EARNINGS CALL PRESENTATION Q3 2024

2 The financial results in this document reflect preliminary, unaudited results, which are not final until the Company’s Quarterly Report on Form 10-Q is filed. With the exception of historical information, certain statements contained or incorporated by reference herein may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), such as those pertaining to our guidance, our capital resources and liquidity, our pursuit of growth opportunities, the timing of transaction closings and investment spending, our expected cash flows, the performance of our customers, our expected cash collections and our results of operations and financial condition. Forward-looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of actual events. There is no assurance that the events or circumstances reflected in the forward-looking statements will occur. You can identify forward-looking statements by use of words such as “will be,” “intend,” “continue,” “believe,” “may,” “expect,” “hope,” “anticipate,” “goal,” “forecast,” “pipeline,” “estimates,” “offers,” “plans,” “would” or other similar expressions or other comparable terms or discussions of strategy, plans or intentions contained or incorporated by reference herein. Forward-looking statements necessarily are dependent on assumptions, data or methods that may be incorrect or imprecise. These forward-looking statements represent our intentions, plans, expectations and beliefs and are subject to numerous assumptions, risks and uncertainties. Many of the factors that will determine these items are beyond our ability to control or predict. For further discussion of these factors see “Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K and, to the extent applicable, our Quarterly Reports on Form 10-Q. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on our forward-looking statements, which speak only as of the date hereof or the date of any document incorporated by reference herein. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Except as required by law, we do not undertake any obligation to release publicly any revisions to our forward-looking statements to reflect events or circumstances after the date hereof. DISCLAIMER

INTRODUCTORY COMMENTS

PORTFOLIO

5 PORTFOLIO OVERVIEW Education Portfolio 69 Properties; 8 Operators Leased at 100%** *See Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 for definition and calculation of this non-GAAP measure **Excluding properties EPR intends to sell Experiential Portfolio 283 Properties; 52 Operators $6.4B (93%) Total Investments* Leased at 99%** Total Portfolio Snapshot ~$6.9B Total Investments* 352 Properties Leased at 99%** Q3 Investment Spending $82M

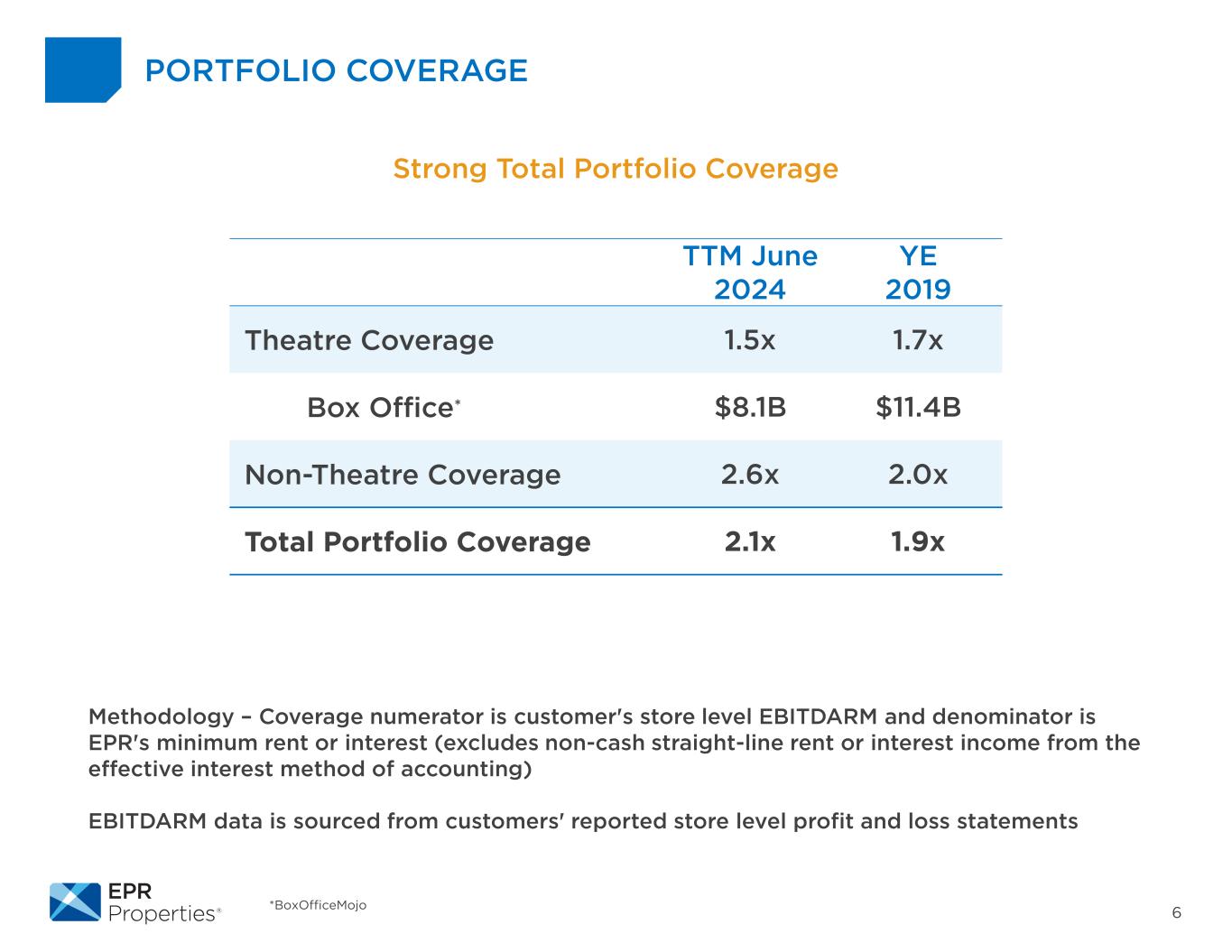

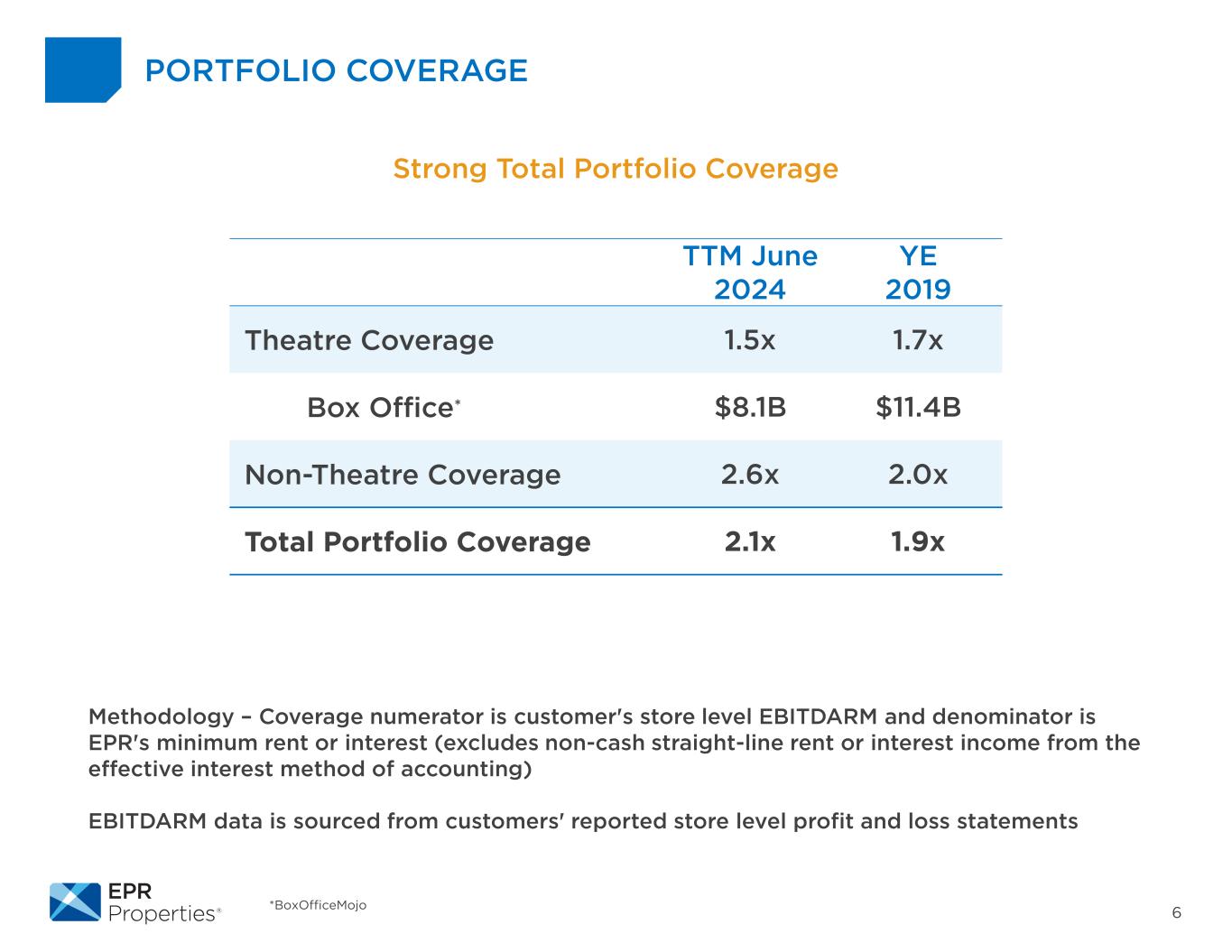

6 PORTFOLIO COVERAGE *BoxOfficeMojo TTM June 2024 YE 2019 Theatre Coverage 1.5x 1.7x Box Office* $8.1B $11.4B Non-Theatre Coverage 2.6x 2.0x Total Portfolio Coverage 2.1x 1.9x Strong Total Portfolio Coverage Methodology – Coverage numerator is customer's store level EBITDARM and denominator is EPR's minimum rent or interest (excludes non-cash straight-line rent or interest income from the effective interest method of accounting) EBITDARM data is sourced from customers' reported store level profit and loss statements

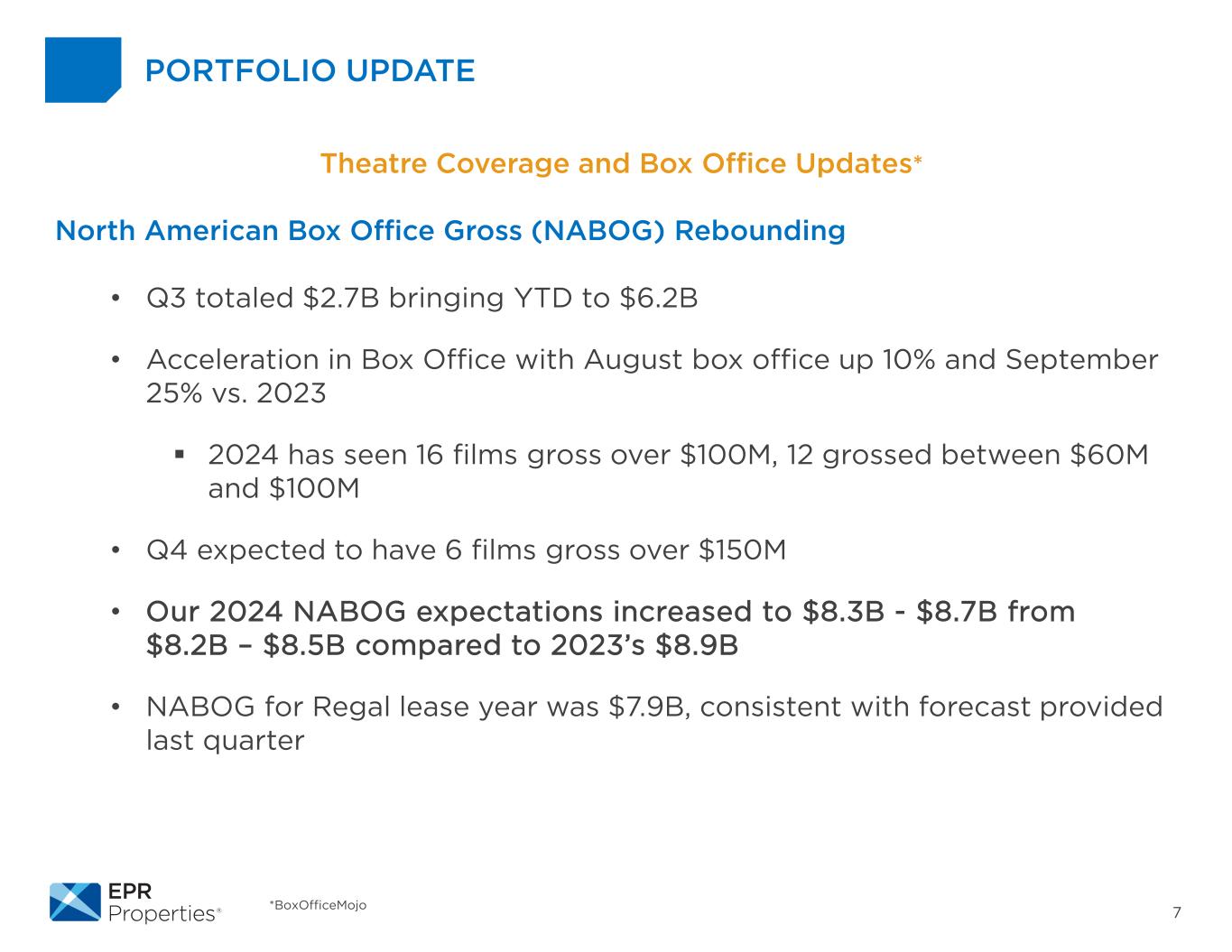

7 PORTFOLIO UPDATE *BoxOfficeMojo Theatre Coverage and Box Office Updates* North American Box Office Gross (NABOG) Rebounding • Q3 totaled $2.7B bringing YTD to $6.2B • Acceleration in Box Office with August box office up 10% and September 25% vs. 2023 2024 has seen 16 films gross over $100M, 12 grossed between $60M and $100M • Q4 expected to have 6 films gross over $150M • Our 2024 NABOG expectations increased to $8.3B - $8.7B from $8.2B – $8.5B compared to 2023’s $8.9B • NABOG for Regal lease year was $7.9B, consistent with forecast provided last quarter

8 PORTFOLIO UPDATE Experiential Lodging – Revenue was up vs. prior year Eat & Play –Andretti construction progressing and Topgolf completed self-funded refreshes at 8 locations or 20% of our portfolio Attractions & Cultural – Six Flags and Cedar Fair completed their merger in July Fitness & Wellness – Gravity Haus Breckenridge named 8th best hotel in the world in Conde Nast Traveler’s Reader’s Choice Awards; expansion project at The Springs Resort expected to open Spring 2025 Operating Properties – Managed theatres show improvement with box office recovery; performance at JV experiential lodging assets lower than expected, driven primarily by impact of two hurricanes on St. Pete Beach and other weather-related issues Other Experiential Property and Operator Updates

9 INVESTMENT SPENDING Q3 Investment spending was $82M; YTD is $214.6M 2024 Investment Spending Guidance $225M-$275M Closed on $52M mortgage on Iron Mountain Hot Springs

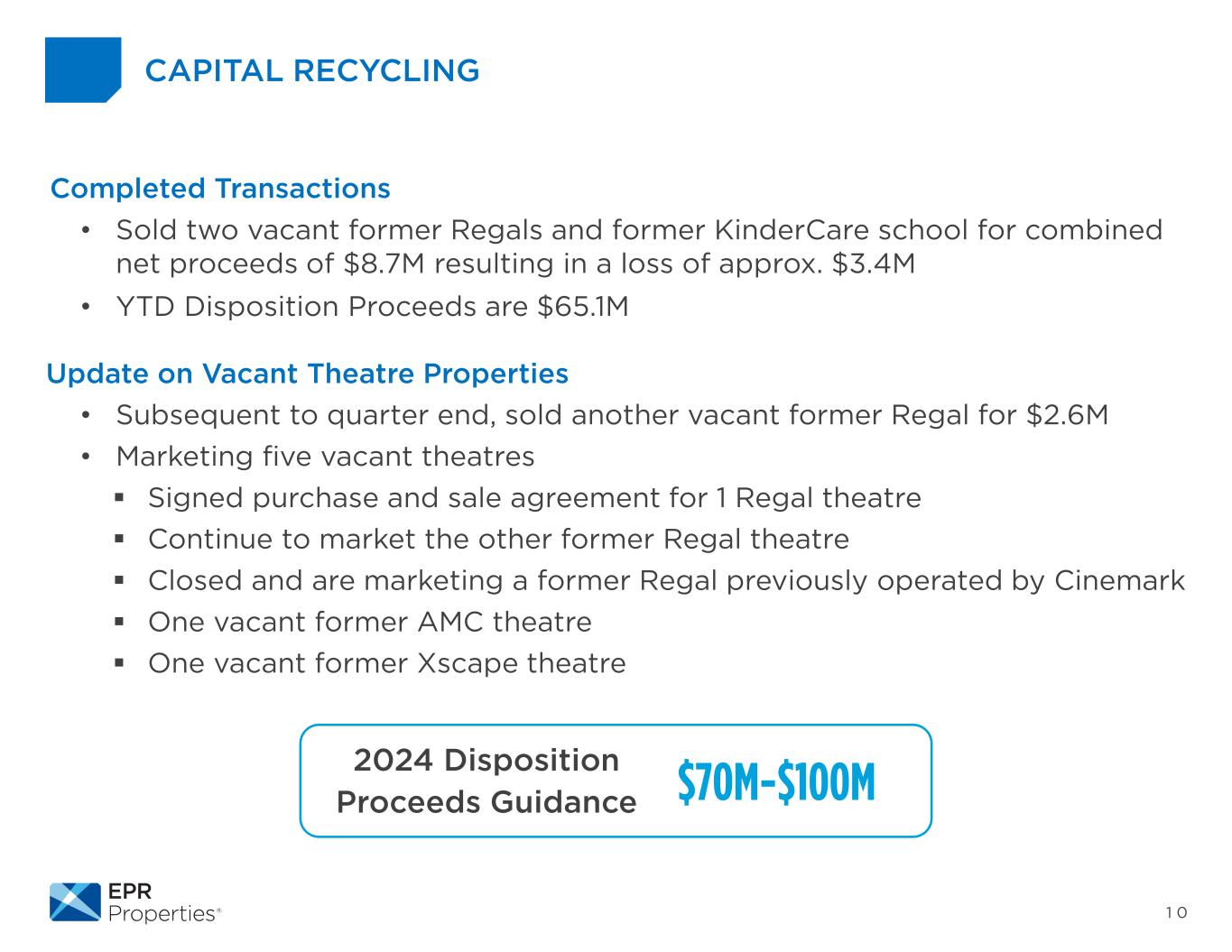

1 0 CAPITAL RECYCLING Completed Transactions • Sold two vacant former Regals and former KinderCare school for combined net proceeds of $8.7M resulting in a loss of approx. $3.4M • YTD Disposition Proceeds are $65.1M Update on Vacant Theatre Properties • Subsequent to quarter end, sold another vacant former Regal for $2.6M • Marketing five vacant theatres Signed purchase and sale agreement for 1 Regal theatre Continue to market the other former Regal theatre Closed and are marketing a former Regal previously operated by Cinemark One vacant former AMC theatre One vacant former Xscape theatre 2024 Disposition Proceeds Guidance $70M-$100M

FINANCIAL REVIEW

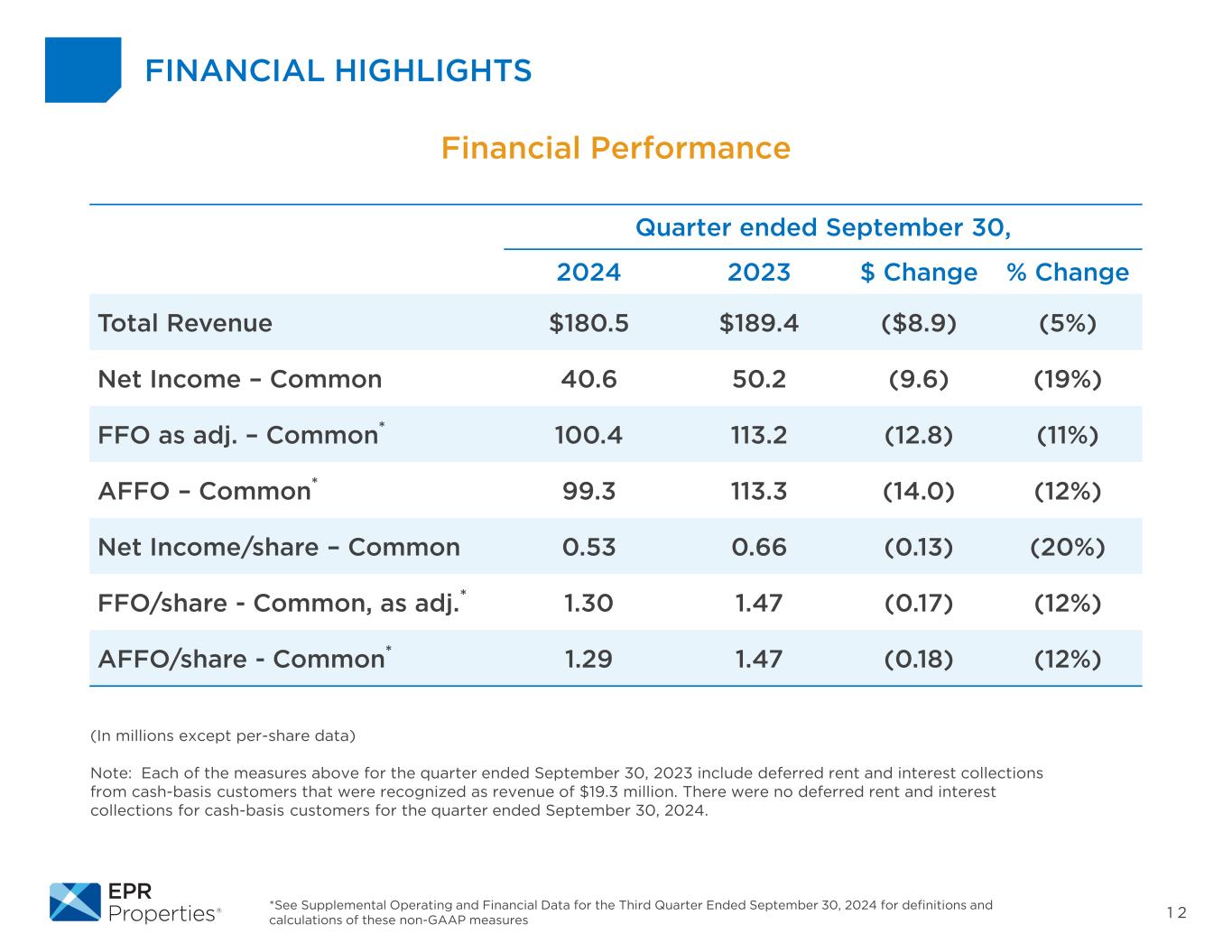

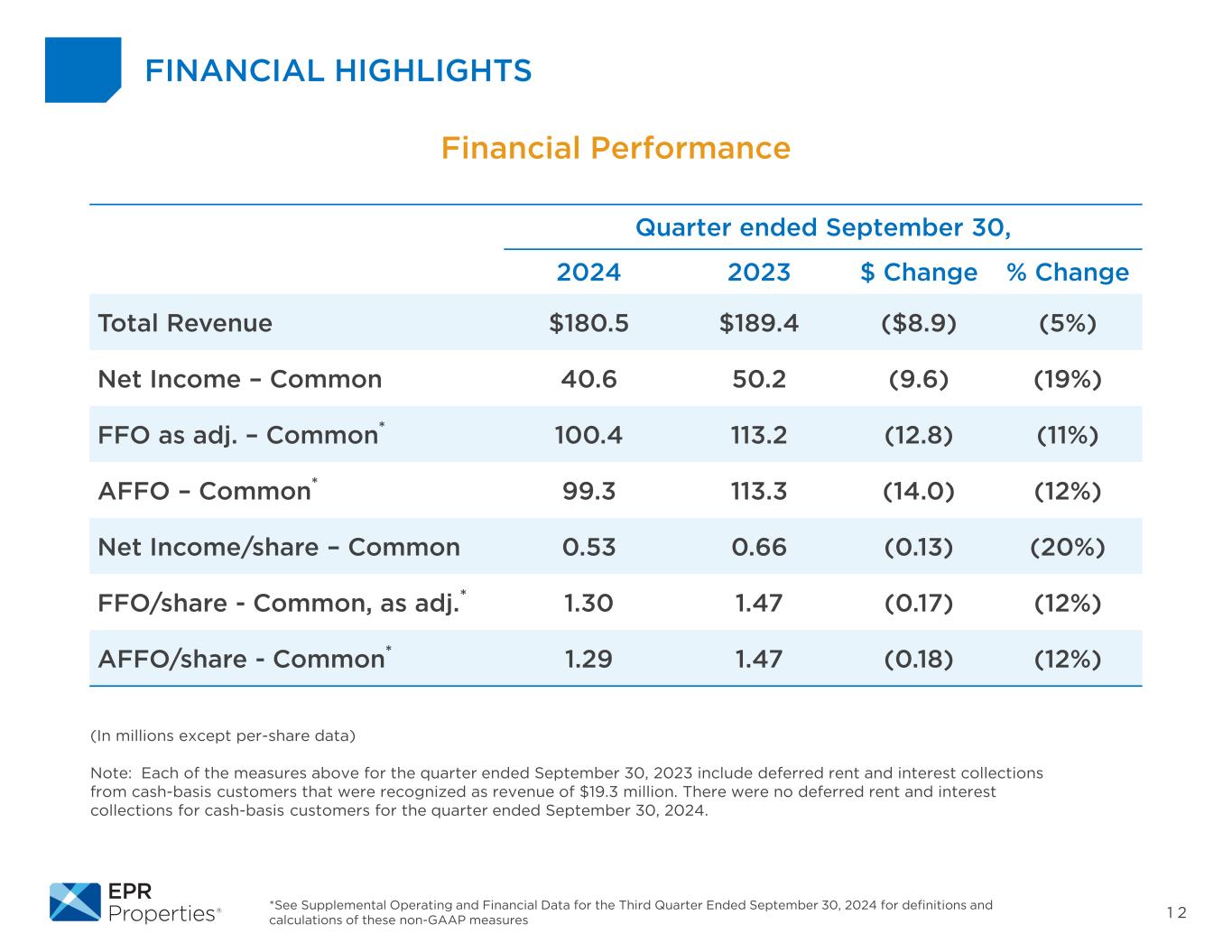

1 2 (In millions except per-share data) Note: Each of the measures above for the quarter ended September 30, 2023 include deferred rent and interest collections from cash-basis customers that were recognized as revenue of $19.3 million. There were no deferred rent and interest collections for cash-basis customers for the quarter ended September 30, 2024. *See Supplemental Operating and Financial Data for the Third Quarter Ended September 30, 2024 for definitions and calculations of these non-GAAP measures FINANCIAL HIGHLIGHTS Financial Performance Quarter ended September 30, 2024 2023 $ Change % Change Total Revenue $180.5 $189.4 ($8.9) (5%) Net Income – Common 40.6 50.2 (9.6) (19%) FFO as adj. – Common* 100.4 113.2 (12.8) (11%) AFFO – Common* 99.3 113.3 (14.0) (12%) Net Income/share – Common 0.53 0.66 (0.13) (20%) FFO/share - Common, as adj.* 1.30 1.47 (0.17) (12%) AFFO/share - Common* 1.29 1.47 (0.18) (12%)

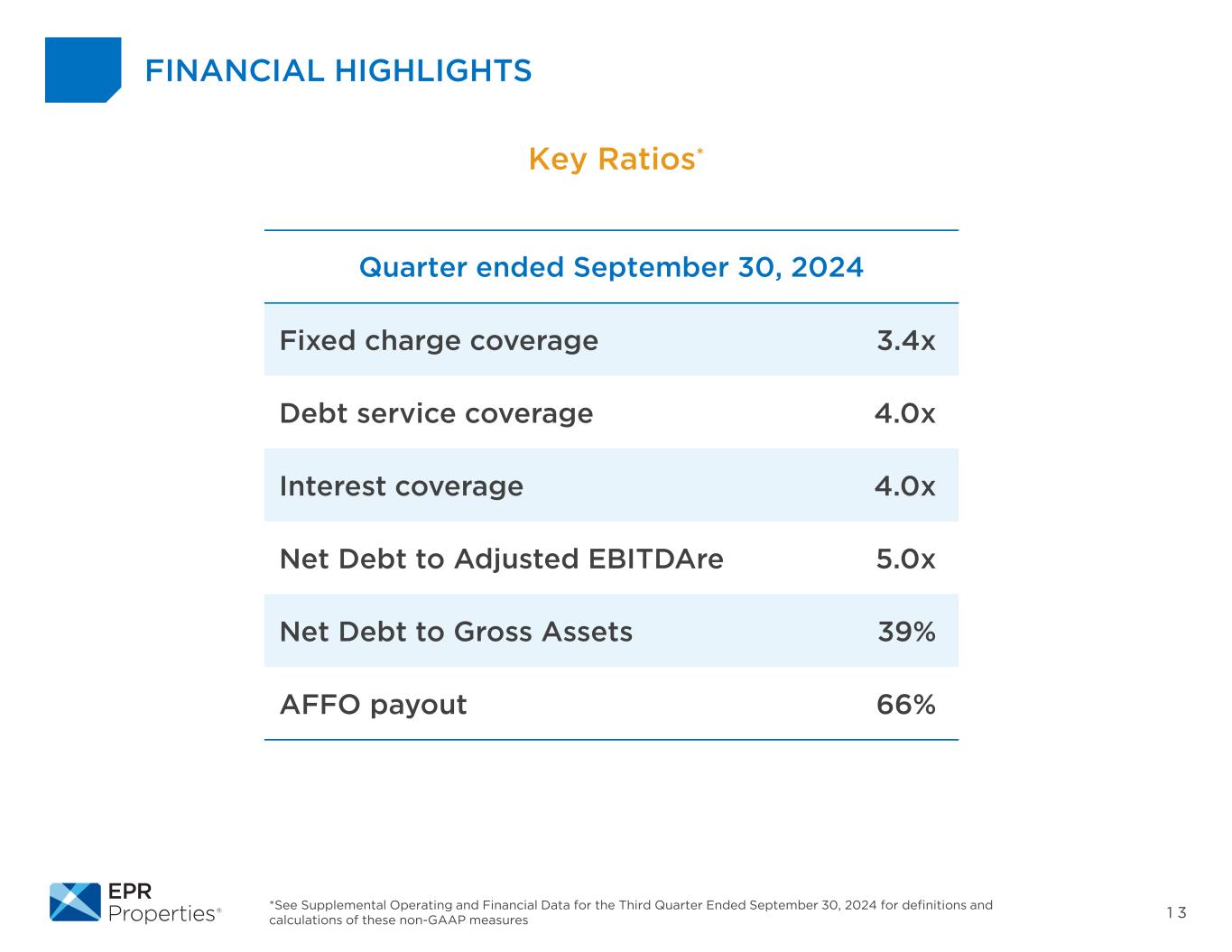

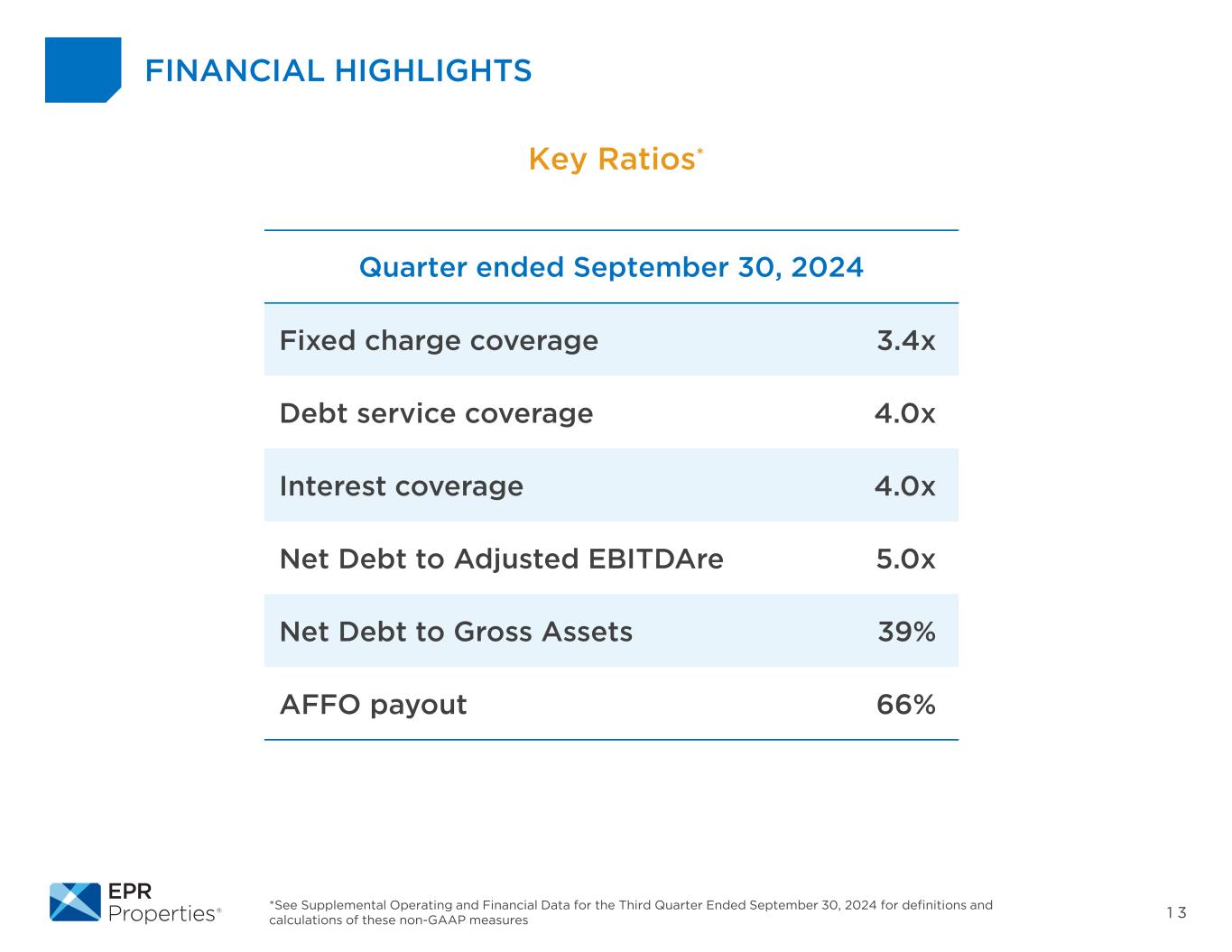

1 3 FINANCIAL HIGHLIGHTS Key Ratios* *See Supplemental Operating and Financial Data for the Third Quarter Ended September 30, 2024 for definitions and calculations of these non-GAAP measures Quarter ended September 30, 2024 Fixed charge coverage 3.4x Debt service coverage 4.0x Interest coverage 4.0x Net Debt to Adjusted EBITDAre 5.0x Net Debt to Gross Assets 39% AFFO payout 66%

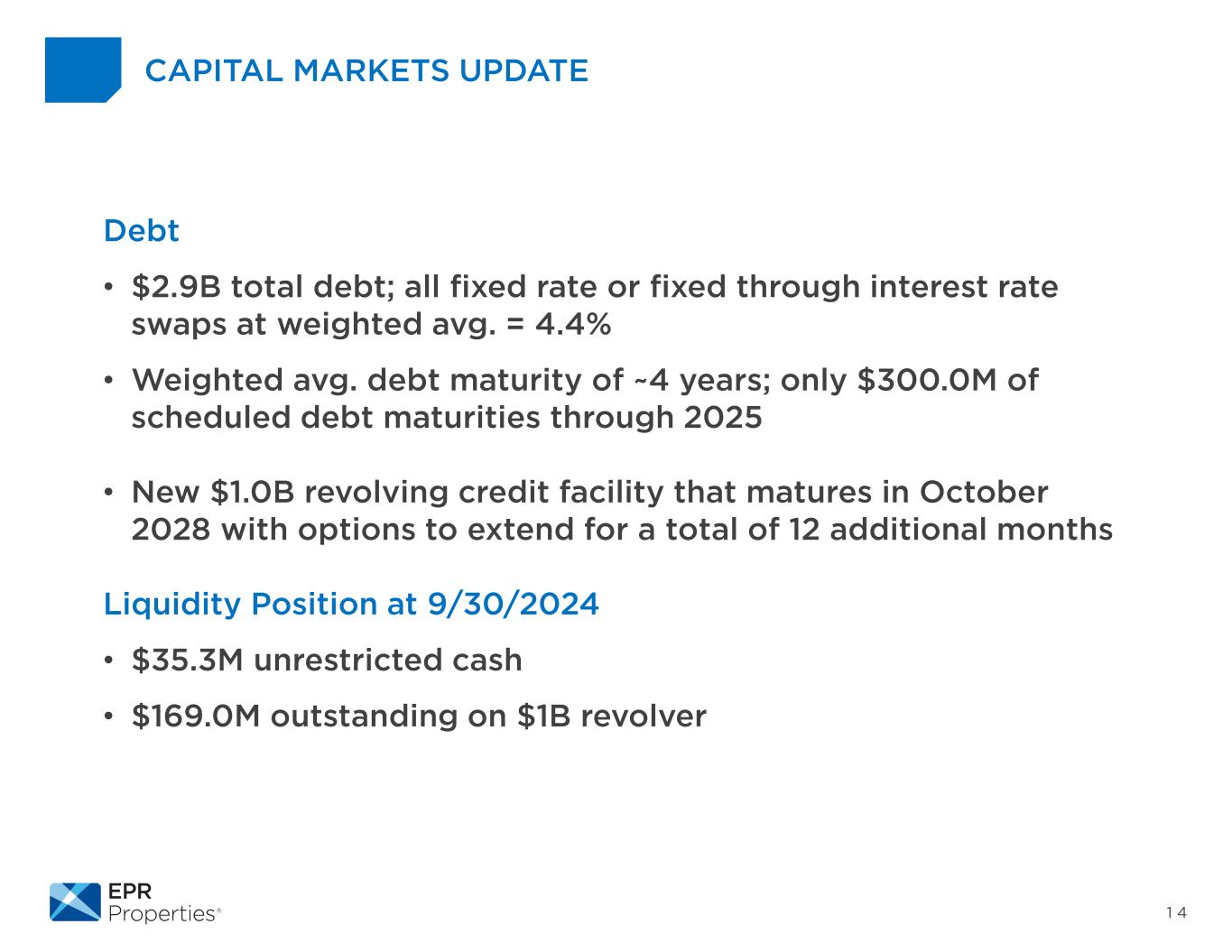

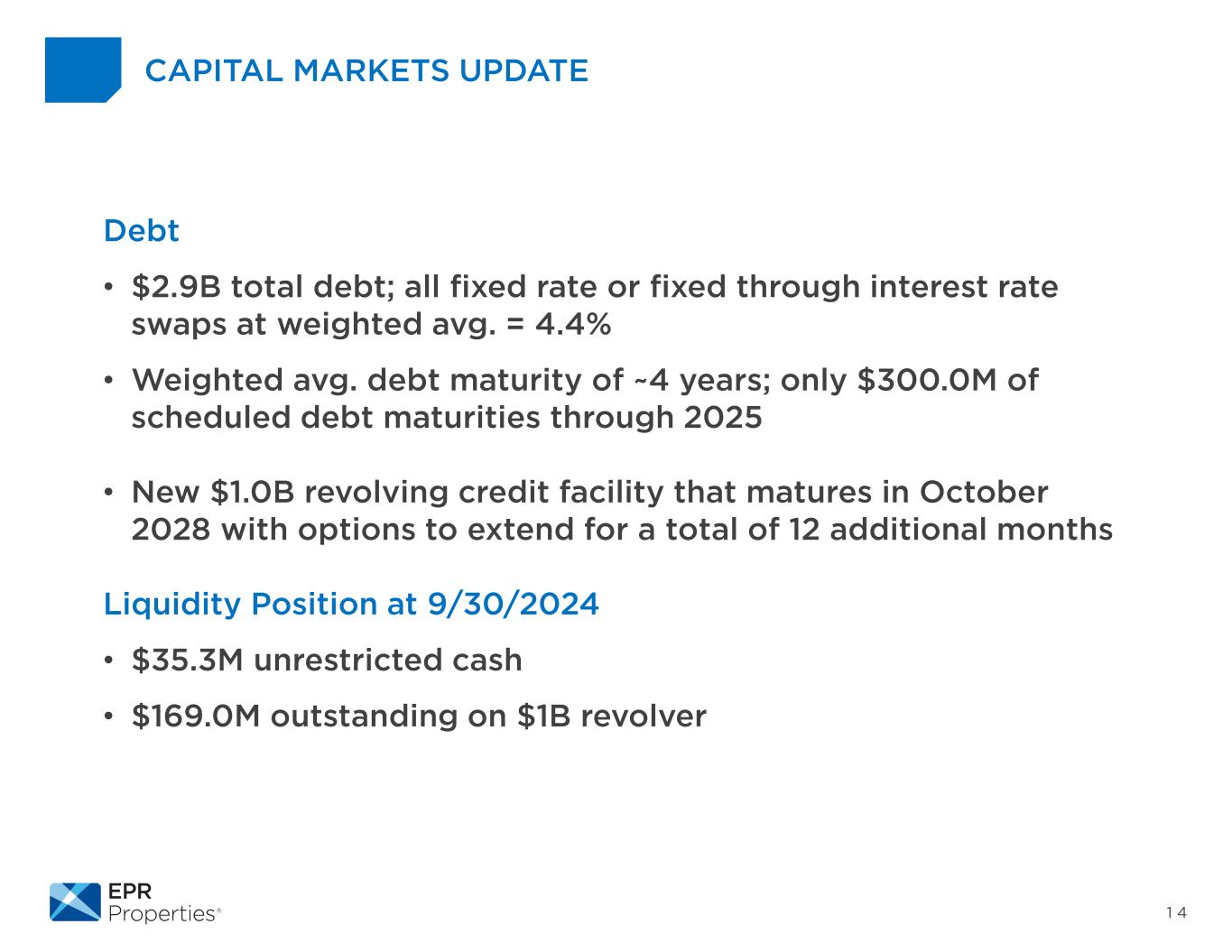

1 4 Debt • $2.9B total debt; all fixed rate or fixed through interest rate swaps at weighted avg. = 4.4% • Weighted avg. debt maturity of ~4 years; only $300.0M of scheduled debt maturities through 2025 • New $1.0B revolving credit facility that matures in October 2028 with options to extend for a total of 12 additional months Liquidity Position at 9/30/2024 • $35.3M unrestricted cash • $169.0M outstanding on $1B revolver CAPITAL MARKETS UPDATE

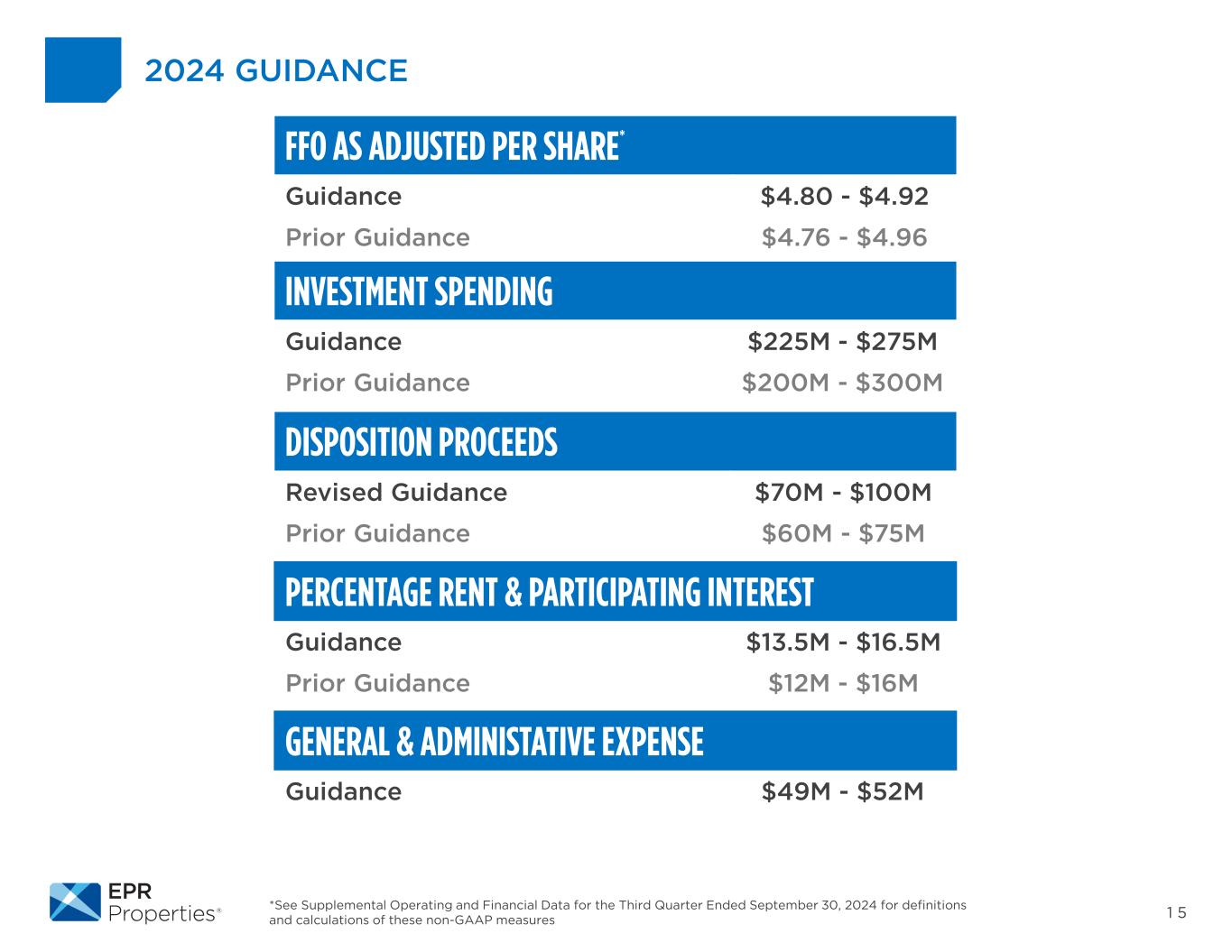

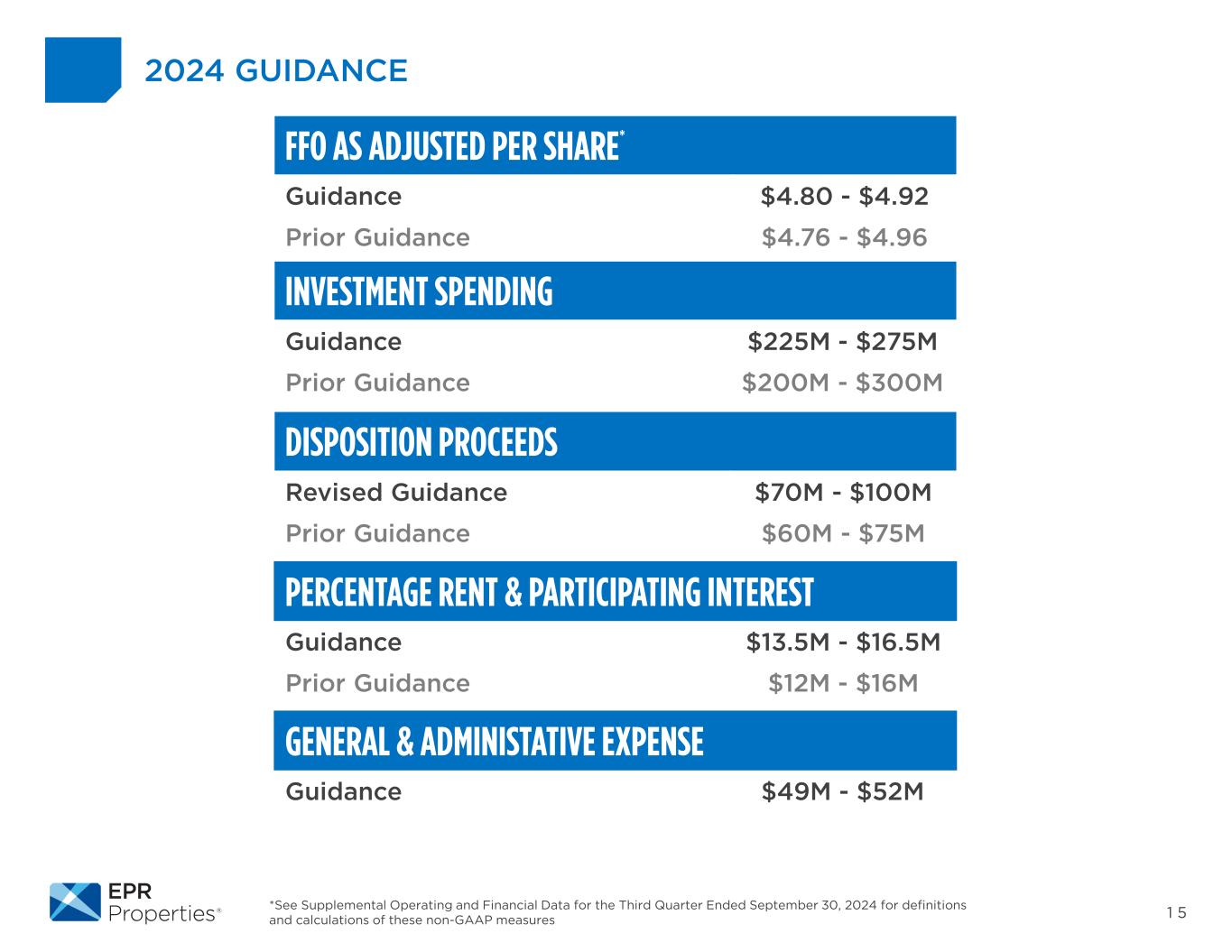

1 5 2024 GUIDANCE *See Supplemental Operating and Financial Data for the Third Quarter Ended September 30, 2024 for definitions and calculations of these non-GAAP measures FFO AS ADJUSTED PER SHARE* Guidance $4.80 - $4.92 Prior Guidance $4.76 - $4.96 INVESTMENT SPENDING Guidance $225M - $275M Prior Guidance $200M - $300M DISPOSITION PROCEEDS Revised Guidance $70M - $100M Prior Guidance $60M - $75M PERCENTAGE RENT & PARTICIPATING INTEREST Guidance $13.5M - $16.5M Prior Guidance $12M - $16M GENERAL & ADMINISTATIVE EXPENSE Guidance $49M - $52M

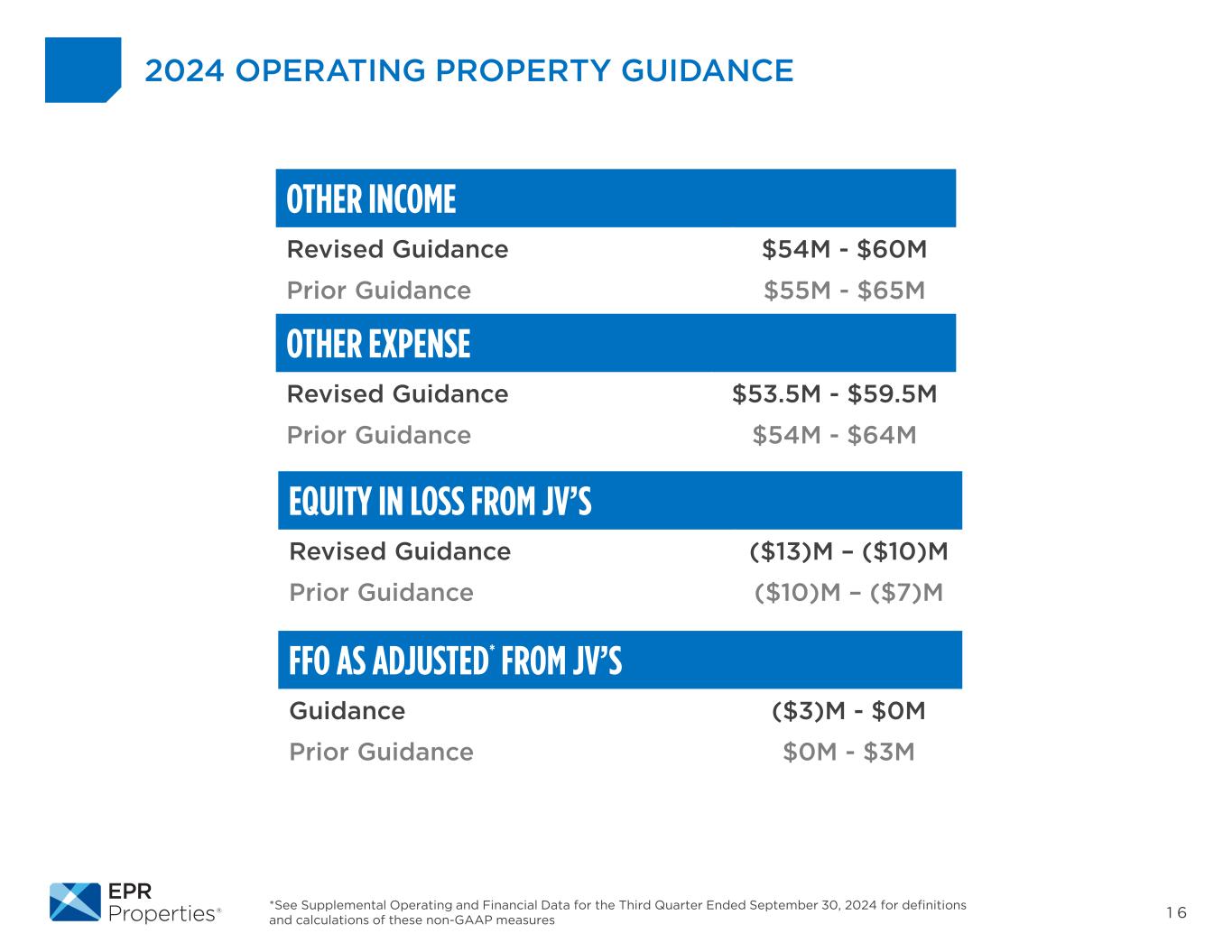

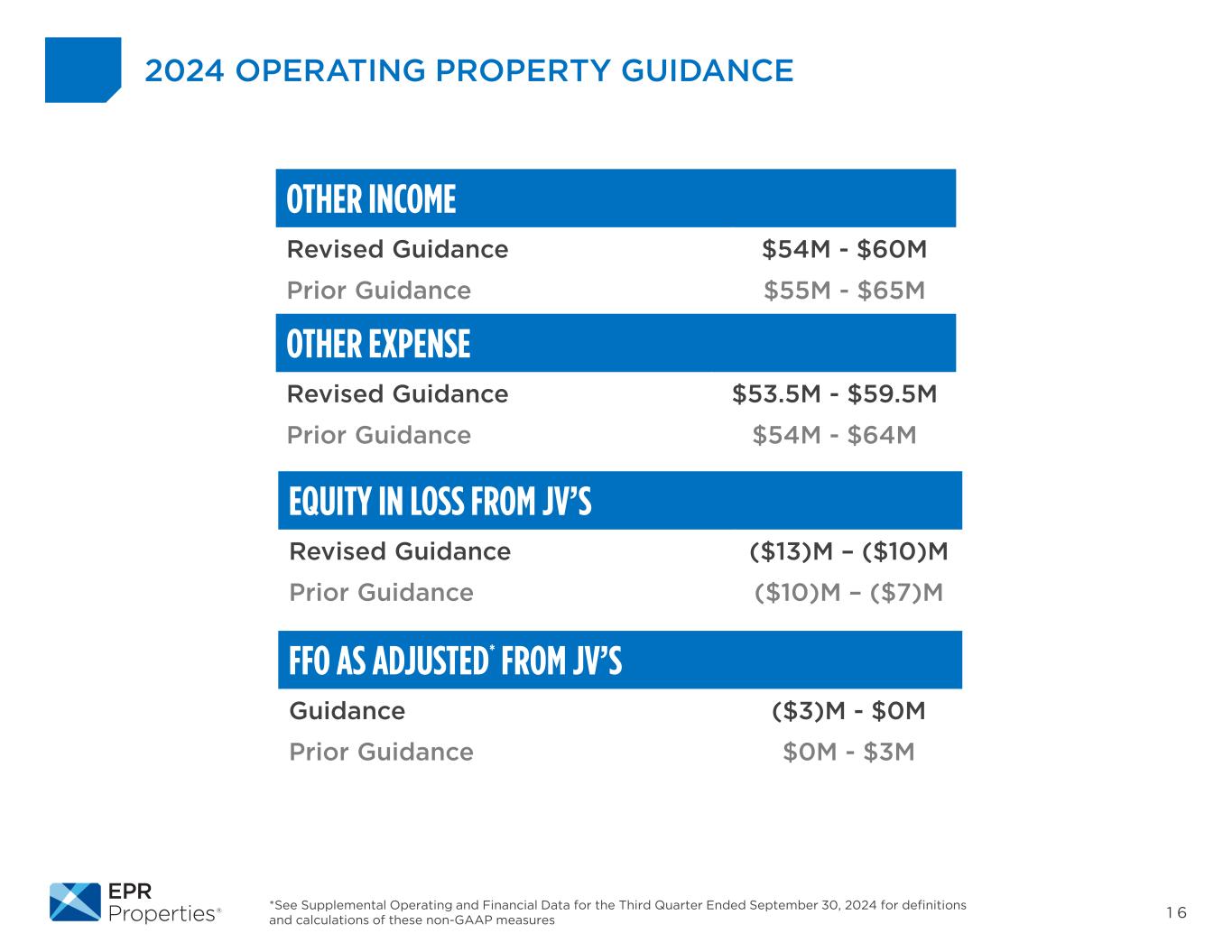

1 6 2024 OPERATING PROPERTY GUIDANCE *See Supplemental Operating and Financial Data for the Third Quarter Ended September 30, 2024 for definitions and calculations of these non-GAAP measures OTHER INCOME Revised Guidance $54M - $60M Prior Guidance $55M - $65M EQUITY IN LOSS FROM JV’S Revised Guidance ($13)M – ($10)M Prior Guidance ($10)M – ($7)M FFO AS ADJUSTED* FROM JV’S Guidance ($3)M - $0M Prior Guidance $0M - $3M OTHER EXPENSE Revised Guidance $53.5M - $59.5M Prior Guidance $54M - $64M

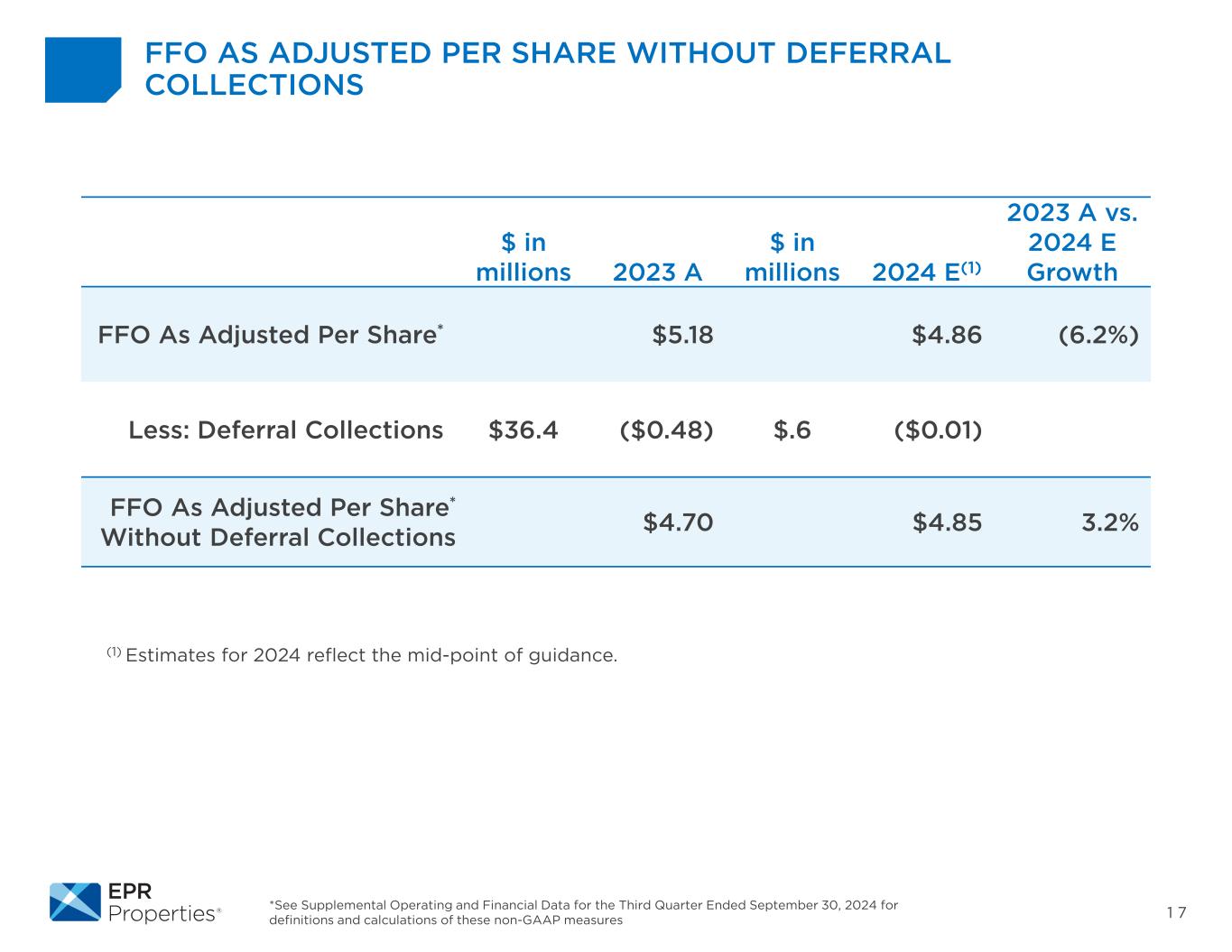

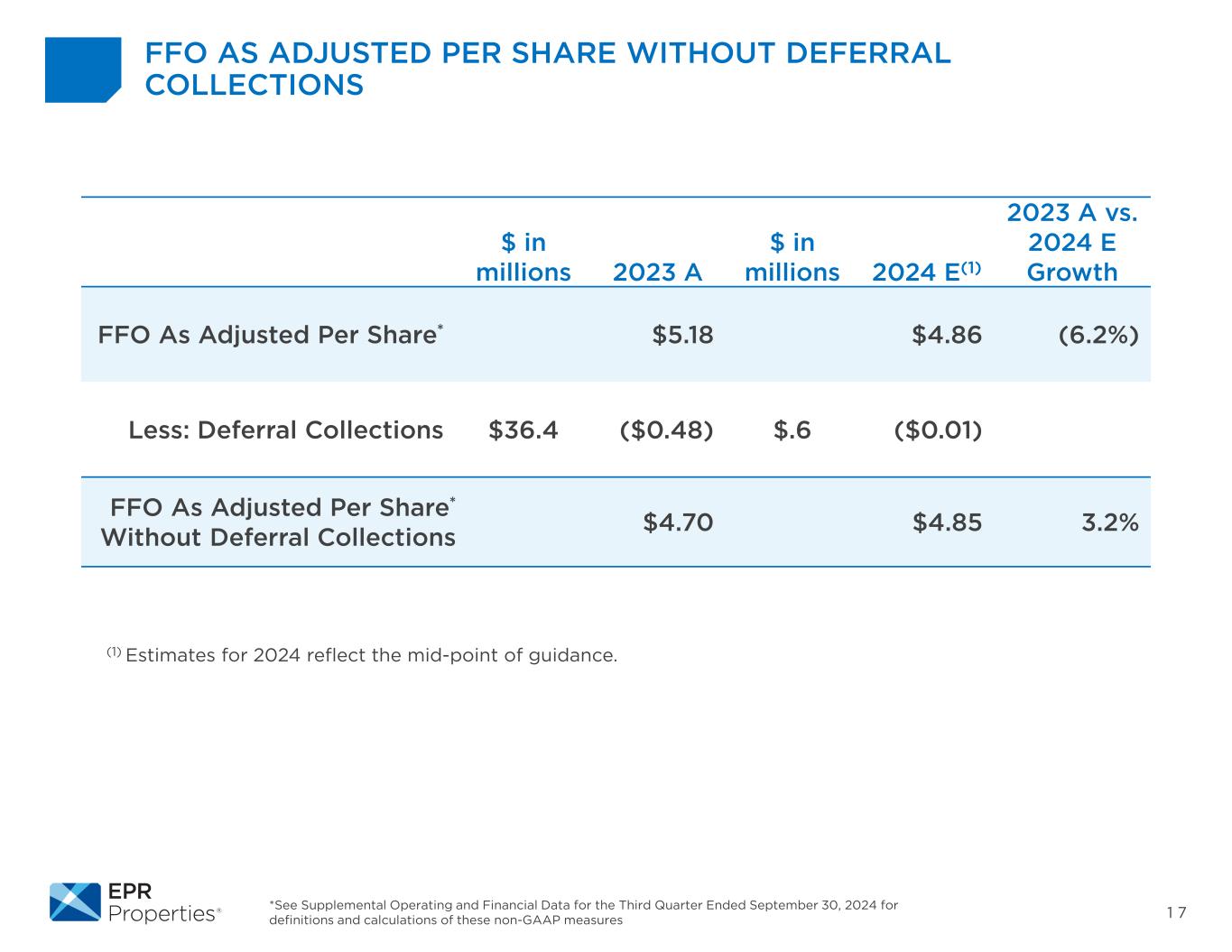

1 7 FFO AS ADJUSTED PER SHARE WITHOUT DEFERRAL COLLECTIONS *See Supplemental Operating and Financial Data for the Third Quarter Ended September 30, 2024 for definitions and calculations of these non-GAAP measures (1) Estimates for 2024 reflect the mid-point of guidance. $ in millions 2023 A $ in millions 2024 E(1) 2023 A vs. 2024 E Growth FFO As Adjusted Per Share* $5.18 $4.86 (6.2%) Less: Deferral Collections $36.4 ($0.48) $.6 ($0.01) FFO As Adjusted Per Share* Without Deferral Collections $4.70 $4.85 3.2%

CLOSING COMMENTS