UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2024

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission File Number: 001-13545 (Prologis, Inc.) 001-14245 (Prologis, L.P.)

Prologis, Inc.

Prologis, L.P.

(Exact name of registrant as specified in its charter)

| | |

Maryland (Prologis, Inc.) Delaware (Prologis, L.P.) |

| 94-3281941 (Prologis, Inc.) 94-3285362 (Prologis, L.P.) |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

| | |

Pier 1, Bay 1, San Francisco, California | | 94111 |

(Address or principal executive offices) | | (Zip Code) |

(415) 394-9000

(Registrants’ telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | |

| | Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

Prologis, Inc. | | Common Stock, $0.01 par value | | PLD | | New York Stock Exchange |

Prologis, L.P. | | 3.000% Notes due 2026 | | PLD/26 | | New York Stock Exchange |

Prologis, L.P. | | 2.250% Notes due 2029 | | PLD/29 | | New York Stock Exchange |

Prologis, L.P. | | 5.625% Notes due 2040 | | PLD/40 | | New York Stock Exchange |

| | | | | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| | | | |

Prologis, Inc. | Yes | ☒ | No | ☐ |

Prologis, L.P. | Yes | ☒ | No | ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter periods that the registrant was required to submit such files).

| | | | |

Prologis, Inc. | Yes | ☒ | No | ☐ |

Prologis, L.P. | Yes | ☒ | No | ☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | |

Prologis, Inc.: | | | | |

Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company ☐ | Emerging growth company ☐ |

| | | | |

Prologis, L.P.: | | | | |

Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Smaller reporting company ☐ | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).

| | | | |

Prologis, Inc. | Yes | ☐ | No | ☒ |

Prologis, L.P. | Yes | ☐ | No | ☒ |

The number of shares of Prologis, Inc.’s common stock outstanding at October 23, 2024, was approximately 926,175,000.

EXPLANATORY NOTE

This report combines the quarterly reports on Form 10-Q for the period ended September 30, 2024, of Prologis, Inc. and Prologis, L.P. Unless stated otherwise or the context otherwise requires, references to “Prologis, Inc.” or the “Parent” mean Prologis, Inc. and its consolidated subsidiaries; and references to “Prologis, L.P.” or the “Operating Partnership” or the “OP” mean Prologis, L.P., and its consolidated subsidiaries. The terms “the Company,” “Prologis,” “we,” “our” or “us” means the Parent and the OP collectively.

The Parent is a real estate investment trust (a “REIT”) and the general partner of the OP. At September 30, 2024, the Parent owned a 97.59% common general partnership interest in the OP and substantially all of the preferred units in the OP. The remaining 2.41% common limited partnership interests are owned by unaffiliated investors and certain current and former directors and officers of the Parent.

We operate the Parent and the OP as one enterprise. The management of the Parent consists of the same members as the management of the OP. These members are officers of the Parent and employees of the OP or one of its subsidiaries. As sole general partner, the Parent has control of the OP through complete responsibility and discretion in the day-to-day management and therefore, consolidates the OP for financial reporting purposes. Because the only significant asset of the Parent is its investment in the OP, the assets and liabilities of the Parent and the OP are the same on their respective financial statements.

We believe combining the quarterly reports on Form 10-Q of the Parent and the OP into this single report results in the following benefits:

•enhances investors’ understanding of the Parent and the OP by enabling investors to view the business as a whole in the same manner as management views and operates the business;

•eliminates duplicative disclosure and provides a more streamlined and readable presentation as a substantial portion of the Company’s disclosure applies to both the Parent and the OP; and

•creates time and cost efficiencies through the preparation of one combined report instead of two separate reports.

It is important to understand the few differences between the Parent and the OP in the context of how we operate the Company. The Parent does not conduct business itself, other than acting as the sole general partner of the OP and issuing public equity from time to time. The OP holds substantially all the assets of the business, directly or indirectly. The OP conducts the operations of the business and is structured as a partnership with no publicly traded equity. Except for net proceeds from equity issuances by the Parent, which are contributed to the OP in exchange for partnership units, the OP generates capital required by the business through the OP’s operations, incurrence of indebtedness and issuance of partnership units to third parties.

The presentation of noncontrolling interests, stockholders’ equity and partners’ capital are the main areas of difference between the consolidated financial statements of the Parent and those of the OP. The differences in the presentations between stockholders’ equity and partners’ capital result from the differences in the equity and capital issuances in the Parent and in the OP.

The preferred stock, common stock, additional paid-in capital, accumulated other comprehensive income (loss) and distributions in excess of net earnings of the Parent are presented as stockholders’ equity in the Parent’s consolidated financial statements. These items represent the common and preferred general partnership interests held by the Parent in the OP and are presented as general partner’s capital within partners’ capital in the OP’s consolidated financial statements. The common limited partnership interests held by the limited partners in the OP are presented as noncontrolling interest within equity in the Parent’s consolidated financial statements and as limited partners’ capital within partners’ capital in the OP’s consolidated financial statements.

To highlight the differences between the Parent and the OP, separate sections in this report, as applicable, individually discuss the Parent and the OP, including separate financial statements and separate Exhibit 31 and 32 certifications. In the sections that combine disclosure of the Parent and the OP, this report refers to actions or holdings as being actions or holdings of Prologis.

PROLOGIS

INDEX

| | | | | | | |

|

|

|

| Page Number |

|

PART I. |

| Financial Information |

| |

|

|

| Item 1. | Financial Statements |

| 1 |

|

|

| Prologis, Inc.: |

|

|

|

|

|

| Consolidated Balance Sheets – September 30, 2024 and December 31, 2023 |

| 1 | |

|

|

| Consolidated Statements of Income – Three and Nine Months Ended September 30, 2024 and 2023 |

| 2 |

|

|

|

| Consolidated Statements of Comprehensive Income – Three and Nine Months Ended September 30, 2024 and 2023 |

| 3 |

|

|

|

| Consolidated Statements of Equity – Three and Nine Months Ended September 30, 2024 and 2023 |

| 4 |

|

|

|

| Consolidated Statements of Cash Flows – Nine Months Ended September 30, 2024 and 2023 |

| 5 |

|

|

| Prologis, L.P.: |

| |

|

|

|

| Consolidated Balance Sheets – September 30, 2024 and December 31, 2023 |

| 6 |

|

|

|

| Consolidated Statements of Income – Three and Nine Months Ended September 30, 2024 and 2023 |

| 7 |

|

|

|

| Consolidated Statements of Comprehensive Income – Three and Nine Months Ended September 30, 2024 and 2023 |

| 8 |

|

|

|

| Consolidated Statements of Capital – Three and Nine Months Ended September 30, 2024 and 2023 |

| 9 |

|

|

|

| Consolidated Statements of Cash Flows – Nine Months Ended September 30, 2024 and 2023 |

| 10 |

|

|

| Prologis, Inc. and Prologis, L.P.: |

| |

|

|

|

| Notes to the Consolidated Financial Statements |

| 11 |

|

| | | Note 1. General |

| 11 | |

| | | Note 2. Real Estate |

| 12 | |

| | | Note 3. Unconsolidated Entities |

| 13 | |

| | | Note 4. Assets Held for Sale or Contribution |

| 15 | |

| | | Note 5. Debt |

| 15 | |

| | | Note 6. Noncontrolling Interests |

| 18 | |

| | | Note 7. Long-Term Compensation |

| 18 | |

| | | Note 8. Earnings Per Common Share or Unit |

| 20 | |

| | | Note 9. Financial Instruments and Fair Value Measurements |

| 21 | |

| | | Note 10. Business Segments |

| 25 | |

| | | Note 11. Supplemental Cash Flow Information |

| 27 |

|

|

|

| Reports of Independent Registered Public Accounting Firm |

| 28 |

|

| | Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 30 | |

| | Item 3. | Quantitative and Qualitative Disclosures About Market Risk | | 50 | |

| | Item 4. | Controls and Procedures | | 51 | |

PART II. | | Other Information |

| |

|

|

| Item 1. | Legal Proceedings |

| 52 |

|

|

| Item 1A. | Risk Factors |

| 52 |

|

|

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds |

| 52 |

|

|

| Item 3. | Defaults Upon Senior Securities |

| 52 |

|

|

| Item 4. | Mine Safety Disclosures |

| 52 |

|

|

| Item 5. | Other Information |

| 52 |

|

|

| Item 6. | Exhibits |

| 52 | |

PART I. FINANCIAL INFORMATION

ITEM 1. Financial Statements

PROLOGIS, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except per share data)

| | | | | | | |

| | | | | |

| September 30, 2024 | | | December 31, 2023 | |

ASSETS | | | | | |

Investments in real estate properties | $ | 92,093,573 | | | $ | 88,666,575 | |

Less accumulated depreciation | | 12,332,799 | | | | 10,931,485 | |

Net investments in real estate properties | | 79,760,774 | | | | 77,735,090 | |

Investments in and advances to unconsolidated entities | | 10,092,765 | | | | 9,543,970 | |

Assets held for sale or contribution | | 325,987 | | | | 461,657 | |

Net investments in real estate | | 90,179,526 | | | | 87,740,717 | |

| | | | | |

Cash and cash equivalents | | 780,871 | | | | 530,388 | |

Other assets | | 4,944,799 | | | | 4,749,735 | |

Total assets | $ | 95,905,196 | | | $ | 93,020,840 | |

| | | | | |

LIABILITIES AND EQUITY | | | | | |

Liabilities: | | | | | |

Debt | $ | 32,289,832 | | | $ | 29,000,501 | |

Accounts payable and accrued expenses | | 1,808,142 | | | | 1,766,018 | |

Other liabilities | | 4,143,130 | | | | 4,430,601 | |

Total liabilities | | 38,241,104 | | | | 35,197,120 | |

| | | | | |

Equity: | | | | | |

Prologis, Inc. stockholders’ equity: | | | | | |

Series Q preferred stock at stated liquidation preference of $50 per share; $0.01 par value;

1,279 shares issued and outstanding and 100,000 preferred shares authorized at

September 30, 2024 and December 31, 2023 | | 63,948 | | | | 63,948 | |

Common stock; $0.01 par value; 926,146 and 924,391 shares issued and outstanding at

September 30, 2024 and December 31, 2023, respectively | | 9,261 | | | | 9,244 | |

Additional paid-in capital | | 54,422,574 | | | | 54,249,801 | |

Accumulated other comprehensive loss | | (572,251 | ) | | | (514,201 | ) |

Distributions in excess of net earnings | | (851,763 | ) | | | (627,068 | ) |

Total Prologis, Inc. stockholders’ equity | | 53,071,769 | | | | 53,181,724 | |

Noncontrolling interests | | 4,592,323 | | | | 4,641,996 | |

Total equity | | 57,664,092 | | | | 57,823,720 | |

Total liabilities and equity | $ | 95,905,196 | | | $ | 93,020,840 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PROLOGIS, INC.

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | September 30, | | | September 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Revenues: | | | | | | | | | | | | |

Rental | | $ | 1,897,164 | | | $ | 1,777,359 | | | $ | 5,577,198 | | | $ | 5,062,583 | |

Strategic capital | | | 135,367 | | | | 136,848 | | | | 418,521 | | | | 1,070,584 | |

Development management and other | | | 3,858 | | | | 457 | | | | 5,245 | | | | 1,055 | |

Total revenues | | | 2,036,389 | | | | 1,914,664 | | | | 6,000,964 | | | | 6,134,222 | |

Expenses: | | | | | | | | | | | | |

Rental | | | 427,425 | | | | 416,076 | | | | 1,326,917 | | | | 1,216,568 | |

Strategic capital | | | 61,342 | | | | 84,069 | | | | 210,689 | | | | 306,684 | |

General and administrative | | | 98,154 | | | | 96,673 | | | | 316,041 | | | | 292,097 | |

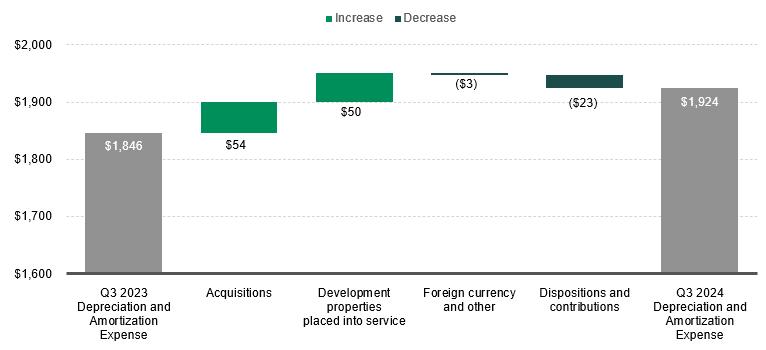

Depreciation and amortization | | | 649,265 | | | | 642,010 | | | | 1,924,075 | | | | 1,846,545 | |

Other | | | 15,683 | | | | 12,342 | | | | 39,371 | | | | 31,686 | |

Total expenses | | | 1,251,869 | | | | 1,251,170 | | | | 3,817,093 | | | | 3,693,580 | |

| | | | | | | | | | | | |

Operating income before gains on real estate transactions, net | | | 784,520 | | | | 663,494 | | | | 2,183,871 | | | | 2,440,642 | |

Gains on dispositions of development properties and land, net | | | 32,005 | | | | 89,030 | | | | 159,487 | | | | 273,907 | |

Gains on other dispositions of investments in real estate, net | | | 434,446 | | | | 129,584 | | | | 651,306 | | | | 158,392 | |

Operating income | | | 1,250,971 | | | | 882,108 | | | | 2,994,664 | | | | 2,872,941 | |

| | | | | | | | | | | | |

Other income (expense): | | | | | | | | | | | | |

Earnings from unconsolidated entities, net | | | 84,749 | | | | 71,365 | | | | 259,558 | | | | 217,786 | |

Interest expense | | | (230,113 | ) | | | (181,053 | ) | | | (631,700 | ) | | | (466,882 | ) |

Foreign currency, derivative and other gains (losses) and other

income (expense), net | | | (37,942 | ) | | | 67,964 | | | | 62,774 | | | | 102,682 | |

Gains on early extinguishment of debt, net | | | - | | | | - | | | | 536 | | | | 3,275 | |

Total other expense | | | (183,306 | ) | | | (41,724 | ) | | | (308,832 | ) | | | (143,139 | ) |

Earnings before income taxes | | | 1,067,665 | | | | 840,384 | | | | 2,685,832 | | | | 2,729,802 | |

Income tax expense | | | (4,214 | ) | | | (41,243 | ) | | | (80,073 | ) | | | (152,541 | ) |

Consolidated net earnings | | | 1,063,451 | | | | 799,141 | | | | 2,605,759 | | | | 2,577,261 | |

Less net earnings attributable to noncontrolling interests | | | 57,732 | | | | 51,514 | | | | 152,977 | | | | 148,983 | |

Net earnings attributable to controlling interests | | | 1,005,719 | | | | 747,627 | | | | 2,452,782 | | | | 2,428,278 | |

Less preferred stock dividends | | | 1,452 | | | | 1,453 | | | | 4,407 | | | | 4,381 | |

Net earnings attributable to common stockholders | | $ | 1,004,267 | | | $ | 746,174 | | | $ | 2,448,375 | | | $ | 2,423,897 | |

| | | | | | | | | | | | |

Weighted average common shares outstanding – Basic | | | 926,427 | | | | 924,395 | | | | 926,017 | | | | 924,228 | |

Weighted average common shares outstanding – Diluted | | | 953,813 | | | | 951,908 | | | | 953,530 | | | | 951,643 | |

| | | | | | | | | | | | |

Net earnings per share attributable to common stockholders – Basic | | $ | 1.08 | | | $ | 0.81 | | | $ | 2.64 | | | $ | 2.62 | |

| | | | | | | | | | | | |

Net earnings per share attributable to common stockholders – Diluted | | $ | 1.08 | | | $ | 0.80 | | | $ | 2.63 | | | $ | 2.61 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PROLOGIS, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(In thousands)

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | September 30, | | | September 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Consolidated net earnings | | $ | 1,063,451 | | | $ | 799,141 | | | $ | 2,605,759 | | | $ | 2,577,261 | |

Other comprehensive income: | | | | | | | | | | | | |

Foreign currency translation gains (losses), net | | | (417,102 | ) | | | 146,281 | | | | (87,659 | ) | | | 284,229 | |

Unrealized gains (losses) on derivative contracts, net | | | (8,669 | ) | | | 3,702 | | | | 26,854 | | | | (19,998 | ) |

Comprehensive income | | | 637,680 | | | | 949,124 | | | | 2,544,954 | | | | 2,841,492 | |

Net earnings attributable to noncontrolling interests | | | (57,732 | ) | | | (51,514 | ) | | | (152,977 | ) | | | (148,983 | ) |

Other comprehensive loss (income) attributable to noncontrolling interests | | | 9,573 | | | | (3,396 | ) | | | 2,755 | | | | (6,405 | ) |

Comprehensive income attributable to common stockholders | | $ | 589,521 | | | $ | 894,214 | | | $ | 2,394,732 | | | $ | 2,686,104 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PROLOGIS, INC.

CONSOLIDATED STATEMENTS OF EQUITY

(Unaudited)

(In thousands)

Three Months Ended September 30, 2024 and 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Common Stock | | | | | | Accumulated | | | Distributions | | | | | | | |

| | | | Number | | | | | | Additional | | | Other | | | in Excess of | | | Non- | | | | |

| Preferred | | | of | | | Par | | | Paid-in | | | Comprehensive | | | Net | | | controlling | | | Total | |

| Stock | | | Shares | | | Value | | | Capital | | | Loss | | | Earnings | | | Interests | | | Equity | |

Balance at July 1, 2024 | $ | 63,948 | | | | 925,880 | | | $ | 9,259 | | | $ | 54,392,526 | | | $ | (156,053 | ) | | $ | (964,620 | ) | | $ | 4,578,261 | | | $ | 57,923,321 | |

Consolidated net earnings | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,005,719 | | | | 57,732 | | | | 1,063,451 | |

Effect of equity compensation plans | | - | | | | 112 | | | | 1 | | | | 16,167 | | | | - | | | | - | | | | 30,565 | | | | 46,733 | |

Capital contributions | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 15,214 | | | | 15,214 | |

Redemption of noncontrolling interests | | - | | | | 154 | | | | 1 | | | | 8,814 | | | | - | | | | - | | | | (8,815 | ) | | | - | |

Foreign currency translation losses, net | | - | | | | - | | | | - | | | | - | | | | (407,729 | ) | | | - | | | | (9,373 | ) | | | (417,102 | ) |

Unrealized losses on

derivative contracts, net | | - | | | | - | | | | - | | | | - | | | | (8,469 | ) | | | - | | | | (200 | ) | | | (8,669 | ) |

Reallocation of equity | | - | | | | - | | | | - | | | | 5,071 | | | | - | | | | - | | | | (5,071 | ) | | | - | |

Dividends ($0.96 per common share)

and other distributions | | - | | | | - | | | | - | | | | (4 | ) | | | - | | | | (892,862 | ) | | | (65,990 | ) | | | (958,856 | ) |

Balance at September 30, 2024 | $ | 63,948 | | | | 926,146 | | | $ | 9,261 | | | $ | 54,422,574 | | | $ | (572,251 | ) | | $ | (851,763 | ) | | $ | 4,592,323 | | | $ | 57,664,092 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Common Stock | | | | | | Accumulated | | | Distributions | | | | | | | |

| | | | Number | | | | | | Additional | | | Other | | | in Excess of | | | Non- | | | | |

| Preferred | | | of | | | Par | | | Paid-in | | | Comprehensive | | | Net | | | controlling | | | Total | |

| Stock | | | Shares | | | Value | | | Capital | | | Income (Loss) | | | Earnings | | | Interests | | | Equity | |

Balance at July 1, 2023 | $ | 63,948 | | | | 923,861 | | | $ | 9,239 | | | $ | 54,115,592 | | | $ | (332,370 | ) | | $ | (390,779 | ) | | $ | 4,612,194 | | | $ | 58,077,824 | |

Consolidated net earnings | | - | | | | - | | | | - | | | | - | | | | - | | | | 747,627 | | | | 51,514 | | | | 799,141 | |

Effect of equity compensation plans | | - | | | | 6 | | | | - | | | | 35,021 | | | | - | | | | - | | | | 68,350 | | | | 103,371 | |

Capital contributions | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 62 | | | | 62 | |

Redemption of noncontrolling interests | | - | | | | 107 | | | | 1 | | | | 6,206 | | | | - | | | | - | | | | (9,497 | ) | | | (3,290 | ) |

Foreign currency translation gains, net | | - | | | | - | | | | - | | | | - | | | | 142,969 | | | | - | | | | 3,312 | | | | 146,281 | |

Unrealized gains on derivative

contracts, net | | - | | | | - | | | | - | | | | - | | | | 3,618 | | | | - | | | | 84 | | | | 3,702 | |

Reallocation of equity | | - | | | | - | | | | - | | | | 41,046 | | | | - | | | | - | | | | (41,046 | ) | | | - | |

Dividends ($0.87 per common share)

and other distributions | | - | | | | - | | | | - | | | | - | | | | - | | | | (806,287 | ) | | | (59,942 | ) | | | (866,229 | ) |

Balance at September 30, 2023 | $ | 63,948 | | | | 923,974 | | | $ | 9,240 | | | $ | 54,197,865 | | | $ | (185,783 | ) | | $ | (449,439 | ) | | $ | 4,625,031 | | | $ | 58,260,862 | |

Nine Months Ended September 30, 2024 and 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Common Stock | | | | | | Accumulated | | | Distributions | | | | | | | |

| | | | Number | | | | | | Additional | | | Other | | | in Excess of | | | Non- | | | | |

| Preferred | | | of | | | Par | | | Paid-in | | | Comprehensive | | | Net | | | controlling | | | Total | |

| Stock | | | Shares | | | Value | | | Capital | | | Income (Loss) | | | Earnings | | | Interests | | | Equity | |

Balance at January 1, 2024 | $ | 63,948 | | | | 924,391 | | | $ | 9,244 | | | $ | 54,249,801 | | | $ | (514,201 | ) | | $ | (627,068 | ) | | $ | 4,641,996 | | | $ | 57,823,720 | |

Consolidated net earnings | | - | | | | - | | | | - | | | | - | | | | - | | | | 2,452,782 | | | | 152,977 | | | | 2,605,759 | |

Effect of equity compensation plans | | - | | | | 405 | | | | 4 | | | | 49,516 | | | | - | | | | - | | | | 130,443 | | | | 179,963 | |

Capital contributions | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 21,245 | | | | 21,245 | |

Redemption of noncontrolling interests | | - | | | | 1,350 | | | | 13 | | | | 77,453 | | | | - | | | | - | | | | (77,965 | ) | | | (499 | ) |

Foreign currency translation losses, net | | - | | | | - | | | | - | | | | - | | | | (84,257 | ) | | | - | | | | (3,402 | ) | | | (87,659 | ) |

Unrealized gains on derivative

contracts, net | | - | | | | - | | | | - | | | | - | | | | 26,207 | | | | - | | | | 647 | | | | 26,854 | |

Reallocation of equity | | - | | | | - | | | | - | | | | 45,815 | | | | - | | | | - | | | | (45,815 | ) | | | - | |

Dividends ($2.88 per common share)

and other distributions | | - | | | | - | | | | - | | | | (11 | ) | | | - | | | | (2,677,477 | ) | | | (227,803 | ) | | | (2,905,291 | ) |

Balance at September 30, 2024 | $ | 63,948 | | | | 926,146 | | | $ | 9,261 | | | $ | 54,422,574 | | | $ | (572,251 | ) | | $ | (851,763 | ) | | $ | 4,592,323 | | | $ | 57,664,092 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Common Stock | | | | | | Accumulated | | | Distributions | | | | | | | |

| | | | Number | | | | | | Additional | | | Other | | | in Excess of | | | Non- | | | | |

| Preferred | | | of | | | Par | | | Paid-in | | | Comprehensive | | | Net | | | controlling | | | Total | |

| Stock | | | Shares | | | Value | | | Capital | | | Income (Loss) | | | Earnings | | | Interests | | | Equity | |

Balance at January 1, 2023 | $ | 63,948 | | | | 923,142 | | | $ | 9,231 | | | $ | 54,065,407 | | | $ | (443,609 | ) | | $ | (457,695 | ) | | $ | 4,625,811 | | | $ | 57,863,093 | |

Consolidated net earnings | | - | | | | - | | | | - | | | | - | | | | - | | | | 2,428,278 | | | | 148,983 | | | | 2,577,261 | |

Effect of equity compensation plans | | - | | | | 330 | | | | 4 | | | | 70,176 | | | | - | | | | - | | | | 152,176 | | | | 222,356 | |

Capital contributions | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,760 | | | | 1,760 | |

Redemption of noncontrolling interests | | - | | | | 502 | | | | 5 | | | | 29,004 | | | | - | | | | - | | | | (98,768 | ) | | | (69,759 | ) |

Foreign currency translation gains, net | | - | | | | - | | | | - | | | | - | | | | 277,341 | | | | - | | | | 6,888 | | | | 284,229 | |

Unrealized losses on derivative

contracts, net | | - | | | | - | | | | - | | | | - | | | | (19,515 | ) | | | - | | | | (483 | ) | | | (19,998 | ) |

Reallocation of equity | | - | | | | - | | | | - | | | | 33,281 | | | | - | | | | - | | | | (33,281 | ) | | | - | |

Dividends ($2.61 per common share)

and other distributions | | - | | | | - | | | | - | | | | (3 | ) | | | - | | | | (2,420,022 | ) | | | (178,055 | ) | | | (2,598,080 | ) |

Balance at September 30, 2023 | $ | 63,948 | | | | 923,974 | | | $ | 9,240 | | | $ | 54,197,865 | | | $ | (185,783 | ) | | $ | (449,439 | ) | | $ | 4,625,031 | | | $ | 58,260,862 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PROLOGIS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

| | | | | | | | |

| | Nine Months Ended | |

| | September 30, | |

| | 2024 | | | 2023 | |

Operating activities: | | | | | | |

Consolidated net earnings | | $ | 2,605,759 | | | $ | 2,577,261 | |

Adjustments to reconcile net earnings to net cash provided by operating activities: | | | | | | |

Straight-lined rents and amortization of above and below market leases | | | (470,289 | ) | | | (466,686 | ) |

Equity-based compensation awards | | | 164,302 | | | | 210,022 | |

Depreciation and amortization | | | 1,924,075 | | | | 1,846,545 | |

Earnings from unconsolidated entities, net | | | (259,558 | ) | | | (217,786 | ) |

Operating distributions from unconsolidated entities | | | 417,296 | | | | 536,104 | |

Decrease (increase) in operating receivables from unconsolidated entities | | | 37,769 | | | | (98,227 | ) |

Amortization of debt discounts and debt issuance costs, net | | | 58,446 | | | | 55,526 | |

Gains on dispositions of development properties and land, net | | | (159,487 | ) | | | (273,907 | ) |

Gains on other dispositions of investments in real estate, net | | | (651,306 | ) | | | (158,392 | ) |

Unrealized foreign currency and derivative losses (gains), net | | | 61,188 | | | | (22,006 | ) |

Gains on early extinguishment of debt, net | | | (536 | ) | | | (3,275 | ) |

Deferred income tax expense | | | 2,201 | | | | 9,836 | |

Decrease (increase) in other assets | | | (209,901 | ) | | | 66,281 | |

Increase in accounts payable and accrued expenses and other liabilities | | | 56,799 | | | | 237,340 | |

Net cash provided by operating activities | | | 3,576,758 | | | | 4,298,636 | |

Investing activities: | | | | | | |

Real estate development | | | (2,376,890 | ) | | | (2,507,664 | ) |

Real estate acquisitions | | | (1,820,308 | ) | | | (3,648,920 | ) |

Duke Transaction, net of cash acquired | | | - | | | | (28,111 | ) |

Tenant improvements and lease commissions on previously leased space | | | (347,488 | ) | | | (271,011 | ) |

Property improvements | | | (248,868 | ) | | | (156,520 | ) |

Proceeds from dispositions and contributions of real estate | | | 1,788,924 | | | | 1,310,442 | |

Investments in and advances to unconsolidated entities | | | (479,897 | ) | | | (246,135 | ) |

Return of investment from unconsolidated entities | | | 54,067 | | | | 304,901 | |

Proceeds from the settlement of net investment hedges | | | 12,797 | | | | 31,045 | |

Payments on the settlement of net investment hedges | | | (1,350 | ) | | | (161 | ) |

Net cash used in investing activities | | | (3,419,013 | ) | | | (5,212,134 | ) |

Financing activities: | | | | | | |

Dividends paid on common and preferred stock | | | (2,677,477 | ) | | | (2,420,022 | ) |

Noncontrolling interests contributions | | | 21,245 | | | | 1,760 | |

Noncontrolling interests distributions | | | (227,803 | ) | | | (178,055 | ) |

Settlement of noncontrolling interests | | | (499 | ) | | | (69,759 | ) |

Tax paid with shares withheld | | | (26,893 | ) | | | (19,814 | ) |

Debt and equity issuance costs paid | | | (28,965 | ) | | | (58,320 | ) |

Net payments on credit facilities and commercial paper | | | (334,164 | ) | | | (1,328,136 | ) |

Repurchase of and payments on debt | | | (917,560 | ) | | | (270,344 | ) |

Proceeds from the issuance of debt | | | 4,283,768 | | | | 5,746,977 | |

Net cash provided by financing activities | | | 91,652 | | | | 1,404,287 | |

| | | | | | |

Effect of foreign currency exchange rate changes on cash | | | 1,086 | | | | (28,431 | ) |

Net increase in cash and cash equivalents | | | 250,483 | | | | 462,358 | |

Cash and cash equivalents, beginning of period | | | 530,388 | | | | 278,483 | |

Cash and cash equivalents, end of period | | $ | 780,871 | | | $ | 740,841 | |

See Note 11 for information on noncash investing and financing activities and other information.

The accompanying notes are an integral part of these Consolidated Financial Statements.

PROLOGIS, L.P.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands)

| | | | | | | |

| | | | | |

| September 30, 2024 | | | December 31, 2023 | |

ASSETS | | | | | |

Investments in real estate properties | $ | 92,093,573 | | | $ | 88,666,575 | |

Less accumulated depreciation | | 12,332,799 | | | | 10,931,485 | |

Net investments in real estate properties | | 79,760,774 | | | | 77,735,090 | |

Investments in and advances to unconsolidated entities | | 10,092,765 | | | | 9,543,970 | |

Assets held for sale or contribution | | 325,987 | | | | 461,657 | |

Net investments in real estate | | 90,179,526 | | | | 87,740,717 | |

| | | | | |

Cash and cash equivalents | | 780,871 | | | | 530,388 | |

Other assets | | 4,944,799 | | | | 4,749,735 | |

Total assets | $ | 95,905,196 | | | $ | 93,020,840 | |

| | | | | |

LIABILITIES AND CAPITAL | | | | | |

Liabilities: | | | | | |

Debt | $ | 32,289,832 | | | $ | 29,000,501 | |

Accounts payable and accrued expenses | | 1,808,142 | | | | 1,766,018 | |

Other liabilities | | 4,143,130 | | | | 4,430,601 | |

Total liabilities | | 38,241,104 | | | | 35,197,120 | |

| | | | | |

Capital: | | | | | |

Partners’ capital: | | | | | |

General partner – preferred | | 63,948 | | | | 63,948 | |

General partner – common | | 53,007,821 | | | | 53,117,776 | |

Limited partners – common | | 887,186 | | | | 848,160 | |

Limited partners – Class A common | | 420,292 | | | | 469,561 | |

Total partners’ capital | | 54,379,247 | | | | 54,499,445 | |

Noncontrolling interests | | 3,284,845 | | | | 3,324,275 | |

Total capital | | 57,664,092 | | | | 57,823,720 | |

Total liabilities and capital | $ | 95,905,196 | | | $ | 93,020,840 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PROLOGIS, L.P.

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

(In thousands, except per unit amounts)

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | September 30, | | | September 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Revenues: | | | | | | | | | | | | |

Rental | | $ | 1,897,164 | | | $ | 1,777,359 | | | $ | 5,577,198 | | | $ | 5,062,583 | |

Strategic capital | | | 135,367 | | | | 136,848 | | | | 418,521 | | | | 1,070,584 | |

Development management and other | | | 3,858 | | | | 457 | | | | 5,245 | | | | 1,055 | |

Total revenues | | | 2,036,389 | | | | 1,914,664 | | | | 6,000,964 | | | | 6,134,222 | |

Expenses: | | | | | | | | | | | | |

Rental | | | 427,425 | | | | 416,076 | | | | 1,326,917 | | | | 1,216,568 | |

Strategic capital | | | 61,342 | | | | 84,069 | | | | 210,689 | | | | 306,684 | |

General and administrative | | | 98,154 | | | | 96,673 | | | | 316,041 | | | | 292,097 | |

Depreciation and amortization | | | 649,265 | | | | 642,010 | | | | 1,924,075 | | | | 1,846,545 | |

Other | | | 15,683 | | | | 12,342 | | | | 39,371 | | | | 31,686 | |

Total expenses | | | 1,251,869 | | | | 1,251,170 | | | | 3,817,093 | | | | 3,693,580 | |

| | | | | | | | | | | | |

Operating income before gains on real estate transactions, net | | | 784,520 | | | | 663,494 | | | | 2,183,871 | | | | 2,440,642 | |

Gains on dispositions of development properties and land, net | | | 32,005 | | | | 89,030 | | | | 159,487 | | | | 273,907 | |

Gains on other dispositions of investments in real estate, net | | | 434,446 | | | | 129,584 | | | | 651,306 | | | | 158,392 | |

Operating income | | | 1,250,971 | | | | 882,108 | | | | 2,994,664 | | | | 2,872,941 | |

| | | | | | | | | | | | |

Other income (expense): | | | | | | | | | | | | |

Earnings from unconsolidated entities, net | | | 84,749 | | | | 71,365 | | | | 259,558 | | | | 217,786 | |

Interest expense | | | (230,113 | ) | | | (181,053 | ) | | | (631,700 | ) | | | (466,882 | ) |

Foreign currency, derivative and other gains (losses) and other

income (expense), net | | | (37,942 | ) | | | 67,964 | | | | 62,774 | | | | 102,682 | |

Gains on early extinguishment of debt, net | | | - | | | | - | | | | 536 | | | | 3,275 | |

Total other expense | | | (183,306 | ) | | | (41,724 | ) | | | (308,832 | ) | | | (143,139 | ) |

Earnings before income taxes | | | 1,067,665 | | | | 840,384 | | | | 2,685,832 | | | | 2,729,802 | |

Income tax expense | | | (4,214 | ) | | | (41,243 | ) | | | (80,073 | ) | | | (152,541 | ) |

Consolidated net earnings | | | 1,063,451 | | | | 799,141 | | | | 2,605,759 | | | | 2,577,261 | |

Less net earnings attributable to noncontrolling interests | | | 32,728 | | | | 32,613 | | | | 91,838 | | | | 87,833 | |

Net earnings attributable to controlling interests | | | 1,030,723 | | | | 766,528 | | | | 2,513,921 | | | | 2,489,428 | |

Less preferred unit distributions | | | 1,452 | | | | 1,453 | | | | 4,407 | | | | 4,381 | |

Net earnings attributable to common unitholders | | $ | 1,029,271 | | | $ | 765,075 | | | $ | 2,509,514 | | | $ | 2,485,047 | |

| | | | | | | | | | | | |

Weighted average common units outstanding – Basic | | | 942,137 | | | | 939,602 | | | | 941,545 | | | | 939,448 | |

Weighted average common units outstanding – Diluted | | | 953,813 | | | | 951,908 | | | | 953,530 | | | | 951,643 | |

| | | | | | | | | | | | |

Net earnings per unit attributable to common unitholders – Basic | | $ | 1.08 | | | $ | 0.81 | | | $ | 2.64 | | | $ | 2.62 | |

| | | | | | | | | | | | |

Net earnings per unit attributable to common unitholders – Diluted | | $ | 1.08 | | | $ | 0.80 | | | $ | 2.63 | | | $ | 2.61 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PROLOGIS, L.P.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(In thousands)

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | | Nine Months Ended | |

| | September 30, | | | September 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Consolidated net earnings | | $ | 1,063,451 | | | $ | 799,141 | | | $ | 2,605,759 | | | $ | 2,577,261 | |

Other comprehensive income: | | | | | | | | | | | | |

Foreign currency translation gains (losses), net | | | (417,102 | ) | | | 146,281 | | | | (87,659 | ) | | | 284,229 | |

Unrealized gains (losses) on derivative contracts, net | | | (8,669 | ) | | | 3,702 | | | | 26,854 | | | | (19,998 | ) |

Comprehensive income | | | 637,680 | | | | 949,124 | | | | 2,544,954 | | | | 2,841,492 | |

Net earnings attributable to noncontrolling interests | | | (32,728 | ) | | | (32,613 | ) | | | (91,838 | ) | | | (87,833 | ) |

Other comprehensive loss (income) attributable to noncontrolling interests | | | (605 | ) | | | 260 | | | | 1,324 | | | | (20 | ) |

Comprehensive income attributable to common unitholders | | $ | 604,347 | | | $ | 916,771 | | | $ | 2,454,440 | | | $ | 2,753,639 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PROLOGIS, L.P.

CONSOLIDATED STATEMENTS OF CAPITAL

(Unaudited)

(In thousands)

Three Months Ended September 30, 2024 and 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| General Partner | | | Limited Partners | | | Non- | | | | |

| Preferred | | | Common | | | Common | | | Class A Common | | | controlling | | | Total | |

| Units | | | Amount | | | Units | | | Amount | | | Units | | | Amount | | | Units | | | Amount | | | Interests | | | Capital | |

Balance at July 1, 2024 | | 1,279 | | | $ | 63,948 | | | | 925,880 | | | $ | 53,281,112 | | | | 15,291 | | | $ | 879,924 | | | | 7,650 | | | $ | 421,376 | | | $ | 3,276,961 | | | $ | 57,923,321 | |

Consolidated net earnings | | - | | | | - | | | | - | | | | 1,005,719 | | | | - | | | | 16,986 | | | | - | | | | 8,018 | | | | 32,728 | | | | 1,063,451 | |

Effect of equity compensation plans | | - | | | | - | | | | 112 | | | | 16,168 | | | | 364 | | | | 30,565 | | | | - | | | | - | | | | - | | | | 46,733 | |

Capital contributions | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 15,214 | | | | 15,214 | |

Redemption of limited partners units | | - | | | | - | | | | 154 | | | | 8,815 | | | | (154 | ) | | | (8,815 | ) | | | - | | | | - | | | | - | | | | - | |

Foreign currency translation gains

(losses), net | | - | | | | - | | | | - | | | | (407,729 | ) | | | - | | | | (6,752 | ) | | | - | | | | (3,226 | ) | | | 605 | | | | (417,102 | ) |

Unrealized losses on derivative

contracts, net | | - | | | | - | | | | - | | | | (8,469 | ) | | | - | | | | (134 | ) | | | - | | | | (66 | ) | | | - | | | | (8,669 | ) |

Reallocation of capital | | - | | | | - | | | | - | | | | 5,071 | | | | - | | | | (4,208 | ) | | | - | | | | (863 | ) | | | - | | | | - | |

Distributions ($0.96 per common

unit) and other | | - | | | | - | | | | - | | | | (892,866 | ) | | | - | | | | (20,380 | ) | | | - | | | | (4,947 | ) | | | (40,663 | ) | | | (958,856 | ) |

Balance at September 30, 2024 | | 1,279 | | | $ | 63,948 | | | | 926,146 | | | $ | 53,007,821 | | | | 15,501 | | | $ | 887,186 | | | | 7,650 | | | $ | 420,292 | | | $ | 3,284,845 | | | $ | 57,664,092 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| General Partner | | | Limited Partners | | | Non- | | | | |

| Preferred | | | Common | | | Common | | | Class A Common | | | controlling | | | Total | |

| Units | | | Amount | | | Units | | | Amount | | | Units | | | Amount | | | Units | | | Amount | | | Interests | | | Capital | |

Balance at July 1, 2023 | | 1,279 | | | $ | 63,948 | | | | 923,861 | | | $ | 53,401,682 | | | | 14,538 | | | $ | 840,369 | | | | 8,595 | | | $ | 469,424 | | | $ | 3,302,401 | | | $ | 58,077,824 | |

Consolidated net earnings | | - | | | | - | | | | - | | | | 747,627 | | | | - | | | | 12,344 | | | | - | | | | 6,557 | | | | 32,613 | | | | 799,141 | |

Effect of equity compensation plans | | - | | | | - | | | | 6 | | | | 35,021 | | | | 331 | | | | 68,350 | | | | - | | | | - | | | | - | | | | 103,371 | |

Capital contributions | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 62 | | | | 62 | |

Redemption of limited partners units | | - | | | | - | | | | 107 | | | | 6,207 | | | | (134 | ) | | | (9,497 | ) | | | - | | | | - | | | | - | | | | (3,290 | ) |

Foreign currency translation

gains (losses), net | | - | | | | - | | | | - | | | | 142,969 | | | | - | | | | 2,307 | | | | - | | | | 1,265 | | | | (260 | ) | | | 146,281 | |

Unrealized gains on derivative

contracts, net | | - | | | | - | | | | - | | | | 3,618 | | | | - | | | | 53 | | | | - | | | | 31 | | | | - | | | | 3,702 | |

Reallocation of capital | | - | | | | - | | | | - | | | | 41,046 | | | | - | | | | (41,675 | ) | | | - | | | | 629 | | | | - | | | | - | |

Distributions ($0.87 per common

unit) and other | | - | | | | - | | | | - | | | | (806,287 | ) | | | - | | | | (17,863 | ) | | | - | | | | (5,559 | ) | | | (36,520 | ) | | | (866,229 | ) |

Balance at September 30, 2023 | | 1,279 | | | $ | 63,948 | | | | 923,974 | | | $ | 53,571,883 | | | | 14,735 | | | $ | 854,388 | | | | 8,595 | | | $ | 472,347 | | | $ | 3,298,296 | | | $ | 58,260,862 | |

Nine Months Ended September 30, 2024 and 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| General Partner | | | Limited Partners | | | Non- | | | | |

| Preferred | | | Common | | | Common | | | Class A Common | | | controlling | | | Total | |

| Units | | | Amount | | | Units | | | Amount | | | Units | | | Amount | | | Units | | | Amount | | | Interests | | | Capital | |

Balance at January 1, 2024 | | 1,279 | | | $ | 63,948 | | | | 924,391 | | | $ | 53,117,776 | | | | 14,760 | | | $ | 848,160 | | | | 8,595 | | | $ | 469,561 | | | $ | 3,324,275 | | | $ | 57,823,720 | |

Consolidated net earnings | | - | | | | - | | | | - | | | | 2,452,782 | | | | - | | | | 41,055 | | | | - | | | | 20,084 | | | | 91,838 | | | | 2,605,759 | |

Effect of equity compensation plans | | - | | | | - | | | | 405 | | | | 49,520 | | | | 1,202 | | | | 130,443 | | | | - | | | | - | | | | - | | | | 179,963 | |

Capital contributions | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 21,245 | | | | 21,245 | |

Redemption of limited partners units | | - | | | | - | | | | 1,350 | | | | 77,466 | | | | (461 | ) | | | (26,127 | ) | | | (945 | ) | | | (51,838 | ) | | | - | | | | (499 | ) |

Foreign currency translation losses, net | | - | | | | - | | | | - | | | | (84,257 | ) | | | - | | | | (1,410 | ) | | | - | | | | (668 | ) | | | (1,324 | ) | | | (87,659 | ) |

Unrealized gains on

derivative contracts, net | | - | | | | - | | | | - | | | | 26,207 | | | | - | | | | 439 | | | | - | | | | 208 | | | | - | | | | 26,854 | |

Reallocation of capital | | - | | | | - | | | | - | | | | 45,815 | | | | - | | | | (44,212 | ) | | | - | | | | (1,603 | ) | | | - | | | | - | |

Distributions ($2.88 per common

unit) and other | | - | | | | - | | | | - | | | | (2,677,488 | ) | | | - | | | | (61,162 | ) | | | - | | | | (15,452 | ) | | | (151,189 | ) | | | (2,905,291 | ) |

Balance at September 30, 2024 | | 1,279 | | | $ | 63,948 | | | | 926,146 | | | $ | 53,007,821 | | | | 15,501 | | | $ | 887,186 | | | | 7,650 | | | $ | 420,292 | | | $ | 3,284,845 | | | $ | 57,664,092 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| General Partner | | | Limited Partners | | | Non- | | | | |

| Preferred | | | Common | | | Common | | | Class A Common | | | controlling | | | Total | |

| Units | | | Amount | | | Units | | | Amount | | | Units | | | Amount | | | Units | | | Amount | | | Interests | | | Capital | |

Balance at January 1, 2023 | | 1,279 | | | $ | 63,948 | | | | 923,142 | | | $ | 53,173,334 | | | | 14,640 | | | $ | 843,263 | | | | 8,595 | | | $ | 464,781 | | | $ | 3,317,767 | | | $ | 57,863,093 | |

Consolidated net earnings | | - | | | | - | | | | - | | | | 2,428,278 | | | | - | | | | 39,919 | | | | - | | | | 21,231 | | | | 87,833 | | | | 2,577,261 | |

Effect of equity compensation plans | | - | | | | - | | | | 330 | | | | 70,180 | | | | 1,174 | | | | 152,176 | | | | - | | | | - | | | | - | | | | 222,356 | |

Capital contributions | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 1,760 | | | | 1,760 | |

Redemption of limited partners units | | - | | | | - | | | | 502 | | | | 29,009 | | | | (1,079 | ) | | | (98,768 | ) | | | - | | | | - | | | | - | | | | (69,759 | ) |

Foreign currency translation

gains, net | | - | | | | - | | | | - | | | | 277,341 | | | | - | | | | 4,422 | | | | - | | | | 2,446 | | | | 20 | | | | 284,229 | |

Unrealized losses on derivative

contracts, net | | - | | | | - | | | | - | | | | (19,515 | ) | | | - | | | | (311 | ) | | | - | | | | (172 | ) | | | - | | | | (19,998 | ) |

Reallocation of capital | | - | | | | - | | | | - | | | | 33,281 | | | | - | | | | (34,018 | ) | | | - | | | | 737 | | | | - | | | | - | |

Distributions ($2.61 per common

unit) and other | | - | | | | - | | | | - | | | | (2,420,025 | ) | | | - | | | | (52,295 | ) | | | - | | | | (16,676 | ) | | | (109,084 | ) | | | (2,598,080 | ) |

Balance at September 30, 2023 | | 1,279 | | | $ | 63,948 | | | | 923,974 | | | $ | 53,571,883 | | | | 14,735 | | | $ | 854,388 | | | | 8,595 | | | $ | 472,347 | | | $ | 3,298,296 | | | $ | 58,260,862 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PROLOGIS, L.P.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

| | | | | | | | |

| | Nine Months Ended | |

| | September 30, | |

| | 2024 | | | 2023 | |

Operating activities: | | | | | | |

Consolidated net earnings | | $ | 2,605,759 | | | $ | 2,577,261 | |

Adjustments to reconcile net earnings to net cash provided by operating activities: | | | | | | |

Straight-lined rents and amortization of above and below market leases | | | (470,289 | ) | | | (466,686 | ) |

Equity-based compensation awards | | | 164,302 | | | | 210,022 | |

Depreciation and amortization | | | 1,924,075 | | | | 1,846,545 | |

Earnings from unconsolidated entities, net | | | (259,558 | ) | | | (217,786 | ) |

Operating distributions from unconsolidated entities | | | 417,296 | | | | 536,104 | |

Decrease (increase) in operating receivables from unconsolidated entities | | | 37,769 | | | | (98,227 | ) |

Amortization of debt discounts and debt issuance costs, net | | | 58,446 | | | | 55,526 | |

Gains on dispositions of development properties and land, net | | | (159,487 | ) | | | (273,907 | ) |

Gains on other dispositions of investments in real estate, net | | | (651,306 | ) | | | (158,392 | ) |

Unrealized foreign currency and derivative losses (gains), net | | | 61,188 | | | | (22,006 | ) |

Gains on early extinguishment of debt, net | | | (536 | ) | | | (3,275 | ) |

Deferred income tax expense | | | 2,201 | | | | 9,836 | |

Decrease (increase) in other assets | | | (209,901 | ) | | | 66,281 | |

Increase in accounts payable and accrued expenses and other liabilities | | | 56,799 | | | | 237,340 | |

Net cash provided by operating activities | | | 3,576,758 | | | | 4,298,636 | |

Investing activities: | | | | | | |

Real estate development | | | (2,376,890 | ) | | | (2,507,664 | ) |

Real estate acquisitions | | | (1,820,308 | ) | | | (3,648,920 | ) |

Duke Transaction, net of cash acquired | | | - | | | | (28,111 | ) |

Tenant improvements and lease commissions on previously leased space | | | (347,488 | ) | | | (271,011 | ) |

Property improvements | | | (248,868 | ) | | | (156,520 | ) |

Proceeds from dispositions and contributions of real estate | | | 1,788,924 | | | | 1,310,442 | |

Investments in and advances to unconsolidated entities | | | (479,897 | ) | | | (246,135 | ) |

Return of investment from unconsolidated entities | | | 54,067 | | | | 304,901 | |

Proceeds from the settlement of net investment hedges | | | 12,797 | | | | 31,045 | |

Payments on the settlement of net investment hedges | | | (1,350 | ) | | | (161 | ) |

Net cash used in investing activities | | | (3,419,013 | ) | | | (5,212,134 | ) |

Financing activities: | | | | | | |

Distributions paid on common and preferred units | | | (2,754,091 | ) | | | (2,488,993 | ) |

Noncontrolling interests contributions | | | 21,245 | | | | 1,760 | |

Noncontrolling interests distributions | | | (151,189 | ) | | | (109,084 | ) |

Redemption of common limited partnership units | | | (499 | ) | | | (69,759 | ) |

Tax paid with shares of the Parent withheld | | | (26,893 | ) | | | (19,814 | ) |

Debt and equity issuance costs paid | | | (28,965 | ) | | | (58,320 | ) |

Net payments on credit facilities and commercial paper | | | (334,164 | ) | | | (1,328,136 | ) |

Repurchase of and payments on debt | | | (917,560 | ) | | | (270,344 | ) |

Proceeds from the issuance of debt | | | 4,283,768 | | | | 5,746,977 | |

Net cash provided by financing activities | | | 91,652 | | | | 1,404,287 | |

| | | | | | |

Effect of foreign currency exchange rate changes on cash | | | 1,086 | | | | (28,431 | ) |

Net increase in cash and cash equivalents | | | 250,483 | | | | 462,358 | |

Cash and cash equivalents, beginning of period | | | 530,388 | | | | 278,483 | |

Cash and cash equivalents, end of period | | $ | 780,871 | | | $ | 740,841 | |

See Note 11 for information on noncash investing and financing activities and other information.

The accompanying notes are an integral part of these Consolidated Financial Statements.

PROLOGIS, INC. AND PROLOGIS, L.P.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1. GENERAL

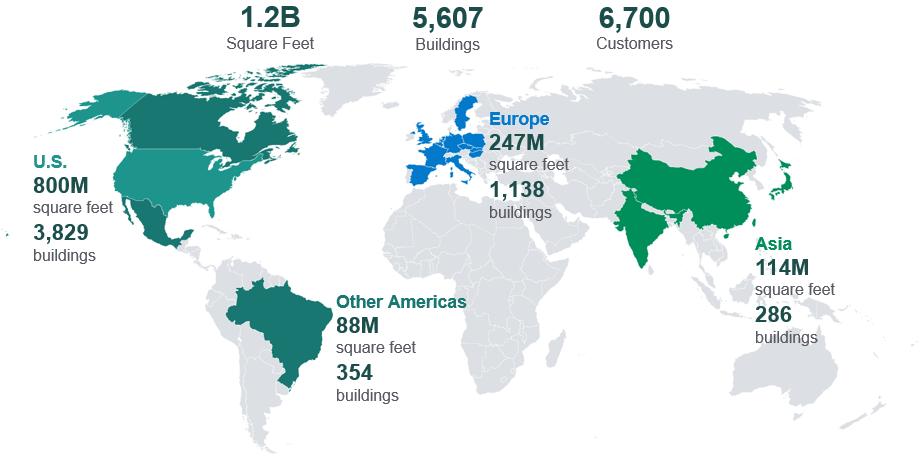

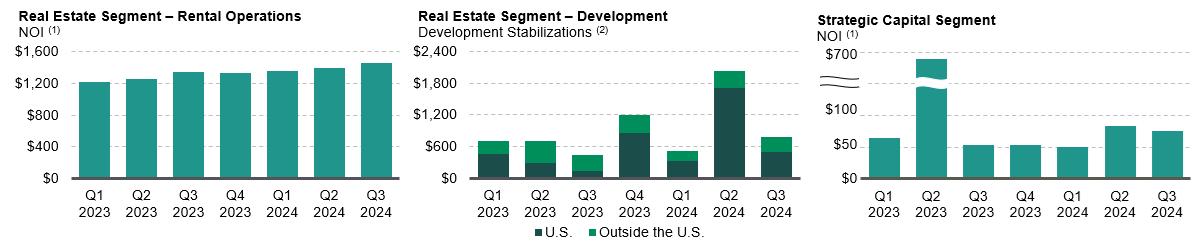

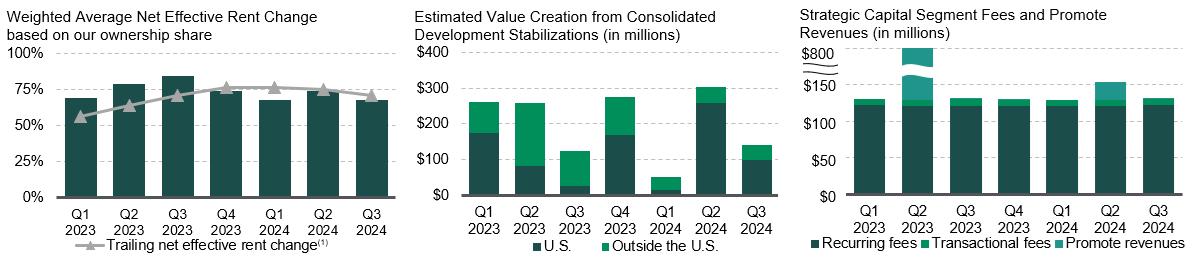

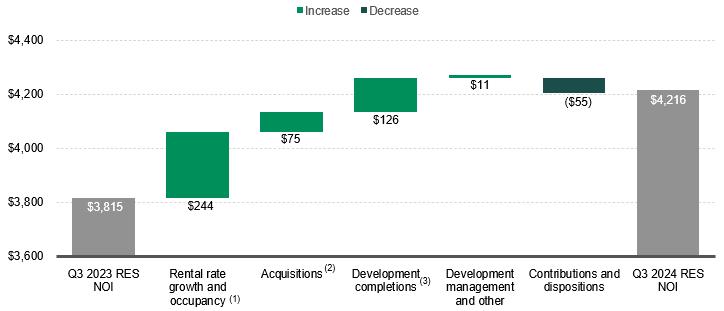

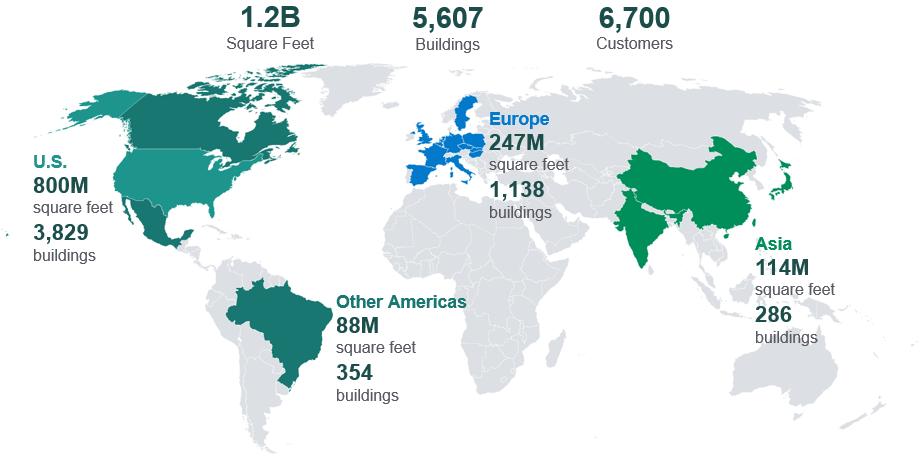

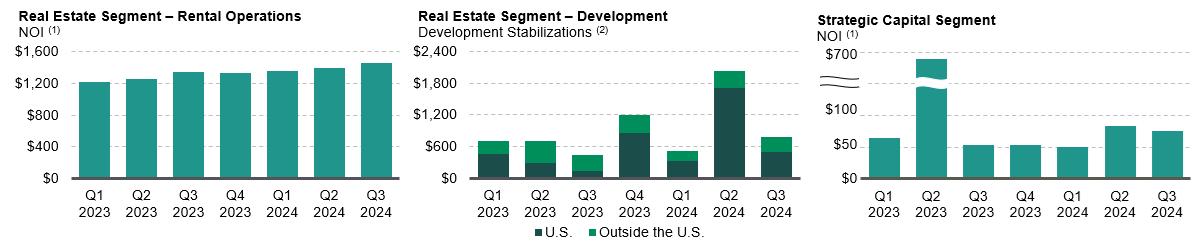

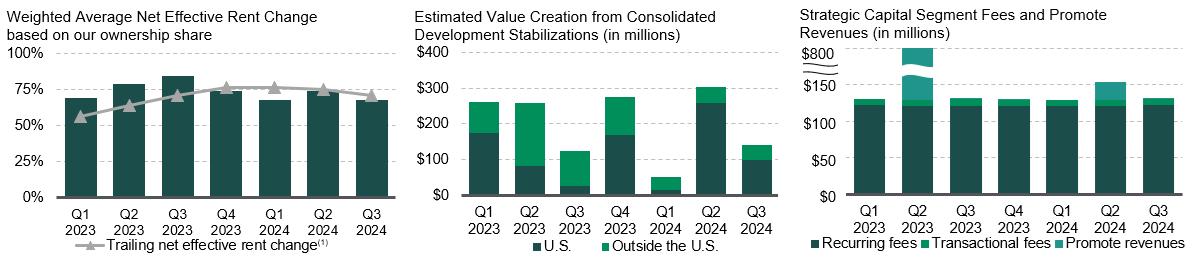

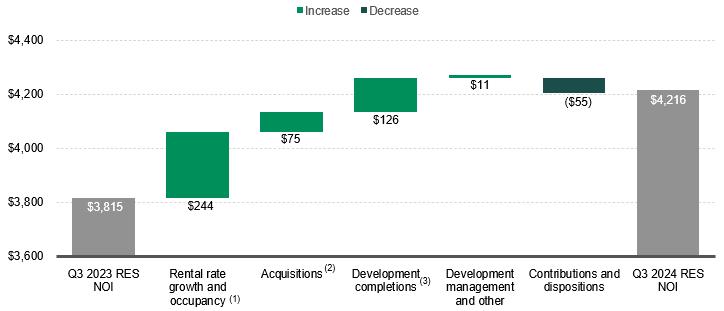

Business. Prologis, Inc. (or the “Parent”) commenced operations as a fully integrated real estate company in 1997, elected to be taxed as a real estate investment trust (“REIT”) under the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code” or “IRC”), and believes the current organization and method of operation will enable it to maintain its status as a REIT. The Parent is the general partner of Prologis, L.P. (or the “Operating Partnership” or “OP”). Through the OP, we are engaged in the ownership, acquisition, development and management of logistics facilities with a focus on key markets in 20 countries on four continents. We invest in real estate through wholly owned subsidiaries and other entities through which we co-invest with partners and investors. We maintain a significant level of ownership in these co-investment ventures, which may be consolidated or unconsolidated based on our level of control of the entity. Our current business strategy consists of two operating business segments: Real Estate (Rental Operations and Development) and Strategic Capital. Our Real Estate Segment represents the ownership, leasing and development of logistics properties. Our Strategic Capital Segment represents the management of properties owned by our unconsolidated co-investment ventures and other ventures. See Note 10 for further discussion of our business segments. Unless otherwise indicated, the Notes to the Consolidated Financial Statements apply to both the Parent and the OP. The terms “the Company,” “Prologis,” “we,” “our” or “us” means the Parent and OP collectively.

For each share of preferred or common stock the Parent issues, the OP issues a corresponding preferred or common partnership unit, as applicable, to the Parent in exchange for the contribution of the proceeds from the stock issuance. At September 30, 2024, the Parent owned a 97.59% common general partnership interest in the OP and substantially all of the preferred units in the OP. The remaining 2.41% common limited partnership interests, which include Class A common limited partnership units (“Class A Units”) in the OP, are owned by unaffiliated investors and certain current and former directors and officers of the Parent. Each partner’s percentage interest in the OP is determined based on the number of OP units held, including the number of OP units into which Class A Units are convertible, compared to total OP units outstanding at each period end and is used as the basis for the allocation of net income or loss to each partner. At the end of each reporting period, a capital adjustment is made in the OP to reflect the appropriate ownership interest for each of the common unitholders. These adjustments are reflected in the line items Reallocation of Equity in the Consolidated Statements of Equity of the Parent and Reallocation of Capital in the Consolidated Statements of Capital of the OP.

As the sole general partner of the OP, the Parent has complete responsibility and discretion in the day-to-day management and control of the OP, and we operate the Parent and the OP as one enterprise. The management of the Parent consists of the same members as the management of the OP. These members are officers of the Parent and employees of the OP or one of its subsidiaries. As general partner with control of the OP, the Parent is the primary beneficiary and therefore consolidates the OP. Because the Parent’s only significant asset is its investment in the OP, the assets and liabilities of the Parent and the OP are the same on their respective financial statements.

Basis of Presentation. The accompanying Consolidated Financial Statements are prepared in accordance with United States (“U.S.”) generally accepted accounting principles (“GAAP”) and are presented in our reporting currency, the U.S. dollar. Intercompany transactions with consolidated entities have been eliminated.

The accompanying unaudited interim financial information has been prepared according to the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”). Certain information and note disclosures normally included in our annual financial statements prepared in accordance with GAAP have been condensed or omitted in accordance with such rules and regulations. Our management believes that the disclosures presented in these financial statements are adequate to make the information presented not misleading. In our opinion, all adjustments and eliminations, consisting only of normal recurring adjustments, necessary to present fairly the financial position and results of operations for both the Parent and the OP for the reported periods have been included. The results of operations for such interim periods are not necessarily indicative of the results for the full year. The accompanying unaudited interim financial information should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC, and other public information.

Accounting Pronouncements.

New Accounting Standards Issued but not yet Adopted

Segment Reporting. In November 2023, the Financial Accounting Standards Board (“FASB”) issued an accounting standard update (“ASU”) to improve reportable segments disclosure requirements. The ASU requires existing annual segment disclosures to also be disclosed on an interim basis, and also requires additional disclosures around significant segment expenses and disclosures to identify the title and position of the chief operating decision maker ("CODM"). The standard is effective for the fiscal year ended December 31, 2024 and interim periods thereafter. We do not expect the standard to have a material impact on our Consolidated Financial Statements as we anticipate the primary change will be additional disclosures in Note 10.

NOTE 2. REAL ESTATE

Investments in real estate properties consisted of the following (dollars and square feet in thousands):

| | | | | | | | | | | | | | | | | | |

| Square Feet | | Number of Buildings | | | |

| Sep 30, | | Dec 31, | | Sep 30, | | Dec 31, | | Sep 30, | | Dec 31, | |

| 2024 | | 2023 | | 2024 | | 2023 | | 2024 | | 2023 | |

Operating properties: | | | | | | | | | | | | |

Buildings and improvements | | 650,111 | | | 630,955 | | | 3,016 | | | 2,960 | | $ | 55,326,967 | | $ | 52,626,191 | |

Improved land | | | | | | | | | | 23,851,292 | | | 22,809,306 | |

Development portfolio, including

land costs: | | | | | | | | | | | | |

Prestabilized | | 5,957 | | | 13,369 | | | 21 | | | 45 | | | 855,419 | | | 1,838,805 | |

Properties under development | | 21,529 | | | 26,438 | | | 76 | | | 85 | | | 2,288,124 | | | 2,528,650 | |

Land (1) | | | | | | | | | | 4,395,022 | | | 3,775,553 | |

Other real estate investments (2) | | | | | | | | | | 5,376,749 | | | 5,088,070 | |

Total investments in real estate

properties | | | | | | | | | | 92,093,573 | | | 88,666,575 | |

Less accumulated depreciation | | | | | | | | | | 12,332,799 | | | 10,931,485 | |

Net investments in real estate

properties | | | | | | | | | $ | 79,760,774 | | $ | 77,735,090 | |

(1)At September 30, 2024 and December 31, 2023, our land was comprised of 8,651 and 8,197 acres, respectively.

(2)Included in other real estate investments were principally: (i) land parcels we own and lease to third parties; (ii) non-strategic real estate assets that we do not intend to operate long term; (iii) renewable energy assets, including solar panels and electric vehicle chargers, and energy storage systems; and (iv) non-industrial real estate assets that we intend to redevelop as industrial properties or other higher use assets.

Acquisitions

The following table summarizes our real estate acquisition activity, including energy assets (dollars and square feet in thousands):

| | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | 2024 (1) | | | 2023 | | | 2024 (1) | | | 2023 (2) | |

Number of operating properties | | | 46 | | | | - | | | | 54 | | | | 76 | |

Square feet | | | 8,770 | | | | - | | | | 11,047 | | | | 14,941 | |

Acres of land | | | 342 | | | | 890 | | | | 707 | | | | 1,128 | |

Acquisition cost of net investments in real estate, excluding other real

estate investments | | $ | 1,431,598 | | | $ | 116,112 | | | $ | 1,999,129 | | | $ | 3,626,672 | |

| | | | | | | | | | | | |

Acquisition cost of other real estate investments | | $ | 184,761 | | | $ | 37,343 | | | $ | 235,004 | | | $ | 77,624 | |

(1)During the three and nine months ended September 30, 2024, we acquired our partners' interest in an unconsolidated venture and began consolidating the properties, including 30 operating properties aggregating 6.0 million square feet. In addition, through our investment in consolidated joint ventures in India, we entered a new market and acquired 225 acres of land.

(2)On June 29, 2023, we acquired a real estate portfolio comprised of 70 operating properties in the U.S., aggregating 13.8 million square feet, for cash consideration of $3.1 billion.

Dispositions

The following table summarizes our dispositions of net investments in real estate which include contributions to unconsolidated co-investment ventures and dispositions to third parties (dollars and square feet in thousands):

| | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Dispositions of development properties and land, net (1) | | | | | | | | | | | | |

Number of properties | | | 3 | | | | 2 | | | | 10 | | | | 7 | |

Square feet | | | 1,284 | | | | 1,530 | | | | 3,123 | | | | 3,652 | |

Net proceeds | | $ | 202,386 | | | $ | 272,250 | | | $ | 580,876 | | | $ | 738,207 | |

Gains on dispositions of development properties and land, net | | $ | 32,005 | | | $ | 89,030 | | | $ | 159,487 | | | $ | 273,907 | |

| | | | | | | | | | | | |

Other dispositions of investments in real estate, net (2) | | | | | | | | | | | | |

Number of properties | | | 19 | | | | 19 | | | | 71 | | | | 24 | |

Square feet | | | 6,131 | | | | 2,415 | | | | 13,954 | | | | 2,775 | |

Net proceeds | | $ | 893,054 | | | $ | 263,567 | | | $ | 1,776,112 | | | $ | 635,140 | |

Gains on other dispositions of investments in real estate, net | | $ | 434,446 | | | $ | 129,584 | | | $ | 651,306 | | | $ | 158,392 | |

(1)The gains we recognize in Gains on Dispositions of Development Properties and Land, Net in the Consolidated Statements of Income are principally driven by the contribution of newly developed properties to our unconsolidated co-investment ventures and occasionally sales to a third party.

(2)The three and nine months ended September 30, 2024 include the contribution of operating properties to our unconsolidated co-investment venture in the U.S. During the nine months ended September 30, 2023, we sold our ownership interest in an unconsolidated office joint venture.

Leases

We recognized lease right-of-use assets of $720.3 million and $683.7 million within Other Assets and lease liabilities of $624.2 million and $597.6 million within Other Liabilities, for land and office space leases in which we are the lessee, in the Consolidated Balance Sheets at September 30, 2024 and December 31, 2023, respectively.

Off-Balance Sheet Liabilities

We have entered into agreements, principally performance and surety bonds and standby letters of credit in connection with certain development and energy projects. At September 30, 2024 and December 31, 2023, we had $594.9 million and $498.5 million, respectively, outstanding under such arrangements.

NOTE 3. UNCONSOLIDATED ENTITIES

Summary of Investments

We have investments in entities through a variety of ventures. We co-invest in entities that own multiple properties with partners and investors and we provide asset management and property management services to these entities, which we refer to as co-investment ventures. These entities may be consolidated or unconsolidated depending on the structure, our partner’s participation and other rights and our level of control of the entity. This note details our investments in unconsolidated co-investment ventures, which are related parties and accounted for using the equity method of accounting. See Note 6 for more detail regarding our consolidated investments that are not wholly owned.

We also have investments in other ventures, generally with one partner, which we generally account for using the equity method. We refer to our investments in both unconsolidated co-investment ventures and other ventures, collectively, as unconsolidated entities.

The following table summarizes our investments in and advances to unconsolidated entities (in thousands):

| | | | | | | | |

| | September 30, | | | December 31, | |

| | 2024 | | | 2023 | |

Unconsolidated co-investment ventures | | $ | 9,275,611 | | | $ | 8,379,265 | |

Other ventures (1) | | | 817,154 | | | | 1,164,705 | |

Total | | $ | 10,092,765 | | | $ | 9,543,970 | |

(1)In August 2024, we acquired our partners' interest in an unconsolidated venture and began consolidating the properties.

Unconsolidated Co-Investment Ventures

The following table summarizes the Strategic Capital Revenues we recognized in the Consolidated Statements of Income related to our unconsolidated co-investment ventures (in thousands):

| | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | 2024 | | | 2023 | | | 2024 | | | 2023 | |

Recurring fees | | $ | 117,855 | | | $ | 113,947 | | | $ | 345,776 | | | $ | 340,842 | |

Transactional fees | | | 14,372 | | | | 15,757 | | | | 39,786 | | | | 44,359 | |

Promote revenue (1) | | | 908 | | | | 3,993 | | | | 25,027 | | | | 673,665 | |

Total strategic capital revenues from unconsolidated

co-investment ventures (2) | | $ | 133,135 | | | $ | 133,697 | | | $ | 410,589 | | | $ | 1,058,866 | |

(1)The nine months ended September 30, 2023 primarily includes promote revenue earned from our unconsolidated co-investment venture in the U.S.

(2)These amounts exclude strategic capital revenues from other ventures.

The following table summarizes the key property information, financial position and operating information of our unconsolidated co-investment ventures on a U.S. GAAP basis (not our proportionate share) and the amounts we recognized in the Consolidated Financial Statements related to these ventures (dollars and square feet in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. | | | Other Americas (1) | | | Europe | | | Asia | | | Total | |

At: | Sep 30,

2024 | | | Dec 31,

2023 | | | Sep 30,

2024 (2) | | | Dec 31,

2023 | | | Sep 30,

2024 | | | Dec 31,

2023 | | | Sep 30,

2024 | | | Dec 31,

2023 | | | Sep 30,

2024 | | | Dec 31,

2023 | |

Key property information: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Ventures | | 1 | | | | 1 | | | | 2 | | | | 2 | | | | 2 | | | | 2 | | | | 4 | | | | 4 | | | | 9 | | | | 9 | |

Operating properties | | 748 | | | | 745 | | | | 285 | | | | 275 | | | | 1,017 | | | | 1,007 | | | | 240 | | | | 228 | | | | 2,290 | | | | 2,255 | |

Square feet | | 130 | | | | 126 | | | | 67 | | | | 65 | | | | 227 | | | | 223 | | | | 98 | | | | 94 | | | | 522 | | | | 508 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financial position: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets ($) | | 13,183 | | | | 11,884 | | | | 4,083 | | | | 4,106 | | | | 24,819 | | | | 23,504 | | | | 10,224 | | | | 10,226 | | | | 52,309 | | | | 49,720 | |

Third-party debt ($) | | 5,396 | | | | 4,185 | | | | 1,062 | | | | 915 | | | | 6,167 | | | | 5,804 | | | | 4,003 | | | | 3,983 | | | | 16,628 | | | | 14,887 | |

Total liabilities ($) | | 6,244 | | | | 4,930 | | | | 1,147 | | | | 997 | | | | 8,325 | | | | 7,849 | | | | 4,439 | | | | 4,429 | | | | 20,155 | | | | 18,205 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Our investment balance ($) (3) | | 2,814 | | | | 2,257 | | | | 1,189 | | | | 1,152 | | | | 4,434 | | | | 4,126 | | | | 839 | | | | 844 | | | | 9,276 | | | | 8,379 | |

Our weighted average ownership (4) | | 30.3 | % | | | 27.3 | % | | | 33.4 | % | | | 39.3 | % | | | 32.2 | % | | | 31.9 | % | | | 15.2 | % | | | 15.2 | % | | | 28.6 | % | | | 28.1 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. | | | Other Americas (1) | | | Europe | | | Asia | | | Total | |

Operating Information: | Sep 30,

2024 | | | Sep 30,

2023 | | | Sep 30,

2024 | | | Sep 30,

2023 | | | Sep 30,

2024 | | | Sep 30,

2023 | | | Sep 30,

2024 | | | Sep 30,

2023 | | | Sep 30,

2024 | | | Sep 30,

2023 | |

For the three months ended: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenues ($) | | 355 | | | | 330 | | | | 110 | | | | 109 | | | | 467 | | | | 429 | | | | 162 | | | | 164 | | | | 1,094 | | | | 1,032 | |

Net earnings ($) | | 103 | | | | 86 | | | | 41 | | | | 52 | | | | 96 | | | | 66 | | | | 11 | | | | 28 | | | | 251 | | | | 232 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Our earnings from unconsolidated

co-investment ventures, net ($) | | 31 | | | | 24 | | | | 13 | | | | 18 | | | | 36 | | | | 23 | | | | 2 | | | | 5 | | | | 82 | | | | 70 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For the nine months ended: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total revenues ($) | | 1,070 | | | | 983 | | | | 350 | | | | 314 | | | | 1,359 | | | | 1,255 | | | | 475 | | | | 491 | | | | 3,254 | | | | 3,043 | |

Net earnings ($) | | 322 | | | | 262 | | | | 150 | | | | 142 | | | | 259 | | | | 226 | | | | 48 | | | | 56 | | | | 779 | | | | 686 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Our earnings from unconsolidated

co-investment ventures, net ($) | | 97 | | | | 71 | | | | 49 | | | | 49 | | | | 91 | | | | 74 | | | | 9 | | | | 10 | | | | 246 | | | | 204 | |

(1)Prologis Brazil Logistics Venture and our other Brazilian joint ventures are combined as one venture for the purpose of this table.

(2)In August 2024, FIBRA Prologis in Mexico completed a tender offer to acquire 77.1% of Terrafina, a Mexican FIBRA, through a combination of stock and cash, and began consolidating Terrafina. At June 30, 2024, Terrafina owned and managed 42.2 million square feet of industrial real estate, including 288 industrial operating properties. As a result of the transaction, our ownership percentage in FIBRA Prologis decreased to 35.5%. The assets and liabilities of Terrafina are not included in key property information as FIBRA Prologis is a publicly traded vehicle in Mexico that has not yet reported results for the third quarter of 2024.

(3)Prologis’ investment balance is presented at our adjusted basis. The difference between our ownership interest of a venture’s equity and our investment balance at September 30, 2024 and December 31, 2023, results principally from four types of transactions: (i) deferred gains from the contribution of property to a venture prior to January 1, 2018; (ii) recording additional costs associated with our investment in the venture; (iii) receivables, principally for fees and promotes; and (iv) customer security deposits retained subsequent to property contributions to Nippon Prologis REIT, Inc. and Prologis Japan Core Logistics Fund.

(4)Represents our weighted average ownership interest in all unconsolidated co-investment ventures based on each entity’s contribution of total assets before depreciation, net of other liabilities.

Equity Commitments Related to Certain Unconsolidated Co-Investment Ventures

At September 30, 2024, our outstanding equity commitments were $317.1 million, primarily for Prologis China Logistics Venture. The equity commitments expire from 2024 to 2033 if they have not been previously called. Typically, equity commitments are used for future development and acquisitions in the unconsolidated co-investment ventures.

NOTE 4. ASSETS HELD FOR SALE OR CONTRIBUTION

We had investments in certain real estate properties that met the criteria to be classified as held for sale or contribution at September 30, 2024 and December 31, 2023. At the time of classification, these properties were expected to be sold to third parties or were recently stabilized and expected to be contributed to unconsolidated co-investment ventures within twelve months. The amounts included in Assets Held for Sale or Contribution in the Consolidated Balance Sheets represented real estate investment balances and the related assets and liabilities.

Assets held for sale or contribution consisted of the following (dollars and square feet in thousands):

| | | | | | | | |

| | September 30,

2024 | | | December 31,

2023 | |

Number of operating properties | | | 10 | | | | 12 | |

Square feet | | | 3,303 | | | | 3,469 | |

Total assets held for sale or contribution | | $ | 325,987 | | | $ | 461,657 | |

Total liabilities associated with assets held for sale or contribution – included in Other Liabilities | | $ | 2,705 | | | $ | 14,182 | |

NOTE 5. DEBT

All debt is incurred by the OP or its consolidated subsidiaries. The following table summarizes our debt (dollars in thousands):

| | | | | | | | | | | | | | | | | | |

| | September 30, 2024 | | | December 31, 2023 | |

| | Weighted Average | | Amount | | | Weighted Average | | Amount | |

| | Interest Rate (1) | | Years (2) | | Outstanding (3) | | | Interest Rate (1) | | Years (2) | | Outstanding (3) | |

Credit facilities and

commercial paper | | 3.3% | | 2.8 | | | $ | 660,737 | | | 5.9% | | 3.1 | | | $ | 979,313 | |

Senior notes | | 3.2% | | 10.0 | | | | 29,386,420 | | | 2.9% | | 10.1 | | | | 25,311,647 | |

Term loans and

unsecured other | | 1.9% | | 4.1 | | | | 1,956,822 | | | 2.8% | | 3.7 | | | | 2,330,520 | |

Secured mortgage | | 4.4% | | 3.6 | | | | 285,853 | | | 3.9% | | 3.4 | | | | 379,021 | |

Total | | 3.1% | | 9.5 | | | $ | 32,289,832 | | | 3.0% | | 9.3 | | | $ | 29,000,501 | |

(1)The weighted average interest rates presented represent the effective interest rates (including amortization of debt issuance costs and noncash premiums or discounts) for the debt outstanding and include the impact of designated interest rate swaps, which effectively fix the interest rate on certain variable rate debt.

(2)The weighted average years represents the remaining maturity in years on the debt outstanding at period end.

(3)We borrow in the functional currencies of the countries where we invest. Included in the outstanding balances were borrowings denominated in the following currencies:

| | | | | | | | | | | | | | | | | | | | | |

| | | September 30, 2024 | | | December 31, 2023 | |

| | | Weighted Average Interest Rate | | Amount Outstanding | | | % of Total | | | Weighted Average Interest Rate | | Amount Outstanding | | | % of Total | |

| British pound sterling | | 3.0% | | $ | 1,834,209 | | | | 5.7 | % | | 2.1% | | $ | 1,299,628 | | | | 4.5 | % |

| Canadian dollar | | 5.0% | | | 1,127,241 | | | | 3.5 | % | | 5.0% | | | 829,886 | | | | 2.9 | % |

| Chinese renminbi | | 3.6% | | | 650,315 | | | | 2.0 | % | | 3.7% | | | 241,820 | | | | 0.8 | % |

| Euro | | 2.2% | | | 10,879,967 | | | | 33.7 | % | | 2.0% | | | 10,083,601 | | | | 34.8 | % |

| Japanese yen | | 1.1% | | | 3,354,111 | | | | 10.4 | % | | 1.0% | | | 3,085,970 | | | | 10.6 | % |

| U.S. dollar | | 4.1% | | | 14,443,989 | | | | 44.7 | % | | 4.1% | | | 13,459,596 | | | | 46.4 | % |

| Total | | 3.1% | | $ | 32,289,832 | | | | 100.0 | % | | 3.0% | | $ | 29,000,501 | | | | 100.0 | % |

In May 2022, Refinitive Benchmark Services (UK) Ltd. ("RBSL"), the administrator of the Canadian Dollar Offered Rate ("CDOR") formally announced that it would cease the calculation and publication of all tenors of CDOR effective June 28, 2024. In June 2024, we modified the interest rates on our Canadian term loan from 2022 ("2022 Canadian Term Loan") and our credit facility agreements that bore interest at CDOR plus a spread over the applicable benchmark to the Canadian Overnight Repo Rate Average ("CORRA"). The modification did not have a material impact on our Consolidated Financial Statements.

Credit Facilities and Commercial Paper

The following table summarizes information about our available liquidity at September 30, 2024 (in millions):

| | | | |

Aggregate lender commitments | | | |

Credit facilities | | $ | 6,501 | |

Less: | | | |

Credit facility borrowings outstanding | | | 661 | |

Commercial paper borrowings outstanding (1) | | | - | |

Outstanding letters of credit | | | 26 | |

Current availability | | | 5,814 | |

Cash and cash equivalents | | | 781 | |

Total liquidity | | $ | 6,595 | |

(1)We are required to maintain available commitments under our credit facilities in an amount at least equal to the commercial paper borrowings outstanding.

Credit Facilities

We have two global senior credit facilities (the “2022 Global Facility” and "2023 Global Facility"), each with a borrowing capacity of $3.0 billion (subject to currency fluctuations). We may draw on both facilities in British pounds sterling, Canadian dollars, euro, Japanese yen, Mexican pesos and U.S. dollars on a revolving basis. The 2022 Global Facility is scheduled to initially mature in June 2026 and the 2023 Global Facility in June 2027; however, we can extend the maturity date for each facility by six months on two occasions, subject to the payment of extension fees. We also have the ability to increase each credit facility to $4.0 billion, subject to currency fluctuations and obtaining additional lender commitments.