Exhibit 17(d)

Goldman

Sachs Variable Insurance Trust

GOLDMAN SACHS ASSET MANAGEMENT 32 OLD SLIP, NEW YORK, NEW YORK 10005

Annual Report

December 31, 2002

GOLDMAN SACHS VARIABLE INSURANCE TRUST GROWTH AND INCOME FUND

Shareholder Letter

Dear Shareholders:

This report provides an overview on the performance of the Goldman Sachs Variable Insurance Trust – Growth and Income Fund for the one-year period that ended December 31, 2002.

Market Review

2002 experienced continued volatility in the equity markets. The market underwent considerable changes — from large corporate bankruptcies to corporate governance issues and sell-side analyst scrutiny. On the economic front, mixed signals prevailed as stocks finished their third year in a row in negative territory. Despite lower consumer confidence and an uncertain outlook for job security, lower borrowing costs seemed to keep consumer spending from falling off. Confidence in the health of the world economy has been stifled by concerns about a U.S.-led war on Iraq and additional terrorist attacks.

In market declines, such as in 2002, investors often sell for emotional reasons, which usually results in valuations compressing within industries as investors engage in the market equivalent of “throwing out the baby with the bath water.” During these times, as prepared investors we seek to upgrade our portfolios as higher quality companies become available to us at very attractive prices. The Fund’s management team avoided some of the market’s major “torpedoes,” which we attribute to our strong research governance. We adhere to a principle of not compromising on our fundamental research process, which can help us to put only quality names into our portfolios. In summary, we continue to emphasize balance sheet quality, cash flow stability, and companies with superior management teams.

Performance Review

Over the one-year period that ended December 31, 2002, the Fund generated a cumulative total return of -11.34%. Over the same time period, the Fund’s benchmark, the Standard & Poor’s 500 Index (with dividends reinvested) generated a cumulative total return of

- -22.10%. While the Fund could not escape the widespread market weakness, it did significantly outperform its benchmark due to strong stock selection. The Fund’s quality bias and emphasis on price and future prospects, not merely price, has been well founded during the challenging investing environment in 2002.

During the reporting period, the Fund’s holdings in the Financials, Industrials, Utilities, and Insurance sectors were particularly strong. Bank of America Corp. (“Bank of America”) was a top contributor to performance. Bank of America, the Fund’s largest holding as of December 31, 2002, provides a diversified range of banking and non-banking financial services and products. The company has been experiencing earnings-per-share growth and continues to find ways to help expand its asset base and strengthen relationships with current customers.

Citigroup, Inc. (“Citigroup”) was a negative contributor to performance due in part to investor concern over the amount of bad debt exposure and highly publicized research fines. We see the current problems as short term and continue to hold Citigroup due to the strength of its diverse business mix across products lines and international markets.

Currently our portfolio is underweight in Utilities and Consumer stocks and overweight in Insurance and Industrials. The environment continues to be a difficult one for Utilities as

1

GOLDMAN SACHS VARIABLE INSURANCE TRUST GROWTH AND INCOME FUND

Shareholder Letter (continued)

certain segments face over-capacity and decreasing demand. In the Consumer area, volatility has increased as investors react to short-term sales announcements. We typically like to invest in Consumer companies that we know have strong product pipelines and do not have to rely solely on price increases in order to increase revenues. In Insurance, as of December 31, 2002 we were overweight in the Life Insurance industry with names like Metropolitan Life Insurance Co. (“MetLife”) and in the Property Insurance industry with companies such as RenaissanceRe Holdings and PartnerRe Ltd. In the Industrial Sector, we have exposure in the Defense/ Aerospace and Industrial Parts industries.

Prior to the fourth quarter, the Fund had been extremely underweight in the Telecom industry due to concerns over excess capacity, increased competition, and regulatory constraints, all of which plagued the industry. While other value managers were attracted to the industry because of dividend yields, we thought that the businesses were in decline and felt that the industry was expensive. More recently, as companies have been reducing capital expenditures and the regulatory environment has been showing signs of improvement, we have found opportunities to increase positions in those companies that have improving cash flows, balance sheets and quality managements. Examples of holdings in this area include SBC Communications Inc. and BellSouth Corp. We believe that these companies, when compared to their peers, offer a better, more attractive risk/reward profile.

Investment Objective

The Fund seeks long-term growth of capital and growth of income through a diversified portfolio of equity securities.

Portfolio Composition

Top 10 Portfolio Holdings as of December 31, 2002*

| | | | | | | |

| | | | % of Total |

| Company | | Business | | Net Assets |

| |

| |

|

| Bank of America Corp. | | Banks | | | 3.8 | % |

| SBC Communications, Inc. | | Telephone | | | 3.3 | |

| Citigroup, Inc. | | Banks | | | 3.1 | |

| Exxon Mobil Corp. | | Energy Resources | | | 2.6 | |

| Fox Entertainment Group, Inc. | | Media | | | 2.4 | |

| Philip Morris Companies, Inc. | | Tobacco | | | 2.3 | |

| U.S. Bancorp | | Banks | | | 2.2 | |

| Freddie Mac | | Financial Services | | | 2.1 | |

| Pfizer, Inc. | | Drugs | | | 2.1 | |

| BellSouth Corp. | | Telephone | | | 2.1 | |

* Opinions expressed in this report represent our present opinions only. Reference to individual securities should not be construed as a commitment that such securities will be retained in the Fund. From time to time, the Fund may change the individual securities it holds, the number or types of securities held and the markets in which it invests. References to individual securities do not constitute a recommendation to the investor to buy, hold or sell such securities. In addition, references to past performance of the Fund do not indicate future returns, which are not guaranteed and will vary. Furthermore, the value of shares of the Fund may fall as well as rise.

2

GOLDMAN SACHS VARIABLE INSURANCE TRUST GROWTH AND INCOME FUND

Portfolio Outlook

Economists generally believe that the economy will expand in 2003, but increasing global tensions may stifle the growth. Although we do not attempt to predict market movements, we continue to view firsthand fundamental research as the most important part of our investment process. In addition, our team-based approach gives each team member industry/sector-specific responsibility and allows these individuals to provide in-depth industry expertise. Our continued focus on price and fundamentals allows us to buy quality companies with future prospects when we believe temporary situations cause the stock price to fall. We believe our consistent investment philosophy will help allow our portfolios to perform well in a variety of market conditions.

We thank you for your investment and look forward to your continued confidence.

Goldman Sachs Value Portfolio Management Team

January 9, 2003

3

GOLDMAN SACHS VARIABLE INSURANCE TRUST GROWTH AND INCOME FUND

Performance Summary

December 31, 2002

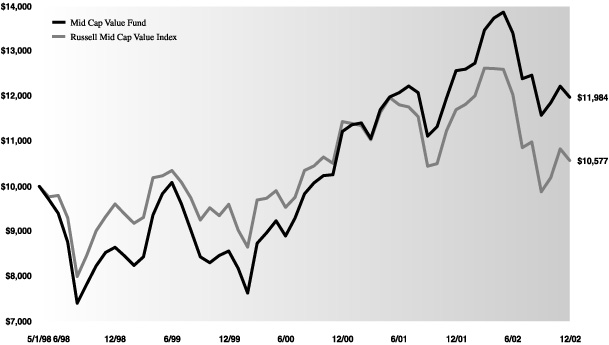

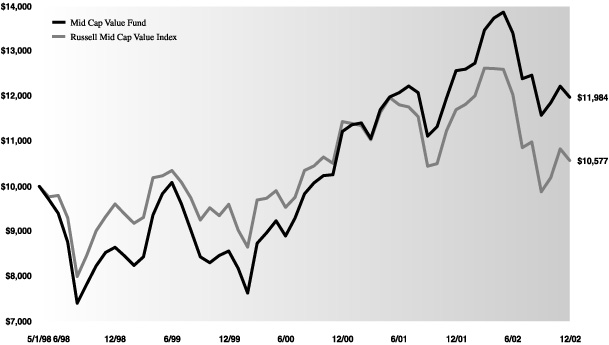

The following graph shows the value as of December 31, 2002, of a $10,000 investment made on January 12, 1998 (commencement of operations). For comparative purposes, the performance of the Fund’s benchmark (the Standard and Poor’s 500 Index (“S&P 500 Index”)) is shown. This performance data represents past performance and should not be considered indicative of future performance which will fluctuate with changes in market conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| Growth and Income Fund’s Lifetime Performance |

Growth of a $10,000 Investment, Distributions Reinvested from January 12, 1998 to December 31, 2002.

| | | | | | | |

| | Since Inception | | One Year | | |

|

|

|

|

Average Annual Total Return Through December 31, 2002 |

|

|

|

|

Growth and Income Fund (commenced January 12, 1998) | | -3.17% | | -11.34% | | |

|

4

GOLDMAN SACHS VARIABLE INSURANCE TRUST GROWTH AND INCOME FUND

Statement of Investments

December 31, 2002

| | | | | | | | | | | |

| | | | | | |

| | Shares | | Description | | Value |

| | |

Common Stocks – 96.9% |

|

| | | Airlines – 0.5% |

| | | | 12,936 | | | Southwest Airlines Co. | | $ | 179,810 | |

| | |

|

| | | Alcohol – 0.6% |

| | | | 4,196 | | | Anheuser-Busch Companies, Inc. | | | 203,086 | |

| | |

|

| | | Apartments – 2.0% |

| | | | 10,775 | | | Archstone-Smith Trust | | | 253,644 | |

| | | | 20,075 | | | Equity Residential Properties Trust | | | 493,443 | |

| | | | | | | | | |

| |

| | | | | | | | | | 747,087 | |

| | |

|

| | | Banks – 16.5% |

| | | | 20,075 | | | Bank of America Corp. | | | 1,396,618 | |

| | | | 6,798 | | | Charter One Financial, Inc. | | | 195,306 | |

| | | | 32,459 | | | Citigroup, Inc. | | | 1,142,232 | |

| | | | 28,650 | | | KeyCorp | | | 720,261 | |

| | | | 3,099 | | | M&T Bank Corp. | | | 245,906 | |

| | | | 3,927 | | | Mellon Financial Corp. | | | 102,534 | |

| | | | 10,600 | | | National City Corp. | | | 289,592 | |

| | | | 38,704 | | | U.S. Bancorp | | | 821,299 | |

| | | | 13,900 | | | Wachovia Corp. | | | 506,516 | |

| | | | 14,144 | | | Wells Fargo & Co. | | | 662,929 | |

| | | | | | | | | |

| |

| | | | | | | | | | 6,083,193 | |

| | |

|

| | | Brokers – 0.5% |

| | | | 5,225 | | | Merrill Lynch & Co., Inc. | | | 198,289 | |

| | |

|

| | | Chemicals – 1.4% |

| | | | 8,725 | | | Praxair, Inc. | | | 504,043 | |

| | |

|

| | | Computer Hardware – 1.4% |

| | | | 25,300 | | | Apple Computer, Inc.* | | | 362,549 | |

| | | | 10,400 | | | Cisco Systems, Inc.* | | | 136,240 | |

| | | | | | | | | |

| |

| | | | | | | | | | 498,789 | |

| | |

|

| | | Computer Software – 0.8% |

| | | | 5,800 | | | Microsoft Corp.* | | | 299,860 | |

| | |

|

| | | Defense/ Aerospace – 3.2% |

| | | | 8,375 | | | General Dynamics Corp. | | | 664,724 | |

| | | | 8,614 | | | United Technologies Corp. | | | 533,551 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,198,275 | |

| | |

|

| | | Department Stores – 0.9% |

| | | | 14,904 | | | The May Department Stores Co. | | | 342,494 | |

| | |

|

| | | Drugs – 3.6% |

| | | | 24,800 | | | Pfizer, Inc. | | | 758,136 | |

| | | | 15,000 | | | Wyeth | | | 561,000 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,319,136 | |

| | |

|

| | | Electrical Utilities – 5.6% |

| | | | 27,358 | | | Energy East Corp. | | | 604,338 | |

| | | | 5,457 | | | Entergy Corp. | | | 248,785 | |

| | | | 6,099 | | | Exelon Corp. | | | 321,844 | |

| | | | 11,260 | | | FirstEnergy Corp. | | | 371,242 | |

| | | | 3,275 | | | FPL Group, Inc. | | | 196,926 | |

| | | | 9,221 | | | PPL Corp. | | | 319,784 | |

| | | | | | | | | |

| |

| | | | | | | | | | 2,062,919 | |

| | |

|

| | | Energy Resources – 10.6% |

| | | | 6,500 | | | Apache Corp. | | | 370,435 | |

| | | | 9,500 | | | BP PLC ADR | | | 386,175 | |

| | | | 15,300 | | | ConocoPhillips | | | 740,367 | |

| | | | 27,431 | | | Exxon Mobil Corp. | | | 958,439 | |

| | | | 12,200 | | | Murphy Oil Corp. | | | 522,770 | |

| | | | 33,150 | | | Ocean Energy, Inc. | | | 662,005 | |

| | | | 10,379 | | | Pioneer Natural Resources Co.* | | | 262,070 | |

| | | | | | | | | |

| |

| | | | | | | | | | 3,902,261 | |

| | |

|

| | | Environmental Services – 0.7% |

| | | | 11,573 | | | Waste Management, Inc. | | | 265,253 | |

| | |

|

| | | Financial Services – 4.5% |

| | | | 8,921 | | | Countrywide Credit Industries, Inc. | | | 460,770 | |

| | | | 1,743 | | | Fannie Mae | | | 112,127 | |

| | | | 13,282 | | | Freddie Mac | | | 784,302 | |

| | | | 2,971 | | | SLM Corp. | | | 308,568 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,665,767 | |

| | |

|

| | | Food & Beverage – 3.3% |

| | | | 26,975 | | | ConAgra Foods, Inc. | | | 674,645 | |

| | | | 13,127 | | | H.J. Heinz Co. | | | 431,484 | |

| | | | 1,490 | | | Hershey Foods Corp. | | | 100,486 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,206,615 | |

| | |

|

| | | Forest – 1.1% |

| | | | 9,386 | | | Bowater, Inc. | | | 393,743 | |

| | |

|

| | | Gas Utilities – 1.0% |

| | | | 10,752 | | | KeySpan Corp. | | | 378,901 | |

| | |

|

| | | Heavy Electrical – 0.8% |

| | | | 2,254 | | | 3M Co. | | | 277,918 | |

| | |

|

| | | Heavy Machinery – 1.0% |

| | | | 7,948 | | | Deere & Co. | | | 364,416 | |

| | |

|

| | | Home Products – 4.3% |

| | | | 9,300 | | | Avon Products, Inc. | | | 500,991 | |

| | | | 7,740 | | | Kimberly-Clark Corp. | | | 367,418 | |

| | | | 8,466 | | | The Procter & Gamble Co. | | | 727,568 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,595,977 | |

| | |

|

| | | Industrial Parts – 2.3% |

| | | | 5,325 | | | American Standard Companies, Inc.* | | | 378,821 | |

| | | | 7,500 | | | Illinois Tool Works, Inc. | | | 486,450 | |

| | | | | | | | | |

| |

| | | | | | | | | | 865,271 | |

| | |

|

| | | Information Services – 1.7% |

| | | | 35,595 | | | Accenture Ltd.* | | | 640,354 | |

| | |

|

| | | Life Insurance – 2.8% |

| | | | 12,001 | | | John Hancock Financial Services, Inc. | | | 334,828 | |

| | | | 11,100 | | | MetLife, Inc. | | | 300,144 | |

| | | | 12,650 | | | The Principal Financial Group, Inc. | | | 381,144 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,016,116 | |

| | |

|

| | | Media – 3.7% |

| | | | 7,650 | | | Cox Communications, Inc.* | | | 217,260 | |

| | | | 33,579 | | | Fox Entertainment Group, Inc.* | | | 870,704 | |

| | | | 25,100 | | | General Motors Corp. Class H* | | | 268,570 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,356,534 | |

| | |

|

The accompanying notes are an integral part of these financial statements. 5

GOLDMAN SACHS VARIABLE INSURANCE TRUST GROWTH AND INCOME FUND

Statement of Investments (continued)

December 31, 2002

| | | | | | | | | | | |

| | | | | | |

| | Shares | | Description | | Value |

| | |

Common Stocks – (continued) |

|

| | | Mining – 0.5% |

| | | | 8,185 | | | Alcoa, Inc. | | $ | 186,454 | |

| | |

|

| | | Office Industrial – 2.4% |

| | | | 7,425 | | | Boston Properties, Inc. | | | 273,686 | |

| | | | 15,775 | | | Equity Office Properties Trust | | | 394,059 | |

| | | | 6,864 | | | Liberty Property Trust | | | 219,236 | |

| | | | | | | | | |

| |

| | | | | | | | | | 886,981 | |

| | |

|

| | | Oil Services – 1.0% |

| | | | 11,200 | | | BJ Services Co.* | | | 361,872 | |

| | |

|

| | | Other REIT – 0.3% |

| | | | 3,900 | | | iStar Financial, Inc. | | | 109,395 | |

| | |

|

| | | Property Insurance – 5.8% |

| | | | 12,725 | | | PartnerRe Ltd. | | | 659,410 | |

| | | | 17,742 | | | RenaissanceRe Holdings Ltd. | | | 702,583 | |

| | | | 5,900 | | | The St. Paul Companies, Inc. | | | 200,895 | |

| | | | 7,468 | | | XL Capital Ltd. | | | 576,903 | |

| | | | | | | | | |

| |

| | | | | | | | | | 2,139,791 | |

| | |

|

| | | Publishing – 0.5% |

| | | | 4,440 | | | Dow Jones & Co., Inc. | | | 191,941 | |

| | |

|

| | | Railroads – 0.8% |

| | | | 6,913 | | | Canadian National Railway Co. | | | 287,304 | |

| | |

|

| | | Retail – 1.0% |

| | | | 11,150 | | | Simon Property Group, Inc. | | | 379,881 | |

| | |

|

| | | Security/ Asset Management – 1.3% |

| | | | 15,875 | | | Alliance Capital Management Holding L.P. | | | 492,125 | |

| | |

|

| | | Telephone – 5.7% |

| | | | 4,908 | | | AT&T Corp. | | | 128,148 | |

| | | | 29,300 | | | BellSouth Corp. | | | 757,991 | |

| | | | 45,400 | | | SBC Communications, Inc. | | | 1,230,794 | |

| | | | | | | | | |

| |

| | | | | | | | | | 2,116,933 | |

| | |

|

| | | Tobacco – 2.8% |

| | | | 21,218 | | | Philip Morris Companies, Inc. | | | 859,966 | |

| | | | 5,400 | | | UST, Inc. | | | 180,522 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,040,488 | |

| | |

|

| | | TOTAL COMMON STOCKS |

| | | (Cost $36,605,804) | | $ | 35,759,272 | |

| | |

|

| | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | Principal | | Interest | | Maturity | | |

| | Amount | | Rate | | Date | | |

| | | | | | | | Value |

| | |

Repurchase Agreement – 3.2% |

|

| | | Joint Repurchase Agreement Account II^ |

| | | $ | 1,200,000 | | | | 1.25 | % | | | 01/02/2003 | | | $ | 1,200,000 | |

| | | Maturity Value: $1,200,083 |

| | |

|

| | | TOTAL REPURCHASE AGREEMENT |

| | | (Cost $1,200,000) | | $ | 1,200,000 | |

| | |

|

| | | TOTAL INVESTMENTS BEFORE SECURITIES LENDING COLLATERAL |

| | | (Cost $37,805,804) | | $ | 36,959,272 | |

| | |

|

| | | | | | | | | | | |

| | | | | | |

| | Shares | | Description | | Value |

| | |

Securities Lending Collateral – 1.3% |

|

| | | | 480,000 | | | Boston Global Investment Trust – Enhanced Portfolio | | $ | 480,000 | |

| | |

|

| | | TOTAL SECURITIES LENDING COLLATERAL |

| | | (Cost $480,000) | | $ | 480,000 | |

| | |

|

| | | TOTAL INVESTMENTS |

| | | (Cost $38,285,804) | | $ | 37,439,272 | |

| | |

|

| | |

| * | | Non-income producing security. |

| |

| ^ | | Joint repurchase agreement was entered into on December 31, 2002. |

| |

| | The percentage shown for each investment category reflects the value of investments in that category as a percentage of total net assets. |

| | | | | | | |

| | |

|

| | | Investment Abbreviation: |

| | | ADR | | — | | American Depositary Receipt |

| | | REIT | | — | | Real Estate Investment Trust |

| | |

|

6 The accompanying notes are an integral part of these financial statements.

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE U.S. EQUITY FUND

Shareholder Letter

Dear Shareholders:

This report provides an overview on the performance of the Goldman Sachs Variable Insurance Trust — CORE U.S. Equity Fund for the one-year period that ended December 31, 2002.

Market Review

All 13 sectors in the S&P 500 Index (the “Index”) posted negative performance, with Telecommunications posting the largest absolute negative returns, followed by the heavily weighted Technology, which also contributed (weight times performance) most negatively to the Index performance over the period.

Performance Review

Over the one-year period that ended December 31, 2002, the Fund generated a cumulative total return of -21.89%. Over the same time period, the Fund’s benchmark, the Standard & Poor’s 500 Index (with dividends reinvested) generated a cumulative total return of

- -22.10%.

The goal of the Fund is to very closely match the benchmark, both at the sector and the security level, reproducing the risk characteristics and sector exposures of the Index. We seek to outperform the benchmark by maintaining a similar risk profile but overweighting stocks we expect to outperform the benchmark, and underweighting those that we think may lag. The result is that the Fund’s absolute returns will generally track the Index’s fairly closely.

2002 was a difficult one for the U.S. equity market. The world economy continued to be plagued by political uncertainty, and financial scandals undermined investor confidence. Since in managing the Fund we do not take market timing bets but typically construct a portfolio that has industry exposure, size, and style characteristics that are very similar to its benchmark, the Fund was down significantly in absolute terms along with the Index.

Similar to the Index, all 13 sectors posted negative absolute returns in the Fund, particularly the Telecommunications sector, followed by the Commercial Services sector. The heavily weighted Technology sector, however, contributed (weight times performance) the most to the Fund’s negative absolute return over the year.

The outperformance of the Fund relative to the Index was largely due to the CORE stock selection criteria. Profitability and Momentum added the most to outperformance versus the benchmark, followed by Valuation. Earnings Quality and Fundamental Research also contributed positively to excess returns over the Index, albeit more modestly, for the period.

In terms of sectors, the Fund’s holdings in 6 of the 13 sectors had better results than their peers in the Index. Outperformance, particularly in heavily weighted sectors such as Financial, Technology and Health Care, outweighed the losses in other areas over the period and helped the Fund to slightly outperform its benchmark. On the downside, the Fund’s holdings in the Telecommunications sector detracted the most from relative returns for the year.

7

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE U.S. EQUITY FUND

Shareholder Letter (continued)

Investment Objective and Strategies

The Fund seeks long-term capital growth and dividend income through a broadly diversified portfolio of large-cap and blue chip equity securities representing all major sectors of the U.S. economy.

The portfolio employs a disciplined approach that combines fundamental investment research provided by Goldman, Sachs & Co.’s Global Investment Research Department and consensus opinions with quantitative analysis generated by the Asset Management Division’s proprietary model. This quantitative system evaluates each stock using many different criteria, including valuation measures, price momentum, earnings quality and profitability measures. While maintaining a profile close to that of the benchmark, those stocks ranked highly by the CORE multifactor model are selected to have overweight positions in the portfolio.

Portfolio Composition

Top 10 Portfolio Holdings as of December 31, 2002*

| | | | | | | |

| | | | % of Total |

| Company | | Business | | Net Assets |

| |

| |

|

| Microsoft Corp. | | Computer Software | | | 4.3 | % |

| Wal-Mart Stores, Inc | | Department Stores | | | 3.6 | % |

| Citigroup, Inc. | | Banks | | | 3.0 | % |

| Johnson & Johnson | | Drugs | | | 2.6 | % |

| Exxon Mobil Corp. | | Energy Resources | | | 2.6 | % |

| Bank of America Corp. | | Banks | | | 2.3 | % |

| General Electric Co. | | Financial Services | | | 2.2 | % |

| The Procter & Gamble Co. | | Home Products | | | 2.2 | % |

| Pfizer, Inc. | | Drugs | | | 2.1 | % |

| International Business Machines Corp. | | Computer Software | | | 1.9 | % |

* Opinions expressed in this report represent our present opinions only. Reference to individual securities should not be construed as a commitment that such securities will be retained in the Fund. From time to time, the Fund may change the individual securities it holds, the number or types of securities held and the markets in which it invests. References to individual securities do not constitute a recommendation to the investor to buy, hold or sell such securities. In addition, references to past performance of the Fund do not indicate future returns, which are not guaranteed and will vary. Furthermore, the value of shares of the Fund may fall as well as rise.

8

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE U.S. EQUITY FUND

Portfolio Outlook

Looking ahead, we continue to believe that cheaper stocks should outpace more expensive ones and good momentum stocks should do better than poor momentum stocks. We also prefer stocks about which fundamental research analysts are becoming more positive and companies with strong profit margins and sustainable earnings. As such, we anticipate remaining fully invested and expect that the value we add over time will be due to stock selection, as opposed to sector or size allocations.

We thank you for your investment and look forward to your continued confidence.

Goldman Sachs Quantitative Equity Portfolio Management Team

January 9, 2003

9

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE U.S. EQUITY FUND

Performance Summary

December 31, 2002

The following graph shows the value as of December 31, 2002, of a $10,000 investment made on February 13, 1998 (commencement of operations). For comparative purposes, the performance of the Fund’s benchmark (the Standard and Poor’s 500 Index (“S&P 500 Index”)) is shown. This performance data represents past performance and should not be considered indicative of future performance which will fluctuate with changes in market conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| CORE U.S. Equity Fund’s Lifetime Performance |

Growth of a $10,000 Investment, Distributions Reinvested from February 13, 1998 to December 31, 2002.

| | | | | | | |

| | Since Inception | | One Year | | |

|

|

|

|

Average Annual Total Return Through December 31, 2002 |

|

|

|

|

CORE U.S. Equity Fund (commenced February 13, 1998) | | -2.44% | | -21.89% | | |

|

10

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE U.S. EQUITY FUND

Statement of Investments

December 31, 2002

| | | | | | | | | | | |

| | | | | | |

| | Shares | | Description | | Value |

| | |

Common Stocks – 99.3% |

|

| | | Airlines – 0.1% |

| | | | 12,100 | | | Delta Air Lines, Inc. | | $ | 146,410 | |

| | |

|

| | | Apparel – 0.2% |

| | | | 14,900 | | | Sara Lee Corp. | | | 335,399 | |

| | |

|

| | | Banks – 10.4% |

| | | | 10,600 | | | Associated Banc-Corp. | | | 359,764 | |

| | | | 47,231 | | | Bank of America Corp. | | | 3,285,861 | |

| | | | 8,800 | | | Bank One Corp. | | | 321,640 | |

| | | | 124,166 | | | Citigroup, Inc. | | | 4,369,401 | |

| | | | 31,300 | | | J.P. Morgan Chase & Co. | | | 751,200 | |

| | | | 1,800 | | | M&T Bank Corp. | | | 142,830 | |

| | | | 4,600 | | | Marshall & Ilsley Corp. | | | 125,948 | |

| | | | 4,200 | | | Regions Financial Corp. | | | 140,112 | |

| | | | 6,900 | | | SouthTrust Corp. | | | 171,465 | |

| | | | 25,700 | | | SunTrust Banks, Inc. | | | 1,462,844 | |

| | | | 61,900 | | | U.S. Bancorp | | | 1,313,518 | |

| | | | 8,400 | | | Union Planters Corp. | | | 236,376 | |

| | | | 51,100 | | | Wachovia Corp. | | | 1,862,084 | |

| | | | 6,600 | | | Wells Fargo & Co. | | | 309,342 | |

| | | | | | | | | |

| |

| | | | | | | | | | 14,852,385 | |

| | |

|

| | | Biotechnology – 2.4% |

| | | | 11,452 | | | Amgen, Inc.* | | | 553,590 | |

| | | | 36,900 | | | Applera Corp. – Applied Biosystems Group | | | 647,226 | |

| | | | 11,000 | | | Biogen, Inc.* | | | 440,660 | |

| | | | 17,500 | | | Chiron Corp.* | | | 658,000 | |

| | | | 32,600 | | | Gilead Sciences, Inc.* | | | 1,108,400 | |

| | | | | | | | | |

| |

| | | | | | | | | | 3,407,876 | |

| | |

|

| | | Brokers – 1.6% |

| | | | 21,100 | | | Merrill Lynch & Co., Inc. | | | 800,745 | |

| | | | 24,000 | | | The Bear Stearns Companies, Inc. | | | 1,425,600 | |

| | | | | | | | | |

| |

| | | | | | | | | | 2,226,345 | |

| | |

|

| | | Chemicals – 0.9% |

| | | | 5,500 | | | Air Products and Chemicals, Inc. | | | 235,125 | |

| | | | 3,600 | | | Avery Dennison Corp. | | | 219,888 | |

| | | | 3,300 | | | Carlisle Companies, Inc. | | | 136,554 | |

| | | | 3,100 | | | Ecolab, Inc. | | | 153,450 | |

| | | | 5,400 | | | Rohm & Haas Co. | | | 175,392 | |

| | | | 13,100 | | | The Goodyear Tire & Rubber Co. | | | 89,211 | |

| | | | 9,500 | | | The Sherwin-Williams Co. | | | 268,375 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,277,995 | |

| | |

|

| | | Clothing – 0.2% |

| | | | 20,900 | | | Limited Brands | | | 291,137 | |

| | |

|

| | | Computer Hardware – 4.2% |

| | | | 19,000 | | | Cisco Systems, Inc.* | | | 248,900 | |

| | | | 93,200 | | | Dell Computer Corp.* | | | 2,492,168 | |

| | | | 121,000 | | | Hewlett-Packard Co. | | | 2,100,560 | |

| | | | 83,500 | | | Ingram Micro, Inc.* | | | 1,031,225 | |

| | | | 5,400 | | | Tech Data Corp.* | | | 145,584 | |

| | | | | | | | | |

| |

| | | | | | | | | | 6,018,437 | |

| | |

|

| | | Computer Software – 7.2% |

| | | | 10,000 | | | Electronic Arts, Inc.* | | | 497,700 | |

| | | | 35,000 | | | International Business Machines Corp. | | | 2,712,500 | |

| | | | 118,800 | | | Microsoft Corp.* | | | 6,141,960 | |

| | | | 89,800 | | | Oracle Corp.* | | | 969,840 | |

| | | | | | | | | |

| |

| | | | | | | | | | 10,322,000 | |

| | |

|

| | | Defense/ Aerospace – 1.0% |

| | | | 7,600 | | | Honeywell International, Inc. | | | 182,400 | |

| | | | 5,400 | | | ITT Industries, Inc. | | | 327,726 | |

| | | | 4,700 | | | Lockheed Martin Corp. | | | 271,425 | |

| | | | 14,800 | | | Raytheon Co. | | | 455,100 | |

| | | | 4,500 | | | The Boeing Co. | | | 148,455 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,385,106 | |

| | |

|

| | | Department Stores – 4.1% |

| | | | 8,200 | | | Dillard’s, Inc. | | | 130,052 | |

| | | | 5,200 | | | Federated Department Stores, Inc.* | | | 149,552 | |

| | | | 9,100 | | | J. C. Penney Co., Inc. | | | 209,391 | |

| | | | 11,200 | | | Target Corp. | | | 336,000 | |

| | | | 101,000 | | | Wal-Mart Stores, Inc. | | | 5,101,510 | |

| | | | | | | | | |

| |

| | | | | | | | | | 5,926,505 | |

| | |

|

| | | Drugs – 10.4% |

| | | | 16,200 | | | Abbott Laboratories | | | 648,000 | |

| | | | 11,200 | | | AmerisourceBergen Corp. | | | 608,272 | |

| | | | 24,600 | | | Cardinal Health, Inc. | | | 1,456,074 | |

| | | | 5,100 | | | Forest Laboratories, Inc.* | | | 500,922 | |

| | | | 70,500 | | | Johnson & Johnson | | | 3,786,555 | |

| | | | 50,700 | | | McKesson Corp. | | | 1,370,421 | |

| | | | 47,500 | | | Merck & Co., Inc. | | | 2,688,975 | |

| | | | 96,650 | | | Pfizer, Inc. | | | 2,954,591 | |

| | | | 22,400 | | | Pharmacia Corp. | | | 936,320 | |

| | | | | | | | | |

| |

| | | | | | | | | | 14,950,130 | |

| | |

|

| | | Electrical Equipment – 0.6% |

| | | | 20,700 | | | Agilent Technologies, Inc.* | | | 371,772 | |

| | | | 10,700 | | | Fisher Scientific International, Inc.* | | | 321,856 | |

| | | | 5,700 | | | Jabil Circuit, Inc.* | | | 102,144 | |

| | | | 22,600 | | | Solectron Corp.* | | | 80,230 | |

| | | | | | | | | |

| |

| | | | | | | | | | 876,002 | |

| | |

|

| | | Electrical Utilities – 2.0% |

| | | | 22,100 | | | American Electric Power Co., Inc. | | | 603,993 | |

| | | | 5,100 | | | Constellation Energy Group, Inc. | | | 141,882 | |

| | | | 13,000 | | | Edison International* | | | 154,050 | |

| | | | 33,400 | | | Entergy Corp. | | | 1,522,706 | |

| | | | 13,800 | | | PG&E Corp.* | | | 191,820 | |

| | | | 6,400 | | | Progress Energy, Inc. | | | 277,440 | |

| | | | | | | | | |

| |

| | | | | | | | | | 2,891,891 | |

| | |

|

The accompanying notes are an integral part of these financial statements. 11

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE U.S. EQUITY FUND

Statement of Investments (continued)

December 31, 2002

| | | | | | | | | | | |

| | | | | | |

| | Shares | | Description | | Value |

| | |

Common Stocks – (continued) |

|

| | | Energy Resources – 4.8% |

| | | | 41,023 | | | ConocoPhillips | | $ | 1,985,103 | |

| | | | 107,212 | | | Exxon Mobil Corp. | | | 3,745,987 | |

| | | | 39,600 | | | Occidental Petroleum Corp. | | | 1,126,620 | |

| | | | | | | | | |

| |

| | | | | | | | | | 6,857,710 | |

| | |

|

| | | Entertainment – 1.3% |

| | | | 47,373 | | | Viacom, Inc. Class B* | | | 1,930,923 | |

| | |

|

| | | Environmental Services – 0.4% |

| | | | 26,700 | | | Waste Management, Inc. | | | 611,964 | |

| | |

|

| | | Financial Services – 4.3% |

| | | | 46,200 | | | American Express Co. | | | 1,633,170 | |

| | | | 2,800 | | | Countrywide Credit Industries, Inc. | | | 144,620 | |

| | | | 4,000 | | | Dun & Bradstreet Corp.* | | | 137,960 | |

| | | | 3,400 | | | Freddie Mac | | | 200,770 | |

| | | | 131,800 | | | General Electric Co. | | | 3,209,330 | |

| | | | 3,200 | | | Marsh & McLennan Companies, Inc. | | | 147,872 | |

| | | | 33,600 | | | MBNA Corp. | | | 639,072 | |

| | | | | | | | | |

| |

| | | | | | | | | | 6,112,794 | |

| | |

|

| | | Food & Beverage – 4.6% |

| | | | 28,200 | | | Archer-Daniels-Midland Co. | | | 349,680 | |

| | | | 28,000 | | | ConAgra Foods, Inc. | | | 700,280 | |

| | | | 36,600 | | | Kraft Foods, Inc. | | | 1,424,838 | |

| | | | 16,400 | | | PepsiCo, Inc. | | | 692,408 | |

| | | | 38,500 | | | SUPERVALU, INC. | | | 635,635 | |

| | | | 56,300 | | | Sysco Corp. | | | 1,677,177 | |

| | | | 11,100 | | | The Coca-Cola Co. | | | 486,402 | |

| | | | 55,100 | | | Tyson Foods, Inc. | | | 618,222 | |

| | | | | | | | | |

| |

| | | | | | | | | | 6,584,642 | |

| | |

|

| | | Forest – 0.3% |

| | | | 4,100 | | | International Paper Co. | | | 143,377 | |

| | | | 6,300 | | | Weyerhaeuser Co. | | | 310,023 | |

| | | | | | | | | |

| |

| | | | | | | | | | 453,400 | |

| | |

|

| | | Gas Utilities – 0.2% |

| | | | 16,300 | | | ONEOK, Inc. | | | 312,960 | |

| | |

|

| | | Gold – 0.2% |

| | | | 8,900 | | | Freeport-McMoRan Copper & Gold, Inc. Class B* | | | 149,342 | |

| | | | 4,800 | | | Newmont Mining Corp., Holding Co. | | | 139,344 | |

| | | | | | | | | |

| |

| | | | | | | | | | 288,686 | |

| | |

|

| | | Heavy Electrical – 1.5% |

| | | | 12,600 | | | 3M Co. | | | 1,553,580 | |

| | | | 10,700 | | | Emerson Electric Co. | | | 544,095 | |

| | | | | | | | | |

| |

| | | | | | | | | | 2,097,675 | |

| | |

|

| |

| | | Heavy Machinery – 0.3% |

| | | | 8,900 | | | Deere & Co. | | | 408,065 | |

| | |

|

| | | Home Products – 4.1% |

| | | | 21,500 | | | Avon Products, Inc. | | | 1,158,205 | |

| | | | 7,300 | | | Colgate-Palmolive Co. | | | 382,739 | |

| | | | 20,500 | | | Newell Rubbermaid Inc. | | | 621,765 | |

| | | | 14,300 | | | The Clorox Co. | | | 589,875 | |

| | | | 36,300 | | | The Procter & Gamble Co. | | | 3,119,622 | |

| | | | | | | | | |

| |

| | | | | | | | | | 5,872,206 | |

| | |

|

| | | Industrial Parts – 0.3% |

| | | | 7,100 | | | W.W. Grainger, Inc. | | | 366,005 | |

| | |

|

| | | Information Services – 1.1% |

| | | | 38,200 | | | Moody’s Corp. | | | 1,577,278 | |

| | |

|

| | | Internet – 0.2% |

| | | | 19,400 | | | Yahoo!, Inc.* | | | 317,190 | |

| | |

|

| | | Leisure – 0.6% |

| | | | 20,400 | | | Eastman Kodak Co. | | | 714,816 | |

| | | | 3,100 | | | Harley-Davidson, Inc. | | | 143,220 | |

| | | | | | | | | |

| |

| | | | | | | | | | 858,036 | |

| | |

|

| | | Life Insurance – 3.2% |

| | | | 19,000 | | | Aetna, Inc. | | | 781,280 | |

| | | | 4,600 | | | John Hancock Financial Services, Inc. | | | 128,340 | |

| | | | 51,900 | | | MetLife, Inc. | | | 1,403,376 | |

| | | | 15,500 | | | Nationwide Financial Services, Inc. | | | 444,075 | |

| | | | 6,000 | | | Principal Financial Group, Inc. | | | 180,780 | |

| | | | 51,000 | | | Prudential Financial, Inc. | | | 1,618,740 | |

| | | | | | | | | |

| |

| | | | | | | | | | 4,556,591 | |

| | |

|

| | | Media – 3.5% |

| | | | 187,450 | | | AOL Time Warner, Inc.* | | | 2,455,595 | |

| | | | 39,495 | | | Comcast Corp.* | | | 930,897 | |

| | | | 54,300 | | | Fox Entertainment Group, Inc.* | | | 1,407,999 | |

| | | | 12,900 | | | PanAmSat Corp.* | | | 188,856 | |

| | | | | | | | | |

| |

| | | | | | | | | | 4,983,347 | |

| | |

|

| | | Medical Products – 0.9% |

| | | | 23,100 | | | Boston Scientific Corp.* | | | 982,212 | |

| | | | 3,600 | | | Medtronic, Inc. | | | 164,160 | |

| | | | 4,500 | | | Zimmer Holdings, Inc.* | | | 186,840 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,333,212 | |

| | |

|

| | | Medical Providers – 1.2% |

| | | | 7,900 | | | Health Net, Inc.* | | | 208,560 | |

| | | | 13,400 | | | PacifiCare Health Systems, Inc.* | | | 376,540 | |

| | | | 14,100 | | | UnitedHealth Group, Inc. | | | 1,177,350 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,762,450 | |

| | |

|

12 The accompanying notes are an integral part of these financial statements.

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE U.S. EQUITY FUND

| | | | | | | | | | | |

| | | | | | |

| | Shares | | Description | | Value |

| | |

Common Stocks – (continued) |

|

| | | Motor Vehicle – 3.2% |

| | | | 83,900 | | | AutoNation, Inc.* | | $ | 1,053,784 | |

| | | | 19,200 | | | Ford Motor Co. | | | 178,560 | |

| | | | 49,300 | | | General Motors Corp. | | | 1,817,198 | |

| | | | 18,300 | | | Johnson Controls, Inc. | | | 1,467,111 | |

| | | | 19,100 | | | Visteon Corp. | | | 132,936 | |

| | | | | | | | | |

| |

| | | | | | | | | | 4,649,589 | |

| | |

|

| | | Office Industrial – 0.2% |

| | | | 10,800 | | | Equity Office Properties Trust | | | 269,784 | |

| | |

|

| | | Oil Refining – 0.9% |

| | | | 7,600 | | | Marathon Oil Corp. | | | 161,804 | |

| | | | 30,200 | | | Valero Energy Corp. | | | 1,115,588 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,277,392 | |

| | |

|

| | | Oil Services – 1.1% |

| | | | 7,400 | | | Halliburton Co. | | | 138,454 | |

| | | | 63,000 | | | Transocean, Inc. | | | 1,461,600 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,600,054 | |

| | |

|

| | | Property Insurance – 2.6% |

| | | | 6,300 | | | American Financial Group, Inc. | | | 145,341 | |

| | | | 21,206 | | | American International Group, Inc. | | | 1,226,767 | |

| | | | 22,100 | | | CNA Financial Corp.* | | | 565,760 | |

| | | | 34,900 | | | Loews Corp. | | | 1,551,654 | |

| | | | 18,421 | | | Travelers Property Casualty Corp. Class B* | | | 269,868 | |

| | | | | | | | | |

| |

| | | | | | | | | | 3,759,390 | |

| | |

|

| | | Publishing – 1.2% |

| | | | 23,700 | | | Deluxe Corp. | | | 997,770 | |

| | | | 12,200 | | | The McGraw-Hill Companies, Inc. | | | 737,368 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,735,138 | |

| | |

|

| | | Securities/ Asset Management – 1.3% |

| | | | 11,200 | | | Franklin Resources, Inc. | | | 381,696 | |

| | | | 21,800 | | | Lehman Brothers Holdings, Inc. | | | 1,161,722 | |

| | | | 3,500 | | | Morgan Stanley | | | 139,720 | |

| | | | 5,300 | | | The John Nuveen Co. | | | 134,355 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,817,493 | |

| | |

|

| | | Semiconductors – 2.0% |

| | | | 34,000 | | | Arrow Electronics, Inc.* | | | 434,860 | |

| | | | 57,200 | | | Avnet, Inc.* | | | 619,476 | |

| | | | 86,400 | | | Intel Corp. | | | 1,345,248 | |

| | | | 15,200 | | | SanDisk Corp.* | | | 308,560 | |

| | | | 13,000 | | | Vishay Intertechnology, Inc.* | | | 145,340 | |

| | | | | | | | | |

| |

| | | | | | | | | | 2,853,484 | |

| | |

|

| | | Specialty Retail – 1.4% |

| | | | 1,900 | | | AutoZone, Inc.* | | | 134,235 | |

| | | | 14,300 | | | CVS Corp. | | | 357,071 | |

| | | | 41,600 | | | Office Depot, Inc.* | | | 614,016 | |

| | | | 51,800 | | | Staples, Inc.* | | | 947,940 | |

| | | | | | | | | |

| |

| | | | | | | | | | 2,053,262 | |

| | |

|

| | | Telecommunications Equipment – 0.6% |

| | | | 60,600 | | | Motorola, Inc. | | | 524,190 | |

| | | | 10,000 | | | QUALCOMM Inc.* | | | 363,900 | |

| | | | | | | | | |

| |

| | | | | | | | | | 888,090 | |

| | |

|

| | | Telephone – 3.6% |

| | | | 14,013 | | | AT&T Corp. | | | 365,879 | |

| | | | 17,100 | | | BellSouth Corp. | | | 442,377 | |

| | | | 47,422 | | | SBC Communications, Inc. | | | 1,285,610 | |

| | | | 83,600 | | | Sprint Corp. | | | 1,210,528 | |

| | | | 49,194 | | | Verizon Communications, Inc. | | | 1,906,268 | |

| | | | | | | | | |

| |

| | | | | | | | | | 5,210,662 | |

| | |

|

| | | Tobacco – 1.2% |

| | | | 7,200 | | | Loews Corp. - Carolina Group | | | 145,944 | |

| | | | 3,500 | | | Philip Morris Companies, Inc. | | | 141,855 | |

| | | | 33,600 | | | R.J. Reynolds Tobacco Holdings, Inc. | | | 1,414,896 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,702,695 | |

| | |

|

| | | Truck Freight – 0.6% |

| | | | 5,600 | | | FedEx Corp. | | | 303,632 | |

| | | | 7,900 | | | United Parcel Service, Inc. | | | 498,332 | |

| | | | | | | | | |

| |

| | | | | | | | | | 801,964 | |

| | |

|

| | | Wireless – 1.1% |

| | | | 22,600 | | | ALLTEL Corp. | | | 1,152,600 | |

| | | | 48,124 | | | AT&T Wireless Services, Inc.* | | | 271,901 | |

| | | | 2,400 | | | Telephone & Data Systems, Inc. | | | 112,848 | |

| | | | 500 | | | United States Cellular Corp.* | | | 12,510 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,549,859 | |

| | |

|

| | | TOTAL COMMON STOCKS |

| | | (Cost $156,928,749) | | $ | 142,361,608 | |

| | |

|

The accompanying notes are an integral part of these financial statements. 13

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE U.S. EQUITY FUND

Statement of Investments (continued)

December 31, 2002

| | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | Principal | | Interest | | Maturity | | |

| | Amount | | Rate | | Date | | Value |

| | |

Repurchase Agreement – 0.2% |

|

| | | Joint Repurchase Agreement Account II^ |

| | | $ | 300,000 | | | | 1.25% | | | | 01/02/2003 | | | $ | 300,000 | |

| | | Maturity Value: $300,021 |

| | |

|

| | | TOTAL REPURCHASE AGREEMENT |

| | | (Cost $300,000) | | $ | 300,000 | |

| | |

|

| | | TOTAL INVESTMENTS |

| | | (Cost $157,228,749) | | $ | 142,661,608 | |

| | |

|

| | |

| * | | Non-income producing security. |

| ^ | | Joint repurchase agreement was entered into on December 31, 2002. |

| |

| | The percentage shown for each investment category reflects the value of investments in that category as a percentage of total net assets. |

14 The accompanying notes are an integral part of these financial statements.

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE SMALL CAP EQUITY FUND

Shareholder Letter

Dear Shareholders:

This report provides an overview on the performance of the Goldman Sachs Variable Insurance Trust — CORE Small Cap Equity Fund for the one-year period that ended December 31, 2002.

Market Review

Within the Russell 2000 Index (the “Index”), only one sector — Financials — generated positive absolute returns for the year. Telecommunications emerged as the worst absolute performer, down 62%, followed by the heavily weighted Technology, which contributed (weight times performance) the most to the Index decline.

Performance Review

Over the one-year period that ended December 31, 2002, the Fund generated a cumulative total return of -14.97%. Over the same time period, the Fund’s benchmark, the Russell 2000 Index (with dividends reinvested), generated a cumulative total return of -20.48%.

The goal of the Fund is to very closely match the benchmark, both at the sector and the security level, reproducing the risk characteristics and sector exposures of the Index. We seek to outperform the benchmark by maintaining a similar risk profile but overweighting stocks we expect to outperform the benchmark, and underweighting those that we think may lag. The result is that the Fund’s absolute returns will generally track the Index’s fairly closely.

2002 was a difficult one for the U.S. equity market. The world economy continued to be plagued by political uncertainty, and financial scandals undermined investor confidence. Since in managing the Fund we do not take market timing bets but typically construct a portfolio that has industry exposure, size, and style characteristics that are very similar to its benchmark, the Fund was down significantly in absolute terms along with the Index.

Similar to the Index, absolute sector performance in the Fund was weak, with only 1 (Financial) of 13 sectors posting a positive return. Telecommunications was the worst absolute performer, followed by Technology, which was also the biggest negative contributor (weight times performance) to the Fund’s negative absolute return for the year.

The outperformance of the Fund relative to the Index was largely due to the CORE stock selection criteria Profitability contributed the most to outperformance versus the benchmark. Following at some distance was Momentum, which struggled in the fourth quarter 2002. Valuation and Earnings Quality also contributed positively to excess returns over the Index, while returns to Fundamental Research were flatter for the year.

In terms of sectors, the Fund’s holdings in 8 of the 13 sectors had better performance than their peers in the Index. While the Fund’s holdings in the weighted Technology and Healthcare sectors declined in value, they outperformed those areas in the benchmark on a relative basis. Conversely, the Fund’s holdings in the Energy and Consumer Non-Cyclicals sectors detracted the most from relative performance.

15

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE SMALL CAP EQUITY FUND

Shareholder Letter (continued)

Investment Objective

The Fund seeks long-term capital growth, primarily through a broadly diversified portfolio of equity securities of U.S. issuers with risk characteristics similar to those of the Russell 2000 Index.

The portfolio employs a disciplined approach that combines fundamental investment research provided by Goldman, Sachs & Co.’s Global Investment Research Department and consensus opinions with quantitative analysis generated by the Asset Management Division’s proprietary model. This quantitative system evaluates each stock using many different criteria, including valuation measures, price momentum, earnings quality and profitability measures. While maintaining a profile close to that of the benchmark, those stocks ranked highly by the CORE multifactor model are selected to have overweight positions in the portfolio.

Portfolio Composition

Top 10 Portfolio Holdings as of December 31, 2002*

| | | | | | | |

| | | | % of Total |

| Company | | Business | | Net Assets |

| |

| |

|

| ONEOK, Inc. | | Gas Utilities | | | 1.1 | % |

| Techne Corp. | | Biotechnology | | | 0.8 | |

| Benchmark Electronics, Inc | | Electrical Equipment | | | 0.8 | |

| Pioneer-Standard Electronics, Inc. | | Electrical Equipment | | | 0.7 | |

| The Toro Co. | | Consumer Durables | | | 0.7 | |

| Western Digital Corp. | | Computer Hardware | | | 0.7 | |

| IDEXX Laboratories, Inc. | | Drugs | | | 0.7 | |

| Anixter International, Inc. | | Electrical Equipment | | | 0.6 | |

| IDT Corp. | | Telephone | | | 0.6 | |

| Carlisle Companies, Inc. | | Chemicals | | | 0.6 | |

* Opinions expressed in this report represent our present opinions only. Reference to individual securities should not be construed as a commitment that such securities will be retained in the Fund. From time to time, the Fund may change the individual securities it holds, the number or types of securities held and the markets in which it invests. References to individual securities do not constitute a recommendation to the investor to buy, hold or sell such securities. In addition, references to past performance of the Fund do not indicate future returns, which are not guaranteed and will vary. Furthermore, the value of shares of the Fund may fall as well as rise.

Portfolio Outlook

Looking ahead, we continue to believe that cheaper stocks should outpace more expensive ones and good momentum stocks should do better than poor momentum stocks. We also prefer stocks about which fundamental research analysts are becoming more positive and companies with strong profit margins and sustainable earnings. As such, we anticipate remaining fully invested and expect that the value we add over time will be due to stock selection as opposed to sector or size allocations.

We thank you for your investment and look forward to your continued confidence.

Goldman Sachs Quantitative Equity Management Team

January 9, 2003

16

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE SMALL CAP EQUITY FUND

Performance Summary

December 31, 2002

The following graph shows the value as of December 31, 2002, of a $10,000 investment made February 13, 1998 (commencement of operations). For comparative purposes, the performance of the Fund’s benchmark (the Russell 2000 Index) is shown. All performance data shown represents past performance and should not be considered indicative of future performance which will fluctuate with changes in market conditions. These performance fluctuations will cause an investor’s shares, when redeemed, to be worth more or less than their original cost. Returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| CORE Small Cap Equity Fund’s Lifetime Performance |

Growth of a $10,000 investment, Distributions Reinvested from February 13, 1998 to December 31, 2002.

| | | | | | | |

| | Since Inception | | One Year | | |

|

|

|

|

Average Annual Total Return Through December 31, 2002 |

|

|

|

|

CORE Small Cap Equity Fund (commenced February 13, 1998) | | -0.74% | | -14.97% | | |

|

17

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE SMALL CAP EQUITY FUND

Statement of Investments

December 31, 2002

| | | | | | | | | | | |

| | | | | | |

| | Shares | | Description | | Value |

| | |

Common Stocks – 99.2% |

|

| | | Airlines – 0.4% |

| | | | 3,700 | | | Alaska Air Group, Inc.* | | $ | 80,105 | |

| | | | 6,200 | | | Continental Airlines, Inc. Class B* | | | 44,950 | |

| | | | 4,200 | | | Delta Air Lines, Inc. | | | 50,820 | |

| | | | 4,600 | | | Midwest Express Holdings, Inc.* | | | 24,610 | |

| | | | | | | | | |

| |

| | | | | | | | | | 200,485 | |

| | |

|

| | | Alcohol – 0.2% |

| | | | 2,400 | | | The Robert Mondavi Corp.* | | | 74,400 | |

| | |

|

| | | Apartment – 0.2% |

| | | | 4,600 | | | Mid-America Apartment Communities, Inc. | | | 112,470 | |

| | |

|

| | | Apparel – 0.9% |

| | | | 7,100 | | | Kellwood Co. | | | 184,600 | |

| | | | 3,800 | | | Quaker Fabric Corp.* | | | 26,410 | |

| | | | 27,300 | | | Skechers U.S.A., Inc.* | | | 231,777 | |

| | | | | | | | | |

| |

| | | | | | | | | | 442,787 | |

| | |

|

| | | Banks – 6.7% |

| | | | 1,500 | | | Bank of Hawaii Corp. | | | 45,585 | |

| | | | 3,200 | | | Berkshire Hills Bancorp, Inc. | | | 75,360 | |

| | | | 2,200 | | | Capital City Bank Group, Inc. | | | 86,218 | |

| | | | 11,100 | | | Commercial Federal Corp. | | | 259,185 | |

| | | | 5,300 | | | Corus Bankshares, Inc. | | | 231,398 | |

| | | | 5,500 | | | East West Bancorp, Inc. | | | 198,440 | |

| | | | 1,700 | | | First BanCorp. | | | 38,420 | |

| | | | 2,800 | | | First Citizens BancShares, Inc. | | | 270,480 | |

| | | | 3,100 | | | Flushing Financial Corp. | | | 50,772 | |

| | | | 3,237 | | | Fulton Financial Corp. | | | 57,165 | |

| | | | 2,300 | | | GBC Bancorp | | | 44,528 | |

| | | | 4,300 | | | Hancock Holding Co. | | | 191,995 | |

| | | | 6,000 | | | Independence Community Bank Corp. | | | 152,280 | |

| | | | 6,900 | | | OceanFirst Financial Corp. | | | 154,905 | |

| | | | 5,066 | | | Pacific Capital Bancorp | | | 128,930 | |

| | | | 2,700 | | | Port Financial Corp. | | | 120,474 | |

| | | | 4,200 | | | Prosperity Bancshares, Inc. | | | 79,800 | |

| | | | 2,900 | | | Provident Financial Group, Inc. | | | 75,487 | |

| | | | 2,600 | | | Silicon Valley Bancshares* | | | 47,450 | |

| | | | 4,200 | | | Sterling Bancorp | | | 110,544 | |

| | | | 3,200 | | | Sterling Bancshares, Inc. | | | 39,104 | |

| | | | 5,800 | | | Susquehanna Bancshares, Inc. | | | 120,878 | |

| | | | 1,300 | | | Texas Regional Bancshares, Inc. | | | 46,203 | |

| | | | 6,600 | | | Trustmark Corp. | | | 156,618 | |

| | | | 3,570 | | | UMB Financial Corp. | | | 136,592 | |

| | | | 4,600 | | | Unizan Financial Corp. | | | 90,850 | |

| | | | 4,950 | | | Wintrust Financial Corp. | | | 155,034 | |

| | | | | | | | | |

| |

| | | | | | | | | | 3,164,695 | |

| | |

|

| | | Biotechnology – 5.3% |

| | | | 1,800 | | | Affymetrix, Inc.* | | | 41,202 | |

| | | | 3,100 | | | Albany Molecular Research, Inc.* | | | 45,852 | |

| | | | 2,200 | | | Alexion Pharmaceuticals, Inc.* | | | 31,064 | |

| | | | 9,600 | | | Applera Corp. — Celera Genomics Group* | | | 91,680 | |

| | | | 1,900 | | | Bio-Rad Laboratories, Inc.* | | | 73,530 | |

| | | | 7,400 | | | Celgene Corp.* | | | 158,878 | |

| | | | 6,600 | | | Cell Genesys, Inc.* | | | 73,597 | |

| | | | 5,400 | | | Cephalon, Inc.* | | | 262,807 | |

| | | | 1,500 | | | Charles River Laboratories International, Inc.* | | | 57,720 | |

| | | | 10,500 | | | Connetics Corp.* | | | 126,210 | |

| | | | 6,700 | | | Corixa Corp.* | | | 42,813 | |

| | | | 3,300 | | | Enzo Biochem, Inc.* | | | 46,200 | |

| | | | 8,200 | | | Gene Logic, Inc.* | | | 51,578 | |

| | | | 8,450 | | | Immucor, Inc.* | | | 171,112 | |

| | | | 12,800 | | | Isis Pharmaceuticals, Inc.* | | | 84,352 | |

| | | | 7,800 | | | Kos Pharmaceuticals, Inc.* | | | 148,200 | |

| | | | 4,700 | | | Lexicon Genetics, Inc.* | | | 22,231 | |

| | | | 3,300 | | | Maxygen, Inc.* | | | 25,146 | |

| | | | 4,800 | | | Protein Design Labs, Inc.* | | | 40,800 | |

| | | | 3,200 | | | Scios, Inc.* | | | 104,256 | |

| | | | 10,800 | | | Serologicals Corp.* | | | 118,800 | |

| | | | 8,900 | | | SICOR, Inc.* | | | 141,065 | |

| | | | 13,200 | | | Techne Corp.* | | | 377,098 | |

| | | | 3,500 | | | United Therapeutics Corp.* | | | 58,450 | |

| | | | 6,300 | | | Vertex Pharmaceuticals, Inc.* | | | 99,855 | |

| | | | 3,500 | | | Vical, Inc.* | | | 12,145 | |

| | | | | | | | | |

| |

| | | | | | | | | | 2,506,641 | |

| | |

|

| | | Brokers – 0.2% |

| | | | 3,800 | | | LaBranche & Co., Inc.* | | | 101,232 | |

| | |

|

| | | Chemicals – 3.0% |

| | | | 12,900 | | | A. Schulman, Inc. | | | 240,069 | |

| | | | 11,400 | | | Arch Chemicals, Inc. | | | 208,050 | |

| | | | 3,000 | | | Brady Corp. | | | 100,050 | |

| | | | 6,700 | | | Carlisle Companies, Inc. | | | 277,246 | |

| | | | 7,600 | | | Crompton Corp. | | | 45,220 | |

| | | | 5,700 | | | Great Lakes Chemical Corp. | | | 136,116 | |

| | | | 3,700 | | | H.B. Fuller Co. | | | 95,756 | |

| | | | 1,900 | | | Jarden Corp.* | | | 45,353 | |

| | | | 5,700 | | | Millennium Chemicals, Inc. | | | 54,264 | |

| | | | 16,500 | | | PolyOne Corp. | | | 64,680 | |

| | | | 2,400 | | | Rogers Corp.* | | | 53,400 | |

| | | | 2,100 | | | The Scotts Co.* | | | 102,984 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,423,188 | |

| | |

|

| | | Clothing – 0.9% |

| | | | 45,900 | | | Charming Shoppes, Inc.* | | | 191,862 | |

| | | | 900 | | | Payless ShoeSource, Inc.* | | | 46,323 | |

| | | | 3,400 | | | Shoe Carnival, Inc.* | | | 47,637 | |

| | | | 8,000 | | | Stein Mart, Inc.* | | | 48,800 | |

| | | | 9,300 | | | The Finish Line, Inc.* | | | 98,115 | |

| | | | | | | | | |

| |

| | | | | | | | | | 432,737 | |

| | |

|

| | | Computer Hardware – 4.0% |

| | | | 15,900 | | | 3Com Corp.* | | | 73,617 | |

| | | | 4,400 | | | Checkpoint Systems, Inc.* | | | 45,496 | |

| | | | 2,000 | | | Coinstar, Inc.* | | | 45,300 | |

| | | | 12,600 | | | CompuCom Systems, Inc.* | | | 70,686 | |

| | | | 6,500 | | | Computer Network Technology Corp.* | | | 46,150 | |

18 The accompanying notes are an integral part of these financial statements.

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE SMALL CAP EQUITY FUND

| | | | | | | | | | | |

| | | | | | |

| | Shares | | Description | | Value |

| | |

Common Stocks – (continued) |

|

| | | Computer Hardware – (continued) |

| | | | 6,400 | | | Daisytek International Corp.* | | $ | 50,752 | |

| | | | 6,100 | | | Foundry Networks, Inc.* | | | 42,944 | |

| | | | 22,800 | | | Gateway, Inc.* | | | 71,592 | |

| | | | 2,600 | | | Global Imaging Systems, Inc.* | | | 47,788 | |

| | | | 7,100 | | | Hutchinson Technology, Inc.* | | | 146,970 | |

| | | | 6,100 | | | IKON Office Solutions, Inc. | | | 43,615 | |

| | | | 5,600 | | | Imation Corp.* | | | 196,448 | |

| | | | 6,100 | | | InFocus Corp.* | | | 37,576 | |

| | | | 6,100 | | | Ingram Micro, Inc.* | | | 75,335 | |

| | | | 10,000 | | | Iomega Corp.* | | | 78,500 | |

| | | | 27,500 | | | Maxtor Corp.* | | | 139,150 | |

| | | | 3,200 | | | PC Connection, Inc.* | | | 16,224 | |

| | | | 2,600 | | | RadiSys Corp.* | | | 20,748 | |

| | | | 1,300 | | | ScanSource, Inc.* | | | 64,090 | |

| | | | 3,400 | | | Storage Technology Corp.* | | | 72,828 | |

| | | | 5,400 | | | Symbol Technologies, Inc. | | | 44,388 | |

| | | | 2,300 | | | Take-Two Interactive Software, Inc.* | | | 54,027 | |

| | | | 2,700 | | | Tech Data Corp.* | | | 72,792 | |

| | | | 48,400 | | | Western Digital Corp.* | | | 309,276 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,866,292 | |

| | |

|

| | | Computer Software – 3.7% |

| | | | 3,300 | | | Acxiom Corp.* | | | 50,754 | |

| | | | 16,500 | | | Aspen Technology, Inc.* | | | 46,695 | |

| | | | 9,400 | | | Avid Technology, Inc.* | | | 215,730 | |

| | | | 3,900 | | | Borland Software Corp.* | | | 47,970 | |

| | | | 6,400 | | | DocuCorp International, Inc.* | | | 42,374 | |

| | | | 2,550 | | | EPIQ Systems, Inc.* | | | 39,066 | |

| | | | 3,700 | | | FileNET Corp.* | | | 45,140 | |

| | | | 5,000 | | | Hyperion Solutions Corp.* | | | 128,350 | |

| | | | 2,700 | | | IDX Systems Corp.* | | | 45,981 | |

| | | | 13,700 | | | Intergraph Corp.* | | | 243,312 | |

| | | | 4,200 | | | JDA Software Group, Inc.* | | | 40,572 | |

| | | | 12,800 | | | Mentor Graphics Corp.* | | | 100,608 | |

| | | | 9,700 | | | MSC.Software Corp.* | | | 74,884 | |

| | | | 4,600 | | | NetIQ Corp.* | | | 56,810 | |

| | | | 3,000 | | | Network Associates, Inc.* | | | 48,270 | |

| | | | 28,600 | | | Novell, Inc.* | | | 95,524 | |

| | | | 6,000 | | | Pharmacopeia, Inc.* | | | 53,520 | |

| | | | 6,500 | | | Phoenix Technologies Ltd.* | | | 37,505 | |

| | | | 3,300 | | | Pinnacle Systems, Inc.* | | | 44,913 | |

| | | | 5,000 | | | Radiant Systems, Inc.* | | | 48,150 | |

| | | | 22,600 | | | ScanSoft, Inc.* | | | 117,520 | |

| | | | 2,400 | | | SERENA Software, Inc.* | | | 37,896 | |

| | | | 1,600 | | | SRA International, Inc.* | | | 43,344 | |

| | | | 11,900 | | | VitalWorks, Inc.* | | | 45,815 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,750,703 | |

| | |

|

| | | Construction – 0.8% |

| | | | 800 | | | American Woodmark Corp. | | | 38,000 | |

| | | | 8,000 | | | Fleetwood Enterprises, Inc.* | | | 62,800 | |

| | | | 4,650 | | | Griffon Corp.* | | | 63,333 | |

| | | | 3,700 | | | Hovnanian Enterprises, Inc.* | | | 117,290 | |

| | | | 1,700 | | | M/I Schottenstein Homes, Inc. | | | 47,260 | |

| | | | 150 | | | NVR, Inc.* | | | 48,825 | |

| | | | | | | | | |

| |

| | | | | | | | | | 377,508 | |

| | |

|

| | | Consumer Durables – 1.1% |

| | | | 11,900 | | | Interface, Inc. | | | 36,533 | |

| | | | 7,900 | | | Kimball International, Inc. Class B | | | 112,575 | |

| | | | 4,300 | | | Steelcase, Inc. | | | 47,128 | |

| | | | 4,900 | | | The Toro Co. | | | 313,110 | |

| | | | 92 | | | Vialta, Inc.* | | | 28 | |

| | | | | | | | | |

| |

| | | | | | | | | | 509,374 | |

| | |

|

| | | Defense/ Aerospace – 1.1% |

| | | | 8,100 | | | Aviall, Inc.* | | | 65,205 | |

| | | | 2,500 | | | Curtiss-Wright Corp. | | | 159,550 | |

| | | | 1,600 | | | Moog, Inc.* | | | 49,664 | |

| | | | 1,400 | | | Sequa Corp.* | | | 54,754 | |

| | | | 3,800 | | | Stewart & Stevenson Services, Inc. | | | 53,732 | |

| | | | 4,500 | | | Teledyne Technologies, Inc.* | | | 70,560 | |

| | | | 2,100 | | | United Defense Industries, Inc.* | | | 48,930 | |

| | | | | | | | | |

| |

| | | | | | | | | | 502,395 | |

| | |

|

| | | Department Stores – 1.0% |

| | | | 2,700 | | | Dillard’s, Inc. | | | 42,822 | |

| | | | 15,200 | | | Saks, Inc.* | | | 178,448 | |

| | | | 18,500 | | | Shopko Stores, Inc.* | | | 230,325 | |

| | | | | | | | | |

| |

| | | | | | | | | | 451,595 | |

| | |

|

| | | Drugs – 1.8% |

| | | | 9,700 | | | Alpharma, Inc. | | | 115,527 | |

| | | | 2,800 | | | American Pharmaceutical Partners, Inc.* | | | 49,840 | |

| | | | 2,700 | | | Biosite, Inc.* | | | 91,854 | |

| | | | 1,700 | | | CIMA Labs, Inc.* | | | 41,125 | |

| | | | 4,600 | | | D & K Healthcare Resources, Inc. | | | 47,109 | |

| | | | 2,000 | | | Eon Labs, Inc.* | | | 37,820 | |

| | | | 9,400 | | | IDEXX Laboratories, Inc.* | | | 308,790 | |

| | | | 9,500 | | | Perrigo Co.* | | | 115,425 | |

| | | | 2,072 | | | Priority Healthcare Corp. Class B* | | | 48,070 | |

| | | | | | | | | |

| |

| | | | | | | | | | 855,560 | |

| | |

|

| | | Electrical Equipment – 5.4% |

| | | | 3,300 | | | 3D Systems Corp.* | | | 25,740 | |

| | | | 17,500 | | | Allen Telecom, Inc.* | | | 165,725 | |

| | | | 8,700 | | | Anaren Microwave, Inc.* | | | 76,560 | |

| | | | 12,100 | | | Anixter International, Inc.* | | | 281,325 | |

| | | | 22,000 | | | Arris Group, Inc.* | | | 78,540 | |

| | | | 16,000 | | | Audiovox Corp.* | | | 165,456 | |

| | | | 4,900 | | | BEI Technologies, Inc. | | | 54,831 | |

| | | | 13,100 | | | Benchmark Electronics, Inc.* | | | 375,446 | |

| | | | 10,500 | | | C-COR.net Corp.* | | | 34,860 | |

| | | | 2,800 | | | Coherent, Inc.* | | | 55,860 | |

| | | | 2,700 | | | DSP Group, Inc.* | | | 42,714 | |

| | | | 4,700 | | | Esterline Technologies Corp.* | | | 83,049 | |

| | | | 2,100 | | | Fisher Scientific International, Inc.* | | | 63,168 | |

| | | | 1,600 | | | FLIR Systems, Inc.* | | | 78,080 | |

| | | | 5,500 | | | Harvard Bioscience, Inc.* | | | 18,139 | |

| | | | 3,700 | | | II-VI, Inc.* | | | 59,422 | |

| | | | 7,600 | | | Inrange Technologies Corp. Class B* | | | 17,860 | |

| | | | 8,100 | | | Inter-Tel, Inc. | | | 169,371 | |

| | | | 2,000 | | | Itron, Inc.* | | | 38,340 | |

The accompanying notes are an integral part of these financial statements. 19

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE SMALL CAP EQUITY FUND

Statement of Investments (continued)

December 31, 2002

| | | | | | | | | | | |

| | | | | | |

| | Shares | | Description | | Value |

| | |

Common Stocks – (continued) |

|

| | | Electrical Equipment – (continued) |

| | | | 6,100 | | | MTS Systems Corp. | | $ | 61,122 | |

| | | | 34,500 | | | Pioneer-Standard Electronics, Inc. | | | 316,710 | |

| | | | 4,900 | | | Planar Systems, Inc.* | | | 101,087 | |

| | | | 6,800 | | | Plexus Corp.* | | | 59,704 | |

| | | | 4,500 | | | Trimble Navigation Ltd.* | | | 56,205 | |

| | | | 10,600 | | | Turnstone Systems, Inc.* | | | 28,620 | |

| | | | 5,900 | | | Vicor Corp.* | | | 48,681 | |

| | | | | | | | | |

| |

| | | | | | | | | | 2,556,615 | |

| | |

|

| | | Electrical Utilities – 1.5% |

| | | | 14,900 | | | Avista Corp. | | | 172,244 | |

| | | | 1,000 | | | CH Energy Group, Inc. | | | 46,630 | |

| | | | 7,500 | | | Energy East Corp. | | | 165,675 | |

| | | | 12,900 | | | Integrated Electrical Services, Inc.* | | | 49,665 | |

| | | | 4,500 | | | Northeast Utilities | | | 68,265 | |

| | | | 2,000 | | | PNM Resources, Inc. | | | 47,640 | |

| | | | 9,200 | | | Sierra Pacific Resources | | | 59,800 | |

| | | | 4,200 | | | Westar Energy, Inc. | | | 41,580 | |

| | | | 1,700 | | | WPS Resources Corp. | | | 65,994 | |

| | | | | | | | | |

| |

| | | | | | | | | | 717,493 | |

| | |

|

| | | Energy Resources – 1.8% |

| | | | 2,100 | | | Energen Corp. | | | 61,110 | |

| | | | 7,500 | | | Patina Oil & Gas Corp. | | | 237,375 | |

| | | | 1,900 | | | Pogo Producing Co. | | | 70,775 | |

| | | | 2,900 | | | Remington Oil & Gas Corp.* | | | 47,589 | |

| | | | 3,400 | | | The Houston Exploration Co.* | | | 104,040 | |

| | | | 7,200 | | | Vintage Petroleum, Inc. | | | 75,960 | |

| | | | 1,300 | | | Western Gas Resources, Inc. | | | 47,905 | |

| | | | 7,200 | | | XTO Energy, Inc. | | | 177,840 | |

| | | | | | | | | |

| |

| | | | | | | | | | 822,594 | |

| | |

|

| | | Entertainment – 0.4% |

| | | | 8,500 | | | Handleman Co.* | | | 97,750 | |

| | | | 11,200 | | | World Wrestling Federation Entertainment, Inc.* | | | 90,160 | |

| | | | | | | | | |

| |

| | | | | | | | | | 187,910 | |

| | |

|

| | | Environmental Services – 0.5% |

| | | | 6,600 | | | Casella Waste Systems, Inc.* | | | 58,674 | |

| | | | 7,900 | | | Republic Services, Inc.* | | | 165,742 | |

| | | | | | | | | |

| |

| | | | | | | | | | 224,416 | |

| | |

|

| | | Financial Services – 2.2% |

| | | | 2,100 | | | American Financial Holdings, Inc. | | | 62,748 | |

| | | | 2,400 | | | Clark/ Bardes, Inc.* | | | 46,200 | |

| | | | 3,200 | | | Credit Acceptance Corp.* | | | 20,419 | |

| | | | 2,600 | | | Financial Federal Corp.* | | | 65,338 | |

| | | | 19,200 | | | Fremont General Corp. | | | 86,208 | |

| | | | 2,200 | | | FTI Consulting, Inc.* | | | 88,330 | |

| | | | 14,400 | | | Insignia Financial Group, Inc.* | | | 104,400 | |

| | | | 2,900 | | | InterCept, Inc.* | | | 49,100 | |

| | | | 8,000 | | | LendingTree, Inc.* | | | 103,040 | |

| | | | 2,900 | | | NCO Group, Inc.* | | | 46,255 | |

| | | | 5,500 | | | New Century Financial Corp. | | | 139,645 | |

| | | | 4,800 | | | Novastar Financial, Inc. | | | 148,944 | |

| | | | 11,200 | | | Providian Financial Corp.* | | | 72,688 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,033,315 | |

| | |

|

| | | Food & Beverage – 2.6% |

| | | | 4,600 | | | Corn Products International, Inc. | | | 138,598 | |

| | | | 12,300 | | | Fleming Companies, Inc. | | | 80,811 | |

| | | | 4,500 | | | Flowers Foods, Inc. | | | 87,795 | |

| | | | 4,600 | | | International Multifoods Corp.* | | | 97,474 | |

| | | | 8,000 | | | Interstate Bakeries Corp. | | | 122,000 | |

| | | | 3,500 | | | J & J Snack Foods Corp.* | | | 124,985 | |

| | | | 8,200 | | | Nash-Finch Co. | | | 63,386 | |

| | | | 2,000 | | | Performance Food Group Co.* | | | 67,918 | |

| | | | 9,900 | | | Pilgrim’s Pride Corp. | | | 81,180 | |

| | | | 4,200 | | | Ralcorp Holdings, Inc.* | | | 105,588 | |

| | | | 3,300 | | | The J.M. Smucker Co. | | | 131,373 | |

| | | | 4,000 | | | United Natural Foods, Inc.* | | | 101,400 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,202,508 | |

| | |

|

| | | Forest – 1.6% |

| | | | 4,300 | | | Chesapeake Corp. | | | 76,755 | |

| | | | 2,100 | | | Greif Bros. Corp. | | | 49,980 | |

| | | | 6,200 | | | Longview Fibre Co.* | | | 44,826 | |

| | | | 8,100 | | | Louisiana-Pacific Corp.* | | | 65,286 | |

| | | | 1,800 | | | Potlatch Corp. | | | 42,984 | |

| | | | 3,900 | | | Rock-Tenn Co. | | | 52,572 | |

| | | | 3,700 | | | Schweitzer-Mauduit International, Inc. | | | 90,650 | |

| | | | 7,100 | | | United Stationers, Inc.* | | | 204,487 | |

| | | | 6,800 | | | Universal Forest Products, Inc. | | | 144,983 | |

| | | | | | | | | |

| |

| | | | | | | | | | 772,523 | |

| | |

|

| | | Gas Utilities – 1.6% |

| | | | 2,500 | | | Cascade Natural Gas Corp. | | | 50,000 | |

| | | | 6,700 | | | NorthWestern Corp. | | | 34,036 | |

| | | | 2,800 | | | NUI Corp. | | | 48,328 | |

| | | | 27,300 | | | ONEOK, Inc. | | | 524,160 | |

| | | | 2,700 | | | South Jersey Industries, Inc. | | | 89,154 | |

| | | | | | | | | |

| |

| | | | | | | | | | 745,678 | |

| | |

|

| | | Gold – 0.1% |

| | | | 2,200 | | | Royal Gold, Inc. | | | 54,826 | |

| | |

|

| | | Grocery – 0.7% |

| | | | 11,100 | | | Pathmark Stores, Inc.* | | | 56,277 | |

| | | | 7,000 | | | Ruddick Corp. | | | 95,830 | |

| | | | 16,600 | | | The Great Atlantic & Pacific Tea Co., Inc.* | | | 133,796 | |

| | | | 4,100 | | | Wild Oats Markets, Inc.* | | | 42,312 | |

| | | | | | | | | |

| |

| | | | | | | | | | 328,215 | |

| | |

|

| | | Heavy Electrical – 0.6% |

| | | | 5,200 | | | Belden, Inc. | | | 79,144 | |

| | | | 6,800 | | | Cable Design Technologies Corp.* | | | 40,120 | |

| | | | 900 | | | EMCOR Group, Inc.* | | | 47,709 | |

20 The accompanying notes are an integral part of these financial statements.

GOLDMAN SACHS VARIABLE INSURANCE TRUST CORE SMALL CAP EQUITY FUND

| | | | | | | | | | | |

| | | | | | |

| | Shares | | Description | | Value |

| | |

Common Stocks – (continued) |

|

| | | Heavy Electrical – (continued) |

| | | | 3,400 | | | LSI Industries, Inc. | | $ | 47,090 | |

| | | | 1,600 | | | Woodward Governor Co. | | | 69,600 | |

| | | | | | | | | |

| |

| | | | | | | | | | 283,663 | |

| | |

|

| | | Heavy Machinery – 0.4% |

| | | | 4,500 | | | NACCO Industries, Inc. | | | 196,965 | |

| | |

|

| | | Home Products – 1.2% |

| | | | 7,700 | | | Central Garden & Pet Co.* | | | 142,527 | |

| | | | 3,000 | | | Chattem, Inc.* | | | 61,650 | |

| | | | 21,400 | | | Nu Skin Enterprises, Inc. | | | 256,158 | |

| | | | 4,100 | | | The Dial Corp. | | | 83,517 | |

| | | | | | | | | |

| |

| | | | | | | | | | 543,852 | |

| | |

|

| | | Hotels – 1.0% |

| | | | 24,100 | | | FelCor Lodging Trust, Inc. | | | 275,704 | |

| | | | 25,000 | | | La Quinta Corp.* | | | 110,000 | |

| | | | 12,400 | | | MeriStar Hospitality Corp. | | | 81,840 | |

| | | | | | | | | |

| |

| | | | | | | | | | 467,544 | |

| | |

|

| | | Industrial Parts – 3.7% |

| | | | 9,300 | | | A.O. Smith Corp. | | | 251,193 | |

| | | | 2,400 | | | Applied Films Corp.* | | | 47,976 | |

| | | | 12,900 | | | Applied Industrial Technologies, Inc. | | | 243,810 | |

| | | | 1,700 | | | Briggs & Stratton Corp. | | | 72,199 | |

| | | | 2,200 | | | CoorsTek, Inc.* | | | 56,210 | |

| | | | 6,200 | | | Hughes Supply, Inc. | | | 169,384 | |

| | | | 5,400 | | | Kaman Corp. | | | 59,400 | |

| | | | 18,900 | | | Lennox International, Inc. | | | 237,195 | |

| | | | 1,900 | | | Lindsay Manufacturing Co. | | | 40,660 | |

| | | | 3,100 | | | Lufkin Industries, Inc. | | | 72,695 | |

| | | | 1,400 | | | Nortek Holdings, Inc.* | | | 64,050 | |

| | | | 2,000 | | | SPS Technologies, Inc.* | | | 47,500 | |

| | | | 3,000 | | | Tecumseh Products Co. | | | 132,390 | |

| | | | 3,300 | | | The Shaw Group, Inc.* | | | 54,285 | |

| | | | 3,000 | | | The Timken Co. | | | 57,300 | |

| | | | 9,300 | | | Watsco, Inc. | | | 152,334 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,758,581 | |

| | |

|

| | | Industrial Services – 2.7% |

| | | | 1,700 | | | Bright Horizons Family Solutions, Inc.* | | | 47,804 | |

| | | | 7,600 | | | CDI Corp.* | | | 205,048 | |

| | | | 3,900 | | | Corinthian Colleges, Inc.* | | | 147,654 | |

| | | | 3,800 | | | Corrections Corp. of America* | | | 65,170 | |

| | | | 4,700 | | | Dollar Thrifty Automotive Group, Inc.* | | | 99,405 | |

| | | | 5,800 | | | EGL, Inc.* | | | 82,650 | |

| | | | 7,200 | | | ITT Educational Services, Inc.* | | | 169,560 | |

| | | | 12,100 | | | Kforce, Inc.* | | | 51,062 | |

| | | | 11,400 | | | Labor Ready, Inc.* | | | 73,188 | |

| | | | 18,000 | | | MPS Group, Inc.* | | | 99,720 | |

| | | | 30,800 | | | Spherion Corp.* | | | 206,360 | |

| | | | | | | | | |

| |

| | | | | | | | | | 1,247,621 | |

| | |

|

| | | Information Services – 4.2% |

| | | | 5,600 | | | Allscripts Heathcare Solutions, Inc.* | | | 13,384 | |

| | | | 4,100 | | | American Management Systems, Inc.* | | | 49,159 | |

| | | | 6,200 | | | Arbitron, Inc.* | | | 207,700 | |

| | | | 1,600 | | | BARRA, Inc.* | | | 48,528 | |

| | | | 13,500 | | | BearingPoint, Inc.* | | | 93,150 | |

| | | | 1,800 | | | CACI International, Inc.* | | | 64,152 | |

| | | | 1,000 | | | Cognizant Technology Solutions Corp.* | | | 72,230 | |

| | | | 4,700 | | | Daktronics, Inc.* | | | 62,886 | |

| | | | 5,900 | | | FactSet Research Systems, Inc. | | | 166,793 | |

| | | | 1,200 | | | Fair, Isaac & Co., Inc. | | | 51,240 | |

| | | | 8,200 | | | Fidelity National Information Solutions, Inc.* | | | 141,450 | |

| | | | 6,400 | | | Lightbridge, Inc.* | | | 39,360 | |

| | | | 2,500 | | | Manhattan Associates, Inc.* | | | 59,150 | |

| | | | 2,000 | | | MICROS Systems, Inc.* | | | 44,840 | |