September 30, 2011

Suzanne Hayes

Assistant Director

United States Securities and Exchange Commission

Washington, D.C. 20549

| | Re: | Canadian Imperial Bank of Commerce |

| | | Form 40-F for the Fiscal Year Ended October 31, 2010 |

| | | Filed May 26, 2011 and July 29, 2011 |

Dear Ms. Hayes:

Thank you for your letter dated August 30, 2011, addressed to Kevin Glass of Canadian Imperial Bank of Commerce (“we”, “us”, “CIBC” or “the Company”), setting forth comments of the staff of the Division of Corporation Finance (the “Staff”) on CIBC’s Form 40-F for the fiscal year ended October 31, 2010 filed on December 6, 2010 and Forms 6-K filed on May 26, 2011 and July 29, 2011.

We appreciate the effort that went into the Staff’s comments. We have provided our responses in the order the comments appeared in the Staff’s comment letter, which we have reproduced in bold face text. Our responses follow each comment.

1

Form 40-F filed December 6, 2010

Exhibit B.3(b) - Audited annual financial statements for the year ended October 31, 2010

Note 6 Securitizations and Variable Interest Entities, page 133

| 1. | We note here that you securitize insured residential mortgage loans through the creation of MBS under the Canadian Mortgage Bond program. |

The securitization process that we follow for our residential mortgage loans is a two-step process:

First, residential mortgage loans that we originate are pooled together based on criteria laid out by the Canada Mortgage and Housing Corporation (“CMHC”) and then assigned to the CMHC, under a legal process specified within the National Housing Act (“NHA”) Mortgage Backed Securities (“MBS”) Program, in exchange for a mortgage-backed security.

In the second step, these mortgage-backed securities may then be sold to the Canada Housing Trust (“CHT”) which in turn issues a Canada Mortgage Bond (“CMB”) to external investors to fund the purchase of the mortgage-backed securities.

Please address the following:

| | Ÿ | | For your residential mortgage loans, tell us and revise your future filings to disclose whether you or the borrower is required to obtain mortgage loan insurance. If the response depends on the terms of the loan then clearly state this and discuss the key terms that drive mortgage insurance like the loan to value ratio. |

Specific mortgage insurance requirements are covered under the Bank Act (Canada) (the “Act”) which regulates financial institutions. Under the Act, we are permitted to originate mortgages meeting specified credit criteria including those with a loan-to-value (“LTV”) ratio of less than 80% at origination, without requiring the mortgagor (or borrower) to obtain mortgage insurance. Where mortgage loans do not meet these specified credit criteria, the Act requires the mortgagors to obtain individual mortgage insurance. The mortgages which require insurance must be insured either by the CMHC or a qualifying mortgage insurance company that meets certain requirements laid out by the CMHC. The majority of our mortgages are insured by the CMHC.

As mentioned above, in order to access the NHA MBS Program we need to first pool qualifying mortgages based on criteria laid out by the CMHC. If we intend to sell the mortgage-backed security to CHT one of those criteria is

2

insurance. Those mortgages with a LTV ratio of greater than 80% are insured by the borrower who owns the insurance. The borrower can take the insurance to another mortgage provider if they decide to repay the mortgage provided by CIBC and refinance with another financial institution. Those mortgages with a LTV ratio of less than 80%, and which are part of a mortgage-backed security to be sold to the CHT, are insured under portfolio insurance purchased by CIBC, mainly from the CMHC. This insurance remains the property of CIBC and can be reallocated to any new qualifying mortgages that may be used to “top-up” the program.

We will revise future filings to provide this information.

| | Ÿ | | Explain to us the insurance claims process for both your residential mortgage loans held and those securitized under the Canadian Mortgage Bond program. In addition, tell us and revise to disclose in future filings where applicable if any of the mortgage insurance policies provide less than 100% protection against credit losses. |

The insurance claims process is not related to the CMB program in any way. The process is dictated by guidance laid out by the CMHC and is the same whether the mortgage is part of a mortgage-backed security ultimately sold to the CHT or not.

The insurance claim for credit losses incurred on mortgage loans requires CIBC to work with the borrower for a certain period of time to assess whether the credit problems can be resolved. Once it is determined that no resolution can be arrived at with the borrower, the process follows specified legal steps which could ultimately lead to CIBC being given the right to take ownership of the property and the right to sell it. CIBC must make all reasonable efforts to sell the property for market value. Once the property is sold, CIBC submits an insurance claim to the CMHC or the insurance company for any deficiency. CMHC or the insurance company then pays CIBC in the normal course.

Mortgage insurance covers 100% of incurred losses, including all reasonable legal and other direct costs incurred to recover the mortgage balance.

We will revise future filings to provide this information.

| | Ÿ | | Tell us and revise to disclose in future filings whether, as an issuer and servicer of these loans, you have to cover any shortfall in the amount collected from the mortgagor, and if so, are these amounts fully reimbursed by the government or government agency that guarantees the securities or the insurer of the mortgage loan. |

3

Under the NHA MBS Program, we are required to make timely payment of principal and interest on the mortgage-backed security that we securitize/sell as the issuer and servicer regardless of whether we collect these cash flows from the underlying mortgages. If we do not receive payment from the underlying mortgages in respect of interest and principal to permit ultimate payment to the mortgage-backed security holder, we submit a claim to the insurer and receive all owed interest and principal not recovered through the foreclosure and sale process. If there is a delay between receipt of the insurance payment and when the payment is made to the mortgage-backed security holder, CIBC is responsible for ensuring that payment is made to the mortgage-backed security holder.

In addition, where we hold third party mortgage-backed securities as an investor, if the issuer was unable to cover payment to us, the CMHC would be required to make the payment under the terms of the timely payment guarantee provided to the mortgage-backed security investor.

We will revise future filings to provide this information.

| | Ÿ | | Tell us and disclose in future filings if you have incurred losses on the residential mortgage loans securitized due to legal action on the default of the mortgage and the amount of losses incurred in year ended October 31, 2010. |

We had no losses, net of insurance claims, for the year ended October 31, 2010, on defaulted mortgage loans that we securitized. The insurance claim can include all reasonable legal costs as well as other direct costs in order to complete the process of foreclosure and sale of the property. Costs that are not considered reasonable may be precluded from any claim payment made in respect of defaulted mortgage loans, but these have been insignificant.

If this amount becomes significant in the future we will disclose it in future filings.

| 2. | We note your disclosure on page 133 that you securitize residential mortgage loans and you sell these securities. In addition, we note that you retain the responsibility for servicing the mortgages and you had a servicing liability of C$126 million at October 31, 2010. In an effort to provide clear and transparent disclosures on your securitization of loans and related servicing rights, please tell us and consider revising your disclosures in future filings to discuss how you determine the prepayment rate assumption for your valuation of the retained interest |

4

| | in the securitization structure. Also, for the securitization that had a 15% prepayment rate assumption, please tell us the total amount of loans securitized and the value of the retained interest and provide a description of the terms of the underlying residential mortgage loans. |

U.S. mortgages are typically 30-year open term mortgages, whereas most Canadian mortgages have 5-year terms and amortize to a balloon principal payment amount that must be refinanced by the mortgager (or borrower) at the end of the term, if not yet paid in full. The vast majority of Canadian fixed-rate mortgages include prepayment penalty provisions when the amount of prepayment is above a specified threshold. When the threshold is breached the prepayment penalty provisions require penalty payments to be made by the mortgagor to the lender in order to immunize the lender for lost interest and for associated administration costs. Variable rate mortgages also include a prepayment penalty.

History has shown, due to these penalties, that the decision to prepay is largely a non-economic decision made by the mortgagor and is driven more by life events such as death, divorce or re-location. Consequently, the historically observed prepayment rates are quite stable with some minor variability for seasonality.

We develop our prepayment rate expectations by reviewing historical analysis of prepayment rates at the portfolio level for securitized mortgages, stratified by rate type (variable vs. fixed) and origination channel (branch vs. broker). This analysis also takes into account any available and relevant information at the time, including current and future interest rate movement scenarios and views. The portfolio prepayment rate in our model is a constant parameter that represents the long term average expected prepayment rate, factoring in seasonality.

On a quarterly basis, we review the prepayment rate estimates for each of the portfolios by comparing these estimates to the actual portfolio behavior to assess validity and to ensure the quality of the results. Realized portfolio prepayment rates should be within a 95% confidence band of the seasonally adjusted long-term prepayment average that is being used to ensure that the prepayment assumption is valid.

During fiscal 2010, we securitized $2.6 billion of mortgages that had a 15% prepayment rate assumption which generated a retained interest of $94 million. These were largely 5-year term variable rate mortgages.

We will revise future filings to provide this information.

5

Note 8 Goodwill, Software and Other Intangible Assets, page 137

| 3. | We note from your goodwill rollforward on page 137 that you have C$43 million of goodwill allocated to the Corporate and Other reporting unit. We note also your description of the Corporate and Other segment in Note 28. In addition, we note your disclosure on page 90 within MD&A that Wealth Management and FirstCaribbean is a separate reporting unit for goodwill impairment test. Please tell us and consider revising future filings to present the goodwill rollforward at the same level that the impairment test is performed at, reporting unit, instead of the segment level. |

We conduct our goodwill impairment testing as at April 30 each year. As at October 31, 2010, the goodwill roll-forward by reporting unit was as follows:

| | | | | | | | | | | | | | | | | | | | |

$ millions, for the year ended October 31, 2010 | | CIBC

FirstCaribbean | | | Wealth

management | | | Capital

markets | | | Other | | | CIBC Total | |

Balance at beginning of year | | $ | 984 | | | $ | 878 | | | $ | 40 | | | $ | 95 | | | $ | 1,997 | |

Acquisitions | | | - | | | | - | | | | - | | | | 5 | | | | 5 | |

Dispositions | | | - | | | | - | | | | - | | | | (32 | ) | | | (32 | ) |

Adjustments(1) | | | (56 | ) | | | - | | | | - | | | | (1 | ) | | | (57 | ) |

Balance at end of year | | $ | 928 | | | $ | 878 | | | $ | 40 | | | $ | 67 | | | $ | 1,913 | |

| | (1) | Includes foreign currency translation adjustments. |

We will revise future filings to provide this information.

Note 28 Segmented and Geographic Information, page 166

| 4. | We note your disclosure beginning here regarding the recent changes in your segment allocations as well as the changes made in the first quarter of fiscal 2011. For purposes of providing greater transparency for the reader, please revise your future filings to more clearly disclose how both the specific and general allowance for loan losses as well as provision for credit losses are allocated to the segments. |

We will revise our future filings to include enhanced disclosure on how the specific and general allowances for loan losses, as well as provision for credit losses, are allocated to the segments. Also beginning fiscal year 2012, when we adopt IFRS, we will disclose how the individually assessed and collectively assessed allowances are allocated to the segments.

6

Note 30 Reconciliation of Canadian and U.S. Generally Accepted Accounting Principles, page 169

| 5. | We also note your disclosure that you believe the outcome of any legal proceedings, individually or in the aggregate, would not have a material adverse effect on your consolidated financial position, but could be material to your operating results. Please tell us and revise the appropriate section of your future filings to provide the disclosures required by ASC 450. As part of such disclosure, clearly disclose the range of reasonably possible loss in excess of amounts accrued or confirm in your disclosure that such amounts are not estimable. |

We will enhance our disclosure in future filings in substantially the following form:

“In the ordinary course of business, CIBC and its subsidiaries are routinely named as defendants in legal actions and regulatory matters. Claims for significant monetary damages are often asserted in many of these matters. It is inherently difficult to predict the eventual outcomes of such matters given their complexity and the particular facts and circumstances. However, on the basis of our current knowledge and understanding, we do not believe that judgments or settlements, if any, arising from these matters (either individually or in the aggregate, after giving effect to applicable reserves and insurance coverage), will have a material adverse effect on the consolidated financial position or liquidity of CIBC, although they could have a material effect on net income in a given period.

In view of the inherent unpredictability of outcomes in litigation and regulatory matters, particularly where: (i) the damages sought are substantial or indeterminate; (ii) the proceedings are in the early stages; or (iii) the matters involve novel legal theories or a large number of parties, there is considerable uncertainty concerning possible eventual loss, if any, associated with each such matter. In accordance with applicable accounting guidance, CIBC establishes reserves for litigation and regulatory matters when those matters proceed to a stage where they present loss contingencies that are both probable and reasonably estimable. In such cases, there may be a possible exposure to loss in excess of any amounts accrued. CIBC will continue to monitor such matters for developments that could affect the amount of the reserve, and will adjust the reserve amount as appropriate. If the loss contingency in question is not both probable and reasonably estimable, CIBC does not establish a reserve and the matter will continue to be monitored for any developments that would make the loss contingency both probable and reasonably estimable. CIBC believes that its

7

total accruals for legal proceedings are appropriate and in the aggregate, are not material to the consolidated financial position of CIBC, although future accruals could have a material effect on net income in a given period.

For certain of those matters described herein for which a loss contingency may, in the future, be reasonably possible (whether in excess of a related accrued liability or where there is no accrued liability), CIBC is currently unable to estimate a range of reasonably possible loss.

The actual cost of resolving legal claims may be substantially higher or lower than the amounts reserved for those claims. Although there can be no assurance as to the ultimate outcome, CIBC has generally denied, or believes we have a meritorious defence and will deny, liability in all significant litigation pending against us, including the matters described below, which we intend to defend vigorously:

Lehman Bros. Spec. Financing Inc. v. Bank of America Nat’l Ass’n, et al.

In the fourth quarter of 2008, we recognized a gain of $895 million (US$841 million), resulting from the reduction to zero of our unfunded commitment on a variable funding note (VFN) issued by a collateralized debt obligation (CDO). This reduction followed certain actions of the indenture trustee for the CDO following the September 15, 2008 bankruptcy filing of Lehman Brothers Holdings, Inc. (Lehman), the guarantor of a related credit default swap agreement with the CDO. In September 2010, just prior to the expiration of a statute of limitations, the Lehman Estate instituted an adversary proceeding against numerous financial institutions, indenture trustees and note holders, including CIBC, related to this and more than 40 other CDOs. The Lehman Estate seeks a declaration that the indenture trustee’s actions were improper and that CIBC remains obligated to fund the VFN. At the request of the Lehman Estate, the bankruptcy court issued an order staying all proceedings in the action until January 20, 2012.

Canadian Imperial Bank of Commerce v. Her Majesty the Queen (re: Enron)

On October 2, 2009 and March 17, 2010, the Canada Revenue Agency (CRA) issued reassessments disallowing the deduction of approximately $3.0 billion of the 2005 Enron settlement payments and related legal expenses. Also during the year ended October 31, 2010, the CRA proposed to disallow legal expenses related to 2006. On April 30, May 19, and September 9, 2010, we filed Notices of Appeal with the Tax Court of Canada. On September 30 and November 12, 2010, we received Replies from the Department of Justice which confirmed CRA’s reassessments. The matter is now in Canadian litigation. Should we successfully defend our tax filing position in its entirety, we would be able to

8

recognize an additional accounting tax benefit of $214 million and taxable refund interest of approximately $167 million. Should we fail to defend our position in its entirety, additional tax expense of approximately $865 million and non-deductible interest of approximately $128 million would be incurred.

Green v. Canadian Imperial Bank of Commerce, et al.

In July 2008, a shareholder plaintiff commenced this proposed class action in the Ontario Superior Court of Justice against CIBC and several former and current CIBC officers and directors. It alleges that CIBC and the individual officers and directors violated the Ontario Securities Act through material misrepresentations and non-disclosures relating to CIBC’s exposure to the U.S. sub-prime mortgage market. The plaintiffs instituted this action on behalf of all CIBC shareholders in Canada who purchased shares between May 31, 2007 and February 28, 2008. The action seeks damages of $1.7 billion under the Ontario Securities Act claim and $10 billion under the negligence claim. The plaintiffs’ motions for leave to file the statement of claim and for class certification are scheduled to be heard in February 2012.

Fresco v. Canadian Imperial Bank of Commerce

Gaudet v. Canadian Imperial Bank of Commerce

In June 2007, two proposed class actions were filed against CIBC in the Ontario Superior Court of Justice (Fresco v. CIBC) and in the Quebec Superior Court (Gaudet v. CIBC). Each makes identical claims for unpaid overtime for full-time, part-time, and retail frontline non-management employees. The Ontario action seeks $500 million in damages plus $100 million in punitive damages for all employees in Canada, while the Quebec action is limited to employees in Quebec and has been stayed pending the outcome of the Ontario action. In June 2009, in the Ontario action, the motion judge denied certification of the matter as a class action. In February 2010, the motion judge awarded CIBC $525,000 for its costs in defending the certification motion. In September 2010, the Ontario Divisional Court upheld the motion judge’s denial of the plaintiff’s certification motion and the award of costs to CIBC by a two to one majority. In January 2011, the Court of Appeal granted the plaintiff leave to appeal the decision denying certification. The appeal was heard in September 2011 and the court reserved decision.

Brown v. Canadian Imperial Bank of Commerce and CIBC World Markets Inc.

9

In 2008, this proposed class action was filed in the Ontario Superior Court of Justice against CIBC World Markets Inc. claiming $350 million for unpaid overtime on behalf of investment bankers, investment advisors, traders, analysts, and others. In 2009, the plaintiff amended the statement of claim adding CIBC as a co-defendant and adding a new plaintiff. The proposed amended class includes all analysts and investment advisors level 6 and above in Ontario who were not paid overtime or treated as eligible for overtime. The class certification motion is scheduled to be heard in January 2012.

VISA Credit Card Class Actions:

Marcotte v. Bank of Montreal, et al.

Corriveau v. Amex Bank of Canada, et al.

Lamoureux v. Bank of Montreal, et al.

St. Pierre v. Bank of Montreal, et al.

Marcotte v. Bank of Montreal, et al. (II)

Giroux v. Royal Bank of Canada, et al.

Since 2004, a number of proposed class actions have been filed in the Quebec Superior Court against CIBC and numerous other financial institutions. The actions, brought on behalf of cardholders, allege that the financial institutions are in breach of certain provisions of the Quebec Consumer Protection Act (“CPA”). The alleged violations include charging fees on foreign currency transactions, charging fees on cash advances, increasing credit limits without the cardholder’s express consent, and failing to allow a 21-day grace period before posting charges to balances upon which interest is calculated. CIBC and the other defendant banks are jointly raising a constitutional challenge to the CPA applying to them on the basis that banks are not required to comply with provincial legislation because banking and cost of borrowing disclosure is a matter of exclusive federal jurisdiction.

The first of these class actions, (Marcotte v. Bank of Montreal, et al.) which alleges that charging cardholders fees on foreign currency transactions violates the CPA, went to trial in 2008. In a decision released in June 2009 the trial judge found in favour of the plaintiffs concluding that the CPA is constitutionally applicable to federally regulated financial institutions and awarding damages against all the defendants. The court awarded compensatory damages against CIBC in the amount of $38 million plus an additional sum to be determined at a future date. The court awarded punitive damages against a number of the other defendants, but not against CIBC. CIBC and the other financial institutions have appealed this decision. The appeal was heard by the Quebec Court of Appeal in September 2011 and the court reserved decision.

Trial dates have not been scheduled for any of the other VISA credit card class actions.”

10

Income Taxes, page 171

| 6. | We note your disclosure on page 159 that if all foreign subsidiaries’ retained earnings were distributed to the Canadian parent as dividends that you would have a tax payable of C$231 million. We note that during the past three fiscal years you had capital repatriation activities. Also, we note your disclosure in Note 30 that the application of ASC 740 did not result in an adjustment to your Canadian GAAP financial statements. Please explain to us how you considered the guidance in ASC 740-30-25-2 related to undistributed earnings of a subsidiary in your U.S. GAAP reconciliation. |

The capital repatriation activities over the past three fiscal years consisted of repatriations of both capital and undistributed earnings of certain subsidiaries. The impacts of these transactions, incorporating foreign exchange movements in our investment in and undistributed earnings of foreign operations, and applicable foreign exchange (“FX”) hedging activities, were reflected in our Canadian GAAP consolidated statements of operations.

While there was significant tax expense related to the above repatriations, these taxes were mostly Canadian income tax paid in respect of FX hedges that CIBC had entered into in connection with the underlying investment in and undistributed earnings of the applicable foreign operations. Under Canadian GAAP, these foreign exchange and tax balances had been accumulated in the foreign currency translation adjustment component of AOCI and released proportionately into operating income (and correspondingly removed from AOCI) as repatriations occurred. Under U.S. GAAP, the amounts have remained in AOCI because the repatriations did not represent a substantial liquidation.

The tax payable noted on page 159 of our 2010 annual financial statements, relates to particular foreign subsidiaries’ undistributed earnings that have not been repatriated. These earnings constitute “taxable surplus” earnings and would attract Canadian tax only on repatriation to Canada. There is no intention to repatriate these particular earnings and they will remain invested in the foreign subsidiaries for the foreseeable future. Earnings that have been repatriated have typically been “exempt surplus” earnings, which do not attract additional Canadian tax on repatriation.

| 7. | We note your disclosure on page 160 that you have recognized an accounting tax benefit related to the 2005 Enron settlement payments and related legal expenses. In addition, we note that after several attempts to repeal the disallowance of these deductions you have been |

11

| | unsuccessful and are now proceeding to litigation. Please address the following: |

| | Ÿ | | Tell us and consider revising your future filings to disclose the amount of tax benefit you have recognized to date related to the Enron settlement payments and legal expenses for Canadian GAAP purposes. |

| | Ÿ | | We note your disclosure on page 172 that the application of ASC 740 did not result in any adjustment to your Canadian GAAP financial statements. Please tell us how you considered ASC 740-10-25 and the definition of more-likely-than-not in your initial recognition of the tax benefit referred to on page 160 in determining that no adjustment was warranted. |

| | Ÿ | | Tell us how you considered the guidance in ASC 740-10-35 upon receipt of the replies from the Department of Justice which confirmed Canada Revenue Agency’s reassessments. |

On Page 160 of our 2010 annual financial statements under the heading “Enron”, we discuss amounts relating to the Enron matter. As noted therein, as at October 31, 2010, we have an unrecognized tax benefit of $214 million and, should we fail to defend our position in its entirety, would need to book additional tax expense of approximately $865 million.

The cumulative tax benefit recognized in connection with Enron met the definition of “more-likely-than-not”. The amounts booked are supported by an external opinion received from our legal advisors.

We are currently in Canadian litigation on the Enron matter. We considered the reply from the Canadian Department of Justice (DOJ) in preparing our 2010 financial statements. The DOJ acts as legal counsel for Canada Revenue Agency (CRA) and we expect that they would “confirm” assessments issued by CRA. In our view, their confirmation is merely a formality and it added no new information that would result in us changing our tax provisioning.

Under Canadian GAAP, we are utilizing FASB Interpretation Number 48 to account for uncertain tax positions, and, accordingly there are no tax measurement uncertainty differences in our U.S. GAAP reconciliation.

Accounting for non-controlling interests, page 176

12

| 8. | We note your disclosure here that the adoption of ASC 810 (SFAS 160) resulted in C$168 million of non-controlling interests being reclassified from liabilities to shareholders’ equity. In addition, we note your discussion of the presentation of non-controlling interests in the statement of operations, but we were unable to locate this presentation in the condensed consolidated statement of operations on page 170. Please tell us how you complied with the presentation guidance in ASC 810-10-45-16. |

We will revise future filings to present the amount of consolidated net income attributable to common shareholders and to non-controlling interests separately on the face of the U.S. GAAP consolidated statement of operations.

Specifically, in the reconciliation of our consolidated statement of operations, we will gross-up the U.S. GAAP net income by excluding the non-controlling interests. We will then include the non-controlling interests in a separate line item as an offsetting adjustment to determine the U.S. GAAP net income available to common shareholders. For the year ended October 31, 2010 or the six month period ended April 30, 2011, this revision would not have had any impact on the ultimate net income attributable to CIBC’s common shareholders based on U.S. GAAP.

Disclosures about post-retirement benefit plan assets, page 177

| 9. | We note your disclosure on page 177 that the majority of the post-retirement benefit plan disclosures required by ASC 715-20-50 were presented in Note 22. In addition, we note the disclosures in Note 22 including the discussion of the investment policy. Please revise future filings either here or in Note 22 to include the following disclosures required by ASC 715-20-50-1(d): |

| | Ÿ | | In greater detail discuss how investment allocation decisions are made, including the factors that are pertinent to an understanding of investment policies and strategies; |

We will revise future filings to amend our “Employee Future Benefits” note (Note 22 of our 2010 Annual Report) to provide disclosure in substantially the following form:

“CIBC’s Board of Directors have delegated the responsibility for establishing pension fund investment objectives and policies and monitoring pension investment policy to the Board’s Management Resources and Compensation Committee (“MRCC”). The MRCC is responsible for establishing investment policies such as asset mix, permitted investments, and use of derivatives.

13

While specific investment policies are determined at a plan level to reflect the unique characteristics of each plan, common investment policies for all plans include the optimization of the risk-return relationship using a portfolio of various asset classes diversified by market segment, economic sector, and issuer. The objectives are to secure the obligations of our funded plans, to maximize investment returns while not compromising the security of the respective plans, and to manage the level of funding contributions.

To reduce investment specific risk and to enhance expected returns, investments are allocated among multiple asset classes, with publicly traded fixed income and equities in active markets, representing the most significant asset allocations. Use of derivative financial instruments is limited to generating the synthetic return of debt or equity instruments. Investments in specific asset classes are further diversified across funds, managers, strategies, vintages, sectors and geographies, depending on the specific characteristics of each asset class. The exposure to any one of these asset classes will be determined by our assessment of the needs of the plan assets and economic and financial market conditions. Factors evaluated before adopting the asset mix include demographics, cash-flow payout requirements, liquidity requirements, actuarial assumptions, expected benefit increases, and corporate cash flows.

Management of the assets of the various Canadian plans has been delegated primarily to the Pension and Benefits Investment Committee (“PBIC”), which is a committee composed of CIBC management. The PBIC has appointed investment managers, including CIBC Global Asset Management Inc., a wholly owned subsidiary of CIBC. These managers have investment discretion within established target asset mix ranges as set by the MRCC. Should the actual mix fall outside specified ranges, the assets are rebalanced as required to the target asset mix. Similar committees exist for the management of our non-Canadian plans.

Risk management oversight as performed by PBIC and other committees includes but is not limited to the following activities:

| | ¡ | | Periodic asset/liability management and strategic asset allocation studies; |

| | ¡ | | Monitoring of funding levels and funding ratios; |

| | ¡ | | Monitoring compliance with asset allocation guidelines; |

| | ¡ | | Monitoring asset class performance against asset class benchmarks; and |

| | ¡ | | Monitoring investment manager performance against benchmarks.” |

| | Ÿ | | The inputs and valuation techniques used to measure the fair value of plan assets; and |

14

In future filings, we will amend our “U.S. GAAP reconciliation” note (Note 30 of our 2010 annual financial statements) to provide disclosure in substantially the following form:

“The following financial instruments are valued using the basis described below. We have established control procedures to ensure that the policies are applied consistently and processes for changing methodologies are well controlled.

| | ¡ | | “Short-term investments, including Government of Canada treasury bills, overnight deposits and foreign currency denominated short term investments, including any related foreign exchange gain or loss, are recorded at cost and valued at cost plus accrued interest, which approximates fair value; |

| | ¡ | | Bond prices are provided by independent pricing services that calculate bond prices based on price quotations from recognized securities dealers; |

| | ¡ | | Equities listed on a public stock exchange are valued at their closing sale price at the date of the consolidated statement of net assets available for benefits. Equities not traded on that date are valued at the most recent traded prices. Where equities are not listed on a public stock exchange, the quoted market prices for similar securities or other third-party evidence are used to determine fair value; |

| | ¡ | | Pooled fund investments are valued at the unit values supplied by the pooled fund administrators, which represent the underlying net assets at fair values determined using closing market prices; |

| | ¡ | | Income producing real estate is carried at appraised values determined not less than bi-annually by professionally qualified independent appraisers. For those appraisals not performed near the date of the consolidated statement of net assets available for benefits by independent appraisers, the appraisals are updated internally at that date. At the date of the consolidated statement of net assets available for benefits, approximately one quarter of the properties were appraised by independent appraisers. The appraisals are in accordance with generally accepted appraisal practices and procedures, based mainly on discounted cash flows; |

| | ¡ | | The fair value of a private equity investment is based on the net asset value provided by the partnership’s general partner unless there is a specific and objectively verifiable reason to vary from the value provided by the general partner; |

| | ¡ | | Exchange-traded future contracts are valued at quoted market prices; and |

| | ¡ | | Fair value of over-the-counter currency forward contracts is based on the market price of the underlying currency at the reporting date.” |

15

| | Ÿ | | Significant concentrations of risk within plan assets and a narrative description of investment policies and strategies, including investment goals, risk management practices, permitted and prohibited investments including the use of derivatives, diversification, and the relationship between plan assets and benefit obligations. |

In future filings, we will amend our “Employee Future Benefits” note (Note 22 of our 2010 annual financial statements) to provide disclosure in substantially the form noted in the discussion under the first bullet of this question.

Exhibit B.3(c) - Management’s discussion and analysis excerpted from pages 31-103 of CIBC’s 2010 Annual Report

Basel II Capital Accord and recent revisions to regulatory capital requirements, page 59

| 10. | We note your disclosure here that you are working on enhancements to your market Value-at-Risk (VaR) models due to new regulatory requirements. We note your disclosure on page 78 that your daily trading losses did not exceed your 99% one-day VaR. Also, we note in your Report to Shareholders filed as exhibits to the Forms 6-K filed on February 24, 2011 and May 26, 2011 that your trading losses did not exceed VaR for both the first and second quarters of 2011. Please address the following: |

| | Ÿ | | Given that from a statistical standpoint, using a 99% confidence level you would expect for your trading losses to exceed your VaR one out of every hundred days or roughly three times per year, tell us why you believe your trading losses have not exceeded your VaR since November 20, 2008. |

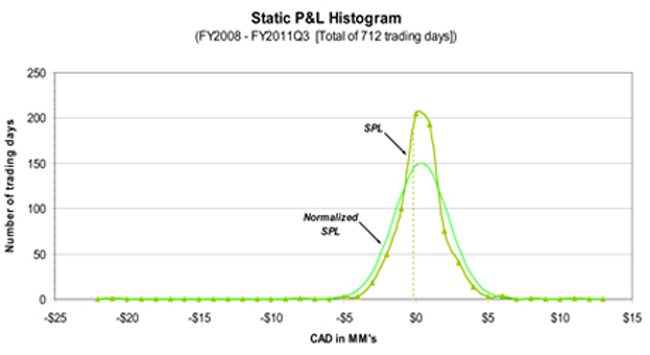

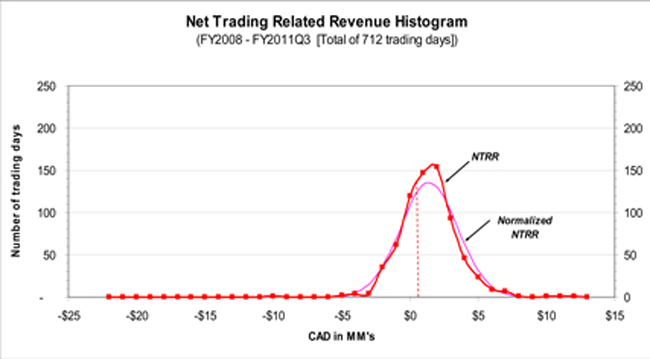

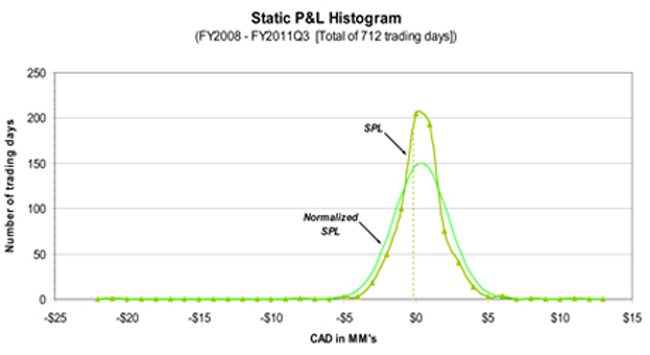

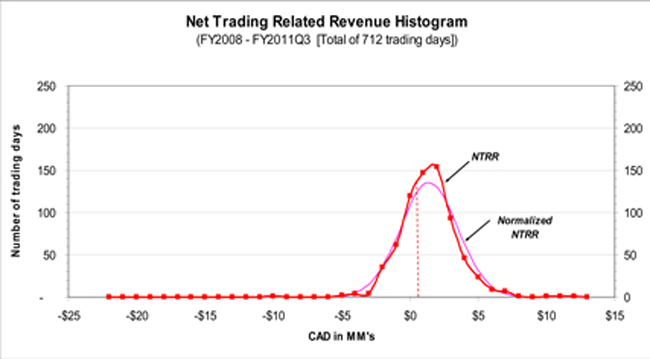

The expectation of one exception out of every 100 days is based on the assumption of a symmetric distribution of trading revenue about the average daily gain. In reality, the distribution of trading revenue is skewed to the positive and, therefore, has a lower probability of exceeding the one-day VaR than expected under the assumption of a symmetric distribution. Refer to the charts below, which describe the actual and normalized distributions of the static profit and loss and net trading related revenue for the fiscal years 2008 through to the third quarter of 2011.

16

| | Ÿ | | Explain to us and disclose in future filings how you determined your VaR model is still statistically appropriate in light of the fact that your trading losses have not exceeded your VaR since November 20, 2008. |

17

Backtesting allows CIBC to evaluate the performance of the VaR model against actual results. We backtest our VaR model daily against both static profit and loss and trading revenue. This backtesting is conducted at the level of consolidated CIBC and at lower levels, including business lines and individual portfolios. Static profit and loss and trading losses in excess of the one-day VaR are investigated. Based upon our backtesting results, we are able to ensure that our VaR model appropriately measures the risk. Page 78 of our 2010 MD&A refers to our backtesting approach in ensuring that our models are still appropriate.

| | Ÿ | | Address any changes you made to your VaR methodology or assumptions during the last three years, particularly highlighting any changes made because no trading losses were in excess of your one-day VaR in 2010 and first half of 2011. |

Our VaR model remains a variance-covariance model. Changes to our model have fallen into two broad categories. The first category is changes to address risk not previously included in our VaR model. These were implemented in the first quarter of fiscal 2011 and disclosed in the quarterly report. The second is to improve the operational efficiency of our model and has no impact on the results of the model. These changes were not made to our VaR model to address the lack of trading losses in excess of one day VaR. For the reason outlined in our response to the first bullet above, we do not believe any such changes are required to our VaR model.

| | Ÿ | | Tell us and disclose a more detailed discussion of the enhancements you are making to your VaR model due to the Basel II market risk framework. |

During 2010, the Office of the Superintendent of Financial Institutions (“OSFI”), our Canadian prudential regulator, postponed the implementation date for the Basel II market risk framework until the first quarter of fiscal 2012. We will be providing comprehensive disclosure of the changes resulting from these new requirements in our report for the first quarter of fiscal 2012. The changes that we are making to our VaR model due to the Basel II market risk framework comprise the introduction of a stressed VaR measure and an incremental risk charge. The stressed VaR measure shows the worst VaR measure for the current portfolio if that portfolio was held at the worst period since 2007. The incremental risk charge assigns capital to the credit migration and default risk for securities held in the trading portfolios.

18

Total loans and acceptances, page 75

| 11. | In future filings please provide an expanded discussion of your lending criteria for each type of loan. For example, for each of your loan categories you should disclose loan-to-value requirements, required credit scores, whether loans are issued at fixed or variable rates, and documentation requirements. If you issue both primary and second lien loans, these should be shown separately. If you issue second lien loans, we may have additional comments. |

We will update future filings to provide an expanded discussion of our lending criteria.

CIBC does issue secondary lien loans through our Home Equity Line of Credit (HELOC) product. Of the total outstanding HELOCs of approximately $20 billion as at July 31, 2011, exposures where CIBC did not have the first charge on the property (i.e. secondary lien loans) accounted for approximately $1.6 billion. The average LTV ratio on the secondary lien loans was 45%, whereas the average LTV ratio for the entire HELOC portfolio was 47%.

In future filings, we will also include disclosures related to the lending criteria for our secondary lien loans.

Allowance for credit losses, page 76

| 12. | We note your disclosure on page 76 that you had a refinement in how you calculate your general allowance. Please tell us and revise future filings to include a detailed discussion of the specific changes you made to your loan loss methodology, including how those changes impacted the timing and amount of your charge-offs and recording of the provision for credit losses. |

For the small business, we changed the loss identification period from an eighteen month to a twelve month time horizon. We examined ten years of internal default data to determine the length of time from when CIBC first observes a problem with an account, to when it gets moved to impaired status. On average this represents 12 months for small business. This is supported by a benchmarking study of Canadian Banks, performed by an external consultant, which suggested many Canadian Banks are also using a 12 month time horizon for small business. Prior to implementation of material general allowance methodology changes, we review the methodology changes and impacts with OSFI, as mandated by OSFI Guidance C-5.

19

We will enhance our disclosure in future filings in substantially the following form:

“The decrease in general allowance for credit losses related to business and government loans was $77 million or 20%, driven by a decrease in the Canadian portfolio of $37 million, other countries (mainly Europe and the Caribbean) portfolio of $31 million, and the U.S. portfolio of $9 million. The decrease in the Canadian general allowance was driven by a refinement in how we calculate our general allowance for small business. Based on internal data and other external benchmarks, we shortened the loss identification period for small business, which led to a reduction of $44 million in the general allowance as at October 31, 2010. Additional information on the general allowance as a percentage of total net loans is provided in the “Supplementary annual financial information” section.”

We will also enhance future disclosures for any material changes in general allowance methodology by providing a description of the new methodology and the impact of the change.

Form 6-K Filed on May 26, 2011

Exhibit 99.1 Report To Shareholders for the Second Quarter, 2011

Non-GAAP Measures, page 9

| 13. | We note your disclosure here of “cash net income applicable to common shares” and “cash basic and diluted earnings per share.” In addition, we note from your disclosure on page 42 of your 2010 Annual Report that you believe these measures permit uniform measurement, which enable users of your financial information to make comparisons more readily. Please tell us and revise your future filings to include a more detailed discussion of the reasons why you believe the disclosure of these measures provides useful information to investors regarding your liquidity or results of operations. In your response, specify whether you use these financial measures as measures of liquidity or of performance. Also, revise to identify the various inherent limitations of the usefulness of these measures and discuss how you considered those limitations in your use of the measures. Alternatively, confirm you will not use these measures in future filings. |

The “cash net income applicable to common shares” and “cash basic and diluted earnings per share” measures we use adjust our GAAP based results only for the

20

impact of after-tax amortization of other intangible assets, as disclosed on pages 42 and 43 of our 2010 annual MD&A. We use these measures as performance measures and not as liquidity measures. These performance measures provide greater consistency and comparability between our results and those of some of our Canadian peer banks who make similar adjustments in their public disclosure. In addition, these performance measures are used by some analysts to develop their earnings forecasts. Presenting these performance measures may assist them in their analysis. We will provide this information in our future filings.

We note in the introduction to the “Non-GAAP Measures” section on page 42 of our 2010 annual MD&A that all of our non-GAAP financial measures do not have a standardized meaning under GAAP and that our measures may not be comparable to similar measures used by other companies. We do not believe there are any other material inherent limitations on the usefulness of these performance measures.

Structured Credit Run-Off Business & Other Selected Activities, page 15

| 14. | We note your discussion of the structured credit run-off business and other selected activities like the businesses you exited here and that you disclose the fluctuation of net income (loss) for the periods presented for these businesses. In addition, we note from the disclosure on page 12 that the structured credit run-off business is included in your Wholesale Banking segment and has significantly impacted the results of the reportable segment. Please tell us how you considered the guidance in ASC 280, specifically the definition of an operating segment, in your decision to not present the structured credit run-off business and other exited businesses as a separate segment at October 31, 2010 and April 30, 2011 under U.S. GAAP. In an effort to provide clear disclosure on the impact that the structured credit run-off business has on your results of operations and the performance of this business year over year, please consider revising future filings to disclose here the revenue, provision for credit losses, non-interest expense, income tax expense, net income, and total assets for the structured credit run-off business. |

We choose to separately disclose certain aspects of the results of our structured credit run-off business mainly to assist readers in understanding the results of our risk reduction activities for the underlying run-off positions and the effect that these activities had on our Wholesale Banking segment. The fact that separate disclosure is provided does not mean that the business is a component of CIBC that meets the definition of an operating segment.

21

In evaluating whether the structured credit run-off business constitutes an operating segment, we considered the guidance in ASC 280-10-50-1, wherein the definition of an operating segment refers to business activities from which an entity earns revenue and incurs expenses. As we have disclosed in our MD&A, given the uncertain capital market positions and to focus on our core business within Wholesale Banking, we curtailed our activities in the structured credit business such that it is in run-off mode with no new exposures being sought (unless incidental to reducing the overall exposure of the portfolio). While the structured credit run-off business earns revenue and incurs expenses, the revenue and expenses are the result of activities that are undertaken primarily for the purpose of reducing exposures that resulted prior to the business being placed into run-off mode rather than for the purposes of generating ongoing income from new business. As a result, we consider the business activities of the structured credit run-off business to not constitute ongoing “business activities” as contemplated in ASC 280-10-50-1. Instead, we consider the activities to represent trading activities which are similar in nature to the activities of other capital markets trading operations within Wholesale Banking, except that they are specifically focused on reducing certain specified exposures in Wholesale Banking.

We also note that while the Chief Operating Decision Maker (CODM) may review discrete financial information for the structured credit run-off business, the primary purpose of the review is to assess the remaining exposures and the impacts that exposure reduction activities have had on results, rather than to assess financial performance for the purpose of making decisions about resources to be allocated to either the Wholesale Banking segment or to the structured credit run-off business as contemplated under ASC 280-50-1(b).

As a result, we believe that the activities undertaken in the structured credit run-off business represent wholesale banking activities (i.e., trading activities) that should be aggregated with the other activities within the Wholesale Banking segment.

Furthermore, the structured credit run off business does not constitute a discontinued operation as: (i) the business itself is not being sold or otherwise disposed of (i.e., we are in contrast managing down the exposures that existed within the business at the time we decided to place the business into run-off); and (ii) the assets of the business are primarily financial instruments that are outside the scope of ASC Topic 360-10 Property, Plant and Equipment, sub-topic 45 Other Presentation Matters and ASC Topic 205-20 Discontinued Operations.

In addition to the net income (loss) from the structured credit run-off business which we presently disclose, we will revise our future filings to provide the net interest income, trading income (loss), fair value option related income (loss), other income, provision for credit losses, non-interest expenses, and income tax recovery (expense). Also, we presently disclose our total positions (which incorporate our total assets and derivatives to which we have exposure) in the Position Summary table on page 15 of the report to shareholders for the second quarter 2011.

22

Exposure to certain countries and regions, page 22

| 15. | Refer to your disclosure here that you have no direct sovereign exposure to Greece, Ireland, Italy, Portugal, and Spain, but that you do have direct non-sovereign exposure to borrowers within the above countries except Greece and Portugal. In addition, you disclose you have indirect exposure through CLO securities to these European countries. Please tell us and revise your future filings to disclose the quantitative exposure (both direct and indirect) by country to financial institutions and corporations domiciled in those five countries. As such, please address the following: |

| | Ÿ | | Present the gross exposure you have to each of these countries separately broken out between sovereign, corporate institutions, financial institutions, retail, small businesses, etc.; |

| | Ÿ | | Discuss any hedges and collateral maintained to arrive at your net exposure at the balance sheet date; |

| | Ÿ | | Separately discuss, by country, and on a gross basis, the unfunded exposure to these countries along with any hedging instruments you may be using to help mitigate your exposure; and |

| | Ÿ | | Please clarify if you have any credit derivatives purchased or sold related to these countries, and if so, how they are included in your gross and net amounts of exposure. |

The following table provides our exposure to certain European and selected countries in the Middle East and North Africa. As at April 30, 2011, we had no exposure to corporate entities in these countries and no retail or small business exposure (October 31, 2010: nil). We have not purchased or sold credit derivatives related to these countries (October 31, 2010: nil).

23

| | | | | | | | | | | | | | | | | | | | |

| | | Loans and securities | | | Unfunded

exposure (1) | | | Derivative

mark-to-market

receivables | |

| $ millions, as at April 30, 2011 | | Sovereign | | | Banks | | | Total | | | Banks | | | Banks | |

Greece | | $ | - | | | $ | - | | | $ | - | | | | - | | | $ | - | |

Ireland | | | - | | | | - | | | | - | | | | 2 | | | | 134 | |

Italy | | | - | | | | 88 | | | | 88 | | | | - | | | | 34 | |

Middle East and North Africa(2) | | | - | | | | - | | | | - | | | | 5 | | | | 5 | |

Portugal

| | | - | | | | - | | | | - | | | | - | | | | - | |

Spain | | | - | | | | - | | | | - | | | | - | | | | 23 | |

Gross exposure | | | - | | | | 88 | | | | 88 | | | | 7 | | | | 196 | |

Less : collateral held(3) | | | - | | | | - | | | | - | | | | - | | | | 111 | |

Net exposure | | $ | - | | | $ | 88 | | | $ | 88 | | | $ | 7 | | | $ | 85 | |

October 31, 2010 | | $ | 43 | | | $ | 232 | | | $ | 275 | | | $ | 16 | | | $ | 54 | |

| | (1) | Unfunded exposure comprises of letters of credit and guarantees. |

| | (2) | Includes Algeria, Bahrain, Egypt, Jordan, Lebanon, Libya, Morocco, Oman, Saudi Arabia, Syria, Tunisia, and Yemen. |

| | (3) | The collateral from these counterparties was in the form of cash and comprised $82 million from banks in Ireland, $12 million from Italy and $17 million from Spain. |

We will enhance our future filings to include the above disclosure.

Form 6-K filed on July 29, 2011

Exhibit 99.1 Item 5 of Form F-3 Filed with the Securities and Exchange Commission Pursuant to the Securities Exchange Act of 1934

Additional Notes to the Interim Consolidated Financial Statements (Unaudited), page 4 Accounting for transfers of financial assets and repurchase financing transactions, page 6

| 16. | We note your disclosures beginning on page seven that discuss the various VIEs you assessed for consolidation under ASC 810 (SFAS 167) during the period. In addition, we note your disclosures in Note 5 of your Canadian Financial Statements for the six-months ended April 30, 2011. Please tell us and revise your future filings to disclose more clearly which VIEs are consolidated under U.S. GAAP, but not under Canadian GAAP and vice versa. |

In our future filings, we will amend our description of VIEs assessed for consolidation under ASC 810 (SFAS 167) to more clearly indicate which VIEs are consolidated under U.S. GAAP but not under Canadian GAAP and vice versa. It should be noted that current Canadian GAAP is substantially the same as U.S. GAAP was prior to the implementation of ASC 810 (SFAS 167) and thus the disclosure in our Form 6-K filed on July 29, 2011 does in effect describe the differences between AC 810 (SFAS 167) and both prior U.S. GAAP and current Canadian GAAP.

Specifically we will provide the following for specific VIEs where there are differences:

24

| | ¡ | | In our description of our credit card securitization trusts, we will amend future filings to include the following: |

“Under Canadian GAAP, which is substantially the same as previous U.S. GAAP, our credit card trusts meet the requirements of a QSPE and are exempted from the scope of VIE consolidation.”

| | ¡ | | In our description of our residential mortgage securitization trust, we will amend future filings to include the following: |

“Under Canadian GAAP, which is substantially the same as previous U.S. GAAP, our residential mortgage trust meets the requirements of a QSPE and is exempted from the scope of VIE consolidation.”

| | ¡ | | In our description of our structured vehicles, specifically in regard to certain VIEs that are consolidated under Canadian GAAP, we will amend future filings to include the following: |

“Under Canadian GAAP, which is substantially the same as previous U.S. GAAP, these structured vehicles were consolidated.”

It should be noted that effective the third quarter of 2011, we entered into a transaction to transfer the risks and rewards of these underlying exposures to a third party. The transaction was a reconsideration event that resulted in the deconsolidation of these entities under Canadian GAAP. As a result, there is no ongoing Canadian/U.S. GAAP difference effective the third quarter of 2011. This will be disclosed in our year end filing as at October 31, 2011.

| | ¡ | | In our description of the Capital Trust structure, we will amend future filings to include the following: |

“Under Canadian GAAP, which is substantially the same as previous U.S. GAAP, the Capital Trust is not consolidated.”

| 17. | We note your disclosure on page eight that you deconsolidated certain structured vehicles that were previously consolidated in accordance with FIN 46(R). In addition, we note the disclosure on page seven that the adoption of ASC 810 (SFAS 167) reduced your opening retained earnings by C$127 million, net of taxes and increased your total assets by C$3 billion. Please address the following: |

25

| | Ÿ | | Tell us whether the impact on your financial statements upon adoption was the gross impact from VIEs now consolidated or the net impact as it included both the consolidated and deconsolidated amounts. Revise your disclosure in future filings to present the gross impact to your financial statements for both VIEs now consolidated and those deconsolidated. |

The retained earnings reduction of $127 million, net of taxes and increase of total assets of $3 billion is the net impact of the incremental consolidation of VIEs and the deconsolidation of VIEs.

We will revise future filings to provide disclosure in substantially the following form to reflect the gross presentation:

“Upon the adoption of FASB ASC 810 (SFAS 167) we consolidated certain VIEs at the carrying values of their assets and liabilities as at November 1, 2010 and deconsolidated certain VIEs. The consolidation of these VIEs resulted in an increase in our total assets of approximately $3.8 billion and total liabilities of approximately $3.9 billion. It also reduced our opening retained earnings by $127 million, net of taxes, to reflect the cumulative transition impact related to prior periods and decreased our AOCI by $13 million, net of taxes. The deconsolidation of VIEs resulted in a reduction in assets and liabilities of approximately $800 million with no retained earnings impact.”

| | Ÿ | | Tell us and revise to disclose in future filings the primary factors that caused the deconsolidation of certain structured vehicles and provide the impact the deconsolidation had on your U.S. GAAP financial statements. In your response, discuss the factors and impact deconsolidation had separately for structured vehicle(s) with different risk and reward characteristics from the other structures. Refer to ASC 810-10-50-5A. |

The impact of the deconsolidation of VIEs on our U.S. GAAP financial statements was a reduction in assets and liabilities of approximately $800 million with no retained earnings impact.

In order to disclose the primary factors that caused the deconsolidation of certain structured vehicles we will revise our future filings to provide disclosure in substantially the following form:

“We hold exposures to structured collateralized debt obligations (CDO) and collateralized loan obligations (CLO) vehicles (“structured vehicles”) through investments in, or written credit derivatives referencing, these structured

26

vehicles. We may also provide liquidity facilities or other credit facilities. The structured vehicles are funded through the issuance of senior and subordinated tranches. We may hold a portion of those senior and/or subordinated tranches.

Under FASB ASC 810-10-15 (SFAS 167) we do not consolidate the structured vehicles as we do not have the power to direct any of the activities that most significantly impact the economic performance of the entity.

Effective November 1, 2010, we deconsolidated certain structured vehicles that were previously consolidated in accordance with Canadian GAAP, which is substantially the same as previous U.S. GAAP under FIN 46(R). At the inception of our initial exposure to these VIEs, we simultaneously entered into hedging transactions to pass the risk and returns of the underlying VIE exposure to third parties. These third parties were considered to have the implicit variable interests of the VIE exposure and as a result, we were not considered to be the primary beneficiary. Upon the subsequent elimination of the hedges, which were considered to be reconsideration events, we were considered to be the primary beneficiary as we absorbed the majority of the conduits’ remaining expected losses. Accordingly, under Canadian GAAP and previous U.S. GAAP, we consolidated these VIEs.”

| | Ÿ | | Please revise your non-consolidated VIEs table on page nine in future filings to disaggregate your structured vehicles column similar to the presentation on page 43 in your Canadian Financial Statements (i.e. CIBC-structured CDO vehicles, Third-party structured vehicles run-off, etc). |

We will revise our future filings to amend our “U.S. GAAP reconciliation” note (Note 30 of our 2010 annual financial statements) to disaggregate “Structured vehicles” exposure within our non-consolidated VIE exposure table to align with our presentation under Canadian GAAP (i.e. CIBC-structured vehicles, Third-party structured vehicles - run-off, and Third-party structured vehicles - continuing). The effect of this for the second quarter of 2011 is presented below:

27

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Non consolidated VIEs | |

$ millions, as at April 30, 2011 | | CIBC

sponsored

conduits | | | Residential

mortgage

securitization

vehicle(3) | | | CIBC-

structured

vehicles | | | Third-party

structured vehicles | | | Pass

through

investment structures | | | Commercial

mortgages

securitization vehicle | |

| | | | | Run-off | | | Continuing | | | |

| |

On balance sheet assets(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Trading securities | | $ | 5 | | | $ | - | | | $ | - | | | $ | 725 | | | $ | 82 | | | $ | 223 | | | $ | - | |

AFS securities | | | - | | | | 916 | | | | 5 | | | | 2 | | | | 1,832 | | | | - | | | | 5 | |

FVO | | | - | | | | - | | | | - | | | | - | | | | 130 | | | | - | | | | - | |

Loans | | | 73 | | | | - | | | | 385 | | | | 5,060 | | | | 38 | | | | - | | | | - | |

Derivatives(2) | | | - | | | | - | | | | | | | | | | | | | | | | 74 | | | | - | |

Total assets | | $ | 78 | | | $ | 916 | | | $ | 390 | | | $ | 5,787 | | | $ | 2,082 | | | $ | 297 | | | $ | 5 | |

On balance sheet liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Derivatives(2) | | $ | - | | | $ | - | | | $ | 30 | | | $ | 1,423 | | | $ | - | | | $ | 24 | | | $ | - | |

Total liabilities | | $ | - | | | $ | - | | | $ | 30 | | | $ | 1,423 | | | $ | - | | | $ | 24 | | | $ | - | |

| Maximum exposure to loss, net of hedges | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment and loans | | $ | 78 | | | $ | 916 | | | $ | 390 | | | $ | 5,787 | | | $ | 2,082 | | | $ | 223 | | | $ | 5 | |

| Written derivatives, net of fair value gains and losses(3) | | | - | | | | - | | | | 302 | | | | 3,945 | | | | - | | | | 50 | | | | - | |

| Liquidity and credit facilities | | | 1,526 | | | | - | | | | 33 | | | | 525 | | | | 9 | | | | - | | | | - | |

| Less: hedges of investment, loans and written derivatives exposures | | | - | | | | - | | | | (600 | ) | | | (8,277 | ) | | | - | | | | (273 | ) | | | - | |

Maximum exposure to loss | | $ | 1,604 | | | $ | 916 | | | $ | 125 | | | $ | 1,980 | | | $ | 2,091 | | | $ | - | | | $ | 5 | |

| | (1) | Excludes VIEs containing third party originated assets established by Canada Mortgage and Housing Corporation (CMHC), Federal National Mortgage Association (Fannie Mae), Federal Home Loan Mortgage Corporation (Freddie Mac), Government National Mortgage Association (Ginnie Mae), Federal Home Loan Banks, Federal Farm Credit Bank, and Student Loan Marketing Association (Sallie Mae). |

| | (2) | Comprises written credit default swaps and total return swaps under which we assume exposures and excludes all other derivatives. |

| | (3) | Excludes interest rate swaps with Canada Housing Trust, a VIE sponsored by CMHC. |

Disclosures about the credit quality of financing receivables and the allowance for credit losses, page 10

| 18. | We note your disclosure here that ASU 2010-20 became effective for you on November 1, 2010. Please address the following related to your ASU 2010-20 disclosures either here or in your Canadian GAAP Financial Statement disclosures in future filings: |

| | Ÿ | | Describe in greater detail your policy for charging off uncollectible financing receivables by loan portfolio segment as required by ASC 310-10-50-11B(b). In your response discuss the specific factors you consider in your determination when to charge-off a loan. |

We note the following disclosure is contained on page 115 in our “Summary of Accounting Policies” note (Note 1 of our 2010 annual financial statements) concerning our write-off policy for credit cards receivables:

28

“Credit card loans are not classified as impaired and are fully written off when payments are contractually 180 days in arrears or upon customer bankruptcy.”

In addition, we propose to include the following expanded description of our accounting policy for charging off uncollectible financing receivables in the “Summary of significant accounting policies” note in our 2011 annual consolidated financial statements:

“Loans are written off, in whole or in part, against the related allowance for credit losses upon settlement (realization) of collateral or in advance of settlement (no realization) when the determination of recoverable value is completed and there is no realistic prospect of future recovery above the recoverable value.”

| | Ÿ | | Provide us and revise to disclose a breakdown of the loan portfolio separately identifying both segment and class. |

CIBC’s loan portfolios are managed and reported in the following four portfolio segments: (i) residential mortgages; (ii) personal; (iii) credit card; and (iv) business and government. For the first three portfolio segments, the class of financing receivables is the same as the portfolio segment, as the underlying receivables share common risk characteristics. The business and government portfolio segment is comprised of different classes of financing receivables, mostly based on the industry group of the customer.

We will revise our future filings to provide a breakdown of our loan portfolio separately identifying both segment and class.

| | Ÿ | | Disclose the amount of any purchases, sales or reclassifications of loans to held for sale during the period (310-10-50-11B(e) and (f)). |

We did not purchase, sell or reclassify any “Held for sale” loans during the six months period ended April 30, 2011.

| | Ÿ | | Disclose in future filings a detailed discussion of your policy for determining past due or delinquency status (310-10-50-6(e)). For example, disclose if there is a grace period before you would consider a payment past due. |

We note the following policy for reporting contractually past due loans on page 132 of our 2010 Notes to Consolidated Financial Statements:

29

“Contractually past due loans are loans where repayments of principal or payment of interest is contractually in arrears”.

While our business practice may allow for a grace period in certain circumstances, such period is not included when considering whether a loan is delinquent or not.

Furthermore, on pages 114 and 115 of our 2010 annual financial statements, in our “Summary of Accounting Policies” note (Note 1 of our 2010 annual financial statements) we disclose our policy for identifying impaired loans.

| | Ÿ | | Revise future filings to disclose all of the information required by ASU 2010-20 in the notes to your financial statements or here as opposed to your MD&A. |

We note that the shaded sections of our “MD&A Management of Risk” forms an integral part of our 2010 annual financial statements as disclosed on page 168 of our annual financial statements in the “Financial Instruments – Disclosures” note and on page 66 of our annual MD&A. Accordingly, the disclosures required by ASU 2010-20 that are included in the shaded section of our MD&A are part of our consolidated annual financial statements.

| 19. | We were unable to locate your discussion of the risk characteristics of each portfolio segment here, in your Form 6-K filed May 26, 2011, or in your Form 40-F. Please tell us where these disclosures are located or revise future filings to include the discussion by portfolio segment. Refer to ASC 310-10-50-11B(a)(2)). |

The discussion of our Risk Rating Method (pages 71 to 73 of our 2010 annual MD&A) is based on our exposure categorization under Basel II guidelines while the classification of loans in Note 5 to the financial statements (page 131 of our 2010 annual financial statements) is based on accounting categories. In Note 29 – Financial Instruments – Disclosures (page 168 of our 2010 annual financial statements) we provide Basel II drawn credit exposure broken down by accounting categories. In addition, on page 74 of our 2010 annual MD&A, we provide industry group breakdown of our business and government exposures under the Risk Rating Method. As noted in our response to the last bullet in question 18 above, certain disclosures which have been shaded within the annual MD&A, including the disclosures on pages 71 to 74, form an integral part of the annual financial statements.

In our Report to Shareholders for the Second Quarter, 2011, we note at the beginning of our Management of Risk section (page 21) that our approach to management of risk has not changed significantly from that described on pages 66 to 85 of the 2010 annual MD&A.

30

| 20. | We note from your disclosures beginning on page 10 that all ASU 2010-20 tables were presented by the following loan categories: residential mortgages, personal, credit card, and business and government. ASU 2010-20 clearly defines the level that the disclosures should be presented, either by portfolio segment or class of financing receivables. Given that all the disclosures were provided at the same level we were unable to determine whether these categories represent your portfolio segments or your classes of financing receivables as defined in ASC 31-10-20. Also, we note disclosures that refer to your home equity lines of credit lending and your classification of the retained interests in credit card receivables securitization within the business and government loan portfolio instead of the credit card portfolio. Please revise your disclosures in future filings to provide a discussion of your portfolio segments and classes of financing receivables. In your response specifically state which portfolio segment and class of financing receivable the above noted loans are classified within and support for that classification. Last, as needed revise your ASU 2010-20 disclosures in future filings to present the applicable disclosures by class of financing receivables. |

We believe this point is partially addressed by our response to the second bullet of question 18 pertaining to disclosing the breakdown of our portfolios by segment and class. Our present disclosures are provided at the level of the portfolio segment. We will revise our future filings to provide information at the levels of both the portfolio segment and the class of financing receivables.

In response to the question on classification of our retained interests in credit cards receivables as business and government loans, they were classified as such under Canadian GAAP as they represent receivables from a non-consolidated trust. We will revise our fiscal 2011 U.S. GAAP reconciliation note to clarify that:

“Our retained interests in credit cards receivables, in the form of notes, which were classified within business and government loans under Canadian GAAP, are eliminated under U.S. GAAP as we consolidate the trusts pursuant to ASC-810.”

| 21. | We note from your allowance for credit losses tabular disclosures on page 11 that you wrote-off loans only to the specific allowance and none to the general allowance though you record a provision for credit |

31

| | losses to the both. In addition, we note your disclosure in your Form 40-F that generally loans that are contractually 90 days in arrears, except for credit card balances and loans guaranteed or insured by the Canadian government or a Canadian government agency, are classified as impaired. In an effort to provide clear and transparent disclosures, please tell us and revise future filings to discuss in detail the relationship between the specific and general allowance and why there were no write-offs to the general allowance in the past two fiscal years. In particular, please address how the impaired loan policy affects your specific allowance. Specifically address the fact that all write-offs of credit cards are against the specific allowance even though you also disclose that no specific allowance is maintained for credit cards loans as you maintain only a general allowance for credit card loans. |

For our business and government loans portfolio segment, a general allowance is collectively provided for loans that have not been specifically identified as impaired (i.e., performing loans), whereas a specific allowance is provided for those loans that have been specifically identified as being impaired. To the extent performing loans become non-performing due to delinquency or other impairment events, a specific allowance is provided on the loan on an individual basis and the loan would no longer be collectively assessed for the general allowance. The loan would be written off in accordance with our write-off policy only in the event it is already impaired, at which time there would be only a specific allowance (i.e., no general allowance). Therefore, loans are written off only to specific allowances.

For our retail loans portfolio segment other than credit cards, we provide specific and general allowances for the loans based on their state of delinquency. General allowances are established only for loans that are current or in the early stages of delinquency, while specific allowances are established only for loans that are in the later stages of delinquency (i.e., all other loans). Therefore, as the delinquency status of a loan worsens, the loan would no longer be provided for through the general allowance and instead would be provided for through the specific allowance. When there is no realistic prospect of future recovery above the recoverable value, the loan would be written off in accordance with our write-off policy.

For our credit card loans, as stated in our “Summary of significant accounting policies”, the loans are not classified as impaired and are fully written off when payments are contractually 180 days in arrears or upon customer bankruptcy. Credit card loans only have general allowance until such time the card balances are 180 days in arrears or upon customer bankruptcy, upon which the general allowance is reduced and the credit card balance is written off as a specific provision for credit losses.

32

Impaired Loans, page 11

| 22. | We note your impaired loans tabular disclosure and footnotes here. In addition, we note footnote two to the table that tells us how to calculate the unpaid principal balance for the impaired loans in the aggregate and footnote five that provides the interest income recognized on impaired loans in the aggregate. |

Please provide the following ASC 31010-50-15 disclosures in future filings by class of financing receivables:

| | Ÿ | | The unpaid principal balance of the impaired loans for the current period and comparable period; |

For disclosure of unpaid principal of impaired loans, we note that we have provided disclosure under the “Gross amount” column of the Impaired Loans table in our July 29, 2011 filing with cross-reference to footnote 2. However, we will revise our future filings to provide separate amounts for each class of financing receivables.

| | Ÿ | | The average recorded investment during the period in impaired loans; |

We will revise future filings to provide average recorded investment in impaired loans for each class of financing receivables.

| | Ÿ | | The amount of interest income recognized on impaired loans during the period including the portion that was recognized using a cash-basis method of accounting; and |