QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

ENHERENT CORP. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Robert D. Merkl

Chairman, President and Chief Executive Officer

March 28, 2003

Dear enherent Stockholder:

On behalf of your Board of Directors and your management, I cordially invite you to attend the 2003 Annual Meeting of Stockholders of enherent Corp. The meeting will be held on May 9, 2003 at 2:00 p.m. EDT, at the Hartford/Windsor Marriott Airport Hotel, 28 Day Hill Road, Windsor, Connecticut, 06095.

Enclosed are the Notice of Meeting and Proxy Statement relating to the Annual Meeting, along with the 2002 Annual Report to Stockholders on Form 10-K. Information regarding the matters to be voted upon at the meeting is set forth in the Notice of Meeting and Proxy Statement.

Your vote is important to us. Whether or not you plan to attend the meeting, please complete and return the attached proxy card in the enclosed envelope. Please note that your completed proxy will not prevent you from attending the meeting and voting in person should you so choose.

We look forward to seeing you at the meeting.

| | | Sincerely, |

|

|

/s/ ROBERT D. MERKL

Robert D. Merkl |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 9, 2003

To the Stockholders of

enherent Corp.:

The Annual Meeting of Stockholders of enherent Corp. ("enherent" or the "Company") will be held at the Hartford/Windsor Marriott Airport Hotel, 28 Day Hill Road, Windsor, Connecticut, 06095 on May 9, 2003 at 2:00 p.m. EDT, for the following purposes:

- 1.

- To elect two (2) directors for a three-year term as described in the accompanying proxy materials;

- 2.

- To ratify the appointment of Ernst & Young LLP as auditors to audit the accounts of the Company for 2003; and

- 3.

- To consider and act upon such other business as may properly come before the meeting or any adjournment thereof.

Stockholders of record at the close of business on March 11, 2003 are entitled to vote at the meeting. A complete list of those stockholders will be open for examination by any stockholder, for any purpose germane to the meeting, during ordinary business hours at the principal executive offices of enherent Corp., 80 Lamberton Rd., Windsor, CT, 06095, for a period of 10 days prior to the meeting.

Your attention is directed to the accompanying Proxy Statement and proxy.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE MARK, SIGN AND RETURN THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE. NO POSTAGE IS REQUIRED FOR MAILING IN THE UNITED STATES.

| | | By order of the Board of Directors | | |

|

|

/s/ FELICIA A. NORVELL

Secretary |

|

|

March 28, 2003

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 9, 2003

The enclosed proxy is solicited by the Board of Directors of enherent Corp. ("enherent" or the "Company") to be voted at the Annual Meeting of Stockholders to be held on May 9, 2003, or any adjournments thereof (the "Annual Meeting"). A stockholder returning a proxy may revoke it at any time prior to the voting at the Annual Meeting by notifying the Secretary of the Company in writing. A proxy returned by a stockholder, which is not subsequently revoked, will be voted in accordance with the instructions indicated thereon. If no instructions are indicated on a returned and duly executed proxy, the shares represented by the proxy will be voted FOR the election of the two nominees for director proposed by the Board of Directors and set forth herein, FOR the ratification of the appointment of Ernst & Young LLP as the independent public accountants of enherent for 2003, and in accordance with the judgment of the persons named in the proxy as to such other matters as may properly come before the Annual Meeting.

Only stockholders of record at the close of business on March 11, 2003 are entitled to notice of and to vote at the Annual Meeting. As of March 11, 2003, enherent's classes of capital stock consisted of Common Stock and the Series A Senior Participating Redeemable Convertible Preferred Stock outstanding that is entitled to vote, together with the Common Stock, on an as-converted basis. The following table indicates, as of March 11, 2003, the number of issued and outstanding shares of each class of capital stock and each class's associated voting power:

| | ISSUED AND

OUTSTANDING

| | AS-CONVERTED

VOTING POWER

|

|---|

| Common Stock | | 17,502,188 | | 17,502,188 |

| Series A Senior Participating Redeemable Convertible Preferred Stock | | 7,000,000 | | 7,000,000 |

| | | | |

|

| Total Votes Eligible | | | | 24,502,188 |

A majority of shares of common stock, including, for this purpose, the shares of common stock issuable upon conversion of the Series A Senior Participating Redeemable Convertible Preferred Stock, must be represented at the meeting, in person or represented by proxy, and will constitute a quorum for the transaction of business at the Annual Meeting. With the exception of the election of directors, which requires a plurality of the votes cast, the affirmative vote of a majority of the votes cast at the meeting is required for each item set forth in the Notice of Annual Meeting. Abstentions and broker non-votes are counted for purposes of determining whether a quorum is present at the meeting. For the purpose of determining whether a proposal (except for the election of directors) has received a majority vote, abstentions will be included in the vote totals with the result that an abstention will have the same effect as a negative vote. In instances where brokers are prohibited from exercising discretionary authority for beneficial owners who have not returned a proxy (broker non-votes), those shares will not be included in the vote totals and, therefore, will have no effect on the vote.

This Proxy Statement and the enclosed form of proxy are being mailed on or about April 4, 2003 to stockholders entitled to notice of, and to vote at, the Annual Meeting. The mailing address of enherent's principal executive offices is 80 Lamberton Rd., Windsor, CT 06095.

The cost of soliciting proxies will be borne by enherent. In addition to solicitation by mail, employees of enherent, without extra remuneration, may solicit proxies in person or by telephone. Mellon Investor Services, LLC has been retained by enherent to assist in the solicitation of proxies for a fee of $4,250 plus reimbursement of expenses. enherent may also reimburse brokerage firms, nominees, custodians and

fiduciaries for their out-of-pocket expenses for forwarding proxy materials to beneficial owners and seeking instruction with respect thereto.

ELECTION OF DIRECTORS

enherent's Certificate of Incorporation provides for three classes of directors to be as nearly equal in number as possible, with each class serving a three-year term and with one class being elected each year. Currently, the Board of Directors is comprised of six members. The three Class II directors whose terms expire at the Annual Meeting are Robert P. Forlenza, Irwin J. Sitkin and Dan S. Woodward. The Board of Directors has nominated Messrs. Forlenza and Sitkin for re-election as Class II directors. The terms of these directors, if elected, will expire at the Annual Meeting of Stockholders in 2006, or at such times as their successors are elected and qualified. Other directors will continue in office until the expiration of the terms of their classes at the Annual Meeting of Stockholders in 2004 and 2005, as the case may be.

In the event that any of the nominees for director should become unavailable for nomination or election, the persons designated as proxies will have full discretion to cast votes for another person designated by the Board of Directors, unless the Board of Directors reduces the number of directors. If properly executed and timely returned, the accompanying proxy will be voted FOR the election of the two nominees set forth below.

Certain information as of March 11, 2003 with respect to the nominees for directors and as to each current director in the classes continuing in office is shown below.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR

EACH OF THE NOMINEES FOR DIRECTOR.

Nominees for Class II Directors for a Three-Year Term Expiring at the Annual Meeting in 2006

Robert P. Forlenza, 47

Robert P. Forlenza has been a Director of enherent since November 1996. Since 1995, Mr. Forlenza has also served as Vice President of Tudor Investment Corporation and Managing Director of the Tudor Private Equity Group. Prior to joining Tudor, Mr. Forlenza was a Vice President at Carlisle Capital Corporation from 1989 to 1994. Mr. Forlenza graduated from Harvard University Graduate School of Business Administration in 1982 with an M.B.A. and from Washington and Lee University in 1978 with a B.S. in Business Administration and Accounting.

Irwin J. Sitkin, 73

Irwin J. Sitkin has been a Director of enherent since July 1990. In 1989 he retired as Vice President, Corporate Administration of Aetna Life and Casualty after 35 years with the company. Since retiring, Mr. Sitkin has been a consultant to, among others, Unisys, Memorex Telex Corporation, Amdahl Corporation, Digital Equipment Corporation, IBM and Northern Telcom Inc. Mr. Sitkin is an honorary trustee of the Computer Museum, University of Hartford's Ward College of Technology and the Northern Middlesex County (CT) YMCA and an active member of the Society for Information Management (SIM). Mr. Sitkin graduated from Cornell University in 1952 with a B.S. in Economics.

Members of Board of Directors Continuing in Office

Class I

Term Expiring at the Annual Meeting in 2004

Douglas K. Mellinger, 38

Douglas K. Mellinger founded PRT Corp. of America, enherent's predecessor, in 1989 and was CEO from its inception until June 1999. Mr. Mellinger has been a director of enherent since 1989. Currently, Mr. Mellinger is Chairman/CEO of Foundation Source, a philanthropic solutions company. Mr. Mellinger

2

is founder and Partner of Zeno Ventures, a holding company. Prior to starting enherent, Mr. Mellinger was the National and International Director of the Association of Collegiate Entrepreneurs. Mr. Mellinger is the Chairman of the National Commission on Entrepreneurship in Washington, D.C., on the Board of The Kauffman Center for Entrepreneurial Leadership and on the Advisory Board for the London Business School. Mr. Mellinger is the past International President of the Young Entrepreneurs' Organization and a member of the Young Presidents' Organization.

Isaac Shapiro, 72

Isaac Shapiro has been a Director of enherent since July 1991 and is Of Counsel to the law firm of Skadden, Arps, Slate, Meagher & Flom LLP. Mr. Shapiro has been with Skadden, Arps since April 1986. From 1956 to 1986 Mr. Shapiro was with the law firm of Milbank, Tweed, Hadley & McCloy and was a partner in that firm from 1966 to 1986. Mr. Shapiro is a Trustee of the Bank of Tokyo-Mitsubishi Foundation in New York and President of the Board of Trustees of the Isamu Noguchi Foundation, also in New York. Mr. Shapiro is a graduate of Columbia College and Columbia Law School and was a Fulbright Scholar at the University of Paris from 1956 to 1957.

Class III

Term Expiring at the Annual Meeting in 2005

Robert D. Merkl, 49

Robert D. Merkl has been a Director of enherent since May 2002 and serves as Chairman, President and Chief Executive Officer of enherent. Mr. Merkl joined enherent in 2000 as Senior Vice President, Operations. Mr. Merkl was named Chief Operating Officer and Executive Vice President on August 2, 2001. Effective March 7, 2002, Mr. Merkl became President of enherent Corp. On September 10, 2002, Mr. Merkl was named Chairman of the Board and Chief Executive Officer. Prior to joining enherent, Mr. Merkl was an Account Manager at Electronic Data Systems (EDS). Mr. Merkl also enjoyed a distinguished 23-year career in the United States Army. In addition to a wide variety of senior command posts in the United States Army culminating as Chief, Western Hemisphere Operations, Mr. Merkl also served as a Professor of Economics at the United States Military Academy at West Point. Mr. Merkl holds a Bachelor of Science in Engineering from the United States Military Academy at West Point, a Masters of Military Arts and Science from the Command and General Staff College at Fort Leavenworth, Kansas, a Masters of Business Administration with Honors from the University of Chicago, and a Masters Degree in National Security Strategy from the National War College.

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information regarding the beneficial ownership of enherent common stock as of March 11, 2003 by each director and nominee for director, the executive officers named in the Summary Compensation table below and by all directors and executive officers as a group. Except as set forth below, each of the individuals listed below has sole voting and investment power over such shares and is the owner of less than one percent of the outstanding shares of enherent common stock. The business address of each director and executive officer is: c/o enherent Corp., 80 Lamberton Rd., Windsor, CT 06095.

3

Director and Executive Officer enherent Common Stock Ownership

Name and Address of

Beneficial Owner

| | Shares

Beneficially

Owned(1)

| | Percent

Of Class(1)

|

|---|

| Robert P. Forlenza(2) | | 50,000 | | * |

Douglas K. Mellinger(3) |

|

1,910,290 |

|

11 |

Robert D. Merkl(4) |

|

61,666 |

|

* |

Felicia A. Norvell(5) |

|

6,333 |

|

* |

Isaac Shapiro(6) |

|

311,230 |

|

2 |

Irwin J. Sitkin(7) |

|

63,500 |

|

* |

George Warman(8) |

|

94,318 |

|

* |

Dan S. Woodward(9) |

|

796,648 |

|

4 |

Directors and executive officers of enherent group, 11 persons(10) |

|

3,247,318 |

|

17 |

*less than 1%

- (1)

- Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. These rules require that we consider all shares of common stock that can be issued under convertible securities, warrants or options currently or within 60 days ("common stock equivalents") to be outstanding for the purpose of computing the percentage ownership of the person holding those securities, but do not consider those securities to be outstanding for computing the percentage ownership of any other person. Each owner's percentage is calculated by dividing the number of shares owned by that owner plus the number of shares that can be obtained (by exercise or conversion) by that owner within 60 days by the sum of the number of shares of outstanding common stock, 17,502,188, and the number of shares that owner has the right to acquire/convert within 60 days.

- (2)

- Consists of shares subject to options currently exercisable or exercisable within 60 days of the date hereof.

- (3)

- Includes 30,000 shares subject to options currently exercisable or exercisable within 60 days of the date hereof.

- (4)

- Consists of shares subject to options currently exercisable or exercisable within 60 days of the date hereof.

- (5)

- Includes 3,333 shares subject to options currently exercisable or exercisable within 60 days of the date hereof.

- (6)

- Includes 57,000 shares subject to options currently exercisable or exercisable within 60 days of the date hereof. Also includes 15,230 shares held by Mr. Shapiro's wife, for which Mr. Shapiro disclaims beneficial ownership.

- (7)

- Includes 58,500 shares subject to options currently exercisable or exercisable within 60 days of the date hereof. Also includes 5,000 shares held by the Sitkin Family Foundation, for which Mr. Sitkin disclaims beneficial ownership.

- (8)

- Includes 82,318 shares subject to options currently exercisable or exercisable within 60 days of the date hereof.

- (9)

- Includes 766,648 shares subject to options currently exercisable or exercisable within 60 days of the date hereof.

- (10)

- Of the total number of shares beneficially owned by the directors and executive officers, 1,062,798 are subject to stock options currently exercisable or exercisable within 60 days of the date hereof.

4

5% Beneficial Owners

The following table sets forth certain information regarding the beneficial ownership of enherent common stock as of March 11, 2003 by each person or group known to enherent to beneficially own more than 5% of the outstanding common stock, as well as the outstanding Series A Senior Participating Redeemable Convertible Preferred Stock.

Name and Address of

Beneficial Owner

| | Number of Common Shares

Beneficially

Owned(1)

| | Percent

of Class(1)

| | Series A

Preferred

Stock(1)

| | Percent

of Class(1)

|

|---|

Douglas K. Mellinger

1241 Westover Road

Stamford, CT 06902 | | 1,910,290 | (2) | 11 | | | | |

Paul L. Mellinger

209 33rd Street

Manhattan Beach, CA 90266 |

|

2,043,080 |

|

12 |

|

|

|

|

Gregory S. Mellinger

172 Route 101, Unit #9

Bedford, NH 03110-5416 |

|

1,785,980 |

|

10 |

|

|

|

|

Tudor BI Global Portfolio Ltd.

40 Rowes Wharf

Boston, MA 02110 |

|

6,387,300 |

(3) |

28 |

|

3,750,000 |

|

54 |

Primesoft LLC

8603 Westwood Center Drive, Suite 200

Vienna, VA 22182 |

|

4,625,000 |

(4) |

11 |

|

2,750,000 |

(5) |

39 |

Rho Management, Inc.

152 West 57th Street, 23rd Floor

New York, NY 10019 |

|

1,103,308 |

|

6 |

|

|

|

|

- (1)

- Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. These rules require that we consider all shares of common stock that can be issued under convertible securities, warrants or options currently or within 60 days ("common stock equivalents") to be outstanding for the purpose of computing the percentage ownership of the person holding those securities, but do not consider those securities to be outstanding for computing the percentage ownership of any other person. Each owner's percentage is calculated by dividing the number of shares owned by that owner plus the number of shares that can be obtained (by exercise or conversion) by that owner within 60 days by the sum of the number of shares of outstanding common stock, 17,502,188, and the number of shares that owner has the right to acquire/convert within 60 days.

- (2)

- Includes 30,000 shares subject to options exercisable or exercisable within 60 days of the date hereof.

- (3)

- Consists of 3,750,000 shares issuable upon conversion of Series A Senior Participating Redeemable Convertible Preferred Stock held by Tudor BVI Global Portfolio Ltd., Raptor Global Portfolio Ltd., and Tudor Arbitrage Partners L/P (collectively "Tudor"). Also includes 1,875,000 shares subject to warrants currently exercisable or exercisable within 60 days of the date hereof. Tudor's percentage of the number of common shares beneficially owned is calculated by dividing Tudor's total number of shares beneficially held, 6,387,300, by the sum of enherent's outstanding common stock, 17,502,188

5

plus the number of shares of common stock that Tudor has the right to acquire upon exercise or conversion within 60 days, 5,625,000.

- (4)

- Consists of 2,750,000 shares issuable upon conversion of Series A Senior Participating Redeemable Convertible Preferred Stock held by Primesoft. Also includes 1,875,000 shares subject to warrants currently exercisable or exercisable within 60 days of the date hereof. Primesoft's percentage of the number of common shares beneficially owned is calculated by dividing Primesoft's total number of shares beneficially held, 4,625,000 by the sum of enherent's outstanding common stock, 17,502,188, plus the number of shares of common stock that Primesoft has the right to acquire upon exercise or conversion within 60 days, 4,625,000.

MEETINGS AND CERTAIN COMMITTEES OF THE BOARD

The Board of Directors held six meetings in 2002. All current directors attended at least 75% of the meetings of the Board of Directors and Board committees of which they are members. The Company has an Audit Committee, a Compensation Committee and a Nominating Committee.

AUDIT COMMITTEE. The Audit Committee is currently comprised of Robert P. Forlenza and Irwin Sitkin, both of whom are non-employee directors. The Audit Committee is directly responsible for the appointment, retention, compensation and oversight of the work of any registered public accounting firm employed by enherent (including resolution of disagreements between enherent's management and the accounting firm regarding financial reporting) for the purpose of preparing or issuing an audit report or related work or performing other audit, review or other attest services for enherent. Any such registered public accounting firm must report directly to the Audit Committee. The Audit Committee has the ultimate authority and responsibility to evaluate and, where appropriate, replace the registered public accounting firm. The Audit Committee met on six occasions during the year ended December 31, 2002. On February 3, 2003, the Audit Committee ratified and approved the Audit Committee Charter attached hereto as "Annex A."

COMPENSATION COMMITTEE. The Compensation Committee is responsible for the administration of all salary, bonus and incentive compensation plans for the officers and key employees of the Company. The Compensation Committee also administers the Company's Amended and Restated 1996 Stock Option Plan (the "Stock Option Plan"). The members of the Compensation Committee are Douglas K. Mellinger, Irwin J. Sitkin and Robert Forlenza, all of whom are non-employee directors. During 2002, the Compensation Committee met one time.

NOMINATING COMMITTEE. The Nominating Committee is responsible for preparing a list of candidates to fill the expiring terms of directors on the enherent Board of Directors. The Nominating Committee submits the list of candidates to the Board of Directors who determines which candidates will be nominated to serve on the Board of Directors. All the nominees are submitted for election at the Annual Meeting of stockholders. In selecting candidates for the enherent Board of Directors, the Nominating Committee keeps in mind the functions of this body, as well as any Nominating Agreements entered into by enherent Corp. The Nominating Committee also submits to the entire Board of Directors a list of candidates to fill any interim vacancies on the Board resulting from the departure of a Board member for any reason prior to the expiration of his term. The Nominating Committee charter does not include procedures for shareholders to recommend Board candidates to the Nominating Committee. The members of the Nominating Committee are Douglas K. Mellinger, Robert Forlenza, and Isaac Shapiro. During 2002, the Nominating Committee did not meet. The Nominating Committee met once in January, 2003, and at that meeting determined to recommend Messrs. Forlenza and Sitkin for election to the Board.

DIRECTOR COMPENSATION

Directors are not entitled to fees for serving on the Board of Directors or committees thereof. All directors, however, are reimbursed for travel expenses incurred in connection with attending Board and

6

committee meetings. In addition, under the terms of the Company's Stock Option Plan, prior to December 1999, directors who were not executive officers of the Company were automatically granted annually options to purchase up to 3,000 shares of enherent common stock. In December 1999, the Board of Directors approved an increase in the number of options granted to directors to 20,000 options.

EXECUTIVE OFFICERS

The following table sets forth the executive officers of the Company and their ages as of December 31, 2002 (collectively, the "Management").

Name

| | Age

| | Position with the Company

|

|---|

| Robert D. Merkl | | 49 | | Chairman, President and Chief Executive Officer |

| George Warman | | 40 | | Chief Financial Officer, Executive Vice President |

| Felicia A. Norvell | | 42 | | General Counsel, Secretary |

Robert D. Merkl is Chairman, President and Chief Executive Officer for enherent Corp. Mr. Merkl joined enherent in 2000 as Senior Vice President, Operations. Mr. Merkl was named Chief Operating Officer and Executive Vice President effective August 2, 2001. Effective March 7, 2002, Mr. Merkl became President of enherent Corp. On September 10, 2002, Mr. Merkl was named Chairman of the Board of Directors and Chief Executive Officer. Prior to joining enherent, Mr. Merkl was an Account Manager at Electronic Data Systems (EDS) from January 26, 1999 to January 30, 2000. Mr. Merkl also enjoyed a distinguished 23-year career in the United States Army. In addition to a wide variety of senior command posts in the United States Army culminating as Chief, Western Hemisphere Operations, Mr. Merkl also served as a Professor of Economics at the United States Military Academy at West Point. Mr. Merkl holds a Bachelor of Science in Engineering from the United States Military Academy at West Point, a Masters of Military Arts and Science from the Command and General Staff College at Fort Leavenworth, Kansas, a Masters of Business Administration with Honors from the University of Chicago, and a Masters Degree in National Security Strategy from the National War College.

George Warman has served as Chief Financial Officer and Executive Vice President for enherent Corp. since January 1, 2002. Mr. Warman served as Controller and Vice President, Finance from October of 1999 until January 1, 2002. Mr. Warman joined enherent Corp. from Electronic Data Systems (EDS), where he served in accounting and financial positions for 10 years. Mr. Warman's final position at EDS was Divisional Controller in the Communications Industry Group, In that capacity, Mr. Warman provided accounting and new business analysis support. Prior to joining EDS, Mr. Warman was in the Supervision and Regulations Division at the Federal Reserve Bank in Dallas. Mr. Warman earned his bachelor's degree in Accounting from Arkansas Tech University in Russellville, Arkansas.

Felicia A. Norvell has served as General Counsel and Corporate Secretary for enherent Corp. since August 2002. Ms. Norvell served as Staff Attorney for enherent Corp. from February 2001 until August 2002. Ms. Norvell joined enherent Corp from TimesThree Inc., a cellular location services company, where she served as Staff Attorney from November 1, 2000 to January 31, 2001. In addition to a corporate practice background, Ms. Norvell has 15 years experience as a trial attorney in several areas, including criminal defense, criminal prosecution and insurance defense. Ms. Norvell earned her bachelor's degree in Political Science from the University of Oklahoma and her Juris Doctorate degree from the University of Oklahoma College of Law in Norman, Oklahoma.

7

EXECUTIVE COMPENSATION

Report of Compensation Committee

The Compensation Committee of the Board of Directors (the "Committee"), which is comprised entirely of non-employee directors, is responsible for the establishment and administration of the compensation programs for enherent's executive officers, including the Chief Executive Officer. The Committee met one time in 2002 to address items related to the compensation and benefits of enherent's executive officers.

Compensation Philosophy; CEO Compensation

The Committee has adopted a compensation philosophy based on the premise that executives should receive competitive compensation determined by reference to both enherent's performance and the individual's contribution to that performance. Compensation plans and programs are intended to motivate and reward executives for long-term strategic management and the enhancement of stockholder value, support a performance-oriented environment that rewards achievement of internal business goals and attract and retain executives whose abilities are critical to the long-term success and competitiveness of enherent.

enherent's compensation programs are designed to provide executives with a competitive earnings opportunity, with earnings linked to the short-term and long-term performance of enherent. The Committee has developed executive compensation principles to provide guidance in the design and operation of the senior management compensation plans and in the review of executive performance. enherent's executive compensation program consists of three key elements: (a) base salary; (b) short-term incentives, i.e., annual bonus; and (c) long-term incentives, i.e., stock options.

The Committee sets salary levels at levels that it believes are competitive with salaries offered by other entities with similar size and in similar industries. As the Company's total revenues have decreased, the base salary payable to its Chief Executive Officer has decreased. For example, Dan S. Woodward, enherent's former Chief Executive Officer, received a base salary of $318,000, while Robert Merkl, enherent's current Chief Executive Officer, receives a base salary of $192,000.

The Committee believes that it is important to offer members of senior management short-term incentive compensation in the form of bonuses based on performance targets for the Company and/or the individual. Therefore, most of the Company's senior management is entitled to receive a performance bonus based on achievement of targeted objectives. In the case of the Company's Chief Executive Officer, the Company has established performance targets based on revenues, cash on hand and earnings before interest, taxes, depreciation and amortization. The Chief Executive Officer's annual target bonus opportunity is $96,000, or approximately one-third of total potential cash compensation.

Finally, the Committee believes that the use of stock options as long-term incentive compensation aligns the interests of senior management and the Company's stockholders. The Chief Executive Officer and each member of senior management hold what the Committee considers to be a substantial number of stock options.

The factors the Committee considered in determining the CEO compensation for 2002 are included in the preceding discussion.

Section 162(m) of the Internal Revenue Code generally limits the deductibility of compensation to the Chief Executive Officer and the four other most highly compensated officers in excess of $1 million per year, provided, however, that certain "performance-based" compensation may be excluded from such $1 million limitation. While neither the Chief Executive Officer nor the four other most highly compensated officers of the Company earned in excess of $1 million in fiscal year 2002, the Committee intends to

8

structure future annual cash bonus awards and stock option grants under the Stock Option Plan in a manner designed to make such awards "performance-based" compensation to the extent practicable.

Douglas K. Mellinger, Compensation Committee Member

Irwin J. Sitkin, Compensation Committee Member

Robert Forlenza, Compensation Committee Member

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is composed of Douglas K. Mellinger, Robert Forlenza and Irwin J. Sitkin, none of whom are employees or current officers of enherent. Mr. Mellinger was CEO of enherent until June 1999. Mr. Forlenza and Mr. Sitkin are not former officers of enherent.

9

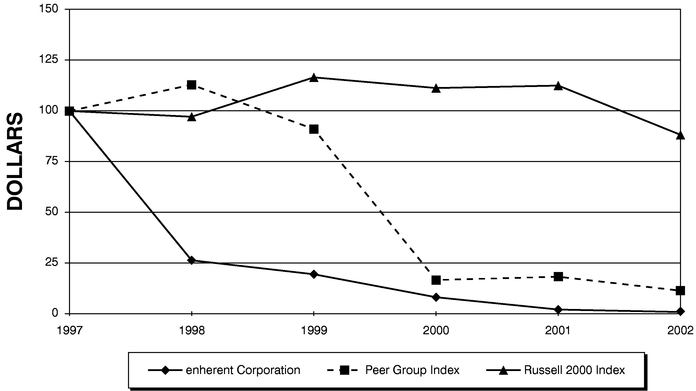

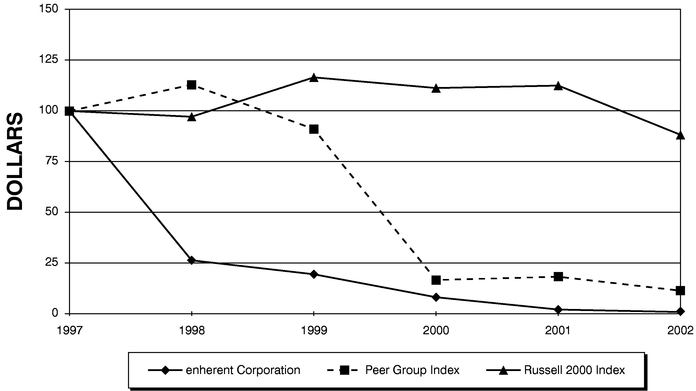

Performance Graph

The following graph compares the cumulative total stockholder return on enherent common stock, including reinvestment of dividends for the 5 years ending December 31, 2002, with the cumulative total return of the Russell 2000 index and a peer group index assuming an investment of $100 for the 5 years ending December 31, 2002.

THE FOLLOWING GRAPH IS PRESENTED IN ACCORDANCE WITH SECURITIES AND EXCHANGE COMMISSION REQUIREMENTS. STOCKHOLDERS ARE CAUTIONED AGAINST DRAWING ANY CONCLUSIONS FROM THE DATA CONTAINED THEREIN, AS PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE PERFORMANCE. THIS GRAPH IN NO WAY REFLECTS ENHERENT'S FORECAST OF FUTURE FINANCIAL PERFORMANCE.

Comparison of Cumulative Total Return Since Publicly Traded

DIVIDEND REINVESTED TOTAL RETURN

|

|---|

Company/Index Name

| | 12/31/97

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

|

|---|

|

|---|

| enherent | | $ | 100 | | $ | 26.37 | | $ | 19.23 | | $ | 8.25 | | $ | 1.93 | | $ | 0.79 |

| Peer Index | | $ | 100 | | $ | 112.68 | | $ | 91.05 | | $ | 16.57 | | $ | 18.33 | | $ | 11.43 |

| Russell 2000 Index | | $ | 100 | | $ | 97.20 | | $ | 116.24 | | $ | 111.22 | | $ | 112.36 | | $ | 88.11 |

Peer Index (CVNS, CHRZ, IGTE, ITIG)

Notwithstanding anything to the contrary set forth in any of enherent's filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended (the "Exchange Act"), that might incorporate future filings by reference, including this Proxy Statement, in whole or in part, the foregoing Report of the Compensation Committee and Performance Graph shall not be incorporated by reference into any such filings.

10

Summary Compensation Table

The following Summary Compensation Table sets forth information with respect to the compensation paid by enherent during each of the three years ended December 31, 2002, 2001 and 2000 to (i) each individual who served as Chief Executive Officer during the fiscal year ended December 31, 2002, and (ii) each of the other executive officers of enherent whose total salary and bonus exceeded $100,000 during 2002 and who were serving as executive officers as of December 31, 2002:

| | Annual Compensation

| |

| |

| |

| |

|---|

Name and

Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other

Annual

Compensation

($)

| | Number of

Securities

Underlying

Options (#)

| | All Other

Compensation

($)(2)

| |

|---|

Dan S. Woodward(1)

Chairman & Chief Executive

Officer | | 2002

2001

2000 | | 225,250

318,000

318,000 | | 50,000

36,750

515,809 | | 0

0

0 | |

0

269,585 | | 266,976

27,197

99,059 | (3)

|

Robert D. Merkl(4)

Chairman, President and

Chief Executive Officer |

|

2002

2001

2000 |

|

192,000

155,625

98,958 |

|

20,000

32,324

18,000 |

|

0

0

0 |

|

500,000

100,000

40,000 |

|

0

0

0 |

|

George Warman(5)

Executive Vice President,

Chief Financial Officer and

Treasurer |

|

2002

2001

2000 |

|

150,000

135,000

125,000 |

|

20,000

60,000

0 |

|

0

0 |

|

300,000

0

38,985 |

|

0

0

10,558 |

|

- (1)

- Mr. Woodward's employment began in May 1999. Mr. Woodward served as Chairman, President and CEO from June 1999 until March 7, 2002 when Robert D. Merkl was named President. Mr. Woodward continued to serve as Chairman and CEO until September 2002 when Robert D. Merkl was named Chairman and CEO. The year 2002 "All Other Compensation" consists of payments made to Mr. Woodward in accordance with the Separation Agreement and Release dated September 13, 2002 and detailed below under "Employment Contracts, Termination of Employment and Change-in-Control Arrangements." The year 2000 bonus amount includes a $230,000 bonus guarantee for 1999, which was paid in 2000. The "All Other Compensation" amounts for prior years consisted of costs of Company-provided automobile, housing, personal travel and meals allowance.

- (2)

- This amount includes personal travel, housing, car allowance, meal allowance and termination compensation where specified.

- (3)

- This figure includes $256,000 which was paid to Mr. Woodward as severance.

- (4)

- Mr. Merkl's employment began in February 2000 as Senior Vice President, Operations. Mr. Merkl was named Chief Operating Officer and Executive Vice President effective August 2, 2001. Mr. Merkl became President of enherent Corp. on March 7, 2002, and Chairman and Chief Executive Officer effective September 10, 2002 and currently serves as Chairman, President and Chief Executive Officer.

- (5)

- Mr. Warman's employment began in October 1999. Mr. Warman was named Controller and Vice President, Finance effective November 1, 2000. Mr. Warman was named Chief Financial Officer and Executive Vice President effective January 1, 2002. Mr. Warman was named Treasurer effective September 9, 2002.

11

Option Grants in Last Fiscal Year

The following table sets forth information concerning the grant of stock options to each of the named executive officers during the last fiscal year.

Option Grants In Last Fiscal Year

INDIVIDUAL GRANTS

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

|---|

Name

| | Number of

Securities

Underlying

Options Granted

(#)

| | % of Total

Options

Granted to

Employees

in Fiscal

Year

| | Exercise

or Base

Price

($/Sh)

| | Expiration

Date

| | 5% ($)

| | 10% ($)

|

|---|

|

|---|

| Dan S. Woodward | | 0 | | 0 | | 0 | | 0 | | | | |

Robert D. Merkl |

|

500,000 |

|

46.3 |

|

0.025 |

|

2012 |

|

7,861.97 |

|

19,921.80 |

George Warman |

|

300,000 |

|

27.8 |

|

0.025 |

|

2012 |

|

4,716.73 |

|

11,954.25 |

Aggregate Option Exercises in Last Fiscal Year and Fiscal Year End Option Values

The following table sets forth information concerning the exercise of stock options during the last fiscal year by each of the named executive officers and year-end values of unexercised options.

Name

| | Number of

Shares

Acquired

on

Exercise

(#)

| | Value

Realized

($)

| | Number of Shares Underlying

Unexercised Options at Fiscal

Year End (#)

Exercisable/Unexercisable

| | Value of Unexercised

In-the-Money Options at

Fiscal Year-End ($)(1)

Exercisable/Unexercisable

|

|---|

|

|---|

| Dan S. Woodward | | 0 | | 0 | | 766,648/0 | | 0/0 |

Robert D. Merkl |

|

0 |

|

0 |

|

59,999/580,001 |

|

0/32,500 |

George Warman |

|

0 |

|

0 |

|

75,989/312,985 |

|

0/19,500 |

- (1)

- Based on the difference between the exercise price of the options and the fair-market value of the enherent common stock on December 31, 2002 ($0.09).

12

Employment Contracts, Termination of Employment and Change-in-Control Arrangements

On April 30, 2002, the Company entered into an employment agreement with Dan S. Woodward for an initial one-year term (the "Woodward Agreement") commencing on January 1, 2002. The Woodward Agreement provided for an automatic renewal on January 1, 2003 for an additional 12-month period. The term of the Woodward Agreement included the renewal period.

Under the Woodward Agreement, Mr. Woodward served as Chief Executive Officer and Chairman of the Board, earning a base salary of $318,000, with a target bonus opportunity of $100,000 and an over-achievement bonus opportunity of $50,000. Mr. Woodward received a retention incentive bonus of $50,000 upon execution of the Woodward Agreement and was scheduled to receive an additional $50,000 on January 1, 2003. The Company agreed to pay over the term of the Woodward Agreement up to a total of $50,000 per year as reimbursement for all reasonable and documented costs associated with Mr. Woodward's traveling to and from his residence, local housing, automobile costs and other costs directly related to Mr. Woodward's housing or travel. Under the Woodward Agreement, his annual base salary would have been reviewed annually by the Board of Directors and increased (but not decreased) if the Board of Directors, in its discretion, determined an increase to be appropriate.

The Woodward Agreement provided if Mr. Woodward's employment was terminated (i) by the Company Without Cause (as defined in the Woodward Agreement), or (ii) by Mr. Woodward for Good Reason (as defined in the Woodward Agreement)) prior to the expiration of the term of the Woodward Agreement, the Company would pay Mr. Woodward (i) his then-current annual base salary for the shorter of (a) one (1) year, or (b) the remainder of the term of the Woodward Agreement; (ii) any earned performance bonus prorated as of the date of termination; and (iii) the retention bonus required to be paid January 1, 2003 if such termination occurred prior to that date. Payment was to be made in accordance with the Company's then-current payroll practices. Additionally, the Woodward Agreement provided if Mr. Woodward's employment is terminated by the Company Without Cause or by Mr. Woodward for Good Reason, any stock options granted to Mr. Woodward would be exercisable as per the original vesting schedule of the applicable option grant.

The Woodward Agreement provided that a Change in Control (as defined in the Woodward Agreement) in the Company during the term of the Woodward Agreement, resulting in a material adverse change in duties, responsibilities or role, or reporting relationships of Mr. Woodward would be treated as a termination by the Company Without Cause. If such termination Without Cause occurred following Change in Control, the Woodward Agreement provided that Mr. Woodward would be entitled to elect to receive such termination payments in a single lump sum and all stock options held by Mr. Woodward would become immediately exercisable, except that the Company's Board of Directors could elect to exchange such options for a cash payment.

On September 13, 2002, the Company entered into a Separation Agreement and Release with Mr. Woodward in order to amicably resolve the terms of Mr. Woodward's separation from the Company. Under the terms of the Separation Agreement and Release, the Company agreed to pay Mr. Woodward $306,000 as follows: $256,000 on September 13, 2002, $25,000 on August 1, 2003, and $25,000 on September 1, 2003, each such amount less all applicable state and federal taxes. The Company chose to make the $25,000 payments payable to Mr. Woodward on August 1, 2003 and September 1, 2003 in March 2003. In addition to the above, Mr. Woodward's non-vested Incentive Stock Options (ISOs) vested on September 13, 2002 in accordance with the terms of the original award. Mr. Woodward had 90 days following September 13, 2002, to exercise all vested ISOs. All non-vested Non Qualified Stock Options (NQs) were cancelled effective September 13, 2002. NQs that vested as of September 13, 2002 continue to be exercisable in accordance with their original terms. Pursuant to the Separation Agreement and Release, Mr. Woodward also received the cash equivalent of his current welfare benefits ($10,976) for the remainder of his term of employment under the Woodward Agreement, which was paid concurrently with the execution of the Separation Agreement and Release.

13

Mr. Woodward released the Company, its officers, directors, stockholders, corporate affiliates, attorneys, agents and employees from any and all claims of every kind which he ever had or now has, including, but not limited to, claims arising out of his employment, any claims of violation of Title VII of the Civil Rights Act of 1964, the Employee Retirement Income Security Act of 1974, the Fair Credit Reporting Act, the Americans with Disabilities Act or any claims brought under the Age Discrimination in Employment Act. Mr. Woodward also agreed not to compete with the Company for a period of two years and not to solicit employees of the Company for one year.

Mr. Woodward has continued to serve as a member of the Board of Directors and will do so until the expiration of his term at the Annual Meeting in 2003.

Robert D. Merkl currently serves as Chairman, Chief Executive Officer and President, earning a base salary of $192,000. The remaining terms of Mr. Merkl's employment are currently being negotiated and the Company anticipates that it will enter into an employment agreement with Mr. Merkl prior to the Annual Meeting in 2003.

During his employment with the Company, Mr. Merkl has been awarded 640,000 stock options, the strike prices of which are 5,000 at $1.125, 5,000 at $0.6875, 30,000 at $0.625, 100,000 at $0.10, and 500,000 at $0.025.

On November 1, 2002, the Company entered into an employment agreement with George Warman for an eight (8) month term (the "Warman Agreement") commencing on November 1, 2002.

Under the Warman Agreement, Mr. Warman serves as Chief Financial Officer and Executive Vice President, earning a base salary of $150,000, with a target bonus opportunity of $20,000. The Warman Agreement also provides that Mr. Warman will receive a $50,000 bonus on May 1, 2003 in the event that he remains employed by the Company on April 30, 2003. The annual base salary will be reviewed annually by the President of the Company and increased (but not decreased) if the Board of Directors, in its discretion, determines such an increase to be appropriate.

If Mr. Warman's employment is terminated by the Company Without Cause (as defined in the Warman Agreement) prior to the expiration of the term of the Warman Agreement, the Company shall pay Mr. Warman (i) his salary through the end of the eight month term of the Agreement: (ii) any earned performance bonus prorated as of the date of termination, and (iii) the stay bonus of $50,000 that is payable on May 1, 2003 if said bonus has not been paid at the time of termination. Additionally, if Mr. Warman's employment is terminated by the Company Without Cause, (i) any incentive stock options granted to Mr. Warman shall immediately vest and remain exercisable in accordance with the terms of the Plan, (ii) any non-qualified options held by Mr. Warman that are vested at the date of termination will remain exercisable in accordance with the terms of the Plan and any non-qualified options held by Mr. Warman at the date of termination shall expire.

If Mr. Warman's employment is terminated by Mr. Warman for Good Reason (as defined in the Warman Agreement), the Company shall pay Mr. Warman the same amounts as would have been paid had his employment been terminated Without Cause (as defined in the Warman Agreement). "Good Reason" includes a material diminution in Mr. Warman's position, authorities, duties or responsibilities, a material breach by the Company of its obligations under the Warman Agreement and a termination by the Company of Mr. Warman's employment following a Change in Control (as defined in the Warman Agreement) prior to the expiration of the term of the Warman Agreement and within six (6) months of the Change in Control. The Warman Agreement provides that in the event of a Change in Control of the Company, incentive options held by Mr. Warman shall immediately vest and remain exercisable in accordance with the terms of the Plan. All non-qualified options held by Mr. Warman at the date of the Change in Control that are vested at that date are to remain exercisable in accordance with the terms of the Plan, and all such non-qualified options that are not vested at the date of the Change in Control shall expire. At its option, in the event of a Change in Control, the Company may elect to exchange any such

14

vested option for cash. During his employment with the Company, Mr. Warman has been awarded 388,985 stock options, the strike prices of which are 50,000 at $1.8750, 18,985 at $1.1880, 20,000 at $0.6875, and 300,000 at $0.025.

Certain Transactions

On January 30, 2002, with the approval of the Board of Directors, enherent entered into a Stock Purchase Agreement with The Travelers Indemnity Company ("The Travelers"). The Travelers converted one million (1,000,000) shares of its Series A Senior Participating Redeemable Convertible Preferred Stock to 1,000,000 shares of enherent Common Stock. Under the terms of the Stock Purchase Agreement, The Travelers then sold the 1,000,000 shares of Common Stock to enherent for $200,000. enherent has retired the 1,000,000 shares of Series A Senior Participating Redeemable Convertible Preferred Stock.

Section 16(a) Beneficial Ownership Reporting Compliance

enherent's directors, executive officers and beneficial owners of more than 10% of its common stock (collectively, "insiders") are required under the Exchange Act to file with the Securities and Exchange Commission (the "SEC") reports of ownership and changes in ownership in their holdings of enherent common stock. Copies of these reports must also be furnished to enherent. The SEC has established specific due dates, and we are required to disclose in the proxy statement any failure to file by those dates. Based on our review of copies of Section 16(a) reports that we received from insiders for their 2002 transactions, we believe that our insiders have complied with all Section 16(a) filing requirements applicable to them during 2002 with the following exceptions. A Form 4 covering Robert D. Merkl's Employee Stock Option Grant for 500,000 shares of enherent common stock was filed in February 2003 rather than by October 30 2002. A Form 4 covering George Warman's Employee Stock Option Grant for 300,000 shares of enherent Common Stock was filed in February 2003 rather than by October 30, 2002. A Form 4 covering Felicia A. Norvell's Employee Stock Option Grant for 50,000 shares of enherent common stock was filed in February 2003 rather than by October 30, 2002. Form 4's covering Robert Forlenza, Irwin Sitkin and Isaac Shapiro's Director Stock Option Grants for 20,000 shares of enherent common stock each were all filed in February 2003 rather than by October 30, 2002. A Form 4 covering Douglas Mellinger's Director Stock Option Grant for 20,000 shares of enherent common stock was filed in March 2003 rather than by October 30, 2002.

APPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTS

The Board of Directors, ratified the decision of the Audit Committee to select Ernst & Young LLP to serve as enherent's independent public accountants for the year ending December 31, 2003. Ernst & Young LLP has been enherent's auditors since July, 1997.

The following table shows the fees paid or accrued by the Company for the audit and other services provided by Ernst & Young LLP for fiscal years 2001 and 2002.

| | 2002

| | 2001

|

|---|

| Audit services(1) | | $ | 127,448 | | $ | 123,589 |

| All other fees: | | | | | | |

| | Audit-related services(2) | | | 2,500 | | | 71,200 |

| | Tax compliance and advisory services(3) | | | 4,800 | | | 77,476 |

| | All other services(4) | | | 12,401 | | | 14,940 |

| | |

| |

|

| Total all other fees(5) | | | 19,701 | | | 163,616 |

Total fees |

|

$ |

147,149 |

|

$ |

287,205 |

| | |

| |

|

15

Ernst & Young LLP did not render professional services relating to financial information systems design and implementation for the fiscal year ended December 31, 2001 or the fiscal year ended December 31, 2002.

- (1)

- Audit services of Ernst & Young LLP for 2001 and 2002 consisted of the examination of the consolidated financial statements of the Company and quarterly review of financial statements as well as statutory audits, which are required for certain international subsidiaries, services related to filings made with the Securities and Exchange Commission and other attest services.

- (2)

- Audit-related services include, among other items, the required audits of the Company's employee benefit plans, as well as accounting advisory services related to financial accounting matters and mergers and acquisitions.

- (3)

- Tax compliance and advisory services include assistance with the preparation of tax returns of certain of the Company's international subsidiaries, as well as advising management as to the tax implications of certain transactions undertaken by the Company.

- (4)

- All other services include assistance with the preparation of tax returns of certain of the Company's expatriate employees, as well as advising the employees on tax matters.

- (5)

- The Audit Committee has determined that the provision of services related to audit services, audit-related services, and tax compliance and advisory services is compatible with maintaining the principal accountant's independence.

The Audit Committee has reviewed and believes that the non-audit related fees are compatible with maintaining auditor independence.

Your ratification of the Company's selection of Ernst & Young LLP is not necessary because the Audit Committee has responsibility for selection of the Company's independent auditors. Nevertheless, if the appointment is not approved, the Audit Committee and the Board of Directors will reconsider its appointment. A representative of Ernst & Young LLP is not expected to be present at the Annual Meeting and therefore, will not respond to questions and will not have the opportunity to make a statement.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR

THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS

INDEPENDENT PUBLIC ACCOUNTANTS FOR 2003.

VOTING RESULTS OF THE ANNUAL MEETING

The Company will announce the voting results at the meeting and will publish the results in its quarterly report on Form 10-Q for the second quarter of 2003. The Company will file that report with the Securities and Exchange Commission, and you can get a copy by contacting either the Company's Secretary at (972) 243-8345 or the Securities and Exchange Commission at (800) SEC-0330 or www.sec.gov.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee oversees the Company's financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process including the systems of internal controls. In fulfilling its oversight responsibilities, the Committee reviewed the audited financial statements in the Annual Report with management including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Committee reviewed with the independent auditors, who are responsible for expressing an opinion on the conformity of enherent's audited financial statements with generally accepted accounting

16

principles, their judgments as to the quality, not just the acceptability, of the Company's accounting principles and such other matters as are required to be discussed with the Committee under generally accepted auditing standards. In addition, the Committee has discussed with the independent auditors the auditors' independence from management and the Company including the matters in the written disclosures required by the Independence Standards Board and considered the compatibility of nonaudit services with the auditors' independence..

The Committee discussed with the independent auditors the overall scope and plans for their audits. The Committee meets with the independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company's internal controls, and the overall quality of the Company's financial reporting. The Committee held six meetings during fiscal year 2002. In reliance on the reviews and discussions referred to above, the Committee determined (and the Board has ratified) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the Securities and Exchange Commission. The Committee also selected (and the Board ratified) Ernst & Young LLP as the Company's independent auditors for 2003.

Robert Forlenza, Audit Committee Member

Irwin Sitkin, Audit Committee Member

17

STOCKHOLDER PROPOSALS FOR 2004 ANNUAL MEETING

Under the rules of the SEC, the date by which proposals of stockholders intended to be presented at the 2004 Annual Meeting of Stockholders must be received by enherent for inclusion in its Proxy Statement and form of proxy relating to that meeting is December 6, 2003. Proposals may be mailed to enherent Corp., Secretary, 80 Lamberton Rd., Windsor, CT 06095.

In addition, a stockholder may bring business before the annual meeting, other than a proposal included in the Proxy Statement, or may submit nominations for director if the stockholder complies with the requirements specified in enherent's bylaws. The requirements include: (i) providing written notice to enherent's Secretary at the above address that is received not less than sixty (60) days nor more than ninety (90) days prior to the anniversary date of the immediately preceding annual meeting of stockholders (subject to adjustment if the subsequent year's annual meeting date is substantially moved, as provided in the bylaws); and (ii) supplying the additional information listed in Article II, Section 7 of enherent's bylaws.

OTHER MATTERS

As of the date of this Proxy Statement, the Board of Directors knows of no matters that will be presented for consideration at the Annual Meeting other than the proposals set forth in this Proxy Statement. However, if any other matter calling for a vote of stockholders is properly presented at the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote in accordance with their best judgment on such matters.

A COPY OF ENHERENT'S ANNUAL REPORT ON FORM 10-K (WITHOUT EXHIBITS)

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS BEING MAILED TOGETHER WITH THIS PROXY STATEMENT. SUCH REPORT SHOULD NOT BE CONSIDERED AS PART OF THE PROXY MATERIALS. ADDITIONAL COPIES ARE AVAILABLE AND WILL BE SENT TO ANY STOCKHOLDER WITHOUT CHARGE UPON WRITTEN REQUEST TO ENHERENT CORP., 12300 FORD ROAD, SUITE 450, ATTENTION: FELICIA A. NORVELL, CORPORATE SECRETARY. THE ANNUAL REPORT ON FORM 10-K IS ALSO AVAILABLE ELECTRONICALLY ON ENHERENT'S INTERNET WEBSITE AT HTTP://WWW.ENHERENT.COM. OR ON THE SEC'S WEBSITE AT WWW.SEC.GOV.

| | | By order of the Board of Directors | | |

|

|

/s/ FELICIA A. NORVELL

Secretary |

|

|

March 28, 2003

18

ANNEX A

ENHERENT CORP. AUDIT COMMITTEE CHARTER

ORGANIZATION

This charter governs the operation of the audit committee. The audit committee shall review and reassess this charter at least annually and obtain the approval of the board of directors. The audit committee shall be appointed by the board of directors and shall comprise at least two directors, each of whom are independent of management and enherent Corp. (the "Company"). Members of the audit committee shall be considered independent if they have no relationship that may interfere with the exercise of their independence from management and the Company and are not an affiliated person of the Company or its subsidiaries, and meet the independence requirements of the stock exchange listing standards promulgated by the American Stock Exchange or the New York Stock Exchange. Members of the audit committee shall not, except in their capacities as members of the audit committee, the board of directors or any other committee of the board of directors, directly or indirectly, accept any consulting, advisory or other compensatory fee from the Company or any affiliate of the Company. All committee members shall have accounting or financial management expertise and qualify as financially literate, and at least one member shall be a "financial expert," as defined by applicable SEC regulations.

The audit committee shall have the authority to engage independent counsel and other advisors as it determines necessary to carry out its duties. The Company shall provide appropriate funding, as determined by the audit committee, for payment of compensation to (i) the registered public accounting firm employed by the Company for the purpose of rendering or issuing an audit report and (ii) to any advisors employed by the audit committee.

STATEMENT OF POLICY

The audit committee shall provide assistance to the board of directors in fulfilling its oversight responsibility to the shareholders, potential shareholders, the investment community, and others relating to the Company's financial statements and the financial reporting process, the Company's systems of internal accounting and financial controls, the performance of the independent auditors, the independent auditors' qualifications and independence, the annual independent audit of the Company's financial statements, and the legal compliance and ethics programs as established by management and the board. In so doing, it is the responsibility of the audit committee to maintain free and open communication between the audit committee, independent auditors and management of the Company.

In discharging its oversight role, the audit committee is empowered to investigate any matter brought to its attention with full access to all books, records, facilities, and personnel of the Company and the power to retain outside counsel, or other experts for this purpose.

RESPONSIBILITIES AND PROCESSES

The primary responsibility of the audit committee is to oversee the Company's financial reporting process on behalf of the board and report the results of their activities to the board. While the audit committee has the responsibilities and powers set forth in this Charter, it is not the duty of the audit committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and are in accordance with generally accepted accounting principles. Management is responsible for the preparation, presentation, and integrity of the Company's financial statements, and for the appropriateness of the accounting principles and reporting policies that are used by the Company. The independent auditors are responsible for auditing the Company's financial statements and for reviewing the Company's unaudited interim financial statements.

1

The audit committee in carrying out its responsibilities believes its policies and procedures should remain flexible, in order to best react to changing conditions and circumstances. The audit committee should take the appropriate actions to set the overall corporate "tone" for quality financial reporting, sound business risk practices, and ethical behavior. Any fraud or misuse of the Company's assets will immediately be brought to the attention of management and the audit committee.

In fulfilling its general responsibilities, the audit committee shall have the following specific responsibilities:

- •

- The audit committee shall be directly responsible for the appointment, retention, compensation and oversight of the work of any registered public accounting firm employed by the Company (including resolution of disagreements between the Company's management and the accounting firm regarding financial reporting) for the purpose of preparing or issuing an audit report or related work or performing other audit, review or other attestation services for the Company. Each such registered public accounting firm shall report directly to the audit committee. The audit committee shall have the ultimate authority and responsibility to evaluate and, where appropriate, replace the registered public accounting firm. The audit committee shall discuss with the registered public accounting firm its independence from management and the Company and the matters included in the written disclosures required by the Independence Standards Board.

- •

- The audit committee must pre-approve all audit and non-audit services provided to the Company by its registered public accountants, except as otherwise provided in Section 10A of the Securities Exchange Act of 1934. The audit committee shall approve such provision of audit and non-audit services only to the extent that provision of such services is not prohibited under the Securities Exchange Act of 1934. The audit committee may delegate to one of its members the authority to grant any such pre-approvals. The decision of any member of the audit committee to whom pre-approval authority is delegated shall be presented to the full audit committee at each of its scheduled meetings.

- •

- At least annually, the committee shall obtain and review a report by the independent auditors describing the firm's internal quality control procedures, any material issues raised by the most recent internal quality control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the firm, and any steps taken to deal with any such issues. The report should include all relationships between the independent auditor and the Company.

- •

- The audit committee shall establish procedures for (i) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and (ii) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters.

- •

- The audit committee shall discuss with the registered public accounting firm the overall scope and plans for their respective audits including the adequacy of staffing and compensation. Also, the audit committee shall discuss with management, the internal auditors, and the registered public accounting firm the adequacy and effectiveness of the accounting and financial controls, including the Company's system to monitor and manage business risk, and legal and ethical compliance programs. Further, the audit committee shall meet separately with the registered public accounting firm, with and without management present, to discuss the results of their examinations.

- •

- The audit committee shall review the interim financial statements with management and the registered public accounting firm prior to the filing of the Company's Quarterly Report on Form 10-Q. Also, the audit committee shall discuss the results of the quarterly review and any other matters required to be communicated to the audit committee by the registered public accounting

2

3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Please Mark

Here for

Address Change

or Comments |

o |

1. Election of Directors |

FOR

o |

WITHHELD

o |

EXCEPTIONS*

o |

|

2. Ratification of the appointment of accountants. The Board of Directors recommends a vote "FOR" the ratification of accountants. |

FOR

o |

AGAINST

o |

ABSTAIN

o |

The Board of Directors recommends a vote "FOR" the nominees listed below: (Nominees: 01 Robert Forlenza and 02 Irwin Sitkin) |

|

3. In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the meeting or any adjournment thereof. |

To vote your shares for all director nominees mark the "For" box

on Item 1. To withhold your votes for all nominees, mark the

"Withheld" box. If you do not wish your shares voted for a |

|

Check here if you:

I plan to attend the Annual Meeting |

|

o |

|

| particular nominee, mark the "Exceptions" box and enter the name(s) of the exception(s) in the space provided. Such a mark will be deemed a vote "FOR" a nominee other than these listed as exceptions. | | I want to stop receiving

more than one Annual Report at this address | o | |

*Exceptions:

|

|

Please sign name exactly as it appears on this card. Joint owners should each sign. Attorneys, trustees, executors, administrators, custodians, guardians or corporate officers should give full title. |

|

|

|

|

|

Dated: ____________________________________________, 2003 |

|

|

|

|

|

___________________________________________________

Signature |

|

|

|

|

|

___________________________________________________

Signature |

SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE |

|

|

|

|

FOLD AND DETACH HERE

|

Vote by Internet or Telephone or Mail

24 Hours a Day, 7 Days a Week

Internet and telephone voting is available through 11PM Eastern Time

the day prior to annual meeting day.

Your Internet or telephone vote authorizes the named proxies to vote your shares in the same manner

as if you marked, signed and returned your proxy card.

Internet

http://www.eproxy.com/enht |

OR |

Telephone

1-800-435-6710 |

OR |

Mail |

Use the Internet to vote your proxy. Have your proxy card in hand when you access the web site. You will be prompted to enter your control number, located in the box below, to create and submit an electronic ballot. |

|

Use any touch-tone telephone to vote your proxy. Have your proxy card in hand when you call. You will be prompted to enter your control number, located in the box below, and then follow the directions given. |

|

Mark, sign and date your proxy card and return it in the enclosed postage-paid envelope.

|

If you vote your proxy by Internet or by telephone,

you do NOT need to mail back your proxy card.

enherent

PROXY/VOTING INSTRUCTION CARD

This Proxy is solicited on behalf of the Board of Directors of enherent Corp. for the Annual Meeting of Stockholders on May 9, 2003.

The undersigned hereby authorizes Felicia A. Norvell and George O. Warman, and each or any of them with power to appoint his substitute, to vote as Proxy for the undersigned at the Annual Meeting of Stockholders to be held at the Hartford/Windsor Marriott Airport Hotel, 28 Day Hill Road, Windsor, Connecticut, 06095 on May 9, 2003 at 2:00 p.m. EST, or any adjournment or postponement thereof, the number of shares which the undersigned would be entitled to vote if personally present. The proxies shall vote subject to the directions indicated on the reverse side of this card and proxies are authorized to vote in their discretion upon such other business as may properly come before the meeting and any adjournments or postponements thereof. The proxies will vote as the Board of Directors recommends where the undersigned does not specify a choice.

CAUTION! PLEASE DO NOT FOLD, STAPLE, OR TEAR THIS CARD

Address Change/Comments(Mark the corresponding box on the reverse side)

FOLD AND DETACH HERE

QuickLinks

ELECTION OF DIRECTORSTHE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE NOMINEES FOR DIRECTOR.SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERSMEETINGS AND CERTAIN COMMITTEES OF THE BOARDDIRECTOR COMPENSATIONEXECUTIVE OFFICERSEXECUTIVE COMPENSATIONDIVIDEND REINVESTED TOTAL RETURNOption Grants In Last Fiscal YearAPPOINTMENT OF INDEPENDENT PUBLIC ACCOUNTANTSTHE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS INDEPENDENT PUBLIC ACCOUNTANTS FOR 2003.VOTING RESULTS OF THE ANNUAL MEETINGREPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORSSTOCKHOLDER PROPOSALS FOR 2004 ANNUAL MEETINGOTHER MATTERSANNEX AENHERENT CORP. AUDIT COMMITTEE CHARTER