- PLD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Prologis (PLD) 8-KResults of Operations and Financial Condition

Filed: 6 Feb 13, 12:00am

Earnings Release and Supplemental Information Unaudited Fourth Quarter 2012 |

Copyright © 2013 Prologis Supplemental 4Q 2012 Table of Contents Overview Press Release 1 Highlights Company Profile 4 Company Performance 5 Financial Information Consolidated Balance Sheets 6 Consolidated Statements of Operations 7 Reconciliation of Net Earnings (Loss) to FFO 8 EBITDA Reconciliation 9 Pro-rata Information 10 Operations Overview Operating Portfolio 12 Operating Metrics 15 Customer Information 16 Capital Deployment Building Dispositions and Contributions 17 Third Party Building Acquisitions 18 Development Starts 19 Development Portfolio 21 Land Portfolio 22 Private Capital Detail Information 24 Operating and Balance Sheet Information 25 Capitalization Debt and Equity Summary 26 Debt Covenants and Other Metrics 27 Assets Under Management 28 Net Asset Value Components 29 Notes and Definitions 31 Prologis Park Dallas, TX, United States Prologis Park Zama 1, Zama, Japan Milton Keynes Marston Gate, Bedfordshire, United Kingdom Cover: Prologis Park Isle d'Abeau Distribution Center, France |

Copyright © 2013 Prologis 1 Prologis, Inc. Announces Fourth Quarter 2012 Earnings Results - Record 40.5 million square feet of leasing in Q4; 145 million in 2012 - - Occupancy increases to 94.0 percent at year end - - $1.3 billion in contributions and dispositions in Q4; $2.7 billion in 2012 - - Ahead of schedule on 10 Quarter Strategic Plan - SAN FRANCISCO (Feb. 6, 2013) – Prologis, Inc. (NYSE: PLD), the leading global owner, operator and developer of industrial real estate, today reported results for the fourth quarter and full year 2012. Core funds from operations (Core FFO) per fully diluted share was $0.42 for the fourth quarter 2012 compared to $0.44 for the same period in 2011. Core FFO per fully diluted share for full year 2012 was $1.74 compared to $1.58 for full year 2011. Net loss per fully diluted share was $0.50 for the fourth quarter 2012 compared to a net loss of $0.10 for the same period in 2011. Net loss per share was $0.18 for the full year 2012 compared to a net loss of $0.51 for the same period in 2011. The net loss for the quarter and year was principally due to impairment charges and losses on the early extinguishment of debt which were partially offset by gains on acquisitions and dispositions of real estate. “This marks the first full year as a combined company and Prologis delivered very strong results,” said Hamid Moghadam, chairman and CEO, Prologis. “We are ahead of schedule on our 10 Quarter Plan and we’ve built a solid foundation upon which we will continue to grow the company.” Operating Portfolio Metrics The company leased a record 40.5 million square feet (3.8 million square meters) in its combined operating and development portfolios in the fourth quarter, and 145.3 million square feet (13.5 million square meters) in the full year 2012. Prologis ended the quarter with 94.0 percent occupancy in its operating portfolio, up 90 basis points over the prior quarter and 180 basis points over year end 2011. Tenant retention in the quarter was 87.3 percent, with tenant renewals totaling 25.1 million square feet (2.3 million square meters). “Our team did an exceptional job setting another quarterly record for leasing around the globe,” said Moghadam. “Increasing demand and lack of supply remain the theme in most markets, and we expect our overall rent change on rollover to turn positive this year. In the United States, in particular, occupancy in our small spaces increased 280 basis points year over year, and we expect this trend will continue given improvements in the housing market.” Same-store net operating income (NOI) increased 0.1 percent in the fourth quarter and 1.3 percent in the full year 2012. Rental rates on leases signed in the fourth quarter same-store pool decreased by 2.4 percent from in-place rents. Dispositions and Contributions Prologis completed $1.3 billion in contributions and dispositions in the fourth quarter, of which more than $1.0 billion was Prologis’ share. This includes approximately: $878 million of third-party building and land dispositions primarily in the United States and Europe, of which $700 million was the company's share; and $401 million of contributions to Prologis European Properties Fund II, Prologis Europe Logistics Venture, Prologis Targeted Europe Logistics Fund, and joint ventures in Brazil, of which $325 million was the company’s share. In the full year 2012, contributions and dispositions totaled $2.7 billion, of which more than $2.1 billion was the company's share. Additionally, the company has approximately $5 billion of operating portfolio assets in Japan and Europe scheduled for contribution in the first quarter of 2013, in connection with Nippon Prologis REIT (NPR) and Prologis European Logistics Partners Sàrl (PELP), subject to the listing of NPR and customary closing conditions. The combination of these transactions, in conjunction with fourth quarter activity, positions the company ahead of its 10 Quarter Plan. “We continue to make excellent progress executing on our priority to realign our portfolio,” said Thomas Olinger, chief financial officer, Prologis. “These dispositions and contributions reflect the diversity of our activities as well as the market’s demand for high quality industrial real estate.” |

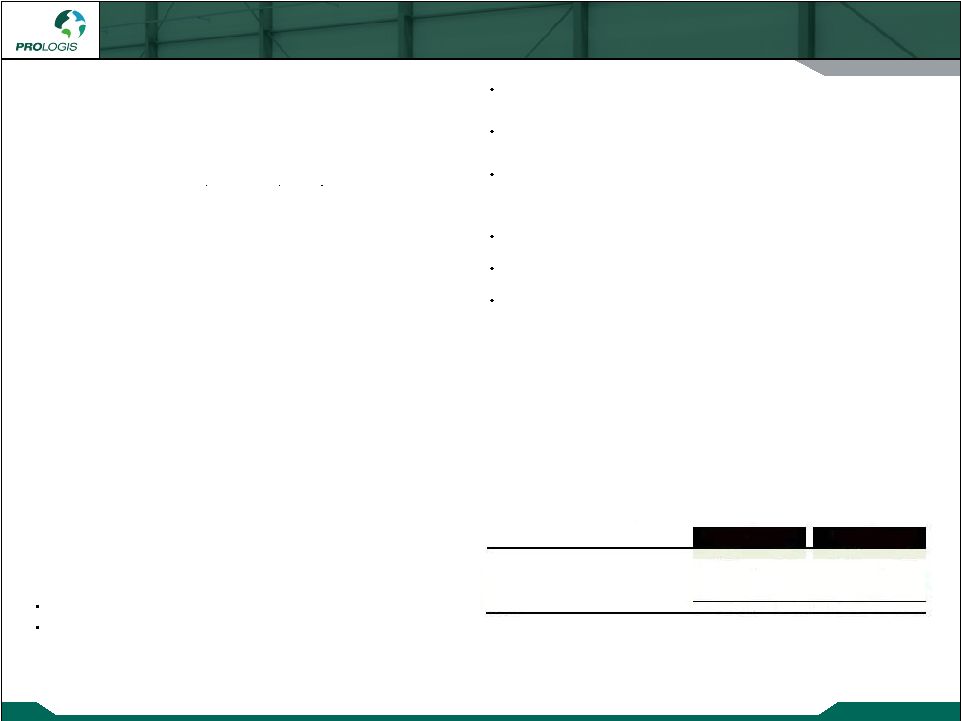

Copyright © 2013 Prologis 2 Development Starts and Building Acquisitions Committed capital during the fourth quarter 2012 totaled approximately $1.2 billion, of which $909 million was Prologis' share, including: Development starts of $727 million, of which $613 million was Prologis’ share. These starts totaled 7.3 million square feet (675,000 square meters), and monetized $190 million of land. The company’s estimated share of value creation on development starts in the fourth quarter was $71 million. Acquisitions of $458 million, including $276 million in buildings with a stabilized capitalization rate of 7.4 percent and an investment of $182 million in land and land infrastructure. Of the total acquisitions, $295 million was Prologis’ share. Capital committed during the year totaled approximately $2.5 billion, of which $2.0 billion was the company’s share. This included development starts of $1.6 billion, of which 57 percent were build-to-suits, and acquisitions of $983 million, including $544 million in buildings with a stabilized capitalization rate of 7.3 percent and an investment of $439 million in land and land infrastructure. At quarter end, Prologis' global development pipeline comprised 22.5 million square feet (2.1 million square meters), with a total expected investment of $2.1 billion, of which Prologis' share was $1.9 billion. The company’s share of estimated value creation at stabilization is expected to be $354 million, with a weighted average stabilized yield of 7.8 percent and a margin of approximately 19 percent. Private Capital Activity In 2012, Prologis raised or received commitments for $1.9 billion in new, third- party equity. This was primarily due to PELP, and also included Prologis Targeted U.S. Logistics Fund and Prologis Targeted Europe Logistics Fund. The company continued streamlining its co-investment ventures into fewer, more profitable and differentiated investment vehicles, rationalizing six funds in 2012. In the fourth quarter, Prologis concluded the Prologis North American Fund I. Two of the fund’s assets were sold to third parties with the remaining portfolio divided up between the partners, of which Prologis’ share was $117 million. Capital Markets Prologis completed approximately $1.1 billion of capital markets activity in the fourth quarter and $4.8 billion for the full year 2012. This includes debt financings, re-financings, and pay-downs. Subsequent to quarter end, the company paid off $141 million of its 1.875 percent convertible notes and repaid $319 million of secured debt. Guidance for 2013 Prologis established a full-year 2013 Core FFO guidance range of $1.60 to $1.70 per diluted share. On a GAAP basis, the company expects to recognize a range of a net loss of ($0.07) per share to net earnings of $0.03 per share. From a fourth quarter run rate perspective, this slight decline from 2012 is primarily due to near-term dilution from disposition and contribution activities, which are expected to significantly deleverage the company by the end of the first quarter. The Core FFO and earnings guidance reflected above excludes any potential future gains (losses) recognized from real estate transactions. In reconciling from net earnings to Core FFO, Prologis makes certain adjustments, including but not limited to real estate depreciation and amortization expense, impairment charges, deferred taxes, early extinguishment of debt, and unrealized gains or losses on foreign currency or derivative activity. The difference between the company's Core FFO and net earnings guidance for 2013 predominantly relates to real estate depreciation and recognized gains on real estate transactions. The principal drivers supporting Prologis’ 2013 guidance include the following: Year end occupancy in its operating portfolio between 94 to 95 percent (consistent with historical seasonal trends, the company expects occupancy to decrease in the first quarter and trend higher through the remainder of the year); Same-store NOI growth of 1.5 to 2.5 percent, excluding the impact of foreign exchange movements; Development starts of $1.5 to $1.8 billion, of which approximately 75 percent is expected to be the company’s share; Building acquisitions of $400 to $600 million, of which approximately 35 percent is expected to be the company’s share; Building and land dispositions and contributions of $7.5 to $10.0 billion, of which approximately 60 percent is expected to be the company’s share; and A euro exchange rate of $1.35; and a yen exchange rate of JPY 92 per U.S. dollar. |

Copyright © 2013 Prologis 3 Webcast and Conference Call Information The company will host a webcast /conference call to discuss quarterly results, current market conditions and future outlook today, Feb. 6, 2013, at 12:00 p.m. U.S. Eastern Time. Interested parties are encouraged to access the live webcast by clicking the microphone icon located near the top of the opening page of the Prologis Investor Relations website (http://ir.prologis.com). Interested parties also can participate via conference call by dialing +1 877- 256-7020 (from the U.S. and Canada toll free) or +1 973-409-9692 (from all other countries) and enter conference code 86463676 A telephonic replay will be available from Feb. 6 through March 6 at +1 855- 859-2056 (from the U.S. and Canada) or +1 404-537-3406 (from all other countries), with conference code 86463676. The webcast and podcast replay will be posted when available in the "Financial Information" section of Investor Relations on the Prologis website. About Prologis Prologis, Inc., is the leading owner, operator and developer of industrial real estate, focused on global and regional markets across the Americas, Europe and Asia. As of Dec. 31, 2012, Prologis owned or had investments in, on a consolidated basis or through unconsolidated joint ventures, properties and development projects expected to total approximately 554 million square feet (51.5 million square meters) in 21 countries. The company leases modern distribution facilities to more than 4,500 customers, including manufacturers, retailers, transportation companies, third-party logistics providers and other enterprises. The statements in this release that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on current expectations, estimates and projections about the industry and markets in which Prologis operates, management's beliefs and assumptions made by management. Such statements involve uncertainties that could significantly impact Prologis' financial results. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates," variations of such words and similar expressions are intended to identify such forward-looking statements, which generally are not historical in nature. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future — including statements relating to rent and occupancy growth, development activity and changes in sales or contribution volume of developed properties, disposition activity, general conditions in the geographic areas where we operate, synergies to be realized from our recent merger transaction, our debt and financial position, our ability to form new property funds and the availability of capital in existing or new property funds — are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Some of the factors that may affect outcomes and results include, but are not limited to: (i) national, international, regional and local economic climates, (ii) changes in financial markets, interest rates and foreign currency exchange rates, (iii) increased or unanticipated competition for our properties, (iv) risks associated with acquisitions, dispositions and development of properties, (v) maintenance of real estate investment trust ("REIT") status and tax structuring, (vi) availability of financing and capital, the levels of debt that we maintain and our credit ratings, (vii) risks related to our investments in our co-investment ventures and funds, including our ability to establish new co-investment ventures and funds, (viii) risks of doing business internationally, including currency risks, (ix) environmental uncertainties, including risks of natural disasters, and (x) those additional factors discussed in reports filed with the Securities and Exchange Commission by Prologis under the heading "Risk Factors." Prologis undertakes no duty to update any forward-looking statements appearing in this release Media Contacts Tracy Ward, Tel: +1 415 733 9565, tward@prologis.com, San Francisco Atle Erlingsson, Tel: +1 415 733 9495, aerlingsson@prologis.com, San Francisco |

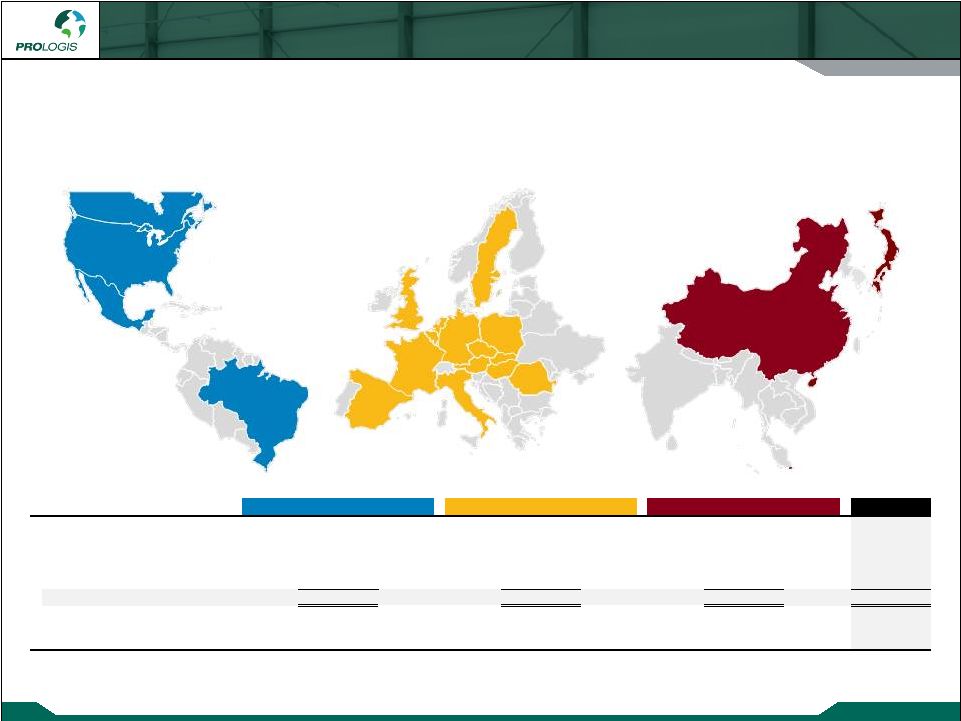

Copyright © 2013 Prologis Supplemental 4Q 2012 Highlights Company Profile 4 (A) Generally represents properties in which Prologis has an ownership interest but does not manage (6 msf) and other properties owned by Prologis (4 msf), which includes value added properties (3 msf). (B) Original cost basis for the total land portfolio is $3.0 billion. Number of operating portfolio buildings 2,330 585 77 360 135 27 12 2 8 8 1 1 Total (msf) 380 138 36 $968 $203 $921 7,614 3,485 170 $1,074 $710 $109 Land (acres) Land gross book value (millions) (B) AMERICAS (4 countries) ASIA (3 countries) EUROPE (14 countries) Operating Portfolio (msf) Development Portfolio (msf) Other (msf) (A) Development portfolio TEI (millions) TOTAL 522 1,893 $ 2,092 $ 10 22 554 11,269 2,992 Prologis, Inc. is the leading owner, operator and developer of industrial real estate, focused on global and regional markets across the Americas, Europe and Asia. As of December 31, 2012, Prologis owned or had investments in, on a consolidated basis or through unconsolidated joint ventures, properties and development projects totaling 554 million square feet (51.5 million square meters) in 21 countries. The company leases modern distribution facilities to more than 4,500 customers, including manufacturers, retailers, transportation companies, third-party logistics providers and other enterprises. |

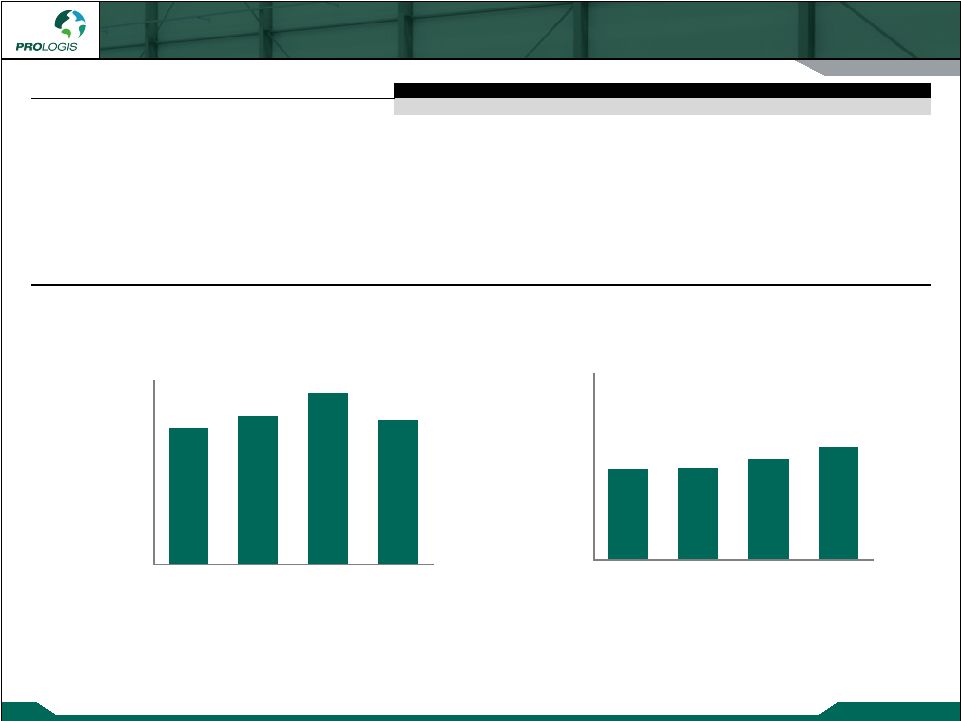

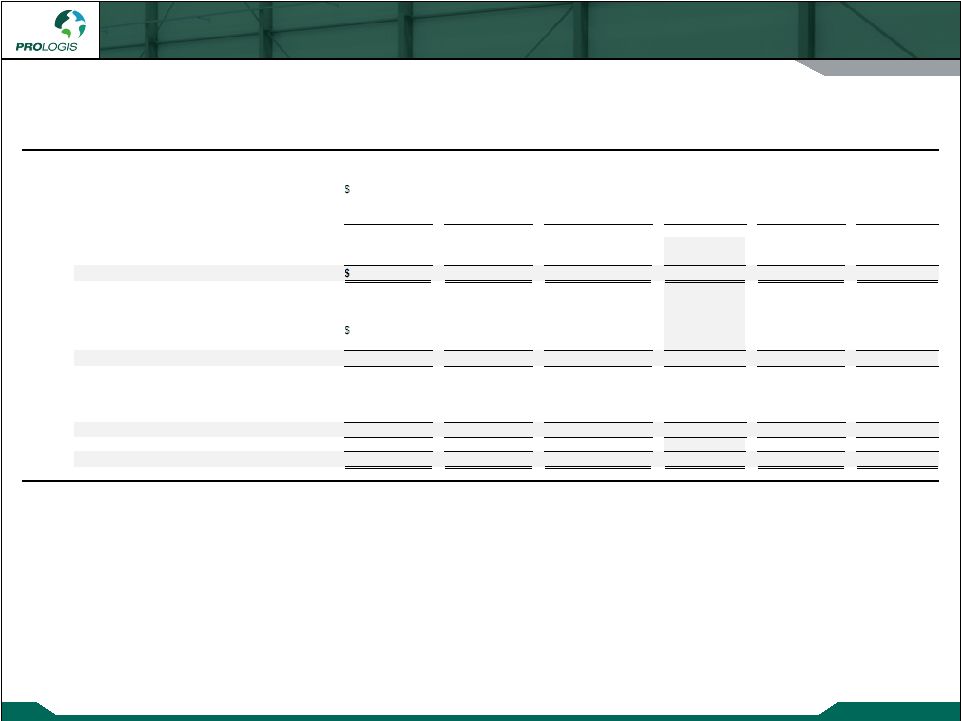

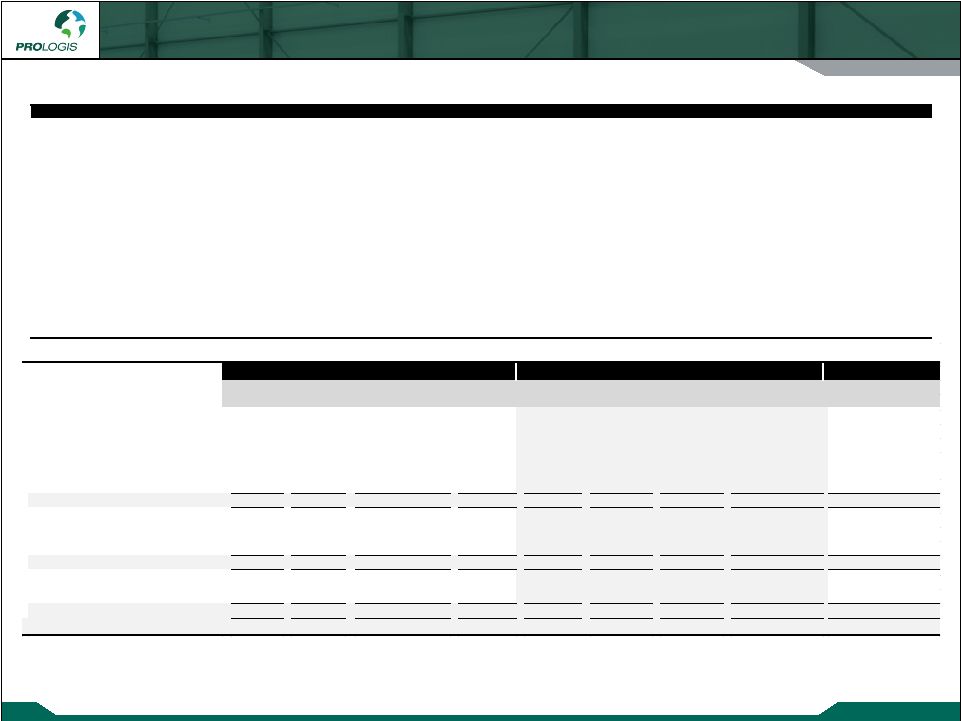

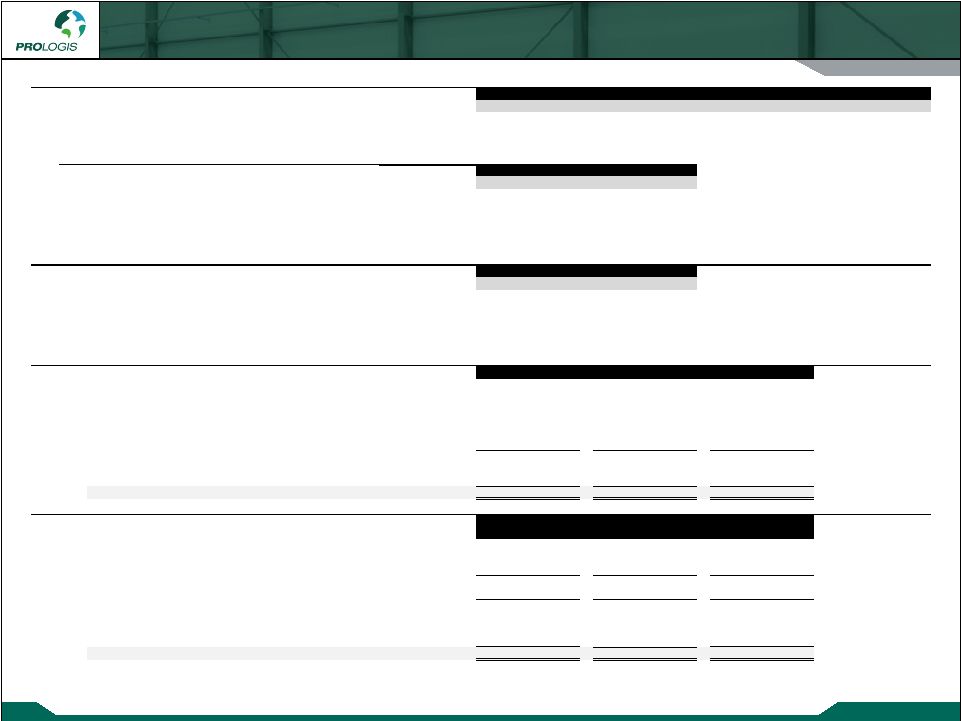

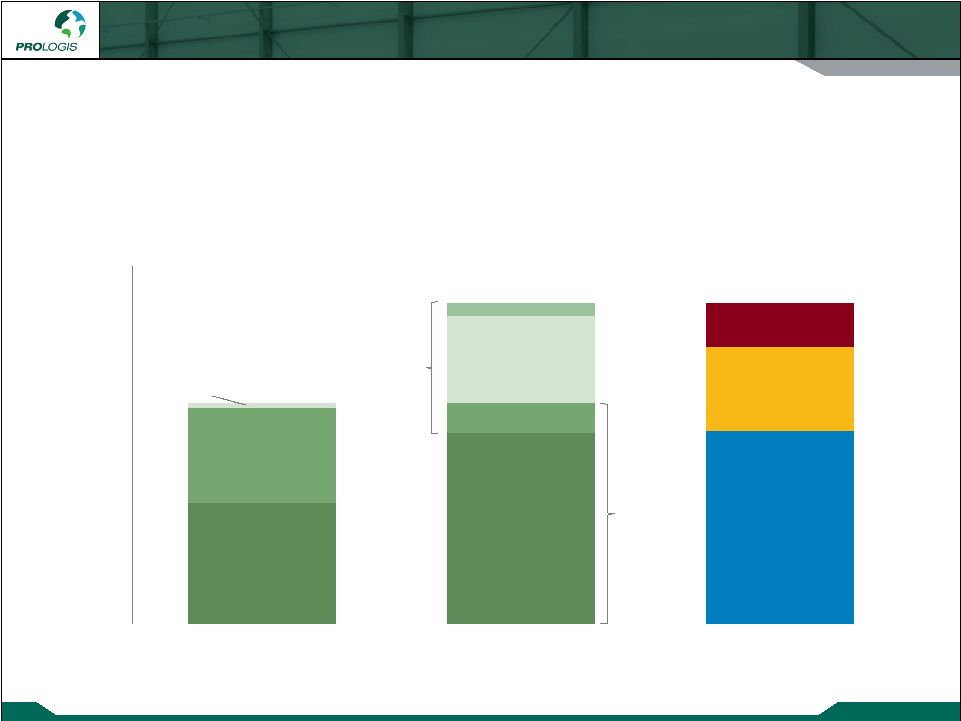

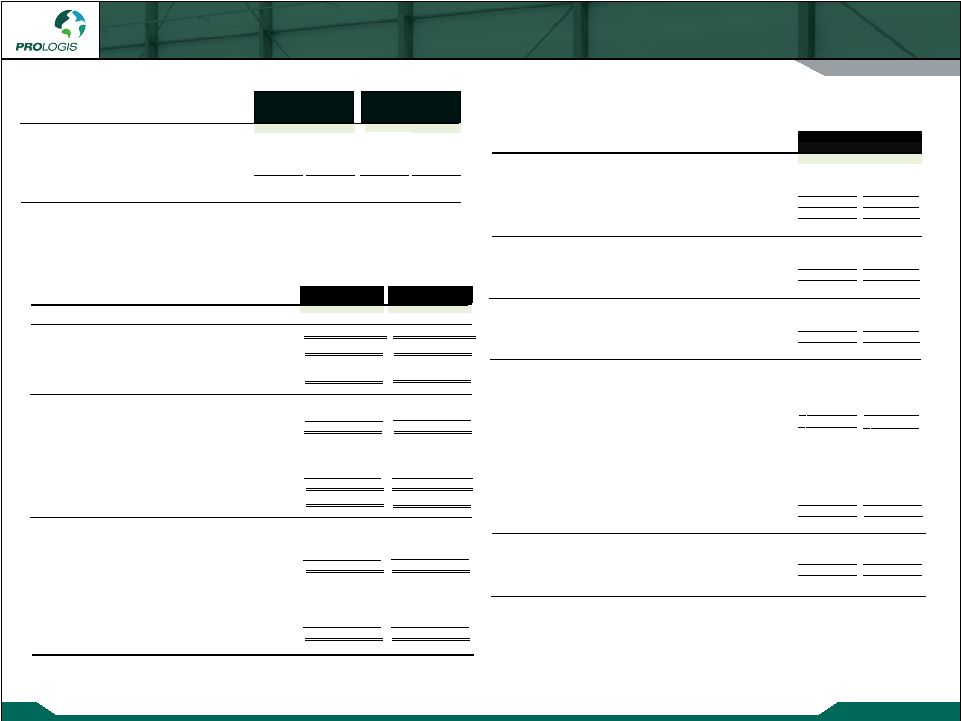

Copyright © 2013 Prologis Supplemental 4Q 2012 Highlights Company Performance 5 (A) AMB and Prologis completed a merger (the “Merger”) in June 2011. The financial results presented throughout this supplemental include Prologis for the full period and AMB results from the date of the Merger going forward. See the Notes and Definitions for more information. 2012 2011 2012 2011 (A) 517,557 $ 456,777 $ 2,005,961 $ 1,451,327 $ (228,713) (45,459) (80,946) (188,110) (88,199) 134,147 552,435 411,688 195,816 203,945 813,863 593,917 110,786 147,934 563,180 431,450 376,940 386,965 1,516,263 1,514,150 Net loss available for common stockholders (0.50) $ (0.10) $ (0.18) $ (0.51) $ FFO, as defined by Prologis (0.19) 0.29 1.19 1.10 Core FFO 0.42 0.44 1.74 1.58 Per common share - diluted: FFO, as defined by Prologis Core FFO AFFO Adjusted EBITDA Year ended December 31, Revenues Net loss available for common stockholders (dollars in thousands, except per share data) Three months ended December 31, $- $50 $100 $150 $200 $250 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Core FFO (in millions) 92.3% 92.4% 93.1% 94.0% 85% 90% 95% 100% Q1 2012 Q2 2012 Q3 2012 Q4 2012 Operating Portfolio - Owned and Managed Period Ending Occupancy % |

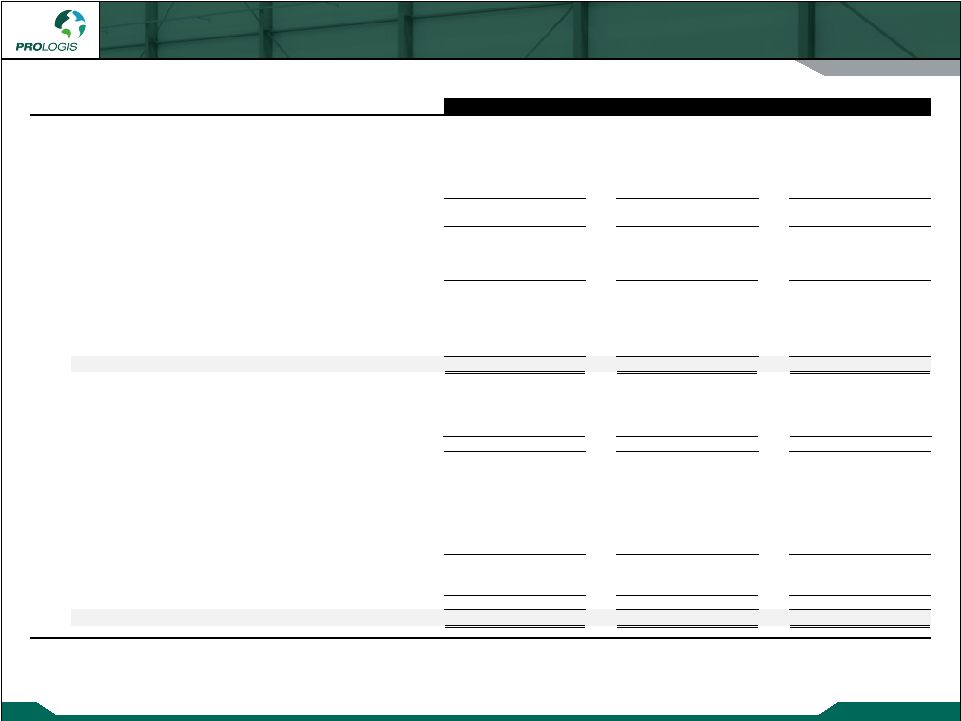

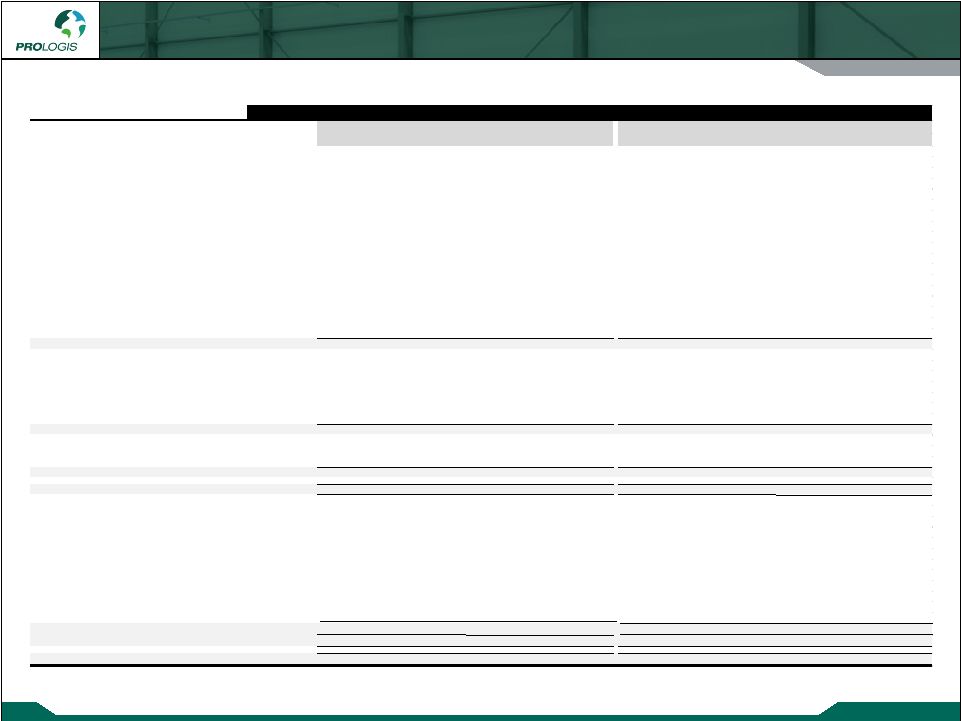

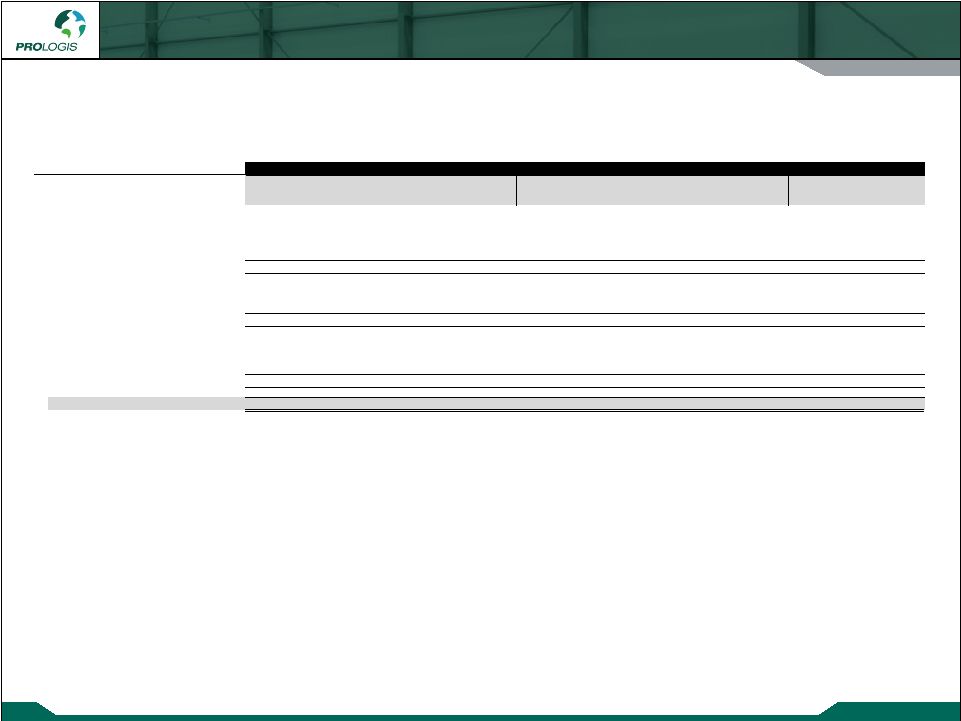

Copyright © 2013 Prologis Supplemental 4Q 2012 Financial Information Consolidated Balance Sheets 6 (in thousands) $ 22,608,248 $ 23,304,246 $ 21,552,548 951,643 774,821 860,531 1,794,364 1,924,626 1,984,233 454,868 457,373 390,225 25,809,123 26,461,066 24,787,537 2,480,660 2,389,214 2,157,907 Net investments in properties 23,328,463 24,071,852 22,629,630 2,195,782 2,242,075 2,857,755 188,000 243,979 322,834 26,027 376,642 444,850 Net investments in real estate 25,738,272 26,934,548 26,255,069 100,810 158,188 176,072 176,926 172,515 71,992 171,084 181,855 147,999 1,123,053 1,129,316 1,072,780 Total assets $ 27,310,145 $ 28,576,422 $ 27,723,912 $ 11,790,794 $ 12,578,060 $ 11,382,408 1,746,015 1,823,841 1,886,030 Total liabilities 13,536,809 14,401,901 13,268,438 582,200 582,200 582,200 4,618 4,609 4,594 16,411,855 16,395,797 16,349,328 (233,563) (165,100) (182,321) (3,696,093) (3,335,757) (3,092,162) Total stockholders' equity 13,069,017 13,481,749 13,661,639 653,125 639,631 735,222 51,194 53,141 58,613 Total equity 13,773,336 14,174,521 14,455,474 Total liabilities and equity $ 27,310,145 $ 28,576,422 $ 27,723,912 Noncontrolling interests - limited partnership unitholders Preferred stock Accounts payable, accrued expenses, and other liabilities Debt Distributions in excess of net earnings Equity: Common stock Additional paid-in capital Accumulated other comprehensive loss Noncontrolling interests Stockholders' equity: Other assets Liabilities: Less accumulated depreciation Restricted cash Accounts receivable Cash and cash equivalents Liabilities and Equity: December 31, 2011 Investments in and advances to unconsolidated entities Land Assets held for sale Operating properties Development portfolio Notes receivable backed by real estate December 31, 2012 Investments in real estate assets: September 30, 2012 Assets: Other real estate investments |

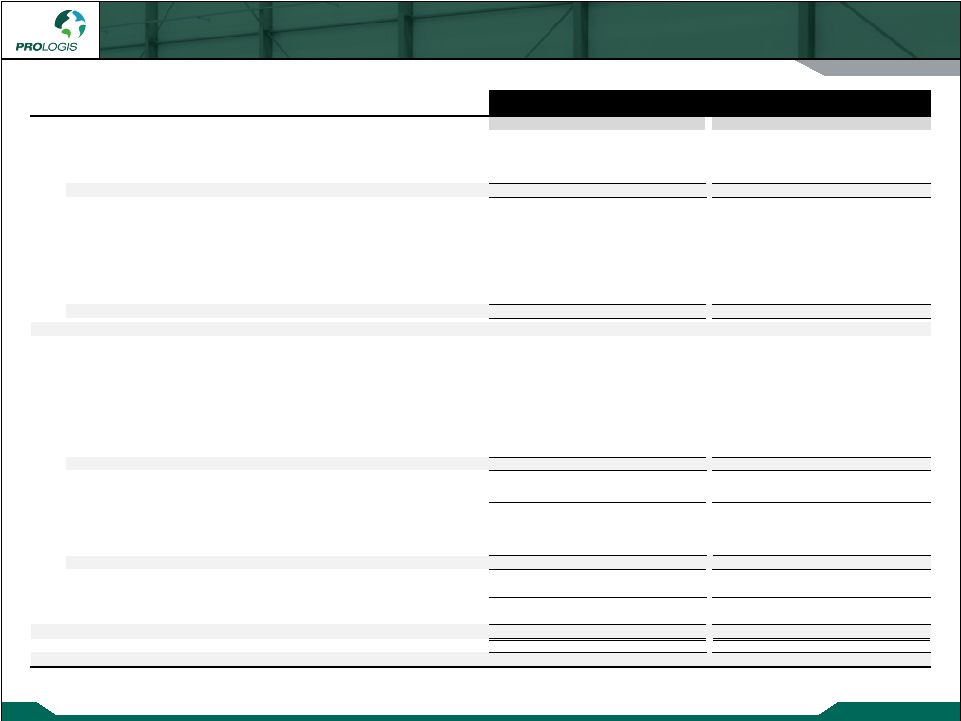

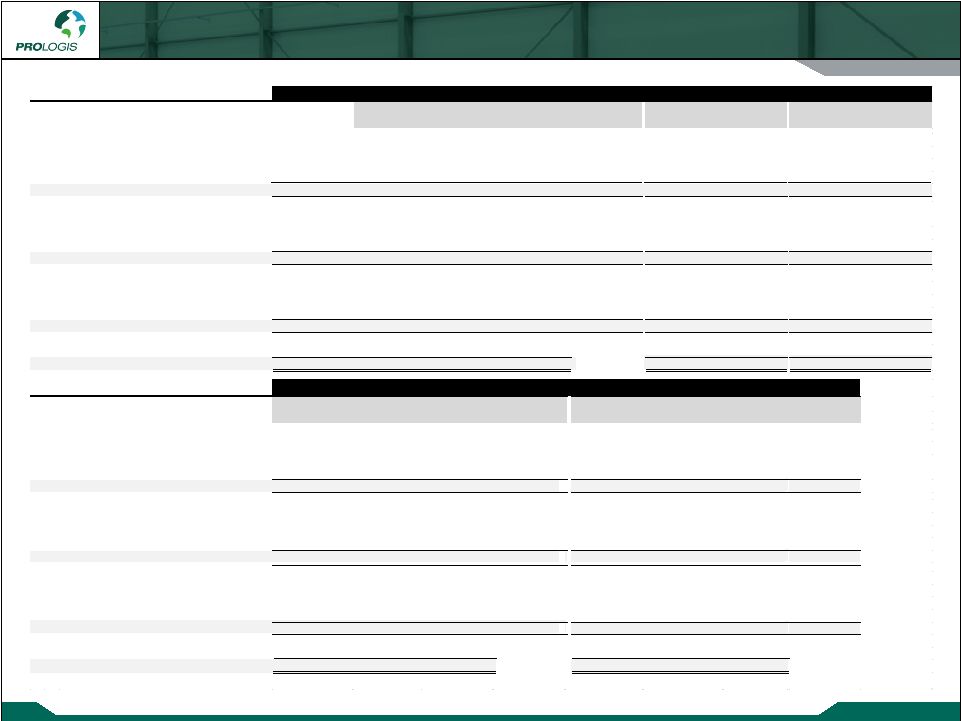

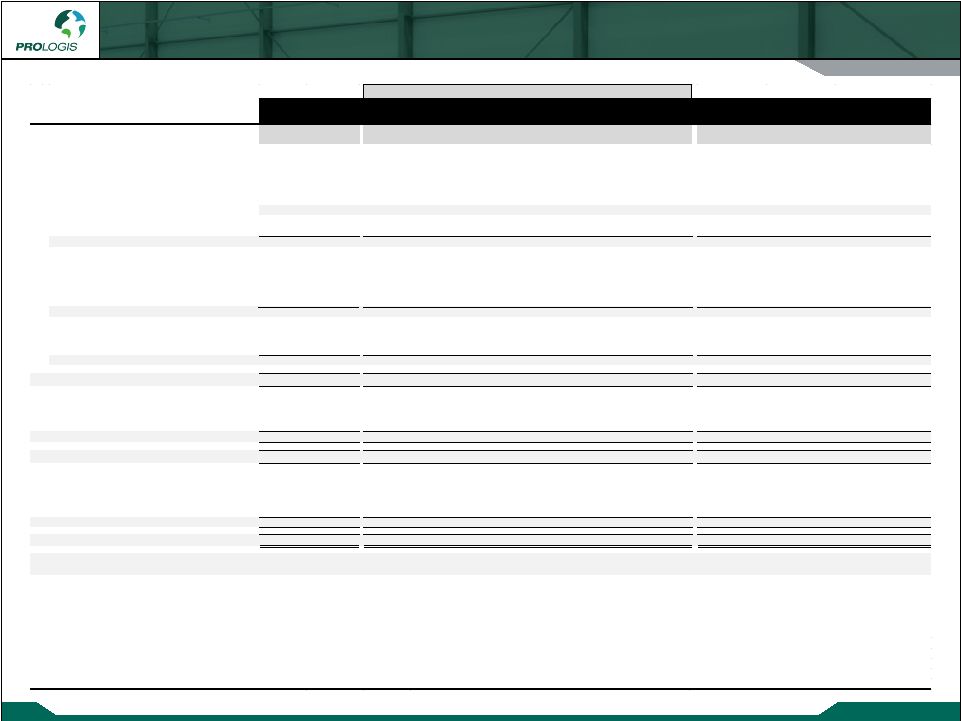

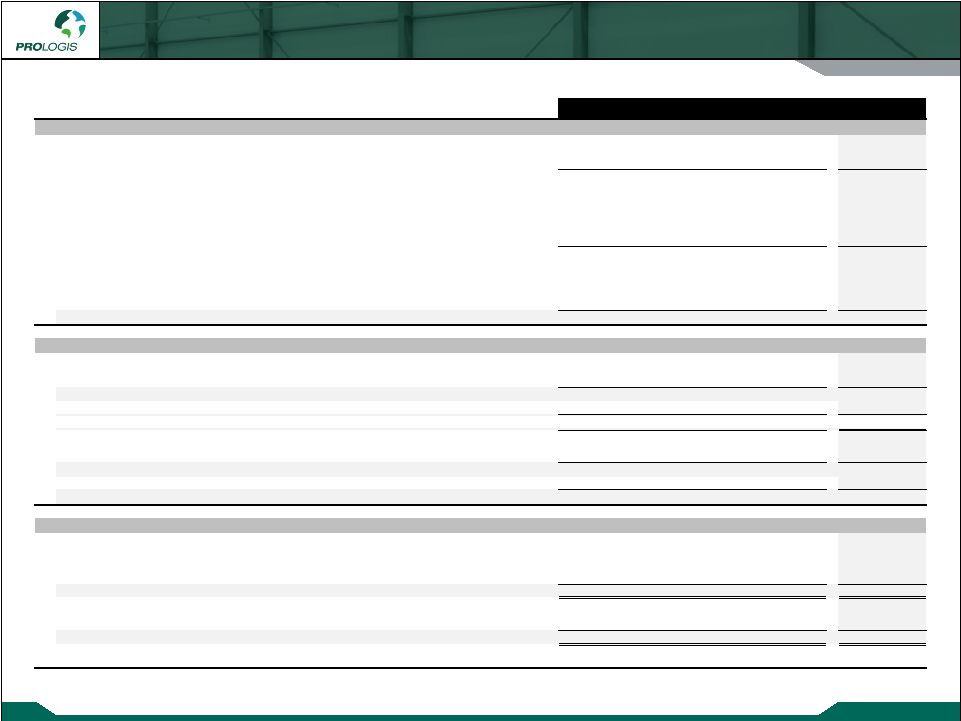

Copyright © 2013 Prologis Supplemental 4Q 2012 Financial Information Consolidated Statements of Operations 7 (A) The financial results include Prologis for the full period and AMB and PEPR results from approximately June 1, 2011. (B) See Calculation of Per Share Amounts in the Notes and Definitions. (in thousands, except per share amounts) $ 481,743 $ 415,226 $ 1,869,224 $ 1,294,872 31,715 40,230 126,779 137,619 4,099 1,321 9,958 18,836 517,557 456,777 2,005,961 1,451,327 131,696 110,169 505,499 358,559 16,134 15,734 63,820 54,962 60,608 50,797 228,068 195,161 28,103 18,772 80,676 140,495 243,138 21,237 252,914 21,237 187,770 180,628 739,981 552,849 9,414 9,789 26,556 24,031 676,863 407,126 1,897,514 1,347,294 (159,306) 49,651 108,447 104,033 10,414 904 25,703 49,326 815 3,016 5,973 10,609 5,107 5,780 22,299 19,843 (123,623) (129,055) (507,484) (468,072) - (22,609) (16,135) (126,432) 24,639 (2,966) 305,607 111,684 (2,567) (3,584) (19,918) 33,337 (19,033) 556 (14,114) 258 (104,248) (147,958) (198,069) (369,447) (263,554) (98,307) (89,622) (265,414) 3,364 (8,184) 3,580 1,776 (266,918) (90,123) (93,202) (267,190) 2,958 13,039 27,632 50,638 48,620 37,069 35,098 58,614 51,578 50,108 62,730 109,252 (215,340) (40,015) (30,472) (157,938) (3,068) 4,832 (9,248) 4,524 (218,408) (35,183) (39,720) (153,414) 10,305 10,276 41,226 34,696 $ (228,713) $ (45,459) $ (80,946) $ (188,110) 460,447 458,383 459,895 370,534 $ (0.50) $ (0.10) $ (0.18) $ (0.51) 2012 2011 (A) Twelve Months Ended December 31, Expenses: 2012 2011 Revenues: Rental income Private capital revenue Development management and other income Total revenues Three Months Ended December 31, Interest expense Earnings from other unconsolidated joint ventures, net Rental expenses Private capital expenses General and administrative expenses Impairment of real estate properties Depreciation and amortization Merger, acquisition and other integration expenses Total expenses Operating income (loss) Other income (expense): Earnings from unconsolidated co-investment ventures, net Interest income Other expenses Discontinued operations: Impairment of other assets Gain (loss) on acquisitions and dispositions of investments in real estate, net Foreign currency and derivative gains (losses) and other income (expenses), net Gain (loss) on early extinguishment of debt, net Total other income (expense) Loss before income taxes Income tax expense (benefit) - current and deferred Loss from continuing operations Income attributable to disposed properties and assets held for sale Net gain on dispositions, including related impairment charges and taxes Consolidated net loss Net loss (earnings) attributable to noncontrolling interests Net loss attributable to controlling interests Less preferred stock dividends Net loss available for common stockholders Total discontinued operations Net loss per share available for common stockholders - Diluted Weighted average common shares outstanding - Diluted (B) |

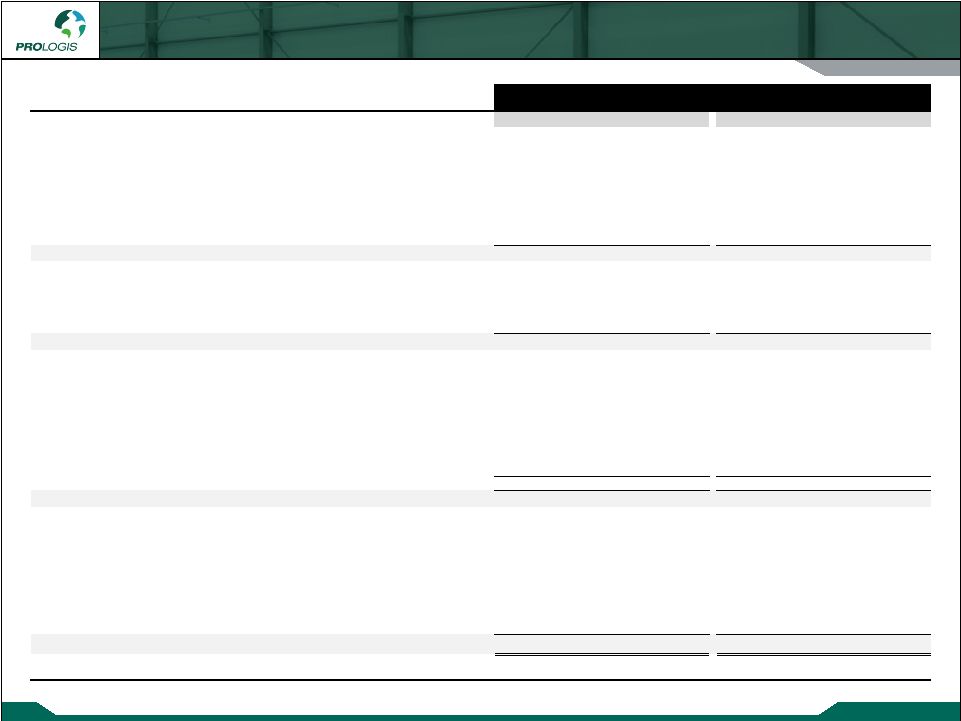

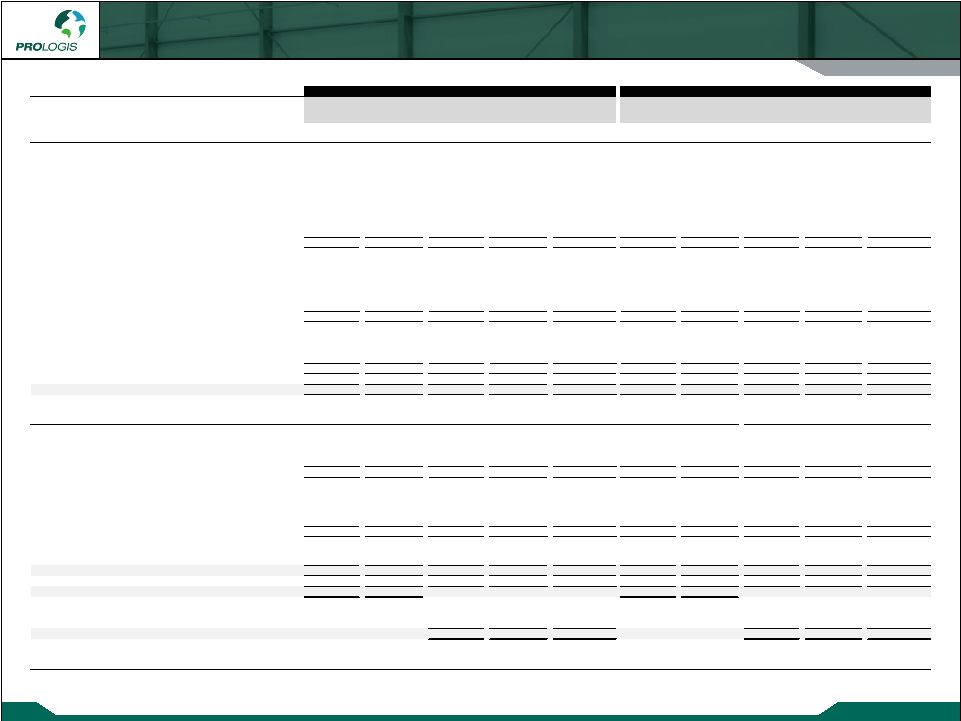

Copyright © 2013 Prologis Supplemental 4Q 2012 Financial Information Reconciliations of Net Earnings (Loss) to FFO 8 (A) The financial results include Prologis for the full period and AMB and PEPR results from approximately June 1, 2011. $ (228,713) $ (45,459) $ (80,946) $ (188,110) 182,134 175,754 721,436 533,854 13,141 5,300 34,801 5,300 (65,866) (20,265) (222,752) (7,338) (5,592) (8,199) (27,680) (19,889) 23,032 43,879 127,323 147,608 (81,864) 151,010 552,182 471,425 (666) 6,002 14,892 (39,034) (2,162) (22,558) (8,804) (19,803) (3,507) (307) (5,835) (900) (88,199) 134,147 552,435 411,688 229,997 38,546 264,844 145,028 - - - 5,210 �� 28,103 18,772 80,676 140,495 (5,835) 2,538 (121,303) (117,800) 19,033 (556) 14,114 (258) - 5,415 - 7,331 Our share of reconciling items included in earnings from unconsolidated entities 12,717 5,083 23,097 2,223 284,015 69,798 261,428 182,229 $ 195,816 $ 203,945 $ 813,863 $ 593,917 (5,543) (8,678) (27,753) (42,287) (36,037) (21,473) (90,144) (64,918) (26,970) (19,558) (95,566) (60,975) (19,481) (15,739) (56,629) (44,905) Amortization of management contracts 1,805 1,925 6,419 6,749 Amortization of debt discounts/(premiums) and financing costs, net of capitalization (6,877) (2,344) (19,688) 12,387 Stock compensation expense 8,073 9,856 32,678 31,482 AFFO $ 110,786 $ 147,934 $ 563,180 $ 431,450 Common stock dividends $ 131,624 $ 130,573 $ 522,986 $ 388,333 Adjustments to arrive at Adjusted FFO ("AFFO"), including our share of unconsolidated entities: Adjustments to arrive at Core FFO, including our share of unconsolidated entities: Adjustments to arrive at Core FFO Impairment charges Japan disaster expenses Merger, acquisition and other integration expenses Loss (gain) on early extinguishment of debt, net Income tax expense on dispositions Loss (gain) on acquisitions and dispositions of investments in real estate, net Straight-lined rents and amortization of lease intangibles Property improvements Tenant improvements Leasing commissions Reconciliation of net loss to FFO Subtotal-NAREIT defined FFO FFO, as defined by Prologis Reconciling items related to noncontrolling interests Core FFO Net loss available for common stockholders Add (deduct) NAREIT defined adjustments: Add (deduct) our defined adjustments: Real estate related depreciation and amortization Net gain on non-FFO dispositions and acquisitions Our share of reconciling items included in earnings from unconsolidated entities Unrealized foreign currency and derivative losses (gains), net Deferred income tax benefit Our share of reconciling items included in earnings from unconsolidated entities Impairment charges on certain real estate properties 2012 2011 (A) Twelve Months Ended December 31, 2012 2011 Three Months Ended December 31, (in thousands) |

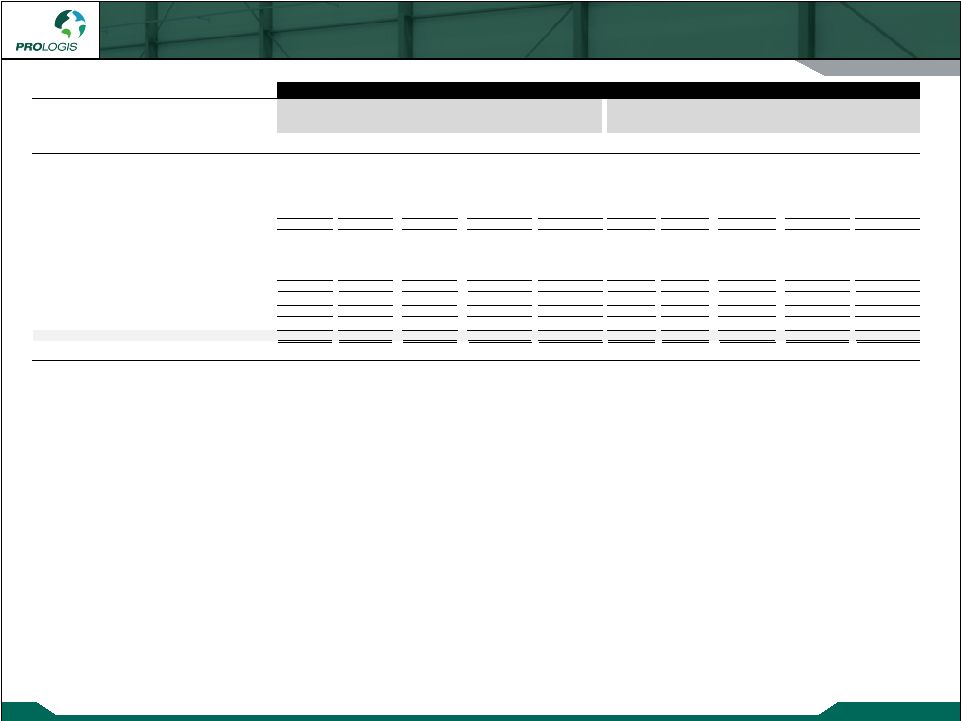

Copyright © 2013 Prologis Supplemental 4Q 2012 Financial Information EBITDA Reconciliation 9 (A) Adjustments during 2012 include the effects of Prologis North American Industrial Fund II and Prologis California to reflect NOI for the full period. See Notes and Definitions for more detail. Reconciliation of consolidated net loss to Adjusted EBITDA $ (228,713) $ (45,459) $ (80,946) $ (188,110) (73,492) (35,403) (371,534) (176,173) 187,770 180,628 739,981 552,849 123,623 129,055 507,484 468,072 243,138 43,846 299,645 150,328 28,103 18,772 80,676 140,495 19,033 (556) 14,114 (258) 3,597 (6,884) 3,813 4,992 - - 12,352 263,994 (2,958) (13,039) (27,632) (50,638) (113) 8,560 (431) 21,551 3,068 (4,832) 9,248 (4,524) 10,305 10,276 41,226 34,696 7,407 15,858 47,570 (7,551) - - - 5,210 320,768 300,822 1,275,566 1,214,933 (2,330) 5,083 1,993 5,083 32,101 43,879 129,547 147,608 22,659 37,231 92,381 �� 142,282 5,674 - 11,673 - 304 - 4,200 - 1,271 257 6,738 4,918 (3,507) (307) (5,835) (900) - - - 226 $ 376,940 $ 386,965 $ 1,516,263 $ 1,514,150 Depreciation and amortization from continuing operations Pro forma adjustment (A) 2011 2012 Interest expense from continuing operations Current and deferred income tax expense (benefit) Impairment charges Merger, acquisition and other integration expenses Twelve Months Ended December 31, 2012 2011 Net gain on acquisitions and dispositions of investments in real estate Net loss available for common stockholders Three Months Ended December 31, Loss (gain) on early extinguishment of debt Adjusted EBITDA Interest expense Current income tax expense Realized losses on derivative activity Depreciation and amortization Unrealized gains and deferred income tax benefit Our share of reconciling items from unconsolidated entities: Income attributable to disposal properties and assets held for sale Net loss (gain) on disposition of real estate, net Other adjustments made to arrive at Core FFO Adjusted EBITDA, prior to our share of unconsolidated entities Unrealized losses (gains) and stock compensation expense, net Loss on early extinguishment of debt Net earnings (loss) attributable to noncontrolling interest Preferred stock dividends Impairment of real estate properties and other assets NOI attributable to assets held for sale (in thousands) |

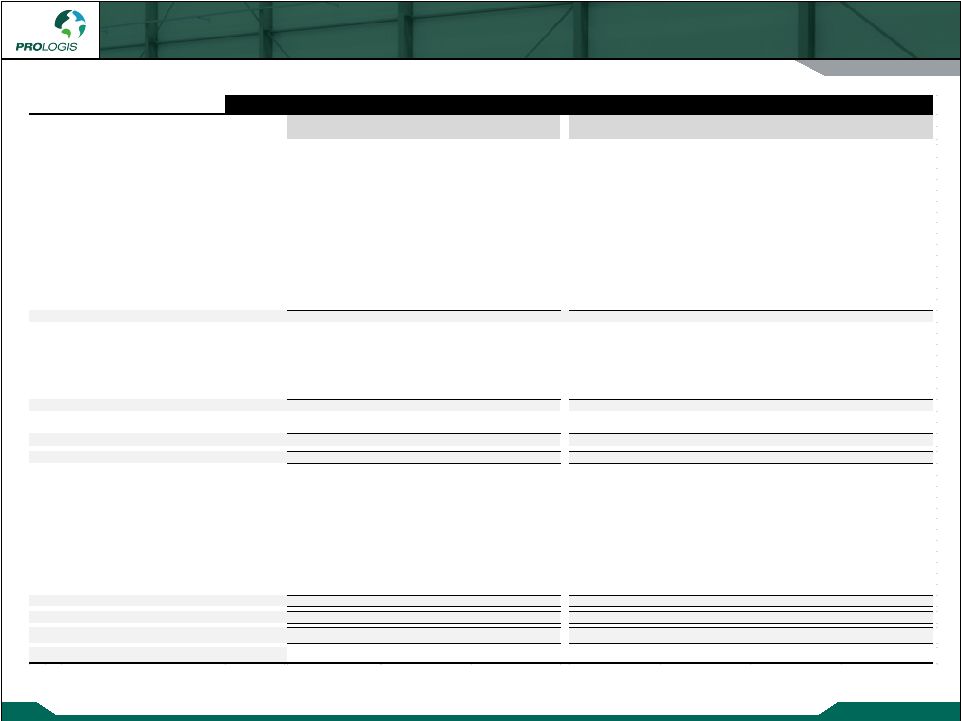

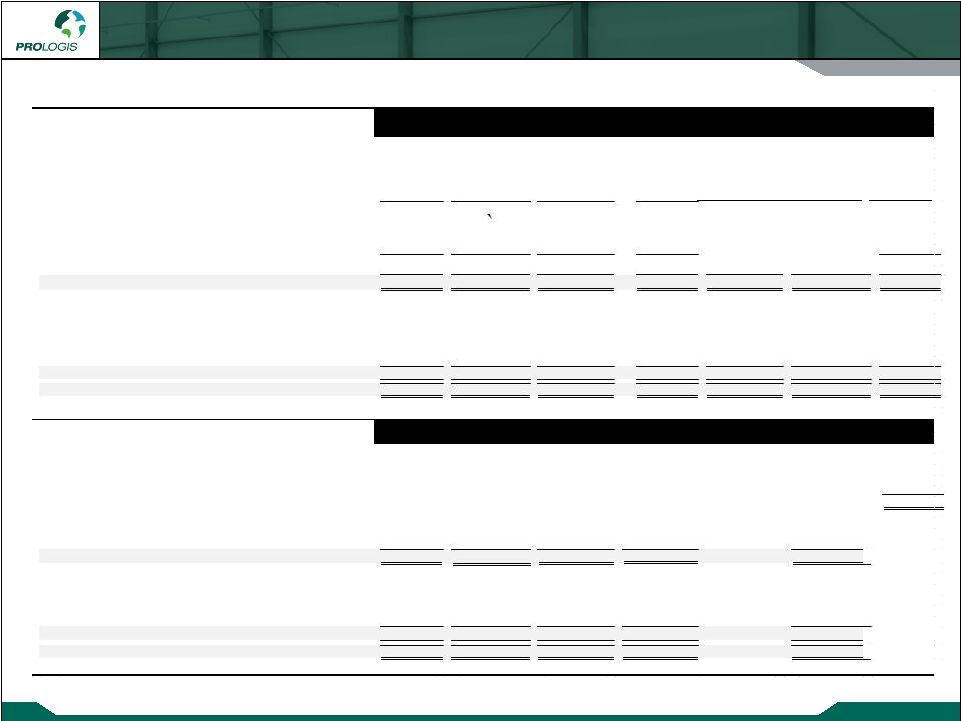

Copyright © 2013 Prologis Supplemental 4Q 2012 Financial Information Pro-rata Balance Sheet Information 10 (in thousands) Investments in real estate assets: 22,608,248 $ (894,076) $ 4,406,432 $ 26,120,604 $ 14,113,579 $ 40,234,183 3,200,875 (58,135) 114,084 3,256,824 232,721 3,489,545 (2,480,660) 35,533 (359,453) (2,804,580) (1,129,630) (3,934,210) 23,328,463 (916,678) 4,161,063 26,572,848 13,216,670 39,789,518 2,195,782 (63,210) (2,132,572) - 63,210 63,210 1,785,900 (227,350) 19,225 1,577,775 1,085,806 2,663,581 Total assets 27,310,145 $ (1,207,238) $ 2,047,716 $ 28,150,623 $ 14,365,686 $ 42,516,309 - Liabilities: 11,790,794 $ (364,164) $ 1,781,510 $ 13,208,140 $ 5,775,205 $ 18,983,345 1,746,015 (138,755) 266,206 1,873,466 866,752 2,740,218 Total liabilities 13,536,809 (502,919) 2,047,716 15,081,606 6,641,957 21,723,563 Equity: 13,069,017 - - 13,069,017 7,723,729 20,792,746 704,319 (704,319) - - - - Total equity 13,773,336 (704,319) - 13,069,017 7,723,729 20,792,746 Total liabilities and equity $ 27,310,145 $ (1,207,238) $ 2,047,716 $ 28,150,623 $ 14,365,686 $ 42,516,309 Net investments in properties Pro-rata Balance Sheet Information as of December 31, 2012 Consolidated Less Non Controlling Interest Liabilities and Equity: Gross operating properties Other real estate Less accumulated depreciation Investments in unconsolidated investees Other assets PLD Total Share Investors' Share of Ventures Total Owned and Managed Assets: Plus PLD Share of Unconsolidated Co-Investment Ventures Noncontrolling interests Debt Other liabilities Stockholders' / partners' equity On this page and the following page, we present balance sheet and income statement information on a pro-rata basis reflecting our proportionate economic ownership of each entity included in our Total Owned and Managed portfolio. The consolidated amounts shown are derived from, and prepared on a consistent basis with, our consolidated financial statements. The PLD Share of Unconsolidated Co-Investment Ventures column was derived on an entity-by-entity basis by applying our ownership percentage to each line item to calculate our share of that line item. For purposes of balance sheet data, we used our ownership percentage at the end of the period and for operating information, we used our average ownership percentage for the period, consistent with how we calculate our share of net income (loss) during the period. We used a similar calculation to derive the noncontrolling interests’ share of each line item. In order to present the Total Owned and Managed portfolio, we added our investors’ share of each line item in the unconsolidated co-investment ventures and the noncontrolling interests share of each line item to the PLD Total Share. |

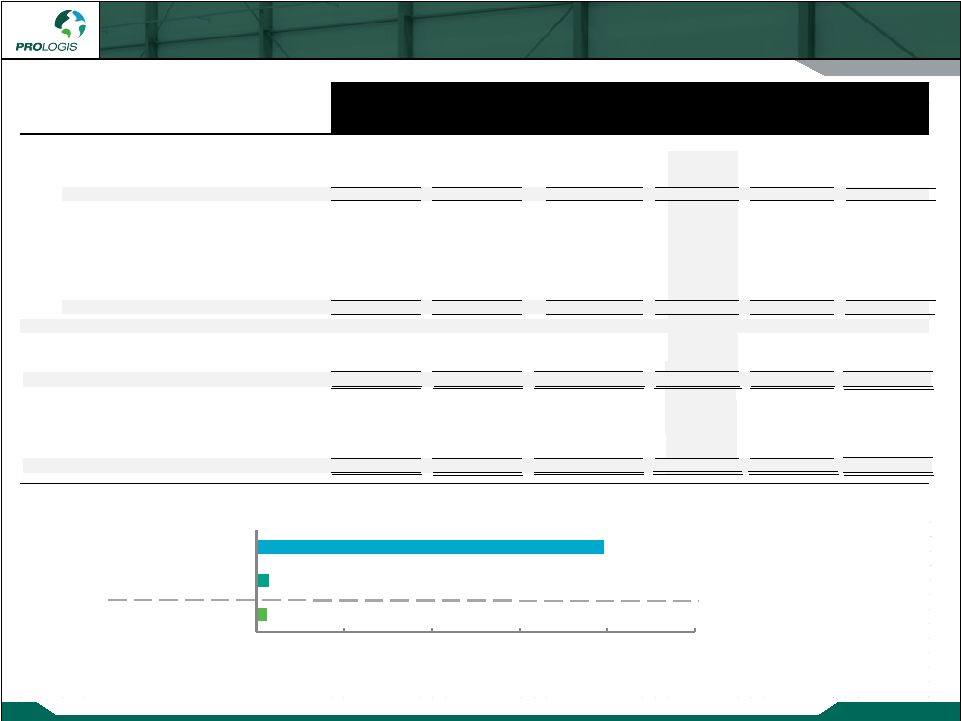

Copyright © 2013 Prologis Supplemental 4Q 2012 Financial Information Pro-rata Operating Information 11 (in thousands) Prologis’ Share (in millions) Real Estate Operations NOI Private Capital NOI Development Value Creation (B) $ 481,743 $ (19,004) $ 87,793 $ 550,532 $ 272,664 $ 823,196 31,715 (16) - 31,699 16 31,715 4,099 - 381 4,480 355 4,835 517,557 (19,020) 88,174 586,711 273,035 859,746 131,696 (5,854) 22,475 148,317 71,433 219,750 16,134 - - 16,134 - 16,134 60,608 (479) 3,258 63,387 10,796 74,183 28,103 - - 28,103 - 28,103 243,138 - 1,684 244,822 4,375 249,197 187,770 (7,242) 32,585 213,113 105,744 318,857 9,414 (510) 1,596 10,500 7,399 17,899 676,863 (14,085) 61,598 724,376 199,747 924,123 (159,306) (4,935) 26,576 (137,665) 73,288 (64,377) 66,586 - (66,586) - - 469,660 (8,163) 40,010 501,507 121,931 623,438 $ 376,940 $ (13,098) $ - $ 363,842 $ 195,219 $ 559,061 $ 344,732 $ (12,640) $ 64,103 $ 396,195 $ 194,187 $ 590,382 15,581 (16) - 15,565 16 15,581 66,586 - (66,586) - - - (49,959) (442) 2,483 (47,918) 1,016 (46,902) $ 376,940 $ (13,098) $ - $ 363,842 $ 195,219 $ 559,061 Total reconciling items to Adjusted EBITDA Adjusted EBITDA (A) Adjusted EBITDA Private Capital NOI General and administrative and other expenses Our share of co-investment ventures Adjusted EBITDA by segment: Real Estate Operations NOI Total Owned and Managed Plus PLD Share of Unconsolidated Co-Investment Ventures PLD Total Share Impairment of real estate properties Less Non Controlling Interest Total revenues Pro-rata Operating Information for Three Months Ended December 31, 2012 Consolidated General and administrative expenses Merger, acquisition and other integration expenses Depreciation and amortization Other expenses Total expenses Operating income (loss) Our share of co-investment ventures Investors' Share of Ventures Development management and other income Expenses: Rental expenses Private capital expenses Revenues: Rental income Private capital revenue $- $100 $200 $300 $400 $500 $396.6 (96%) $15.6 (4%) $13.2 (A) See reconciliation of Consolidated Net Loss to Adjustd EBITDA on page 9. (B) Represents Value Creation for development properties that reached Stabilization during the quarter and moved into the Operating Portfolio. - |

Copyright © 2013 Prologis Supplemental 4Q 2012 Operations Overview Operating Portfolio – Square Feet, Occupied and Leased 12 (A) Selected and ordered by Prologis share of NOI ($). (square feet in thousands) Region # of Buildings Total Owned and Managed Prologis Share Prologis Share (%) % of Total Total Owned and Managed Prologis Share Total Owned and Managed Prologis Share Atlanta East 117 14,053 11,320 80.6% 3.1% 86.1% 86.1% 86.1% 86.1% Baltimore/Washington East 68 8,095 5,340 66.0% 1.5% 95.3% 94.8% 95.3% 94.8% Central Valley Northwest 24 8,970 7,127 79.5% 1.9% 91.9% 92.3% 93.4% 94.2% Central & Eastern PA East 27 14,049 7,136 50.8% 1.9% 94.2% 96.4% 95.1% 96.8% Chicago Central 221 36,329 28,355 78.1% 7.8% 91.4% 91.7% 91.4% 91.7% Dallas/Ft. Worth Central 159 22,878 18,863 82.5% 5.2% 95.3% 95.8% 95.7% 96.2% Houston Central 77 9,420 6,815 72.3% 1.9% 98.2% 98.6% 98.2% 98.6% New Jersey/New York City East 169 21,656 15,940 73.6% 4.4% 95.5% 94.7% 95.5% 94.7% San Francisco Bay Area Northwest 242 19,992 17,007 85.1% 4.6% 91.7% 92.0% 91.7% 92.1% Seattle Northwest 76 10,205 5,018 49.2% 1.4% 96.3% 96.9% 96.3% 96.9% South Florida East 91 10,553 7,579 71.8% 2.1% 96.5% 95.5% 96.5% 95.5% Southern California Southwest 300 55,794 45,426 81.4% 12.4% 97.9% 98.3% 98.2% 98.6% On Tarmac Various 31 2,598 2,373 91.3% 0.6% 91.9% 91.2% 91.9% 91.2% East 19 6,383 5,080 79.6% 1.4% 99.9% 100.0% 99.9% 100.0% Latin America 185 29,832 17,243 57.8% 4.7% 93.4% 92.9% 93.4% 92.9% Latin America 7 2,161 292 13.5% 0.1% 100.0% 100.0% 100.0% 100.0% Americas total 1,813 272,968 200,914 73.6% 55.0% 94.5% 94.6% 94.7% 94.8% Northern 9 2,016 1,245 61.8% 0.3% 99.6% 99.4% 99.6% 99.4% Southern 124 29,505 20,925 70.9% 5.7% 94.8% 94.1% 94.8% 94.1% Northern 88 18,284 7,932 43.4% 2.2% 99.7% 99.6% 99.7% 99.6% Northern 53 10,699 5,496 51.4% 1.5% 89.8% 89.2% 93.6% 92.6% CEE 95 20,572 11,793 57.3% 3.2% 87.0% 85.4% 90.7% 89.3% Southern 26 7,126 6,006 84.3% 1.6% 81.1% 82.6% 88.0% 85.8% UK 73 17,231 10,520 61.1% 2.9% 97.5% 96.9% 97.5% 96.9% 468 105,433 63,917 60.6% 17.4% 93.2% 92.2% 94.8% 93.5% China 25 5,499 2,312 42.0% 0.6% 91.9% 95.8% 91.9% 95.8% Japan 47 20,781 14,977 72.1% 4.1% 98.0% 97.8% 98.0% 97.8% Singapore 5 942 942 100.0% 0.3% 100.0% 100.0% 100.0% 100.0% 77 27,222 18,231 67.0% 5.0% 96.9% 97.7% 96.9% 97.7% 2,358 405,623 283,062 69.8% 77.4% 94.3% 94.3% 94.9% 94.7% CEE 29 6,824 5,099 74.7% 1.4% 95.0% 93.3% 97.8% 97.1% Southern 27 8,378 7,690 91.8% 2.1% 86.0% 85.5% 86.0% 85.5% CEE 30 5,346 3,822 71.5% 1.1% 85.1% 86.2% 86.5% 88.2% Central 17 6,270 5,474 87.3% 1.5% 99.8% 99.8% 99.8% 99.8% Columbus - Americas Central 37 9,727 7,763 79.8% 2.1% 96.4% 95.6% 96.4% 95.6% Central 50 5,606 4,185 74.7% 1.2% 94.2% 95.1% 94.3% 95.3% Sweden - Europe Northern 10 3,807 2,546 66.9% 0.7% 100.0% 100.0% 100.0% 100.0% Northwest 33 5,208 4,254 81.7% 1.2% 96.6% 95.9% 96.6% 95.9% Central 27 6,663 4,142 62.2% 1.2% 98.9% 98.2% 98.9% 98.2% Central 35 4,360 3,425 78.6% 0.9% 91.0% 89.3% 91.0% 89.3% Various 87 17,591 11,745 66.8% 3.2% 95.9% 94.9% 95.9% 94.9% 382 79,780 60,145 75.4% 16.6% 94.5% 93.7% 94.9% 94.2% Various 252 36,769 22,037 59.9% 6.0% 89.8% 92.9% 90.0% 93.1% 2,992 522,172 365,244 69.9% 100.0% 94.0% 94.1% 94.5% 94.5% Czech Republic - Europe Italy - Europe San Antonio - Americas Orlando - Americas Regional markets total Remaining other regional (5 markets) Denver - Americas Cincinnati - Americas Memphis - Americas Hungary - Europe Other markets (14 markets) Total operating portfolio - owned and managed Regional markets (A) Asia total Total global markets Occupied Leased Japan Global Markets U.S. Canada Belgium Mexico Brazil Square Feet Netherlands Poland Spain Europe total United Kingdom Singapore China France Germany ` |

Copyright © 2013 Prologis Supplemental 4Q 2012 Operations Overview Operating Portfolio – NOI and Gross Book Value 13 (A) Selected and ordered by Prologis share of NOI ($). (dollars in thousands) Region Atlanta East $8,792 $6,771 77.0% 1.7% $635,503 $474,398 74.6% 1.8% Baltimore/Washington East 9,252 5,746 62.1% 1.4% 620,631 374,892 60.4% 1.4% Central Valley Northwest 5,917 4,747 80.2% 1.2% 470,376 365,198 77.6% 1.4% Central & Eastern PA East 12,388 6,289 50.8% 1.6% 804,849 393,751 48.9% 1.5% Chicago Central 26,725 20,529 76.8% 5.2% 2,167,484 1,634,526 75.4% 6.1% Dallas/Ft. Worth Central 14,554 11,425 78.5% 2.9% 1,093,351 849,441 77.7% 3.1% Houston Central 10,008 5,958 59.5% 1.5% 523,766 330,740 63.1% 1.2% New Jersey/New York City East 25,861 16,937 65.5% 4.3% 1,896,226 1,265,329 66.7% 4.7% San Francisco Bay Area Northwest 26,018 23,469 90.2% 5.9% 1,973,782 1,683,632 85.3% 6.3% Seattle Northwest 11,164 5,246 47.0% 1.3% 947,506 468,153 49.4% 1.7% South Florida East 12,954 9,882 76.3% 2.5% 1,031,022 768,108 74.5% 2.8% Southern California Southwest 59,561 48,975 82.2% 12.4% 5,017,690 4,042,857 80.6% 15.0% On Tarmac Various 7,489 6,681 89.2% 1.7% 313,749 275,344 87.8% 1.0% East 8,576 6,709 78.2% 1.7% 639,332 504,677 78.9% 1.9% Latin America 27,321 16,193 59.3% 4.1% 1,783,499 979,633 54.9% 3.6% Latin America 4,449 666 15.0% 0.2% 196,065 23,292 11.9% 0.1% 271,029 196,223 72.4% 49.6% 20,114,831 14,433,971 71.8% 53.6% Northern 2,018 1,297 64.3% 0.3% 168,167 101,488 60.3% 0.4% Southern 39,647 25,946 65.4% 6.5% 2,470,341 1,651,308 66.8% 6.1% Northern 25,175 11,001 43.7% 2.8% 1,587,730 641,633 40.4% 2.4% Northern 12,816 6,998 54.6% 1.8% 1,013,788 495,569 48.9% 1.8% CEE 18,645 10,814 58.0% 2.7% 1,371,702 711,538 51.9% 2.6% Southern 8,864 7,925 89.4% 2.0% 599,207 522,722 87.2% 1.9% UK 33,058 19,646 59.4% 5.0% 2,048,259 1,135,565 55.4% 4.2% 140,223 83,627 59.6% 21.1% 9,259,194 5,259,823 56.8% 19.4% China 4,220 1,383 32.8% 0.4% 286,301 89,696 31.3% 0.3% Japan 63,554 45,253 71.2% 11.4% 4,067,908 2,841,262 69.8% 10.6% Singapore 2,493 2,493 100.0% 0.6% 149,669 149,669 100.0% 0.6% 70,267 49,129 69.9% 12.4% 4,503,878 3,080,627 68.4% 11.5% 481,519 328,979 68.3% 83.1% 33,877,903 22,774,421 67.2% 84.5% CEE 8,519 6,444 75.6% 1.6% 545,279 385,017 70.6% 1.4% Southern 6,729 6,082 90.4% 1.5% 543,882 489,656 90.0% 1.8% CEE 5,449 3,828 70.3% 1.0% 377,890 237,827 62.9% 0.9% Central 4,459 3,789 85.0% 1.0% 207,423 179,302 86.4% 0.7% Central 4,945 3,697 74.8% 0.9% 371,554 287,153 77.3% 1.1% Central 4,585 3,513 76.6% 0.9% 256,149 181,775 71.0% 0.7% Northern 5,563 3,482 62.6% 0.9% 346,701 216,557 62.5% 0.8% Northwest 4,386 3,427 78.1% 0.9% 291,347 241,816 83.0% 0.9% Central 5,622 3,089 54.9% 0.8% 268,989 151,460 56.3% 0.6% Central 3,501 2,585 73.8% 0.6% 283,619 212,581 75.0% 0.8% Various 12,933 7,473 57.8% 1.9% 800,379 475,936 59.5% 1.8% 66,691 47,409 71.1% 12.0% 4,293,212 3,059,080 71.3% 11.5% Various 31,376 19,466 62.0% 4.9% 1,923,762 1,074,773 55.9% 4.0% $579,586 $395,854 68.3% 100.0% $40,094,877 $26,908,274 67.1% 100.0% Sweden - Europe Other markets (14 markets) Total operating portfolio - owned and managed Orlando - Americas Regional markets total Denver - Americas Cincinnati - Americas Remaining other regional (5 markets) Italy - Europe San Antonio - Americas Columbus - Americas Memphis - Americas Japan Singapore Asia total Total global markets Regional markets (A) Czech Republic - Europe Hungary - Europe Poland Spain United Kingdom Europe total China Americas total Belgium France Germany Netherlands Global Markets U.S. Canada Mexico Brazil Total Owned and Managed Prologis Share ($) Prologis Share (%) Gross Book Value % of Total Fourth Quarter NOI Total Owned and Managed Prologis Share ($) Prologis Share (%) % of Total |

Copyright © 2013 Prologis Supplemental 4Q 2012 14 Operations Overview Operating Portfolio – Summary by Division (square feet and dollars in thousands) # of Buildings Total Owned and Managed Prologis Share Prologis Share (%) % of Total Total Owned and Managed Prologis Share Total Owned and Managed Prologis Share 1,529 232,650 232,650 100.0% 63.7% 94.7% 94.7% 94.9% 94.9% 273 65,127 65,127 100.0% 17.9% 90.9% 90.9% 92.1% 92.1% 33 16,218 16,218 100.0% 4.4% 97.9% 97.9% 97.9% 97.9% Total operating portfolio - consolidated 1,835 313,995 313,995 100.0% 86.0% 94.1% 94.1% 94.5% 94.5% 801 126,879 28,516 22.5% 7.8% 93.3% 93.5% 93.5% 93.6% 312 70,294 20,720 29.5% 5.6% 94.9% 94.8% 96.6% 96.5% 44 11,004 2,013 18.3% 0.6% 95.4% 95.9% 95.4% 95.9% Total operating portfolio - unconsolidated 1,157 208,177 51,249 24.6% 14.0% 94.0% 94.1% 94.6% 94.9% 2,330 359,529 261,166 72.6% 71.5% 94.2% 94.6% 94.4% 94.8% 585 135,421 85,847 63.4% 23.5% 93.0% 91.8% 94.4% 93.1% 77 27,222 18,231 67.0% 5.0% 96.9% 97.7% 96.9% 97.7% Total operating portfolio - owned and managed 2,992 522,172 365,244 69.9% 100.0% 94.0% 94.1% 94.5% 94.5% 18 2,352 2,352 100.0% 45.6% 45.6% 45.6% 45.6% 6 576 138 24.0% 36.0% 36.0% 36.0% 36.0% Total owned and managed 3,016 525,100 367,734 70.0% 93.8% 93.8% 94.2% 94.2% $211,946 $211,946 100.0% 53.6% $15,001,381 $15,001,381 100.0% 55.7% 78,405 78,405 100.0% 19.8% 4,771,549 4,771,549 100.0% 17.7% 44,053 44,053 100.0% 11.1% 2,739,270 2,739,270 100.0% 10.2% $334,404 $334,404 100.0% 84.5% $22,512,200 $22,512,200 100.0% 83.6% $124,010 $27,955 22.5% 7.0% $9,147,380 $2,070,646 22.7% 7.7% 94,958 28,419 29.9% 7.2% 6,670,689 1,984,071 29.7% 7.4% 26,214 5,076 19.4% 1.3% 1,764,608 341,357 19.3% 1.3% $245,182 $61,450 25.1% 15.5% $17,582,677 $4,396,074 25.0% 16.4% $335,956 $239,901 71.4% 60.6% $24,148,761 $17,072,027 70.7% 63.4% 173,363 106,824 61.6% 27.0% 11,442,238 6,755,620 59.0% 25.1% 70,267 49,129 69.9% 12.4% 4,503,878 3,080,627 68.4% 11.5% $579,586 $395,854 68.3% 100.0% $40,094,877 $26,908,274 67.1% 100.0% 162 162 100.0% 96,048 96,048 100.0% 104 25 24.0% 43,258 10,358 23.9% $579,852 $396,041 68.3% $40,234,183 $27,014,680 67.1% Occupied Leased Europe Consolidated Europe Total operating portfolio - consolidated Americas Asia Americas Consolidated Americas Europe Asia Unconsolidated Total Owned and Managed Value added properties - unconsolidated Asia Total Total operating portfolio - owned and managed Unconsolidated Europe Asia Total operating portfolio - unconsolidated Americas Americas % of Total Prologis Share ($) Prologis Share (%) % of Total Total Owned and Managed Value added properties - consolidated Value added properties - unconsolidated Total owned and managed Square Feet Gross Book Value Prologis Share ($) Prologis Share (%) Europe Asia Fourth Quarter NOI Americas Europe Asia Total Value added properties - consolidated |

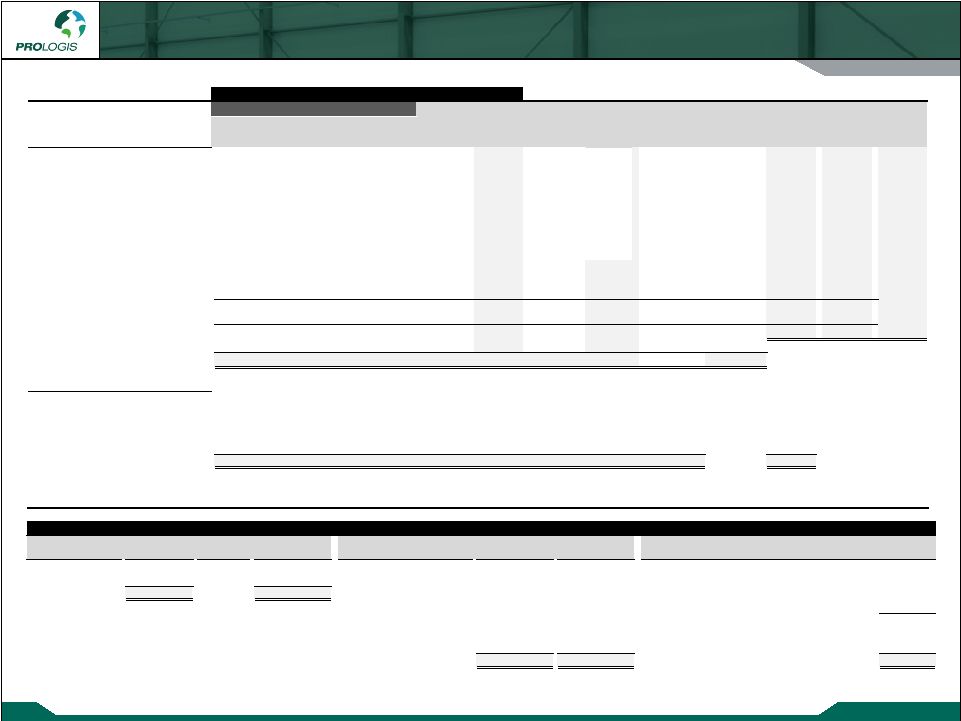

Copyright © 2013 Prologis Supplemental 4Q 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2012 1,017 2,863 2,279 3,772 522,571 519,939 514,031 501,957 New leases 10,023 11,947 12,102 11,571 (0.6%) 1.5% 2.3% 1.8% Renewals 19,812 20,189 24,599 25,118 (6.6%) 4.8% 1.1% 6.8% 30,852 34,999 38,980 40,461 1.7% 0.4% 2.7% 0.1% 78.3% 82.4% 87.5% 87.3% Net operating income - adjusted cash 3.1% 2.3% 3.0% 0.8% $ 1.14 $ 1.50 $ 1.50 $ 1.36 2.6% 2.9% 2.3% 2.1% 28,227 30,127 33,852 34,758 Q1 2012 Q2 2012 Q3 2012 Q4 2012 (1.1%) (3.9%) (1.8%) (2.4%) 17,100 $ 21,056 $ 33,704 $ 47,517 $ 0.03 $ 0.04 $ 0.06 $ 0.09 $ 28,598 29,243 31,515 36,715 16,401 18,523 21,483 25,166 Total turnover costs 44,999 47,766 52,998 61,881 62,099 $ 68,822 $ 86,702 $ 109,398 $ 11.9% (C) 12.0% (C) 12.7% 13.9% 76.9% 72.2% 72.0% 75.4% 47,734 $ 49,689 $ 62,428 $ 82,488 $ Same Store Information (A) Prologis share Weighted average ownership percent Leasing Activity Total square feet of leases signed Properties under development Trailing four quarters - % of gross NOI $ per square foot Average occupancy Total capital expenditures Leasing commissions Property improvements Rental income Rental expenses Operating portfolio: Weighted average customer retention Percentage change in rental rates Tenant improvements Capital Expenditures Incurred Square feet of leases signed: Square feet of population Percentage change: Net operating income - GAAP Square feet of leasing activity Turnover costs (per square foot) (B) 92.1% 92.1% 96.2% 92.3% 92.2% 92.1% 96.8% 92.4% 93.3% 92.0% 96.5% 93.1% 94.2% 93.0% 96.9% 94.0% 85% 90% 95% 100% Total Asia Americas Europe Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Operations Overview Operating Metrics – Owned and Managed 15 (A) See the Notes and Definitions for further explanations. (B) Turnover costs per foot represent expected costs based on the leases signed during the quarter, rather than costs incurred as presented in the “Capital Expenditures Incurred” section. (C) This metric is calculated using the trailing twelve month NOI based on pro forma information for the pre-Merger period. (square feet and dollars in thousands) Period Ending Occupancy by Division |

Copyright © 2013 Prologis Supplemental 4Q 2012 Operations Overview Customer Information – Owned and Managed 16 1 DHL 2.0% 12,074 Month to month customers $ 39,295 1.5% 11,851 2.4% 2 CEVA Logistics 1.4% 6,872 2013 342,020 12.6% 64,196 13.1% 3 Kuehne & Nagel 1.3% 7,074 2014 388,289 14.3% 75,030 15.3% 4 Geodis 1.0% 5,726 2015 411,423 15.2% 79,793 16.2% 5 Amazon.com, Inc. 0.9% 4,678 2016 350,782 13.0% 63,626 13.0% 6 Home Depot, Inc. 0.9% 4,326 2017 328,410 12.1% 60,939 12.4% 7 FedEx Corporation 0.8% 2,376 Thereafter 846,453 31.3% 135,657 27.6% 8 PepsiCo 0.8% 5,350 Total $ 2,706,672 100% 491,092 100% 9 Hitachi Ltd 0.8% 2,141 10 United States Government 0.8% 1,483 10.7% 52,100 11 Panasonic Logistics Co. Ltd. 0.7% 2,248 12 Tesco PLC 0.7% 2,693 Month to month customers $ 27,321 1.5% 8,570 2.5% 13 Sagawa Express 0.6% 1,112 2013 249,631 13.4% 47,004 13.7% 14 Nippon Express Group 0.6% 1,575 2014 278,486 15.0% 56,068 16.3% 15 ND Logistics 0.6% 2,724 2015 275,210 14.8% 54,968 16.0% 16 Wal-Mart Stores 0.6% 3,239 2016 249,409 13.4% 46,316 13.5% 17 Panalpina, Inc. 0.6% 2,457 2017 215,577 11.6% 39,881 11.6% 18 Kraft Foods, Inc. 0.5% 3,020 Thereafter 561,431 30.3% 90,893 26.4% 19 Unilever 0.5% 3,920 Total $ 1,857,065 100% 343,700 100% 20 UPS SCS (United Parcel Service Inc.) 0.5% 2,217 21 DB Schenker 0.5% 2,410 22 Caterpillar Logistics Services 0.4% 1,153 23 APL (Neptune Orient Lines) 0.4% 3,983 24 LG 0.4% 2,540 25 La Poste 0.4% 1,278 18.7% 88,669 Percentage of Total Top Customers Lease Expirations - Operating Portfolio - Owned and Managed Year Percentage of Total % of Annual Base Rent Total Square Feet Occupied Square Feet Annual Base Rent Top 10 Customers Top 25 Customers Lease Expirations - Operating Portfolio - Prologis Share Year Annual Base Rent Percentage of Total Occupied Square Feet Percentage of Total (square feet and dollars in thousands) |

Copyright © 2013 Prologis Supplemental 4Q 2012 Capital Deployment Dispositions and Contributions 17 (A) Prologis share reflects our effective ownership. For contributions, this amount reflects cash proceeds to Prologis (net of units received for partial consideration). (B) This is a consolidated fund. (C) This was a consolidated fund through the second quarter of 2012. Beginning in the third quarter, the assets and liabilities of this fund are now wholly owned. (square feet and dollars in thousands) Prologis wholly owned 7,216 7,216 $332,488 $332,488 100.0% 14,414 14,414 $714,375 $714,375 100.0% Prologis AMS (B) 204 78 14,560 5,604 38.5% 204 78 14,560 5,604 38.5% Prologis Institutional Alliance Fund II (B) 420 118 33,693 9,485 28.2% 850 239 62,693 17,649 28.2% Prologis North American Industrial Fund 1,541 355 56,817 13,102 23.1% 1,601 369 59,217 13,656 23.1% Prologis North America Properties Fund I 1,406 581 58,769 24,272 41.3% 1,406 581 58,769 24,272 41.3% Prologis North American Properties Fund XI - - - - - 3,616 723 138,959 27,791 20.0% Prologis Targeted U.S. Logistics Fund 753 180 52,449 12,561 23.9% 819 196 56,081 13,468 24.0% Total Americas 11,540 8,528 548,776 397,512 72.4% 22,910 16,600 1,104,654 816,815 73.9% Prologis wholly owned 5,214 5,214 251,114 251,114 100.0% 7,390 7,390 386,136 386,136 100.0% Prologis European Properties (C) - - - - - 3,670 3,439 338,862 317,513 93.7% Prologis European Properties Fund II 553 164 30,569 9,085 29.7% 2,596 772 180,743 53,715 29.7% Prologis Targeted Europe Logistics Fund 128 41 7,445 2,393 32.1% 345 111 15,813 5,079 32.1% Total Europe 5,895 5,419 289,128 262,592 90.8% 14,001 11,712 921,554 762,443 82.7% Asia Prologis wholly owned - - - - - 592 592 36,938 36,938 100.0% Prologis Japan Fund 1 - - - - - 8 2 993 199 20.0% Total Asia - - - - - 600 594 37,931 37,137 97.9% Total Third Party Building Dispositions 17,435 13,947 $837,904 $660,104 78.8% 37,511 28,906 $2,064,139 $1,616,395 78.3% Brazil Fund and joint ventures 515 129 $52,482 $13,121 25.0% 815 204 $80,844 $20,211 25.0% Prologis Mexico Fondo Logistico (B) - - - - - 755 755 40,650 32,520 80.0% Total Americas 515 129 52,482 13,121 25.0% 1,570 959 121,494 52,731 43.4% Prologis European Properties Fund II 2,104 2,104 169,933 169,933 100.0% 2,240 2,240 185,947 185,947 100.0% Europe Logistics Venture 1 1,781 1,781 131,633 111,888 85.0% 1,920 1,920 148,508 126,231 85.0% Prologis Targeted Europe Logistics Fund 624 624 47,434 29,690 62.6% 624 624 47,434 29,690 62.6% Total Europe 4,509 4,509 349,000 311,511 89.3% 4,784 4,784 381,889 341,868 89.5% Asia Total Asia - - - - - - - - - - 5,024 4,638 $401,482 $324,632 80.9% 6,354 5,743 $503,383 $394,599 78.4% 22,459 18,585 $1,239,386 $984,736 79.5% 43,865 34,649 $2,567,522 $2,010,994 78.3% 36,435 36,435 100.0% 91,306 91,306 100.0% 3,412 3,412 100.0% 16,836 15,455 91.8% $1,279,233 $1,024,583 80.1% $2,675,664 $2,117,755 79.1% 7.3% 7.3% Americas FY 2012 Prologis Share of Proceeds (%) (A) Prologis Share of Square Feet Prologis Share of Proceeds (%) (A) Total Proceeds Prologis Share of Proceeds ($) Square Feet Prologis Share of Square Feet Prologis Share of Proceeds ($) Total Proceeds Weighted average stabilized cap rate on building dispositions and contributions Grand Total Dispositions and Contributions Europe Square Feet Q4 2012 Land dispositions and contributions Other real estate dispositions Americas Europe Total Contributions and Dispositions to Co-Investment Ventures Total Building Dispositions and Contributions Building Contributions and Dispositions to Co-Investment Ventures Third Party Building Dispositions |

Copyright © 2013 Prologis Supplemental 4Q 2012 Capital Deployment Third Party Building Acquisitions 18 Prologis Share of Prologis Share of Acquisition Cost (%) (A) Acquisition Cost (%) (A) Third Party Building Acquisitions Prologis wholly owned (B) 2,556 2,556 $ 111,976 $ 111,976 100.0% 3,563 3,563 $ 169,019 $ 169,019 100.0% Prologis Mexico Fondo Logistico (C) 159 32 6,773 1,355 20.0% 449 90 17,048 3,410 20.0% Prologis North American Industrial Fund - - - - - 41 9 2,886 667 23.1% Prologis Targeted U.S. Logistics Fund 2,154 516 157,718 37,766 23.9% 3,125 770 267,679 66,099 24.7% Total Americas (D) 4,869 3,104 276,467 151,097 54.7% 7,178 4,432 456,632 $ 239,195 52.4% Europe Logistics Venture 1 - - - - - 762 114 50,194 7,529 15.0% Prologis European Properties Fund II - - - - - 717 213 36,812 10,940 29.7% Total Europe - - - - - 1,479 327 87,006 18,469 21.2% Asia - - - - - - - - - - 4,869 3,104 $ 276,467 $ 151,097 54.7% 8,657 4,759 $ 543,638 $ 257,664 47.4% 7.4% 7.3% Q4 2012 FY 2012 Prologis Share of Acquisition Cost ($) Prologis Share of Square Feet Square Feet Acquisition Cost Prologis Share of Acquisition Cost ($) Acquisition Cost Square Feet Americas Weighted average stabilized cap rate Prologis Share of Square Feet Total Third Party Building Acquisitions Europe (square feet and dollars in thousands) (A) Prologis share reflects our effective ownership. (B) Includes properties totaling 2.4 million square feet for total acquisition costs of $97.8 million that were acquired upon dissolution of one of our other unconsolidated joint ventures during the fourth quarter. (C) This is a consolidated fund. (D) Includes properties acquired in the fourth quarter and designated as Value Added Acquisitions totaling 2.2 million square feet for total acquisition costs of $107.8 million, of which 1.7 million square feet and $76.4 million of acquisition costs were Prologis’ share. |

Copyright © 2013 Prologis Supplemental 4Q 2012 Capital Deployment Development Starts – Current Quarter 19 (in thousands, except percent and per square foot) (A) Prologis share reflects our effective ownership. (B) Value Creation excludes fees or promotes that we may earn. See complete definition in the Notes and Definitions section. Square Feet Total Expected Investment Cost Per Square Foot Leased % at Start Square Feet Total Expected Investment Cost Per Square Foot Leased % at Start Square Feet Total Expected Investment Americas 3,661 $377,958 $103 47.9% 3,661 $377,958 $103 47.9% 100.0% 100.0% Brazil Fund and joint ventures 1,478 151,600 103 45.7% 370 37,900 102 45.7% 25.0% 25.0% Total Americas 5,139 529,558 103 47.3% 4,031 415,858 103 47.7% 78.4% 78.5% Europe 820 70,086 85 100.0% 820 70,086 85 100.0% 100.0% 100.0% 820 70,086 85 100.0% 820 70,086 85 100.0% 100.0% 100.0% Asia 1,308 127,547 98 33.5% 1,308 127,547 98 33.5% 100.0% 100.0% 1,308 127,547 98 33.5% 1,308 127,547 98 33.5% 100.0% 100.0% Total 7,267 $727,191 $100 50.8% 6,159 $613,491 $100 51.7% 84.8% 84.4% Prologis Share ($) - Q4 Prologis Share (%) - Q4 (A) Consolidated Total Europe Consolidated Total Asia Total Q4 2012 Consolidated Weighted average estimated stabilized yield 7.9% $57,095 Weighted average estimated cap rate at stabilization 6.8% $106,640 Estimated development margin 14.7% Prologis share of value creation on development starts (B) 66.4% Prologis share of value creation on development starts (B) $70,776 Pro forma NOI Estimated value creation (B) |

Copyright © 2013 Prologis Supplemental 4Q 2012 $- $200,000 $400,000 $600,000 $800,000 $1,000,000 $1,200,000 $1,400,000 $1,600,000 $1,800,000 2009 2010 2011 2012 Americas Europe Asia Capital Deployment Development Starts – FY 2012 20 (A) Prologis share reflects our effective ownership. (B) Value Creation excludes fees or promotes that we may earn. See complete definition in the Notes and Definitions section. (C) This represents the economic gain realized from the sale of a Value Added Conversion “VAC” property during the year. The gain represents the amount by which the sales proceeds exceeds the amount included in NAV for this property. FY 2012 Development Starts Historical Development Starts (TEI) (in thousands, except percent and per square foot) $313,877 $758,905 $1,016,763 $1,552,785 Americas Europe Asia Prologis Share Partners’ Share Speculative Build to Suit $133,639 9% $193,598 12% $671,263 43% $832,415 53% $586,731 38% $1,359,187 88% $881,522 57% Square Feet Total Expected Investment Cost Per Square Foot Leased % at Start Square Feet Total Expected Investment Cost Per Square Foot Leased % at Start Square Feet Total Expected Investment Americas 8,514 $612,561 $72 39.6% 8,514 $612,561 $72 39.6% 100.0% 100.0% Brazil Fund and joint ventures 2,210 219,854 99 63.7% 553 54,964 99 63.7% 25.0% 25.0% Total Americas 10,724 832,415 78 44.6% 9,067 667,525 74 41.1% 84.5% 80.2% Europe 1,709 133,639 78 84.5% 1,709 133,639 78 84.5% 100.0% 100.0% 1,709 133,639 78 84.5% 1,709 133,639 78 84.5% 100.0% 100.0% Asia 3,859 552,957 143 77.5% 3,859 552,957 143 77.5% 100.0% 100.0% Prologis China Logistics Venture I 598 33,774 56 0.0% 90 5,066 56 0.0% 15.0% 15.0% 4,457 586,731 132 67.1% 3,949 558,023 141 75.7% 88.6% 95.1% Total 16,890 $1,552,785 $92 54.5% 14,725 $1,359,187 $92 55.4% 87.2% 87.5% Weighted average estimated stabilized yield 7.9% $122,624 Weighted average estimated cap rate at stabilization 6.7% $281,006 Estimated development margin 18.1% Prologis share of value creation on development starts (B) 79.8% Prologis share of value creation on development starts (B) $224,262 Prologis share of value creation realized on VAC buildings (C) 10,954 $235,216 Prologis Share ($) - FY 2012 Prologis Share (%) - FY 2012 (A) Consolidated Total Europe Consolidated Total Prologis share of estimated and realized value creation year to date Pro forma NOI Estimated value creation (B) Total Asia Total FY 2012 Consolidated |

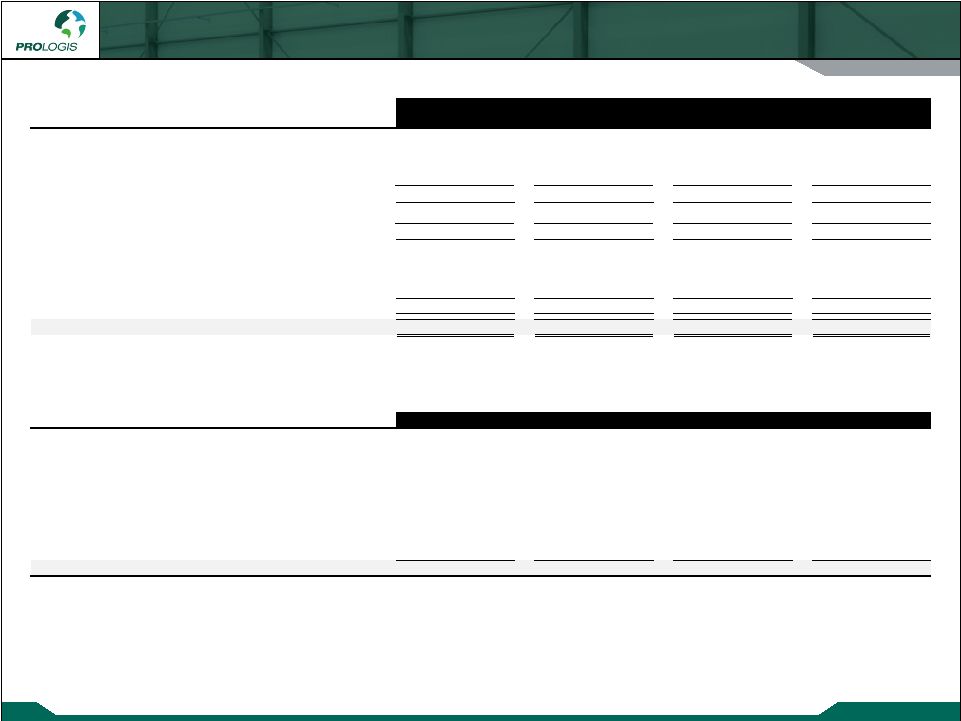

Copyright © 2013 Prologis Supplemental 4Q 2012 Capital Deployment Development Portfolio 21 (in thousands, except percent) (A) Value creation excludes fees or promotes that we may earn. See complete definition in the Notes and Definitions section. Sq Ft TEI $ Sq Ft TEI $ Sq Ft TEI $ Sq Ft TEI $ TEI $ Prologis share of TEI $ % of Total Leased % 147 $7,717 1,334 $57,250 - $0 1,334 $57,250 $64,967 $64,967 3.5% 33.7% 706 71,717 1,612 69,182 879 101,742 2,491 170,924 242,641 242,641 13.1% 75.5% - - 1,258 134,220 - - 1,258 134,220 134,220 134,220 7.2% 80.9% 415 26,850 800 48,145 - - 800 48,145 74,995 74,995 4.0% 0.0% U.S. Total 1,268 106,284 5,004 308,797 879 101,742 5,883 410,539 516,823 27.8% 55.0% - - 910 107,351 - - 910 107,351 107,351 107,351 5.8% 0.0% 383 19,368 854 53,085 - - 854 53,085 72,453 72,453 3.9% 8.1% Americas total 1,651 125,652 6,768 469,233 879 101,742 7,647 570,975 696,627 37.5% 43.3% - - - - - - - - - - 0.0% 0.0% 507 38,862 - - 262 16,681 262 16,681 55,543 55,543 3.0% 48.4% 201 10,647 265 14,773 - - 265 14,773 25,420 25,420 1.4% 100.0% - - 698 76,575 - - 698 76,575 76,575 76,575 4.1% 100.0% Europe total 708 49,509 963 91,348 262 16,681 1,225 108,029 157,538 157,538 8.5% 79.5% 2,166 317,070 2,203 333,298 1,087 154,166 3,290 487,464 804,534 804,534 43.3% 79.2% - - 568 22,913 - - 568 22,913 22,913 22,913 1.2% 77.0% Asia total 2,166 317,070 2,771 356,211 1,087 154,166 3,858 510,377 827,447 827,447 44.5% 79.0% 4,525 492,231 10,502 916,792 2,228 272,589 12,730 1,189,381 1,681,612 1,681,612 90.5% 59.9% - - 486 22,694 - - 486 22,694 22,694 22,694 1.2% 0.0% 260 14,648 - - - - - - 14,648 14,648 0.8% 0.5% 260 14,648 486 22,694 - - 486 22,694 37,342 37,342 2.0% 0.2% 4,785 506,879 10,988 939,486 2,228 272,589 13,216 1,212,075 1,718,954 1,718,954 92.5% 57.4% Prologis Targeted U.S. Logistics Fund 272 32,196 - - - - - - 32,196 7,709 0.4% 0.0% Brazil Fund and joint ventures - - 2,249 217,144 - - 2,249 217,144 217,144 108,572 5.8% 48.5% Prologis Targeted Europe Logistics Fund 47 5,862 250 24,691 - - 250 24,691 30,553 9,820 0.5% 0.0% Prologis China Logistics Venture I - - 598 34,067 1,078 59,264 1,676 93,331 93,331 14,000 0.8% 0.0% 319 38,058 3,097 275,902 1,078 59,264 4,175 335,166 373,224 140,101 7.5% 24.3% 5,104 $ 544,937 14,085 $ 1,215,388 3,306 $ 331,853 17,391 1,547,241 $ 2,092,178 $ 1,859,055 100.0% 50.8% 4,865 $ 516,472 12,283 $ 1,061,104 2,389 $ 281,478 14,672 $ 1,342,582 $ 1,859,054 55.7% 95.3% 94.8% 87.2% 87.3% 72.3% 84.8% 84.4% 86.8% 88.9% $ 38,087 $ 651,527 $ 253,386 $ 904,913 $ 943,000 $ 32,845 $ 575,552 $ 219,301 $ 794,853 $ 827,698 0.0% 64.0% 23.5% 55.5% 40.1% 53.7% 52.0% 40.8% 49.9% 50.8% 7.6% 7.9% 7.5% 7.9% 7.8% $ 163,113 Weighted average estimated cap rate at stabilization 6.5% $ 398,151 Estimated development margin 19.0% $ 354,340 89.0% Total Development Portfolio Consolidated Total Under Development U.S. 2014 and thereafter Expected Completion 2013 Expected Completion Pre-Stabilized Developments Prologis share of value creation (A) Prologis share of cost to complete Percent build to suit (based on Prologis share) Leased percent Prologis share of value creation (A) Pro forma NOI Estimated value creation (A) Weighted average estimated stabilized yield Cost to complete Central East Northwest United Kingdom Europe Southwest Northern Europe Southern Europe Latin America Europe Central Europe Japan Asia China Canada Under Development Total development portfolio - owned & managed Total global markets Total unconsolidated development portfolio Total regional and other markets Regional and other markets Americas Unconsolidated Total consolidated development portfolio 516,823 696,627 Total development portfolio - Prologis share (%) Total development portfolio - Prologis share $ |

Copyright © 2013 Prologis Supplemental 4Q 2012 Capital Deployment Land Portfolio – Owned and Managed 22 (A) Ordered by our share of current book value. (dollars in thousands) Region Prologis Prologis Prologis Prologis % of Share Share (%) Share ($) Share (%) Total Atlanta East 616 616 100.0% $ 25,656 $ 25,656 100.0% 1.4% Baltimore/Washington East 106 106 100.0% 13,137 13,137 100.0% 0.7% Central Valley Northwest 1,155 1,155 100.0% 37,521 37,521 100.0% 2.0% Central & Eastern PA East 311 311 100.0% 27,187 27,187 100.0% 1.5% Chicago Central 567 567 100.0% 49,233 49,233 100.0% 2.7% Dallas/Ft. Worth Central 459 459 100.0% 26,909 26,909 100.0% 1.5% Houston Central 47 47 100.0% 5,422 5,422 100.0% 0.3% New Jersey/New York City East 323 323 100.0% 132,340 132,340 100.0% 7.2% South Florida East 377 377 100.0% 148,691 148,691 100.0% 8.1% Southern California Southwest 882 882 100.0% 184,053 184,053 100.0% 10.0% Canada 183 183 100.0% 62,451 62,451 100.0% 3.4% Mexico 901 901 100.0% 177,060 177,060 100.0% 9.6% Brazil 269 135 50.0% 78,508 39,254 50.0% 2.1% 6,196 6,062 97.8% 968,168 928,914 95.9% 50.5% Northern 30 30 100.0% 10,363 10,363 100.0% 0.6% Southern 503 503 100.0% 89,911 89,911 100.0% 4.9% Northern 116 116 100.0% 22,405 22,405 100.0% 1.2% Northern 68 68 100.0% 67,839 67,839 100.0% 3.7% CEE 775 775 100.0% 96,606 96,606 100.0% 5.3% Southern 100 100 100.0% 15,717 15,717 100.0% 0.9% UK 987 987 100.0% 257,055 257,055 100.0% 14.0% 2,579 2,579 100.0% 559,896 559,896 100.0% 30.6% China 103 31 30.1% 29,063 11,550 39.7% 0.6% Japan 67 67 100.0% 80,071 80,071 100.0% 4.4% 170 98 57.6% 109,134 91,621 84.0% 5.0% 8,945 8,739 97.7% 1,637,198 1,580,431 96.5% 86.1% C.E.E. 247 247 100.0% 40,530 40,530 100.0% 2.2% C.E.E. 338 338 100.0% 38,111 38,111 100.0% 2.1% Southern 107 107 100.0% 32,840 32,840 100.0% 1.8% East 129 129 100.0% 25,686 25,686 100.0% 1.4% C.E.E. 95 95 100.0% 16,915 16,915 100.0% 0.9% East 229 229 100.0% 13,097 13,097 100.0% 0.7% Northwest 66 66 100.0% 8,727 8,727 100.0% 0.5% Central 165 165 100.0% 7,293 7,293 100.0% 0.4% Central 199 199 100.0% 6,692 6,692 100.0% 0.4% Central 127 127 100.0% 4,474 4,474 100.0% 0.2% Central 15 15 100.0% 1,480 1,480 100.0% 0.1% 1,717 1,717 100.0% 195,845 195,845 100.0% 10.7% Total other markets (10 markets) Various 607 607 100.0% 60,433 60,433 100.0% 3.2% Total land portfolio - owned and managed 11,269 11,063 98.2% 1,893,476 $ 1,836,709 $ 97.0% 100.0% Original Cost Basis 3,017,610 $ 2,976,621 $ Columbus Regional markets (A) Netherlands Poland Spain Total global markets China Japan Asia total Europe total United Kingdom Land by Market Total Owned & Managed Current Book Value Brazil Mexico Acres Global markets U.S. Canada Cincinnati Americas total Total Owned & Managed Total regional markets Central Florida Savannah Slovakia Memphis Indianapolis Hungary Italy Czech Republic Belgium France Germany Denver |

Copyright © 2013 Prologis Supplemental 4Q 2012 Capital Deployment Land Portfolio – Summary and Roll Forward 23 Investment at Acres % of Total December 31, 2012 % of Total 7,345 65.2% 996,161 $ 52.6% Brazil Fund and joint ventures 269 2.4% 78,508 4.1% Total Americas 7,614 67.6% 1,074,669 56.7% 3,485 30.8% 709,673 37.5% 85 0.8% 88,530 4.7% Prologis China Logistics Venture 1 85 0.8% 20,604 1.1% Total Asia 170 1.6% 109,134 5.8% 11,269 100.0% 1,893,476 $ 100.0% Americas Europe Asia Total 1,111,379 $ 758,502 $ 138,039 $ 2,007,920 $ Acquisitions 103,706 24,167 16,348 144,221 Dispositions (9,262) (15,906) (7,651) (32,819) Development starts (143,986) (18,550) (27,603) (190,139) Infrastructure costs 30,324 5,461 1,917 37,702 Reclasses 7,628 - - 7,628 Impairment charges (21,144) (56,403) - (77,547) Effect of changes in foreign exchange rates and other (3,976) 12,402 (11,916) (3,490) 1,074,669 $ 709,673 $ 109,134 $ 1,893,476 $ Land Portfolio Summary Consolidated Americas Total land portfolio - owned and managed Consolidated Europe Asia Consolidated As of December 31, 2012 Land Roll Forward - Owned and Managed As of September 30, 2012 (dollars in thousands) . |

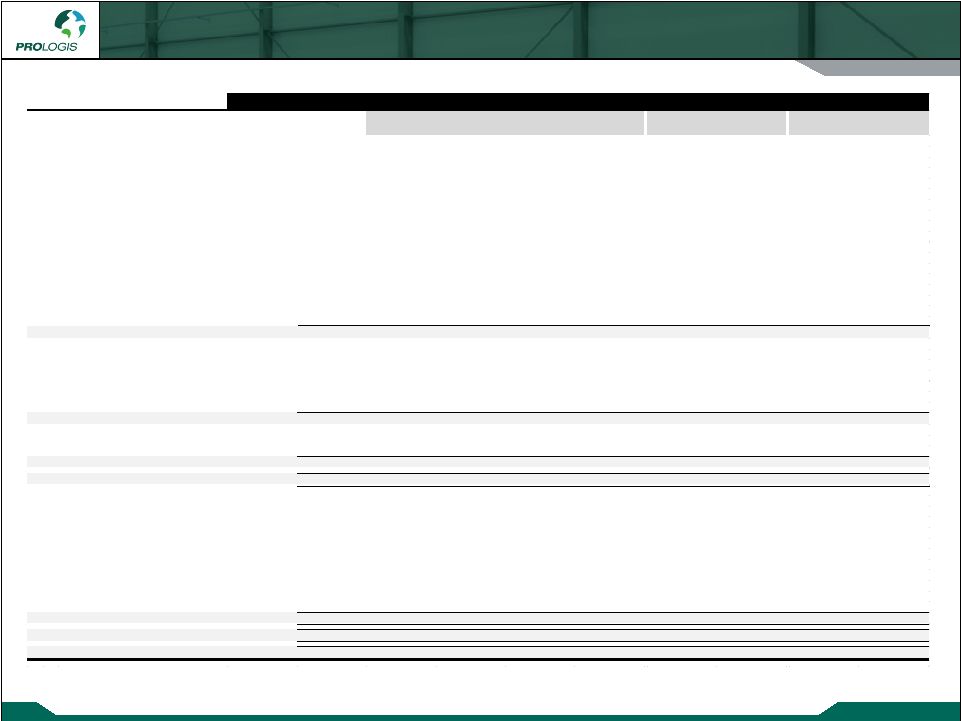

Copyright © 2013 Prologis Supplemental 4Q 2012 Private Capital Detail Information 24 Investment Information Co-Investment Ventures Type Investment Type Geographic Focus Ownership Date Established Term Prologis Institutional Alliance Fund II Core Consolidated US 28.2% June 2001 Closed end Prologis AMS Core Consolidated US 38.5% June 2004 Closed end Prologis Mexico Fondo Logistico (A) Core/Development Consolidated Mexico 20.0% July 2010 Closed end Prologis Targeted U.S. Logistics Fund (A) Core Unconsolidated US 23.9% October 2004 Open end Prologis North American Industrial Fund Core Unconsolidated US 23.1% March 2006 Open end Prologis DFS Fund I Development Unconsolidated US 15.0% October 2006 Closed end Prologis North American Industrial Fund III Core Unconsolidated US 20.0% July 2007 Closed end Prologis SGP Mexico Core Unconsolidated Mexico 21.6% December 2004 Closed end Prologis Mexico Industrial Fund Core Unconsolidated Mexico 20.0% August 2007 Closed end Prologis Brazil Logistics Partners Fund I (A)(B) Development Unconsolidated Brazil 50.0% December 2010 Closed end Prologis Targeted Europe Logistics Fund (A) Core Unconsolidated Europe 32.4% June 2007 Open end Prologis European Properties Fund II (A) Core Unconsolidated Europe 29.7% August 2007 Open end Europe Logistics Venture 1 (A) Core Unconsolidated Europe 15.0% February 2011 Open end Prologis Japan Fund 1 Core Unconsolidated Japan 20.0% June 2005 Closed end Prologis China Logistics Venture 1 (A) Core/Development Unconsolidated China 15.0% March 2011 Closed end 24 (A) These funds are or will be actively investing in new properties through acquisition and/or development activities, whereas the remaining funds do not expect to be actively investing in new properties. (B) We have a 50% ownership interest in and consolidate an entity that in turn owns 50% of an entity that is accounted for on the equity method (“Brazil Fund”). The Brazil Fund develops industrial properties in Brazil and has sold properties to an entity in which it maintains an equity interest. We also have other joint ventures that we account for using the equity method. We show our ownership in these entities at our effective ownership and include the properties in our owned and managed pool. (C) Values represent Prologis’ stepped up basis and may not be comparable to values reflected in the entities’ stand alone financial statements calculated on a different basis. Prologis Investment In and Advances To 47,340 $41,914 $2,888,458 $1,192,165 $9,665 $38,660 $274,913 $13,693 209,580 17,655 12,993 941,724 647,774 2,599 10,396 129,555 28,872 20,860 44,436 50,726 4,151,258 1,566,099 12,146 48,584 375,004 2,492 645,241 9,502 7,931 598,120 214,149 1,586 6,344 42,830 669 50,681 6,361 6,101 415,013 215,282 1,318 5,272 46,501 (11,272) 33,245 2,161 4,449 196,065 - 666 2,664 - (2,951) 152,224 Americas 127,455 124,114 9,190,638 3,835,469 27,980 111,920 868,803 31,503 1,111,831 55,275 71,174 4,881,068 1,734,126 21,153 84,612 515,382 (47,626) 398,291 11,896 21,578 1,545,944 650,100 6,935 27,740 208,954 21,152 280,430 Europe Logistics Venture I 3,123 2,206 243,677 - 331 1,324 - 906 44,027 Europe 70,294 94,958 6,670,689 2,384,226 28,419 113,676 724,336 (25,568) 722,748 7,255 22,876 1,533,307 848,856 4,575 18,300 169,771 18,218 144,352 3,749 3,338 231,301 124,000 501 2,004 18,600 4,313 34,149 Asia 11,004 26,214 1,764,608 972,856 5,076 20,304 188,371 22,531 178,501 208,753 $245,286 $17,625,935 $7,192,551 $61,475 $245,900 $1,781,510 $28,466 $2,013,080 Information by Unconsolidated Co-investment Venture (C): Prologis' Share Fourth Gross Book Value of Fourth Annualized Debt Quarter NOI (in thousands) Square Feet Quarter NOI Operating Buildings Pro forma NOI Debt Assets (Liabilities) Total Prologis North American Industrial Fund III Prologis Targeted U.S. Logistics Fund Prologis Mexico Industrial Fund Prologis SGP Mexico Brazil Fund and joint ventures Prologis European Properties Fund II Prologis Targeted Europe Logistics Fund Prologis Japan Fund 1 Prologis China Logistics Venture 1 Prologis North American Industrial Fund Total Other Tangible |

Copyright © 2013 Prologis Supplemental 4Q 2012 Private Capital Operating and Balance Sheet Information 25 (A) Includes the unconsolidated co-investment ventures listed on the previous page. (B) Represents the entire entity, not our proportionate share. (dollars in thousands) $ (99) $ 10,136 $ (323) $ 9,714 632 12 56 700 533 10,148 (267) 10,414 17,602 9,164 4,896 31,662 $ 18,135 $ 19,312 $ 4,629 $ 42,076 $ 9,190,638 $ 6,670,689 $ 1,764,608 $ 17,625,935 (878,707) (492,243) (82,600) (1,453,550) 211,773 22,415 54,482 288,670 546,718 404,297 200,520 1,151,535 $ 9,070,422 $ 6,605,158 $ 1,937,010 $ 17,612,590 $ 3,835,469 2,384,226 972,856 $ 7,192,551 334,942 569,615 89,645 994,202 $ 4,170,411 $ 2,953,841 $ 1,062,501 $ 8,186,753 23.2% 29.7% 19.2% 25.1% Properties under development and land Prologis' share of the co-investment ventures' net earnings (loss) Interest income Earnings (loss) from unconsolidated co-investment ventures, net Weighted average ownership Other assets Other liabilities Total liabilities Fees earned by Prologis Condensed Balance Sheet of the Unconsolidated Co-Investment Ventures, Aggregated (A)(B) Total earnings recognized by Prologis, net As of December 31, 2012 Third party debt Total assets Operating industrial properties, before depreciation Accumulated depreciation $ 178,349 $ 128,412 $ 34,692 $ 341,453 (49,672) (29,904) (8,478) (88,054) 128,677 98,508 26,214 253,399 (4,311) (3,123) (122) (7,556) (40,273) (13,742) (2,257) (56,272) (3,631) (4,952) (4,992) (13,575) (57,224) (29,178) (5,030) (91,432) (1,207) (1,719) (1,076) (4,002) 22,031 45,794 12,737 80,562 (76,670) (40,094) (14,245) (131,009) 3,667 (372) 900 4,195 38,048 8,844 - 46,892 (2,381) 9,701 (52) 7,268 $ (15,305) $ 23,873 $ (660) $ 7,908 $ 7,466 $ 16,031 $ 3,433 $ 26,930 632 12 56 700 8,098 16,043 3,489 27,630 17,602 9,164 4,896 31,662 General and administrative expenses Americas Europe Asia Total Rental income For the Three Months Ended December 31, 2012 FFO and Net Earnings (Loss) of the Co-Investment Ventures, Aggregated (A)(B) Rental expenses Net operating income from properties Other expense, net Loss on dispositions of investments in real estate, impairment charges and early extinguishment of debt, net Interest expense Current income tax expense FFO of the unconsolidated co-investment ventures Real estate related depreciation and amortization For the Three Months Ended December 31, 2012 Prologis' Share of FFO and Net Earnings (Loss) of the Unconsolidated Co-Investment Ventures (A) Gain on dispositions of investments in real estate, net Deferred tax benefit (expense) and other income (expense), net Net earnings (loss) of the unconsolidated co-investment ventures Prologis' share of the co-investment ventures' FFO Interest income Fees earned by Prologis FFO from unconsolidated co-investment ventures, net Foreign currency exchange and unrealized derivative gains (losses), net Total FFO recognized by Prologis, net $ 25,700 $ 25,207 8,385 $ 59,292 $ |

Copyright © 2013 Prologis Supplemental 4Q 2012 Capitalization Debt and Equity Summary 26 (A) Based on Prologis share of the total debt. Interest rate is based on the effective rate (which includes the amortization of related premiums and discounts) assuming the net premiums (discounts) associated with the respective debt were included in the maturities by year. (B) Interest rate is based on the effective rate and weighted based on borrowings outstanding. Dividend Security Shares Value Series Rate Value Common Stock 461.0 $36.49 $16,822 Series L 6.5% $49 $2,118 Partnership Units 3.2 $36.49 117 Series M 6.8% 58 Total 464.2 $16,939 Series O 7.0% 75 Borrowings outstanding 889 Series P 6.9% 50 Outstanding letters of credit 68 Series Q 8.5% 100 $1,161 Series R 6.8% 125 Series S 6.8% 125 101 7.1% $582 $1,262 Less: Current availability Unrestricted cash Total liquidity Market Equity Preferred Stock Liquidity Price Aggregate lender commitments (dollars and shares in millions) $376 $483 $0 $0 $410 $1,269 $207 $1,476 $1,405 $2,881 $1,641 57.0% 4.4% 916 - 420 640 981 2,957 65 3,022 1,225 4,247 3,330 78.4% 3.6% 287 460 469 1 205 1,422 25 1,447 788 2,235 1,654 74.0% 3.5% 640 - - 1 318 959 127 1,086 1,301 2,387 1,291 54.1% 5.3% 700 - - 1 544 1,245 4 1,249 752 2,001 1,411 70.5% 4.2% 900 - - 1 309 1,210 74 1,284 266 1,550 1,287 83.0% 5.0% 647 - - 1 501 1,149 2 1,151 225 1,376 1,216 88.4% 5.4% 677 - - 1 9 687 2 689 723 1,412 878 62.2% 5.9% - - - 1 155 156 2 158 345 503 239 47.5% 3.4% - - - - 7 7 3 10 139 149 42 28.2% 5.8% - 1 - 10 137 148 5 153 - 153 150 98.0% 7.4% Subtotal 5,143 944 889 657 3,576 11,209 516 11,725 7,169 18,894 13,139 69.5% 80 (67) - - 50 63 3 66 24 90 70 77.8% Subtotal 5,223 877 889 657 3,626 11,272 519 11,791 7,193 18,984 $13,209 69.6% 4.4% - - - - - - (364) (364) (5,411) (5,775) Prologis share of debt $5,223 $877 $889 $657 $3,626 $11,272 $155 $11,427 $1,782 $13,209 $4,547 $877 $55 $29 $1,689 $7,197 $130 $7,327 $886 9,395 $ $8,213 559 - 226 482 504 1,771 21 1,792 574 2,887 2,366 - - 28 - 172 200 - 200 139 533 339 117 - 580 146 1,261 2,104 - 2,104 170 1,617 2,274 - - - - - - 4 4 13 35 17 Prologis share of debt $5,223 $877 $889 $657 $3,626 $11,272 $155 $11,427 $1,782 $13,209 Unamortized net premiums (discounts) Third party share of debt Prologis share of debt by local currency Dollars Euro GBP 2019 2020 2021 Yen Other Thereafter 2022 2018 Entities Consolidated Entities 2016 Debt Debt Debt Maturity Debt Debt 2013 2014 2015 Total Mortgage 2017 Facilities Debt Senior Exchangeable Credit Other Prologis Debt Total Debt Unsecured Consolidated Total Unconsolidated Secured Debt Prologis Total Share of Wtd. Avg. Interest Rate (A) Prologis Share (%) 4.3 1.2 1.8 1.5 3.9 3.6 3.0 3.6 3.5 4.1 3.6 Weighted average remaining maturity in years 5.6% 4.6% 1.5% 1.8% 4.0% 4.4% 4.4% 4.4% 4.7% 4.4% Weighted average interest rate (B) |

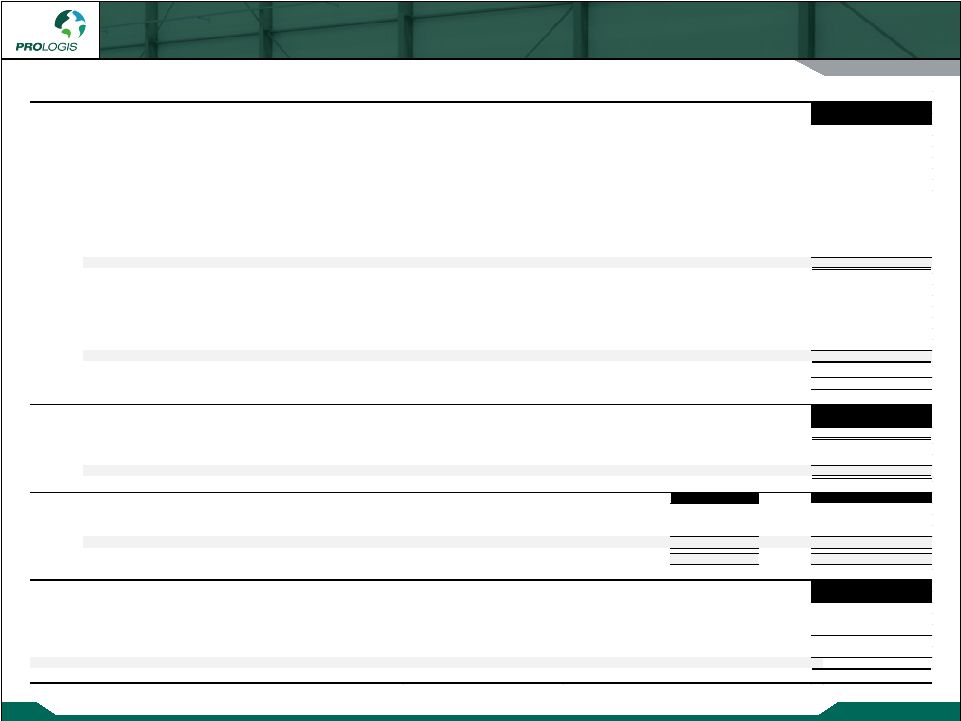

Copyright © 2013 Prologis Supplemental 4Q 2012 Capitalization Debt Covenants and Other Metrics 27 (A) These calculations are made in accordance with the respective debt agreements, may be different than other covenants or metrics presented and are not calculated in accordance with the applicable SEC rules. (B) All metrics include both consolidated and Prologis share of unconsolidated entities. (C) See Notes and Definitions for calculation of amounts. (dollars in thousands) Covenant Actual Covenant Actual <60% 39.4% <60% 39.4% >1.5x 2.72x >1.5x 2.71x <40% 13.5% <40% 13.5% >150% 276.6% >150% 276.6% Covenant Actual <60% 43.0% >1.5x 2.41x >1.5x 3.33x <35% 14.9% >$10.0 billion $15.4 billion Fourth Quarter Third Quarter 43.9% 44.7% 18.3% 19.5% 234.6% 227.1% 2.18x 2.26x 8.89x 9.00x Unencumbered Encumbered Total 14,095,141 $ 8,513,107 $ 22,608,248 $ 951,643 - 951,643 1,727,275 67,089 1,794,364 454,868 - 454,868 - 188,000 188,000 7,973 18,054 26,027 Total consolidated 17,236,900 8,786,250 26,023,150 1,210,593 3,195,839 4,406,432 109,073 5,011 114,084 Gross real estate assets 18,556,566 $ 11,987,100 $ 30,543,666 $ Unsecured Secured Debt Mortgage Debt Total 7,632,700 $ 3,576,086 $ 11,208,786 $ 67,749 448,103 515,852 208,903 1,566,540 1,775,443 Total debt - at par 7,909,352 5,590,729 13,500,081 (50,099) (312,332) (362,431) Total Prologis share of debt - at par 7,859,253 5,278,397 13,137,650 16,334 49,822 66,156 - (1,733) (1,733) - 6,067 6,067 Total debt, net of premium (discount) 7,875,587 $ 5,332,553 $ 13,208,140 $ New Prologis Indenture Legacy AMB Indenture Debt as % of gross real estate assets Debt/Adjusted EBITDA Unencumbered debt service coverage ratio Outstanding indebtedness to adjusted total assets Maximum consolidated leverage to total asset value Global Line Debt Metrics (A) (B) (C) Fixed charge coverage ratio 2012 Covenants as of December 31, 2012 (A) Minimum net worth Fixed charge coverage ratio Maximum secured debt to adjusted total assets Unencumbered assets ratio to unsecured debt Fixed charge coverage ratio Maximum secured debt to total asset value Unconsolidated development portfolio and land - Prologis' share Operating properties Unconsolidated operating properties - Prologis' share Encumbrances as of December 31, 2012 Secured debt as % of gross real estate assets Unencumbered gross real estate assets to unsecured debt Consolidated: Development portfolio Land Other real estate investments Notes receivable backed by real estate Assets held for sale Our share of premium (discount) - unconsolidated Premium (discount) - consolidated Secured and Unsecured Debt as of December 31, 2012 Prologis debt Consolidated entities debt Our share of unconsolidated entities debt Third party share of consolidated debt premium (discount) Third party share of consolidated debt |

Copyright © 2013 Prologis Supplemental 4Q 2012 Capitalization Assets Under Management 28 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 Europe 26.0% Asia 13.7% $ 30,730 $ 44,751 Debt $13,209 Committed Equity/Investment $1,791 Americas 60.3% $ 44,751 Direct owned and other assets $26,602 Equity Cap $16,939 AUM Private Capital $18,149 Preferred Shares $582 Investors' share of assets in JVs/funds $12,230 Prologis share of assets in JVs/funds $4,128 Total Enterprise Value $30,730 Total Enterprise Value Total AUM by Division Assets Under Management (dollars in millions) |