SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. __)

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

x Preliminary Proxy Statement ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

¨ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-12

NVIDIA Corporation

(Name of Registrant as Specified In Its Certificate)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

¨ Fee paid previously with preliminary materials.

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

NVIDIA CORPORATION

2701 San Tomas Expressway

Santa Clara, CA 95050

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JULY 11, 2002

DEAR STOCKHOLDER:

You are cordially invited to attend the Annual Meeting of Stockholders of NVIDIA Corporation, a Delaware corporation. The meeting will be held on Thursday, July 11, 2002 at 2:00 p.m. local time at our executive offices, 2701 San Tomas Expressway, Santa Clara, California 95050, for the following purposes:

| | 1. | | To elect two directors to hold office until the 2005 Annual Meeting of Stockholders. |

| | 2. | | To approve an amendment to our certificate of incorporation to increase the authorized number of shares of common stock from 500,000,000 to 1,000,000,000 shares. |

| | 3. | | To ratify the selection of KPMG LLP as our independent auditors for our fiscal year ending January 26, 2003. |

| | 4. | | To conduct any other business properly brought before the meeting. |

These items of business are more fully described in the proxy statement accompanying this notice.

The record date for the Annual Meeting is May 15, 2002. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

| | By | Order of the Board of Directors |

Santa Clara, California

May 28, 2002

YOUARECORDIALLYINVITEDTOATTENDTHEMEETINGINPERSON. WHETHERORNOTYOUEXPECTTOATTENDTHEMEETING,PLEASECOMPLETE,DATE,SIGNANDRETURNTHEENCLOSEDPROXY,ORVOTEOVERTHETELEPHONEORTHE INTERNETASINSTRUCTEDINTHESEMATERIALS,ASPROMPTLYASPOSSIBLEINORDERTOENSUREYOURREPRESENTATIONATTHEMEETING. ARETURNENVELOPE (WHICHISPOSTAGEPREPAIDIFMAILEDINTHE UNITED STATES)ISENCLOSEDFORYOURCONVENIENCE. EVENIFYOUHAVEVOTEDBYPROXY,YOUMAYSTILLVOTEINPERSONIFYOUATTENDTHEMEETING. PLEASENOTE,HOWEVER,THATIFYOURSHARESAREHELDOFRECORDBYABROKER,BANKOROTHERNOMINEEANDYOUWISHTOVOTEATTHEMEETING,YOUMUSTOBTAINAPROXYISSUEDINYOURNAMEFROMTHATRECORDHOLDER.

NVIDIA CORPORATION

2701 San Tomas Expressway

Santa Clara, CA 95050

PROXY STATEMENT

FOR THE 2002 ANNUAL MEETING OF STOCKHOLDERS

July 11, 2002

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

WHYAM IRECEIVINGTHESEMATERIALS?

We sent you this proxy statement and the enclosed proxy card because the Board of Directors of NVIDIA Corporation is soliciting your proxy to vote at the 2002 Annual Meeting of Stockholders. You are invited to attend the annual meeting and we request that you vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or on the Internet.

We intend to mail this proxy statement and accompanying proxy card on or about May 31, 2002 to all stockholders of record entitled to vote at the annual meeting.

WHOCANVOTEATTHEANNUALMEETING?

Only stockholders of record at the close of business on May 15, 2002 will be entitled to vote at the annual meeting. On this record date, there were151,973,562 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on May 15, 2002 your shares were registered directly in your name with NVIDIA’s transfer agent, Mellon Investor Services LLC, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on May 15, 2002 your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

1

WHATAM IVOTINGON?

There are three matters scheduled for a vote:

| | • | | Election of two directors; |

| | • | | Proposed amendment to our certificate of incorporation to increase the authorized number of shares of common stock from 500,000,000 to 1,000,000,000 shares; and |

| | • | | Ratification of KPMG LLP as our independent auditors for our fiscal year ending January 26, 2003. |

HOWDO IVOTE?

You may either vote “For” all the nominees to the Board of Directors or you may abstain from voting for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting, vote by proxy using the enclosed proxy card, vote by proxy over the telephone, or vote by proxy on the Internet. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person if you have already voted by proxy.

| | • | | To vote in person, come to the annual meeting and we will give you a ballot when you arrive. |

| | • | | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

| | • | | To vote over the telephone, dial toll-free 1-800-435-6710 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 4:00 p.m., Eastern Daylight Savings Time on July 10, 2002 to be counted. |

| | • | | To vote on the Internet, go towww.eproxy.com/nvda to complete an electronic proxy card. You will be asked to provide the company number and control number from the enclosed proxy card. Your vote must be received by 4:00 p.m., Eastern Daylight Savings Time on July 10, 2002 to be counted. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from NVIDIA.Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

WEPROVIDE INTERNETPROXYVOTINGTOALLOWYOUTOVOTEYOURSHARESON-LINE,WITHPROCEDURESDESIGNEDTOENSURETHEAUTHENTICITYANDCORRECTNESSOFYOURPROXYVOTEINSTRUCTIONS. HOWEVER,PLEASEBEAWARETHATYOUMUSTBEARANYCOSTSASSOCIATEDWITHYOUR INTERNETACCESS,SUCHASUSAGECHARGESFROM INTERNETACCESSPROVIDERSANDTELEPHONECOMPANIES.

2

CAN IVOTEBYTELEPHONEORELECTRONICALLY?

If your shares were registered directly in your name with our transfer agent, you may vote by telephone or electronically through the Internet by following the instructions included on your proxy card. The Internet and telephone voting procedures are designed to authenticate the stockholder’s identity and to allow stockholders to vote their shares and confirm that their voting instructions have been properly recorded.

If your shares are held in the name of a broker, bank, dealer or other agent, otherwise known as being held in “street name,” you are eligible to vote your shares electronically over the Internet or by telephone. To vote your shares by telephone or by Internet, please follow the instructions indicated on the Vote Instruction Form included with this proxy statement. The deadline for voting by telephone or Internet is 4:00 p.m., Eastern Daylight Savings Time on July 10, 2002.

We would like to encourage all of our stockholders, both beneficial and of record, to receive future financial communications, including our Annual Report on Form 10-K, proxy statement and other documents relating to our future annual meeting of stockholders, via the Internet. Receiving these financial communications electronically will assist us in controlling the costs relating to the printing and distribution of these materials. If you are a holder of record, you may elect to receive future financial communications over the Internet by following the instructions included on your proxy card and if you are a beneficial holder, by following the instructions provided in the Vote Instruction Form included with this proxy statement.

HOWMANYVOTESDO IHAVE?

On each matter to be voted upon, you have one vote for each share of common stock you own as of May 15, 2002.

WHATIF IRETURNAPROXYCARDBUTDONOTMAKESPECIFICCHOICES?

If you return a signed and dated proxy card without marking any voting selections, your shares will be voted “For” the election of both nominees for director, “For” the proposed amendment to our certificate of incorporation, and “For” the ratification of KPMG LLP as our independent auditors for our fiscal year ending January 26, 2003. If any other matter is properly presented at the meeting, your proxy Jen-Hsun Huang or Mary Dotz will vote your shares using his or her best judgment.

WHOISPAYINGFORTHISPROXYSOLICITATION?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

WHATDOESITMEANIF IRECEIVEMORETHANONEPROXYCARD?

If you receive more than one proxy card, your shares are registered in more than one name or are registered in different accounts. Please complete, sign and returneach proxy card to ensure that all of your shares are voted.

If you would like to modify your instructions so that you receive one proxy card for each household, please contact your broker, bank, dealer or other agent.

3

WHATDOESITMEANIFMULTIPLEMEMBERSOFMYHOUSEHOLDARESTOCKHOLDERSBUTWEONLYRECEIVEDONESETOFPROXYMATERIALS?

In accordance with a notice sent earlier this year to certain brokers, banks, dealers or other agents, we are sending only one Annual Report on Form 10-K and proxy statement to that address unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, if any stockholder residing at such an address wishes to receive a separate Annual Report on Form 10-K or proxy statement in the future, they may telephone our Stock Administration department at (408) 486-2000 or write to our Stock Administration department at 2701 San Tomas Expressway, Santa Clara, California 95050.

CAN ICHANGEMYVOTEAFTERSUBMITTINGMYPROXY?

Yes. You can revoke your proxy at any time before the final vote at the meeting. You may revoke your proxy in any one of three ways:

| | • | | You may submit another properly completed proxy card with a later date. |

| | • | | You may send a written notice that you are revoking your proxy to NVIDIA’s Secretary at 2701 San Tomas Expressway, Santa Clara, California 95050. |

| | • | | You may attend the annual meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

WHENARESTOCKHOLDERPROPOSALSDUEFORNEXTYEAR’SANNUALMEETING?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by January 31, 2003 to NVIDIA Corporation, 2701 San Tomas Expressway, Santa Clara, CA 95050, attention: Corporate Secretary. If you wish to submit a proposal that is not to be included in next year’s proxy materials, you must do so by no earlier than the close of business on March 13, 2003 and no later than the close of business on April 12, 2003.

HOWAREVOTESCOUNTED?

Votes will be counted by the inspector of election appointed for the meeting, who will separately count “For” and “Against” votes, abstentions and broker non-votes. “Broker non-vote” refers to a proposal for which a broker or bank does not have the authority to vote but has the authority to vote and does vote on some proposals. Abstentions will be counted towards the vote total for each proposal, and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal except Proposal 2. For Proposal 2, broker non-votes will have the same effect as “Against” votes.

HOWMANYVOTESARENEEDEDTOAPPROVEEACHPROPOSAL?

| | • | | For the election of directors, Proposal No. 1, the two nominees receiving the most “For” votes, among votes properly cast in person or by proxy, will be elected. Broker non-votes will have no effect. |

| | • | | To be approved, Proposal No. 2, the proposed amendment of our certificate of incorporation must receive a “For” vote from the majority of the outstanding shares either in person or by proxy. If you do not vote, or “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have the same effect as an “Against” vote. |

| | • | | To be approved, Proposal No. 3, the ratification of KPMG LLP as our independent auditors for the fiscal year ending January 26, 2003 must receive a “For” vote from the majority of shares either in person or by proxy. If you do not vote, or “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

4

WHATISTHEQUORUMREQUIREMENT?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares entitled to vote are represented by votes at the meeting or by proxy. On the record date, there were 151,973,562 outstanding and entitled to vote. Thus 75,986,782 must be represented by votes at the meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy vote or vote at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

HOWCAN IFINDOUTTHERESULTSOFTHEVOTINGATTHEANNUALMEETING?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in our quarterly report on Form 10-Q for the quarter ended July 28, 2002, which will be filed with Securities and Exchange Commission, or SEC, on or before September 12, 2002.

5

PROPOSAL 1

ELECTION OF DIRECTORS

NVIDIA’s Board of Directors is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors, and each class has a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy in a class shall serve for the remainder of the full term of that class, and until the director’s successor is elected and qualified. This includes vacancies created by an increase in the number of directors.

The Board of Directors presently has seven members. There are two directors in the class whose term of office expires in 2002. Each of the nominees for election to this class is currently an NVIDIA director. If elected at the annual meeting, each of these nominees would serve until the 2005 annual meeting and until his successor is elected and has qualified, or until the director’s death, resignation or removal.

The following is a brief biography of each nominee and each director whose term will continue after the annual meeting.

NOMINEESFOR ELECTIONFORA THREE-YEAR TERM EXPIRINGATTHE 2005 ANNUAL MEETING

Harvey C. Jones, age 49, has served as an NVIDIA director since November 1993. Mr. Jones is the Chairman of the Board of Tensilica Inc., a privately-held company he co-founded in 1997. Tensilica designs and licenses application-specific microprocessors for use in high-volume embedded systems. From December 1987 through February 1998, Mr. Jones held various positions at Synopsys, Inc., a developer of electronic design automation software, where he served as President through December 1992, as Chief Executive Officer until January 1994 and as Executive Chairman of the Board until February 1998. Prior to joining Synopsys, Mr. Jones served as President and Chief Executive Officer of Daisy Systems Corporation, a computer-aided engineering company that he co-founded in 1981. Mr. Jones currently serves on the Board of Directors of Simplex Solutions, a deep submicron circuit verification company and Numerical Technology Corporation, an integrated circuit technology and software company. Mr. Jones holds a B.S. degree in Mathematics and Computer Sciences from Georgetown University and an M.S. degree in Management from Massachusetts Institute of Technology.

William J. Miller, age 56, has served as an NVIDIA director since November 1994. Mr. Miller has acted as an independent consultant to several technology companies since October 1999. From April 1996 through October 1999, Mr. Miller was Chief Executive Officer and Chairman of the Board of Avid Technology, Inc., a provider of digital tools for multimedia. Mr. Miller also served as President of Avid Technology from September 1996 through October 1999. From March 1992 to October 1995, Mr. Miller served as Chief Executive Officer of Quantum Corporation, a mass storage company. He was a member of the Board of Directors of Quantum, and Chairman thereof, from May 1992 and September 1993, respectively, to August 1995. From 1981 to March 1992, he served in various positions at Control Data Corporation, a supplier of computer hardware, software and services, most recently as Executive Vice President and President, Information Services. Mr. Miller serves on the Board of Directors of Waters Corporation, a scientific instrument manufacturing company and on the Board of Directors of AvantGo, Inc., a maker of mobile enterprise solution software. Mr. Miller holds B.A. and J.D. degrees from the University of Minnesota.

THE BOARDOF DIRECTORS RECOMMENDS

A VOTEIN FAVOROF EACH NAMED NOMINEE

6

DIRECTORS CONTINUINGIN OFFICE UNTILTHE 2003 ANNUAL MEETING

Tench Coxe, age 44,has served as an NVIDIA director since June 1993. Mr. Coxe is a managing director of Sutter Hill Ventures, a venture capital investment firm. Prior to joining Sutter Hill Ventures in 1987, Mr. Coxe was Director of Marketing and MIS at Digital Communication Associates. Mr. Coxe also serves on the Board of Directors of Clarus Corporation, a software company, Copper Mountain Networks Inc., a provider of high speed DSL solutions, E-Loyalty Corp., a customer loyalty software firm, and several privately held companies. Mr. Coxe holds a B.A. degree in Economics from Dartmouth College and an M.B.A. degree from Harvard Business School.

Mark A. Stevens, age 42, has served as an NVIDIA director since June 1993. Mr. Stevens has been a managing member of Sequoia Capital, a venture capital investment firm, since March 1993. Prior to that time, beginning in July 1989, he was an associate at Sequoia Capital. Prior to joining Sequoia, he held technical sales and marketing positions at Intel Corporation. Mr. Stevens currently serves on the Board of Directors of Pixelworks, Inc., a fabless semiconductor company developing image processors, and several privately held companies. Mr. Stevens holds a B.S.E.E. degree, a B.A. degree in Economics and an M.S. degree in Computer Engineering from the University of Southern California and an M.B.A. degree from Harvard Business School.

DIRECTORS CONTINUINGIN OFFICE UNTILTHE 2004 ANNUAL MEETING

James C. Gaither, age 64, has served as an NVIDIA director since December 1998. Mr. Gaither is a managing director of Sutter Hill Ventures, a venture capital investment firm. He is also senior counsel to the law firm of Cooley Godward LLP and was a partner of the firm from 1971 until July 2000. Prior to beginning his law practice with the firm in 1969, Mr. Gaither served as a law clerk to The Honorable Earl Warren, Chief Justice of the United States, Special Assistant to the Assistant Attorney General in the United States Department of Justice and Staff Assistant to the President of the United States, Lyndon Johnson. Mr. Gaither is a former president of the Board of Trustees at Stanford University and is a member of the Board of Directors of The William and Flora Hewlett Foundation, and the James Irvine Foundation. Mr. Gaither currently serves on the Board of Directors of Basic American, Inc., a food processing company, Levi Strauss & Company, a manufacturer and marketer of brand-name apparel, and Siebel Systems, Inc., an information software systems company. Mr. Gaither holds a B.A. in Economics from Princeton University and a J.D. degree from Stanford University.

Jen-Hsun Huang, age 39, co-founded NVIDIA in April 1993 and has served as our President, Chief Executive Officer and a member of the Board of Directors since our inception. From 1985 to 1993, Mr. Huang was employed at LSI Logic Corporation, a computer chip manufacturer, where he held a variety of positions, most recently as Director of Coreware, the business unit responsible for LSI’s “system-on-a-chip” strategy. From 1984 to 1985, Mr. Huang was a microprocessor designer for Advanced Micro Devices, Inc., a semiconductor company. In October 1999, Mr. Huang was selected as a member of the Board of Trustees of RAND Corporation, a nonprofit institution that helps improve policy and decision-making through research and analysis. Mr. Huang holds a B.S.E.E. degree from Oregon State University and an M.S.E.E. degree from Stanford University.

A. Brooke Seawell, age 54, has served as an NVIDIA director since December 1997. Mr. Seawell has been a general partner of Technology Crossover Ventures since February 2000. Mr. Seawell served as NVIDIA’s interim Chief Financial Officer during the fourth quarter of NVIDIA’s 1999 fiscal year. Mr. Seawell acted as an independent consultant to several technology companies from 1999 to 2000. From 1997 to 1998, Mr. Seawell was Executive Vice President of NetDynamics, Inc., an Internet application server software company. From 1991 to 1997, Mr. Seawell was Senior Vice President and Chief Financial Officer of Synopsys, Inc., an electronic design automation software company. Mr. Seawell also serves on the Board of Directors of Informatica Corporation, a data integration software company, and several privately held companies. Mr. Seawell holds a B.A. degree in Economics and an M.B.A. degree in Finance from Stanford University.

7

BOARD COMMITTEESAND MEETINGS

During the fiscal year ended January 27, 2002 the Board of Directors held five meetings and acted by unanimous written consent six times. The Board of Directors has an Audit Committee and a Compensation Committee.

The Audit Committee of the Board of Directors of NVIDIA oversees NVIDIA’s financial reporting process. The Audit Committee performs several functions:

| | • | | meets with NVIDIA’s independent auditors to review the results of the annual audit and discuss the financial statements; |

| | • | | selects the independent auditors to be retained; |

| | • | | oversees the independence of the independent auditors; |

| | • | | evaluates the independent auditors’ performance; and |

| | • | | considers the independent auditors’ comments regarding the adequacy of staff and management performance and procedures in connection with audit and financial controls. |

The Audit Committee is comprised of three non-employee directors: Messrs. Miller, Seawell and Stevens. Mr. Miller serves as Chairman of the Audit Committee. It met eight times during our past fiscal year. All members of the Audit Committee are independent as independence is defined in Rule 4200(a)(14) of the NASD listing standards, except for Mr. Seawell. Mr. Seawell served as our interim Chief Financial Officer during the fourth quarter of the 1999 fiscal year. Mr. Seawell was asked to serve in this temporary position due his extensive finance and accounting background, which includes a B.A. degree in Economics and an M.B.A. degree in Finance from Stanford University, and his service as Senior Vice President and Chief Financial Officer of Synopsys, Inc. from 1991 to 1997. Mr. Seawell received an option to purchase 128,200 shares of common stock at an exercise price of $1.75 per share for serving in this interim capacity. As a result of this service and related option grant, under the Nasdaq standards, Mr. Seawell is not currently classified as an independent director. However, in accordance with Nasdaq guidelines, the Board of Directors has unanimously determined that Mr. Seawell’s background makes him highly qualified to be a member of the Audit Committee and that his service is in our best interest. The Board of Directors has adopted a written Audit Committee Charter that is attached as Appendix A to these proxy materials.

The Compensation Committee makes recommendations concerning salaries and incentive compensation, awards stock options to employees and consultants under our stock option plans and otherwise determines compensation levels and performs such other functions regarding compensation as the Board may delegate. The Compensation Committee has delegated to Jen-Hsun Huang, a director and our President and Chief Executive Officer, the ability to determine salaries, incentive compensation and stock option awards for employees below the executive officer level. The Compensation Committee is comprised of three non-employee directors: Messrs. Coxe, Gaither and Jones. It met one time during fiscal year 2002 and acted by written consent four times.

During the fiscal year ended January 27, 2002, each Board member attended 75% or more of the aggregate of the meetings of the Board and of the committees on which he served, that were held during the period for which he was a director or committee member, respectively.

8

REPORTOFTHE AUDIT COMMITTEEOFTHE BOARDOF DIRECTORS1

The Board of Directors adopted the charter of the Audit Committee in May 2000, and amended the charter in May 2001 and April 2002. A copy of the amended charter is included in this proxy statement as Appendix A. The amended charter provides that the Audit Committee will perform new functions, including but not limited to the following:

| | • | | selecting the independent auditors; |

| | • | | approving the fees for audit services to be paid to the independent auditors; |

| | • | | approving the retention of and payment of fees in excess of $25,000 per engagement to be paid to the independent auditors for non-audit services; |

| | • | | recommending to the Board of Directors guidelines for hiring employees of the independent auditors that were engaged on NVIDIA’s account; |

| | • | | monitoring NVIDIA’s compliance with its Code of Conduct; and |

| | • | | taking appropriate actions to set the overall corporate “tone” for quality financial reporting, sound business practices and ethical behavior. |

In accordance with the Audit Committee’s charter, the Audit Committee assists NVIDIA’s Board of Directors in fulfilling its responsibility for oversight of the quality and integrity of our accounting, auditing and financial reporting practices. Management is responsible for NVIDIA’s internal controls. Our independent auditors are responsible for performing an independent audit of NVIDIA’s consolidated financial statements in accordance with generally accepted auditing standards and issuing a report thereon. The Audit Committee has general oversight responsibilities with respect to our financial reporting and reviews the results and scope of the audit and other services provided by the independent auditors.

In this context, the Audit Committee has reviewed and discussed the audited financial statements for fiscal year 2002 with management and with the independent auditors. Specifically, the Audit Committee has discussed with the independent auditors the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU Section 380), which include, among other things:

| | • | | methods used to account for significant unusual transactions; |

| | • | | the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus; |

| | • | | the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors’ conclusions regarding the reasonableness of those estimates; and |

| | • | | disagreements with management over the application of accounting principles, the basis for management’s accounting estimates and the disclosures in the financial statements. |

The Audit Committee has received the written disclosures and the letter from the independent auditors, KPMG LLP, required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees. Additionally, the Audit Committee has discussed with KPMG LLP the issue of its independence from us.

The SEC staff informed us in January 2002 that it had concerns relating to certain accounting matters and that the SEC along with the U.S. Attorney’s Office for the Northern District of California had authorized a private investigation into such matters. In accordance with the suggestion and advice of the SEC staff, NVIDIA

| 1 | | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing. |

9

launched a review of these matters. On April 29, 2002, NVIDIA announced that the Audit Committee had with assistance from the law firm of Cooley Godward LLP and forensic auditors from the firm of KPMG LLP, concluded NVIDIA’s review and determined that it was appropriate to restate NVIDIA’s financial statements for fiscal 2000, 2001 and the first three quarters of fiscal 2002. The Audit Committee has worked in cooperation with the SEC and has provided the SEC with extensive information and the conclusions of the review.

Based on its review of the audited financial statements and the various discussions noted above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended January 27, 2002.

| | Wi | lliam J. Miller, Chairman |

10

PROPOSAL 2

APPROVALOF INCREASEIN NUMBEROF AUTHORIZED SHARESOF COMMON STOCK

The Board of Directors is requesting stockholder approval of an amendment to our certificate of incorporation to increase our authorized number of shares of common stock from 500,000,000 shares to 1,000,000,000 shares.

The additional common stock to be authorized by adoption of the amendment would have rights identical to our currently outstanding common stock. Adoption of the proposed amendment and issuance of the common stock would not affect the rights of the holders of our currently outstanding common stock, except for effects incidental to increasing the number of shares of NVIDIA common stock outstanding, such as dilution of the earnings per share and voting rights of current holders of common stock. If the amendment is adopted, it will become effective upon filing of a Certificate of Amendment of our Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware.

In addition to the 151,282,593 shares of common stock outstanding on March 31, 2002, the Board has reserved 61,505,212 shares for issuance upon exercise of options and rights granted under our stock option and stock purchase plans, up to approximately 6,471,793 shares of common stock which may be issued upon conversion of outstanding convertible subordinated notes and up to 20,000,000 shares which may be issued pursuant to our registration statement on Form S-3 filed on November 30, 2001. In addition, the Board has reserved up to 2,000,000 shares of common stock which may be issued pursuant to the terms of the Asset Purchase Agreement between and among 3dfx Interactive, Inc., NVIDIA US Investment Company and NVIDIA.

Although at present the Board of Directors has no plans to issue the additional shares of common stock, it desires to have the shares available to provide additional flexibility to use its capital stock for business and financial purposes in the future. The additional shares may be used for various purposes without further stockholder approval. These purposes may include:

| | • | | providing equity incentives to employees, officers or directors; |

| | • | | establishing strategic relationships with other companies; |

| | • | | expanding the company’s business or product lines through the acquisition of other businesses or products; |

| | • | | stock dividends to existing stockholders; and |

The additional shares of common stock that would become available for issuance if the proposal is adopted could also be used by NVIDIA to oppose a hostile takeover attempt or to delay or prevent changes in control or management of NVIDIA. For example, without further stockholder approval, the Board could adopt a “poison pill” that would, under certain circumstances related to an acquisition of shares not approved by the Board of Directors, give certain holders the right to acquire additional shares of common stock at a low price, or the Board could strategically sell shares of common stock in a private transaction to purchasers who would oppose a takeover or favor the current Board. Although this proposal to increase the authorized common stock has been prompted by business and financial considerations and not by the threat of any hostile takeover attempt (nor is the Board currently aware of any such attempts directed at NVIDIA), nevertheless, stockholders should be aware that approval of proposal could facilitate future efforts by NVIDIA to deter or prevent changes in control of NVIDIA, including transactions in which the stockholders might otherwise receive a premium for their shares over then-current market prices.

11

NVIDIA’s audited consolidated financial statements, management’s discussion and analysis of financial condition and results of operations, and supplementary financial information are incorporated by reference from NVIDIA’s 2002 Annual Report on Form 10-K for the fiscal year ended January 27, 2002.

The affirmative vote of the holders of a majority of the outstanding shares of the common stock will be required to approve this amendment to our Amended and Restated Certificate of Incorporation. As a result, abstentions and broker non-votes will have the same effect as negative votes.

THE BOARDOF DIRECTORS RECOMMENDS

A VOTEIN FAVOROF PROPOSAL 2

12

PROPOSAL 3

RATIFICATIONOF SELECTIONOF INDEPENDENT AUDITORS

The Audit Committee has selected KPMG LLP as our independent auditors for our fiscal year ending January 26, 2003 and has further directed that management submit the selection of independent auditors for ratification by the stockholders at the Annual Meeting. KPMG LLP has audited our financial statements since April 1995.Representatives of KPMG LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither NVIDIA’s bylaws nor other governing documents or law requires stockholder ratification of the selection of KPMG LLP as our independent auditors. However, we are submitting the selection of KPMG LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain KPMG LLP. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of NVIDIA and our stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the annual meeting will be required to ratify the selection of KPMG LLP. Abstentions will be counted toward the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

AUDIT FEES. For the fiscal year ended January 27, 2002, the aggregate fees billed by KPMG LLP for the audit of the our financial statements for such fiscal year, for the review of our interim financial statements and for the restatement of our financial statements for fiscal 2000, 2001 and the first three quarters of fiscal 2002 were approximately $928,000.

FINANCIAL INFORMATION SYSTEMS DESIGN AND IMPLEMENTATION FEES. For the fiscal year ended January 27, 2002, there were no fees billed by KPMG LLP for information technology consulting.

ALL OTHER FEES. For the fiscal year ended January 27, 2002, the aggregate fees billed by KPMG LLP for other professional services were approximately $684,000, comprised of approximately $551,000 for tax related services and approximately $133,000 for audit-related services. Audit-related services generally include fees for accounting consultations, registration statements and business acquisitions.

As discussed in the Report of the Audit Committee, following its review of certain accounting matters, our Audit Committee determined that it was appropriate to restate our financial statements for fiscal 2000, 2001 and the first three quarters of fiscal 2002. The Audit Committee was assisted in its review by forensic auditors from KPMG LLP. Fees billed by KPMG LLP in connection with such review were approximately $2,049,000.

The Audit Committee has determined the rendering of the information technology consulting fees and other professional services by KPMG LLP is compatible with maintaining the auditor’s independence.

THE BOARDOF DIRECTORS RECOMMENDS

A VOTEIN FAVOROF PROPOSAL 3

13

SECURITY OWNERSHIPOF

CERTAIN BENEFICIAL OWNERSAND MANAGEMENT

The following table presents information regarding the ownership of our common stock as of March 31, 2002 by:

| | • | | each director and nominee for director; |

| | • | | each of the executive officers named in the Summary Compensation Table; |

| | • | | all of our directors, nominees and executive officers as a group; and |

| | • | | all those known by us to be beneficial owners of more than five percent of our common stock. |

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Beneficial ownership also includes shares of common stock subject to options currently exercisable within 60 days of March 31, 2002. These shares are not deemed outstanding for purposes of computing the percentage ownership of each other person. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, we believe that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Percentage of beneficial ownership is based on 151,282,593 shares of our common stock outstanding as of March 31, 2002. Unless otherwise indicated, the address of each of the individuals and entities listed below is c/o NVIDIA Corporation, 2701 San Tomas Expressway, Santa Clara, California 95050.

Name and Address of Beneficial Owner

| | Shares Issuable Pursuant to Options Exercisable Within 60 days of | | Shares Beneficially Owned (Including the Number of Shares Shown in the First Column)

| |

| | March 31, 2002

| | Number

| | Percent

| |

Directors and Executive Officers | | | | | | | |

| Jen-Hsun Huang (1) | | 2,049,000 | | 11,107,322 | | 7.2 | % |

| Jeffrey D. Fisher (2) | | 111,042 | | 419,759 | | * | |

| Christine B. Hoberg | | 98,750 | | 125,546 | | * | |

| Chris A. Malachowsky (3) | | 1,042,500 | | 7,856,500 | | 5.2 | % |

| Tench Coxe (4) | | 270,000 | | 1,053,836 | | * | |

| James C. Gaither | | 207,500 | | 257,500 | | * | |

| Harvey C. Jones | | 200,000 | | 979,204 | | * | |

| William J. Miller | | 265,000 | | 415,000 | | * | |

| A. Brooke Seawell | | 400,000 | | 400,000 | | * | |

| Mark A. Stevens | | 285,000 | | 527,872 | | * | |

| All directors, nominees and executive officers as a group (10 persons) (5) | | 4,928,792 | | 23,142,539 | | 14.8 | % |

|

5% Stockholders | | | | | | | |

FMR Corporation (6) Edward C. Johnson 3d and Abigail P. Johnson 82 Devonshire Street Boston, MA 02109 | | — | | 17,892,588 | | 11.8 | % |

Janus Capital Corporation (7) Thomas H. Bailey 100 Fillmore Street Denver, CO 80206-4923 | | — | | 10,812,367 | | 7.1 | % |

14

| (1) | | Includes 8,055,922 shares of common stock held by The Jen-Hsun and Lori Huang Living Trust dated May 1, 1995, of which Mr. Huang and his wife are trustees, and 1,002,400 shares of common stock held by J. and L. Huang Investments, L.P., of which Mr. Huang and his wife are general partners. |

| (2) | | Includes 229,986 shares of common stock held by the Fisher Family Trust, of which Mr. Fisher and his wife are trustees, and 78,000 held by Mr. Fisher, as custodian for his three minor children under the Uniform Gifts to Minors Act. |

| (3) | | Includes 5,785,000 shares of common stock held by The Chris and Melody Malachowsky Living Trust, dated October 20, 1994, of which Mr. Malachowsky and his wife are trustees, 954,000 shares of common stock held by Malachowsky Investments L.P., of which Mr. Malachowsky and his wife are general partners, and 75,000 shares held by the Malachowsky Family Foundation, of which Mr. Malachowsky and his wife are officers and directors. |

| (4) | | Includes 82,104 shares of common stock held in a retirement trust over which Mr. Coxe exercises voting and investment power. |

| (5) | | Includes shares described in footnotes one through four above. |

| (6) | | Based solely on a Schedule 13G jointly filed on February 15, 2002 by FMR Corp., Edward C. Johnson 3d and Abigail P. Johnson reporting ownership as of December 31, 2001. |

| (7) | | Based solely on a Schedule 13G jointly filed on February 11, 2002 by Janus Capital Corporation and Thomas H. Bailey reporting ownership as of December 31, 2001. |

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other of our equity securities. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal year ended January 27, 2002, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with.

15

EXECUTIVE COMPENSATION

COMPENSATIONOF DIRECTORS

Directors do not receive any cash compensation for their services as members of the Board of Directors. The members of the Board of Directors are eligible for reimbursement for their expenses incurred in attending Board meetings in accordance with our policies.

We grant stock options to our directors who are not employees of NVIDIA or our subsidiaries under the 1998 Non-Employee Directors’ Stock Option Plan, or the Directors’ Plan, and the 1998 Equity Incentive Plan, or the 1998 Plan. In July 2000, the Board of Directors amended the 1998 Plan, to incorporate the automatic grant provisions of the Directors’ Plan into the 1998 Plan. Only non-employee directors or affiliates of such directors, as defined in the Internal Revenue Code, are eligible to receive options under the automatic grant provisions of such plans. Options granted under such plans are intended not to qualify as incentive stock options under the Internal Revenue Code and are non-discretionary.

Initial Grants

Each non-employee director who is elected or appointed for the first time is automatically granted an option to purchase 200,000 shares, which vests monthly over a four-year period, such that the initial grant will be fully vested on the fourth anniversary of the date of grant.

Annual Grants

On the day following our annual meeting, each non-employee director is automatically granted an option to purchase 80,000 shares, the Annual Grant. Also, on that date, each non-employee director who is a member of a committee of the Board of Directors is automatically granted an option to purchase 20,000 shares, the Committee Grant. However, if the person has not been serving on the Board or committee since the prior year annual meeting, the number of shares granted under an Annual Grant and/or a Committee Grant will be reduced pro rata for each full quarter prior to the date of grant during which such person did not serve as a director or committee member.

Annual Grants and Committee Grants vest in full on the first anniversary of the date of grant, provided that the director has attended at least 75% of the regularly scheduled meetings. If the director fails to attend at least 75% of the regularly scheduled meetings, then the Annual Grants and Committee Grants will vest annually over four years following the date of grant at the rate of 10% per year for the first three years and 70% for the fourth year, such that the entire option will become fully vested on the four-year anniversary of the date of grant.

General Provisions

The exercise price for such options is equal to 100% of the fair market value on the date of grant. No option granted under such provisions may be exercised after the expiration of 10 years from the date it was granted. Such options generally are non-transferable except to family members, a family trust, a family partnership or a family limited liability company. However, an optionee may designate a beneficiary who may exercise the option following the optionee’s death. An optionee whose service relationship with NVIDIA or any of our affiliates, whether as a non-employee director or subsequently as an employee, director or consultant ceases for any reason, may exercise vested options for the term provided in the option agreement, 12 months generally, 18 months in the event of death.

If we sell substantially all of our assets, or we are involved in any merger or any consolidation in which we are not the surviving corporation, or if there is any other change in control, all outstanding stock options either will be assumed or substituted for by any surviving entity. If the surviving entity does not assume or substitute for the stock options, the stock options will terminate if they are not exercised prior to any sale of assets, merger or consolidation.

16

As of March 31, 2002, options to purchase 990,000 shares of common stock were outstanding and no shares remained available for future grant under the Directors’ Plan. Unless terminated sooner, the Directors’ Plan will terminate in February 2008. As of March 31, 2002, options to purchase 1,075,000 shares of common stock were outstanding pursuant to grants made to non-employee directors under the 1998 Plan. Future grants to non-employee directors will be made from shares available under our 1998 Plan unless shares are otherwise available under the Directors’ Plan. Unless sooner terminated, the 1998 Plan will also terminate in February 2008.

During the last fiscal year, we granted options covering 100,000 shares to each non-employee director at an exercise price per share of $42.975. The exercise price of each option was equal to the closing price of our common stock as reported on the Nasdaq Stock Market for the last market trading day prior to the date of grant. As of January 27, 2002, options covering 210,000 shares had been exercised under the Directors’ Plan.

17

COMPENSATIONOF EXECUTIVE OFFICERS

SUMMARYOF COMPENSATION

The following table presents summary information for the fiscal years ended January 30, 2000, January 28, 2001 and January 27, 2002, concerning the compensation earned by our Chief Executive Officer and three executive officers at January 27, 2002.

| | | Fiscal Year

| | Annual Compensation

| | Long Term Compensation Awards

| | All Other Compensation

| |

| | | | | Securities Underlying | |

Name and Principal Position

| | | Salary

| | | Bonus $

| | Options

| |

Jen-Hsun Huang President and Chief Executive Officer | | 2002 2001 2000 | | $ | 400,000 400,000 300,000 | | | $ | 400,000 400,000 300,000 | | 500,000 1,600,000 — | | — — — | |

|

Jeffrey D. Fisher Executive Vice President, Worldwide Sales | | 2002 2001 2000 | | | 302,308 399,558 418,250 | (1) (1) | | | 237,500 42,083 23,600 | | 70,000 160,000 84,000 | | — — 2,357 | (2) |

|

Christine B. Hoberg Chief Financial Officer (3) | | 2002 2001 2000 | | | 200,000 200,000 200,000 | | | | — 102,083 15,710 | | 120,000 100,000 — | | — — — | |

|

Chris A. Malachowsky Vice President, Engineering | | 2002 2001 2000 | | | 240,000 209,000 191,250 | | | | 80,000 84,583 19,700 | | 120,000 130,000 — | | — — — | |

| (1) | | Includes sales commission of $299,558 and $318,280 in fiscal years 2001 and 2000, respectively. |

| (2) | | Represents market value of commemorative gift of property, including income taxes incurred for such gift, received in recognition of five years of service to NVIDIA. |

| (3) | | On April 29, 2002, Ms. Hoberg began a leave of absence, and Mary Dotz was named Chief Financial Officer. |

18

STOCK OPTION GRANTS AND EXERCISES

OPTION GRANTSIN LAST FISCAL YEAR

We grant options to our executive officers under our 1998 Equity Incentive Plan, the 1998 Plan. As of March 31, 2002, options to purchase a total of 34,884,052 shares were outstanding under the 1998 Plan and options to purchase 8,497,896 shares remained available for grant under the 1998 Plan. The following table presents each stock option grant during fiscal 2002 to each of the individuals listed in the Summary Compensation Table. The exercise price of each option was equal to the closing price of our common stock as reported on the Nasdaq Stock Market for the last market trading day prior to the date of grant. The exercise price may be paid in cash, in shares of our common stock valued at fair market value on the exercise date or through a cashless exercise procedure involving a same-day sale of the purchased shares.

The potential realizable value is calculated based on the ten-year term of the option at the time of grant. Stock price appreciation of 5% and 10% is assumed pursuant to rules promulgated by the SEC and does not represent our prediction of our stock price performance. The potential realizable values at 5% and 10% appreciation are calculated by:

| | • | | multiplying the number of shares of common stock subject to a given option by the exercise price per share; |

| | • | | assuming that the aggregate stock value derived from that calculation compounds at the annual 5% or 10% rate shown in the table until the expiration of the option; and |

| | • | | subtracting from that result the aggregate option exercise price. |

The shares listed in the following table under “Number of Securities Underlying Options Granted” are subject to vesting. With the exception of the option granted to Mr. Huang for 500,000 shares, the options listed shall begin vesting on July 25, 2003, and vest at a rate of 12.5% each quarter thereafter. Mr. Huang’s option shall begin vesting on June 25, 2003 and vest at a rate of 10% each quarter thereafter. Each option has a ten-year term, subject to earlier termination if the optionee’s service with us ceases. Under certain circumstances following a change of control, the vesting of such option grants may accelerate and become immediately exercisable.

Percentages shown under “Percent of Total Options Granted to Employees in Fiscal Year” are based on an aggregate of 14,554,700 options granted to our employees under all equity incentive plans during the fiscal year ended January 27, 2002.

| | | Individual Grants

| | | Exercise Price Per Share

| | Expiration Date

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term

|

| | | Number of Securities Underlying Options | | Percent of Total Options Granted to Employees in Fiscal Year

| | | | |

Name

| | Granted

| | | | | 5%

| | 10%

|

| Jen-Hsun Huang | | 500,000 | | 3.44 | % | | $ | 35.845 | | 07/25/11 | | $ | 11,271,364 | | $ | 28,563,849 |

| Jeffrey D. Fisher | | 70,000 | | 0.48 | % | | $ | 35.845 | | 07/25/11 | | $ | 1,577,991 | | $ | 3,998,939 |

| Christine B. Hoberg | | 120,000 | | 0.82 | % | | $ | 35.845 | | 07/25/11 | | $ | 2,705,127 | | $ | 6,855,324 |

| Chris A. Malachowsky | | 120,000 | | 0.82 | % | | $ | 35.845 | | 07/25/11 | | $ | 2,705,127 | | $ | 6,855,324 |

19

AGGREGATED OPTION EXERCISESIN LAST FISCAL YEAR,AND FISCAL YEAR-END OPTION VALUES

The following table presents the aggregate option exercises during the fiscal year ended January 27, 2002, as well as the number and value of securities underlying unexercised options that are held by, each of the individuals listed in the Summary Compensation Table as of January 27, 2002.

Amounts shown under the column “Value Realized” are based on the fair market value of our common stock on the exercise date as reported on the Nasdaq National Market less the aggregate exercise price. Amounts shown under the column “Value of Unexercised In-the-Money Options at January 27, 2002” are based on a price of $65.47 per share, which was the last reported sale price of our common stock on the Nasdaq National Market on January 25, 2002, the last trading day of fiscal year 2002, without taking into account any taxes that may be payable in connection with the transaction, multiplied by the number of shares underlying the option, less the exercise price payable for these shares.

| | | Shares Acquired on Exercise

| | Value Realized

| | Number of Securities Underlying Unexercised Options at January 27, 2002

| | Value of Unexercised In-the-Money Options at January 27, 2002

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Jen-Hsun Huang | | 271,000 | | $ | 12,156,307 | | 1,789,000 | | 1,640,000 | | $ | 110,961,203 | | $ | 79,629,045 |

| Jeffrey D. Fisher | | 140,000 | | $ | 5,212,939 | | 70,768 | | 399,152 | | $ | 4,201,314 | | $ | 21,000,004 |

| Christine B. Hoberg | | 368,752 | | $ | 15,652,987 | | 18,750 | | 496,250 | | $ | 946,894 | | $ | 26,455,606 |

| Chris A. Malachowsky | | 0 | | $ | 0 | | 971,874 | | 278,126 | | $ | 61,267,771 | | $ | 12,071,734 |

CHANGEOF CONTROL AGREEMENTS

1998 Equity Incentive Plan

If we sell substantially all of our assets, or we are involved in any merger or any consolidation in which we are not the surviving corporation, or if there is any other change in control, all outstanding awards under the 1998 Equity Incentive Plan either will be assumed or substituted for by any surviving entity. If the surviving entity does not assume or substitute for the awards, the awards will terminate if they are not exercised prior to any sale of assets, merger or consolidation.

20

REPORTOFTHE COMPENSATION COMMITTEEOFTHE BOARDOF DIRECTORS

ON EXECUTIVE COMPENSATION2

INTRODUCTION

Our executive compensation policies and practices are established and administered by the Compensation Committee of the Board of Directors. The Compensation Committee consists of three non-employee directors: Tench Coxe, James C. Gaither and Harvey C. Jones. The Compensation Committee’s determinations regarding compensation of the Chief Executive Officer and other executive officers are reviewed with all the non-employee directors.

PHILOSOPHY

The goals of our compensation program are: (1) to align the financial interests of the executive officers and other key employees with those of the stockholders; and (2) to provide a means for NVIDIA to attract, retain and reward high-quality executives who contribute to our long-term success.

| | • | | Our philosophy regarding base salaries for executives is conservative, with the goal of maintaining base salaries at the industry median for comparable companies. |

| | • | | We maintain semi-annual incentive bonus opportunities that are intended to motivate executives to achieve specific operating and strategic objectives. The combination of base and incentive bonus is targeted to bring total compensation to competitive levels. |

| | • | | We provide significant equity-based incentives for executives and other key employees to ensure they are motivated over the long-term to increase stockholder value and to contribute to our long-term growth. |

COMPENSATION PLANS

Our executive compensation comprises three elements, each of which is intended to support the overall compensation philosophy.

Base Salary. We recognize the importance of maintaining compensation levels competitive with semiconductor and other leading technology companies with which we compete for talent. Base salary is targeted at the median level for companies in similar businesses and with similar characteristics such as sales volume, capitalization and financial performance. We review with the Chief Executive Officer an annual salary plan for our executive officers, other than the Chief Executive Officer. The salary plan is modified as we deem appropriate upon our approval. The annual salary plan is developed based on an annual review of executive salaries at semiconductor and other comparable technology companies, including the Radford Survey. Such annual plan also takes into account past performance and expected future contributions of the individual executive.

Bonus. We introduced a semi-annual incentive bonus plan in the second half of fiscal 2000, which provides bonus compensation to executives, based on achievement of specific financial performance targets. The plan is funded based on achieving a minimum threshold in operating margin and is distributed based on individual performance objectives.

Long-Term Incentives. Long-term incentives have been in the form of stock options. We believe that equity-based compensation closely aligns the interests of executive officers with your interests as stockholders by providing an incentive to manage NVIDIA with a focus on long-term strategic objectives set by the Board of

| 2 | | The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filings that we make under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing. |

21

Directors relating to growth and stockholder value. Stock options are granted under the 1998 Equity Incentive Plan. Stock options are granted at not less than fair market value and have value only if NVIDIA’s stock price increases.

The size of the option grant is determined based on competitive practices in the technology industry and our philosophy of significantly linking executive compensation with stockholder interests. Stock options generally vest in a series of installments over a four-year period, contingent upon the executives continued employment at NVIDIA. Options terminate 10 years after the date of grant. Subsequent grants are based on a number of factors, including individual performance, job level, expected future performance and the competitive environment.

Executive officers are also generally eligible to participate in NVIDIA’s 1998 Employee Stock Purchase Plan. Participation levels in such plan are at the discretion of each executive. However, as a result of applicable laws regarding stock ownership, Messrs. Huang and Malachowsky are not eligible to participate in this plan.

In fiscal 2002, we determined that each of the executive officers should receive option grants. The table on page 19 reflects such grants. Out of a total of 14,554,700 options granted to employees under the 1998 Equity Incentive Plan and 2000 Nonstatutory Equity Incentive Plan in fiscal 2002, executive officers received grants for 810,000 shares, or approximately 5.5% of the total options granted to employees under the 1998 Equity Incentive Plan and the 2000 Nonstatutory Equity Incentive Plan.

We believe the programs described above provide compensation that is competitive with comparable technology companies, that they link the interests of our executives together with yours as stockholders, and that they provide the basis for us to attract and retain qualified executives. We will continue to monitor the relationship among executive compensation, NVIDIA’s performance and stockholder value.

CHIEF EXECUTIVE OFFICER COMPENSATION

A process similar to that discussed above for executive officers determines compensation for Jen-Hsun Huang, the Chief Executive Officer. Following our review of compensation paid to chief executive officers at other comparable technology companies, we maintained Mr. Huang’s base salary for fiscal 2002 at $400,000. In addition, Mr. Huang’s fiscal 2002 bonus target was set at $600,000, based on achieving key financial and other strategic objectives. We determined that Mr. Huang achieved a significant portion of his objectives in fiscal 2002, and he received a bonus of $400,000. For fiscal 2003, we determined to leave Mr. Huang’s base salary at $400,000, and increased his annual bonus target to $800,000. The bonus, if any, that Mr. Huang will be paid for fiscal 2003 performance continues to be based on achieving key financial and other strategic objectives. In fiscal 2002, Mr. Huang was also granted an option to acquire 500,000 shares of common stock at an exercise price of $35.845, which was the fair market value of the stock on such date. This option shall begin vesting on June 25, 2003 and vest at a rate of 10% each quarter thereafter. This grant was intended to continue to maintain the overall competitiveness of Mr. Huang’s compensation package and strengthen the alignment of Mr. Huang’s interests with those of our stockholders during a critical phase of NVIDIA’s development.

We intend to continue to monitor Mr. Huang’s compensation level in light of his performance and the compensation levels of executives at comparable companies.

FEDERAL TAX CONSIDERATIONS

Section 162(m) of the Internal Revenue Code limits NVIDIA to a deduction for federal income tax purposes of no more than $1 million of compensation paid to certain executive officers in a taxable year. Compensation above $1 million may be deducted if it is “performance-based compensation” within the meaning of the code.

The statute containing this law and the applicable Treasury regulations offer a number of transitional exceptions to this deduction limit for pre-existing compensation plans, arrangements and binding contracts. The

22

Compensation Committee has not yet established a policy for determining which forms of incentive compensation awarded to our executive officers will be designed to qualify as “performance-based compensation.” The Compensation Committee intends to continue to evaluate the effects of the statute and any applicable Treasury regulations and to comply with code section 162(m) in the future in a manner consistent with NVIDIA’s best interests.

COMPENSATION COMMITTEE INTERLOCKSAND INSIDER PARTICIPATION

For the fiscal year ended January 27, 2002, the Compensation Committee consisted of Messrs. Coxe, Gaither and Jones. No member of the Compensation Committee is an officer or employee of NVIDIA, and none of our executive officers serve as a member of a compensation committee of any entity that has one or more executive officers serving as a member of the Compensation Committee. Each of our directors or their affiliated entities, other than Mr. Seawell, has purchased and holds NVIDIA securities.

James C. Gaither is Senior Counsel to Cooley Godward LLP, which has provided legal services to us since our inception.

23

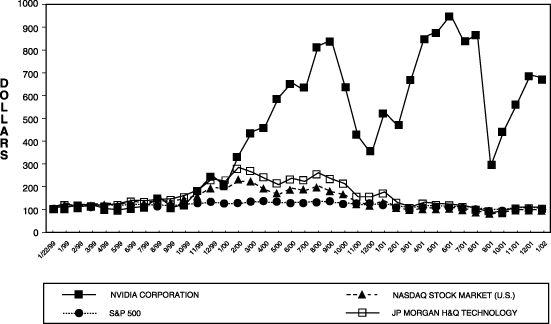

PERFORMANCE MEASUREMENT COMPARISON

The following graph shows the total stockholder return of an investment of $100 in cash on January 22, 1999, the date our common stock began trading on the Nasdaq National Market, for:

| | • | | the Standard & Poor’s 500 Index; |

| | • | | the Nasdaq Stock Market (U.S.) Index; and |

| | • | | the JP Morgan H&Q Technology Index. |

We were added to the Standard & Poor’s 500 Index during the fiscal year ended January 27, 2002. Historic stock price performance is not necessarily indicative of future stock price performances. All values assume reinvestment of the full amount of all dividends:

This section is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

24

CERTAIN TRANSACTIONS

We have entered into indemnity agreements with our officers and directors which provide, among other things, that we will indemnify such officer or director, under the circumstances and to the extent provided for therein, for expenses, damages, judgments, fines and settlements he or she may be required to pay in actions or proceedings which he or she is or may be made a party by reason of his or her position as a director, officer or other agent of NVIDIA, and otherwise to the fullest extent permitted under Delaware law and our Bylaws. We also intend to execute these agreements with our future officers and directors.

James C. Gaither, one of our directors and a member of our Compensation Committee, is Senior Counsel to Cooley Godward LLP, which has provided legal services to us since our inception.

HOUSEHOLDINGOF PROXY MATERIALSFOR BENEFICIAL HOLDERS

In December 2000, the Securities and Exchange Commission adopted new rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements, prospectuses and annual reports with respect to two or more stockholders sharing the same address by delivering a single copy of proxy statements, prospectuses and annual reports, as the case may be, addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

If you currently receive multiple copies of our proxy statement and Annual Report on Form 10-K at your address and would like to request “householding” of your communications, please contact your broker. Once you have elected “householding” of your communications, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate proxy statement and annual report, please notify your broker.

ELECTRONIC DELIVERYOF FUTURE COMMUNICATIONS

We are encouraging all of our stockholders, both beneficial and of record, to receive future financial communications, including our Annual Report on Form 10-K, proxy statement and other documents relating to our future annual meeting of stockholders, via the Internet. Receiving these financial communications electronically will assist us in controlling the costs relating to the printing and distribution of these materials. If you are a holder of record, you may elect to receive future financial communications over the Internet by following the instructions included on your proxy card and if you are a beneficial holder, byfollowing the instructions provided in the Vote Instruction Form included with this proxy statement.

25

OTHER MATTERS

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

| | By | Order of the Board of Directors |

May 28, 2002

ACOPYOFOUR ANNUAL REPORTTOTHE SECURITIESAND EXCHANGE COMMISSIONON FORM 10-KFORTHEFISCALYEARENDED JANUARY 27, 2002ISAVAILABLEWITHOUTCHARGEUPONWRITTENREQUESTTO: INVESTOR RELATIONS, NVIDIA CORPORATION, 2701 SAN TOMAS EXPRESSWAY, SANTA CLARA, CALIFORNIA 95050.

26

Appendix A

NVIDIA CORPORATION

Charter of the Audit Committee of the Board of Directors

Adopted May 2000

Amended May 2001

Amended April 2002

I. AUDIT COMMITTEE PURPOSE

The Audit Committee is appointed by the Board of Directors to assist the Board in fulfilling its oversight responsibilities. The Audit Committee’s primary duties and responsibilities are to:

| | • | | Monitor the integrity of the Company’s financial statements, financial reporting process and systems of internal controls. |

| | • | | Monitor the Company’s legal and regulatory compliance. |

| | • | | Select the independent auditors. |

| | • | | Monitor the independence and performance of the Company’s independent and internal auditors. |

| | • | | Provide an avenue of communication among the independent auditors, the internal auditors, management and the Board of Directors. |

| | • | | Take appropriate actions to set the overall corporate “tone” for quality financial reporting, sound business risk practices and ethical behavior. |

The Audit Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities, and it has direct access to the independent auditors, the Company’s legal counsel, as well as any officer or employee of the organization. The Audit Committee has the ability to retain, at the Company’s expense, special legal, accounting, or other consultants or experts it deems appropriate in the performance of its duties.

II. AUDIT COMMITTEE COMPOSITIONAND MEETINGS

Audit Committee members shall meet the requirements of the Nasdaq National Market. The Audit Committee shall comprise at least three directors as determined by the Board of Directors, none of whom shall be an employee and each of whom shall be free from any relationship that would interfere with the exercise of his or her independent judgment, as determined by the Board of Directors, in accordance with applicable Nasdaq requirements. All members of the Committee shall have a basic understanding of finance and accounting and be able to read and understand fundamental financial statements, including the Company’s balance sheet, income statement and cash flow statement. The Chairman of the Audit Committee shall have accounting or related financial management expertise, including being or having been chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities.

Audit Committee members shall be appointed by the Board of Directors.

The Committee shall meet at least four times annually, or more frequently as circumstances dictate. The Committee should meet privately in executive session at least annually with management, the independent auditors, the internal auditors and as a committee to discuss any matters that the Committee or each of these groups believe should be discussed. In addition, the Committee should communicate with management and the independent auditors quarterly to review the Company’s financial statements and significant findings based upon the auditors’ limited review procedures.

A-1

III. AUDIT COMMITTEE RESPONSIBILITIESAND DUTIES

REVIEW PROCEDURES

| | 1. | | Review and reassess the adequacy of this Charter at least annually. Submit the Charter or any recommendations of proposed changes to the Board of Directors for approval and have the document published at least every three years in accordance with Securities and Exchange Commission regulations. |

| | 2. | | Review the Company’s annual audited financial statements prior to filing or distribution. Review should include discussion with management, the internal auditors and the independent auditors of the adequacy of internal controls, significant issues regarding accounting principles, practices, and judgments. |

| | 3. | | In consultation with the management, the internal auditors and the independent auditors, consider the integrity of the Company’s financial reporting processes and controls. Discuss significant financial risk exposures and the steps management has taken to monitor, control, and report such exposures. Review significant findings prepared by the independent auditors together with management’s responses, including the status of previous recommendations and any disagreements with management. |

| | 4. | | Review with management, the internal auditors and the independent auditors the effect of regulatory and accounting initiatives as well as any off-balance sheet structures on the Company’s financial statements. |

| | 5. | | Review with financial management, the internal auditors and the independent auditors the Company’s quarterly financial results prior to the release of earnings and/or the Company’s quarterly financial statements prior to filing or distribution. Discuss any significant changes to the Company’s accounting principles and any items required to be communicated by the independent auditors in accordance with SAS 61 (see item 11). |

INDEPENDENT AND INTERNAL AUDITORS

| | 6. | | The independent auditors are ultimately accountable to the Audit Committee and the Board of Directors as representatives of the Company’s stockholders. The Audit Committee shall review the independence and performance of the independent auditors, as well as whether it is appropriate to adopt a policy of rotating independent auditors on a regular basis, and annually select the independent auditors or approve any discharge of auditors when circumstances warrant. |

| | 7. | | Approve the fees for audit services to be paid to the independent auditors. |

| | 8. | | Approve the retention of and payments of fees in excess of $25,000 per engagement to be paid to the independent auditors for non-audit services. |

| | 9. | | On an annual basis, the Committee should review and discuss with the independent auditors all significant relationships they have with the Company that could impair the auditors’ independence. |

| | 10. | | Review the internal and independent auditors audit plans—discuss scope, staffing, compensation, locations, reliance upon management and general audit approach. |