UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-08411

(Investment Company Act file number)

James Advantage Funds

(Exact name of registrant as specified in charter)

1349 Fairground Road

Beavercreek, Ohio 45385

(Address of principal executive offices) (Zip code)

Barry R. James

P.O. Box 8

Alpha, Ohio 45301

(Name and address of agent for service)

Registrant’s telephone number, including area code: (937) 426-7640

Date of fiscal year end: June 30

Date of reporting period: July 1, 2011 – June 30, 2012

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| Shareholder Letter | 1 | |||||

| Growth of $10,000 Charts | 3 | |||||

| Representation of Schedules of Investments | 6 | |||||

| Disclosure of Fund Expenses | 7 | |||||

| Schedule of Investments | ||||||

| 8 | ||||||

| 17 | ||||||

| 20 | ||||||

| 22 | ||||||

| 24 | ||||||

| Statements of Assets and Liabilities | 29 | |||||

| Statements of Operations | 31 | |||||

| Statements of Changes in Net Assets | 32 | |||||

| Financial Highlights | ||||||

| 38 | ||||||

| 39 | ||||||

| 40 | ||||||

| 41 | ||||||

| 42 | ||||||

| 43 | ||||||

| Notes to Financial Statements | 44 | |||||

| Report of Independent Registered Public Accounting Firm | 52 | |||||

| Additional Information | 53 | |||||

| Trustees & Officers | 56 | |||||

| Privacy Policy | 58 | |||||

James Advantage Funds | Shareholder Letter | |

| June 30, 2012 (Unaudited) |

Like last year, I’d like to thank you for helping us achieve another major milestone. This past year, the James Balanced: Golden Rainbow Fund crossed a significant threshold of $1.5 billion in assets. As you know, in the past, the Fund had received recognition from sources such as US News and World Report and Lipper. As more assets come into the Fund, this is good news for you as fees drop. The advisory fee rate drops for assets in excess of $500 million and again for assets in excess of $1 billion.

Despite worries about the economy, employment, the national debt and Europe, the stock market edged ahead. Last year, we discussed many problems but concluded, “In the face of these problems, we are optimistic for the future, but believe a conservative allocation is prudent for the present.” While volatile, both stocks and bonds advanced, and it was a year for lower speculation as investors sought safety. Large stocks outperformed smaller stocks as did stocks with greater growth characteristics. Here is this year’s Annual Report to the James Advantage Funds’ shareholders.

The Market Over the Past Year

Commonly used as a barometer of the stock market, the S&P 500 rose by 5.45% over the twelve months ending June 30, 2012, a below normal year. The Dow Jones Industrials rose a little more, 6.63%, while smaller capitalization stocks, represented by the Russell 2000, actually fell 2.08%.

This last year was pretty good for homebuilding stocks, computer stocks and some retail material stocks. It wasn’t a great year for many basic material or trucking stocks.

The bond market started strong and then finished the same way, especially for longer term bonds. The Barclay’s Intermediate Gov/Credit Index, a broad measure of high grade U.S. fixed income securities, returned 5.42%. Rates started to rise early in 2012, but economic worries and low inflation helped bond prices rebound in the second quarter of 2012. Many pundits had expected rates to rise rapidly all year long. We are glad we follow our own research.

Investment Goals and Objectives

James Investment Research has a long history of value investing and we do not drift from our style because the markets are temporarily moving in one direction or another. We believe that value investing will outperform over the long run and that value stocks will hold up better than growth or speculative stocks in difficult markets.

The objectives of our Funds are stated in the Prospectus, and each Fund has a benchmark that the portfolio management team strives to beat. This is not always going to happen, but if we can outperform over the long run without deviating from our stated objectives and style, we believe we will be serving our shareholders well.

Investment Philosophy

We believe our research team is among the best in the business. We have a very sophisticated process that is both quantitative and qualitative. We have an investment committee that adds wisdom and experience to the quantitative work and we have evolved a process that we believe is unparalleled in our profession. However, all this is built on a strong foundation of value investing. Our modeling and our fundamental analysis is premised on our conclusion that the preponderance of evidence shows value stocks outperform growth stocks over the long run.

Our strategy is premised on preserving capital in declining markets. The execution of this strategy includes holding undervalued stocks, which we call value stocks. We believe this strategy can provide consistent returns that will, over the long run, outperform the Funds’ benchmarks.

Fund Performance

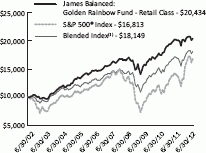

The Balanced: Golden Rainbow Fund Retail Class shares rose 3.98% over the twelve months ending June 30, 2012. Its benchmark, a blended index comprised of the Russell 2000 Index, the S&P 500 Index and the Barclays Intermediate Government/Credit Bond Index, rose by 4.11%. The Fund lagged its benchmark as our stock holdings reduced the strong performance of our long bond holdings. While the portfolio kept very modest levels of equities throughout the year, value stocks and smaller capitalization stocks lagged growth and large cap stocks. This led to the Fund’s underperformance versus its benchmark. We note that the S&P 500 Value Index returned only 2.98% over the year, while the S&P 500 Growth Index returned 7.77%. And we note that the Russell 2000, a small cap index, fell 2.08% over the year, while the S&P 500 advanced 5.45%. Clearly, this was not the year for value or for smaller capitalization stocks.

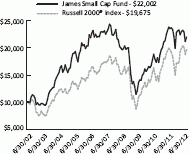

The James Small Cap Fund rose slightly, advancing 0.16% over the fiscal year versus a decline of 2.08% for the Russell 2000, its benchmark. Value oriented small cap stocks outperformed a bit this last year, as their higher dividends offset the general downtrend. We are pleased the portfolio held up in spite of a downturn in small cap stocks.

Annual Report | June 30, 2012 | 1 |

Shareholder Letter | James Advantage Funds | |

June 30, 2012 (Unaudited) |

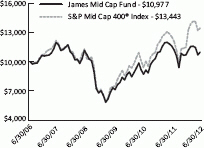

The James Mid Cap Fund fell 5.26%, lagging its benchmark, the S&P Mid Cap 400 Index, which fell 0.86%. The Fund was affected by poor performance among the non-cyclical, energy and technology sectors.

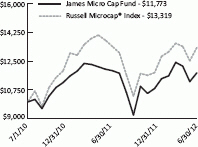

The James Micro Cap Fund fell slightly, 1.15% for the year. This fund focuses on companies that are less than $250 million in size. Of course, micro cap stocks are much more volatile than large capitalization companies. For comparison’s sake, the benchmark, the Russell Microcap Index, fell 1.54% for the year. Your Fund’s outperformance was due to stock selection and active management.

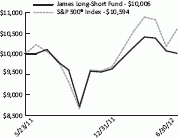

The James Long/Short Fund had its first full year of operations. It fell slightly, down 0.93% for the year. For comparison the equity index, the S&P 500, rose 5.45% for the year. This fund seeks to take advantage of volatile markets through the use of some leverage and some shorting of overpriced stocks. The Fund lagged its benchmark because value stocks lagged growth stocks and because small cap stocks lagged large cap stocks. Given the Fund’s ability to leverage itself, to hold bonds, and to short securities, investors should not expect a tight correlation to the S&P 500.

Please see the following charts for longer term comparisons for all our funds.

Expectations for the Future

A short time ago, JP Morgan reported its trading in derivatives had gone awry. Losses of $2 billion were said to be sustained by the company. While the losses were to be taken by the JP Morgan Company, not customers or the public, it was taken as a sign of instability.

A short time later, shares of Facebook were brought to the investment public as part of an Initial Public Offering (IPO.) The shares were sold at $38 per share, for a total of nearly $104 billion. Shortly after the sale, prices began to slip and had reached lows of $25.52, which would represent a loss of over 32% to the unhappy buyers. Your Funds did not participate in the Facebook offering. However, you should know that current and future holdings involve risk.

What’s new? In spite of bad news from Europe and on the home front, our market risk indicators are temporarily neutral. The volume on down days is getting lighter, while it is rising on up days. In addition, the market is tending to shrug off bad news. Furthermore, the Federal Reserve announced it would continue Operation Twist (selling short term bonds to buy longer term bonds in an attempt to change the shape of the yield curve). We note the stock market had very strong returns during the last two Quantitative Easings (secondary market purchases of U.S. government securities to add money to the banking system). Lastly, history points to some strong summer rallies in election years.

While our economy is not likely to have a strong rebound anytime soon, our stock market looks more attractive than many others and negative sentiment has perhaps gone too far. We suspect the stock market may present a good opportunity to add stocks, which we will gradually do. The outlook for bonds continues favorable. If this proves correct, we should see higher returns for a time. Still, in spite of numerous economic headwinds, we are optimistic for the future but believe a conservative allocation is prudent for the present.

Barry R. James, CFA, CIC

President

You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of a Fund before investing. The Funds’ prospectuses contain this and other information. You may obtain a current copy of a Fund’s prospectus by calling 1-800-995-2637. Past performance is no guarantee of future results. The investment return and principal value of an investment in any Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Barry R. James is a registered representative of ALPS Distributors, Inc.

CFA® is a trademark owned by the CFA Institute.

The Dow Jones Industrial Average is a price-weighted overage of 30 actively traded Blue-Chip stocks.

The S&P 500 Value and Growth Indices are market-capitalization-weighted indices developed by Standard and Poor’s consisting of those stocks within the S&P 500 Index that exhibit either strong value or growth characteristics, respectively.

| 2 | www.jamesfunds.com |

James Advantage Funds | Growth of $10,000 Charts | |

| June 30, 2012 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in the James Balanced: Golden Rainbow Fund – Retail Class

James Balanced: Golden Rainbow Fund, S&P 500® Index and Blended Index Average Annual Total Returns

1 Year | 5 Years | 10 Years | Since Inception(2) | |||||||||||||

James Balanced: Golden Rainbow – Retail Class | 3.98 | % | 5.17 | % | 7.41 | % | 8.18 | % | ||||||||

S&P 500® Index | 5.45 | % | 0.22 | % | 5.33 | % | 8.48 | % | ||||||||

Russell 2000® Index | -2.08 | % | 0.54 | % | 7.00 | % | 9.20 | % | ||||||||

Barclays Capital Intermediate Government/Credit Index | 5.42 | % | 6.01 | % | 5.07 | % | 6.29 | % | ||||||||

Blended Index(1) | 4.11 | % | 3.84 | % | 6.14 | % | 8.03 | % | ||||||||

| ||||||||||||||||

James Balanced: Golden Rainbow - Institutional Class | 4.22 | % | N/A | N/A | 13.62 | % | ||||||||||

S&P 500® Index | 5.45 | % | N/A | N/A | 24.71 | % | ||||||||||

Russell 2000® Index | -2.08 | % | N/A | N/A | 27.97 | % | ||||||||||

Barclays Capital Intermediate Government/Credit Index | 5.42 | % | N/A | N/A | 5.90 | % | ||||||||||

Blended Index(1) | 4.11 | % | N/A | N/A | 16.34 | % | ||||||||||

| (1) | The Blended Index is comprised of a 25% weighting in the S&P 500® Index, a 25% weighting in the Russell 2000® Index and a 50% weighting in the Barclays Capital Intermediate Government/Credit Index. |

| (2) | Retail Class inception was July 1, 1991. Institutional Class inception was March 2, 2009. |

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2011, was 1.13% for the Retail Class and 0.88% for the Institutional Class.

Comparison of the Change in Value of a $10,000 Investment in the James Small Cap Fund

James Small Cap Fund and Russell 2000® Index Average Annual Total Returns

| 1 Year | 5 Years | 10 Years | Since Inception(1) | |||||||||||

James Small Cap Fund | 0.16% | -0.29% | 8.20% | 7.38% | ||||||||||

Russell 2000® Index | -2.08% | 0.54% | 7.00% | 7.58% | ||||||||||

| (1) | Fund inception was October 2, 1998. |

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2011, was 1.50%.

Mid, Small and Micro Cap investing involve greater risk not associated with investing in more established companies, such as greater price volatility, business risk, less liquidity and increased competitive threat.

The S&P 500® Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the 2,000 smallest U.S. domiciled publicly-traded common stocks of the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index, an unmanaged index of the 3,000 largest U.S. domiciled publicly-traded common stocks by market capitalization.

The Barclays Capital Intermediate Government/Credit Index measures the performance of U.S. Dollar denominated U.S. Treasuries, government-related and investment grade U.S. corporate securities that have a remaining maturity of greater than one year and less than ten years.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

The S&P 500® Index, Russell 2000® Index, Barclays Capital Intermediate Government/Credit Index, S&P Mid Cap 400® Index, and Russell Microcap® Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

Annual Report | June 30, 2012 | 3 |

Growth of $10,000 Charts | James Advantage Funds | |

June 30, 2012 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in the James Mid Cap Fund

James Mid Cap Fund and S&P Mid Cap 400® Index Average Annual Total Returns

| 1 Year | 5 Year | Since Inception(1) | ||||

James Mid Cap Fund | -5.26% | -1.34% | 1.57% | |||

S&P Mid Cap 400® Index | -0.86% | 0.98% | 3.69% |

| (1) | Fund inception was June 30, 2006. |

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2011, was 1.50%.

Comparison of the Change in Value of a $10,000 Investment in the James Micro Cap Fund

James Micro Cap Fund and Russell Microcap® Index Average Annual Total Returns

| 1 Year | Since Inception(1) | |||

James Micro Cap Fund | -1.15% | 8.52% | ||

Russell Microcap® Index | -0.54% | 15.43% |

| (1) | Fund inception was July 1, 2010. |

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2011 was 1.50%.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

The Mid-Cap Fund invests in stocks of mid-cap companies which tend to be more volatile and can be less liquid than stocks of large-cap companies. Diversification does not guarantee a profit or protect against loss. Current and future portfolio holdings are subject to risk.

Mid, Small and Micro Cap investing involve greater risk not associated with investing in more established companies, such as greater price volatility, business risk, less liquidity and increased competitive threat.

The S&P 500® Index, Russell 2000® Index, Barclays Capital Intermediate Government/Credit Index, S&P Mid Cap 400® Index, and Russell Microcap® Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The S&P Mid Cap 400® Value Index is a recognized, unmanaged index of mid cap stocks considered to be value stocks using Standard and Poor’s methodology.

The Russell Microcap® Index measures the performance of the microcap segment of the U.S. equity market. It makes up less than 3% of the U.S. equity market. It includes 1,000 of the smallest securities in the small cap Russell 2000® Index, plus the next smallest eligible securities by market cap.

| 4 | www.jamesfunds.com |

James Advantage Funds | Growth of $10,000 Charts | |

| June 30, 2012 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in the James Long-Short Fund

James Long-Short Fund and S&P 500® Index Average Annual Total Returns

| 1 Year | Since Inception(1) | |||||

James Long-Short Fund | -0.93% | 0.05% | ||||

S&P 500® Index | 5.45% | 5.36% |

| (1) | Fund inception was May 23, 2011. |

| The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2011, was 1.75%. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

Short selling incurs significant additional risk; theoretically, stocks sold short have unlimited upside risk potential. In addition, this strategy depends on the Adviser’s ability to correctly identify undervalued and overvalued stocks, and that the stock markets are reasonable and efficient. Periods of extreme volatility may harm the performance of this product. The Long-Short Fund may have a high portfolio turnover rate. A high portfolio turnover rate can result in increased brokerage commission costs and may expose taxable shareholders to potentially larger current tax liability.

The S&P 500® Index, Russell 2000® Index, Barclays Capital Intermediate Government/Credit Index, S&P Mid Cap 400® Index, and Russell Microcap® Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The S&P 500® Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation.

Annual Report | June 30, 2012 | 5 |

| Representation of Schedules of Investments | James Advantage Funds | |

June 30, 2012 (Unaudited) |

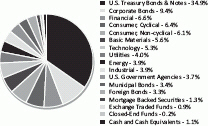

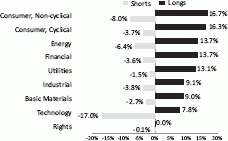

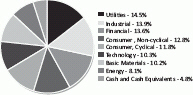

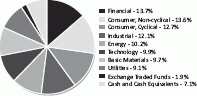

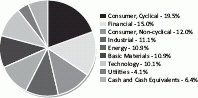

The illustrations below provide the industry sectors for the James Balanced: Golden Rainbow Fund, James Small Cap Fund, James Mid Cap Fund, James Micro Cap Fund, and James Long-Short Fund.

James Balanced: Golden Rainbow Fund - Industry Sector Allocation (% of Net Assets)

James Long-Short Fund - Industry Sector Allocation (% of Net Assets)

(Cash and Cash Equivalents not included)

James Small Cap Fund - Industry Sector Allocation (% of Net Assets)

James Mid Cap Fund - Industry Sector Allocation

(% of Net Assets)

James Micro Cap Fund - Industry Sector Allocation (% of Net Assets)

| 6 | www.jamesfunds.com |

James Advantage Funds | Disclosure of Fund Expenses | |

| June 30, 2012 (Unaudited) |

Example. As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including reinvested dividends or other distributions, and redemption fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period January 1, 2012 through June 30, 2012.

Actual Expenses. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

| Net Expense Ratio Annualized June 30, 2012(a) | Beginning Account Value January 1, 2012 | Ending Account Value June 30, 2012 | Expense Paid During Period(b) | |||||||

James Balanced: Golden Rainbow Fund | ||||||||||

Retail Class Actual | 1.06% | $ 1,000.00 | $ 1,027.20 | $ | 5.34 | |||||

Retail Class Hypothetical (5% return before expenses) | 1.06% | $ 1,000.00 | $ 1,019.59 | $ | 5.32 | |||||

Institutional Class Actual | 0.81% | $ 1,000.00 | $ 1,028.20 | $ | 4.08 | |||||

Institutional Class Hypothetical (5% return before expenses) | 0.81% | $ 1,000.00 | $ 1,020.84 | $ | 4.07 | |||||

James Small Cap Fund | ||||||||||

Actual | 1.50% | $ 1,000.00 | $ 1,018.80 | $ | 7.53 | |||||

Hypothetical (5% return before expenses) | 1.50% | $ 1,000.00 | $ 1,017.40 | $ | 7.52 | |||||

James Mid Cap Fund | ||||||||||

Actual | 1.50% | $ 1,000.00 | $ 1,025.90 | $ | 7.56 | |||||

Hypothetical (5% return before expenses) | 1.50% | $ 1,000.00 | $ 1,017.40 | $ | 7.52 | |||||

James Micro Cap Fund | ||||||||||

Actual | 1.50% | $ 1,000.00 | $ 1,088.30 | $ | 7.79 | |||||

Hypothetical (5% return before expenses) | 1.50% | $ 1,000.00 | $ 1,017.40 | $ | 7.52 | |||||

James Long-Short Fund | ||||||||||

Actual | 3.44%(c) | $ 1,000.00 | $ 1,039.50 | $ | 17.44 | |||||

Hypothetical (5% return before expenses) | 3.44%(c) | $ 1,000.00 | $ 1,007.76 | $ | 17.17 | |||||

| (a) | Annualized, based on the Fund’s most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (182), divided by 366. Note the expense example is typically based on a six-month period. |

| (c) | Dividend and interest expense on securities sold short and interest expense totaled 1.93% (annualized) of average net assets for the six months ended June 30, 2012. |

Annual Report | June 30, 2012 | 7 |

Schedule of Investments | James Balanced: Golden Rainbow Fund | |

June 30, 2012 |

Shares or Principal Amount | Value | |||||||||

COMMON STOCKS-41.8% | ||||||||||

Basic Materials-5.6% | ||||||||||

170,000 | Barrick Gold Corp. | $6,386,900 | ||||||||

420,000 | Buckeye Technologies, Inc. | 11,965,800 | ||||||||

83,000 | Cabot Corp. | 3,378,100 | ||||||||

77,200 | CF Industries Holdings, Inc. | 14,956,728 | ||||||||

45,000 | E.I. du Pont de Nemours & Co. | 2,275,650 | ||||||||

95,000 | FMC Corp. | 5,080,600 | ||||||||

10,000 | H.B. Fuller Co. | 307,000 | ||||||||

161,000 | Innophos Holdings, Inc. | 9,090,060 | ||||||||

100,000 | Innospec, Inc.* | 2,961,000 | ||||||||

57,000 | International Paper Co. | 1,647,870 | ||||||||

90,000 | Newmont Mining Corp. | 4,365,900 | ||||||||

311,040 | PolyOne Corp. | 4,255,027 | ||||||||

90,000 | PPG Industries, Inc. | 9,550,800 | ||||||||

48,540 | Terra Nitrogen Co. LP | 10,280,772 | ||||||||

|

| |||||||||

| 86,502,207 | ||||||||||

|

| |||||||||

Consumer, Cyclical-6.4% | ||||||||||

300,000 | Alaska Air Group, Inc.* | 10,770,000 | ||||||||

7,500 | AutoZone, Inc.* | 2,753,775 | ||||||||

35,000 | Big Lots, Inc.* | 1,427,650 | ||||||||

177,700 | The Cato Corp., Class A | 5,412,742 | ||||||||

13,000 | Dillard’s, Inc., Class A | 827,840 | ||||||||

98,900 | DineEquity, Inc.* | 4,414,896 | ||||||||

65,000 | DIRECTV, Class A* | 3,173,300 | ||||||||

300,000 | Dollar Tree, Inc.* | 16,140,000 | ||||||||

535,500 | Ford Motor Co. | 5,135,445 | ||||||||

519,300 | Macy’s, Inc. | 17,837,955 | ||||||||

151,300 | Moody’s Corp. | 5,530,015 | ||||||||

31,900 | PetSmart, Inc. | 2,174,942 | ||||||||

118,000 | RR Donnelley & Sons Co. | 1,388,860 | ||||||||

625,315 | Sinclair Broadcast Group, Inc., Class A | 5,665,354 | ||||||||

34,800 | Target Corp. | 2,025,012 | ||||||||

163,500 | Viacom, Inc., Class A | 8,335,230 | ||||||||

147,000 | Viacom, Inc., Class B | 6,911,940 | ||||||||

10,000 | Wyndham Worldwide Corp. | 527,400 | ||||||||

|

| |||||||||

| 100,452,356 | ||||||||||

|

| |||||||||

Consumer, Non-cyclical-6.1% | ||||||||||

10,000 | Archer-Daniels-Midland Co. | 295,200 | ||||||||

15,000 | Darling International, Inc.* | 247,350 | ||||||||

220,000 | Eli Lilly & Co. | 9,440,200 | ||||||||

203,000 | Forest Laboratories, Inc.* | 7,102,970 | ||||||||

15,000 | Grand Canyon Education, Inc.* | 314,100 | ||||||||

4,000 | Helen of Troy, Ltd.* | 135,560 | ||||||||

255,000 | Hi-Tech Pharmacal Co., Inc.* | 8,262,000 | ||||||||

200,600 | Ingredion, Inc. | 9,933,712 | ||||||||

169,000 | LifePoint Hospitals, Inc.* | 6,925,620 | ||||||||

285,000 | Merck & Co., Inc. | 11,898,750 | ||||||||

140,000 | Mylan, Inc.* | 2,991,800 | ||||||||

105,000 | Newell Rubbermaid, Inc. | 1,904,700 | ||||||||

483,000 | Pfizer, Inc. | 11,109,000 | ||||||||

4,400 | Seaboard Corp.* | 9,385,112 | ||||||||

75,000 | Tupperware Brands Corp. | 4,107,000 | ||||||||

See Notes to Financial Statements. | ||

| 8 | www.jamesfunds.com |

James Balanced: Golden Rainbow Fund | Schedule of Investments | |

| June 30, 2012 |

| Shares or Principal Amount | Value | |||||||||

Consumer, Non-cyclical (continued) | ||||||||||

148,000 | UnitedHealth Group, Inc. | $8,658,000 | ||||||||

27,075 | WellPoint, Inc. | 1,727,114 | ||||||||

|

| |||||||||

| 94,438,188 | ||||||||||

|

| |||||||||

Energy-3.9% | ||||||||||

86,500 | Apache Corp. | 7,602,485 | ||||||||

121,670 | Chevron Corp. | 12,836,185 | ||||||||

18,500 | Devon Energy Corp. | 1,072,815 | ||||||||

28,800 | Diamond Offshore Drilling, Inc. | 1,702,944 | ||||||||

129,500 | Exxon Mobil Corp. | 11,081,315 | ||||||||

385,244 | HollyFrontier Corp. | 13,649,195 | ||||||||

8,000 | Plains All American Pipeline LP | 646,480 | ||||||||

127,500 | Stone Energy Corp.* | 3,230,850 | ||||||||

374,000 | Tesoro Corp.* | 9,335,040 | ||||||||

|

| |||||||||

| 61,157,309 | ||||||||||

|

| |||||||||

Financial-6.6% | ||||||||||

230,000 | American Financial Group, Inc. | 9,022,900 | ||||||||

180,000 | AmTrust Financial Services, Inc. | 5,347,800 | ||||||||

200,000 | Annaly Capital Management, Inc., REIT | 3,356,000 | ||||||||

589,000 | Brookfield Office Properties, Inc. | 10,260,380 | ||||||||

257,000 | Capital One Financial Corp. | 14,047,620 | ||||||||

215,000 | CBL & Associates Properties, Inc., REIT | 4,201,100 | ||||||||

148,000 | EZCORP, Inc., Class A* | 3,472,080 | ||||||||

216,000 | FBL Financial Group, Inc., Class A | 6,050,160 | ||||||||

526,000 | Fifth Third Bancorp | 7,048,400 | ||||||||

307,600 | First Industrial Realty Trust, Inc., REIT* | 3,881,912 | ||||||||

34,000 | Home Properties, Inc., REIT | 2,086,240 | ||||||||

915,000 | KeyCorp | 7,082,100 | ||||||||

140,000 | Nelnet, Inc., Class A | 3,220,000 | ||||||||

14,000 | PNC Financial Services Group, Inc. | 855,540 | ||||||||

50,000 | Post Properties, Inc., REIT | 2,447,500 | ||||||||

191,000 | Protective Life Corp. | 5,617,310 | ||||||||

316,060 | Rent-A-Center, Inc. | 10,663,865 | ||||||||

67,000 | Torchmark Corp. | 3,386,850 | ||||||||

|

| |||||||||

| 102,047,757 | ||||||||||

|

| |||||||||

Industrial-3.9% | ||||||||||

94,100 | Amerco, Inc. | 8,466,177 | ||||||||

408,000 | American Axle & Manufacturing Holdings, Inc.* | 4,279,920 | ||||||||

37,800 | Cascade Corp. | 1,778,490 | ||||||||

35,000 | CSX Corp. | 782,600 | ||||||||

68,000 | Cummins, Inc. | 6,589,880 | ||||||||

3,000 | Deere & Co. | 242,610 | ||||||||

71,000 | Eaton Corp. | 2,813,730 | ||||||||

20,000 | FedEx Corp. | 1,832,200 | ||||||||

31,000 | Jarden Corp. | 1,302,620 | ||||||||

152,000 | Littelfuse, Inc. | 8,647,280 | ||||||||

42,305 | NACCO Industries, Inc., Class A | 4,917,956 | ||||||||

392,000 | Sturm Ruger & Co., Inc. | 15,738,800 | ||||||||

70,000 | Timken Co. | 3,205,300 | ||||||||

|

| |||||||||

| 60,597,563 | ||||||||||

|

| |||||||||

See Notes to Financial Statements. | ||

Annual Report | June 30, 2012 | 9 |

Schedule of Investments | James Balanced: Golden Rainbow Fund | |

June 30, 2012 |

Shares or Principal Amount | Value | |||||||||||

| Technology-5.3% | ||||||||||||

| 348,000 | Amkor Technology, Inc.* | $1,698,240 | ||||||||||

| 150,000 | Arrow Electronics, Inc.* | 4,921,500 | ||||||||||

| 145,000 | Avnet, Inc.* | 4,474,700 | ||||||||||

| 316,910 | Deluxe Corp. | 7,903,735 | ||||||||||

| 5,500 | Equifax, Inc. | 256,300 | ||||||||||

| 50,000 | Hewlett-Packard Co. | 1,005,500 | ||||||||||

| 141,000 | Integrated Silicon Solution, Inc.* | 1,422,690 | ||||||||||

| 280,000 | Intel Corp. | 7,462,000 | ||||||||||

| 77,500 | International Business Machines Corp. | 15,157,450 | ||||||||||

| 164,000 | Intersections, Inc. | 2,599,400 | ||||||||||

| 215,000 | Kulicke & Soffa Industries, Inc.* | 1,917,800 | ||||||||||

| 62,000 | Lexmark International, Inc., Class A | 1,647,960 | ||||||||||

| 61,840 | Northrop Grumman Corp. | 3,944,774 | ||||||||||

| 25,000 | Photronics, Inc.* | 152,500 | ||||||||||

| 111,500 | SYNNEX Corp.* | 3,845,635 | ||||||||||

| 293,840 | Triumph Group, Inc. | 16,534,377 | ||||||||||

| 248,200 | Western Digital Corp.* | 7,565,136 | ||||||||||

|

| |||||||||||

| 82,509,697 | ||||||||||||

|

| |||||||||||

| Utilities-4.0% | ||||||||||||

| 115,000 | American Electric Power Co., Inc. | 4,588,500 | ||||||||||

| 240,000 | AT&T, Inc. | 8,558,400 | ||||||||||

| 382,000 | BCE, Inc. | 15,738,400 | ||||||||||

| 100,000 | Cleco Corp. | 4,183,000 | ||||||||||

| 112,840 | DTE Energy Co. | 6,694,797 | ||||||||||

| 75,600 | Edison International | 3,492,720 | ||||||||||

| 112,000 | El Paso Electric Co. | 3,713,920 | ||||||||||

| 143,000 | Exelon Corp. | 5,379,660 | ||||||||||

| 20,000 | Genie Energy Ltd., Class B | 155,400 | ||||||||||

| 42,000 | NorthWestern Corp. | 1,541,400 | ||||||||||

| 10,000 | OGE Energy Corp. | 517,900 | ||||||||||

| 15,000 | PG&E Corp. | 679,050 | ||||||||||

| 255,000 | Portland General Electric Co. | 6,798,300 | ||||||||||

|

| |||||||||||

| 62,041,447 | ||||||||||||

|

| |||||||||||

TOTAL COMMON STOCKS (Cost $538,294,306) | 649,746,524 | |||||||||||

|

| |||||||||||

CLOSED-END FUNDS-0.2% | ||||||||||||

| 128,000 | Eaton Vance Risk-Managed Diversified Equity Income Fund | 1,312,000 | ||||||||||

| 11,500 | Nuveen Ohio Quality Income Municipal Fund, Inc. | 208,265 | ||||||||||

| 50,000 | Nuveen Premium Income Municipal Fund 2 | 772,000 | ||||||||||

|

| |||||||||||

TOTAL CLOSED-END FUNDS (Cost $2,154,172) | 2,292,265 | |||||||||||

|

| |||||||||||

See Notes to Financial Statements. | ||

| 10 | www.jamesfunds.com |

James Balanced: Golden Rainbow Fund | Schedule of Investments | |

| June 30, 2012 |

Shares or Principal Amount | Value | |||||||||||

EXCHANGE TRADED FUNDS-0.9% | ||||||||||||

| 50,000 | iShares® Cohen & Steers Realty Majors Index Fund | $3,932,000 | ||||||||||

| 45,000 | iShares® MSCI Canada Index Fund | 1,162,800 | ||||||||||

| 20,000 | iShares® MSCI Indonesia Investable Market Index Fund | 573,600 | ||||||||||

| 32,900 | iShares® MSCI New Zealand Investable Market Index Fund | 953,771 | ||||||||||

| 193,000 | iShares® MSCI Singapore Index Fund | 2,377,760 | ||||||||||

| 12,000 | iShares® MSCI South Korea Index Fund | 657,720 | ||||||||||

| 10,000 | iShares® S&P® National Municipal Bond Fund | 1,100,700 | ||||||||||

| 5,000 | iShares® Silver Trust Index Fund* | 133,250 | ||||||||||

| 122,900 | SPDR® Nuveen Barclays Capital Short Term Municipal Bond ETF | 3,002,447 | ||||||||||

|

| |||||||||||

TOTAL EXCHANGE TRADED FUNDS (Cost $13,429,084) | 13,894,048 | |||||||||||

|

| |||||||||||

PREFERRED STOCKS-0.0%(a) | ||||||||||||

| Financial-0.0%(a) | ||||||||||||

| 8,000 | General Electric Capital Corp., 6.000% | 206,160 | ||||||||||

|

| |||||||||||

TOTAL PREFERRED STOCKS (Cost $197,406) | 206,160 | |||||||||||

|

| |||||||||||

CORPORATE BONDS-9.4% | ||||||||||||

| Basic Materials-0.8% | ||||||||||||

| $ | 5,000,000 | BHP Billiton Finance USA, Ltd., 1.000%, 2/24/15 | 5,009,210 | |||||||||

| 5,000,000 | E.I. du Pont de Nemours & Co., 2.750%, 4/1/16 | 5,314,405 | ||||||||||

| 1,500,000 | E.I. du Pont de Nemours & Co., 5.750%, 3/15/19 | 1,834,963 | ||||||||||

|

| |||||||||||

| 12,158,578 | ||||||||||||

|

| |||||||||||

| Communications-0.3% | ||||||||||||

| 5,000,000 | BellSouth Corp., 5.200%, 9/15/14 | 5,441,930 | ||||||||||

|

| |||||||||||

| Consumer, Cyclical-0.6% | ||||||||||||

| 785,000 | McDonald’s Corp., 5.700%, 2/1/39 | 1,023,997 | ||||||||||

| 5,000,000 | The Home Depot, Inc., 5.950%, 4/1/41 | 6,514,340 | ||||||||||

| 2,000,000 | Wal-Mart Stores, Inc., 5.250%, 9/1/35 | 2,423,638 | ||||||||||

|

| |||||||||||

| 9,961,975 | ||||||||||||

|

| |||||||||||

| Consumer, Non-cyclical-1.7% | ||||||||||||

| 5,000,000 | Colgate-Palmolive Co., 3.150%, 8/5/15 | 5,381,110 | ||||||||||

| 5,475,000 | Johnson & Johnson, 4.500%, 9/1/40 | 6,441,431 | ||||||||||

| 5,000,000 | PepsiCo, Inc., 0.800%, 8/25/14 | 5,018,975 | ||||||||||

| 3,000,000 | The Hershey Co., 4.125%, 12/1/20 | 3,367,461 | ||||||||||

| 5,465,000 | Wyeth LLC, 5.500%, 2/15/16 | 6,326,371 | ||||||||||

|

| |||||||||||

| 26,535,348 | ||||||||||||

|

| |||||||||||

| Energy-1.5% | ||||||||||||

| 5,000,000 | Apache Corp., 3.250%, 4/15/22 | 5,225,335 | ||||||||||

| 5,000,000 | BP Capital Markets PLC, 3.245%, 5/6/22 | 5,181,305 | ||||||||||

| 5,000,000 | Occidental Petroleum Corp., 1.750%, 2/15/17 | 5,086,620 | ||||||||||

| 5,000,000 | Shell International Finance BV, 6.375%, 12/15/38 | 7,084,960 | ||||||||||

|

| |||||||||||

| 22,578,220 | ||||||||||||

|

| |||||||||||

| Financial-3.1% | ||||||||||||

| 5,000,000 | Aflac, Inc., 2.650%, 2/15/17 | 5,117,755 | ||||||||||

| 5,000,000 | Bank of America Corp., 5.100%, 4/27/16(b) | 4,864,725 | ||||||||||

| 5,000,000 | Berkshire Hathaway, Inc., 3.750%, 8/15/21 | 5,338,035 | ||||||||||

| 5,000,000 | Citigroup, Inc., 4.450%, 1/10/17 | 5,243,360 | ||||||||||

| 4,000,000 | General Electric Capital Corp., 0.967%, 2/6/14(b) | 3,997,576 | ||||||||||

See Notes to Financial Statements. | ||

Annual Report | June 30, 2012 | 11 |

Schedule of Investments | James Balanced: Golden Rainbow Fund | |

June 30, 2012 |

Shares or Principal Amount | Value | |||||||||||

| Financial (continued) | ||||||||||||

| $2,000,000 | General Electric Capital Corp., 6.875%, 1/10/39 | $2,583,468 | ||||||||||

| 5,000,000 | Morgan Stanley, 4.750%, 3/22/17 | 4,991,095 | ||||||||||

| 5,000,000 | Morgan Stanley & Co., 3.450%, 11/2/15 | 4,842,470 | ||||||||||

| 5,000,000 | National City Corp., 4.900%, 1/15/15 | 5,438,460 | ||||||||||

| 5,000,000 | UBS AG, 5.875%, 12/20/17 | 5,587,660 | ||||||||||

|

| |||||||||||

| 48,004,604 | ||||||||||||

|

| |||||||||||

| Industrial-0.2% | ||||||||||||

| 1,000,000 | Caterpillar, Inc., 7.900%, 12/15/18 | 1,349,229 | ||||||||||

| 1,000,000 | Caterpillar, Inc., 8.250%, 12/15/38 | 1,620,800 | ||||||||||

|

| |||||||||||

| 2,970,029 | ||||||||||||

|

| |||||||||||

| Technology-0.8% | ||||||||||||

| 5,000,000 | Hewlett-Packard Co., 3.750%, 12/1/20 | 4,989,150 | ||||||||||

| 3,000,000 | International Business Machines Corp., 1.950%, 7/22/16 | 3,087,297 | ||||||||||

| 3,700,000 | Microsoft Corp., 5.200%, 6/1/39 | 4,605,468 | ||||||||||

|

| |||||||||||

| 12,681,915 | ||||||||||||

|

| |||||||||||

| Utilities-0.4% | ||||||||||||

| 5,000,000 | Florida Power Corp., 5.800%, 9/15/17 | 6,011,900 | ||||||||||

|

| |||||||||||

TOTAL CORPORATE BONDS (Cost $141,642,494) | 146,344,499 | |||||||||||

|

| |||||||||||

MORTGAGE BACKED SECURITIES-1.3% | ||||||||||||

| Federal National Mortgage Association-0.7% | ||||||||||||

| 4,886,774 | 3.000%, 3/1/27 | 5,129,294 | ||||||||||

| 4,915,889 | 3.000%, 4/1/27 | 5,174,450 | ||||||||||

|

| |||||||||||

| 10,303,744 | ||||||||||||

|

| |||||||||||

| Government National Mortgage Association-0.6% | ||||||||||||

| 8,882,049 | 4.000%, 12/20/40, Pool #4882 | 9,720,195 | ||||||||||

|

| |||||||||||

TOTAL MORTGAGE BACKED SECURITIES (Cost $19,189,941) | 20,023,939 | |||||||||||

|

| |||||||||||

U.S. GOVERNMENT AGENCIES-3.7% | ||||||||||||

| Federal Farm Credit Banks-1.9% | ||||||||||||

| 15,000,000 | 0.390%, 6/12/14 | 15,000,195 | ||||||||||

| 4,000,000 | 0.860%, 10/2/15 | 4,000,152 | ||||||||||

| 10,000,000 | 1.070%, 4/11/16 | 10,002,000 | ||||||||||

|

| |||||||||||

| 29,002,347 | ||||||||||||

|

| |||||||||||

| Federal Government Loan Mortgage Corporation-0.3% | ||||||||||||

| 4,988,426 | 3.500%, 5/1/42 | 5,239,863 | ||||||||||

|

| |||||||||||

| Federal Home Loan Banks-0.6% | ||||||||||||

| 8,750,000 | 0.500%, 10/13/15 (c) | 8,750,700 | ||||||||||

|

| |||||||||||

| Federal Home Loan Mortgage Corporation-0.6% | ||||||||||||

| 9,353,451 | 3.000%, 11/1/26 | 9,801,874 | ||||||||||

|

| |||||||||||

See Notes to Financial Statements. | ||

| 12 | www.jamesfunds.com |

James Balanced: Golden Rainbow Fund | Schedule of Investments | |

| June 30, 2012 |

Shares or Principal Amount | Value | |||||||||||

| United States Department of Housing and Urban Development-0.3% | ||||||||||||

| $5,000,000 | 2.050%, 8/1/19 | $5,183,850 | ||||||||||

|

| |||||||||||

TOTAL U.S. GOVERNMENT AGENCIES (Cost $57,565,846) | 57,978,634 | |||||||||||

|

| |||||||||||

U.S. TREASURY BONDS & NOTES-34.9% | ||||||||||||

| U.S. Treasury Bonds-5.0% | ||||||||||||

| 35,000,000 | 3.500%, 2/15/39 | 40,550,790 | ||||||||||

| 31,000,000 | 3.750%, 8/15/41 | 37,447,039 | ||||||||||

|

| |||||||||||

| 77,997,829 | ||||||||||||

|

| |||||||||||

| U.S. Treasury Inflation Indexed Notes-3.7% | ||||||||||||

| �� | 15,663,863 | 2.500%, 7/15/16 | 17,941,247 | |||||||||

| 18,119,805 | 1.625%, 1/15/18 | 20,693,379 | ||||||||||

| 15,960,749 | 1.375%, 1/15/20 | 18,574,322 | ||||||||||

|

| |||||||||||

| 57,208,948 | ||||||||||||

|

| |||||||||||

| U.S. Treasury Notes-26.2% | ||||||||||||

| 59,300,000 | 3.875%, 2/15/13 | 60,652,752 | ||||||||||

| 50,000,000 | 1.125%, 6/15/13 | 50,414,050 | ||||||||||

| 35,000,000 | 2.625%, 12/31/14 | 36,966,020 | ||||||||||

| 20,000,000 | 2.000%, 1/31/16 | 21,050,000 | ||||||||||

| 30,000,000 | 1.000%, 9/30/16 | 30,478,140 | ||||||||||

| 58,000,000 | 4.625%, 2/15/17 | 68,353,928 | ||||||||||

| 15,400,000 | 3.500%, 2/15/18 | 17,628,195 | ||||||||||

| 70,000,000 | 2.750%, 2/15/19 | 77,738,290 | ||||||||||

| 15,000,000 | 3.500%, 5/15/20 | 17,535,930 | ||||||||||

| 25,000,000 | 2.125%, 8/15/21 | 26,298,825 | ||||||||||

|

| |||||||||||

| 407,116,130 | ||||||||||||

|

| |||||||||||

TOTAL U.S. TREASURY BONDS & NOTES (Cost $507,571,300) | 542,322,907 | |||||||||||

|

| |||||||||||

FOREIGN BONDS-3.3% | ||||||||||||

| Australia Government-0.8% | ||||||||||||

| AUD 10,000,000 | 5.250%, 3/15/19 | 11,798,186 | ||||||||||

|

| |||||||||||

| Canada Government-0.7% | ||||||||||||

| CAD 5,000,000 | 3.750%, 6/1/19 | 5,646,940 | ||||||||||

| CAD 5,000,000 | 3.500%, 6/1/20 | 5,621,010 | ||||||||||

|

| |||||||||||

| 11,267,950 | ||||||||||||

|

| |||||||||||

| International Bank for Reconstruction & Development-0.3% | ||||||||||||

| TRY 8,000,000 | 10.250%, 8/24/12 | 4,427,979 | ||||||||||

|

| |||||||||||

| Netherlands Government-0.3% | ||||||||||||

| EUR 3,000,000 | 4.000%, 7/15/19 | 4,375,642 | ||||||||||

|

| |||||||||||

| Norway Government-0.3% | ||||||||||||

| NOK 21,000,000 | 4.500%, 5/22/19 | 4,166,286 | ||||||||||

|

| |||||||||||

| Queensland Treasury Corp.-0.3% | ||||||||||||

| AUD 5,000,000 | 6.000%, 10/14/15 | 5,568,298 | ||||||||||

|

| |||||||||||

See Notes to Financial Statements. | ||

Annual Report | June 30, 2012 | 13 |

Schedule of Investments | James Balanced: Golden Rainbow Fund | |

June 30, 2012 |

Shares or Principal Amount | Value | |||||||||||

| Sweden Government-0.6% | ||||||||||||

| SEK 52,000,000 | 5.000%, 12/1/20 | $9,585,765 | ||||||||||

|

| |||||||||||

TOTAL FOREIGN BONDS (Cost $46,699,274) | 51,190,106 | |||||||||||

|

| |||||||||||

MUNICIPAL BONDS-3.4% | ||||||||||||

| California-0.1% | ||||||||||||

| $1,000,000 | Citrus Community College District General Obligation Unlimited Bonds, Series B, 4.750%, 6/1/31 | 1,052,640 | ||||||||||

|

| |||||||||||

| Colorado-0.1% | ||||||||||||

| 1,000,000 | Adams County School District No. 14 General Obligation Unlimited Bonds, 5.000%, 12/1/26 | 1,114,710 | ||||||||||

|

| |||||||||||

| Connecticut-0.4% | ||||||||||||

| 5,350,000 | State of Connecticut, Series B, 5.000%, 11/1/25 | 6,392,020 | ||||||||||

|

| |||||||||||

| Florida-0.1% | ||||||||||||

| 1,000,000 | Florida State Board of Education Capital Outlay General Obligation Bonds, Series D, 5.000%, 6/1/38 | 1,113,560 | ||||||||||

|

| |||||||||||

| Georgia-0.2% | ||||||||||||

| 3,000,000 | State of Georgia General Obligation Unlimited Bonds, Series B, 4.500%, 1/1/29 | 3,357,330 | ||||||||||

|

| |||||||||||

| Illinois-0.1% | ||||||||||||

| 500,000 | Kane & DeKalb Counties Community Unit School District No. 302 Kaneland General Obligation Unlimited Bonds (School Building), 5.500%, 2/1/28 | 557,840 | ||||||||||

| 1,000,000 | Village of Bolingbrook General Obligation Unlimited Bonds, 5.000%, 1/1/37 | 1,069,160 | ||||||||||

|

| |||||||||||

| 1,627,000 | ||||||||||||

|

| |||||||||||

| Louisiana-0.1% | ||||||||||||

| 1,000,000 | East Baton Rouge Sewerage Commission Revenue Bonds, Series A, 5.125%, 2/1/29 | 1,118,920 | ||||||||||

|

| |||||||||||

| Massachusetts-0.1% | ||||||||||||

| 1,000,000 | Commonwealth of Massachusetts General Obligation Limited Bonds, Series C, 5.250%, 8/1/22 | 1,192,190 | ||||||||||

|

| |||||||||||

| Michigan-0.1% | ||||||||||||

| 1,000,000 | Marysville Public School District General Obligation Unlimited Bonds (School Building & Site), 5.000%, 5/1/32 | 1,065,070 | ||||||||||

|

| |||||||||||

| Ohio-0.8% | ||||||||||||

| 4,620,000 | Columbus City School District Taxable Facilities & Improvement Build America Bonds, Series B, 6.150%, 12/1/33 | 5,060,286 | ||||||||||

| 1,100,000 | Miamisburg City School District General Obligation Unlimited Bonds (School Facilities Construction & Improvement), 5.000%, 12/1/33 | 1,192,598 | ||||||||||

| 500,000 | Mount Healthy City School District General Obligation Unlimited Bonds (School Improvement), 5.000%, 12/1/26 | 551,745 | ||||||||||

| 1,000,000 | Ohio State University General Recipients Revenue Bonds, 4.910%, 6/1/40 | 1,200,560 | ||||||||||

| 1,000,000 | Ohio State University General Recipients Revenue Bonds, Series A, 5.000%, 12/1/28 | 1,165,120 | ||||||||||

| 500,000 | Springboro Community City School District General Obligation Unlimited Bonds, 5.250%, 12/1/23 | 610,680 | ||||||||||

| 1,000,000 | State of Ohio General Obligation Unlimited Bonds, Series A, 5.375%, 9/1/28 | 1,173,170 | ||||||||||

| 2,000,000 | State of Ohio General Obligation Unlimited Bonds, Series B, 5.000%, 2/1/22 | 2,146,020 | ||||||||||

|

| |||||||||||

| 13,100,179 | ||||||||||||

|

| |||||||||||

See Notes to Financial Statements. | ||

| 14 | www.jamesfunds.com |

James Balanced: Golden Rainbow Fund | Schedule of Investments | |

| June 30, 2012 |

Shares or Principal Amount | Value | |||||||||||

| Texas-0.6% | ||||||||||||

| $1,000,000 | Friendswood Independent School District General Obligation Unlimited Bonds (Schoolhouse), 5.000%, 2/15/37 | $1,083,200 | ||||||||||

| 1,000,000 | Judson Independent School District General Obligation Unlimited Bonds (School Building), 5.000%, 2/1/37 | 1,073,330 | ||||||||||

| 500,000 | Lamar Consolidated Independent School District General Obligation Unlimited Bonds (Schoolhouse), 5.000%, 2/15/38 | 542,075 | ||||||||||

| 5,335,000 | Port of Houston Authority, 5.000%, 10/1/35 | 6,188,760 | ||||||||||

| 1,000,000 | Tyler Independent School District General Obligation Unlimited Bonds (School Building), 5.000%, 2/15/34 | 1,094,980 | ||||||||||

|

| |||||||||||

| 9,982,345 | ||||||||||||

|

| |||||||||||

| Washington-0.3% | ||||||||||||

| 5,000,000 | State of Washington, 4.000%, 2/1/37 | 5,095,600 | ||||||||||

|

| |||||||||||

| Wisconsin-0.4% | ||||||||||||

| 5,000,000 | State of Wisconsin, 5.000%, 5/1/25 | 5,940,400 | ||||||||||

|

| |||||||||||

TOTAL MUNICIPAL BONDS (Cost $49,417,713) | 52,151,964 | |||||||||||

|

| |||||||||||

SHORT TERM INVESTMENTS-1.2% | ||||||||||||

| 19,217,239 | First American Government Obligations Fund, 7-Day Yield 0.016% | 19,217,239 | ||||||||||

|

| |||||||||||

TOTAL SHORT TERM INVESTMENTS (Cost $19,217,239) | 19,217,239 | |||||||||||

|

| |||||||||||

TOTAL INVESTMENT SECURITIES-100.1% (Cost $1,395,378,775) | 1,555,368,285 | |||||||||||

OTHER LIABILITIES IN EXCESS OF ASSETS-(0.1)% | (1,410,036) | |||||||||||

|

| |||||||||||

NET ASSETS-100.0% | $1,553,958,249 | |||||||||||

|

| |||||||||||

See Notes to Financial Statements. | ||

Annual Report | June 30, 2012 | 15 |

Schedule of Investments | James Balanced: Golden Rainbow Fund | |

| June 30, 2012 |

Percentages shown are based on Net Assets. The classifications shown on the Schedule of Investments are unaudited.

| * | Non-income producing security. |

| (a) | Less than 0.05% of Net Assets. |

| (b) | Variable rate security. Interest rate disclosed is that which is in effect at June 30, 2012. |

| (c) | Step bond. Coupon increases periodically based upon a predetermined schedule. Interest rate disclosed is that which is in effect at June 30, 2012. |

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by the shareholders

AUD - Australian Dollar

BV - Besloten Vennootschap is the Dutch term for private limited liability company

CAD - Canadian Dollar

ETF - Exchange Traded Fund

EUR - Euro

LLC - Limited Liability Company

LP - Limited Partnership

Ltd. - Limited

MSCI - Morgan Stanley Capital International

NOK - Norwegian Krone

PLC - Public Limited Company

REIT - Real Estate Investment Trust

S&P - Standard & Poor’s

SEK - Swedish Krona

SPDR - Standard & Poor’s Depositary Receipts

TRY - New Turkish Lira

Foreign Bonds Securities Allocation | ||||

| % of Net Assets | ||||

Asia - Pacific | 1.1% | |||

Europe | 1.2% | |||

Europe - Euro | 0.3% | |||

North America | 0.7% | |||

| ||||

| 3.3% | ||||

| ||||

See Notes to Financial Statements. | ||

| 16 | www.jamesfunds.com |

| Schedule of Investments | ||

| June 30, 2012 |

Shares | Value | |||||||||||

COMMON STOCKS-95.2% | ||||||||||||

| Basic Materials-10.2% | ||||||||||||

| 18,325 | Aceto Corp. | $165,475 | ||||||||||

| 147,555 | Buckeye Technologies, Inc. | 4,203,842 | ||||||||||

| 2,120 | Great Northern Iron Ore Properties | 160,208 | ||||||||||

| 91,635 | Innophos Holdings, Inc. | 5,173,712 | ||||||||||

| 68,855 | Innospec, Inc.* | 2,038,797 | ||||||||||

| 54,906 | Material Sciences Corp.* | 450,229 | ||||||||||

| 24,214 | Neenah Paper, Inc. | 646,272 | ||||||||||

| 37,760 | PH Glatfelter Co. | 618,131 | ||||||||||

| 8,360 | Universal Stainless & Alloy* | 343,596 | ||||||||||

|

| |||||||||||

| 13,800,262 | ||||||||||||

|

| |||||||||||

| Consumer, Cyclical-11.8% | ||||||||||||

| 50,250 | 1-800-Flowers.com, Inc., Class A* | 175,372 | ||||||||||

| 113,370 | The Cato Corp., Class A | 3,453,250 | ||||||||||

| 73,510 | Dorman Products, Inc.* | 1,844,366 | ||||||||||

| 22,270 | Fiesta Restaurant Group, Inc.* | 294,632 | ||||||||||

| 13,520 | Flexsteel Industries, Inc. | 267,426 | ||||||||||

| 40,720 | Fred’s, Inc., Class A | 622,609 | ||||||||||

| 27,630 | Friedman Industries, Inc. | 280,997 | ||||||||||

| 173,025 | LeapFrog Enterprises, Inc.* | 1,775,236 | ||||||||||

| 27,625 | Luby’s, Inc.* | 185,087 | ||||||||||

| 106,350 | Myers Industries, Inc. | 1,824,966 | ||||||||||

| 41,230 | PC Connection, Inc. | 437,863 | ||||||||||

| 46,000 | Pool Corp. | 1,861,160 | ||||||||||

| 30,245 | Rocky Brands, Inc.* | 398,932 | ||||||||||

| 141,845 | Sinclair Broadcast Group, Inc., Class A | 1,285,116 | ||||||||||

| 14,770 | Susser Holdings Corp.* | 549,001 | ||||||||||

| 43,325 | Town Sports International Holdings, Inc.* | 575,789 | ||||||||||

|

| |||||||||||

| 15,831,802 | ||||||||||||

|

| |||||||||||

| Consumer, Non-cyclical-12.8% | ||||||||||||

| 6,125 | Alico, Inc. | 187,058 | ||||||||||

| 97,655 | Bridgepoint Education, Inc.* | 2,128,879 | ||||||||||

| 49,340 | Carriage Services, Inc. | 410,509 | ||||||||||

| 14,800 | Dollar Thrifty Automotive Group, Inc.* | 1,198,208 | ||||||||||

| 44,280 | Elizabeth Arden, Inc.* | 1,718,507 | ||||||||||

| 74,120 | Helen of Troy, Ltd.* | 2,511,927 | ||||||||||

| 61,660 | Hi-Tech Pharmacal Co., Inc.* | 1,997,784 | ||||||||||

| 109,195 | LifePoint Hospitals, Inc.* | 4,474,811 | ||||||||||

| 65,645 | Metropolitan Health Networks, Inc.* | 628,223 | ||||||||||

| 9,195 | Nature’s Sunshine Products, Inc. | 138,844 | ||||||||||

| 22,050 | Pozen, Inc.* | 137,592 | ||||||||||

| 64,235 | Sciclone Pharmaceuticals, Inc.* | 450,287 | ||||||||||

| 16,600 | The Toro Co. | 1,216,614 | ||||||||||

|

| |||||||||||

| 17,199,243 | ||||||||||||

|

| |||||||||||

| Energy-8.1% | ||||||||||||

| 12,180 | Adams Resources & Energy, Inc. | 510,586 | ||||||||||

| 101,340 | Delek US Holdings, Inc. | 1,782,571 | ||||||||||

| 73,825 | Energy Partners Ltd.* | 1,247,642 | ||||||||||

| 25,876 | Mitcham Industries, Inc.* | 439,116 | ||||||||||

| 11,035 | REX American Resources Corp.* | 215,403 | ||||||||||

| 81,480 | Stone Energy Corp.* | 2,064,703 | ||||||||||

See Notes to Financial Statements. | ||

Annual Report | June 30, 2012 | 17 |

Schedule of Investments | James Small Cap Fund | |

June 30, 2012 |

Shares | Value | |||||||||||

| Energy (continued) | ||||||||||||

| 84,390 | Sunoco Logistics Partners LP | $3,060,825 | ||||||||||

| 47,113 | TGC Industries, Inc.* | 457,467 | ||||||||||

| 30,940 | Transmontaigne Partners LP | 1,029,064 | ||||||||||

| 8,950 | Whiting USA Trust I | 158,505 | ||||||||||

|

| |||||||||||

| 10,965,882 | ||||||||||||

|

| |||||||||||

| Financial-13.6% | ||||||||||||

| 8,275 | Altisource Portfolio Solutions SA* | 605,978 | ||||||||||

| 124,660 | American Financial Group, Inc. | 4,890,412 | ||||||||||

| 11,090 | Arlington Asset Investment Corp., Class A | 240,764 | ||||||||||

| 8,600 | BofI Holding, Inc.* | 169,936 | ||||||||||

| 72,649 | Capital Trust, Inc., Class A, REIT* | 209,229 | ||||||||||

| 18,100 | Coinstar, Inc.* | 1,242,746 | ||||||||||

| 17,235 | ePlus, Inc.* | 557,552 | ||||||||||

| 6,200 | Federal Agricultural Mortgage Corp., Class C | 162,626 | ||||||||||

| 20,370 | MainSource Financial Group, Inc. | 240,977 | ||||||||||

| 96,980 | Nelnet, Inc., Class A | 2,230,540 | ||||||||||

| 16,305 | Nicholas Financial, Inc. | 209,030 | ||||||||||

| 16,340 | Peoples Bancorp, Inc. | 359,153 | ||||||||||

| 144,725 | Rent-A-Center, Inc. | 4,883,022 | ||||||||||

| 43,475 | Southside Bancshares, Inc. | 977,318 | ||||||||||

| 20,920 | World Acceptance Corp.* | 1,376,536 | ||||||||||

|

| |||||||||||

| 18,355,819 | ||||||||||||

|

| |||||||||||

| Industrial-13.9% | ||||||||||||

| 81,145 | Alamo Group, Inc. | 2,545,519 | ||||||||||

| 28,410 | Amerco, Inc. | 2,556,048 | ||||||||||

| 25,975 | Ballantyne Strong, Inc.* | 155,071 | ||||||||||

| 33,850 | Blyth, Inc. | 1,169,856 | ||||||||||

| 24,925 | Franklin Electric Co. Inc | 1,274,415 | ||||||||||

| 30,005 | Littelfuse, Inc. | 1,706,984 | ||||||||||

| 13,720 | Miller Industries, Inc. | 218,560 | ||||||||||

| 15,785 | Park-Ohio Holdings Corp.* | 300,388 | ||||||||||

| 9,065 | Standex International Corp. | 385,897 | ||||||||||

| 28,275 | StealthGas, Inc.* | 164,278 | ||||||||||

| 166,247 | Sturm Ruger & Co., Inc. | 6,674,817 | ||||||||||

| 61,620 | Trimas Corp.* | 1,238,562 | ||||||||||

| 19,264 | UFP Technologies, Inc.* | 325,562 | ||||||||||

|

| |||||||||||

| 18,715,957 | ||||||||||||

|

| |||||||||||

| Technology-10.3% | ||||||||||||

| 37,500 | Datalink Corp.* | 358,125 | ||||||||||

| 142,525 | Deluxe Corp. | 3,554,573 | ||||||||||

| 6,145 | Formula Systems 1985 Ltd., Sponsored ADR* | 100,839 | ||||||||||

| 22,435 | Intersections, Inc. | 355,595 | ||||||||||

| 52,125 | Lionbridge Technologies, Inc.* | 164,194 | ||||||||||

| 119,025 | Mentor Graphics Corp.* | 1,785,375 | ||||||||||

| 32,700 | Nova Measuring Instruments Ltd.* | 285,144 | ||||||||||

| 52,630 | SYNNEX Corp.* | 1,815,209 | ||||||||||

| 7,395 | Tessco Technologies, Inc. | 163,060 | ||||||||||

| 87,150 | Triumph Group, Inc. | 4,903,930 | ||||||||||

| 29,580 | USA Mobility, Inc. | 380,399 | ||||||||||

|

| |||||||||||

| 13,866,443 | ||||||||||||

|

| |||||||||||

See Notes to Financial Statements. | ||

| 18 | www.jamesfunds.com |

James Small Cap Fund | Schedule of Investments | |

| June 30, 2012 |

| Shares | Value | |||||

Utilities-14.5% | ||||||

115,550 | Cleco Corp. | $4,833,457 | ||||

143,445 | El Paso Electric Co. | 4,756,636 | ||||

45,605 | HickoryTech Corp. | 506,672 | ||||

56,140 | The Laclede Group, Inc. | 2,234,933 | ||||

65,995 | NorthWestern Corp. | 2,422,016 | ||||

32,240 | PNM Resources, Inc. | 629,970 | ||||

130,635 | Portland General Electric Co. | 3,482,729 | ||||

15,000 | UIL Holdings Corp. | 537,900 | ||||

81,850 | Vonage Holdings Corp.* | 164,518 | ||||

|

| |||||

| 19,568,831 | ||||||

|

| |||||

TOTAL COMMON STOCKS (Cost $108,292,435) | 128,304,239 | |||||

|

| |||||

SHORT TERM INVESTMENTS-1.8% | ||||||

2,369,463 | First American Government Obligations Fund, 7-Day Yield 0.016% | 2,369,463 | ||||

|

| |||||

TOTAL SHORT TERM INVESTMENTS (Cost $2,369,463) | 2,369,463 | |||||

|

| |||||

TOTAL INVESTMENT SECURITIES-97.0% (Cost $110,661,898) | 130,673,702 | |||||

OTHER ASSETS IN EXCESS OF LIABILITIES-3.0% | 4,053,338 | |||||

|

| |||||

NET ASSETS-100.0% | $134,727,040 | |||||

|

| |||||

Percentages shown are based on Net Assets. The classifications shown on the Schedule of Investments are unaudited.

| * | Non-income producing security. |

ADR - American Depositary Receipt

LP - Limited Partnership

Ltd. - Limited

REIT - Real Estate Investment Trust

SA - Generally designates corporations in various countries, mostly those employing the civil law

See Notes to Financial Statements. | ||

Annual Report | June 30, 2012 | 19 |

Schedule of Investments | James Mid Cap Fund | |

June 30, 2012 |

| Shares | Value | |||||

COMMON STOCKS-91.0% | ||||||

Basic Materials-9.7% | ||||||

5,000 | Buckeye Technologies, Inc. | $142,450 | ||||

4,125 | Domtar Corp. | 316,429 | ||||

5,150 | FMC Corp. | 275,422 | ||||

5,000 | Innophos Holdings, Inc. | 282,300 | ||||

15,500 | PolyOne Corp. | 212,040 | ||||

|

| |||||

| 1,228,641 | ||||||

|

| |||||

Consumer, Cyclical-12.7% | ||||||

8,250 | Alaska Air Group, Inc.* | 296,175 | ||||

2,300 | Dillard’s, Inc., Class A | 146,464 | ||||

14,450 | Dollar Tree, Inc.* | 777,410 | ||||

6,500 | Foot Locker, Inc. | 198,770 | ||||

15,500 | RR Donnelley & Sons Co. | 182,435 | ||||

|

| |||||

| 1,601,254 | ||||||

|

| |||||

Consumer, Non-cyclical-13.6% | ||||||

4,125 | Ingredion, Inc. | 204,270 | ||||

10,325 | LifePoint Hospitals, Inc.* | 423,118 | ||||

125 | Seaboard Corp.* | 266,623 | ||||

3,200 | The Toro Co. | 234,528 | ||||

7,225 | Tupperware Brands Corp. | 395,641 | ||||

10,325 | Tyson Foods, Inc., Class A | 194,420 | ||||

|

| |||||

| 1,718,600 | ||||||

|

| |||||

Energy-10.2% | ||||||

2,600 | Diamond Offshore Drilling, Inc. | 153,738 | ||||

8,250 | HollyFrontier Corp. | 292,298 | ||||

10,000 | Stone Energy Corp.* | 253,400 | ||||

5,850 | Targa Resources Partners LP | 208,552 | ||||

9,300 | Tesoro Corp.* | 232,128 | ||||

4,125 | World Fuel Services Corp. | 156,874 | ||||

|

| |||||

| 1,296,990 | ||||||

|

| |||||

Financial-13.7% | ||||||

8,775 | American Financial Group, Inc. | 344,243 | ||||

12,900 | Brookfield Office Properties, Inc. | 224,718 | ||||

4,125 | Home Properties, Inc., REIT | 253,110 | ||||

11,350 | Nelnet, Inc., Class A | 261,050 | ||||

6,825 | Protective Life Corp. | 200,723 | ||||

13,425 | Rent-A-Center, Inc. | 452,960 | ||||

|

| |||||

| 1,736,804 | ||||||

|

| |||||

Industrial-12.1% | ||||||

7,225 | AGCO Corp.* | 330,399 | ||||

3,000 | Amerco, Inc. | 269,910 | ||||

7,750 | Jarden Corp. | 325,655 | ||||

6,700 | Timken Co. | 306,793 | ||||

8,250 | TRW Automotive Holdings Corp.* | 303,270 | ||||

|

| |||||

| 1,536,027 | ||||||

|

| |||||

Technology-9.9% | ||||||

34,525 | Amkor Technology, Inc.* | 168,482 | ||||

See Notes to Financial Statements. | ||

| 20 | www.jamesfunds.com |

James Mid Cap Fund | Schedule of Investments | |

| June 30, 2012 |

| Shares | Value | |||||

Technology (continued) | ||||||

7,750 | Arrow Electronics, Inc.* | $254,277 | ||||

13,950 | Deluxe Corp. | 347,913 | ||||

3,100 | Lexmark International, Inc., Class A | 82,398 | ||||

25,500 | LSI Corp.* | 162,435 | ||||

4,125 | Triumph Group, Inc. | 232,114 | ||||

|

| |||||

| 1,247,619 | ||||||

|

| |||||

Utilities-9.1% | ||||||

15,550 | CMS Energy Corp. | 365,425 | ||||

4,975 | DTE Energy Co. | 295,167 | ||||

6,000 | NorthWestern Corp. | 220,200 | ||||

8,000 | Portland General Electric Co. | 213,280 | ||||

25,825 | Vonage Holdings Corp.* | 51,908 | ||||

|

| |||||

| 1,145,980 | ||||||

|

| |||||

TOTAL COMMON STOCKS (Cost $9,877,404) | 11,511,915 | |||||

|

| |||||

EXCHANGE TRADED FUNDS-1.9% | ||||||

3,100 | iShares® Cohen & Steers Realty Majors Index Fund | 243,784 | ||||

|

| |||||

TOTAL EXCHANGE TRADED FUNDS (Cost $217,510) | 243,784 | |||||

|

| |||||

SHORT TERM INVESTMENTS-7.6% | ||||||

963,246 | First American Government Obligations Fund, 7-Day Yield 0.016% | 963,246 | ||||

|

| |||||

TOTAL SHORT TERM INVESTMENTS (Cost $963,246) | 963,246 | |||||

|

| |||||

TOTAL INVESTMENT SECURITIES-100.5% (Cost $11,058,160) | 12,718,945 | |||||

OTHER LIABILITIES IN EXCESS OF ASSETS-(0.5)% | (61,753) | |||||

|

| |||||

NET ASSETS-100.0% | $12,657,192 | |||||

|

| |||||

Percentages shown are based on Net Assets. The classifications shown on the Schedule of Investments are unaudited.

| * | Non-income producing security. |

LP - Limited Partnership

REIT - Real Estate Investment Trust

See Notes to Financial Statements. | ||

Annual Report | June 30, 2012 | 21 |

Schedule of Investments | James Micro Cap Fund | |

June 30, 2012 |

| Shares | Value | |||||

COMMON STOCKS-93.6% | ||||||

Basic Materials-10.9% | ||||||

11,420 | Aceto Corp. | $103,123 | ||||

1,340 | Great Northern Iron Ore Properties | 101,264 | ||||

34,277 | Material Sciences Corp.* | 281,071 | ||||

15,085 | Neenah Paper, Inc. | 402,619 | ||||

5,220 | Universal Stainless & Alloy* | 214,542 | ||||

|

| |||||

| 1,102,619 | ||||||

|

| |||||

Consumer, Cyclical-19.5% | ||||||

31,340 | 1-800-Flowers.com, Inc., Class A* | 109,377 | ||||

13,920 | Fiesta Restaurant Group, Inc.* | 184,162 | ||||

8,425 | Flexsteel Industries, Inc. | 166,647 | ||||

18,530 | Friedman Industries, Inc. | 188,450 | ||||

17,220 | Luby’s, Inc.* | 115,374 | ||||

25,715 | PC Connection, Inc. | 273,093 | ||||

18,853 | Rocky Brands, Inc.* | 248,671 | ||||

9,202 | Susser Holdings Corp.* | 342,038 | ||||

27,060 | Town Sports International Holdings, Inc.* | 359,627 | ||||

|

| |||||

| 1,987,439 | ||||||

|

| |||||

Consumer, Non-cyclical-12.0% | ||||||

3,800 | Alico, Inc. | 116,052 | ||||

30,781 | Carriage Services, Inc. | 256,098 | ||||

40,975 | Metropolitan Health Networks, Inc.* | 392,131 | ||||

5,760 | Nature’s Sunshine Products, Inc. | 86,976 | ||||

13,740 | Pozen, Inc.* | 85,737 | ||||

40,060 | Sciclone Pharmaceuticals, Inc.* | 280,821 | ||||

|

| |||||

| 1,217,815 | ||||||

|

| |||||

Energy-10.9% | ||||||

7,620 | Adams Resources & Energy, Inc. | 319,430 | ||||

16,161 | Mitcham Industries, Inc.* | 274,252 | ||||

6,900 | REX American Resources Corp.* | 134,688 | ||||

29,369 | TGC Industries, Inc.* | 285,173 | ||||

5,580 | Whiting USA Trust I | 98,822 | ||||

|

| |||||

| 1,112,365 | ||||||

|

| |||||

Financial-15.0% | ||||||

6,900 | Arlington Asset Investment Corp., Class A | 149,799 | ||||

5,360 | BofI Holding, Inc.* | 105,914 | ||||

45,340 | Capital Trust, Inc., Class A, REIT* | 130,579 | ||||

16,490 | ePlus, Inc.* | 533,451 | ||||

3,860 | Federal Agricultural Mortgage Corp., Class C | 101,248 | ||||

12,720 | MainSource Financial Group, Inc. | 150,478 | ||||

10,202 | Nicholas Financial, Inc. | 130,790 | ||||

10,180 | Peoples Bancorp, Inc. | 223,756 | ||||

|

| |||||

| 1,526,015 | ||||||

|

| |||||

Industrial-11.1% | ||||||

16,200 | Ballantyne Strong, Inc.* | 96,714 | ||||

8,565 | Miller Industries, Inc. | 136,440 | ||||

9,860 | Park-Ohio Holdings Corp.* | 187,636 | ||||

5,665 | Standex International Corp. | 241,159 | ||||

17,620 | StealthGas, Inc.* | 102,372 | ||||

See Notes to Financial Statements. | ||

| 22 | www.jamesfunds.com |

James Micro Cap Fund | Schedule of Investments | |

| June 30, 2012 |

| Shares | Value | |||||

Industrial (continued) | ||||||

4,130 | Sturm Ruger & Co., Inc. | $165,820 | ||||

12,004 | UFP Technologies, Inc.* | 202,868 | ||||

|

| |||||

| 1,133,009 | ||||||

|

| |||||

Technology-10.1% | ||||||

23,420 | Datalink Corp.* | 223,661 | ||||

11,895 | Formula Systems 1985 Ltd., Sponsored ADR* | 195,197 | ||||

13,980 | Intersections, Inc. | 221,583 | ||||

32,500 | Lionbridge Technologies, Inc.* | 102,375 | ||||

20,410 | Nova Measuring Instruments Ltd.* | 177,975 | ||||

4,620 | Tessco Technologies, Inc. | 101,871 | ||||

|

| |||||

| 1,022,662 | ||||||

|

| |||||

Utilities-4.1% | ||||||

28,480 | HickoryTech Corp. | 316,413 | ||||

51,040 | Vonage Holdings Corp.* | 102,590 | ||||

|

| |||||

| 419,003 | ||||||

|

| |||||

TOTAL COMMON STOCKS (Cost $7,886,457) | 9,520,927 | |||||

|

| |||||

SHORT TERM INVESTMENTS-6.1% | ||||||

616,890 | First American Government Obligations Fund, 7-Day Yield 0.016% | 616,890 | ||||

|

| |||||

TOTAL SHORT TERM INVESTMENTS (Cost $616,890) | 616,890 | |||||

|

| |||||

TOTAL INVESTMENT SECURITIES-99.7% (Cost $8,503,347) | 10,137,817 | |||||

OTHER ASSETS IN EXCESS OF LIABILITIES-0.3% | 34,996 | |||||

|

| |||||

NET ASSETS-100.0% | $10,172,813 | |||||

|

| |||||

Percentages shown are based on Net Assets. The classifications shown on the Schedule of Investments are unaudited.

| * | Non- income producing security. |

ADR - American Depositary Receipt

Ltd. - Limited

REIT - Real Estate Investment Trust

See Notes to Financial Statements. | ||

Annual Report | June 30, 2012 | 23 |

Schedule of Investments | James Long-Short Fund | |

June 30, 2012 |

| Shares | Value | |||||

COMMON STOCKS-99.4% | ||||||

Basic Materials-9.0% | ||||||

10,680 | Buckeye Technologies, Inc.(a) | $304,273 | ||||

2,830 | Freeport-McMoRan Copper & Gold, Inc.(a) | 96,418 | ||||

8,825 | The Goodyear Tire & Rubber Co.* | 104,223 | ||||

5,715 | Innophos Holdings, Inc.(a) | 322,669 | ||||

|

| |||||

| 827,583 | ||||||

|

| |||||

Consumer, Cyclical-16.3% | ||||||

2,900 | Alaska Air Group, Inc.* | 104,110 | ||||

1,005 | AutoZone, Inc.*(a) | 369,006 | ||||

3,010 | Dillard’s, Inc., Class A(a) | 191,677 | ||||

6,230 | Dollar Tree, Inc.*(a) | 335,174 | ||||

6,970 | Fred’s, Inc., Class A | 106,571 | ||||

9,295 | Sinclair Broadcast Group, Inc., Class A(a) | 84,212 | ||||

2,750 | Viacom, Inc., Class A(a) | 140,195 | ||||

2,265 | Wal-Mart Stores, Inc. | 157,916 | ||||

|

| |||||

| 1,488,861 | ||||||

|

| |||||

Consumer, Non-cyclical-16.7% | ||||||

5,605 | Eli Lilly & Co.(a) | 240,511 | ||||

5,665 | Helen of Troy, Ltd.*(a) | 191,987 | ||||

3,360 | Hi-Tech Pharmacal Co., Inc.* | 108,864 | ||||

10,985 | Pfizer, Inc.(a) | 252,655 | ||||

2,750 | The Toro Co.(a) | 201,547 | ||||

5,350 | UnitedHealth Group, Inc.(a) | 312,975 | ||||

3,400 | WellPoint, Inc.(a) | 216,886 | ||||

|

| |||||

| 1,525,425 | ||||||

|

| |||||

Energy-13.7% | ||||||

840 | Apache Corp. | 73,828 | ||||

3,005 | Chevron Corp.(a) | 317,027 | ||||

16,435 | Flotek Industries, Inc.* | 153,503 | ||||

5,925 | HollyFrontier Corp.(a) | 209,923 | ||||

16,800 | Parker Drilling Co.* | 75,768 | ||||

8,290 | Stone Energy Corp.* | 210,069 | ||||

8,770 | Tesoro Corp.* | 218,899 | ||||

|

| |||||

| 1,259,017 | ||||||

|

| |||||

Financial-13.7% | ||||||

6,050 | Annaly Capital Management, Inc., REIT | 101,519 | ||||

2,760 | Brookfield Office Properties, Inc. | 48,079 | ||||

7,635 | Capital One Financial Corp.(a) | 417,329 | ||||

3,000 | CBL & Associates Properties, Inc., REIT | 58,620 | ||||

11,805 | Fifth Third Bancorp | 158,187 | ||||

3,260 | PNC Financial Services Group, Inc.(a) | 199,219 | ||||

5,425 | Protective Life Corp. | 159,549 | ||||

4,926 | Southside Bancshares, Inc. | 110,737 | ||||

|

| |||||

| 1,253,239 | ||||||

|

| |||||

Industrial-9.1% | ||||||

1,380 | Amerco, Inc.(a) | 124,159 | ||||

2,215 | Cascade Corp. | 104,216 | ||||

3,335 | Littelfuse, Inc.(a) | 189,728 | ||||

830 | NACCO Industries, Inc., Class A | 96,487 | ||||

See Notes to Financial Statements. | ||

| 24 | www.jamesfunds.com |

James Long-Short Fund | Schedule of Investments | |

| June 30, 2012 |

| Shares | Value | |||||

Industrial (continued) | ||||||

6,465 | Sturm Ruger & Co., Inc. | $259,570 | ||||

1,265 | Timken Co. | 57,924 | ||||

|

| |||||

| 832,084 | ||||||

|

| |||||

Technology-7.8% | ||||||

6,955 | Deluxe Corp.(a) | 173,458 | ||||

4,020 | Intel Corp.(a) | 107,133 | ||||

8,595 | Kulicke & Soffa Industries, Inc.* | 76,667 | ||||

1,355 | Lockheed Martin Corp.(a) | 117,993 | ||||

5,975 | Symantec Corp.*(a) | 87,295 | ||||

2,725 | Triumph Group, Inc. | 153,336 | ||||

|

| |||||

| 715,882 | ||||||

|

| |||||

Utilities-13.1% | ||||||

4,325 | AT&T, Inc.(a) | 154,230 | ||||

6,295 | BCE, Inc.(a) | 259,354 | ||||

1,835 | DTE Energy Co. | 108,871 | ||||

6,310 | Exelon Corp.(a) | 237,382 | ||||

5,425 | PNM Resources, Inc. | 106,005 | ||||

9,690 | Portland General Electric Co.(a) | 258,335 | ||||

39,340 | Vonage Holdings Corp.* | 79,073 | ||||

|

| |||||

| 1,203,250 | ||||||

|

| |||||

TOTAL COMMON STOCKS (Cost $8,555,479) | 9,105,341 | |||||

|

| |||||

SHORT TERM INVESTMENTS-2.8% | ||||||

258,791 | First American Government Obligations Fund, 7-Day Yield 0.016% | 258,791 | ||||

|

| |||||

TOTAL SHORT TERM INVESTMENTS (Cost $258,791) | 258,791 | |||||

|

| |||||

TOTAL INVESTMENT SECURITIES-102.2% (Cost $8,814,270) | 9,364,132 | |||||

SEGREGATED CASH WITH BROKERS-44.6%(a) | 4,085,139 | |||||

SECURITIES SOLD SHORT-(46.8)% (Proceeds $4,222,613) | (4,284,523 | ) | ||||

OTHER LIABILITIES IN EXCESS OF ASSETS-(0.1)% | (5,184 | ) | ||||

|

| |||||

NET ASSETS-100.0% | $9,159,564 | |||||

|

| |||||

| Shares | Value | |||||

SCHEDULE OF SECURITIES SOLD SHORT | ||||||

COMMON STOCKS-(46.7)% | ||||||

Basic Materials-(2.7)% | ||||||

(2,230) | Braskem SA, Sponsored ADR | $(29,681) | ||||

(4,665) | Ivanhoe Mines, Ltd. | (45,157) | ||||

(8,330) | Novagold Resources, Inc. | (43,983) | ||||

(3,050) | Quanex Building Products Corp. | (54,534) | ||||

(3,064) | Seabridge Gold, Inc. | (44,397) | ||||

(2,319) | Solazyme, Inc. | (32,234) | ||||

|

| |||||

| (249,986) | ||||||

|

| |||||

See Notes to Financial Statements. | ||

Annual Report | June 30, 2012 | 25 |

Schedule of Investments | James Long-Short Fund | |

June 30, 2012 |

| Shares | Value | |||||

Consumer, Cyclical-(3.7)% | ||||||

(230) | Amazon.com, Inc. | $(52,521) | ||||

(1,920) | Arcos Dorados Holdings, Inc., Class A | (28,378) | ||||

(2,000) | Caesars Entertainment Corp. | (22,800) | ||||

(1,170) | Home Inns & Hotels Management, Inc., ADR | (26,512) | ||||

(1,885) | JC Penney Co., Inc | (43,939) | ||||

(3,850) | Panasonic Corp., Sponsored ADR | (31,185) | ||||

(1,920) | Sony Corp., Sponsored ADR | (27,341) | ||||

(6,030) | TiVo, Inc. | (49,868) | ||||

(1,155) | Vail Resorts, Inc. | (57,842) | ||||

|

| |||||

| (340,386) | ||||||

|

| |||||

Consumer, Non-cyclical-(8.0)% | ||||||

(2,190) | Accretive Health, Inc. | (24,002) | ||||

(3,100) | Ariad Pharmaceuticals, Inc. | (53,351) | ||||

(1,955) | AVEO Pharmaceuticals, Inc. | (23,773) | ||||

(1,630) | BRF - Brasil Foods SA, ADR | (24,760) | ||||

(3,140) | Brookdale Senior Living, Inc. | (55,704) | ||||

(1,385) | Cepheid, Inc. | (61,979) | ||||

(4,518) | DexCom, Inc. | (58,553) | ||||

(3,330) | Emeritus Corp. | (56,044) | ||||

(3,676) | Endologix, Inc. | (56,757) | ||||

(2,739) | Insulet Corp. | (58,532) | ||||

(2,260) | K12, Inc. | (52,658) | ||||

(2,255) | MAKO Surgical Corp. | (57,751) | ||||