| | |

| | Filing under Rule 425 under the U.S. Securities Act of 1933 Filing by: The Sumitomo Trust and Banking Co., Ltd. Subject Company: The Sumitomo Trust and Banking Co., Ltd. Commission File Number: 132-02705 Dated September 24, 2010 |

The Management Integration Plan

Towards creation of “The Trust Bank” with a Combination of Expertise and Comprehensive Capabilities

August 27, 2010

| | • | | I am Kazuo Tanabe, President of Chuo Mitsui Trust Holdings Inc. |

| | • | | On August 24, Chuo Mitsui Trust Group and Sumitomo Trust and Banking Group have reached the final agreement on the management integration announced in November of last year. Today, I will explain the outline of this management integration. |

| | • | | Please take a look at page 2 of the presentation material. |

Objectives and Vision of the New Trust Bank Group

Objectives of the Management Integration

CMTH and STB will combine their personnel, know-how and other managerial resources

?form “The Trust Bank”, a new trust bank group with significant expertise and a wide range of capabilities in swiftly providing comprehensive solutions to its clients

Vision of the New Trust Bank Group (“Sumitomo Mitsui Trust Group”)

Management Principles (“Mission”)

(i) Swiftly provide comprehensive solutions to its clients by fully utilizing its significant expertise and comprehensive capabilities

(ii) Adhere to the principles of sound management based on a high degree of self-discipline with the background of “Trustee Spirit” and establish strong credibility from society

(iii) Strive to fulfill all shareholder expectations by creating distinct values through fusing the various functions featuring the trust bank group

(iv) Offer a workplace where the diversity and creativity of its employees are more fully utilized to add value to the organization and where employees can have pride and be highly motivated in fulfilling their missions

Ideal Model (“Vision”)

—Towards “The Trust Bank” -

Based on the “Trustee Spirit” and with significant expertise and comprehensive capabilities, Sumitomo Mitsui Trust Group will create distinct values by leveraging a new business model, combining its Banking, Asset Management and Administration, and Real Estate businesses, and will move onto the global stage as a leading trust bank group which boasts the largest and highest status in Japan

[Blank]

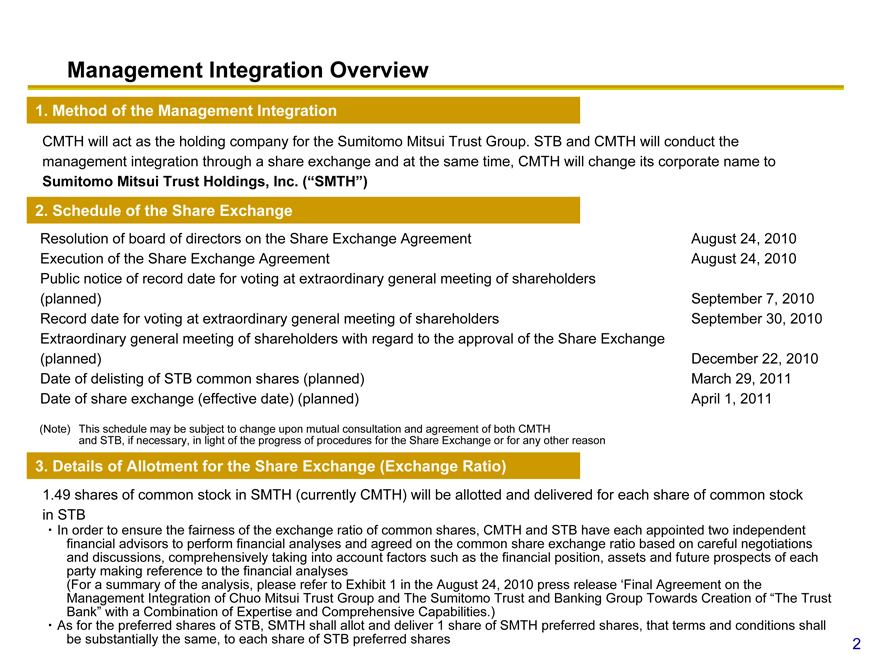

Management Integration Overview

1. Method of the Management Integration

CMTH will act as the holding company for the Sumitomo Mitsui Trust Group. STB and CMTH will conduct the management integration through a share exchange and at the same time, CMTH will change its corporate name to Sumitomo Mitsui Trust Holdings, Inc. (“SMTH”)

2. Schedule of the Share Exchange

Resolution of board of directors on the Share Exchange Agreement

August

24, 2010

Execution of the Share Exchange Agreement

August

24, 2010

Public notice of record date for voting at extraordinary general meeting of shareholders

(planned)

September 7, 2010

Record date for voting at extraordinary general meeting of shareholders

September 30, 2010

Extraordinary general meeting of shareholders with regard to the approval of the Share Exchange

(planned)

December 22, 2010

Date of delisting of STB common shares (planned)

March 29, 2011

Date of share exchange (effective date) (planned)

April 1,

2011

(Note) This schedule may be subject to change upon mutual consultation and agreement of both CMTH and STB, if necessary, in light of the progress of procedures for the Share Exchange or for any other reason

3. Details of Allotment for the Share Exchange (Exchange Ratio)

1.49 shares of common stock in SMTH (currently CMTH) will be allotted and delivered for each share of common stock in STB

? In order to ensure the fairness of the exchange ratio of common shares, CMTH and STB have each appointed two independent financial advisors to perform financial analyses and agreed on the common share exchange ratio based on careful negotiations and discussions, comprehensively taking into account factors such as the financial position, assets and future prospects of each party making reference to the financial analyses

(For a summary of the analysis, please refer to Exhibit 1 in the August 24, 2010 press release ‘Final Agreement on the Management Integration of Chuo Mitsui Trust Group and The Sumitomo Trust and Banking Group Towards Creation of “The Trust Bank” with a Combination of Expertise and Comprehensive Capabilities.)

? As for the preferred shares of STB, SMTH shall allot and deliver 1 share of SMTH preferred shares, that terms and conditions shall be substantially the same, to each share of STB preferred shares

2

| | • | | The management integration will be conducted through a share exchange by The Sumitomo Trust and Banking Co., Ltd. (“STB”) with Chuo Mitsui Trust Holdings Inc. (“CMTH”). |

| | • | | Also, simultaneously with the management integration, CMTH will change its corporate name to Sumitomo Mitsui Trust Holdings, Inc. |

| | • | | The schedule of share exchange is described in page 2 of the presentation material. |

| | • | | Extraordinary general meetings of shareholders of both companies are scheduled on December 22, 2010. |

| | • | | With regard to the share exchange ratio, 1.49 shares of common stock in Sumitomo Mitsui Trust Holdings will be allotted and delivered for each share of common stock in STB. |

| | • | | Next, I will describe the management structure of Sumitomo Mitsui Trust Group. Please turn to page 4. |

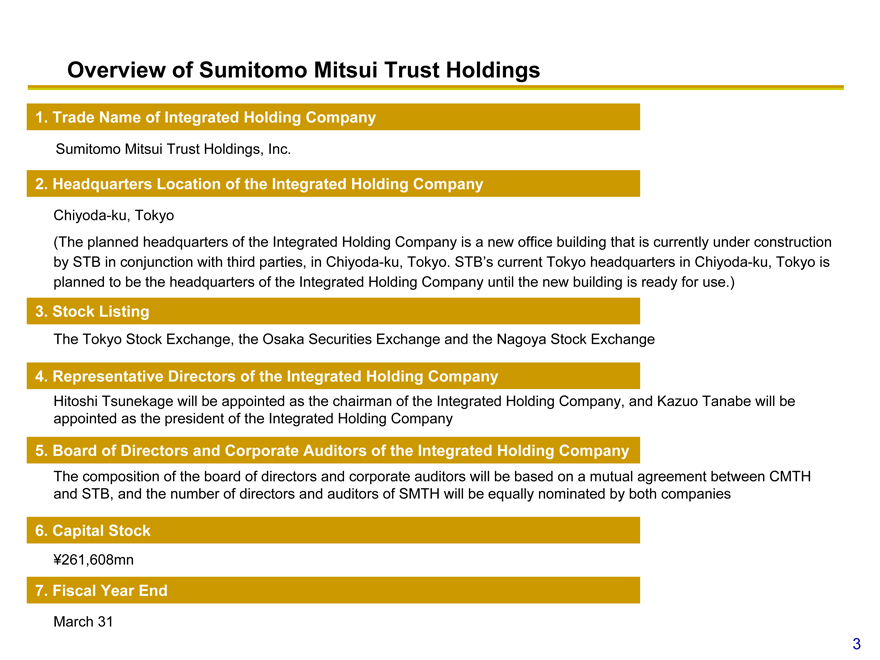

Overview of Sumitomo Mitsui Trust Holdings

1. Trade Name of Integrated Holding Company

Sumitomo Mitsui Trust Holdings, Inc.

2. Headquarters Location of the Integrated Holding Company

Chiyoda-ku, Tokyo

(The planned headquarters of the Integrated Holding Company is a new office building that is currently under construction by STB in conjunction with third parties, in Chiyoda-ku, Tokyo. STB’s current Tokyo headquarters in Chiyoda-ku, Tokyo is planned to be the headquarters of the Integrated Holding Company until the new building is ready for use.)

3. Stock Listing

The Tokyo Stock Exchange, the Osaka Securities Exchange and the Nagoya Stock Exchange

4. Representative Directors of the Integrated Holding Company

Hitoshi Tsunekage will be appointed as the chairman of the Integrated Holding Company, and Kazuo Tanabe will be appointed as the president of the Integrated Holding Company

5. Board of Directors and Corporate Auditors of the Integrated Holding Company

The composition of the board of directors and corporate auditors will be based on a mutual agreement between CMTH and STB, and the number of directors and auditors of SMTH will be equally nominated by both companies

6. Capital Stock

¥261,608mn

7. Fiscal Year End

March 31

3

[Blank]

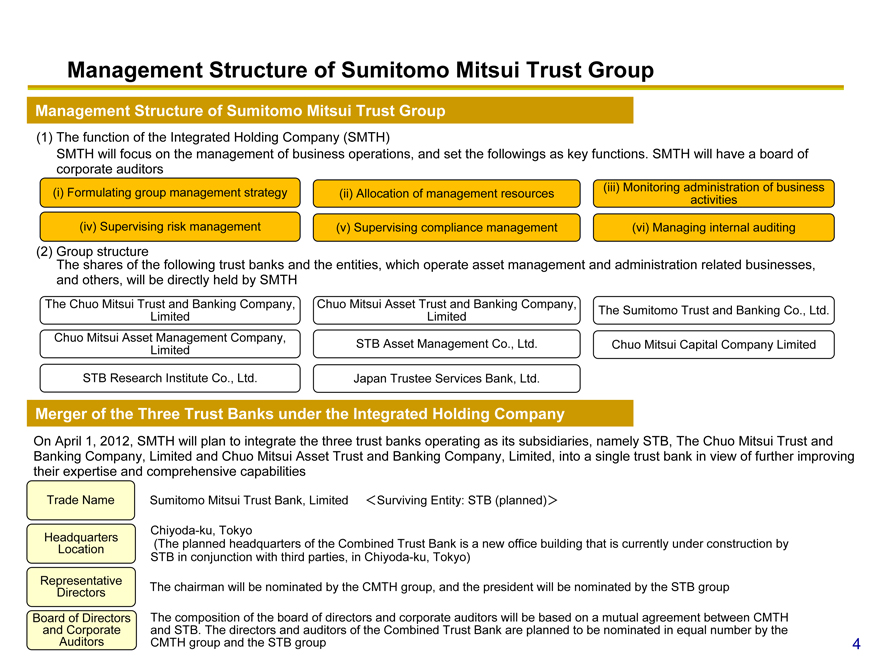

Management Structure of Sumitomo Mitsui Trust Group

Management Structure of Sumitomo Mitsui Trust Group

(1) The function of the Integrated Holding Company (SMTH)

SMTH will focus on the management of business operations, and set the followings as key functions. SMTH will have a board of corporate auditors

(i) Formulating group management strategy

(ii) Allocation of management resources

(iii) Monitoring administration of business activities

(iv) Supervising risk management

(v) Supervising compliance management

(vi) Managing internal auditing

(2) Group structure

The shares of the following trust banks and the entities, which operate asset management and administration related businesses, and others, will be directly held by SMTH

The Chuo Mitsui Trust and Banking Company, Limited

Chuo Mitsui Asset Trust and Banking Company, Limited

The Sumitomo Trust and Banking Co., Ltd.

Chuo Mitsui Asset Management Company, Limited

STB Asset Management Co., Ltd.

Chuo Mitsui Capital Company Limited

STB Research Institute Co., Ltd.

Japan Trustee Services Bank, Ltd.

Merger of the Three Trust Banks under the Integrated Holding Company

On April 1, 2012, SMTH will plan to integrate the three trust banks operating as its subsidiaries, namely STB, The Chuo Mitsui Trust and Banking Company, Limited and Chuo Mitsui Asset Trust and Banking Company, Limited, into a single trust bank in view of further improving their expertise and comprehensive capabilities

Trade Name

Sumitomo Mitsui Trust Bank, Limited <Surviving Entity: STB (planned)>

Headquarters Location

Chiyoda-ku, Tokyo

(The planned headquarters of the Combined Trust Bank is a new office building that is currently under construction by STB in conjunction with third parties, in Chiyoda-ku, Tokyo)

Representative Directors

The chairman will be nominated by the CMTH group, and the president will be nominated by the STB group

Board of Directors and Corporate Auditors

The composition of the board of directors and corporate auditors will be based on a mutual agreement between CMTH and STB. The directors and auditors of the Combined Trust Bank are planned to be nominated in equal number by the CMTH group and the STB group

4

| | • | | The integrated holding company will focus on the monitoring and administration of business operations, and set (i) to (vi) as key functions. |

| | • | | It means that each subsidiary of the integrated holding company will have authority to conduct its business, and that the integrated holding company will exercise the monitoring and certain administrative functions of the subsidiaries from a variety of perspectives. |

| | • | | I will explain the structure of Sumitomo Mitsui Trust Group and the planned merger of three trust banking subsidiaries. Please refer to page 5 and 6. |

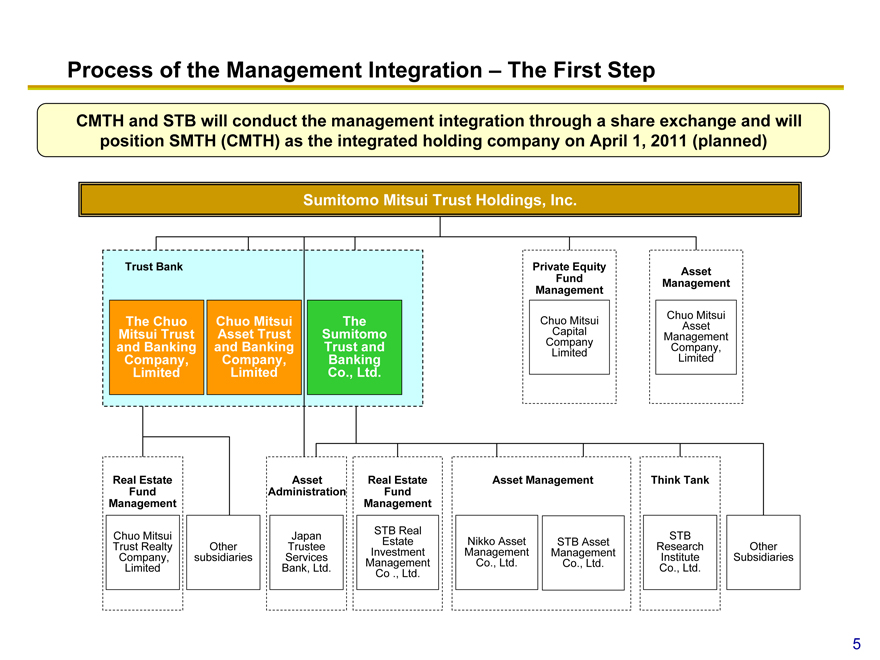

Process of the Management Integration – The First Step

CMTH and STB will conduct the management integration through a share exchange and will position SMTH (CMTH) as the integrated holding company on April 1, 2011 (planned)

Sumitomo Mitsui Trust Holdings, Inc.

Trust Bank

The Chuo Mitsui Trust and Banking Company, Limited

Chuo Mitsui Asset Trust and Banking Company, Limited

The Sumitomo Trust and Banking Co., Ltd.

Private Equity Fund Management

Chuo Mitsui Capital Company Limited

Asset Management

Chuo Mitsui Asset Management Company, Limited

Real Estate Fund Management

Asset Administration

Real Estate Fund Management

Asset Management

Think Tank

Chuo Mitsui Trust Realty Company, Limited

Other subsidiaries

Japan Trustee Services Bank, Ltd.

STB Real Estate Investment Management Co ., Ltd.

Nikko Asset Management Co., Ltd.

STB Asset Management Co., Ltd.

STB Research Institute Co., Ltd.

Other Subsidiaries

5

| | • | | This chart shows a picture of the management integration on April 1, 2011, which positions Sumitomo Mitsui Trust Holdings as the integrated holding company, conducted through a share exchange. At this stage, three trust bank subsidiaries will exist simultaneously under the holding company. |

| | • | | Next, I will explain the details of a merger of trust banking subsidiaries. Please turn to page 6. |

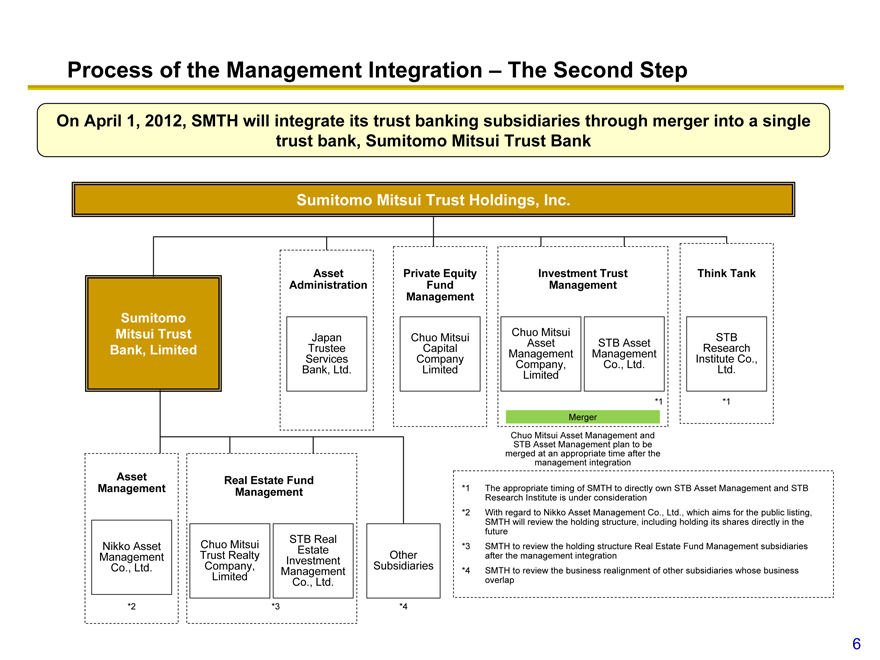

Process of the Management Integration – The Second Step

On April 1, 2012, SMTH will integrate its trust banking subsidiaries through merger into a single trust bank, Sumitomo Mitsui Trust Bank

Sumitomo Mitsui Trust Holdings, Inc.

Sumitomo Mitsui Trust Bank, Limited

Asset Administration

Private Equity Fund Management

Investment Trust Management

Think Tank

Japan Trustee Services Bank, Ltd.

Chuo Mitsui Capital Company Limited

Chuo Mitsui Asset Management Company, Limited

STB Asset Management Co., Ltd.

STB Research Institute Co., Ltd.

Merger

Chuo Mitsui Asset Management and STB Asset Management plan to be merged at an appropriate time after the management integration

*1

*1

Asset Management

Real Estate Fund Management

Nikko Asset Management Co., Ltd.

Chuo Mitsui Trust Realty Company, Limited

STB Real Estate Investment Management Co., Ltd.

Other Subsidiaries

*1 The appropriate timing of SMTH to directly own STB Asset Management and STB Research Institute is under consideration

*2 With regard to Nikko Asset Management Co., Ltd., which aims for the public listing, SMTH will review the holding structure, including holding its shares directly in the future

*3 SMTH to review the holding structure Real Estate Fund Management subsidiaries after the management integration

*4 SMTH to review the business realignment of other subsidiaries whose business overlap

*2 *3 *4

6

| | • | | On April 1, 2012, Sumitomo Mitsui Trust Holdings plans to merge three trust banking subsidiaries, and establish Sumitomo Mitsui Trust Bank, Limited. STB is planned to be a surviving entity. |

| | • | | In addition, group structure is altered in some points from the perspective of rearranging the group structure. Please refer to *1 to *4 for details. |

| | • | | Next, please look at page 7. |

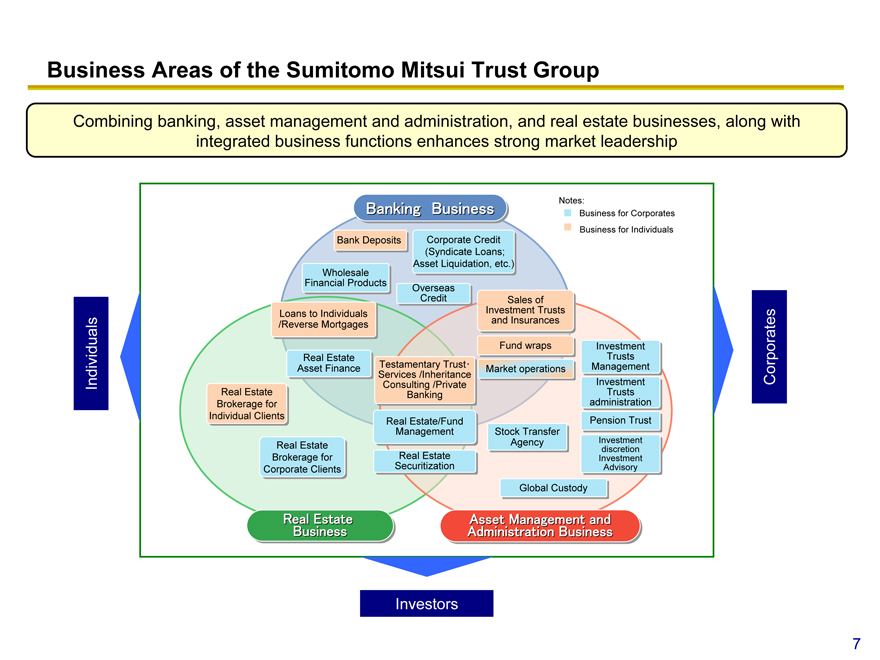

Business Areas of the Sumitomo Mitsui Trust Group

Combining banking, asset management and administration, and real estate businesses, along with integrated business functions enhances strong market leadership

Notes: Business for Corporates

Business for Individuals

Banking Business

Bank Deposits

Corporate Credit

(Syndicate Loans;

Asset Liquidation, etc.)

Wholesale Financial Products

Overseas Credit

Sales of Investment Trusts and Insurances

Loans to Individuals /Reverse Mortgages

Real Estate Asset Finance

Testamentary Trust?Services /Inheritance Consulting /Private Banking

Fund wraps

Market operations

Investment Trusts Management

Investment Trusts administration

Pension Trust

Investment discretion Investment Advisory

Stock Transfer Agency

Real Estate/Fund Management

Real Estate Brokerage for Individual Clients

Real Estate Brokerage for Corporate Clients

Real Estate Securitization

Global Custody

Real Estate Business

Asset Management and Administration Business

Investors

Individuals

Corporates

7

| | • | | This chart shows the business areas of Sumitomo Mitsui Trust Group. |

| | • | | We believe we will possess a unique characteristic which other financial groups will not: wide-ranging business areas spanning the banking business, asset management and administration business, and real estate business. In business areas that combine these three businesses in particular, we think the Group will be capable of leveraging strengths not found in other financial groups. |

| | • | | For instance, with regard to the investment trust sales, one of the strengths will be the comprehensive coverage within the Group of areas including management and administration of investment trusts, in addition to investment trust product development and sales. |

| | • | | Another strength of the new trust bank will be the capability of offering overall advice and consulting concerning the management, administration, and disposal of assets, including real estate, in the areas of inheritance consulting and testamentary trust services, which are shown in the center of the chart. |

| | • | | We believe that this capability of providing specialized, comprehensive solutions concerning clients’ assets will become an unsurpassed strength which is exactly requested as the aging and maturation of Japanese society progresses. |

| | • | | Next, I will discuss the institutional scale of Sumitomo Mitsui Trust Group. Please proceed to page 8. |

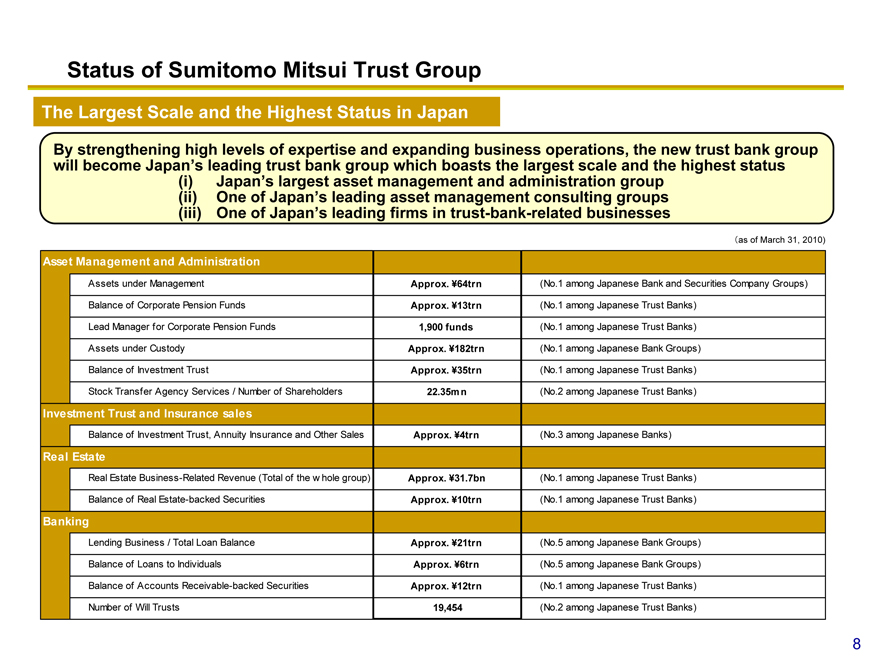

Status of Sumitomo Mitsui Trust Group

The Largest Scale and the Highest Status in Japan

By strengthening high levels of expertise and expanding business operations, the new trust bank group

will become Japan’s leading trust bank group which boasts the largest scale and the highest status

(i) | Japan’s largest asset management and administration group |

(ii) One of Japan’s leading asset management consulting groups

(iii) One of Japan’s leading firms in trust-bank-related businesses

as of March 31, 2010)

Asset Management and Administration

Assets under Management Approx. ¥64trn (No.1 among Japanese Bank and Securities Company Groups)

Balance of Corporate Pension Funds Approx. ¥13trn (No.1 among Japanese Trust Banks)

Lead Manager for Corporate Pension Funds 1,900 funds (No.1 among Japanese Trust Banks)

Assets under Custody Approx. ¥182trn (No.1 among Japanese Bank Groups)

Balance of Investment Trust Approx. ¥35trn (No.1 among Japanese Trust Banks)

Stock Transfer Agency Services / Number of Shareholders 22.35mn (No.2 among Japanese Trust Banks)

Investment Trust and Insurance sales

Balance of Investment Trust, Annuity Insurance and Other Sales Approx. ¥4trn (No.3 among Japanese Banks)

Real Estate

Real Estate Business-Related Revenue (Total of the w hole group) Approx. ¥31.7bn (No.1 among Japanese Trust Banks)

Balance of Real Estate-backed Securities Approx. ¥10trn (No.1 among Japanese Trust Banks)

Banking

Lending Business / Total Loan Balance Approx. ¥21trn (No.5 among Japanese Bank Groups)

Balance of Loans to Individuals Approx. ¥6trn (No.5 among Japanese Bank Groups)

Balance of Accounts Receivable-backed Securities Approx. ¥12trn (No.1 among Japanese Trust Banks)

Number of Will Trusts 19,454 (No.2 among Japanese Trust Banks)

| | • | | With regard to asset management and administration business, Sumitomo Mitsui Trust Group should rank first among Japanese bank and securities company groups by an overwhelming scale, with assets under management of ¥64 trillion. As you can see on the right side of the table concerning our status among Japanese financial institutions with regard to the balance of corporate pension funds, the number of the lead manager for corporate pension funds, and assets under custody etc., we think that the Group will become Japan’s largest asset management and administration group. |

| | • | | The Group should be ranked third among Japanese banks, including mega banks, in the balance of investment trust, insurance and other sales. We think that the Sumitomo Mitsui Trust Group will be one of the Japan’s leading asset management consulting groups. |

| | • | | Next, with regard to the real estate business which we position as a strategic area, the Group should rank first among trust banks in real estate related revenue as well as in the balance of real estate-backed securities. |

| | • | | Taking into consideration our status mentioned above, we think that the Sumitomo Mitsui Trust Group will be the leading trust bank group which boasts the largest scale and the highest status in Japan. Although we are seeking not only to expand our business scale, we are confident that the business operations of the integrated trust bank group will be worthy of being called “The Trust Bank”. |

| | • | | We firmly believe that by taking advantage of expanded business operations, we would like to seek further growth and establish a substantial presence not only in Japan, but also in global markets. |

| | • | | Next, I will discuss Sumitomo Mitsui Trust Group’s branch networks and human resources. Please proceed to page 9. |

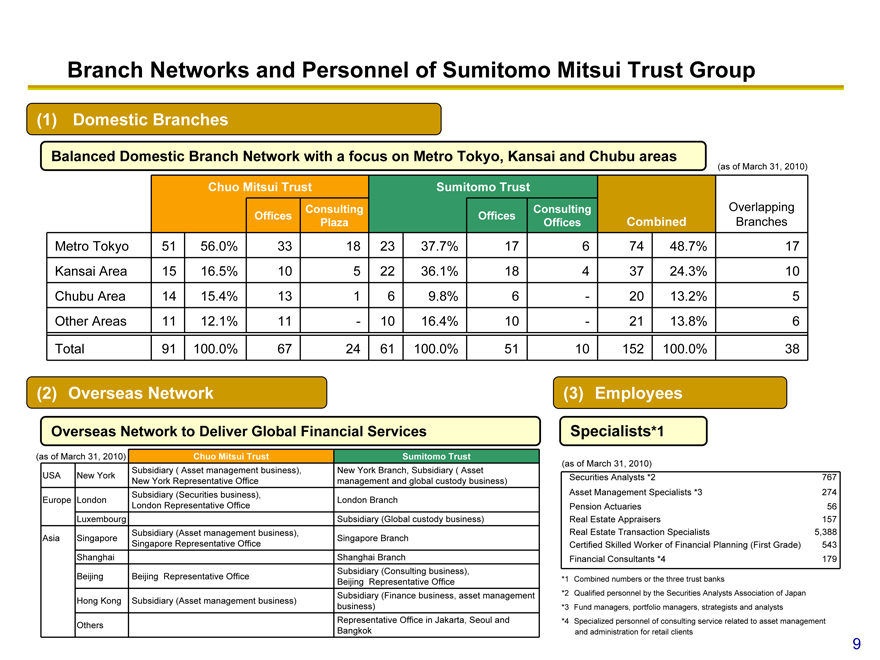

Branch Networks and Personnel of Sumitomo Mitsui Trust Group

Balanced Domestic Branch Network with a focus on Metro Tokyo, Kansai and Chubu areas (as of March 31, 2010)

Chuo Mitsui Trust Sumitomo Trust

Consulting Consulting Overlapping

Offices Offices

Plaza Offices Combined Branches

Metro Tokyo 51 56.0% 33 18 23 37.7% 17 6 74 48.7% 17

Kansai Area 15 16.5% 10 5 22 36.1% 18 4 37 24.3% 10

Chubu Area 14 15.4% 13 1 6 9.8% 6—20 13.2% 5

Other Areas 11 12.1% 11—10 16.4% 10—21 13.8% 6

Total 91 100.0% 67 24 61 100.0% 51 10 152 100.0% 38

(2) | Overseas Network (3) Employees |

Overseas Network to Deliver Global Financial Services

(as of March 31, 2010) Chuo Mitsui Trust Sumitomo Trust

Subsidiary ( Asset management business), New York Branch, Subsidiary ( Asset

USA New York New York Representative Office management and global custody business)

Subsidiary (Securities business),

Europe London London Branch

London Representative Office

Luxembourg Subsidiary (Global custody business)

Subsidiary (Asset management business),

Asia Singapore Singapore Branch

Singapore Representative Office

Shanghai Shanghai Branch

Subsidiary (Consulting business),

Beijing Beijing Representative Office Beijing Representative Office

Hong Kong Subsidiary (Asset management business) Subsidiary (Finance business, asset management

business)

Others Representative Office in Jakarta, Seoul and

Bangkok

Specialists*1

(as of March 31, 2010)

Securities Analysts *2 767

Asset Management Specialists *3 274

Pension Actuaries 56

Real Estate Appraisers 157

Real Estate Transaction Specialists 5,388

Certified Skilled Worker of Financial Planning (First Grade) 543

Financial Consultants *4 179

*1 Combined numbers or the three trust banks

*2 Qualified personnel by the Securities Analysts Association of Japan

*3 Fund managers, portfolio managers, strategists and analysts

*4 Specialized personnel of consulting service related to asset management

and administration for retail clients

9

| | • | | With regard to domestic branch network, Chuo Mitsui Trust has a solid branch network in the Chubu area in addition to its branch organization centered on metropolitan Tokyo. On the other hand, Sumitomo Trust has a large number of branches in the Kansai area in addition to metropolitan Tokyo. As shown in the combined figures in the column to the right, the management integration will result in a geographically balanced branch network in metropolitan Tokyo, the Kansai area, and the Chubu area. |

| | • | | There will be an overlap of 38 branches. We plan to consider a reorganization of these 38 overlaps including consulting plaza/offices in addition to the overlapping 29 branches. |

| | • | | With regard to overseas branches and offices, we belie we will have an overseas network capable of providing global financial services through the overseas subsidiaries of the two groups that handle the asset management and administration business and the overseas branches of Sumitomo Trust. |

| | • | | Next, I will describe the human resources of Sumitomo Mitsui Trust Group. As a result of the integration, Sumitomo Mitsui Trust Group will be a financial institution with an exceptionally high number of employees with specialized expertise. The Group’s 767 securities analysts, 56 actuaries, 157 real estate appraisers, more than 5,300 real estate transaction specialists, and other specialists will constitute an overwhelmingly large workforce unrivalled by other financial institutions. We think it will be possible to achieve substantial results through reallocation of personnel with specialized knowledge and qualifications to strategic areas. |

| | • | | I will now hand over the presentation to President Tsunekage, who will describe the new trust bank group’s strategy for utilizing the business base that will result from the integration. |

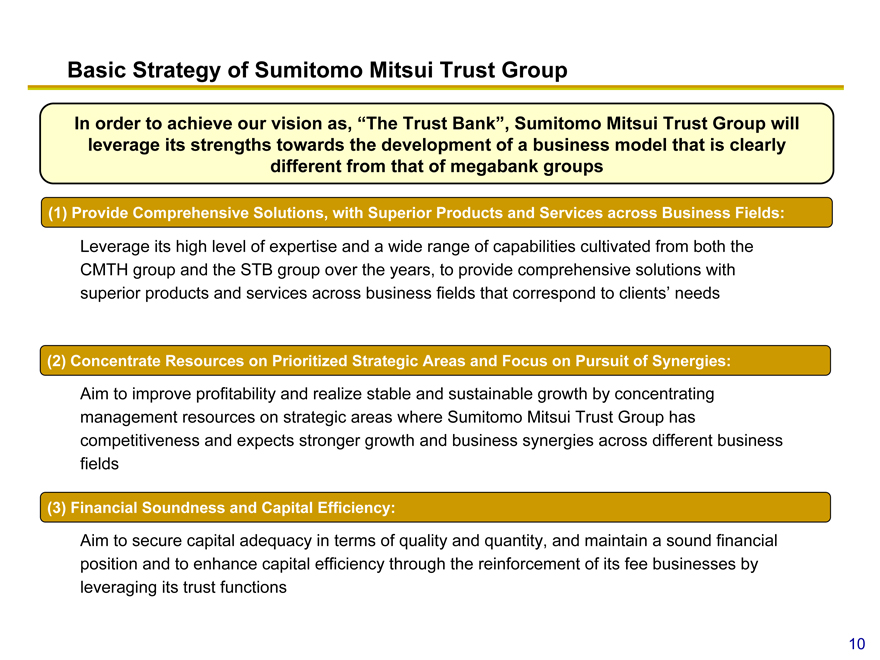

Basic Strategy of Sumitomo Mitsui Trust Group

In order to achieve our vision as, “The Trust Bank”, Sumitomo Mitsui Trust Group will leverage its strengths towards the development of a business model that is clearly different from that of megabank groups

(1) | Provide Comprehensive Solutions, with Superior Products and Services across Business Fields: |

Leverage its high level of expertise and a wide range of capabilities cultivated from both the CMTH group and the STB group over the years, to provide comprehensive solutions with superior products and services across business fields that correspond to clients’ needs

(2) | Concentrate Resources on Prioritized Strategic Areas and Focus on Pursuit of Synergies: |

Aim to improve profitability and realize stable and sustainable growth by concentrating management resources on strategic areas where Sumitomo Mitsui Trust Group has competitiveness and expects stronger growth and business synergies across different business fields

(3) | Financial Soundness and Capital Efficiency: |

Aim to secure capital adequacy in terms of quality and quantity, and maintain a sound financial position and to enhance capital efficiency through the reinforcement of its fee businesses by leveraging its trust functions

10

| | • | | I am Hitoshi Tsunekage, President and CEO of The Sumitomo Trust & Banking Co., Ltd. Thank you for attending today’s meeting for the joint presentation held by Chuo Mitsui Trust Holdings, Inc. and The Sumitomo Trust and Banking Co., Ltd. despite your busy schedule and short notice of invitation. |

| | • | | I hereby explain the growth strategies of Sumitomo Mitsui Trust Group, synergy effects, and revenue and financial targets based on the strategies. Please take a look at page 10 of the presentation material. |

| | • | | We have 3 key points as the basic strategy of the new trust bank group—Sumitomo Mitsui Trust Group. |

| | • | | The first point is to provide comprehensive solutions for significantly expanded client base through the business integration, with highest-standard products and services, leveraging high level of expertise and comprehensive capabilities cultivated by both the CMTH group and the STB group in the banking, asset management and administration and real estate businesses. |

| | • | | The second point is to improve profitability and realize stable and sustainable growth by concentrating management resources, which are expanded by the management integration, on the prioritized strategic areas of the new trust bank group. I will explain our growth strategy in detail from the next page onward. |

| | • | | The third point is to maintain a sound financial position by securing capital adequacy in terms of quality and quantity and to enhance capital efficiency through the reinforcement of fee businesses. As to the financial targets of Sumitomo Mitsui Trust Group, I will summarize at the end of this presentation. |

| | • | | Now I explain the growth strategy of the new trust bank group. Please turn to page 11. |

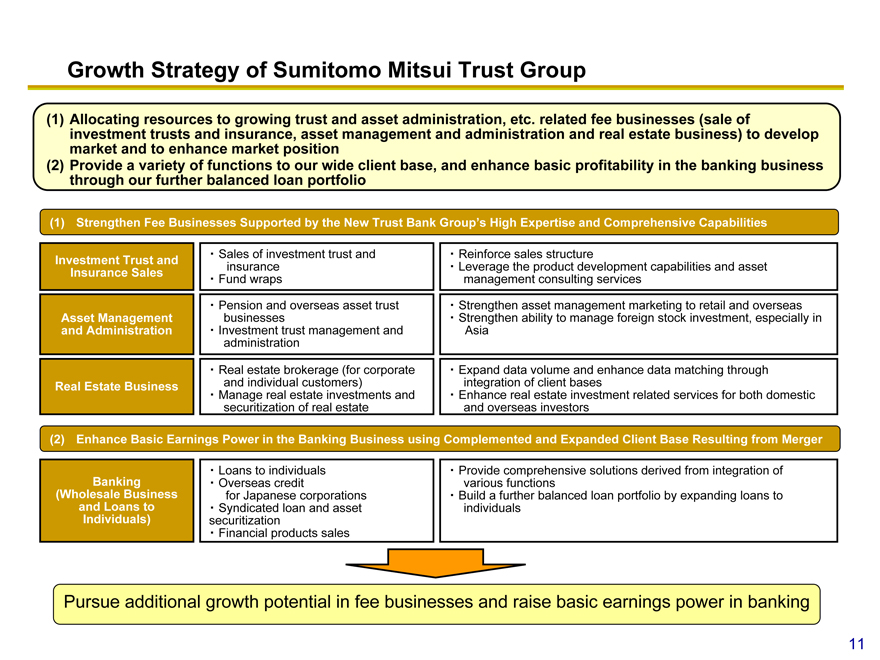

Growth Strategy of Sumitomo Mitsui Trust Group

(1) | Allocating resources to growing trust and asset administration, etc. related fee businesses (sale of |

investment trusts and insurance, asset management and administration and real estate business) to develop

market and to enhance market position

(2) | Provide a variety of functions to our wide client base, and enhance basic profitability in the banking business |

through our further balanced loan portfolio

(1) | Strengthen Fee Businesses Supported by the New Trust Bank Group’s High Expertise and Comprehensive Capabilities |

Sales of investment trust and Reinforce sales structure

Investment Trust and insurance Leverage the product development capabilities and asset

Insurance Sales Fund wraps management consulting services

Pension and overseas asset trust Strengthen asset management marketing to retail and overseas

Asset Management businesses Strengthen ability to manage foreign stock investment, especially in

and Administration Investment trust management and Asia

administration

Real estate brokerage (for corporate Expand data volume and enhance data matching through

Real Estate Business and individual customers) integration of client bases

Manage real estate investments and Enhance real estate investment related services for both domestic

securitization of real estate and overseas investors

(2) Enhance Basic Earnings Power in the Banking Business using Complemented and Expanded Client Base Resulting from Merger

Loans to individuals Provide comprehensive solutions derived from integration of

Banking Overseas credit various functions

(Wholesale Business for Japanese corporations Build a further balanced loan portfolio by expanding loans to

and Loans to Syndicated loan and asset individuals

Individuals) securitization

Financial products sales

Pursue additional growth potential in fee businesses and raise basic earnings power in banking

11

| | • | | First, Sumitomo Mitsui Trust Group will position fee businesses as a growth area, and concentrate management resources on this area to explore new markets in Japan and overseas and enhance market position. Specifically, the growth area includes investment trust and insurance sales, asset management and administration and real estate businesses. |

| | • | | On the other hand, other banking businesses are regarded as an area that supports basic profitability. Sumitomo Mitsui Trust Group will prioritize and reinforce the strategic areas, by offering diverse functions for our client base, which will be supplemented and expanded by the management integration, and by building a further balanced loan portfolio, which is mainly based on the expansion of loans to individuals. |

| | • | | Strategic areas of each business are summarized in the middle part of the table. Let me explain our business strategies in these strategic areas from the next page onwards. |

| | • | | Please proceed to page 12. |

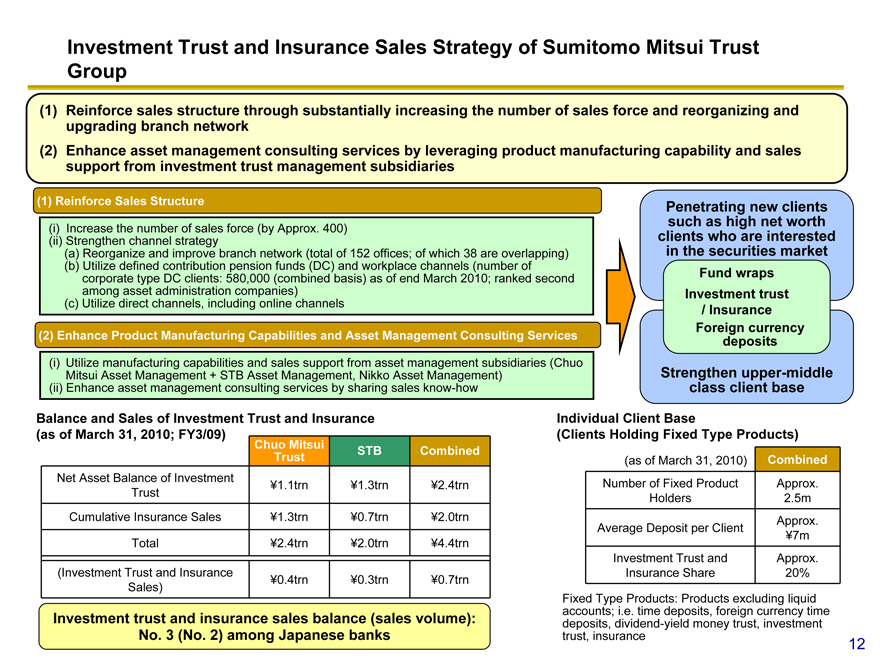

Investment Trust and Insurance Sales Strategy of Sumitomo Mitsui Trust Group

(1) | Reinforce sales structure through substantially increasing the number of sales force and reorganizing and |

upgrading branch network

(2) | Enhance asset management consulting services by leveraging product manufacturing capability and sales |

support from investment trust management subsidiaries

(1) | Reinforce Sales Structure |

(i) | Increase the number of sales force (by Approx. 400) (ii) Strengthen channel strategy |

(a) Reorganize and improve branch network (total of 152 offices; of which 38 are overlapping) (b) Utilize defined contribution pension funds (DC) and workplace channels (number of corporate type DC clients: 580,000 (combined basis) as of end March 2010; ranked second among asset administration companies) (c) Utilize direct channels, including online channels

(2) | Enhance Product Manufacturing Capabilities and Asset Management Consulting Services |

(i) Utilize manufacturing capabilities and sales support from asset management subsidiaries (Chuo Mitsui Asset Management + STB Asset Management, Nikko Asset Management) (ii) Enhance asset management consulting services by sharing sales know-how

Balance and Sales of Investment Trust and Insurance

(as of March 31, 2010; FY3/09)

Chuo Mitsui STB Combined

Trust

Net Asset Balance of Investment ¥1.1trn ¥1.3trn ¥2.4trn

Trust

Cumulative Insurance Sales ¥1.3trn ¥0.7trn ¥2.0trn

Total ¥2.4trn ¥2.0trn ¥4.4trn

(Investment Trust and Insurance ¥0.4trn ¥0.3trn ¥0.7trn

Sales)

Investment trust and insurance sales balance (sales volume):

No. 3 (No. 2) among Japanese banks

Penetrating new clients such as high net worth clients in the who securities are interested market Fund wraps Investment trust

/ Insurance Foreign currency deposits

Strengthen class client upper base -middle

Individual Client Base

(Clients Holding Fixed Type Products)

(as of March 31, 2010) Combined

Number of Fixed Product Approx.

Holders 2.5m

Average Deposit per Client Approx.

¥7m

Investment Trust and Approx.

Insurance Share 20%

Fixed Type Products: Products excluding liquid

accounts; i.e. time deposits, foreign currency time

deposits, dividend-yield money trust, investment

trust, insurance

12

| | • | | I will explain investment trust and insurance sales strategy targeting retail clients, from the perspectives of sales structure, product offering and asset management consulting services. |

| | • | | Regarding the sales structure, sales force will be significantly increased by redeploying approx. 400 employees out of approx. 500 employees in the headquarters subsequent to the management integration. Moreover, as a measure to reinforce the sales channels, we will not only reorganize existing branch network but also consider opening new branches in areas where reinforcement is critical. |

| | • | | Furthermore, we aim to develop effective marketing activities by fully leveraging strong channels that trust banks have such as client base of defined contribution pension plans and workplace channel, in which Sumitomo Mitsui Trust Group ranks the second as an asset administration company, as well as internet channels. |

| | • | | On the other hand, as a measure to enhance product manufacturing capability and asset management consulting services, we will leverage product manufacturing and sales support capabilities of the new group’s asset management subsidiaries that are further reinforced by the management integration, and will reinforce consulting asset management capability by sharing sales know-how held by both trust banks. |

| | • | | Through these measures, we will reinforce existing upper-middle-class and higher client base, and further develop new client base among wealthy tiers that have more interest in the securities markets. |

| | • | | The management integration results in approx. ¥4.4 trillion sales balance as of March 31, 2010, and approx. ¥700.0 billion sales volume for FY2009, showing the second highest sales capability among Japanese banks in terms of sales volume. The new trust bank group will further develop this strength and secure its presence as one of the leading Japanese banks. |

| | • | | Next, please proceed to page 13 for asset management and administration business of Sumitomo Mitsui Trust Group. |

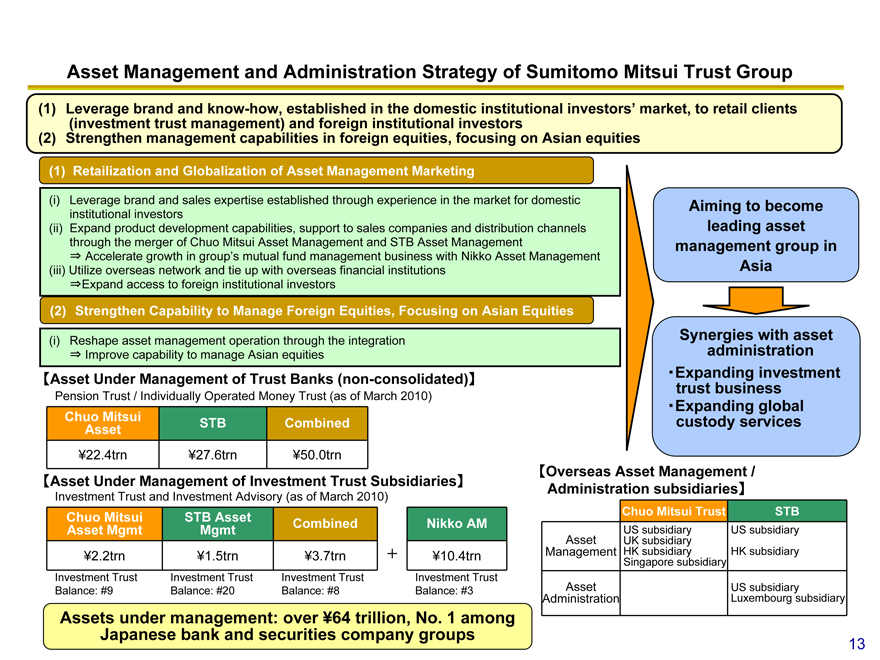

Asset Management and Administration Strategy of Sumitomo Mitsui Trust Group

(1) | Leverage brand and know-how, established in the domestic institutional investors’ market, to retail clients |

(investment trust management) and foreign institutional investors

(2) | Strengthen management capabilities in foreign equities, focusing on Asian equities |

(1) | Retailization and Globalization of Asset Management Marketing |

(i) | Leverage brand and sales expertise established through experience in the market for domestic |

institutional investors

(ii) Expand product development capabilities, support to sales companies and distribution channels

through the merger of Chuo Mitsui Asset Management and STB Asset Management

Accelerate growth in group’s mutual fund management business with Nikko Asset Management

(iii) Utilize overseas network and tie up with overseas financial institutions

Expand access to foreign institutional investors

(2) | Strengthen Capability to Manage Foreign Equities, Focusing on Asian Equities |

(i) | Reshape asset management operation through the integration |

Improve capability to manage Asian equities

Asset Under Management of Trust Banks (non-consolidated)

Pension Trust / Individually Operated Money Trust (as of March 2010)

Chuo Mitsui

Asset STB Combined

¥22.4trn ¥27.6trn ¥50.0trn

Asset Under Management of Investment Trust Subsidiaries

Investment Trust and Investment Advisory (as of March 2010)

Chuo Mitsui STB Asset

Asset Mgmt Mgmt Combined Nikko AM

¥2.2trn ¥1.5trn ¥3.7trn ¥10.4trn

Investment Trust Investment Trust Investment Trust Investment Trust

Balance: #9 Balance: #20 Balance: #8 Balance: #3

Assets under management: over ¥64 trillion, No. 1 among

Japanese bank and securities company groups

Aiming to become leading asset management group in Asia

Synergies administration with asset

Expanding investment business trust

Expanding global custody services

Overseas Asset Management

/

Administration subsidiaries

Chuo Mitsui Trust STB

US subsidiary US subsidiary

Asset UK subsidiary

Management HK subsidiary HK subsidiary

Singapore subsidiary

Asset US subsidiary

Administration Luxembourg subsidiary

13

| | • | | In the asset management business, the core growth strategy is to promote marketing for retail and global markets by leveraging brands established by respective company through experience in the market of domestic institutional investors. |

| | • | | Concerning the retail market, the new trust bank group will fundamentally reinforce its product development and sales companies support capabilities through the integration of Chuo Mitsui Asset Management Company, Limited. and STB Asset Management Co., Ltd. In addition to the reinforced sales capability of the new trust bank, we will also expand distribution channel through other financial institutions. Along with Nikko Asset Management Co., Ltd., we aim to strategically develop the integrated asset management company as an investment trust management subsidiary that leads growth of the Group’s investment trust management business. |

| | • | | In order to receive mandates from foreign institutional investors, Sumitomo Mitsui Trust Group will utilize the overseas asset management and sales networks held by both groups as well as partnership with overseas financial institutions to expand access to new investors. |

| | • | | In terms of asset management capabilities, we will reshape its operation by optimizing management resources that are reinforced by the management integration and further strengthen its capability to manage foreign equities, focusing on Asian equities. |

| | • | | Through these measures, Sumitomo Mitsui Trust Group will aim to consolidate its presence as one of the top asset management and administration groups in Asian market. Expansion of asset management business due to the progress of retailization and globalization will bring forth synergy effects to asset administration business such as investment trust business and global custody service, and we think that asset management business is strategically important. |

| | • | | Please proceed to page 14 for the real estate business of Sumitomo Mitsui Trust Group. |

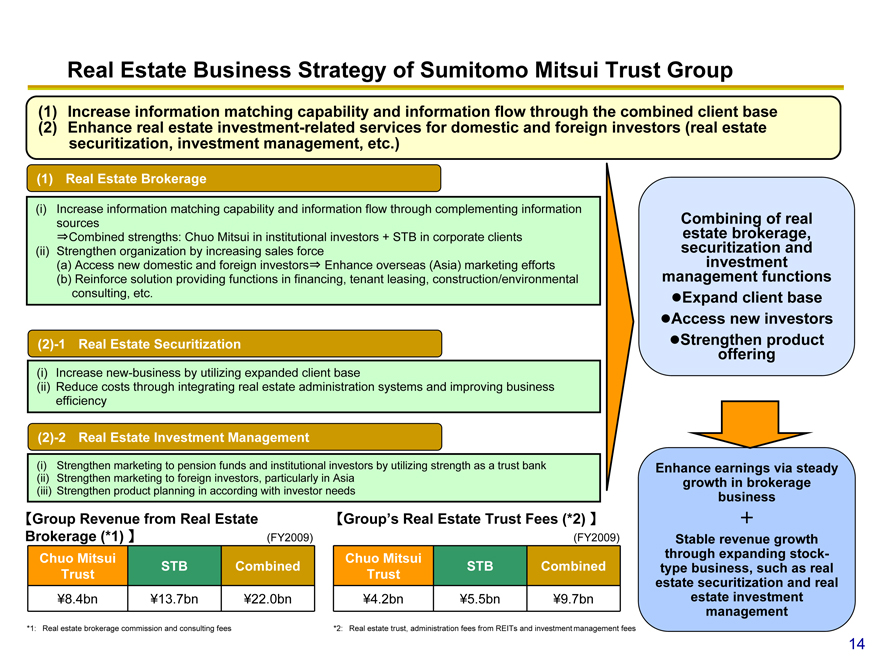

Real Estate Business Strategy of Sumitomo Mitsui Trust Group

(1) | Increase information matching capability and information flow through the combined client base |

(2) | Enhance real estate investment-related services for domestic and foreign investors (real estate |

securitization, investment management, etc.)

(i) | Increase information matching capability and information flow through complementing information |

sources

Combined strengths: Chuo Mitsui in institutional investors + STB in corporate clients

(ii) Strengthen organization by increasing sales force

(a) | Access new domestic and foreign investors Enhance overseas (Asia) marketing efforts |

(b) | Reinforce solution providing functions in financing, tenant leasing, construction/environmental |

consulting, etc.

(2)-1 Real Estate Securitization

(i) | Increase new-business by utilizing expanded client base |

(ii) Reduce costs through integrating real estate administration systems and improving business

efficiency

(2)-2 Real Estate Investment Management

(i) | Strengthen marketing to pension funds and institutional investors by utilizing strength as a trust bank |

(ii) Strengthen marketing to foreign investors, particularly in Asia

(iii) Strengthen product planning in according with investor needs

Group Revenue from Real Estate Group’s Real Estate Trust Fees (*2)

Brokerage (*1) (FY2009) (FY2009)

Chuo Mitsui Chuo Mitsui

STB Combined STB Combined

Trust Trust

¥8.4bn ¥13.7bn ¥22.0bn ¥4.2bn ¥5.5bn ¥9.7bn

*1: Real estate brokerage commission and consulting fees *2: Real estate trust, administration fees from REITs and investment management fees

Combining estate brokerage, of real securitization investment and management functions ?Expand client base ?Access new investors ?Strengthen offering product

Enhance earnings via steady growth in brokerage business

Stable revenue growth through expanding stock-type business, such as real estate securitization and real estate investment management

14

| | • | | In real estate brokerage business, in addition to the increase of information flow through the integration of both companies’ client base, Sumitomo Mitsui Trust Group reinforces its information matching capability regarding to sales and purchase. |

| | • | | CMTH has a strong base in institutional investors, and STB has a relatively stronger base in corporate clients, which makes CMTH and STB supplementary with each other in terms of client base. We will also increase sales force, promote access to new investors in Japan and other Asian areas as well as the rest of the world, reinforce real estate brokerage-related services such as financing, tenant leasing and construction/environmental consulting, thereby improving added values. |

| | • | | In real estate securitization and real estate investment management businesses as well, Sumitomo Mitsui Trust Group will strengthen marketing capabilities targeting domestic and foreign investors, optimize synergy effects to reduce costs and strengthen product development capabilities to achieve stable revenue growth through expanding stock-type business. |

| | • | | The bottom of this page shows actual data for FY2009 on “Group Revenue from Real Estate Brokerage” such as brokerage commission and consulting fees and “Group’s Real Estate Trust Fees” such as real estate trust and investment management fees. Currently total revenue of the real estate business of Sumitomo Mitsui Trust Group is approx. ¥32.0 billion, of which “Real Estate Trust Fees” that belong to the revenue from stock-type business account for about one third. By steadily developing this revenue and through steady growth of the brokerage business, we aim to realize growth of revenues of the entire real estate businesses. |

| | • | | Next, let me explain the banking business strategy of Sumitomo Mitsui Trust Group, which supports basic profitability. Please proceed to page 15. |

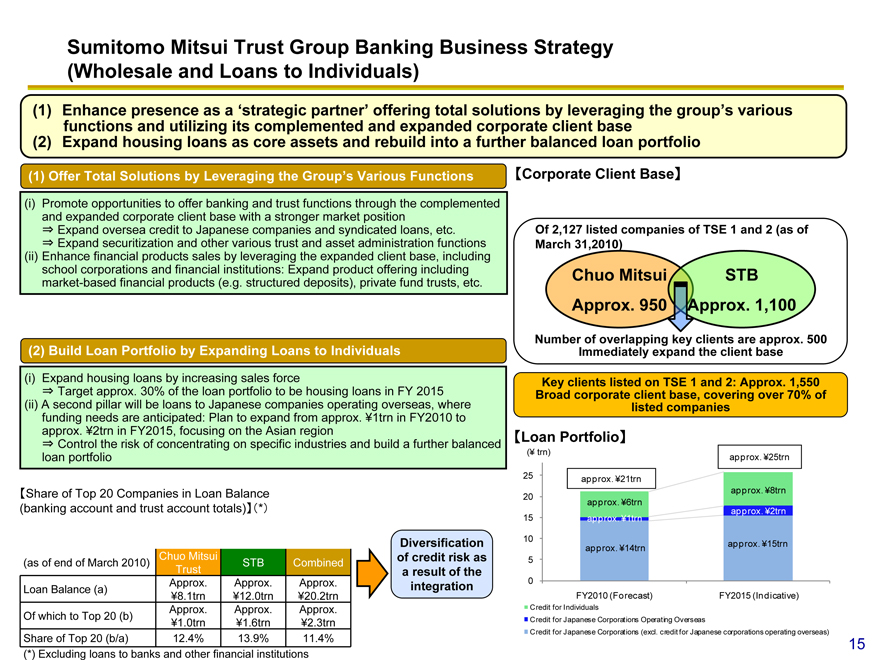

Sumitomo Mitsui Trust Group Banking Business Strategy

(Wholesale and Loans to Individuals)

(1) | Enhance presence as a ‘strategic partner’ offering total solutions by leveraging the group’s various |

functions and utilizing its complemented and expanded corporate client base

(2) | Expand housing loans as core assets and rebuild into a further balanced loan portfolio |

(1) | Offer Total Solutions by Leveraging the Group’s Various Functions |

(i) | Promote opportunities to offer banking and trust functions through the complemented |

and expanded corporate client base with a stronger market position

Expand oversea credit to Japanese companies and syndicated loans, etc.

Expand securitization and other various trust and asset administration functions

(ii) Enhance financial products sales by leveraging the expanded client base, including

school corporations and financial institutions: Expand product offering including

market-based financial products (e.g. structured deposits), private fund trusts, etc.

(2) | Build Loan Portfolio by Expanding Loans to Individuals |

(i) | Expand housing loans by increasing sales force |

Target approx. 30% of the loan portfolio to be housing loans in FY 2015

(ii) A second pillar will be loans to Japanese companies operating overseas, where

funding needs are anticipated: Plan to expand from approx. ¥1trn in FY2010 to

approx. ¥2trn in FY2015, focusing on the Asian region

Control the risk of concentrating on specific industries and build a further balanced

loan portfolio

Share of Top 20 Companies in Loan Balance

(banking account and trust account totals) *

Chuo Mitsui

(as of end of March 2010) STB Combined

Trust

Loan Balance (a) Approx. Approx. Approx.

¥8.1trn ¥12.0trn ¥20.2trn

Of which to Top 20 (b) Approx. Approx. Approx.

¥1.0trn ¥1.6trn ¥2.3trn

Share of Top 20 (b/a) 12.4% 13.9% 11.4%

(*) Excluding loans to banks and other financial institutions

Diversification of credit risk as a result of the integration

Corporate Client Base

Of 2,127 listed companies of TSE 1 and 2 (as of March 31,2010)

Chuo Mitsui STB Approx. 950 Approx. 1,100

Number of overlapping key clients are approx. 500 Immediately expand the client base

Key clients listed on TSE 1 and 2: Approx. 1,550

Broad corporate client base, covering over 70% of

listed companies

Loan Portfolio

(¥(¥trn)trn) approx. ¥25trn

25 approx. ¥21trn

approx. ¥8trn

20 approx. ¥6trn

approx. ¥2trn

15 approx. ¥1trn

10

approx. ¥14trn approx. ¥15trn

0

FY2010 (Forecast) FY2015 (Indicative)

Credit for Individuals

Credit for Japanese Corporations Operating Overseas

Credit for Japanese Corporations (excl. credit for Japanese corporations operating overseas)

15

| | • | | In wholesale business, by utilizing its corporate client base that is supplemented and expanded as a result of the management integration, Sumitomo Mitsui Trust Group aims to significantly enhance its presence as a “strategic partner” which offers total solutions to these corporate clients. |

| | • | | As shown in the figure on the right, the new trust bank is expected to have business base of approx. 1,550 corporations, which covers over 70% of more than 2,100 listed companies on Tokyo stock exchange 1st section and 2nd section. We will enhance basic profitability including fee revenues, by cross-selling that leverages functions and products for which each company has a competitive edge. Specifically, in addition to banking functions such as loans to Japanese companies operating overseas and syndicated loans, we will aggressively utilize trust functions such as securitization to achieve this goal. |

| | • | | Regarding the client base such as school corporations and financial institutions as well, we will develop cross-selling by offering asset management products. |

| | • | | With regard to the loan portfolio, we will build it with a core strategy to expand housing loans. As shown in the chart on the right, we expect that the amount of housing loans will be expanded to approx. ¥8 trillion, which accounts for 30% of the total loan portfolio of approx. ¥25 trillion in FY2015. Loans to Japanese companies operating overseas are projected to nearly double whereas we expect modest growth in loans to Japanese companies operating in Japan. |

| | • | | The management integration has the effects of reducing concentration on specific clients, and we will build a further balanced loan portfolio by reducing concentration on specific industries in medium-term. |

| | • | | Please proceed to the next page. |

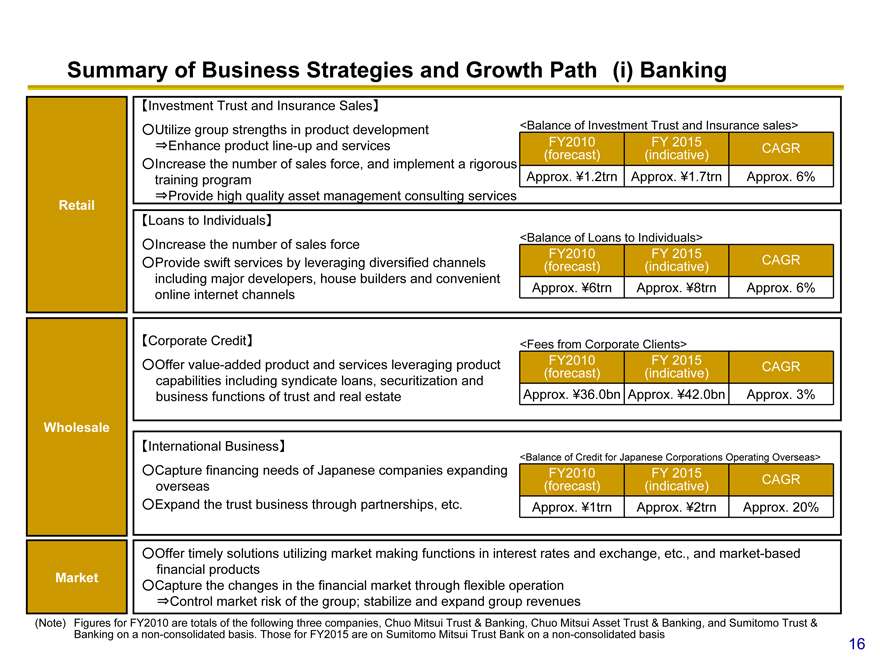

Summary of Business Strategies and Growth Path (i) Banking

Investment Trust and Insurance Sales

Utilize group strengths in product development <Balance of Investment Trust and Insurance sales >

Enhance product line-up and services FY2010 FY 2015 CAGR

Increase the number of sales force, and implement a rigorous (forecast) (indicative)

training program Approx. ¥1.2trn Approx. ¥1.7trn Approx. 6%

Provide high quality asset management consulting services

Retail

Loans to Individuals

Increase the number of sales force <Balance of Loans to Individuals>

FY2010 FY 2015

Provide swift services by leveraging diversified channels (forecast) (indicative) CAGR

including major developers, house builders and convenient

online internet channels Approx. ¥6trn Approx. ¥8trn Approx. 6%

Corporate Credit <Fees from Corporate Clients>

Offer value-added product and services leveraging product FY2010 FY 2015 CAGR

capabilities including syndicate loans, securitization and (forecast) (indicative)

business functions of trust and real estate Approx. ¥36.0bn Approx. ¥42.0bn Approx. 3%

Wholesale

International Business

<Balance of Credit for Japanese Corporations Operating Overseas>

Capture financing needs of Japanese companies expanding FY2010 FY 2015

overseas (forecast) (indicative) CAGR

Expand the trust business through partnerships, etc. Approx. ¥1trn Approx. ¥2trn Approx. 20%

Offer timely solutions utilizing market making functions in interest rates and exchange, etc., and market-based

financial products

Market Capture the changes in the financial market through flexible operation

Control market risk of the group; stabilize and expand group revenues

(Note) Figures for FY2010 are totals of the following three companies, Chuo Mitsui Trust & Banking, Chuo Mitsui Asset Trust & Banking, and Sumitomo Trust &

Banking on a non-consolidated basis. Those for FY2015 are on Sumitomo Mitsui Trust Bank on a non-consolidated basis

16

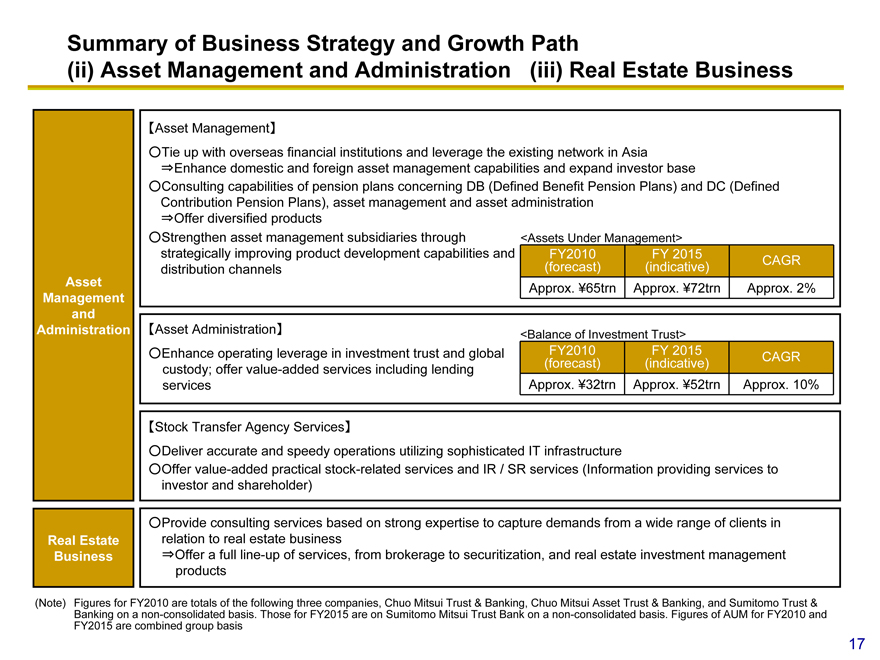

| | • | | On pages 16 and 17, we have summarized strategies for Sumitomo Mitsui Trust Group’s major businesses and shown the business growth in the prioritized areas. We project the annual growth rate of investment trust and insurance sales, which is a pillar of the growth strategy, to be 6% and that of the Group’s assets under management to be 2%. |

| | • | | Please proceed to page 18. |

Summary of Business Strategy and Growth Path

(ii) Asset Management and Administration (iii) Real Estate Business

Asset Management

Tie up with overseas financial institutions and leverage the existing network in Asia

Enhance domestic and foreign asset management capabilities and expand investor base

Consulting capabilities of pension plans concerning DB (Defined Benefit Pension Plans) and DC (Defined

Contribution Pension Plans), asset management and asset administration

Offer diversified products

Strengthen asset management subsidiaries through <Assets Under Management>

strategically improving product development capabilities and FY2010 FY 2015 CAGR

distribution channels (forecast) (indicative)

Asset Approx. ¥65trn Approx. ¥72trn Approx. 2%

Management

and

Administration Asset Administration <Balance of Investment Trust>

Enhance operating leverage in investment trust and global FY2010 FY 2015 CAGR

custody; offer value-added services including lending (forecast) (indicative)

services Approx. ¥32trn Approx. ¥52trn Approx. 10%

Stock Transfer Agency Services

Deliver accurate and speedy operations utilizing sophisticated IT infrastructure

Offer value-added practical stock-related services and IR / SR services (Information providing services to

investor and shareholder)

Provide consulting services based on strong expertise to capture demands from a wide range of clients in

Real Estate relation to real estate business

Business Offer a full line-up of services, from brokerage to securitization, and real estate investment management

products

(Note) Figures for FY2010 are totals of the following three companies, Chuo Mitsui Trust & Banking, Chuo Mitsui Asset Trust & Banking, and Sumitomo Trust &

Banking on a non-consolidated basis. Those for FY2015 are on Sumitomo Mitsui Trust Bank on a non-consolidated basis. Figures of AUM for FY2010 and

FY2015 are combined group basis

17

[Blank]

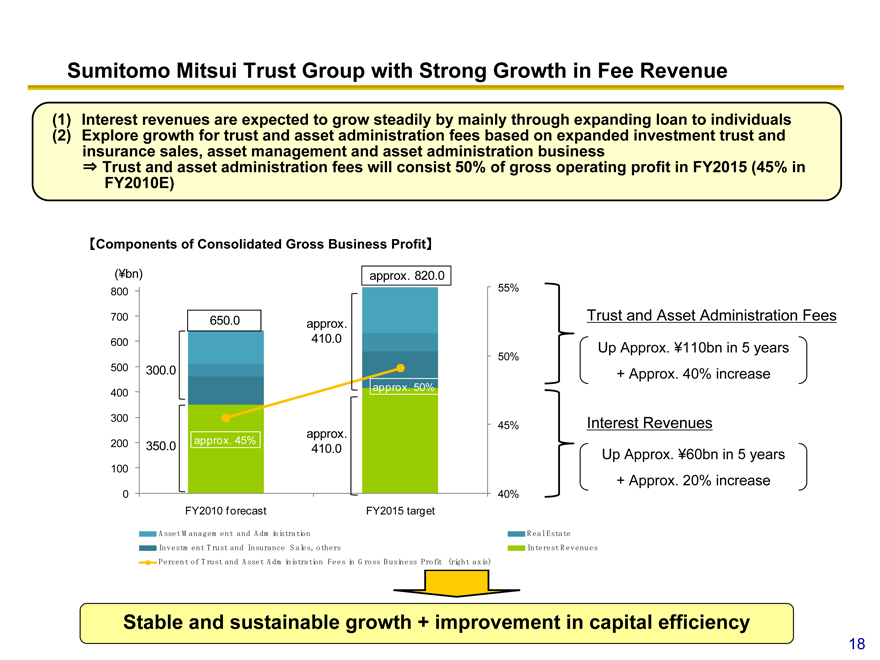

Sumitomo Mitsui Trust Group with Strong Growth in Fee Revenue

(1) | Interest revenues are expected to grow steadily by mainly through expanding loan to individuals |

(2) | Explore growth for trust and asset administration fees based on expanded investment trust and |

insurance sales, asset management and asset administration business

Trust and asset administration fees will consist 50% of gross operating profit in FY2015 (45% in

FY2010E)

Components of Consolidated Gross Business Profit

(¥bn) approx. 820.0

800 55%

700 650.0 approx.

600 410.0

50%

500 300.0

400 approx. 50%

300 45%

approx.

200 350.0 approx. 45% 410.0

100

0 40%

FY2010 forecast FY2015 target

Trust and Asset Administration Fees

Up Approx. ¥110bn in 5 years

+ Approx. 40% increase

Interest Revenues

Up Approx. ¥60bn in 5 years

+ Approx. 20% increase

AssetManagem entnistration and Adm i Real Estate Investm ent Trust and es, Insurance others Sal InterestRevenues Percent of Trustnistration and Asset Fees n G Adm ross i i Business t ght(ri s) axi Profi

Stable and sustainable growth + improvement in capital efficiency

18

| | • | | This page shows the new trust bank group’s gross operating profit target based on the growth strategies as described in the previous pages and its breakdown. Interest revenues, which we regard as stable businesses, are expected to increase by approx. ¥60.0 billion, or about 20%, in five years mainly due to expanding loans to individuals. |

| | • | | On the other hand, we project trust and asset administration fees to increase by approx. ¥110.0 billion, or about 40%, in five years due to expansion of investment trust and insurance sales, asset management and administration business etc, that we regard as growth businesses. |

| | • | | By reinforcing basic profitability mainly in the banking business and expanding trust and asset administration fees, we will achieve stable and sustainable growth of profitability and improve capital efficiency. |

| | • | | Next, I will explain synergy effects based on the business strategies as described in the previous pages. Please turn to page 19. |

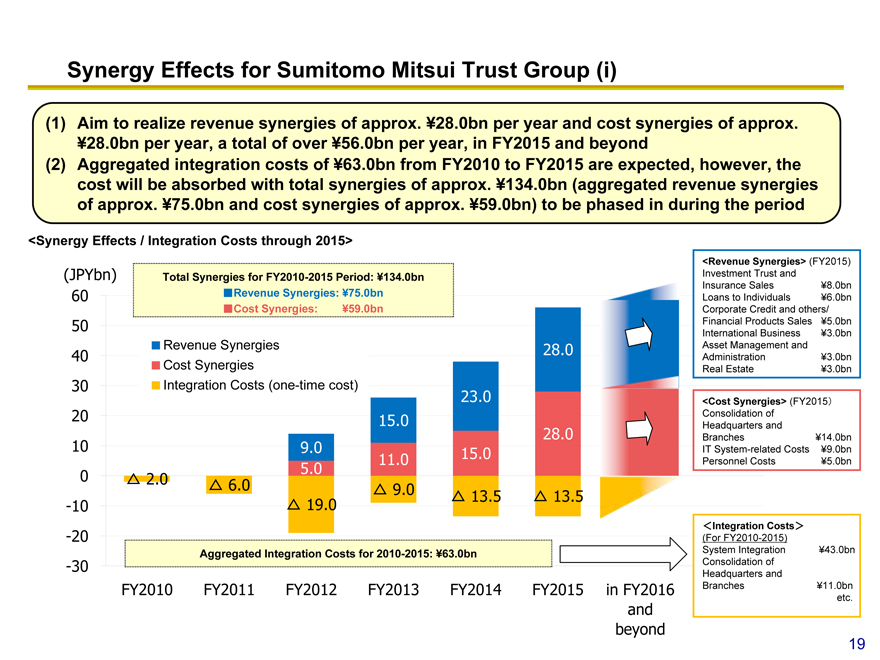

Synergy Effects for Sumitomo Mitsui Trust Group (i)

(1) Aim to realize revenue synergies of approx. ¥28.0bn per year and cost synergies of approx.

¥28.0bn per year, a total of over ¥56.0bn per year, in FY2015 and beyond

(2) Aggregated integration costs of ¥63.0bn from FY2010 to FY2015 are expected, however, the

cost will be absorbed with total synergies of approx. ¥134.0bn (aggregated revenue synergies

of approx. ¥75.0bn and cost synergies of approx. ¥59.0bn) to be phased in during the period

<Synergy Effects / Integration Costs through 2015>

(JPYbn) Total Synergies for FY2010-2015 Period: ¥134.0bn

60 Revenue Synergies: ¥75.0bn

Cost Synergies: ¥59.0bn

50

40 Revenue Synergies 28.0

Cost Synergies

30 Integration Costs (one-time cost) 23.0

20 15.0

28.0

10 9.0

11.0 15.0

0 ? 2.0 ? 6.0 5.0 ? 9.0

-10 ? 19.0 ? 13.5 ? 13.5

-20

Aggregated Integration Costs for 2010-2015: ¥63.0bn

-30

FY2010 FY2011 FY2012 FY2013 FY2014 FY2015 in FY2016

and

beyond

<Revenue Synergies> (FY2015)

Investment Trust and

Insurance Sales ¥8.0bn

Loans to Individuals ¥6.0bn

Corporate Credit and others/

Financial Products Sales ¥5.0bn

International Business ¥3.0bn

Asset Management and

Administration ¥3.0bn

Real Estate ¥3.0bn

<Cost Synergies> (FY2015

Consolidation of

Headquarters and

Branches ¥14.0bn

IT System-related Costs ¥9.0bn

Personnel Costs ¥5.0bn

Integration Costs

(For FY2010-2015)

System Integration ¥43.0bn

Consolidation of

Headquarters and

Branches ¥11.0bn

etc.

19

| | • | | Sumitomo Mitsui Trust Group projects approx. ¥28.0 billion a year as revenue synergies that are included in the gross operating profit target explained in the previous pages and approx. ¥28.0 billion a year as cost synergies through consolidation of offices and system integration, aiming to achieve synergy effects of more than ¥56.0 billion a year for FY2015 in total. |

| | • | | Such synergy effects will be realized in FY2012 and beyond, when three trust banks are scheduled to be integrated. The chart shows projected annual synergy effects. |

| | • | | On the other hand, approx. ¥63.0 billion is projected to be accumulated for six years until FY2015 as temporary costs associated with system integration and reorganization of offices, which will, however, be fully absorbed by aggregated synergy effects of ¥134.0 billion to be realized in the same period. |

| | • | | Please refer to the next page, page 20, for the breakdown of the synergy effects. |

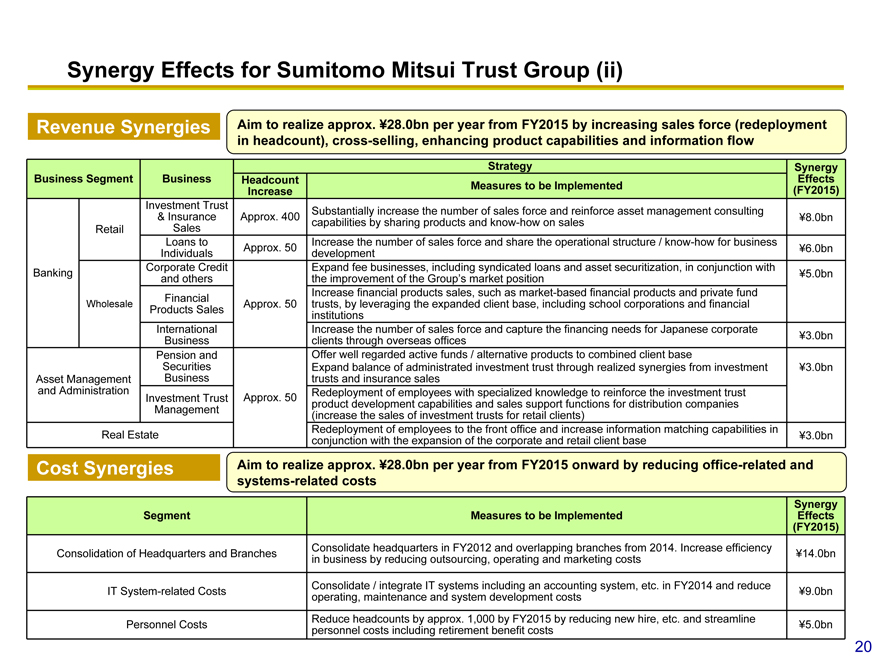

Synergy Effects for Sumitomo Mitsui Trust Group (ii)

Revenue Synergies Aim to realize approx. ¥28.0bn per year from FY2015 by increasing sales force (redeployment

in headcount), cross-selling, enhancing product capabilities and information flow

Strategy Synergy

Business Segment Business Headcount Effects

Increase Measures to be Implemented (FY2015)

Investment Trust Substantially increase the number of sales force and reinforce asset management consulting

& Insurance Approx. 400 capabilities by sharing products and know-how on sales ¥8.0bn

Retail Sales

Loans to Increase the number of sales force and share the operational structure / know-how for business

Approx. 50 ¥6.0bn

Individuals development

Corporate Credit Expand fee businesses, including syndicated loans and asset securitization, in conjunction with

Banking and others the improvement of the Group’s market position ¥5.0bn

Financial Increase financial products sales, such as market-based financial products and private fund

Wholesale Approx. 50 trusts, by leveraging the expanded client base, including school corporations and financial

Products Sales institutions

International Increase the number of sales force and capture the financing needs for Japanese corporate

Business clients through overseas offices ¥3.0bn

Pension and Offer well regarded active funds / alternative products to combined client base

Securities Expand balance of administrated investment trust through realized synergies from investment ¥3.0bn

Asset Management Business trusts and insurance sales

and Administration Redeployment of employees with specialized knowledge to reinforce the investment trust

Investment Trust Approx. 50 product development capabilities and sales support functions for distribution companies

Management (increase the sales of investment trusts for retail clients)

Redeployment of employees to the front office and increase information matching capabilities in

Real Estate conjunction with the expansion of the corporate and retail client base ¥3.0bn

Cost Synergies Aim to realize approx. ¥28.0bn per year from FY2015 onward by reducing office-related and

systems-related costs

Synergy

Segment Measures to be Implemented Effects

(FY2015)

Consolidate headquarters in FY2012 and overlapping branches from 2014. Increase efficiency

Consolidation of Headquarters and Branches ¥14.0bn

in business by reducing outsourcing, operating and marketing costs

Consolidate / integrate IT systems including an accounting system, etc. in FY2014 and reduce

IT System-related Costs ¥9.0bn

operating, maintenance and system development costs

Reduce headcounts by approx. 1,000 by FY2015 by reducing new hire, etc. and streamline

Personnel Costs ¥5.0bn

personnel costs including retirement benefit costs

20

| | • | | The upper table shows revenue synergies expected to be realized in the strategic areas by increasing sales force, cross-selling in conjunction with expansion of client base and reinforcing product and information powers. Revenue synergies of ¥8.0 billion is projected in the investment trust and insurance sales business to which workforce is mainly redeployed from the headquarters; ¥6.0 billion is projected in loans to individuals; ¥8.0 billion in the wholesale business in which cross-selling effects are anticipated. |

| | • | | In terms of cost synergies, integration of offices and reduction of outsourcing costs will reduce approx. ¥14.0 billion costs, system integration will reduce ¥9.0 billion and cutting personnel costs by reducing headcounts and other measures will help reduce ¥5.0 billion. |

| | • | | I will explain revenue and financial targets for the new trust bank group. Please proceed to page 21. |

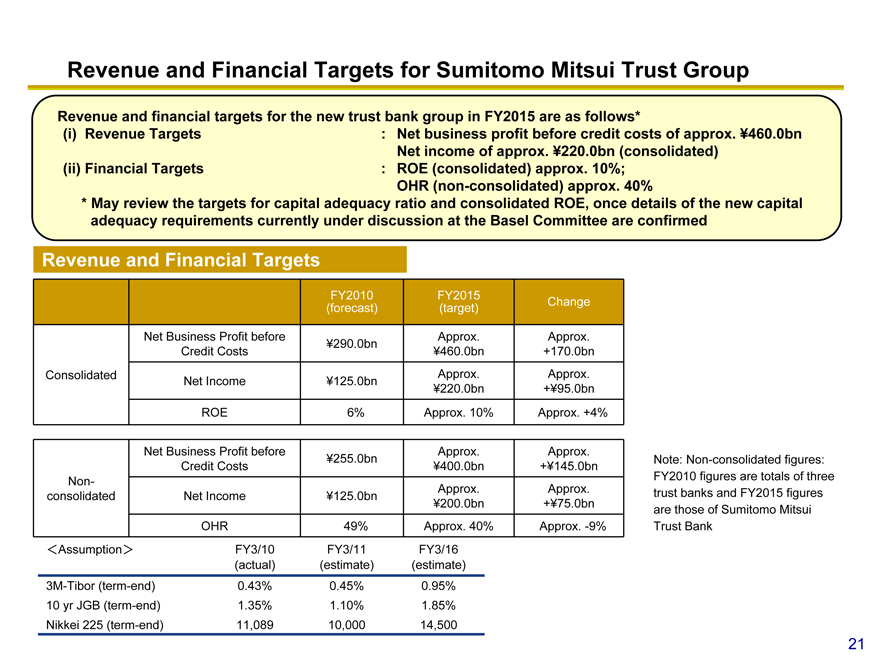

Revenue and Financial Targets for Sumitomo Mitsui Trust Group

Revenue and financial targets for the new trust bank group in FY2015 are as follows*

(i) | Revenue Targets : Net business profit before credit costs of approx. ¥460.0bn |

Net income of approx. ¥220.0bn (consolidated)

(ii) Financial Targets : ROE (consolidated) approx. 10%;

OHR (non-consolidated) approx. 40%

* | May review the targets for capital adequacy ratio and consolidated ROE, |

once details of the new capital adequacy requirements currently under discussion at the Basel Committee

are confirmed

Revenue and Financial Targets

FY2010 FY2015

(forecast) (target) Change

Net Business Profit before Approx. Approx.

¥290.0bn

Credit Costs ¥460.0bn +170.0bn

Consolidated Approx. Approx.

Net Income ¥125.0bn ¥220.0bn +¥95.0bn

ROE 6% Approx. 10% Approx. +4%

Net Business Profit before Approx. Approx.

¥255.0bn

Credit Costs ¥400.0bn +¥145.0bn

Non-

consolidated Net Income ¥125.0bn Approx. Approx.

¥200.0bn +¥75.0bn

OHR 49% Approx. 40% Approx. -9%

Assumption FY3/10 FY3/11 FY3/16

(actual) (estimate) (estimate)

3M-Tibor (term-end) 0.43% 0.45% 0.95%

10 yr JGB (term-end) 1.35% 1.10% 1.85%

Nikkei 225 (term-end) 11,089 10,000 14,500

Note: Non-consolidated figures: FY2010 figures are totals of three trust banks and FY2015 figures are those of Sumitomo Mitsui Trust Bank

21

| | • | | As revenue targets for FY2015, Sumitomo Mitsui Trust Group will aim to achieve approx. ¥460.0 billion as consolidated net business profit before credit costs; approx. ¥220.0 billion as consolidated net income; and approx. 10% for ROE (consolidated). On the non-consolidated basis, as a target of a standalone trust bank, Sumitomo Mitsui Trust Group will aim to achieve approx. 40% for OHR. |

| | • | | Assumed environmental factors behind these target figures are shown on the lower left. We assume continuous moderate economic recovery, specifically, short-term interest rate of less than 1% and Nikkei 225 (term-end) of ¥14,500 as of March 31, 2016. |

| | • | | We have summarized the breakdown of the revenue plan in the next page. Please take a look at it. |

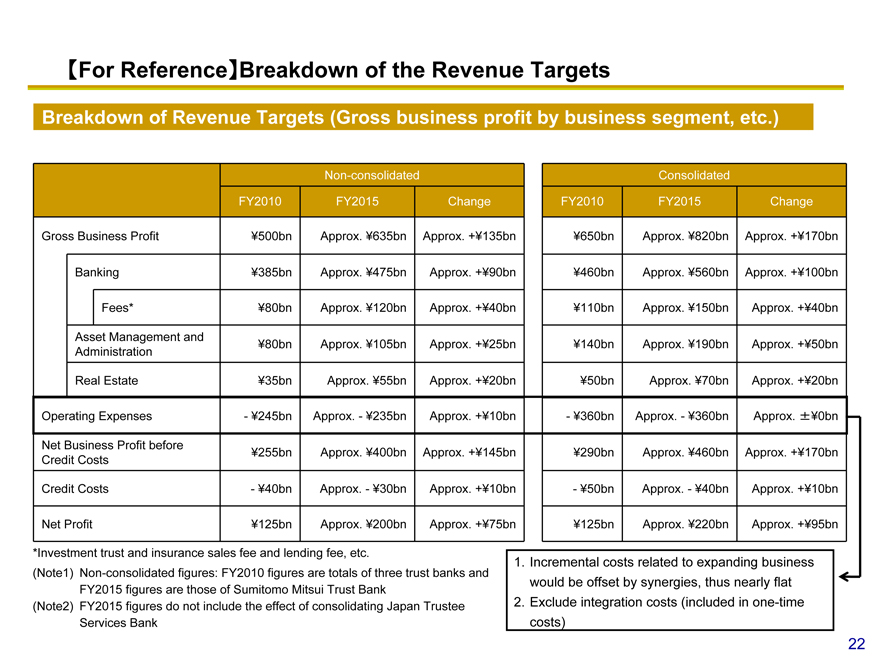

For Reference Breakdown of the Revenue Targets

Breakdown of Revenue Targets (Gross business profit by business segment, etc.)

Non-consolidated Consolidated

FY2010 FY2015 Change FY2010 FY2015 Change

Gross Business Profit ¥500bn Approx. ¥635bn Approx. +¥135bn ¥650bn Approx. ¥820bn Approx. +¥170bn

Banking ¥385bn Approx. ¥475bn Approx. +¥90bn ¥460bn Approx. ¥560bn Approx. +¥100bn

Fees* ¥80bn Approx. ¥120bn Approx. +¥40bn ¥110bn Approx. ¥150bn Approx. +¥40bn

Asset Management and ¥80bn Approx. ¥105bn Approx. +¥25bn ¥140bn Approx. ¥190bn Approx. +¥50bn

Administration

Real Estate ¥35bn Approx. ¥55bn Approx. +¥20bn ¥50bn Approx. ¥70bn Approx. +¥20bn

Operating Expenses—¥245bn Approx.—¥235bn Approx. +¥10bn—¥360bn Approx.—¥360bn Approx. ¥0bn

Net Business Profit before ¥255bn Approx. ¥400bn Approx. +¥145bn ¥290bn Approx. ¥460bn Approx. +¥170bn

Credit Costs

Credit Costs—¥40bn Approx.—¥30bn Approx. +¥10bn—¥50bn Approx.—¥40bn Approx. +¥10bn

Net Profit ¥125bn Approx. ¥200bn Approx. +¥75bn ¥125bn Approx. ¥220bn Approx. +¥95bn

*Investment trust and insurance sales fee and lending fee, etc.

1. Incremental costs related to expanding business

(Note1) Non-consolidated figures: FY2010 figures are totals of three trust banks and

FY2015 figures are those of Sumitomo Mitsui Trust Bank would be offset by synergies, thus nearly flat

(Note2) FY2015 figures do not include the effect of consolidating Japan Trustee 2. Exclude integration costs (included in one-time

Services Bank costs)

22

| | • | | Consolidated gross business profit is expected to increase by approx. ¥170.0 billion mainly due to an increase of trust and asset administration fees. |

| | • | | In terms of operating expenses, an approx. ¥28.0 billion increase in variable costs such as operating expenses related to expanding business will be offset by cost synergies, resulting in a projection of costs that will be flat compared with those of FY2010. |

| | • | | Concerning credit costs, approx. ¥40.0 billion is assumed, which corresponds to approx. 15 bps of a total loan balance on the consolidated basis. |

| | • | | Please proceed to page 23. |

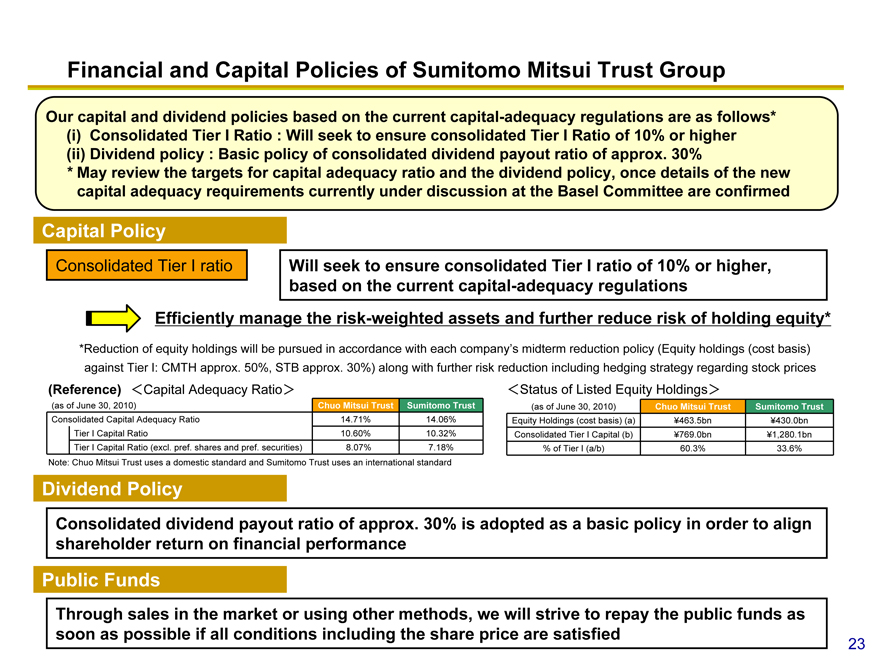

Financial and Capital Policies of Sumitomo Mitsui Trust Group

Our capital and dividend policies based on the current capital-adequacy regulations are as follows*

(i) | Consolidated Tier I Ratio : Will seek to ensure consolidated Tier I Ratio of 10% or |

higher

(ii) Dividend policy : Basic policy of consolidated dividend payout ratio of approx. 30%

* | May review the targets for capital adequacy ratio and the dividend policy, once details of the new |

capital adequacy requirements currently under discussion at the Basel Committee are confirmed

Capital Policy

Consolidated Tier I ratio Will seek to ensure consolidated Tier I ratio of 10% or higher,

based on the current capital-adequacy regulations

Efficiently manage the risk-weighted assets and further reduce risk of holding equity*

*Reduction of equity holdings will be pursued in accordance with each company’s midterm reduction policy (Equity holdings (cost basis)

against Tier I: CMTH approx. 50%, STB approx. 30%) along with further risk reduction including hedging strategy regarding stock prices

(Reference) Capital Adequacy Ratio Status of Listed Equity Holdings

(as of June 30, 2010) Chuo Mitsui Trust Sumitomo Trust (as of June 30, 2010) Chuo Mitsui Trust Sumitomo Trust

Consolidated Capital Adequacy Ratio 14.71% 14.06% Equity Holdings (cost basis) (a) ¥463.5bn ¥430.0bn

Tier I Capital Ratio 10.60% 10.32% Consolidated Tier I Capital (b) ¥769.0bn ¥1,280.1bn

Tier I Capital Ratio (excl. pref. shares and pref. securities) 8.07% 7.18% % of Tier I (a/b) 60.3% 33.6%

Note: Chuo Mitsui Trust uses a domestic standard and Sumitomo Trust uses an international standard

Dividend Policy

Consolidated dividend payout ratio of approx. 30% is adopted as a basic policy in order to align shareholder return on financial performance

Public Funds

Through sales in the market or using other methods, we will strive to repay the public funds as soon as possible if all conditions including the share price are satisfied

23

| | • | | Lastly, I explain financial and capital policies of the new trust bank group. |

| | • | | Regarding the capital adequacy ratio, Sumitomo Mitsui Trust Group aims to ensure consolidated Tier I ratio of 10% or higher based on the current capital adequacy regulations. |

| | • | | Although both CMTH and STB have secured a 10% level, we will strive to further reinforce our financial position by efficiently managing risk-weighted assets, further reducing risks of holding equity and accumulating retained earnings to improve capital adequacy in terms of quality and quantity. |

| | • | | As the BASEL III is currently under development by Basel Committee on Banking Supervision, the targets for capital adequacy ratio may be reviewed later, once details of the new capital adequacy requirements are confirmed. |

| | • | | With regard to the dividend policy, consolidated dividend payout ratio of approx. 30% is adopted as a basic policy which we think is an adequate standard at present for the new trust bank group to better balance securing capital adequacy and capital efficiency. |

| | • | | In terms of public funds, as we previously announced, we will strive to repay the public funds as soon as possible through sales in the market or using other methods, if all conditions including the share price are satisfied. Should we fail to repay them before the management integration, we would show our measures and achievements to increase the market value of the new trust bank group and thereby strive for early repayment. |

(Please proceed to the next page.)

The Management Integration Plan

~Towards creation of “The Trust Bank” with a Combination of Expertise and Comprehensive Capabilities~

24

| | • | | Current macro-environmental prospects have increasing uncertainties such as sign of change seen in domestic and foreign economies and volatile share price movement. |

| | • | | Although the management model of the new trust bank group surely shows stronger resistance to downside risks, the management will tackle challenges such as early achievement and further accumulation of synergy effects. |

| | • | | With President Kazuo Tanabe and all the management staff of CMTH group and STB group, in order to extract the new trust bank group’s strength to the maximum and create “The Trust Bank” quickly, we will strive to establish management and business models that are different from those of megabanks with concerted efforts. |

| | • | | That concludes my explanation. Thank you for listening. |

Cautionary Statement Regarding Forward-Looking Statements

This announcement contains certain forward-looking statements that reflect the plans and expectations of Chuo Mitsui Trust Holdings, Inc. and The Sumitomo Trust and Banking Co., Ltd. in relation to, and the benefits resulting from, their proposed business combination and business alliance. These forward-looking statements may be identified by words such as ‘believes’, ‘expects’, ‘anticipates’, ‘projects’, ‘intends’, ‘should’, ‘seeks’, ‘estimates’, ‘future’ or similar expressions or by discussion of, among other things, strategy, goals, plans or intentions. Actual results may differ materially in the future from those reflected in forward-looking statements contained in this document, due to various factors including but not limited to:

l failure of the parties to agree on some or all of the terms of business combination;

l failure to obtain a necessary shareholder approval;

l inability to obtain some or all necessary regulatory approvals or to fulfill any other condition to the closing of the transaction;

l changes in laws or accounting standards, or other changes in the business environment relevant to the parties;

l challenges in executing our business strategies;

l the effects of financial instability or other changes in general economic or industry conditions; and

l other risks to consummation of the transaction.

Additional Information and Where to Find It

Chuo Mitsui Trust Holdings, Inc. may file a registration statement on Form F-4 with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its proposed business combination with The Sumitomo Trust and Banking Co., Ltd. The Form F-4, if filed, will contain a prospectus and other documents. If the Form F-4 is filed and declared effective, the prospectus contained in the Form F-4 is expected to be mailed to U.S. shareholders of The Sumitomo Trust and Banking Co., Ltd. prior to the shareholders’ meeting at which the proposed business combination will be voted upon. The Form F-4, if filed, and prospectus, as they may be amended from time to time, will contain important information about Chuo Mitsui Trust Holdings, Inc. and The Sumitomo Trust and Banking Co., Ltd., the business combination and related matters including the terms and conditions of the transaction. U.S. shareholders of The Sumitomo Trust and Banking Co., Ltd. are urged to read carefully the Form F-4, the prospectus and the other documents, as they may be amended from time to time, that have been or may be filed with the SEC in connection with the transaction before they make any decision at the shareholders meeting with respect to the business combination. The Form F-4, if filed, the prospectus and all other documents filed with the SEC in connection with the business combination will be available when filed, free of charge, on the SEC’s web site at www.sec.gov. In addition, the prospectus and all other documents filed with the SEC in connection with the business combination will be made available to U.S. shareholders of The Sumitomo Trust and Banking Co., Ltd., free of charge, by faxing a request to Chuo Mitsui Trust Holdings, Inc. at +81-3-5232-8716 or to The Sumitomo Trust and Banking Co., Ltd. at +81-3-3286-4654.