UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2017

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from______ to______

Commission file number: 001-13425

Ritchie Bros. Auctioneers Incorporated

(Exact Name of Registrant as Specified in its Charter)

| Canada | | N/A |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| 9500 Glenlyon Parkway | | |

| Burnaby, British Columbia, Canada | | V5J 0C6 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(778) 331-5500

(Registrant’s Telephone Number, including Area Code)

Indicate by checkmark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesx No¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YesxNo¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x

Accelerated filer ¨

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

Smaller reporting company ¨

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Yes¨ Nox

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practical date: 106,985,954 common shares, without par value, outstanding as of May 2, 2017.

RITCHIE BROS. AUCTIONEERS INCORPORATED

FORM 10-Q

For the quarter ended March 31, 2017

INDEX

Cautionary Note Regarding Forward-Looking Statements

The information discussed in this Quarterly Report on Form 10-Q of Ritchie Bros. Auctioneers Incorporated (“Ritchie Bros.”, the “Company”, “we” or “us”) includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”) and Canadian securities laws. These statements are based on our current expectations and estimates about our business and markets, and include, among others, statements relating to:

| · | our future strategy, objectives, targets, projections, performance, and key enablers; |

| · | our ability to drive shareholder value; |

| · | our internet initiatives and the level of participation in our auctions by internet bidders, and the success of EquipmentOne and our other online marketplaces; |

| · | our ability to grow our businesses, acquire new customers, enhance our sector reach, drive geographic depth, and scale our operations; |

| · | the impact of our initiatives, services, investments, and acquisitions on us and our customers; |

| · | the acquisition or disposition of properties; |

| · | our ability to integrate our acquisitions; |

| · | potential future mergers and acquisitions, including the planned merger of Ritchie Bros. and IronPlanet Holdings, Inc., and the consummation of regulatory review and closing; |

| · | potential future strategic alliances, including the planned alliance between Ritchie Bros., IronPlanet, Inc., and Caterpillar Inc. |

| · | our ability to add new business and information solutions, including, among others, our ability to maximize and integrate technology to enhance our existing services and support additional value-added service offerings; |

| · | the supply trend of equipment in the market and the anticipated price environment for late model equipment, as well as the resulting effect on our business and Gross Auction Proceeds (“GAP”) (as defined under “Part I, Item 2: Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Quarterly Report on Form 10-Q); |

| · | fluctuations in our quarterly revenues and operating performance resulting from the seasonality of our business; |

| · | our compliance with all laws, rules regulations and requirements that affect our business; |

| · | effects of various economic, financial, industry, and market conditions or policies, including the supply and demand for property, equipment, or natural resources; |

| · | the behavior of oil and gas equipment pricing; |

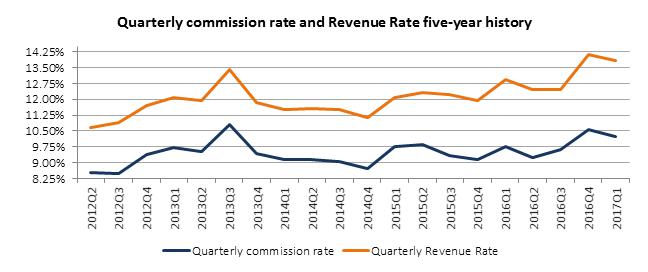

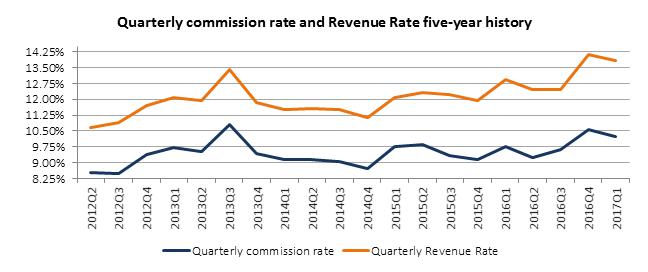

| · | the relative percentage of GAP represented by straight commission or underwritten (guarantee and inventory) contracts, and its impact on revenues and profitability; |

| · | ourRevenue Rates (as described under “Part I, Item 2: Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Quarterly Report on Form 10-Q), the sustainability of those rates, the impact of our commission rate and fee changes, and the seasonality of GAP and revenues; |

| · | our future capital expenditures and returns on those expenditures; |

| · | the proportion of our revenues, operating expenses, and operating income denominated in currencies other than the United States (“U.S.”) dollar or the effect of any currency exchange and interest rate fluctuations on our results of operations; |

| · | the grant and satisfaction of equity awards pursuant to our compensation plans; |

| · | any future declaration and payment of dividends, including the tax treatment of any such dividends; |

| · | financing available to us, our ability to refinance borrowings, and the sufficiency of our working capital to meet our financial needs; and |

| · | our ability to satisfy our present operating requirements and fund future growth through existing working capital and credit facilities. |

Forward-looking statements are typically identified by such words as “aim”, “anticipate”, “believe”, “could”, “continue”, “estimate”, “expect”, “intend”, “may”, “ongoing”, “plan”, “potential”, “predict”, “will”, “should”, “would”, “could”, “likely”, “generally”, “future”, “period to period”, “long-term”, or the negative of these terms, and similar expressions intended to identify forward-looking statements. Our forward-looking statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict.

While we have not described all potential risks related to our business and owning our common shares, the important factors discussed in “Part II, Item 1A: Risk Factors” of this Quarterly Report on Form 10-Q and in “Part I, Item 1A: Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2016, which is available on our website atwww.rbauction.com, on EDGAR atwww.sec.gov, or on SEDAR atwww.sedar.com, are among those that we consider may affect our performance materially or could cause our actual financial and operational results to differ significantly from our expectations. Except as required by applicable securities law and regulations of relevant securities exchanges, we do not intend to update publicly any forward-looking statements, even if our expectations have been affected by new information, future events or other developments. You should consider our forward-looking statements in light of the factors listed or referenced under “Risk Factors” herein and other relevant factors.

PART I

| ITEM 1: | CONDENSED CONSOLIDATED FINANCIAL STATEMENTS |

| Condensed Consolidated Income Statements |

| (Expressed in thousands of United States dollars, except share and per share data) |

| (Unaudited) |

| Three months ended March 31, | | 2017 | | | 2016 | |

| Revenues (note 6) | | $ | 124,499 | | | $ | 131,945 | |

| Costs of services, excluding depreciation and amortization (note 7) | | | 12,813 | | | | 15,313 | |

| | | | 111,686 | | | | 116,632 | |

| Selling, general and administrative expenses (note 7) | | | 70,575 | | | | 67,110 | |

| Acquisition-related costs (note 7) | | | 8,627 | | | | 1,197 | |

| Depreciation and amortization expenses (note 7) | | | 10,338 | | | | 10,080 | |

| Gain on disposition of property, plant and equipment | | | (721 | ) | | | (246 | ) |

| Foreign exchange gain | | | (730 | ) | | | (683 | ) |

| | | | | | | | | |

| Operating income | | | 23,597 | | | | 39,174 | |

| | | | | | | | | |

| Other income (expense): | | | | | | | | |

| Interest income | | | 955 | | | | 498 | |

| Interest expense | | | (8,133 | ) | | | (1,363 | ) |

| Equity income (loss) (note 17) | | | (53 | ) | | | 519 | |

| Other, net | | | 1,382 | | | | 698 | |

| | | | (5,849 | ) | | | 352 | |

| | | | | | | | | |

| Income before income taxes | | | 17,748 | | | | 39,526 | |

| | | | | | | | | |

| Income tax expense (recovery) (note 8): | | | | | | | | |

| Current | | | 7,488 | | | | 10,009 | |

| Deferred | | | (173 | ) | | | (477 | ) |

| | | | 7,315 | | | | 9,532 | |

| | | | | | | | | |

| Net income | | $ | 10,433 | | | $ | 29,994 | |

| | | | | | | | | |

| Net income attributable to: | | | | | | | | |

| Stockholders | | $ | 10,377 | | | $ | 29,406 | |

| Non-controlling interests | | | 56 | | | | 588 | |

| | | $ | 10,433 | | | $ | 29,994 | |

| | | | | | | | | |

| Earnings per share attributable to stockholders (note 9): | | | | | | | | |

| Basic | | $ | 0.10 | | | $ | 0.28 | |

| Diluted | | $ | 0.10 | | | $ | 0.27 | |

| | | | | | | | | |

| Weighted average number of shares outstanding (note 9): | | | | | | | | |

| Basic | | | 106,851,595 | | | | 106,917,280 | |

| Diluted | | | 107,788,949 | | | | 107,159,010 | |

See accompanying notes to the condensed consolidated financial statements.

| Condensed Consolidated Statements of Comprehensive Income |

| (Expressed in thousands of United States dollars) |

| (Unaudited) |

| Three months ended March 31, | | 2017 | | | 2016 | |

| | | | | | | | | |

| Net income | | $ | 10,433 | | | $ | 29,994 | |

| Other comprehensive income, net of income tax: | | | | | | | | |

| Foreign currency translation adjustment | | | 7,440 | | | | 12,195 | |

| | | | | | | | | |

| Total comprehensive income | | $ | 17,873 | | | $ | 42,189 | |

| | | | | | | | | |

| Total comprehensive income attributable to: | | | | | | | | |

| Stockholders | | | 17,813 | | | | 41,434 | |

| Non-controlling interests | | | 60 | | | | 755 | |

| | | $ | 17,873 | | | $ | 42,189 | |

See accompanying notes to the condensed consolidated financial statements.

| Condensed Consolidated Balance Sheets |

| (Expressed in thousands of United States dollars, except share data) |

| (Unaudited) |

| | | March 31, | | | December 31, | |

| | | 2017 | | | 2016 | |

| Assets | | | | | | | | |

| Current assets: | | | | | | | | |

| Cash and cash equivalents | | $ | 236,894 | | | $ | 207,867 | |

| Restricted cash | | | 137,986 | | | | 50,222 | |

| Trade and other receivables | | | 112,353 | | | | 52,979 | |

| Inventory (note 12) | | | 20,868 | | | | 28,491 | |

| Advances against auction contracts | | | 7,485 | | | | 5,621 | |

| Prepaid expenses and deposits | | | 15,114 | | | | 19,005 | |

| Assets held for sale (note 13) | | | 242 | | | | 632 | |

| Income taxes receivable | | | 15,091 | | | | 13,181 | |

| | | | 546,033 | | | | 377,998 | |

| Property, plant and equipment (note 14) | | | 515,019 | | | | 515,030 | |

| Equity-accounted investments (note 17) | | | 7,197 | | | | 7,326 | |

| Restricted cash (note 10) | | | 500,000 | | | | 500,000 | |

| Deferred debt issue costs | | | 5,853 | | | | 6,182 | |

| Other non-current assets | | | 4,711 | | | | 4,027 | |

| Intangible assets (note 15) | | | 74,987 | | | | 72,304 | |

| Goodwill (note 16) | | | 98,065 | | | | 97,537 | |

| Deferred tax assets | | | 22,450 | | | | 19,129 | |

| | | $ | 1,774,315 | | | $ | 1,599,533 | |

| Liabilities and Equity | | | | | | | | |

| Current liabilities: | | | | | | | | |

| Auction proceeds payable | | $ | 278,195 | | | $ | 98,873 | |

| Trade and other payables | | | 115,434 | | | | 124,694 | |

| Income taxes payable | | | 1,378 | | | | 5,355 | |

| Short-term debt (note 18) | | | 24,616 | | | | 23,912 | |

| | | | 419,623 | | | | 252,834 | |

| Long-term debt (note 18) | | | 596,438 | | | | 595,706 | |

| Share unit liabilities | | | 2,404 | | | | 4,243 | |

| Other non-current liabilities | | | 14,972 | | | | 14,583 | |

| Deferred tax liabilities | | | 39,691 | | | | 36,387 | |

| | | | 1,073,128 | | | | 903,753 | |

| Contingencies (note 21) | | | | | | | | |

| Contingently redeemable performance share units (note 20) | | | 5,021 | | | | 3,950 | |

| Stockholders' equity (note 19): | | | | | | | | |

| Share capital: | | | | | | | | |

| Common stock; no par value, unlimited shares authorized, issued and outstanding shares: 106,954,951 (December 31, 2016: 106,822,001) | | | 129,625 | | | | 125,474 | |

| Additional paid-in capital | | | 28,227 | | | | 27,638 | |

| Retained earnings | | | 593,212 | | | | 601,071 | |

| Accumulated other comprehensive loss | | | (59,690 | ) | | | (67,126 | ) |

| Stockholders' equity | | | 691,374 | | | | 687,057 | |

| Non-controlling interest | | | 4,792 | | | | 4,773 | |

| | | | 696,166 | | | | 691,830 | |

| | | $ | 1,774,315 | | | $ | 1,599,533 | |

See accompanying notes to the condensed consolidated financial statements.

| Condensed Consolidated Statements of Changes in Equity |

| (Expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| | | Attributable to stockholders | | | | | | | | | Contingently | |

| | | | | | Additional | | | | | | Accumulated | | | Non- | | | | | | redeemable | |

| | | Common stock | | | paid-In | | | | | | other | | | controlling | | | | | | performance | |

| | | Number of | | | | | | capital | | | Retained | | | comprehensive | | | interest | | | Total | | | share units | |

| | | shares | | | Amount | | | ("APIC") | | | earnings | | | income (loss) | | | ("NCI") | | | equity | | | ("PSUs") | |

| Balance, December 31, 2016 | | | 106,822,001 | | | $ | 125,474 | | | $ | 27,638 | | | $ | 601,071 | | | $ | (67,126 | ) | | $ | 4,773 | | | $ | 691,830 | | | $ | 3,950 | |

| Net income | | | - | | | | - | | | | - | | | | 10,377 | | | | - | | | | 56 | | | | 10,433 | | | | - | |

| Other comprehensive income | | | - | | | | - | | | | - | | | | - | | | | 7,436 | | | | 4 | | | | 7,440 | | | | - | |

| | | | - | | | | - | | | | - | | | | 10,377 | | | | 7,436 | | | | 60 | | | | 17,873 | | | | - | |

| Stock option exercises | | | 132,950 | | | | 4,151 | | | | (739 | ) | | | - | | | | - | | | | - | | | | 3,412 | | | | - | |

| Stock option compensation expense (note 20) | | | - | | | | - | | | | 1,311 | | | | - | | | | - | | | | - | | | | 1,311 | | | | - | |

| Equity-classified PSU expense (note 20) | | | - | | | | - | | | | 15 | | | | - | | | | - | | | | - | | | | 15 | | | | 997 | |

| Equity-classified PSU dividend equivalents | | | - | | | | - | | | | 2 | | | | (47 | ) | | | - | | | | - | | | | (45 | ) | | | 45 | |

| Change in value of contingently redeemable equity-classified PSUs | | | - | | | | - | | | | - | | | | (29 | ) | | | - | | | | - | | | | (29 | ) | | | 29 | |

| Cash dividends paid (note 19) | | | - | | | | - | | | | - | | | | (18,160 | ) | | | - | | | | (41 | ) | | | (18,201 | ) | | | - | |

| Balance, March 31, 2017 | | | 106,954,951 | | | $ | 129,625 | | | $ | 28,227 | | | $ | 593,212 | | | $ | (59,690 | ) | | $ | 4,792 | | | $ | 696,166 | | | $ | 5,021 | |

See accompanying notes to the condensed consolidated financial statements.

| Condensed Consolidated Statements of Cash Flows |

| (Expressed in thousands of United States dollars) |

| (Unaudited) |

| Three months ended March 31, | | 2017 | | | 2016 | |

| Cash provided by (used in): | | | | | | | | |

| Operating activities: | | | | | | | | |

| Net income | | $ | 10,433 | | | $ | 29,994 | |

| Adjustments for items not affecting cash: | | | | | | | | |

| Depreciation and amortization expenses (note 7) | | | 10,338 | | | | 10,080 | |

| Inventory write down (note 12) | | | 355 | | | | - | |

| Stock option compensation expense (note 20) | | | 1,311 | | | | 1,070 | |

| Equity-classified PSU expense (note 20) | | | 1,012 | | | | - | |

| Deferred income tax recovery | | | (173 | ) | | | (477 | ) |

| Equity loss (income) less dividends received | | | 53 | | | | (519 | ) |

| Unrealized foreign exchange gain | | | (240 | ) | | | (621 | ) |

| Change in fair value of contingent consideration | | | (430 | ) | | | - | |

| Gain on disposition of property, plant and equipment | | | (721 | ) | | | (246 | ) |

| Debt issue cost amortization | | | 445 | | | | - | |

| Other, net | | | 114 | | | | - | |

| Net changes in operating assets and liabilities (note 10) | | | 112,045 | | | | 126,394 | |

| Net cash provided by operating activities | | | 134,542 | | | | 165,675 | |

| Investing activities: | | | | | | | | |

| Acquisition of Mascus (note 22) | | | - | | | | (27,812 | ) |

| Property, plant and equipment additions | | | (1,863 | ) | | | (2,444 | ) |

| Intangible asset additions | | | (5,664 | ) | | | (3,711 | ) |

| Proceeds on disposition of property, plant and equipment | | | 1,505 | | | | 824 | |

| Other, net | | | - | | | | (173 | ) |

| Net cash used in investing activities | | | (6,022 | ) | | | (33,316 | ) |

| Financing activities: | | | | | | | | |

| Issuances of share capital | | | 3,412 | | | | 3,031 | |

| Share repurchase (note 19) | | | - | | | | (36,726 | ) |

| Dividends paid to stockholders (note 19) | | | (18,160 | ) | | | (17,154 | ) |

| Dividends paid to NCI | | | (41 | ) | | | (2,296 | ) |

| Proceeds from short-term debt | | | 1,219 | | | | 30,179 | |

| Repayment of short-term debt | | | (1,009 | ) | | | (2,283 | ) |

| Repayment of finance lease obligations | | | (438 | ) | | | (493 | ) |

| Other, net | | | (48 | ) | | | 32 | |

| Net cash used in financing activities | | | (15,065 | ) | | | (25,710 | ) |

| Effect of changes in foreign currency rates on cash and cash equivalents | | | 3,336 | | | | 12,123 | |

| Cash, cash equivalents, and restricted cash: | | | | | | | | |

| Increase | | | 116,791 | | | | 118,772 | |

| Beginning of period | | | 758,089 | | | | 293,246 | |

| Cash, cash equivalents, and restricted cash, end of period (note 10) | | $ | 874,880 | | | | 412,018 | |

See accompanying notes to the condensed consolidated financial statements.

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

Ritchie Bros. Auctioneers Incorporated and its subsidiaries (collectively referred to as the “Company”) provide asset management and disposition services for the construction, agricultural, transportation, energy, mining, forestry, material handling, marine and real estate industries through its unreserved auctions, online marketplace services, value-added services and listing and software services. Ritchie Bros. Auctioneers Incorporated is a company incorporated in Canada under the Canada Business Corporations Act, whose shares are publicly traded on the Toronto Stock Exchange (“TSX”) and the New York Stock Exchange (“NYSE”).

| 2. | Significant accounting policies |

These unaudited condensed consolidated interim financial statements have been prepared in accordance with United States generally accepted accounting principles (“US GAAP”). They include the accounts of Ritchie Bros. Auctioneers Incorporated and its subsidiaries (collectively referred to as the “Company”) from their respective dates of formation or acquisition. All significant intercompany balances and transactions have been eliminated.

Certain information and footnote disclosure required by US GAAP for complete annual financial statements have been omitted and, therefore, these condensed consolidated interim financial statements should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2016, included in the Company’s Annual Report on Form 10-K, filed with the Securities Exchange Commission (“SEC”). In the opinion of management, these unaudited condensed consolidated interim financial statements reflect all adjustments, consisting of normal recurring adjustments, which are necessary to present fairly, in all material respects, the Company’s consolidated financial position, results of operations, cash flows and changes in equity for the interim periods presented. The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Revenues are comprised of:

| · | commissions earned at the Company’s auctions through the Company acting as an agent for consignors of equipment and other assets, as well as commissions on online marketplace sales, and |

| · | fees earned in the process of conducting auctions, fees from value-added services, as well as fees paid by buyers on online marketplace sales. |

The Company recognizes revenue when persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, the price is fixed or determinable, and collectability is reasonably assured. For auction or online marketplace sales, revenue is recognized when the auction or online marketplace sale is complete and the Company has determined that the sale proceeds are collectible. Revenue is measured at the fair value of the consideration received or receivable and is shown net of value-added tax and duties.

Commissions from sales at the Company’s auctions represent the percentage earned by the Company on the gross auction proceeds from equipment and other assets sold at auction. The majority of the Company’s commissions are earned as a pre-negotiated fixed rate of the gross selling price. Other commissions from sales at the Company’s auctions are earned from underwritten commission contracts, when the Company guarantees a certain level of proceeds to a consignor or purchases inventory to be sold at auction. Commissions also include those earned on online marketplace sales.

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 2. | Significant accounting policies (continued) |

| (b) | Revenue recognition (continued) |

Commissions from sales at auction

The Company accepts equipment and other assets on consignment or takes title for a short period of time prior to auction, stimulates buyer interest through professional marketing techniques, and matches sellers (also known as consignors) to buyers through the auction or private sale process.

In its role as auctioneer, the Company matches buyers to sellers of equipment on consignment, as well as to inventory held by the Company, through the auction process. Following the auction, the Company invoices the buyer for the purchase price of the property, collects payment from the buyer, and where applicable, remits to the consignor the net sale proceeds after deducting its commissions, expenses and applicable taxes. Commissions are calculated as a percentage of the hammer price of the property sold at auction.

On the fall of the auctioneer’s hammer, the highest bidder becomes legally obligated to pay the full purchase price, which is the hammer price of the property purchased and the seller is legally obligated to relinquish the property in exchange for the hammer price less any seller’s commissions. Commission revenue is recognized on the date of the auction sale upon the fall of the auctioneer’s hammer, which is the point in time when the Company has substantially accomplished what it must do to be entitled to the benefits represented by the commission revenue. Subsequent to the date of the auction sale, the Company’s remaining obligations for its auction services relate only to the collection of the purchase price from the buyer and the remittance of the net sale proceeds to the seller. These remaining service obligations are not an essential part of the auction services provided by the Company.

Under the standard terms and conditions of its auction sales, the Company is not obligated to pay a consignor for property that has not been paid for by the buyer, provided the property has not been released to the buyer. In the rare event where a buyer refuses to take title of the property, the sale is cancelled in the period in which the determination is made, and the property is returned to the consignor. Historically, cancelled sales have not been material in relation to the aggregate hammer price of property sold at auction.

Commission revenues are recorded net of commissions owed to third parties, which are principally the result of situations when the commission is shared with a consignor or with the counterparty in an auction guarantee risk and reward sharing arrangement. Additionally, in certain situations, commissions are shared with third parties who introduce the Company to consignors who sell property at auction.

Underwritten commission contracts can take the form of guarantee or inventory contracts. Guarantee contracts typically include a pre-negotiated percentage of the guaranteed gross proceeds plus a percentage of proceeds in excess of the guaranteed amount. If actual auction proceeds are less than the guaranteed amount, commission is reduced; if proceeds are sufficiently lower, the Company can incur a loss on the sale. Losses, if any, resulting from guarantee contracts are recorded in the period in which the relevant auction is completed. If a loss relating to a guarantee contract held at the period end to be sold after the period end is known or is probable and estimable at the financial statement reporting date, the loss is accrued in the financial statements for that period. The Company’s exposure from these guarantee contracts fluctuates over time (note 21).

Revenues related to inventory contracts are recognized in the period in which the sale is completed, title to the property passes to the purchaser and the Company has fulfilled any other obligations that may be relevant to the transaction, including, but not limited to, delivery of the property. Revenue from inventory sales is presented net of costs within revenues on the income statement, as the Company takes title only for a short period of time and the risks and rewards of ownership are not substantially different than the Company’s other underwritten commission contracts.

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 2. | Significant accounting policies (continued) |

| (b) | Revenue recognition (continued) |

Fees

Fees earned in the process of conducting the Company’s auctions include administrative, documentation, and advertising fees. Fees from value-added services include financing and technology service fees. Fees also include amounts paid by buyers (a “buyer’s premium”) on online marketplace sales. Fees are recognized in the period in which the service is provided to the customer.

| (c) | Costs of services, excluding depreciation and amortization expenses |

Costs of services are comprised of expenses incurred in direct relation to conducting auctions (“direct expenses”), earning online marketplace revenues, and earning other fee revenues. Direct expenses include direct labour, buildings and facilities charges, and travel, advertising and promotion costs. Costs of services incurred to earn online marketplace revenues include inventory management, referral, inspection, sampling, and appraisal fees. Costs of services incurred in earning other fee revenues include direct labour (including commissions on sales), software maintenance fees, and materials. Costs of services exclude depreciation and amortization expenses.

The Company classifies a share-based payment award as an equity or liability payment based on the substantive terms of the award and any related arrangement.

Equity-classified share-based payments

The Company has a stock option compensation plan that provides for the award of stock options to selected employees, directors and officers of the Company. The cost of options granted is measured at the fair value of the underlying option at the grant date using the Black-Scholes option pricing model. The Company also has a senior executive performance share unit (“PSU”) plan that provides for the award of PSUs to selected senior executives of the Company. The Company has the option to settle executive PSU awards in cash or shares and expects to settle them in shares. The cost of PSUs granted is measured at the fair value of the underlying PSUs at the grant date using a binomial model.

This fair value of awards expected to vest under these plans is expensed over the respective remaining service period of the individual awards, on a straight-line basis, with recognition of a corresponding increase to APIC in equity. At the end of each reporting period, the Company revises its estimate of the number of equity instruments expected to vest. The impact of the revision of the original estimates, if any, is recognized in earnings, such that the consolidated expense reflects the revised estimate, with a corresponding adjustment to equity.

Any consideration paid on exercise of the stock options is credited to the common shares together with any related compensation recognized for the award. Dividend equivalents on the senior executive plan PSUs are recognized as a reduction to retained earnings over the service period.

PSUs awarded under the senior executive and employee PSU plans (described in note 20) are contingently redeemable in cash in the event of death of the participant. The contingently redeemable portion of the senior executive PSU awards, which represents the amount that would be redeemable based on the conditions at the date of grant, to the extent attributable to prior service, is recognized as temporary equity. The balance reported in temporary equity increases on the same basis as the related compensation expense over the service period of the award, with any excess of the temporary equity value over the amount recognized in compensation expense charged against retained earnings. In the event it becomes probable an award is going to become eligible for redemption by the holder, the award would be reclassified to a liability award.

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 2. | Significant accounting policies (continued) |

| (d) | Share-based payments (continued) |

Liability-classified share-based payments

The Company maintains other share unit compensation plans that vest over a period of up to five years after grant. Under those plans, the Company is either required or expects to settle vested awards on a cash basis or by providing cash to acquire shares on the open market on the employee’s behalf, where the settlement amount is determined using the volume weighted average price of the Company’s common shares for the twenty days prior to the vesting date or, in the case of deferred share unit (“DSU”) recipients, following cessation of service on the Board of Directors.

These awards are classified as liability awards, measured at fair value at the date of grant and re-measured at fair value at each reporting date up to and including the settlement date. The determination of the fair value of the share units under these plans is described in note 20. The fair value of the awards is expensed over the respective vesting period of the individual awards with recognition of a corresponding liability. Changes in fair value after vesting are recognized through compensation expense. Compensation expense reflects estimates of the number of instruments expected to vest.

The impact of forfeitures and fair value revisions, if any, are recognized in earnings such that the cumulative expense reflects the revisions, with a corresponding adjustment to the settlement liability. Liability-classified share unit liabilities due within 12 months of the reporting date are presented in trade and other payables while settlements due beyond 12 months of the reporting date are presented in non-current liabilities.

Goodwill represents the excess of the purchase price of an acquired enterprise over the fair value assigned to the assets acquired and liabilities assumed in a business combination. Goodwill is allocated to the Core Auction, the EquipmentOne, or the Mascus reporting unit.

Goodwill is not amortized, but it is tested annually for impairment at the reporting unit level as of December 31 and between annual tests if indicators of potential impairment exist. The Company has the option of performing a qualitative assessment of a reporting unit to first determine whether the quantitative impairment test is necessary. This involves an assessment of qualitative factors to determine the existence of events or circumstances that would indicate whether it is more likely than not that the carrying amount of the reporting unit to which goodwill belongs is less than its fair value. If the qualitative assessment indicates it is not more likely than not that the reporting unit’s carrying amount is less than its fair value, a quantitative impairment test is not required.

Where a quantitative impairment test is required, the procedure is to identify potential impairment by comparing the reporting unit’s fair value with its carrying amount, including goodwill. The reporting unit’s fair value is determined using various valuation approaches and techniques that involve assumptions based on what the Company believes a hypothetical marketplace participant would use in estimating fair value on the measurement date. An impairment loss is recognized as the difference between the reporting unit’s carrying amount and its fair value to the extent the difference does not exceed the total amount of goodwill allocated to the reporting unit.

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 2. | Significant accounting policies (continued) |

| (f) | Early adoption of new accounting pronouncements |

| (i) | In January 2017, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2017-04,Intangibles – Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment,which eliminates Step 2 from the goodwill impairment test. Entities still have the option of performing a qualitative assessment of a reporting unit to first determine whether the quantitative impairment test is necessary. Where an annual or interim quantitative impairment test is necessary, there is only one step, which is to compare the fair value of a reporting unit with its carrying value. An impairment loss is recognized as the difference between the reporting unit’s carrying amount and its fair value to the extent the difference does not exceed the total amount of goodwill allocated to the reporting unit. |

ASU 2017-04 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. Early adoption is permitted for interim and annual goodwill impairment tests performed on testing dates after January 1, 2017. The amendments are applied on a prospective basis. Because the amendments reduce the cost and complexity of goodwill impairment testing, the Company has early adopted ASU 2017-04 in the first quarter of 2017.

| (g) | New and amended accounting standards |

| (i) | Effective January 1, 2017, the Company adopted ASU 2016-06,Derivatives and Hedging (Topic 815): Contingent Put and Call Options in Debt Instruments, which impacts entities that are issuers of or investors in debt instruments – or hybrid financial instruments determined to have a debt host – with embedded call (put) options. One of the criteria for bifurcating an embedded derivative is assessing whether the economic characteristics and risks of call (put) options are clearly and closely related to those of their debt hosts. The amendments of ASU 2016-06 clarify the steps required in making this assessment for contingent call (put) options that can accelerate the payment of principal on debt instruments. Specifically, ASU 2016-06 requires the call (or put) options to be assessed solely in accordance with a four-step decision sequence. Consequently, when a call (put) option is contingently exercisable, an entity does not have to assess whether the triggering event is related to interest rates or credit risks. The standard was applied on a modified retrospective basis to existing debt instruments as of January 1, 2017. Adoption of this standard did not have a significant impact on the Company’s consolidated financial statements. |

| (ii) | Effective January 1, 2017, the Company adopted ASU 2016-09,Compensation – Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting, which requires an entity to recognize share-based payment (“SBP”) award income tax effects in the income statement when the awards vest or are settled. Consequently, the requirement for entities to track additional paid-in capital (“APIC”) pools is eliminated. Other amendments include: |

| | | |

| · | All excess tax benefits and tax deficiencies (including tax benefits of dividends on share-based payment awards) are recognized as income tax expense or benefit in the income statement. The tax effects of exercised or vested awards are treated as discrete items in the reporting period in which they occur. Excess tax benefits are recognized regardless of whether the benefit reduces taxes payable in the current period. These amendments were applied prospectively. |

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 2. | Significant accounting policies (continued) |

| (g) | New and amended accounting standards (continued) |

| · | Because excess taxes no longer flow through APIC, when applying the treasury stock method in calculating diluted earnings per share (“EPS”), the assumed proceeds will no longer include any estimated excess taxes. Excess tax benefits increase assumed proceeds, which results in more hypothetical shares being reacquired. The incremental number of dilutive shares for diluted EPS is calculated as the number of shares from the assumed exercise of the stock less the hypothetical shares reacquired. Therefore, removing excess tax benefits from the equation results in fewer hypothetical shares being reacquired, increasing the incremental number of dilutive shares. |

| · | Excess tax benefits are classified along with other income tax cash flows as an operating activity in the statement of cash flows. The Company elected to apply this amendment prospectively. |

| · | An entity can make an entity-wide accounting policy election to either estimate the number of awards that are expected to vest or account for forfeitures as they occur. Since forfeiture rates of the Company’s stock awards have historically been nominal and represent an insignificant assumption used in management’s estimate of the fair value of those awards, the Company has elected to account for forfeitures as they occur. This accounting policy change was applied on a modified retrospective basis and did not have an impact on the Company’s consolidated financial statements. |

| · | The threshold to qualify for equity classification permits withholding up to the maximum statutory tax rates in the applicable jurisdictions. This amendment was applied on a modified retrospective basis. |

| · | Cash paid by an employer when directly withholding shares for tax-withholding purposes is classified as a financing activity in the statement of cash flows. This amendment was applied prospectively. |

Adoption of this standard did not have a significant impact on the Company’s consolidated financial statements.

| (h) | Recent accounting standards not yet adopted |

| (i) | In May 2014, the FASB issued ASU 2014-09,Revenue from Contracts with Customers (Topic 606), which requires an entity to recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. In particular, it moves away from the current industry and transaction specific requirements. ASU 2014-09 creates a five-step model that requires entities to exercise judgment when considering the terms of the contract(s) which include: |

| 1. | Identifying the contract(s) with the customer, |

| 2. | Identifying the separate performance obligations in the contract, |

| 3. | Determining the transaction price, |

| 4. | Allocating the transaction price to the separate performance obligations, and |

| 5. | Recognizing revenue as each performance obligation is satisfied. |

The amendments also contain extensive disclosure requirements designed to enable users of the financial statements to understand the nature, amount, timing and uncertainty of revenue and cash flows arising from contracts with customers. In July 2015, the FASB delayed the effective date of ASU 2014-09 by one year so that ASU 2014-09 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017. ASU 2014-09 permits the use of either the retrospective or modified retrospective (cumulative effect) transition method.

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 2. | Significant accounting policies (continued) |

| (h) | Recent accounting standards not yet adopted (continued) |

In 2015, the Company established a global new revenue accounting standard adoption team, consisting of financial reporting and accounting advisory representatives from across all geographical regions and business operations. The team developed an adoption framework that continues to be used as guidance in identifying the Company’s significant contracts with customers. In 2016, the team commenced its analysis, with the initial focus being on the impact of the amendments on accounting for the Company’s straight commission contracts, underwritten (inventory and guarantee) commission contracts, and ancillary service contracts. The team is currently in the process of identifying the appropriate changes to our business processes, systems, and controls required to adopt the amendments based on preliminary findings.

Since its inception, the team has regularly reported the findings and progress of the adoption project to management and the Audit Committee. The team is also working closely with management and the Audit Committee to determine the most appropriate method of adoption of ASU 2014-09, which has not yet been selected primarily due to the uncertainty over if and when the Company will receive approval to acquire IronPlanet Holdings, Inc. (note 21). Due to the complexity of applying the amendments retrospectively in the event the acquisition is approved, the Company is evaluating recently issued guidance on practical expedients as part of the adoption method decision.

The team has been closely monitoring FASB activity related to ASU 2014-09 in order to conclude on specific interpretative issues. In early 2016, the team’s progress was aided by the FASB issuing ASU 2016-08,Revenue from Contracts with Customers (Topic 606), Principal versus Agent Considerations (Reporting Revenue Gross versus Net), which clarifies the implementation guidance on principal versus agent considerations, focusing on whether an entity controls a specified good or service before that good or service is transferred to a customer. The team continues to assess the potential effect that these amendments are expected to have on the accounting for inventory commission and certain value-added service contracts, which are currently accounted for on a net as an agent basis within commission and fee revenues, respectively.

| (ii) | In February 2016, the FASB issued ASU 2016-02,Leases (Topic 842), which requires lessees to recognize almost all leases, including operating leases, on the balance sheet through a right-of-use asset and a corresponding lease liability. For short-term leases, defined as those with a term of 12 months or less, the lessee is permitted to make an accounting policy election not to recognize the lease assets and liabilities, and instead recognize the lease expense generally on a straight-line basis over the lease term. The accounting treatment under this election is consistent with current operating lease accounting. No extensive amendments were made to lessor accounting, but amendments of note include changes to the definition of initial direct costs and accounting for collectability uncertainties in a lease. |

ASU 2016-02 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018, with early adoption permitted. Both lessees and lessors must apply ASU 2016-02 using a “modified retrospective transition”, which reflects the new guidance from the beginning of the earliest period presented in the financial statements. However, lessees and lessors can elect to apply certain practical expedients on transition.The Company is evaluating the new guidance to determine the impact it will have on its consolidated financial statements.

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 2. | Significant accounting policies (continued) |

| (h) | Recent accounting standards not yet adopted (continued) |

| (iii) | In March 2016, the FASB issued ASU 2016-08,Revenue from Contracts with Customers (Topic 606), Principal versus Agent Considerations (Reporting Revenue Gross versus Net). The amendments in ASU 2016-08 clarify the implementation guidance on principal versus agent considerations, focusing on whether an entity controls a specified good or service before that good or service is transferred to a customer. Where such control exists – i.e. where the entity is required to provide the specified good or service itself – the entity is a ‘principal’. Where the entity is required to arrange for another party to provide the good or service, it is an agent. |

The effective date and transition requirements of ASU 2016-08 are the same as for ASU 2014-09, which is for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017. The Company is evaluating the new guidance to determine the impact it will have on its consolidated financial statements.

| (iv) | In June 2016, the FASB issued ASU 2016-13,Financial Instruments – Credit Losses (Topic 326), Measurement of Credit Losses on Financial Instruments, which replaces the ‘incurred loss methodology’ credit impairment model with a new forward-looking “methodology that reflects expected credit losses and requires consideration of a broader range of reasonable and supportable information to inform credit loss estimates.” ASU 2016-13 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. Early adoption is only permitted for fiscal years beginning after December 15, 2018, including interim periods within those years. The Company is evaluating the new guidance to determine the impact it will have on its consolidated financial statements. |

| (v) | In January 2017, the FASB issued ASU 2017-01,Business Combinations (Topic 805): Clarifying the Definition of a Business, whose amendments provide a screen to determine when an integrated set of assets and activities does not constitute a business as defined by Topic 805. Specifically, the amendments require that a set is not a business when substantially all the fair value of gross assets acquired (or disposed of) is concentrated in a single identifiable asset or group of similar identifiable assets. This screen reduces the number of transactions that need to be further evaluated and as such, it is anticipated that more acquisitions will be accounted for as asset acquisitions rather than business combinations. If the screen is not met, the amendments: |

| | | |

| 1) | Require that the set must, at a minimum, include an input and a substantive process that together significantly contribute to the ability to create an output in order to be considered a business; and |

| 2) | Remove the evaluation of whether a market participant could replace missing elements. |

The amendments also provide a framework to assist in evaluating whether both an input and a substantive process are present, and this framework includes two sets of criteria to consider that depend on whether a set has outputs. Finally, the amendments narrow the definition of the term “output” so the term is consistent with how outputs are described in Topic 606Revenue from Contracts with Customers.

ASU 2017-01 is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017. The amendments are applied prospectively on or after the effective date. No disclosures are required at transition. The Company is evaluating the new guidance to determine the impact it will have on its consolidated financial statements.

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 2. | Significant accounting policies (continued) |

| (h) | Recent accounting standards not yet adopted (continued) |

| (vi) | In February 2017, the FASB issued ASU 2017-05,Other Income – Gains and Losses from the Derecognition of Nonfinancial Assets (Subtopic 610-20): Clarifying the Scope of Asset Derecognition Guidance and Accounting for Partial Sales of Nonfinancial Assets, which clarifies the scope of Subtopic 610-20 and adds clarity around accounting for partial sales of nonfinancial assets and the identification of, allocation of consideration to, and derecognition of distinct nonfinancial assets. The amendments also define ‘in substance nonfinancial assets’, which are within the scope of Subtopic 610-20, and clarify that nonfinancial assets within the scope of Subtopic 610-20 may include nonfinancial assets transferred within a legal entity to a counterparty. |

ASU 2017-05 is effective at the same time as ASU 2014-09, which is for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2017. Early adoption is permitted, including adoption in an interim period. The amendments in ASU 2017-05 must be applied at the same time as the amendments in ASU 2014-09. Entities may elect to apply these amendments retrospectively to each period presented in the financial statements or using a modified retrospective basis as of the beginning of the fiscal year of adoption. The Company is evaluating the new guidance to determine the impact it will have on its consolidated financial statements.

| 3. | Significant judgments, estimates and assumptions |

The preparation of financial statements in conformity with US GAAP requires management to make judgments, estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period.

Future differences arising between actual results and the judgments, estimates and assumptions made by the Company at the reporting date, or future changes to estimates and assumptions, could necessitate adjustments to the underlying reported amounts of assets, liabilities, revenues and expenses in future reporting periods.

Judgments, estimates and underlying assumptions are evaluated on an ongoing basis by management, and are based on historical experience and other factors including expectations of future events that are believed to be reasonable under the circumstances. Existing circumstances and assumptions about future developments, however, may change due to market changes or circumstance and such changes are reflected in the assumptions when they occur. Significant estimates include the estimated useful lives of long-lived assets, as well as valuation of goodwill, underwritten commission contracts, and share-based compensation.

| 4. | Seasonality of operations |

The Company's operations are both seasonal and event driven. Revenues tend to be highest during the second and fourth calendar quarters. The Company generally conducts more auctions during these quarters than during the first and third calendar quarters. Late December through mid-February and mid-July through August are traditionally less active periods.

The Company’s principal business activity is the sale of industrial equipment and other assets at auctions. The Company’s operations are comprised of one reportable segment and other business activities that are not reportable as follows:

| · | Core Auction segment, a network of auction locations that conduct live, unreserved auctions with both on-site and online bidding; and |

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 5. | Segmented information (continued) |

| · | Other includes the results of the Company’s EquipmentOne and Mascus online services, which are not material to the Company’s consolidated financial statements. On February 19, 2016, the Company acquired Mascus and updated its segment reporting such that the results of EquipmentOne and Mascus (subsequent to acquisition) are reported as “Other.” |

| | | Three months ended | |

| | | March 31, 2017 | |

| | | Core | | | | | | | |

| | | Auction | | | Other | | | Consolidated | |

| Revenues | | $ | 117,772 | | | $ | 6,727 | | | $ | 124,499 | |

| Costs of services, excluding depreciation and amortization | | | (12,038 | ) | | | (775 | ) | | | (12,813 | ) |

| Selling, General, and administrative expenses ("SG&A") | | | (65,570 | ) | | | (5,005 | ) | | | (70,575 | ) |

| Depreciation and amortization expenses | | | (9,454 | ) | | | (884 | ) | | | (10,338 | ) |

| | | $ | 30,710 | | | $ | 63 | | | $ | 30,773 | |

| Acquisition-related costs | | | | | | | | | | | (8,627 | ) |

| Gain on disposition of property, plant and equipment | | | | | | | | | | | 721 | |

| Foreign exchange gain | | | | | | | | | | | 730 | |

| Operating income | | | | | | | | | | $ | 23,597 | |

| Equity loss | | | | | | | | | | | (53 | ) |

| Other and income tax expenses | | | | | | | | | | | (13,111 | ) |

| Net income | | | | | | | | | | $ | 10,433 | |

| | | Three months ended | |

| | | March 31, 2016 | |

| | | Core | | | | | | | |

| | | Auction | | | Other | | | Consolidated | |

| Revenues | | $ | 127,340 | | | $ | 4,605 | | | $ | 131,945 | |

| Costs of services, excluding depreciation and amortization | | | (14,785 | ) | | | (528 | ) | | | (15,313 | ) |

| SG&A expenses | | | (64,514 | ) | | | (2,596 | ) | | | (67,110 | ) |

| Depreciation and amortization expenses | | | (9,304 | ) | | | (776 | ) | | | (10,080 | ) |

| | | $ | 38,737 | | | $ | 705 | | | $ | 39,442 | |

| Acquisition-related costs | | | | | | | | | | | (1,197 | ) |

| Gain on disposition of property, plant and equipment | | | | | | | | | | | 246 | |

| Foreign exchange gain | | | | | | | | | | | 683 | |

| Operating income | | | | | | | | | | $ | 39,174 | |

| Equity income | | | | | | | | | | | 519 | |

| Other and income tax expenses | | | | | | | | | | | (9,699 | ) |

| Net income | | | | | | | | | | $ | 29,994 | |

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

The Company’s revenue from the rendering of services is as follows:

| Three months ended March 31, | | 2017 | | | 2016 | |

| Commissions | | $ | 91,944 | | | $ | 99,793 | |

| Fees | | | 32,555 | | | | 32,152 | |

| | | $ | 124,499 | | | $ | 131,945 | |

Net profits on inventory sales included in commissions are:

| Three months ended March 31, | | 2017 | | | 2016 | |

| Revenue from inventory sales | | $ | 76,048 | | | $ | 124,557 | |

| Cost of inventory sold | | | (63,401 | ) | | | (111,536 | ) |

| | | $ | 12,647 | | | $ | 13,021 | |

Certain prior period operating expenses have been reclassified to conform with current year presentation.

Costs of services, excluding depreciation and amortization

| Three months ended March 31, | | 2017 | | | 2016 | |

| Employee compensation expenses | | $ | 5,476 | | | $ | 6,258 | |

| Buildings, facilities and technology expenses | | | 1,546 | | | | 2,295 | |

| Travel, advertising and promotion expenses | | | 4,656 | | | | 5,937 | |

| Other costs of services | | | 1,135 | | | | 823 | |

| | | $ | 12,813 | | | $ | 15,313 | |

SG&A expenses

| Three months ended March 31, | | 2017 | | | 2016 | |

| Employee compensation expenses | | $ | 44,455 | | | $ | 44,011 | |

| Buildings, facilities and technology expenses | | | 12,270 | | | | 11,236 | |

| Travel, advertising and promotion expenses | | | 6,586 | | | | 5,530 | |

| Professional fees | | | 3,100 | | | | 2,766 | |

| Other SG&A expenses | | | 4,164 | | | | 3,567 | |

| | | $ | 70,575 | | | $ | 67,110 | |

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 7. | Operating expenses (continued) |

Acquisition-related costs

| Three months ended March 31, | | 2017 | | | 2016 | |

| IronPlanet | | $ | 7,691 | | | $ | - | |

| Mascus: (note 22) | | | | | | | | |

| Continuing employment costs | | | 156 | | | | 173 | |

| Other acquisition-related costs | | | - | | | | 718 | |

| Xcira: | | | | | | | | |

| Continuing employment costs | | | 381 | | | | 306 | |

| Petrowsky: (note 22) | | | | | | | | |

| Continuing employment costs | | | 212 | | | | - | |

| Kramer: (note 22) | | | | | | | | |

| Continuing employment costs | | | 115 | | | | - | |

| Other acquisition-related costs | | | 72 | | | | - | |

| | | $ | 8,627 | | | $ | 1,197 | |

Depreciation and amortization expenses

| Three months ended March 31, | | 2017 | | | 2016 | |

| Depreciation expense | | $ | 6,792 | | | $ | 7,783 | |

| Amortization expense | | | 3,546 | | | | 2,297 | |

| | | $ | 10,338 | | | $ | 10,080 | |

At the end of each interim period, the Company estimates the effective tax rate expected to be applicable for the full fiscal year. The estimate reflects, among other items, management’s best estimate of operating results. It does not include the estimated impact of foreign exchange rates or unusual and/or infrequent items, which may cause significant variations in the customary relationship between income tax expense and income before income taxes.

The Company’s consolidated effective tax rate in respect of operations for the three months ended March 31, 2017 was 41.2% (2016: 24.1%). The effective tax rate for the three months ended March 31, 2017 was impacted by a $2,290,000 expense related to an increase in uncertain tax positions and the effect of estimated non-deductible acquisition-related costs to be incurred in 2017.

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 9. | Earnings per share attributable to stockholders |

Basic earnings per share (“EPS”) attributable to stockholders was calculated by dividing the net income attributable to stockholders by the weighted average (“WA”) number of common shares outstanding. Diluted EPS attributable to stockholders was calculated by dividing the net income attributable to stockholders after giving effect to outstanding dilutive stock options and PSUs by the WA number of shares outstanding adjusted for all dilutive securities.

| | | Net income | | | WA | | | | |

| | | attributable to | | | number | | | Per share | |

| Three months ended March 31, 2017 | | stockholders | | | of shares | | | amount | |

| Basic | | $ | 10,377 | | | | 106,851,595 | | | $ | 0.10 | |

| Effect of dilutive securities: | | | | | | | | | | | | |

| PSUs | | | 27 | | | | 263,557 | | | | - | |

| Stock options | | | - | | | | 673,797 | | | | - | |

| Diluted | | $ | 10,404 | | | | 107,788,949 | | | $ | 0.10 | |

| | | Net income | | | WA | | | | |

| | | attributable to | | | number | | | Per share | |

| Three months ended March 31, 2016 | | stockholders | | | of shares | | | amount | |

| Basic | | $ | 29,406 | | | | 106,917,280 | | | $ | 0.28 | |

| Effect of dilutive securities: | | | | | | | | | | | | |

| Stock options | | | - | | | | 241,730 | | | | (0.01 | ) |

| Diluted | | $ | 29,406 | | | | 107,159,010 | | | $ | 0.27 | |

In respect of PSUs awarded under the senior executive and employee PSU plans (described in note 20), performance and market conditions, depending on their outcome at the end of the contingency period, can reduce the number of vested awards to nil or to a maximum of 200% of the number of outstanding PSUs. For the three months ended March 31, 2017, PSUs to purchase nil common shares were outstanding but excluded from the calculation of diluted EPS attributable to stockholders as they were anti-dilutive (2016: nil). For the three months ended March 31, 2017, stock options to purchase nil common shares were outstanding but excluded from the calculation of diluted EPS attributable to stockholders as they were anti-dilutive (2016: 2,980,470).

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 10. | Supplemental cash flow information |

| Three months ended March 31, | | 2017 | | | 2016 | |

| Trade and other receivables | | | (58,839 | ) | | | (67,653 | ) |

| Inventory | | | 7,813 | | | | 30,476 | |

| Advances against auction contracts | | | (1,806 | ) | | | 1,048 | |

| Prepaid expenses and deposits | | | 4,010 | | | | 278 | |

| Income taxes receivable | | | (1,910 | ) | | | (6,097 | ) |

| Auction proceeds payable | | | 178,655 | | | | 184,437 | |

| Trade and other payables | | | (11,402 | ) | | | 4,113 | |

| Income taxes payable | | | (4,052 | ) | | | (12,305 | ) |

| Share unit liabilities | | | (408 | ) | | | (2,358 | ) |

| Other | | | (16 | ) | | | (5,545 | ) |

| Net changes in operating assets and liabilities | | $ | 112,045 | | | $ | 126,394 | |

| Three months ended March 31, | | 2017 | | | 2016 | |

| Interest paid, net of interest capitalized | | $ | 7,622 | | | $ | 1,393 | |

| Interest received | | | 956 | | | | 498 | |

| Net income taxes paid | | | 14,756 | | | | 27,172 | |

| | | | | | | | | |

| Non-cash transactions: | | | | | | | | |

| Non-cash purchase of property, plant and equipment under capital lease | | | 207 | | | | 361 | |

| | | March 31, | | | December 31, | |

| | | 2017 | | | 2016 | |

| Cash and cash equivalents | | $ | 236,894 | | | $ | 207,867 | |

| Restricted cash: | | | | | | | | |

| Current | | | 137,986 | | | | 50,222 | |

| Non-current | | | 500,000 | | | | 500,000 | |

| Cash, cash equivalents, and restricted cash | | $ | 874,880 | | | $ | 758,089 | |

On December 21, 2016, the Company completed the offering of $500,000,000 aggregate principal amount of 5.375% senior unsecured notes due January 15, 2025 (note 18). Upon the closing of the offering, the gross proceeds from the offering were deposited in to an Escrow account. The funds will be held in escrow until the completion of the transactions contemplated by the Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which the Company will acquire IronPlanet (note 21).

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 10. | Supplemental cash flow information (continued) |

In the fourth quarter of 2016, Company early adopted ASU 2016-18,Statement of Cash Flows (Topic 230), Restricted Cash,which requires that the change in the total of cash, cash equivalents, and restricted cash during a reporting period be explained in the Statement of Cash Flows (“SCF”). Therefore, the Company has included its restricted cash balances when reconciling the total beginning and end of period amounts shown on the face of the SCF. The effect of this change is detailed below.

| Three months ended March 31, | | 2016 | |

| Net changes in operating assets and liabilities: | | | | |

| As reported | | $ | 94,733 | |

| Current presentation | | | 126,394 | |

| Net cash provided by (used in) operating activities: | | | | |

| As reported | | | 134,014 | |

| Current presentation | | | 165,675 | |

| Effect of changes in foreign currency rates on cash: | | | | |

| As reported | | | 8,938 | |

| Current presentation | | | 12,123 | |

| Increase (decrease) in cash: | | | | |

| As reported | | | 83,926 | |

| Current presentation | | | 118,772 | |

| Cash and cash equivalents | | | 294,074 | |

| Total cash, cash equivalents and restricted cash | | | 412,018 | |

| 11. | Fair value measurement |

All assets and liabilities for which fair value is measured or disclosed in the condensed consolidated financial statements are categorized within the fair value hierarchy, described as follows, based on the lowest level input that is significant to the fair value measurement or disclosure:

| ● Level 1: | Unadjusted quoted prices in active markets for identical assets or liabilities that the entity can access at measurement date; |

| ● Level 2: | Inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly; and |

| ● Level 3: | Unobservable inputs for the asset or liability. |

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 11. | Fair value measurement (continued) |

| | | | | March 31, 2017 | | | December 31, 2016 | |

| | | Category | | Carrying

amount | | | Fair value | | | Carrying

amount | | | Fair value | |

| Fair values disclosed, recurring: | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | Level 1 | | $ | 236,894 | | | $ | 236,894 | | | $ | 207,867 | | | $ | 207,867 | |

| Restricted cash | | Level 1 | | | 637,986 | | | | 637,986 | | | | 550,222 | | | | 550,222 | |

| Short-term debt (note 18) | | Level 2 | | | 24,616 | | | | 24,616 | | | | 23,912 | | | | 23,912 | |

| Long-term debt (note 18) | | | | | | | | | | | | | | | | | | |

| Senior unsecured notes | | Level 1 | | | 495,863 | | | | 508,750 | | | | 495,780 | | | | 509,500 | |

| Revolving loans | | Level 2 | | | 100,575 | | | | 100,575 | | | | 99,926 | | | | 99,926 | |

The carrying value of the Company‘s cash and cash equivalents, restricted cash, trade and other receivables, advances against auction contracts, auction proceeds payable, trade and other payables, and revolving loans approximate their fair values due to their short terms to maturity. The fair value of the senior unsecured notes is determined by reference to a quoted market price.

At each period end, inventory is reviewed to ensure that it is recorded at the lower of cost and net realizable value. During the three months ended March 31, 2017, the Company recorded an inventory write-down of $355,000 (2016: $nil).

Of inventory held at March 31, 2017, 99% is expected to be sold prior to the end of June 2017 with the remainder sold by the end of November 2017(December 31, 2016: 93% sold by the end of March 2017 with the remainder sold by the end of June 2017).

| Balance, December 31, 2016 | | $ | 632 | |

| Disposal | | | (390 | ) |

| Balance, March 31, 2017 | | $ | 242 | |

During the three months ended March 31, 2017, the Company sold excess auction site acreage in Orlando, United States, for net proceeds of $953,000 resulting in a gain of $564,000.

As at March 31, 2017, the Company’s assets held for sale consisted of excess auction site acreage located in Denver, United States. Management made the strategic decision to sell this excess acreage to maximize the Company’s return on invested capital. This land asset belongs to the Core Auction reportable segment.

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 13. | Assets held for sale (continued) |

The property continues to be actively marketed for sale through an independent real estate broker, and management expects the sales to be completed within 12 months of March 31, 2017.

| 14. | Property, plant and equipment |

| As at March 31, 2017 | | Cost | | | Accumulated

depreciation | | | Net book value | |

| Land and improvements | | $ | 366,236 | | | $ | (62,549 | ) | | $ | 303,687 | |

| Buildings | | | 258,414 | | | | (94,256 | ) | | | 164,158 | |

| Yard and automotive equipment | | | 55,038 | | | | (38,974 | ) | | | 16,064 | |

| Computer software and equipment | | | 67,311 | | | | (58,966 | ) | | | 8,345 | |

| Office equipment | | | 23,247 | | | | (17,149 | ) | | | 6,098 | |

| Leasehold improvements | | | 20,427 | | | | (13,057 | ) | | | 7,370 | |

| Assets under development | | | 9,297 | | | | - | | | | 9,297 | |

| | | $ | 799,970 | | | $ | (284,951 | ) | | $ | 515,019 | |

| As at December 31, 2016 | | Cost | | | Accumulated

depreciation | | | Net book value | |

| Land and improvements | | $ | 362,283 | | | $ | (60,576 | ) | | $ | 301,707 | |

| Buildings | | | 256,168 | | | | (91,323 | ) | | | 164,845 | |

| Yard and automotive equipment | | | 55,352 | | | | (38,560 | ) | | | 16,792 | |

| Computer software and equipment | | | 66,265 | | | | (57,624 | ) | | | 8,641 | |

| Office equipment | | | 22,963 | | | | (16,706 | ) | | | 6,257 | |

| Leasehold improvements | | | 20,199 | | | | (12,541 | ) | | | 7,658 | |

| Assets under development | | | 9,130 | | | | - | | | | 9,130 | |

| | | $ | 792,360 | | | $ | (277,330 | ) | | $ | 515,030 | |

During the three months ended March 31, 2017, interest of $17,000 was capitalized to the cost of assets under development (2016: $12,000). These interest costs relating to qualifying assets are capitalized at a weighted average rate of 2.40% (2016: 6.03%).

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| As at March 31, 2017 | | Cost | | | Accumulated

amortization | | | Net book value | |

| Trade names and trademarks | | $ | 5,643 | | | $ | (151 | ) | | $ | 5,492 | |

| Customer relationships | | | 25,773 | | | | (1,722 | ) | | | 24,051 | |

| Software | | | 48,864 | | | | (16,001 | ) | | | 32,863 | |

| Software under development | | | 12,581 | | | | - | | | | 12,581 | |

| | | $ | 92,861 | | | $ | (17,874 | ) | | $ | 74,987 | |

| As at December 31, 2016 | | Cost | | | Accumulated

amortization | | | Net book value | |

| Trade names and trademarks | | $ | 5,585 | | | $ | (50 | ) | | $ | 5,535 | |

| Customer relationships | | | 25,618 | | | | (1,072 | ) | | | 24,546 | |

| Software | | | 36,566 | | | | (13,116 | ) | | | 23,450 | |

| Software under development | | | 18,773 | | | | - | | | | 18,773 | |

| | | $ | 86,542 | | | $ | (14,238 | ) | | $ | 72,304 | |

During the three months ended March 31, 2017, interest of $37,000 was capitalized to the cost of software under development (2016: $80,000). These interest costs relating to qualifying assets are capitalized at a weighted average rate of 2.43% (2016: 6.39%).

| Balance, December 31, 2016 | | $ | 97,537 | |

| Foreign exchange movement | | | 528 | |

| Balance, March 31, 2017 | | $ | 98,065 | |

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

| 17. | Equity-accounted investments |

The Company holds a 48% share interest in a group of companies detailed below (together, the Cura Classis entities), which have common ownership. The Cura Classis entities provide dedicated fleet management services in three jurisdictions to a common customer unrelated to the Company. The Company has determined the Cura Classis entities are variable interest entities and the Company is not the primary beneficiary, as it does not have the power to make any decisions that significantly affect the economic results of the Cura Classis entities. Accordingly, the Company accounts for its investments in the Cura Classis entities following the equity method.

A condensed summary of the Company's investments in and advances to equity-accounted investees are as follows (in thousands of U.S. dollars, except percentages):

| | | Ownership | | | March 31, | | | December 31, | |

| | | percentage | | | 2017 | | | 2016 | |

| Cura Classis entities | | | 48 | % | | $ | 4,519 | | | $ | 4,594 | |

| Other equity investments | | | 32 | % | | | 2,678 | | | | 2,732 | |

| | | | | | | | 7,197 | | | | 7,326 | |

As a result of the Company’s investments, the Company is exposed to risks associated with the results of operations of the Cura Classis entities. The Company has no other business relationships with the Cura Classis entities. The Company’s maximum risk of loss associated with these entities is the investment carrying amount.

| | | Carrying amount | |

| | | March 31, | | | December 31, | |

| | | 2017 | | | 2016 | |

| Short-term debt | | $ | 24,616 | | | $ | 23,912 | |

| | | | | | | | | |

| Long-term debt: | | | | | | | | |

| | | | | | | | | |

| Revolving loan, denominated in Canadian dollars, unsecured, bearing interest at a weighted average rate of 2.426%, due in monthly installments of interest only, with the committed, revolving credit facility available until October 2021 | | | 70,575 | | | | 69,926 | |

| | | | | | | | | |

| Revolving loan, denominated in United States dollars, unsecured, bearing interest at a weighted average rate of 2.280%, due in monthly installments of interest only, with the committed, revolving credit facility available until October 2021 | | | 30,000 | | | | 30,000 | |

| | | | | | | | | |

| Senior unsecured notes, bearing interest at 5.375% due in semi-annual installments, with the full amount of principal due in January 2025 | | | 500,000 | | | | 500,000 | |

| Less: unamortized debt issue costs | | | (4,137 | ) | | | (4,220 | ) |

| | | | 596,438 | | | | 595,706 | |

| | | | | | | | | |

| Total debt | | $ | 621,054 | | | $ | 619,618 | |

| Notes to the Condensed Consolidated Financial Statements |

| (Tabular amounts expressed in thousands of United States dollars, except where noted) |

| (Unaudited) |

Short-term debt at March 31, 2017 is comprised of drawings in different currencies on the Company’s committed revolving credit facilities and have a weighted average interest rate of 2.2% (December 31, 2016: 2.2%).