- BAX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Baxter International (BAX) DEF 14ADefinitive proxy

Filed: 23 Mar 23, 7:31am

☑ Filed by the Registrant | ☐ Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: |

☐ Preliminary Proxy Statement |

☐ Confidential, For Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

☑ Definitive Proxy Statement |

☐ Definitive Additional Materials |

☐ Soliciting Material Under Rule14a-12 |

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | ||

☑ | No fee required. | |

☐ | Fee paid previously with preliminary materials: | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11 | |

Notice of 2023

Annual Meeting

of Stockholders

and Proxy Statement

May 2, 2023

Baxter International Inc.

Headquarters

One Baxter Parkway

Deerfield, Illinois 60015

|

Baxter International Inc. One Baxter Parkway Deerfield, Illinois 60015 | March 23, 2023 |  | ||

Dear Fellow Stockholder:

It is my pleasure to invite you to attend Baxter’s Annual Meeting of Stockholders (Annual Meeting) on Tuesday, May 2, 2023, at 9 a.m. Central Daylight Time. The attached Notice of Annual Meeting of Stockholders and Proxy Statement will serve as your guide to the business to be conducted.

For more than nine decades, Baxter has been in a state of near-constant evolution. Our fundamental focus on medically essential products has never wavered; yet we are always in pursuit of new, more effective ways to advance our Mission to Save and Sustain Lives. This is evident through our distinguished track record of research and development (R&D), geographic expansion, business development, corporate citizenship, and more, all focused on enhancing our impact for the patients, clinicians, employees, stockholders and other communities that place their trust in us.

Our current enterprise-wide transformation, initiated in 2016 following the spinoff of our Baxalta bioscience business, is most certainly an expression of this drive, and the December 2021 acquisition of Hill-Rom Holdings, Inc. (Hillrom) as well as the proposed spinoff of our Renal Care and Acute Therapies businesses highlight the depth of our transformative spirit.

Baxter’s acquisition of Hillrom significantly diversified our medical technology portfolio while unlocking new potential in connected care across our combined product lines. Much of our energy in 2022 centered on integrating Hillrom’s operations and exploring new possibilities in connected care, while also advancing meaningful synergies for cost reduction beyond our original modeling.

At the same time, we spent much of the year evaluating Baxter’s trajectory and performance amid the contours of an increasingly dynamic marketplace. Our markets and environment have been shifting at an unprecedented pace in light of macroeconomic conditions, the COVID-19 pandemic, supply chain disruptions, inflationary pressures and a range of other headwinds also affecting our healthcare peers and countless other industries globally. Our immediate response to these and related challenges has always been driven, definitively, by our Mission and our need to help ensure access to our life-sustaining products. Taking a longer-term view of ever evolving market dynamics, it was clear that a fundamental rethinking of our profile and operating model was essential to unlock further stockholder value and position all of our businesses for the optimal levels of performance and innovation we demand of ourselves.

Upon extensive evaluation, we opened 2023 by announcing our plan to spin off our pioneering Renal Care and Acute Therapies businesses into an independent, publicly traded company. Additionally, we shared our plans to implement a streamlined, vertically integrated operating model across our remaining businesses and to pursue strategic alternatives for our BioPharma Solutions (BPS) contract manufacturing business (including a potential sale), which has limited strategic alignment with our broader portfolio. While completion of the proposed spinoff is subject to customary conditions, these collective actions are designed to create compelling benefits for both companies, including greater strategic clarity, increased operational effectiveness, and sharper focus in R&D and commercial investments to fuel long-term growth and innovation.

We are building for the future on a strong platform. Our products are fundamental to healthcare worldwide, making a difference each year for an estimated 350 million patients across more than 100 countries. Our multiyear transformation has fortified our strength, agility and resilience. Notwithstanding the operational challenges of 2022, we have maintained a disciplined and deliberate capital allocation strategy staying squarely focused on our priorities to further deleverage and optimize our balance sheet while continuing to drive innovation and growth and return value to stockholders.

Our 2022 performance also reflects our commitments as a corporate citizen across three pillars: Empower our Patients; Protect our Planet; and Champion our People and Communities. Fueled by the passion of our employees, Baxter is regularly cited worldwide for its environmental, social and governance (ESG) leadership. As part of our continuing emphasis on ESG reporting transparency, we plan to report against the framework established by the Task Force on Climate-Related Disclosures (TCFD) beginning later this year (likely as part of a standalone supplement to our 2022 Corporate Responsibility Report).

Central to our emphasis on sound corporate governance, we are constantly working to ensure that the experiences and skill sets represented by our Board of Directors are aligned with the evolving strategic direction of the business and are refreshed from time to time in the interest of bringing new perspectives to the Board. | ||||

To this end, we proudly welcomed two new board members in May 2022: Brent Shafer, former chairman and chief executive officer of Cerner Corporation; and Peter Wilver, former executive vice president and chief administrative officer of Thermo Fisher Scientific Inc.

I also extend my deep appreciation to two board members departing this April following long, valued tenures: Albert Stroucken, who has been with us since 2004 and was appointed Lead Independent Director in February 2021 after having served as the chair of our Audit Committee; and Thomas Chen, who has served as a Baxter director since 2012 and currently serves as the chair of our Nominating, Corporate Governance & Public Policy Committee.

To provide a safe, consistent and convenient experience to all stockholders and employees regardless of location, the Annual Meeting will be held only in a virtual format. We hope that you are able to join us to discuss our 2022 results and learn more about our strategic priorities and trajectory for 2023 and beyond. Please review the information on attendance provided on p. 93 of the attached Notice of Annual Meeting of Stockholders and Proxy Statement (proxy statement).

Details of the business to be conducted at the Annual Meeting are included in the proxy statement, which we encourage you to read carefully.

Your vote is very important to us, and I urge you to vote your shares as promptly as possible. You may vote your shares by Internet or by telephone. If you received a paper copy of the proxy card by mail, you may sign, date and return the proxy card in the enclosed envelope.

You will be able to submit questions in advance of and during the Annual Meeting.

It is my privilege to recognize the immeasurable efforts of our Baxter employees as we prepare for the next stage of our transformation. This diverse, globe-spanning team, and its unyielding pursuit of our Mission, is the ultimate power behind our life-sustaining impact.

On behalf of the Board, senior management and our employees, thank you for your continued confidence and support as we advance our Mission for patients worldwide. We look forward to your participation in the Annual Meeting.

Sincerely yours,

José (Joe) E. Almeida Chair of the Board, President and Chief Executive Officer | ||||

|

Baxter International Inc. One Baxter Parkway Deerfield, Illinois 60015 | March 23, 2023 |  | ||

Dear Stockholder:

On behalf of the Board, I would like to thank you for your continued investment in Baxter and for the confidence you place in the Board to oversee your interests in our company. While we continue to face ongoing macroeconomic headwinds and inflationary pressures as a company and work to successfully integrate the Hillrom business, we are confident about the steps Baxter is taking to better execute against its long-term strategy while continuing to provide support to hospitals, healthcare providers and patients. We are committed to creating long-term stockholder value and strongly believe that the recently announced strategic initiatives (including the proposed spinoff of our Renal Care and Acute Therapies businesses, the potential sale of our BPS business and the simplification of Baxter’s operating model and manufacturing footprint) will better position Baxter to address these challenges in the future and help to generate additional value for all stockholders in support of the company’s Mission to Save and Sustain lives.

The Board is committed to providing critical oversight and nurturing a culture that values protecting and growing your investment over the long term. As directors, we continue to play an integral role in both determining and overseeing the strategic direction of the company, monitoring the execution by Baxter’s management and helping to ensure that the company’s corporate culture supports and aligns with its long-term strategy.

As we approach the Annual Meeting, I would like to take a moment to reflect on some of the Board’s key focus areas over the last fiscal year:

• Effectively Overseeing Baxter’s Strategy: An essential role of the Board is to provide effective oversight related to Baxter’s corporate strategy and execution. The Board works closely with Joe Almeida and other members of senior leadership in developing and executing on the company’s strategy and positioning Baxter to drive long-term value as a global medical technology leader. The steps Baxter is taking demonstrate continued momentum in our business as we execute on our strategic priorities and aim to drive further growth and long-term stockholder value.

In January 2023, we announced various strategic actions (as discussed above) in the interest of enhancing operational effectiveness, accelerating innovation for patients and driving additional value for stockholders. These actions were announced after a detailed assessment of Baxter’s portfolio that spanned several months. We are working to finalize and implement these actions (some of which are subject to the satisfaction of customary conditions) and we believe they will better position Baxter to respond to continuing macroeconomic challenges and capture opportunities ahead of us.

• Refreshing Our Board with New Perspectives: The Board includes a diverse and experienced group of independent directors with a wide range of skills and qualifications that support Baxter’s strategy and help to position the company for long-term success in a complex and rapidly changing healthcare environment. We invigorate Board discussion through the appointment of new directors and the rotation of directors through different Board roles. Thoughtful and ongoing attention to Board composition is an important part of our role as we seek to ensure an appropriate mix of tenure and expertise that provides a balance of fresh perspectives and significant institutional knowledge.

As part of our thoughtful approach to Board composition, this year we appointed Brent Shafer and Peter Wilver to the Board. Brent now sits on our Audit Committee and our Nominating, Corporate Governance & Public Policy (NCGPP) Committee and will be assuming my role of Lead Independent Director effective April 28, 2023. As the former chief executive officer and chairman of Cerner Corporation, Brent possesses significant experience leading multinational corporations (including those with strong digital health capabilities) and helping to transformcomplex organizations. Peter is scheduled to join and chair our Audit Committee effective April 28th and has demonstrated financial expertise as the former chief financial officer and chief administrative officer of Thermo Fisher Scientific Inc. He also sits on our Compensation and Human Capital Committee (formerly known as our Compensation Committee (CHC Committee)), which has recently assumed responsibility for certain human capital management matters to help ensure appropriate Board oversight and focus on these important topics, aligned with evolving market practices. We believe Brent’s and Peter’s experiences have brought valuable insights to our Board and contribute to the full Board’s wide range of experiences and skills that are crucial for overseeing Baxter’s long-term strategy as the company positions itself for further growth.

We would also like to thank Thomas Chen for his years of service to the Board and Baxter. Thomas is the outgoing chair of the NCGPP Committee, helping to lead our corporate governance outreach program and the continuing refreshment of the Board, and is a longstanding member of our Quality, Compliance & Technology (QCT) Committee. During his | ||||

over ten-year tenure we have benefited greatly from his insights and contributions, both as a Board member and through his leadership positions on the Board. Additionally, we would like to thank Cathy Smith for her contributions as Audit Committee chair and her willingness to assume the NCGPP Committee chair upon Thomas’ retirement.

• Engaging Regularly with Stockholders. Engagement with stockholders remains a key focus for Baxter and an important part of the Board’s longstanding commitment to sound governance practices. Our annual stockholder engagement program involves meeting with a broad base of stockholders to discuss corporate governance, executive compensation, corporate responsibility practices and other matters of importance (including the company’s 2030 Corporate Responsibility Commitment and Goals). Our commitment to this program enables ongoing dialogue that we believe is important in furthering sound and effective corporate governance practices. It also provides us with valuable insight and feedback from stockholders throughout the year, allowing the Board to better understand our stockholders’ priorities and perspectives and to incorporate them into its deliberations and decision-making process. During 2022, we proactively reached out to stockholders representing more than 50% of the shares of Baxter’s outstanding common stock and we engaged with stockholders representing approximately 40% of the shares of Baxter’s outstanding common stock (each percentage calculated as of December 31, 2022).

• Responding to Stockholder Feedback. In addition to the Board’s commitment to being responsive to the views of stockholders, it remains committed to maintaining strong corporate governance practices and protecting stockholder rights. This commitment is evidenced by, among other things, Baxter’s proxy access bylaw, the complete declassification of the Board in 2018, a majority voting standard for directors, the removal of super-majority voting provisions from Baxter’s organizational documents and Board composition and refreshment efforts (including with respect to the recent appointments of Brent Shafer and Peter Wilver to the Board and Brent’s appointment as the Board’s next Lead Independent Director).

Following stockholder approval of a written consent proposal at the 2021 annual meeting and extensive engagement efforts by both management and the Board (including as part of the company’s annual stockholder engagement program), the Board took action to permit stockholders to act by written consent and to reduce the special meeting threshold from 25% to 15%. These changes to the company’s organizational documents were approved at the 2022 annual meeting and are now effective.

As we move forward in 2023 and beyond, we will continue to work hard on your behalf as stewards of the company to help ensure the continued success of Baxter, including with respect to the recently announced key strategic initiatives and the ongoing integration of the Hillrom business. While I will be leaving the Board next month (consistent with the company’s mandatory retirement age), I am confident the company will continue to build on its momentum with the Board’s active involvement, valuable input and support, under the thoughtful leadership of Brent Shafer as the new Lead Independent Director. On behalf of my fellow directors, thank you for your investment in, and continued support of Baxter. We look forward to hearing your views at the Annual Meeting and in the year to come.

Best regards,

Albert P.L. Stroucken Lead Independent Director | ||||

| Table of Contents |

i | |

Table of Contents

investor.baxter.com

| Notice of 2023 Annual Meeting of Stockholders and Proxy Statement |

1 | |

Notice of 2023 Annual Meeting of Stockholders and Proxy Statement

The Annual Meeting is scheduled to be held by means of a virtual format only, to provide a safe, consistent and convenient experience to all stockholders and employees regardless of location. The Annual Meeting will take place on Tuesday, May 2, 2023 at 9:00 a.m., Central Time. Online access to the meeting will begin at 8:30 a.m., Central Time. The Annual Meeting will be held for the following purposes:

| ||

| To elect the ten directors named in the proxy statement. | |

| To hold an advisory vote to approve named executive officer compensation for 2022. | |

| To hold an advisory vote on the frequency of executive compensation advisory votes. | |

| To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for Baxter International Inc. (Baxter or the company) in 2023. | |

| To vote on the two stockholder proposals as described in the proxy statement, if such proposals are properly presented at the Annual Meeting. | |

| To transact any other business that may properly come before the meeting. | |

| ||

The Board recommends that stockholders vote FOR Items 1, 2, and 4 and ONE YEAR with respect to Item 3. The Board recommends that stockholders vote AGAINST each of the stockholder proposals referred to in Item 5. Stockholders of record at the close of business on March 10, 2023 will be entitled to vote at the meeting.

By order of the Board,

Ellen K. Bradford Corporate Secretary |

How Do I Vote?

| By Internet, following the instructions on the Notice of Internet Availability of Proxy Materials or the proxy card; | |

| By telephone, using the telephone number printed on the proxy card; or | |

| By mail (if you received your proxy materials by mail), using the enclosed proxy card and return envelope. | |

|

Important Notice Regarding

the Availability of Proxy Materials for

the Annual Meeting of Stockholders

|

The proxy statement relating to the

Annual Meeting and the

Annual Report to Stockholders for the year

ended December 31, 2022 are available at

http://materials.proxyvote.com/071813.

|

The Annual Meeting will again be held only in a virtual format to provide a safe, consistent and convenient experience to all stockholders and employees regardless of location. As always, you are encouraged to vote your shares prior to the Annual Meeting whether or not you plan to attend the Annual Meeting. Details on how to attend the Annual Meeting and further information can be found at “Other Information—Attending the Annual Meeting” in the proxy statement.

Proxy Statement

The accompanying proxy is solicited on behalf of the Board for use at the Annual Meeting to be held on Tuesday, May 2, 2023. On or about March 23, 2023, Baxter began mailing to stockholders of record a Notice of Internet Availability of Proxy Materials providing instructions on how to access proxy materials via the Internet and how to vote online (www.proxyvote.com). Stockholders who did not receive the Notice of Internet Availability of Proxy Materials as a result of a previous election will receive a paper or electronic copy of the proxy materials, which Baxter also began sending on or about March 23, 2023.

investor.baxter.com

2 | Proxy Statement Highlights | |

Proxy Statement Highlights

To assist you in reviewing the proposals to be acted upon at the Annual Meeting, this section presents concise detail about each non-routine voting item. For more complete information, please review the company’s Annual Report on Form 10-K for the year ended December 31, 2022 (the 2022 Form 10-K) and the complete proxy statement.

|

Election of Directors

What am I voting on? You are asked to vote for the election of the ten director nominees set forth below for a term of one year.

What is the Board’s recommendation? The Board recommends a vote FOR the election of each of the director nominees. As demonstrated in the director skills matrix included on page 6, the Board believes that the ten directors standing for election possess a desirable mix of skills, backgrounds, professional and industry experience and qualifications, reflective of the Board’s ongoing refreshment efforts, including with respect to the appointment in May 2022 of Messrs. Brent Shafer and Peter Wilver. Each director is individually qualified to make unique and substantial contributions to the Board, and, collectively, the Board believes the directors’ diverse skillsets and viewpoints ensure that the Board continues to be well-suited to provide the company with valuable insight and effective oversight with respect to its business, overall performance and strategic direction. The Board has demonstrated an ability to effectively consult with management on the company’s strategic and operational plans and oversee the company’s performance, including with respect to the proposed spinoff of the company’s Renal Care and Acute Therapies businesses and the company’s other recently announced strategic initiatives and in connection with the ongoing Hillrom integration. See below for additional information regarding the qualifications, experiences and backgrounds of the Board and recent Board developments.

Where can I find more information? Concise supporting information is presented below. | |||

| See also “Corporate Governance at Baxter International Inc.—Proposal 1—Election of Directors” for additional information.

| |||

| 2023 Annual Meeting of Stockholders and Proxy Statement

| 2023 Annual Meeting of Stockholders and Proxy Statement

| Proxy Statement Highlights |

3 | |

|

Name1

|

Age

|

Director

|

Independent

|

Key Attributes

|

A2

|

CHC |

NCGPP2 |

QCT | |||||||||

José (Joe) E. Almeida Chair, President and CEO, Baxter International Inc. |

60 |

2016 |

N |

✓ Significant experience in the medical device industry ✓ Extensive experience leading and helping to transform global, multi-faceted corporations | ||||||||||||||

Michael F. Mahoney Chair, President and CEO, Boston Scientific Corporation | 58 | 2015 | Y | ✓ Extensive experience leading global, medical products companies, including most recently as Chairman and Chief Executive Officer of Boston Scientific Corporation | ⬛ | |||||||||||||

Patricia B. Morrison Executive Vice President, Customer Support Services & Chief Information Officer, Cardinal Health, Inc. (retired) | 63 | 2019 | Y | ✓ Significant experience in IT and cybersecurity at global healthcare companies | ⬛ | |||||||||||||

Stephen N. Oesterle, M.D. Healthcare Industry Consultant, former Senior Vice President, Medicine and Technology, Medtronic plc | 72 | 2017 | Y | ✓ Significant experience in the medical products and healthcare industries ✓ Strong scientific and medical background, including as a former practicing cardiologist | ⬛ | p | ||||||||||||

Nancy M. Schlichting President and CEO, Henry Ford Health System (retired) | 68 | 2021 | Y | ✓ Significant experience in healthcare administration in senior-level executive roles ✓ Meaningful human capital management experience | p | ⬛ | ||||||||||||

Brent Shafer Chair and Chief Executive Officer, Cerner Corporation (retired) | 66 | 2022 | Y | ✓ Significant experience leading global organizations, including most recently as Chair and Chief Executive Officer of Cerner Corporation ✓ Strong digital health capabilities and experience transforming complex organizations | ⬛ | ⬛ | ||||||||||||

Cathy R. Smith Chief Financial Officer, Bright Health Inc. | 59 | 2017 | Y | ✓ Significant financial expertise and corporate leadership experience, including in response to cybersecurity incidents and in the area of human capital management (as a Chief Administrative Officer) | ⬛ | p | ||||||||||||

Amy A. Wendell Senior Vice President of Strategy and Business Development, Covidien (retired) | 62 | 2019 | Y | ✓ Extensive experience in business development and strategy in healthcare industry, including significant restructuring and integration experience | ⬛ | ⬛ | ||||||||||||

David S. Wilkes, M.D. Former Dean of University of Virginia School of Medicine, Chief Scientific Officer and Co- Founder, ImmuneWorks, Inc. | 66 | 2021 | Y | ✓ Significant scientific and medical experience ✓ Extensive experience leading large, complex organizations, including as a former dean of two large medical schools | ⬛ | |||||||||||||

Peter M. Wilver Executive Vice President and Chief Administrative Officer, Thermo Fisher Scientific Inc. (retired) | 63 | 2022 | Y | ✓ Significant financial expertise, most recently as Chief Financial Officer and Chief Administrative Officer of Thermo Fisher Scientific Inc. | p | ⬛ | ||||||||||||

Key

p Committee Chairperson ⬛ Committee Member | A Audit Committee CHC Compensation and Human Capital Committee | NCGPP Nominating, Corporate Governance & Public Policy Committee QCT Quality, Compliance and Technology Committee

|

| 1 | Directors standing for re-election on May 2, 2023. Committee assignments reflected in this chart speak as of the same date. |

| 2 | As of March 23, 2023, Thomas Chen serves as the chair of the NCGPP Committee and Cathy Smith serves as the chair of the Audit Committee. Effective April 28, 2023 in connection with Mr. Chen’s retirement, Ms. Smith will stop serving as the chair of the Audit Committee and become chair of the NCGPP Committee. Additionally, Peter Wilver will join the Audit Committee as its chair. |

investor.baxter.com

4 | Proxy Statement Highlights | |

2022 Board and Governance Highlights

Board Refreshment Activities |

|

See pages 18 |

| |

• Continued Board focus on refreshment led to the appointment of two new independent directors in 2022, as described below. Additionally, the Board has retained an independent search firm to assist in the recruitment of a potential new director to the Board.

1 After giving effect to the departures of Messrs. Chen and Stroucken.

| ||||

Governance Practices

|

|

See page 20 |

| |

• Strong Governance Practices: The company remains committed to strong corporate governance practices and protecting stockholder rights including with respect to the following matters: • Annual director elections; • Majority voting standard; |

| 2023 Annual Meeting of Stockholders and Proxy Statement

| 2023 Annual Meeting of Stockholders and Proxy Statement

| Proxy Statement Highlights |

5 | |

• Strong Lead Independent Director (including with respect to a newly appointed Lead Independent Director effective April 28, 2023) with robust and clearly defined responsiblities; • All directors, except the current Chair, President and Chief Executive Officer (CEO), are independent; • All Board committee chairs are independent; • Executive sessions of independent directors held at each regularly scheduled Board meeting; • Mandatory retirement age; • No supermajority voting provisions; • Single class of voting stock; • Proxy access rights; • Stockholders’ right to call a special meeting (recently reduced from 25% to a 15% threshold); and • Stockholders’ right to act by written consent • Stockholder Outreach: As part of the company’s corporate governance outreach program, the company approached select institutional investors to engage in discussions with Mr. Albert Stroucken (the Lead Independent Director and former Audit Committee chair) and Mr. Thomas Chen (the chair of the NCGPP Committee) and certain members of management. • In the fall of 2022, the company engaged in discussions with stockholders representing approximately 40% of the company’s outstanding shares (calculated as of December 31, 2022). The company, with participation from select directors, intends to continue having these conversations with interested investors. • Topics discussed with stockholders in 2022 included company strategy and performance (including ongoing operational and performance challenges and the company’s response to the COVID-19 pandemic), the continued integration of Hillrom, corporate governance matters (including board composition, diversity and refreshment), the Board’s leadership structure, executive compensation and corporate responsibility initiatives. Stockholder feedback was shared with the full Board and relevant committees. This feedback informed the Board’s decision to put forth management proposals to permit stockholders to act by written consent and to reduce the special meeting threshold from 25% to 15%. | ||

• Responsiveness to Stockholders: The company is committed to being responsive to the views of stockholders and has continued to make significant governance enhancements throughout 2022. In response to the support received for a 2021 stockholder proposal, the company put forth a management proposal to permit stockholders to act by written consent at the 2022 annual meeting. At the same meeting, the company also put forth a management proposal to lower its special meeting threshold from 25% to 15%. After both management proposals were approved, the company promptly implemented these changes. • Overboarding: In February 2022, the Board amended its Corporate Governance Guidelines to reduce the maximum number of boards of directors on which a director may serve to two public companies (from three) for directors who are employed full time or to four public companies (from five) for all other directors, subject to a related transition period. |

investor.baxter.com

6 | Proxy Statement Highlights | |

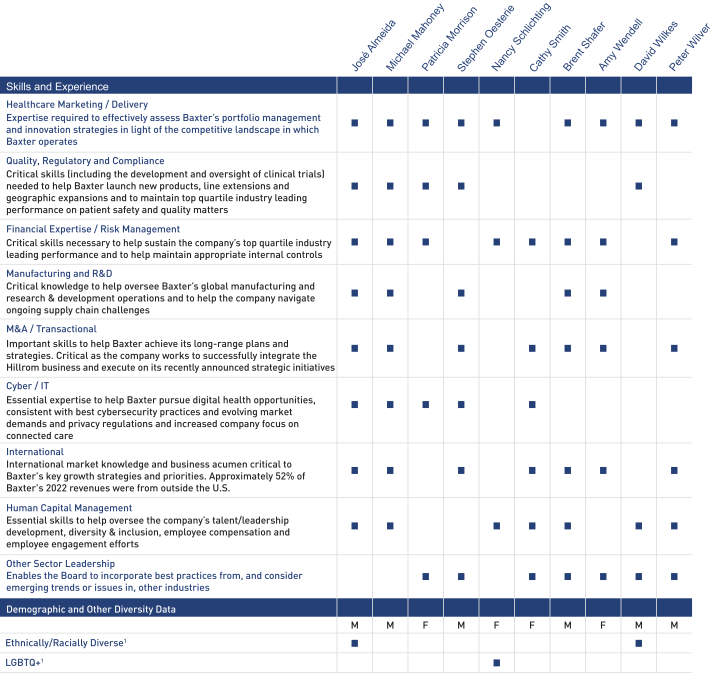

Board Qualifications, Experiences and Backgrounds

The matrix included below represents some of the key skills, experiences and backgrounds that the Board has identified as particularly valuable to the oversight of the company and illustrates how the current directors individually and collectively represent these key competencies and backgrounds. While all of these qualifications were considered by the Board and the NCGPP Committee in connection with this year’s director nomination process, the matrix does not encompass all of the skills, experience, qualifications and attributes of the director nominees. Additionally, the fact that a particular skill, experience, qualification or attribute for a nominee is not listed below does not mean that he or she does not possess that skill, experience, qualification or attribute. The Board firmly believes that its highly qualified director nominees provide the Board with a diverse complement of skills, experience and perspectives necessary to help ensure effective oversight.

| 1 | As self-identified by the director nominees |

| 2023 Annual Meeting of Stockholders and Proxy Statement

| 2023 Annual Meeting of Stockholders and Proxy Statement

| Proxy Statement Highlights |

7 | |

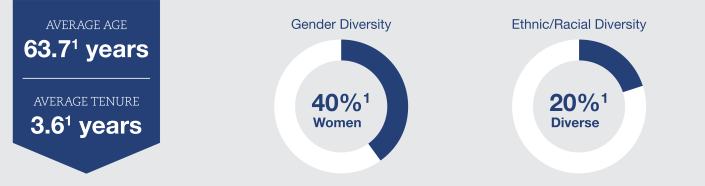

Additional information regarding the director nominees, including with respect to average tenure and average age and gender and racial diversity statistics, is set forth below:

| 1 | Calculations represent the Board’s composition for all directors standing for re-election at the Annual Meeting as of April 28, 2023 (after giving effect to the departures of Messrs. Chen and Stroucken) |

|

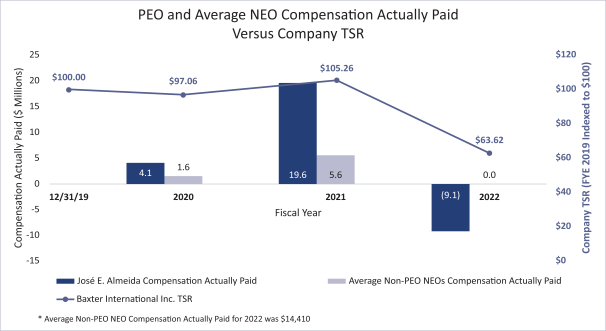

Advisory Vote to Approve Named Executive Officer Compensation

What am I voting on? You are asked to cast a non-binding advisory vote to approve Baxter’s 2022 compensation programs as described in the “Executive Compensation—Compensation Discussion and Analysis” section of the proxy statement. | |||

What is the Board’s recommendation? The Board recommends a vote FOR this proposal. The Board and the CHC Committee believe that Baxter’s executive compensation programs appropriately align executives’ interests with Baxter’s strategies and long-term objectives, including Baxter’s ongoing pursuit of top quartile financial performance. See “—Performance Highlights” below for additional information regarding 2022 financial and compensation design highlights.

Where can I find more information? Concise supporting information is presented below. | ||||

| See “Executive Compensation—Proposal 2—Advisory Vote to Approve Named Executive Officer Compensation” for additional information. | |||

investor.baxter.com

8 | Proxy Statement Highlights | |

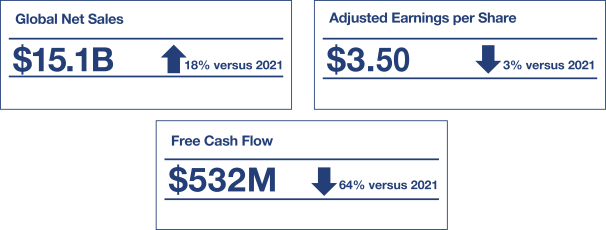

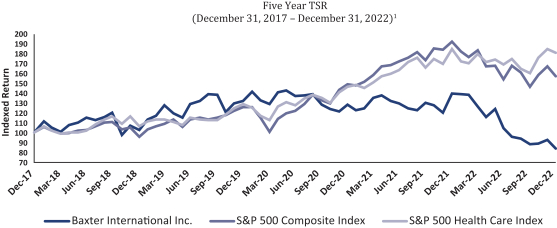

Performance Highlights

Further Information | ||

Financial results for 2022

The company’s financial results for 2022 are set forth below. While these results fell short of the company’s expectations for the year, they reflect the impact of continuing global economic challenges that the company is working to address through various actions, including through the strategic initiatives announced on January 6, 2023. These initiatives include the proposed spinoff of the company’s Renal Care and Acute Therapies businesses into an independent, publicly traded company, the company’s plans to implement a new operating model and the potential sale of the company’s BPS contract manufacturing business. |

See page 35 |

| 1 | The amounts set forth above represent Baxter’s publicly disclosed results for 2022. Free cash flow represents cash flow from continuing operations calculated in accordance with U.S. generally accepted accounting principles (GAAP) less capital expenditures. See Baxter’s Periodic Report on Form 8-K dated February 9, 2023 for a reconciliation of the amounts set forth above to the applicable measure calculated in accordance with GAAP. |

For purposes of calculating performance under the company’s 2022 annual incentive plan, net sales were calculated at budgeted exchange rates (as of January 1, 2022). This measure is referred to as Adjusted Net Sales in the proxy statement. Adjusted Net Sales for the purposes of Baxter’s 2022 annual incentive plan were $15.8 billion, a 27% increase from 2021. |

See “Executive Compensation—Compensation Discussion and Analysis—Elements of Executive Compensation—Annual Incentive Plan—Determination of 2022 Annual Incentive Plan Payouts” for a reconciliation of Adjusted Net Sales, adjusted earnings per share (Adjusted EPS) and Free Cash Flow to the applicable measures calculated in accordance with GAAP. |

| 2023 Annual Meeting of Stockholders and Proxy Statement

| 2023 Annual Meeting of Stockholders and Proxy Statement

| Proxy Statement Highlights |

9 | |

Compensation Design for 2022

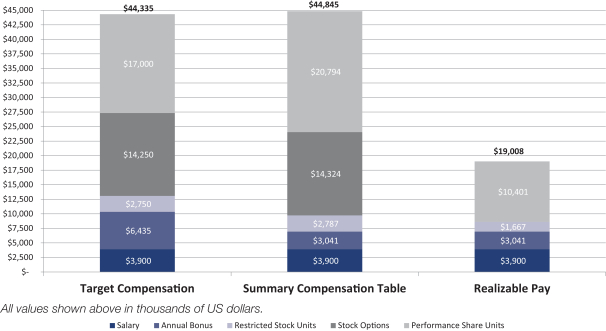

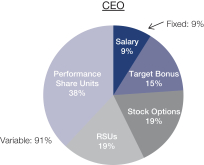

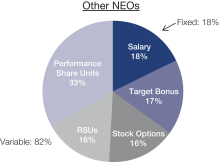

| See page 34 | |

Base Salary

| ||

• Provides a base level of competitive compensation • Used to attract and retain executive talent | ||

2022 Annual Incentive Plan

| ||

• Motivates and rewards executives for company and individual performance against annually established financial targets and individual objectives • Financial targets and relative weightings for 2022 included: • Adjusted Net Sales (50%); • Adjusted EPS (25%); and • Free Cash Flow (25%) | ||

2022 Long-Term Incentive (LTI) Plan*

| ||

Performance Share Units (PSUs) (50%)

• Motivates and rewards executives for company performance against financial targets tied to Baxter’s long-term strategy (including financial goals) and relative total shareholder return (TSR) • Recognizes that a portion of an executive’s LTI grants should be completely “at risk” • Are subject to measurement over the entire three-year performance period (as described below) • Financial measures for 2022 PSU awards included: • Adjusted Net Sales Compound Annual Growth Rate (CAGR) (33-1/3%)—based on company performance as compared to the three-year Adjusted Net Sales CAGR target • Adjusted Return on Invested Capital (ROIC) (33-1/3%)—based on company performance as compared to the three-year Adjusted ROIC target • Relative TSR (33-1/3%)—based on the change in company stock price over a three-year performance period, including reinvested dividends, as compared to the TSR of the company’s peer group over the same performance period (as further described in “Executive Compensation—Compensation Discussion and Analysis—Elements of Executive Compensation—Long-Term Incentive Plan”) • In the event TSR is negative during the three-year performance period, the maximum PSU payout is capped at 100% of target | ||

Restricted Stock Units (RSUs) (25%)

• Motivates and rewards executives consistent with the company’s long-term objectives and promotes retention, consistent with the practices of the company’s peer companies

Stock Options (25%)

• Motivates and rewards executives consistent with the company’s long-term objectives and increasing stockholder value, including direct alignment with the company’s stock price performance | ||

| *Percentages set forth in this section represent the split of long-term equity awards for the company’s executive officers (including all named executive officers) for 2022 based on face value of PSUs and RSUs (as of the grant date), and grant date fair value of stock options | ||

Other Compensation Matters

As described in greater detail in the Compensation Discussion and Analysis section below, the company’s Executive Leadership Team’s individual performance assessment, which is used in determining the payouts under the Annual Incentive Plan, was initially determined in connection with an assessment of the company’s performance against pre-established measures for strategic 2022 priorities. The strategic 2022 priorities are included in three categories: Patient Safety and Quality, Best Place to Work and Growth Through Innovation. This approach is intended to further motivate and incent the company’s executive leadership team to meet key 2022 priorities focused on various strategic areas, including ESG issues, while continuing to help ensure the delivery of strong financial results through the financial metrics used to calculate aggregate financial performance.

| ||

investor.baxter.com

10 | Proxy Statement Highlights | |

|

Advisory Vote on the Frequency of Executive Compensation Advisory Votes

What am I voting on? You are asked to cast a non-binding advisory vote on the frequency of Baxter’s “say-on-pay” votes (as described in Proposal 2 for 2022). | |||

What is the Board’s recommendation? The Board of Directors recommends a ONE YEAR vote for this proposal.

Where can I find more information? Concise supporting information is presented below. | ||||

| See “Management Proposals—Proposal 3–Advisory Vote on the Frequency of Executive Compensation Advisory Votes.” | |||

|

Shareholder Ratification of Excessive Termination Pay

What am I voting on? If properly presented, you will be asked to vote on a stockholder proposal that asks the Board to seek shareholder approval of any senior manager’s new or renewed pay package providing severance or termination payments with an estimated value exceeding 2.99 times the sum of the executive’s base salary plus target short term bonus. | |||

What is the Board’s recommendation? The Board of Directors recommends a vote AGAINST the stockholder proposal.

Where can I find more information? Concise supporting information is presented below. | ||||

| See “Stockholder Proposals—Proposal 5—Shareholder Ratification of Excessive Termination Pay” for additional information. | |||

Items to consider when evaluating this proposal: |

• Cash severance payments under Baxter’s current executive compensation policies and practices are already limited to less than 2.99 times base salary plus annual bonus: Baxter has adopted a policy to codify the cash severance cap and commit the company to seek stockholder ratification of any new severance agreement, plan or policy covering an executive officer providing for cash severance benefits exceeding 2.99 times the sum of such executive officer’s base salary plus target annual bonus opportunity. • The proposal would discourage the use of long-term equity incentive awards, which may place the company at a competitive disadvantage: By including equity awards in the calculation of the proposed severance limit, the proposal discourages the use of long-term equity incentives. Limiting executives’ ability to realize the value of their compensation could hurt Baxter’s ability to recruit and retain senior talent. • The company’s equity compensation plan, which was overwhelmingly approved by stockholders at the 2021 annual meeting, expressly provides for double-trigger acceleration of outstanding equity awards in the event of a qualifying termination following a Change in Control: Termination protection of equity awards is particularly important in the context of a change in control transaction. The risk of job loss following a change in control, coupled with an arbitrary limit on compensation and the value that may be realized from executives’ outstanding equity awards, may present an unnecessary distraction for company executives. • The proposal is unnecessary because stockholders already have opportunities to express their approval of the company’s post-termination compensation policies: Stockholders have the opportunity to address Baxter’s compensation policies and practices through the company’s annual say-on-pay advisory vote and the requirement of the New York Stock Exchange (NYSE) to seek stockholder approval of new or amended equity compensation plans. In addition, in the event of a change in control of the company or similar event, stockholders would likely have a further opportunity to express their views on any compensation to be paid to the company’s named executive officers in connection with that transaction. |

| 2023 Annual Meeting of Stockholders and Proxy Statement

| 2023 Annual Meeting of Stockholders and Proxy Statement

| Proxy Statement Highlights |

11 | |

|

Executives to Retain Significant Stock

What am I voting on? If properly presented, you will be asked to vote on a stockholder proposal that asks the Board to adopt a policy requiring senior executives to retain a significant percentage of stock acquired through equity pay programs until reaching normal retirement age and to report to stockholders regarding the policy in the company’s next annual proxy statement. | |||

What is the Board’s recommendation? The Board of Directors recommends a vote AGAINST the stockholder proposal.

Where can I find more information? Concise supporting information is presented below. | ||||

| See “Stockholder Proposals—Proposal 6—Executives to Retain Significant Stock” for additional information. | |||

Items to consider when evaluating this proposal: |

• Baxter’s current stock ownership guidelines already require significant stock retention by executives: Baxter’s Chief Executive Officer is required to achieve ownership of Baxter common stock valued at a minimum of six times annual base salary within five years of appointment. Each other executive officer (including all of the senior executives of the company who would be covered by this proposal) is required to achieve ownership of Baxter common stock valued at a minimum of four times annual base salary within five years of becoming an executive officer. • The company’s existing stock ownership guidelines are generally accomplishing their intended purpose: As of March 1, 2023, each of the named executive officers who were still employed by the company as of such date had met his ownership requirements or, using reasonable assumptions, were on track to achieve his stock ownership objective within the prescribed time frame. Although recent declines in company stock price have made compliance with the guidelines more challenging and have caused one or more executives to fall out of compliance with the guidelines at different points in the year, on average, the remaining named executive officers (after giving effect to Mr. Accogli’s voluntary departure) held over 150% of the required equity holdings as of March 1, 2023. • The proposal fails to strike a reasonable balance between aligning the interests of stockholders and management and motivating desired management behavior: The Board believes that Baxter’s emphasis on long-term incentive grants motivates executives to drive the long-term performance of the company and aligns their long-term interests with those of stockholders. However, the company also recognizes the fact that executives need some flexibility to manage their own financial affairs, which may, from time to time, include the sale of Baxter stock held as a result of the vesting of these performance grants that exceed the ownership guidelines. |

investor.baxter.com

12 | Corporate Governance at Baxter International Inc. | |

Corporate Governance at Baxter International Inc.

|

Election of Directors

The Board will consist of ten members following the departures of Messrs. Chen and Stroucken prior to the Annual Meeting. The Board has nominated all remaining directors for election for a term of one year.

The Board of Directors recommends a vote FOR the election of each of the director nominees named below under “—Nominees for Election as Directors.”

| |

Baxter’s Bylaws require each director to be elected by the majority of the votes cast with respect to that director in uncontested elections; that is, the number of shares voted “for” a director must exceed 50% of the number of votes cast with respect to that director. Abstentions will not be considered votes cast. In a contested election (a situation in which the number of nominees exceeds the number of directors to be elected), the standard for election of directors will be a plurality of the shares represented in person or by proxy and entitled to vote on the election of directors. If a nominee who is serving as a director is not elected at the Annual Meeting, under Delaware law, the director would continue to serve on the Board as a “holdover director.” However, under the company’s Bylaws, any incumbent director who fails to be reelected at an annual meeting must offer his or her resignation to the Board. The NCGPP Committee would then make a recommendation to the Board whether to accept or reject the resignation, or whether other action should be taken. In accordance with the Bylaws, the Board would consider the NCGPP Committee’s recommendation when deciding whether to accept or reject the tendered resignation and publicly disclose its decision and the rationale behind it within 90 days from the date that the election results are certified. The director who offers his or her resignation would not participate in the Board’s discussions or decision.

All of the nominees have indicated their willingness to serve if elected, but if any nominee should be unable or unwilling to stand for election, proxies may be voted for a substitute nominee designated by the Board. No nominations for directors were received from stockholders (including as a result of any proxy access nominations) and no other candidates are eligible for election as directors at the Annual Meeting. Accordingly, there is no director election contest, and each director nominee must receive a majority of the votes cast with respect to that director nominee in order to be reelected to the Board. Unless proxy cards are marked otherwise, the individuals named as proxies intend to vote the shares represented by proxy in favor of all of the Board’s nominees.

Set forth below under “—Nominees for Election as Directors” is information concerning each of the nominees for election.

| 2023 Annual Meeting of Stockholders and Proxy Statement

| 2023 Annual Meeting of Stockholders and Proxy Statement

| Corporate Governance at Baxter International Inc. |

13 | |

Nominees for Election as Directors

José (Joe) E. Almeida

Chair of the Board, President and CEO Age 60 Director since 2016

Biography Mr. Almeida was appointed Chair, President and CEO effective January 1, 2016. He began serving as an executive officer of the company in October 2015. He served as Senior Advisor with The Carlyle Group, a multinational private equity, alternative asset management and financial services corporation, from May 2015 to October 2015. Previously, he served as the Chair, President and Chief Executive Officer of Covidien plc (Covidien), a global healthcare products company, from March 2012 through January 2015, prior to the acquisition of Covidien by Medtronic plc (Medtronic), and President and Chief Executive Officer of Covidien from July 2011 to March 2012. Mr. Almeida served as a member of the Board of Directors of Walgreens Boots Alliance, Inc. from 2017 to 2022, Partners in Health from 2013 to 2021 and Ortho-Clinical Diagnostics, Inc. from 2015 to 2020. Mr. Almeida currently serves as a director of Bank of America.

Key Attributes, Experience and Skills Substantial knowledge of the medical device industry and extensive experience leading, operating and transforming global corporations as a result of his roles as Chair, President and CEO at Baxter and Covidien and in other senior management roles at other medical device companies. |

Michael F. Mahoney

Independent Director Age 58 Director since 2015

Committees: Compensation and Human Capital

Biography Mr. Mahoney is the Chair, President and Chief Executive Officer of Boston Scientific Corporation (Boston Scientific), a global developer, manufacturer and marketer of medical devices. He has served in that role since 2016. Between 2012 and 2016, he served as President and Chief Executive Officer of Boston Scientific. He first joined Boston Scientific in 2011, with a 24-year track record of building medical device, capital equipment and healthcare IT businesses. Prior to joining Boston Scientific, Mr. Mahoney served as Worldwide Chairman of Johnson & Johnson Medical Devices and Diagnostics Division and as Worldwide Group Chair of Johnson & Johnson’s DePuy Orthopedics and Neuro Science Business. He was President and Chief Executive Officer of the Global Healthcare Exchange, a leading supply chain solutions company, from 2001 to 2007 before joining Johnson & Johnson. Earlier in his career, he advanced through a series of leadership roles at General Electric Medical Systems. He serves as a director of AdvaMed.

Key Attributes, Experience and Skills Significant knowledge of the global medical products business and extensive experience leading and operating within global, multi-faceted medical products companies as a result of his roles at Boston Scientific and Johnson & Johnson. These experiences include significant merger and acquisition activity. |

investor.baxter.com

14 | Corporate Governance at Baxter International Inc. | |

Patricia B. Morrison

Independent Director Age 63 Director since 2019

Committees: Audit

Biography From 2009 to 2018, Ms. Morrison served as Executive Vice President, Customer Support Services and Chief Information Officer (CIO), of Cardinal Health Inc. (Cardinal), a global, integrated healthcare services and products company. At Cardinal, she led global IT operations, which included the transformation of multiple business segments, acquisition integration and digital strategy. Prior to Cardinal, Ms. Morrison was the Chief Executive Officer of Mainstay Partners, a technology advisory firm, from 2008 to 2009. She previously served as CIO of both Motorola, Inc. and Office Depot, Inc. and held senior-level IT positions at General Electric Company, PepsiCo, Inc., The Procter & Gamble Company and The Quaker Oats Company. She currently serves as a director of Splunk Inc. She previously served as a director of Aramark Corporation and Virtusa Corporation.

Key Attributes, Experience and Skills Extensive experience of across diverse global industries overseeing strategic, operational and financial aspects of IT including cybersecurity, global IT master planning and digital transformation, including in the medical products industry. |

Stephen N. Oesterle, M.D.

Independent Director Age 73 Director since 2017

Committees: Nominating, Corporate Governance & Public Policy and Quality, Compliance and Technology

Biography Dr. Oesterle is a consultant, advising private equity and operating companies in the healthcare industry. From 2002 to 2015, he served as a member of the Executive Committee of Medtronic, a global medical technology, services and solutions company, and as Medtronic’s Senior Vice President, Medicine and Technology. Previously, he served as an Associate Professor of Medicine and Director of Invasive Cardiology Services at each of Massachusetts General Hospital (1998 to 2002), Stanford University Medical Center (1992 to 1998) and Georgetown University Medical Center (1991 to 1992). Dr. Oesterle currently serves as a director of Paragon 28, Peijia Medical Ltd. and Sigilon Therapeutics, Inc. He previously served as a director of Montes Archimedes Acquisition Corp. (prior to its merger with Roivant Sciences), and REVA Medical, Inc. (REVA).

Key Attributes, Experience and Skills Extensive experience in the medical products and healthcare industries with a strong scientific and medical background. Substantial knowledge of the medical device industry and extensive medical and leadership experience as a result of his role as Senior Vice President, Medicine and Technology at Medtronic and as a director at various healthcare companies as well as positions held at Harvard Medical School, Stanford University Medical Center and other leading hospitals. |

| 2023 Annual Meeting of Stockholders and Proxy Statement

| 2023 Annual Meeting of Stockholders and Proxy Statement

| Corporate Governance at Baxter International Inc. |

15 | |

Nancy M. Schlichting

Independent Director Age 68 Director since 2021

Committees: Compensation and Human Capital and Quality, Compliance and Technology

Biography Ms. Schlichting joined the Board following Baxter’s acquisition of Hillrom, where she had previously served as a director and Chair of its Compensation and Management Development Committee. Ms. Schlichting is the retired President and Chief Executive Officer of Henry Ford Health System (HFHS) in Detroit, Michigan, a non-profit healthcare organization, serving in this role from June 2003 to January 2017. She joined HFHS in 1998 as Senior Vice President and Chief Administrative Officer and was promoted to Executive Vice President and Chief Operating Officer from 1999 to 2003 and President and Chief Executive Officer of Henry Ford Hospital from 2001 to 2003. She currently serves as a director of Walgreens Boots Alliance and Encompass Health, InStride, Inc., as a trustee of the Kresge Foundation and Duke University and as the vice-chair of the Duke University Health System Board. She previously served as a director of Pear Therapeutics, Inc.

Key Attributes, Experience and Skills Extensive healthcare administration (including human capital management) experience that spans more than 35 years in senior-level executive roles. This experience includes leading HFHS through a financial turnaround and for leading various customer service, quality and diversity initiatives. |

Brent Shafer

Independent Director Age 65 Director since 2022

Committees: Audit and Nominating, Corporate Governance & Public Policy

Biography Mr. Shafer is the former Chairman and Chief Executive Officer of Cerner, a leading provider of various health information technologies, ranging from medical devices to electronic health records to hardware, serving in this role from 2018 to 2021. He will become the Lead Independent Director effective April 28, 2023. Prior to Cerner, Mr. Shafer held a number of roles at Koninklijke Philips NV (Philips), a health technology company focused on improving people’s health across the health continuum from healthy living and prevention, to diagnosis, treatment, and home care, including Chief Executive Officer of Philips North America, a leader in diagnostic imaging, image-guided therapy, patient monitoring and health informatics, as well as in consumer health and home care. Mr. Shafer was also the Chief Executive Officer of Philips Home Healthcare Solutions (Philips) business. Before joining Philips, Mr. Shafer was Vice President and General Manager of Hillrom’s Patient Care Environment Division and worked at GE Medical Systems where he served in key positions in sales, marketing, and general management. Mr. Shafer has also held senior roles at Hewlett Packard’s Medical Products Group and Johnson & Johnson. Mr. Shafer currently services as a director of Tactile Systems Technology.

Key Attributes, Experience and Skills Substantial knowledge of the health information technology industry and extensive experience leading, operating and transforming global corporations as a result of his roles as Chairman and Chief Executive Officer at Cerner and key roles at Philips and in other senior management roles at other medical device companies. |

investor.baxter.com

16 | Corporate Governance at Baxter International Inc. | |

Cathy R. Smith

Independent Director Age 59 Director since 2017

Committees: Audit and Nominating, Corporate Governance & Public Policy

Biography Ms. Smith has served as Chief Financial and Administrative Officer of Bright Health, a diversified consumer-focused healthcare company, since January 2020. Prior to that, Ms. Smith was Executive Vice President and Chief Financial Officer at Target Corporation (Target), from September 2015 to November 2019. Prior to joining Target in 2015, Ms. Smith served as Executive Vice President and Chief Financial Officer at Express Scripts Holding Company (Express Scripts), an independent pharmacy benefits management company, from 2014 to 2015 and at Walmart International (Walmart), a division of Walmart Stores Inc., from 2010 to 2014. Earlier in her career, she served as Chief Financial Officer at GameStop. Ms. Smith currently serves as director of PPG Industries, Inc.

Key Attributes, Experience and Skills Significant financial expertise and corporate leadership experience as a result of her senior positions held at Bright Health, Target, Express Scripts and Walmart. This experience includes work helping to oversee cybersecurity incident response and human capital management expertise (as a Chief Administrative Officer at Bright Health). |

Amy A. Wendell

Independent Director Age 62 Director since 2019

Committees: Compensation and Human Capital and Quality, Compliance and Technology

Biography Ms. Wendell served as Senior Advisor at Perella Weinberg Partners L.P., a global financial services firm, consulting on strategy, corporate finance and investing practices in the healthcare industry from January 2016 to May 2019. From 2015 to September 2018, Ms. Wendell served as a Senior Advisor to McKinsey & Company (McKinsey), a management consulting firm, in its strategy and corporate finance practice and also served as a member of McKinsey’s transactions advisory board. She previously served as Senior Vice President of Strategy and Business Development and Licensing at Covidien from 2006 to 2015, where she led the company’s strategy and portfolio management initiatives and managed business development activities. From 1986 to 2015, Ms. Wendell held roles of increasing responsibility at Covidien (including its predecessors, Tyco International plc and Kendall Healthcare Products Company), from engineering to product management and business development. Ms. Wendell currently serves as a director of Axogen, Inc. and Hologic, Inc. She previously served as a director of EKSO Bionics Holdings, Inc.

Key Attributes, Experience and Skills Extensive expertise in the healthcare sector in the areas of global business development and licensing, portfolio management, mergers and acquisitions, resource allocation and identifying new market opportunities, as a result of her roles at Covidien and its predecessors as well as significant restructuring and integration experience. |

| 2023 Annual Meeting of Stockholders and Proxy Statement

| 2023 Annual Meeting of Stockholders and Proxy Statement

| Corporate Governance at Baxter International Inc. |

17 | |

David S. Wilkes, M.D.

Independent Director Age 66 Director since 2021

Committees: Quality, Compliance and Technology

Biography Dr. Wilkes served as dean of the University of Virginia School of Medicine from 2015 to 2021 and currently serves as dean emeritus. He previously served in positions of increasing responsibility at Indiana University School of Medicine, most recently as the Executive Associate Director for Research Affairs and as the August M. Watanabe Professor of Medical Research between 2009 and 2015. Dr. Wilkes is the co-founder of ImmuneWorks Inc. (ImmuneWorks), a biotechnology start-up company, and has served as its Chief Scientific Officer since 2005. Since 2006, he has served as the National Director of the Harold Amos Medical Faculty Development Program of the Robert Wood Johnson Foundation. This program seeks to increase underrepresented minority physician-scientists at leading medical schools in the United States. Dr. Wilkes is a military veteran, having served three years as a major in the U.S. Air Force Medical Corps. In 2020, he was elected to the National Academy of Medicine. Dr. Wilkes currently serves as a director of Syneos Health.

Key Attributes, Experience and Skills Extensive experience with, and medical and scientific expertise and knowledge of, the healthcare industry and its providers as a result of the positions he held with the University of Virginia School of Medicine and the Indiana University School of Medicine, as well as the leadership experience he developed at both institutions and in forming and advising ImmuneWorks. |

Peter M. Wilver

Independent Director Age 63 Director since 2022

Committees: Compensation and Human Capital; To join Audit effective April 28, 2023

Biography Mr. Wilver served as Executive Vice President and Chief Administrative Officer of Thermo Fisher, a world leader and supplier of scientific instrumentation, reagents and consumables and services and software, from 2015 until he retired in 2017. He previously served as the Chief Financial Officer at Thermo Fisher from 2004 to 2015. Prior to Thermo Fisher, Mr. Wilver was the Chief Financial Officer of Honeywell’s Electronic Materials Division (Honeywell), a multinational conglomerate corporation. Before joining Honeywell, Mr. Wilver held various finance roles at Grimes Aerospace Company, a manufacturer of aircraft lighting systems, and General Electric Company, a multinational company in the power, aviation and healthcare sectors. Mr. Wilver previously served as director of CIRCOR International, and Tenet Healthcare Corporation. He currently serves as a director of Evoqua Water Technologies Corporation, Livanova PLC, and Shoals Technologies Group, Inc.

Key Attributes, Experience and Skills Substantial experience leading and operating large, complex corporations and significant financial expertise through his leadership roles with Thermo Fisher and Honeywell, as well as through positions at Grimes Aerospace Company and General Electric Company. |

investor.baxter.com

18 | Corporate Governance at Baxter International Inc. | |

Board of Directors

In accordance with the mandatory retirement age set forth in Baxter’s Corporate Governance Guidelines, Mr. Stroucken is not eligible to stand for re-election at the Annual Meeting and will cease serving as a director effective April 28, 2023. Additionally, on February 13, 2023, Mr. Chen tendered his retirement notice effective April 28, 2023. Following these departures, the Board will consist of ten members.

Director Independence

Baxter’s Corporate Governance Guidelines, as most recently amended in February 2022, require that the Board be composed of a majority of directors who meet the criteria for “independence” established by the rules of the NYSE. To be considered independent, the Board must affirmatively determine that a director does not have any direct or indirect material relationship with Baxter (either directly or as a partner, stockholder or officer of an organization that has a relationship with Baxter) and, solely with regard to CHC Committee members, consider all relevant factors that could impair his or her ability to make independent judgments about executive compensation.

In making its independence determinations, the Board considers transactions, relationships and arrangements between Baxter and entities with which directors are associated as partner, stockholder or officer. When these transactions, relationships and arrangements have existed, they have generally been in the ordinary course of business and of a type customary for a global diversified company such as Baxter.

After careful consideration, the Board has determined that each of the following directors standing for re-election satisfies Baxter’s independence standards and the NYSE listing standards for independence: Michael F. Mahoney; Patricia B. Morrison; Stephen N. Oesterle, M.D.; Nancy M. Schlichting; Brent Shafer, Cathy R. Smith; Amy A. Wendell; David S. Wilkes, M.D.; and Peter M. Wilver.

Director Attendance

In 2022, the Board held nine meetings. Each director attended at least 75% of the total number of Board meetings and meetings of the committees on which he or she served during the related period of service in 2022. Baxter’s Corporate Governance Guidelines set forth the company’s expectation that directors attend each annual meeting of stockholders. In 2022, all of the directors then in office participated in the 2022 annual meeting.

Director Tenure, Refreshment and Diversity

The Board recognizes the importance of periodic refreshment and maintaining an appropriate balance of tenure, experience, and perspectives on the Board. The Board has a mix of relatively new and longer-tenured directors. This mix provides the Board with the benefit of new perspectives and insights from directors who have familiarity with, and knowledge of, the organization and governance of the company and the issues confronting it. The directors standing for re-election have an average tenure of 3.6 years.

To ensure appropriate refreshment, the NCGPP Committee and the Board regularly evaluate the company’s evolving needs and add new skills, qualifications and experience to the Board as necessary to ensure that the Board remains capable of addressing the risks, trends and opportunities facing the company. Notably, as a result of this process, six directors have been appointed in the past five years.

The Corporate Governance Guidelines also require directors to retire at the age of 75, subject to certain exceptions (such as, during a CEO succession or during a material merger, acquisition or disposition). The Board has not granted any waivers with respect to this mandatory retirement age (including with respect to Mr. Stroucken who will not be standing for reelection at the Annual Meeting).

The Board is also committed to achieving a diverse and broadly inclusive membership. The Board believes that having diverse directors with varying perspectives and a breadth of experience will positively contribute to robust discussion at Board meetings and help guide Baxter’s strategy and long-term value creation. A diverse board is also more reflective of Baxter’s global customer base. As a result, and consistent with the Corporate Governance Guidelines and the charter of the NCGPP Committee, diversity of background, including diversity of gender, race, ethnic or geographic origin, age and experience (including in business, government and education as well as healthcare, science, technology and other areas relevant to the company’s activities), is a relevant factor in the selection process. Additionally, the Board looks to create a diverse candidate pool for each director search the Board undertakes. Of the eight directors most recently appointed to the Board, five are women or ethnically or racially diverse.

| 2023 Annual Meeting of Stockholders and Proxy Statement

| 2023 Annual Meeting of Stockholders and Proxy Statement

| Corporate Governance at Baxter International Inc. |

19 | |

Additionally, as discussed below, the Board conducts an annual assessment of itself and its committees to help identify potential gaps or areas that the Board may look to augment in light of the company’s strategies, including by taking into account the overall diversity of the Board.

Director Qualifications

As discussed below in “—Nomination of Directors,” directors are selected on the basis of the specific criteria set forth in Baxter’s Corporate Governance Guidelines. The skills, experience, expertise and knowledge represented by the Board as a collective body allow the Board to continue to lead Baxter in a manner that serves the best interests of its stockholders. Key attributes, experience and skills for each of the company’s director nominees are included above in their biographies and under “Proxy Statement Highlights—Board Qualifications, Experiences and Backgrounds.”

Director Overboarding

The Board values the experience directors bring from other boards on which they serve but recognizes that those boards may also present demands on a director’s time and availability.

In February 2022, the Board amended Baxter’s Corporate Governance Guidelines to reduce that the maximum number of public company boards of directors on which a director may serve to two (inclusive of the Board) for directors who are employed full time or to four (inclusive of the Board) for all other directors. Any director who is no longer in compliance with these limitations is required to make good faith efforts to reduce the number of public company boards on which he or she serves in order to comply prior to the time he or she is eligible to be nominated for reelection.

Nomination of Directors

The NCGPP Committee considers candidates for director recommended by stockholders, members of the Board and management in accordance with the policies outlined in Baxter’s Bylaws, Corporate Governance Guidelines and charter of the NCGPP Committee.

Additionally, in 2022, the Board retained outside search firms to identify potential new directors with strong healthcare experience and those with strong finance and accounting backgrounds. These searches resulted in the identification and appointment of Messrs. Shafer and Wilver. The Board retained another independent search firm, in late 2022, to identify a potential new director.

The NCGPP Committee evaluates all candidates for director in the same manner regardless of the source of the recommendation. Stockholder recommendations for candidates for director must include the same information required by Baxter’s Bylaws for stockholder director nominees and be sent to the Nominating, Corporate Governance & Public Policy Committee, c/o Corporate Secretary, Baxter International Inc., One Baxter Parkway, Deerfield, Illinois 60015.

Baxter’s Corporate Governance Guidelines provide that director nominees selected by the NCGPP Committee must:

| • | possess fundamental qualities of intelligence, honesty, perceptiveness, good judgment, maturity, high ethics and standards, integrity, fairness and responsibility; |

| • | have a genuine interest in the company and recognition that, as a member of the Board, each director is accountable to all stockholders of the company, not to any particular interest group; |

| • | have a background that demonstrates an understanding of business and financial affairs and the complexities of a large, multifaceted, global business, governmental or educational organization; |

| • | be or have been in a senior position in a complex organization such as a corporation, university or major unit of government or a large not-for-profit institution; |

| • | have no conflict of interest or legal impediment that would interfere with the duty of loyalty owed to the company and its stockholders; |

| • | have the ability and be willing to spend the time required to function effectively as a director; |

| • | be compatible and able to work well with other directors and executives in a team effort with a view to a long-term relationship with the company as a director; and |

| • | have independent opinions and be willing to state them in a constructive manner. |

investor.baxter.com

20 | Corporate Governance at Baxter International Inc. | |

If a vacancy occurs or is expected to occur on the Board and the Board desires to fill the position, the Board initiates a process to identify potential candidates, such as by engaging an independent search firm. Once a candidate has been identified, the NCGPP Committee (on behalf of the Board) and the independent search firm will engage in a process that includes a thorough investigation of the candidate, an examination of his or her business background and education, research on the individual’s accomplishments and qualifications, in-person interviews and reference checking. If this process generates a positive indication, the Lead Independent Director, members of the NCGPP Committee and the Chair of the Board will meet with the candidate and then confer with each other regarding the candidate. After consideration of these background screens and interviews (possibly with multiple candidates), the NCGPP Committee may then recommend the individual to the full Board for further evaluation, and ultimately, election. If the full Board agrees, the Chair of the Board is then authorized to extend an offer to the individual candidate to join the Board at that time or nominate the candidate for election at the next annual meeting of stockholders.

In addition to making recommendations to the Board, eligible stockholders are able to nominate a candidate for election to the Board through the proxy access provisions of Baxter’s Bylaws. Subject to compliance with the related requirements (including with respect to the nominating stockholders and the nominee), the nominee will be included in the proxy statement as a stockholder nominee. The proxy access provision provides that a group of up to 20 stockholders that have held at least 3% of Baxter’s outstanding shares for at least three years can nominate up to two individuals or 20% of the Board, whichever is greater, for election at an annual stockholders’ meeting. No stockholders submitted any proxy access nominees for consideration at the Annual Meeting.

Stockholders may also nominate individuals for election as directors by complying with the procedures set forth in Baxter’s Bylaws and Rule 14a-19 under the Exchange Act. For more information about this process, see “Other Information—Nominations of Individuals for Election as Directors at the 2024 Annual Meeting” below.

Annual Board Evaluation

Each year, the NCGPP Committee oversees a review of the structure and composition of the Board and each committee thereof. This review is conducted to help ensure that the Board and each Board committee continues to function effectively in light of the company’s strategic objectives, the company’s Corporate Governance Guidelines and each committee charter. As part of this process, the Board identifies any potential skill or experience gaps or areas that the Board would like to augment either by appointing new directors, rotating existing directors off the Board or refreshing committee assignments. This process helped result in the appointment of Messrs. Shafer and Wilver to the Board in May 2022 and the hiring of a search firm in late 2022.

The Board periodically hires an independent third party to conduct this self-assessment process, typically every two to three years, or as circumstances warrant it.

Communicating with the Board of Directors

Stockholders and other interested parties may contact any of Baxter’s directors, including the Lead Independent Director or the non-management directors as a group, by writing a letter to Baxter Board of Directors, c/o Corporate Secretary, Baxter International Inc., One Baxter Parkway, Deerfield, Illinois 60015, or by sending an e-mail to boardofdirectors@baxter.com. Baxter’s Corporate Secretary will forward communications directly to the Lead Independent Director, unless a different director is specified.

See “—Other Corporate Governance Information—Stockholder Engagement” below for a discussion of the company’s stockholder outreach efforts.

Other Corporate Governance Information

Corporate Governance Guidelines