2506 Winford Avenue, Nashville, TN 37211

December 7, 2015

Dear Fellow Shareholder:

The Board of Trustees (the “Board”) of Monteagle Funds (the “Trust”) has called a Special Meeting of Shareholders (“Meeting”) of Monteagle Fixed Income Fund, Monteagle Informed Investor Growth Fund, Monteagle Quality Growth Fund, Monteagle Select Value Fund and Monteagle Value Fund and The Texas Fund (each a “Fund” and collectively, the “Funds”). The Meeting is scheduled to be held on January 21, 2016.

The Proxy Statement contains two (2) proposals. Shareholders of each Fund are being asked to vote on the proposal. Please take the time to read these materials and cast your vote promptly, as the proposals to be voted on are important to the Funds and to you as a shareholder.

In Proposal 1, elect two new Trustees to serve on the Board of Trustees of each Fund until such time as their successors shall be duly elected and qualified. The individuals nominated for election as Trustees will, upon election, serve on the Trust’s Board until such time as their successors shall be duly elected and qualified.

In Proposal 2, the Board asks you for authority to transact such other business as may properly come before the shareholders of the Funds.

The Board highly recommends that all shareholders of the Funds approve all proposals.

Your vote is important regardless of the number of shares you own. In order to avoid the added cost of follow-up solicitations and possible adjournments, please read the Proxy Statement and cast your vote promptly. It is important that your vote be received no later than January 20, 2016. If you have any questions about the Proxy Statement, please do not hesitate to call us at toll-free at 1-888-263-5593.

We appreciate your participation and prompt response and thank you for your continued support.

Sincerely,

/s/ Larry J. Anderson

Larry J. Anderson

Chairman of the Board of the Trustees

PROXY STATEMENT

PLEASE VOTE

YOUR VOTE IS EXTREMELY IMPORTANT AND VOTING ONLY TAKES A FEW MINUTES. ACT NOW TO HELP THE FUNDS AVOID ADDITIONAL EXPENSE.

Monteagle Funds (the “Trust”) will hold a special meeting of shareholders on January 21, 2016 (the “Meeting”). It is important for you to vote on the issue described in this Proxy Statement. We recommend that you read the Proxy Statement in its entirety - the explanations in the Proxy Statement will help you decide on the issue.

The following is an introduction to the proposals and the process:

Why am I being asked to vote?

Mutual funds are required to obtain shareholders’ votes for certain types of changes, like those included in this Proxy Statement. You have a right to vote on these changes.

What issues am I being asked to vote on?

The proposal includes the election of two new Trustees to serve on the Board of Trustees of each Fund.

What are the responsibilities of the Board of Trustees?

The Board of Trustees is responsible for the general oversight of the Trust’s business. The Board represents the shareholders and can exercise all of the Trust’s powers, except those reserved only for shareholders. The Board, for example, periodically reviews the investment performance of the Funds as well as the quality of other services provided to the Funds.

Why are Trustees being elected?

Prior to March 12, 2015, the Board of Trustees of Monteagle Funds consisted of Brian Green, Chairman, Larry J. Anderson and Charles M. Kinard. Mr. Green passed away unexpectedly on March 12, 2015. Section 16(a) of the Investment Company Act of 1940 (the “1940 Act”) requires that at least two-thirds of the trustees of the Trust are elected to such office by shareholders of the Trust. Mr. Anderson and Mr. Kinard were previously approved by shareholder vote on November 29, 2002. In light of the untimely death of Brian Green and applicable 1940 Act requirements, the Board of Trustees has nominated two qualified individuals for shareholder consideration.

The Proxy Statement includes a brief description of each nominee’s qualifications.

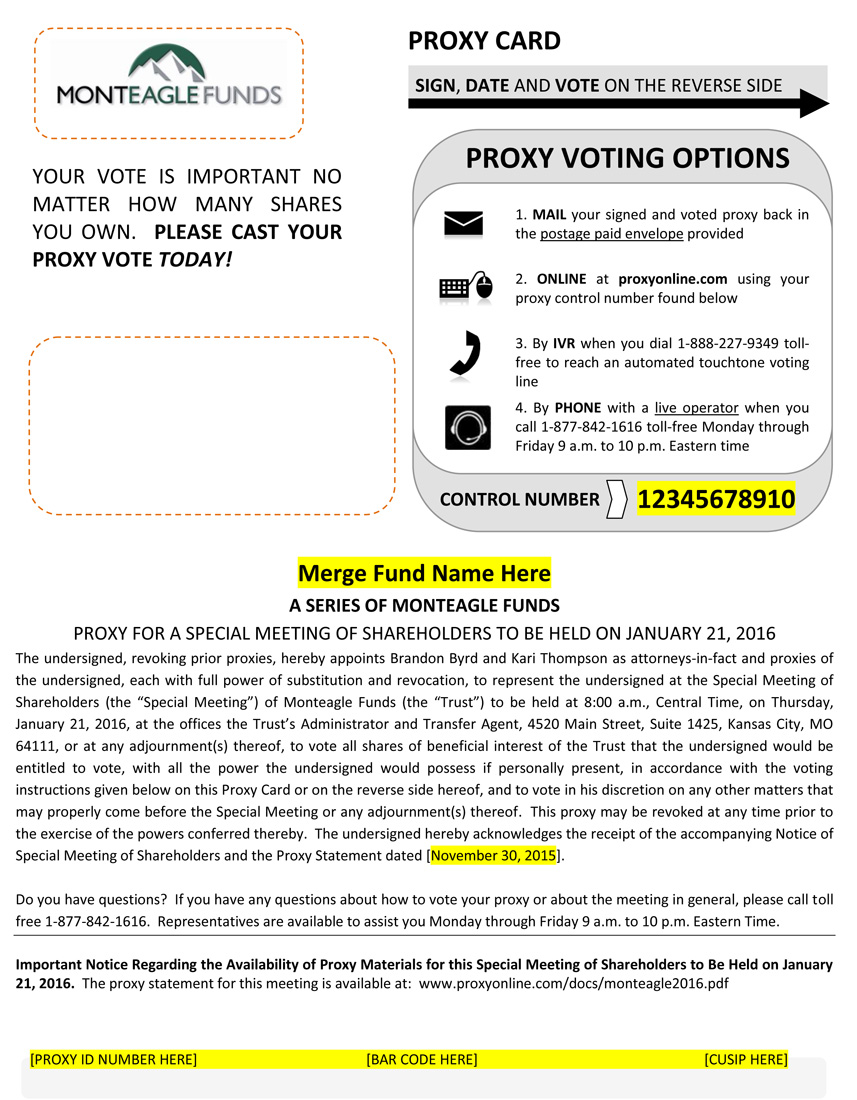

How do I vote my shares?

You may vote your shares in person at the Meeting. You may also vote by returning the enclosed Proxy Card. If you do not respond at all, the Funds’ proxy solicitor may contact you by telephone to request that you cast your vote.

Who do I call if I have questions about the Proxy Statement?

If you have any questions or need further assistance in voting, please feel free to call M3Sixty Administration, LLC (“M3Sixty”), the Trust’s Administrator and Transfer Agent, toll-free at 1-888-263-5593.

You may also call Paul B. Ordonio, President of the Trust, at Nashville Capital Corporation., toll-free at 1-800-459-9084.

After careful consideration, the Board of Trustees has unanimously approved this proposal. The Board recommends that you read the enclosed materials carefully and vote FOR the proposal.

2506 Winford Avenue, Nashville, TN 37211

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD JANUARY 21, 2016

To the Shareholders of the Funds:

Notice is hereby given that a special meeting of shareholders (the “Meeting”) of the Monteagle Fixed Income Fund (the “Fixed Income Fund”), Monteagle Informed Investor Growth Fund (the “Informed Investor Fund”), Monteagle Quality Growth Fund (the “Quality Growth Fund”), Monteagle Select Value Fund (“Select Value Fund”), Monteagle Value Fund (“Value Fund”) and The Texas Fund (the “Texas Fund”) (collectively the “Funds” and individually the “Fund”), six series of Monteagle Funds (the “Trust”), will be held at the offices of M3Sixty Administration, LLC (“M3Sixty”), the Trust’s Administrator and Transfer Agent, 4520 Main Street, Suite 1425, Kansas City, MO 64111, on January 21, 2016, at 8:00 a.m. (Central time). The purpose of the Meeting is:

| 1. | Elect two new Trustees to serve on the Board of Trustees of each Fund until such time as their successors shall be duly elected and qualified. |

| 2. | To transact such other business as may properly come before the Meeting. |

The Proposals are discussed in greater detail in the attached Proxy Statement. You are entitled to vote at the Meeting and any adjournment thereof if you owned shares of one or more of the Funds at the close of business on November 27, 2015. If you attend the Meeting, you may vote your shares in person. Whether or not you intend to attend the Meeting in person, you may vote by proxy – vote, sign, date and return the enclosed proxy card in the enclosed postage-paid envelope or by fax.

The Trust’s Board of Trustees has fixed the close of business on November 27, 2015, as the record date for the determination of shareholders entitled to notice of and to vote at the Meeting or any adjournment thereof. Please carefully read the accompanying Proxy Statement.

By order of the Board of Trustees,

Paul B. Ordonio, JD

President

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN.

PLEASE RETURN YOUR PROXY CARD PROMPTLY. |

Shareholders are invited to attend the Meeting in person. Any shareholder who does not expect to attend the Meeting is urged to indicate voting instructions on the enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. If you sign, date and return the proxy card but give no instructions, your shares will be voted “FOR” the Proposals described above and “FOR” or “AGAINST” any other matter acted upon at the Meeting in the discretion of the persons named as proxies. Alternatively, you may vote your proxy by telephone in accordance with the instructions on the enclosed proxy card. To avoid the additional expense of further solicitation, we ask your cooperation in mailing your proxy promptly, no matter how large or small your holdings may be. |

MONTEAGLE FUNDS

2506 Winford Avenue, Nashville, TN 37211

PROXY STATEMENT

Special Meeting of Shareholders

January 21, 2016

INTRODUCTION

The enclosed proxy is solicited by the Board of Trustees of Monteagle Funds (the “Trust”), a Delaware business trust, on behalf of the Monteagle Fixed Income Fund, Monteagle Informed Investor Growth Fund, Monteagle Quality Growth Fund, Monteagle Select Value Fund, Monteagle Value Fund and The Texas Fund (each a “Fund” and collectively, the “Funds”). The Trust is a registered open-end investment company whose executive offices are located at 2506 Winford Avenue, Nashville, TN 37211. Proxies will be voted at the special meeting of shareholders (the “Meeting”) of the Funds to be held at the offices of M3Sixty Administration, LLC, the Trust’s Administrator and Transfer Agent, 4520 Main Street, Suite 1425, Kansas City, MO 64111, on January 21, 2016, at 8:00 a.m. (Central time), and any adjournment thereof for the purposes set forth in the accompanying notice of special meeting of shareholders. This Proxy Statement and the enclosed notice of meeting and proxy card are being mailed to shareholders on or about December 7, 2015.

The Trust’s Annual Report to shareholders for the period ended August 31, 2015, that includes financial statements for the Funds, has previously been mailed to shareholders. Shareholders may request a copy of the Annual Report without charge by calling M3Sixty, the Funds’ administrator, at 1-888-263-5593.

The solicitation of proxies will be primarily by mail but may also include telephone or oral communications by the officers of the Trust, by regular employees of M3Sixty or their affiliates, or by a third party proxy solicitation firm. The Funds will bear all of the costs of the Meeting and the preparation, printing and mailing of this Proxy Statement and of other proxies.

Purpose of Meeting

As more fully described in this Proxy Statement, the purpose of the Meeting is to vote on the following proposals:

| 1. | Elect two new Trustees to serve on the Board of Trustees of each Fund until such time as their successors shall be duly elected and qualified. |

| 2. | To transact such other business as may properly come before the Meeting. |

Description of Voting

Section 7.04 of the November 25, 1997, Trust Instrument governing Trust affairs, provides, in pertinent part, that one-third (⅓) of shares entitled to vote in person or by proxy shall be a quorum for the transaction of business at a shareholders’ meeting except when a larger vote is required by law. It also provides that any lesser number shall be sufficient only for holding a vote to adjourn the meeting. With respect to the vote required, Section 7.04 provides, except when a larger vote is required by law, that a majority of shares voted in person or by proxy shall decide any questions and a plurality shall elect a Trustee.

Approval of Proposal 1 with respect to the election of two new Trustees, shall require a plurality as required by Section 7.04 of the Trust Instrument. Shareholders of the Trust shall vote together, not separately by Fund.

Approval of Proposal 2, with respect to other business, shall require a majority vote as required by Section 7.04. Shareholders of the Trust shall vote separately by Fund.

Shareholders

Shareholders of record at the close of business on November 27, 2015, (the “Record Date”), will be entitled to notice of, and to vote at, the Meeting, including any adjournment thereof. As of Record Date, shares of each Fund issued and outstanding are as follows: (Monteagle Fixed Income Fund – 4,828,767 , Monteagle Informed Investor Growth Fund – 1,113,948, Monteagle Quality Growth Fund – 1,887,090 , Monteagle Select Value Fund – 810,213 , Monteagle Value Fund – 1,333,682 , The Texas Fund Class I Shares – 1,155,020 and The Texas Fund Class C Shares – 2,260). As of the Record Date, all Trustees and Officers of the Trust, as a group, owned beneficially less than 1% of the outstanding shares of any or all the Funds. As of the Record Date, the following shareholders beneficially owned more than 5% of the outstanding shares of each Fund:

| Fund | Name and Addresses | Shares | % of Fund |

| Fixed Income Fund | Mitra & Co. FBO 47 | 4,359,563 | 90.28% |

| | 11270 W. Park Place, Suite 400 | | |

| | Milwaukee, WI 53224-3638 | | |

| | | | |

| | Charles Schwab | 343,551 | 7.11% |

| | 101 Montgomery Street | | |

| | San Francisco, CA 94104-4151 | | |

| | | | |

| Informed Investor Fund | Maril & Co. FBO 47 | 1,025,139 | 92.03% |

| | 480 Pilgrim Way, Suite 100 | | |

| | Green Bay, WI 54304 | | |

| | | | |

| Quality Growth Fund | Maril & Co. FBO 47 | 1,766,372 | 93.60% |

| | 480 Pilgrim Way, Suite 100 | | |

| | Green Bay, WI 54304 | | |

| | | | |

| | Charles Schwab | 102,734 | 5.44% |

| | 101 Montgomery Street | | |

| | San Francisco, CA 94104-4151 | | |

| Fund | Name and Addresses | Shares | % of Fund |

| Select Value Fund | Charles Schwab | 730,629 | 90.18% |

| | 211 Main St. | | |

| | San Francisco, CA 94105 | | |

| | | | |

| Value Fund | Maril & Co. FBO 47 | 1,328,047 | 99.58% |

| | 480 Pilgrim Way, Suite 100 | | |

| | Green Bay, WI 54304 | | |

| | | | |

| Texas Fund | NFS Susan Blevins | 1,023 | 45.28% |

| Class C shares | 601 E. Woodcreek Ct. | | |

| | Granbury, TX 76049 | | |

| | | | |

| | NFS Michael Ross Blevins | 1,031 | 45.62% |

| | 601 E. Woodcreek Ct. | | |

| | Granbury, TX 76049 | | |

| | | | |

| | Joseph Team | 205 | 9.09% |

| | 601 Gill Dr. | | |

| | Abilene, TX 79601 | | |

From time to time, certain shareholders may own a large percentage of the shares of a Fund. Accordingly, those shareholders may be able to greatly affect (if not determine) the outcome of a shareholder vote. As of Record Date, the following persons beneficially owned 25% or more of the shares of a Fund (or of the Trust) and may be deemed to control the Fund (or the Trust).

Controlling Person Information

| Shareholders | Fund Name | Percentage of Fund Shares Owned |

| Mitra & Co. FBO 47 | Fixed Income Fund | 90.28% |

| Maril & Co. FBO 47 | Informed Investor Fund | 92.03% |

| Maril & Co. FBO 47 | Quality Growth Fund | 93.60% |

| Charles Schwab | Select Value Fund | 90.18% |

| Maril & Co. FBO 47 | Value Fund | 99.58% |

| NFS Susan Blevins | Texas Fund - Class C shares | 45.28% |

| NFS Michael Ross Blevins | Texas Fund – Class C shares | 45.62% |

Each shareholder will be entitled to one vote for each whole share and a fractional vote for each fractional share held. Shares may be voted in person or by proxy. Shareholders holding one-third of the outstanding shares of the Funds at the close of business on the Record Date present in person or by proxy will constitute a quorum for the transaction of business regarding the Funds at the Meeting. All properly executed proxies received in time to be voted at the Meeting will be counted at the Meeting, and any adjournment thereof, in accordance with the instructions marked thereon or otherwise provided therein.

For purposes of determining the presence of a quorum and counting votes on the matters presented, shares represented by abstentions and “broker non-votes” will be counted as present, but not as votes cast at the Meeting. Broker non-votes are shares held in street name for which the broker indicates that instructions have not been received from the beneficial owners and other persons entitled to vote and for which the broker lacks discretionary voting authority. Under the 1940 Act, the affirmative vote necessary to approve a matter under consideration may be determined with reference to a percentage of votes present at the Meeting. For this reason, abstentions and non-votes have the effect of votes AGAINST a proposal. In completing proxies, therefore, shareholders should be aware that checking the box labeled ABSTAIN will result in the shares covered by the proxy being treated as if they were voted AGAINST a proposal.

IF YOU DO NOT SPECIFY A CHOICE ON THE PROXY, PROPERLY EXECUTED PROXIES THAT ARE RETURNED IN TIME TO BE VOTED AT THE MEETING WILL BE VOTED FOR THE APPROVAL OF EACH PROPOSAL DESCRIBED IN THIS PROXY STATEMENT.

If a quorum is not present at the Meeting, or if a quorum is present at the Meeting, but sufficient votes to approve a proposal are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies with respect to a proposal. In determining whether to adjourn the Meeting, the following factors may be considered: the nature of a proposal, the percentage of votes cast, the percentage of negative votes cast, the nature of any further solicitation and the information to be provided to shareholders with respect to the reasons for the solicitation. Any adjournment will require the affirmative vote of a majority of shares represented in person or by proxy at the Meeting. In that case, the persons named as proxies will vote all proxies that they are entitled to vote FOR such an adjournment; provided, however, any proxies required to be voted against a proposal will be voted AGAINST such adjournment. A shareholder vote may be taken prior to adjournment if sufficient votes have been received and it is otherwise appropriate.

Quorum; Adjournment: The presence at the Meeting, in person or by proxy, of shareholders entitled to vote a majority of each Fund’s outstanding shares is required for a quorum. In the event that a quorum is not present or a quorum is present at the Meeting but sufficient votes to approve the new item are not received, the persons named as proxies may propose one or more adjournments of such Meeting to permit further solicitation of proxies. The affirmative vote of less than a majority of the votes entitled to be cast represented in person or by proxy is sufficient for adjournments. In such case, the persons named as proxies will vote those proxies which they are entitled to vote in favor of such item “FOR” such an adjournment, and will vote those proxies required to be voted against such item “AGAINST” such an adjournment. A shareholder vote may be taken on the nominations in this Proxy Statement prior to any such adjournment if sufficient votes have been received and it is otherwise appropriate.

Broker Non-Votes; Abstentions: Broker non-votes are shares for which (i) the beneficial owner has not voted and (ii) the broker holding the shares does not have discretionary authority to vote on the particular matter. All shares that are voted and votes to abstain will be counted towards establishing a quorum, as will broker non-votes. An abstention by a shareholder, either by proxy or by vote in person at the Meeting, has the same effect as a negative vote. Abstentions and broker non-votes are also effectively a vote against an adjournment of the Proposals because the required vote is a percentage of the shares present at the Meeting, but will have no impact on the Proposal to elect Trustees because the required vote is a plurality of the votes cast at the Meeting.

Any shareholder may revoke his or her proxy at any time prior to exercise thereof by giving written notice of revocation or by executing and delivering a later dated proxy to M3Sixty Administration, LLC., 4520 Main Street, Suite 1425, Kansas City, MO 64111, or by personally casting a vote at the Meeting.

PROPOSAL ONE: ELECTION OF TWO NEW TRUSTEES

The Board of Trustees has nominated the individuals identified below for election to Monteagle Funds’ Board of Trustees. Under the proposal, shareholders are being asked to vote on these nominees pertinent information about each nominee is set forth below.

The business of the Trust is conducted under the direction of the Board. Trustees of the Trust may be directors, officers or employees of persons providing services to the Trust. The business and affairs of the Trust are managed under the direction of the Board in compliance with the laws of the state of Delaware.

As a Delaware business trust, Monteagle Funds does not contemplate holding annual shareholder meetings for the purpose of electing Trustees. Thus, the Trustees will be elected for indefinite terms until a subsequent special shareholder meeting is called for the purpose of electing Trustees. It is the intention of the persons named in the enclosed proxy card to vote in favor of the election of each nominee for Trustee. Each nominee has consented to be named in this Proxy Statement and to serve as Trustee if elected. The Board has no reason to believe that any of the nominees will become unavailable for election as a Trustee, but if that should occur before the Meeting, the proxies will be voted for such other nominee(s) as the Board may recommend. If at a future date, a Board vacancy shall exist, the remaining Trustees may fill such vacancy by appointing another Trustee, so long as, immediately after the appointment, at least two-thirds of the Trustees have been elected by shareholders.

The following tables contain data concerning the individuals nominated by the current disinterested Trustees. The column for positions with the Trust assumes shareholder approval of the election to the Board for all Funds. The names of the Trustees and officers of the Trust, their intended position with the Trust, year of birth and principal occupations during the past five years are set forth below. Correspondence intended for each nominee may be sent to M3Sixty Administration, LLC, 4520 Main Street, Suite 1425, Kansas City, MO 64111.

Information Regarding Nominees For Election As Trustee

| DISINTERESTED TRUSTEES |

| Name & Year of Birth | Position Held with Trust | Term of Office & Length of Time Served | Principal Occupation(s) During the Past 5 Years | Number of Trust Portfolios Overseen by Trustee or Nominee | Other Directorships Held by Trust or Nominee |

David J. Gruber 1963 | Trustee | Not Applicable | President, DJG Financial Consulting, 2007 to present; Trustee | 6 | Trustee, Asset Management Fund, 2015 to present (3 portfolios); Trustee, Cross Shore Discovery Fund, 2014 to present; Trustee, Fifth Third Funds 2003 to 2012 (20 portfolios) |

Jeffrey W. Wallace 1964 | Trustee | Not Applicable | Senior Director of Operations, Baylor University Office of Investments, 2009 to present | 6 | None |

Information Regarding Current Trustees

| DISINTERESTED TRUSTEES |

| Name & Year of Birth | Position Held with Trust | Term of Office & Length of Time Served | Principal Occupation(s) During the Past 5 Years | Number of Trust Portfolios Overseen by Trustee or Nominee | Other Directorships Held by Trust or Nominee |

Larry J. Anderson 1948 | Trustee | Since 11-29-02 | Certified Public Accountant, Anderson & West, P.C. January 1985 to present | 6 | None |

Charles M. Kinard 1943 | Trustee | Since 11-29-02 | Retired, Senior Vice President and Trust Officer, First National Bank of Abilene until December 1998 | 6 | None |

| OFFICERS |

Name, Address & Date of Birth | Position(s) Held of Funds | Principal Occupation(s) During the Past 5 Years |

Paul B. Ordonio, JD 1967 | President, CCO | Monteagle Funds, President/CCO from 11/02 to present; Nashville Capital Corporation, VP of Development, 05/09 to present; Matrix Capital Group, Representative 05/09 to present; P.O. Properties, Inc., Vice President from 06/99 to present; WordWise Document Services, LLC, President from 08/97 to present; Ordonio & Assoc., President from 11/97 to present; Blue Horse Financial Advisors, Secretary from 07/15 to present; PJO Holdings, LLC from 07/15 to present. |

Andras P. Teleki 1971 | Secretary, Anti-Money Laundering Officer | Chief Legal Officer, M3Sixty Administration, LLC and M3Sixty Advisors, LLC (2015 to present); Chief Compliance Officer and Secretary, 360 Funds (2015 to present); Secretary and Assistant Treasurer, Capital Management Investment Trust (2015 to present); Secretary and Anti-Money Laundering Compliance Officer, Monteagle Funds (2015 to present); Partner, K&L Gates, (2009-2015) |

Larry E. Beaver, Jr. 1969 | Treasurer, CFO | Matrix 360 Administration LLC, Director of Accounting and Administration 8/10 to present, Matrix Capital Group, Inc., Director of Accounting and Administration 1/05 to 7/10; Capital Management Investment Trust, Treasurer 5/08 to present; Epiphany Funds, Chief Financial Officer and Treasurer 7/07 to 3/10; Congressional Effect Fund, Treasurer 5/08 to present; AMIDEX Funds, Inc., Chief Accounting Officer 5/03 to present. |

The nominees have also been appointed to each of the Board Committees. The Valuation Committee is responsible for monitoring the value of the Funds' assets and, if necessary between Board meetings, taking emergency action to value securities.. The Nominating Committee is responsible for overseeing the composition of both the Board as well as the various committees of the Trust to ensure that these positions are filled by competent and capable candidates. The Audit Committee is responsible for meeting with the Trust's independent registered public accounting firm to: (a) review the arrangements and scope of any audit; (b) discuss matters of concern relating to the Trust's financial statements, including any adjustments to such statements recommended by the accounting firm, or other results of any audit; (c) consider the accounting firm's comments with respect to the Trust's financial policies, procedures, and internal accounting controls; and (d) review any form of opinion the accounting firm proposes to render to the Trust.

Fund Shares Owned by Trustees

The dollar range of each Fund’s securities owned by each Trustee as of the end of this year’s fiscal year end August 31, 2015 is set forth below.

| Nominee/Trustee | Dollar Range of Equity Securities in the Fund | Aggregate Dollar Range of Equity Securities in All Funds Overseen or to be Overseen by Director or Nominee in Family of Investment Companies |

| David J. Gruber | N/A | N/A |

| Jeffrey W. Wallace | N/A | N/A |

| Larry J. Anderson | Fixed Income Fund $1-$10,000 Informed Investor Growth Fund $1-$10,000 Quality Growth Fund $1-$10,000 Select Value Fund $1-$10,000 Value Fund $1-$10,000 The Texas Fund $1-$10,000 | $1-$10,000 |

| Charles M. Kinard | Fixed Income Fund $1-$10,000 Informed Investor Growth Fund $1-$10,000 Quality Growth Fund $1-$10,000 Select Value Fund $1-$10,000 Value Fund $1-$10,000 The Texas Fund $1-$10,000 | $1-$10,000 |

Compensation of Trustees and Officers

Each Trustee receives an annual fee of $2,500 and a fee of $1,000 per Fund, and is also paid $1,000 for each quarterly meeting attended and $500 for each special meeting attended. A portion of the fees paid to the Trustees are paid in Fund shares and allocated pro rata among the Funds in the complex.

Trustees and officers are also reimbursed for travel and related expenses incurred in attending meetings of the Board.

Trustees that are affiliated with the Adviser receive no compensation for their services or reimbursement for their associated expenses. The following table sets forth the fees paid by the Funds to each Trustee of the Trust and the only Trust officer who receives compensation from the Trust, for the year ended August 31, 2015:

| Name of Person, Position | Aggregate Compensation From Fund | Pension or Retirement Benefits Accrued as Part of Fund Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation From Fund and Complex Paid to Directors |

| David J. Gruber, Nominee | N/A | N/A | N/A | N/A |

| Jeffrey W. Wallace, Nominee | N/A | N/A | N/A | N/A |

| Larry J. Anderson, Trustee | $13,400 | $0 | $0 | $13,400 |

| Charles M. Kinard, Trustee | $13,400 | $0 | $0 | $13,400 |

| Paul B. Ordonio, JD, Chief Compliance Officer | $99,000 | $0 | $0 | N/A |

Additional Information

If elected, the Trustees will hold office without limit in time except that (1) any Trustee may resign; (2) any Trustee may be removed by written instrument, signed by at least two-thirds of the number of Trustees prior to such removal; (3) any Trustee who requests to be retired or who has become incapacitated by illness or injury may be retired by written instrument signed by a majority of the other Trustees; and (4) a Trustee may be removed at any special meeting of shareholders by a two-thirds vote of the outstanding voting securities of the Trust.

In case a vacancy shall for any reason exist, the remaining Trustees will fill such vacancy by appointing another Trustee, so long as, immediately after such appointment, at least a majority of the Trustees have been elected by shareholders. In addition, as a condition to obtaining the SEC Order, at all times, a majority of the Board will consist of disinterested Trustees (that is, independent Trustees), and the nomination of new or additional disinterested Trustees will be placed with the discretion of the then serving disinterested Trustees. If at any time, less than a majority of the Trustees holding office has been elected by shareholders, the Trustees then in office will promptly call a shareholders meeting for the purpose of electing Trustees. Otherwise, there will normally be no meeting of shareholders for the purpose of electing Trustees.

The Board currently consists of two disinterested Trustees. There are vacancies that have not been filled. The nominees (the proposed Board of Trustees) consist of two disinterested persons. This ratio, with at least 75% disinterested persons, has been selected in light of Section 15(f) of the 1940 Act discussed above.

The Board has nominated the two persons named above to serve as Trustees of the Funds. The persons named in the accompanying form of proxy/voting instruction card intend to vote such proxy for the election as Trustees of the following nominees.

THE BOARD OF TRUSTEES RECOMMENDS

THAT SHAREHOLDERS VOTE “FOR” PROPOSAL ONE.

PROPOSAL TWO: OTHER BUSINESS

The Board does not intend to bring any matters before the Meeting other than Proposal 1 and knows of no other business that will be presented at the Meeting. Should any other matters requiring a vote of shareholders arise, the proxy in the accompanying form will confer upon the person or persons entitled to vote the shares represented by such proxy the discretionary authority to vote the shares as to any such other matters in accordance with their best judgment in the interest of the Funds.

In the event sufficient votes in favor of one or more proposals set forth in the Meeting of shareholders are not received by the date of the Meeting, the persons named in the enclosed proxy may propose one or more adjournments of the Meeting. If a quorum is present but sufficient votes in favor of one or more of the proposals have not been received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies with respect to any such proposal. All such adjournments will require the affirmative vote of a majority of the shares present in person or by proxy at the session of the Meeting to be adjourned. A vote may be taken on the proposal in this proxy statement prior to any such adjournment if sufficient votes for its approval have been received and it is otherwise appropriate. If any additional matters should be properly presented, it is intended that the enclosed proxy will be voted in accordance with the judgment of the persons named in the proxy.

THE BOARD OF TRUSTEES RECOMMENDS

THAT SHAREHOLDERS VOTE “FOR” PROPOSAL TWO.

DISTRIBUTOR AND ADMINISTRATOR

Matrix Capital Group, Inc., a registered broker-dealer and member of the Financial Industry Regulatory Authority, Inc., is the distributor (principal underwriter) of the Funds’ shares. The distributor acts as the agent of Monteagle Funds in connection with the offering of shares of the Fund.

M3Sixty Administration, LLC is the Funds’ administrator, fund accountant, transfer agent and dividend disbursing agent.

AFFILIATED BROKERAGE

Neither Nashville Capital Corporation nor the sub-advisers for the Funds effect brokerage transactions through affiliates of the Adviser, the sub-advisers or the Funds (or affiliates of such persons).

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

Monteagle Funds’ financial statements for the fiscal year ended August 31, 2015, were audited by Cohen Fund Audit Services, Ltd. (“Cohen”). Cohen, in accordance with the Independence Standards Board Standard No. 1 (ISB No. 1) has confirmed to the Trust’s Audit Committee that they are independent registered public accountants with respect to the Funds.

The independent registered public accountants examine the annual financial statements for the Funds and provide other non-audit and tax-related services to the Funds. The Trust’s Audit Committee does not consider the other non-audit services provided by Cohen to be incompatible with maintaining the independence of Cohen in its audit of the Funds, taking into account representations from Cohen, in accordance with ISB No. 1, regarding its independence from the Funds and their related entities.

Fund Related Fees

Audit Fees - The aggregate fees billed for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $58,800 and $60,025 with respect to the registrant’s fiscal years ended August 31, 2015 and 2014, respectively.

Audit-Related Fees – The aggregate fees billed for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item were $1,300 and $1,390 with respect to the registrant’s fiscal years ended August 31, 2015 and 2014, respectively. The services comprising these fees are for consents and review of the registrant’s dividend calculations.

Tax Fees - The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning were $15,000 and $12,500 with respect to the registrant’s fiscal years ended August 31, 2015 and 2014, respectively. The services comprising these fees are the preparation of the registrant’s federal income and excise tax returns.

All Other Fees - The aggregate fees billed in each of the last two fiscal years for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this item were $2,200 and $2,100 for the fiscal years ended August 31, 2015 and 2014, respectively. The services comprising these fees were for the review of the Funds’ semi-annual financial report.

SHAREHOLDER PROPOSALS

It is anticipated that, following the Meeting, the Funds will not hold any meetings of shareholders except as required by Federal or Delaware state law. Shareholders wishing to submit proposals for inclusion in a proxy statement for a subsequent shareholder meeting should send proposals to the Secretary of the Trust, in care of M3Sixty Administration, LLC, 4520 Main Street, Suite 1425, Kansas City, MO 64111.

YOU ARE URGED TO FILL IN, DATE, SIGN AND RETURN THE ENCLOSED PROXY PROMPTLY.

By Order of the Board of Trustees,

/s/ Larry J. Anderson

Larry J. Anderson

Chairman of the Board of Trustees