UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 10-K / A

________________

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 28, 2003

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________ .

Commission file number 000-32527

BRIAZZ, INC.

(Exact name of registrant as specified in its charter)

Washington | 91-1672311 |

(Jurisdiction of incorporation) | (I.R.S. Employer Identification No.) |

3901 7th Avenue South, Suite 200

Seattle, Washington 98108

(Address of principal executive offices)

Registrant's telephone number: (206) 467-0994

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

|

|

| None | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, no par value

(Title of Class)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold on the OTC Bulletin Board as of the last business day of the registrant’s most recently completed second fiscal quarter, which was June 29, 2003, was $1,078,365.

The number of shares of the registrant’s Common Stock outstanding as of May 11, 2004 was 5,990,916.

DOCUMENTS INCORPORATED BY REFERENCE

None.

.

December 28, 2003

Annual Report on Form 10-K / A

TABLE OF CONTENTS

This Annual Report on Form 10-K/A is being filed to include as part of this

Form 10-K/A Part III, Item 10, 11, 12, 13 and 14 information rather than to incorporate

by reference this information from the Company’s Proxy Statement and to file additional exhibits.

| | | |

| | | Page |

| |

|

| | PART III. | |

| ITEM 10. | Directors and Executive Officers of the Registrant | 3 |

| ITEM 11. | Executive Compensation | 5 |

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management | 10 |

| ITEM 13. | Certain Relationships and Related Transactions | 13 |

| ITEM 14. | Principal Accountant Fees and Services | 14 |

| | PART IV. | |

| ITEM 15. | Exhibits, Financial Statement Schedules and Reports on Form 8-K | 14 |

| | | |

| SIGNATURES | | 19 |

Unless the context indicates otherwise, the terms “we,” “us,” “our,” the “Company,” or “BRIAZZ” refer to BRIAZZ, INC., a Washington corporation

PART III

Item 10. Directors and Executive Officers of the Registrant.

The following table sets forth information regarding our Directors as of May 11, 2004:

Name | Age | Position |

|

|

|

| | | |

| Victor D. Alhadeff | 57 | Director and Chairman of the Board, Secretary and Chief Financial Officer |

| Paul Bigler | 46 | Director |

| David Cotton | 51 | Director |

| Sue L. Gin | 61 | Director |

| Glenn MacMullin | 33 | Director |

| Charles C. Matteson Jr. | 61 | Director |

Victor D. Alhadeff.Mr.Alhadeff has served as a Director and our Chairman of the Board since founding BRIAZZ in 1995 and as our Chief Financial Officer and Secretary since 2002. Mr. Alhadeff also served as our Chief Executive Officer from 1996 to 2003, as our President from 1995 to 1996, as our Secretary from 1995 to 2001 and as our Treasurer from 1996 to 2001. In 1983, Mr. Alhadeff founded Egghead, Inc., a specialty retailer of personal computer software and accessories. Mr. Alhadeff served as Chairman of Egghead until 1990, when he purchased Egghead University, the software training division of Egghead. Egghead University was renamed Catapult, and Mr. Alhadeff served as its Chairman and Chief Executive Officer until 1993, when Catapult was purchased by IBM. Prior to founding Egghead, Mr. Alhadeff founded Equities Northwest Inc. (ENI), a corporation that formed, marketed and operated oil and gas partnerships, in 1971, and served as its Chief Executive Officer until the company was sold in 1983. While Mr. Alhadeff served at Egghead and ENI, each company, and Mr. Alhadeff, along with other officers and directors of each company, were the subject of shareholder lawsuits. All shareholder lawsuits were settled or dismissed. From 1969 to 1971, Mr. Alhadeff served as a First Lieutenant in the United States Army. Mr. Alhadeff received a B.A. in Business Administration from the University of Washington in 1968.

Paul Bigler. Mr. Bigler has served as one of our Directors since September 2003. Mr. Bigler has served as the managing director and chief operating officer of DB Advisors, LLC since the beginning of 2003. From 2002 to 2003, he served as managing director of global head equity market risk management for Deutsche Bank Securities Inc. Prior to joining Deutsche Bank Securities Inc., Mr. Bigler served in various capacities with Deutsche Bank AG from 1999 to 2001 including managing director of global finance and managing director, UK region treasurer. From 1996 through 1999, Mr. Bigler held positions with ABN-AMRO Bank N.V. including managing director – fixed income, senior vice president (global head of short term trading) and senior vice president and regional treasurer (Middle East and Africa). Mr. Bigler received a BA in business administration from Van derbilt University and a MBA – Finance from the Wharton School of Business, University of Pennsylvania.

David Cotton.Mr. Cotton has served as one of our Directors since September 2003. Mr. Cotton has been the chief financial officer of Flying Food Fare, Inc. and its subsidiaries and affiliates, including Flying Food Group, L.L.C. since 1996 and has served in the same role for Briazz Venture, L.L.C. since its formation.

Sue L. Gin.Ms. Gin has served as one of our Directors since September 2003. Ms. Gin is the founder, owner, chairman and chief executive officer of Flying Food Group, L.L.C., and has been for over five years. Ms. Gin has also served as a Director of Exelon Corporation since October 2000. In addition, Ms. Gin has previously served as a director of Unicom Corporation and Commonwealth Edison Company.

Glenn MacMullin.Mr. MacMullin has served as one of our Directors since September 2003.Mr. MacMullin has served as a director of DB Advisors, LLC since May 2002. From April 2001 to April 2002 he served as a director at Deutsche Bank Securities, Inc. From 1998 to 2001 he served in various positions with Deutsche Bank Offshore including head of investment funds and manager – investment funds. Mr. MacMullin received a bachelor of business administration from St. Francis Xavier University and is a chartered accountant in Canada.

Charles C. Matteson, Jr., Director.Mr. Matteson has served as one of our directors since March 2002. Since 2001, Mr. Matteson has served as the Managing Director and was a Founding Partner of Spinnaker Capital Partners, LLC, a Private Equity investment firm in partnership with European banking interests specializing in Consumer, Franchisable and Food Technology Firms. From 1997 to 2000, Mr. Matteson was an Operations Director and Founding Partner of Incontrol Systems, LLC, a retail-based healthcare company. In 1987, Mr. Matteson founded Matteson Companies International, Inc., which became one of the largest franchisees for Nutri/System’s medically/professionally supervised weight loss clinics. Mr. Matteson was the CEO for Matteson Companies International, Inc. from 1987 through 1997.

The following table sets forth information regarding our executive officers and other key personnel as of December 28, 2003:

Name | Age | Position |

|

|

|

| | | |

| Victor D. Alhadeff | 57 | Chairman of the Board, Chief Financial Officer, and Secretary |

| Milton Liu | 36 | Chief Executive Officer (since resigned) |

| Nancy Lazara | 47 | Vice President Food |

Victor D. Alhadeff, Chief Financial Officer, Secretary and Chairman of the Board. See above under Directors.

Milton Liu, Chief Executive Officer. Mr. Liu served as Director of Operations since May 2003. Mr. Liu was appointed as one of the Company’s Directors in September 2003 and as our Chief Executive Officer in December 2003. Prior to contracting with the Company, Mr. Liu served in various capacities, including as Chief Operating Officer with Flying Food Goup L.L.C., a private food service company, from 1998 until 2003. On May 6, 2004, Mr. Liu resigned as the Company’s Chief Exective Officer and as Director. As of May 11, 2004, the Company has not appointed a Chief Executive Officer.

Nancy Lazara, Vice President Food. Ms. Lazara has served as our Vice President Food since joining BRIAZZ in 1998. Ms. Lazara is responsible for menu strategy, product development, quality assurance and product purchasing. Prior to joining us, Ms. Lazara was Vice President of Product Development for H-E-B Grocery Company, a San Antonio-based supermarket chain, from 1989 to 1996; and Vice President, Food Services for Larry's Markets, a Seattle-based supermarket chain, from 1984 to 1989. Ms. Lazara received a Grande Diplome from Le Cordon Bleu Cooking School in France in 1975.

Section 16(a) Beneficial Ownership Reporting Compliance – Section 16(a) of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), requires that our officers and directors, and persons who own more than ten percent (10%) of a registered class of the Company’s equity securities, file reports of ownership and changes of ownership with the Securities and Exchange Commission (the “SEC”). Officers, directors and greater than ten percent (10%) shareholders are required by SEC regulation to furnish us with copies of all such reports they file.

Based solely on our review of the copies of such reports received by us, and on written representations by our officers and directors regarding their compliance with the applicable reporting requirements under Section 16(a) of the Exchange Act, we believe that, with respect to the fiscal year ended December 28, 2003, our officers and directors, and all of the persons known to us to own more than ten percent (10%) of our Common Stock, filed all required reports on a timely basis, except as follows:

Victor D. Alhadeff, Chairman of the Board, Chief Financial Officer and Secretary, has not filed a Form 4 reflecting an option grant received in November 2003 and the purchase of Series G Preferred Stock in December 2003.

Milton Liu, formerly Chief Executive Officer and a Director, has not filed a Form 3 reflecting his appointment as an officer and director and has not filed a Form 4 for grants of restricted stock and stock options in November and December 2003.

Sue Gin, a director, has not filed a Form 3 reflecting the acquisition of Series D Preferred Stock by Briazz Venture L.L.C., in which she has an 87.5% interest, and has not filed a Form 4 reflecting the surrender of the Series D Preferred Stock for Series F Preferred Stock and her appointment as a director in August 2003.

David Cotton, a director, has not filed a Form 3 reflecting his appointment as a director.

William Zang, a 10% shareholder, has not filed a Form 3 reflecting his acquisition of shares of Series F Preferred Stock pursuant to a restricted stock grant.

Item 11. Executive Compensation.

The following table sets forth the compensation paid to our Chief Executive Officer and other executive officers for the fiscal years ended December 30, 2001, December 29,

2002 and December 28, 2003. No other executive officer of BRIAZZ earned a salary and bonus for fiscal 2003 in excess of $100,000.

| | | |

| | | | Annual Compensation | Long-Term Compensation |

| | | |

|

| Name and Principal Position | | Bonus | Salary | Bonus | Restricted Stock Awards | Securities Underlying Options |

| | | | | | | |

| Victor D. Alhadeff, Chief Executive Officer, | | 2003 | $143,461 | -- | $49,000(5) | -- |

| Chief Financial Officer, Secretary and | | 2002 | -- | -- | -- | -- |

| Chairman of the Board(1) | | 2001 | -- | -- | -- | 122,833 |

| | | | | | | |

Milton Liu, Chief Executive Officer(2) | | 2003 | 110,768 | -- | $12,400(6) | -- |

| | | | | | | |

| C. William Vivian, President and Chief | | 2003 | 49,704 | -- | -- | -- |

| Operating Officer(3) | | 2002 | 215,927 | -- | -- | -- |

| | | 2001 | 209,999 | | | 129,998 |

| | | | | | | |

| Nancy Lazara, Vice President Food | | 2003 | 93,340 | -- | -- | -- |

| | | 2002 | 115,287 | -- | -- | 8,000 |

| | | 2001 | 115,750 | -- | -- | 21,998 |

| | | | | | | |

| Joel Sjostrom, Vice President Retail | | 2003 | 64,890 | -- | -- | -- |

| Operations(4) | | 2002 | 119,800 | -- | -- | 13,000 |

| | | 2001 | 117,431 | -- | -- | 21,997 |

| | | | | | | |

| | | | | |

(1) Mr. Alhadeff assumed the roles of Chief Financial Officer and Secretary upon the resignation of Tracy Warner effective October 31, 2002. In December 2003, he resigned as Chief Executive Officer.

(2) Mr. Liu was hired as Director of Operations in May 2003 and was appointed the role of Chief Executive Officer in December 2003.

(3) Mr. Vivian resigned as President and Chief Operating Officer effective February 28, 2003.

(4) Mr. Sjostrom’s employment as Vice President of Retail Operations ceased effective June 20, 2003.

(5) Represents the fair value of 250,000 shares of Series F Preferred Stock convertible into 2.5 million shares of common stock granted to Mr. Alhadeff in November 2003.

(6) Represents the fair value of 100,000 shares of Series F Preferred Stock convertible into 1 million shares of common stock granted to Mr. Liu in December 2003.

Option Grants in Last Fiscal Year–The following table sets forth certain information regarding stock option grants to our Chief Executive Officer and four most highly compensated executive officers during the year ended December 28, 2003. The potential realizable value is calculated based on the assumption that the common stock appreciates at the annual rate shown, compounded annually, from the date of grant until the expiration of its term. These amounts are calculated based on SEC requirements and do not reflect our projection or estimate of future stock price growth. Potential realizable values are computed by: multiplying the number of shares of common stock subject to a given option by the exercise price;

assuming that the aggregate stock value derived from that calculation compounds at the annual five percent (5%) or ten percent (10%) rate shown in the table for the entire ten-year term of the option; and

subtracting from that result the aggregate option exercise price.

| | Option Grants in Fiscal 2003 | |

| | Number of Securities | % of Total Options Granted to | | |

Potential Realizable Value at Assumed Annual Rates of Stock Price |

| | Underlying | Employees in | Exercise Price | | Appreciation for Option Term |

Name | Options Granted | Fiscal Year (1) | (per share) (2) | Expiration Date | 5% | 10% |

|

| Victor D. Alhadeff | 2,500,000 | 54.7% | $0.16 | November 25, 2013 | $251,557.85 | $637,496.98 |

| | | | | | | |

| Milton Liu | 1,150,000 | 25.2% | $0.16 | November 25, 2013 | $115,716.61 | $296,248.61 |

| | | | | | | |

| Nancy Lazara | 200,000 | 4.4% | $0.16 | November 25, 2013 | $20,124.63 | $50,999.76 |

(1) During the fiscal year ended December 28, 2003, options to purchase 4,568,000 shares were issued to employees.

(2) The exercise price per share was equal to the fair market value of the common stock on the date of grant as determined by the board of directors.

Option Exercises and Fiscal Year End Values – The following table sets forth for our Chief Executive Officer and four most highly compensated executive officers the number of shares acquired upon exercise of stock options during the year ended December 28, 2003 and the number of shares subject to exercisable and unexercisable stock options held at December 28, 2003.

|

| | | |

| | Securities Acquired on | Value Realized | Number of Securities Underlying Unexercised Options at December 28, 2003 | Value of Unexercised In-the-Money Options at December 28, 2003(1) |

| Name | Exercise (#) | ($) | Exercisable | Unexercisable | Exercisable | Unexercisable |

|

| Victor D. Alhadeff | -- | -- | 702,000 | 2,000,000 | -- | -- |

| Milton Liu | -- | -- | 150,000 | 1,000,000 | -- | -- |

| Nancy Lazara | -- | -- | 55,000 | 200,000 | -- | -- |

(1) The closing price of the common stock on December 26, 2003, the last trading day before the fiscal year end on December 28, 2003, was $0.10 per share. As of December 28, 2003, no options were in-the-money.

1996 Amended Stock Option Plan – The 1996 Amended Stock Option Plan was initially adopted by our Board of Directors and approved by our shareholders in December 1995 and was last amended in June 2002. The plan currently provides for the issuance of up to 1,165,000 shares of common stock upon the exercise of options granted thereunder, subject to adjustment for stock dividends, stock splits, reverse stock splits and other similar changes in our capitalization.

We have implemented a stock option program under the terms of the plan that we refer to as our "Fresh Options" program. The Fresh Options program currently provides for all hourly employees to receive a one-time grant of non-qualified stock options (within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended) after working 1,300 hours. The number of shares covered by the option is based on the employee's wages. Additional options may be granted to employees who remain employed for more than three years. Fresh Options are granted two times per year, on May 1st and November 1st.

Management-level employees are eligible to receive an initial grant of stock options at the next semi-annual grant date after the date of hire. The number of shares covered by the option is based on the manager's salary level. If an hourly employee is promoted to the management level, an option to purchase additional shares is granted in an amount equal to that granted to a newly hired manager.

Senior management-level employees are eligible to receive an initial grant of stock options on the employee's hire date and performance-based annual grants as determined on a case-by-case basis.

Directors are eligible to receive an initial grant of non-qualified stock options when elected or appointed to the board.

On March 3, 1997, the Board of Directors authorized the compensation committee to serve as the plan administrator. The exercise price per share for options granted pursuant to the plan is the fair market value of the shares on the date of grant, as determined by the plan administrator. Options typically vest in equal annual installments over a four-year period. No options vest in any year in which the optionee, if an employee, works less than a minimum of 500 hours.

With certain exceptions, each outstanding option terminates, to the extent not previously exercised, upon the occurrence of the first of the following events:

the expiration of the term of the option, which is specified by the plan administrator at the time of grant (generally ten years; or, with respect to incentive stock options granted to greater-than-ten-percent shareholders, a maximum of five years);

the date of an optionee's termination of employment or contractual relationship with us for cause;

the expiration of three months from the date of an optionee's termination of employment or contractual relationship with us for any reason other than cause, death or disability, unless, in the case of a non-qualified stock option, extended by the plan administrator until a date no later than the expiration date of the option; or

the expiration of one year from the date of an optionee's cessation of employment or contractual relationship with us by reason of death or disability, unless, in the case of a non-qualified stock option, the exercise period is extended by the plan administrator until a date not later than the expiration date of the option.

Upon exercise, the exercise price may be paid in cash or by:

with the approval of the plan administrator, delivering shares of common stock previously held;

having shares withheld or sold or margined from the number of shares to be received; or

complying with any other payment mechanisms the plan administrator may approve.

The plan administrator may amend, modify or terminate the plan, or modify or amend options granted under the plan, except that no amendment with respect to an outstanding option that has the effect of reducing the holder's benefits may be made over the objection of the holder (other than those provisions triggering acceleration of vesting of outstanding options).

2003 Stock Plan

In July 2003, the Company adopted a new stock incentive plan that authorizes the issuance of 12 million shares of common stock upon exercise of stock options or upon the grant of restricted stock. As of December 28, 2003, the Company had issued to certain new and existing members of Company management shares of Series F Preferred Stock convertible into 4.5 million shares of Company common stock and stock options exercisable for approximately 5.4 million shares of common stock. Under the Plan, stock options may be granted to employees, directors and such other persons as the plan administrator may select.

As of December 28, 2003, options to acquire 6,522,952 shares of common stock were outstanding and options to acquire 1,313,795 shares of common stock were exercisable under the plans. In 2003, no options were exercised. Of the outstanding options:

5,917,500 were at an exercise price of $0.16 per share;

51,806 were at an exercise price of $0.69 per share

4,211 were at an exercise price of $0.95 per share;

4,000 were at an exercise price of $1.00 per share;

57,773 were at an exercise price of $1.26 per share

220,384 were at an exercise price of $1.50 per share;

6,667 were at an exercise price of $1.66 per share;

2,000 were at an exercise price of $2.34 per share;

195,402 were at an exercise price of $4.70 per share;

61,614 were at an exercise price of $6.00 per share;

300 were at an exercise price of $600.00 per share;

640 were at an exercise price of $1,632.00 per share;

413 were at an exercise price of $1,800.00 per share; and

242 were at an exercise price of $3,900.00 per share.

Employment Agreements –We have entered into a non-competition agreement with our Chairman of the Board, Victor D. Alhadeff, dated October 18, 1996. This agreement provides that during the term of his employment with us and for two years thereafter, Mr. Alhadeff will not act as an agent of, own (except for less than 5% of a competitor’s equity interests) or participate in the management of any of our competitors, without geographical limitation, or induce any of our employees, consultants or agents to leave us.

We previously maintained an employment agreement with C. William Vivian, our former President and Chief Operating Officer. Mr. Vivian resigned as our President and Chief Operating Officer effective February 28, 2003. The agreement provided that, in the event that we terminate Mr. Vivian's employment without cause, we agree to provide Mr. Vivian with monthly separation payments equal to Mr. Vivian's base monthly salary, for a period of 12 months, subject to Mr. Vivian providing us with a waiver and release of all claims. This clause was not triggered because Mr. Vivian ended his employment with us by tendering his resignation.

Director Compensation –Directors who are also our officers or employees do not receive any compensation for their services as directors. Each non-employee director receives reimbursement for reasonable expenses of attending board meetings. In addition, we sometimes grant nonqualified stock options to each non-employee director. During 2003, no such grants were made.

Compensation Committee Interlocks and Insider Participation –BRIAZZ’s Compensation Committee is currently composed of Paul Bigler, Sue Gin and Charles Matteson, Jr. No member of the Compensation Committee is an officer or employee of BRIAZZ. No executive officer of BRIAZZ serves as a member of the board or compensation committee of any entity that has one or more executive officers serving as a member of our board or Compensation Committee. In addition, no interlocking relationship exists between any member of our Compensation Committee and any member of the compensation committee of any other company, nor has any such interlocking relationship existed in the past.

Report on Executive Compensation –The Compensation Committee of the Board of Directors recommends, reviews and approves the salaries, benefits and stock incentive plans for our executive officers, and reviews and approves compensation recommendations made by the Chief Executive Officer for the other officers and key employees. The Committee is also responsible for administering all of our compensation plans.

The Company’s Chief Executive Officer’s annual compensation was $143,461 for 2003 as compared to $150,000 in each of the two previous years. The decrease was due primarily to a corporate-wide management pay reduction and, to a lesser extent, to a reduction in pay in December as a result of no longer being Chief Executive Officer.

BRIAZZ administers several incentive-based programs for our executive officers and other employees.

The Compensation Committee awards stock options to employees pursuant to our 1996 Amended Stock Option Plan and our 2003 stock option plan based upon the employee's salary, level of responsibility and length of service. Senior management-level employees, including our named executive officers, are eligible to receive an initial grant of stock options on the employee's hire date and performance-based annual grants as determined on a case-by-case basis.

The Compensation Committee administers annual cash incentive plans that are targeted toward specific groups of employees, including senior management, managers, supervisors, sales specialists and other salaried employees, except for those officers and executives with operational responsibilities. The bonus plan for officers and executives with operational responsibilities was based on the roll-up of their unit’s ability to exceed pre-tax contributions and the company exceeding pre-tax contributions. The 2003 bonus plan for eligible officers and executives was based solely on Briazz exceeding the budgeted pre-tax earnings. Eligible officers and executives could earn 30-35% of their annual base salary if Briazz meets specific financial goals. None of the eligible officers and executives received any compensation from this plan since Briazz did not exceed its pre-tax goals. The 2004 bonus plan remains the same

Under the Omnibus Budget Reconciliation Act of 1993, the federal income tax deduction for certain types of compensation paid to the chief executive officer and four other most highly compensated executive officers of publicly held companies is limited to $1 million per officer per fiscal year unless such compensation meets certain requirements. The Committee is aware of this limitation and believes no compensation paid by BRIAZZ during 2003 exceeded the $1 million limitation.

Compensation Committee

Paul Bigler

Sue L. Gin

Charles Matteson, Jr.

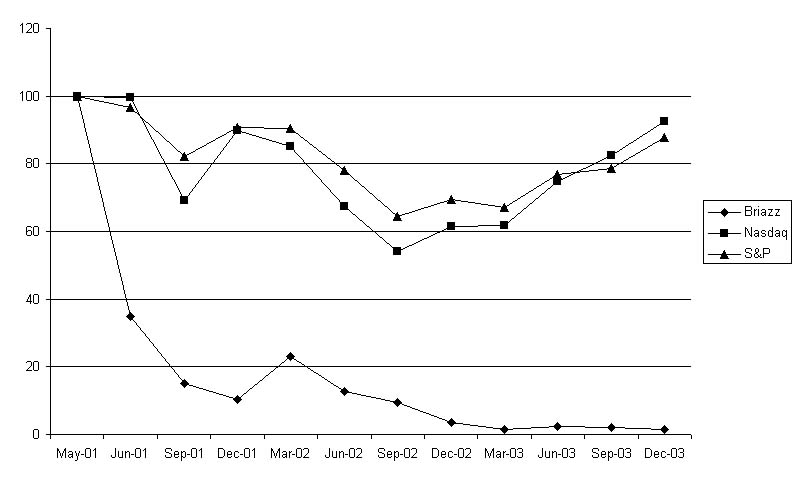

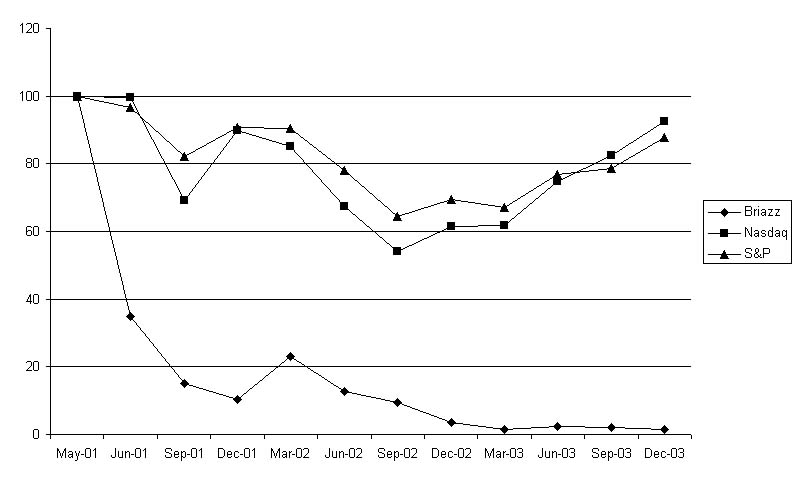

Performance Graph – The following chart presents a comparison of the cumulative total return to shareholders since the date of BRIAZZ's initial public offering (May 2, 2001) of our Common Stock, the Nasdaq Composite Index, and the S&P Small Cap Restaurant Index. The graph assumes an initial investment of $100 and reinvestment of all dividends, if any. The stock performance shown on the graph below is not necessarily indicative of future price performance.

Item 12. Security Ownership of Certain Beneficial Owners and Management.

The following table sets forth certain information known to BRIAZZ with respect to the beneficial ownership of our common stock as of May 11, 2004, by

(i) | | each person known by us to be the beneficial owner of more than five percent (5%) of the outstanding common stock, |

| | | |

(ii) | | each of our directors, |

| | | |

(iii) | | each of our named executive officers, and | |

| | | | |

(iv) | | all directors and officers as a group. | |

Except as otherwise indicated, we believe that the beneficial owners of the common stock listed below, based on information furnished by such owners, have sole investment and voting power with respect to such shares, subject to community property laws where applicable.

Directors, Named Executive Officers and 5% Shareholders (1) | Number of SharesBeneficially Owned (2) | Percent ofClass |

|

|

|

| Victor D. Alhadeff | 14,477,246(3) | 73.63% |

| Nancy Lazara | 105,000(4) | 1.74% |

| Charles C. Matteson, Jr. | 6,420,126(5) | 51.75% |

| Sue L. Gin | 32,028,790(6) | 84.24% |

| Paul Bigler | -- | * |

| David Cotton | -- | * |

| Glenn MacMullin | -- | * |

All directors and executive officers (7 persons) | 53,031,162(7) | 91.49% |

|

|

|

| | | |

| | | |

5% Shareholders | | |

| | |

| DB Advisors, L.L.C. | 64,059,190(8) | 91.45% |

| Briazz Venture, L.L.C. | 25,622,670(9) | 84.24% |

| Flying Food Group, L.L.C. | 6,406,120(10) | 51.68% |

| Spinnaker Investment Partners, L.P. | 6,406,120(11) | 51.68% |

| Milton Liu | 1,462,500(12) | 19.62% |

| Weisburg Limited | 1,281,220(13) | 17.62% |

| Jack Benaroya | 676,152(14) | 10.95% |

| Whitney Equity Partners, L.P. | 639,050(15) | 10.63% |

| Wells Fargo & Company | 492,961 | 8.23% |

| Alhadeff Limited Partnership II | 473,807 | 7.91% |

| Howard Schultz | 387,997(16) | 6.35% |

* Represents beneficial ownership of less than one percent (1%) of the common stock.

| (1) | | Unless otherwise indicated, the address of each beneficial owner is the address of BRIAZZ |

| | | |

| (2) | | Beneficial ownership is determined in accordance with the rules of the SEC, based on factors including voting and investment power with respect to shares. Common stock subject to options and warrants currently exercisable, or exercisable within 60 days after April 10, 2003, are deemed outstanding for computing the percentage ownership of the person holding such options or warrants, but are not deemed outstanding for computing the percentage ownership for any other person. Applicable percentage ownership is based on the aggregate common stock outstanding as of May 11, 2004, which was 5,990,916, together with the applicable options and warrants of such shareholder. |

| | | |

| (3) | | Represents, with respect to Mr. Alhadeff, 331,019 shares held directly, 101,430 shares issuable upon exercise of warrants exercisable at $5.74 per share, 1,452,000 shares issuable upon the exercise of stock options, of which 1,250,000 are exercisable at $0.17 per share, 79,067 are exercisable at $1.50 per share, 2,000 are exercisable at $2.34 per share, 114,314 are exercisable at $4.70 per share, 6,519 are exercisable at $6.00 per share and 100 are exercisable at $1,632 per share, 2,500,000 shares issuable upon conversion of 250,000 shares of Series F Convertible Preferred Stock at a price per share of $0.10, 9,417,000 shares issuable upon conversion of shares of Series G Convertible Preferred Stock at a price per share of $0.10 and 473,807 shares held by Alhadeff Limited Partnership II. |

| | | |

| (4) | | Represents 50,000 shares held directly and 55,000 shares issuable upon exercise of stock options, of which 13,000 are exercisable at $0.69 per share, 19,905 are exercisable at $1.50 per share, 19,842 are exercisable at $4.70 per share, 2,156 are exercisable at $6.00 per share, 34 are exercisable at $1,632.00 per share and 63 are exercisable at $1,800.00 per share. |

| | | |

| (5) | | Represents 4,006 shares held directly by Mr. Matteson, 10,000 shares issuable upon exercise of stock options exercisable at $1.26 per share and up to approximately 6,406,120 shares of common stock issuable to Spinnaker Investment Partners, L.P. (“Spinnaker”) upon conversion of 640,612 shares of Series F Convertible Preferred Stock at a conversion price of $0.10 per share. Mr. Matteson is a limited partner in Spinnaker Investment Partners, L.P. and disclaims all beneficial ownership of these shares. The address of Spinnaker Investment Partners, L.P. is 56 John Street Southport, Connecticut 06890. |

| | | |

| (6) | | Represents up to approximately 25,622,670 shares issuable upon conversion of 2,562,267 shares of Series F Convertible Preferred Stock at a conversion price of $0.10 per share held by Briazz Venture, L.L.C. (“BV”) Ms.Gin owns an 87.5% interest in Briazz Venture, L.L.C. In addition, it represents the 6,406,120 shares of common stock issuable to Flying Food Group, L.L.C. as described in footnote10. Ms. Gin is the Chief Executive Officer and Chairman of Flying Food L.L.C. (“FFG”). The address for Briazz Venture, L.L.C. is 212 North Sangamon, Suite 1-A Chicago, Illinois 60607 |

| | | |

| (7) | | Includes 1,618,430 shares subject to options or warrants exercisable within 60 days of May 11, 2004, approximately 34,528,790 shares issuable upon conversion of shares of Series F Convertible Preferred Stock and 15,823,120 shares issuable upon conversion of shares of Series G Convertible Preferred Stock. |

| | | |

| (8) | | Represents up to approximately 43,559,620 shares issuable upon conversion of 4,355,962 shares of Series F Convertible Preferred Stock at a price per share of $0.10, 11,088,700 shares issuable upon conversion of 1,108,870 shares of Series G Convertible Preferred Stock at a price per share of $0.10, 6,400,000 shares issuable upon conversion of 640,000 shares of Series G Convertible Preferred Stock at a price per share of $0.10 issuable upon extension of the maturity of a secured promissory note and 3,010,870 shares issuable upon exercise of a warrant at a price per share of $0.10. The address for DB Advisors, L.L.C. is 31 West 52nd Street, New York, New York 10019. DB Advisors L.L.C. is holding shares on behalf of Deutsche Banke London AG. |

| | | |

| (9) | | Represents 25,622,670 shares issuable upon exercise of shares of Series F Convertible Preferred Stock as described in footnote 6. |

| | | |

| (10) | | Represents 6,120 shares issuable upon conversion of 612 shares of Series G Convertible Preferred Stock at a price per share of $0.10 and 6,400,000 shares issuable upon conversion of 640,000 shares of Series G Convertible Preferred Stock at a price per share of $0.10 issuable upon extension of the maturity of a secured promissory note. Flying Food Group, L.L.C.’s address is 212 North Sangamon, Suite 1-A Chicago, Illinois 60607.

|

| | | |

| (11) | | Represents 6,406,120 shares issuable upon exercise of shares of Series F Convertible Preferred Stock described in footnote 5 |

| | | |

| (12) | | Represents 462,500 shares issuable upon exercise of stock option at a price per share of $0.16 and 1,000,000 shares issuable upon conversion of 100,000 shares of Series F Convertible Preferred Stock at a price per share of $0.10. |

| | | |

| (13) | | Represents 1,281,220 shares issuable upon exercise of a warrant at a price per share of $0.10. |

| | | |

| (14) | | Represents 492,961 shares held directly and 183,191 shares issuable upon exercise of warrants exercisable at $5.74 per share. The address for Mr. Benaroya is c/o Benaroya Capital Company, L.L.C., 1001 Fourth Avenue, Suite 4700, Seattle, Washington 98154. |

| | |

| (15) | | Represents shares beneficially owned by Whitney Equity Partners, L.P. Represents 617,358 shares held directly and 21,692 shares issuable upon exercise of stock options held by Peter Castleman, a Managing Director of Whitney & Co., of which 1,667 are exercisable at $1.50 per share, 10,000 are exercisable at $4.70 per share, 10,000 are exercisable at $6.00 per share and 25 are exercisable at $1,800.00 per share. The name of the general partner of Whitney Equity Partners, L.P. is J. H. Whitney Equity Partners, L.L.C., a Delaware limited liability company, whose business address is 177 Broad Street, Stamford, CT 06901. The names and business address of the members of J. H. Whitney Equity Partners, L.L.C. are as follows: Peter M. Castleman, Jeffrey R. Jay, William Laverack, Jr., Daniel J. O’Brien and Michael R Stone, the business address of each of whom is 177 Broad Street, Stamford, CT 06901. |

| | | |

| (16) | | Represents 271,190 shares held directly, 104,470 shares issuable upon exercise of warrants exercisable at $5.74 per share and 12,337 shares issuable upon exercise of stock options, of which 1,667 are exercisable at $1.50 per share, 10,000 are exercisable at $6.00 per share, 167 are exercisable at $600.00 per share, 261 are exercisable at $1,632.00 per share and 242 shares are exercisable at $3,900.00. The address for Mr. Schultz is c/o Starbucks Corporation, 2401 Utah Avenue South, Seattle, Washington 98134. |

Changes in Control

If we default on payments to Laurus Master Fund Ltd., Laurus has the right to convert outstanding amounts owed under the convertible promissory note into common stock at a conversion price of $0.10 per share with respect to the first $350,700 and $0.30 per share with respect to the remainder outstanding under the note. In addition, Laurus Master Fund holds warrants to acquire up to 400,000 shares of our common stock. If Laurus were to convert or exercise a substantial portion of their convertible note or warrants, Laurus could hold sufficient shares to exercise a great deal of control over our affairs. While Laurus has agreed not to convert into and hold more than 4.99% of our shares of common stock at any given time, it may revoke this limitation at its option on 75 days notice.

DB Advisors, L.L.C. (“DB”), Briazz Venture, L.L.C. (“BV”), Spinnaker Investment Partners, L.P. (“Spinnaker”) and Flying Food Group, L.L.C. (“FFG”) each hold shares of our Preferred Stock convertible into a substantial majority of our common stock. In addition, DB, BV and Spinnaker have the right to nominate up to five directors to our Board of Directors between them. Ms. Gin is the manager of BV, owns 87.5% of the equity of BV and exercises control over BV. In addition, Mr. Liu owns a minority interest of 12.5% in BV. Charles C. Matteson is a limited partner in Spinnaker and a manager of Spinnaker’s general partner. Paul Bigler is the managing director and chief operating officer of DB Advisors LLC, a wholly-owned subsidiary of Deutsche Banke London AG, and Glen MacMullin is a director of DB Advisors LLC.

Equity Compensation Plan Information

| Plan Category | Number of securities to be issued upon exercise of options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

|

|

|

|

| Equity compensation plans approved by security holders | 6,522,952 | $0.86 | 2,142,000 |

|

|

|

|

| Equity compensation plans not approved by security holders | -- | -- | -- |

|

|

|

|

| Total | 6,522,952 | $0.86 | 2,142,000 |

|

|

|

|

Item 13. Certain Relationships and Related Transactions and Related Stockholder Matters.

In 2002, Mr. Alhadeff, our Chief Executive Officer and Chairman of the Board, pledged collateral to secure our $500,000 term note with U.S. Bank National Association. In 2003, Mr. Alhadeff received no compensation from us for pledging this collateral. In 2003, Mr. Alhadeff repaid the Company’s bank borrowings and in consideration thereof was issued $500,000 of Senior Notes and 640,612 shares of Series G Preferred Stock.

In March and April of 2003, the Company issued securities to BV and Spinnaker, such that, subject to shareholder approval, FFG and Spinnaker could own approximately 66.7% and 16.7% respectively of the Company’s common stock on a fully-diluted, post conversion basis. Further, in August 2003, the Company cancelled securities previously issued to BV and Spinnaker and issued new securities to DB, BV, and Spinnaker. Additionally, in December 2003, the Company issued new securities to DB such that DB, BV, and Spinnaker could own approximately 48%, 25%, and 6%, respectively, of the Company’s common stock on a fully-diluted, post conversion basis.

In December 2002, the Company entered into a Food Production Agreement, pursuant to which the Company purchased its food products from FFG in the Chicago, Los Angeles and Seattle markets. The agreement has a term of ten years subject to earlier termination by either party if the other party becomes insolvent. Purchases from FFG approximated $8.30 million and $.45 million for the fiscal years ended December 28, 2003 and December 29, 2002, respectively. Included in accounts payable due to related party at December 28, 2003 and December 29, 2002 is $995,000 and $200,000, respectively, due to FFG.

The Company and FFG have agreed to eliminate the exclusivity provisions of the Food Production Agreement, which allows us to commence in-café production in 2004. As of May 11, 2004, we have completed the transition to in-café production in Chicago and Los Angeles. It is anticipated that once the transition to in-café production is complete in all markets, the Food Production Agreement will be terminated.

Sue L. Gin is the chairman and chief executive officer of Flying Food Group, L.L.C., David Cotton is chief financial officer of Flying Food Group and Milton Liu served as chief operating officer of Flying Food Group until he joined Briazz. In late 2002, we entered into a Food Production Agreement with Flying Food Group pursuant to which we anticipate making payments in excess of five percent of our gross revenues for the last fiscal year. Under the agreement, Flying Food Group has agreed to manufacture and package all food products we sell in our existing markets for the term of the agreement. Currently, Flying Food Group is providing us with products in Chicago and Seattle. Pursuant to the Food Production Agreement, Flying Food Group subcontracts the Los Angeles production to HEMA Foods, Inc. (HEMA). Flying Food Group has declined to serve our cafés in San Francisco. As a result, we continue to operate our central kitchen in that location while actively seeking a third–party provider. We will pay Flying Food Group and HEMA for their actual cost incurred in production of the food items plus a profit factor negotiated with Flying Food Group.

The agreement allows us to change our menu items provided we give reasonable notice to Flying Food Group and the number of items on our menu remains relatively constant. In addition, the agreement generally prohibits Flying Food Group from using our trademarks for its own purposes. However, it does not forbid Flying Food Group to use the same food formulations, recipes or ingredients for products that it sells to the food service industry.

Under the agreement, Flying Food Group must ensure that all products sold to us meet state and federal standards and must maintain a Hazard Analysis Critical Control Point (HACCP) program similar to the program previously maintained at our central kitchens. Flying Food Group must also indemnify us for damages arising from their failure to provide us with food meeting these standards.

As part of the transition to using Flying Food Group and HEMA as our suppliers, we agreed to transfer them, without charge, any of our central kitchen equipment that may be requested by them. Under the terms of the agreement, Flying Food Group and HEMA will retain all transferred equipment.

Item 14. Principal Accountant Fees and Services

Set forth below is information relating to the aggregate fees for professional services billed by our independent accountants for the fiscal years ended December 28, 2003 and December 29, 2002.

| Description of Professional Services | | | 2003 | 2002 |

|

|

|

|

|

| Audit Fees (1) | | | $106,600 | $235,187 |

| Audit Related Fees | | | -- | -- |

| Tax Fees | | | 17,961 | 14,800 |

| All Other Fees | | | -- | -- |

(1) | | Includes fees associated with the annual audit and reviews of the companies quarterly reports on Form 10-Q |

The audit committee approved all engagements and fees of the auditors. The audit committee consisted of Glenn MacMullin (Chairman), David Cotton (Financial Expert) and Chuck C. Matteson, Jr.

Item 15. Exhibits, Financial Statement Schedules and Reports on Form 8-K

(c) Exhibits

| ExhibitNumber | | Description | |

| | | | |

| 3.1(2) | | Amended and Restated Articles of Incorporation. | |

| | | | |

| 3.1.1(5) | | Articles of Amendment filed March 5, 2003 (including designation of Series D Convertible Preferred Stock). |

| | | | |

| 3.1.2(6) | | Articles of Amendment filed April 10, 2003 (including designation of Series E Convertible Preferred Stock). |

| | | | |

| 3.1.3(9) | | Articles of Amendment filed July 30, 2003 (including designation of Series F Convertible Preferred Stock). |

| | | | |

3.1.4 | | Articles of Amendment filed December 10, 2003 (including designation of Series G Convertible Preferred Stock). |

| | | | |

| 3.2(5) | | Amended and Restated Bylaws. | |

| | | | |

| 4.1(2) | | Specimen Stock Certificate for Common Stock | |

| | | | |

| 4.2(9) | | Specimen Stock Certificate for Series F Convertible Preferred Stock. | |

| | | | |

| 10.1(1)(2) | | 1996 Amended Stock Option Plan. | |

| | | | |

| 10.2(1)(2) | | Form of Option Agreement (1996 Plan - Fresh Options prior to February 2001). | |

| | | | |

| 10.3(1)(2) | | Form of Option Agreement (1996 Plan - other options prior to February 2001). | |

| | | | |

| 10.4(1)(2) | | 2001 Employee Stock Purchase Plan. | |

| | | | |

| 10.5(2) | | Form of Warrant (Series C Convertible Preferred Stock financing). | |

| | | | |

| 10.6(1)(2) | | Employment Agreement between BRIAZZ and Charles William Vivian dated July 14, 1999. |

| | | | |

| 10.8(2) | | Form of Registration Rights Agreement between BRIAZZ and certain of our shareholders dated 10.7(2) August 15, 1997, as amended. Agreement between BRIAZZ and Stusser Realty Group Limited Partnership dated January 1998. |

| | | | |

| 10.9(2) | | Sublease between BRIAZZ and Stusser Electric Company regarding 3901 7th Avenue South, Seattle, WA dated February 6, 1998. |

| | | | |

| 10.10(2) | | Sublease Amendment between BRIAZZ and Stusser Electric Company regarding 3901 7th Avenue South, Seattle, WA dated August 28, 2000. |

| | | | |

| 10.11(9) | | Sublease Agreement between BRIAZZ and Norstar Specialty Foods Inc. regarding 3901 7th Avenue South, Seattle, WA dated March 7, 2003. |

| | | | |

| 10.12(2) | | Lease between BRIAZZ and Mission-Taylor Properties regarding 225 Mendell St., San Francisco, CA dated June 28 1996. |

| | | | |

| 10.13(2) | | Amendment to Lease between BRIAZZ and Mission-Taylor Properties regarding 225 Mendell St., San Francisco, CA dated May 25, 2000. |

| | | | |

| 10.14(2) | | Lease between BRIAZZ and Time Realty Investments, Inc. regarding 200 Center St., El Segundo, CA dated December 15, 1997. |

| | | | |

| 10.15(5) | | Surrender of Possession and Termination of Lease Agreement dated December, 2002 regarding lease between BRIAZZ and Time Realty Investments, Inc. regarding 200 Center St., El Segundo, CA dated December 15, 1997. |

| | | | |

| 10.16(2) | | Industrial Building Lease between BRIAZZ and Walnut Street Properties, Inc. regarding 1642 Lake Street, Chicago, IL dated April 7, 1997. |

| | | | |

| 10.17(1)(2) | | Form of Option Agreement (1996 Plan - all options since February 2001). |

| | | | |

| 10.18(2) | | Noncompetition Agreement between BRIAZZ and Victor D. Alhadeff dated October 18, 1996. |

| | | | |

| 10.19(3) | | Convertible Note made by BRIAZZ in favor of Laurus Master Fund, Ltd. dated June 18, 2002 in the principal amount of $1,250,000. |

| | | | |

| 10.20(3) | | Common Stock Purchase Warrant issued by BRIAZZ to Laurus Master Fund, Ltd. dated June 18, 2002. |

| | | | |

| 10.21(3) | | Security Agreement made by BRIAZZ in favor of Laurus Master Fund, Ltd. dated June 18, 2002. |

| | | | |

| 10.22(5) | | Allonge dated December 2, 2002 to the Convertible Note issued by the Company to Laurus Master Fund, Ltd. on June 18, 2002. |

| | | | |

| 10.24(5) | | Common Stock Purchase Warrant issued by BRIAZZ to Laurus Master Fund, Ltd. dated December 2, 2002. |

| | | | |

| 10.25(5) | | Allonge dated January, 2003 to the Convertible Note issued by BRIAZZ to Laurus Master Fund, Ltd. on June 18, 2002. |

| | | | |

| 10.26(5) | | Allonge dated as of February 26, 2003 to the Convertible Note issued by BRIAZZ to Laurus Master Fund, Ltd. on June 18, 2002. |

| | | | |

| 10.27(5) | | Allonge dated as of February 26, 2003 to the Warrant issued by BRIAZZ to Laurus Master Fund, Ltd. on June 18, 2002. |

| | | | |

| 10.28(9) | | Letter Agreement dated as of July 31, 2003 between BRIAZZ and Laurus Master Fund, Ltd. Amendment dated as of July 31, 2003 to the Convertible Note issued by BRIAZZ to Laurus |

| | | | |

| 10.29(9) | | Master Fund, Ltd. on June 18, 2002. | |

| | | | |

10.30(4) | | Form of Secured Convertible Demand Note used in October 2002. | |

| | | | |

| 10.31(5) | | Form of Secured Convertible Demand Note used in December 2002 and January 2003. |

| | | | |

| 10.32(5) | | Food Production Agreement between BRIAZZ and Flying Food Group, L.L.C. dated December 1, 2002 |

| | | | |

| 10.33(5) | | Amended Security Agreement between BRIAZZ, Flying Food Group, L.L.C. and New Management, Ltd., dated December 3, 2002. |

| | | | |

| 10.34(5) | | Amended and Restated Purchase Agreement between BRIAZZ and Briazz Venture, L.L.C., dated March 5, 2003. |

| | | | |

| 10.35(5) | | $2,000,000 Senior Secured Note issued by BRIAZZ in favor of Briazz Venture, L.L.C., dated March 6, 2003. |

| | | | |

| 10.36(5) | | Warrant to purchase 1,193,546 shares of Common Stock issued by BRIAZZ to Briazz Venture, L.L.C. dated March 6, 2003. |

| | | | |

| 10.37(5) | | Amendment dated March 6, 2003 between BRIAZZ and Briazz Venture, L.L.C. to Security Agreement dated December 3, 2002. |

| | | | |

| 10.38(5) | | Voting Agreement between Briazz Venture, L.L.C. and Victor D. Alhadeff, dated as of March 6, 2003. |

| | | | |

| 10.39(5) | | Registration Rights Agreement between BRIAZZ and Briazz Venture, L.L.C., dated March 6, 2003. |

| | | | |

| 10.40(6) | | Purchase agreement between BRIAZZ and Spinnaker Investment Partners, L.P., dated April 10, 2003 |

| | | | |

| 10.41(6) | | $550,000 Senior Secured Note issued by BRIAZZ in favor of Spinnaker Investment, L.P., dated April 10, 2003 |

| | | | |

| 10.42(6) | | Warrant to purchase 1,193,546 shares of Common Stock issued by BRIAZZ to Spinnaker Investment Partners, L.P., dated April 10, 2003 |

| | | | |

| 10.43(6) | | Amended and Restated Security Agreement by and among BRIAZZ, Briazz Venture, L.L.C. and Spinnaker Investment Partners, L.P., dated April 10, 2003 |

| | | | |

| 10.44(6) | | Amended and Restated Agreement Between Creditors by and among BRIAZZ, Laurus Master Fund, Ltd., Spinnaker Investment Partners, L.P. and Flying Food Group L.L.C. and any of its affiliates, including but not limited to Briazz Venture, L.L.C., dated April 10, 2003 |

| | | | |

| 10.45(6) | | Amended and Restated Registration Rights Agreement by and among BRIAZZ, Spinnaker Investment Partners, L.P. and Flying Food Group L.L.C. and any of its affiliates, including but not limited to Briazz Venture, L.L.C., dated April 10, 2003 |

| | | | |

| 10.46.1(7) | | Securities Purchase Agreement by and among BRIAZZ, Deutsche Bank London Ag, Briazz Venture, L.L.C., Spinnaker Investment Partners, L.P. and Delafield Hambrecht, Inc. dated May 28, 2003. |

| | | | |

| 10.46.2(8) | | Amendment date August 1, 2003 to Securities Purchase Agreement by and among BRIAZZ, Deutsche Bank London Ag, Briazz Venture, L.L.C., Spinnaker Investment Partners, L.P. and Delafield Hambrecht, Inc., dated May 28, 2003 |

| | | | |

| 10.47(8) | | Form of Note issued on August 1, 2003 to each of Deutsche Bank London, Ag, Briazz Venture, L.L.C., Spinnaker Investment Partners, L.P. and Delafield Hambrecht, Inc. |

| | | | |

| 10.48(8) | | Security Agreement dated August 1, 2003 among BRIAZZ, Deutsche Bank London Ag and Flying Food Group, L.L.C. |

| | | | |

| 10.49(8) | | Intercreditor Agreement dated August 1, 2003, among BRIAZZ, Laurus Master Fund, Ltd., Deutsche Bank London Ag, Flying Food Group, L.L.C., Briazz Venture, L.L.C., Spinnaker |

| | | | |

| 10.50(8) | | Registration Right Agreement dated August 1, 2003 among BRIAZZ, Laurus Master Fund, Ltd., Deutsche Bank London Ag, Briazz Venture, L.L.C., Spinnaker Investment Partners, L.P., and Delafield Hambrecht, Inc. |

| | | | |

| 10.51(8) | | Letter Agreement dated August 1, 2003 between BRIAZZ and Delafield Hambrecht, Inc. |

| | | | |

| 10.52(9) | | 2003 Stock Plan | |

| | | | |

| 10.53.1 | | Securities Purchase Agreement by and among BRIAZZ, DB Advisors, LLC, and Victor D. Alhadeff dated December 10, 2003. |

| | | | |

| 10.53.2 | | Amendment date January 15, 2004 to Securities Purchase Agreement by and among BRIAZZ, DB Advisors, LLC, Flying Food Group, LLC, Victor D. Alhadeff, Dorsey & Whitney LLP dated December 10, 2003 |

| | | | |

| 10.54.1 | | Form of Note issued on December 10, 2003 to each of DB Advisors, LLC, and Victor D. Alhadeff and on January 15, 2004 to each of DB Advisors, LLC, Flying Food Group, LLC, Dorsey & Whitney LLP |

| | | | |

| 10.54.2 | | Form of Note issued on January 15, 2004 to each of DB Advisors, LLC, and Flying Food Group, LLC, |

| | | | |

| 10.55 | | First Amendment to Security Agreement dated August 1, 2003, by and between BRIAZZ, Deutsche Bank London Ag, Briazz Venture, L.L.C., and Spinnaker Investment Partners, L.P. dated December 10, 2003. |

| | | | |

| 10.56 | | First Amendment to Intercreditor Agreement dated August 1, 2003, by and between BRIAZZ, Laurus Master Fund, Ltd., Deutsche Bank London Ag, Flying Food Group, L.L.C., Briazz Venture, L.L.C., Spinnaker dated December 10, 2003 |

| | | | |

| 10.57 | | First Amendment to Registration Right Agreement dated August 1, 2003 by and between BRIAZZ, and Deutsche Bank London Ag, dated December 10, 2003 |

| | | | |

| 10.58.1 | | Securities Purchase Agreement by and between BRIAZZ and Weisburg Limiteddated April 5, 2004 |

| | | | |

| 10.58.2 | | Form of Note issued on April 2, 2004 to Deutsche Bank London, Ag |

| | | | |

| 10.58.3 | | Warrant to purchase 128,122 shares of Common Stock issued by BRIAZZ to Weisburg Limited, dated April 5, 2004 |

| | | | |

| 14.1 | | Code of Conduct For Chief Executive and Senior Financial Officers |

| | | | |

| 16.1(10) | | Letter from certifying accountants dated February 12, 2004 |

| | | | |

| 23.1(11) | | Consent of Independent Accountants |

| | | | |

| 23.2(11) | | Consent of Independent Accountants | |

| | | | |

| 31.1 | | Certification of Chief Financial Officer required by Rule 13a-14(a) or Rule 15d-14(a) |

| | | |

| (1) | | Indicates management contract. |

| | | |

| (2) | | Incorporated by reference to our registration statement on Form S-1 (No. 333-54922). |

| | | |

| (3) | | Incorporated by reference to our Form 8-K filed on July 20, 2002. |

| | | |

| (4) | | Incorporated by reference to our Form 10-Q for the quarter ended September 29, 2002 |

| | | |

| (5) | | Incorporated by reference to our Form 10-K for the year ended December 29, 2002 |

| | | |

| (6) | | Incorporated by reference to our Form 8-K filed on April 14, 2003. |

| | | |

| (7) | | Incorporated by reference to our Schedule 14A filed on June 26, 2003. |

| | | |

| (8) | | Incorporated by reference to out Form 8-K filed on August 11, 2003. |

| | | |

| (9) | | Incorporated by reference to our Form 10-Q for the quarter ended June 29, 2003. |

| | | |

| (10) | | Incorporated by reference to our Form 8-K filed on December 24, 2003. |

| | | |

| (11) | | Incorporated by reference to our Form 10-K for the year ended December 28, 2003 filed with the commission on March 30, 2004. |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, BRIAZZ, INC. has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | |

| | BRIAZZ, INC. |

|

|

|

| Date: May 11, 2004. | By: | /s/ Victor Alhadeff |

| |

|

| | Victor Alhadeff |

| | Chief Financial Officer |