Exhibit (c)(iii)

Confidential

PROJECT CYPRESS

Presentation to the Special Committee

June 2, 2010

Confidential – For Discussion Purposes

This presentation and any supplemental information (written or oral) or other documents provided in connection therewith (collectively, the “materials”) are provided solely for the information of the Special Committee of the Board of Directors (the “Committee”) of CYPRESS (the “Company”) by Stephens, Inc. (“Stephens”) in connection with the Committee’s consideration of a potential transaction (the “Transaction”) involving the Company. This presentation is incomplete without reference to, and should be considered in conjunction with and supplemental information provided by and discussions with Stephens in connection therewith. Any defined terms used herein shall have the meanings set forth herein, even if such defined terms have been given different meanings elsewhere in the materials.

The materials are for discussion purposes only and may not be relied upon by any person or entity for any purpose except as expressly permitted by Stephens engagement letter. The materials were prepared for specific persons familiar with the business and affairs of the Company for use in a specific context and were not prepared with a view to public disclosure or to conform with any disclosure standards under any state, federal or international securities laws or other laws, rules or regulations, and neither the Committee, the Company nor Stephens takes any responsibility for the use of the materials by persons other than the Committee.

The materials are provided on a confidential basis solely for the information of the Committee and may not be disclosed, summarized, reproduced, disseminated or quoted or otherwise referred to, in whole or in part, without Stephens express prior written consent. The materials necessarily are based on financial, economic, market and other conditions as in effect on, and the information available to Stephens as of, the date of the materials. The materials are not intended to provide the sole basis for evaluation of the Transaction and do not purport to contain all information that may be required. The materials do not address the underlying business decision of the Committee, the Company or any other party to proceed with or effect the Transaction, or the relative merits of the Transaction as compared to any alternative business strategies that might exist for the Company or any other party. The materials do not constitute any opinion, nor do the materials constitute a recommendation to the Committee, any security holder of the Company or any other person as to how to vote or act with respect to any matter relating to the Transaction or whether to buy or sell any assets or securities of any company.

All budgets, projections, estimates, financial analyses, reports and other information with respect to operations reflected in the materials have been prepared by the management of the Company or are derived from such budgets, projections, estimates, financial analyses, reports and other information or from other sources, which involve numerous and significant subjective determinations made by management of the Company and/or which such management has reviewed and found reasonable. The budgets, projections and estimates contained in the materials may or may not be achieved and differences between projected results and those actually achieved may be material. Stephens has relied upon representations made by management of the Company that such budgets, projections and estimates have been reasonably prepared in good faith on bases reflecting the best currently available estimates and judgments of such management (or, with respect to information obtained from public sources, represent reasonable estimates), and Stephens expresses no opinion with respect to such budgets, projections or estimates or the assumptions on which they are based. The scope of the financial analysis contained herein is based on discussions with the Company (including, without limitation, regarding the methodologies to be utilized), and Stephens does not make any representation, express or implied, as to the sufficiency or adequacy of such financial analysis or the scope thereof for any particular purpose.

| | |

| | 2 |

| | |

| DISCLAIMER (CONT’D) | | Confidential |

Stephens has assumed and relied upon the accuracy and completeness of the financial and other information provided to or reviewed by it without (and without assuming responsibility for) independent verification of such information, makes no representation or warranty (express or implied) in respect of the accuracy or completeness of such information and has further relied upon the assurances of the Company that it is not aware of any facts or circumstances that would make such information inaccurate or misleading. In addition, Stephens has relied upon representations made by management of the Company, without independent verification, that there had been no change in the business, assets, liabilities, financial condition, results of operations, cash flows or prospects of the Company or any other participant in the Transaction since the date of the most recent financial statements provided to Stephens that would be material to its analyses, and that the final forms of any draft documents reviewed by Stephens will not differ in any material respect from such draft documents.

The materials are not an offer to sell or solicitation of an indication of interest to purchase any security, option, commodity, future, loan or currency. The materials do not constitute a commitment by Stephens or any of its affiliates to underwrite, subscribe for or place any securities, to extend or arrange credit, or to provide any other services.

| | |

| | 3 |

| | |

| TABLE OF CONTENTS | | Confidential |

| | |

| I. | | TRANSACTION OVERVIEW |

| |

| II. | | PROCESS OVERVIEW |

| |

| III. | | FINANCIAL OVERVIEW |

| |

| IV. | | TRADING & VALUATION PERSPECTIVE |

The contents of this presentation may not be used for any other purpose without the prior written consent of Stephens Inc. This foregoing material has been presented solely for informative purposes as of its stated date and is not a solicitation, or an offer, to buy or sell any security. It does not purport to be a complete description of the products, securities, markets or developments referred to in the material. Information included in the presentation was obtained from sources considered to be reliable, but has not been independently verified and is not guaranteed to be accurate or complete. All expressions of opinion apply on the date of the presentation. No subsequent publication or distribution of this presentation shall mean or imply that any such information or opinion is accurate or remains current at any time after the stated date of the presentation. You will not be advised of any changes in any such information or opinion. Stephens Inc., its employees, officers, directors and/or affiliates may from time to time have a long or short position in the securities mentioned and may sell or buy such securities. Stephens does not provide legal, tax or accounting advice; please consult your legal or tax professional. The individuals principally responsible for preparation of this presentation have received compensation that is based upon, among other factors, Stephens Inc.’s investment banking revenues. Additional information available upon request. ©Stephens Inc. 2010

| | |

| | 4 |

Confidential

I. TRANSACTION OVERVIEW

| | |

| SUMMARY OF KEY TRANSACTION TERMS | | Confidential |

| | |

| Transaction | | • Acquisition of CYPRESS by Wellspring Capital Management (“Wellspring”) through a merger with a Wellspring affiliate (“PARENT”). |

| | • CYPRESS preferred stock will either convert to common stock and be entitled to the right to receive the common stock merger consideration of $2.75 per share or be rolled into PARENT. |

| | • All in-the-money options and warrants will be purchased for cash, net of exercise price, and all out-of-the-money options and warrants will be cancelled. |

| |

Ownership “Roll Over” | | • Messrs. Recatto, Sciotto and Colson will contribute shares of their common and preferred stock of CYPRESS to PARENT immediately prior to closing the merger in return for equity ownership in PARENT. |

| |

Merger Consideration | | • Common stock merger consideration of $2.75 per share. |

| | • 100% Cash. |

| |

| Offer Valuation | | • Consideration of $2.75 per share implies a $72.4 million equity value and $120.1 million enterprise value. |

| |

Go-Shop Provision | | • CYPRESS will have a go-shop period of 30 business days following the signing of the Agreement pursuant to which CYPRESS can pursue other bidders to determine if there is a superior proposal. |

| | |

| Note: | | This summary is intended only as an overview of selected terms and is not intended to cover all terms or details of the Transaction. |

| |

| Sources: | | Draft, dated May 24, 2010, of the Agreement; draft, dated March 18, 2010 of the Equity Commitment Letter; draft, dated May 17, 2010, of the Debt Commitment Letter; draft, dated May 12, 2010, of the Rollover Agreement; draft, dated May 12, 2010, of the form of Voting Agreement; draft, dated May 24, 2010, of the Limited Guaranty. |

| | |

| | 6 |

| | |

| SUMMARY OF KEY TRANSACTION TERMS (CONT’D) | | Confidential |

| | |

| Termination Fee | | • Upon failure to close the transaction by CYPRESS, under certain circumstances, PARENT will be entitled to a breakup fee of 2 1/2 % of equity value (~$1.8mm) as well as reimbursement for its expenses up to $750,000. |

| |

Reverse Termination Fee | | • Upon failure to close the transaction by PARENT, under certain circumstances, CYPRESS will be entitled to a reverse breakup fee of either 6% or 10% of equity value according to the following: • If PARENT receives financing, then CYPRESS will be entitled to a reverse breakup fee of 10% of the equity value of the transaction (~$7.2mm); • If PARENT does not receive financing, then CYPRESS will be entitled to receive a breakup fee of 6% of the equity value of the transaction (~$4.3mm). |

| |

| Limited Guaranty | | • Wellspring will provide a Limited Guaranty of the obligations of PARENT on account of any breach or default by PARENT as to any of its obligations under the Agreement. |

| |

D&O Insurance Continuation | | • PARENT will continue existing levels of director and officer insurance for 6 years following the closing of the transaction so long as the annual premiums paid for that coverage do not exceed 250% of the premium paid for that coverage in the most recent premium year. |

| |

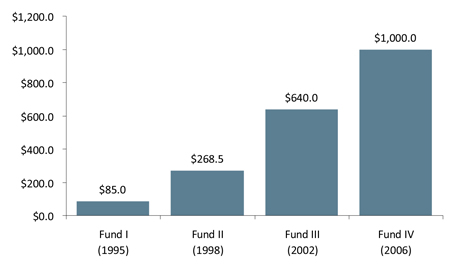

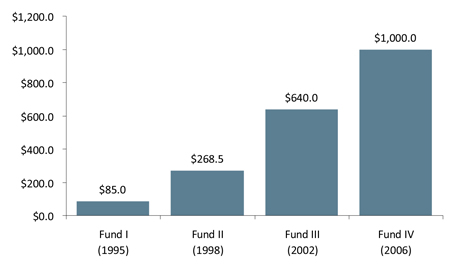

| Equity Commitment | | • Wellspring has committed all of the necessary equity to complete the transaction through their $1.0 billion Wellspring Capital Partners IV, L.P Fund. |

| |

| Debt Commitment | | • Ableco, L.L.C. has committed to provide a $65 million senior secured credit facility consisting of (i) a $20 million revolving credit facility and (ii) a term loan of $45 million. |

| | • All of the debt is senior and has a first priority lien on all of the Company’s assets. |

| | |

| Note: | | This summary is intended only as an overview of selected terms and is not intended to cover all terms or details of the Transaction. |

| |

| Sources: | | Draft, dated May 24, 2010, of the Agreement; draft, dated March 18, 2010 of the Equity Commitment Letter; draft, dated May 17, 2010, of the Debt Commitment Letter; draft, dated May 12, 2010, of the Rollover Agreement; draft, dated May 12, 2010, of the form of Voting Agreement; draft, dated May 24, 2010, of the Limited Guaranty. |

| | |

| | 7 |

| | |

| SUMMARY OF KEY TRANSACTION TERMS (CONT’D) | | Confidential |

| | |

| Voting Considerations | | • Shareholder approval of a majority of those present and voting is required to approve the Transaction. |

| | • Messrs. Recatto, Sciotto and Colson, representing approximately 25% of the voting shares, have agreed to enter into voting agreements to vote their shares in favor of the transaction. |

| | • Series C Preferred stock is expected to vote on an as-converted basis. |

| | • PARENT’s obligations under the Agreement are conditioned upon not more than 10% of the common shares dissenting from the vote and seeking appraisal rights. |

| |

| Estimated Closing | | • September 2010. |

| | |

| Note: | | This summary is intended only as an overview of selected terms and is not intended to cover all terms or details of the Transaction. |

| |

| Sources: | | Draft, dated May 24, 2010, of the Agreement; draft, dated March 18, 2010 of the Equity Commitment Letter; draft, dated May 17, 2010, of the Debt Commitment Letter; draft, dated May 12, 2010, of the Rollover Agreement; draft, dated May 12, 2010, of the form of Voting Agreement; draft, dated May 24, 2010, of the Limited Guaranty. |

| | |

| | 8 |

| | |

| TRANSACTION SOURCES & USES AND ESTIMATED OWNERSHIP | | Confidential |

(Dollars in Millions)

ESTIMATED SOURCES & USES

| | | |

Sources | | |

New Senior Secured Term Loan | | $ | 45.0 |

Rollover of Equity(1) | | | 12.5 |

Rollover of Real Estate and Capital Leases | | | 3.4 |

New Wellspring Investment | | | 68.6 |

| | | |

| |

Total Sources | | $ | 129.5 |

| | | |

| | | |

Uses | | |

Purchase of Equity | | $ | 72.4 |

Refinance Long-Term Debt | | | 46.2 |

Rollover of Real Estate and Capital Leases | | | 3.4 |

Estimated Transaction & Financing Fees | | | 7.5 |

| | | |

| |

Total Uses | | $ | 129.5 |

| | | |

ESTIMATED NEWCO OWNERSHIP(1)

| | | |

Wellspring | | 84.6 | % |

Dennis Sciotto | | 12.0 | % |

Edward Colson | | 1.8 | % |

Brian Recatto | | 1.6 | % |

| | | |

| |

Total | | 100.0 | % |

| | | |

| (1) | Source: draft, Rollover Agreement draft dated June 1, 2010. |

| | |

| | 9 |

| | |

| CYPRESS VALUATION | | Confidential |

(Dollars in Millions, Except per Share)

| | | | | | | | |

| | | Current | | | Offer | |

| | |

Stock Price | | $ | 2.05 | | | $ | 2.75 | |

Premium to May 28, 2010 Closing Price | | | | | | | 34.1 | % |

Premium to 5-Day Average | | | | | | | 34.0 | % |

Premium to 30-Day Average | | | | | | | 21.3 | % |

Premium to 90-Day Average | | | | | | | 45.1 | % |

Premium to 6-Month Average | | | | | | | 56.9 | % |

Premium to 1-Year Average | | | | | | | 56.7 | % |

| | |

Equity Value(1) | | $ | 53.0 | | | $ | 72.4 | |

Plus: Debt (3/31/10) | | | 49.6 | | | | 49.6 | |

Less: Cash (3/31/10) | | | (1.8 | ) | | | (1.8 | ) |

| | | | | | | | |

Enterprise Value | | $ | 100.7 | | | $ | 120.1 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | Valuation Summary | |

| | | |

| | | Data | | Multiples | | | Multiples | |

| | | LTM 3/31/10 | | 12/31/10E | | LTM 3/31/10 | | | 12/31/10E | | | LTM 3/31/10 | | | 12/31/10E | |

| | | | | | |

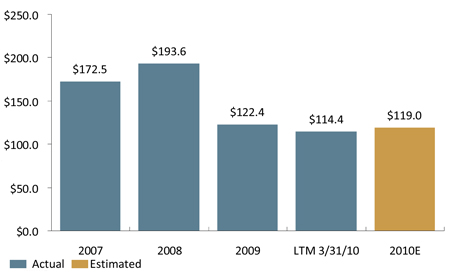

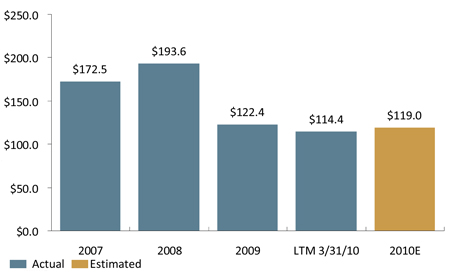

Revenue | | $ | 114.4 | | $ | 119.0 | | 0.9 | x | | 0.8 | x | | 1.1 | x | | 1.0 | x |

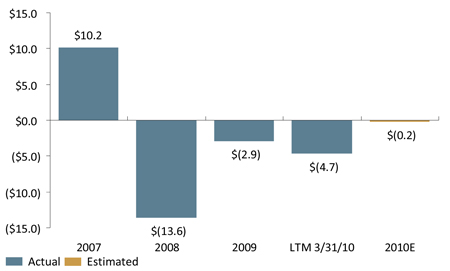

Adjusted EBITDA(2) | | | 15.8 | | | 18.4 | | 6.4 | | | 5.5 | | | 7.6 | | | 6.5 | |

| (1) | Equity Value assumes all in-the-money convertible securities are treated as if converted. |

| (2) | Adjusted EBITDA reflects adjustments for certain non-recurring items, including stock-based compensation expense. |

Source: Capital IQ and Company provided information.

| | |

| | 10 |

| | |

| WELLSPRING CAPITAL & ABLECO OVERVIEW | | Confidential |

(Dollars in Millions)

WELLSPRING & FINANCING OVERVIEW

| • | | Transaction will be funded with a combination of capital contributed by Wellspring’s $1.0 billion Wellspring Capital Partners IV, L.P. institutional fund and a senior credit facility provided by Ableco, L.L.C. |

| • | | Founded in 1995, Wellspring manages over $2 billion of private equity capital provided by pension funds, endowments, corporations and financial institutions in North America and Europe. |

| • | | Wellspring Capital Partners IV, L.P. currently has approximately $300 million of capital available for additional investment. |

ABELCO OVERVIEW

| • | | Ableco Finance LLC is a specialty finance company, formed by the management of Cerberus Capital Management that invests in leveraged buyouts and other similar transactions. |

WELLSPRING FUND GROWTH

WELLSPRING PRIOR TRANSACTIONS

Source: Publicly available information.

| | |

| | 11 |

Confidential

II. PROCESS OVERVIEW

| | |

| PROCESS SUMMARY | | Confidential |

| | |

| | Recent previous processes: |

| |

| | • April 2007 - Investment Banking firm initiated marketing effort for sales process. |

| |

| | • October 2009 - Investment Banking firm initiated marketing effort for senior debt refinancing process. |

| |

| | • Stephens was engaged by the Board of Directors (the “Board”) to investigate strategic alternatives including a take private transaction. |

| |

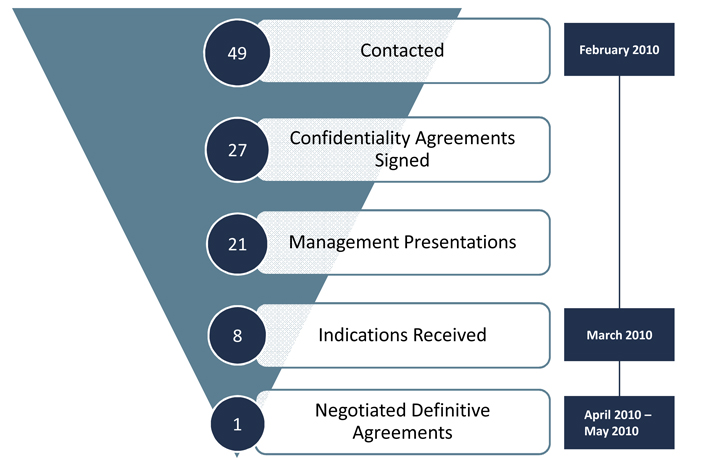

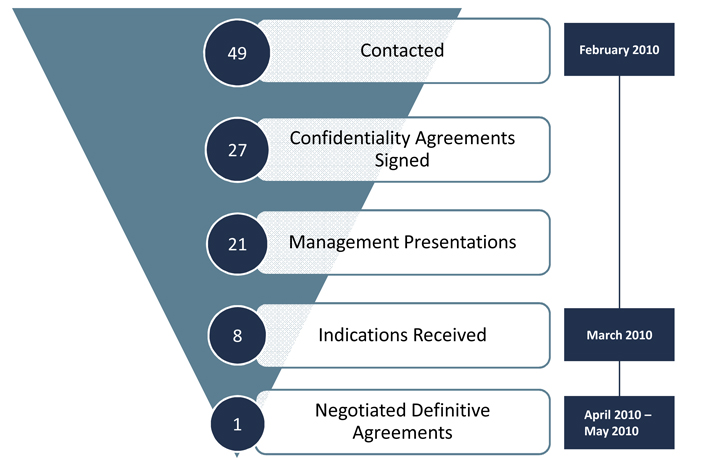

| February 2010 | | • Stephens began contacting parties on a confidential basis, preparing a management presentation and other supplemental descriptive information, and negotiating confidentiality agreements. |

| |

| | • Management presentations were held with numerous private equity firms in New York and Houston. |

| |

| | • Interested parties commenced preliminary due diligence, and Stephens responded to due diligence questions and provided supplemental information to interested parties. |

| |

| March 2010 | | • Stephens received 8 preliminary non-binding indications of interests from private equity firms. |

| |

| | • Stephens met with the Board to brief the board on the marketing process and to provide a review of the indications of interest. |

| |

| | • Stephens was informed by the Board that the indications of interest received were sufficient to continue with the process and the Board directed Stephens to continue discussions with interested parties. |

| |

| | • Stephens conducted conference calls with each of the 8 parties to further understand the level of interest of each party and to request that each party submit a written indication of interest. |

| |

| | • Stephens held a conference call with the Board to brief the board on the marketing process and to provide an updated review of the written indications of interest received. |

| |

| | • Board resolved to form a special committee of three independent board members (the “Special Committee”) and authorized the Special Committee to evaluate the indications of interest Stephens had received. |

| | |

| | 13 |

| | |

| PROCESS SUMMARY (CONT’D) | | Confidential |

| | |

| March 2010 (Continued) | | • Upon formation, the Special Committee engaged Kelly Hart & Hallman LLP (“Kelly Hart”) to serve as its independent legal counsel. |

| |

| | • Stephens, the Special Committee and Kelly Hart met to review the marketing process completed to-date and discussed the written indications of interest received by Stephens. |

| |

| | • After actively engaging in dialogue with Stephens and Kelly Hart, the Special Committee decided pursue a transaction with Wellspring and proposed changes to an exclusivity agreement provided by Wellspring with its indication of interest. |

| |

| | • Stephens was engaged by the Special Committee to serve as its independent financial advisor. |

| |

| | • Special Committee commenced negotiating an exclusivity agreement with Wellspring. |

| |

| April 2010 – May 2010 | | • Special Committee entered into exclusivity agreement with Wellspring in consideration of Wellspring undertaking discussions and negotiations with a view towards entering into a definitive agreement with respect to the Transaction. |

| |

| | • Wellspring initiated detailed due diligence and engaged various professional service providers, including lawyers, accounting and tax consultants, and industry consultants to perform in depth due diligence investigations. |

| |

| | • Management continued to respond to due diligence requests and questions prepared by Wellspring and its representatives. |

| |

| | • Stephens compiled data provided by CYPRESS and prepared an online data room for use during the remainder of Wellspring’s due diligence process and during the “go shop” period. |

| |

| | • Wellspring representatives conducted site visits at the Company’s facilities in Carencro, LA and Port Fourchon, LA. |

| | |

| | 14 |

| | |

| PROCESS SUMMARY (CONT’D) | | Confidential |

| | |

| April 2010 –May 2010 | | • Initial drafts of transaction documents were prepared including the Agreement and Plan of Merger, Form of Voting Agreement, Rollover Agreement, and Limited Guaranty Agreement. |

| | • Stephens conducted regular conference calls with the Special Committee and its legal counsel to review Wellspring’s continuing financial, operational and legal due diligence. |

| | • Wellspring informed Stephens that it had satisfactorily completed its due diligence review of CYPRESS and continued to negotiate and revise documentation with a view towards entering into a definitive agreement with respect to a transaction. |

| | • Counsel to the Special Committee provided Stephens and the Special Committee with a summary of the latest draft of the Agreement and provided a detailed discussion of the salient issues related to the Agreement. |

| | • Special Committee engaged an independent investment bank to deliver a written opinion with respect to the fairness of the transaction, from a financial point of view, to the common shareholders of CYPRESS. |

| June 2010 | | • Special Committee scheduled meeting on June 2, 2010 for the independent investment bank to present its findings and opinion regarding the Transaction. |

| | |

| | 15 |

| | |

| MARKETING PROCESS SUMMARY | | Confidential |

| | |

| | 16 |

| | |

| PRELIMARY INDICATIONS OF INTEREST | | Confidential |

| | | | | | | | | | |

Private

Equity Firm | | Indicated

Price Per Share | | Indicated

Enterprise

Value ($MM) | | Indicated

EBITDA

Multiple | | EBITDA

Basis for

Valuation | | Indication Letter Valuation Language |

| | | | | |

| Wellspring | | $2.75 | | $120.1 | | 7.6x | | $15.8

LTM EBITDA

Q1-2010 | | “The Transaction contemplates that a newly formed company would acquire 100% of the outstanding shares of CYPRESS in accordance with the terms of a definitive merger agreement for an aggregate purchase price of $2.75 per share in cash. The Per Share Price represents a total enterprise valuation of $125.5 million or a multiple of 7.8x estimated EBITDA for the last twelve months ended March 31, 2010. This trailing twelve month EBITDA figure was provided by management and reflects that EBITDA for the first quarter of 2010 will be significantly below the original budget and the prior year period.” |

| | | | | |

| Group A | | $2.40–$2.75 | | $115-$125 | | NA | | $25.6

2010E EBITDA | | “Our non-binding, indicative proposal values the Company between $115 million and $125 million for 100% of the share capital on a debt-free and cash-free basis. The enterprise valuation further assumes that the Company is operating in ordinary course without shareholder distributions prior to closing. The principal assumption underlying the non-binding, indicative valuation is that the Company is tracking its $25.6 million EBITDA forecast for the fiscal year ending December 31, 2010.” |

| | | | | |

| Group B | | NA | | $100-$117.5 | | NA | | NA | | “While it is impossible to determine accurately a fair value for any company so early in the process, we have received enough preliminary information to propose a metric upon which a range for an initial valuation of the Company may be based. Contingent upon the accuracy of the information provided by Stephens, we estimate the enterprise value for the Company to be between $100.0 Million and $117.5 Million. This range of enterprise value assumes that the business is transferred with an adequate amount of working capital. A more specific value will depend on the outcome of further due diligence to include, among other items, an analysis that bridges 2009 actual EBITDA to 2010 budgeted EBITDA.” |

| | | | | |

| Group C | | $2.25–$2.75 | | $100-$115 | | 4.0x – 4.5x | | $25.6

2010E EBITDA | | “Group C estimates the enterprise value of the Company to be in the range of 4.0x – 4.5x 2010 EBITDA as estimated in the Management Presentation provided to us. Based upon the current debt levels, this would imply a common share value of approximately $2.25 - $2.75 per share. The acquisition would be completed by an entity to be formed by Group C (“Newco”). The valuation range assumes: i) an all-cash transaction for the Company and ii) the Company is on track towards the 2010 financial forecast as profiled in the Management Presentation.” |

| | | | | |

| Group D | | $2.50–$2.80 | | NA | | NA | | ~$26.0

2010E EBITDA | | “Based solely on the information and projections provided to date, and assuming we are able to get comfortable through the course of our diligence with an adjusted 2009 EBITDA of roughly $20 million and a projected 2010 EBITDA of roughly $26 million, we are interested in acquiring the Company, or the assets thereof, for a price between $2.50 to $2.80 per share. This purchase price assumes a net debt of no more than $47 million, ordinary course levels of working capital, and only those liabilities related to the ongoing operations of the business. As currently contemplated, the purchase price would be paid entirely in cash at closing and would be funded with a new senior credit facility, newly issued subordinated debt, and equity capital.” |

| | | | | |

| Group E | | NA | | $120 | | NA | | $25.4 2010E

EBITDA | | “Based on our review of the confidential information provided and our understanding of the Company’s business, we have preliminarily valued the Company at an enterprise value of $120 million, subject to validating recurring, sustainable full-year 2010 EBITDA of $25.4 million. This enterprise value assumes the Company is delivered free and clear of all cash and debt, and with normal levels of working capital.” |

| | | | | |

| Group F | | $2.25–$2.75 | | NA | | NA | | NA | | “An affiliate of Group F would acquire 100% of the common equity of the Company for $2.25 to $2.75 per share.” |

| | | | | |

| Group G | | $2.50–$3.00 | | NA | | NA | | NA | | “Based upon public information and the information provided to date, Group G would propose a range of purchase price per share of $2.50–$3.00 (the “Offer”). The Offer is based on the financial forecast and underlying assumptions as provided by the Company and in publicly available information. The Offer may be subject to upward or downward adjustment based on additional information obtained as we move forward with our due diligence process (discussed in more detail below).” |

| | |

| | 17 |

III. FINANCIAL OVERVIEW

| | |

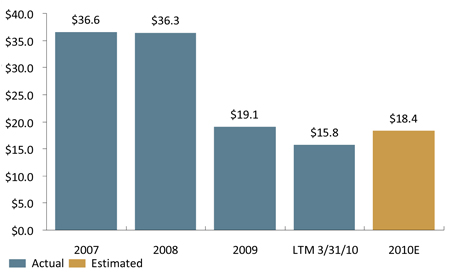

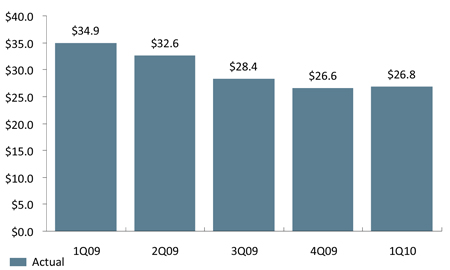

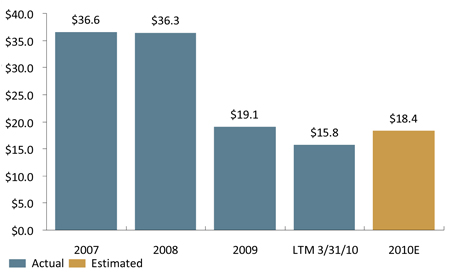

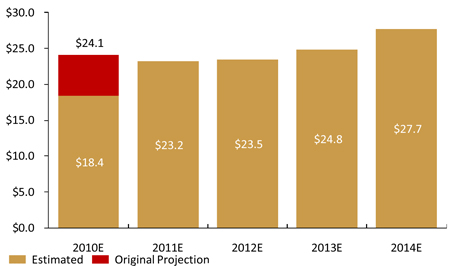

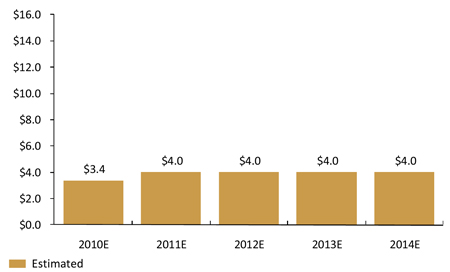

| CYPRESS ANNUAL FINANCIAL DATA | | Confidential |

(Dollars in Millions)

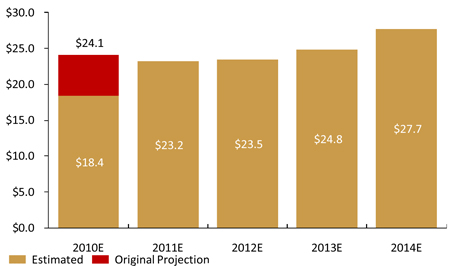

REVENUE

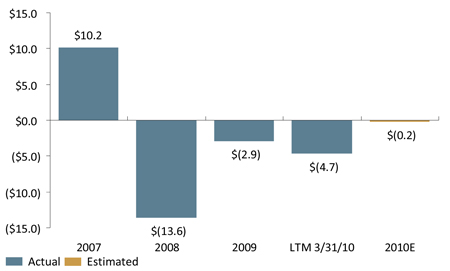

NET INCOME / (LOSS)

ADJUSTED EBITDA

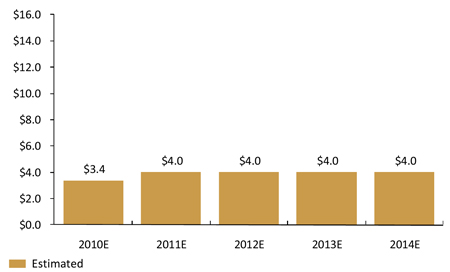

CAPITAL EXPENDITURES

Source: Publicly available filings and Company.

| | |

| | 19 |

| | |

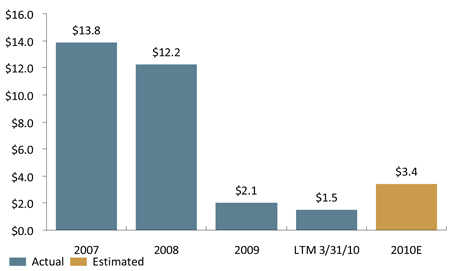

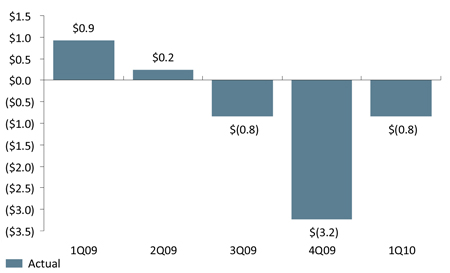

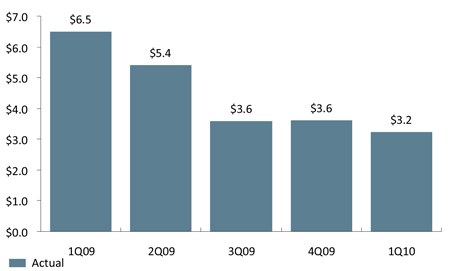

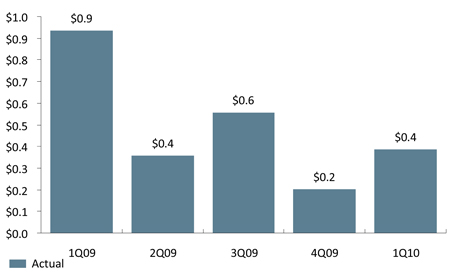

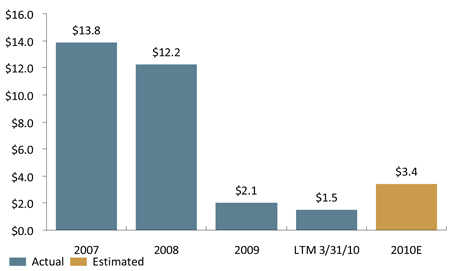

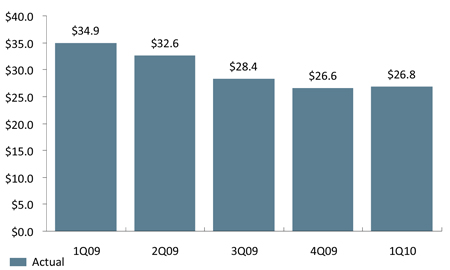

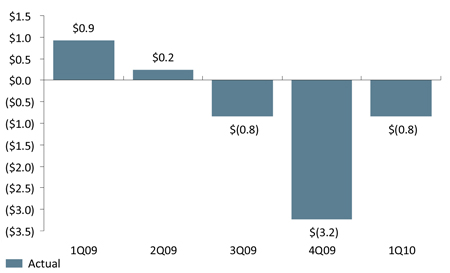

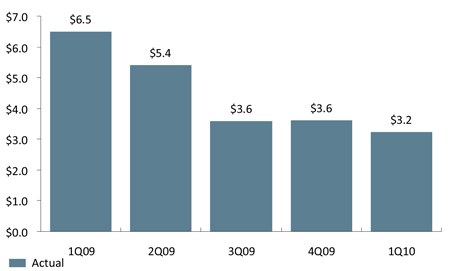

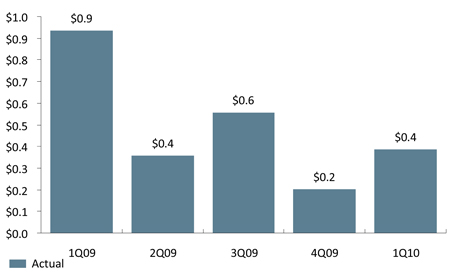

| CYPRESS QUARTERLY FINANCIAL DATA | | Confidential |

(Dollars in Millions)

REVENUE

NET INCOME / (LOSS)

ADJUSTED EBITDA

CAPITAL EXPENDITURES

Source: Publicly available filings and Company.

| | |

| | 20 |

| | |

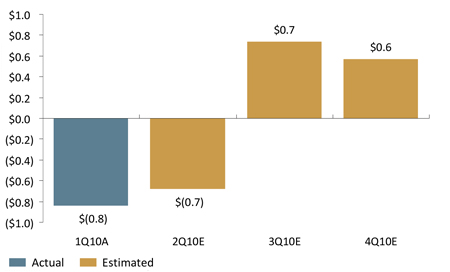

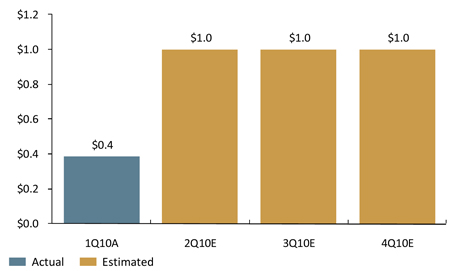

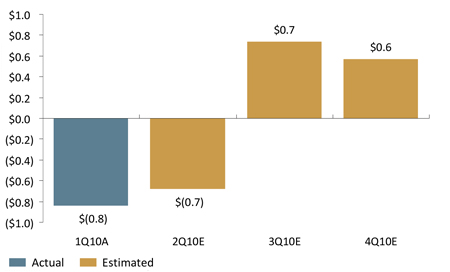

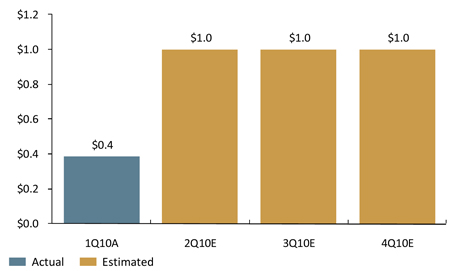

| CYPRESS PROJECTED FINANCIAL DATA – 2010 QUARTERLY | | Confidential |

(Dollars in Millions)

REVENUE

NET INCOME / (LOSS)

ADJUSTED EBITDA

CAPITAL EXPENDITURES

Source: Company provided information.

| | |

| | 21 |

| | |

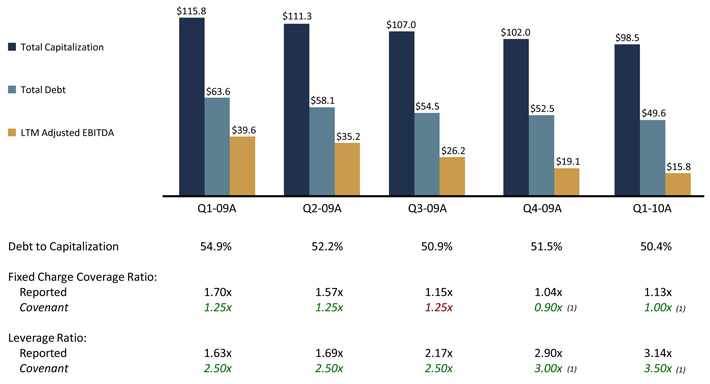

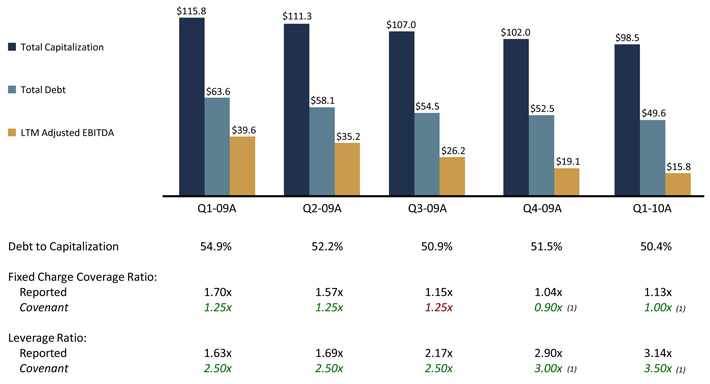

| CYPRESS QUARTERLY FINANCIAL DATA (CONT’D) | | Confidential |

(Dollars in Millions)

| | • | | LTM Adjusted EBITDA declined 60% from Q1-2009 to Q1-2010. |

| | • | | CYPRESS was not able to satisfy the fixed charge coverage ratio under its loan agreement in Q3-2009 and requested that the lenders grant a waiver of default and amend certain sections of the loan agreement. |

| (1) | Reflects amended covenant under the Fourth Amendment and Waiver to Loan Agreement entered into as of November 13, 2009. |

Source: Publicly available filings.

| | |

| | 22 |

| | |

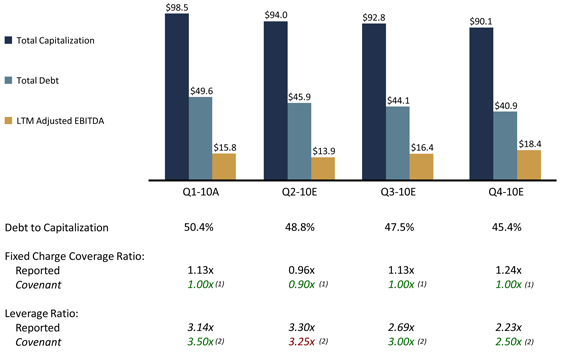

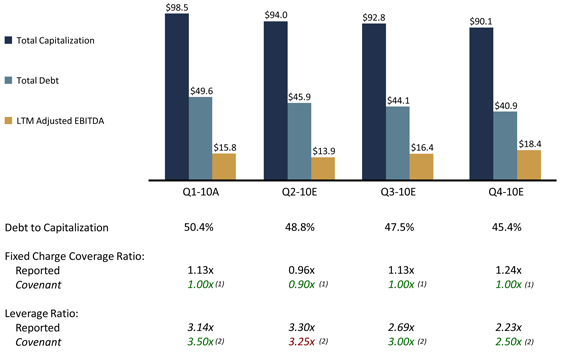

| CYPRESS QUARTERLY FINANCIAL DATA (CONT’D) | | Confidential |

(Dollars in Millions)

| | • | | LTM Adjusted EBITDA declined 17% from Q4-2009 to Q1-2010. |

| | • | | CYPRESS was not able to satisfy the leverage ratio under its loan agreement in Q1-2010 and requested that the lenders grant a waiver of default and amend certain sections of the loan agreement. |

| | • | | Current period leverage ratio of 3.25 to 1.00 as of Q2-2010 may require another amendment to the credit facility. |

| (1) | Reflects amended covenant under the Fourth Amendment and Waiver to Loan Agreement entered into as of November 13, 2009. |

| (2) | Reflects amended covenant under the Fifth Amendment and Waiver to Loan Agreement entered into as of March 31, 2010. |

Source: Company provided information.

| | |

| | 23 |

| | |

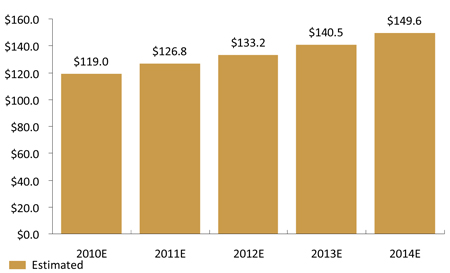

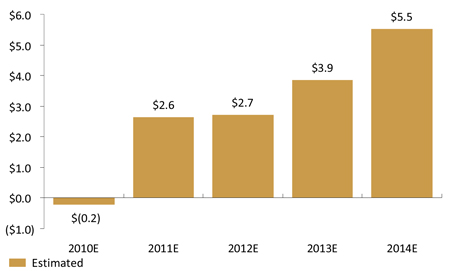

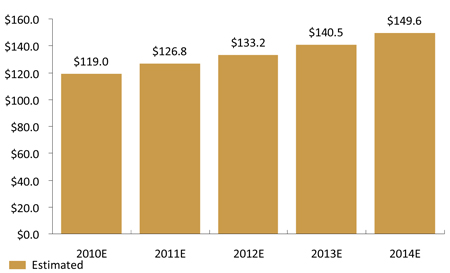

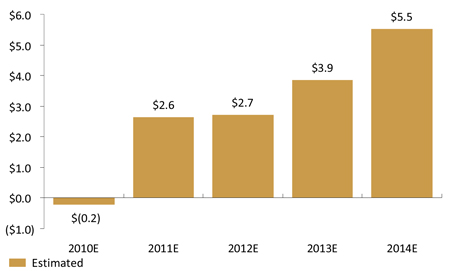

| CYPRESS PROJECTED FINANCIAL DATA – 2010-2014 ANNUAL | | Confidential |

(Dollars in Millions)

PROJECTED REVENUE

PROJECTED NET INCOME / (LOSS)

PROJECTED ADJUSTED EBITDA

PROJECTED CAPITAL EXPENDITURES

Source: Company provided information.

| | |

| | 24 |

| | |

| CURRENT SITUATION REVIEW | | Confidential |

| | |

| |

| Industry | | Natural Gas Price & Storage Environment |

| | U.S. Rig Count Environment |

| | GOM Offshore Event |

| |

| Company | | Loan Covenants |

| | Accounting Issues |

Source: EIA and Baker Hughes as of May 28, 2010.

| | |

| | 25 |

| | |

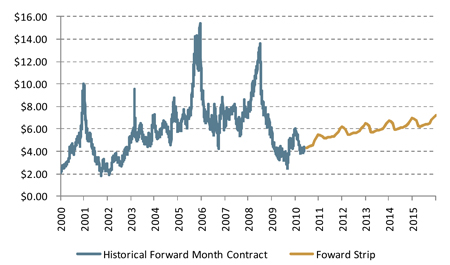

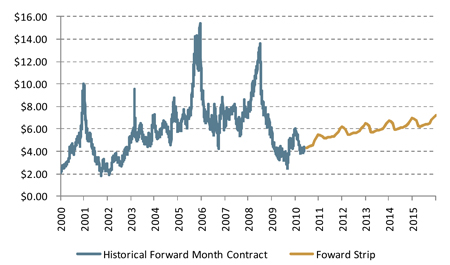

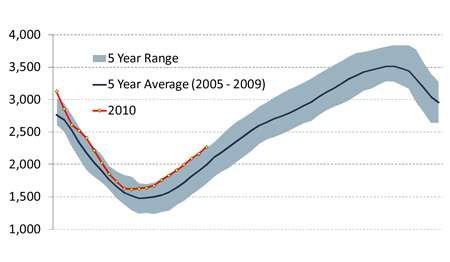

| NATURAL GAS PRICE & STORAGE ENVIRONMENT | | Confidential |

NATURAL GAS HISTORICAL & FORWARD STRIP ($/MMBTU)

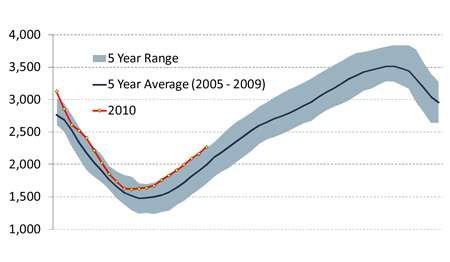

U.S. WORKING GAS IN UNDERGROUND STORAGE (BCF)

| | • | | Sustained levels of domestic production have continued putting downward pressure on prices. |

| | • | | Contrary to expectations of production declines because of a reduction in drilling activity last year, robust domestic marketed production remains at over 60 Bcf per day. |

| | • | | Production increases have been recorded from unconventional gas fields such as the Marcellus Shale in the Northeast/Appalachia region and Haynesville Shale in Louisiana. |

| | • | | Working gas in storage was 2,269 Bcf as of May 21, 2010, according to EIA estimates. |

| | • | | Stocks were 71 Bcf higher than last year at this time and 318 Bcf above the 5-year average of 1,951 Bcf. |

| | • | | At 2,269 Bcf, total working gas is above the 5-year historical range. |

Source: EIA and future price data is from INO.com as of May 28, 2010.

| | |

| | 26 |

| | |

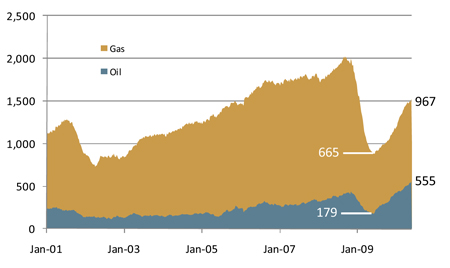

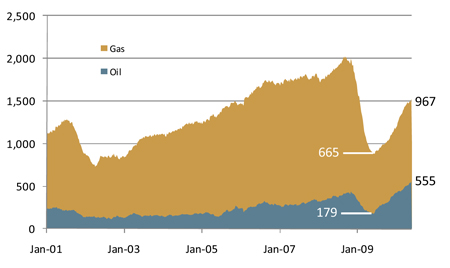

| U.S. RIG COUNT ENVIRONMENT | | Confidential |

TOTAL U.S. RIG COUNT BY COMMODITY (1)

TOTAL U.S. RIG COUNT BY DRILLING RIG TYPE

| • | | At 1,535, the U.S rig count has increased by 75%, or 659 rigs from a low of 876 in June 2009. |

| • | | Oil driven activity has accounted for the largest share of rig count gains: |

| | • | | Oil-directed rig count has increased 210% from the 2009 lows, compared to a 45% recovery for the natural gas rig count. |

| | • | | Oil-directed rig count is at its highest level since February 1991. |

| | • | | Oil-directed drilling is driving both the horizontal rig count (e.g., Williston Basin) and the vertical rig count (e.g., Permian Basin). |

| • | | U.S. rig count recovery has been concentrated among several key basins including: |

| | • | | Permian Basin (Conventional Oil) |

| | • | | East Texas, La-Miss Salt Basins (Haynesville Shale) |

| | • | | Williston Basin (Bakken Shale) |

| | • | | Appalachian Basin (Marcellus Shale) |

| | • | | Anadarko Basin (Granite Wash) |

| • | | Directional rig count represents 67% of current rig count versus 50% at the recent rig count peak (September 08). |

| (1) | Excludes miscellaneous rigs drilling for geothermal or other. |

Source: Baker Hughes as of May 28, 2010.

| | |

| | 27 |

| | |

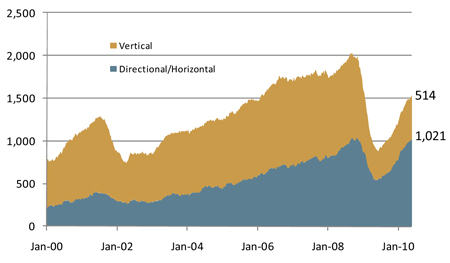

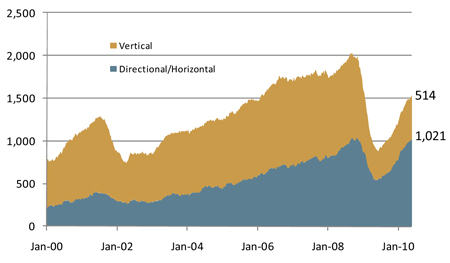

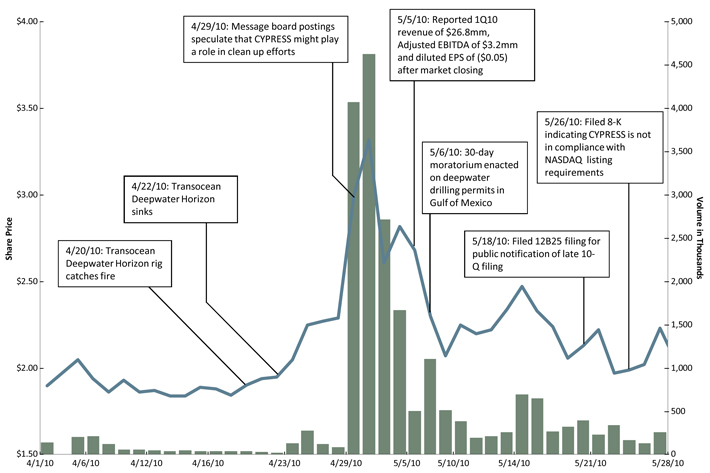

| GOM OFFSHORE EVENT | | Confidential |

TOTAL U.S. OFFSHORE RIGS

| | • | | On April 20, 2010 the deepwater rig, Deepwater Horizon, experienced an explosion and subsequently sank. |

| | • | | The explosion of the rig resulted in the largest offshore spill in US history (on-going today). |

| | • | | U.S. Secretary of the Interior has ordered a six-month moratorium on drilling of new deepwater wells. |

| | • | | Permitted wells currently being drilled in the deepwater in the Gulf of Mexico will be required to halt drilling at the first safe stopping point. |

| | • | | Additional safety checks will be imposed on ongoing deepwater drilling activities as they prepare to shut down their operations. |

| | • | | Government also canceled a pending lease sale in the Western Gulf of Mexico and a proposed lease sale off the coast of Virginia. |

Source: Baker Hughes as of May 28, 2010.

| | |

| | 28 |

IV. TRADING & VALUATION PERSPECTIVE

| | |

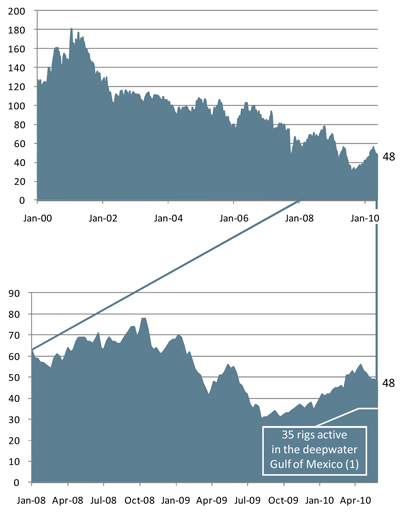

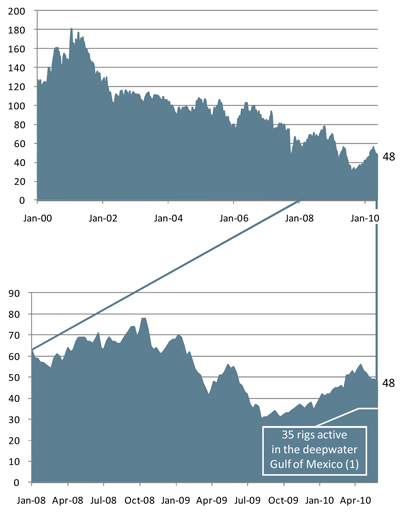

| CYPRESS 2-YEAR PERFORMANCE | | Confidential |

| | | | |

| A | | 8/07/08 | | Announced 2Q08 earnings of $2.6mm vs. earnings of $3.8mm in 2Q07. |

| | |

| B | | 8/21/08 | | Announced that the Company had been awarded a contract to perform a major seismic drilling project in the north Haynesville Shale area. |

| | |

| C | | 11/06/08 | | Announced 3Q08 earnings of $4.1mm vs. earnings of $4.2mm in 3Q07. |

| | |

| D | | 3/11/09 | | Announced FY08 earnings of ($13.6mm) vs. earnings of $10.2mm in FY07. Reported FY08 diluted EPS of ($0.72) vs. FY07 diluted EPS of $0.40. |

| | |

| E | | 3/17/09 | | Director Richard White purchases 41,630 shares at $1.20 per share. |

| | |

| F | | 5/06/09 | | Announced 1Q09 earnings of $0.9mm vs. earnings of ($1.4mm) in 1Q08. |

| | |

| G | | 8/05/09 | | Announced 2Q09 earnings of $0.2mm vs. earnings of $2.7mm in 2Q08. |

| | |

| H | | 10/21/09 | | Announced award of seismic drilling contract in the Marcellus Shale expected to generate approximately $4.0mm in revenue commencing in 1Q10. |

| | |

| I | | 11/04/09 | | Announced 3Q09 earnings of ($0.8mm) vs. earnings of $4.1mm in 3Q08. |

| | |

| J | | 11/16/09 | | Announced amendment to credit facility providing a waiver of the Company’s violation of its fixed charge coverage ratio requirement. |

| | |

| K | | 11/17/09 | | Announced the installation of three IMPACT cleaning systems with Stone Energy Corp of Lafayette, LA |

| | |

| L | | 1/21/10 | | Announced successful test results of all three IMPACT systems on Stone Energy’s Gulf of Mexico platforms |

| | |

| M | | 3/15/10 | | Announced FY09 earnings of ($2.9mm) vs. earnings of ($13.6mm) in FY08 |

| | |

| N | | 4/29/10 | | Rumors circulate on message boards speculating about CYPRESS’ role in the Gulf of Mexico oil spill cleanup |

| | |

| O | | 5/5/10 | | Announces 1Q10 earnings of ($0.8mm) vs. earnings of $0.9mm in 1Q09 |

Sources: Company filings and FactSet.

| | |

| | 30 |

| | |

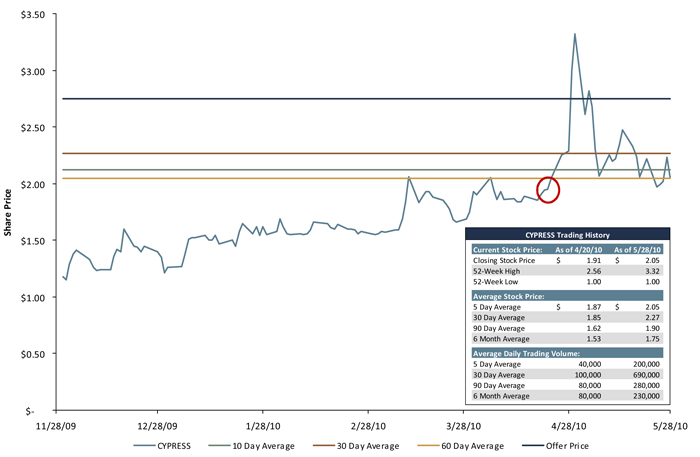

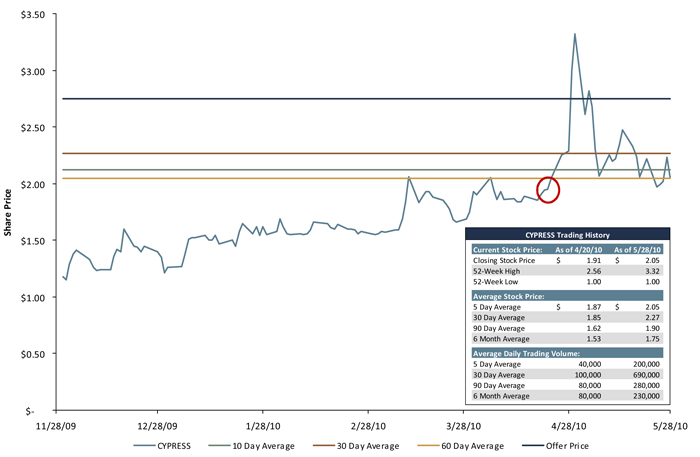

| RECENT PRICE PERFORMANCE (6 MONTHS) | | Confidential |

| | |

| (Dollars in Millions, Volume and per Share Data in Actuals) | | |

Source: Factset and Capital IQ.

| | |

| | 31 |

| | |

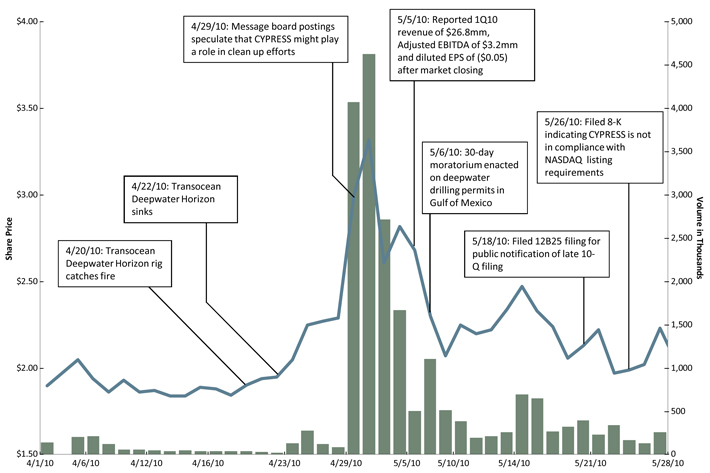

| RECENT PRICE PERFORMANCE (APRIL 1ST TO PRESENT) | | Confidential |

Source: Factset.

| | |

| | 32 |

| | |

| SELECTED COMPANIES – SEISMIC SERVICES | | Confidential |

| | |

| (Dollars in Millions, Except per Share) | | |

| | • | | CYPRESS has no direct comparables within the public seismic equipment and services universe. |

| | • | | Seismic drilling and permitting services (niche services) comprise approximately 30% of CYPRESS revenues. |

| | • | | CYPRESS does not offer seismic data acquisition and processing services or manufacture seismic equipment. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Company | | Ticker

Symbol | | Price

5/28/10 | | % of 52

Week High | | | Equity

Value | | Enterprise

Value | | Revenue | | | EBITDA(2) | |

| | | | | | | LTM | | | 2010E | | | 2011E | | | LTM | | | 2010E | | | 2011E | |

ION Geophysical Corporation | | IO | | $ | 5.43 | | 78.1 | % | | $ | 831.8 | | $ | 968.7 | | 2.4 | x | | 2.2 | x | | 1.9 | x | | 6.4 | x | | 8.5 | x | | 5.6 | x |

| | | | | | | | | | | |

Global Geophysical Services, Inc. (1) | | GGS | | | 9.32 | | 74.7 | % | | | 334.4 | | | 493.5 | | 1.6 | x | | N/M | | | N/M | | | 6.5 | x | | N/M | | | N/M | |

| | | | | | | | | | | |

Geokinetics Inc. | | GOK | | | 5.33 | | 23.6 | % | | | 94.2 | | | 427.8 | | 0.9 | x | | 0.7 | x | | 0.5 | x | | 6.5 | x | | 5.4 | x | | 2.8 | x |

| | | | | | | | | | | |

OYO Geospace Corp. | | OYOG | | | 45.63 | | 86.9 | % | | | 290.0 | | | 278.2 | | 2.8 | x | | 2.2 | x | | 1.9 | x | | N/M | | | 12.0 | x | | 9.4 | x |

| | | | | | | | | | | |

Dawson Geophysical Co. | | DWSN | | | 22.48 | | 62.5 | % | | | 176.3 | | | 127.0 | | 0.7 | x | | 0.6 | x | | 0.5 | x | | 10.9 | x | | 8.6 | x | | 3.0 | x |

| | | | | | | | | | | |

Mitcham Industries Inc. | | MIND | | | 6.21 | | 73.7 | % | | | 60.9 | | | 70.5 | | 1.3 | x | | 1.2 | x | | 1.2 | x | | N/M | | | 3.3 | x | | 2.9 | x |

| | | | | | | | | | | |

TGC Industries Inc. | | TGE | | | 3.38 | | 66.3 | % | | | 61.8 | | | 51.3 | | 0.6 | x | | 0.6 | x | | 0.5 | x | | 4.2 | x | | 3.0 | x | | 2.1 | x |

| | | | | | | | | | | |

Bolt Technology Corp.(1) | | BOLT | | | 8.71 | | 64.3 | % | | | 75.7 | | | 39.0 | | 1.2 | x | | N/M | | | N/M | | | 3.9 | x | | N/M | | | N/M | |

| | | | | | | | | | | |

Summary of Market Multiples: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mean | | | | | | | | | | | | | | | | 1.4 | x | | 1.3 | x | | 1.1 | x | | 6.4 | x | | 6.8 | x | | 4.3 | x |

Median | | | | | | | | | | | | | | | | 1.2 | | | 1.0 | | | 0.8 | | | 6.4 | | | 7.0 | | | 3.0 | |

| (1) | Forward estimates unavailable. |

| (2) | EBITDA reflects adjustments for certain non-recurring items, including stock-based compensation expense. |

Note: No company used in this analysis for comparative purposes is identical to CYPRESS.

Source: Public filings, Capital IQ, Bloomberg, IBES Estimates.

| | |

| | 33 |

| | |

| SELECTED COMPANIES – OILFIELD SERVICES | | Confidential |

| | |

| (Dollars in Millions, Except per Share) | | |

| | • | | CYPRESS has no direct comparables within the public oilfield services universe. |

| | • | | CYPRESS offers fluid transportation and equipment rental services that compete with certain segments of larger oilfield service companies. |

| | • | | These companies are primarily focused on production and workover operations and do not offer seismic drilling and permitting services. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Company | | Ticker

Symbol | | Price

5/28/10 | | % of 52

Week High | | | Equity

Value | | Enterprise

Value | | Revenue | | | EBITDA(1) | |

| | | | | | | LTM | | | 2010E | | | 2011E | | | LTM | | | 2010E | | | 2011E | |

Key Energy Services Inc. | | KEG | | $ | 9.56 | | 82.8 | % | | $ | 1,199.3 | | $ | 1,664.0 | | 1.6 | x | | 1.2 | x | | 1.0 | x | | N/M | | | 8.2 | x | | 4.9 | x |

| | | | | | | | | | | |

Complete Production Services, Inc. | | CPX | | | 13.01 | | 81.0 | % | | | 1,022.3 | | | 1,567.0 | | 1.5 | x | | 1.2 | x | | 1.0 | x | | 9.4 | x | | 6.0 | x | | 4.7 | x |

| | | | | | | | | | | |

Basic Energy Services, Inc. | | BAS | | | 8.16 | | 72.0 | % | | | 336.8 | | | 740.8 | | 1.4 | x | | 1.2 | x | | 1.0 | x | | N/M | | | 8.7 | x | | 5.4 | x |

| | | | | | | | | | | |

Allis-Chalmers Energy, Inc. | | ALY | | | 2.88 | | 58.3 | % | | | 208.8 | | | 710.3 | | 1.4 | x | | 1.2 | x | | 1.0 | x | | 9.6 | x | | 6.3 | x | | 4.5 | x |

| | | | | | | | | | | |

Newpark Resources Inc. | | NR | | | 6.42 | | 79.8 | % | | | 570.7 | | | 686.7 | | 1.3 | x | | 1.0 | x | | 0.9 | x | | N/M | | | 8.4 | x | | 6.6 | x |

| | | | | | | | | | | |

Summary of Market Multiples: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mean | | | | | | | | | | | | | | | | 1.5 | x | | 1.2 | x | | 1.0 | x | | 9.5 | x | | 7.5 | x | | 5.2 | x |

Median | | | | | | | | | | | | | | | | 1.4 | | | 1.2 | | | 1.0 | | | 9.5 | | | 8.2 | | | 4.9 | |

| (1) | EBITDA reflects adjustments for certain non-recurring items, including stock-based compensation expense. |

Note: No company used in this analysis for comparative purposes is identical to CYPRESS.

Source: Public filings, Capital IQ, Bloomberg, IBES Estimates.

| | |

| | 34 |

| | |

| PRECEDENT TRANSACTIONS | | Confidential |

| | | | | | | | | | | | | | | |

Announced | | Closed | | Acquiror | | Target | | Implied

Enterprise Value | | Enterprise Value / | |

| | | | | | LTM Revenue | | | LTM EBITDA | |

|

| Transactions Under $300mm | |

| | | | | | |

| 4/9/2010 | | — | | Halliburton Company | | Boots & Coots, Inc. | | $ | 288.4 | | 1.5 | x | | 12.2 | x |

| 7/30/2007 | | 8/1/2007 | | Oil States International Inc. | | Schooner Petroleum Services, Inc. | | | 67.0 | | 1.3 | x | | 3.1 | x |

| 1/8/2007 | | 3/6/2007 | | Basic Energy Services, Inc. | | JetStar Energy Services, Inc. | | | 126.7 | | 2.0 | x | | 4.9 | x |

| 12/20/2005 | | 1/18/2006 | | Allis-Chalmers Energy, Inc. | | Specialty Rental Tools, Inc. | | | 82.0 | | 4.6 | x | | 4.4 | x |

| 1/28/2004 | | 2/27/2004 | | Cooper Cameron Corp. | | Petreco Process Systems | | | 90.0 | | 0.8 | x | | 6.2 | x |

| 5/26/2003 | | 2/12/2004 | | Patterson-UTI Energy Inc. | | TMBR/Sharp Drilling Inc. | | | 105.5 | | 2.8 | x | | 10.1 | x |

| 5/14/2002 | | 7/19/2002 | | Key Energy Services Inc. | | Q Services Inc. | | | 204.2 | | 1.1 | x | | 7.1 | x |

| | | | | | |

| | | | | | Mean | | $ | 137.7 | | 2.0 | x | | 6.9 | x |

| | | | | | Median | | | 105.5 | | 1.5 | | | 6.2 | |

|

| Transactions Over $300mm | |

| | | | | | |

| 2/21/2010 | | — | | Schlumberger Limited | | Smith International Inc. | | $ | 13,658.4 | | 1.7 | x | | 14.1 | x |

| 8/30/2009 | | 4/28/2010 | | Baker Hughes Incorporated | | BJ Services Company | | | 5,529.6 | | 1.2 | x | | 7.0 | x |

| 6/1/2009 | | 11/18/2009 | | Cameron International Corp | | NATCO Group Inc. | | | 734.6 | | 1.1 | x | | 10.8 | x |

| 6/8/2008 | | 12/23/2008 | | Precision Drilling Trust | | Grey Wolf Inc. | | | 1,745.9 | | 2.0 | x | | 5.3 | x |

| 6/3/2008 | | 8/18/2008 | | Smith International Inc. | | W-H Energy Services, Inc. | | | 3,199.1 | | 2.8 | x | | 9.8 | x |

| 12/17/2007 | | 4/21/2008 | | National Oilwell Varco, Inc. | | Grant Prideco Inc. | | | 7,435.3 | | 3.6 | x | | 9.0 | x |

| 3/28/2007 | | 6/14/2007 | | United States Steel Corp. | | Lone Star Technologies, Inc. | | | 1,951.0 | | 1.4 | x | | 9.6 | x |

| 3/18/2007 | | 7/11/2007 | | Hercules Offshore, Inc. | | TODCO | | | 2,297.3 | | 2.5 | x | | 6.0 | x |

| 2/11/2007 | | 5/7/2007 | | Tenaris SA | | Hydril Company LP | | | 1,973.0 | | 3.9 | x | | 12.8 | x |

| 10/31/2006 | | 2/14/2007 | | ValueAct Capital | | Seitel Inc. | | | 666.8 | | 3.7 | x | | 4.7 | x |

| 10/25/2006 | | 12/18/2006 | | Allis-Chalmers Energy, Inc. | | Oil and Gas Rental Services, Inc. | | | 344.6 | | — | | | 8.6 | x |

| 9/22/2006 | | 12/12/2006 | | Superior Energy Services Inc. | | Warrior Energy Services Corp | | | 355.4 | | 3.6 | x | | 12.3 | x |

| 9/10/2006 | | 12/1/2006 | | IPSCO Inc. | | NS Group Inc. | | | 1,332.3 | | 2.0 | x | | 6.9 | x |

| 6/12/2006 | | 10/5/2006 | | Tenaris SA | | Maverick Tube Corp. | | | 2,836.7 | | 1.5 | x | | 8.1 | x |

| 3/16/2005 | | 7/1/2005 | | Seacor Holdings Inc. | | Seabulk International Inc. | | | 1,049.8 | | 3.0 | x | | 8.4 | x |

| 8/11/2004 | | 3/11/2005 | | National-Oilwell Inc. | | Varco International Inc. | | | 3,055.7 | | 2.1 | x | | 14.1 | x |

| 5/14/2002 | | 8/7/2002 | | Ensco International Inc. | | Chiles Offshore Inc. | | | 696.0 | | — | | | 18.0 | x |

| 2/20/2002 | | 5/31/2002 | | BJ Services Company | | OSCA, Inc. | | | 434.3 | | 2.5 | x | | 15.3 | x |

| | | | | | |

| | | | | | Mean | | $ | 2,738.7 | | 2.4 | x | | 10.0 | x |

| | | | | | Median | | | 1,848.5 | | 2.3 | | | 9.3 | |

| (1) | Implied Enterprise Value based on the announced transaction equity price and other public information available at the time of the announcement. |

| (2) | Based on reported metric for the most recent LTM period prior to the announcement of the transaction. |

Note: No transaction used in this analysis for comparative purposes is identical to the Transaction.

Source: IHS Herold, Factset, Capital IQ, and public company filings.

| | |

| | 35 |

| | |

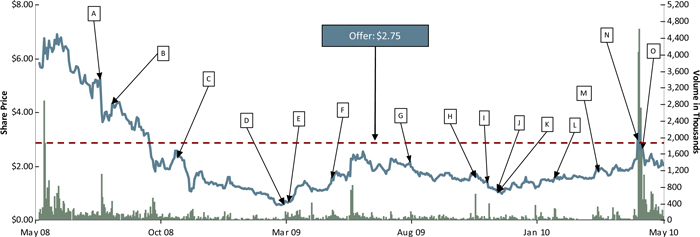

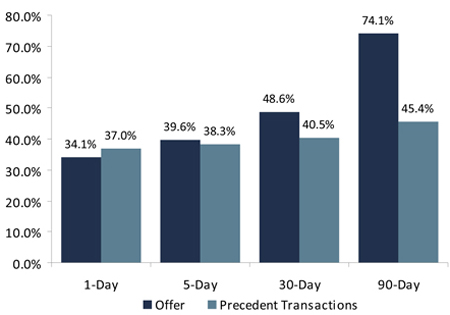

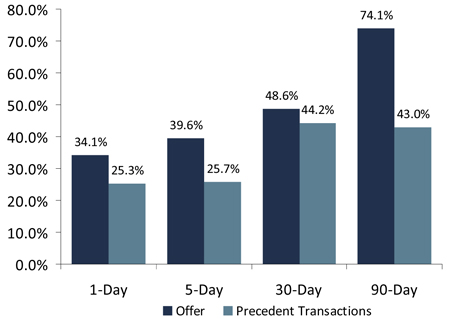

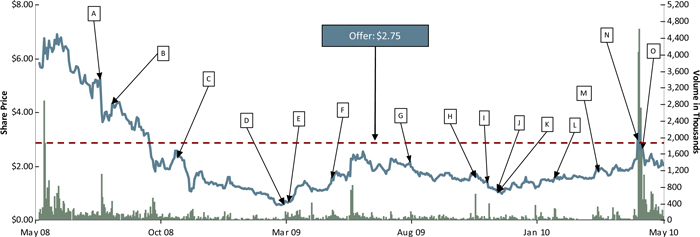

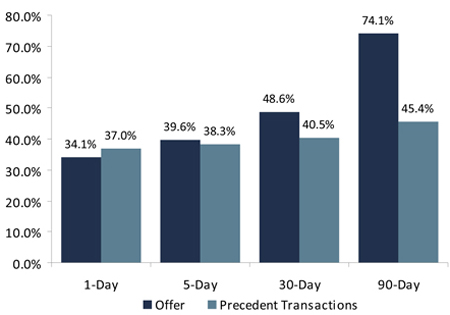

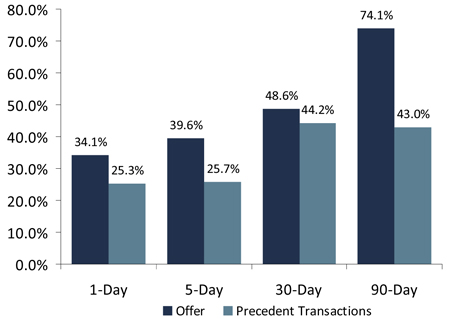

| PREMIUMS PAID ANALYSIS | | Confidential |

| | • | | Stephens reviewed publicly available data from 82 transactions involving U.S. listed companies since 2007. Additionally, Stephens reviewed data from 19 transactions involving U.S. listed oilfield service companies since 2001. Stephens reviewed the premiums represented by the acquisition price per share compared to the share price of the target company one day, 5 days, 30 days and 90 days prior to the announcement. |

| | • | | Stephens also reviewed the $2.75 value of the consideration to be received by holders of the Company’s common stock pursuant to the merger agreement in relation to the closing market price of the Company’s common stock on May 28, 2010 and to the share price of CYPRESS one day, 5 days, 30 days and 90 days prior. |

ALL TRANSACTIONS (82)

OILFIELD SERVICES TRANSACTIONS (19)

Note: No transaction used in this analysis for comparative purposes is identical to the Transaction.

Source: Factset, Capital IQ, and public company filings.

| | |

| | 36 |