Prologis Supplemental Information Unaudited Fourth Quarter 2016

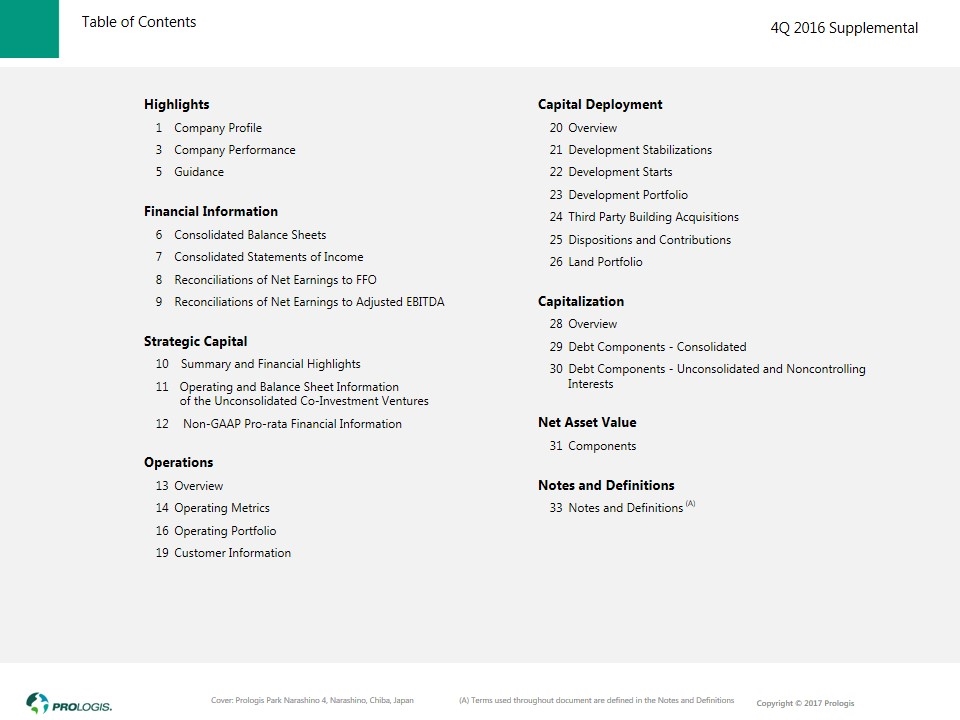

Table of Contents Highlights 1Company Profile 3Company Performance 5Guidance Financial Information 6Consolidated Balance Sheets 7Consolidated Statements of Income 8Reconciliations of Net Earnings to FFO 9Reconciliations of Net Earnings to Adjusted EBITDA Strategic Capital 10 Summary and Financial Highlights Operating and Balance Sheet Information of the Unconsolidated Co-Investment Ventures Non-GAAP Pro-rata Financial Information Operations 13Overview 14Operating Metrics 16Operating Portfolio 19Customer Information Capital Deployment 20Overview 21Development Stabilizations 22Development Starts 23Development Portfolio 24Third Party Building Acquisitions 25Dispositions and Contributions 26Land Portfolio Capitalization 28Overview 29Debt Components - Consolidated 30Debt Components - Unconsolidated and Noncontrolling Interests Net Asset Value 31Components Notes and Definitions 33Notes and Definitions (A) Cover: Prologis Park Narashino 4, Narashino, Chiba, Japan (A) Terms used throughout document are defined in the Notes and Definitions

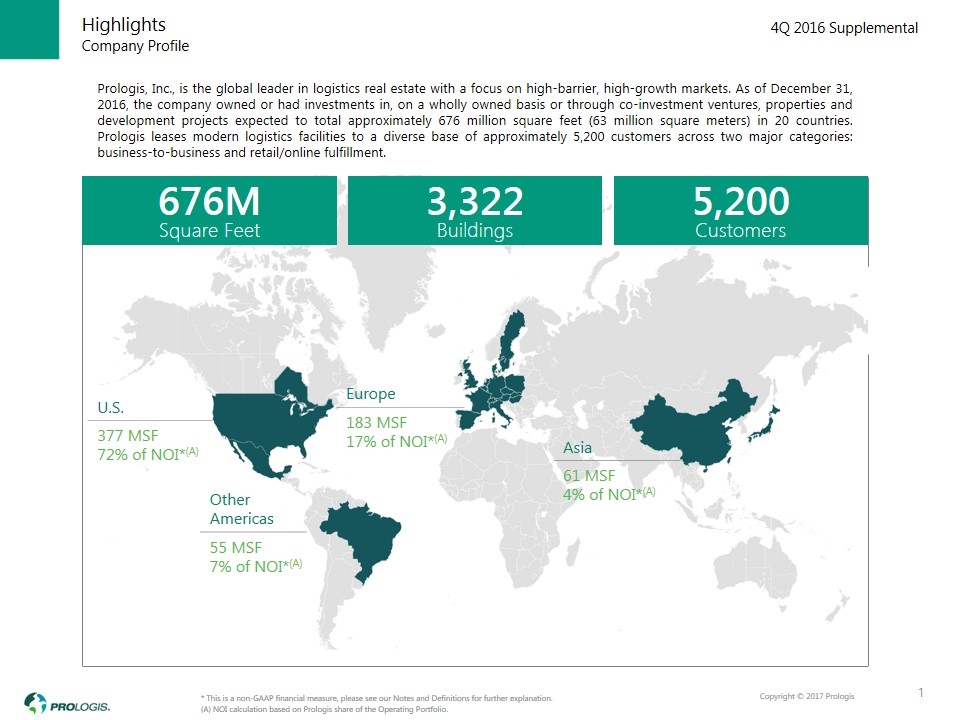

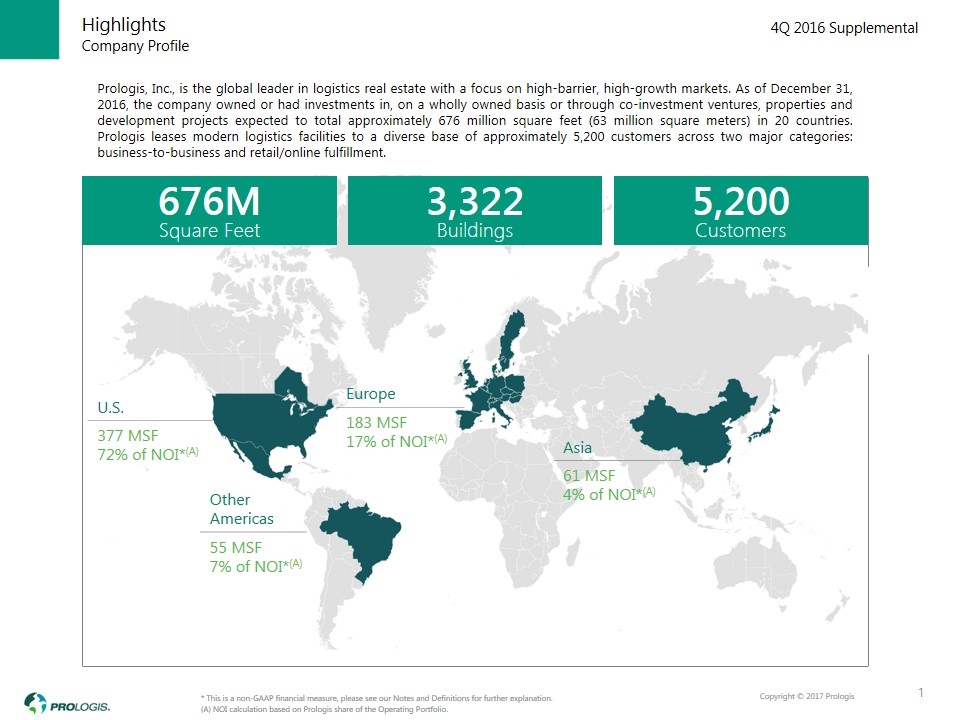

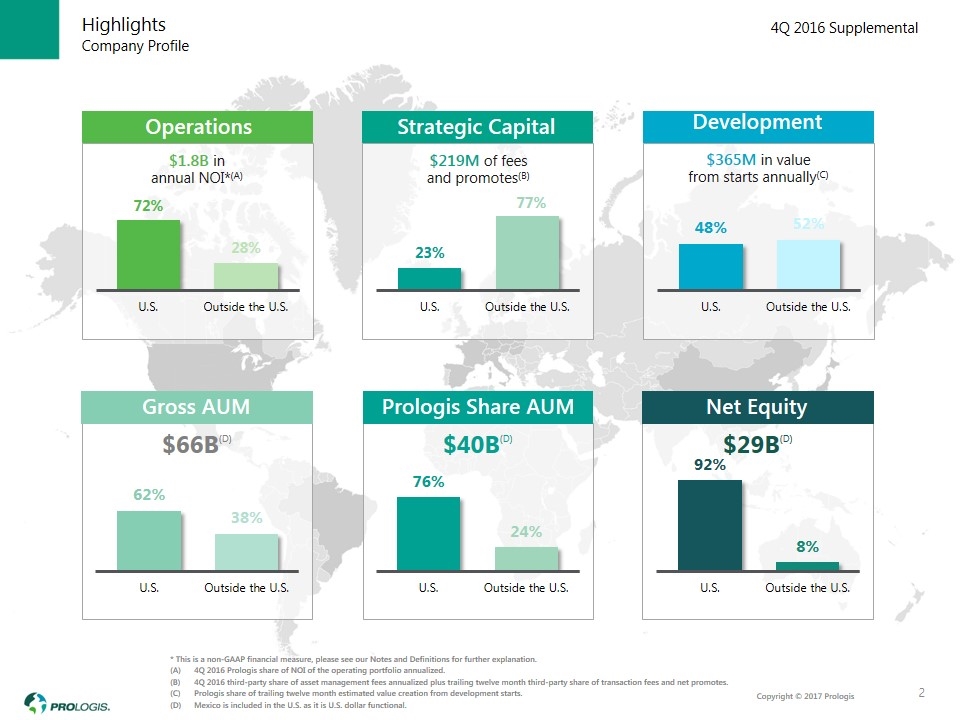

* This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. (A) NOI calculation based on Prologis share of the Operating Portfolio. Company Profile Highlights Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of December 31, 2016, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 676 million square feet (63 million square meters) in 20 countries. Prologis leases modern logistics facilities to a diverse base of approximately 5,200 customers across two major categories: business-to-business and retail/online fulfillment. Asia 61 MSF 4% of NOI*(A) U.S. 377 MSF 72% of NOI*(A) Other Americas 55 MSF 7% of NOI*(A) Europe 183 MSF 17% of NOI*(A) 5,200 Customers 676M Square Feet 3,322 Buildings 1

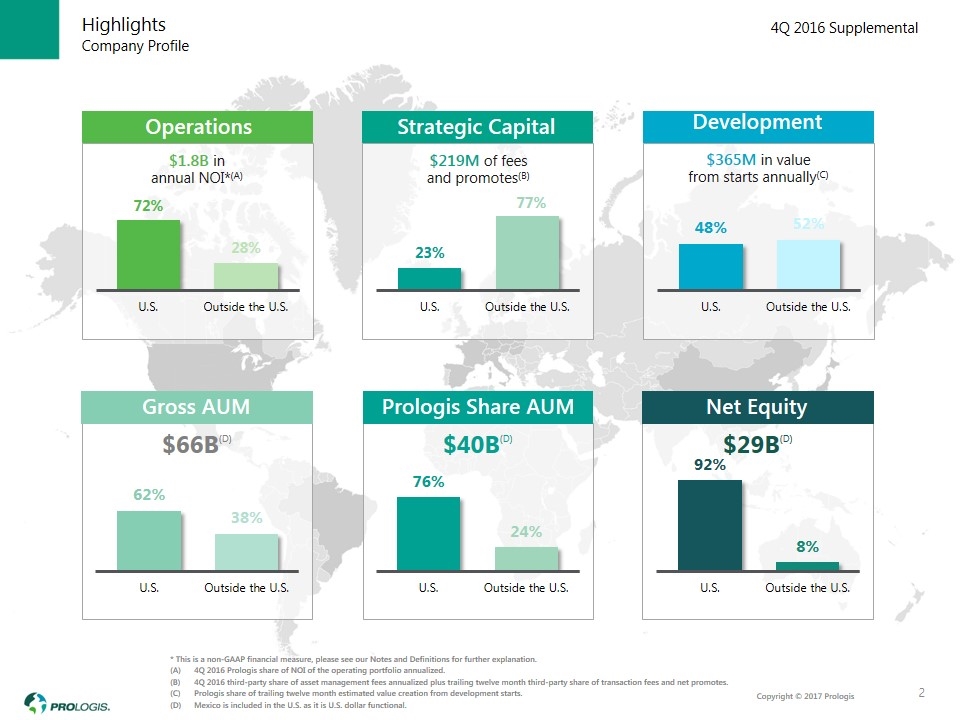

* This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. 4Q 2016 Prologis share of NOI of the operating portfolio annualized. 4Q 2016 third-party share of asset management fees annualized plus trailing twelve month third-party share of transaction fees and net promotes. Prologis share of trailing twelve month estimated value creation from development starts. Mexico is included in the U.S. as it is U.S. dollar functional. Highlights $1.8B in annual NOI*(A) Operations $219M of fees and promotes(B) Strategic Capital Prologis Share AUM $40B(D) Net Equity $29B(D) Gross AUM $66B(D) 2 $365M in value from starts annually(C) Development Company Profile 77%

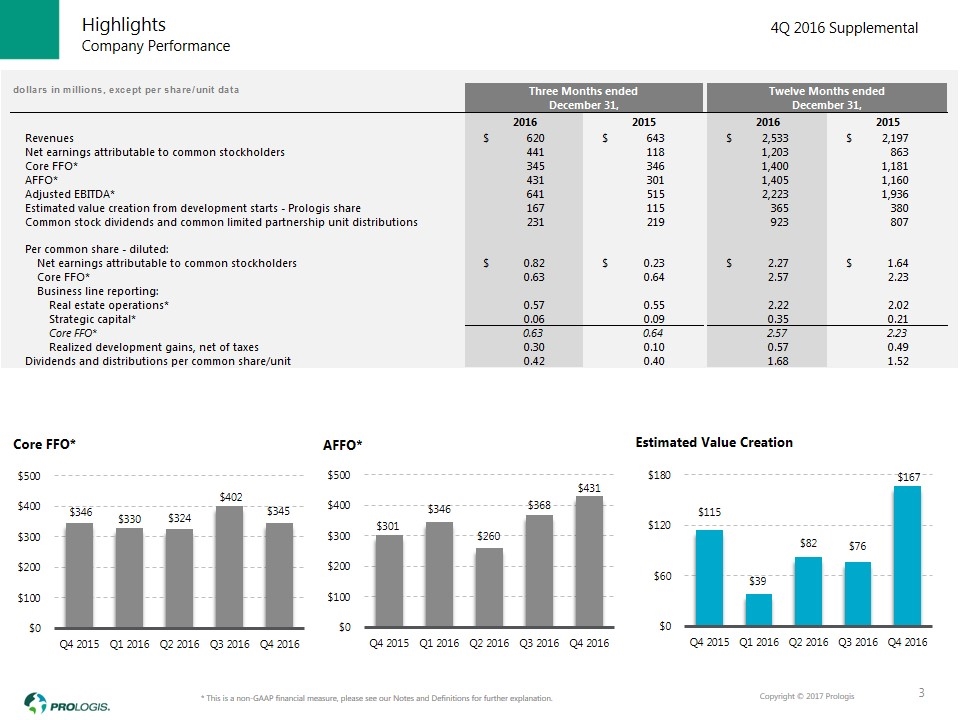

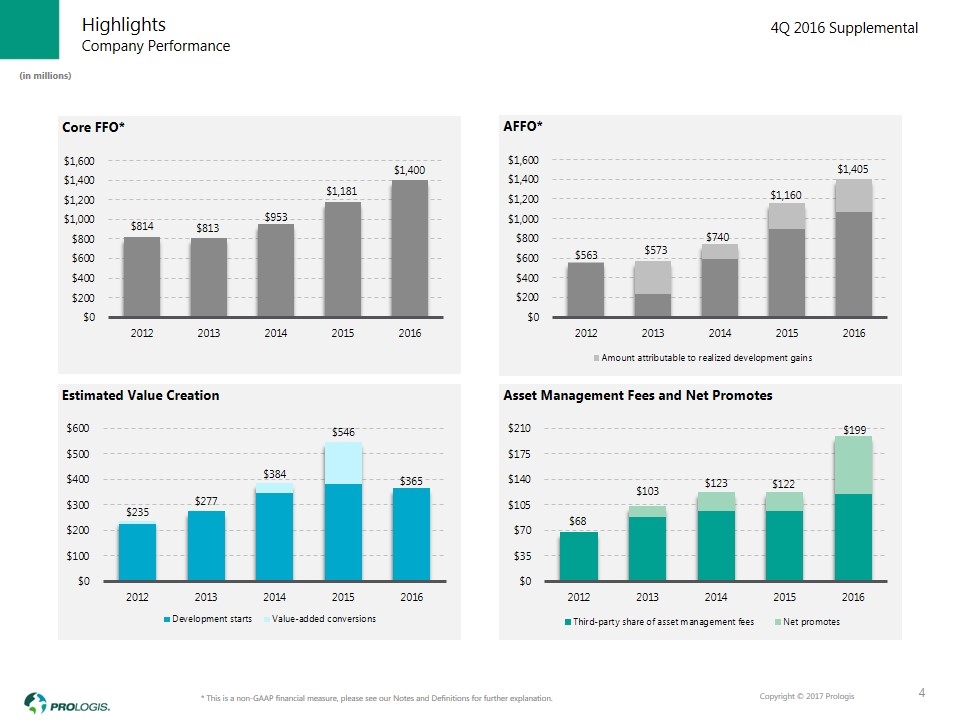

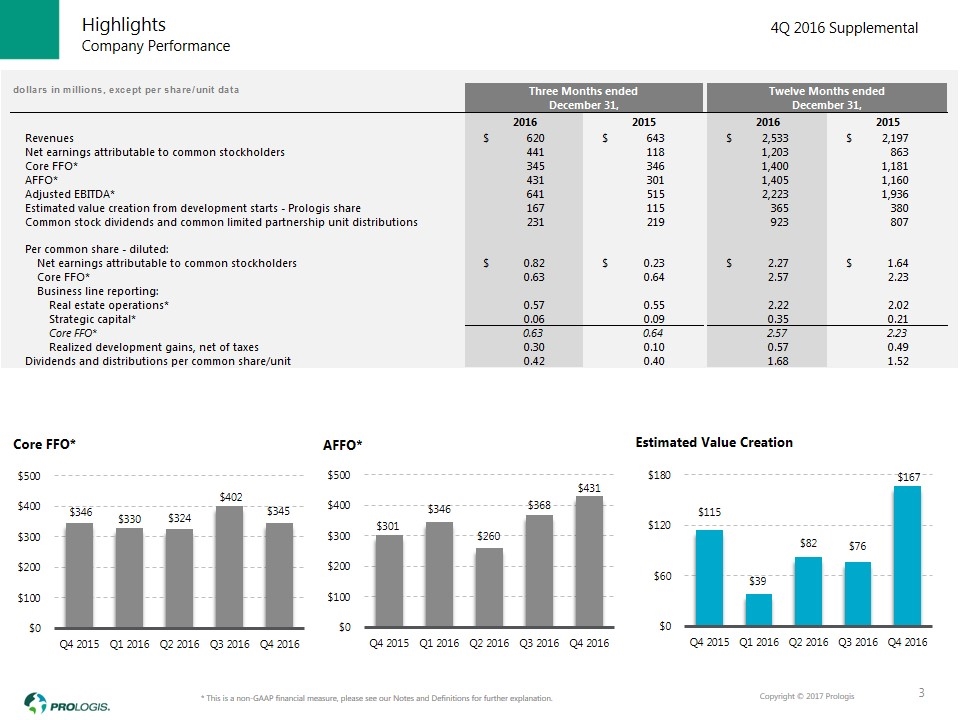

* This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. Company Performance Highlights 3

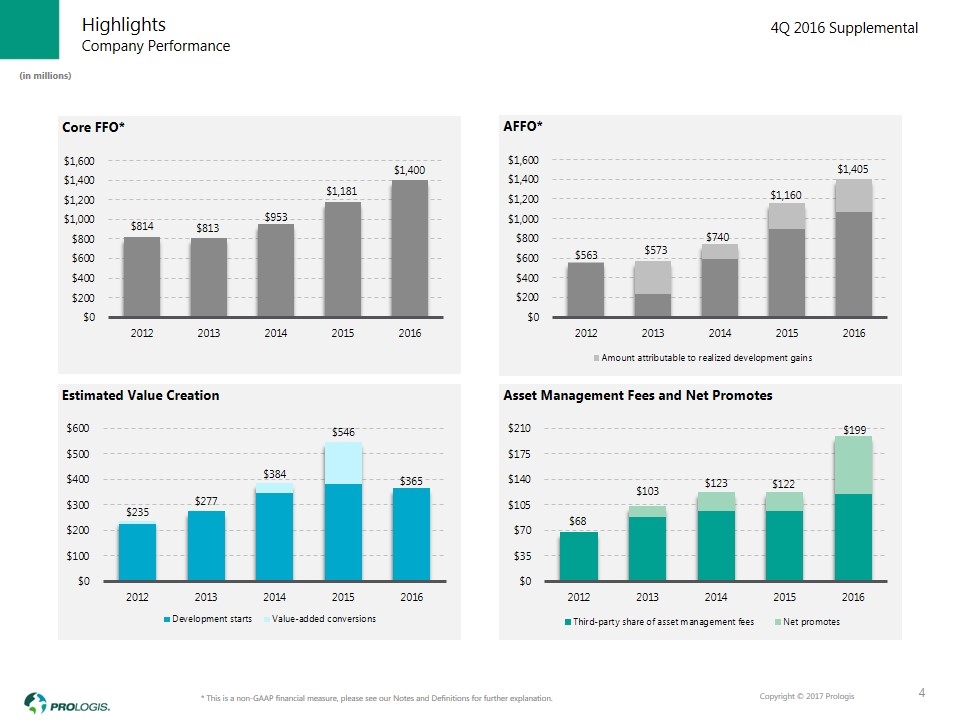

* This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. Company Performance Highlights 4 (in millions)

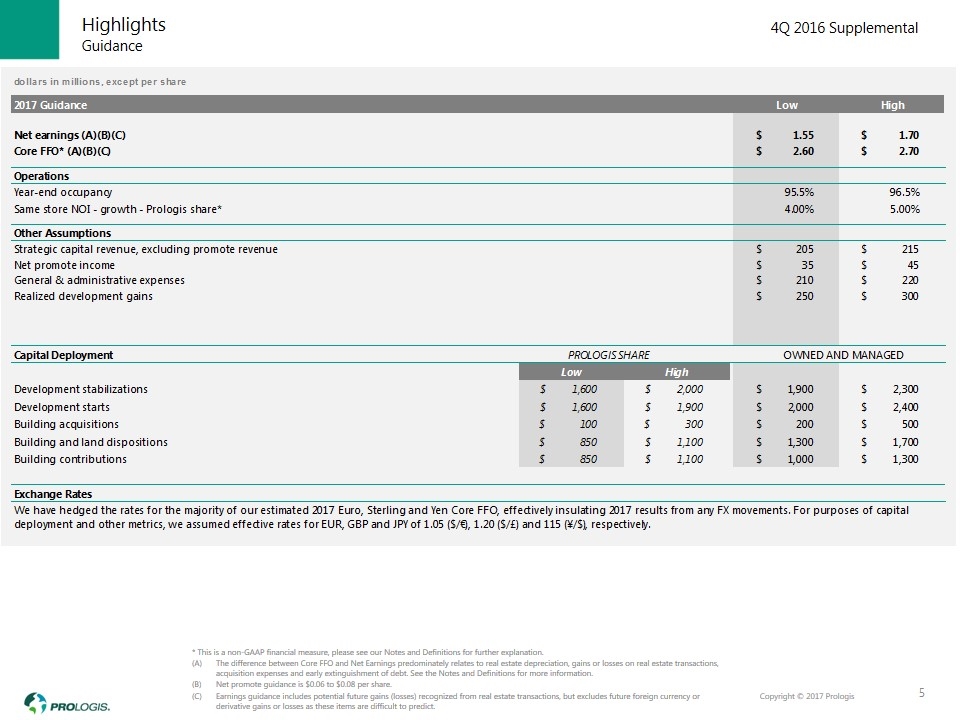

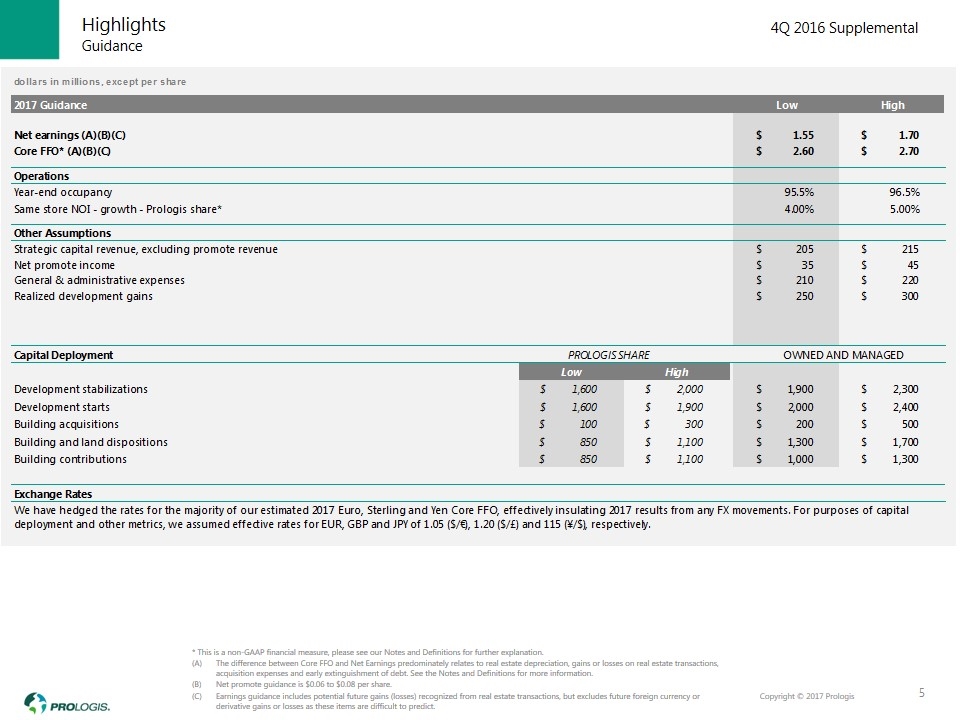

* This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. The difference between Core FFO and Net Earnings predominately relates to real estate depreciation, gains or losses on real estate transactions, acquisition expenses and early extinguishment of debt. See the Notes and Definitions for more information. Net promote guidance is $0.06 to $0.08 per share. Earnings guidance includes potential future gains (losses) recognized from real estate transactions, but excludes future foreign currency or derivative gains or losses as these items are difficult to predict. Guidance Highlights 5

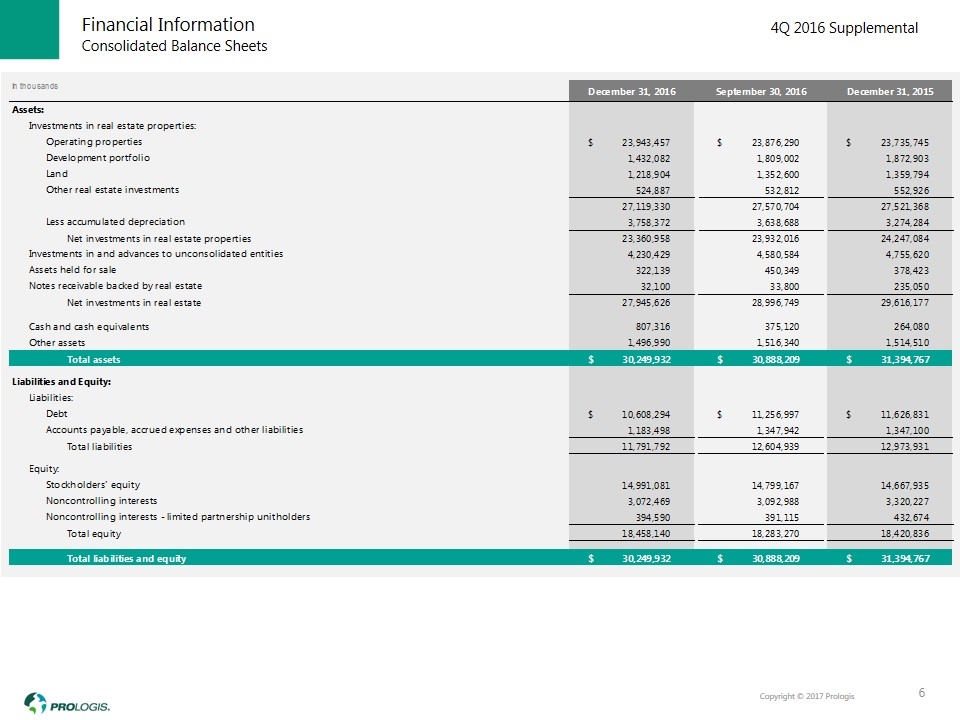

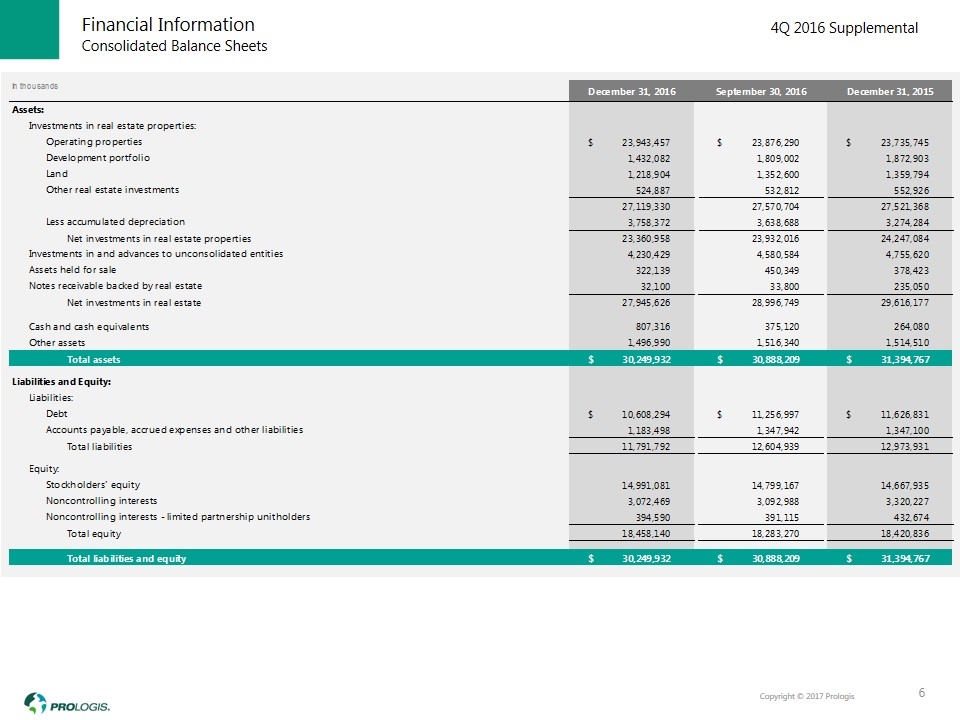

Consolidated Balance Sheets Financial Information 6

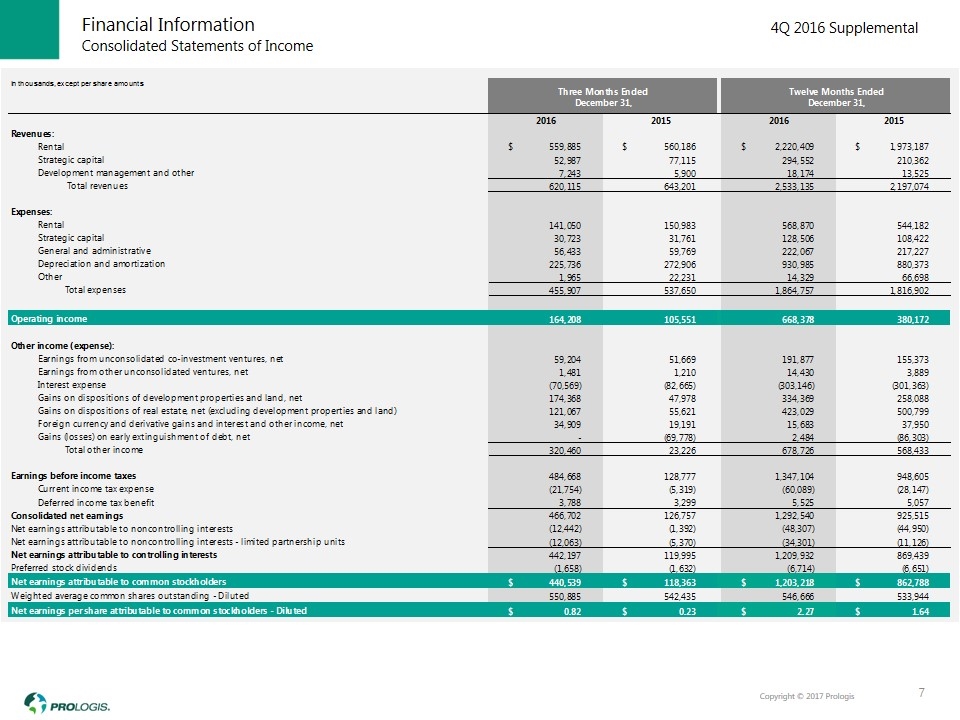

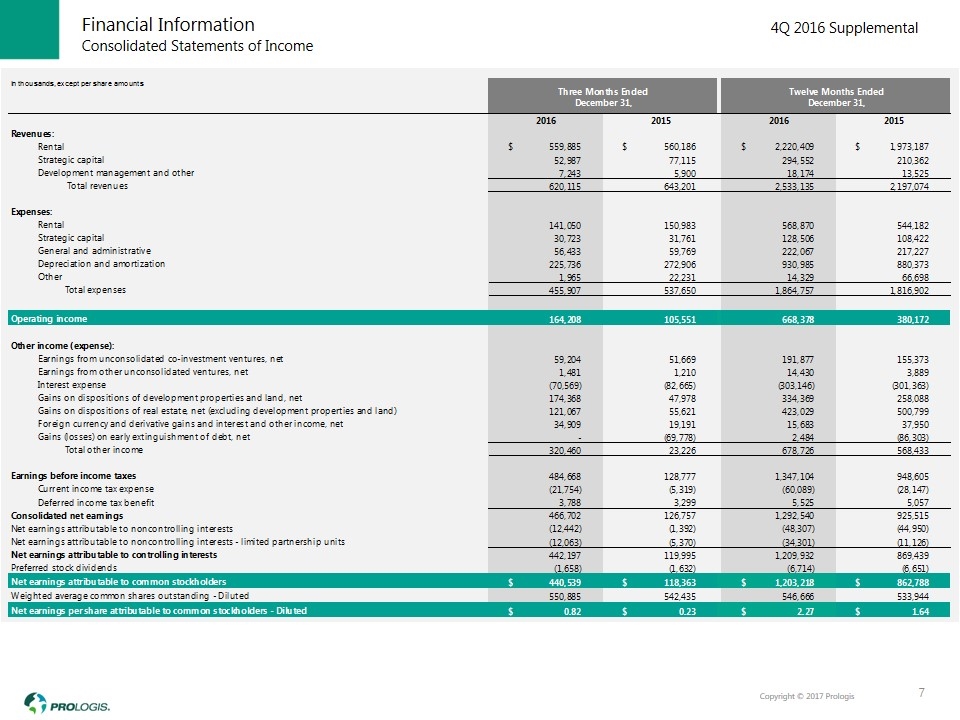

Consolidated Statements of Income Financial Information 7

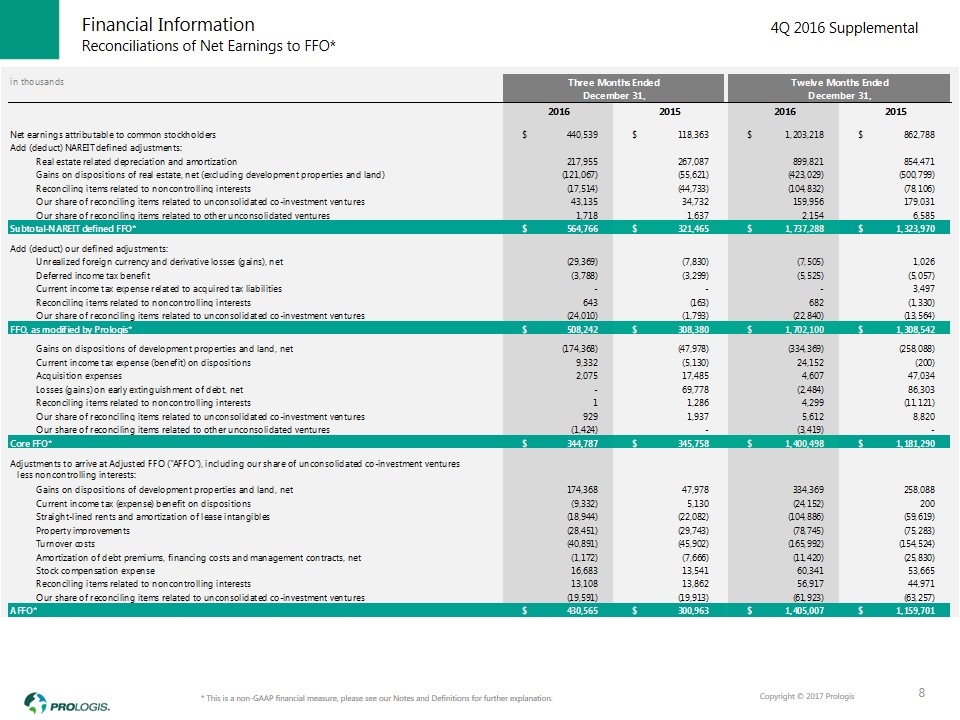

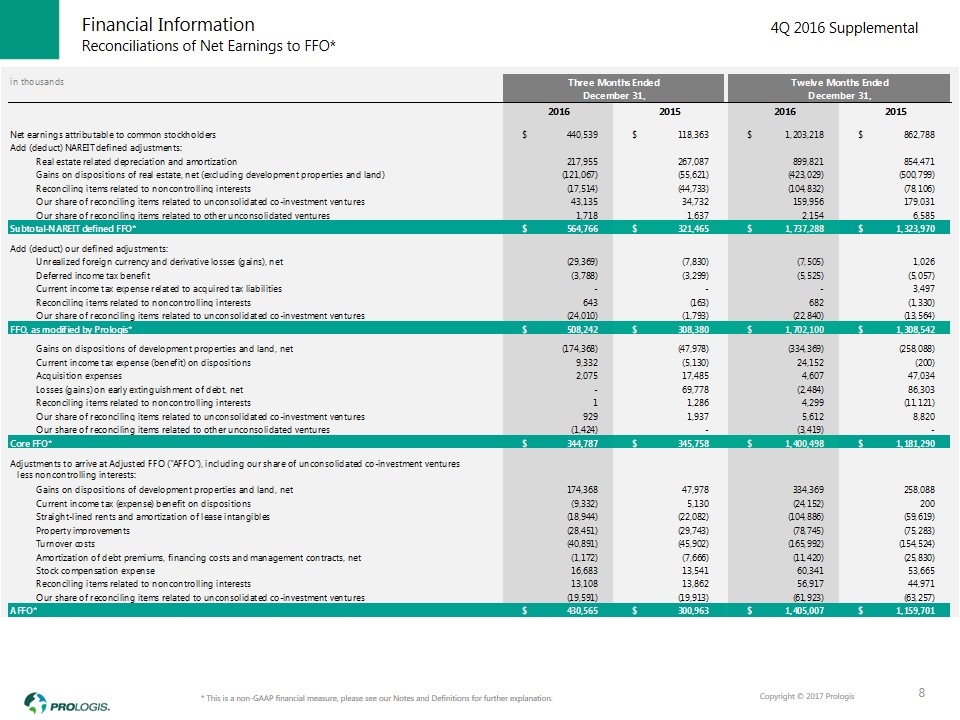

* This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. Reconciliations of Net Earnings to FFO* Financial Information 8

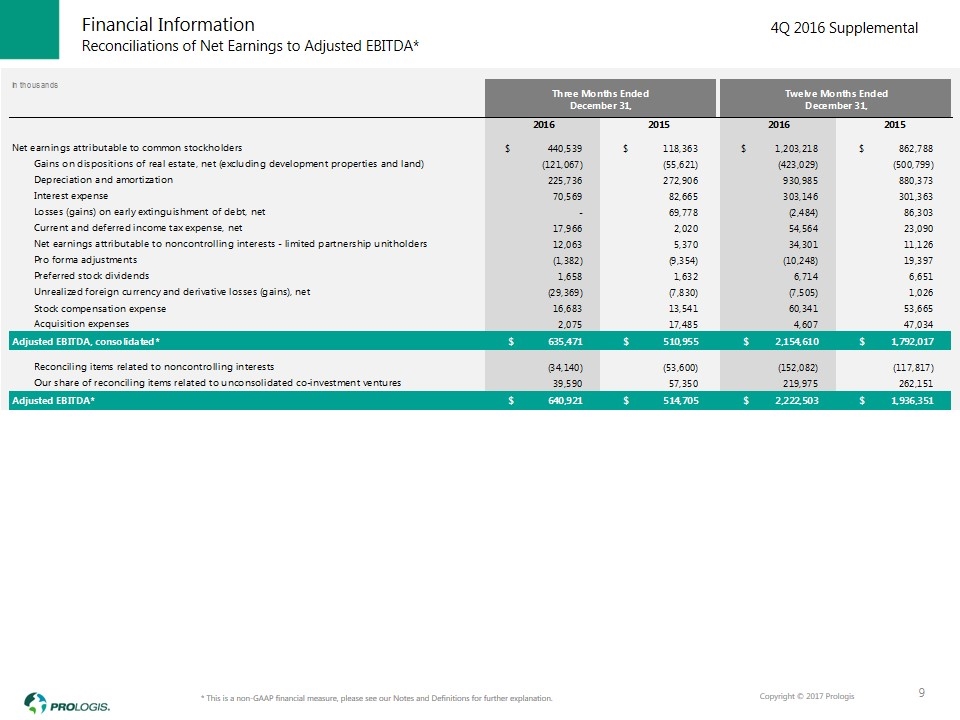

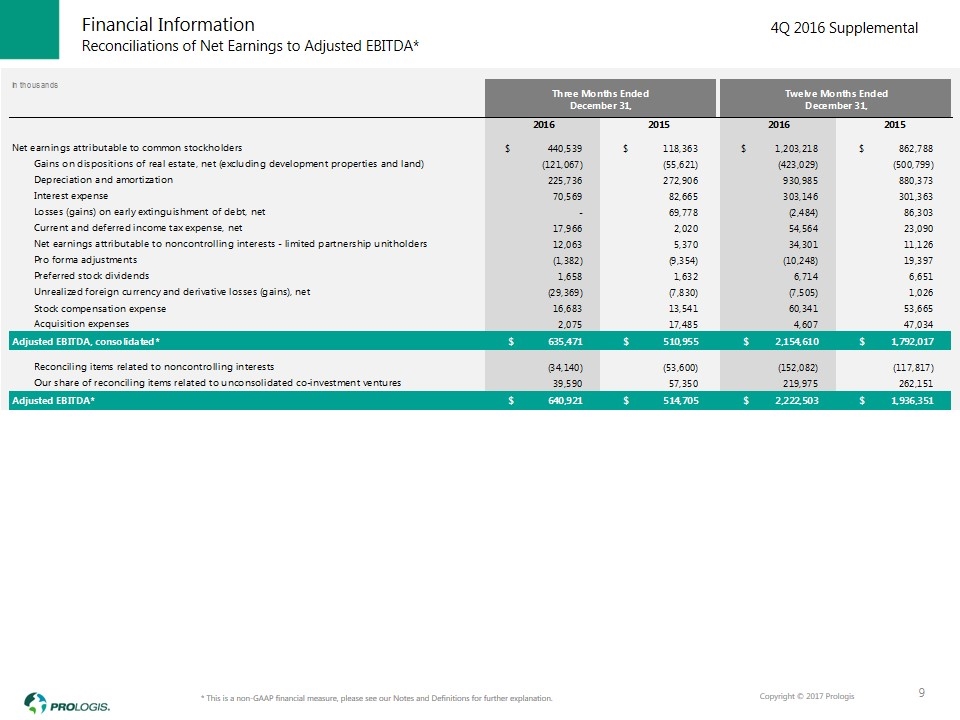

* This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. Reconciliations of Net Earnings to Adjusted EBITDA* Financial Information 9

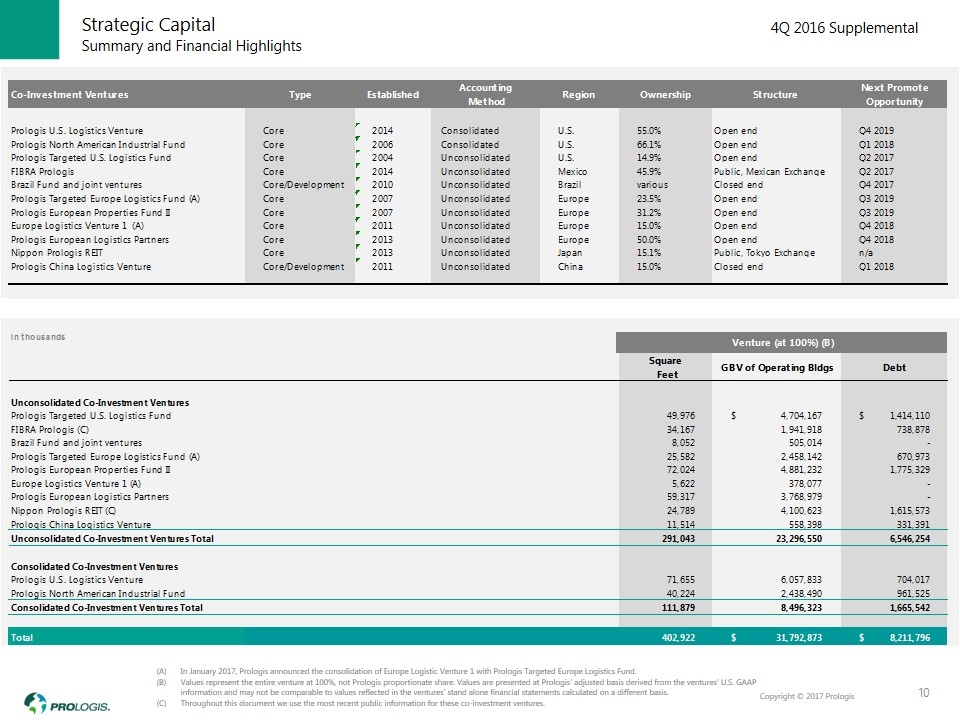

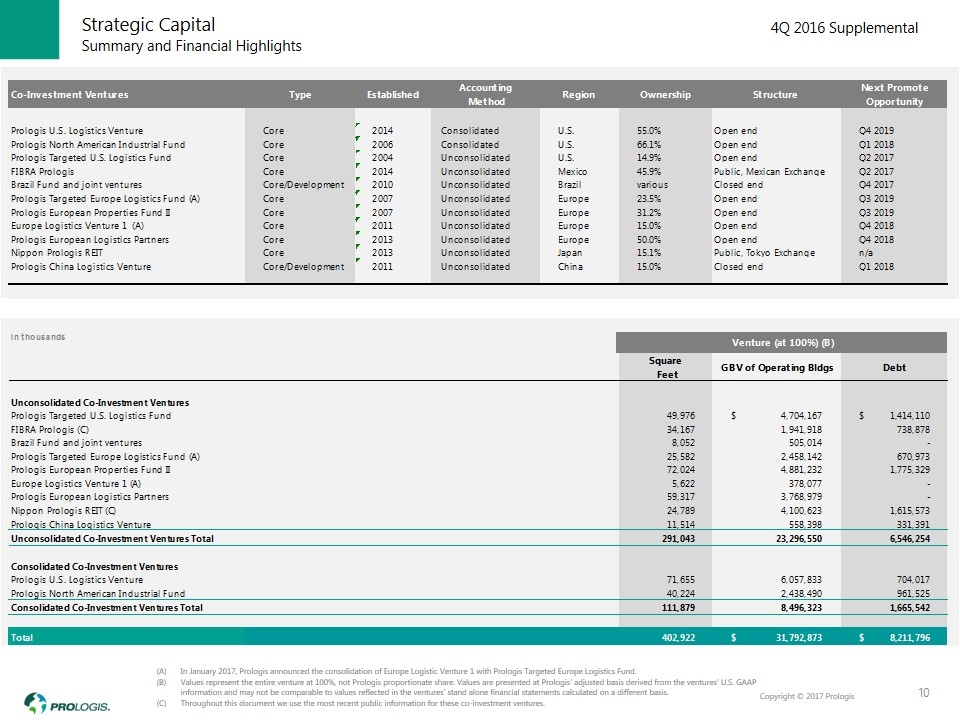

In January 2017, Prologis announced the consolidation of Europe Logistic Venture 1 with Prologis Targeted Europe Logistics Fund. Values represent the entire venture at 100%, not Prologis proportionate share. Values are presented at Prologis’ adjusted basis derived from the ventures’ U.S. GAAP information and may not be comparable to values reflected in the ventures’ stand alone financial statements calculated on a different basis. Throughout this document we use the most recent public information for these co-investment ventures. Summary and Financial Highlights Strategic Capital 10

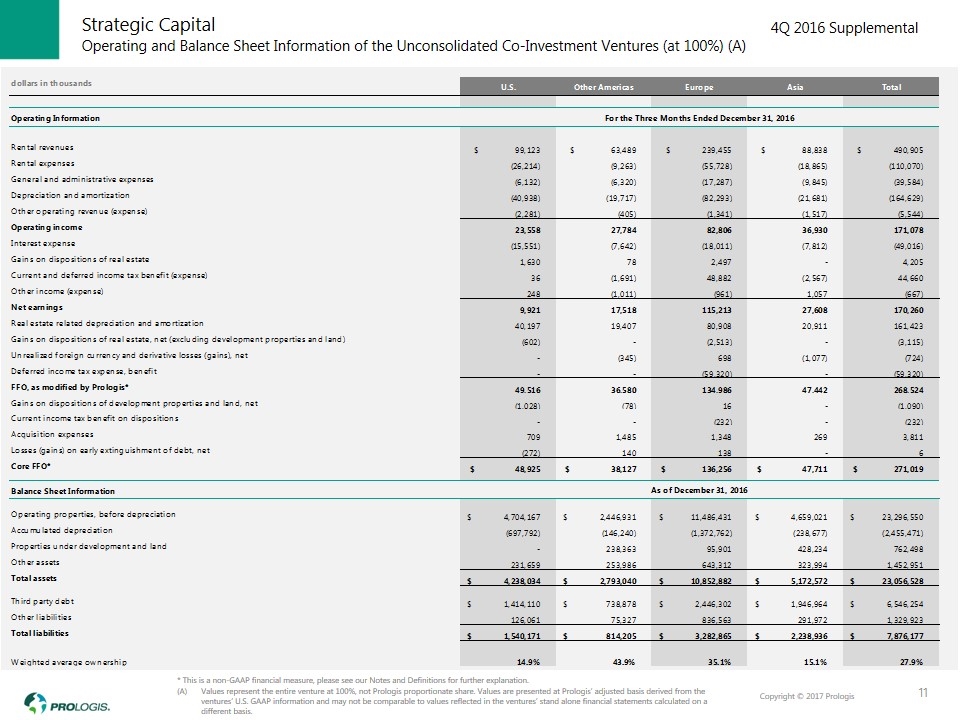

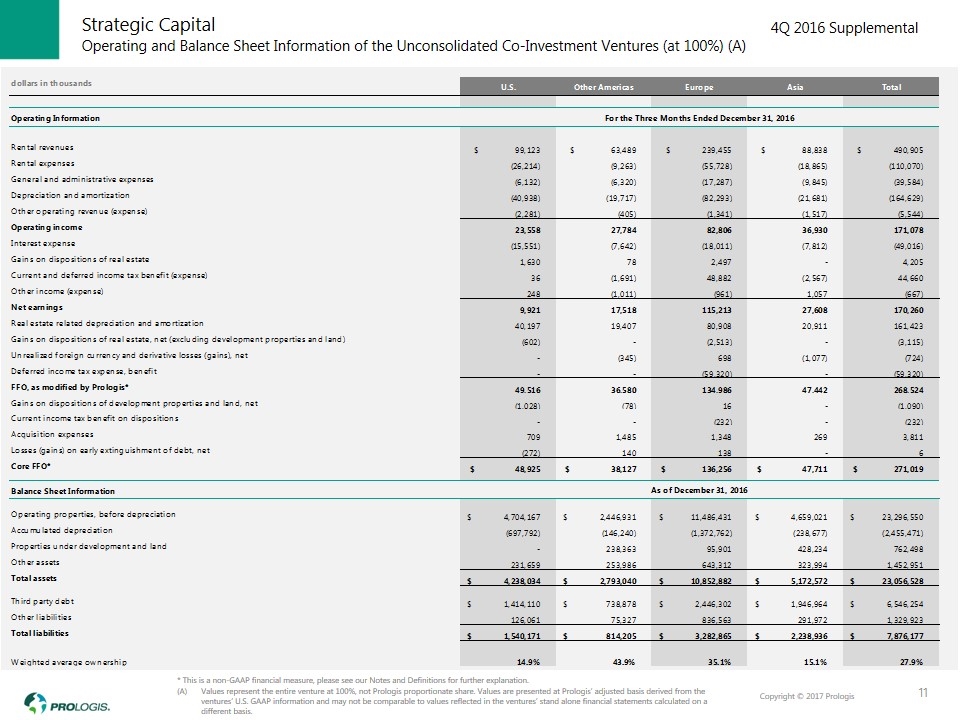

Operating and Balance Sheet Information of the Unconsolidated Co-Investment Ventures (at 100%) (A) Strategic Capital 11 * This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. Values represent the entire venture at 100%, not Prologis proportionate share. Values are presented at Prologis’ adjusted basis derived from the ventures’ U.S. GAAP information and may not be comparable to values reflected in the ventures’ stand alone financial statements calculated on a different basis.

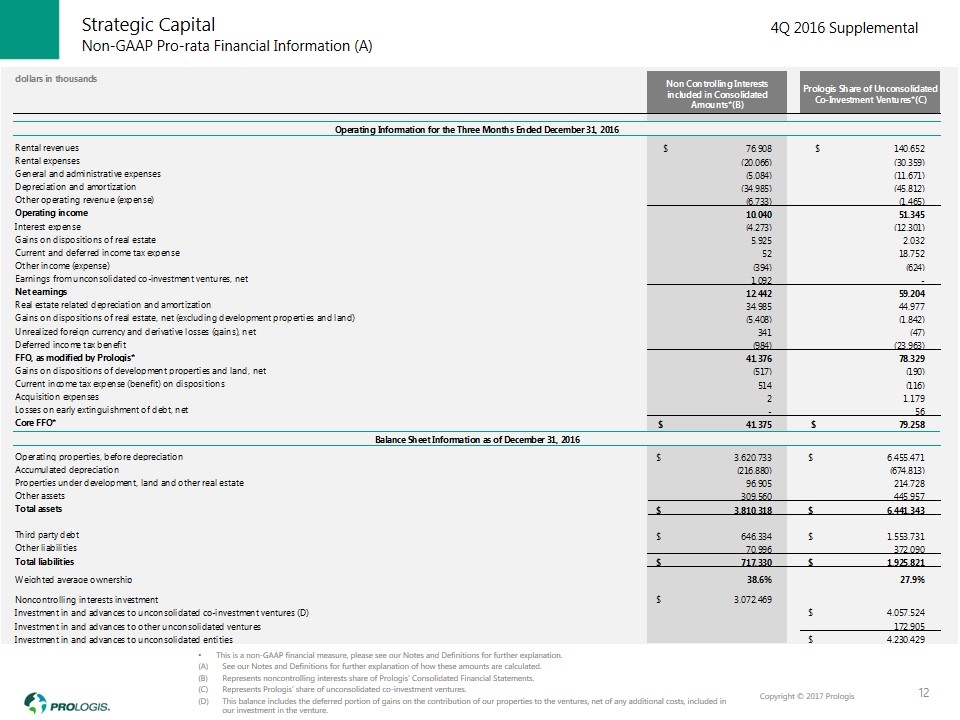

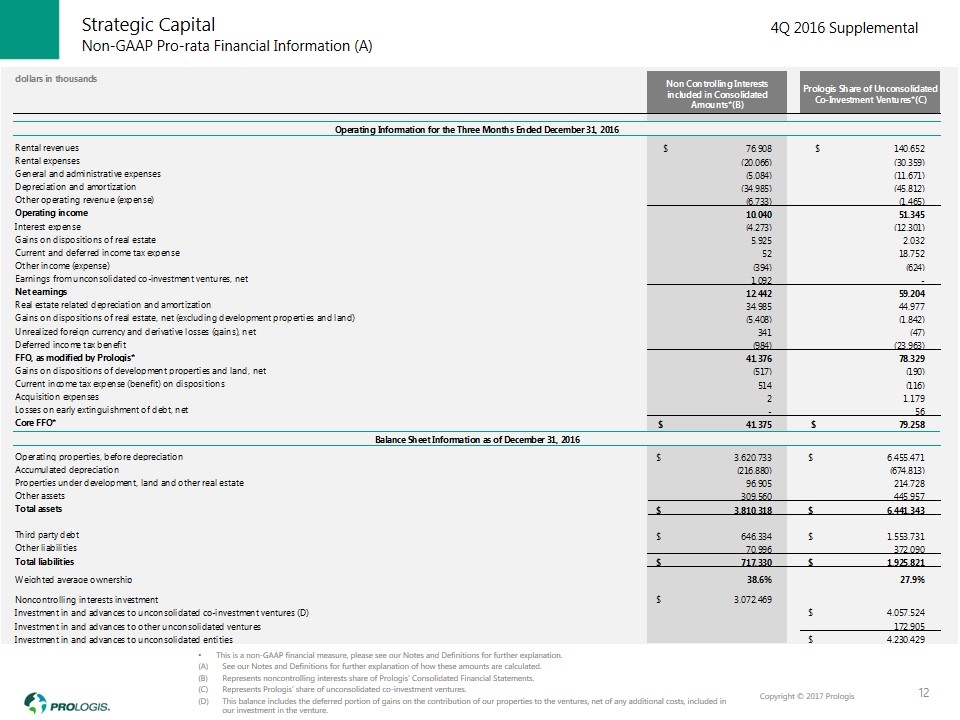

This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. See our Notes and Definitions for further explanation of how these amounts are calculated. Represents noncontrolling interests share of Prologis’ Consolidated Financial Statements. Represents Prologis’ share of unconsolidated co-investment ventures. This balance includes the deferred portion of gains on the contribution of our properties to the ventures, net of any additional costs, included in our investment in the venture. Non-GAAP Pro-rata Financial Information (A) Strategic Capital 12

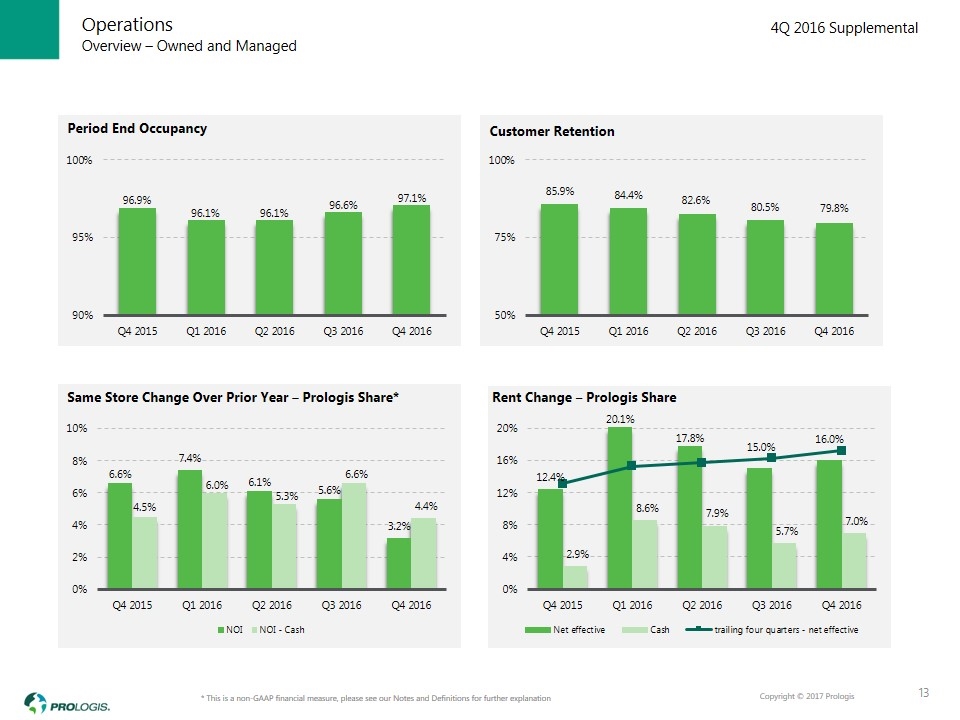

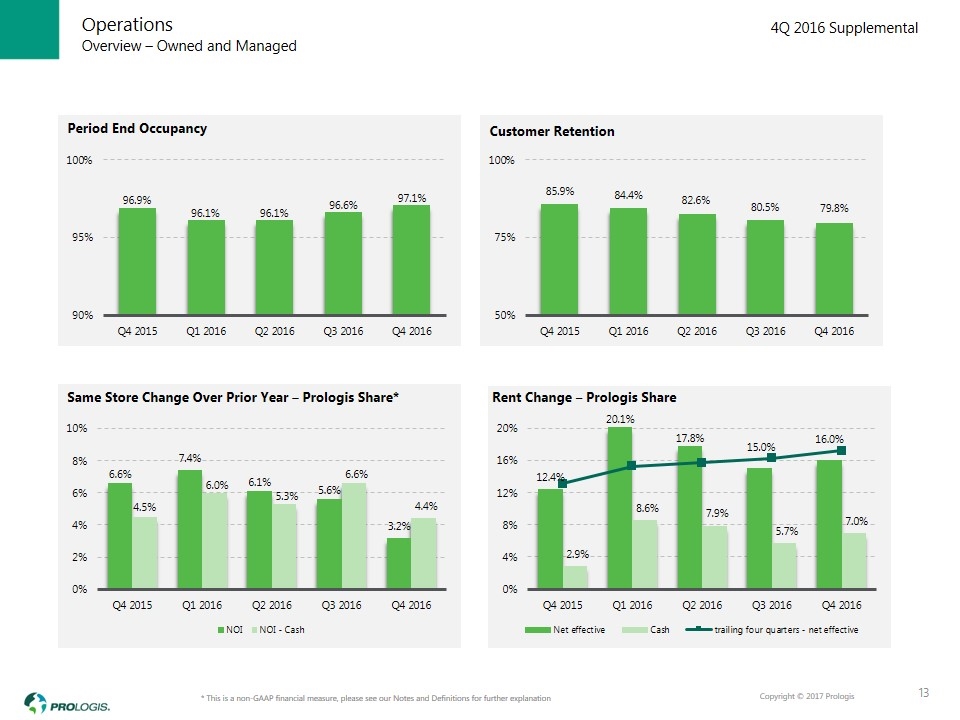

* This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation Overview – Owned and Managed Operations 13

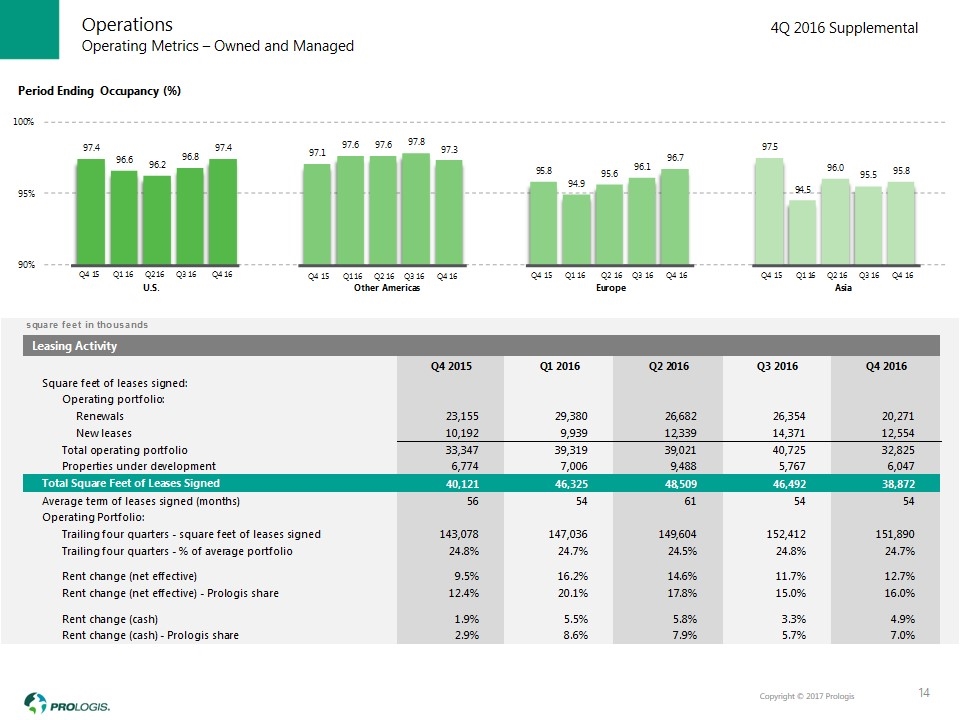

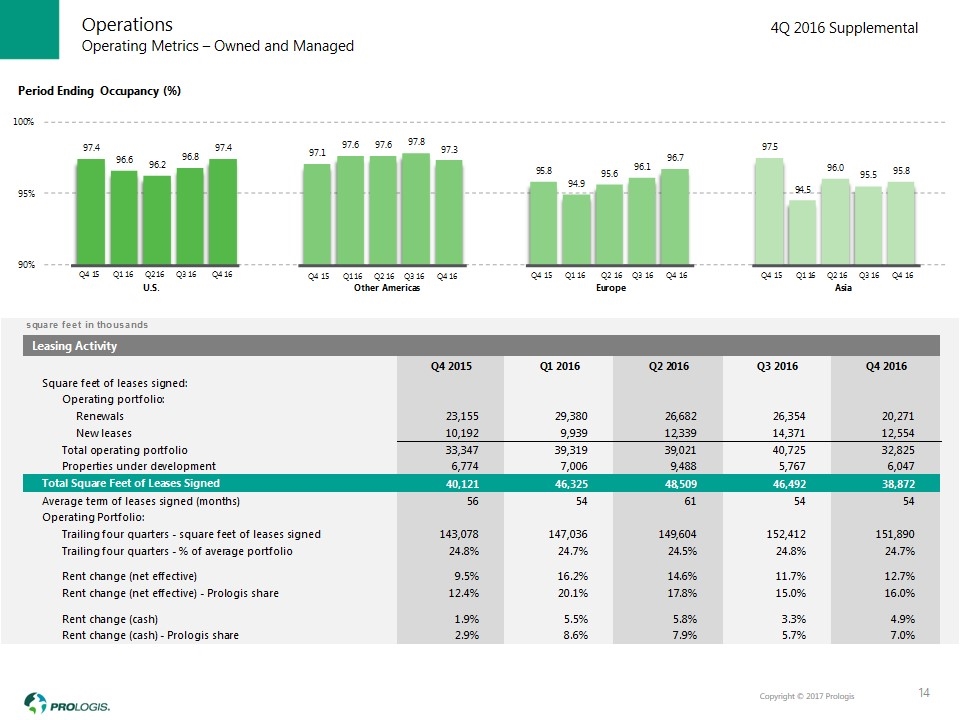

Operating Metrics – Owned and Managed Operations 14

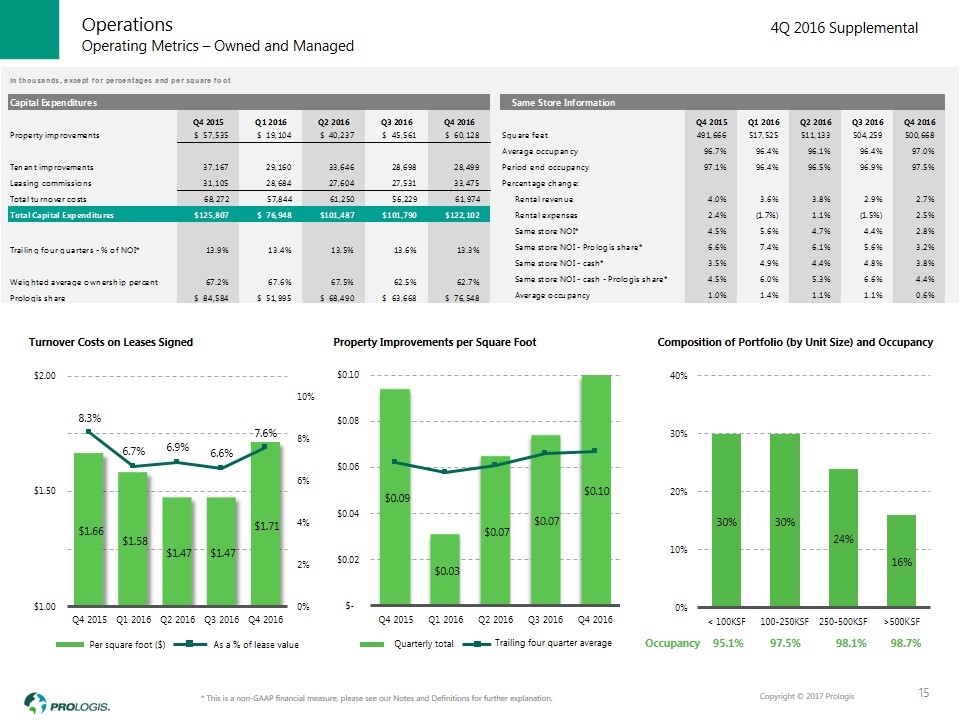

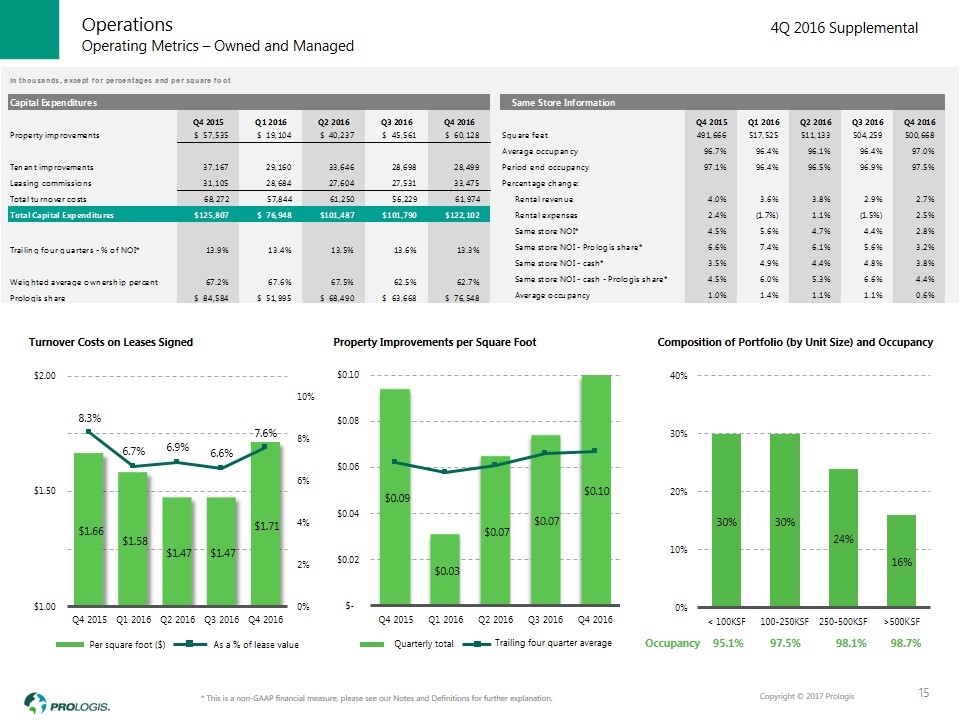

* This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. Operating Metrics – Owned and Managed Operations 15 98.7% Occupancy

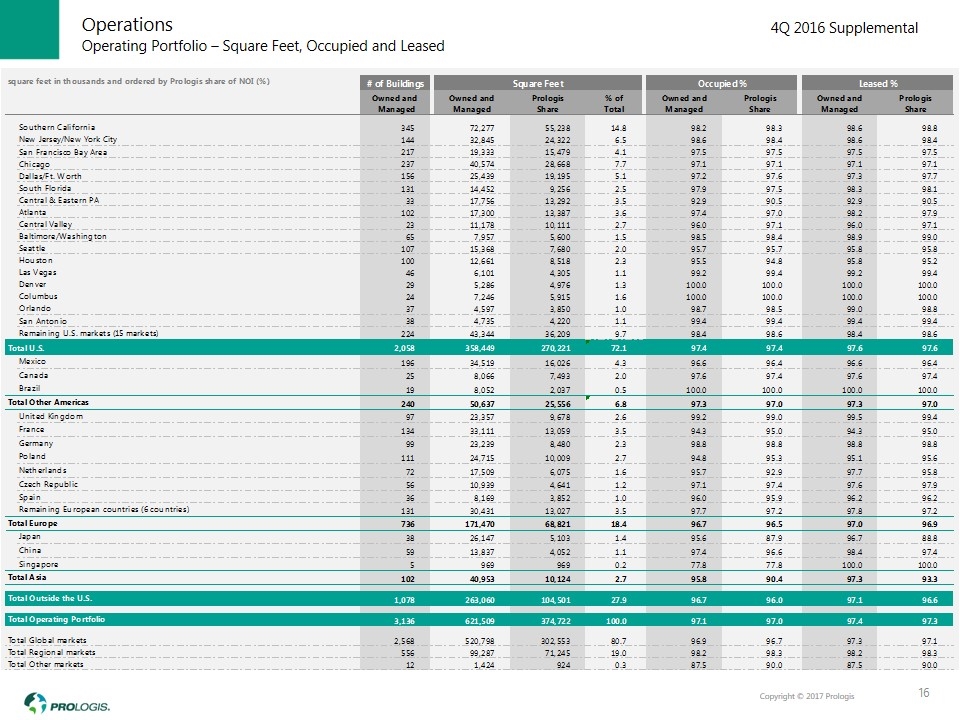

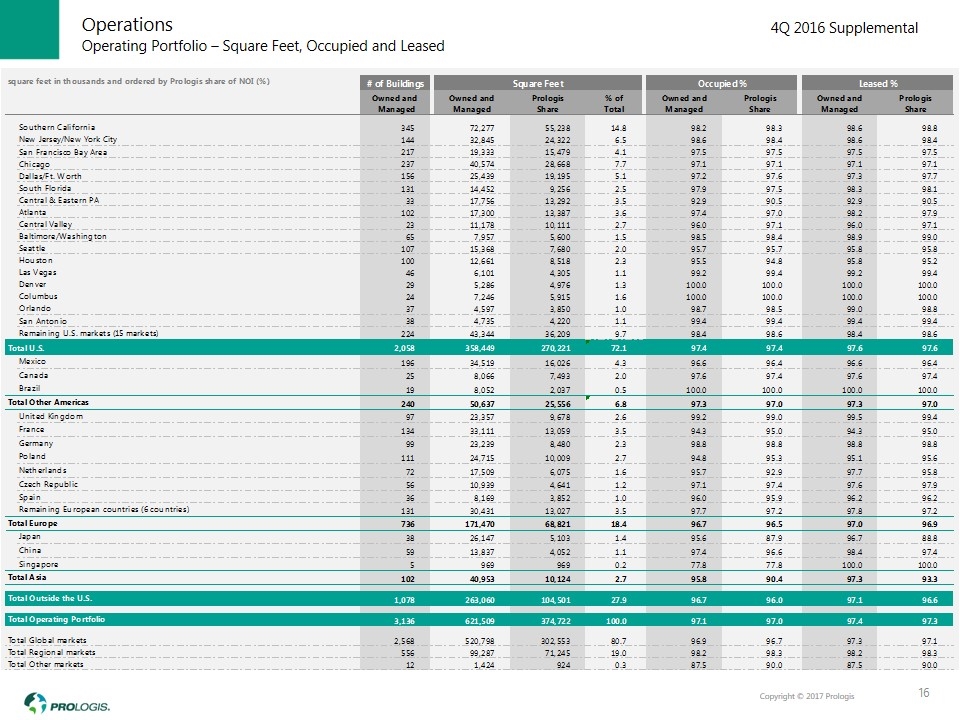

Operating Portfolio – Square Feet, Occupied and Leased Operations 16

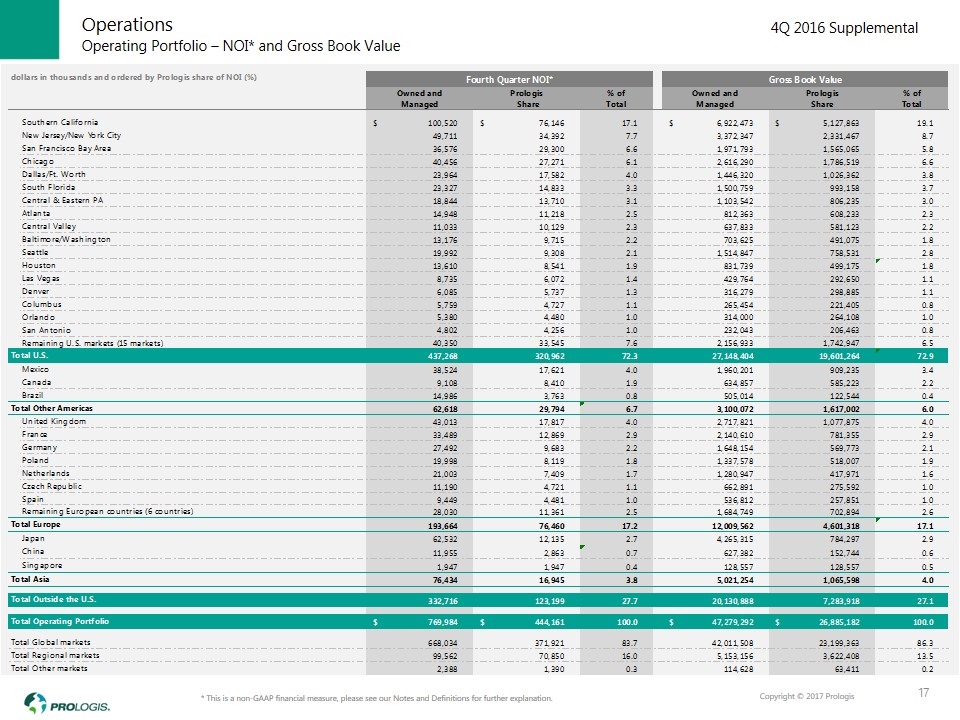

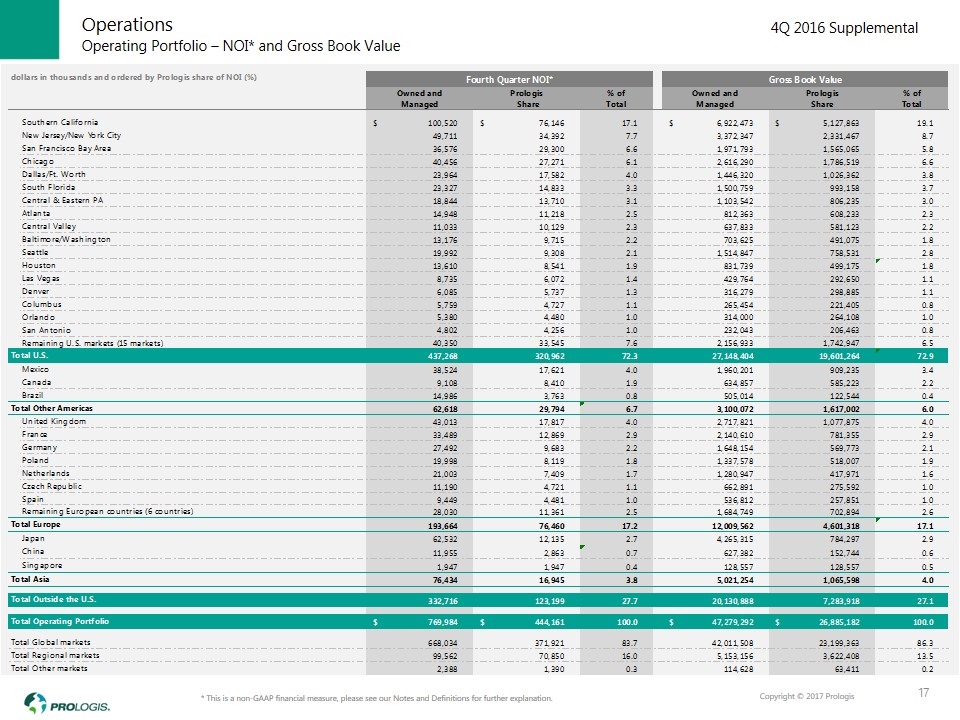

* This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. Operating Portfolio – NOI* and Gross Book Value Operations 17

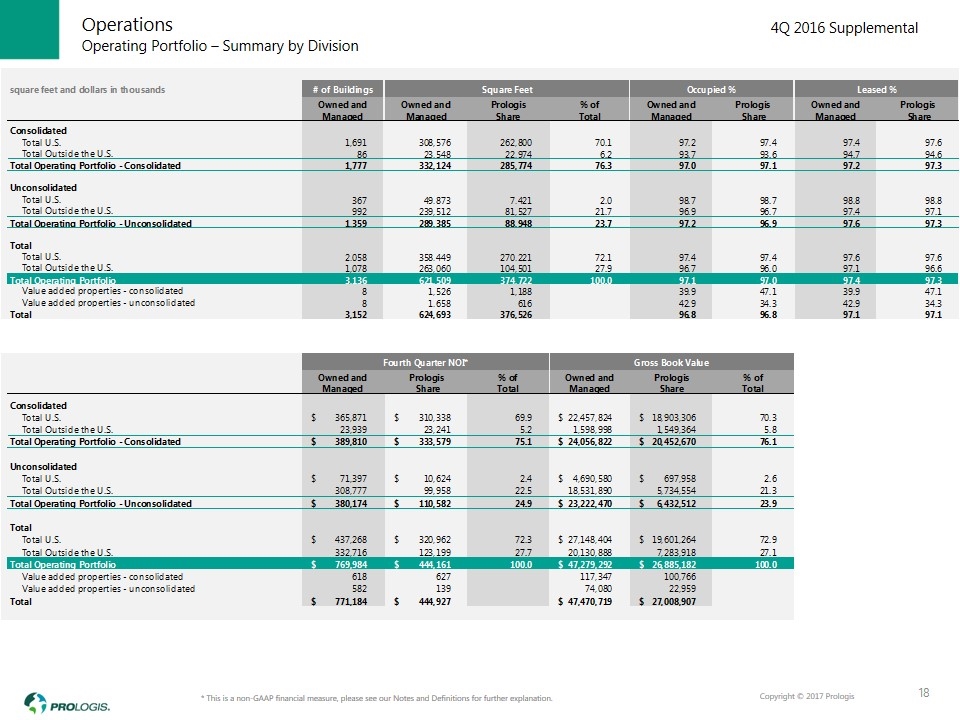

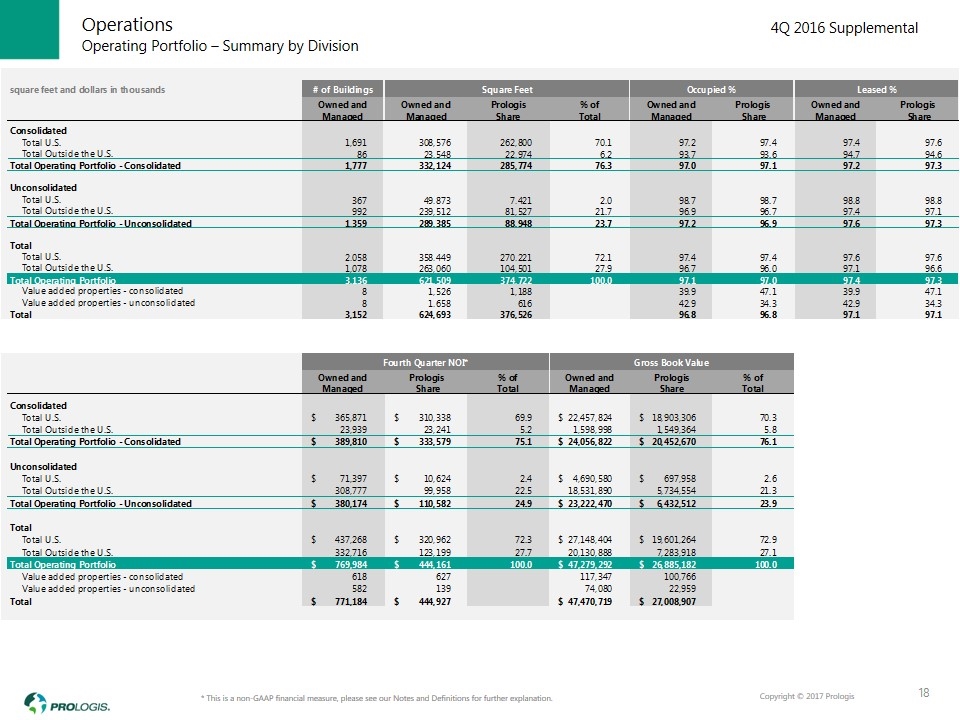

* This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. Operating Portfolio – Summary by Division Operations 18

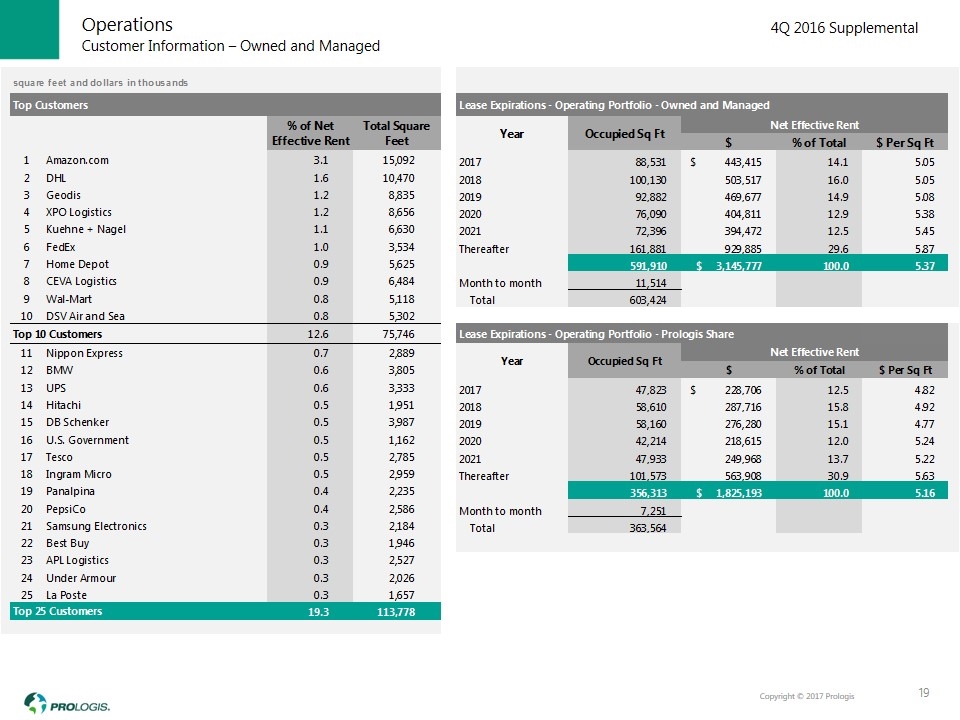

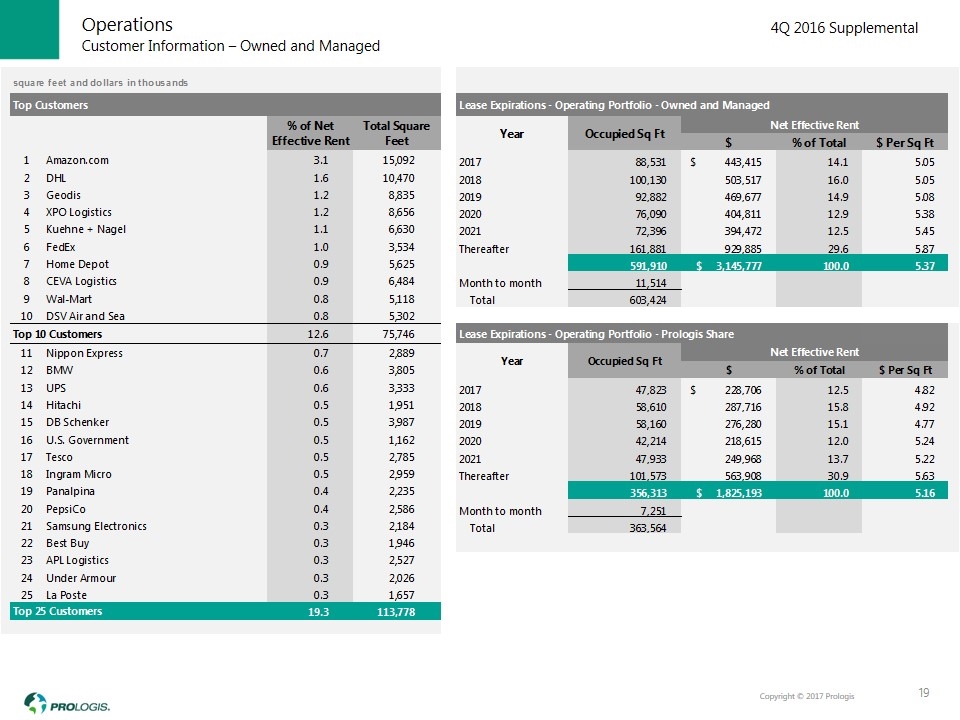

Customer Information – Owned and Managed Operations 19

Overview – Prologis Share Capital Deployment Est Value Creation $ 224 $ 277 $ 347 $ 380 $ 365 Outside the U.S. U.S. 20 (in millions) Wtd avg est stabilized yield 7.8% 7.8% 7.5% 7.3% 6.8% Est Value Creation $148 $372 $236 $533 $571

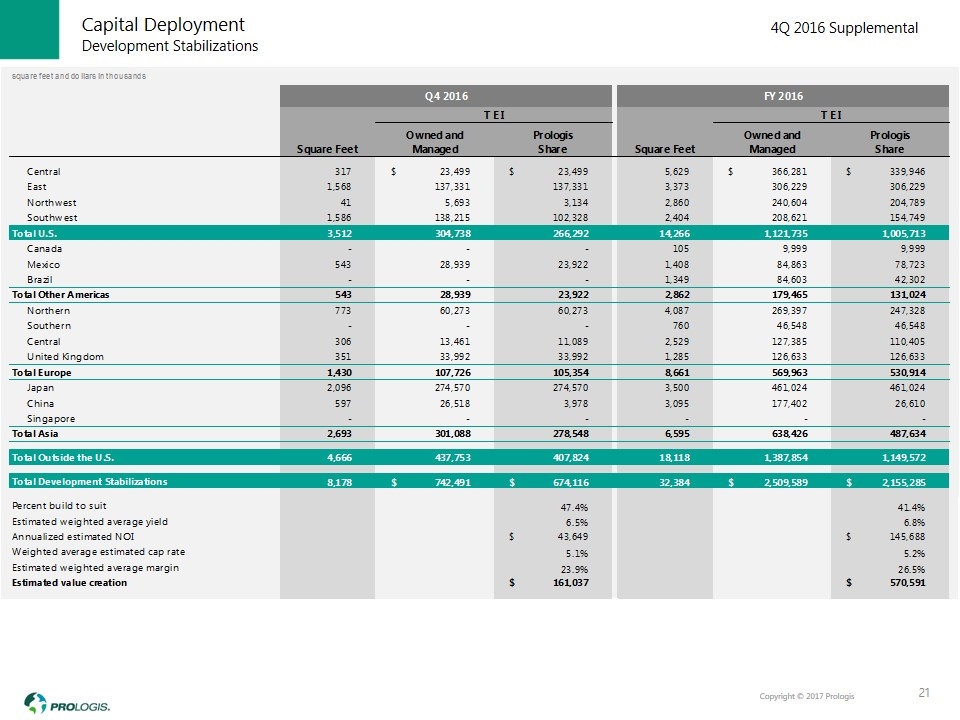

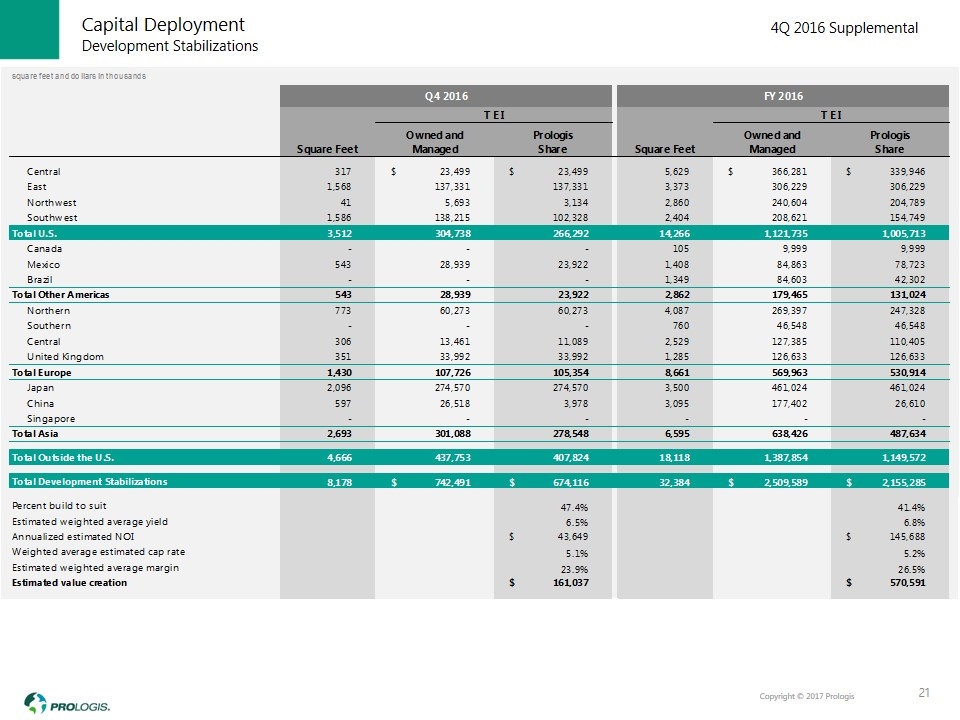

Development Stabilizations Capital Deployment 21

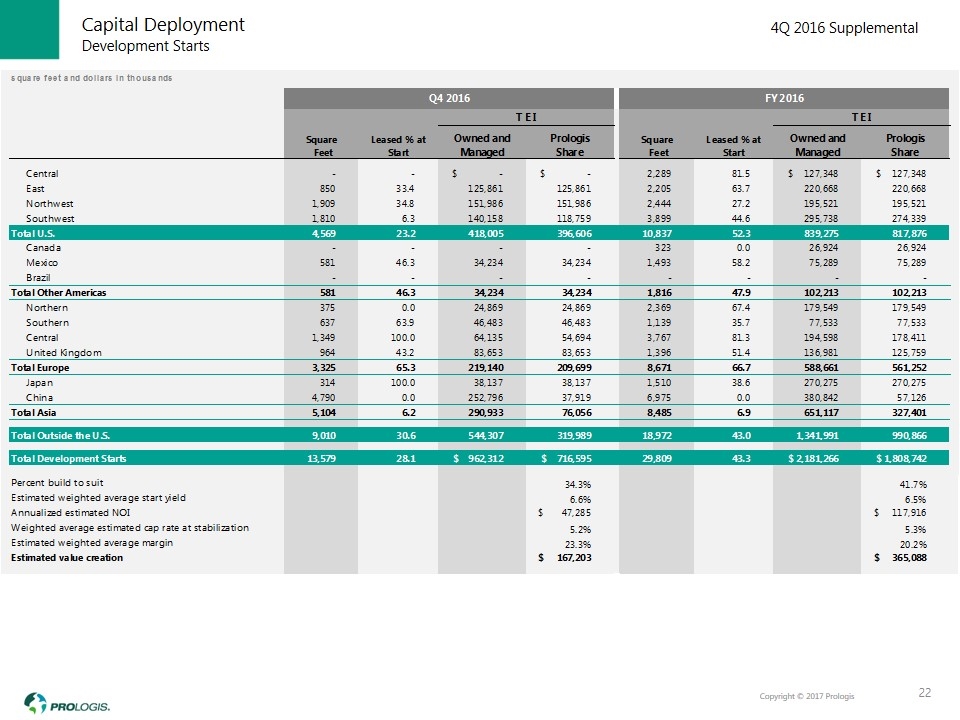

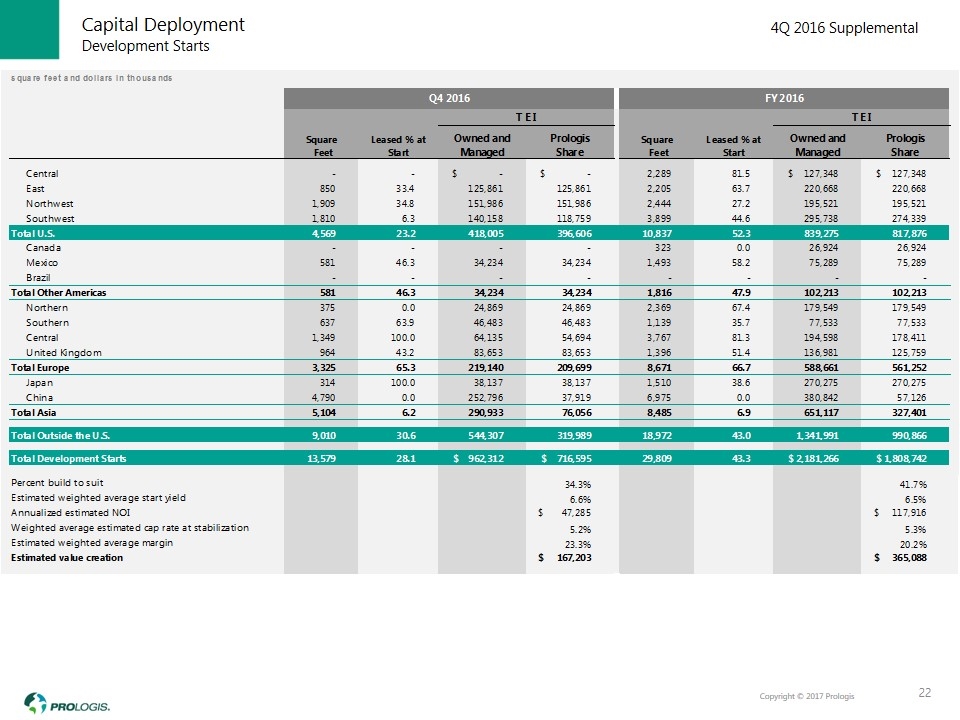

Development Starts Capital Deployment 22

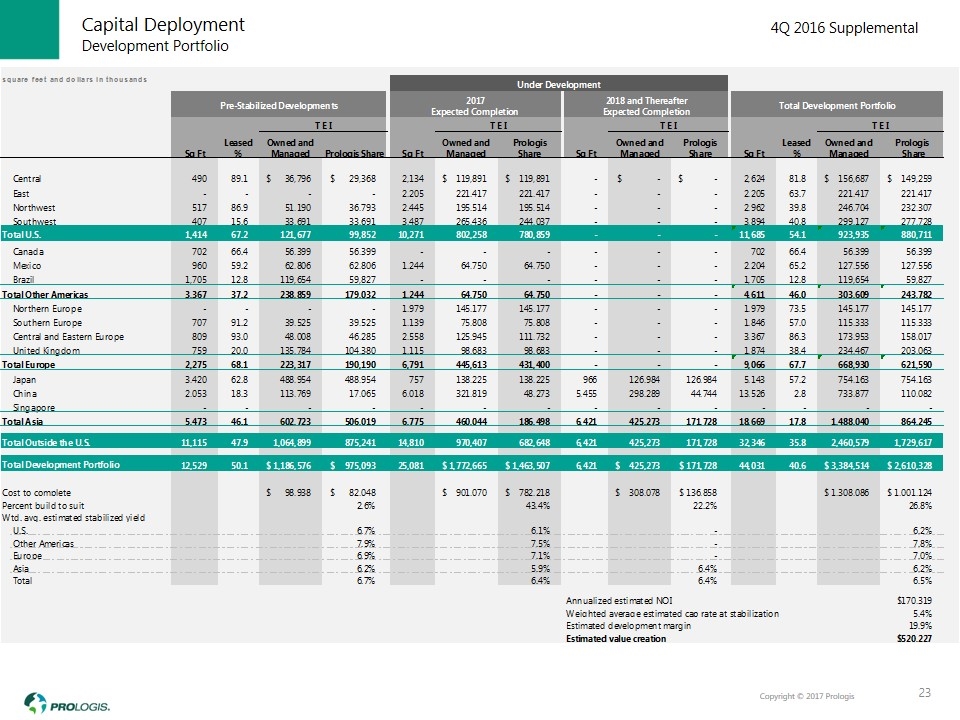

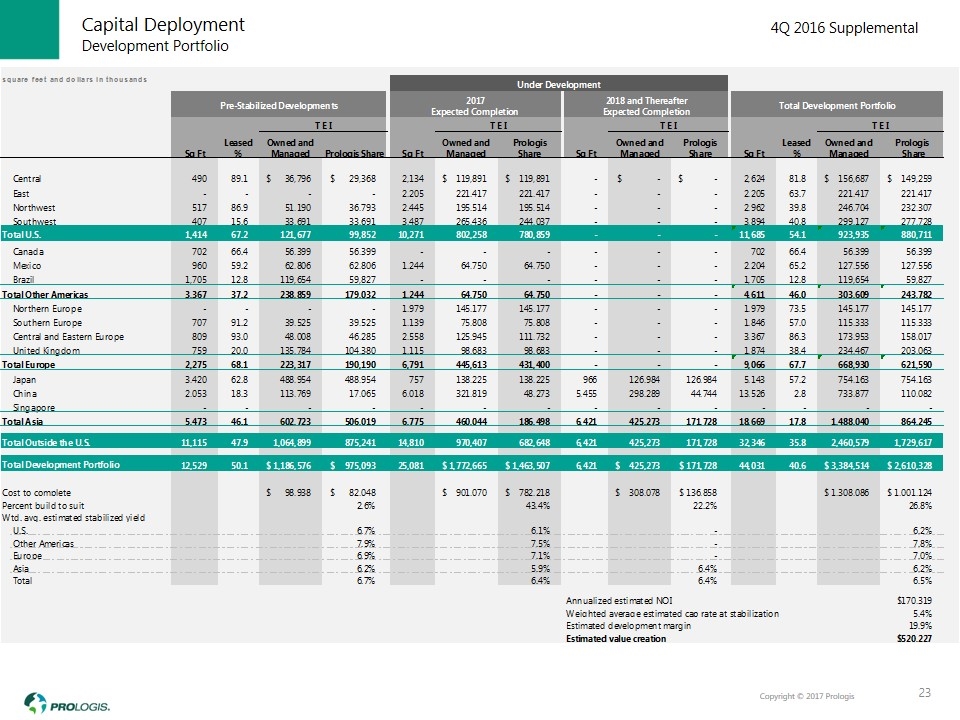

Development Portfolio Capital Deployment 23

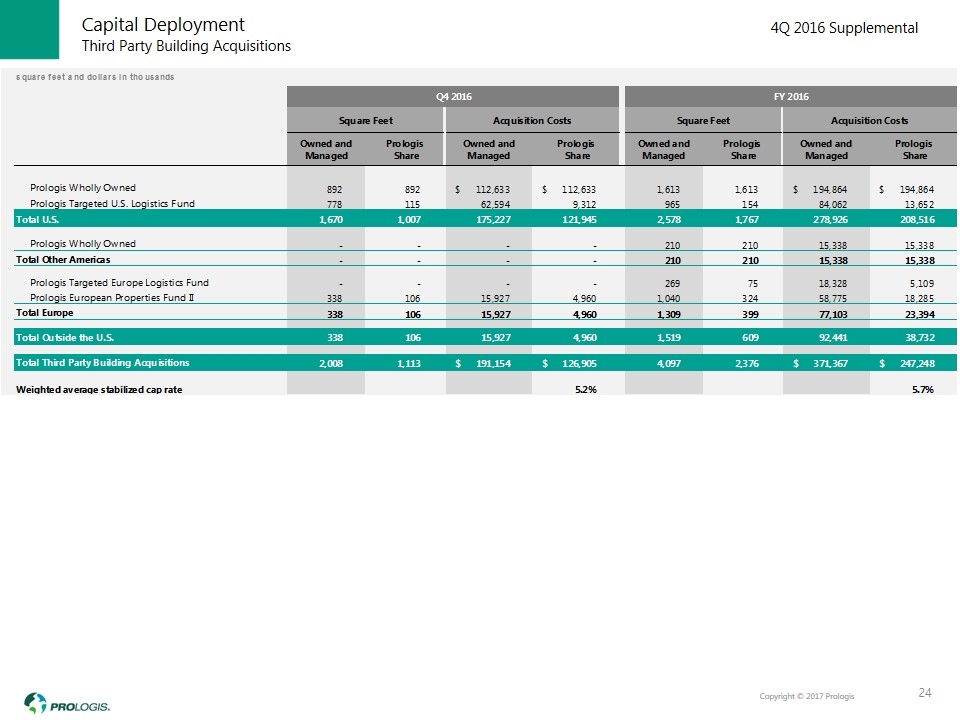

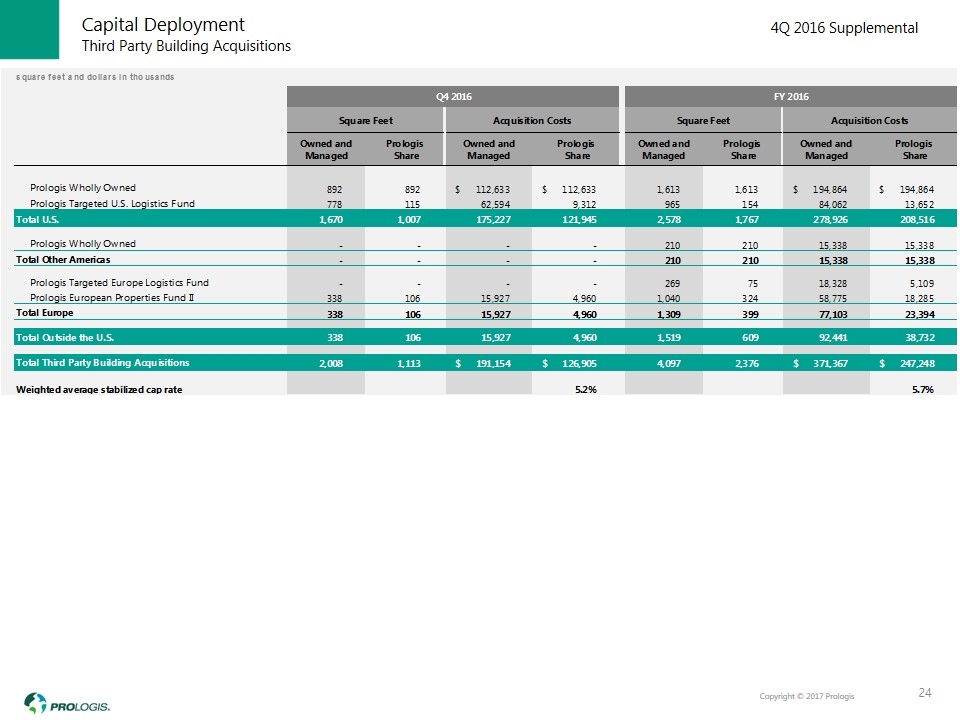

Third Party Building Acquisitions Capital Deployment 24

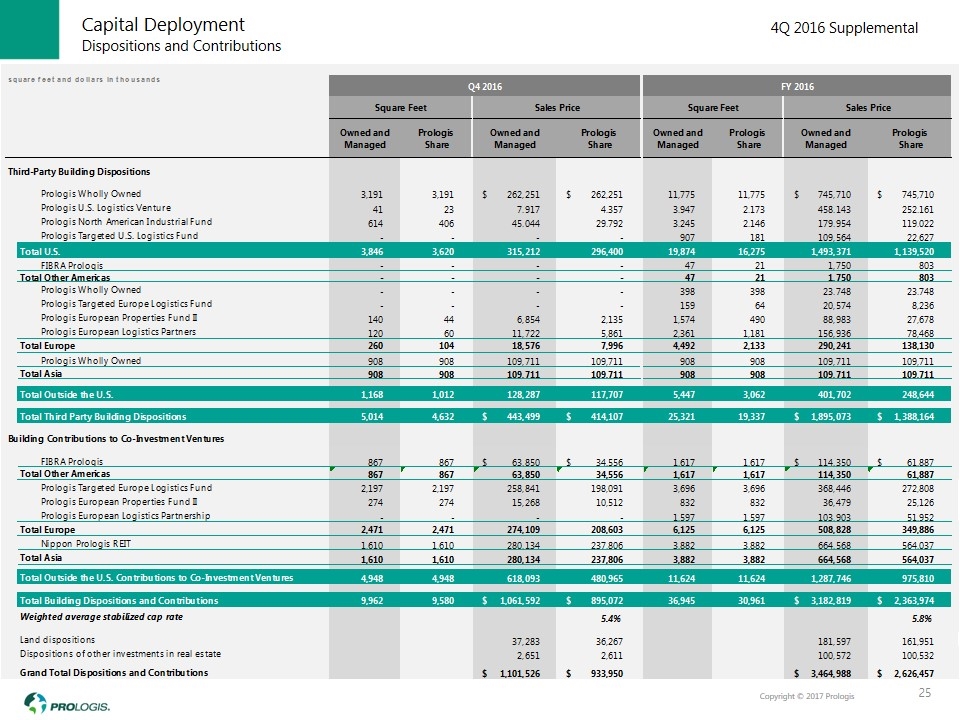

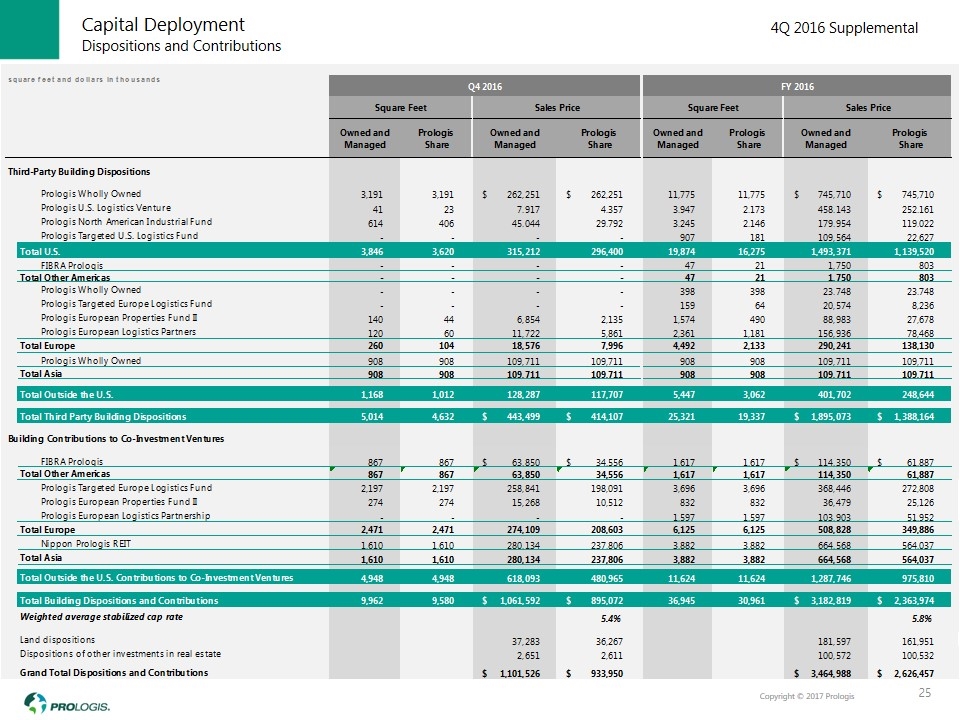

Dispositions and Contributions Capital Deployment 25

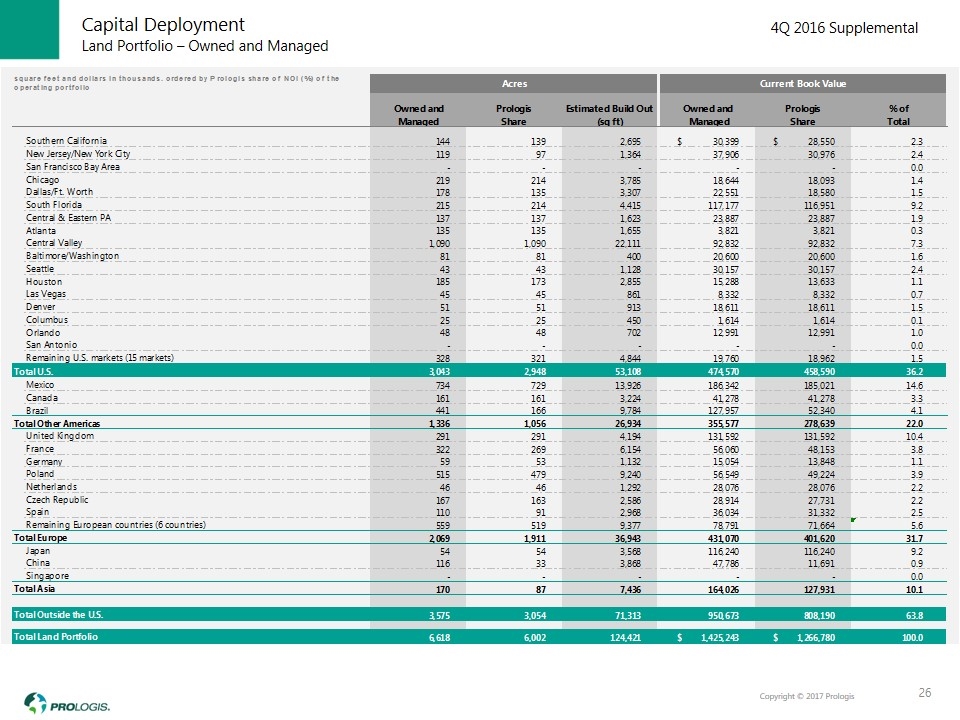

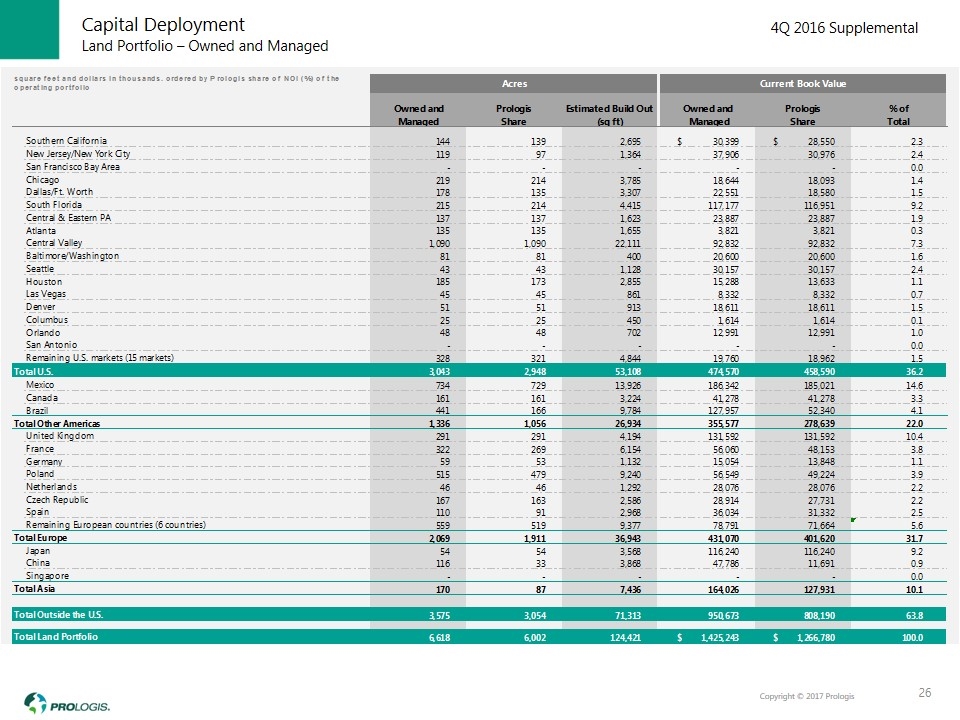

Land Portfolio – Owned and Managed Capital Deployment 26

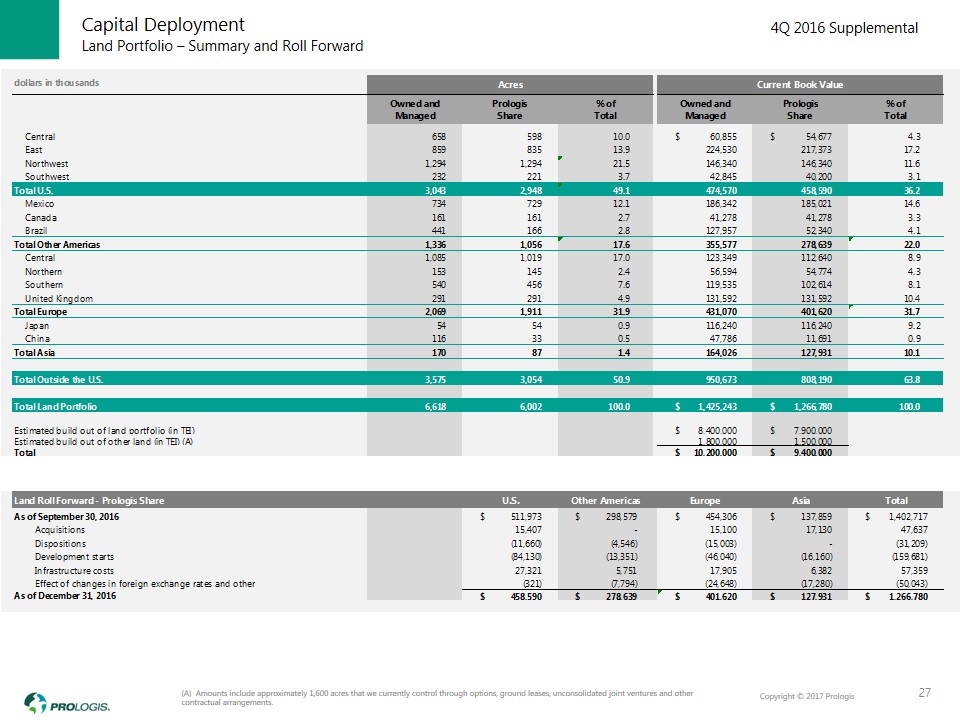

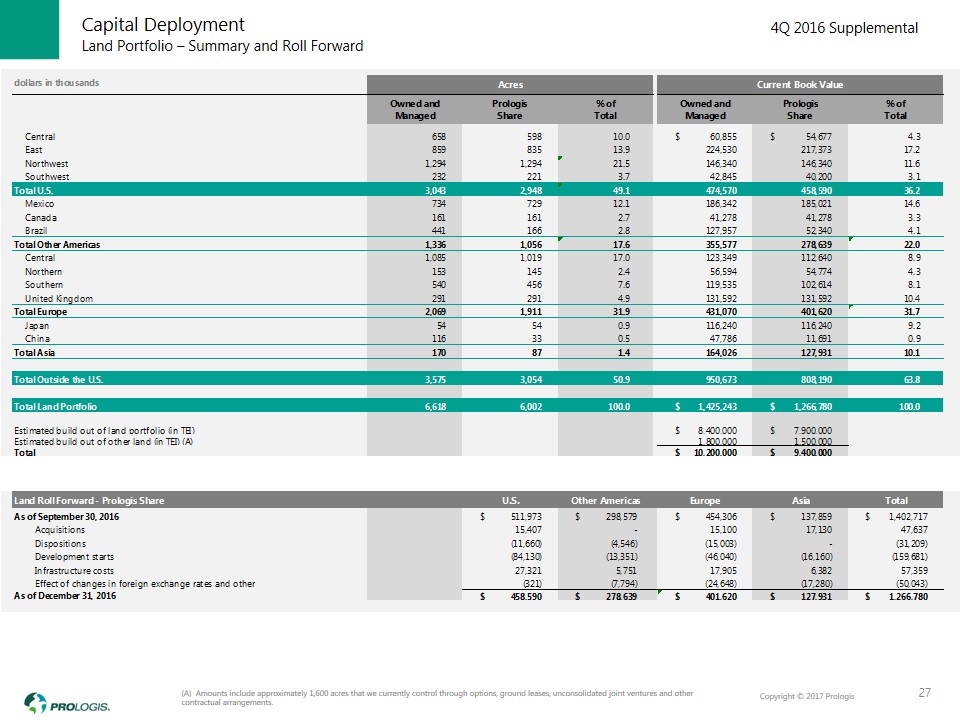

Land Portfolio – Summary and Roll Forward Capital Deployment 27 (A) Amounts include approximately 1,600 acres that we currently control through options, ground leases, unconsolidated joint ventures and other contractual arrangements.

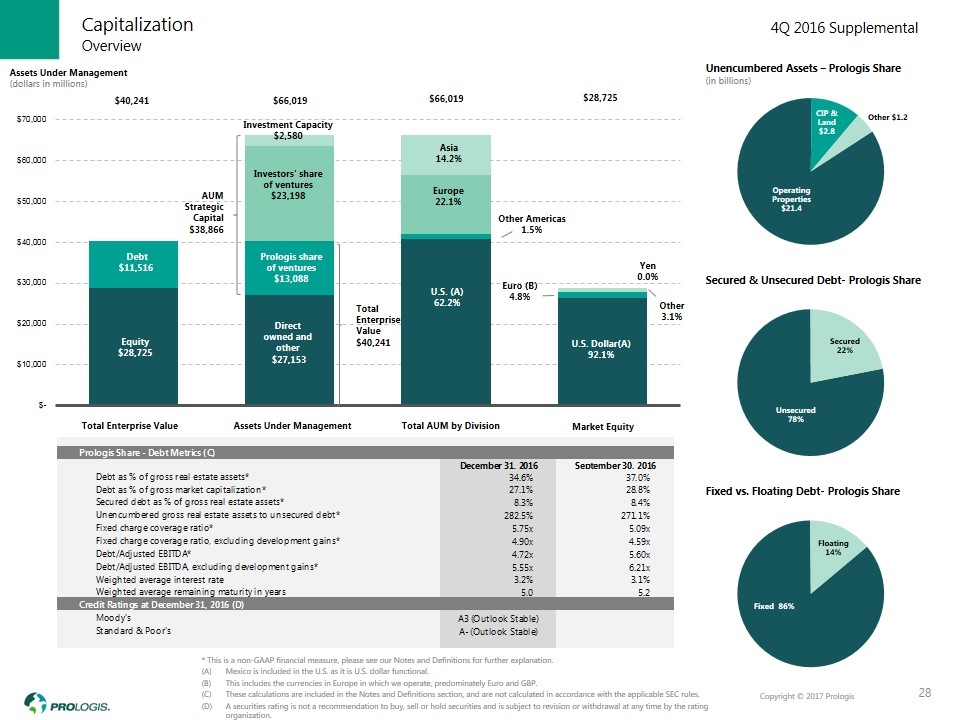

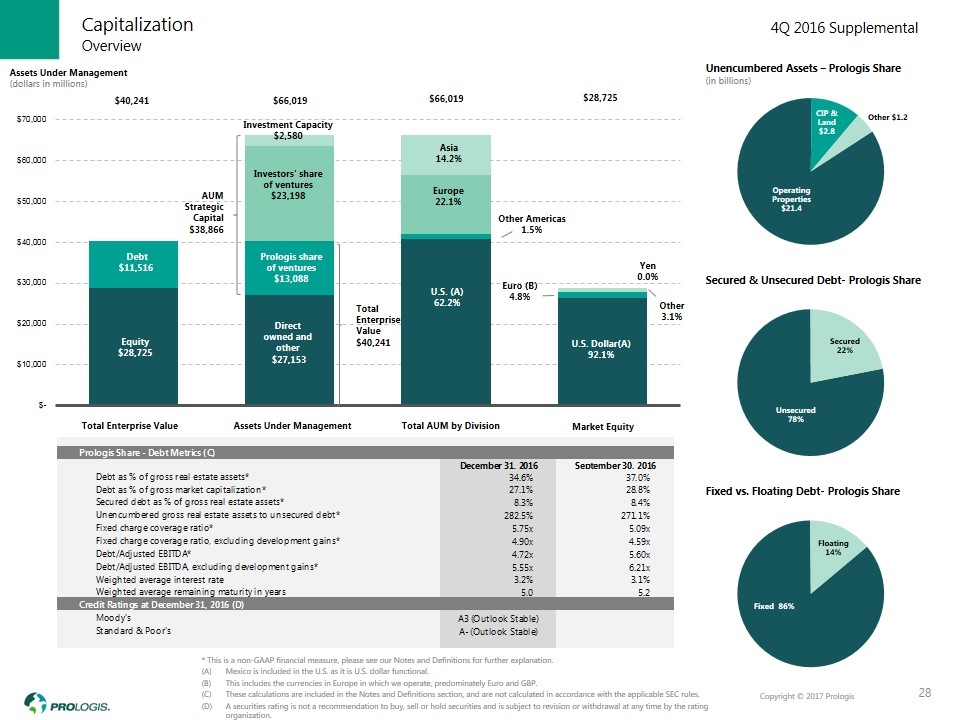

* This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. Mexico is included in the U.S. as it is U.S. dollar functional. This includes the currencies in Europe in which we operate, predominately Euro and GBP. These calculations are included in the Notes and Definitions section, and are not calculated in accordance with the applicable SEC rules. A securities rating is not a recommendation to buy, sell or hold securities and is subject to revision or withdrawal at any time by the rating organization. Overview Capitalization Assets Under Management (dollars in millions) Total Enterprise Value Assets Under Management Total AUM by Division Market Equity 28 Yen 0.0%

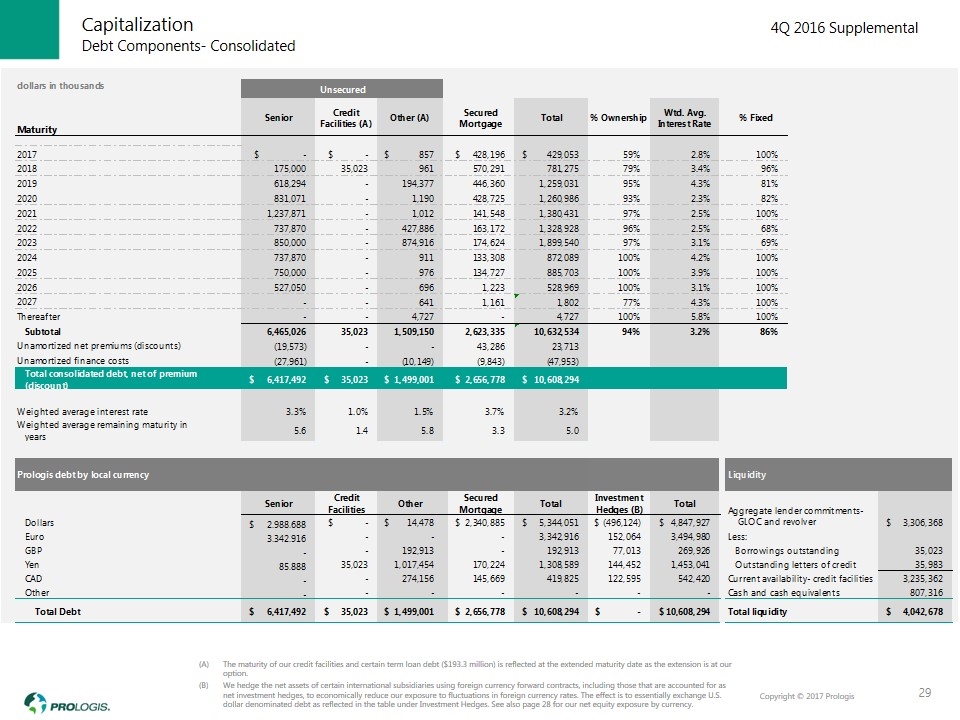

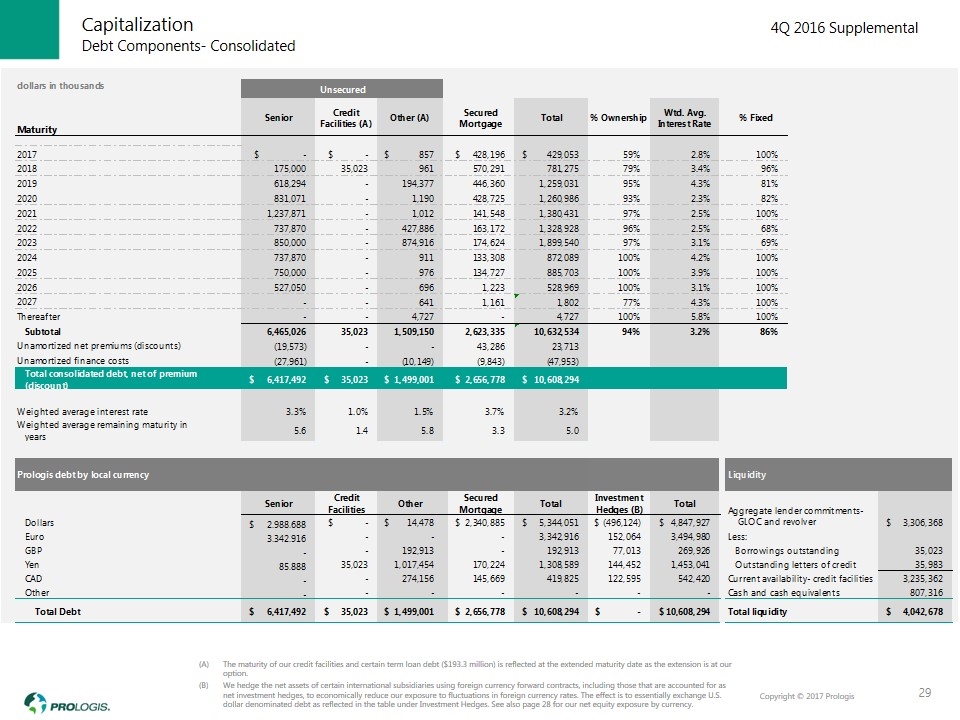

The maturity of our credit facilities and certain term loan debt ($193.3 million) is reflected at the extended maturity date as the extension is at our option. We hedge the net assets of certain international subsidiaries using foreign currency forward contracts, including those that are accounted for as net investment hedges, to economically reduce our exposure to fluctuations in foreign currency rates. The effect is to essentially exchange U.S. dollar denominated debt as reflected in the table under Investment Hedges. See also page 28 for our net equity exposure by currency. Debt Components- Consolidated Capitalization 29

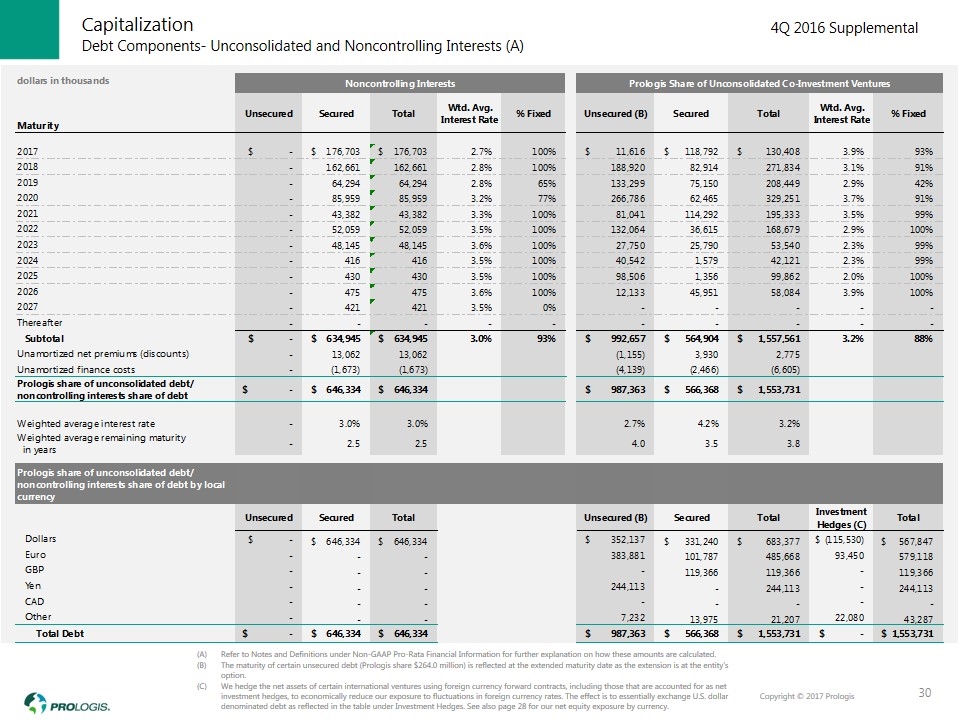

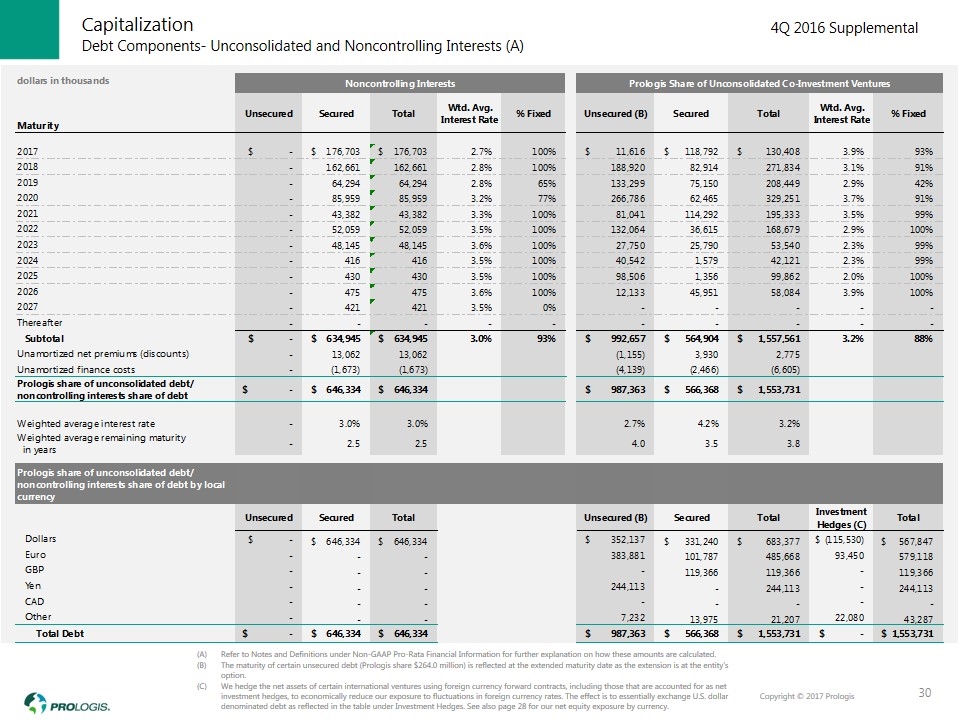

Refer to Notes and Definitions under Non-GAAP Pro-Rata Financial Information for further explanation on how these amounts are calculated. The maturity of certain unsecured debt (Prologis share $264.0 million) is reflected at the extended maturity date as the extension is at the entity’s option. We hedge the net assets of certain international ventures using foreign currency forward contracts, including those that are accounted for as net investment hedges, to economically reduce our exposure to fluctuations in foreign currency rates. The effect is to essentially exchange U.S. dollar denominated debt as reflected in the table under Investment Hedges. See also page 28 for our net equity exposure by currency. Debt Components- Unconsolidated and Noncontrolling Interests (A) Capitalization 30

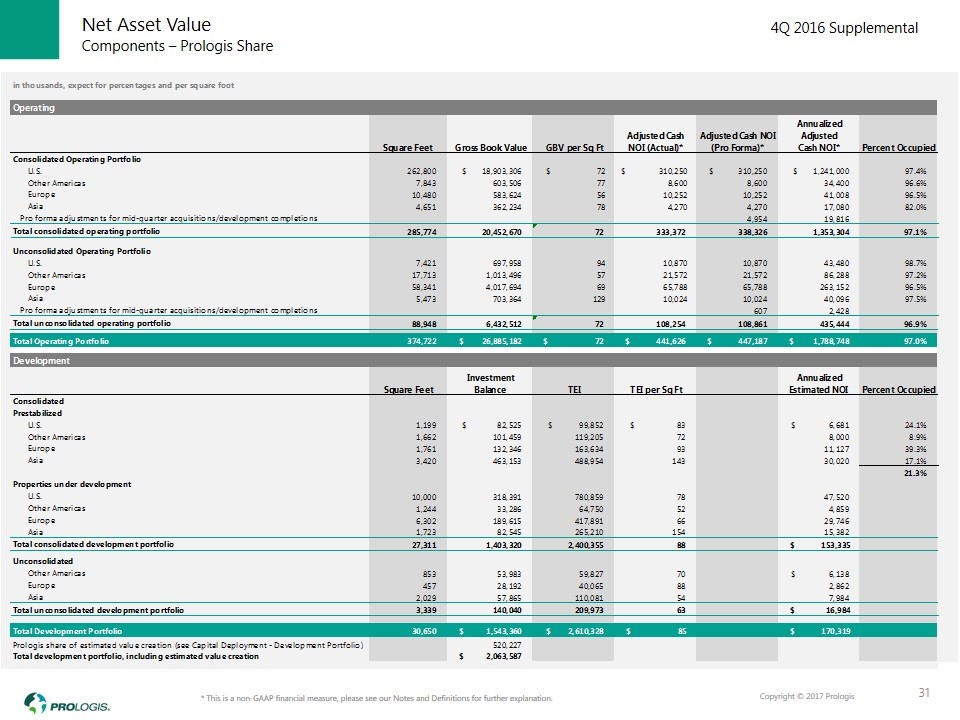

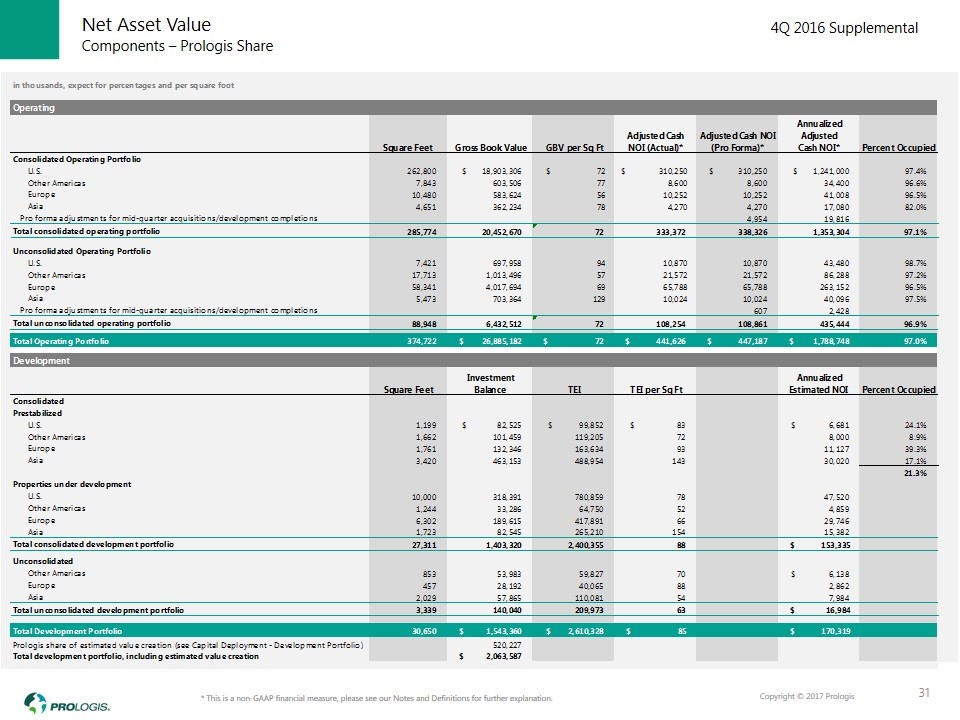

* This is a non-GAAP financial measure, please see our Notes and Definitions for further explanation. Components – Prologis Share Net Asset Value 31

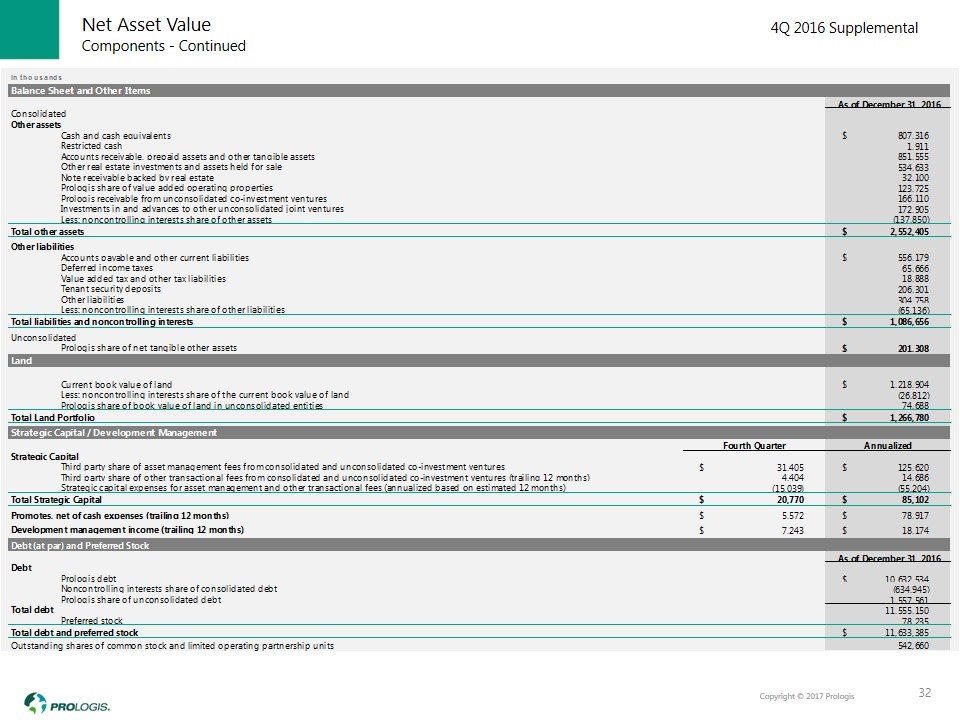

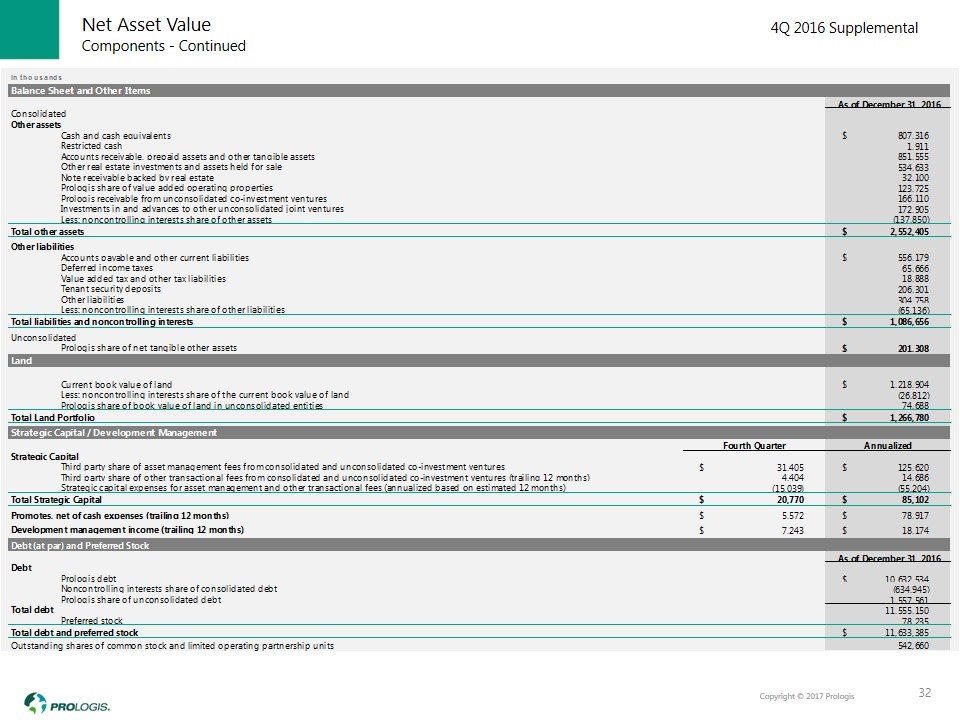

Components - Continued Net Asset Value 32

Notes and Definitions Section 1

Notes and Definitions 34

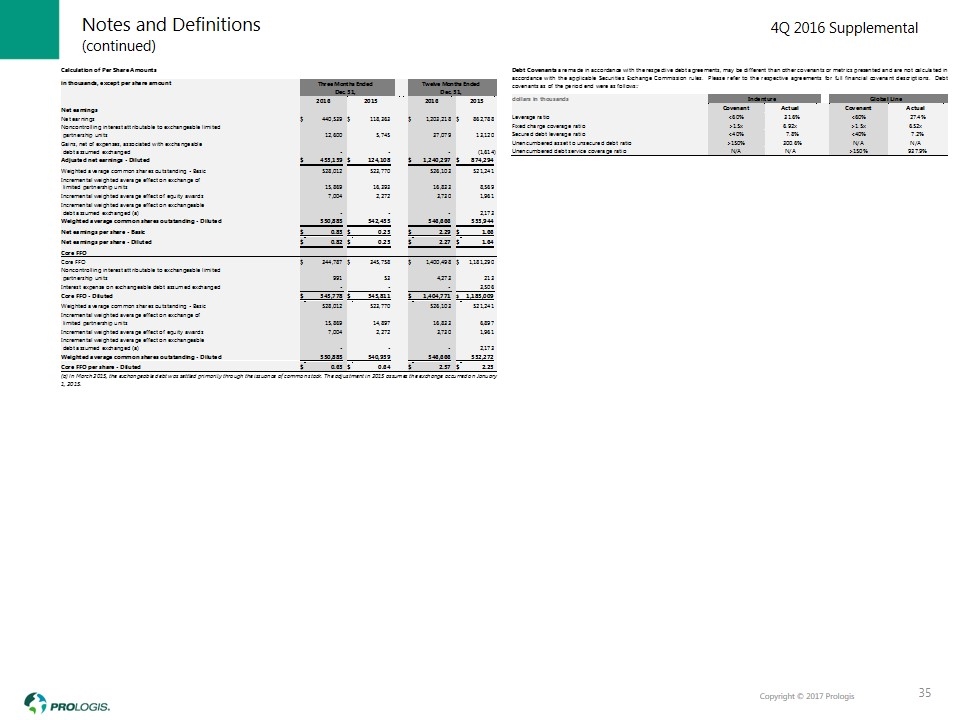

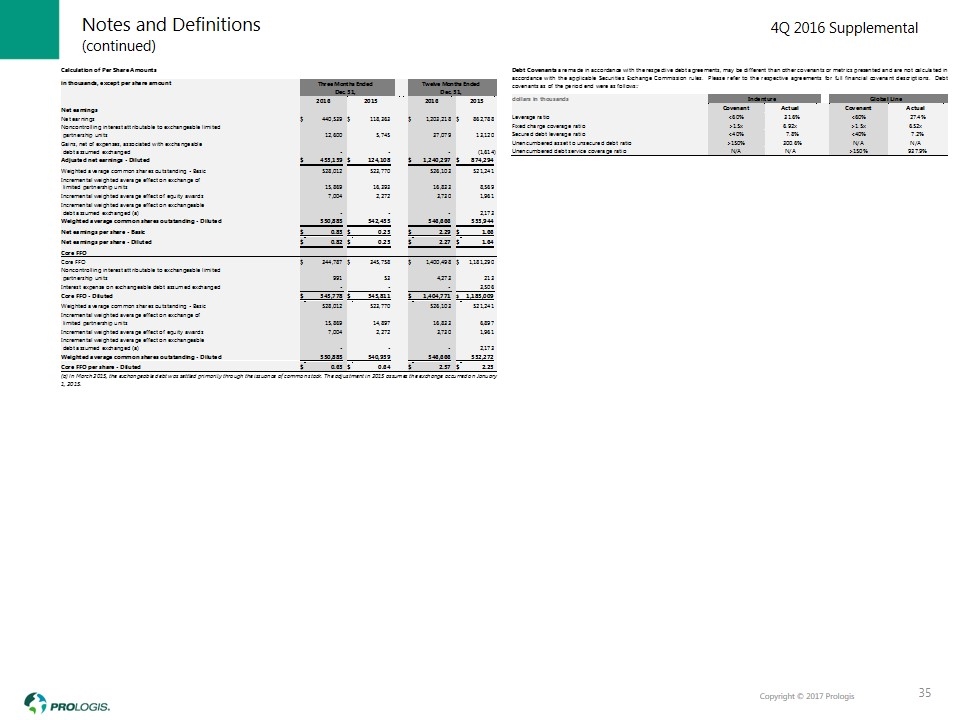

(continued) Notes and Definitions 35

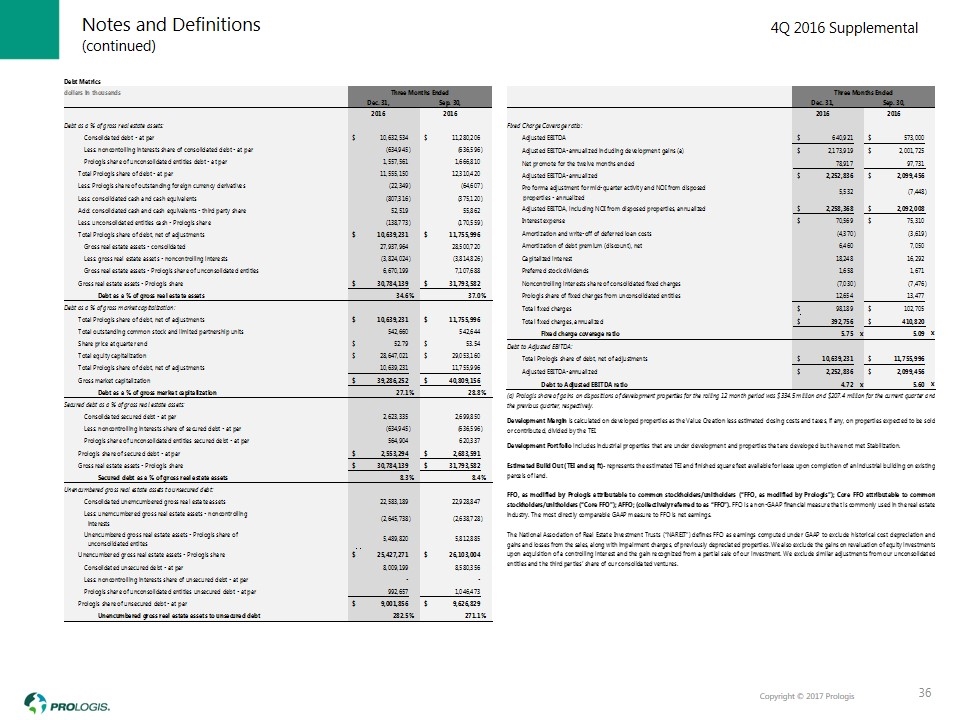

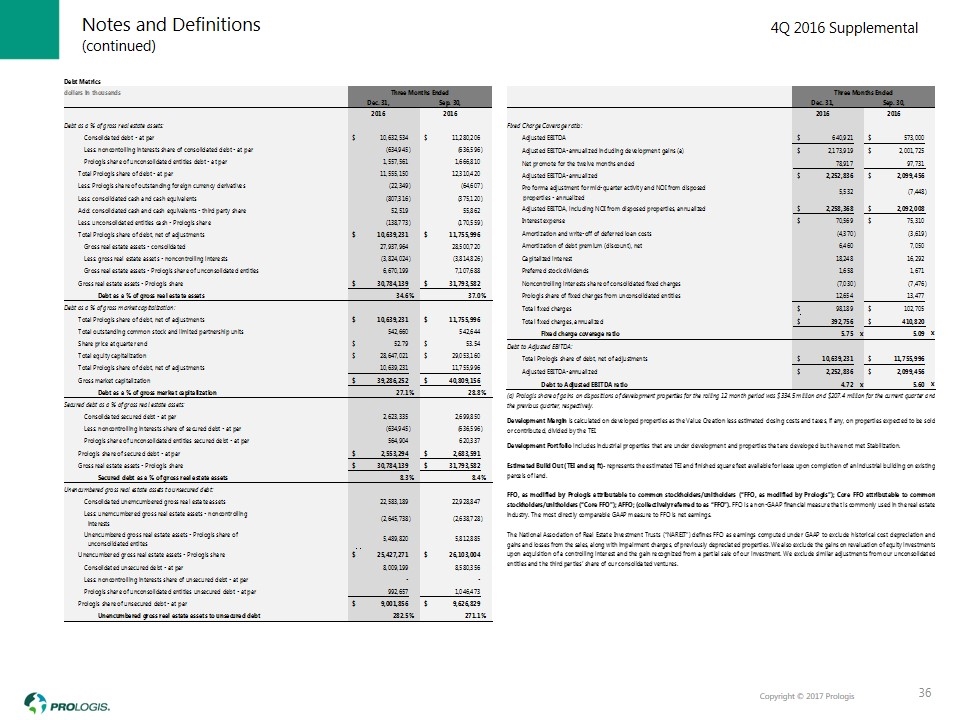

(continued) Notes and Definitions 36

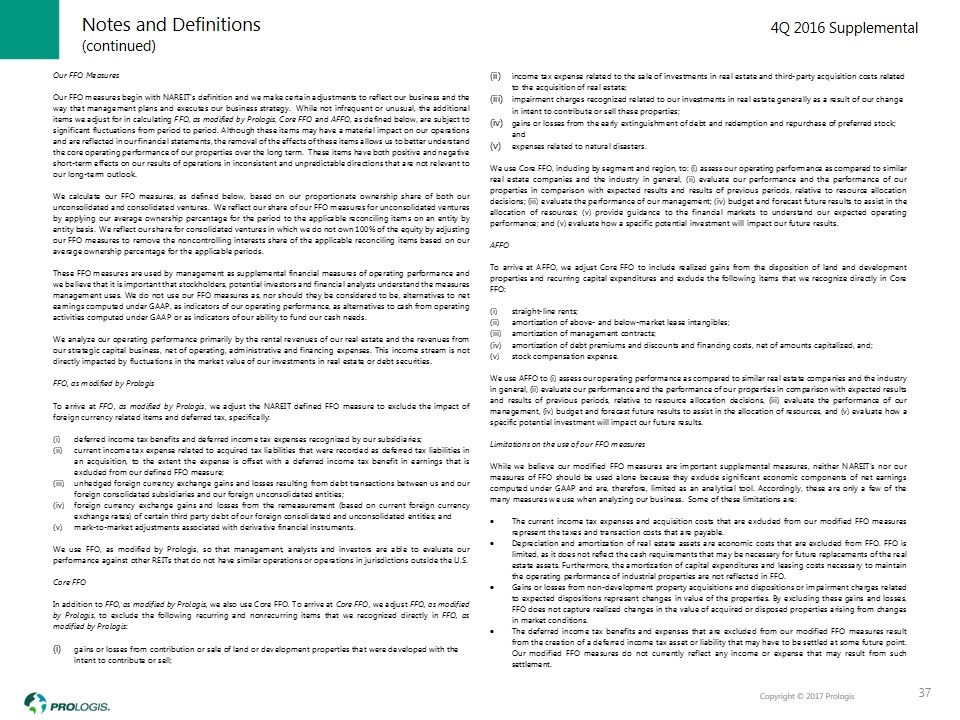

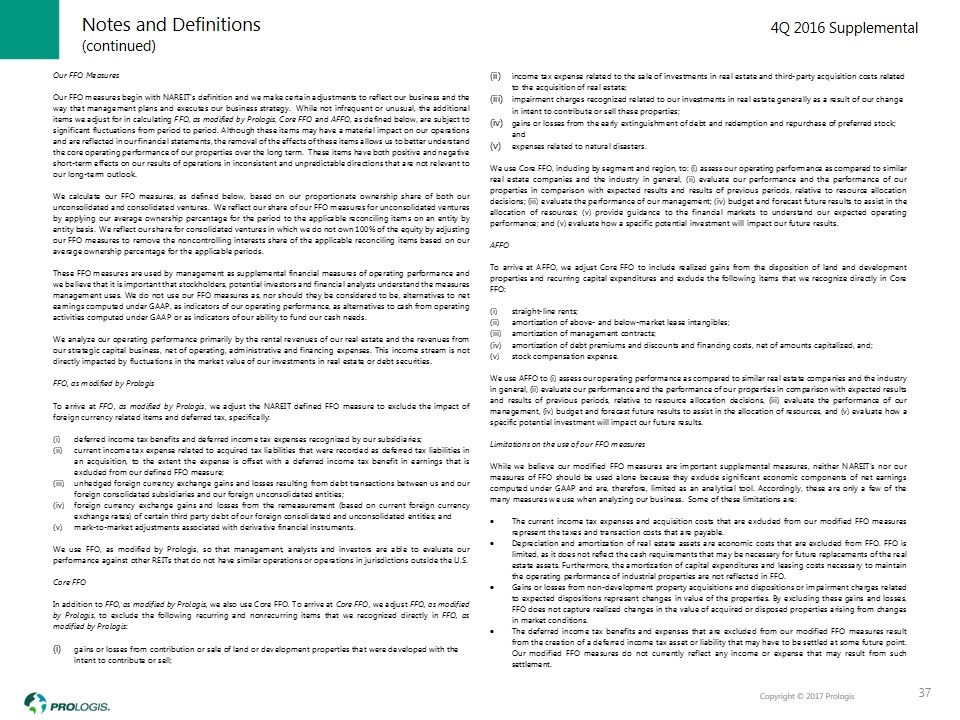

(continued) Notes and Definitions 37

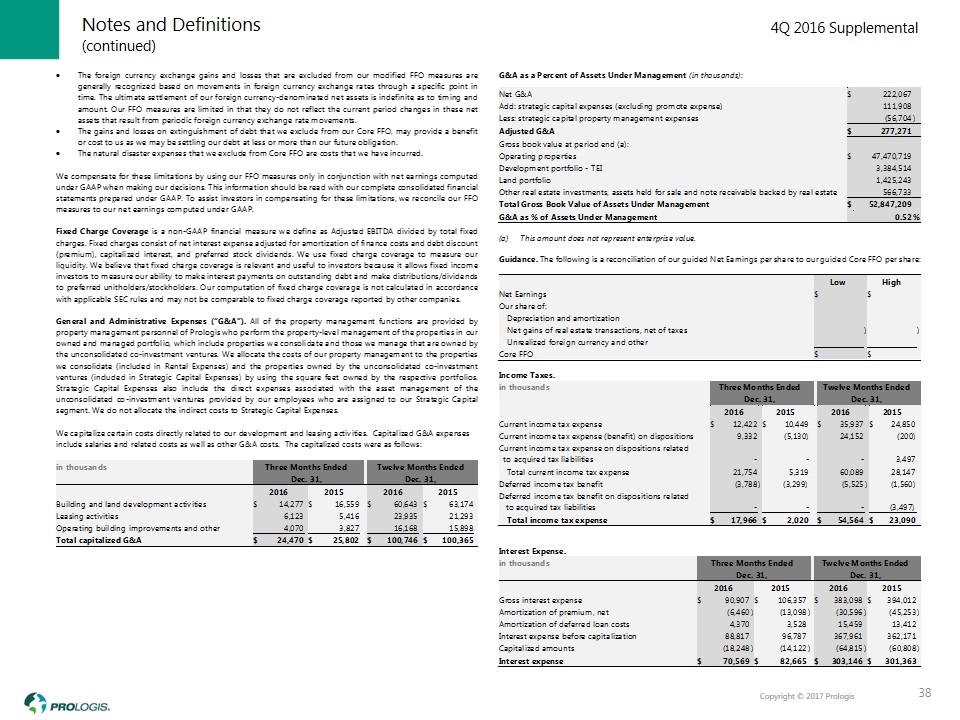

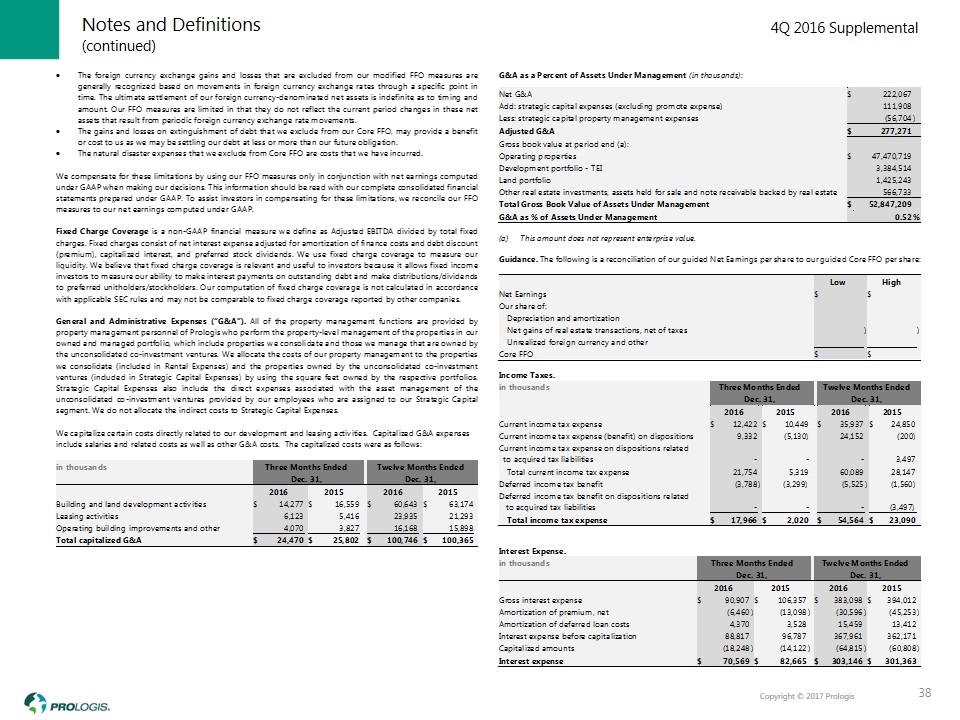

(continued) Notes and Definitions 38

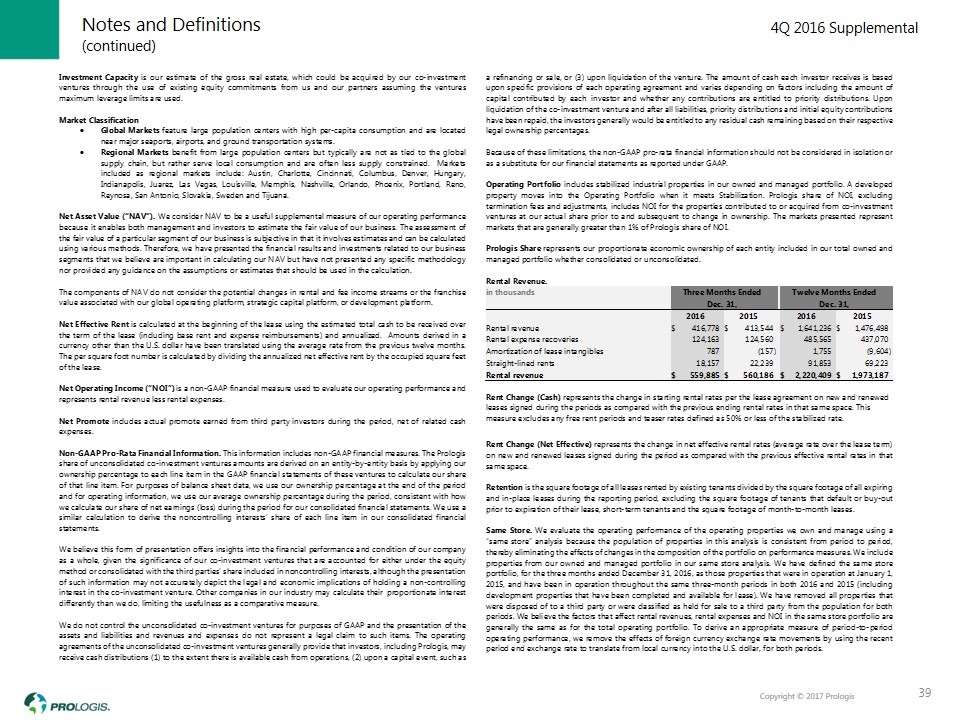

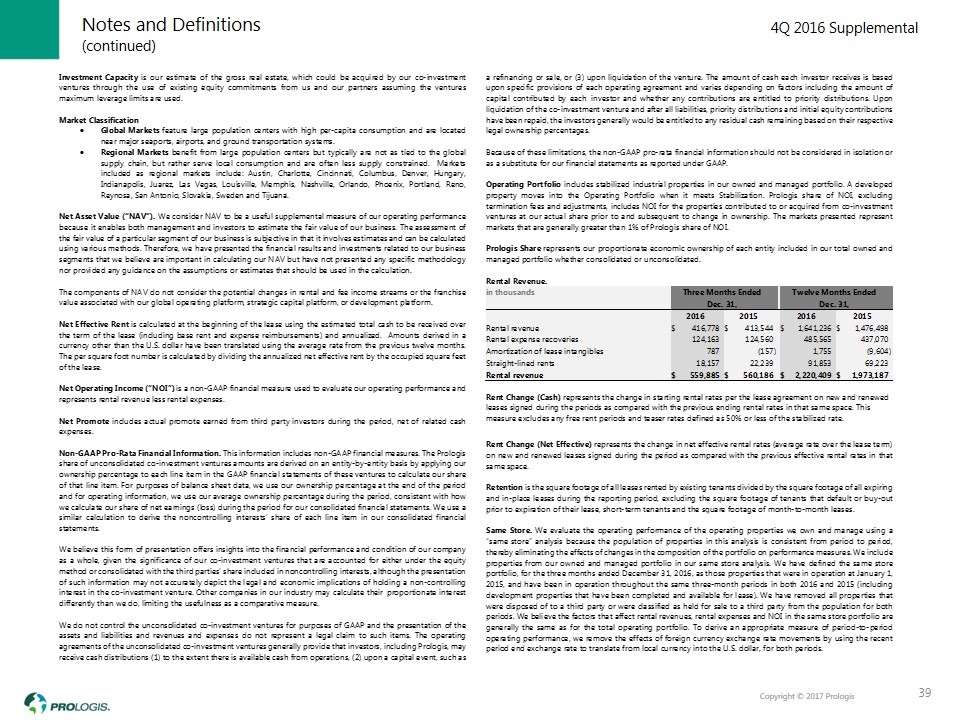

(continued) Notes and Definitions 39

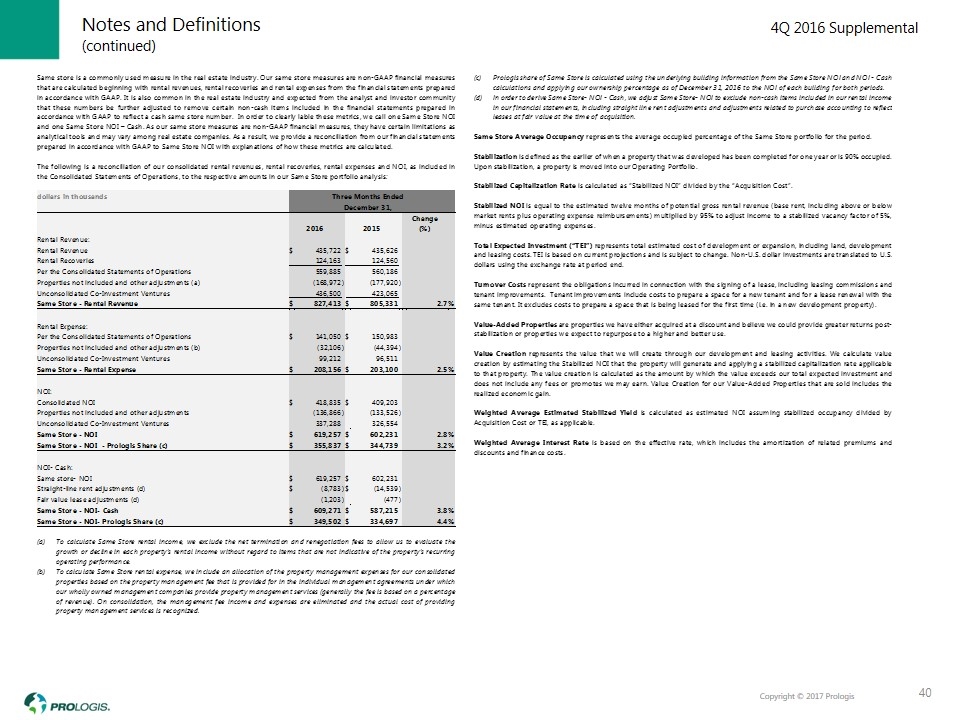

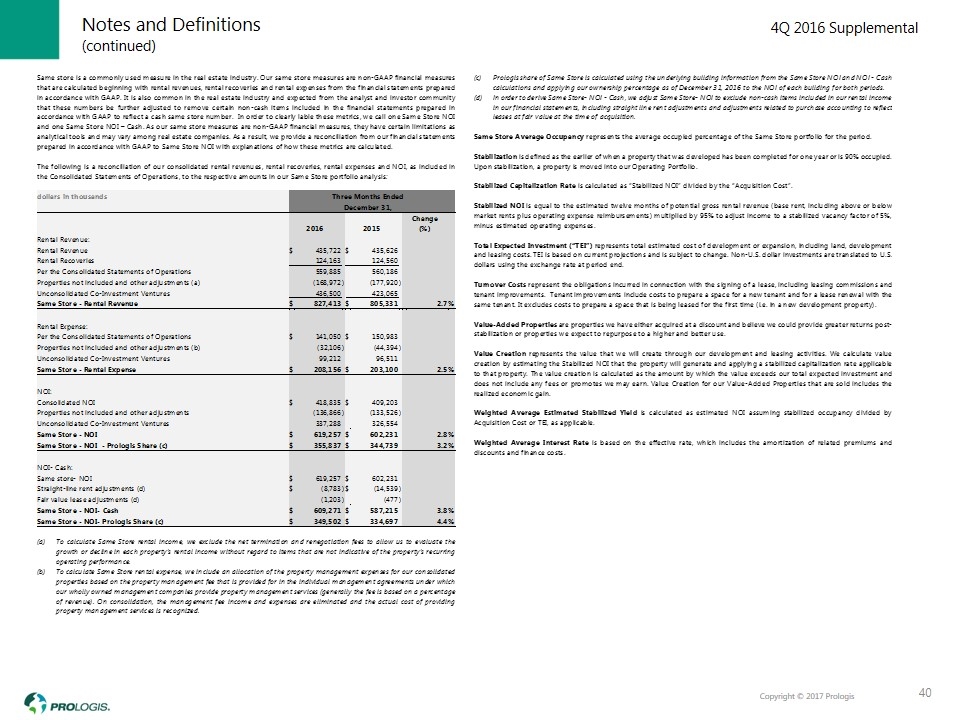

(continued) Notes and Definitions 40