Prologis Supplemental Information Third Quarter 2020 Unaudited Prologis Park Lehigh Valley West 52, Breinigsville, Pennsylvania

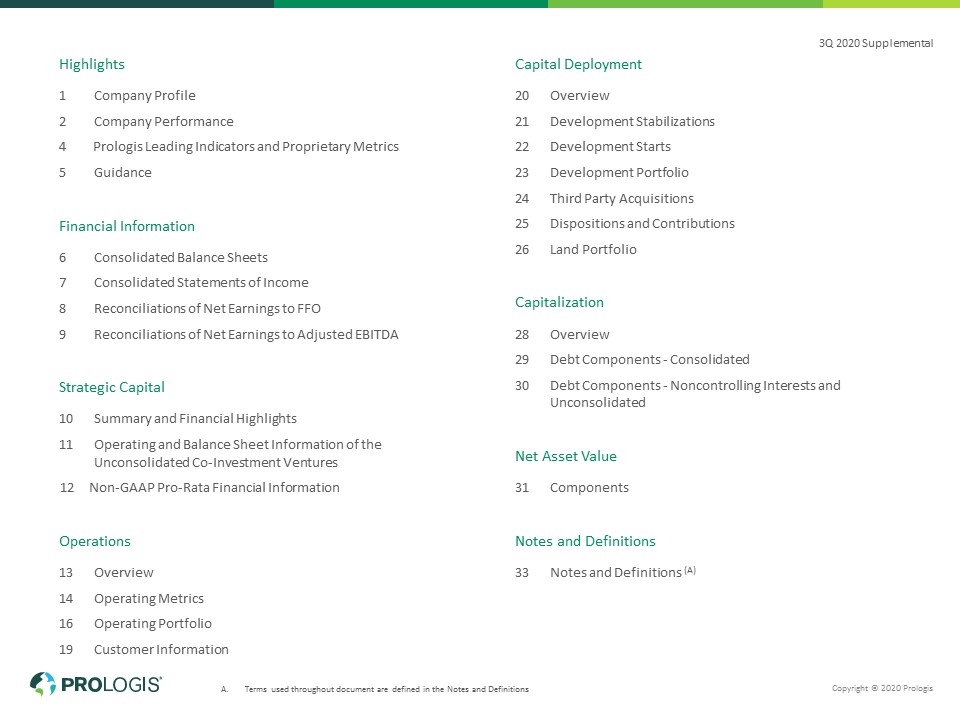

3Q 2020 Supplemental Highlights 1Company Profile 2Company Performance 4 Prologis Leading Indicators and Proprietary Metrics 5Guidance Financial Information 6Consolidated Balance Sheets 7Consolidated Statements of Income 8Reconciliations of Net Earnings to FFO 9Reconciliations of Net Earnings to Adjusted EBITDA Strategic Capital 10Summary and Financial Highlights 11 Operating and Balance Sheet Information of the Unconsolidated Co-Investment Ventures 12 Non-GAAP Pro-Rata Financial Information Operations 13Overview 14Operating Metrics 16Operating Portfolio 19Customer Information Capital Deployment 20Overview 21Development Stabilizations 22Development Starts 23Development Portfolio 24Third Party Acquisitions 25Dispositions and Contributions 26Land Portfolio Capitalization 28Overview 29Debt Components - Consolidated 30Debt Components - Noncontrolling Interests and Unconsolidated Net Asset Value 31Components Notes and Definitions 33Notes and Definitions (A) Terms used throughout document are defined in the Notes and Definitions Copyright © 2020 Prologis

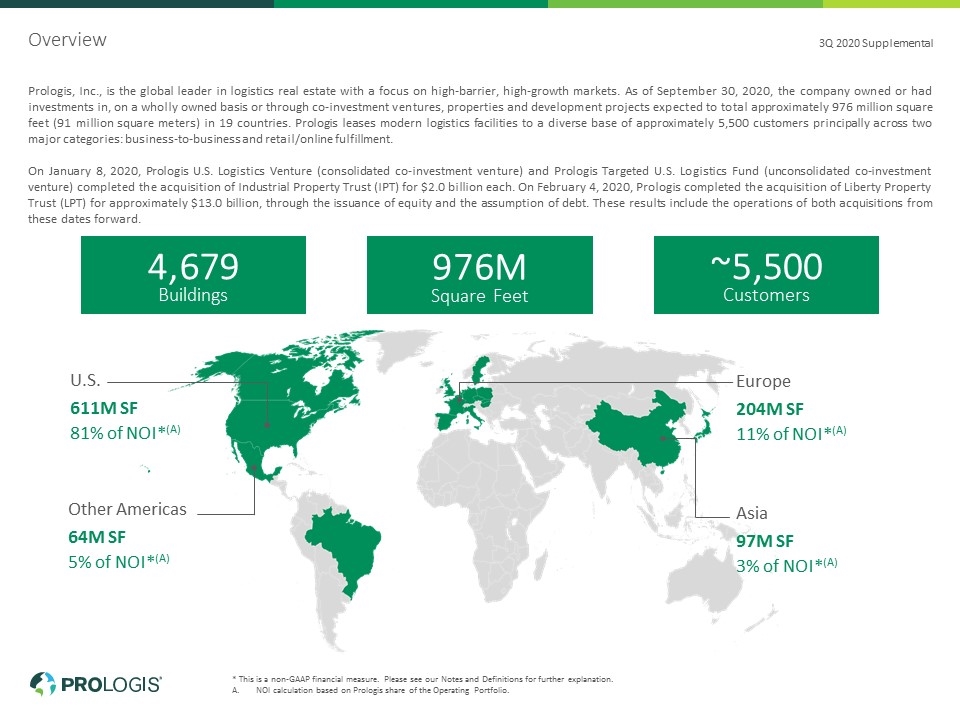

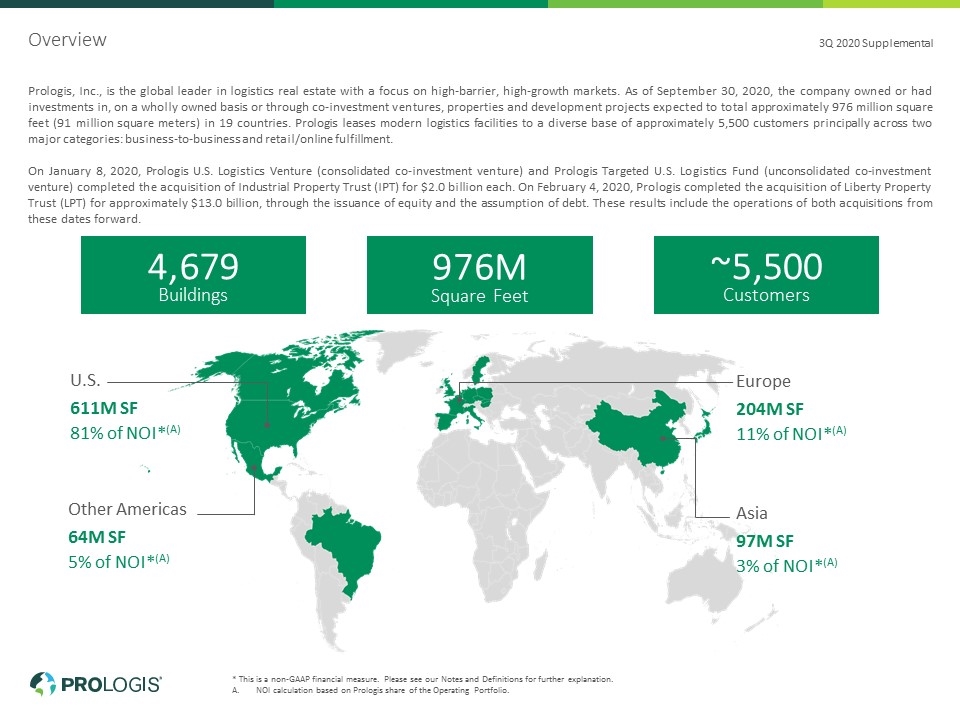

4,679 Buildings Overview * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. NOI calculation based on Prologis share of the Operating Portfolio. 3Q 2020 Supplemental Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of September 30, 2020, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 976 million square feet (91 million square meters) in 19 countries. Prologis leases modern logistics facilities to a diverse base of approximately 5,500 customers principally across two major categories: business-to-business and retail/online fulfillment. On January 8, 2020, Prologis U.S. Logistics Venture (consolidated co-investment venture) and Prologis Targeted U.S. Logistics Fund (unconsolidated co-investment venture) completed the acquisition of Industrial Property Trust (IPT) for $2.0 billion each. On February 4, 2020, Prologis completed the acquisition of Liberty Property Trust (LPT) for approximately $13.0 billion, through the issuance of equity and the assumption of debt. These results include the operations of both acquisitions from these dates forward. 976M Square Feet ~5,500 Customers U.S. 611M SF 81% of NOI*(A) Other Americas 64M SF 5% of NOI*(A) Europe 204M SF 11% of NOI*(A) Asia 97M SF 3% of NOI*(A)

Highlights * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. 3Q 2020 Prologis Share of NOI of the Operating Portfolio annualized. 3Q 2020 third-party share of asset management fees annualized plus trailing twelve month third-party share of transaction fees and net promotes. Prologis Share of trailing twelve month Estimated Value Creation from development stabilizations. Mexico is included in the U.S. as it is U.S. dollar functional. Company Profile 1 3Q 2020 Supplemental Operations $3.0B in annual NOI*(A) Development $878M in value creation from stabilizations(C) Gross AUM $145B(D) Prologis Share AUM $96B(D) Market Equity $76B(D) Strategic capital $ 460M of fees and promotes(B)

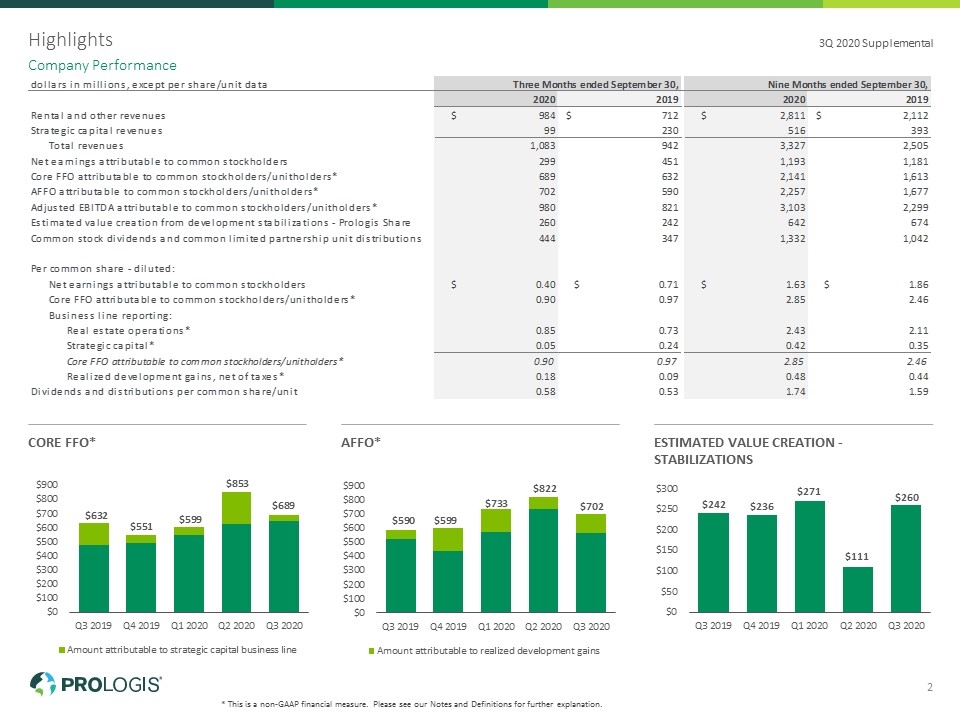

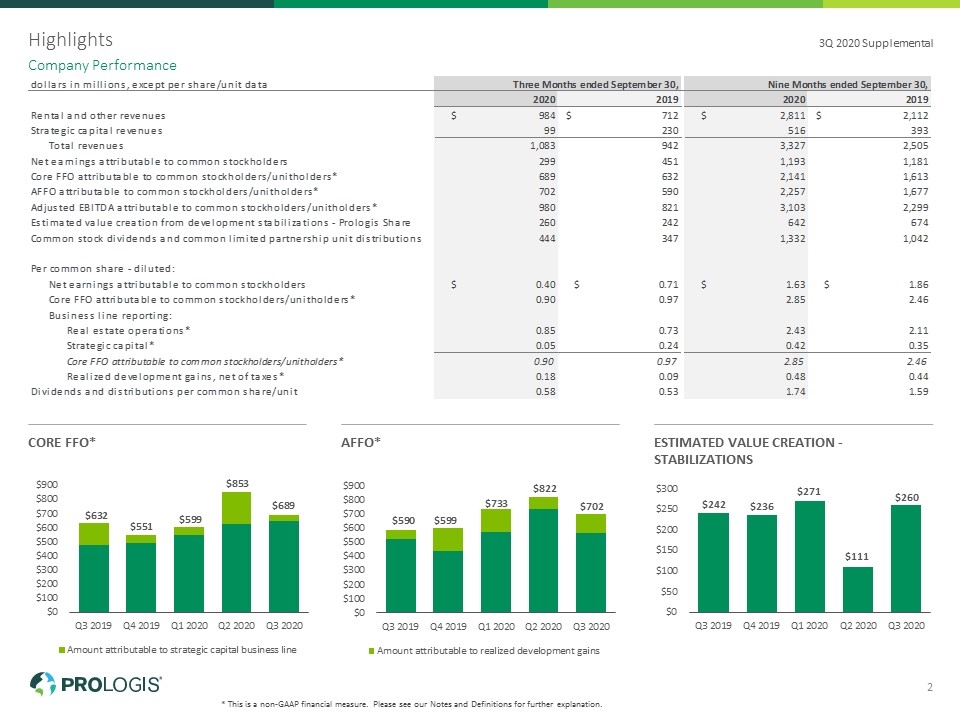

Highlights * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Company Performance 3Q 2020 Supplemental 2 Core FFO* AFFO* Estimated Value Creation - Stabilizations

* This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Core FFO* in millions AFFO* in millions Estimated Value Creation in millions Asset Management Fees and Net Promotes in millions Highlights Company Performance 3Q 2020 Supplemental 3

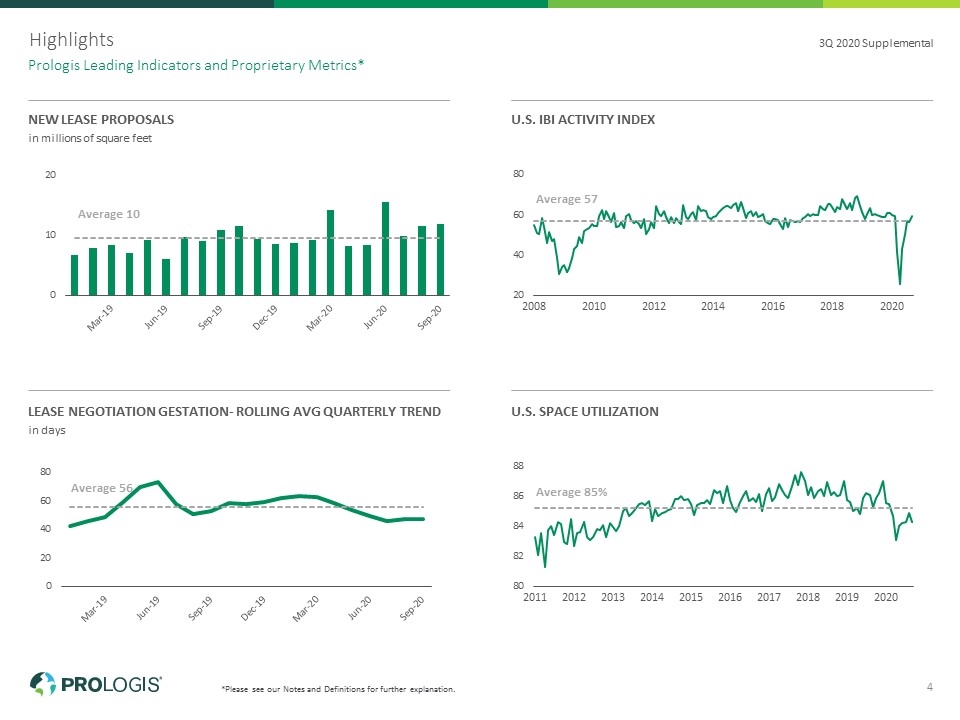

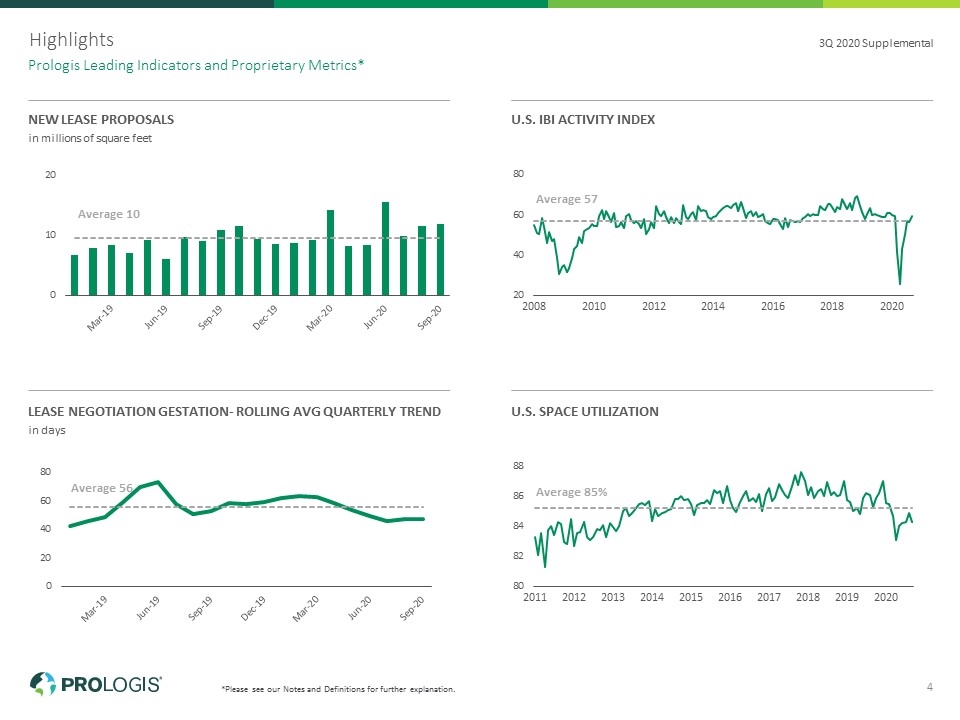

*Please see our Notes and Definitions for further explanation. New Lease Proposals in millions of square feet U.s. IBI activity index Lease negotiation Gestation- rolling Avg quarterly trend in days U.S. space utilization Highlights Prologis Leading Indicators and Proprietary Metrics* 3Q 2020 Supplemental 4 Average 10

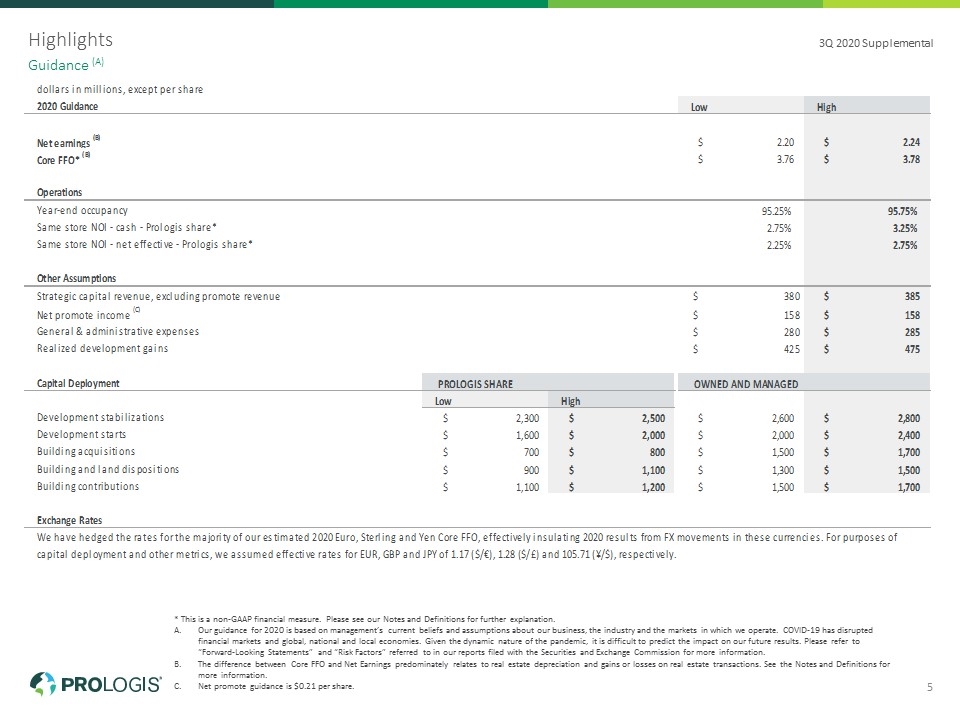

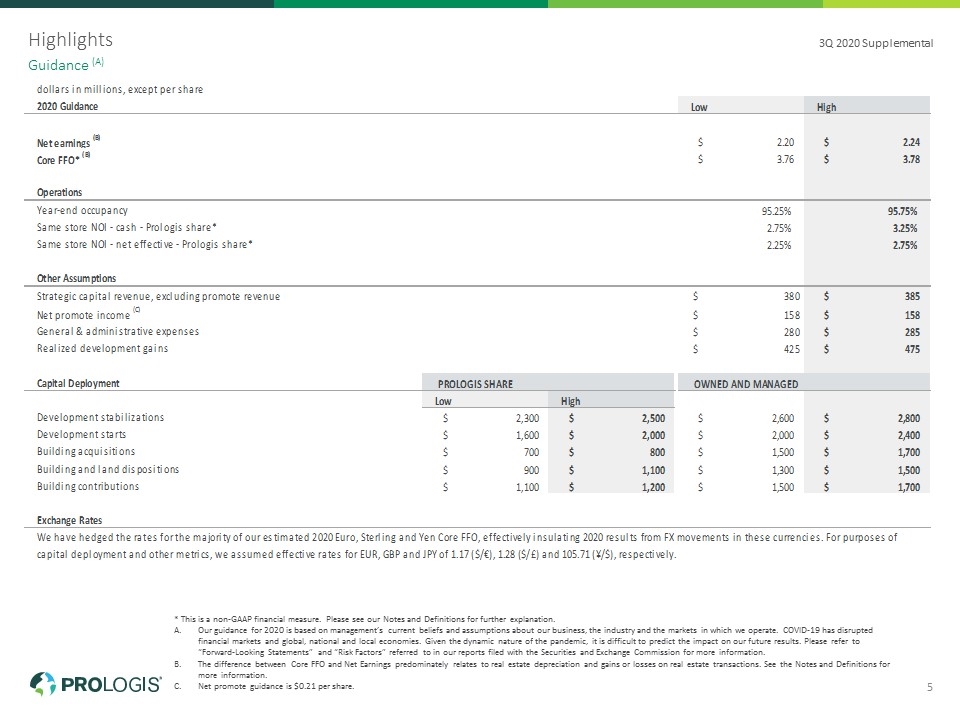

Highlights * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Our guidance for 2020 is based on management’s current beliefs and assumptions about our business, the industry and the markets in which we operate. COVID-19 has disrupted financial markets and global, national and local economies. Given the dynamic nature of the pandemic, it is difficult to predict the impact on our future results. Please refer to “Forward-Looking Statements” and “Risk Factors” referred to in our reports filed with the Securities and Exchange Commission for more information. The difference between Core FFO and Net Earnings predominately relates to real estate depreciation and gains or losses on real estate transactions. See the Notes and Definitions for more information. Net promote guidance is $0.21 per share. Guidance (A) 3Q 2020 Supplemental 5

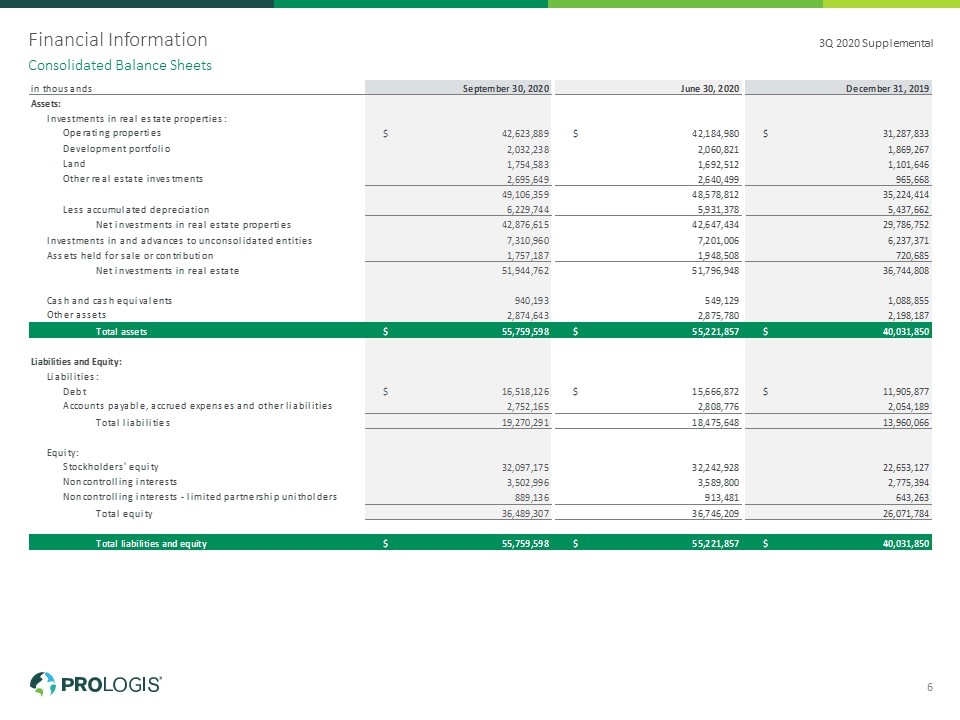

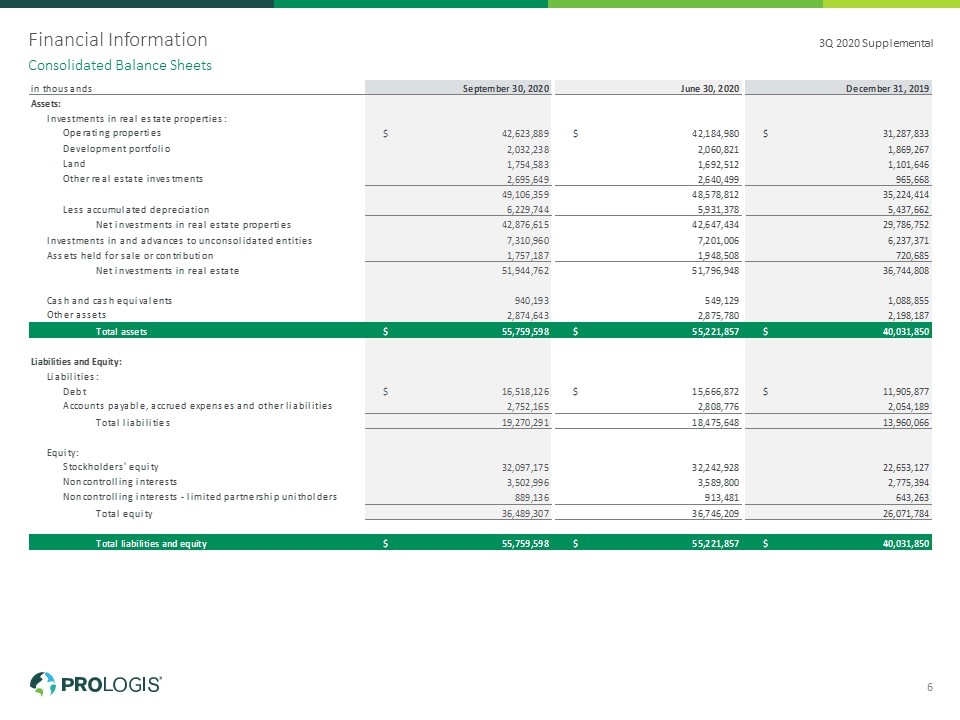

Financial Information Consolidated Balance Sheets 3Q 2020 Supplemental 6

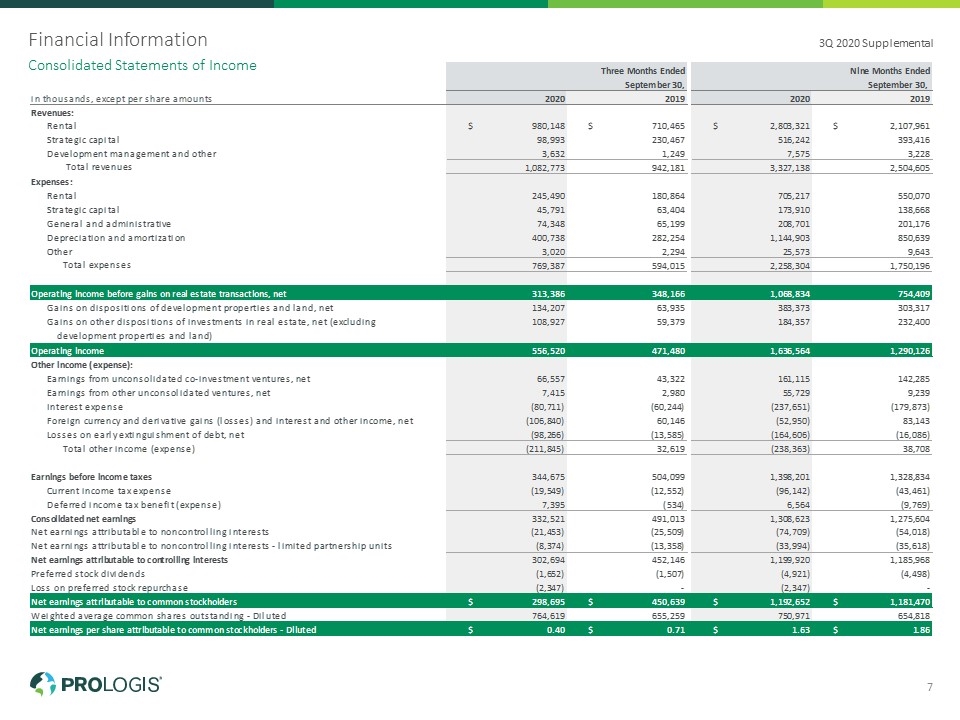

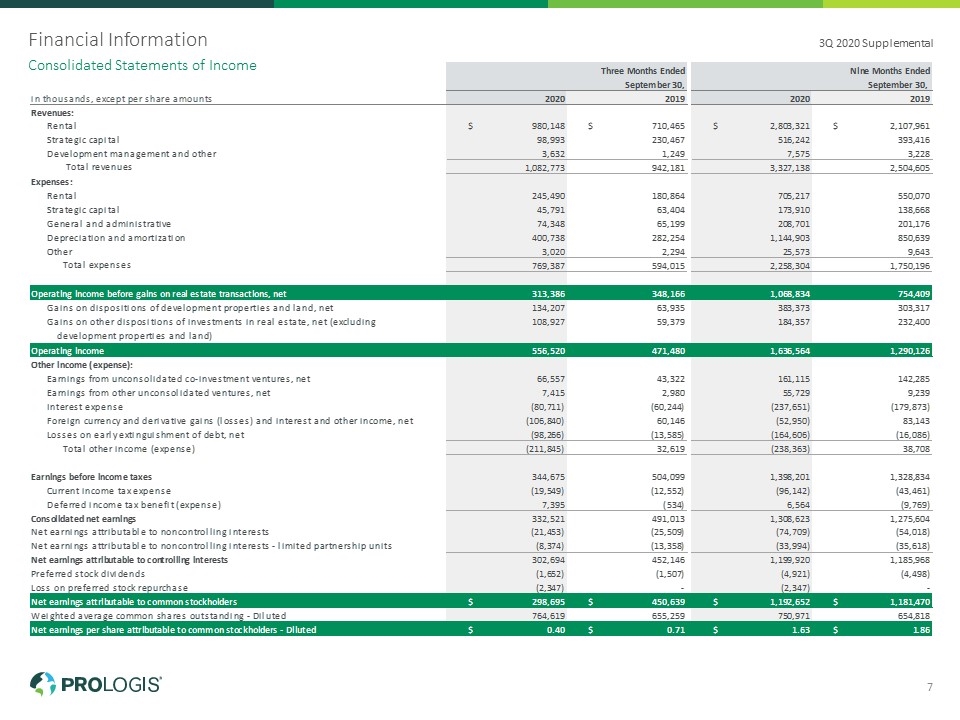

Financial Information Consolidated Statements of Income 3Q 2020 Supplemental 7

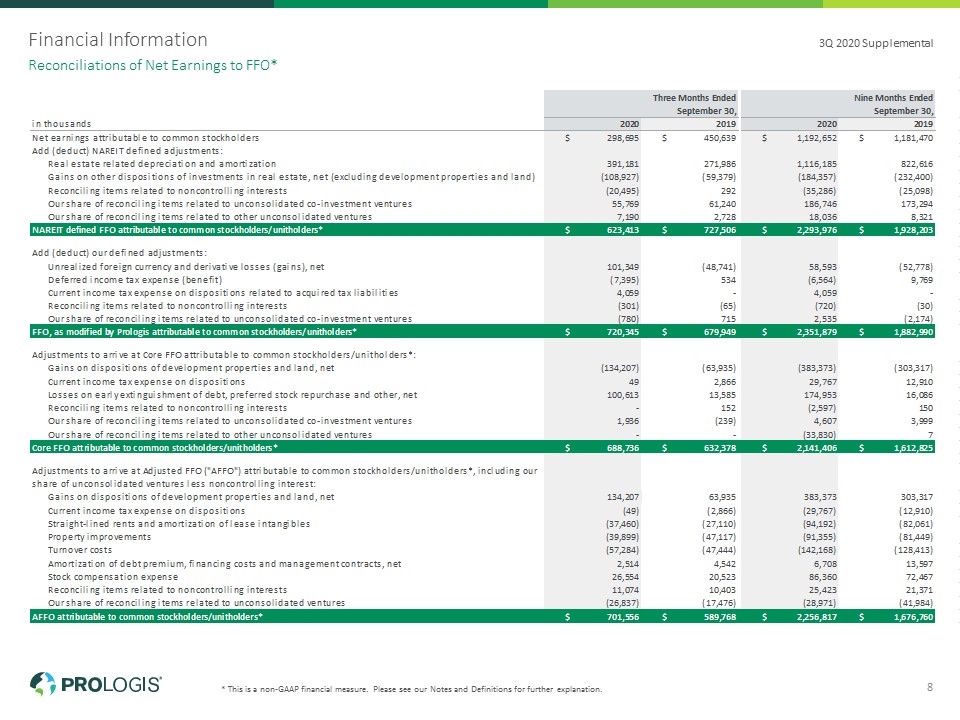

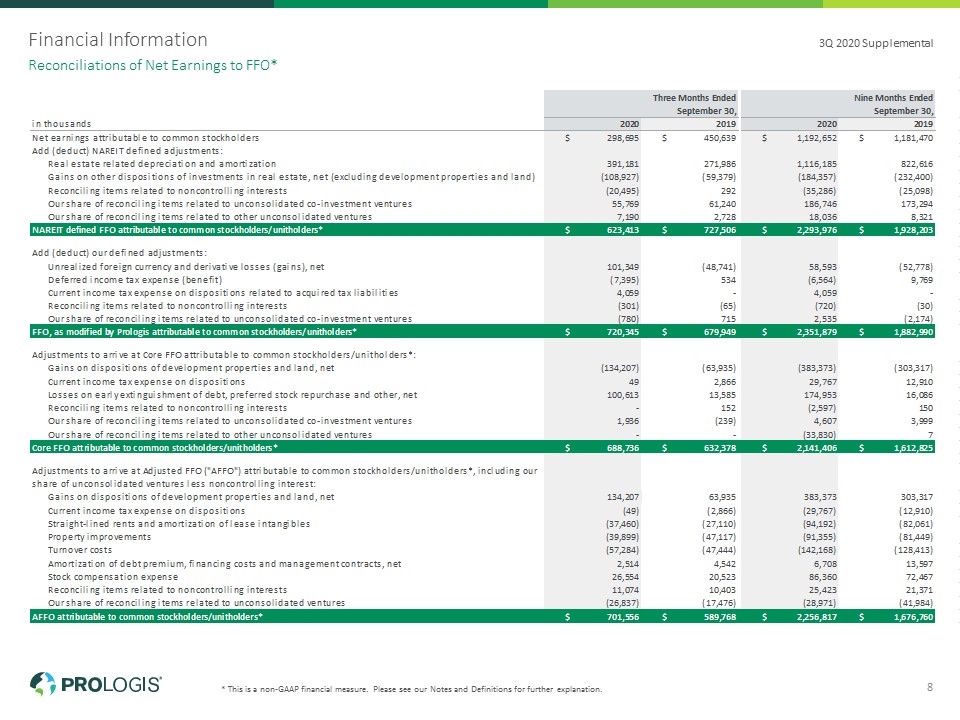

Financial Information * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Reconciliations of Net Earnings to FFO* 3Q 2020 Supplemental 8

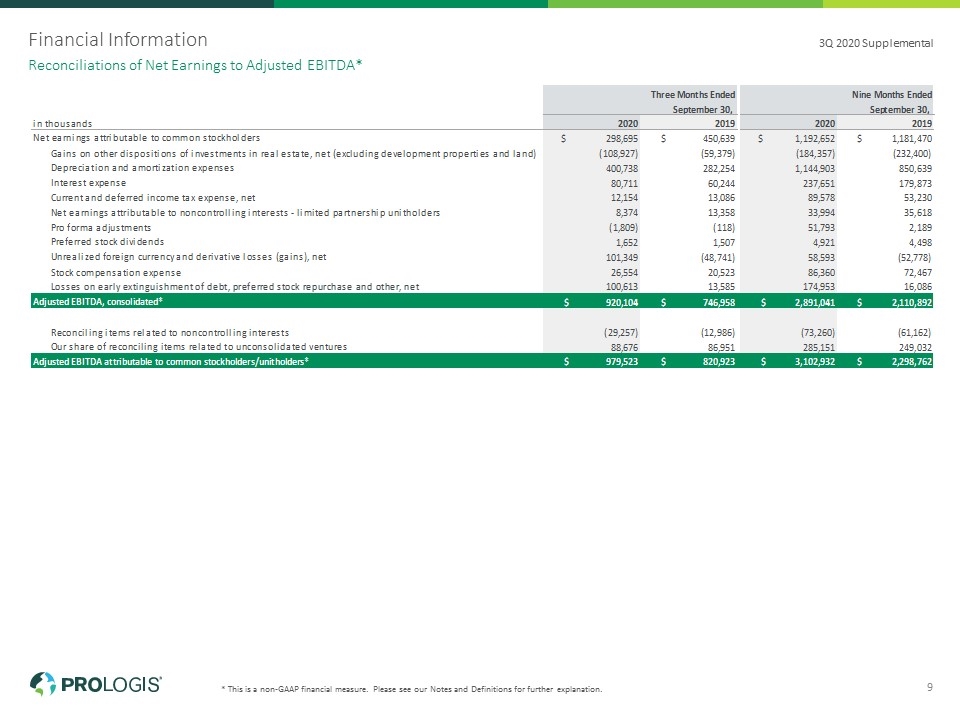

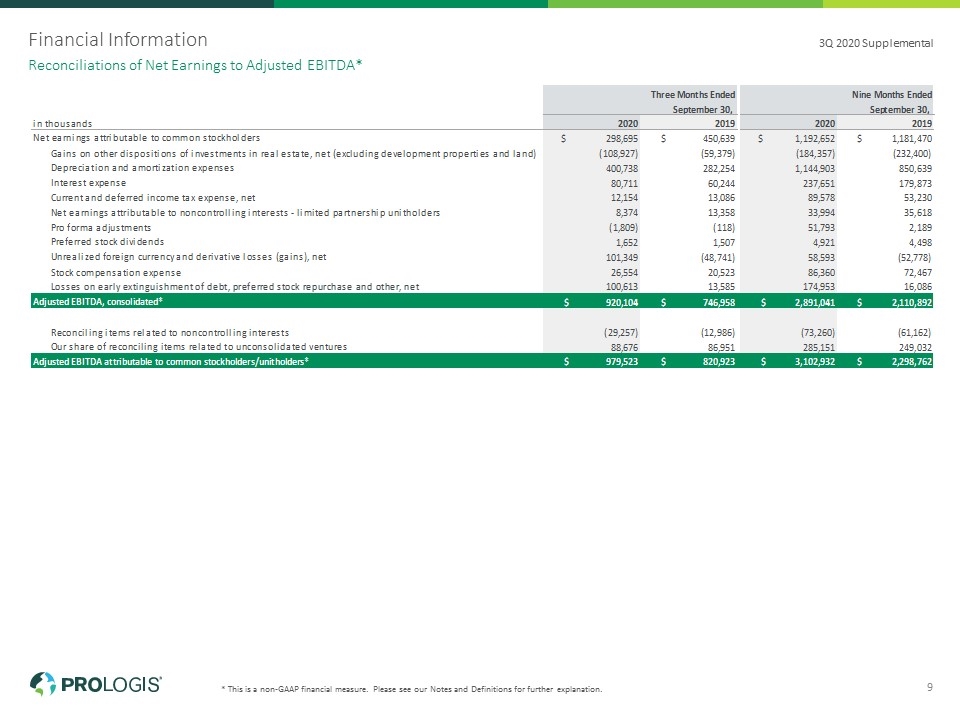

Financial Information * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Reconciliations of Net Earnings to Adjusted EBITDA* 3Q 2020 Supplemental 9

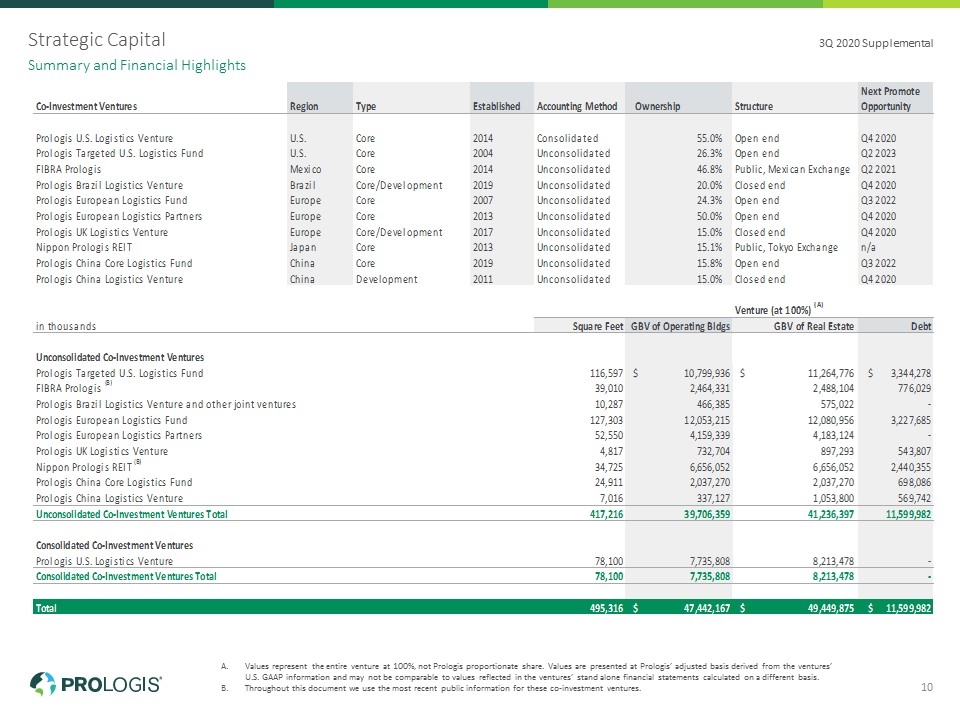

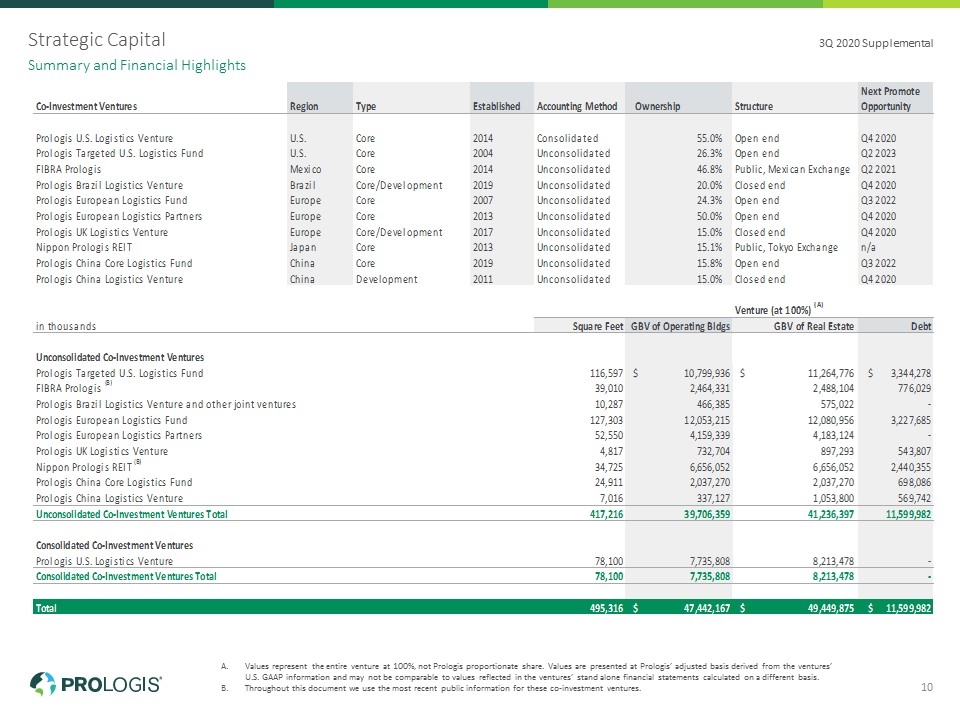

Strategic Capital Values represent the entire venture at 100%, not Prologis proportionate share. Values are presented at Prologis’ adjusted basis derived from the ventures’ U.S. GAAP information and may not be comparable to values reflected in the ventures’ stand alone financial statements calculated on a different basis. Throughout this document we use the most recent public information for these co-investment ventures. Summary and Financial Highlights 3Q 2020 Supplemental 10

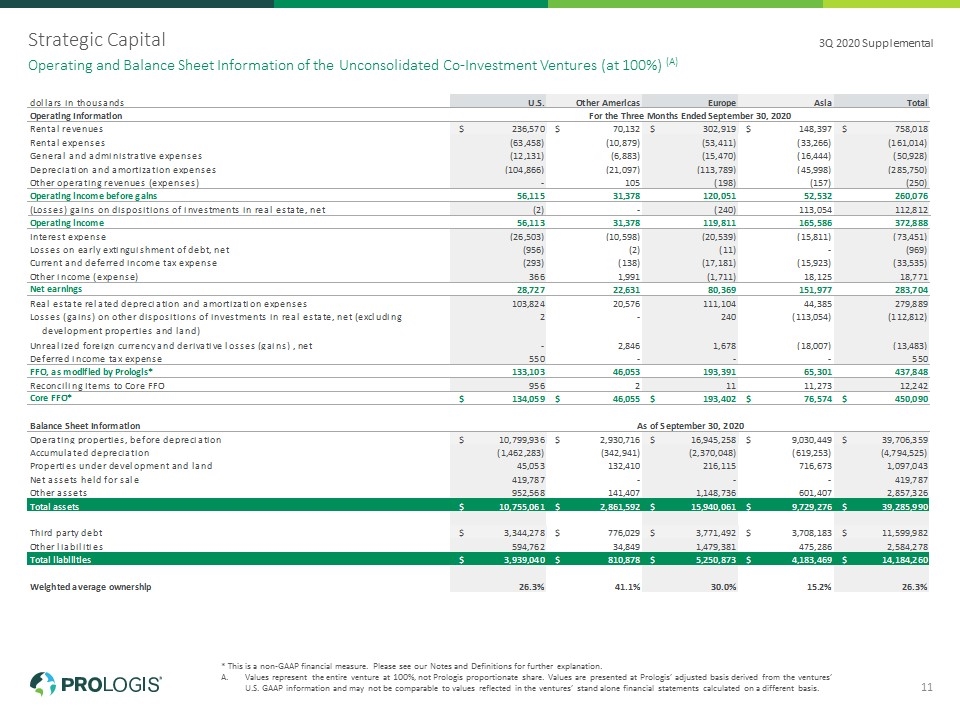

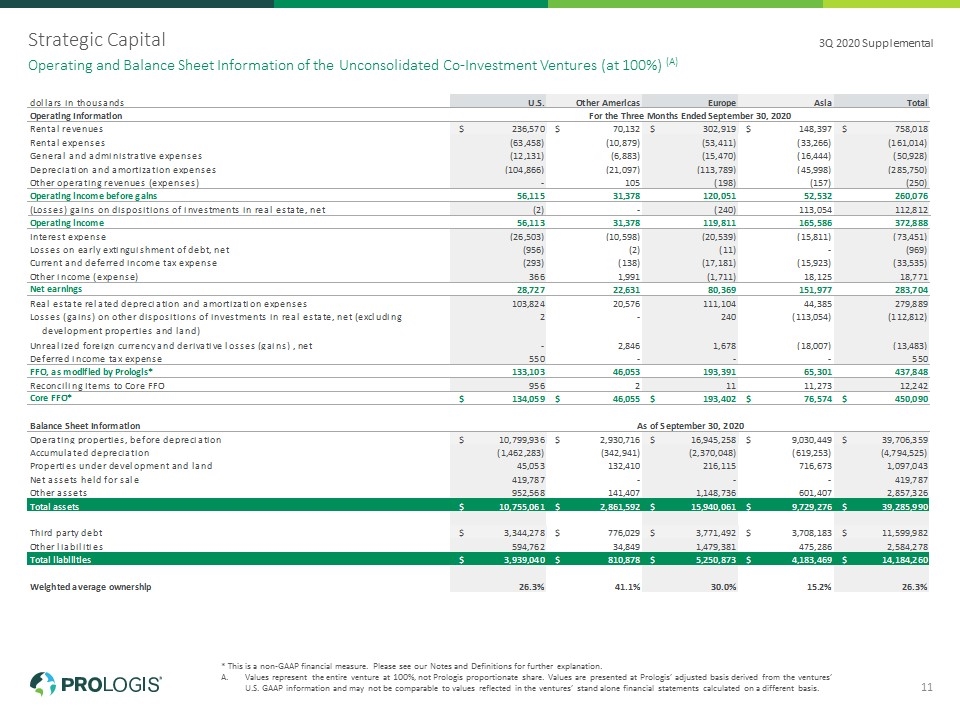

Strategic Capital * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Values represent the entire venture at 100%, not Prologis proportionate share. Values are presented at Prologis’ adjusted basis derived from the ventures’ U.S. GAAP information and may not be comparable to values reflected in the ventures’ stand alone financial statements calculated on a different basis. Operating and Balance Sheet Information of the Unconsolidated Co-Investment Ventures (at 100%) (A) 3Q 2020 Supplemental 11

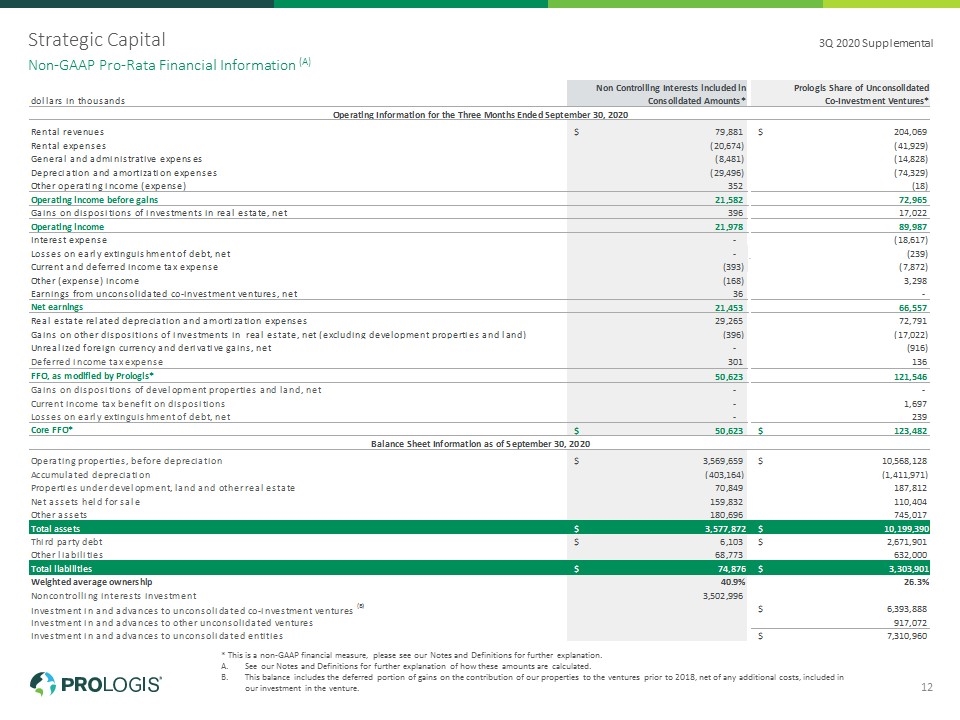

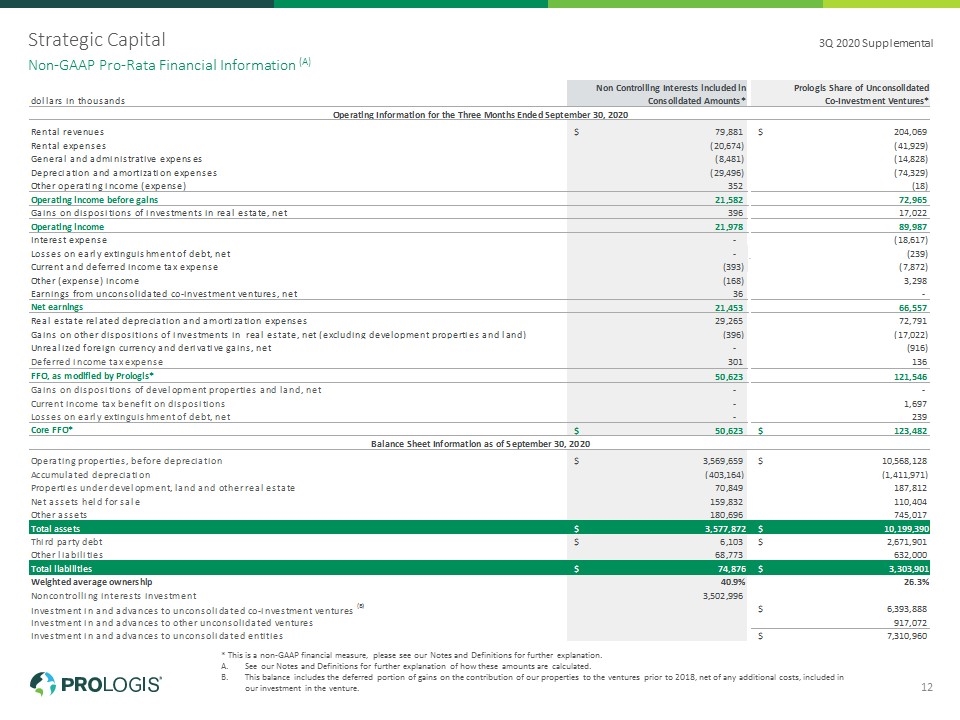

Strategic Capital * This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. See our Notes and Definitions for further explanation of how these amounts are calculated. This balance includes the deferred portion of gains on the contribution of our properties to the ventures prior to 2018, net of any additional costs, included in our investment in the venture. Non-GAAP Pro-Rata Financial Information (A) 3Q 2020 Supplemental 12

* This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Occupancy Customer Retention Same Store Change Over Prior Year – Prologis Share* Rent Change – Prologis Share Operations Overview 3Q 2020 Supplemental 13 Trailing four quarters – net effective

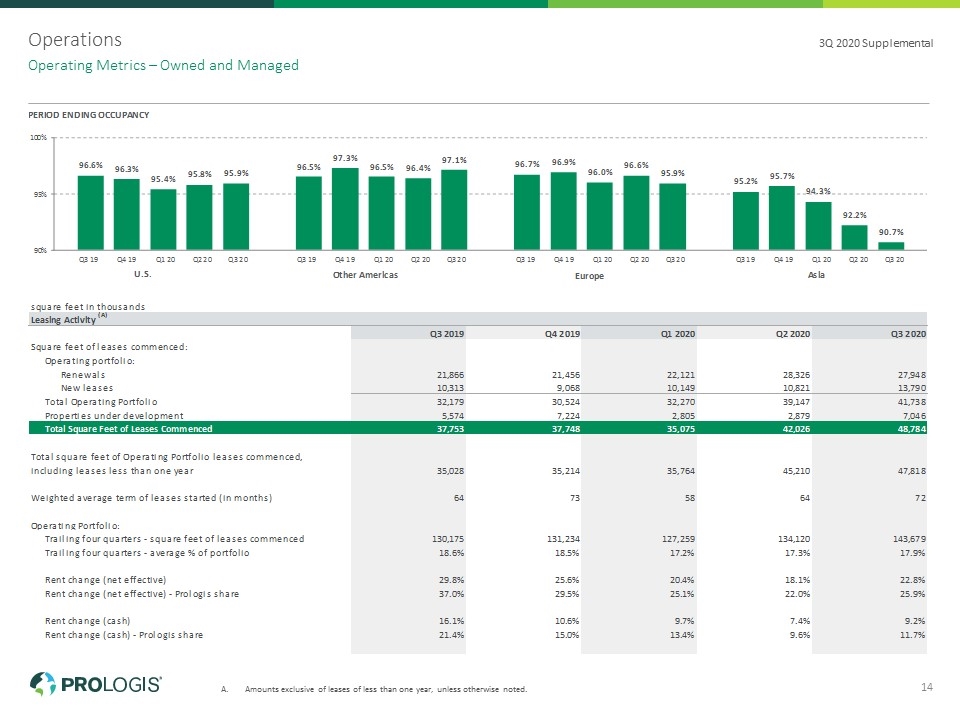

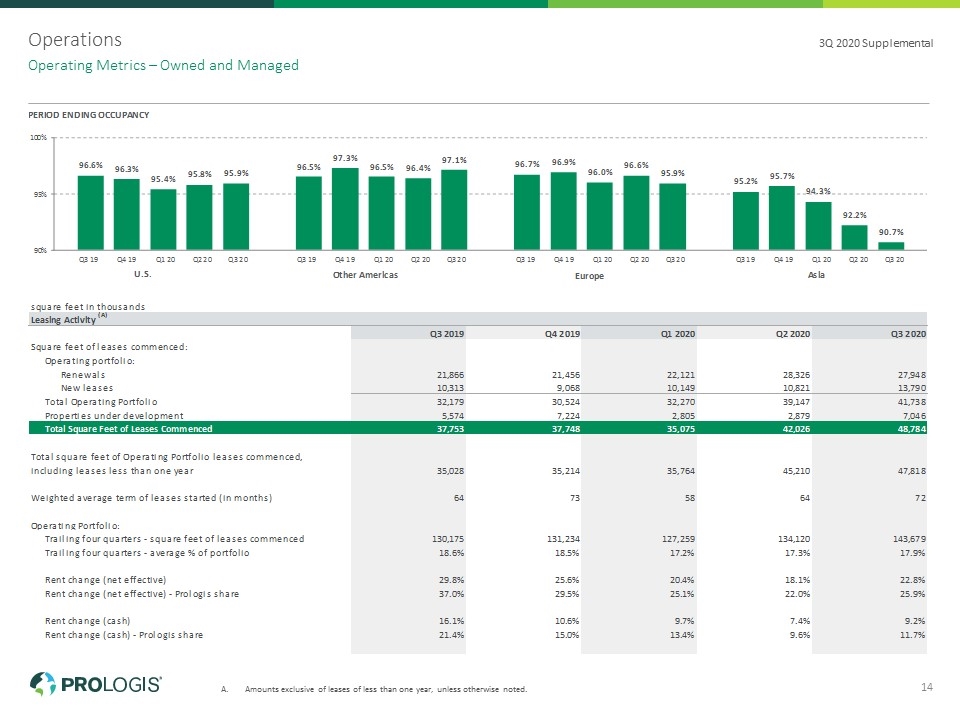

Operations Amounts exclusive of leases of less than one year, unless otherwise noted. Operating Metrics – Owned and Managed 3Q 2020 Supplemental 14

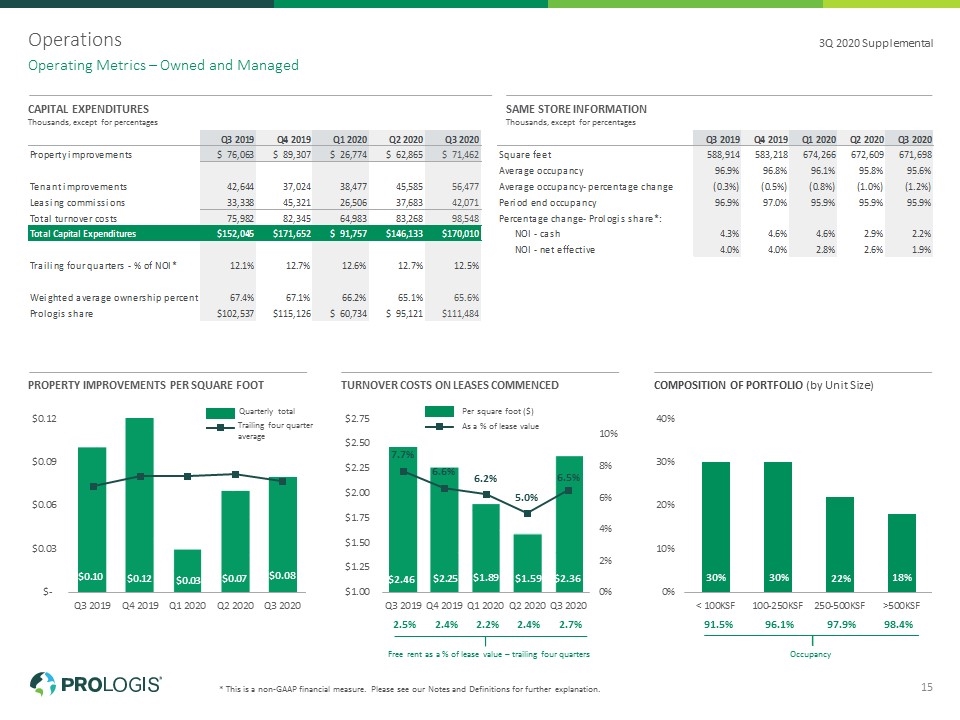

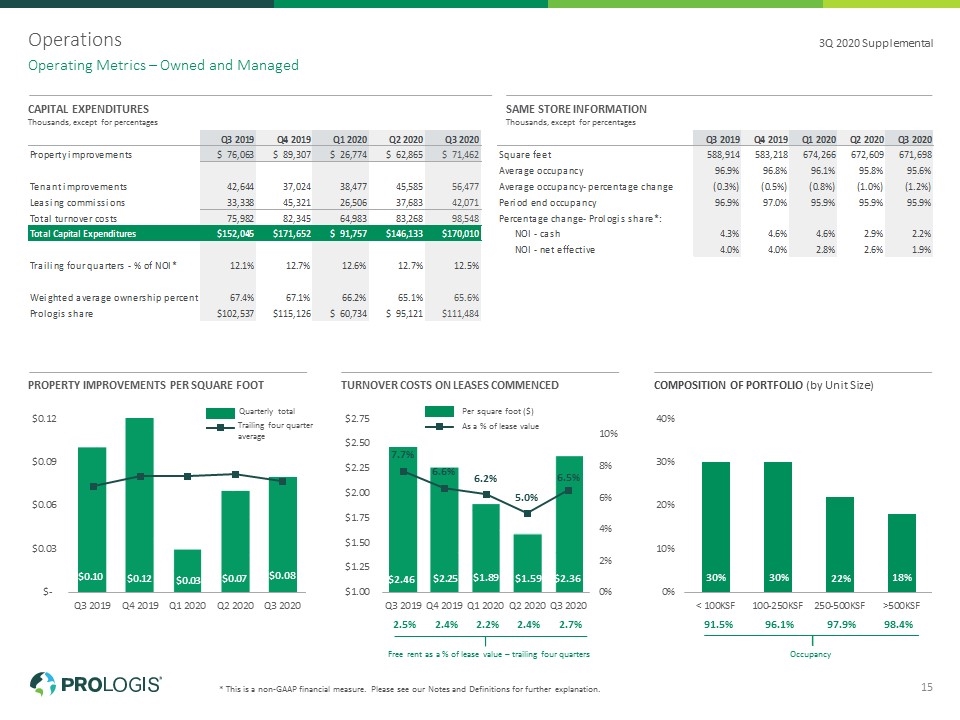

Operations * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Operating Metrics – Owned and Managed 3Q 2020 Supplemental 15 CAPITAL EXPENDITURES Thousands, except for percentages SAME STORE INFORMATION Thousands, except for percentages PROPERTY IMPROVEMENTS PER SQUARE FOOT TURNOVER COSTS ON LEASES COMMENCED COMPOSITION OF PORTFOLIO (by Unit Size) Free rent as a % of lease value – trailing four quarters 2.5% 2.4% 2.2% 2.4% 2.7% Occupancy 91.5% 96.1% 97.9% 98.4% Trailing four quarter average Quarterly total As a % of lease value Per square foot ($)

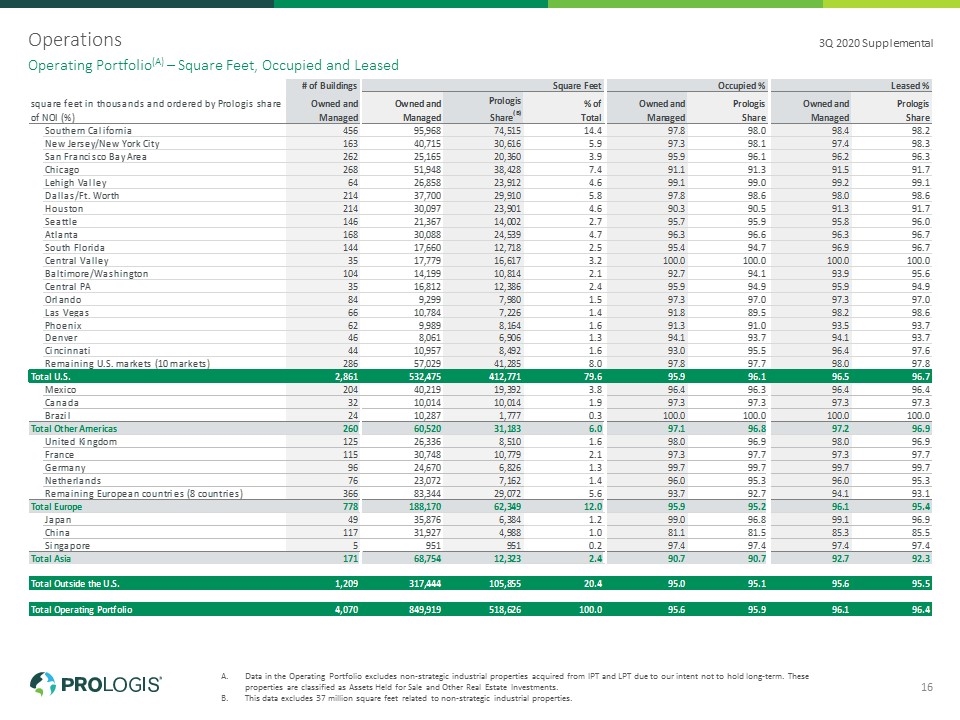

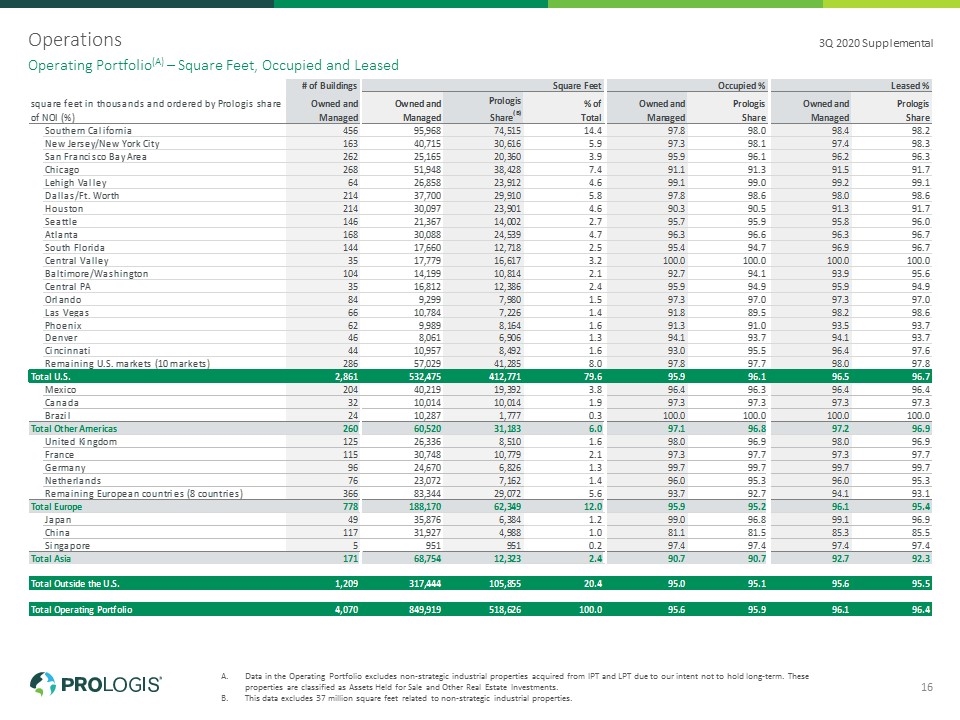

Operations Operating Portfolio(A) – Square Feet, Occupied and Leased 3Q 2020 Supplemental 16 Data in the Operating Portfolio excludes non-strategic industrial properties acquired from IPT and LPT due to our intent not to hold long-term. These properties are classified as Assets Held for Sale and Other Real Estate Investments. This data excludes 37 million square feet related to non-strategic industrial properties.

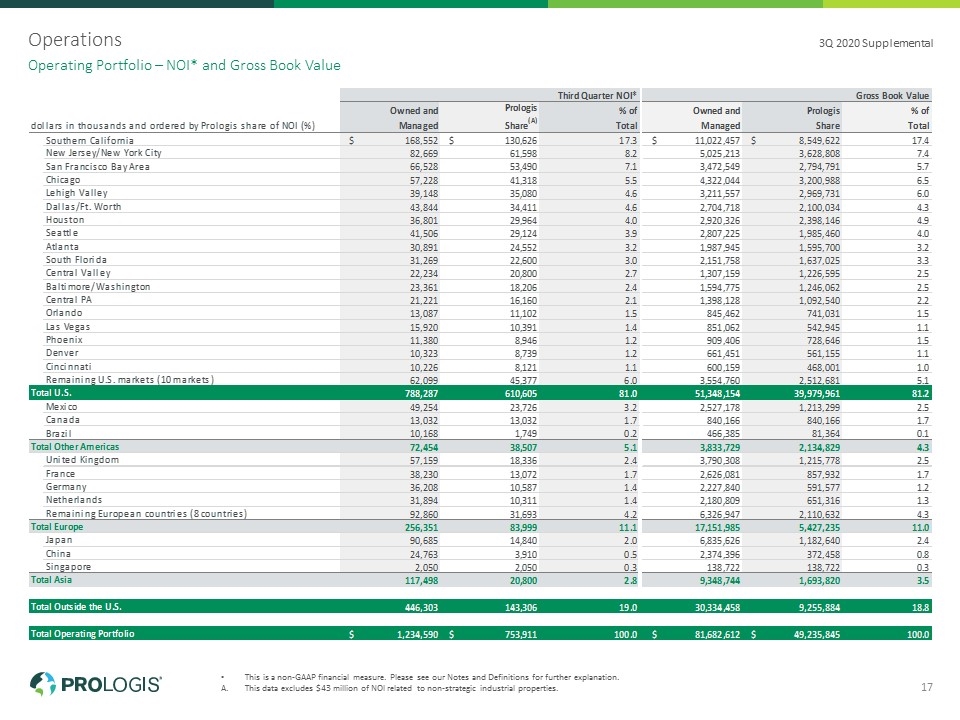

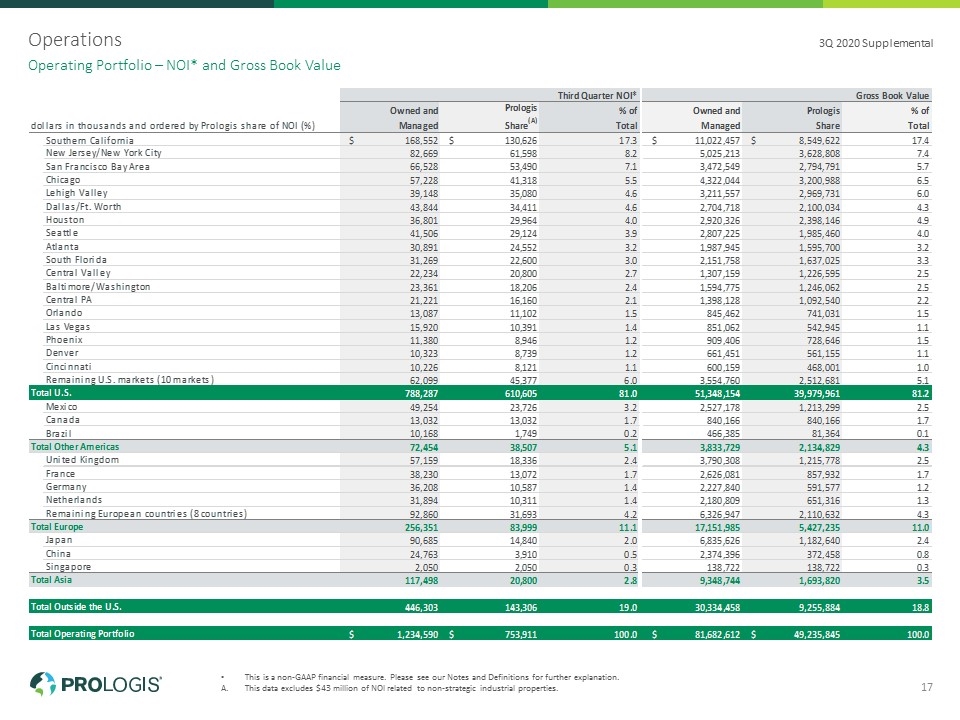

Operations This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. This data excludes $43 million of NOI related to non-strategic industrial properties. Operating Portfolio – NOI* and Gross Book Value 3Q 2020 Supplemental 17

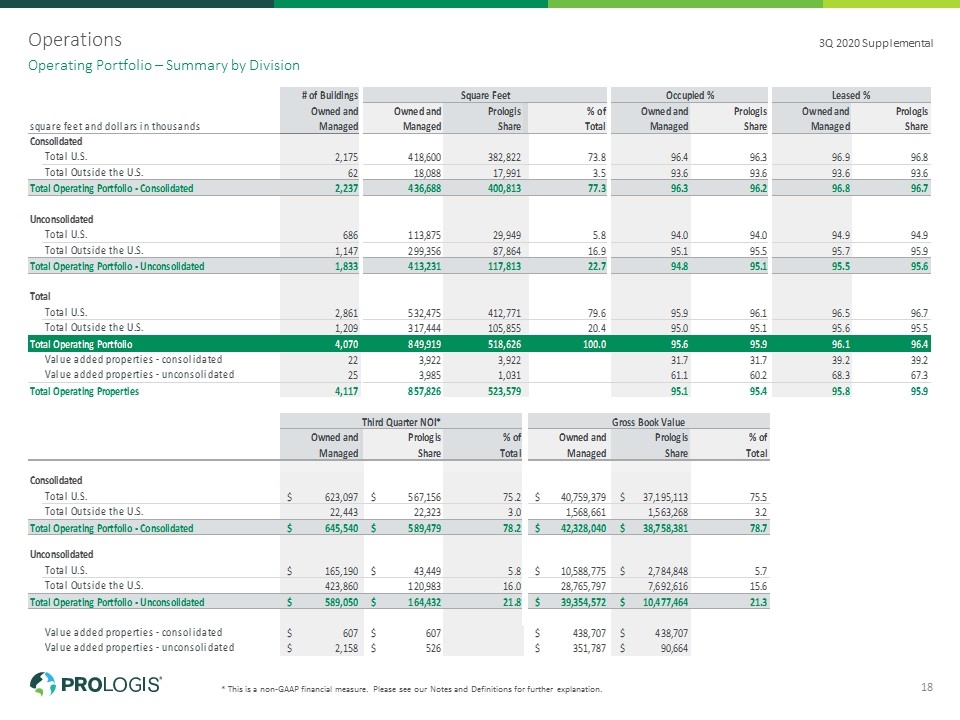

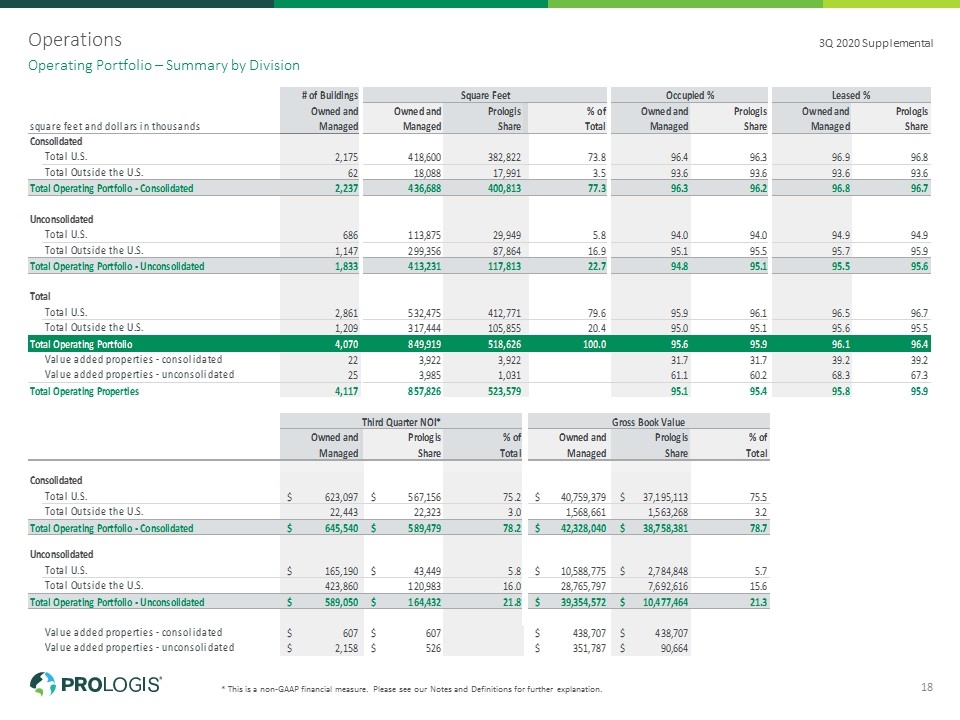

Operations * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Operating Portfolio – Summary by Division 3Q 2020 Supplemental 18

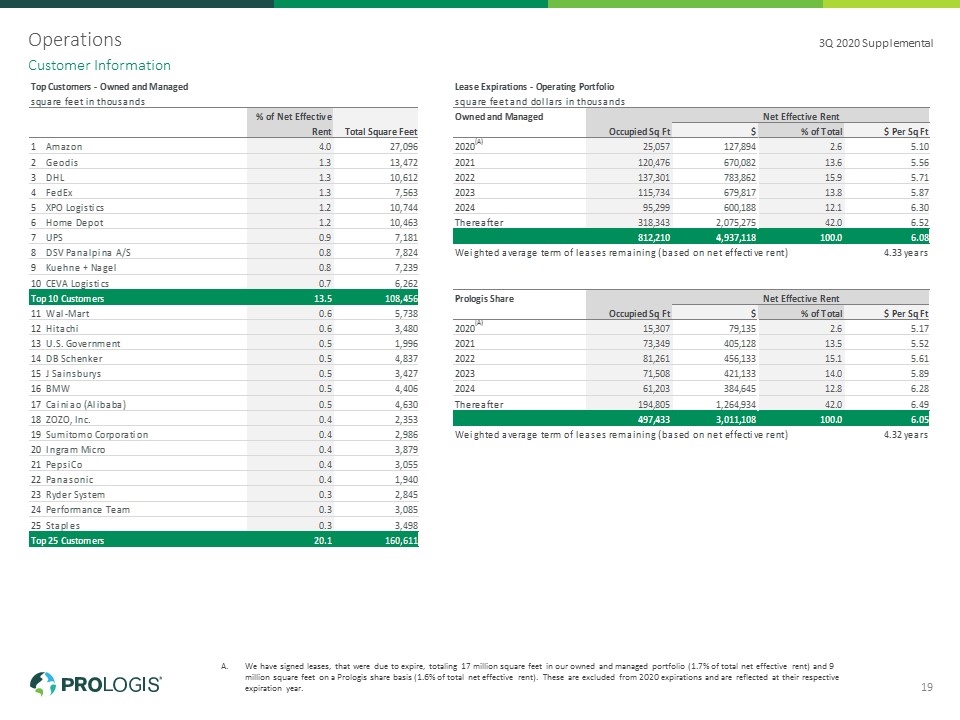

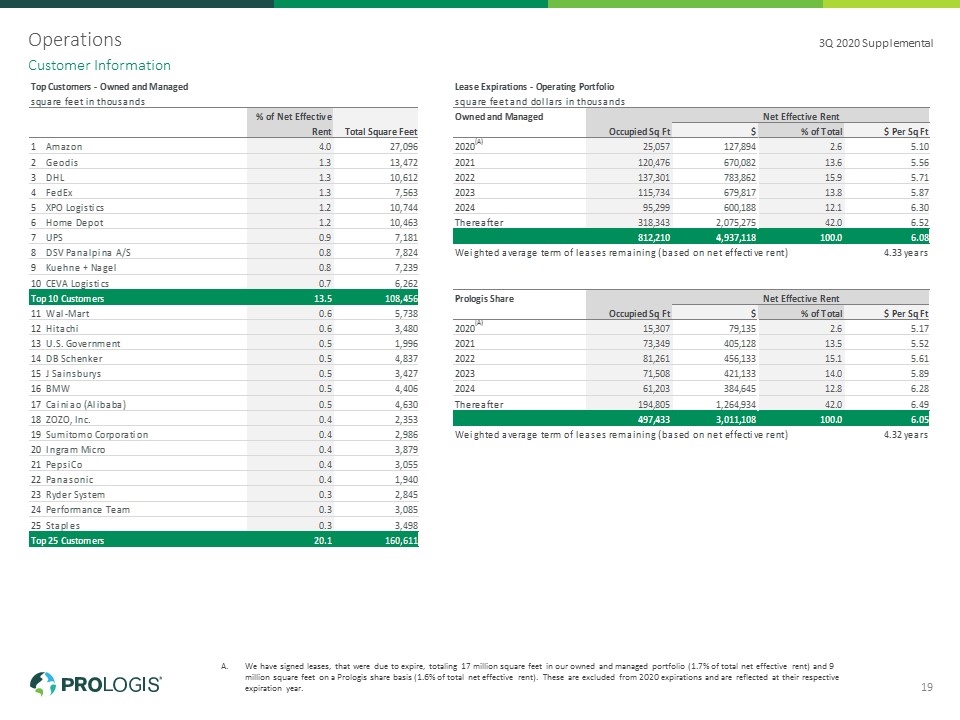

Operations We have signed leases, that were due to expire, totaling 17 million square feet in our owned and managed portfolio (1.7% of total net effective rent) and 9 million square feet on a Prologis share basis (1.6% of total net effective rent). These are excluded from 2020 expirations and are reflected at their respective expiration year. Customer Information 3Q 2020 Supplemental 19

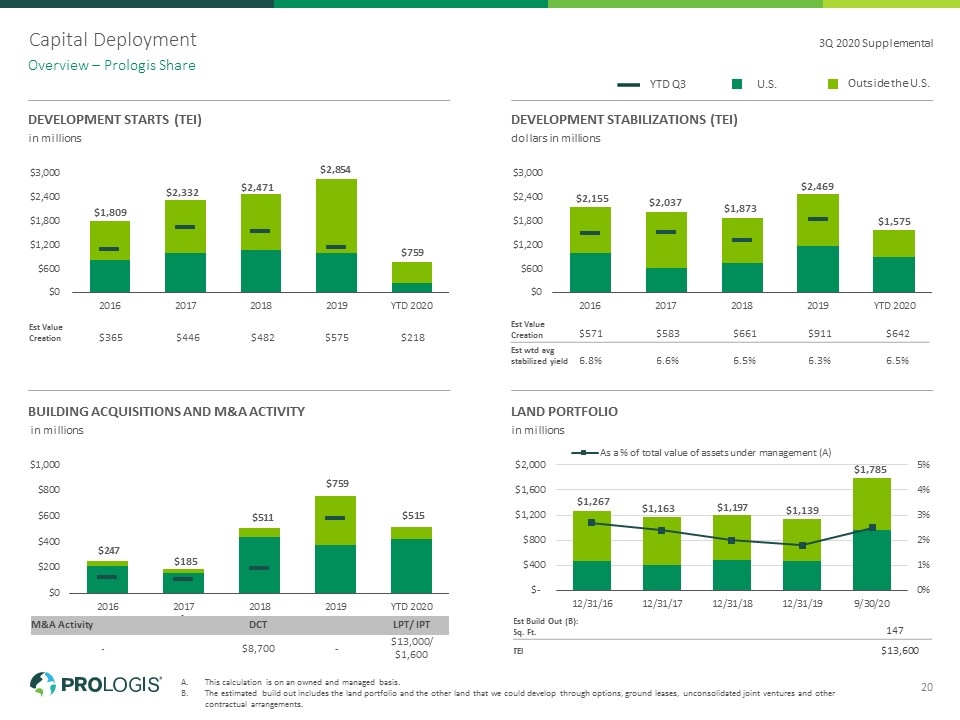

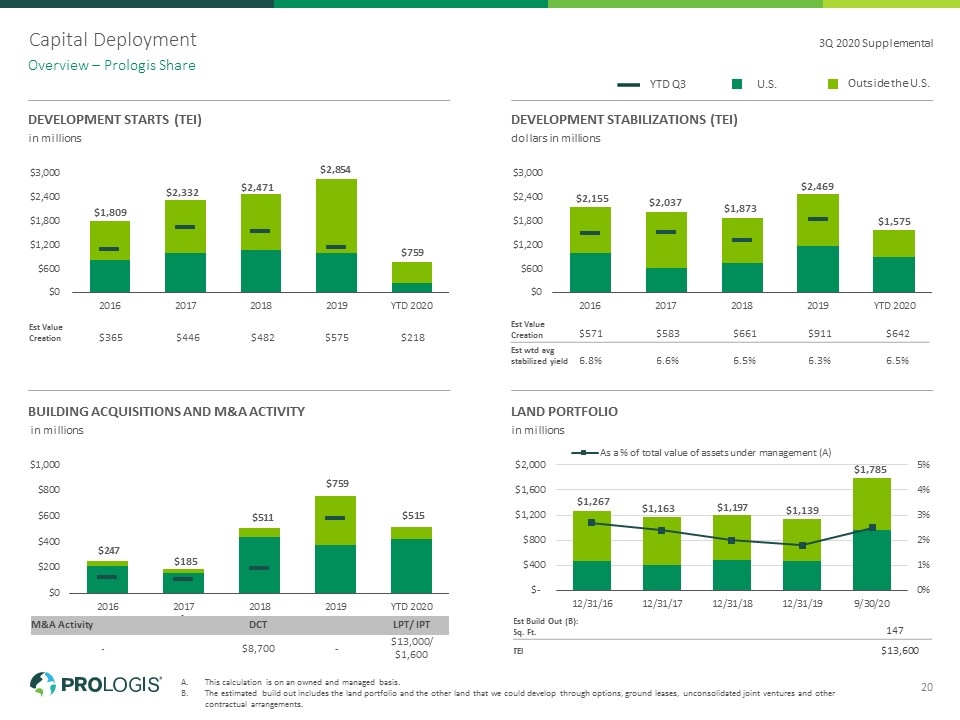

M&A Activity DCT LPT/ IPT - $8,700 - $13,000/ $1,600 Development Starts (TEI) in millions Development Stabilizations (TEI) dollars in millions Building Acquisitions and M&A Activity Land Portfolio in millions Capital Deployment Overview – Prologis Share 3Q 2020 Supplemental 20 Outside the U.S. U.S. Est Value Creation $571 $583 $661 $911 $642 Est wtd avg stabilized yield 6.8% 6.6% 6.5% 6.3% 6.5% Est Value Creation $365 $446 $482 $575 $218 - This calculation is on an owned and managed basis. The estimated build out includes the land portfolio and the other land that we could develop through options, ground leases, unconsolidated joint ventures and other contractual arrangements. Est Build Out (B): Sq. Ft. 147 TEI $13,600 YTD Q3 in millions

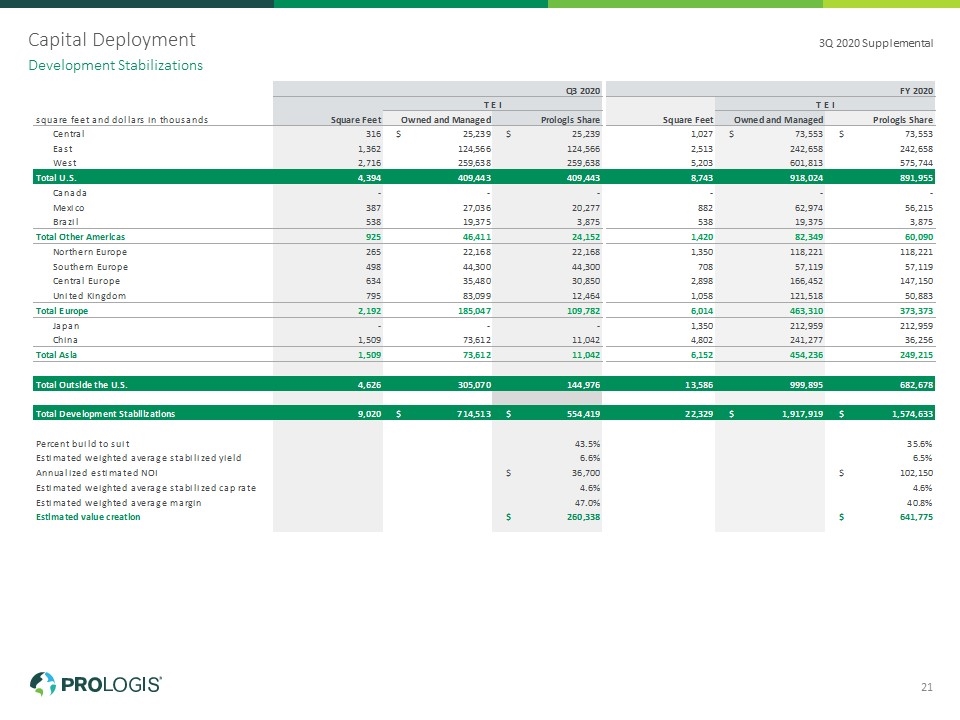

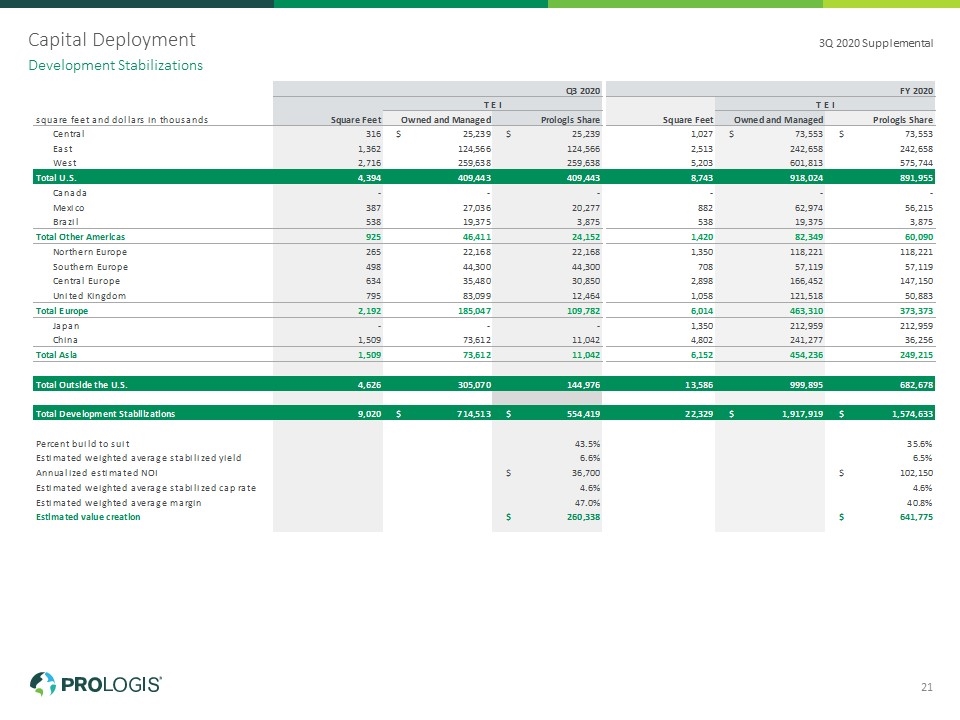

Capital Deployment Development Stabilizations 3Q 2020 Supplemental 21

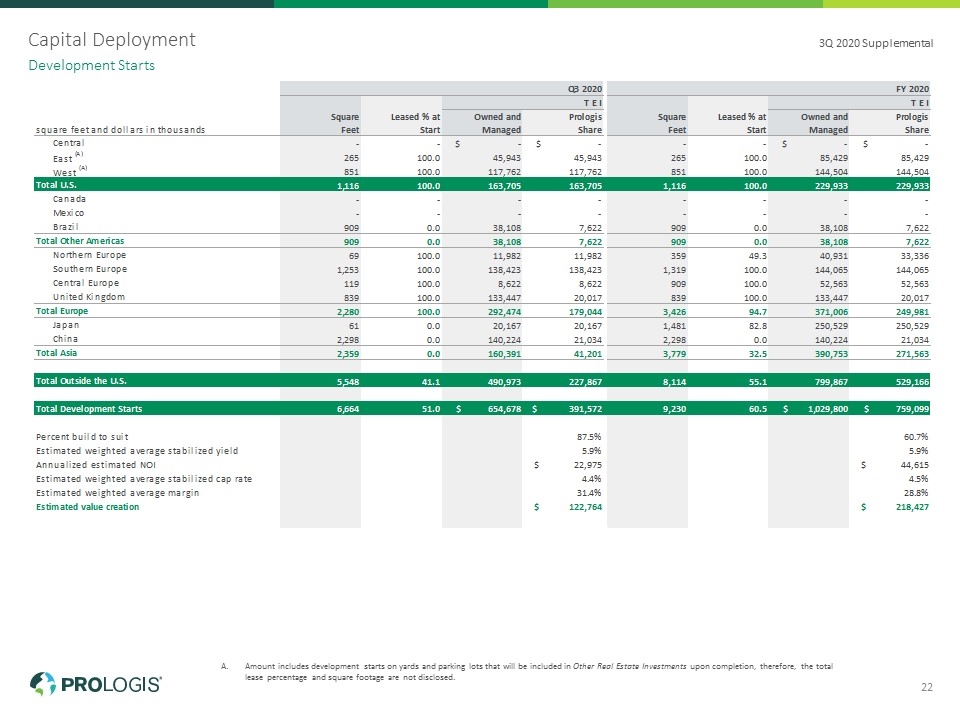

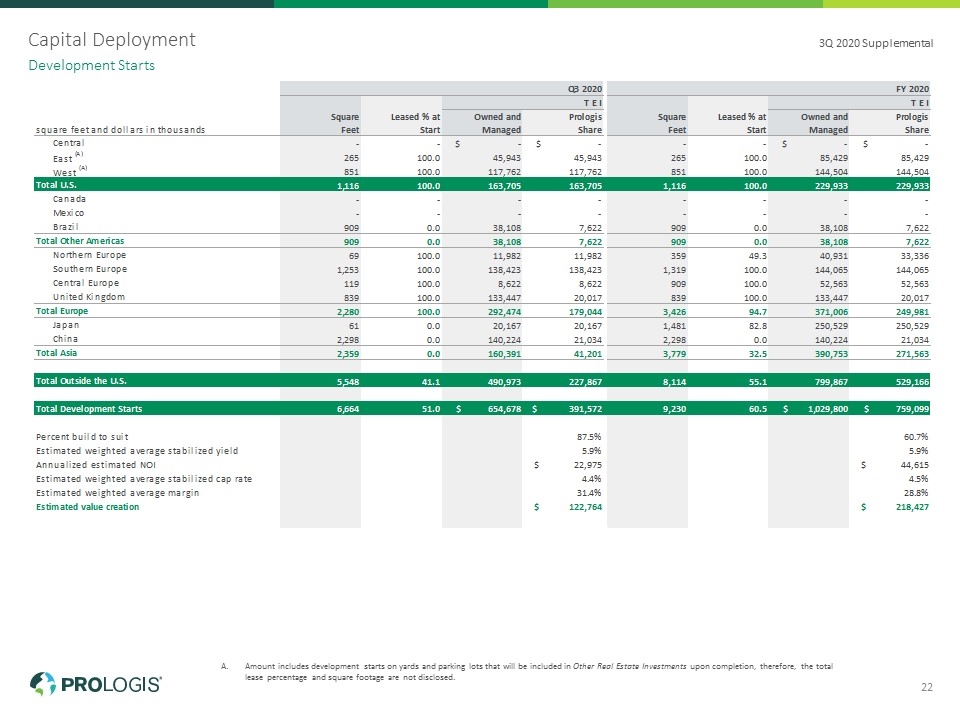

Capital Deployment Amount includes development starts on yards and parking lots that will be included in Other Real Estate Investments upon completion, therefore, the total lease percentage and square footage are not disclosed. Development Starts 3Q 2020 Supplemental 22

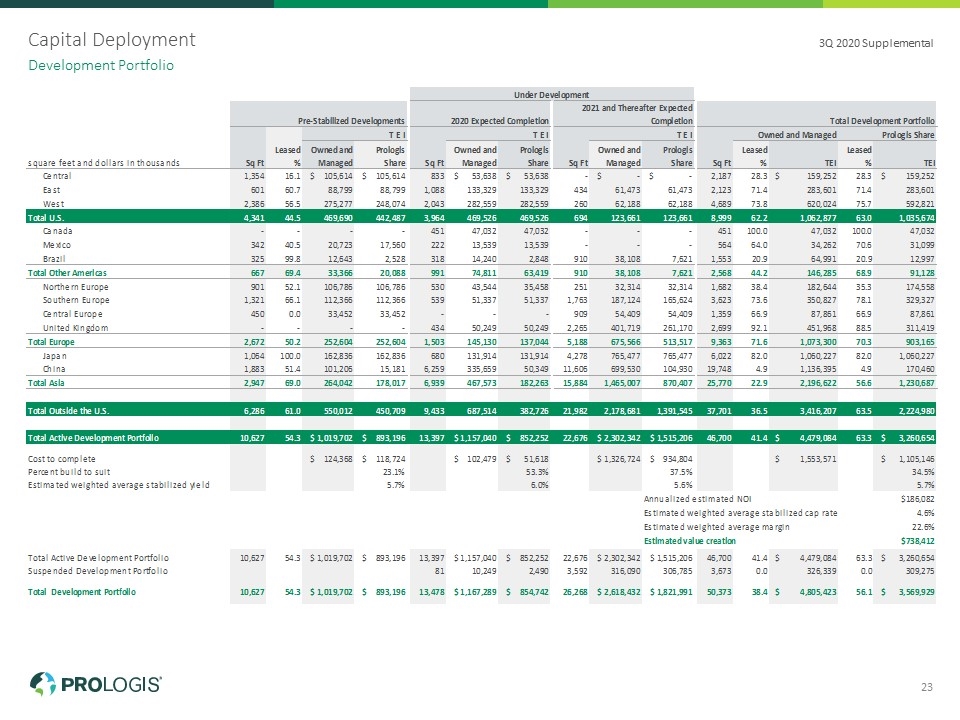

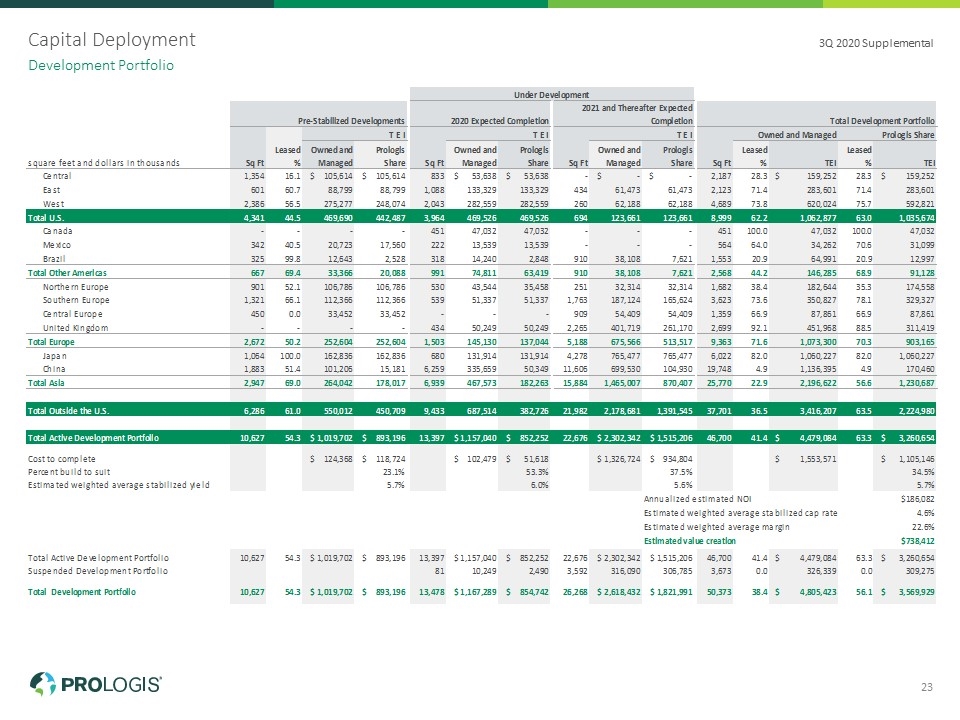

Capital Deployment Development Portfolio 3Q 2020 Supplemental 23

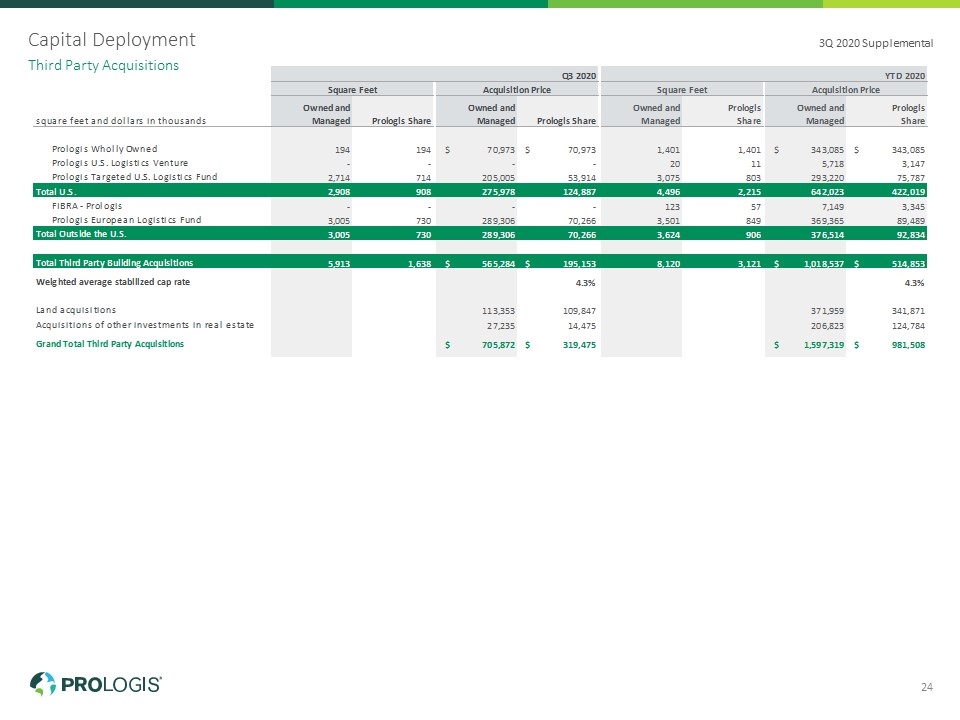

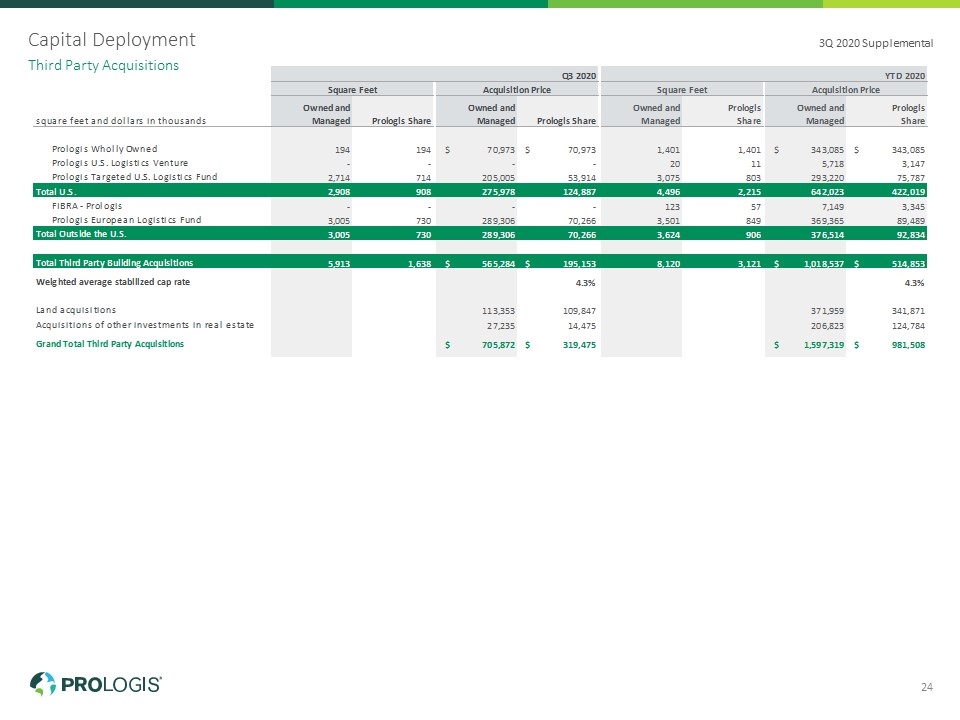

Capital Deployment Third Party Acquisitions 3Q 2020 Supplemental 24

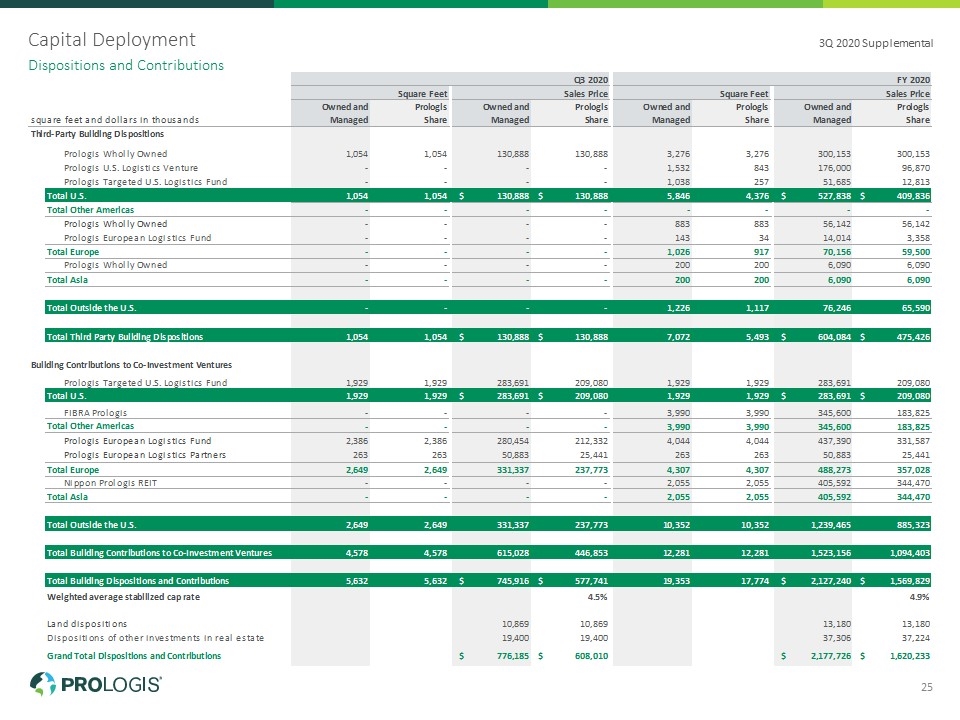

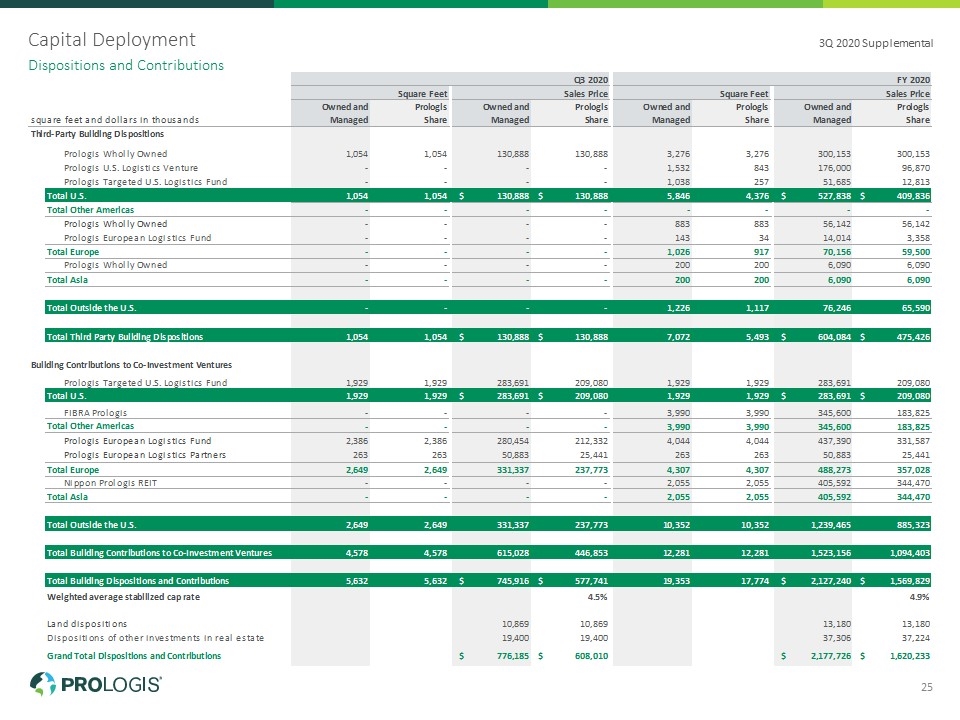

Capital Deployment Dispositions and Contributions 3Q 2020 Supplemental 25

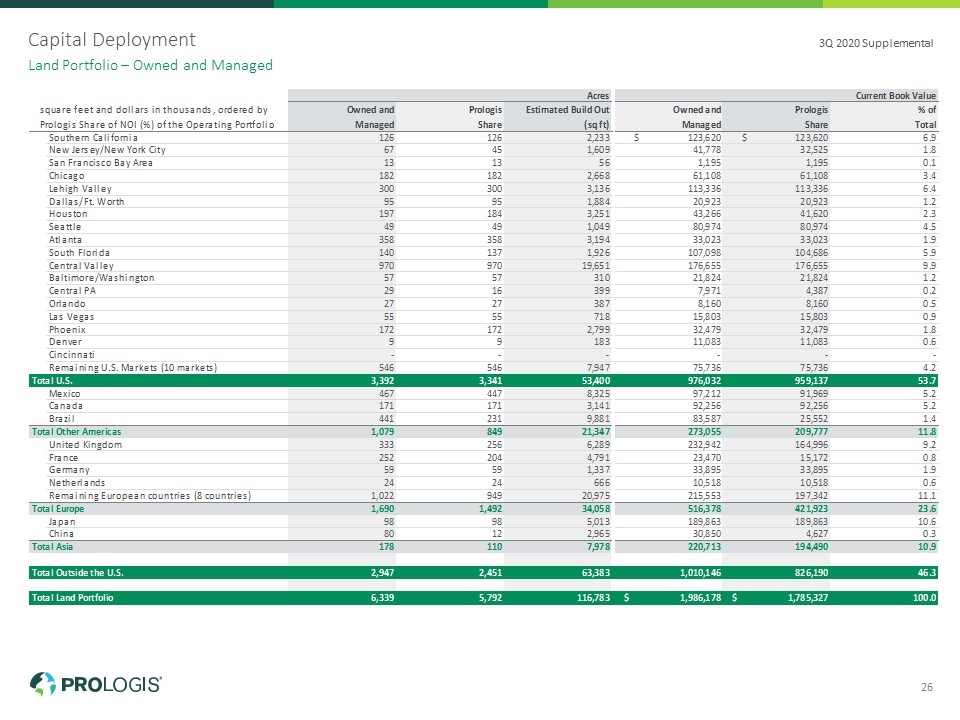

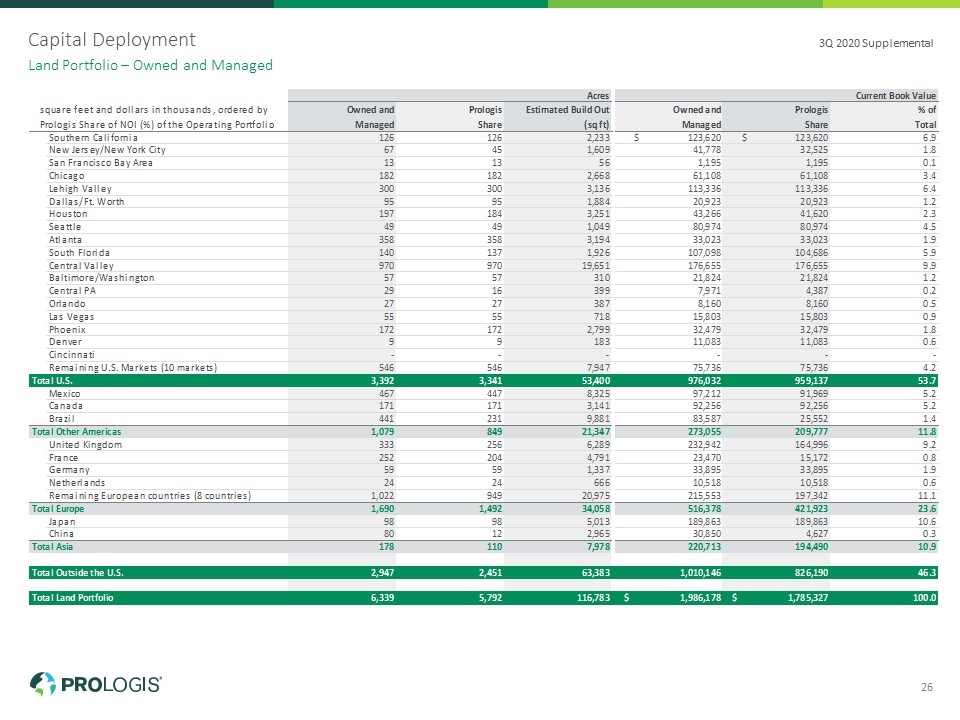

Capital Deployment Land Portfolio – Owned and Managed 3Q 2020 Supplemental 26

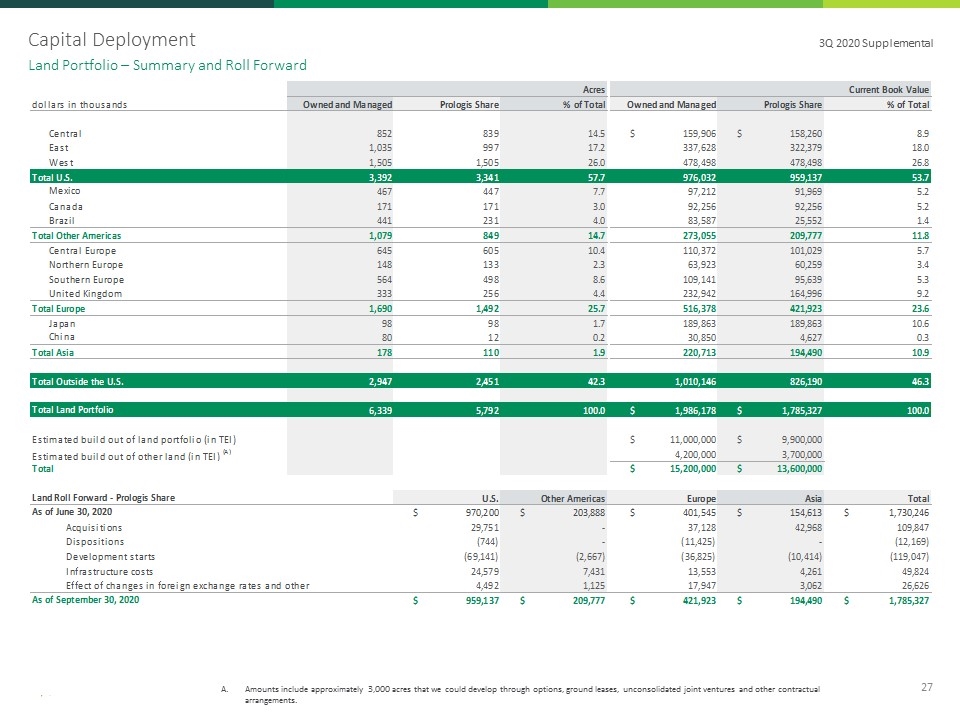

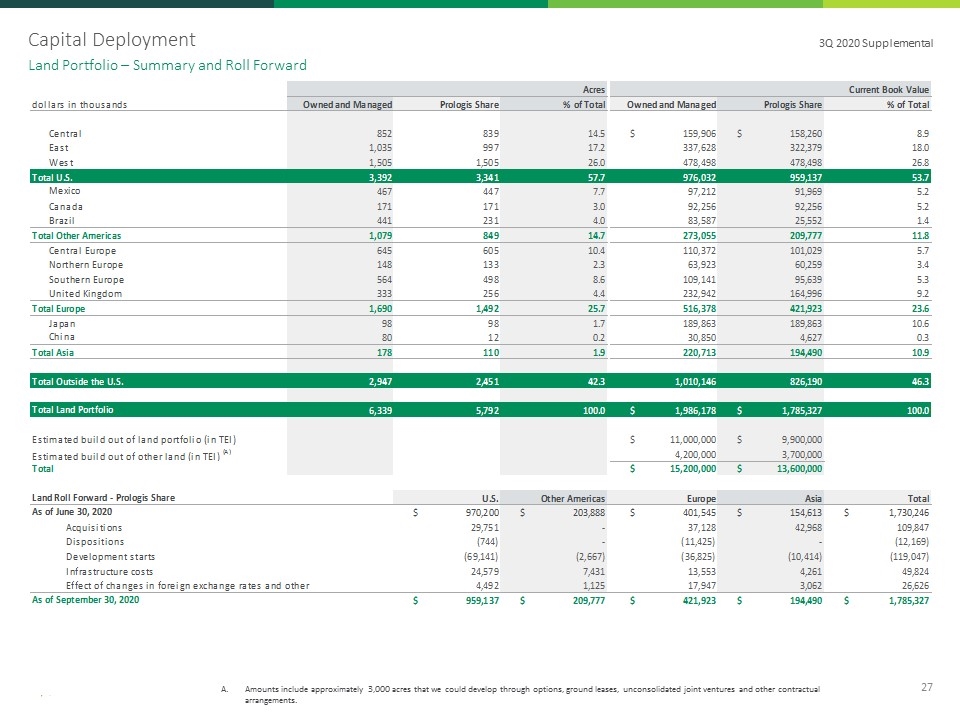

Capital Deployment Amounts include approximately 3,000 acres that we could develop through options, ground leases, unconsolidated joint ventures and other contractual arrangements. Land Portfolio – Summary and Roll Forward 3Q 2020 Supplemental 27

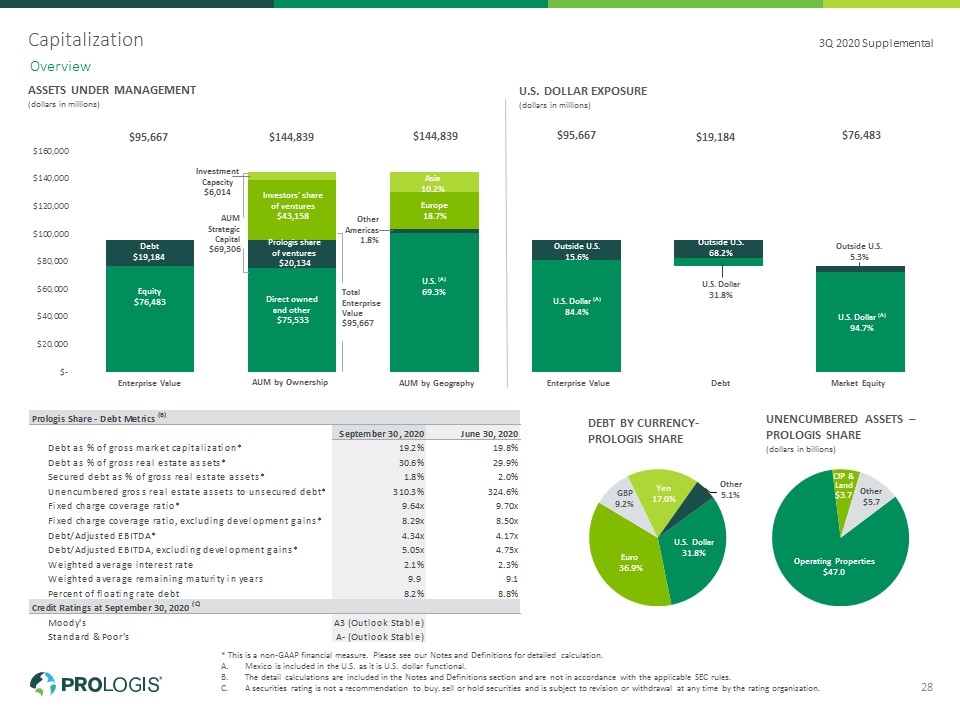

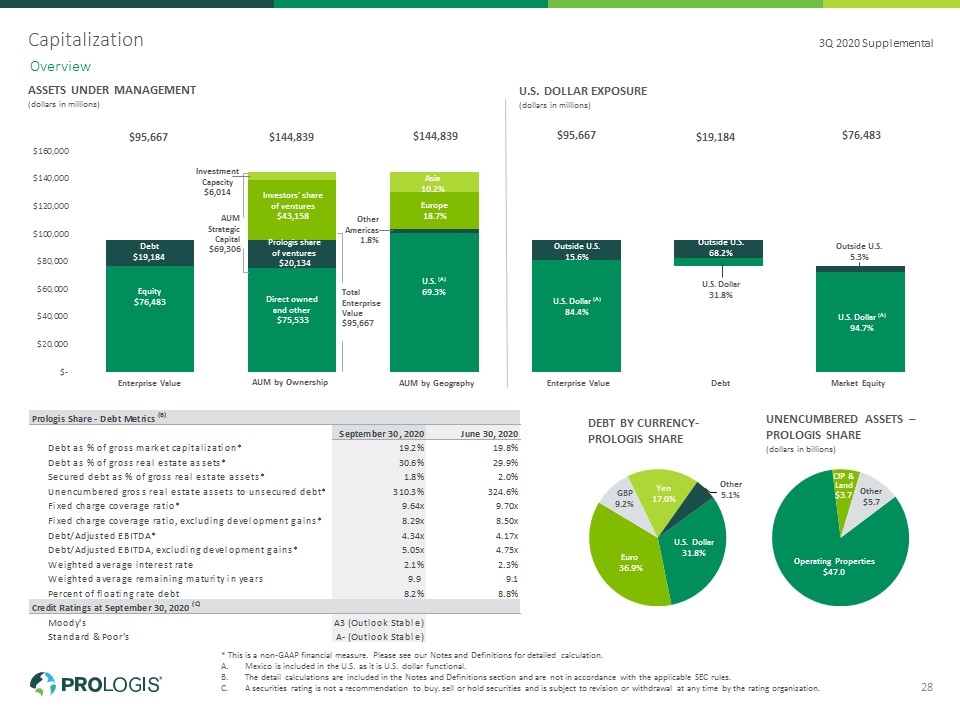

Capitalization * This is a non-GAAP financial measure. Please see our Notes and Definitions for detailed calculation. Mexico is included in the U.S. as it is U.S. dollar functional. The detail calculations are included in the Notes and Definitions section and are not in accordance with the applicable SEC rules. A securities rating is not a recommendation to buy, sell or hold securities and is subject to revision or withdrawal at any time by the rating organization. Overview 3Q 2020 Supplemental 28 ASSETS UNDER MANAGEMENT (dollars in millions) Enterprise Value AUM by Geography Market Equity U.S. DOLLAR EXPOSURE (dollars in millions) Enterprise Value Debt U.S. Dollar 31.8% U.S. Dollar (A) 84.4% Outside U.S. 15.6% Outside U.S. 68.2% DEBT BY CURRENCY- PROLOGIS SHARE UNENCUMBERED ASSETS – PROLOGIS SHARE (dollars in billions) AUM by Ownership

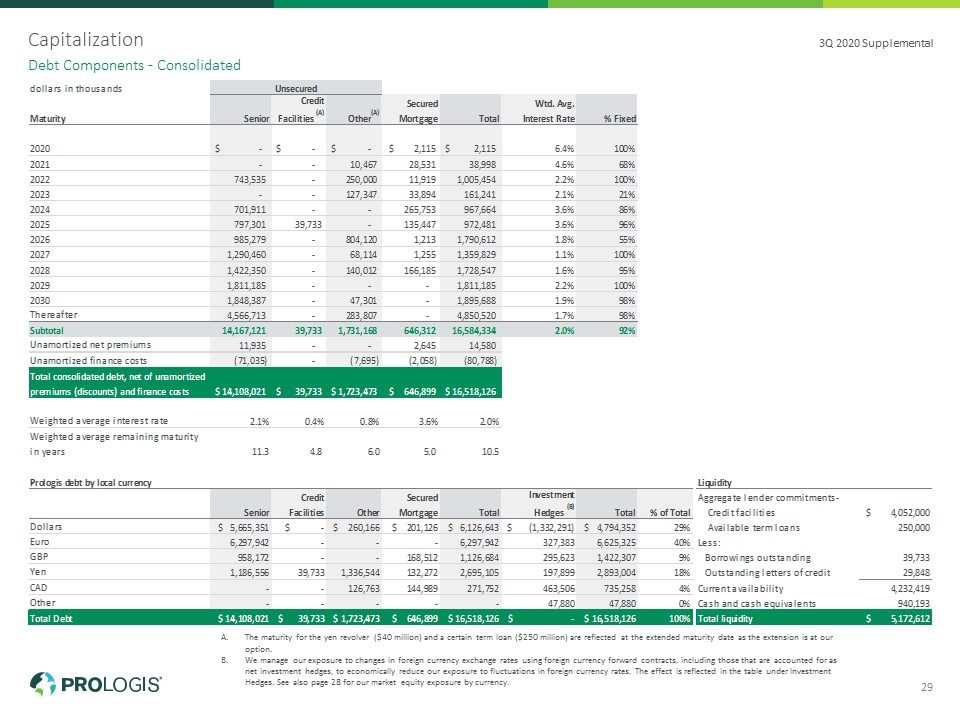

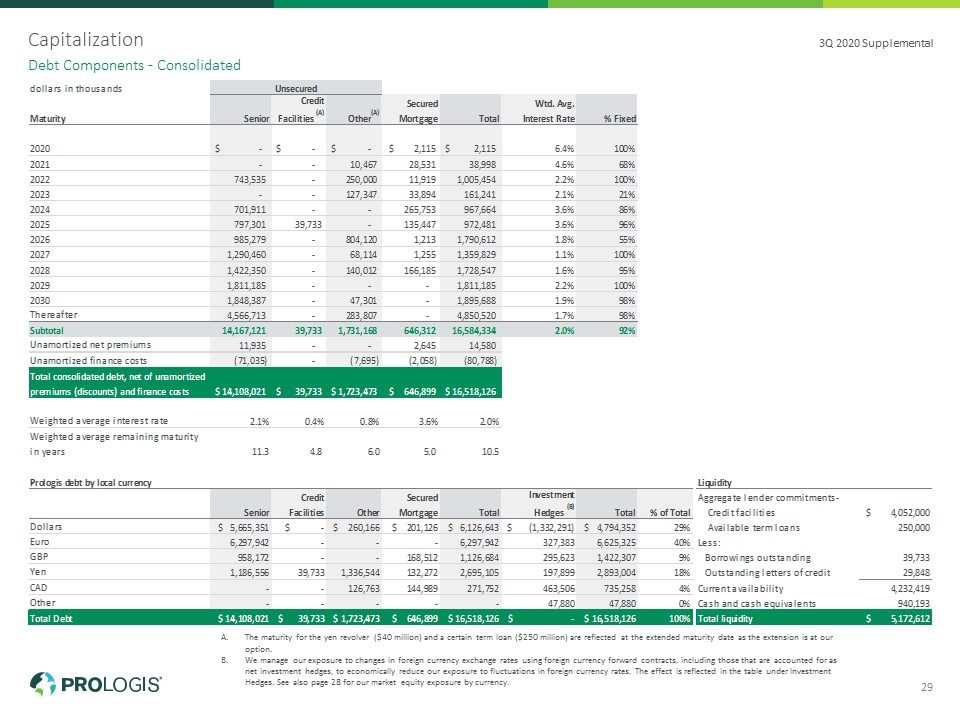

Capitalization The maturity for the yen revolver ($40 million) and a certain term loan ($250 million) are reflected at the extended maturity date as the extension is at our option. We manage our exposure to changes in foreign currency exchange rates using foreign currency forward contracts, including those that are accounted for as net investment hedges, to economically reduce our exposure to fluctuations in foreign currency rates. The effect is reflected in the table under Investment Hedges. See also page 28 for our market equity exposure by currency. Debt Components - Consolidated 3Q 2020 Supplemental 29

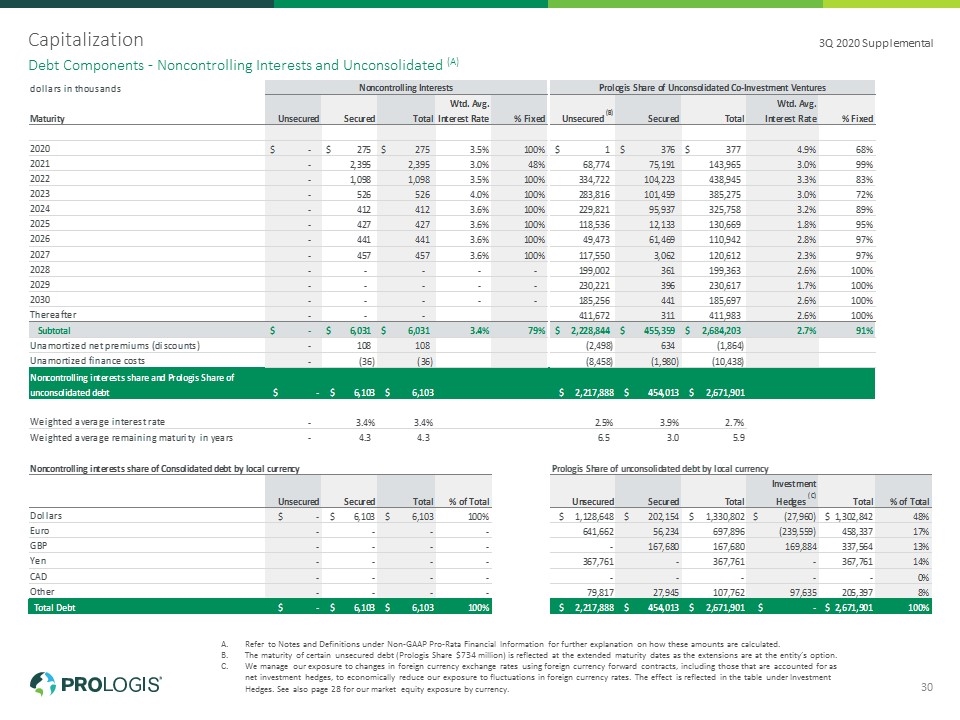

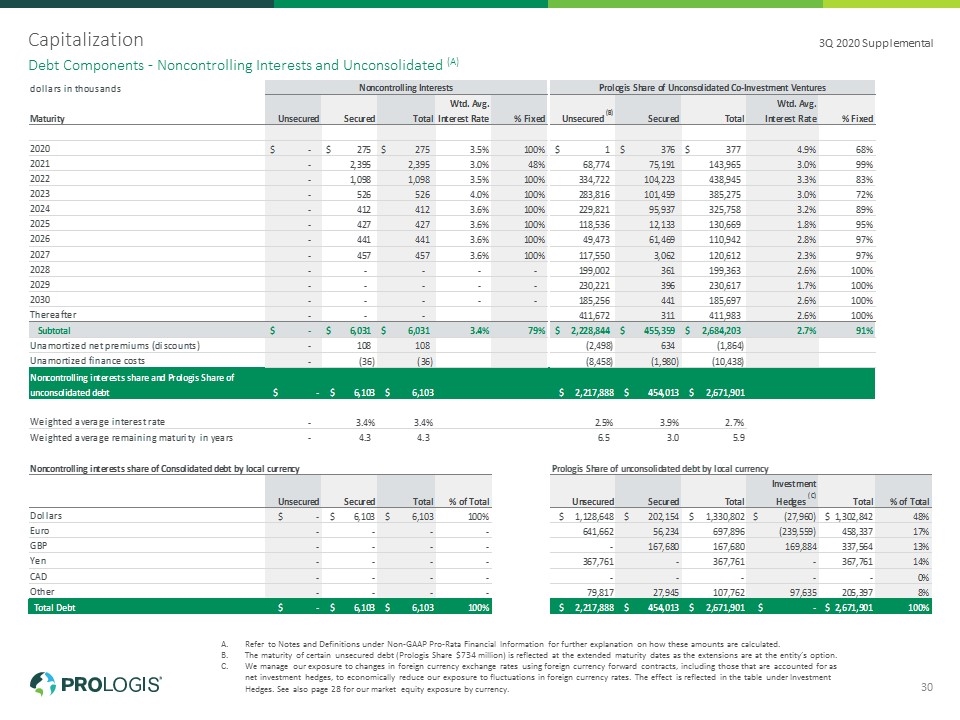

Capitalization Refer to Notes and Definitions under Non-GAAP Pro-Rata Financial Information for further explanation on how these amounts are calculated. The maturity of certain unsecured debt (Prologis Share $734 million) is reflected at the extended maturity dates as the extensions are at the entity’s option. We manage our exposure to changes in foreign currency exchange rates using foreign currency forward contracts, including those that are accounted for as net investment hedges, to economically reduce our exposure to fluctuations in foreign currency rates. The effect is reflected in the table under Investment Hedges. See also page 28 for our market equity exposure by currency. Debt Components - Noncontrolling Interests and Unconsolidated (A) 3Q 2020 Supplemental 30

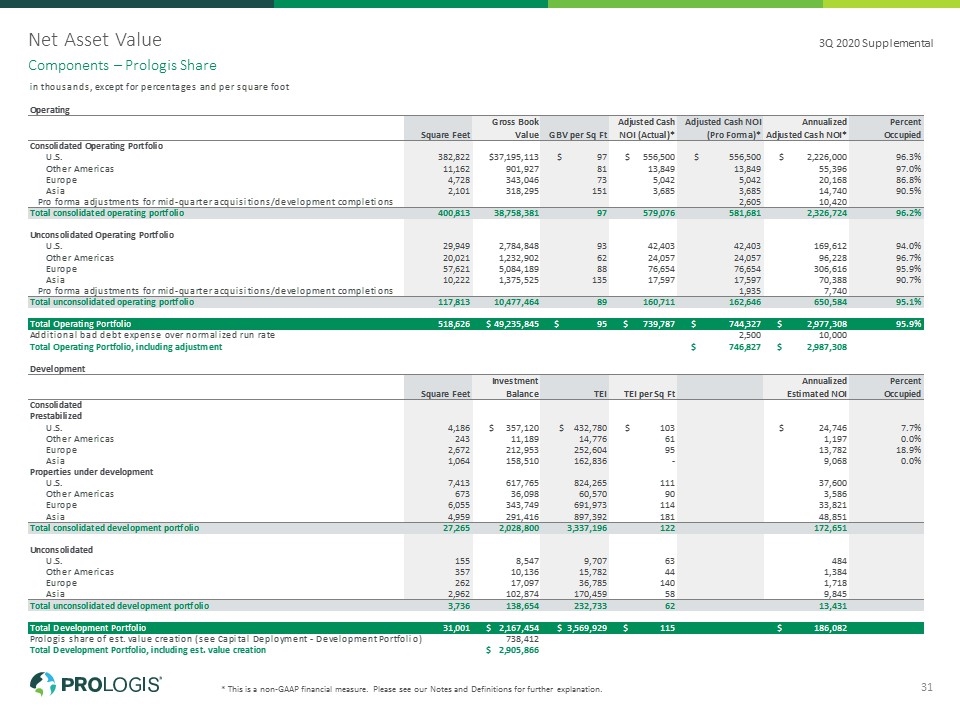

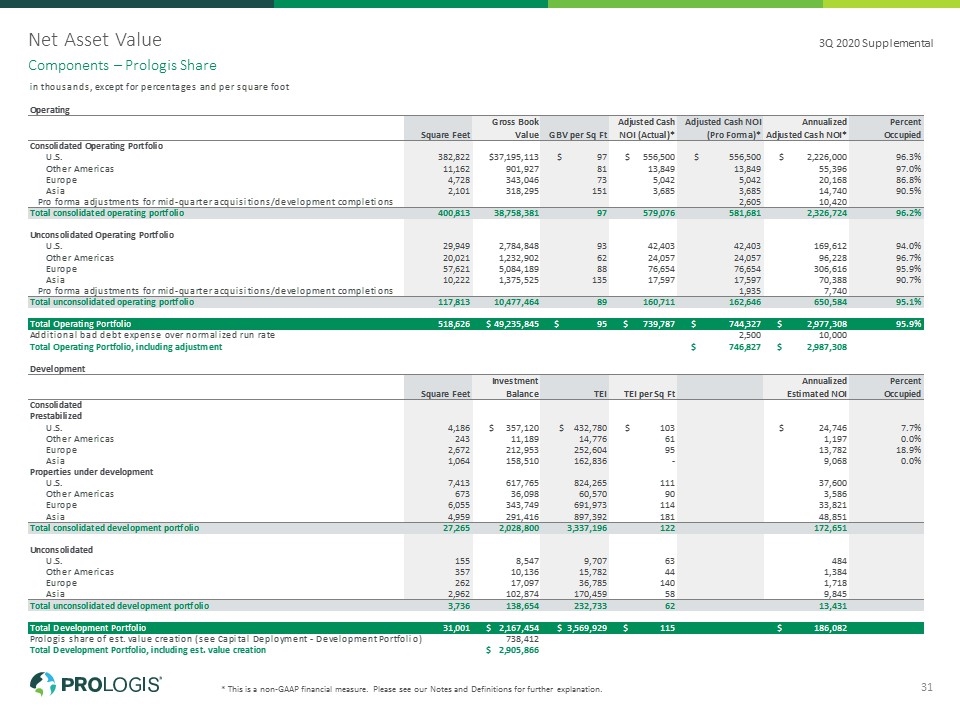

Net Asset Value * This is a non-GAAP financial measure. Please see our Notes and Definitions for further explanation. Components – Prologis Share 3Q 2020 Supplemental 31

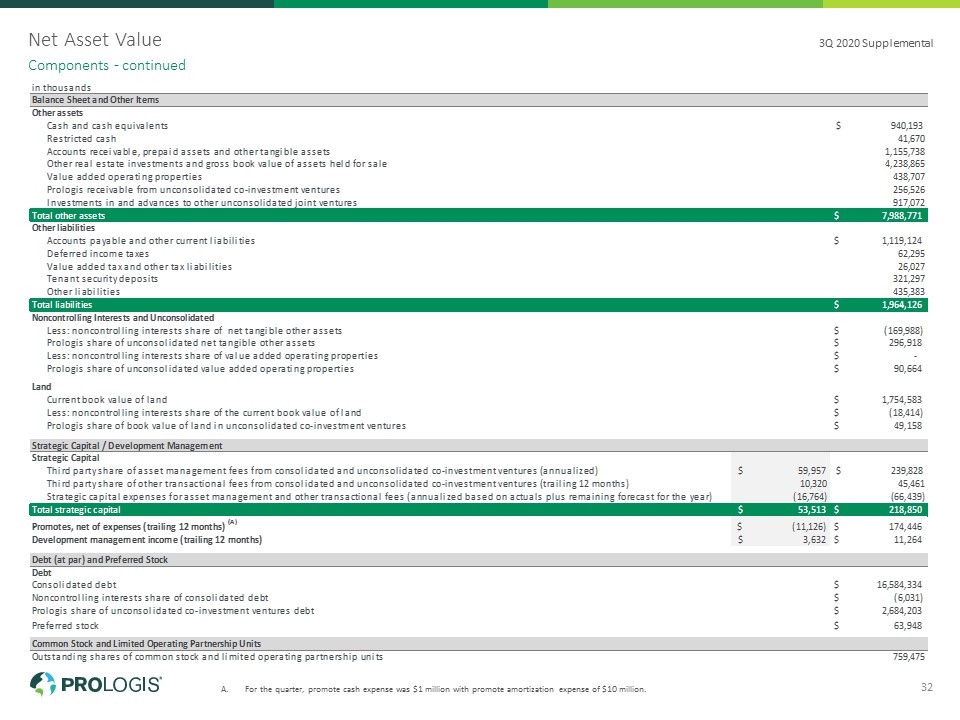

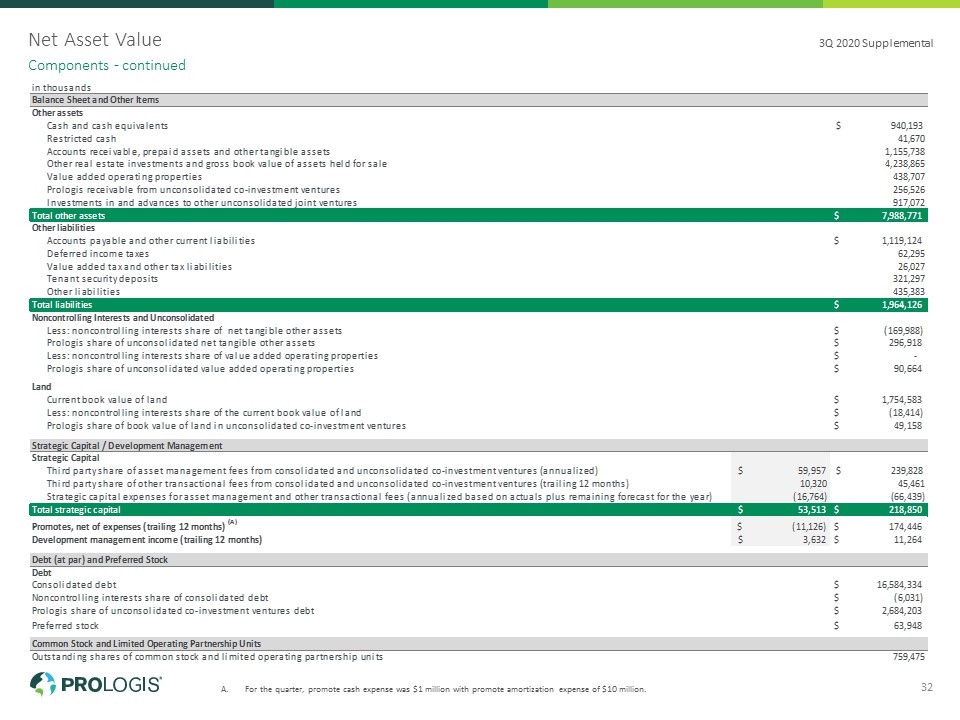

Net Asset Value For the quarter, promote cash expense was $1 million with promote amortization expense of $10 million. Components - continued 3Q 2020 Supplemental 32

Notes and Definitions Prologis Fokker Park, Oude Meer, the Netherlands

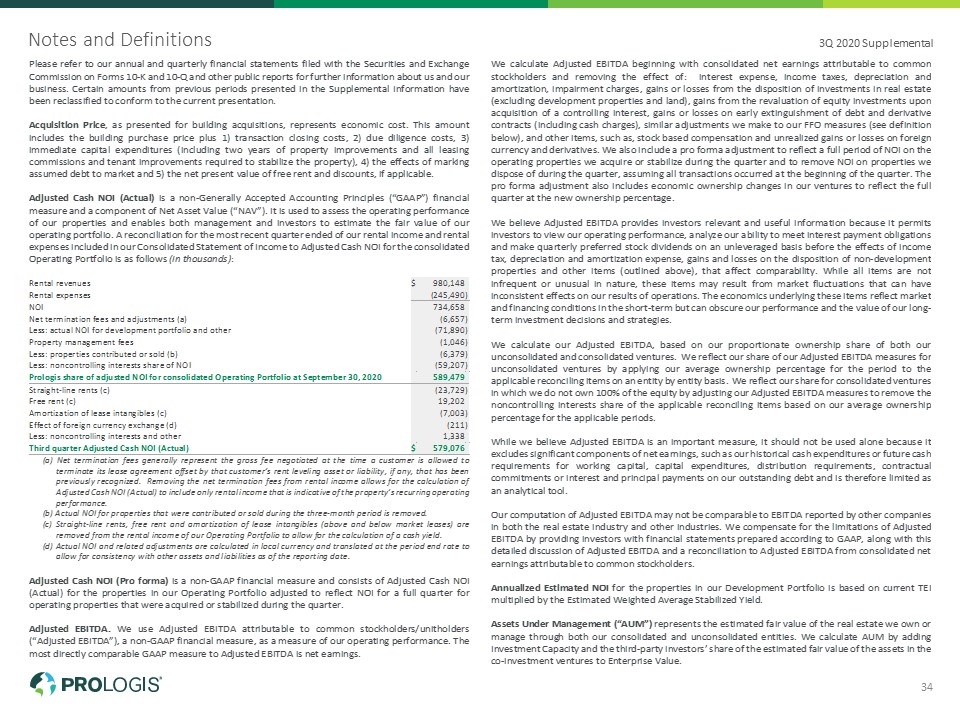

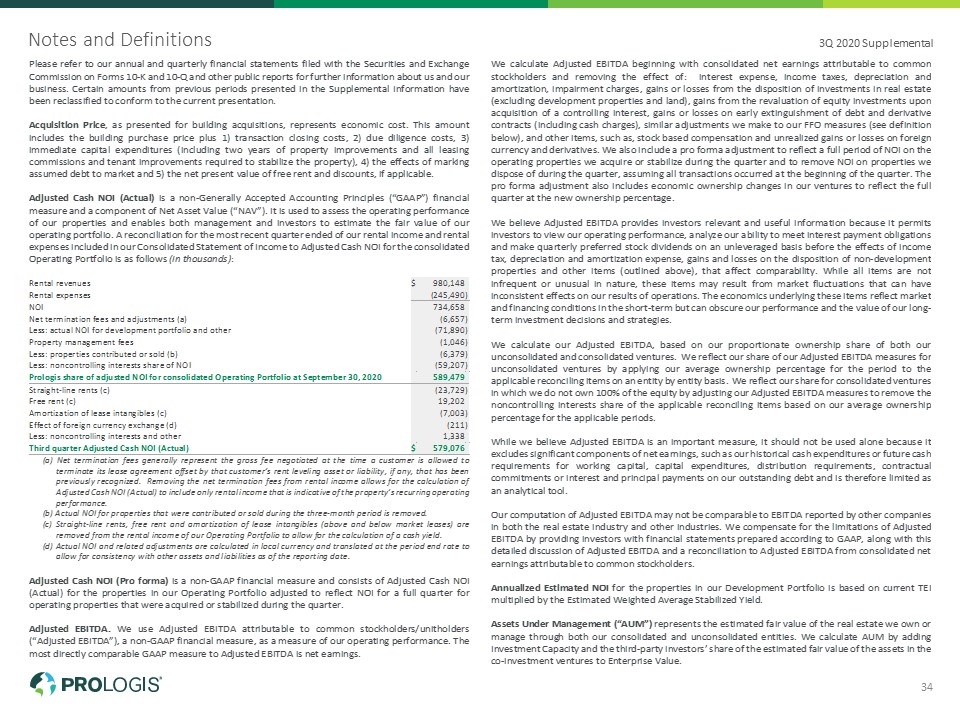

Notes and Definitions 3Q 2020 Supplemental 34

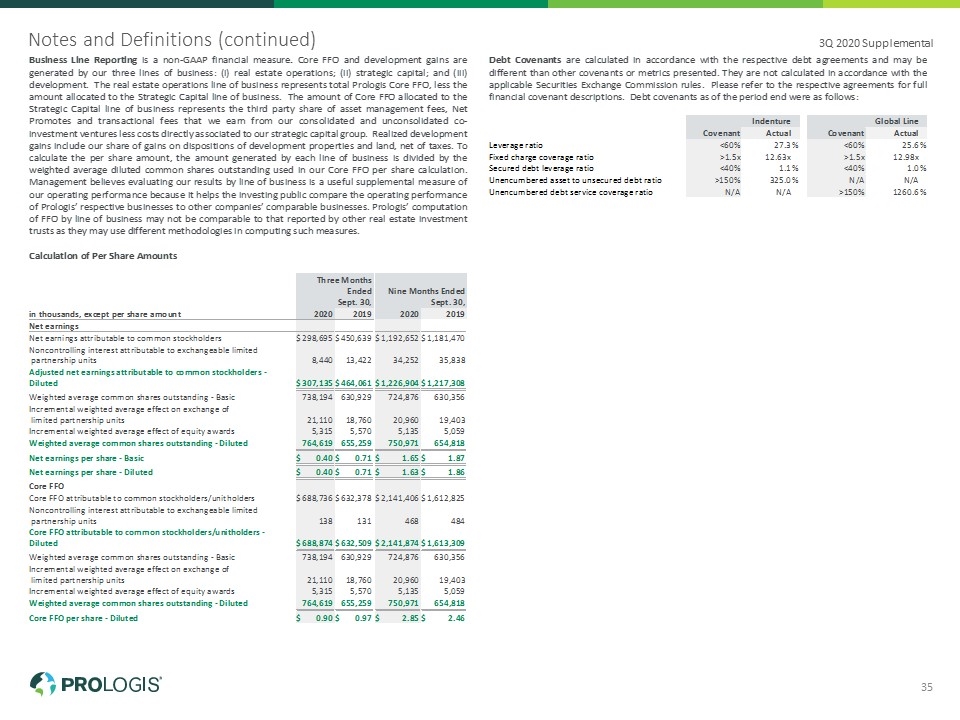

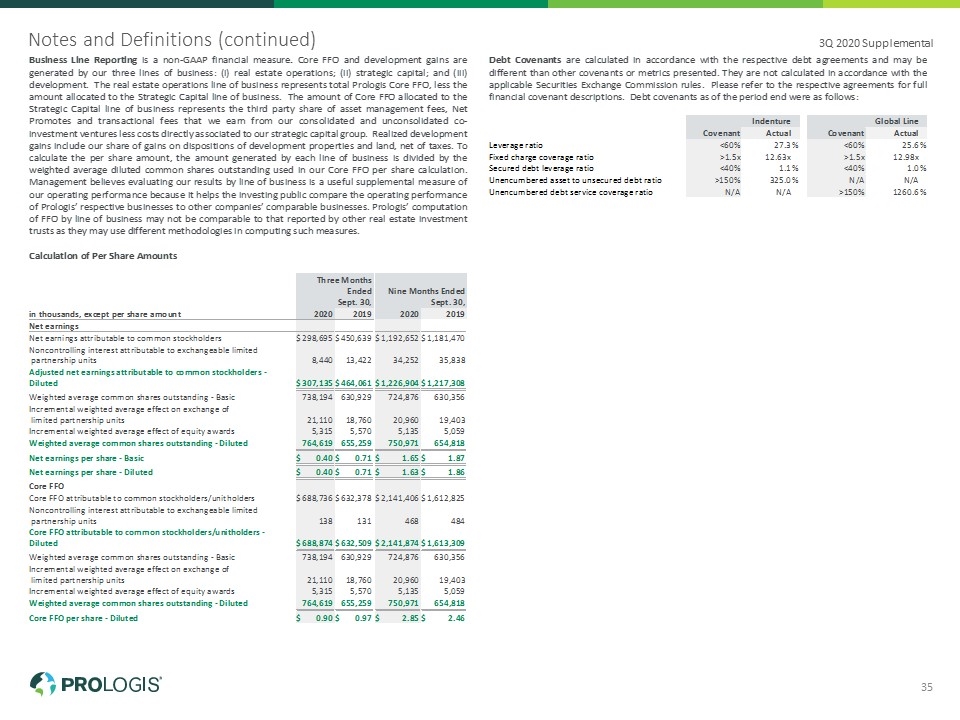

Notes and Definitions (continued) 3Q 2020 Supplemental 35

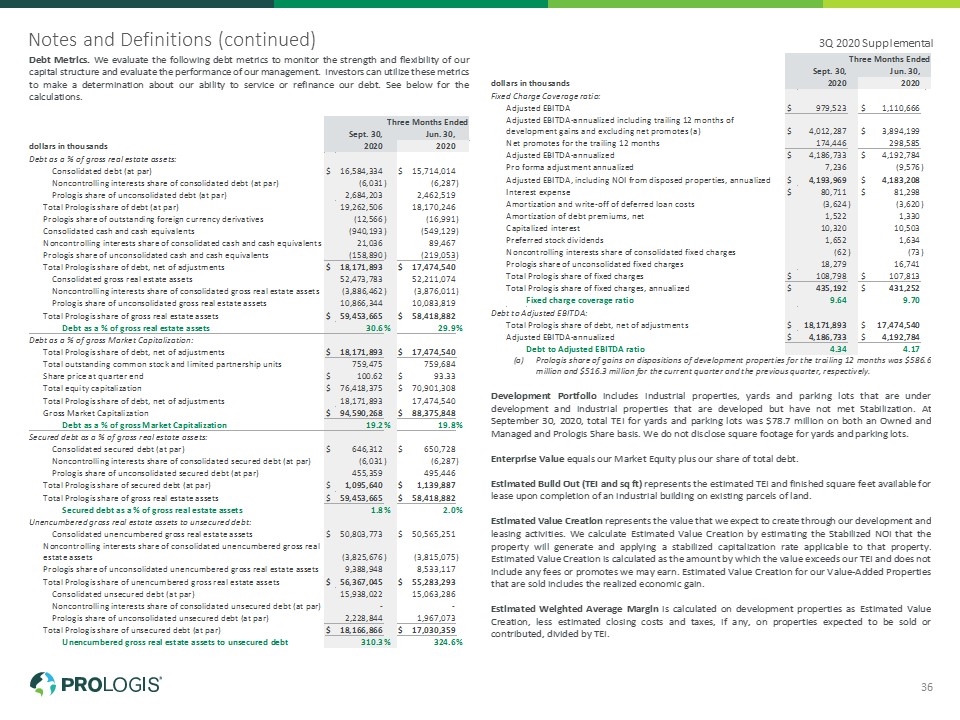

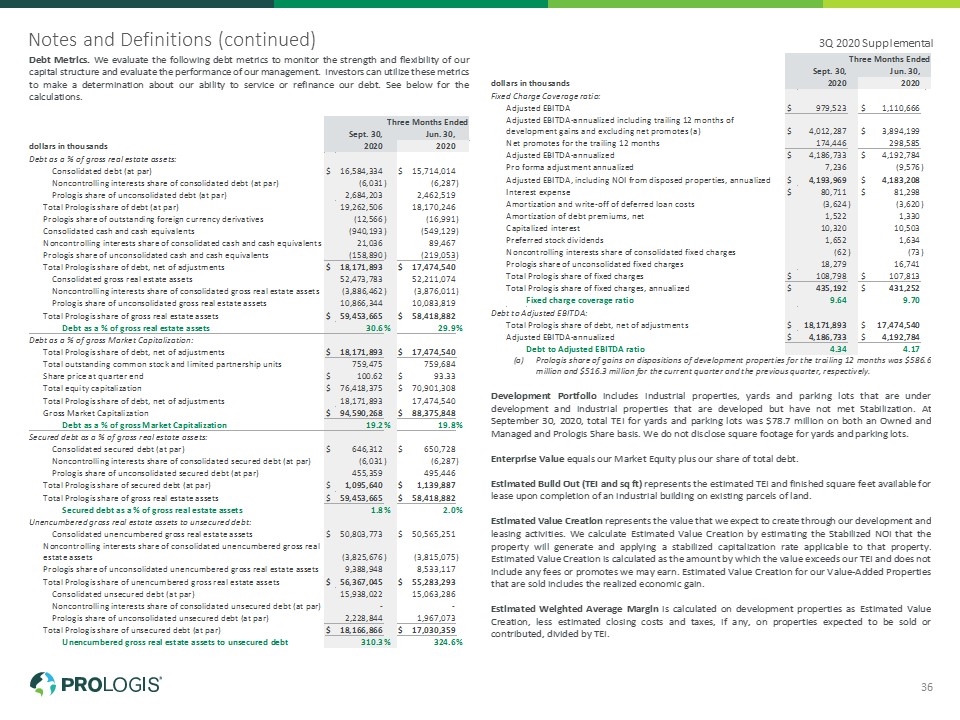

Notes and Definitions (continued) 3Q 2020 Supplemental 36

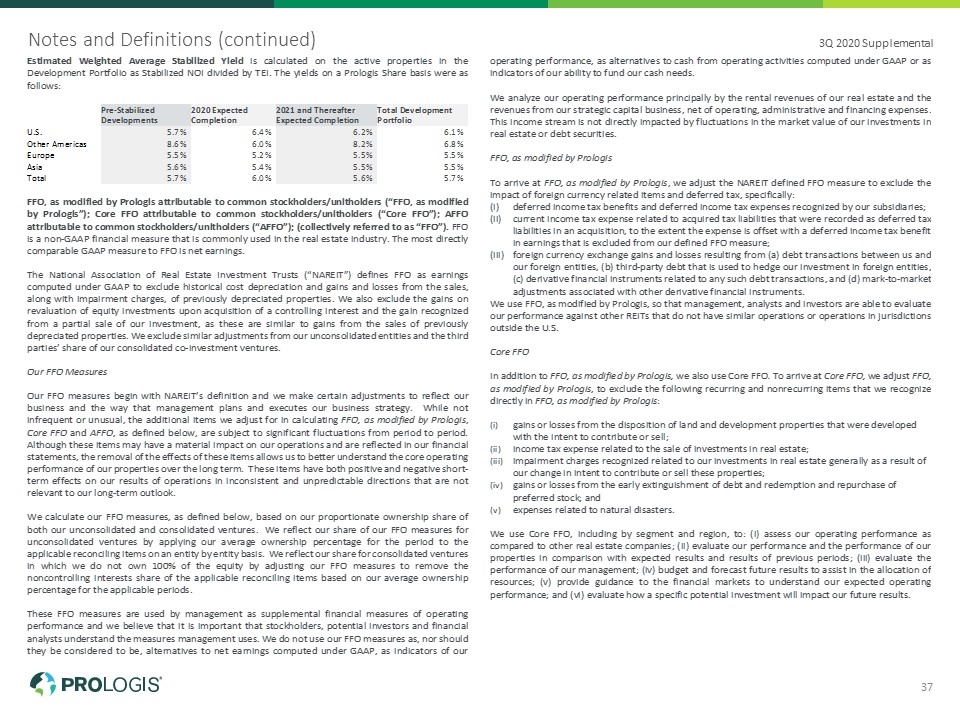

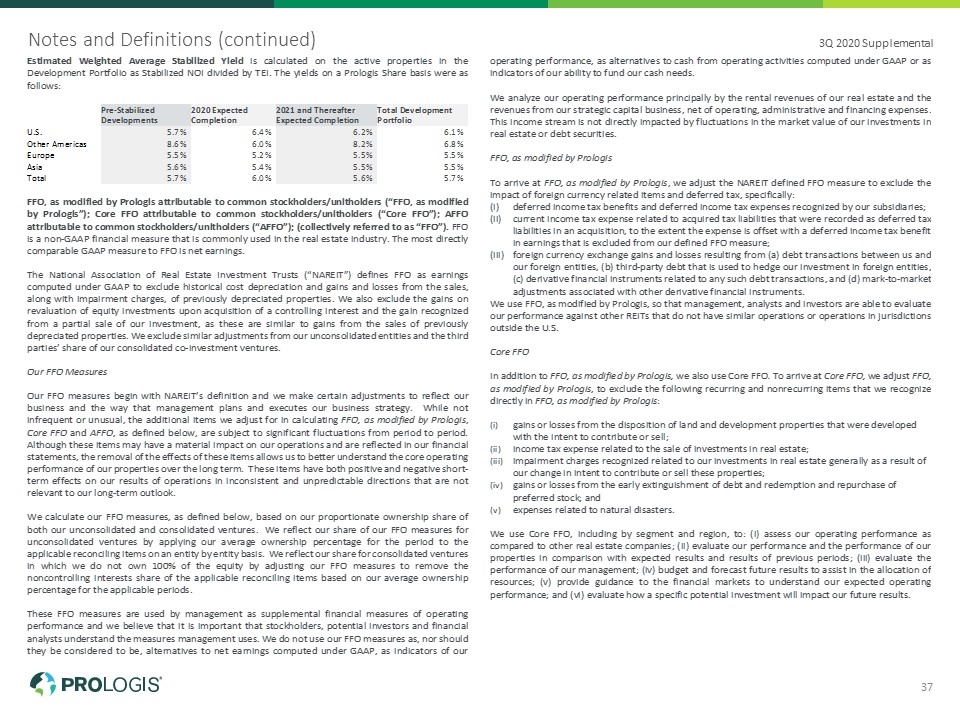

Notes and Definitions (continued) 3Q 2020 Supplemental 37

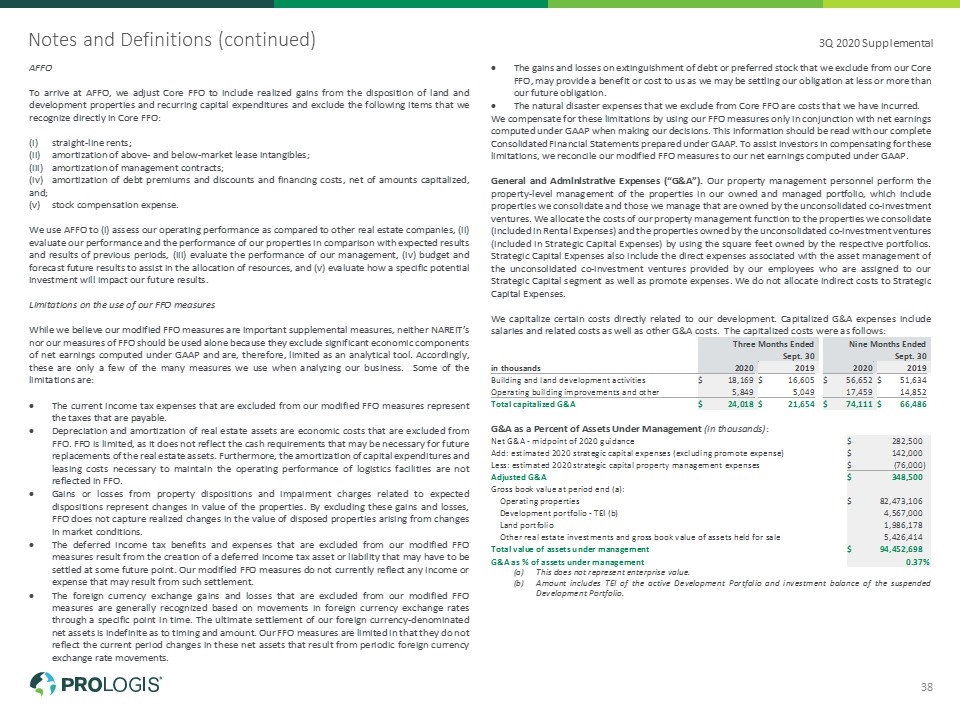

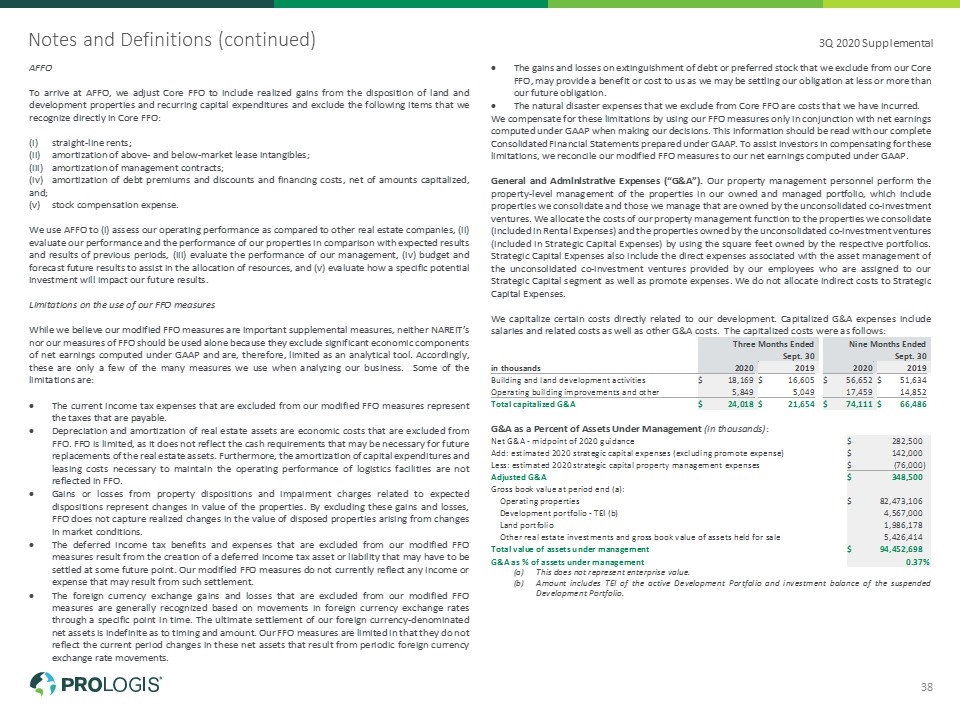

Notes and Definitions (continued) 3Q 2020 Supplemental 38

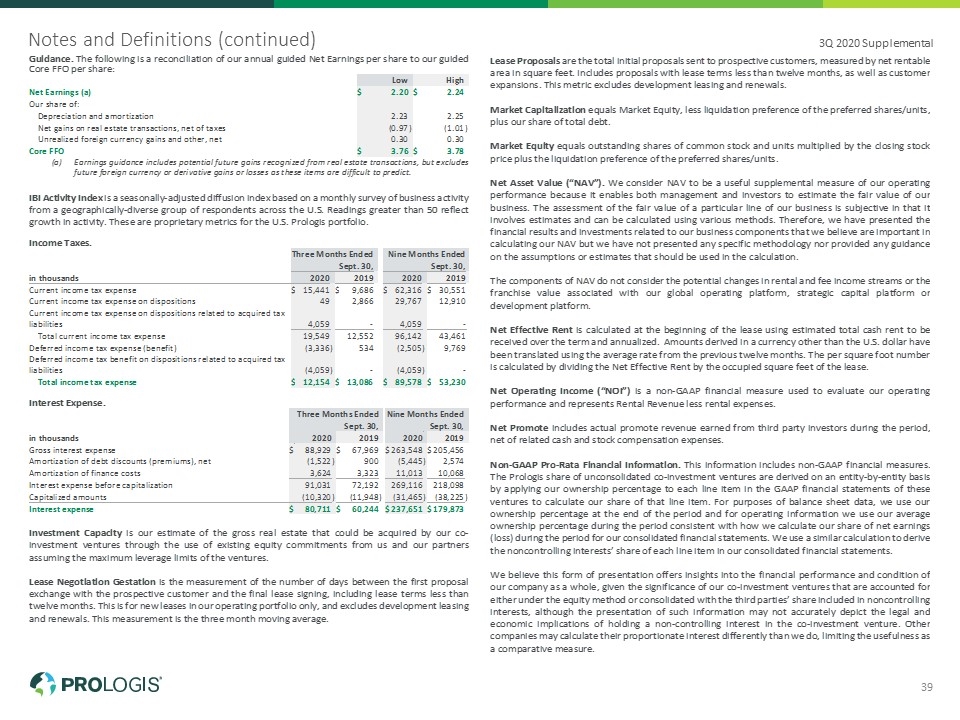

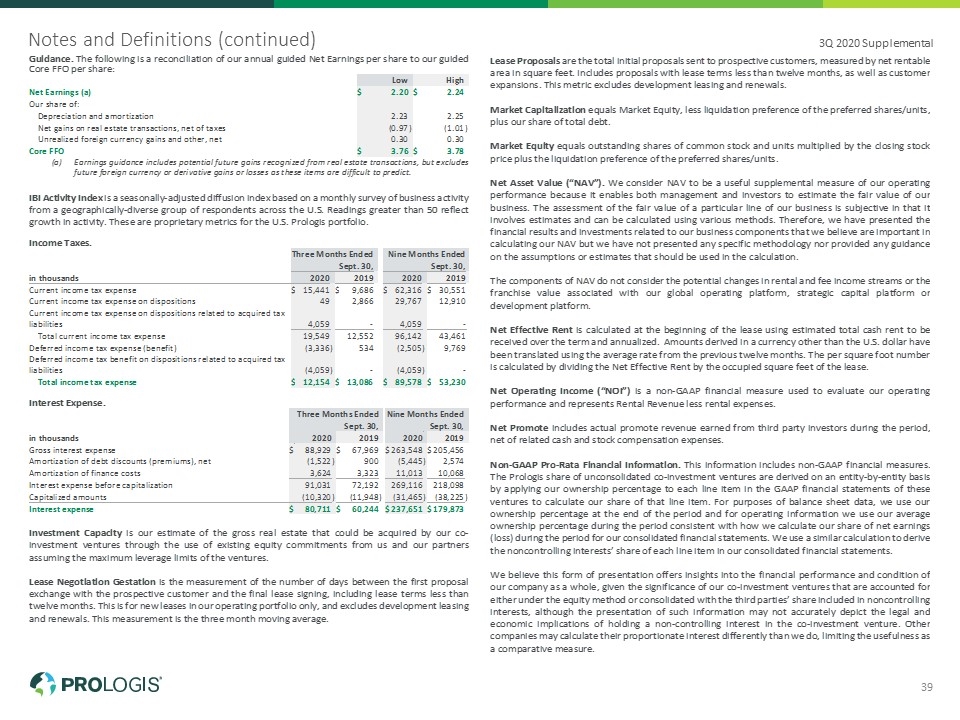

Notes and Definitions (continued) 3Q 2020 Supplemental 39

Notes and Definitions (continued) 3Q 2020 Supplemental 40

Notes and Definitions (continued) 3Q 2020 Supplemental 41