UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-08411

(Investment Company Act file number)

James Advantage Funds

(Exact name of registrant as specified in charter)

1349 Fairground Road

Beavercreek, Ohio 45385

(Address of principal executive offices) (Zip code)

Barry R. James

P.O. Box 8

Alpha, Ohio 45301

(Name and address of agent for service)

Registrant’s telephone number, including area code: (937) 426-7640

Date of fiscal year end: June 30

Date of reporting period: July 1, 2012 – June 30, 2013

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| | |

| James Advantage Funds | | Shareholder Letter |

| | June 30, 2013 (Unaudited) |

Once again, I would like to thank you for helping us achieve another major milestone. This past year the James Balanced: Golden Rainbow Fund crossed the threshold of $2.0 billion in assets. As you know, this fund, as well as the James Small Cap Fund, received recognition from US News and World Report. The good news on the Golden Rainbow Fund is the higher assets have led to a drop in fees. The advisory fee rate has dropped for assets in excess of $500 million, $1 billion and now $2 billion.

In spite of worries about the US Presidential election, the fiscal cliff, sequestration and the possible end of Quantitative Easing, the US stock market made advances to record highs. At the same time, bonds, commodities and emerging market investments struggled. Here is this year’s Annual Report to the James Advantage Funds’ shareholders.

The Market Over the Past Year

Commonly used as a barometer of the stock market, the S&P 500 rose by 20.60% over the twelve months ended June 30, 2013, an exceptional year. The Dow Jones Industrials rose a little less, 18.87%, while smaller capitalization stocks, represented by the Russell 2000, rose an amazing 24.21%.

It was a pretty good year for Healthcare Facility stocks, Oil and Gas Refiner stocks and Automobile Manufacturer stocks. Education Service, Gold and Computer Hardware stocks didn’t do very well.

The bond market started the fiscal year strong but faded. Longer bonds took a significant tumble starting in April, as worries about the end of the Fed’s bond buying and the recent run up in stock prices brought about selling. The Barclay’s Intermediate Gov/Credit Index, a broad measure of high grade U.S. fixed income securities, only rose 0.28%. Longer term bonds fell, with the Barclay’s Long Gov/Credit Index actually losing 4.69%.

Investment Goals and Objectives

James Investment Research has a long history of value investing and we do not drift from our style because the markets are temporarily moving in one direction or another. We believe that value investing will outperform over the long run and that value stocks will hold up better than growth or speculative stocks in difficult markets.

The objectives of our Funds are stated in the Prospectus, and each Fund has a benchmark that the portfolio management team strives to beat. This is not always going to happen, but if we can outperform over the long run without deviating from our stated objectives and style, we believe we will be serving our shareholders well.

Investment Philosophy

We believe our research team is among the best in the business. We have a very sophisticated process that is both quantitative and qualitative. We have an investment committee that adds wisdom and experience to the quantitative work, and we have evolved a process that we believe is unparalleled in our profession. However, all this is built on a strong foundation of value investing. Our modeling and our fundamental analysis is premised on our conclusion that the preponderance of evidence shows value stocks outperform growth stocks over the long run.

Our strategy is premised on preserving capital in declining markets. The execution of this strategy includes holding undervalued stocks, which we call value stocks. We believe this strategy can provide consistent returns that will, over the long run, outperform the Funds’ benchmarks.

Fund Performance

The James Balanced: Golden Rainbow Fund Retail Class shares rose 9.98% over the twelve months ended June 30, 2013. Its benchmark, a blended index comprised of the Russell 2000 Index, the S&P 500 Index and the Barclays Intermediate Government/Credit Bond Index, rose by 10.93%. The Fund lagged its benchmark slightly as the bond holdings reduced the strong performance of the stock holdings. We did increase equity holdings after the Presidential election and later trimmed them in May and June after the strong stock market advance. Unfortunately, bonds fell during the latter part of the year and this diminished performance.

The James Small Cap Fund rose nicely, advancing 22.51% over the fiscal year versus a rise of 24.21% for the Russell 2000, its benchmark. Value oriented small cap stocks did well and the portfolio was helped by investments in Energy, Industrial and Technology stocks. Its REITs and Utility stocks rose in value but were laggards. The portfolio’s cash position, about 6 to 7% of assets for most of the year, was the major reason for the Fund’s underperformance relative to its benchmark.

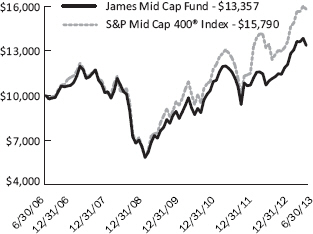

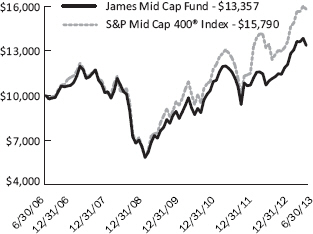

The James Mid Cap Fund rose 21.68%, while its benchmark, the S&P 400 Mid Cap Value Index, rose 27.03%. All major industry sectors rose, but the fund was particularly aided by holdings in Consumer Non-Cyclical and Industrial stocks. The largest contributors to the fund lagging its benchmark

| | |

| | |

| Annual Report | June 30, 2013 | | 1 |

| | |

| Shareholder Letter | | James Advantage Funds |

June 30, 2013 (Unaudited) | | |

were lower returns in Dollar Tree, Stone Energy and Delek (all sold) and the fact the fund held its cash position between 5 and 7% of assets for most of the year.

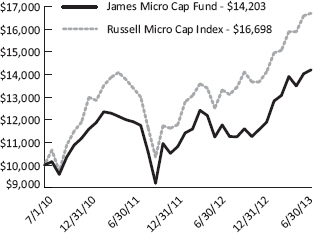

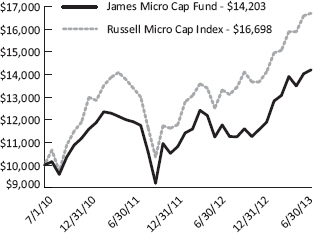

The James Micro Cap Fund rose 20.64%, while its benchmark, the Russell Micro Cap Index rose 25.38%. This fund focuses on companies that are less than $250 million in size. The fund had excellent results in the Finance and Industrial sectors, but lagging performance in several securities in other sectors, as well as its cash position, about 7% of assets for most of the year, were the major reasons for the Fund’s underperformance relative to its benchmark.

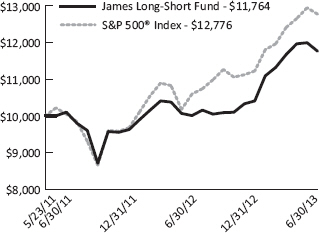

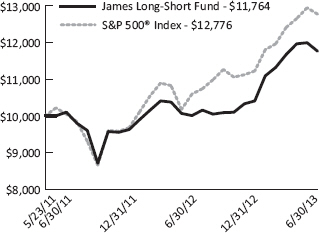

The James Long/Short Fund rose 17.67%, while its benchmark, the S&P 500, rose 20.60%. This fund seeks to take advantage of volatile markets through the use of some leverage and some shorting of overpriced stocks. Given the Fund’s ability to leverage itself, to hold bonds, and to short securities, investors should not expect a tight correlation to the S&P 500. The Fund lagged its benchmark because we had some stocks which were sold short in a rapidly rising stock market and because the Fund’s cash position throughout the year was a drag on performance.

Please see the following charts for longer term comparisons for all our funds.

Expectations for the Future

After crossing many apparent hurdles, the stock market hit new highs and investor sentiment has followed the trend. Today we find many more bulls than bears, and a number of research teams are calling for yet more new highs. Investors are shifting from bonds and cash into equities, and signs of enthusiasm are abundant. In addition, many may have “missed” the market rally from its lows in 2009, and want to join in on the market advance.

However, pitfalls appear to have cropped up in a number of areas. Emerging markets, commodities and bonds have all experienced some significant corrections. Getting investors to take more risk seems to have been the goal of the Federal Reserve with its Quantitative Easing policy, but it is also putting more volatility into prices of all investments. As a result, many are facing a conundrum of how to invest.

Getting back to basics, the economy doesn’t look to make rapid gains. New regulations, higher taxes, weaker exports and a higher dollar all point to sluggish domestic growth. However, gains in housing and automobile sales have been encouraging and bring support in other areas of the economy. Still, consumers are not spending robustly and the job market is not creating a great deal of confidence. This doesn’t lead us to believe a major upturn in earnings is likely.

Bonds appear to be working through a transition period of low rates. We can expect volatility in bond prices, and a moderate approach to bonds is prudent. Stocks are not at the bargain levels they were in 2009 and may experience a correction in spite of their good recent progress. It makes sense to take a moderate approach to equity levels at this time as well. Nonetheless, we are optimistic and look forward to opportunities to add to equity levels in the future.

Barry R. James, CFA, CIC

President

You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of a Fund before investing. The Funds’ prospectuses contain this and other information. You may obtain a current copy of a Fund’s prospectus by calling 1-800-995-2637.

Past performance is no guarantee of future results. The investment return and principal value of an investment in any Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Barry R. James is a registered representative of ALPS Distributors, Inc.

CFA® is a trademark owned by the CFA Institute.

The Dow Jones Industrial Average is a price-weighted overage of 30 actively traded Blue-Chip stocks.

| | |

| James Advantage Funds | | Growth of $10,000 Charts |

| | June 30, 2013 (Unaudited) |

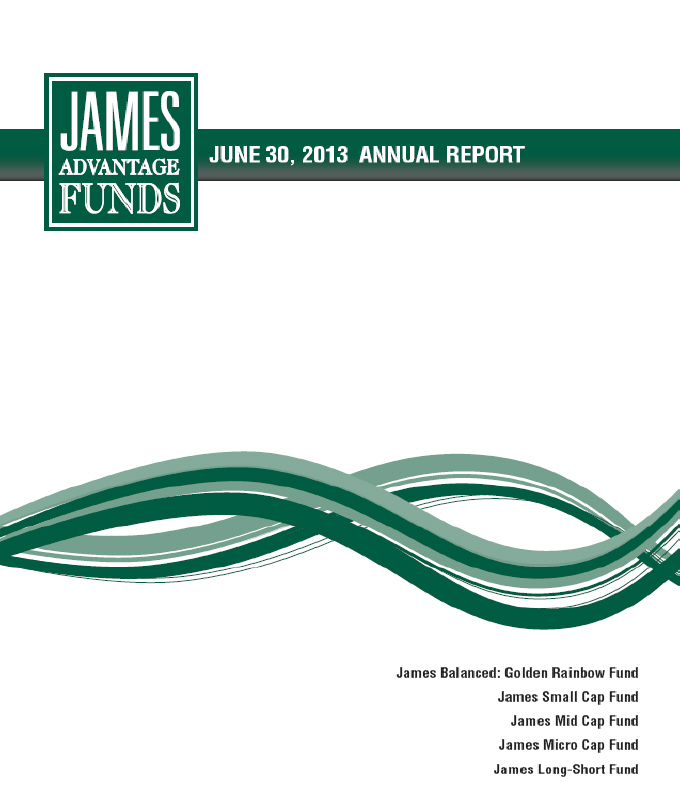

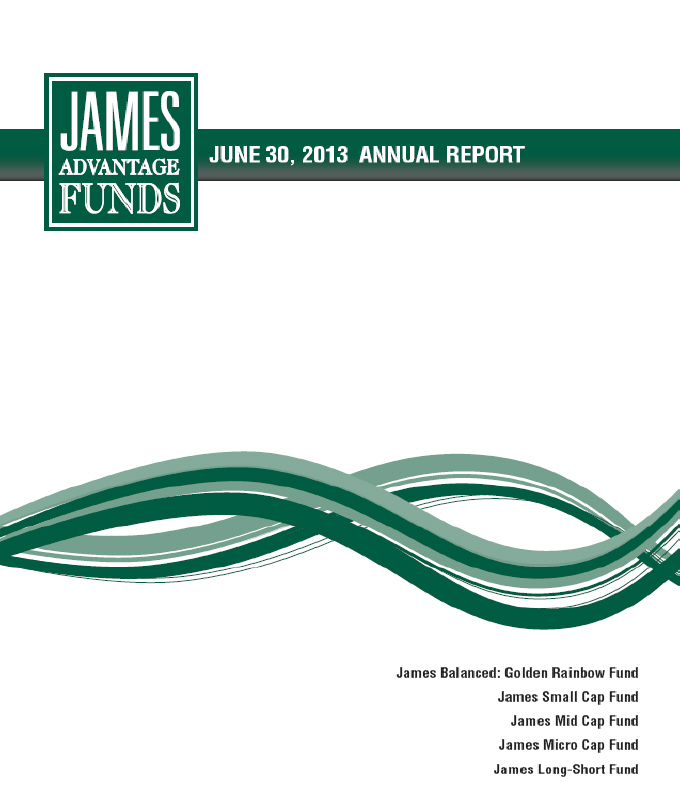

Comparison of the Change in Value of a $10,000 Investment in the James Balanced: Golden Rainbow Fund – Retail Class

James Balanced: Golden Rainbow Fund – Retail, S&P 500® Index and Blended Index Average Annual Total Returns

| | | | | | | | |

| | | 1 Year | | 5

Years | | 10

Years | | Since

Inception(2) |

James Balanced: Golden

Rainbow – Retail Class | | 9.98% | | 6.61% | | 7.97% | | 8.26% |

S&P 500® Index | | 20.60% | | 7.01% | | 7.30% | | 9.00% |

Russell 2000® Index | | 24.21% | | 8.77% | | 9.53% | | 9.84% |

Barclays Capital Intermediate

Government/Credit Index | | 0.28% | | 4.57% | | 4.03% | | 6.01% |

Blended Index(1) | | 10.93% | | 6.87% | | 6.65% | | 8.16% |

| (1) | The Blended Index is comprised of a 25% weighting in the S&P 500® Index, a 25% weighting in the Russell 2000® Index and a 50% weighting in the Barclays Capital Intermediate Government/Credit Index. |

| (2) | Fund inception was July 1, 1991. |

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2012, was 1.07%.

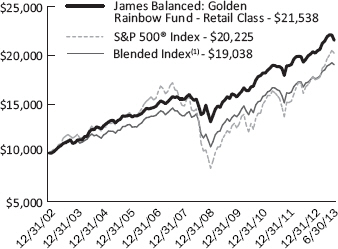

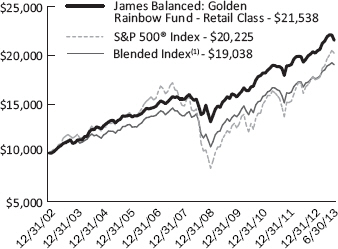

Comparison of the Change in Value of a $10,000 Investment in the James Balanced: Golden Rainbow Fund – Institutional Class

James Balanced: Golden Rainbow Fund – Institutional, S&P 500® Index and Blended Index Average Annual Total Returns

| | | | | | | | |

| | | 1 Year | | 5

Years | | 10

Years | | Since

Inception(2) |

James Balanced: Golden

Rainbow - Institutional Class | | 10.26% | | N/A | | N/A | | 12.83% |

S&P 500® Index | | 20.60% | | N/A | | N/A | | 23.75% |

Russell 2000® Index | | 24.21% | | N/A | | N/A | | 27.09% |

Barclays Capital Intermediate

Government/Credit Index | | 0.28% | | N/A | | N/A | | 4.58% |

Blended Index(1) | | 10.93% | | N/A | | N/A | | 15.07% |

| (1) | The Blended Index is comprised of a 25% weighting in the S&P 500® Index, a 25% weighting in the Russell 2000® Index and a 50% weighting in the Barclays Capital Intermediate Government/Credit Index. |

| (2) | Fund inception was March 2, 2009. |

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2012, was 0.82%.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

The S&P 500® Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the 2,000 smallest U.S. domiciled publicly-traded common stocks of the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index, an unmanaged index of the 3,000 largest U.S. domiciled publicly-traded common stocks by market capitalization.

The Barclays Capital Intermediate Government/Credit Index measures the performance of U.S. Dollar denominated U.S. Treasuries, government-related and investment grade U.S. corporate securities that have a remaining maturity of greater than one year and less than ten years.

The S&P 500® Index, Russell 2000® Index, Barclays Capital Intermediate Government/Credit Index, S&P Mid Cap 400® Index, and Russell Microcap® Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| | |

| | | |

| Annual Report | June 30, 2013 | | 3 |

| | |

| Growth of $10,000 Charts | | James Advantage Funds |

June 30, 2013 (Unaudited) | | |

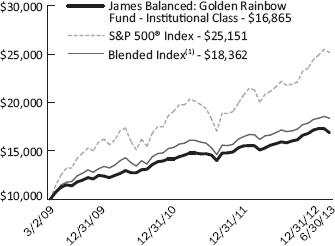

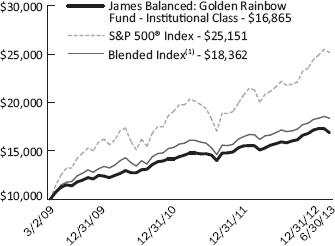

Comparison of the Change in Value of a $10,000 Investment in the James Small Cap Fund

James Small Cap Fund and Russell 2000® Index Average Annual Total Returns

| | | | | | | | |

| | | 1 Year | | 5 Years | | 10 Years | | Since

Inception(1) |

James Small Cap Fund | | 22.51% | | 8.05% | | 9.16% | | 8.35% |

Russell 2000® Value

TR Index | | 24.77% | | 8.59% | | 9.30% | | 9.61% |

Russell 2000® TR | | 24.21% | | 8.77% | | 9.53% | | 8.64% |

| (1) | Fund inception was October 2, 1998. |

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2012, was 1.50%.

Comparison of the Change in Value of a $10,000 Investment in the James Mid Cap Fund

James Mid Cap Fund and S&P Mid Cap 400® Index Average Annual Total Returns

| | | | | | |

| | | 1 Year | | 5 Year | | Since

Inception(1) |

James Mid Cap Fund | | 21.68% | | 4.48% | | 4.22% |

S&P MidCap 400® Index | | 27.03% | | 8.94% | | 6.74% |

| (1) | Fund inception was June 30, 2006. |

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2012, was 1.51%.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

Mid, Small and Micro Cap investing involve greater risk not associated with investing in more established companies, such as greater price volatility, business risk, less liquidity and increased competitive threat.

The Mid-Cap Fund invests in stocks of mid-cap companies which tend to be more volatile and can be less liquid than stocks of large-cap companies. Diversification does not guarantee a profit or protect against loss. Current and future portfolio holdings are subject to risk.

The Russell 2000® Value Index is a widely recognized, unmanaged index that measures the performance of those Russell 2000® Index companies with lower price-to-book ratios and lower forecasted growth values.

The Russell 2000® Index is a widely recognized, unmanaged index comprised of the 2,000 smallest U.S. domiciled publicly-traded common stocks of the Russell 3000® Index, which represents approximately 8% of the total market capitalization of the Russell 3000® Index, an unmanaged index of the 3,000 largest U.S. domiciled publicly-traded common stocks by market capitalization.

The S&P MidCap 400® Value Index is a recognized, unmanaged index of mid cap stocks considered to be value stocks using Standard and Poor’s methodology.

The S&P 500® Index, Russell 2000® Index, Barclays Capital Intermediate Government/Credit Index, S&P MidCap 400® Index, and Russell Microcap® Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| | |

| James Advantage Funds | | Growth of $10,000 Charts |

| | June 30, 2013 (Unaudited) |

Comparison of the Change in Value of a $10,000 Investment in the James Micro Cap Fund

James Micro Cap Fund and Russell Microcap® Index Average Annual Total Returns

| | | | |

| | | 1 Year | | Since

Inception(1) |

James Micro Cap Fund | | 20.64% | | 12.42% |

Russell Microcap® Index | | 25.38% | | 18.66% |

| (1) | Fund inception was July 1, 2010. |

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2012 was 1.50%.

Comparison of the Change in Value of a $10,000 Investment in the James Long-Short Fund

James Long-Short Fund and S&P 500® Index Average Annual Total Returns

| | | | |

| | | 1 Year | | Since

Inception(1) |

James Long-Short Fund | | 17.67% | | 8.07% |

S&P 500® Index | | 20.60% | | 12.35% |

| (1) | Fund inception was May 23, 2011. |

The total annual operating expense ratio as stated in the fee table of the most recent prospectus, dated November 1, 2012, was 2.67%.

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. These performance figures do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Please call 1-800-995-2637 for most recent month-end performance information.

Mid, Small and Micro Cap investing involve greater risk not associated with investing in more established companies, such as greater price volatility, business risk, less liquidity and increased competitive threat.

Short selling incurs significant additional risk; theoretically, stocks sold short have unlimited upside risk potential. In addition, this strategy depends on the Adviser’s ability to correctly identify undervalued and overvalued stocks, and that the stock markets are reasonable and efficient. Periods of extreme volatility may harm the performance of this product. The Long-Short Fund may have a high portfolio turnover rate. A high portfolio turnover rate can result in increased brokerage commission costs and may expose taxable shareholders to potentially larger current tax liability.

The Russell Microcap® Index measures the performance of the microcap segment of the U.S. equity market. It makes up less than 3% of the U.S. equity market. It includes 1,000 of the smallest securities in the small cap Russell 2000® Index, plus the next smallest eligible securities by market cap.

The S&P 500® Index is an unmanaged index of 500 common stocks chosen for market size, liquidity and industry group representation.

The S&P 500® Index, Russell 2000® Index, Barclays Capital Intermediate Government/Credit Index, S&P MidCap 400® Index, and Russell Microcap® Index are widely recognized unmanaged indices of security prices and are representative of a broader market and range of securities than is found in the Fund’s portfolio. The Index returns do not reflect the deduction of expenses, which have been deducted from a Fund’s returns. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in any Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

| | |

| | | |

| Annual Report | June 30, 2013 | | 5 |

| | |

| Representation of Schedules of Investments | | James Advantage Funds |

June 30, 2013 (Unaudited) | | |

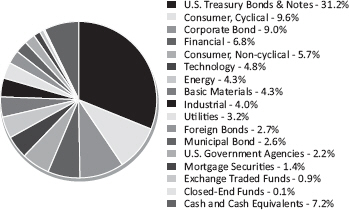

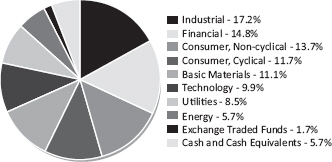

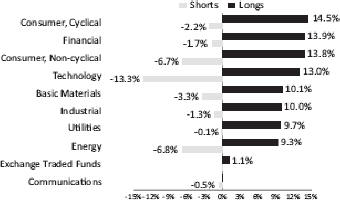

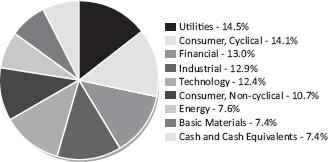

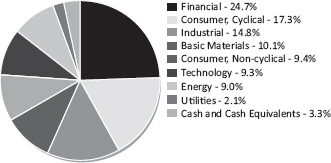

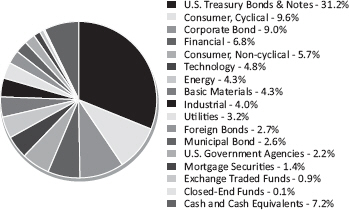

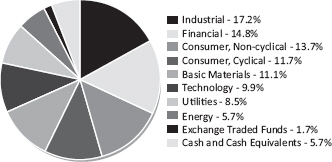

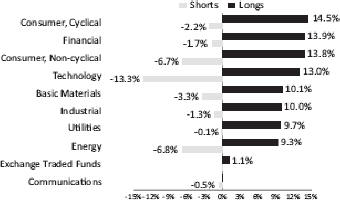

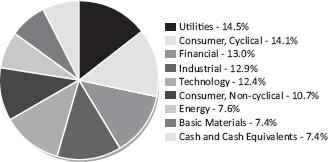

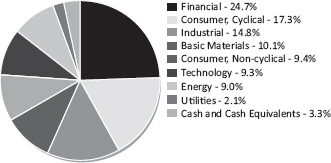

The illustrations below provide the industry sectors for the James Balanced: Golden Rainbow Fund, James Small Cap Fund, James Mid Cap Fund, James Micro Cap Fund, and James Long-Short Fund.

James Balanced: Golden Rainbow Fund - Industry Sector Allocation (% of Net Assets)

James Mid Cap Fund - Industry Sector Allocation

(% of Net Assets)

James Long-Short Fund - Industry Sector Allocation

(% of Net Assets)

(Cash and Cash Equivalents and Other Liabilities in Excess of Assets not included)

James Small Cap Fund - Industry Sector Allocation

(% of Net Assets)

James Micro Cap Fund - Industry Sector Allocation

(% of Net Assets)

| | |

| James Advantage Funds | | Disclosure of Fund Expenses |

| | June 30, 2013 (Unaudited) |

Example. As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including reinvested dividends or other distributions, and redemption fees; and (2) ongoing costs, including management fees, distribution (12b-1) fees, and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period January 1, 2013 through June 30, 2013.

Actual Expenses. The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expense Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second line of the table below provides information about hypothetical account values and hypothetical expenses based on a Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Fund and other mutual funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that expenses shown in the table are meant to highlight and help you compare ongoing costs only. The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

| | | | | | | | | | | | | | | | | | | | | | |

| | | Net Expense

Ratio

Annualized

June 30, 2013(a) | | Beginning

Account Value

January 1, 2013 | | Ending

Account Value

June 30, 2013 | | Expense

Paid During

Period(b) | | |

James Balanced: Golden Rainbow Fund | | | | | | | | | | | | | | | | | | |

Retail Class Actual | | | | 1.03 | % | | | $ | 1,000.00 | | | | $ | 1,044.70 | | | | $ | 5.22 | | | |

Retail Class Hypothetical (5% return before expenses) | | | | 1.03 | % | | | $ | 1,000.00 | | | | $ | 1,019.69 | | | | $ | 5.16 | | | |

| | | | | |

Institutional Class Actual | | | | 0.78 | % | | | $ | 1,000.00 | | | | $ | 1,045.60 | | | | $ | 3.96 | | | |

Institutional Class Hypothetical (5% return before expenses) | | | | 0.78 | % | | | $ | 1,000.00 | | | | $ | 1,020.93 | | | | $ | 3.91 | | | |

| | | | | |

James Small Cap Fund | | | | | | | | | | | | | | | | | | | | | | |

Actual | | | | 1.50 | % | | | $ | 1,000.00 | | | | $ | 1,162.70 | | | | $ | 8.04 | | | |

Hypothetical (5% return before expenses) | | | | 1.50 | % | | | $ | 1,000.00 | | | | $ | 1,017.36 | | | | $ | 7.50 | | | |

| | | | | |

James Mid Cap Fund | | | | | | | | | | | | | | | | | | | | | | |

Actual | | | | 1.50 | % | | | $ | 1,000.00 | | | | $ | 1,105.70 | | | | $ | 7.83 | | | |

Hypothetical (5% return before expenses) | | | | 1.50 | % | | | $ | 1,000.00 | | | | $ | 1,017.36 | | | | $ | 7.50 | | | |

| | | | | |

James Micro Cap Fund | | | | | | | | | | | | | | | | | | | | | | |

Actual | | | | 1.50 | % | | | $ | 1,000.00 | | | | $ | 1,194.20 | | | | $ | 8.16 | | | |

Hypothetical (5% return before expenses) | | | | 1.50 | % | | | $ | 1,000.00 | | | | $ | 1,017.36 | | | | $ | 7.50 | | | |

| | | | | |

James Long-Short Fund | | | | | | | | | | | | | | | | | | | | | | |

Actual | | | | 2.63 | %(c) | | | $ | 1,000.00 | | | | $ | 1,130.40 | | | | $ | 13.89 | | | |

Hypothetical (5% return before expenses) | | | | 2.63 | %(c) | | | $ | 1,000.00 | | | | $ | 1,011.75 | | | | $ | 13.12 | | | |

| (a) | Annualized, based on the Fund’s most recent fiscal half year expenses. |

| (b) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), divided by 365. |

| (c) | Dividend and interest expense on securities sold short and interest expense totaled 1.13% (annualized) of average net assets for the six months ended June 30, 2013. |

| | |

| | | |

| Annual Report | June 30, 2013 | | 7 |

| | |

| Schedule of Investments | | James Balanced: Golden Rainbow Fund |

June 30, 2013 | | |

| | | | | | |

| Shares or Principal Amount | | Value | |

COMMON STOCKS-42.7% | | | | |

| | Basic Materials-4.3% | | | | |

| 160,000 | | Barrick Gold Corp. | | | $2,518,400 | |

| 205,000 | | Buckeye Technologies, Inc. | | | 7,593,200 | |

| 112,500 | | CF Industries Holdings, Inc. | | | 19,293,750 | |

| 225,000 | | Cooper Tire & Rubber Co. | | | 7,463,250 | |

| 18,600 | | Eastman Chemical Co. | | | 1,302,186 | |

| 182,000 | | Huntsman Corp. | | | 3,013,920 | |

| 70,000 | | Innospec, Inc. | | | 2,812,600 | |

| 20,000 | | International Paper Co. | | | 886,200 | |

| 55,000 | | Newmont Mining Corp. | | | 1,647,250 | |

| 40,000 | | Olin Corp. | | | 956,800 | |

| 330,000 | | PH Glatfelter Co. | | | 8,283,000 | |

| 269,040 | | PolyOne Corp. | | | 6,666,811 | |

| 161,200 | | PPG Industries, Inc. | | | 23,601,292 | |

| 45,000 | | Terra Nitrogen Co. LP | | | 9,629,550 | |

| 10,500 | | Westlake Chemical Corp. | | | 1,012,305 | |

| 60,000 | | Worthington Industries, Inc. | | | 1,902,600 | |

| | | | | | |

| | | | | 98,583,114 | |

| | | | | | |

| | |

| | Consumer, Cyclical-9.6% | | | | |

| 694,600 | | Alaska Air Group, Inc. | | | 36,119,200 | |

| 14,500 | | CVS Caremark Corp. | | | 829,110 | |

| 203,100 | | Destination Maternity Corp. | | | 4,996,260 | |

| 288,800 | | Dillard’s, Inc., Class A | | | 23,672,936 | |

| 162,700 | | DIRECTV, Class A* | | | 10,025,574 | |

| 150,000 | | Foot Locker, Inc. | | | 5,269,500 | |

| 1,524,165 | | Ford Motor Co. | | | 23,578,832 | |

| 21,000 | | Haverty Furniture Cos., Inc. | | | 483,210 | |

| 40,000 | | LeapFrog Enterprises, Inc.* | | | 393,600 | |

| 25,000 | | Lennar Corp., Class A | | | 901,000 | |

| 627,800 | | Macy’s, Inc. | | | 30,134,400 | |

| 164,600 | | Moody’s Corp. | | | 10,029,078 | |

| 180,000 | | RR Donnelley & Sons Co. | | | 2,521,800 | |

| 740,315 | | Sinclair Broadcast Group, Inc., Class A | | | 21,750,455 | |

| 71,000 | | Southwest Airlines Co. | | | 915,190 | |

| 213,050 | | Target Corp. | | | 14,670,623 | |

| 135,000 | | TJX Cos., Inc. | | | 6,758,100 | |

| 163,500 | | Viacom, Inc., Class A | | | 11,189,940 | |

| 147,000 | | Viacom, Inc., Class B | | | 10,003,350 | |

| 87,000 | | Wal-Mart Stores, Inc. | | | 6,480,630 | |

| | | | | | |

| | | | | 220,722,788 | |

| | | | | | |

| | |

| | Consumer, Non-cyclical-5.7% | | | | |

| 215,500 | | Dean Foods Co.* | | | 2,159,310 | |

| 341,100 | | Eli Lilly & Co. | | | 16,754,832 | |

| 29,000 | | Grand Canyon Education, Inc.* | | | 934,670 | |

| 12,000 | | Hillshire Brands Co. | | | 396,960 | |

| 207,600 | | Ingredion, Inc. | | | 13,622,712 | |

| 272,000 | | Kroger Co. | | | 9,394,880 | |

| 449,200 | | Merck & Co., Inc. | | | 20,865,340 | |

| 608,000 | | Mylan, Inc.* | | | 18,866,240 | |

| 171,000 | | Newell Rubbermaid, Inc. | | | 4,488,750 | |

| 10,500 | | Omnicare, Inc. | | | 500,955 | |

| | |

| See Notes to Financial Statements. | | |

| 8 | | www.jamesfunds.com |

| | |

| James Balanced: Golden Rainbow Fund | | Schedule of Investments |

| | June 30, 2013 |

| | | | | | |

| Shares or Principal Amount | | Value | |

| | Consumer, Non-cyclical (continued) | | | | |

| 599,000 | | Pfizer, Inc. | | | $16,777,990 | |

| 2,850 | | Seaboard Corp. | | | 7,717,800 | |

| 3,000 | | Seneca Foods Corp., Class A* | | | 92,040 | |

| 30,000 | | Tupperware Brands Corp. | | | 2,330,700 | |

| 155,300 | | UnitedHealth Group, Inc. | | | 10,169,044 | |

| 12,000 | | USANA Health Sciences, Inc.* | | | 868,560 | |

| 31,075 | | WellPoint, Inc. | | | 2,543,178 | |

| 80,592 | | WhiteWave Foods Co., Class A* | | | 1,309,620 | |

| 114,779 | | WhiteWave Foods Co., Class B* | | | 1,744,641 | |

| | | | | | |

| | | | | 131,538,222 | |

| | | | | | |

| | |

| | Energy-4.3% | | | | |

| 156,970 | | Chevron Corp. | | | 18,575,830 | |

| 19,000 | | ConocoPhillips | | | 1,149,500 | |

| 110,000 | | Delek US Holdings, Inc. | | | 3,165,800 | |

| 98,300 | | Exxon Mobil Corp. | | | 8,881,405 | |

| 553,044 | | HollyFrontier Corp. | | | 23,659,222 | |

| 93,800 | | Plains All American Pipeline LP | | | 5,234,978 | |

| 552,500 | | Tesoro Corp. | | | 28,906,800 | |

| 248,000 | | Valero Energy Corp. | | | 8,622,960 | |

| | | | | | |

| | | | | 98,196,495 | |

| | | | | | |

| | |

| | Financial-6.8% | | | | |

| 304,000 | | American Financial Group, Inc. | | | 14,868,640 | |

| 170,900 | | AmTrust Financial Services, Inc. | | | 6,101,130 | |

| 301,000 | | Aspen Insurance Holdings, Ltd. | | | 11,164,090 | |

| 243,000 | | Brookfield Office Properties, Inc. | | | 4,053,240 | |

| 340,000 | | CBL & Associates Properties, Inc., REIT | | | 7,282,800 | |

| 1,041,000 | | Fifth Third Bancorp | | | 18,790,050 | |

| 8,600 | | Goldman Sachs Group, Inc. | | | 1,300,750 | |

| 404,250 | | JPMorgan Chase & Co. | | | 21,340,358 | |

| 993,000 | | KeyCorp | | | 10,962,720 | |

| 30,000 | | Montpelier Re Holdings Ltd. | | | 750,300 | |

| 36,000 | | National Financial Partners Corp.* | | | 911,160 | |

| 340,000 | | Nelnet, Inc., Class A | | | 12,270,600 | |

| 10,000 | | PNC Financial Services Group, Inc. | | | 729,200 | |

| 327,870 | | Protective Life Corp. | | | 12,593,487 | |

| 275,000 | | Rent-A-Center, Inc. | | | 10,326,250 | |

| 101,600 | | Torchmark Corp. | | | 6,618,224 | |

| 85,324 | | Travelers Cos., Inc. | | | 6,819,094 | |

| 282,025 | | Unum Group | | | 8,283,074 | |

| | | | | | |

| | | | | 155,165,167 | |

| | | | | | |

| | |

| | Industrial-4.0% | | | | |

| 117,800 | | AMERCO | | | 19,071,820 | |

| 357,000 | | American Axle & Manufacturing Holdings, Inc.* | | | 6,650,910 | |

| 55,000 | | American Railcar Industries, Inc. | | | 1,843,050 | |

| 37,000 | | CNH Global NV | | | 1,541,420 | |

| 20,000 | | Cummins, Inc. | | | 2,169,200 | |

| 7,000 | | Deere & Co. | | | 568,750 | |

| 60,000 | | Eaton Corp. PLC | | | 3,948,600 | |

| 12,600 | | Ingersoll-Rand PLC | | | 699,552 | |

| 180,000 | | Jarden Corp.* | | | 7,875,000 | |

| | |

| See Notes to Financial Statements. | | |

| Annual Report | June 30, 2013 | | 9 |

| | |

| Schedule of Investments | | James Balanced: Golden Rainbow Fund |

June 30, 2013 | | |

| | | | | | |

| Shares or Principal Amount | | Value | |

| | Industrial (continued) | | | | |

| 82,000 | | Magna International, Inc. | | | $5,840,040 | |

| 8,000 | | Republic Services, Inc. | | | 271,520 | |

| 320,000 | | Sturm Ruger & Co., Inc. | | | 15,372,800 | |

| 110,000 | | Timken Co. | | | 6,190,800 | |

| 289,625 | | TRW Automotive Holdings Corp.* | | | 19,242,685 | |

| 11,000 | | United Rentals, Inc.* | | | 549,010 | |

| | | | | | |

| | | | | 91,835,157 | |

| | | | | | |

| | |

| | Technology-4.8% | | | | |

| 36,500 | | Alliant Techsystems, Inc. | | | 3,005,045 | |

| 220,000 | | Amkor Technology, Inc.* | | | 926,200 | |

| 150,000 | | Arrow Electronics, Inc.* | | | 5,977,500 | |

| 165,000 | | Avnet, Inc.* | | | 5,544,000 | |

| 40,000 | | CSG Systems International, Inc.* | | | 868,000 | |

| 511,910 | | Deluxe Corp. | | | 17,737,682 | |

| 17,000 | | Equifax, Inc. | | | 1,001,810 | |

| 230,000 | | Intel Corp. | | | 5,570,600 | |

| 19,500 | | International Business Machines Corp. | | | 3,726,645 | |

| 45,000 | | Intersections, Inc. | | | 394,650 | |

| 280,500 | | Kulicke & Soffa Industries, Inc.* | | | 3,102,330 | |

| 62,000 | | Lexmark International, Inc., Class A | | | 1,895,340 | |

| 27,000 | | Lockheed Martin Corp. | | | 2,928,420 | |

| 112,740 | | Northrop Grumman Corp. | | | 9,334,872 | |

| 100,000 | | PDL BioPharma, Inc. | | | 772,000 | |

| 20,000 | | TE Connectivity, Ltd. | | | 910,800 | |

| 338,840 | | Triumph Group, Inc. | | | 26,819,186 | |

| 308,200 | | Western Digital Corp. | | | 19,136,138 | |

| | | | | | |

| | | | | 109,651,218 | |

| | | | | | |

| | |

| | Utilities-3.2% | | | | |

| 154,500 | | American Electric Power Co., Inc. | | | 6,918,510 | |

| 9,000 | | American States Water Co. | | | 483,030 | |

| 320,500 | | AT&T, Inc. | | | 11,345,700 | |

| 464,000 | | BCE, Inc. | | | 19,033,280 | |

| 10,000 | | Black Hills Corp. | | | 487,500 | |

| 146,840 | | DTE Energy Co. | | | 9,839,748 | |

| 67,000 | | El Paso Electric Co. | | | 2,365,770 | |

| 20,000 | | Laclede Group, Inc. | | | 913,200 | |

| 69,200 | | Pike Electric Corp. | | | 851,160 | |

| 60,000 | | Pinnacle West Capital Corp. | | | 3,328,200 | |

| 248,000 | | PNM Resources, Inc. | | | 5,503,120 | |

| 255,000 | | Portland General Electric Co. | | | 7,800,450 | |

| 28,000 | | Public Service Enterprise Group, Inc. | | | 914,480 | |

| 134,000 | | TELUS Corp. | | | 3,911,460 | |

| 15,000 | | Westar Energy, Inc. | | | 479,400 | |

| | | | | | |

| | | | | 74,175,008 | |

| | | | | | |

TOTAL COMMON STOCKS | | | | |

(Cost $730,998,719) | | | 979,867,169 | |

| | | | | | |

| | |

| See Notes to Financial Statements. | | |

| 10 | | www.jamesfunds.com |

| | |

| James Balanced: Golden Rainbow Fund | | Schedule of Investments |

| | June 30, 2013 |

| | | | | | |

| Shares or Principal Amount | | Value | |

CLOSED-END FUNDS-0.1% | | | | |

| 140,000 | | Eaton Vance Risk-Managed Diversified Equity Income Fund | | | $1,526,000 | |

| 11,500 | | Nuveen Ohio Quality Income Municipal Fund, Inc. | | | 171,235 | |

| 50,000 | | Nuveen Premium Income Municipal Fund 2 | | | 677,000 | |

| | | | | | |

| |

TOTAL CLOSED-END FUNDS | | | | |

(Cost $2,140,293) | | | 2,374,235 | |

| | | | | | |

| |

EXCHANGE TRADED FUNDS-0.9% | | | | |

| 10,000 | | iShares® Cohen & Steers Realty Majors Index Fund | | | 806,200 | |

| 55,000 | | iShares® MSCI Canada Index Fund | | | 1,441,000 | |

| 15,000 | | iShares® MSCI Germany Index Fund | | | 370,500 | |

| 15,000 | | iShares® MSCI Indonesia Investable Market Index Fund | | | 467,550 | |

| 15,000 | | iShares® MSCI Philippines Investable Market Index Fund | | | 525,600 | |

| 44,540 | | iShares® MSCI Poland Investable Market Index Fund | | | 1,083,213 | |

| 338,000 | | iShares® MSCI Singapore Index Fund | | | 4,323,020 | |

| 12,000 | | iShares® MSCI South Korea Index Fund | | | 638,400 | |

| 70,000 | | iShares® MSCI Switzerland Index Fund | | | 2,005,500 | |

| 10,000 | | iShares® S&P® National Municipal Bond Fund | | | 1,050,400 | |

| 122,900 | | SPDR® Nuveen Barclays Capital Short Term Municipal Bond ETF | | | 2,937,310 | |

| 181,450 | | SPDR® S&P® Homebuilders ETF | | | 5,338,259 | |

| | | | | | |

| |

TOTAL EXCHANGE TRADED FUNDS | | | | |

(Cost $20,430,033) | | | 20,986,952 | |

| | | | | | |

| |

CORPORATE BONDS-9.0% | | | | |

| | Basic Materials-0.5% | | | | |

| $5,000,000 | | BHP Billiton Finance USA, Ltd., 1.000%, 2/24/15 | | | 5,027,025 | |

| 5,000,000 | | E.I. du Pont de Nemours & Co., 2.750%, 4/1/16 | | | 5,226,590 | |

| 1,500,000 | | E.I. du Pont de Nemours & Co., 5.750%, 3/15/19 | | | 1,754,735 | |

| | | | | | |

| | | | | 12,008,350 | |

| | | | | | |

| | Communications-0.2% | | | | |

| 5,000,000 | | BellSouth Corp., 5.200%, 9/15/14 | | | 5,249,900 | |

| | | | | | |

| | |

| | Consumer, Cyclical-0.6% | | | | |

| 5,000,000 | | eBay, Inc., 2.600%, 7/15/22 | | | 4,655,620 | |

| 5,000,000 | | Home Depot, Inc., 5.950%, 4/1/41 | | | 5,962,980 | |

| 785,000 | | McDonald’s Corp., 5.700%, 2/1/39 | | | 928,581 | |

| 2,000,000 | | Wal-Mart Stores, Inc., 5.250%, 9/1/35 | | | 2,173,508 | |

| | | | | | |

| | | | | 13,720,689 | |

| | | | | | |

| | |

| | Consumer, Non-cyclical-1.1% | | | | |

| 5,000,000 | | Colgate-Palmolive Co., 3.150%, 8/5/15 | | | 5,260,160 | |

| 3,000,000 | | Hershey Co., 4.125%, 12/1/20 | | | 3,252,669 | |

| 5,475,000 | | Johnson & Johnson, 4.500%, 9/1/40 | | | 5,622,595 | |

| 5,000,000 | | PepsiCo, Inc., 0.800%, 8/25/14 | | | 5,014,335 | |

| 5,465,000 | | Wyeth LLC, 5.500%, 2/15/16 | | | 6,092,562 | |

| | | | | | |

| | | | | 25,242,321 | |

| | | | | | |

| | Energy-1.1% | | | | |

| 5,000,000 | | Apache Corp., 3.250%, 4/15/22 | | | 4,922,495 | |

| 5,000,000 | | BP Capital Markets PLC, 3.245%, 5/6/22 | | | 4,849,580 | |

| 5,000,000 | | Occidental Petroleum Corp., 1.750%, 2/15/17 | | | 4,994,565 | |

| 5,050,000 | | Shell International Finance BV, 2.375%, 8/21/22 | | | 4,716,215 | |

| | |

| See Notes to Financial Statements. | | |

| Annual Report | June 30, 2013 | | 11 |

| | |

| Schedule of Investments | | James Balanced: Golden Rainbow Fund |

June 30, 2013 | | |

| | | | | | |

| Shares or Principal Amount | | Value | |

| | Energy (continued) | | | | |

| $5,000,000 | | Shell International Finance BV, 6.375%, 12/15/38 | | | $6,448,125 | |

| | | | | | |

| | | | | 25,930,980 | |

| | | | | | |

| | |

| | Financial-3.2% | | | | |

| 5,000,000 | | Aflac, Inc., 2.650%, 2/15/17 | | | 5,117,895 | |

| 5,000,000 | | Bank of America Corp., 1.776%, 4/27/16(a) | | | 5,013,705 | |

| 5,000,000 | | Berkshire Hathaway, Inc., 3.750%, 8/15/21 | | | 5,153,295 | |

| 5,000,000 | | Citigroup, Inc., 4.450%, 1/10/17 | | | 5,352,495 | |

| 4,000,000 | | General Electric Capital Corp., 0.774%, 2/6/14(a) | | | 4,011,088 | |

| 10,000,000 | | General Electric Capital Corp., 1.082%, 4/15/20(a) | | | 9,921,920 | |

| 2,000,000 | | General Electric Capital Corp., 6.875%, 1/10/39 | | | 2,467,132 | |

| 15,000,000 | | JPMorgan Chase & Co., 2.600%, 1/15/16 | | | 15,314,685 | |

| 5,000,000 | | Morgan Stanley & Co., 3.450%, 11/2/15 | | | 5,158,610 | |

| 5,000,000 | | Morgan Stanley & Co., 4.750%, 3/22/17 | | | 5,301,775 | |

| 5,000,000 | | National City Corp., 4.900%, 1/15/15 | | | 5,300,050 | |

| 5,000,000 | | UBS AG, 5.875%, 12/20/17 | | | 5,749,355 | |

| | | | | | |

| | | | | 73,862,005 | |

| | | | | | |

| | Industrial-0.4% | | | | |

| 1,000,000 | | Caterpillar, Inc., 7.900%, 12/15/18 | | | 1,289,382 | |

| 1,000,000 | | Caterpillar, Inc., 8.250%, 12/15/38 | | | 1,503,787 | |

| 5,000,000 | | United Technologies Corp., 3.100%, 6/1/22 | | | 4,936,310 | |

| | | | | | |

| | | | | 7,729,479 | |

| | | | | | |

| | Technology-1.4% | | | | |

| 8,000,000 | | Google, Inc., 3.625%, 5/19/21 | | | 8,356,488 | |

| 5,000,000 | | Intel Corp., 3.300%, 10/1/21 | | | 5,015,750 | |

| 3,000,000 | | International Business Machines Corp., 1.950%, 7/22/16 | | | 3,074,550 | |

| 7,000,000 | | International Business Machines Corp., 1.875%, 8/1/22 | | | 6,255,879 | |

| 3,700,000 | | Microsoft Corp., 5.200%, 6/1/39 | | | 4,087,734 | |

| 5,000,000 | | Oracle Corp., 2.500%, 10/15/22 | | | 4,608,095 | |

| | | | | | |

| | | | | 31,398,496 | |

| | | | | | |

| | Utilities-0.5% | | | | |

| 5,000,000 | | Duke Energy Florida, Inc., 5.800%, 9/15/17 | | | 5,770,100 | |

| 4,600,000 | | San Diego Gas & Electric Co., 3.000%, 8/15/21 | | | 4,621,142 | |

| | | | | | |

| | | | | 10,391,242 | |

| | | | | | |

TOTAL CORPORATE BONDS | | | | |

(Cost $207,501,490) | | | 205,533,462 | |

| | | | | | |

| |

MORTGAGE BACKED SECURITIES-1.4% | | | | |

| | Federal Home Loan Mortgage Corporation-0.5% | | | | |

| 6,580,536 | | 3.000%, 11/1/26 | | | 6,766,601 | |

| 3,863,591 | | 3.500%, 5/1/42 | | | 3,917,090 | |

| | | | | | |

| | | | | 10,683,691 | |

| | | | | | |

| | Federal National Mortgage Association-0.6% | | | | |

| 3,348,490 | | 3.000%, 3/1/27, Pool #AB4726 | | | 3,445,201 | |

| 4,172,431 | | 3.000%, 4/1/27, Pool #AB4927 | | | 4,296,602 | |

| 5,388,658 | | 4.500%, 9/1/40, Pool #MA0547 | | | 5,534,206 | |

| | | | | | |

| | | | | 13,276,009 | |

| | | | | | |

| | |

| See Notes to Financial Statements. | | |

| 12 | | www.jamesfunds.com |

| | |

| James Balanced: Golden Rainbow Fund | | Schedule of Investments |

| | June 30, 2013 |

| | | | | | |

| Shares or Principal Amount | | Value | |

| | Government National Mortgage Association-0.3% | | | | |

| $6,994,325 | | 4.000%, 12/20/40, Pool #4882 | | | $7,379,426 | |

| | | | | | |

| |

TOTAL MORTGAGE BACKED SECURITIES | | | | |

(Cost $31,305,137) | | | 31,339,126 | |

| | | | | | |

| |

U.S. GOVERNMENT AGENCIES-2.2% | | | | |

| | Federal Farm Credit Banks-1.2% | | | | |

| 10,000,000 | | 1.750%, 5/28/20 | | | 9,623,060 | |

| 10,000,000 | | 2.380%, 5/15/23 | | | 9,440,800 | |

| 10,000,000 | | 3.220%, 3/26/31 | | | 9,189,870 | |

| | | | | | |

| | | | | 28,253,730 | |

| | | | | | |

| | Federal Home Loan Bank-0.8% | | | | |

| 5,000,000 | | 1.600%,10/22/20 | | | 4,750,360 | |

| 5,000,000 | | 1.250%, 7/25/22 (b) | | | 4,921,565 | |

| 10,000,000 | | 2.430%, 10/11/22 | | | 9,640,970 | |

| | | | | | |

| | | | | 19,312,895 | |

| | | | | | |

| | United States Department of Housing and Urban Development-0.2% | | | | |

| 5,000,000 | | 2.050%, 8/1/19 | | | 4,966,175 | |

| | | | | | |

| |

TOTAL U.S. GOVERNMENT AGENCIES | | | | |

(Cost $55,212,899) | | | 52,532,800 | |

| | | | | | |

| |

U.S. TREASURY BONDS & NOTES-31.2% | | | | |

| | U.S. Treasury Bonds-4.6% | | | | |

| 97,500,000 | | 3.875%, 8/15/40 | | | 105,498,023 | |

| | | | | | |

| | |

| | U.S. Treasury Inflation Indexed Notes-2.7% | | | | |

| 15,832,575 | | 2.500%,7/15/16 | | | 17,496,230 | |

| 12,764,885 | | 1.625%,1/15/18 | | | 13,967,580 | |

| 26,885,925 | | 1.375%,1/15/20 | | | 29,265,759 | |

| | | | | | |

| | | | | 60,729,569 | |

| | | | | | |

| | U.S. Treasury Notes-23.9% | | | | |

| 55,000,000 | | 2.625%,12/31/14 | | | 56,944,360 | |

| 70,000,000 | | 0.250%, 5/31/15 | | | 69,868,750 | |

| 50,000,000 | | 2.000%,1/31/16 | | | 51,875,000 | |

| 25,000,000 | | 0.250%, 5/15/16 | | | 24,730,475 | |

| 35,000,000 | | 1.000%, 9/30/16 | | | 35,226,940 | |

| 58,000,000 | | 4.625%, 2/15/17 | | | 65,648,750 | |

| 20,000,000 | | 1.500%, 8/31/18 | | | 20,050,000 | |

| 70,000,000 | | 2.750%, 2/15/19 | | | 74,467,960 | |

| 117,000,000 | | 2.625%, 11/15/20 | | | 121,835,376 | |

| 30,000,000 | | 1.750%, 5/15/23 | | | 28,078,140 | |

| | | | | | |

| | | | | 548,725,751 | |

| | | | | | |

TOTAL U.S. TREASURY BONDS & NOTES | | | | |

(Cost $706,473,834) | | | 714,953,343 | |

| | | | | | |

| |

FOREIGN BONDS-2.7% | | | | |

| | Australia Government-0.4% | | | | |

| AUD 10,000,000 | | 5.250%, 3/15/19 | | | 10,102,796 | |

| | | | | | |

| | |

| See Notes to Financial Statements. | | |

| Annual Report | June 30, 2013 | | 13 |

| | |

| Schedule of Investments | | James Balanced: Golden Rainbow Fund |

June 30, 2013 | | |

| | | | | | |

| Shares or Principal Amount | | Value | |

| | Canada Government-0.5% | | | | |

| CAD 5,000,000 | | 3.750%, 6/1/19 | | | $5,218,123 | |

| CAD 5,000,000 | | 3.500%, 6/1/20 | | | 5,168,631 | |

| | | | | | |

| | | | | 10,386,754 | |

| | | | | | |

| | Denmark Government-0.4% | | | | |

| DKK 56,000,000 | | 1.500%, 11/15/23 | | | 9,436,451 | |

| | | | | | |

| | |

| | International Bank for Reconstruction & Development-0.2% | | | | |

| TRY 8,000,000 | | 6.000%, 7/23/15 | | | 4,060,352 | |

| | | | | | |

| | |

| | Netherlands Government-0.2% | | | | |

| EUR 3,000,000 | | 4.000%, 7/15/19 | | | 4,504,889 | |

| | | | | | |

| | |

| | Norway Government-0.4% | | | | |

| NOK 21,000,000 | | 4.500%, 5/22/19 | | | 3,924,222 | |

| NOK 28,000,000 | | 2.000%, 5/24/23 | | | 4,393,267 | |

| | | | | | |

| | | | | 8,317,489 | |

| | | | | | |

| | |

| | Queensland Treasury Corp.-0.2% | | | | |

| AUD 5,000,000 | | 6.000%, 10/14/15 | | | 4,889,266 | |

| | | | | | |

| | |

| | Sweden Government-0.4% | | | | |

| SEK 52,000,000 | | 5.000%, 12/1/20 | | | 9,373,694 | |

| | | | | | |

| |

TOTAL FOREIGN BONDS | | | | |

(Cost $60,877,278) | | | 61,071,691 | |

| | | | | | |

| |

MUNICIPAL BONDS-2.6% | | | | |

| | California-0.0%(c) | | | | |

| 1,000,000 | | Citrus Community College District General Obligation Unlimited Bonds, Series B, 4.750%, 6/1/31 | | | 1,049,770 | |

| | | | | | |

| | |

| | Colorado-0.1% | | | | |

| 1,000,000 | | Adams County School District No. 14 General Obligation Unlimited Bonds,

5.000%, 12/1/26 | | | 1,135,970 | |

| | | | | | |

| | |

| | Connecticut-0.3% | | | | |

| 5,350,000 | | State of Connecticut, Series B, 5.000%, 11/1/25 | | | 6,069,789 | |

| | | | | | |

| | |

| | Florida-0.1% | | | | |

| 1,000,000 | | Florida State Board of Education Capital Outlay General Obligation Bonds, Series D, 5.000%, 6/1/38 | | | 1,085,930 | |

| | | | | | |

| | |

| | Georgia-0.1% | | | | |

| 3,000,000 | | State of Georgia General Obligation Unlimited Bonds, Series B, 4.500%, 1/1/29 | | | 3,272,430 | |

| | | | | | |

| | |

| | Illinois-0.1% | | | | |

| 500,000 | | Kane & DeKalb Counties Community Unit School District No. 302 Kaneland General Obligation Unlimited Bonds (School Building), 5.500%, 2/1/28 | | | 537,340 | |

| 1,000,000 | | Village of Bolingbrook General Obligation Unlimited Bonds, 5.000%, 1/1/37 | | | 1,045,790 | |

| | | | | | |

| | | | | 1,583,130 | |

| | | | | | |

| | Maryland-0.2% | | | | |

| 5,000,000 | | County of Montgomery MD, 3.000%, 11/1/29 | | | 4,543,850 | |

| | | | | | |

| | |

| See Notes to Financial Statements. | | |

| 14 | | www.jamesfunds.com |

| | |

| James Balanced: Golden Rainbow Fund | | Schedule of Investments |

| | June 30, 2013 |

| | | | | | |

| Shares or Principal Amount | | Value | |

| | Massachusetts-0.1% | | | | |

| $1,000,000 | | Commonwealth of Massachusetts General Obligation Limited Bonds, Series C, 5.250%, 8/1/22 | | | $1,162,860 | |

| | | | | | |

| | |

| | Michigan-0.0%(c) | | | | |

| 1,000,000 | | Marysville Public School District General Obligation Unlimited Bonds (School Building & Site), 5.000%, 5/1/32 | | | 1,030,100 | |

| | | | | | |

| | |

| | Ohio-0.8% | | | | |

| 4,620,000 | | Columbus City School District Taxable Facilities & Improvement Build America Bonds, Series B, 6.150%, 12/1/33 | | | 4,869,850 | |

| 5,000,000 | | County of Cuyahoga OH, 4.000%, 12/1/37 | | | 4,695,250 | |

| 1,100,000 | | Miamisburg City School District General Obligation Unlimited Bonds (School Facilities Construction & Improvement), 5.000%, 12/1/33 | | | 1,182,346 | |

| 500,000 | | Mount Healthy City School District General Obligation Unlimited Bonds (School Improvement), 5.000%, 12/1/26 | | | 535,420 | |

| 1,000,000 | | Ohio State University General Recipients Revenue Bonds, 4.910%, 6/1/40 | | | 981,360 | |

| 1,000,000 | | Ohio State University General Recipients Revenue Bonds, Series A, 5.000%, 12/1/28 | | | 1,100,760 | |

| 500,000 | | Springboro Community City School District General Obligation Unlimited Bonds, 5.250%, 12/1/23 | | | 592,570 | |

| 1,000,000 | | State of Ohio General Obligation Unlimited Bonds, Series A, 5.375%, 9/1/28 | | | 1,124,310 | |

| 2,000,000 | | State of Ohio General Obligation Unlimited Bonds, Series B, 5.000%, 2/1/22 | | | 2,055,160 | |

| 1,000,000 | | Wright State University Revenue Bonds, 4.000%, 5/1/18 | | | 1,087,730 | |

| | | | | | |

| | | | | 18,224,756 | |

| | | | | | |

| | |

| | Texas-0.4% | | | | |

| 1,000,000 | | Friendswood Independent School District General Obligation Unlimited Bonds (Schoolhouse), 5.000%, 2/15/37 | | | 1,081,110 | |

| 1,000,000 | | Judson Independent School District General Obligation Unlimited Bonds (School Building), 5.000%, 2/1/37 | | | 1,042,140 | |

| 500,000 | | Lamar Consolidated Independent School District General Obligation Unlimited Bonds (Schoolhouse), 5.000%, 2/15/38 | | | 537,925 | |

| 5,335,000 | | Port of Houston Authority General Obligation Unlimited Bonds, Series D-1, 5.000%, 10/1/35 | | | 5,839,317 | |

| 1,000,000 | | Tyler Independent School District General Obligation Unlimited Bonds (School Building), 5.000%, 2/15/34 | | | 1,058,150 | |

| | | | | | |

| | | | | 9,558,642 | |

| | | | | | |

| | |

| | Washington-0.2% | | | | |

| 5,000,000 | | State of Washington General Obligation Unlimited Bonds, Series D, 4.000%, 2/1/37 | | | 4,682,750 | |

| | | | | | |

| | |

| | Wisconsin-0.2% | | | | |

| 5,000,000 | | State of Wisconsin General Obligation Unlimited Bonds, Series C, 5.000%, 5/1/25 | | | 5,666,750 | |

| | | | | | |

| |

TOTAL MUNICIPAL BONDS | | | | |

(Cost $59,635,270) | | | 59,066,727 | |

| | | | | | |

| |

SHORT TERM INVESTMENTS-6.5% | | | | |

| | Mutual Funds-2.1% | | | | |

| 48,257,162 | | First American Government Obligations Fund, 7-Day Yield 0.016% | | | 48,257,162 | |

| | | | | | |

| | |

| | U.S. Government Agency Securities-4.4% | | | | |

| $100,000,000 | | United States Treasury Bills, 0.098%, 2/6/14(d) | | | 99,949,600 | |

| | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS | | | | |

(Cost $148,197,579) | | | 148,206,762 | |

| | | | | | |

| | |

| See Notes to Financial Statements. | | |

| Annual Report | June 30, 2013 | | 15 |

| | |

| Schedule of Investments | | James Balanced: Golden Rainbow Fund |

June 30, 2013 | | |

| | | | |

TOTAL INVESTMENT SECURITIES-99.3% | | | | |

(Cost $2,022,772,532) | | $ | 2,275,932,267 | |

OTHER ASSETS IN EXCESS OF LIABILITIES-0.7% | | | 15,569,076 | |

| | | | |

NET ASSETS-100.0% | | $ | 2,291,501,343 | |

| | | | |

Percentages shown are based on Net Assets.

| * | Non-income producing security. |

| (a) | Variable rate security. Interest rate disclosed is that which is in effect at June 30, 2013. |

| (b) | Step bond. Coupon increases periodically based upon a predetermined schedule. Interest rate disclosed is that which is in effect at June 30, 2013. |

| (c) | Less than 0.05% of Net Assets |

| (d) | Rate shown represents the bond equivalent yield to maturity at date of purchase. |

AUD - Australian Dollar

BV - Besloten Vennootschap is the Dutch term for private limited liability company

CAD - Canadian Dollar

DKK - Danish Krone

ETF - Exchange Traded Fund

EUR - Euro

LLC - Limited Liability Company

LP - Limited Partnership

Ltd. - Limited

MSCI - Morgan Stanley Capital International

NOK - Norwegian Krone

NV - Naamloze Vennootschap is the Dutch term for a public limited liability corporation

PLC - Public Limited Company

REIT - Real Estate Investment Trust

S&P - Standard & Poor’s

SEK - Swedish Krona

SPDR - Standard & Poor’s Depositary Receipts

TRY - Turkish Lira

| | |

| Foreign Bonds Securities Allocation | | |

| | | % of Net Assets |

Europe | | 1.0% |

Europe - Euro | | 0.6% |

Asia - Pacific | | 0.6% |

North America | | 0.5% |

| | |

| | 2.7% |

| | |

| | |

| See Notes to Financial Statements. | | |

| 16 | | www.jamesfunds.com |

| | |

| James Small Cap Fund | | Schedule of Investments |

| | June 30, 2013 |

| | | | | | |

| Shares or Principal Amount | | Value | |

COMMON STOCKS-92.6% | | | | |

| | Basic Materials-7.4% | | | | |

| 38,545 | | Aceto Corp. | | | $536,932 | |

| 75,860 | | Cooper Tire & Rubber Co. | | | 2,516,276 | |

| 68,855 | | Innospec, Inc. | | | 2,766,594 | |

| 126,340 | | Lydall, Inc.* | | | 1,844,564 | |

| 50,376 | | Material Sciences Corp.* | | | 506,783 | |

| 22,194 | | Neenah Paper, Inc. | | | 705,103 | |

| 78,760 | | PH Glatfelter Co. | | | 1,976,876 | |

| 33,800 | | Worthington Industries, Inc. | | | 1,071,798 | |

| | | | | | |

| | | | | 11,924,926 | |

| | | | | | |

| | |

| | Consumer, Cyclical-14.1% | | | | |

| 46,060 | | 1-800-Flowers.com, Inc., Class A* | | | 285,111 | |

| 6,021 | | Bassett Furniture Industries, Inc. | | | 93,506 | |

| 11,960 | | Courier Corp. | | | 170,789 | |

| 26,500 | | Destination Maternity Corp. | | | 651,900 | |

| 36,830 | | Dorman Products, Inc. | | | 1,680,553 | |

| 14,511 | | Flexsteel Industries, Inc. | | | 353,778 | |

| 40,720 | | Fred’s, Inc., Class A | | | 630,753 | |

| 125,890 | | Haverty Furniture Cos., Inc. | | | 2,896,729 | |

| 38,750 | | Kona Grill, Inc.* | | | 454,150 | |

| 96,180 | | La-Z-Boy, Inc. | | | 1,949,569 | |

| 390,045 | | LeapFrog Enterprises, Inc.* | | | 3,838,043 | |

| 25,360 | | Meritage Homes Corp.* | | | 1,099,610 | |

| 125,730 | | Myers Industries, Inc. | | | 1,887,207 | |

| 37,830 | | PC Connection, Inc. | | | 584,473 | |

| 27,705 | | Rocky Brands, Inc. | | | 418,900 | |

| 176,725 | | Sinclair Broadcast Group, Inc., Class A | | | 5,192,180 | |

| 13,530 | | Susser Holdings Corp.* | | | 647,816 | |

| | | | | | |

| | | | | 22,835,067 | |

| | | | | | |

| | |

| | Consumer, Non-cyclical-10.7% | | | | |

| 12,765 | | Alico, Inc. | | | 512,004 | |

| 27,200 | | Andersons, Inc. | | | 1,446,768 | |

| 184,200 | | Carriage Services, Inc. | | | 3,122,190 | |

| 19,760 | | G&K Services, Inc., Class A | | | 940,576 | |

| 9,316 | | Libbey, Inc.* | | | 223,304 | |

| 109,195 | | LifePoint Hospitals, Inc.* | | | 5,333,084 | |

| 8,465 | | Nature’s Sunshine Products, Inc. | | | 138,403 | |

| 35,320 | | Seneca Foods Corp., Class A* | | | 1,083,618 | |

| 98,100 | | Toro Co. | | | 4,454,721 | |

| | | | | | |

| | | | | 17,254,668 | |

| | | | | | |

| | |

| | Energy-7.6% | | | | |

| 11,220 | | Adams Resources & Energy, Inc. | | | 772,946 | |

| 68,120 | | Alon USA Energy, Inc. | | | 985,015 | |

| 20,206 | | Blueknight Energy Partners LP | | | 171,145 | |

| 34,700 | | Calumet Specialty Products Partners LP | | | 1,262,386 | |

| 113,960 | | Delek US Holdings, Inc. | | | 3,279,769 | |

| 143,225 | | EPL Oil & Gas, Inc.* | | | 4,205,086 | |

| 35,509 | | Star Gas Partners LP | | | 173,639 | |

| 15,780 | | Sunoco Logistics Partners LP | | | 1,009,131 | |

| | |

| See Notes to Financial Statements. | | |

| Annual Report | June 30, 2013 | | 17 |

| | |

| Schedule of Investments | | James Small Cap Fund |

June 30, 2013 | | |

| | | | | | |

| Shares or Principal Amount | | Value | |

| | Energy (continued) | | | | |

| 53,836 | | TGC Industries, Inc. | | | $442,532 | |

| | | | | | |

| | | | | 12,301,649 | |

| | | | | | |

| | Financial-13.0% | | | | |

| 2,437 | | Altisource Asset Management Corp.* | | | 657,990 | |

| 8,124 | | Altisource Residential Corp., Class B* | | | 135,589 | |

| 89,250 | | American Financial Group, Inc. | | | 4,365,217 | |

| 13,080 | | AmTrust Financial Services, Inc. | | | 466,956 | |

| 11,150 | | BofI Holding, Inc.* | | | 510,893 | |

| 27,270 | | Coinstar, Inc.* | | | 1,599,931 | |

| 24,245 | | ePlus, Inc. | | | 1,452,033 | |

| 14,540 | | Federal Agricultural Mortgage Corp., Class C | | | 419,915 | |

| 14,893 | | HCI Group, Inc. | | | 457,513 | |

| 620 | | Investors Title Co. | | | 43,983 | |

| 39,090 | | MainSource Financial Group, Inc. | | | 524,979 | |

| 58,140 | | National Financial Partners Corp.* | | | 1,471,523 | |

| 23,265 | | Nicholas Financial, Inc. | | | 351,767 | |

| 24,960 | | Peoples Bancorp, Inc. | | | 526,157 | |

| 133,645 | | Rent-A-Center, Inc. | | | 5,018,370 | |

| 45,649 | | Southside Bancshares, Inc. | | | 1,090,092 | |

| 20,920 | | World Acceptance Corp.* | | | 1,818,785 | |

| | | | | | |

| | | | | 20,911,693 | |

| | | | | | |

| | |

| | Industrial-12.9% | | | | |

| 81,145 | | Alamo Group, Inc. | | | 3,312,339 | |

| 28,410 | | AMERCO | | | 4,599,579 | |

| 59,140 | | Celadon Group, Inc. | | | 1,079,305 | |

| 77,640 | | Dana Holding Corp. | | | 1,495,346 | |

| 49,850 | | Franklin Electric Co., Inc. | | | 1,677,453 | |

| 14,485 | | Park-Ohio Holdings Corp.* | | | 477,715 | |

| 23,922 | | SORL Auto Parts, Inc.* | | | 62,197 | |

| 12,465 | | Standex International Corp. | | | 657,529 | |

| 46,447 | | StealthGas, Inc.* | | | 510,917 | |

| 3,038 | | Strattec Security Corp. | | | 113,500 | |

| 132,057 | | Sturm Ruger & Co., Inc. | | | 6,344,018 | |

| 23,680 | | Supreme Industries, Inc., Class A* | | | 118,400 | |

| 17,634 | | UFP Technologies, Inc.* | | | 345,274 | |

| | | | | | |

| | | | | 20,793,572 | |

| | | | | | |

| | |

| | Technology-12.4% | | | | |

| 9,360 | | Alliant Techsystems, Inc. | | | 770,609 | |

| 11,610 | | Aware, Inc. | | | 60,372 | |

| 39,092 | | CalAmp Corp.* | | | 570,743 | |

| 21,780 | | CSG Systems International, Inc. | | | 472,626 | |

| 142,525 | | Deluxe Corp. | | | 4,938,491 | |

| 45,230 | | Gilat Satellite Networks, Ltd.* | | | 250,574 | |

| 95,190 | | Kulicke & Soffa Industries, Inc.* | | | 1,052,801 | |

| 86,271 | | Lionbridge Technologies, Inc.* | | | 250,186 | |

| 197,345 | | Mentor Graphics Corp. | | | 3,858,095 | |

| 28,470 | | NetSol Technologies, Inc.* | | | 286,408 | |

| 44,940 | | PDL BioPharma, Inc. | | | 346,937 | |

| 16,430 | | Perion Network, Ltd.* | | | 188,123 | |

| | |

| See Notes to Financial Statements. | | |

| 18 | | www.jamesfunds.com |

| | |

| James Small Cap Fund | | Schedule of Investments |

| | June 30, 2013 |

| | | | | | |

| Shares or Principal Amount | | Value | |

| | Technology (continued) | | | | |

| 87,150 | | Triumph Group, Inc. | | | $6,897,923 | |

| | | | | | |

| | | | | 19,943,888 | |

| | | | | | |

| | |

| | Utilities-14.5% | | | | |

| 115,550 | | Cleco Corp. | | | 5,364,986 | |

| 143,445 | | El Paso Electric Co. | | | 5,065,043 | |

| 56,140 | | Laclede Group, Inc. | | | 2,563,352 | |

| 65,995 | | NorthWestern Corp. | | | 2,633,201 | |

| 93,120 | | PNM Resources, Inc. | | | 2,066,333 | |

| 130,635 | | Portland General Electric Co. | | | 3,996,125 | |

| 8,894 | | Shenandoah Telecommunications Co. | | | 148,352 | |

| 538,170 | | Vonage Holdings Corp. * | | | 1,523,021 | |

| | | | | | |

| | | | | 23,360,413 | |

| | | | | | |

| |

TOTAL COMMON STOCKS | | | | |

(Cost $107,760,624) | | | 149,325,876 | |

| | | | | | |

| |

SHORT TERM INVESTMENTS-7.1% | | | | |

| | Mutual Funds-4.3% | | | | |

| 6,904,824 | | First American Government Obligations Fund, 7-Day Yield 0.016% | | | 6,904,824 | |

| | | | | | |

| | |

| | U.S. Government Agency Securities-2.8% | | | | |

| $4,500,000 | | United States Treasury Bills, 0.060%, 11/14/13(a) | | | 4,498,852 | |

| | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS | | | | |

(Cost $11,403,804) | | | 11,403,676 | |

| | | | | | |

| |

TOTAL INVESTMENT SECURITIES-99.7% | | | | |

(Cost $119,164,428) | | | 160,729,552 | |

OTHER ASSETS IN EXCESS OF LIABILITIES-0.3% | | | 541,653 | |

| | | | | | |

NET ASSETS-100.0% | | | $161,271,205 | |

| | | | | | |

Percentages shown are based on Net Assets.

| * | Non-income producing security. |

| (a) | Rate shown represents the bond equivalent yield to maturity at date of purchase. |

LP - Limited Partnership

Ltd. - Limited

| | |

| See Notes to Financial Statements. | | |

| Annual Report | June 30, 2013 | | 19 |

| | |

| Schedule of Investments | | James Mid Cap Fund |

June 30, 2013 | | |

| | | | | | |

| Shares or Principal Amount | | Value | |

COMMON STOCKS-92.6% | | | | |

| | Basic Materials-11.1% | | | | |

| 7,500 | | Buckeye Technologies, Inc. | | | $277,800 | |

| 13,000 | | Huntsman Corp. | | | 215,280 | |

| 1,000 | | NewMarket Corp. | | | 262,560 | |

| 10,000 | | Olin Corp. | | | 239,200 | |

| 15,500 | | PolyOne Corp. | | | 384,090 | |

| 8,000 | | Worthington Industries, Inc. | | | 253,680 | |

| | | | | | |

| | | | | 1,632,610 | |

| | | | | | |

| | Consumer, Cyclical-11.7% | | | | |

| 8,250 | | Alaska Air Group, Inc. | | | 429,000 | |

| 5,000 | | Dillard’s, Inc., Class A | | | 409,850 | |

| 6,500 | | Foot Locker, Inc. | | | 228,345 | |

| 15,000 | | KB Home | | | 294,450 | |

| 10,000 | | RR Donnelley & Sons Co. | | | 140,100 | |

| 15,000 | | Steelcase, Inc., Class A | | | 218,700 | |

| | | | | | |

| | | | | 1,720,445 | |

| | | | | | |

| | Consumer, Non-cyclical-13.7% | | | | |

| 15,000 | | Dean Foods Co.* | | | 150,300 | |

| 4,125 | | Ingredion, Inc. | | | 270,683 | |

| 10,000 | | Newell Rubbermaid, Inc. | | | 262,500 | |

| 75 | | Seaboard Corp. | | | 203,100 | |

| 6,400 | | Toro Co. | | | 290,624 | |

| 7,225 | | Tupperware Brands Corp. | | | 561,310 | |

| 10,325 | | Tyson Foods, Inc., Class A | | | 265,146 | |

| | | | | | |

| | | | | 2,003,663 | |

| | | | | | |

| | Energy-5.7% | | | | |

| 8,250 | | HollyFrontier Corp. | | | 352,935 | |

| 9,300 | | Tesoro Corp. | | | 486,576 | |

| | | | | | |

| | | | | 839,511 | |

| | | | | | |

| | Financial-14.8% | | | | |

| 8,775 | | American Financial Group, Inc. | | | 429,185 | |

| 8,000 | | Aspen Insurance Holdings, Ltd. | | | 296,720 | |

| 4,125 | | Home Properties, Inc., REIT | | | 269,651 | |

| 11,350 | | Nelnet, Inc., Class A | | | 409,622 | |

| 6,825 | | Protective Life Corp. | | | 262,148 | |

| 13,425 | | Rent-A-Center, Inc. | | | 504,109 | |

| | | | | | |

| | | | | 2,171,435 | |

| | | | | | |

| | Industrial-17.2% | | | | |

| 7,225 | | AGCO Corp. | | | 362,622 | |

| 3,000 | | AMERCO | | | 485,700 | |

| 11,625 | | Jarden Corp.* | | | 508,594 | |

| 6,700 | | Timken Co. | | | 377,076 | |

| 6,000 | | Trinity Industries, Inc. | | | 230,640 | |

| 8,250 | | TRW Automotive Holdings Corp.* | | | 548,130 | |

| | | | | | |

| | | | | 2,512,762 | |

| | | | | | |

| | |

| See Notes to Financial Statements. | | |

| 20 | | www.jamesfunds.com |

| | |

| James Mid Cap Fund | | Schedule of Investments |

| | June 30, 2013 |

| | | | | | |

| Shares or Principal Amount | | Value | |

| | Technology-9.9% | | | | |

| 34,525 | | Amkor Technology, Inc.* | | | $145,350 | |

| 7,750 | | Arrow Electronics, Inc.* | | | 308,837 | |

| 13,950 | | Deluxe Corp. | | | 483,368 | |

| 25,500 | | LSI Corp.* | | | 182,070 | |

| 4,125 | | Triumph Group, Inc. | | | 326,494 | |

| | | | | | |

| | | | | 1,446,119 | |

| | | | | | |

| | |

| | Utilities-8.5% | | | | |

| 15,550 | | CMS Energy Corp. | | | 422,493 | |

| 4,975 | | DTE Energy Co. | | | 333,375 | |

| 8,000 | | Portland General Electric Co. | | | 244,720 | |

| 7,000 | | Vectren Corp. | | | 236,810 | |

| | | | | | |

| | | | | 1,237,398 | |

| | | | | | |

| |

TOTAL COMMON STOCKS | | | | |

(Cost $9,903,710) | | | 13,563,943 | |

| | | | | | |

| |

EXCHANGE TRADED FUNDS-1.7% | | | | |

| 3,100 | | iShares® Cohen & Steers Realty Majors Index Fund | | | 249,922 | |

| | | | | | |

| |

TOTAL EXCHANGE TRADED FUNDS | | | | |

(Cost $217,510) | | | 249,922 | |

| | | | | | |

| |

SHORT TERM INVESTMENTS-9.1% | | | | |

| | Mutual Funds-5.6% | | | | |

| 822,901 | | First American Government Obligations Fund, 7-Day Yield 0.016% | | | 822,901 | |

| | | | | | |

| | |

| | U.S. Government Agency Securities-3.5% | | | | |

| $500,000 | | United States Treasury Bills, 0.046%, 11/14/13(a) | | | 499,873 | |

| | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS | | | | |

(Cost $1,322,813) | | | 1,322,774 | |

| | | | | | |

| |

TOTAL INVESTMENT SECURITIES-103.4% | | | | |

(Cost $11,444,033) | | | 15,136,639 | |

OTHER LIABILITIES IN EXCESS OF ASSETS-(3.4)% | | | (493,815) | |

| | | | | | |

NET ASSETS-100.0% | | | $14,642,824 | |

| | | | | | |

Percentages shown are based on Net Assets.

| * | Non-income producing security. |

| (a) | Rate shown represents the bond equivalent yield to maturity at date of purchase. |

Ltd. - Limited

REIT - Real Estate Investment Trust

| | |

| See Notes to Financial Statements. | | |

| Annual Report | June 30, 2013 | | 21 |

| | |

| Schedule of Investments | | James Micro Cap Fund |

June 30, 2013 | | |

| | | | | | |

| Shares | | | | Value | |

COMMON STOCKS-96.7% | | | | |

| | Basic Materials-10.1% | | | | |

| 26,220 | | Aceto Corp. | | | $365,245 | |

| 34,277 | | Material Sciences Corp.* | | | 344,827 | |

| 15,085 | | Neenah Paper, Inc. | | | 479,250 | |

| | | | | | |

| | | | | 1,189,322 | |

| | | | | | |

| | Consumer, Cyclical-17.3% | | | | |

| 31,340 | | 1-800-Flowers.com, Inc., Class A* | | | 193,995 | |

| 4,094 | | Bassett Furniture Industries, Inc. | | | 63,580 | |

| 8,180 | | Courier Corp. | | | 116,810 | |

| 9,874 | | Flexsteel Industries, Inc. | | | 240,728 | |

| 26,500 | | Kona Grill, Inc.* | | | 310,580 | |

| 25,715 | | PC Connection, Inc. | | | 397,297 | |

| 18,853 | | Rocky Brands, Inc. | | | 285,057 | |

| 9,202 | | Susser Holdings Corp.* | | | 440,592 | |

| | | | | | |

| | | | | 2,048,639 | |

| | | | | | |

| | Consumer, Non-cyclical-9.4% | | | | |

| 8,680 | | Alico, Inc. | | | 348,155 | |

| 30,781 | | Carriage Services, Inc. | | | 521,738 | |

| 6,386 | | Libbey, Inc.* | | | 153,072 | |

| 5,760 | | Nature’s Sunshine Products, Inc. | | | 94,176 | |

| | | | | | |

| | | | | 1,117,141 | |

| | | | | | |

| | Energy-9.0% | | | | |

| 7,620 | | Adams Resources & Energy, Inc. | | | 524,942 | |

| 13,809 | | Blueknight Energy Partners LP | | | 116,962 | |

| 24,290 | | Star Gas Partners LP | | | 118,778 | |

| 36,591 | | TGC Industries, Inc. | | | 300,778 | |

| | | | | | |

| | | | | 1,061,460 | |

| | | | | | |

| | Financial-24.7% | | | | |

| 7,580 | | BofI Holding, Inc.* | | | 347,315 | |

| 16,490 | | ePlus, Inc. | | | 987,586 | |

| 9,880 | | Federal Agricultural Mortgage Corp., Class C | | | 285,334 | |

| 10,128 | | HCI Group, Inc. | | | 311,132 | |

| 420 | | Investors Title Co. | | | 29,795 | |

| 26,560 | | MainSource Financial Group, Inc. | | | 356,701 | |

| 15,922 | | Nicholas Financial, Inc. | | | 240,741 | |

| 16,960 | | Peoples Bancorp, Inc. | | | 357,517 | |

| | | | | | |

| | | | | 2,916,121 | |

| | | | | | |

| | Industrial-14.8% | | | | |

| 9,860 | | Park-Ohio Holdings Corp.* | | | 325,183 | |

| 16,266 | | SORL Auto Parts, Inc.* | | | 42,291 | |

| 8,485 | | Standex International Corp. | | | 447,584 | |

| 31,598 | | StealthGas, Inc.* | | | 347,578 | |

| 2,066 | | Strattec Security Corp. | | | 77,186 | |

| 4,130 | | Sturm Ruger & Co., Inc. | | | 198,405 | |

| 16,101 | | Supreme Industries, Inc., Class A* | | | 80,505 | |

| | |

| See Notes to Financial Statements. | | |

| 22 | | www.jamesfunds.com |

| | |

| James Micro Cap Fund | | Schedule of Investments |

| | June 30, 2013 |

| | | | | | |

| Shares | | | | Value | |

| | Industrial (continued) | | | | |

| 12,004 | | UFP Technologies, Inc.* | | | $235,038 | |

| | | | | | |

| | | | | 1,753,770 | |

| | | | | | |

| | |

| | Technology-9.3% | | | | |

| 7,900 | | Aware, Inc. | | | 41,080 | |

| 26,592 | | CalAmp Corp.* | | | 388,243 | |

| 30,940 | | Gilat Satellite Networks, Ltd.* | | | 171,408 | |

| 58,701 | | Lionbridge Technologies, Inc.* | | | 170,233 | |

| 19,480 | | NetSol Technologies, Inc.* | | | 195,969 | |

| 11,180 | | Perion Network, Ltd.* | | | 128,011 | |

| | | | | | |

| | | | | 1,094,944 | |

| | | | | | |

| | |

| | Utilities-2.1% | | | | |

| 6,050 | | Shenandoah Telecommunications Co. | | | 100,914 | |

| 51,040 | | Vonage Holdings Corp.* | | | 144,443 | |

| | | | | | |

| | | | | 245,357 | |

| | | | | | |

| |

TOTAL COMMON STOCKS | | | | |

(Cost $ 7,614,326) | | | 11,426,754 | |

| | | | | | |

| |

SHORT TERM INVESTMENTS-3.4% | | | | |

| | Mutual Funds-3.4% | | | | |

| 398,855 | | First American Government Obligations Fund, 7-Day Yield 0.016% | | | 398,855 | |

| | | | | | |

| |

TOTAL SHORT TERM INVESTMENTS | | | | |

(Cost $ 398,855) | | | 398,855 | |

| | | | | | |

| |

TOTAL INVESTMENT SECURITIES-100.1% | | | | |

(Cost $ 8,013,181) | | | 11,825,609 | |

OTHER LIABILITIES IN EXCESS OF ASSETS-(0.1)% | | | (8,782) | |

| | | | | | |

NET ASSETS-100.0% | | | $11,816,827 | |

| | | | | | |

Percentages shown are based on Net Assets.

| * | Non-income producing security. |

LP - Limited Partnership

Ltd. - Limited

| | |

| See Notes to Financial Statements. | | |

| Annual Report | June 30, 2013 | | 23 |

| | |

| Schedule of Investments | | James Long-Short Fund |

June 30, 2013 | | |

| | | | | | |

| Shares | | | | Value | |

COMMON STOCKS-94.4% | | | | |

| | Basic Materials-10.1% | | | | |

| 16,230 | | Aceto Corp. | | | $226,084 | |

| 14,510 | | Buckeye Technologies, Inc.(a) | | | 537,451 | |

| 1,170 | | CF Industries Holdings, Inc.(a) | | | 200,655 | |

| 8,690 | | Cooper Tire & Rubber Co. | | | 288,247 | |

| 6,620 | | Olin Corp. | | | 158,350 | |

| 5,590 | | Worthington Industries, Inc. | | | 177,259 | |

| | | | | | |

| | | | | 1,588,046 | |

| | | | | | |

| | |

| | Consumer, Cyclical-14.5% | | | | |

| 5,110 | | Alaska Air Group, Inc. | | | 265,720 | |

| 5,310 | | Dillard’s, Inc., Class A(a) | | | 435,261 | |

| 15,150 | | LeapFrog Enterprises, Inc.* | | | 149,076 | |

| 20,045 | | Sinclair Broadcast Group, Inc., Class A(a) | | | 588,922 | |

| 13,720 | | Southwest Airlines Co. | | | 176,851 | |

| 2,705 | | Target Corp. | | | 186,266 | |

| 2,500 | | Viacom, Inc., Class A(a) | | | 171,100 | |

| 3,995 | | Wal-Mart Stores, Inc. | | | 297,588 | |

| | | | | | |

| | | | | 2,270,784 | |

| | | | | | |

| | |

| | Consumer, Non-cyclical-13.8% | | | | |

| 9,915 | | Eli Lilly & Co.(a) | | | 487,025 | |

| 3,560 | | Merck & Co., Inc. | | | 165,362 | |

| 19,475 | | Pfizer, Inc.(a) | | | 545,494 | |

| 3,280 | | Toro Co.(a) | | | 148,945 | |

| 8,500 | | UnitedHealth Group, Inc.(a) | | | 556,580 | |

| 3,710 | | USANA Health Sciences, Inc.* | | | 268,530 | |

| | | | | | |

| | | | | 2,171,936 | |

| | | | | | |

| | |

| | Energy-9.3% | | | | |

| 3,705 | | Chevron Corp.(a) | | | 438,450 | |

| 10,475 | | HollyFrontier Corp.(a) | | | 448,120 | |

| 10,915 | | Tesoro Cor.(a) | | | 571,073 | |

| | | | | | |

| | | | | 1,457,643 | |

| | | | | | |

| | |

| | Financial-13.9% | | | | |

| 5,280 | | CBL & Associates Properties, Inc., REIT | | | 113,098 | |

| 27,590 | | Fifth Third Bancorp | | | 497,999 | |

| 3,830 | | JPMorgan Chase & Co. | | | 202,186 | |

| 20,570 | | KeyCorp | | | 227,093 | |

| 5,760 | | PNC Financial Services Group, Inc.(a) | | | 420,019 | |

| 9,595 | | Protective Life Corp. | | | 368,544 | |

| 8,222 | | Southside Bancshares, Inc. | | | 196,336 | |

| 2,030 | | Travelers Cos., Inc. | | | 162,238 | |

| | | | | | |

| | | | | 2,187,513 | |

| | | | | | |

| | |

| | Industrial-10.1% | | | | |

| 3,790 | | AGCO Corp. | | | 190,220 | |

| 1,510 | | AMERCO(a) | | | 244,469 | |

| 1,040 | | NACCO Industries, Inc., Class A | | | 59,571 | |

| 11,445 | | Sturm Ruger & Co., Inc.(a) | | | 549,818 | |

| 2,265 | | Timken Co. | | | 127,474 | |

| | |

| See Notes to Financial Statements. | | |

| 24 | | www.jamesfunds.com |

| | |

| James Long-Short Fund | | Schedule of Investments |

| | June 30, 2013 |

| | | | | | |

| Shares | | | | Value | |

| | Industrial (continued) | | | | |

| 3,030 | | TRW Automotive Holdings Corp.* | | | $201,313 | |

| 4,070 | | United Rentals, Inc.* | | | 203,134 | |

| | | | | | |

| | | | | 1,575,999 | |

| | | | | | |

| | |

| | Technology-13.0% | | | | |

| 12,305 | | Deluxe Corp.(a) | | | 426,368 | |