Exhibit 99.1

FORMULA SYSTEMS (1985) LTD.

Terminal Center, 1 Yahadut Canada St., Or Yehuda 6037501, Israel

September 17, 2020

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 2, 2020

Formula Systems (1985) Ltd. Shareholders:

We hereby inform you that the Annual General Meeting of Shareholders, or the Meeting, of Formula Systems (1985) Ltd., or the Company, will be held at 2:00 p.m. (Israel time) on Monday, November 2,2020 at our offices at Terminal Center, 1 Yahadut Canda St., Or Yehuda 6037501, Israel, for the following purposes:

| 1. | To re-elect Mr. Marek Panek to the Company’s board of directors, or the Board, to hold office until our next annual general meeting of shareholders and until his successor is duly elected. |

| 2. | To re-elect Mr. Rafal Kozlowski to the Board, to hold office until our next annual general meeting of shareholders and until his successor is duly elected. |

| 3. | To re-elect Mr. Ohad Melnik to the Board, to hold office until our next annual general meeting of shareholders and until his successor is duly elected. |

| 4. | To approve the re-appointment of Kost Forer Gabbay & Kasierer, registered public accounting firm, a member firm of Ernst & Young Global, as our independent registered public accounting firm for the year ending December 31, 2020 and until our next annual general meeting of shareholders, and to authorize the Board and/or its audit committee to fix the compensation for such independent registered public accountants in accordance with the volume and nature of their services. |

| 5. | To approve an award of equity-based compensation to our chief executive officer, Mr. Guy Bernstein. |

| 6. | To approve amended terms for the Company’s renewed director and officer liability, or D&O, insurance policy. |

In addition to the foregoing proposals, at the Meeting, the audited, consolidated financial statements of the Company for the annual period ended December 31, 2019 will be presented to, and considered by, the Company’s shareholders. The shareholders will furthermore transact such other business as may properly come before the Meeting or any adjournment thereof.

Our Board recommends that you vote in favor of the above proposals, which are described in the proxy statement attached to this notice. The proxy statement and a related proxy card are being furnished to the Securities and Exchange Commission, or SEC, in a report of foreign private issuer on Form 6-K, or a Form 6-K, which may be obtained for free from the SEC’s website at www.sec.gov or at the Company’s website— at http://www.formulasystems.com. The full text of the proposed resolutions, together with the form of proxy card for the Meeting, may also be viewed beginning on Monday, September 21, 2020, at the registered office of the Company, Terminal Center, 1 Yahadut Canada Street, Or Yehuda 6037501, Israel, and thereafter, from Sunday to Thursday, 10:00 a.m. to 3:00 p.m. (Israel time) (excluding Israeli holidays). Our telephone number at our registered office is +972-3-538-9487.

Holders of record of our ordinary shares (including ordinary shares represented by American Depositary Shares, or ADSs) at the close of business on Thursday, September 24, 2020 are entitled to vote at the Meeting.

The affirmative vote of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon (which excludes abstentions and broker non-votes) is necessary for the approval of each of the above proposals.

The approval of Proposal 5 (the approval of an award of equity-based compensation to our chief executive officer) furthermore requires that one of the following two additional voting requirements be met:

| ● | the majority voted in favor of the proposal includes a majority of the shares held by shareholders who are neither controlling shareholders (as described in our proxy statement for the Meeting) nor in possession of a conflict of interest (referred to under the Israeli Companies Law, 5759-1999, or the Companies Law, as a “personal interest”, as described in the proxy statement) in the approval of the proposal that are voted at the Meeting, excluding abstentions; or |

| ● | the total number of shares held by non-controlling, non-conflicted shareholders (as described in the previous bullet-point) voted against the proposal does not exceed 2% of the aggregate voting power in the Company. |

If you are a shareholder of record voting by mail, your proxy card must be received at our registered office at least six (6) hours prior to the appointed time of the Meeting to be validly included in the tally of ordinary shares voted at the Meeting. Your proxy, if properly executed, will be voted in the manner directed by you. If no direction is made, your proxy will be voted “FOR” each of the proposals described above (except for Proposal 5, for which you will be deemed to have abstained, unless you complete Item 5A on the proxy card). If you attend the Meeting, you may vote in person and your proxy will not be used. Detailed proxy voting instructions are provided both in the proxy statement and on the accompanying proxy card.

Beneficial owners who hold ordinary shares through members of the Tel Aviv Stock Exchange, or the TASE, may vote their shares by sending a certificate signed by the TASE Clearing House member through which the shares are held, which complies with the Israel Companies Regulations (Proof of Ownership for Voting in General Meetings)-2000 as proof of ownership of the shares, along with a duly executed proxy (in the form filed by us on MAGNA, the distribution site of the Israeli Securities Authority, at www.magna.isa.gov.il), to the Company at Terminal Center, 1 Yahadut Canada Street, Or Yehuda, 6037501, Israel, Attention: Chief Financial Officer. The foregoing certificate signed by the TASE Clearing House member may instead be presented at the Meeting by a shareholder who wishes to vote at the Meeting itself (subject to the below guidelines re: attendance at the Meeting). Alternatively, shares held through a member of the TASE may be voted by means of an electronic vote, through the electronic voting system of the Israel Securities Authority (votes.isa.gov.il), subject to proof of ownership of the shares on the record date, as required by law. Voting through the electronic voting system will be allowed until 8:00 a.m., Israel time, on Monday, November 2, 2020 (that is six (6) hours before the Meeting).You may receive guidance on the use of the electronic voting system from the TASE member through which you hold your shares.

If your shares are represented by ADSs, you should complete the enclosed voting instruction form to direct the depositary for the ADSs, BNY Mellon, to vote the number of shares represented by your ADSs in accordance with the instructions that you provide. If your ADSs are held in “street name”, through a bank, broker or other nominee, you should follow the instructions in the proxy statement as to how to direct such bank, broker or other nominee to arrange for the depositary to vote the ordinary shares represented by your ADSs in accordance with your voting instructions.

Israeli legal regulations presently limit public gatherings as a result of the current COVID-19 (coronavirus) pandemic. The Company furthermore desires to reduce the risk of further spreading of the virus, and to safeguard the well-being of shareholders, Board and Company representatives at the Meeting.

Consequently, the Company strongly encourages shareholders to mail in their proxy cards or voting instruction forms, or, in the case of shareholders holding our ordinary shares on TASE, to vote electronically at votes.isa.gov.il, in each case, in lieu of attending the Meeting in person. If a shareholder who holds ordinary shares as of the record date for the Meeting (September 24, 2020) nevertheless desires to attend the Meeting, he, she or it must inform the Company in advance. Any such shareholder must contact the Company’s Chief Financial Officer, Mr. Asaf Berenstin, via email (ir@formula.co.il) or telephone (+972-3-538-9487), on or prior to 6:00 p.m., Israel time (11:00 a.m. EDT), on Monday, October 26, 2020. In case you contact the Company via email, if you are a record shareholder or record holder of ADSs, please provide the name under which your shares or ADSs are held of record and proof of ownership (a copy of your share certificate or a statement showing book-entry shares or ADSs). If you hold your shares or ADSs in “street name” (through a bank or broker), please attach to your email the required proof of ownership described in the enclosed proxy statement for the Meeting, namely: a “legal proxy” from the broker, trustee or nominee that holds your shares or ADSs, giving you the right to vote the shares or ADSs at the Meeting, along with an account statement or other proof that shows that you owned your shares or ADSs as of the record date for the Meeting. You will be required to provide similar documentation if you contact the Company’s Chief Financial Officer by phone.

Based on the number of responses that the Company receives from shareholders interested in attending the Meeting, the Company will determine whether it is possible to allow those shareholders to attend physically in person in compliance with the Israeli coronavirus regulations (which may continue to evolve from time to time prior to the Meeting date). The Company will respond to the relevant shareholders by the following day (Tuesday, October 27, 2020) in order to provide to them logistical information as to whether and how they will be able to attend the Meeting.

In accordance with the Companies Law and regulations promulgated thereunder, any shareholder of the Company holding at least 1% of the outstanding voting rights of the Company for the Meeting may submit to the Company a proposed additional agenda item for the Meeting, to the Company’s offices at Terminal Center, 1 Yahadut Canada Street, Or Yehuda, 6037501, Israel, Attention: Chief Financial Officer, email: ir@formula.co.il, no later than Thursday, September 24, 2020. To the extent that there are any additional agenda items that the Board determines to add as a result of any such submission, the Company will publish an updated notice and proxy card with respect to the Meeting, no later than Thursday, October 1, 2020, to be furnished to the SEC under cover of a Form 6-K.

In accordance with the Companies Law and regulations promulgated thereunder, any shareholder of the Company may submit to the Company a position statement on its behalf, expressing its position on an agenda item for the Meeting. Such a position statement should be sent to the Company’s offices, at Terminal Center, 1 Yahadut Canada Street, Or Yehuda, 6037501, Israel, Attention: Chief Financial Officer, email: ir@formula.co.il no later than Friday, October 23, 2020. Any position statement received will be furnished to the SEC on Form 6-K, and will be made available to the public on the SEC’s website at http://www.sec.gov.

| | Sincerely, |

| | |

| | Asaf Berenstin |

| | Chief Financial Officer |

FORMULA SYSTEMS (1985) LTD.

Terminal Center, 1 Yahadut Canada Street, Or Yehuda 6037501, Israel

+972-3-538-9487

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 2, 2020

This Proxy Statement is being furnished in connection with the solicitation of proxies on behalf of the board of directors, or the Board, of Formula Systems (1985) Ltd., to which we refer as Formula, the Company, us or we (or similar expressions), to be voted at an Annual General Meeting of Shareholders, or the Meeting, and at any adjournment thereof, pursuant to the accompanying Notice of Annual General Meeting of Shareholders. The Meeting will be held at 2:00 p.m. (Israel time) on Monday, November 2, 2020, at our offices at Terminal Center, 1 Yahadut Canada Street, Or Yehuda 6037501, Israel.

This Proxy Statement, the attached Notice of Annual General Meeting of Shareholders, and the related proxy card or voting instruction form are being made available or distributed (as appropriate) to holders of Formula ordinary shares, par value NIS 1.00 per share, or ordinary shares, including ordinary shares that are represented by American Depositary Shares, or ADSs, on a one-for-one basis, on or about September 29, 2020.

You are entitled to notice of, and to vote at, the Meeting, if you hold ordinary shares as of the close of business on September 24, 2020, the record date for the Meeting. You can vote your shares by attending the Meeting or by following the instructions under “How You Can Vote” below. Our Board urges you to vote your shares so that they will be counted at the Meeting or at any postponements or adjournments of the Meeting.

Agenda Items

The following proposals are on the agenda for the Meeting:

| 1. | Re-election of Mr. Marek Panek to the Board, to hold office until our next annual general meeting of shareholders and until his successor is duly elected; |

| 2. | Re-election of Mr. Rafal Kozlowski to the Board, to hold office until our next annual general meeting of shareholders and until his successor is duly elected; |

| 3. | Re-election of Mr. Ohad Melnik to the Board, to hold office until our next annual general meeting of shareholders and until his successor is duly elected; |

| 4. | Approval of the re-appointment of Kost Forer Gabbay & Kasierer, registered public accounting firm, a member firm of Ernst & Young Global, as our independent registered public accounting firm for the year ending December 31, 2020 and until our next annual general meeting of shareholders, and to authorize the Board and/or its audit committee to fix the compensation for such independent registered public accountants in accordance with the volume and nature of their services; |

| 5. | Approval of an award of equity-based compensation to our chief executive officer, Mr. Guy Bernstein. |

| 6. | Approval of amended terms for our renewed director and officer liability, or D&O, insurance policy |

In addition to the foregoing proposals, at the Meeting, our audited, consolidated financial statements for the annual period ended December 31, 2019 will be presented to, and considered by, our shareholders. We will also transact such other business as may properly come before the Meeting or any postponement or adjournment thereof.

Our Annual Report on Form 20-F for the year ended December 31, 2019, including our 2019 audited consolidated financial statements, are available at the “Investor Relations” portion of our website, at www.formulasystems.com. To receive a printed copy of that document via mail at no charge, please contact us at Terminal Center, 1 Yahadut Canada Street, Or Yehuda 6037501, Israel, tel: +972-3-538-9487, e-mail: ir@formula.co.il.

Board Recommendation

Our Board of Directors unanimously recommends that you vote “FOR” each of Proposals 1 through 6.

Quorum

On September 15, 2020, we had 15,294,267 ordinary shares issued and outstanding, of which 135,453 were represented by ADSs. The foregoing number of issued and outstanding ordinary shares excludes 568,840 ordinary shares that we repurchased (24,780 in 2002 and 543,840 in 2011), as under applicable Israeli law, shares that are held by the Company have no voting rights. Each ordinary share (including an ordinary share represented by an ADS) outstanding as of the close of business on the record date, September 24, 2020, is entitled to one vote upon each of the matters to be presented at the Meeting. Under our Articles of Association, the Meeting will be properly convened if at least two shareholders (including holders of ordinary shares represented by ADSs) attend the Meeting in person or sign and return proxies, provided that they hold shares representing at least twenty-five percent (25%) of our voting power. If such quorum is not present within one hour from the time scheduled for the Meeting, the Meeting will be adjourned for one week (to the same day, time and place), or to a day, time and place proposed by the Chairman with the consent of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting on the adjournment. If 25% of our voting power is not present within one half-hour of the time designated for the adjourned meeting, any two shareholders attending in person or by proxy will constitute a quorum, regardless of the number of shares they hold or represent.

Who Can Vote

You are entitled to notice of the Meeting and to vote at the Meeting if you are a shareholder of record at the close of business on Thursday, September 24, 2020. You are also entitled to notice of the Meeting and to vote at the Meeting if you held ordinary shares through a bank, broker or other nominee that is one of our shareholders of record at the close of business on Thursday, September 24, 2020, or which appear in the participant listing of a securities depository on that date. If you hold ADSs (whether the ADSs are registered directly in your name or are held in “street name”) as of that date, you are entitled to receive notice of the Meeting and to direct the depositary for the ADSs, The Bank of New York Mellon, as to how to vote the ordinary shares represented by your ADSs at the Meeting.

How You Can Vote

The method of ensuring that your ordinary shares are voted at the Meeting will differ for shares held as a record holder, shares held in “street name” (through a Tel Aviv Stock Exchange, or TASE, member) and shares underlying ADSs that you hold. Record holders of shares will need to complete and execute proxy cards (accessible at the Company’s website) and submit them to the Company. Holders of shares in “street name” through a TASE member will vote via a proxy card, but through a different procedure (as described below) or by electronic voting via the electronic voting system of the Israel Securities Authority. Holders of ADSs (whether registered in their name or in “street name”) will receive voting instruction forms in order to instruct the Depositary how to vote (as described below).

Shareholders of Record

If you are a shareholder of record (that is, you hold a share certificate that is registered in your name or your shares are registered in your name in book-entry form), you can submit your vote by attending the Meeting, or by completing, signing and submitting a proxy card, which will be accessible at the “Investor Relations” section of the Company’s website, as described below under “Availability of Proxy Materials”.

Please follow the instructions on the proxy card. You may change your mind and cancel your proxy card by sending us written notice, by signing and returning a proxy card with a later date, or by voting in person or by proxy at the Meeting. Except if the Chairman of the Meeting determines otherwise, we will not be able to count a proxy card unless our registrar and transfer agent receives it in the enclosed envelope by 11:59 a.m., Eastern time, on Sunday, November 1, 2020, or we receive it at our principal executive offices at Terminal Center, 1 Yahadut Canada Street, Or Yehuda, 6037501, Israel, Attention: Chief Financial Officer, e-mail: ir@formula.co.il, at least six hours prior to the time fixed for the Meeting (that is, by 8:00 a.m., Israel time, on Monday, November 2, 2020). The chairman of the Meeting may waive that six-hour deadline.

Shareholders Holding Through the TASE

If you hold ordinary shares through a bank, broker or other nominee that is admitted as a member of the TASE, your shares can be voted in one of the following three manners: (i) by attending the Meeting and voting in person; (ii) by sending in your vote in advance of the Meeting; or (iii) by voting electronically in advance of the Meeting via the electronic voting system of the Israel Securities Authority. Each of these possibilities is described further in the next paragraph.

If you hold ordinary shares via a member of the TASE, you may vote your shares in person at the Meeting, by presenting a certificate signed by the TASE Clearing House member through which the shares are held, which complies with the Israel Companies Regulations (Proof of Ownership for Voting in General Meetings)-2000 as proof of ownership of the shares (an “ishur baalut”). In the alternative, you may vote in advance of the Meeting by sending that proof-of-ownership certificate, along with a duly executed proxy card (in the form filed by us on MAGNA, the distribution site of the Israeli Securities Authority, at www.magna.isa.gov.il), to the Company at Terminal Center, 1 Yahadut Canada Street, Or Yehuda, 6037501, Israel, Attention: Chief Financial Officer. If you utilize that method, your vote must be received by us at least six hours prior to the time fixed for the Meeting (that is, by 8:00 a.m., Israel time, on Monday, November 2, 2020). The Chairman of the Meeting may waive that six-hour deadline. As a third possibility, you may vote electronically in advance of the Meeting through the electronic voting system of the Israel Securities Authority (votes.isa.gov.il), subject to proof of ownership of the shares on the record date, as required by law. Voting through the electronic voting system will be allowed until six (6) hours before the Meeting, that is, until 8:00 a.m., Israel time, on Monday, November 2, 2020.

If you hold your shares through a TASE member and you voted in advance of the Meeting and seek to change or revoke your vote, then (i) if you sent in your vote (together with proof of ownership) originally to the Company, you can send in a later-dated proxy card and proof of ownership to the Company, or (ii) if you voted originally via the electronic voting system of the Israel Securities Authority, you may change or revoke your vote using the electronic voting system. In either case, you must complete the revocation of your vote before the deadline for submitting a vote (which is described above).

Holders of ADSs

Under the terms of the Deposit Agreement by and among our Company, The Bank of New York Mellon, as depositary, or the Depositary, and the holders of our ADSs, the Depositary shall endeavor (insofar as is practicable and in accordance with applicable law and the Articles of Association of our Company) to vote or cause to be voted the number of shares represented by ADSs in accordance with the instructions provided by the holders of ADSs to the Depositary. For ADSs that are held in “street name”, through a bank, broker or other nominee, the voting process will be based on the underlying beneficial holder of the ADSs directing the bank, broker or other nominee to arrange for the Depositary to vote the ordinary shares represented by the ADSs in accordance with the beneficial holder’s voting instructions. If no instructions are received by the Depositary from any holder of ADSs (whether held directly by a beneficial holder or in “street name”) with respect to any of the shares represented by the ADSs on or before the date established by the Depositary for such purpose, the Depositary shall vote the shares represented by such ADSs in accordance with the recommendation of the Board of our Company as advised by our Company in writing, except that the Depositary shall not vote the shares represented by ADSs with respect to any matter as to which we inform the Depositary (we have agreed to provide that information as promptly as practicable in writing, if applicable) that (x) we do not wish the Depositary to vote, or (y) the matter materially and adversely affects the rights of holders of our ordinary shares.

Multiple Record Shareholders or Accounts

You may receive more than one set of voting materials, including multiple copies of this document and multiple voting instruction forms. For example, shareholders who hold ADSs in more than one brokerage account will receive a separate voting instruction form for each brokerage account in which ADSs are held. Shareholders of record whose shares are registered in more than one name should complete, sign, date and return one proxy card for each name in which shares are held.

Vote Required for Approval of Each Proposal

The affirmative vote of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon (which excludes abstentions) is necessary for the approval of each proposal.

The approval of Proposal 5 (the approval of the award of equity-based compensation to our chief executive officer) furthermore requires that one of the following two additional voting requirements be met:

| ● | the majority voted in favor of the proposal includes a majority of the shares held by shareholders who are neither controlling shareholders nor in possession of a conflict of interest (referred to under the Israeli Companies Law, 5759-1999, or the Companies Law, as a “personal interest”) in the approval of the proposal that are voted at the Meeting, excluding abstentions; or |

| ● | the total number of shares held by non-controlling, non-conflicted shareholders (as described in the previous bullet-point) voted against the proposal does not exceed 2% of the aggregate voting power in the Company. |

For purposes of the foregoing, a “controlling shareholder” is any shareholder that has the ability to direct the Company’s activities (other than by means of being a director or other office holder of the Company). A person is presumed to be a controlling shareholder if he, she or it holds 50% or more of the voting rights in the Company or has the right to appoint the majority of the directors or chief executive officer of the Company, but excludes a shareholder whose power derives solely from his or her position as a director of the Company or from any other position with the Company. For purposes of Proposal 5, a “controlling shareholder” furthermore includes any shareholder holding 25% or more of the voting rights in the Company if no other shareholder holds more than 50% of the voting rights.

As far as we are aware, Asseco Poland S.A., or Asseco, which owns approximately 37.5% of our outstanding share capital, will be deemed to be a controlling shareholder of the Company for purposes of the vote on Proposal 5. Its vote will therefore be excluded in determining whether either of the above-described special majority conditions has been achieved for that proposal.

A conflict of interest (referred to under the Companies Law as a “personal interest”) (i) includes an interest of any member of the shareholder’s immediate family (i.e., spouse, sibling, parent, parent’s parent, descendent, the spouse’s descendent, sibling or parent, and the spouse of each of these) or an interest of an entity with respect to which the shareholder (or such a family member thereof) serves as a director or the chief executive officer, owns at least 5% of the shares or its voting rights or has the right to appoint a director or the chief executive officer; and (ii) excludes an interest arising solely from the ownership of shares of the Company. In determining whether a vote cast by proxy is disinterested, the conflict of interest/ “personal interest” of the proxy holder is also considered and will cause that vote to be treated as the vote of an interested shareholder, even if the shareholder granting the proxy does not have a conflict of interest/ personal interest in the matter being voted upon.

A shareholder must inform us before the vote (or if voting by proxy or voting instruction form, indicate via the proxy card or voting instruction form) whether or not such shareholder is a controlling shareholder or has a conflict of interest in the approval of Proposal 5, and failure to do so disqualifies the shareholder from participating in the vote on that proposal. In order to confirm that you are not a controlling shareholder and that you do not have a conflict of interest with respect to the approval of Proposal 5 (and therefore be counted towards or against the special majority required for approval of Proposal 5), you must check the box “FOR” in Item 5A on the accompanying proxy card or voting instruction form when you record your vote on Proposal 5. If you believe that you, or a related party of yours, is a controlling shareholder or has such a conflict of interest and you wish to participate in the vote on Proposal 5, you should instead check the box “AGAINST” in Item 5A on the enclosed proxy card or voting instruction form. In that case, your vote on Proposal 5 will be counted towards determining whether an ordinary majority has been received in favor or against the proposal, but will not be counted towards determining whether a special majority has been achieved for approval of the proposal.

Various Voting Scenarios

If you are a shareholder of record and do not return your proxy card, your shares will not be voted. If you provide specific instructions (mark boxes) with regard to any of the proposals, your shares will be voted as you instruct. If you sign and return your proxy card without giving specific instructions, your shares will be voted in accordance with the recommendations of the Board, “FOR” Proposals 1 through 4, and 6. If you do not provide voting instructions with respect to Proposal 5, however, you will be deemed to have abstained from voting on that proposal (unless you complete the box “FOR” or “AGAINST” in Item 5A, in which case your shares will be voted in favor of Proposal 5). The proxy holders will furthermore vote in their discretion on any other matters that properly come before the Meeting.

If you hold shares beneficially via a member of the TASE, your shares will also not be voted at the Meeting if you do not follow the above-described instructions for voting, and will not be voted with respect to a particular proposal if you do not indicate how you would like to vote on that proposal.

In the case of ordinary shares represented by ADSs, however, if you do not return your voting instruction form to instruct your broker how to cause the Depositary to vote, the Depositary will vote the shares represented by those ADSs in accordance with the recommendation of the Board, as advised by our Company in writing, unless we inform the Depositary otherwise.

Solicitation of Proxies

A form of proxy for use at the Meeting or a voting instruction form for directing the Depositary has been filed publicly or mailed to you (as appropriate). Shareholders may revoke the authority granted by their execution of proxies at any time before the effective exercise thereof by filing with us a written notice of revocation or duly executed proxy bearing a later date, or by voting in person at the Meeting. Proxies are being made available to shareholders on or about Tuesday, September 29, 2020. Certain officers, directors, employees, and agents of the Company, none of whom will receive additional compensation therefor, may solicit proxies by telephone, emails, or other personal contact. We will bear the cost for the solicitation of the proxies, including postage, printing, and handling, and will reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of shares and ADSs.

Availability of Proxy Materials

Copies of the proxy card, the notice of the Meeting and this Proxy Statement are available at the “Investor Relations” section of our Company website, www.formulasystems.com. The contents of that website are not a part of this Proxy Statement.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the number of ordinary shares beneficially owned, directly or indirectly, by (i) each person known by us to be the owner of more than 5% of our outstanding ordinary shares, and (ii) all of our directors and executive officers as a group, as of June 30, 2020.

| Name | | Number of Ordinary Shares

Beneficially Owned (1) | | | Percentage of Ownership (2) | |

| Asseco Poland S.A. (3) | | | 5,733,574 | | | | 37.5 | % |

| Guy Bernstein (4) | | | 1,817,973 | | | | 11.9 | % |

| Menora Mivtachim Holdings Ltd.(5) | | | 1,101,755 | | | | 7.2 | % |

| Clal Insurance Enterprises Holdings Ltd. and affiliates (6) | | | 960,661 | | | | 6.3 | % |

| Harel Insurance Investments & Financial Services Ltd.(7) | | | 1,238,820 | | | | 8.1 | % |

| Yelin Lapidot Holdings Management Ltd. (8) | | | 951,469 | | | | 6.2 | % |

| Phoenix Holdings Ltd. (9) | | | 964,685 | | | | 6.3 | % |

| All directors and executive officers as a group (8 persons) (10) | | | 1,838,806 | | | | 11.97 | % |

| (1) | Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, or the SEC, and generally includes voting or investment power with respect to securities. Ordinary shares underlying options currently exercisable or exercisable within 60 days of the date of this table are deemed outstanding for computing the ownership percentage of the person holding such options but are not deemed outstanding for computing the ownership percentage of any other person. Except as indicated by footnote, and subject to community property laws where applicable, the persons named in the table above have sole voting and investment power with respect to all shares shown as beneficially owned by them. |

| (2) | The percentages shown are based on 15,294,267 ordinary shares (including shares represented by ADSs, and shares subject to restrictions and repurchase by us) issued and outstanding as of June 30, 2020. |

| (3) | Based on Amendment No. 3 to Schedule 13D filed by Asseco Poland S.A., or Asseco, with the SEC on October 19, 2017 and on a written notification received from Asseco in March 2020. Includes 1,817,973 ordinary shares owned by Mr. Guy Bernstein, with respect to which Asseco currently possesses the voting rights pursuant to a voting agreement between Asseco and Mr. Bernstein. Due to the public ownership of its shares, Asseco is not controlled by any other corporation or any one individual or group of shareholders. |

| (4) | Based on Amendment No. 2 to Schedule 13D filed by Mr. Bernstein with the SEC on October 19, 2017 and on a written notification received from Mr. Bernstein in June 2020 . Consists of (a) (i) 260,040 ordinary shares, and (ii) an additional 1,122,782 ordinary shares, all of which are held in trust for Mr. Bernstein, and (b) an additional 435,151 ordinary shares, of which (iii) 300,366 are held by Mr. Bernstein and (iv) 134,785 are held in trust for Mr. Bernstein. Asseco currently possesses the voting rights to all such shares pursuant to a voting agreement between Asseco and Mr. Bernstein. |

| (5) | Based on written notification received from Menora Mivtachim Holdings Ltd., or Menora Holdings, on June 30, 2020. Such ordinary shares are beneficially owned by Menora Holdings and by entities that are direct or indirect, wholly-owned or majority-owned, subsidiaries of Menora Holdings. The economic interest or beneficial ownership in a portion of the foregoing ordinary shares (including the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, such shares) is held for the benefit of insurance policy holders, the owners of portfolio accounts, or the members of the mutual funds, provident funds, or pension funds, as the case may be. |

| (6) | Based on written notification received from Clal Insurance Enterprises Holdings Ltd., or Clal, on June 30, 2020. Clal is a publicly held Israeli corporation. Out of the 960,661 ordinary shares beneficially owned by Clal: : (i) 1,090,058 are held for members of the public through, among others, provident funds and/or mutual funds and/or pension funds and/or insurance policies and/or exchange traded funds, which are managed by subsidiaries of Harel Insurance, each of which subsidiaries operates under independent management and makes independent voting and investment decisions and (ii) 11,697 ordinary shares are beneficially held for Harel Insurance own account. |

| (7) | Based on written notification received from Harel Insurance Investments & Financial Services Ltd., or Harel Insurance, on June 30, 2020. Harel Insurance is a publicly held Israeli corporation. Out of the 1,238,820 ordinary shares beneficially owned by Harel Insurance: (i) 1,128,417 are held for members of the public through, among others, provident funds and/or mutual funds and/or pension funds and/or insurance policies and/or exchange traded funds, which are managed by subsidiaries of Harel Insurance, each of which subsidiaries operates under independent management and makes independent voting and investment decisions;, and (ii) 110,403 ordinary shares are beneficially held for Harel Insurance own account. |

| (8) | Based on written notification received from Yelin Lapidot on June 30, 2020. Out of the 951,397 ordinary shares beneficially owned by Yelin: (i) 577,440 are beneficially owned Yelin Lapidot Provident Funds Management Ltd., or Yelin Provident, and (ii) 374,029 are beneficially owned by mutual funds managed by Yelin Lapidot Mutual Funds Management Ltd., or Yelin Mutual. Each of Yelin Provident and Yelin Mutual is a wholly-owned subsidiary of Yelin. Messrs. Dov Yelin and Yair Lapidot each own 24.38% of the share capital and 25% of the voting rights of Yelin, and are responsible for the day-to-day management of Yelin Lapidot Holdings. The ordinary shares beneficially owned are held for the benefit of the members of the provident funds and the mutual funds. Each of Yelin, Yelin Provident, Yelin Mutual and Messrs. Yelin and Lapidot disclaims beneficial ownership of the subject ordinary shares. |

| (9) | Based on written notification received from Phoenix Holdings Ltd. on June 30, 2020. The ordinary shares held by Phoenix Holdings are beneficially owned by various direct or indirect, majority or wholly-owned subsidiaries of Phoenix Holdings, or the Phoenix Subsidiaries. The Phoenix Subsidiaries manage their own funds and/or the funds of others, including for holders of exchange-traded notes or various insurance policies, members of pension or provident funds, unit holders of mutual funds, and portfolio management clients. Each of the Phoenix Subsidiaries operates under independent management and makes its own independent voting and investment decisions. As of June 30, 2020, the securities reported herein were held as follows: (i) Excellence trust funds: 198,827; (ii) The Phoenix “nostro” accounts: 45,137; and (iii) Partnership for Israeli shares and partnership for investing in shares indexes: 720,721. (All ownership rights in this partnership belong to companies that are part of Phoenix Group. The amount of ownership rights held by such companies in the partnership changes frequently according to a mechanism provided in the partnership agreement) |

| (10) | Includes the shares described in note (4) above, 10,833 vested restricted shares granted to Asaf Berenstin, the Company’s Chief Financial Officer, on November 13, 2014 and on August 17, 2017 under the Company’s 2011 Employee and Officer Share Incentive Plan. Besides Mr. Bernstein and Mr. Berenstin, Mrs. Maya Solomon-Ella, the Company’s Chief Operations Officer (who was granted 10,000 restricted shares in November 2018, of which 5,000 are vested), none of our other directors or executive officers beneficially owns any ordinary shares (whether actual ordinary shares or shares issuable upon exercise of options). |

Board Practices, Corporate Governance and Compensation of Our Officers and Directors

Item 6.B of our annual report on Form 20-F for the year ended December 31, 2019, which we filed with the SEC on June 29, 2020 and amended on July 2, 2020, or our 2019 Annual Report, contains information regarding compensation paid to our directors and to our three highest-paid office holders in 2019. Item 6.C of our 2019 Annual Report contains additional information regarding our Board, its committees, and our corporate governance practices. We encourage you to review those items of our 2019 Annual Report (which we incorporate by reference herein) to obtain additional information regarding our Board and our other office holders.

PROPOSAL 1, 2 AND 3

RE-ELECTION OF EXISTING (NON-EXTERNAL) DIRECTORS

Background

Under the Companies Law, and our Articles of Association, the management of our business is vested in our Board. The Board may exercise all powers and may take all actions that are not specifically granted to our shareholders.

Our Articles of Association provide that we may have no fewer than three and no more than 11 directors, as may be determined from time to time at a general meeting of shareholders. Our Board currently consists of five directors, including two external directors appointed in accordance with the Companies Law who were re-elected for an additional, third term of three years at the Company’s last special general meeting held on January 4, 2019. Our directors, other than the external directors, are elected at each annual general meeting of shareholders and generally serve until the next annual general meeting, unless earlier removed or replaced. All of the members of our Board, other than external directors, may be re-elected for an unlimited number of terms. Our Board may temporarily fill vacancies in the Board until the next annual general meeting of shareholders, provided that the total number of directors will not exceed the maximum number permitted under our Articles of Association.

Of our current three directors (which excludes external directors), all three— Messrs. Marek Panek, Rafal Kozlowski and Ohad Melnik —have been nominated by our Board for re-election at the Meeting. Our Board recommends that our shareholders re-elect those nominees pursuant to Proposals 1, 2 and 3, respectively. It is intended that proxies (other than those directing the proxy holders to vote against any or all of the listed nominees) will be voted for the election of the three (3) nominees named below as directors.

Among the directors nominated for reelection at the Meeting, Mr. Ohad Melnik has been determined by the Board to satisfy the independent director requirements under the NASDAQ Listing Rules.

Under the Companies Law, the affirmative vote of the holders of a majority of the ordinary shares represented at the Meeting, in person or by proxy, entitled to vote and voting on the matter, is required to reelect as directors the nominees named above.

Each of the nominees, whose professional background is provided below, has advised the Company that he is willing, able and ready to serve as a director if re-elected. Each nominee has certified to us that he meets all of the requirements of the Companies Law for election as a director of a public company, and possesses the necessary qualifications and has sufficient time, to fulfill his duties as a director of the Company, taking into account the size and needs of our Company. We do not have any understanding or agreement with respect to the future election of any of the nominees named.

Biographic Information Regarding Director Nominees

Marek Panek has served as one of our directors since November 2010. Since January 2007 he has been the Executive Board Member of Asseco Poland S.A. and he is responsible for supervising the Capital Group Development Division and the EU Projects Office. Mr. Panek also holds and has held several other positions at Asseco and its affiliates, including Executive Board Member in Asseco International, a.s. (since October 2017), Supervisory Board Member of Asseco Central Europe, a.s. (since September 2011), Member of Board of Directors of Asseco Denmark (since March 2011) and Peak Consulting Group ApS (since January 2016), Supervisory Board Member of Asseco Lietuva UAB (since June 2011), Chairman of GSTN Consulting Sp. z o.o. (since November 2017), Supervisory Board Member of Asseco Innovation Fund Sp. z o.o. (since December 2018) and Chairman of the Supervisory Board of Nextbank Software (since March 2019). Mr. Panek first joined Asseco in 1995, having served in the following positions for the following periods of time: Marketing Specialist (from September 1995 to September 1996); Marketing Director (from October 1996 to March 2003); Sales and Marketing Director (from April 2003 to March 2004); and Member of the Board, Sales and Marketing Director (from March 2004 to January 2007). Prior to joining Asseco, Mr. Panek was employed at the ZE Gantel Sp. z o.o. from 1993 to 1995. Mr. Panek graduated from the Faculty of Mechanical Engineering and Aeronautics of the Rzeszów University of Technology in 1994, having been awarded a master’s degree in engineering.

Rafał Kozlowski has served as one of our directors since August 2012. Since June 2012, Mr. Kozlowski has served as Vice President of the Management Board and Chief Financial Officer of Asseco. Mr. Kozlowski is also a member of the Asseco Group Board of Directors. From May 2008 to May 2012, Mr. Kozlowski served as Vice President of Asseco South Eastern Europe S.A. responsible for the company’s financial management. Mr. Kozlowski was directly involved in the acquisitions of companies incorporated within the holding of Asseco South Eastern Europe, as well as in the holding’s IPO process at the Warsaw Stock Exchange From 1996 to 1998, he served as Financial Director at Delta Software, and subsequently, from 1998 to 2003 as Senior Manager at Veraudyt. In the years 2004-2006, he was Head of Treasury Department at Softbank S.A. where he was delegated to act as Vice President of Finance at the company’s subsidiary Sawan S.A. From 2007 through June 2009, he served as Director of Controlling and Investment Division at Asseco Poland S.A. Mr. Kozlowski graduated of the University of Warsaw, obtaining Master degree at the Faculty of Organization and Management in 1998. He completed the Project Management Program organized by PMI in 2004, the International Accounting Standards Program organized by Ernst & Young Academy of Business in the years 2005-2006 and the Emerging CFO: Strategic Financial Leadership Program by Stanford GSB in 2019.

Ohad Melnik was elected to our Board in January 2019. Mr. Melnik has served as the director of the payment methods department and the finance compliance department of IFOREX International Group since 2004. From 2002 through 2004, Mr. Melnik served as the security officer and logistic planner of Danagis Ltd. In addition, from 2008 through 2015, Mr. Melnik served as a director of Peninsula Group Ltd. From 2012 through 2015, Mr. Melnik served as a director of Jerusalem Technology Investments Ltd. Mr. Melnik holds a B.A. degree in business administration and an M.B.A. degree (cum laude) from the College of Management. Mr. Melnik also graduated from the Executive MS Finance Program of the Baruch College, City University of New York (with Honors).

Proposed Resolutions

It is proposed that at the Meeting, the following resolutions be adopted pursuant to Proposals 1, 2 and 3, respectively:

“RESOLVED, that the reelection of Mr. Marek Panek as a director of the Company, to serve until our next annual general meeting of shareholders and until his successor is duly elected, be, and hereby is, approved in all respects.”

“RESOLVED, that the reelection of Mr. Rafal Kozlowski as a director of the Company, to serve until our next annual general meeting of shareholders and until his successor is duly elected, be, and hereby is, approved in all respects.”

“RESOLVED, that the reelection of Mr. Ohad Melnik as a director of the Company, to serve until our next annual general meeting of shareholders and until his successor is duly elected, be, and hereby is, approved in all respects.”

Required Vote

Under the Companies Law and our Articles of Association, the affirmative vote of the holders of a majority of the ordinary shares represented at the Meeting, in person or by proxy, entitled to vote and voting on the matter (excluding abstentions and broker non-votes), is required to re-elect as directors each of the nominees named above.

Board Recommendation

The Board recommends a vote FOR the reelection of the foregoing director nominees pursuant to Proposals 1, 2 and 3, respectively.

PROPOSAL 4

RE-APPOINTMENT OF INDEPENDENT AUDITORS AND APPROVAL OF THEIR ANNUAL REMUNERATION

Background

At the Meeting, our shareholders will be asked to approve the reappointment of Kost Forer Gabbay & Kasierer, registered public accounting firm, a member firm of Ernst & Young Global, which we refer to as Kost Forer, as our independent registered public accounting firm for the year ending December 31, 2020 and until our next annual general meeting of shareholders, pursuant to the recommendation of our audit committee and Board. Kost Forer has no relationship with us or any of our subsidiaries or affiliates except as independent registered public accountants and, from time to time and to a limited extent, as tax consultants and providers of some audit-related services.

In accordance with applicable law and our articles of association, our Board has delegated to our audit committee the authority to determine the remuneration of Kost Forer based on the volume and nature of its services. At the Meeting, our shareholders will be asked to authorize the Board and, based on that delegation, the audit committee, to determine that remuneration in accordance with the volume and nature of Kost Forer’s services.

The following table sets forth, for the years ended December 31, 2018 and 2019, the fees billed to us (including our subsidiaries and affiliate company) by Kost Forer:

| | | Year Ended December 31, | |

| Services Rendered | | 2018 | | | 2019 | |

| | | (US dollars in thousands) | |

| Audit (1) | | $ | 1,620 | | | $ | 1,756 | |

| Tax and other (2) | | $ | 610 | | | $ | 553 | |

| Total | | $ | 2,230 | | | $ | 2,309 | |

| (1) | The audit fees for the years ended December 31, 2018 and 2019 were for professional services rendered for: the audits of our annual consolidated financial statements; agreed-upon procedures related to the review of our consolidated quarterly information; statutory audits of the Company and its subsidiaries and affiliated companies; issuance of comfort letters and consents; and assistance with review of documents filed with the SEC. |

| (2) | Tax fees for the years ended December 31, 2018 and 2019 were for services related to tax compliance, including the preparation of tax returns and claims for refund, and tax advice. |

The following table sets forth, for the years ended December 31, 2018 and 2019, the fees billed to the Company (on a stand-alone basis, excluding services provided to the subsidiaries and affiliates of the Company) by Kost Forer:

| | | Year Ended December 31, | |

| Services Rendered | | 2018 | | | 2019 | |

| | | (US dollars in thousands) | |

| Audit (1) | | $ | 84 | | | $ | 53 | |

| Tax and other (2) | | $ | 28 | | | $ | 47 | |

| Total | | $ | 112 | | | $ | 100 | |

| (1) | The audit fees for the years ended December 31, 2018 and 2019 were for professional services rendered for: the audits of our annual consolidated financial statements; agreed-upon procedures related to the review of our consolidated quarterly information; statutory audits of Formula; issuance of comfort letters and consents; and assistance with review of documents filed with the SEC. |

| (2) | Tax fees for the years ended December 31, 2018 and 2019 were for services related to tax compliance, including the preparation of tax returns and claims for refund, and tax advice. |

Policy on Pre-Approval of Audit and Non-Audit Services of Independent Auditors

Our audit committee is responsible for the oversight of our (and our subsidiaries’) independent auditors’ work. Our audit committee has adopted a policy and procedures for the pre-approval of audit and non-audit services rendered by our independent registered public accountants, Kost Forer. Pre-approval of an audit or non-audit service may be given as a general pre-approval, as part of the audit committee’s approval of the scope of the engagement of our independent auditor, or on an individual basis. Any proposed services that exceed general pre-approved levels also require specific pre-approval by our audit committee. The policy prohibits retention of the independent public accountants to perform the prohibited non-audit functions defined in Section 201 of the Sarbanes-Oxley Act of 2002 or the rules of the SEC, and also requires the audit committee to consider whether proposed services are compatible with the independence of the public accountants.

Proposed Resolution

We are proposing adoption by our shareholders of the following resolution at the Meeting:

“RESOLVED, that the re-appointment of Kost, Forer, Gabbay & Kasierer, a member of EY Global, as the independent auditors of Formula Systems (1985) Ltd. for the year ending December 31, 2020 and until the next annual general meeting of shareholders of Formula Systems (1985) Ltd. be, and hereby is, approved, and the Board (upon recommendation of the audit committee) and/or the audit committee (subject to ratification of the Board) be, and hereby is, authorized to fix the remuneration of such independent auditors in accordance with the volume and nature of their services.”

Required Vote

The affirmative vote of the holders of a majority of the voting power represented at the Meeting and voting on this proposal in person or by proxy (excluding abstentions and broker non-votes) is necessary to approve the resolution to approve the re-appointment of our independent auditors and authorize the Board and/or audit committee to fix the independent auditors’ remuneration in accordance with the volume and nature of their services, for the year ending December 31, 2020.

Board Recommendation

The Board unanimously recommends a vote FOR the foregoing resolution approving the re-appointment of Kost Forer as our independent auditors and authorization of our Board and/or audit committee to fix the independent auditors’ remuneration, for the year ending December 31, 2020.

PROPOSAL 5

APPROVAL OF THE AWARD OF EQUITY-BASED COMPENSATION TO OUR CHIEF EXECUTIVE OFFICER

Background

Under the Companies Law (as amended in December 2012), the terms of service of the chief executive officer (“CEO”) of a publicly traded company, or any changes to those terms, including the award of equity-based compensation, generally require the approval of the compensation committee, the board of directors and the shareholders of a company by a special majority (as detailed below), in that order. The terms of employment of our CEO, Mr. Guy Bernstein, were originally approved by the Board on December 17, 2008 and amended by the Board on March 17, 2011 and on March 15, 2012.1

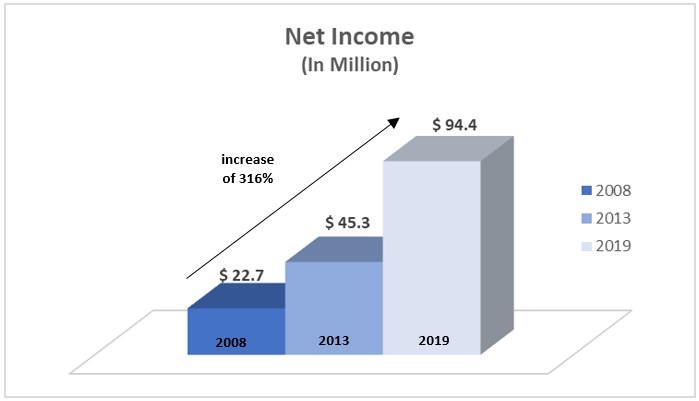

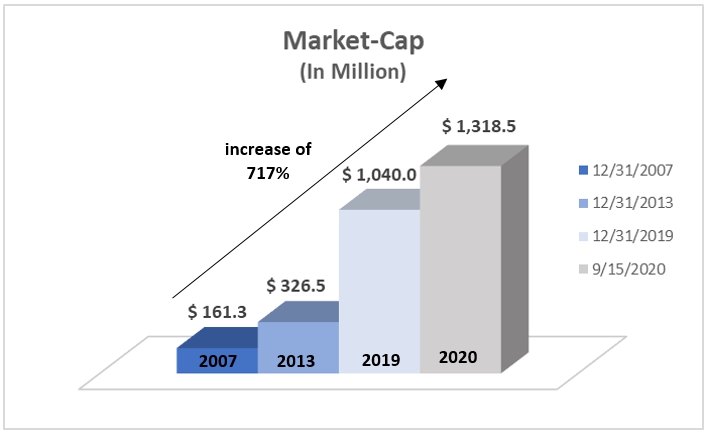

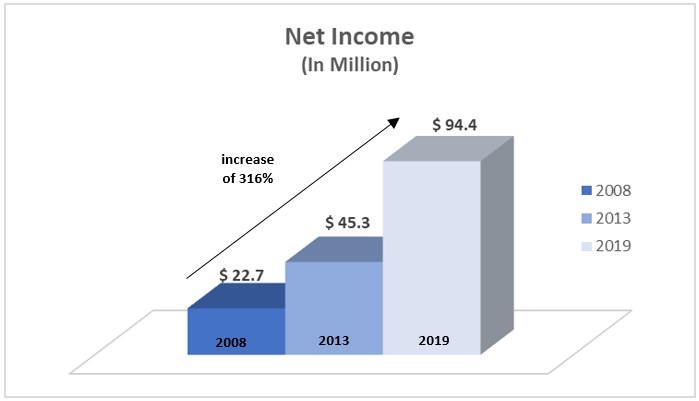

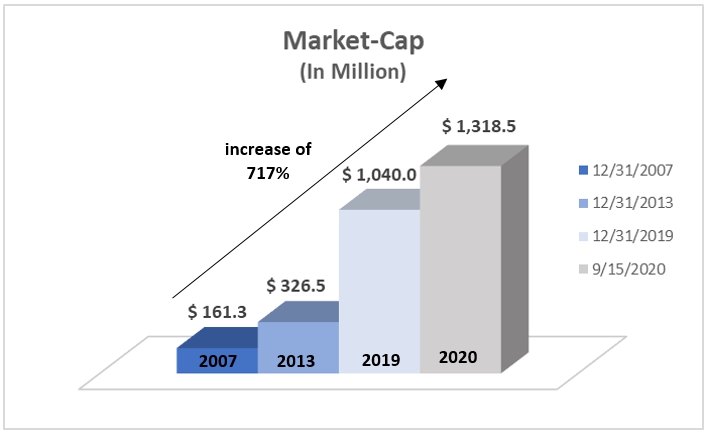

Outstanding Overall Operating Results Under Guy Bernstein

Since the appointment of Mr. Bernstein as the Company’s CEO over twelve years ago (in January 2008), the Company has gone through a significant transformation, in particular the turnaround that Mr. Bernstein has led in the strategy and performance of both Sapiens International Corporation N.V., or Sapiens, and Magic Software Enterprises Ltd., or Magic Software, two subsidiaries of the Company. Mr. Bernstein has served as Chairman of the Board of Directors of each of Matrix IT Ltd., or Matrix (also a subsidiary of the Company), and Sapiens, since 2008 and 2009, respectively, and as the CEO of Magic Software since April 2008. In parallel to those improvements on the subsidiary level, the Company’s own revenues, operating profits, net income, and market cap have grown significantly.

In light of the Company’s performance under the leadership of Mr. Bernstein, and his exceptional achievements since his initial service agreement with our Company was signed, our Compensation Committee and Board believe that Mr. Bernstein is extremely valuable to the success of the Company and the most suitable candidate to continue leading the Company into the future. Given the great importance that the Compensation Committee and the Board attribute to the continuation of Mr. Bernstein's term as CEO of the Company, they have examined the scope and components of retention awards accepted in the market for similar executive officers. As a result of that examination, our Compensation Committee and the Board have approved, and resolved to recommend that our shareholders approve, the grant of a new eight-year equity-based award to our CEO, in order to renew his commitment to the Company and retain him at the Company for at least eight additional years.

| 1 | As of the current time, the services agreement pursuant to which Mr. Bernstein serves as our CEO is being amended in order to provide that his services will be provided (and his compensation paid) to the Company via a private company that he controls. Despite this amendment, Mr. Bernstein remains solely responsible for providing the services personally under the agreement. |

The following graphs demonstrate the extraordinary performance of the Company, under Mr. Bernstein’s leadership:

Peer Compensation Study

In order to evaluate Mr. Bernstein’s prospective eight-year equity-based grant and given our Company’s growth during the last twelve years, our Compensation Committee and Board reviewed benchmark information relating to the compensation of chief executive officers of peer group companies. The benchmark information was based on market surveys conducted in 2020 by two separate and experienced surveying companies, Sharon Aliza Management and Consulting (1997) Ltd. and Alpha Bond Consulting Ltd., which targeted 24 peer group companies that are either from a similar business sector as the Company’s (i.e., technology sector), that have a similar scope and size of operations to that of the Company, or a similar market cap as the Company’s, and that have similar local and international business focuses as the Company. The comparison of Mr. Bernstein’s compensation terms to the benchmark information was conducted by examining the terms and conditions of Mr. Bernstein’s service agreement with the Company, dated as of January 2008, as amended from time to time (and as currently remains in full force and effect), as supplemented by the proposed award of equity-based compensation, to the compensation of CEOs of peer companies.

Overall Compensation Package Overview

Based on the peer compensation study, our Compensation Committee and Board propose to offer to our CEO a new equity-based grant as detailed below. The intention of our Compensation Committee and Board is that following the approval of the proposed new eight-year equity compensation award, no additional changes to our CEO’s compensation package will be made during the next eight years. A significant majority of the value of our CEO’s total annual compensation package (assuming the approval of the proposed equity award) will not be fixed and guaranteed, and will either be performance-linked (annual cash bonus and performance-based RSUs) or subject to his continued engagement with the Company and to the Company’s share price (time-based and performance-based vesting RSUs), thereby creating a strong correlation between payment and performance.

Our Compensation Committee and Board believe that the proposed equity grant will effectively supplement our CEO’s existing compensation by serving the goal of long-term retention, strongly incentivizing our CEO to link his future with our Company, while motivating him to continue pushing and leading the Company to overachieve for the benefit of its shareholders.

Proposed CEO Equity-Based Compensation

RSU Grant

Based on the peer compensation study and other factors identified above, our Compensation Committee, followed by our Board have approved and recommend that our shareholders approve an equity grant of Restricted Stock Units, or RSUs, in respect of ordinary shares of the Company par value NIS 1.00 each, to our CEO, subject to the following terms:

| ● | Number of RSUs: a total grant of 611,771 RSUs, spread into eight individual annual installments, for each of the eight (8) calendar years starting with 2020 (effective as of January 1, 2020), each of which installment constitutes 0.5%2 of the total issued and outstanding share capital of the Company as of the date of grant. |

| ● | Vesting Period and Vesting Terms: Eight (8) year vesting period (from January 1, 2020 to December 31, 2027, which we refer to as the “Vesting Period”) in accordance with the following terms: |

| (i) | 80% of the RSUs (i.e., 489,417 RSUs as of the date hereof) are subject to time-based vesting and shall vest at the end of the Vesting Period, subject to the continued engagement of Mr. Bernstein with the Company as of that time; and |

| (ii) | up to 20% of the RSUs (i.e., 122,354 RSUs as of the date hereof) are subject to performance-based vesting, and shall vest at the end of the Vesting Period, on a pro-rata basis with respect to each fiscal year (starting as of January 1, 2020) during the Vesting Period in which the Target EBITDA (as defined below) is achieved, subject to the continued engagement of Mr. Bernstein with the Company. At the end of the Vesting Period, the number of performance-based RSUs that vests shall be equal to (i) the number of fiscal years in which the Target EBITDA was achieved multiplied by (ii) 15,294.25 RSUs (rounded to the nearest whole number, up to a cap of 122,354 RSUs in total). |

The performance-based criteria for the vesting of the RSUs shall be based on year-over-year improvement of the Company’s financial performance— which will be reflected in the Company’s achievement of the Target EBITDA in a given fiscal year. That indicator for year-over-year improvement that is required to reach the performance vesting criteria is binary, so that there is no partial achievement with respect to that performance criteria.

The “Target EBITDA” in a given fiscal year during the Vesting Period shall mean the Company’s EBITDA in that certain fiscal year (as reflected in the Company’s annual audited consolidated financial statements), excluding the cost attributed to the applicable portion of the RSUs in the Company’s annual audited consolidated financial statements for the applicable fiscal year (as to which the review of performance is made to determine whether one eighth of the performance-based RSUs (i.e., 15,294.25 RSUs) shall become vested at the end of the Vesting Period). The Target EBITDA shall be not less than 105% of 75% of the Company’s EBITDA in the previous fiscal year, excluding the cost attributed to the applicable portion of the RSUs in the Company’s annual audited consolidated financial statements for such previous fiscal year (the “Previous Year”). (For example, the target for the fiscal year 2020 shall only be met if the EBITDA in 2020, excluding the cost attributed to the applicable portion of the RSUs in the Company’s annual audited consolidated financial statements for 2020, is not less than 105% of 75% of the EBITDA in 2019. Such examination of EBITDA shall be made on the basis of the Company’s annual audited consolidated financial statements as reflected in the Company’s annual report on Form 20-F, and in the event that the Company sells any of its operations, the Target EBITDA shall be adjusted as applicable for future reference by removing the results of the operations that were sold.

| 2 | All installments together constitute 4% of the total issued and outstanding share capital of the Company as of the date of grant. |

In the event that with respect to any specific fiscal year (the “Specific Year”), the Target EBITDA is not achieved, the Target EBITDA with respect to such Specific Year will still be deemed to have been met for the purpose of vesting of RSUs in the event that either: (i) the EBITDA in the fiscal year immediately following the Specific Year was at least 110.25% of 75% of the Company’s EBITDA in the year preceding the Specific Year, or (ii) in case that the condition in the foregoing clause (i) was not met, then the EBITDA in the second fiscal year following the Specific Year was at least 115.7625% of 75% of the Company’s EBITDA in the year preceding the Specific Year. Accordingly, in case that either clause (i) or (ii) was met for a certain Specific Year, then the vesting with respect to such Specific Year shall be deemed to have been achieved, and those RSUs shall become vested as of the end of the Vesting Period. In the event that neither of the conditions described in clauses (i) or (ii) was met, the portion of RSUs for the applicable Specific Year shall automatically expire and terminate.

Notwithstanding the foregoing, in case the Target EBITDA is met (in accordance with the above terms) in a certain fiscal year, yet the Target EBITDA is less than 105% of 75% of the average EBITDA for the three fiscal years that consist of the subject fiscal year and the two preceding fiscal years (excluding the cost attributed to the applicable portion of the RSUs in Company’s annual audited consolidated financial statements for such applicable fiscal years), then regardless of meeting the Target EBITDA, the number of performance-based RSUs that vests shall be reduced by 20%.

CEO Dividend Adjustment

In addition to the RSU grant terms described above, our Compensation Committee and our Board have approved and recommend to our shareholders to approve, an adjustment to the above-described RSU grant based on any future dividends that we may distribute to our shareholders. During the Vesting Period of the RSUs, in the event that any dividend, in cash or in kind, is distributed to the shareholders of the Company, then in addition to the distribution to all shareholders, there will be an equivalent payment to the CEO with respect to all RSUs that were not converted into shares (whether or not vested) in an amount equal to the pro-rata portion of the overall dividend amount that the RSUs constitute out of the issued and outstanding share capital of the Company as of the date of the distribution. For those purposes, the RSUs will be counted as if they are already vested and converted into shares. These special RSU dividend amounts shall be paid and/or set aside by the Company for the benefit of Mr. Bernstein, all as described below (we refer to each of these amounts as a “Dividend Amount”). For the purpose of payment of the Dividend Amounts to the CEO, the Vesting Period shall be regarded as if it has commenced on January 1, 2020 (other than with respect to distributions and any related Dividend Amount which were made prior to the grant of the RSUs and which are explicitly excluded), and will be divided into 32 fiscal quarters (each, referred to as a “Fiscal Quarter”). The Dividend Amount within each dividend distributed by the Company to its shareholders will be released to, or set aside for, Mr. Bernstein together with the distribution of the dividend. The portion of the Dividend Amount to be released to Mr. Bernstein will in each case be based on the number of Fiscal Quarters that have lapsed at the time of distribution of the dividend. The remainder of the Dividend Amount will be set aside and paid to Mr. Bernstein on a pro-rata basis upon the expiration of each Fiscal Quarter until the Dividend Amount is released in full at the end of the Vesting Period for the RSUs.

The payment of the CEO’s dividend adjustment is subject to the following terms in case of termination of the CEO’s service for the Company:

| (i) | In case of termination of the CEO’s services agreement by the Company for Cause (as defined in the CEO’s services agreement with the Company), or resignation by the CEO without Good Reason (as defined in the RSU grant agreement appended to this Proxy Statement as Appendix A), any and all previously declared but not fully paid Dividend Amount(s), which would have otherwise been paid to the CEO on a pro-rata basis upon the expiration of each Fiscal Quarter until the applicable Dividend Amount is released in full at the end of the Vesting Period, shall be forfeited as of the termination date and have no further legal validity, nor there be any additional entitlement for future payments resulting from future distributions, |

| (ii) | In case of termination of the CEO’s services agreement by the Company not for Cause, or resignation by the CEO for Good Reason, any and all previously declared but not fully paid Dividend Amount(s) which would have otherwise been paid to the CEO on a pro-rata basis upon the expiration of each Fiscal Quarter until the applicable Dividend Amount is released in full at the end of the Vesting Period, shall fully vest and become due on the date of termination (and there will be no additional entitlement for future payments resulting from distributions declared by the Company following the termination date). |

For example, assuming that the Company distributes at the end of fiscal year 2021 a cash dividend, then the total Dividend Amount to which the CEO would be eligible will be treated as follows: a sum equal to the product of the Dividend Amount multiplied by a fraction, the numerator of which is 8 (since 8 Fiscal Quarters under the Agreement will have elapsed) and the denominator of which is 32 (constituting the total number of Fiscal Quarters during which the RSUs will vest for the CEO) (i.e., 8/32 ) shall be paid immediately to Mr. Bernstein, and thereafter 1/32 of such Dividend Amount shall be released and paid to Mr. Bernstein upon the expiration of each Fiscal Quarter until the Dividend Amount is paid in full.

Accelerated Vesting of RSUs Upon Certain Termination Events

In the event of termination of the CEO’s services agreement with the Company, by the Company for Cause (as defined in the services agreement), the RSUs will immediately terminate and become null and void, and all interests and rights of the CEO in and to the same will expire.

In case of termination of the CEO’s services agreement by the Company not for Cause, or due to the resignation of the CEO for Good Reason, all unvested RSUs that could have vested from the grant date until December 31, 2027, assuming all performance and time conditions and future targets would have been fulfilled (including all targets that would have resulted in vesting with respect to any Previous Year which could have still been met in future years), will accelerate and become immediately vested and exercisable, regardless of the actual occurrence or failure to occur of any of the future performance targets relating to those RSUs.

In the event of resignation by the CEO not for Good Reason, the CEO will vest, in an accelerated manner, in such portion of the then-remaining unvested RSUs as equals the pro-rata portion of the Vesting Period that has already lapsed (based on the full number of Fiscal Quarters that have lapsed form January 1, 2020 until the actual resignation date, including notice period). However, any Performance Based RSUs for which the applicable target was not achieved up until the resignation date (including the notice period) will expire and terminate.

Compensation Policy and Other Considerations

Each of our Compensation Committee and Board has confirmed that the terms of engagement of Mr. Bernstein with the Company, as previously approved by our Board in 2008, and as amended in 2011 and in 2012, as supplemented by the proposed equity-based grant described in this Proposal 5, are consistent with the compensation policy of the Company. Each of the Compensation Committee and Board has furthermore confirmed that our CEO’s proposed total compensation is consistent with our Company’s targets, business strategy and provides our CEO with significant incentive to generate even greater value to our shareholders, and is also within the range of the peer compensation study, though at the upper end of the scale, compared to other companies. Consequently, each of our Compensation Committee and Board believes that it is in the best interest of the Company to approve the proposed award of equity-based compensation to our CEO.

If approved by the shareholders, our CEO’s grant will be effective as of the date of its approval by the shareholders, while the Vesting Period of the RSUs will begin as of January 1, 2020.

A copy of the proposed RSU grant agreement is appended to this Proxy Statement as Appendix A. The description of the grant contained in this Proposal 5 is modified in its entirety by reference to that agreement.

Proposed Resolution

We are proposing the adoption by our shareholders of the following resolution pursuant to this Proposal 5:

“RESOLVED, that the award of equity-based compensation for Mr. Guy Bernstein, the Company’s CEO, as described in Proposal 5 in the Proxy Statement relating to the Meeting, be, and hereby is, approved.”

Required Vote

The vote required for approval of the equity-based compensation award for the CEO under this Proposal 5 is the affirmative vote of the holders of a majority of the voting power present in person or represented by proxy at the Meeting and voting on this proposal (excluding abstentions and broker non-votes).

In addition, under the Companies Law, the approval of the equity-based compensation award for the CEO under this Proposal 5 requires that either of the following two voting conditions be met as part of the approval by a majority of shares present and voting thereon:

| ● | the majority voted in favor of the compensation terms includes a majority of the shares held by shareholders who are not controlling shareholders and do not have a conflict of interest (referred to under the Companies Law as a “personal interest”) in the approval of those compensation terms that are voted at the Meeting (which excludes abstentions and broker non-votes); or |

| ● | the total number of shares held by non-controlling, non-conflicted shareholders (as described in the previous bullet-point) voted against the amendment to our CEO’s compensation terms must not exceed 2% of the aggregate voting power in the Company. |

Please see “Vote Required for Approval of the Proposals” above in this Proxy Statement for an explanation as to what constitutes a controlling shareholder and/or a conflict of interest with respect to your vote on this proposal.

A shareholder must inform us before the vote (or if voting by proxy or voting instruction form, indicate via the proxy card or voting instruction form) whether or not such shareholder is a controlling shareholder or has a conflict of interest in the approval of Proposal 5, and failure to do so disqualifies the shareholder from participating in the applicable vote. In order to confirm that you are not a controlling shareholder and that you do not have a conflict of interest with respect to the approval of Proposal 5 (and to therefore be counted towards or against the special majority required for approval of Proposal 5), you must check the box “FOR” in Item 5A on the accompanying proxy card or voting instruction form when you record your vote on Proposal 5. If you believe that you, or a related party of yours, is a controlling shareholder or has such a conflict of interest and you wish to participate in the vote on Proposal 5, you should instead check the box “AGAINST” in Item 5A on the enclosed proxy card or voting instruction form. In that case, your vote on Proposal 5 will be counted towards determining whether an ordinary majority has been received in favor or against the proposal, but will not be counted towards determining whether a special majority has been achieved for approval of the proposal.

Board Recommendation

Our compensation committee and Board unanimously recommend that you vote in favor of the award of equity-based compensation to our CEO.

PROPOSAL 6

APPROVAL OF AMENDED TERMS FOR RENEWED D&O INSURANCE POLICY

Background

Under the Companies Law, the procurement or amendment of the terms of directors and officers liability, or D&O, insurance coverage for directors and officers of a public company requires the approval of the compensation committee of the board of directors, the board and the shareholders.

Our current D&O insurance policy covers each of our directors and officers and each of the directors and officers of our U.S.-traded subsidiaries— which consist of Sapiens and Magic Software3.

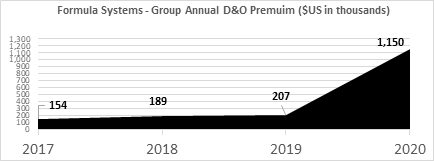

At our 2018 annual general meeting of shareholders held in May 2018, our shareholders approved D&O insurance coverage based on the following parameters:

| (i) | coverage of at least $10,000,000, both per claim and in the aggregate; |

| (ii) | an annual premium to be paid by the Company and its subsidiaries not exceeding an amount representing an increase of 20% or more in any year, as compared to the previous year, and in any event no more than $400,000 per year; and |

| (iii) | any renewal, extension or substitution was to be for the benefit of the Company’s and its subsidiaries’ officers and directors and will otherwise be on terms substantially similar to or better (from the perspective of the directors and officers) than those of the then-effective insurance policy. |

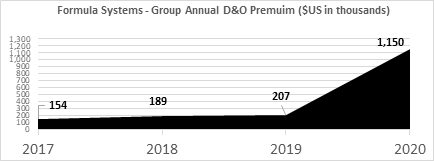

Since that approval, the market for D&O insurance coverage has experienced significant increases in premiums and tightening coverage conditions, especially for U.S.-traded companies. That has been a product, in part, of the substantial growth in the number of class actions filed against U.S.-traded companies, which has doubled in the last three years (from approximately 215 to 400 claims per annum).

The growth in premiums for our D&O insurance coverage (including that of our U.S.-traded subsidiaries) has outpaced the growth in our (and our U.S.-traded subsidiaries’) market capitalization over that same period of time, as shown in the following graphs:

| 3 | None of our subsidiaries Matrix, Michpal Micro Computers (1983) Ltd., InSync Staffing Solutions, Inc. or Ofek Ariel Photography Ltd. is traded publicly in the U.S. For additional information regarding our current subsidiaries, please see our 2019 Annual Report, which we filed with the SEC on June 29, 2020 and amended on July 2, 2020. |

Because of those significant increases in premiums, our D&O insurance coverage for 2020 no longer fits within the parameters approved by our shareholders at our annual shareholder meeting held in May 2018. Consequently, we are required under the Companies Law to currently obtain shareholder approval for amended terms for our renewed D&O insurance as of 2020 and going forward.