THIRD QUARTER 2022 EARNINGS CALL November 3, 2022

2 The financial results in this document reflect preliminary, unaudited results, which are not final until the Company’s Quarterly Report on Form 10-Q is filed. With the exception of historical information, certain statements contained or incorporated by reference herein may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), such as those pertaining to the uncertain financial impact of the COVID-19 pandemic, our guidance, our capital resources and liquidity, our expected dividend payments, our expected cash flows and liquidity, the performance of our customers, our expected cash collections, expected use of proceeds from dispositions and our results of operations and financial condition. The estimates presented herein are based on the Company's current expectations and, given the current economic uncertainty, there can be no assurances that the Company will be able to continue to comply with applicable covenants under its debt agreements, which could materially impact actual performance. Forward-looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of actual events. There is no assurance the events or circumstances reflected in the forward-looking statements will occur. You can identify forward-looking statements by use of words such as “will be,” “intend,” “continue,” “believe,” “may,” “expect,” “hope,” “anticipate,” “goal,” “forecast,” “pipeline,” “estimates,” “offers,” “plans,” “would” or other similar expressions or other comparable terms or discussions of strategy, plans or intentions contained or incorporated by reference herein. Forward-looking statements necessarily are dependent on assumptions, data or methods that may be incorrect or imprecise. These forward-looking statements represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Many of the factors that will determine these items are beyond our ability to control or predict. For further discussion of these factors see “Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K and, to the extent applicable, our Quarterly Reports on Form 10-Q. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date hereof or the date of any document incorporated by reference herein. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except as required by law, we do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date hereof. DISCLAIMER

INTRODUCTORY COMMENTS

PORTFOLIO UPDATE

5 PORTFOLIO OVERVIEW Education Portfolio 74 Properties; 8 Operators Occupancy at 100% *See Quarterly Reports on Form 10-Q for definitions and calculations of these non-GAAP measures Experiential Portfolio 282 Properties; 47 Operators Occupancy at 97% $6.0B Total Investments* Total Portfolio Snapshot ~$6.6B Total Investments* 356 Properties Occupancy at 97% Q3 Investment Spending $82M

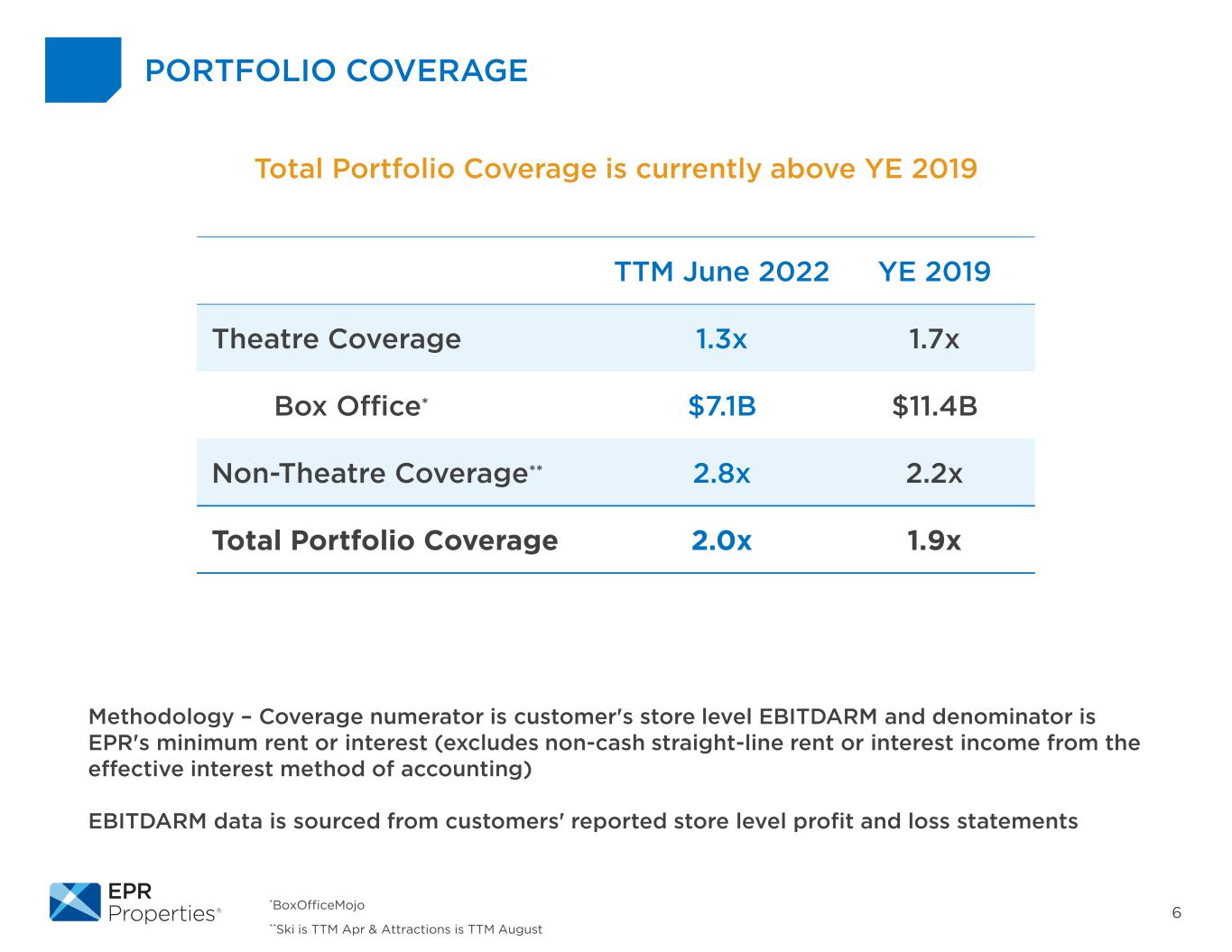

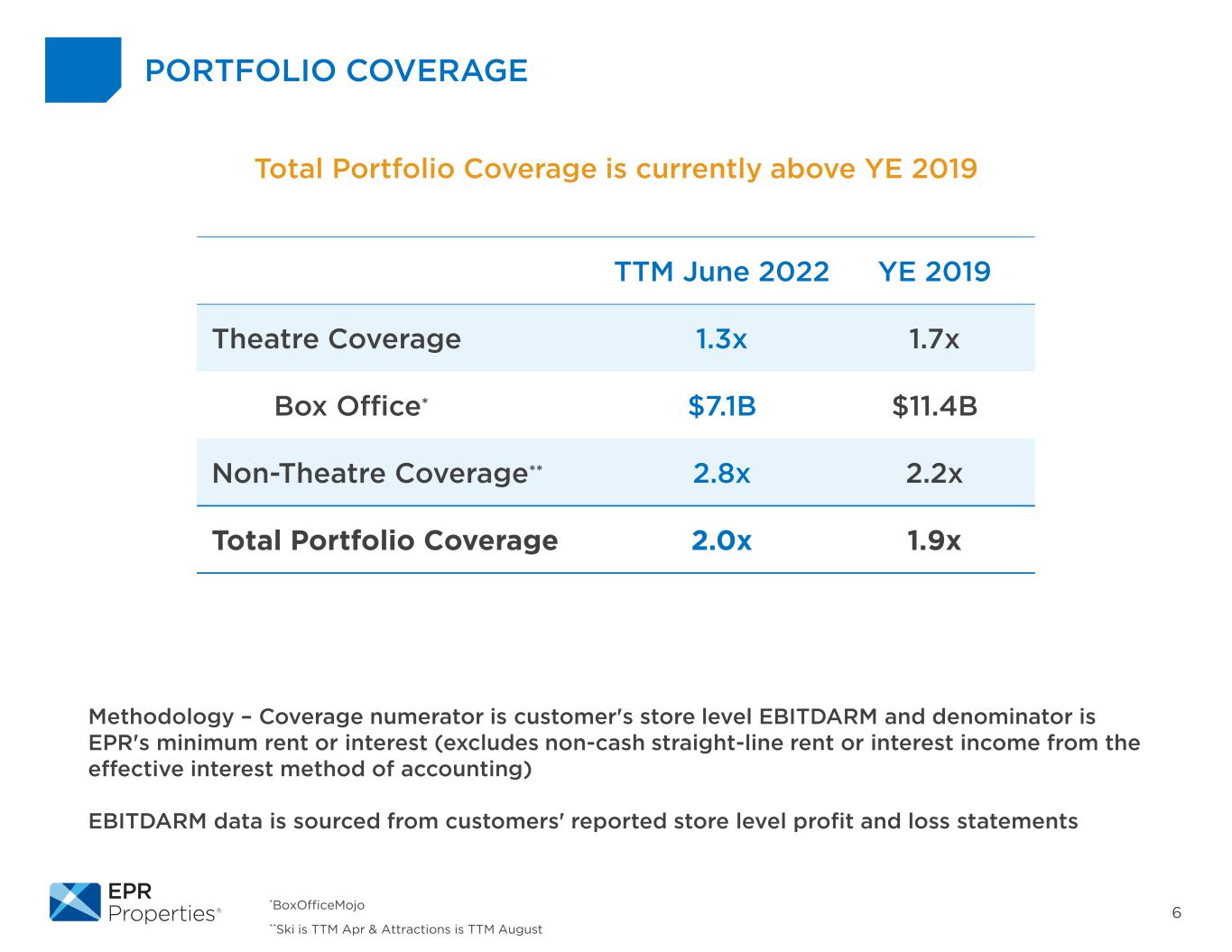

6 PORTFOLIO COVERAGE *BoxOfficeMojo **Ski is TTM Apr & Attractions is TTM August TTM June 2022 YE 2019 Theatre Coverage 1.3x 1.7x Box Office* $7.1B $11.4B Non-Theatre Coverage** 2.8x 2.2x Total Portfolio Coverage 2.0x 1.9x Total Portfolio Coverage is currently above YE 2019 Methodology – Coverage numerator is customer's store level EBITDARM and denominator is EPR's minimum rent or interest (excludes non-cash straight-line rent or interest income from the effective interest method of accounting) EBITDARM data is sourced from customers' reported store level profit and loss statements

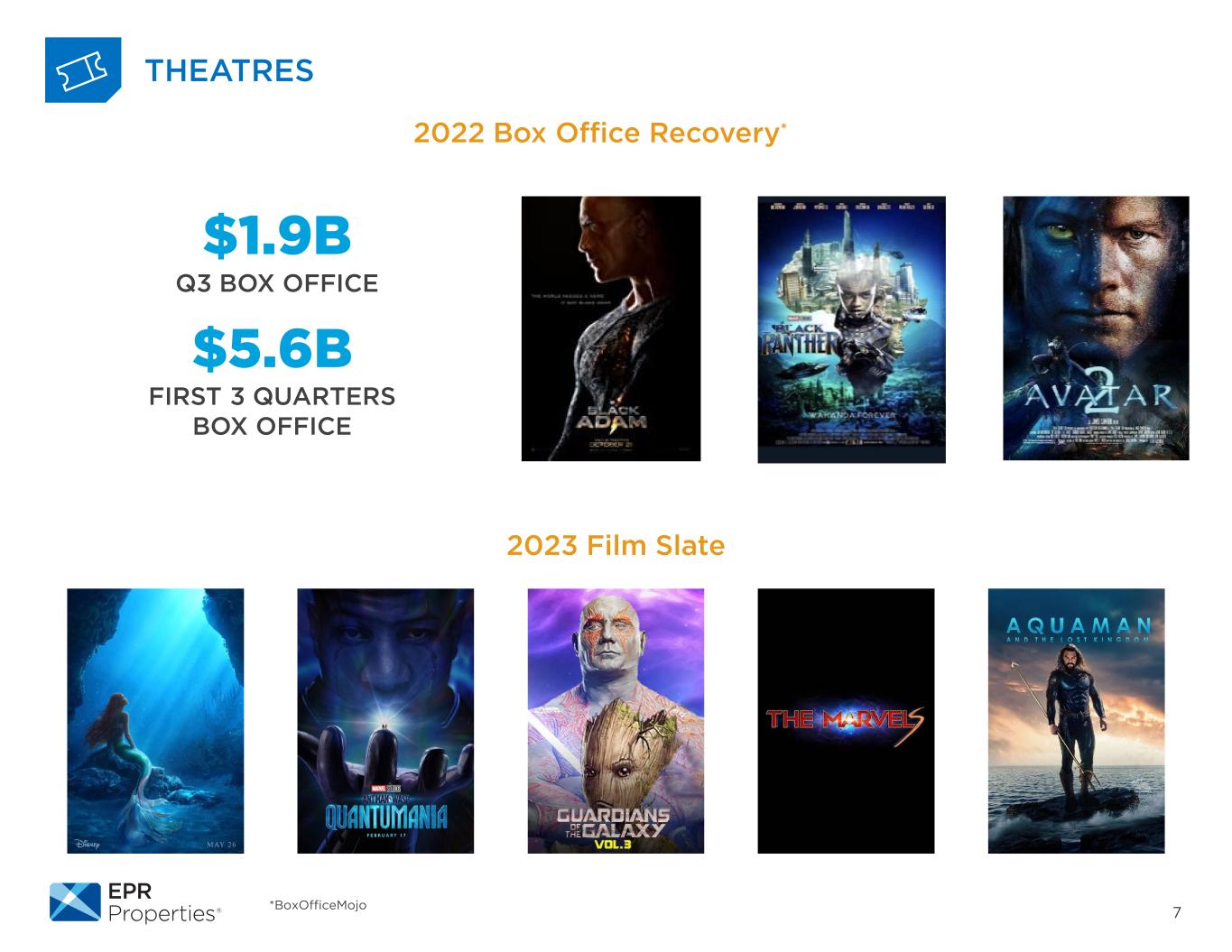

7 THEATRES *BoxOfficeMojo 2022 Box Office Recovery* $1.9B Q3 BOX OFFICE $5.6B FIRST 3 QUARTERS BOX OFFICE 2023 Film Slate

8 PORTFOLIO UPDATE Ski Anticipate strong season based on season pass sales Eat & Play Portfolio revenue up 15% and EBITDARM up 9% over Q3 2021 Attractions & Cultural Attendance and EBITDARM up over Q3 2021 Experiential Lodging Continued revenue and ADR growth Fitness & Wellness Strong occupancy and continued ADR growth at The Springs

9 INVESTMENT SPENDING • Q3 Investment spending was $82M o $43.6M Acquisition – former Conference Center in Murrieta, CA for redevelopment into a natural hot springs resort, EPR to invest another ~$50M over next two years o ~$26M additional financing – Alyeska Resort in Alaska • Subsequent to quarter end o Closed on a commitment for $68M in mortgage financing – with a new partner to add an indoor waterpark to an existing project o $5.6M additional land acquired for expansion – at The Springs Resort in Pagosa Springs, EPR committed to spend ~$58M over next two years • Through Q3 – YTD investment spending is $321M 2022 Investment Spending Guidance $375M-$425M

FINANCIAL REVIEW

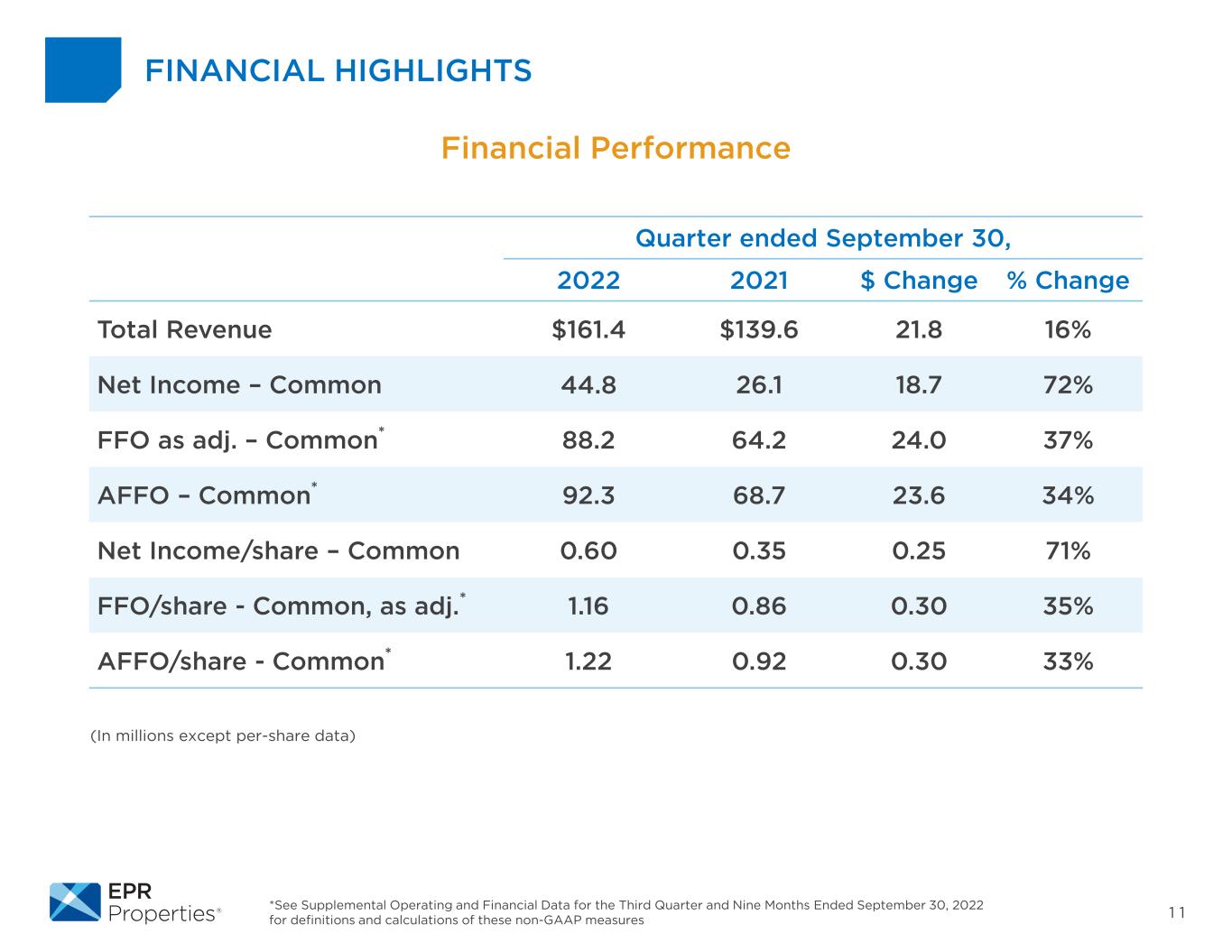

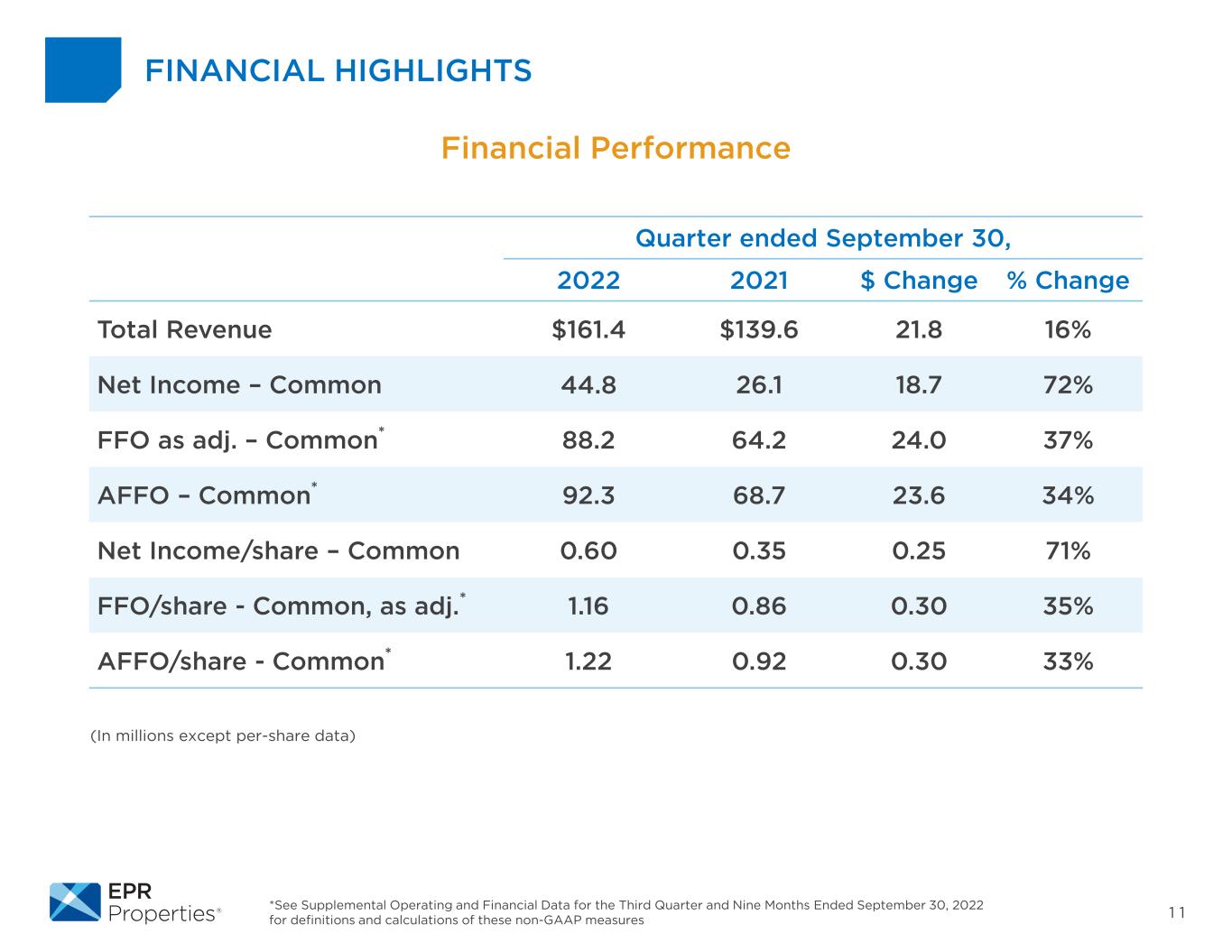

1 1 (In millions except per-share data) *See Supplemental Operating and Financial Data for the Third Quarter and Nine Months Ended September 30, 2022 for definitions and calculations of these non-GAAP measures FINANCIAL HIGHLIGHTS Financial Performance Quarter ended September 30, 2022 2021 $ Change % Change Total Revenue $161.4 $139.6 21.8 16% Net Income – Common 44.8 26.1 18.7 72% FFO as adj. – Common* 88.2 64.2 24.0 37% AFFO – Common* 92.3 68.7 23.6 34% Net Income/share – Common 0.60 0.35 0.25 71% FFO/share - Common, as adj.* 1.16 0.86 0.30 35% AFFO/share - Common* 1.22 0.92 0.30 33%

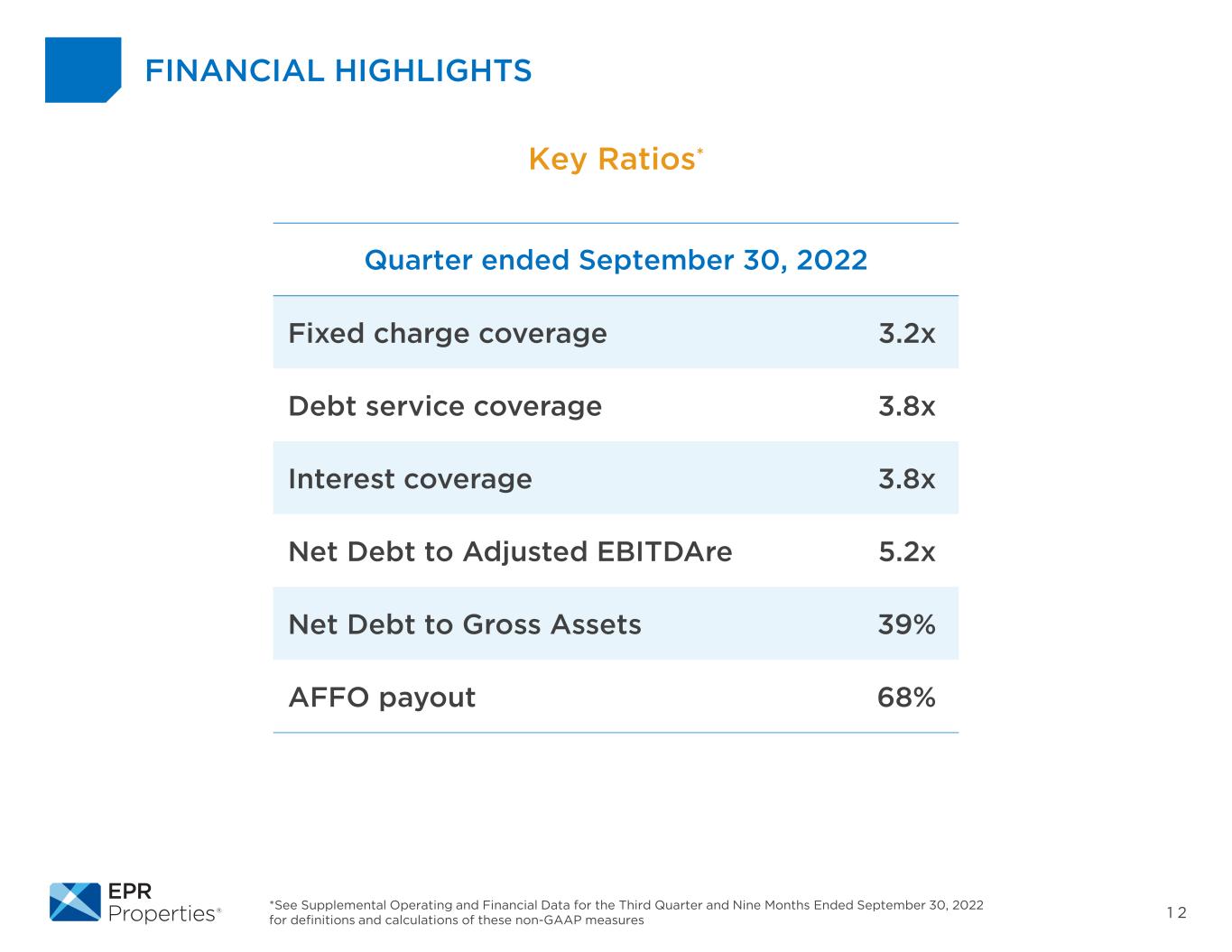

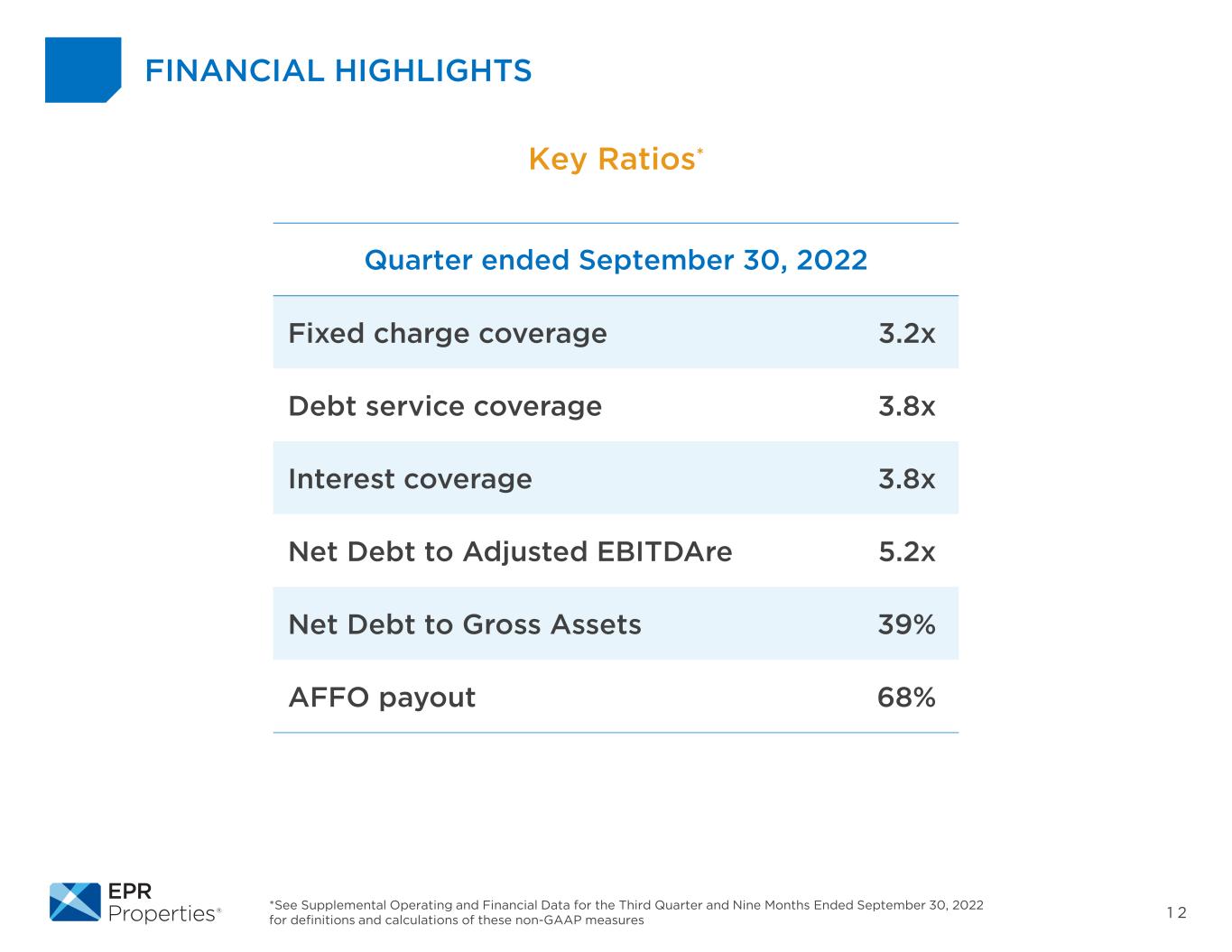

1 2 FINANCIAL HIGHLIGHTS Key Ratios* Quarter ended September 30, 2022 Fixed charge coverage 3.2x Debt service coverage 3.8x Interest coverage 3.8x Net Debt to Adjusted EBITDAre 5.2x Net Debt to Gross Assets 39% AFFO payout 68% *See Supplemental Operating and Financial Data for the Third Quarter and Nine Months Ended September 30, 2022 for definitions and calculations of these non-GAAP measures

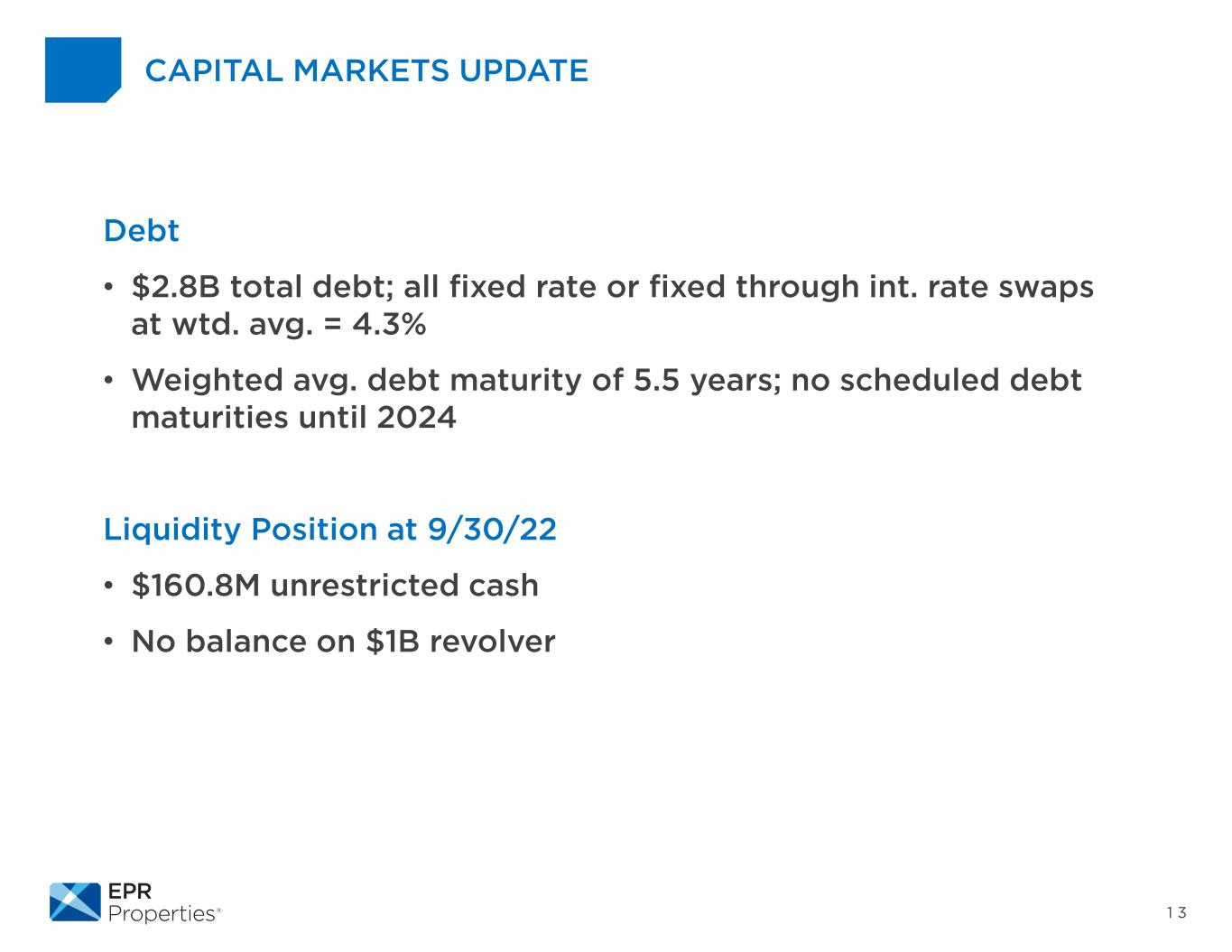

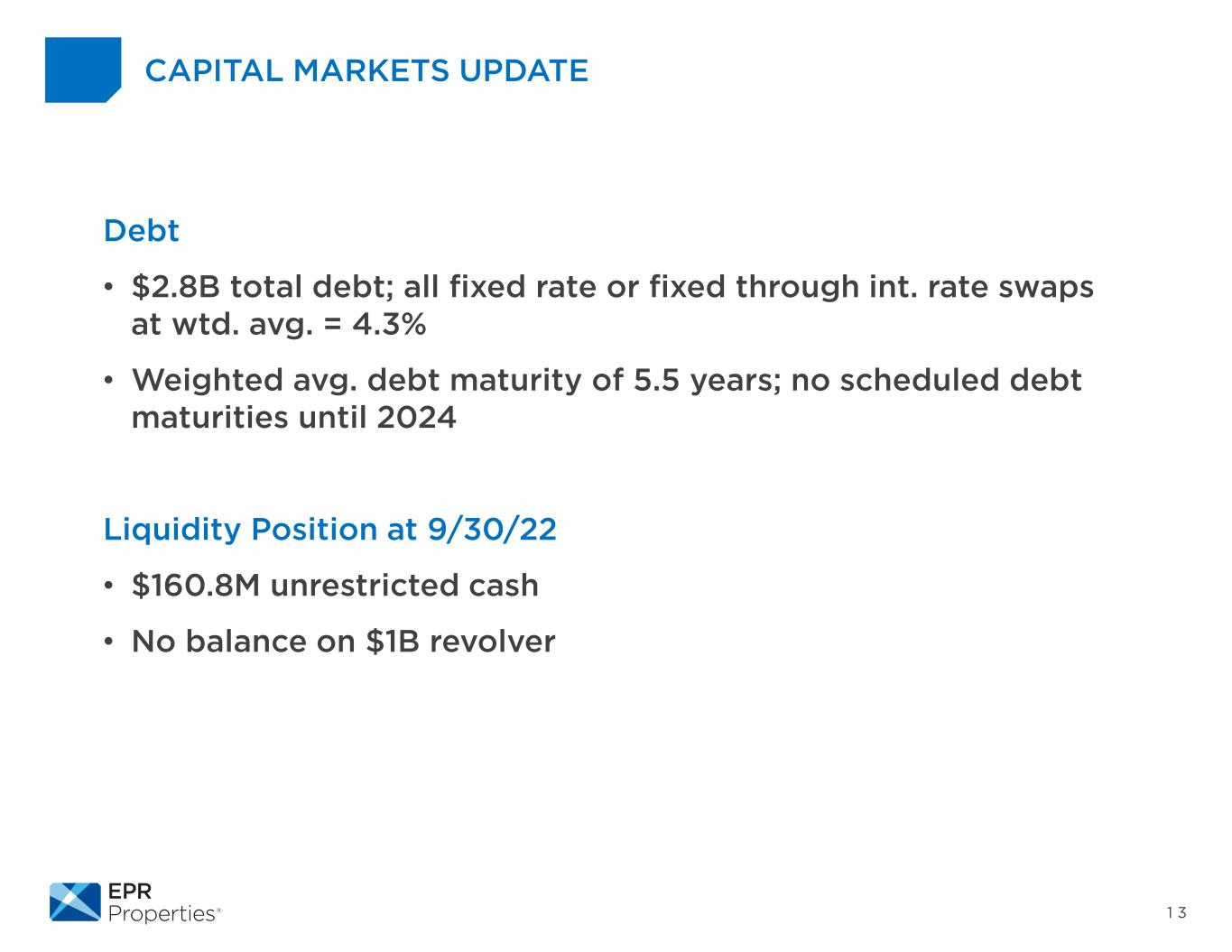

1 3 Debt • $2.8B total debt; all fixed rate or fixed through int. rate swaps at wtd. avg. = 4.3% • Weighted avg. debt maturity of 5.5 years; no scheduled debt maturities until 2024 Liquidity Position at 9/30/22 • $160.8M unrestricted cash • No balance on $1B revolver CAPITAL MARKETS UPDATE

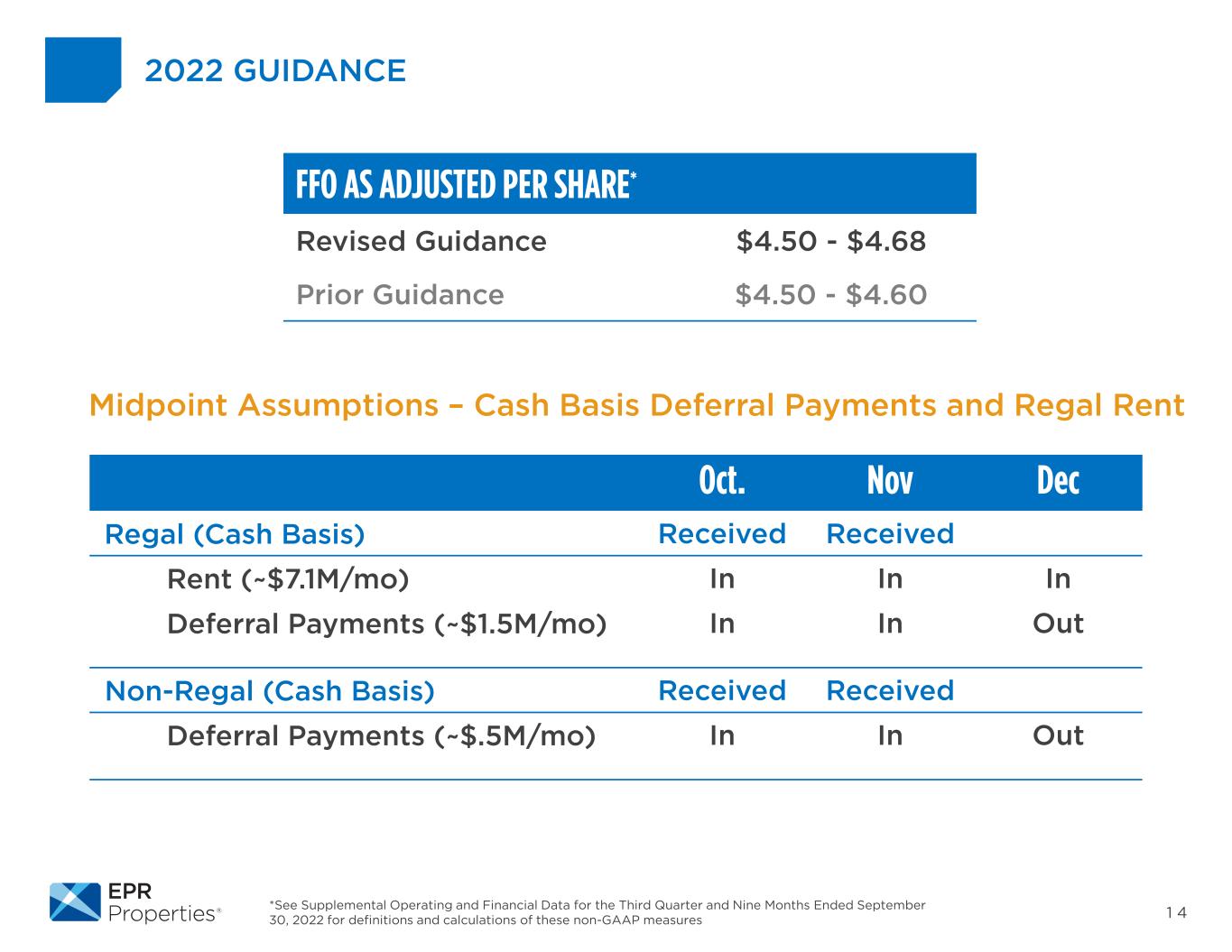

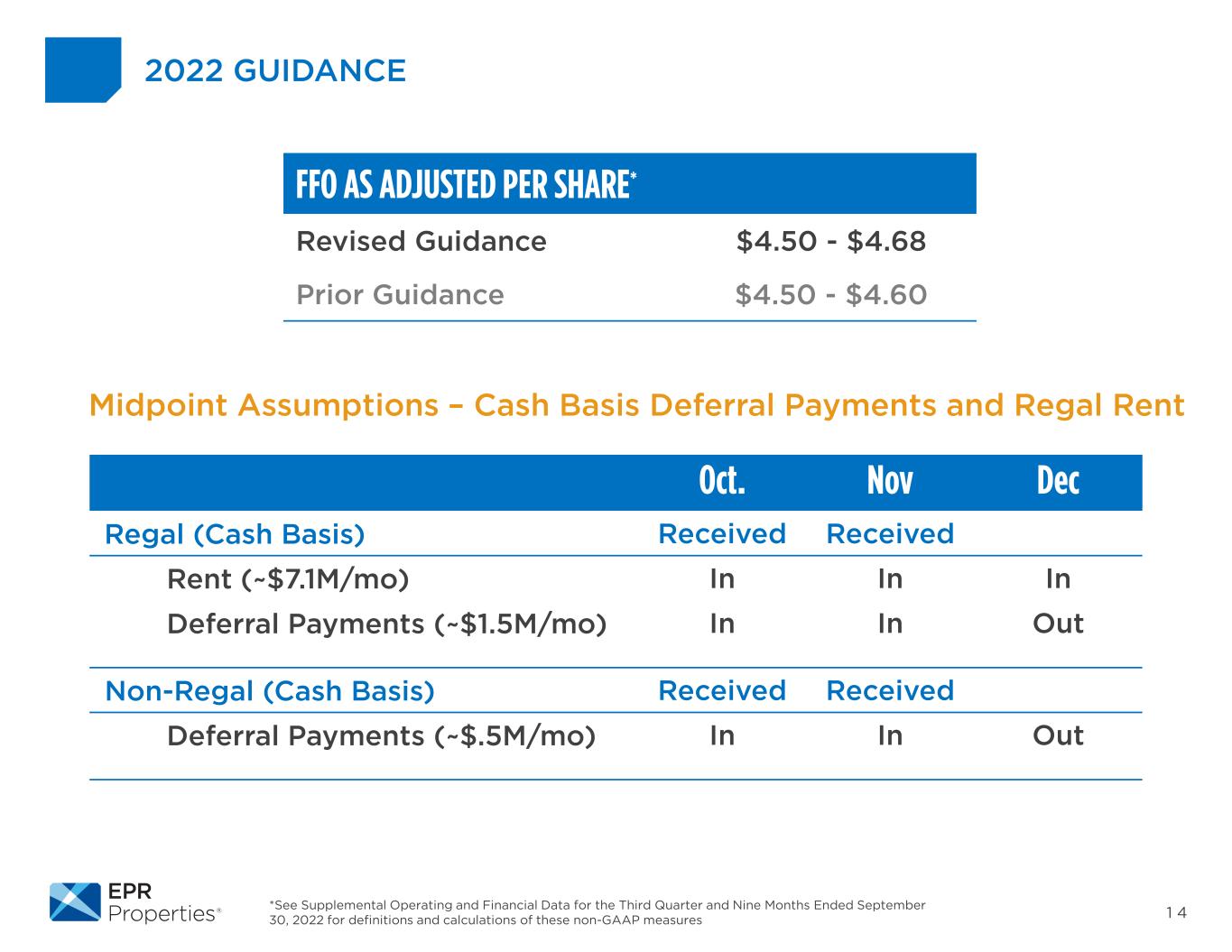

1 4 2022 GUIDANCE *See Supplemental Operating and Financial Data for the Third Quarter and Nine Months Ended September 30, 2022 for definitions and calculations of these non-GAAP measures FFO AS ADJUSTED PER SHARE* Revised Guidance $4.50 - $4.68 Prior Guidance $4.50 - $4.60 Midpoint Assumptions – Cash Basis Deferral Payments and Regal Rent Oct. Nov Dec Regal (Cash Basis) Received Received Rent (~$7.1M/mo) In In In Deferral Payments (~$1.5M/mo) In In Out Non-Regal (Cash Basis) Received Received Deferral Payments (~$.5M/mo) In In Out

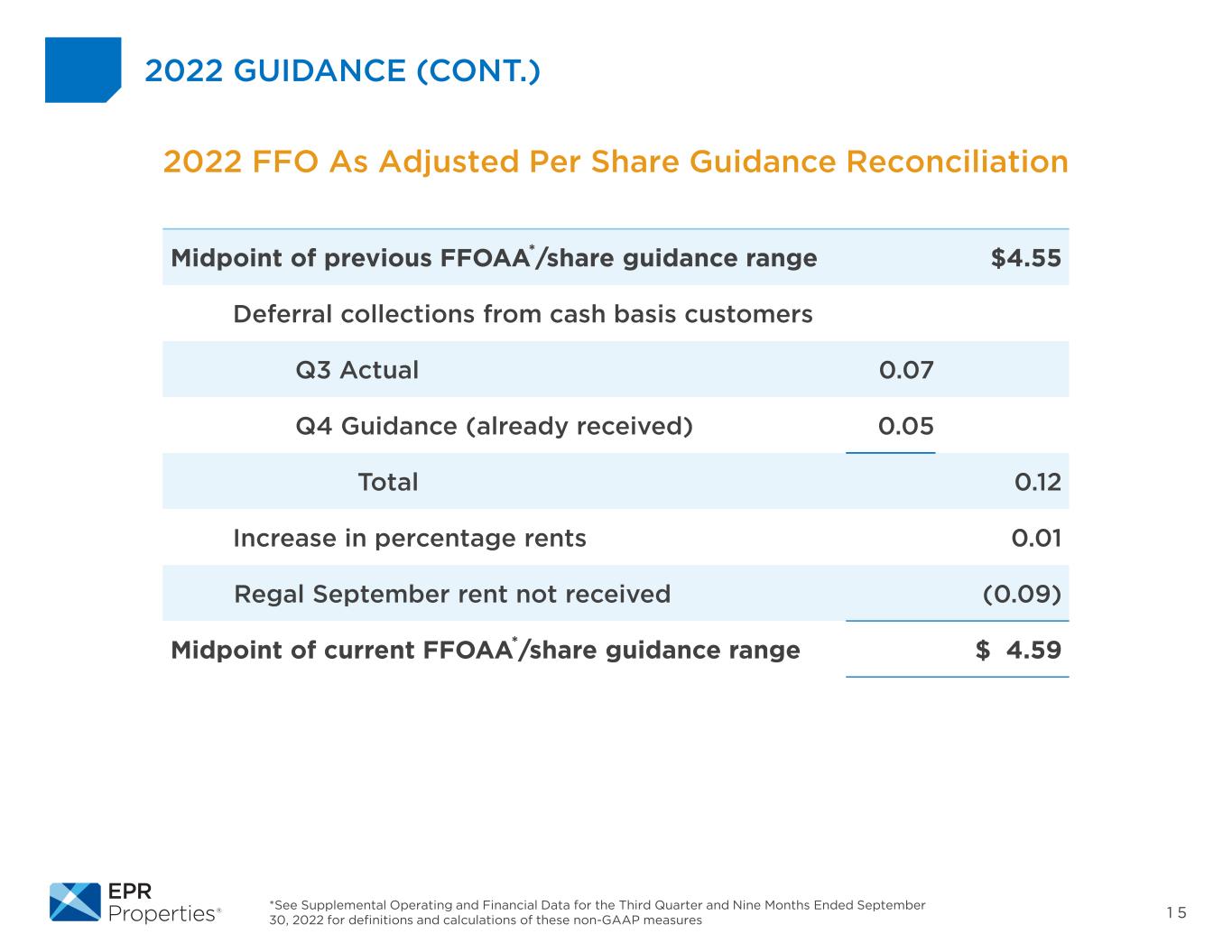

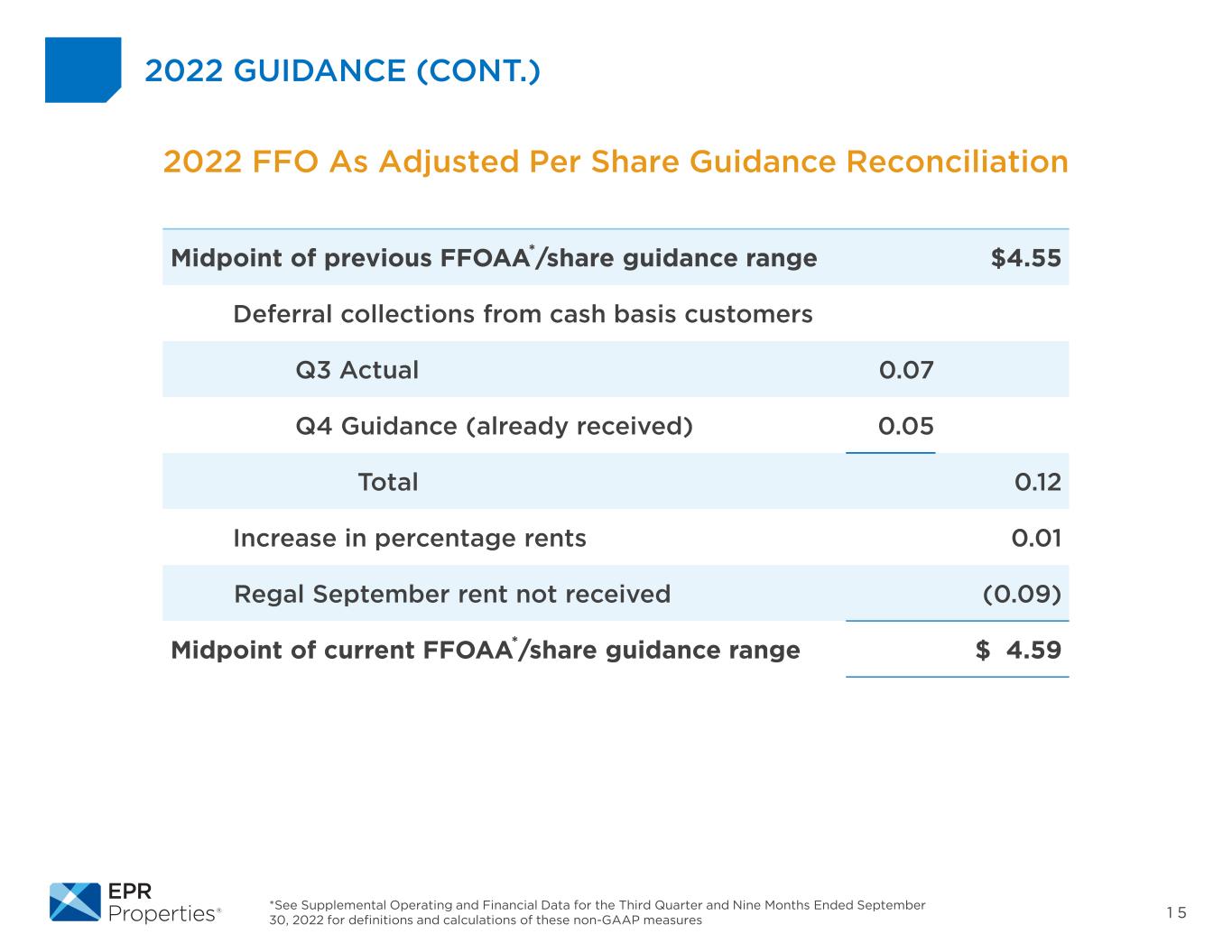

1 5 2022 GUIDANCE (CONT.) *See Supplemental Operating and Financial Data for the Third Quarter and Nine Months Ended September 30, 2022 for definitions and calculations of these non-GAAP measures Midpoint of previous FFOAA*/share guidance range $4.55 Deferral collections from cash basis customers Q3 Actual 0.07 Q4 Guidance (already received) 0.05 Total 0.12 Increase in percentage rents 0.01 Regal September rent not received (0.09) Midpoint of current FFOAA*/share guidance range $ 4.59 2022 FFO As Adjusted Per Share Guidance Reconciliation

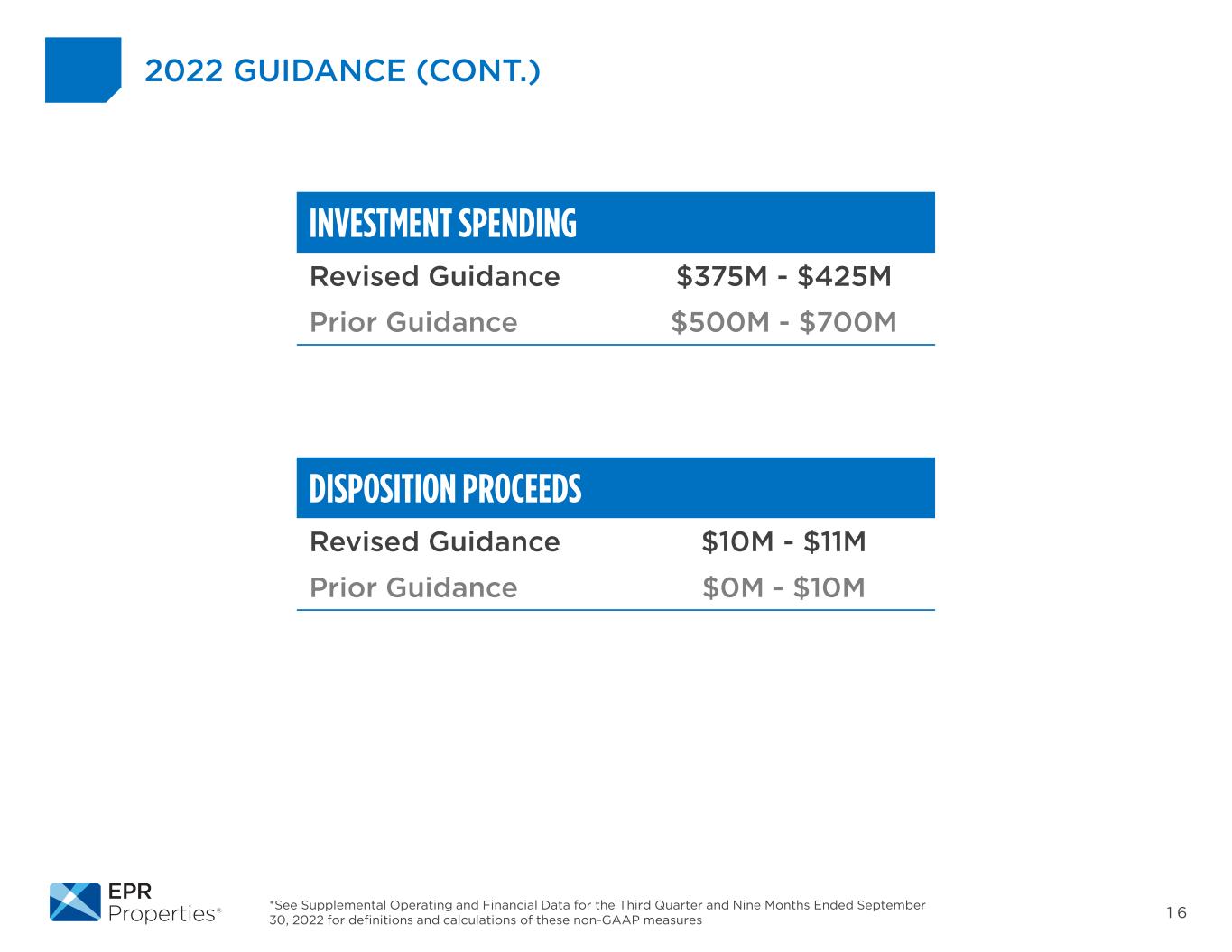

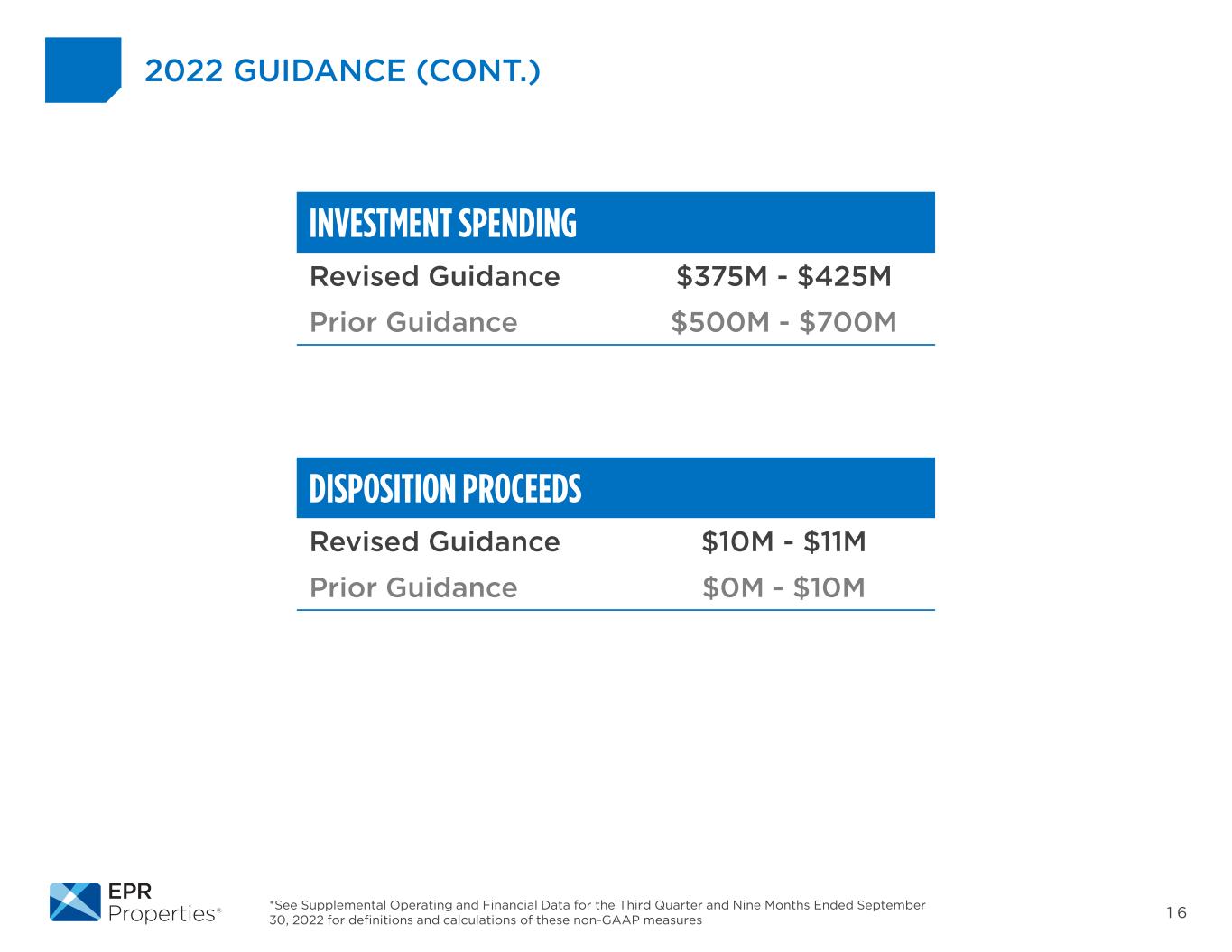

1 6 2022 GUIDANCE (CONT.) *See Supplemental Operating and Financial Data for the Third Quarter and Nine Months Ended September 30, 2022 for definitions and calculations of these non-GAAP measures INVESTMENT SPENDING Revised Guidance $375M - $425M Prior Guidance $500M - $700M DISPOSITION PROCEEDS Revised Guidance $10M - $11M Prior Guidance $0M - $10M

CLOSING COMMENTS

EPR Properties 909 Walnut Street, Suite 200 Kansas City, MO 64106 www.eprkc.com 816-472-1700 info@eprkc.com