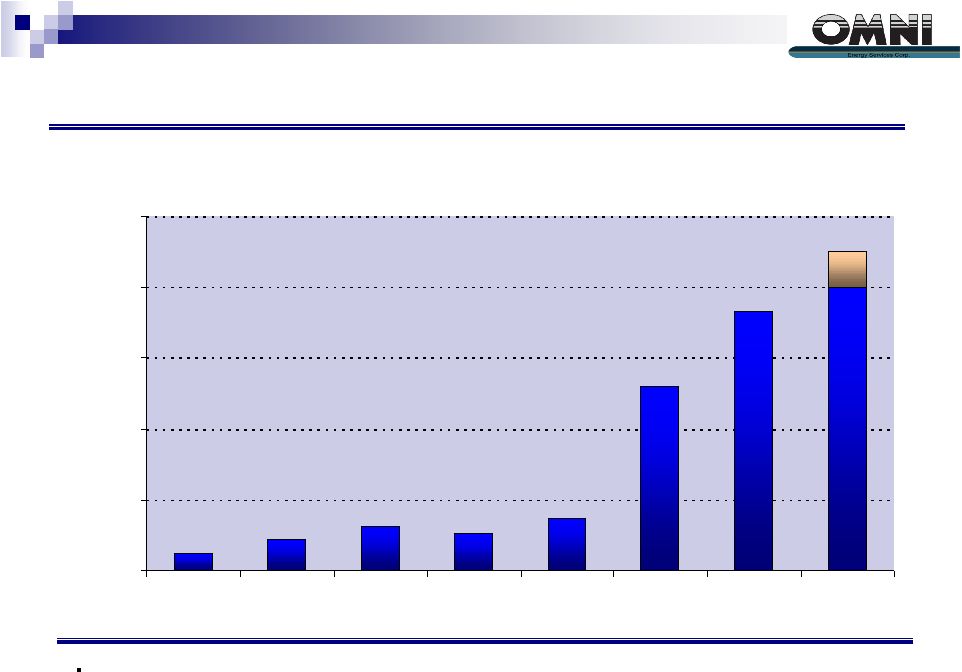

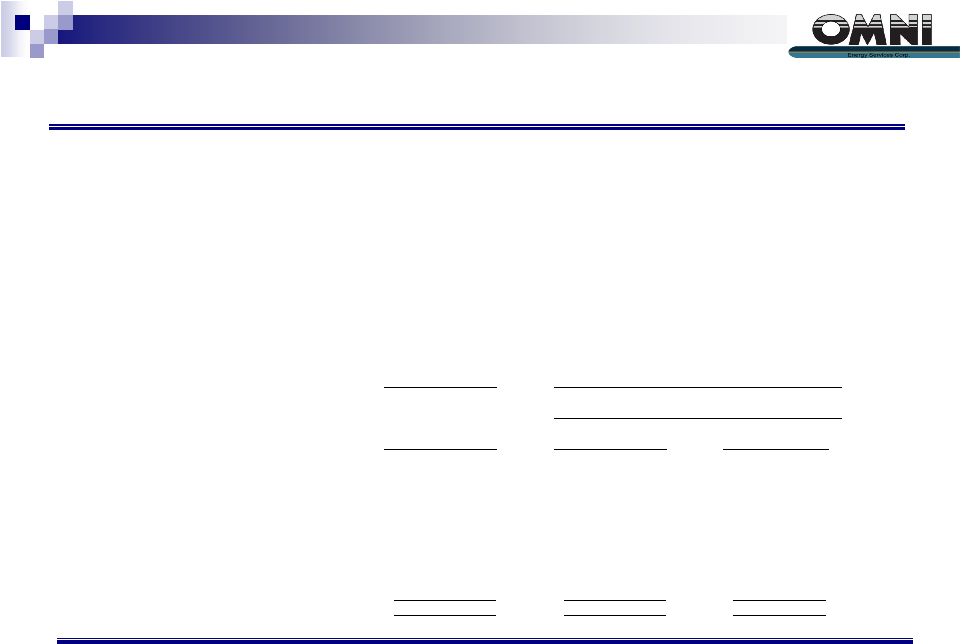

22 2008 Guidance (Adjusted EBITDA Definition and Reconciliation) OMNI calculates Adjusted EBITDA (adjusted earnings before interest, taxes, depreciation and amortization) as net income excluding income taxes, net interest expense, depreciation and amortization, and adjusted for loss on debt extinguishment and stock-based compensation. Adjusted EBITDA is not calculated in accordance with Generally Accepted Accounting Principles (GAAP), but is a non-GAAP measure that is derived from items in OMNI’s GAAP financials and is used as a measure of operational performance. Management references this non-GAAP financial measure frequently in its decision-making because it provides supplemental information that facilitates internal comparisons to historical operating performance of prior periods and external comparisons to competitors’ historical operating performance. OMNI has also aligned the disclosure of Adjusted EBITDA with the financial covenants in its material credit agreements with various lenders, which include ratios requiring a determination of EBITDA, as defined. Adjusted EBITDA is a material component of the financial covenants in OMNI’s credit agreements and non-compliance with the covenants could result in the acceleration of indebtedness. OMNI believes that Adjusted EBITDA is a commonly applied measurement of financial performance by investors. OMNI believes Adjusted EBITDA is useful to investors because it gives a measure of the operational performance without taking into account items that OMNI does not believe related directly to operations or that are subject to variations shat are not caused by operational performance. This non-GAAP measure is not intended to be a substitute for GAAP measures, and investors are advised to review this non-GAAP measure in conjunction with GAAP information provided by OMNI. Adjusted EBITDA should not be construed as a substitute for income from operations, net income or cash flows from operating activities (all determined in accordance with GAAP) for the purpose of analyzing OMNI’s operating performance, financial position and cash flows. OMNI’s computation of Adjusted EBITDA may not be comparable to similarly titled measures of utilized by other companies. A reconciliation of this non-GAAP measure to OMNI’s net income follows: $ 45,000 $ 40,000 $ 36,597 Adjusted EBITDA 9,800 7,800 5,504 Income tax expense 1,000 1,000 2,487 Non-cash stock compensation 14,100 14,100 10,761 Depreciation and amortization — — (360) Other income — — 1,100 Loss on debt extinguishment 4,600 4,600 6,936 Interest expense Plus (minus): $ 15,500 $ 12,500 $ 10,169 Net income High End Low End Actual Projected 2008 2007 $ in thousands |