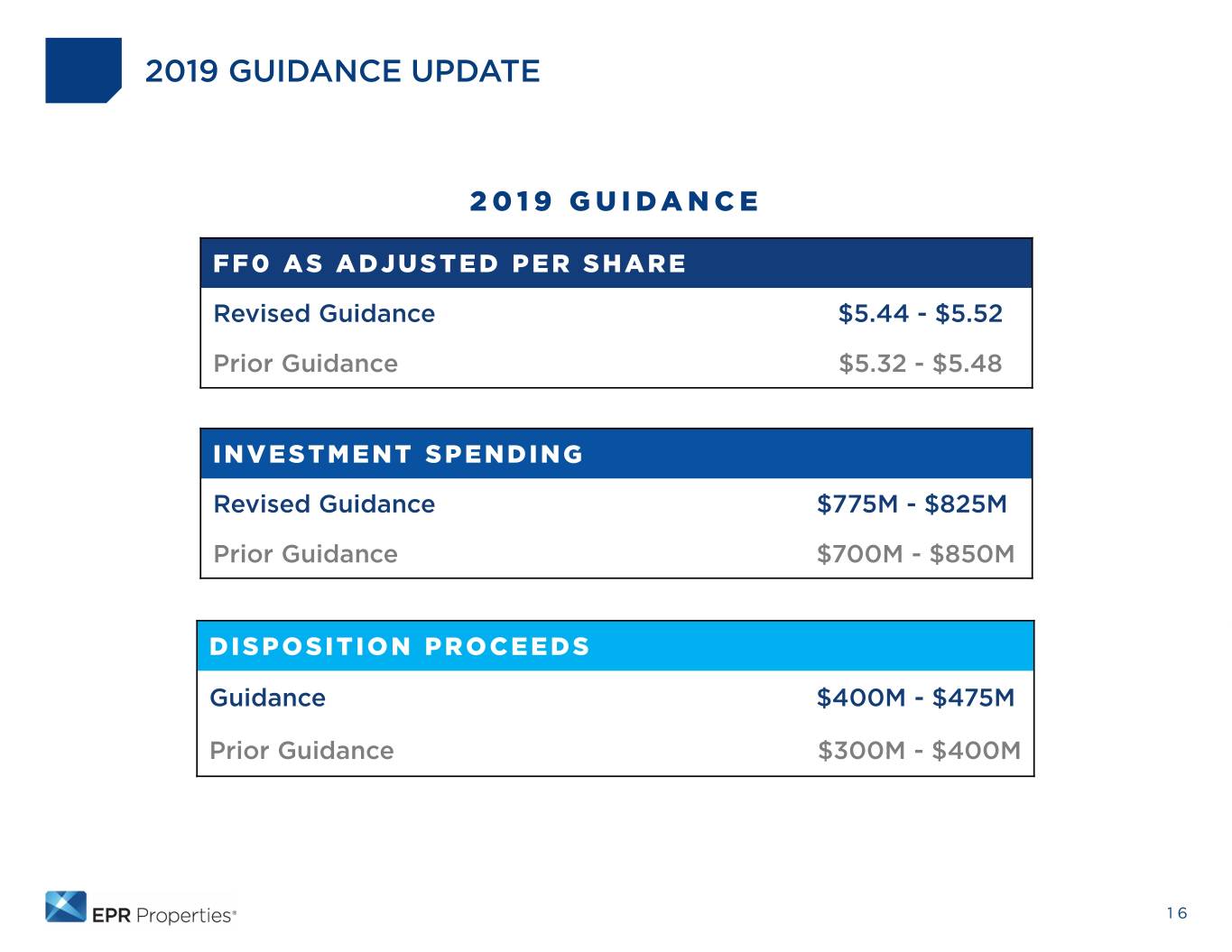

2019 GUIDANCE UPDATE 2019 GUIDANCE FF0 AS ADJUSTED PER SHARE Revised Guidance $5.44 - $5.52 Prior Guidance $5.32 - $5.48 INVESTMENT SPENDING Revised Guidance $775M - $825M Prior Guidance $700M - $850M DISPOSITION PROCEEDS Guidance $400M - $475M Prior Guidance $300M - $400M 16

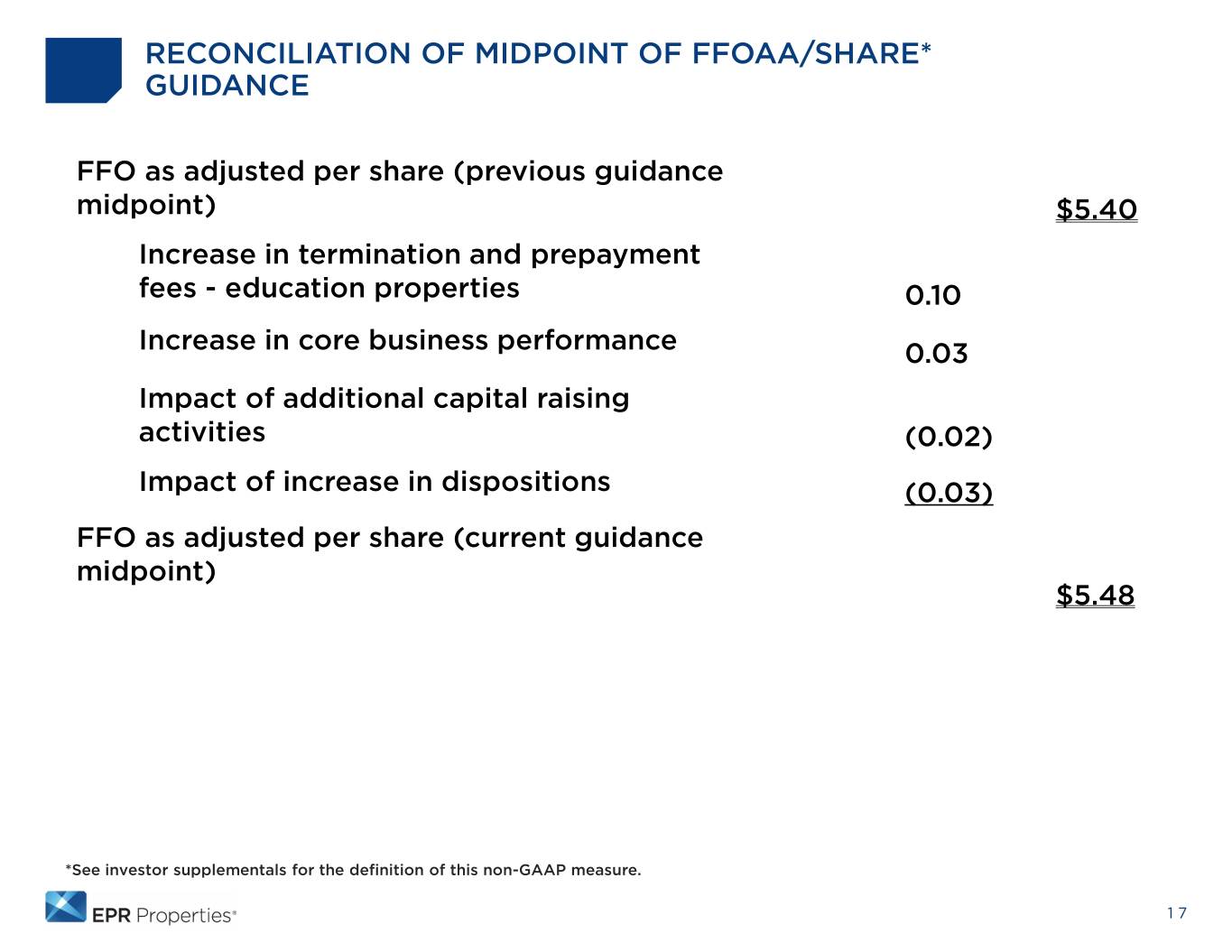

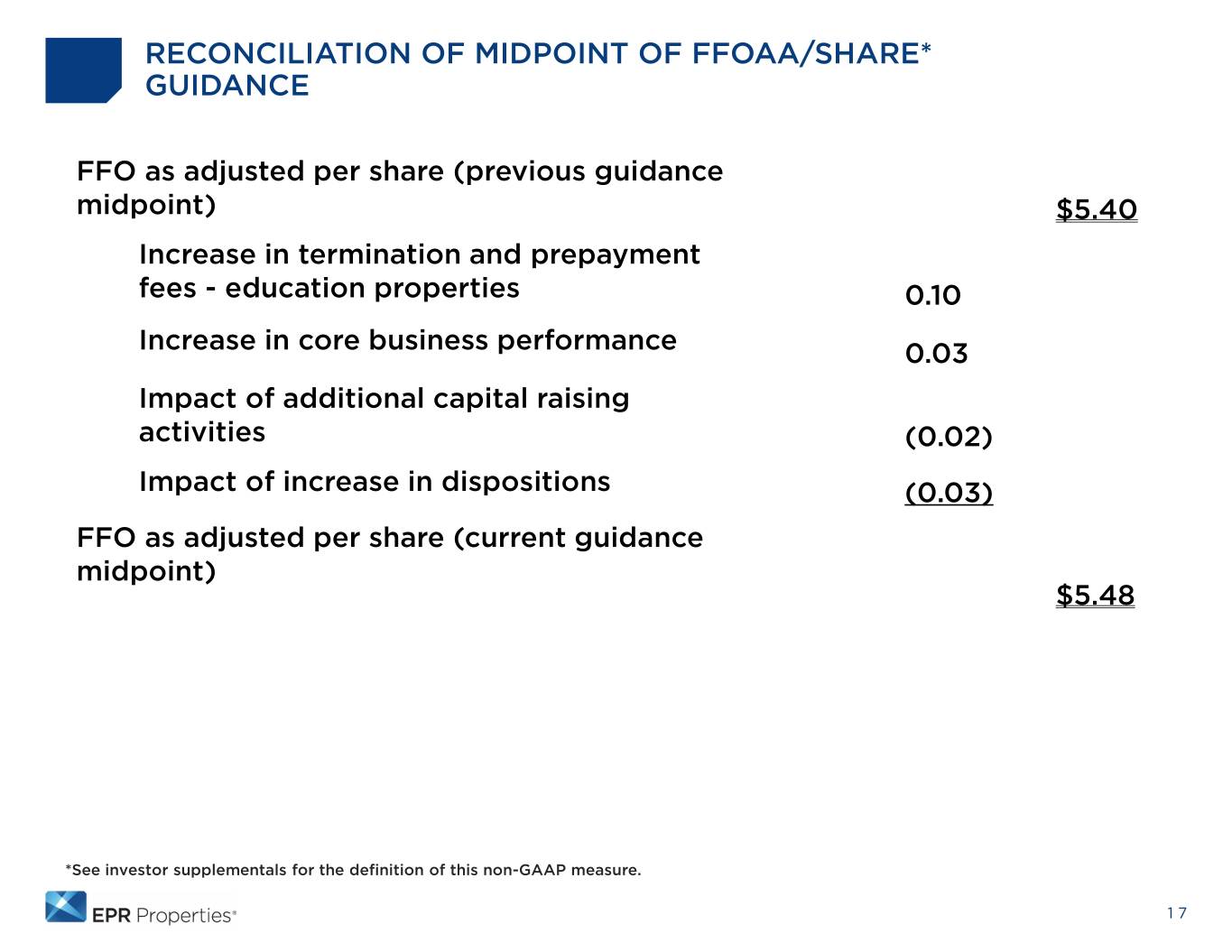

RECONCILIATION OF MIDPOINT OF FFOAA/SHARE* GUIDANCE FFO as adjusted per share (previous guidance midpoint) $5.40 Increase in termination and prepayment fees - education properties 0.10 Increase in core business performance 0.03 Impact of additional capital raising activities (0.02) Impact of increase in dispositions (0.03) FFO as adjusted per share (current guidance midpoint) $5.48 *See investor supplementals for the definition of this non-GAAP measure. 17

CLOSING COMMENTS 18

EPR Properties 909 Walnut Street, Suite 200 Kansas City, MO 64106 www.eprkc.com 816-472-1700 info@eprkc.com