Exhibit 99.1

JP Morgan

Gaming and Lodging Conference

May 4, 2005

Disclaimer

Certain matters discussed in this presentation may constitute forward-looking statements within the meaning of the federal securities law. Such statements are based on management’s beliefs, assumptions and expectations, which in turn are based on information currently available to management. Actual performance and results could differ from those expressed in or contemplated by the forward-looking statements due to a number of risks, uncertainties and other factors, many of which are beyond Choice’s ability to predict or control. For further information on factors that could impact Choice and the statements contained herein, we refer you to the filings made by Choice with the Securities and Exchange Commission, including our report on Form 10-K for the period ended December 31, 2004.

Additional corporate information may be found on the Choice Hotels’ Internet site, which may be accessed at www.choicehotels.com

Company Overview

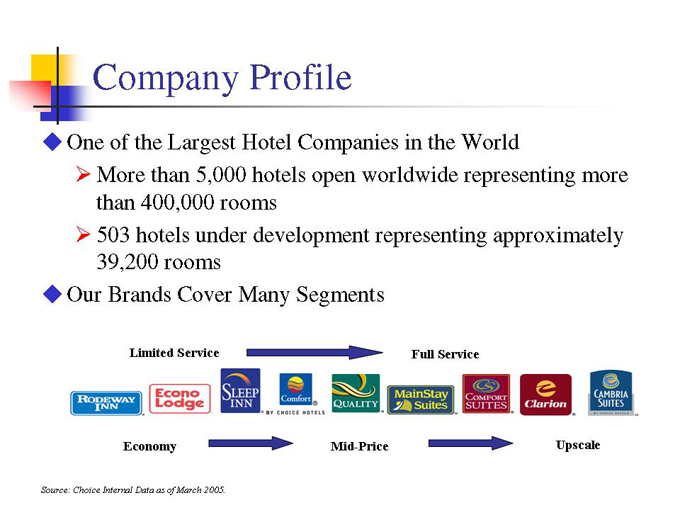

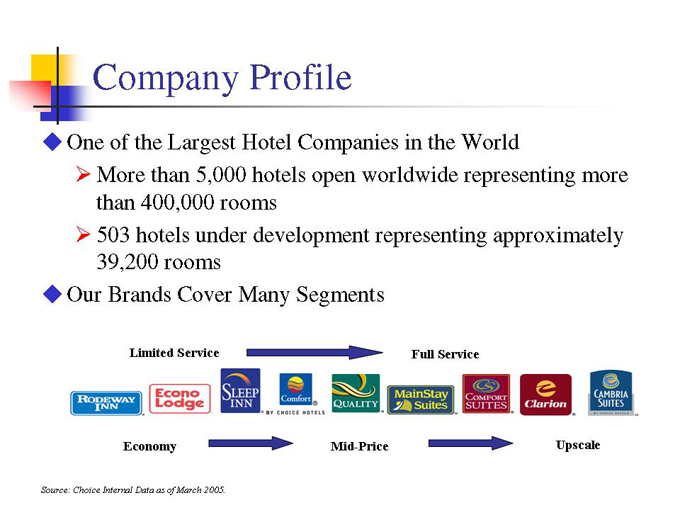

Company Profile

One of the Largest Hotel Companies in the World

More than 5,000 hotels open worldwide representing more than 400,000 rooms 503 hotels under development representing approximately 39,200 rooms

Our Brands Cover Many Segments

Limited Service

Full Service

Economy

Mid-Price

Upscale

Source: Choice Internal Data as of March 2005.

Company Profile (cont.)

Our Focus Is Solely on Hotel Franchising

Highest returning model in the industry (vs. management or ownership) High margin, high cash flow with low capital requirements Scaleable and predictable Provides profitable growth opportunities Highly skilled in this area

Investment Thesis

Strong, Stable and Growing System

5.4% increase in domestic hotels in 2004

552 new hotel contracts signed in 2004 (up from 470) 20 year contracts, barriers to exit

Strong and Growing Annual Earnings and EBITDA

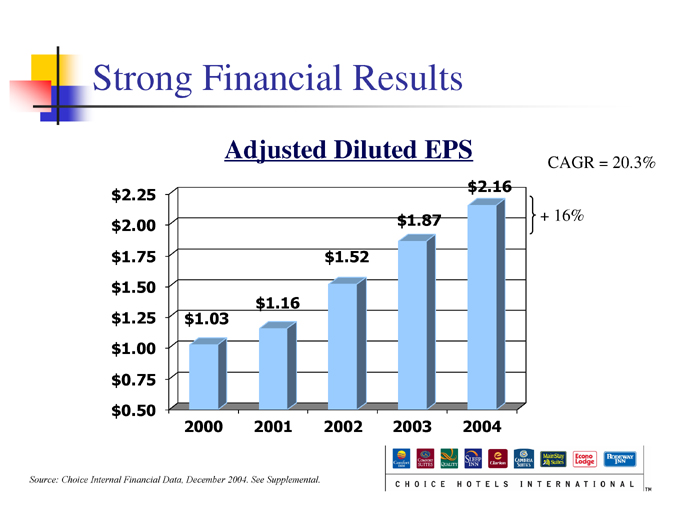

EBITDA—$135 million (8% increase) Adjusted Diluted EPS—$2.16 (16% increase)

Source: Choice Internal Data as of December 2004.

Investment Thesis (cont.)

Management Focused on Creating Value

Share repurchases – 32.8 million repurchased at $20.65 per share as of March 31, 2005; represents more than $676 million since inception of program Dividends – Current quarterly cash dividend of 0.225/share; subject to board approval and business performance, expect to pay future dividends at comparable or increased rate in the future

Equity Performance

5 year annualized share price appreciation in excess of 27%

Source: Choice Internal Data as of December 2004 & March 2005.

Vision and Mission

Vision and Mission

Our Vision: To generate the highest return on investment of any hotel franchise

Our Mission: Deliver a franchise success system of strong brands, exceptional services, vast consumer reach, and size, scale and distribution that delivers guests, satisfies guests, and reduces costs for our hotel owners

Our Passion: Customer Profitability

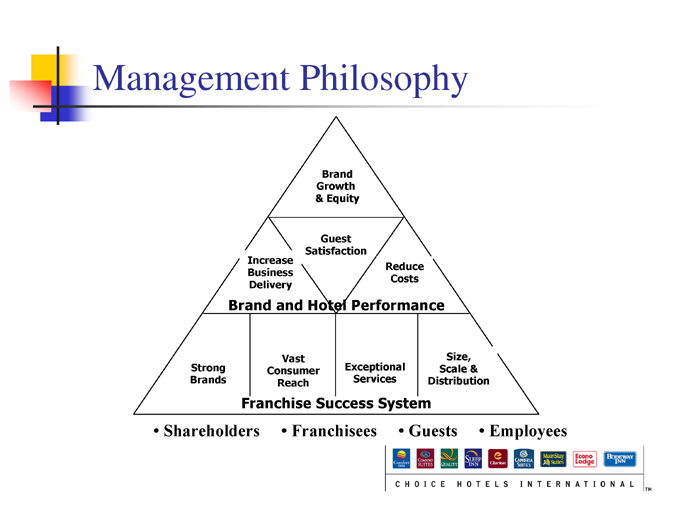

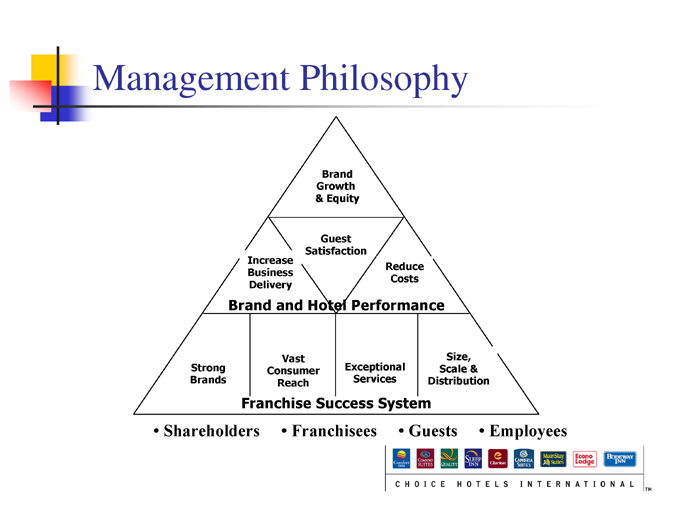

Management Philosophy

Brand Growth & Equity

Guest Satisfaction

Increase Business Delivery

Reduce Costs

Brand and Hotel Performance

Strong Brands

Vast Consumer Reach

Exceptional Services

Size, Scale & Distribution

Franchise Success System

Shareholders

Franchisees

Guests

Employees

2005 Focus

Aggressively Sell Our Brands

Optimize Development Organization Continue to Align with Brand Strategies Diversify and Develop New Customers

Build Brand Equity

Stronger Consumer Focus

Strengthen Brand Consistency, Quality, and Guest Satisfaction

Bolster Information Systems

Create Opportunities in New Segments

Introduce Cambria Suites

Build Capabilities in Extended Stay Build Capabilities in Upscale Segments Grow Internationally

Improve Brand and Hotel Performance

Stronger Property-Level Support Marketing and Reservations Programs Bolster Information Systems

Strategy

Build Strong Brands

Among World’s Most Recognizable Hotel Brands

Improved Brand Consistency and Quality

Improved ROI for Owners

Significantly Enhanced Franchise Sales Capability

Brand Growth & Equity

Guest Satisfaction

Increase Business Delivery

Reduce Costs

Brand and Hotel Performance

Strong Brands

Vast Consumer Reach

Exceptional Services

Size, Scale & Distribution

Franchise Success System

Vast Consumer Reach

$50+ Million Marketing and Advertising Plan

Creates brand awareness and loyalty Drives traffic

Enhanced Loyalty Program

Over 3.4 million members

+$ 1 billion hotel program revenue to date

Strong Direct Sales Capability $600 million in revenue

Brand Growth & Equity

Guest Satisfaction

Increase Business Delivery

Reduce Costs

Brand and Hotel Performance

Strong Brands

Vast Consumer Reach

Exceptional Services

Size, Scale & Distribution

Franchise Success System

Source: Choice Internal Data as of December 2004.

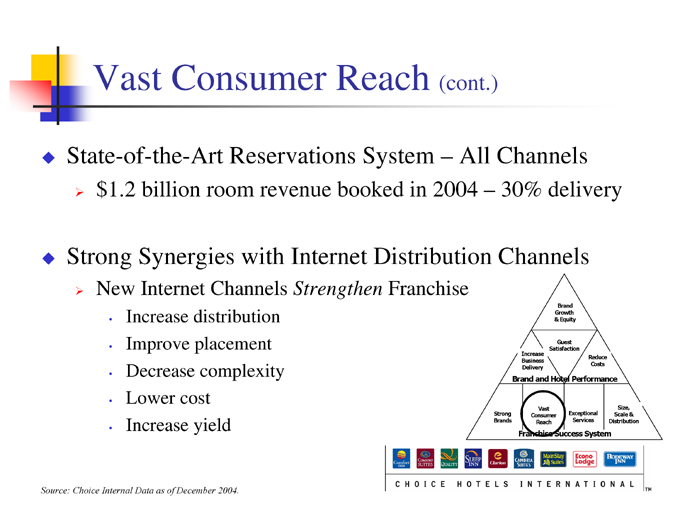

Vast Consumer Reach (cont.)

State-of-the-Art Reservations System – All Channels $1.2 billion room revenue booked in 2004 – 30% delivery

Strong Synergies with Internet Distribution Channels

New Internet Channels Strengthen Franchise

Increase distribution Improve placement Decrease complexity Lower cost Increase yield

Brand Growth & Equity

Guest Satisfaction

Increase Business Delivery

Reduce Costs

Brand and Hotel Performance

Strong Brands

Vast Consumer Reach

Exceptional Services

Size, Scale & Distribution

Franchise Success System

Source: Choice Internal Data as of December 2004.

Exceptional Services

Full Complement of Hands-On Services Improve Profitability and Create Loyalty

Complete Life-Cycle Service Offering

Nationwide Footprint of Field-Based Employees State-of-the-Art Training Capabilities Operational and Yield Management Technology

Purchasing Assistance

Generates $13 million in annual revenue and lowers owner costs

Brand Growth & Equity

Guest Satisfaction

Increase Business Delivery

Reduce Costs

Brand and Hotel Performance

Strong Brands

Vast Consumer Reach

Exceptional Services

Size, Scale & Distribution

Franchise Success System

Source: Choice Internal Data as of December 2004.

Size, Scale, and Distribution

Lowers Costs and Increases Revenues for Owners Enables Highly-Valued Capabilities

Brand awareness National marketing Reservations Services Technologies

Franchising Model is Difficult to Duplicate

Scale required to generate reasonable returns for shareholders Capital required to generate scale Scale is a barrier to entry

Brand Growth & Equity

Guest Satisfaction

Increase Business Delivery

Reduce Costs

Brand and Hotel Performance

Strong Brands

Vast Consumer Reach

Exceptional Services

Size, Scale & Distribution

Franchise Success System

Performance

Business Focus

Profitably Grow

Improve brand performance –ROI to owners (business delivery, reduced operating and development costs, products, marketing, services) Introduce new concepts (product design/innovation) Increase distribution (franchise development)

Maximize Financial Returns and Create Value for Shareholders

Capital allocation – focus on returns

Capital structure – prudent leverage to maximize returns

• S&P recently upgraded credit rating to BBB from BBB-Share repurchases Dividends

Profitably Grow

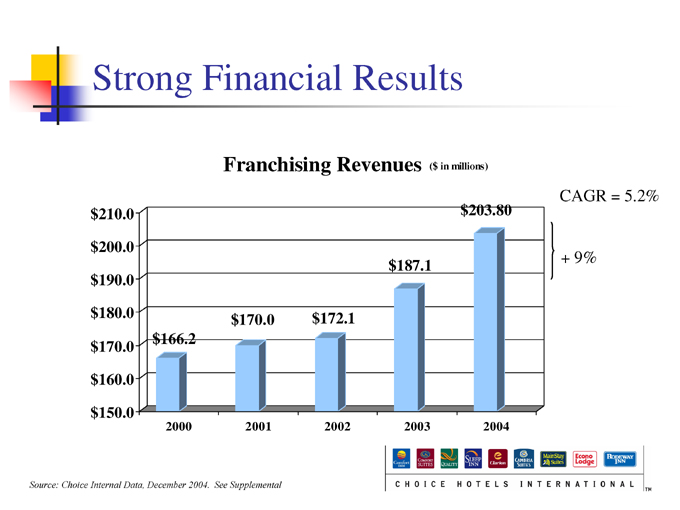

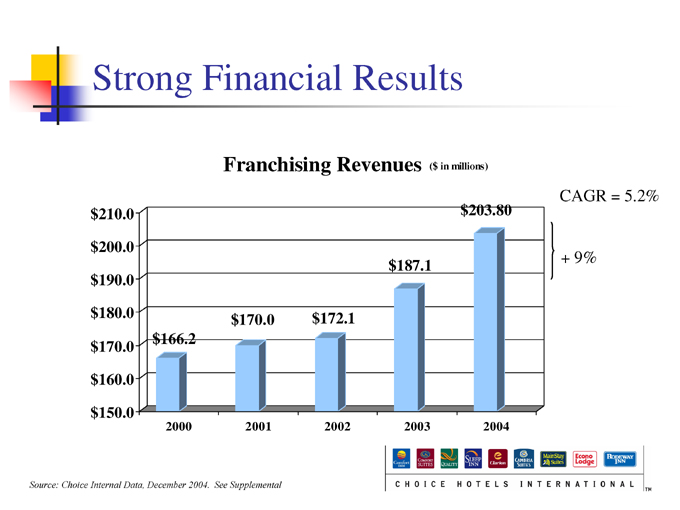

Strong Financial Results

Franchising Revenues ($ in millions)

CAGR = 5.2% $210.0 $200.0 $190.0 $180.0

$170.0 $160.0 $150.0

2000 2001 2002 2003 2004 $166.2 $170.0 $172.1 $187.1 $203.80

+ 9%

Source: Choice Internal Data, December 2004. See Supplemental

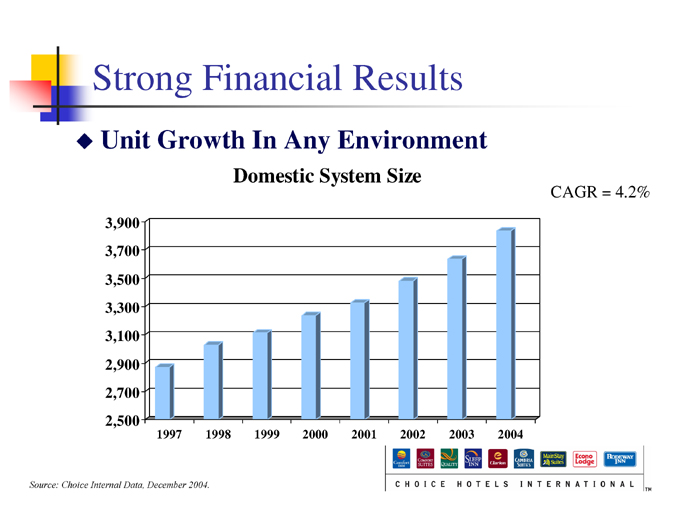

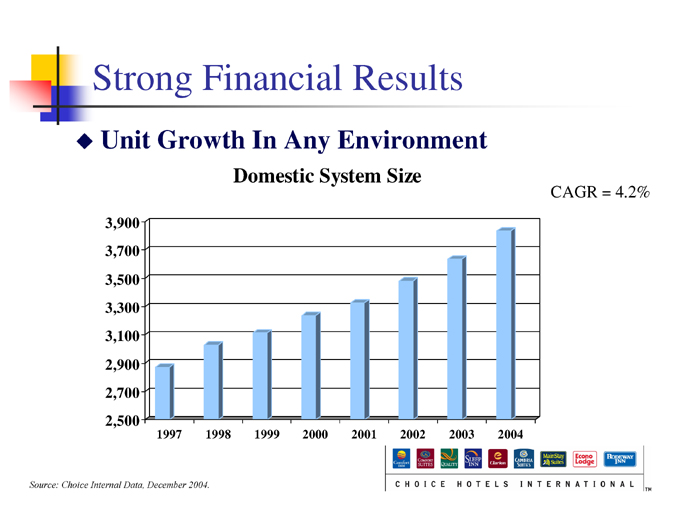

Strong Financial Results

Unit Growth In Any Environment

Domestic System Size

CAGR = 4.2%

3,900 3,700 3,500 3,300 3,100 2,900 2,700 2,500

1997 1998 1999 2000 2001 2002 2003 2004

Source: Choice Internal Data, December 2004.

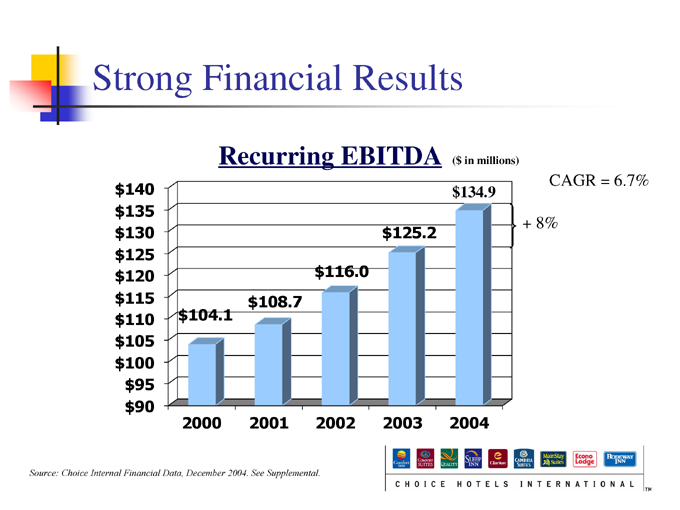

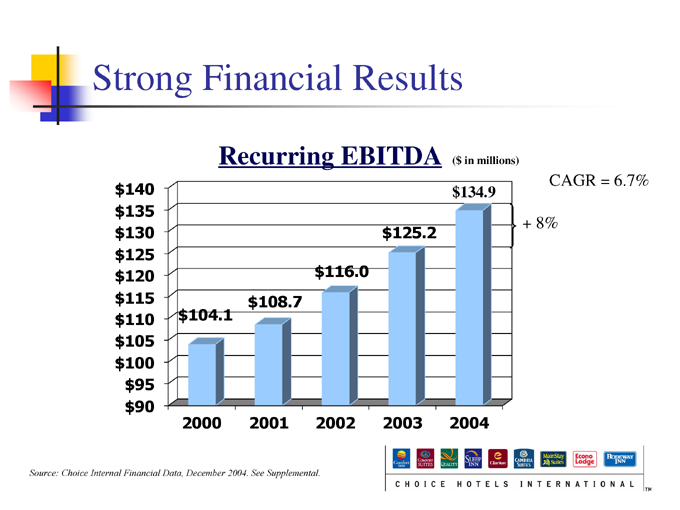

Strong Financial Results

Recurring EBITDA ($ in millions)

$140 $135 $130 $125 $120 $115 $110 $105 $100 $95 $90

2000 2001 2002 2003 2004 $104.1 $108.7 $116.0 $125.2 $134.9

CAGR = 6.7%

+ 8%

Source: Choice Internal Financial Data, December 2004. See Supplemental.

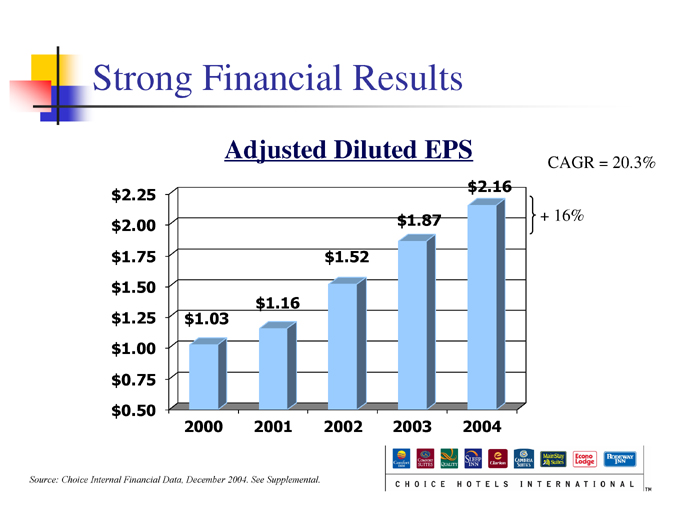

Strong Financial Results

Adjusted Diluted EPS

$2.25 $2.00 $1.75 $1.50 $1.25 $1.00 $0.75 $0.50

2000 2001 2002 2003 2004 $1.03 $1.16 $1.52 $1.87 $2.16

CAGR = 20.3%

+ 16%

Source: Choice Internal Financial Data, December 2004. See Supplemental.

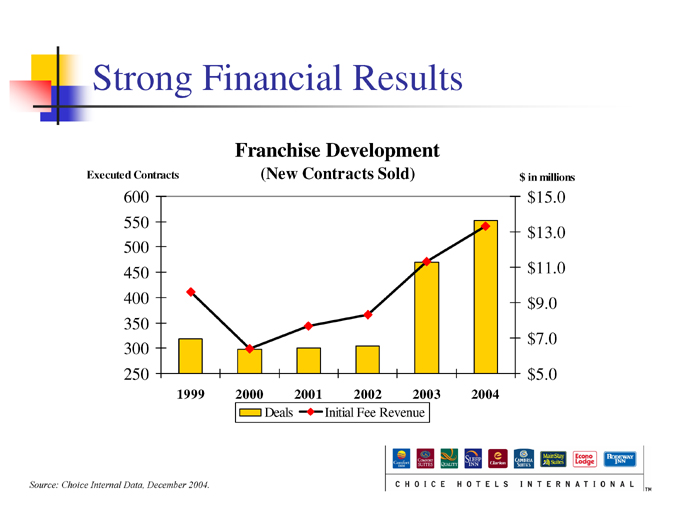

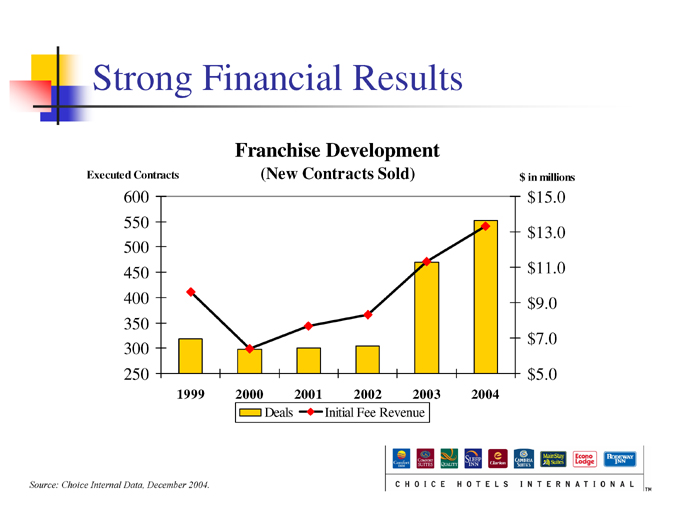

Strong Financial Results

Franchise Development

(New Contracts Sold)

Executed Contracts

600 550 500 450 400 350 300 250

1999 2000 2001 2002 2003 2004 $ in millions $15.0 $13.0 $11.0 $9.0 $7.0 $5.0

Deals Initial Fee Revenue

Source: Choice Internal Data, December 2004.

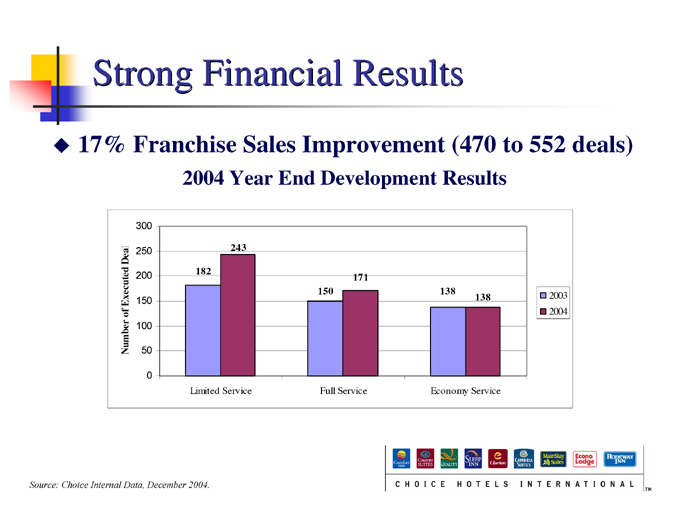

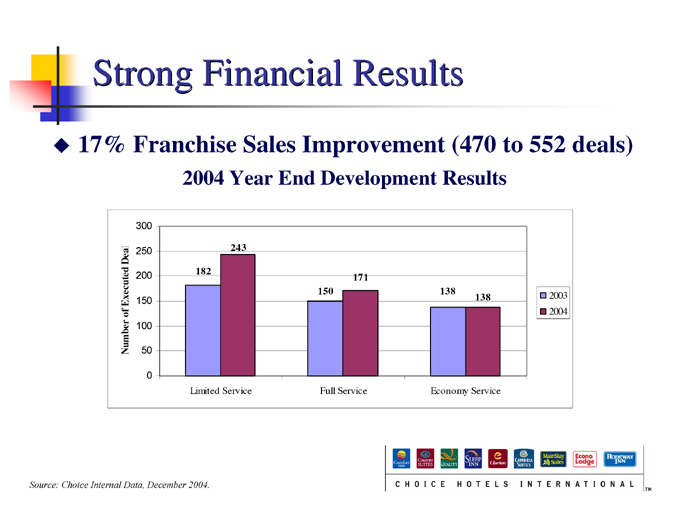

Strong Financial Results

17% Franchise Sales Improvement (470 to 552 deals)

2004 Year End Development Results

Number of Executed Deal

0 50 100 150 200 250 300

Limited Service Full Service Economy Service

182

243

150

171

138

138

2003 2004

Source: Choice Internal Data, December 2004.

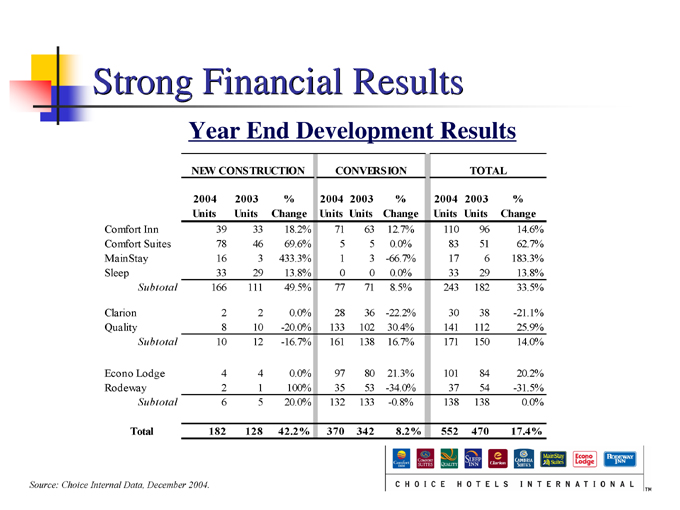

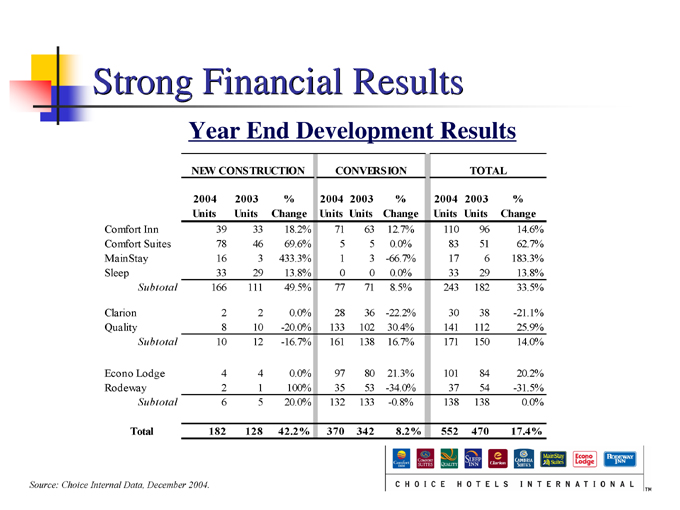

Strong Financial Results

Year End Development Results

NEW CONSTRUCTION CONVERSION TOTAL

2004 2003 % 2004 2003 % 2004 2003 %

Units Units Change Units Units Change Units Units Change

Comfort Inn 39 33 18.2% 71 63 12.7% 110 96 14.6%

Comfort Suites 78 46 69.6% 5 5 0.0% 83 51 62.7%

MainStay 16 3 433.3% 1 3 - -66.7% 17 6 183.3%

Sleep 33 29 13.8% 0 0 0.0% 33 29 13.8%

Subtotal 166 111 49.5% 77 71 8.5% 243 182 33.5%

Clarion 2 2 0.0% 28 36 -22.2% 30 38 -21.1%

Quality 8 10 -20.0% 133 102 30.4% 141 112 25.9%

Subtotal 10 12 -16.7% 161 138 16.7% 171 150 14.0%

Econo Lodge 4 4 0.0% 97 80 21.3% 101 84 20.2%

Rodeway 2 1 100% 35 53 -34.0% 37 54 -31.5%

Subtotal 6 5 20.0% 132 133 -0.8% 138 138 0.0%

Total 182 128 42.2% 370 342 8.2% 552 470 17.4%

Source: Choice Internal Data, December 2004.

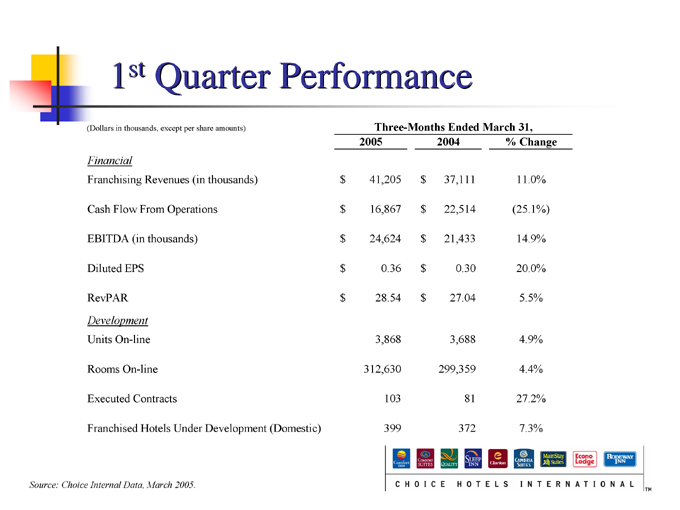

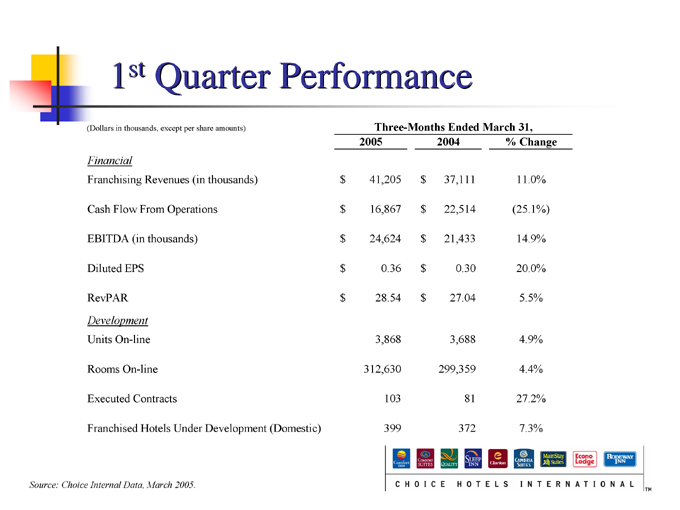

1st Quarter Performance

(Dollars in thousands, except per share amounts) Three-Months Ended March 31,

2005 2004 % Change

Financial

Franchising Revenues (in thousands) $41,205 $37,111 11.0%

Cash Flow From Operations $16,867 $22,514 (25.1%)

EBITDA (in thousands) $24,624 $21,433 14.9%

Diluted EPS $0.36 $0.30 20.0%

RevPAR $28.54 $27.04 5.5%

Development

Units On-line 3,868 3,688 4.9%

Rooms On-line 312,630 299,359 4.4%

Executed Contracts 103 81 27.2%

Franchised Hotels Under Development (Domestic) 399 372 7.3%

Source: Choice Internal Data, March 2005.

Growth Opportunities

Many Markets Remain Available

Market Share Analysis

CHOICE Units Share COMPETITOR Units

Clarion 158 4.6% Other Franchised Properties 2,042

Independents 1,232

Comfort Suites 389 4.2% Holiday Inn Express 1,287

Comfort Inn 1,432 15.6% Hampton Inn/Suites 1,234

Other Franchised Properties 2,345

Independent 2,516

Sleep 311 3.8% Other Franchised Properties 5,305

Independents 2,516

Quality Inn/Suites 576 6.5% Other Franchised Properties 5,836

Independents 2,516

Econo Lodge 781 Super 8 1,975

Rodeway 160 Days Inn 1,727

8.3.% Other Franchised Properties 2,849

Independents 3,880

MainStay 27 1.3% Extended Stay America 388

Homestead Studio Suites 132

Townplace Suites 166

Candlewood 109

Other Extended Stay Hotels 1,299

Source: Smith Travel Research, December 2004; Choice Internal Data, December 2004.

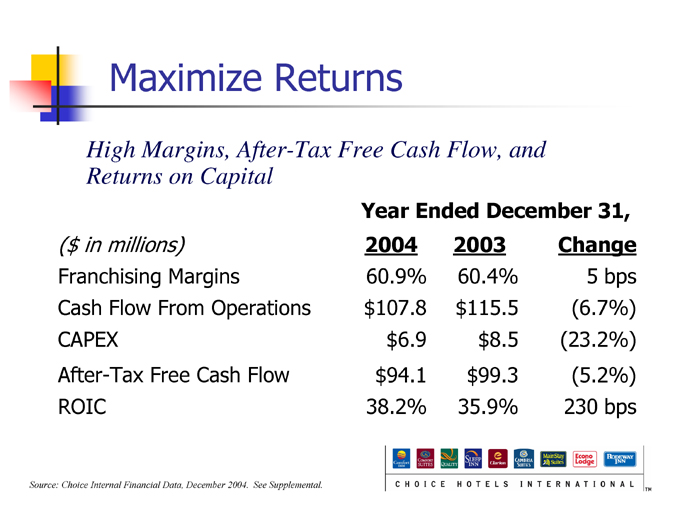

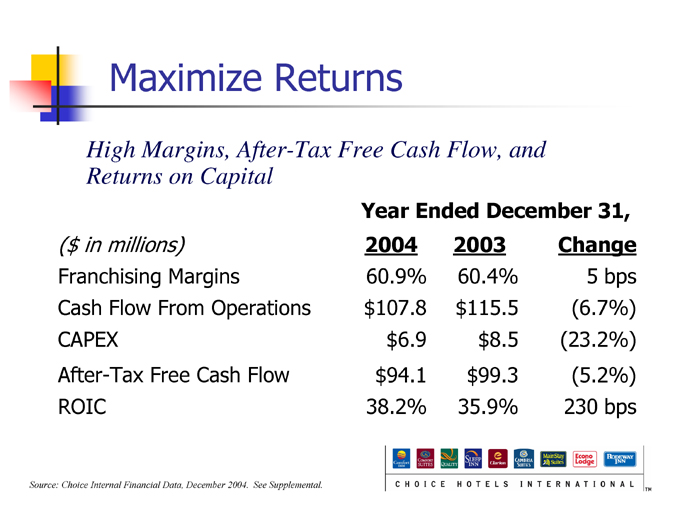

Maximize Returns

Maximize Returns

High Margins, After-Tax Free Cash Flow, and Returns on Capital

Year Ended December 31,

($ in millions) 2004 2003 Change

Franchising Margins 60.9% 60.4% 5 bps

Cash Flow From Operations $107.8 $115.5 (6.7%)

CAPEX $6.9 $8.5 (23.2%)

After-Tax Free Cash Flow $94.1 $99.3 (5.2%)

ROIC 38.2% 35.9% 230 bps

Source: Choice Internal Financial Data, December 2004. See Supplemental.

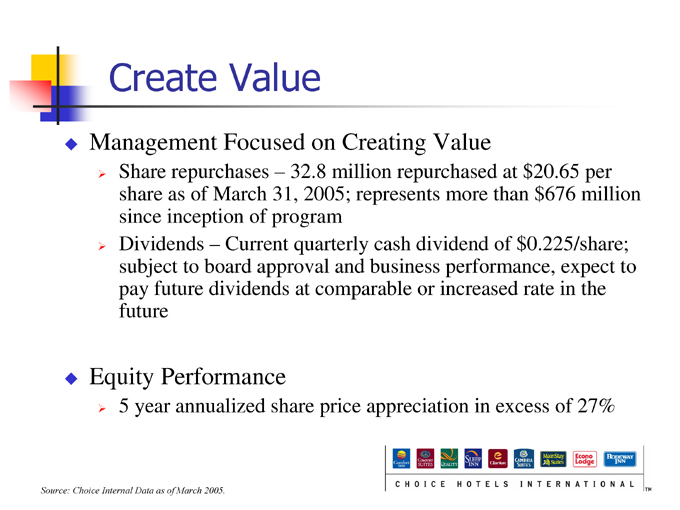

Create Value

Create Value

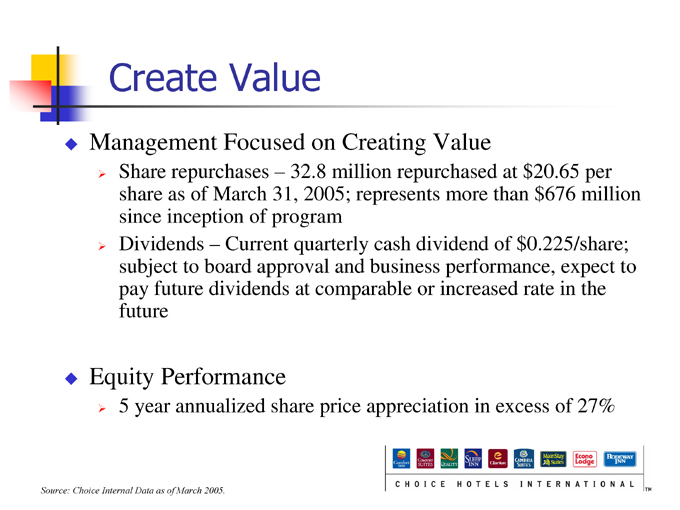

Management Focused on Creating Value

Share repurchases – 32.8 million repurchased at $20.65 per share as of March 31, 2005; represents more than $676 million since inception of program

Dividends – Current quarterly cash dividend of $0.225/share; subject to board approval and business performance, expect to pay future dividends at comparable or increased rate in the future

Equity Performance

5 year annualized share price appreciation in excess of 27%

Source: Choice Internal Data as of March 2005.

Closing Comments

Strong Earnings Per Share, EBITDA, and Cash Flow Growth Proven Earnings Stability Even through Industry/ Economic Downturns Pure-Play Franchise Focus, Highest Returning “Model” in the Industry High Operating Margins Significant Free Cash Flow Experienced Management Team Focused on Shareholder Value

Supplemental

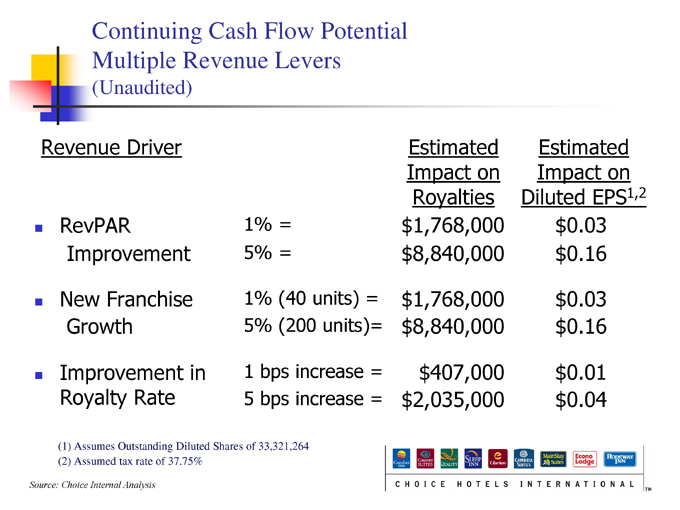

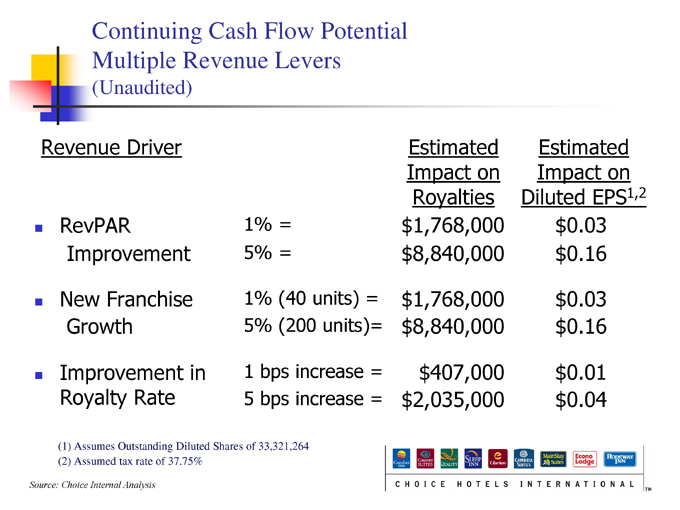

Continuing Cash Flow Potential Multiple Revenue Levers

(Unaudited)

Revenue Driver Estimated Estimated

Impact on Impact on

Royalties Diluted EPS1,2

RevPAR 1% = $1,768,000 $0.03

Improvement 5% = $8,840,000 $0.16

New Franchise 1% (40 units) = $1,768,000 $0.03

Growth 5% (200 units)= $8,840,000 $0.16

Improvement in 1 bps increase = $407,000 $0.01

Royalty Rate 5 bps increase = $2,035,000 $0.04

(1) Assumes Outstanding Diluted Shares of 33,321,264

(2) Assumed tax rate of 37.75%

Source: Choice Internal Analysis

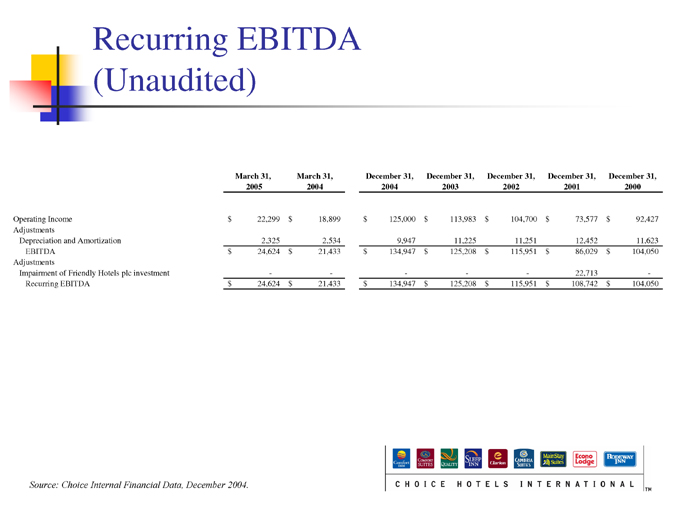

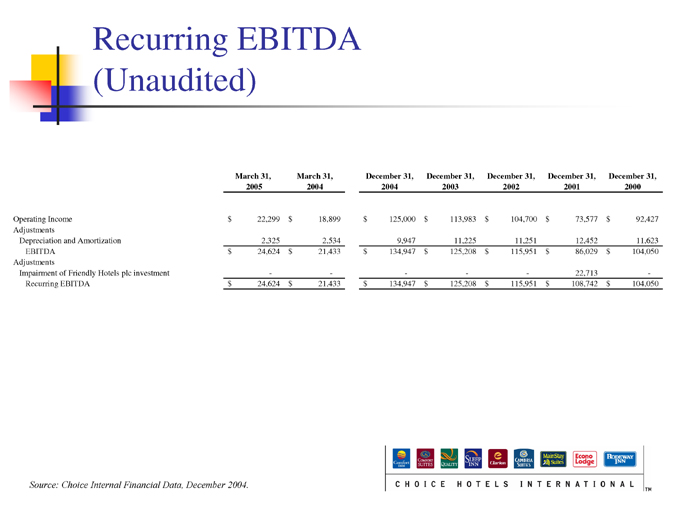

Recurring EBITDA (Unaudited)

March 31, March 31, December 31, December 31, December 31, December 31, December 31,

2005 2004 2004 2003 2002 2001 2000

Operating Income $22,299 $18,899 $125,000 $113,983 $104,700 $73,577 $92,427

Adjustments

Depreciation and Amortization 2,325 2,534 9,947 11,225 11,251 12,452 11,623

EBITDA $24,624 $21,433 $134,947 $125,208 $115,951 $86,029 $104,050

Adjustments

Impairment of Friendly Hotels plc investment - - - - - 22,713 -

Recurring EBITDA $24,624 $21,433 $134,947 $125,208 $115,951 $108,742 $104,050

Source: Choice Internal Financial Data, December 2004.

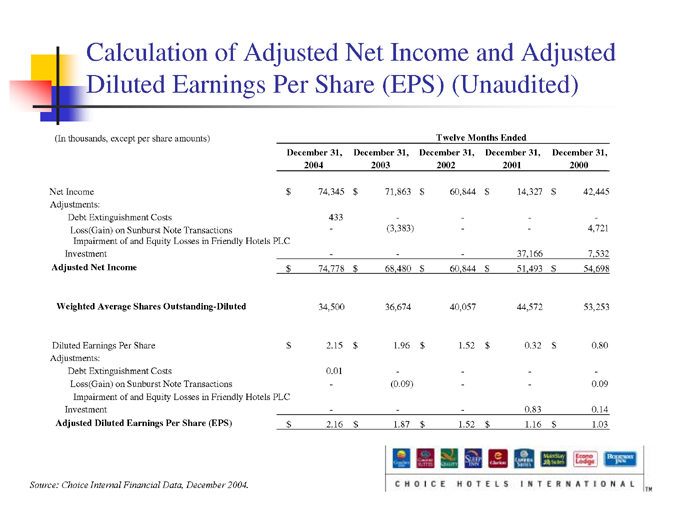

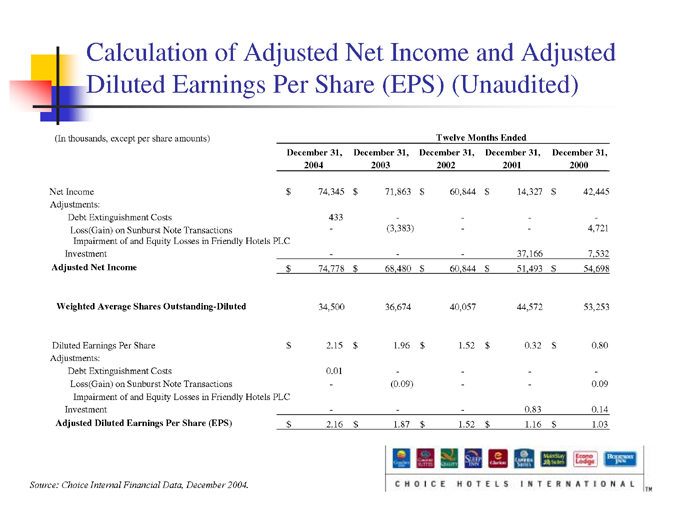

Calculation of Adjusted Net Income and Adjusted Diluted Earnings Per Share (EPS) (Unaudited)

(In thousands, except per share amounts) Twelve Months Ended

December 31, December 31, December 31, December 31, December 31,

2004 2003 2002 2001 2000

Net Income $74,345 $71,863 $60,844 $14,327 $42,445

Adjustments:

Debt Extinguishment Costs 433 - - - -

Loss(Gain) on Sunburst Note Transactions - (3,383) - - 4,721

Impairment of and Equity Losses in Friendly Hotels PLC

Investment - - - 37,166 7,532

Adjusted Net Income $74,778 $68,480 $60,844 $51,493 $54,698

Weighted Average Shares Outstanding-Diluted 34,500 36,674 40,057 44.572 53,253

Diluted Earnings Per Share $2.15 $1.96 $1.52 $0.32 $0.80

Adjustments:

Debt Extinguishment Costs 0.01 - - - -

Loss(Gain) on Sunburst Note Transactions - (0.09) - - 0.09

Impairment of and Equity Losses in Friendly Hotels PLC

Investment - - - 0.83 0.14

Adjusted Diluted Earnings Per Share (EPS) $2.16 $1.87 $1.52 $1.16 $1.03

Source: Choice Internal Financial Data, December 2004.

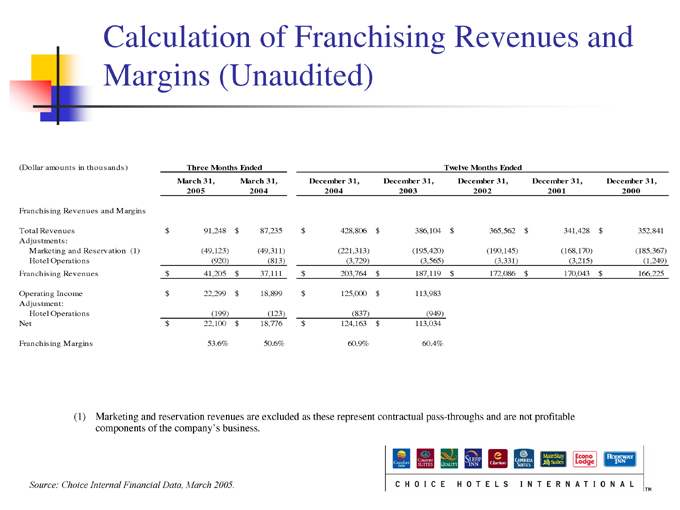

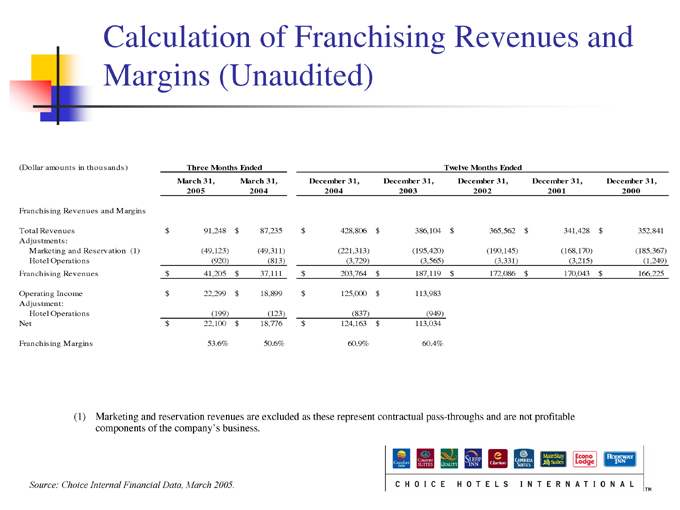

Calculation of Franchising Revenues and Margins (Unaudited)

(Dollar amounts in thousands) Three Months Ended Twelve Months Ended

March 31, March 31, December 31, December 31, December 31, December 31, December 31,

2005 2004 2004 2003 2002 2001 2000

Franchising Revenues and Margins

Total Revenues $91,248 $87,235 $428,806 $386,104 $365,562 $341,428 $352,841

Adjustments:

Marketing and Reservation (1) (49,123) (49,311) (221,313) (195,420) (190,145) (168,170) (185,367)

Hotel Operations (920) (813) (3,729) (3,565) (3,331) (3,215) (1,249)

Franchising Revenues $41,205 $37,111 $203,764 $187,119 $172,086 $170,043 $166,225

Operating Income $22,299 $18,899 $125,000 $113,983

Adjustment:

Hotel Operations (199) (123) (837) (949)

Net $22,100 $18,776 $124,163 $113,034

Franchising Margins 53.6% 50.6% 60.9% 60.4%

(1) Marketing and reservation revenues are excluded as these represent contractual pass-throughs and are not profitable components of the company’s business.

Source: Choice Internal Financial Data, March 2005.

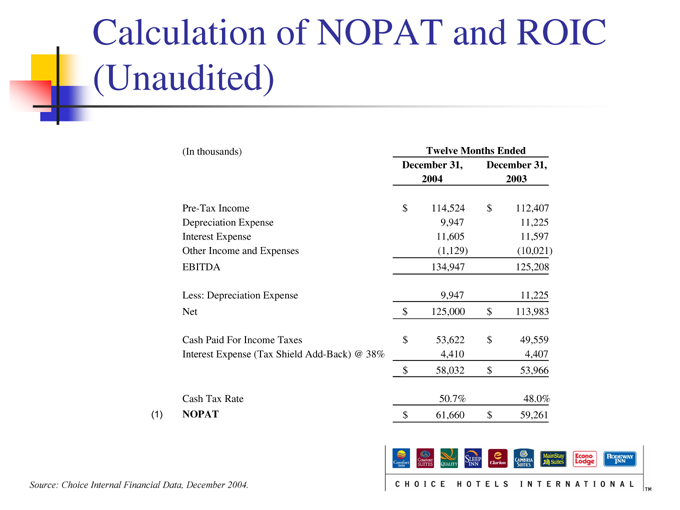

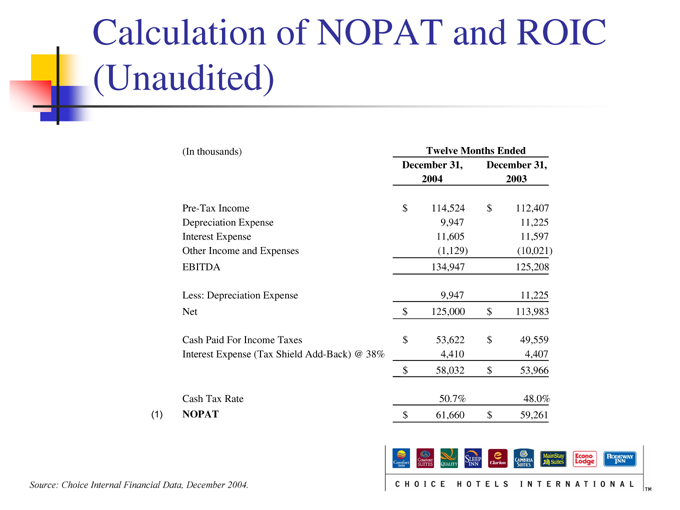

Calculation of NOPAT and ROIC (Unaudited)

(In thousands) Twelve Months Ended

December 31, December 31,

2004 2003

Pre-Tax Income $114,524 $112,407

Depreciation Expense 9,947 11,225

Interest Expense 11,605 11,597

Other Income and Expenses (1,129) (10,021)

EBITDA 134,947 125,208

Less: Depreciation Expense 9,947 11,225

Net $125,000 $113,983

Cash Paid For Income Taxes $53,622 $49,559

Interest Expense (Tax Shield Add-Back) @ 38% 4,410 4,407

$58,032 $53,966

Cash Tax Rate 50.7% 48.0%

(1) NOPAT

Source: Choice Internal Financial Data, December 2004.

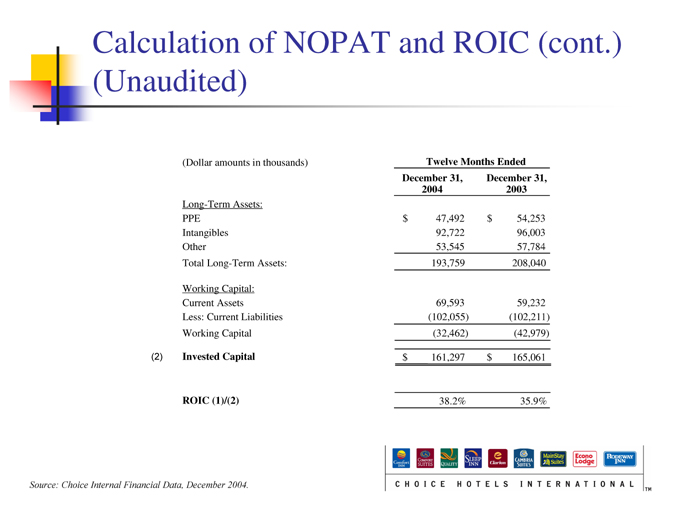

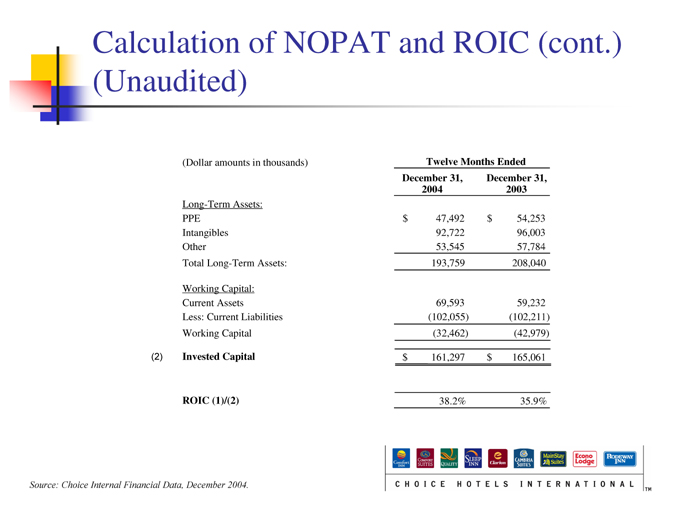

Calculation of NOPAT and ROIC (cont.) (Unaudited)

(Dollar amounts in thousands) Twelve Months Ended

December 31, December 31,

2004 2003

Long-Term Assets:

PPE $47,492 $54,253

Intangibles 92,722 96,003

Other 53,545 57,784

Total Long-Term Assets: 193,759 208,040

Working Capital:

Current Assets 69,593 59,232

Less: Current Liabilities (102,055) (102,211)

Working Capital (32,462) (42,979)

(2) Invested Capital $161,297 $165,061

ROIC (1)/(2) 38.2% 35.9%

Source: Choice Internal Financial Data, December 2004.

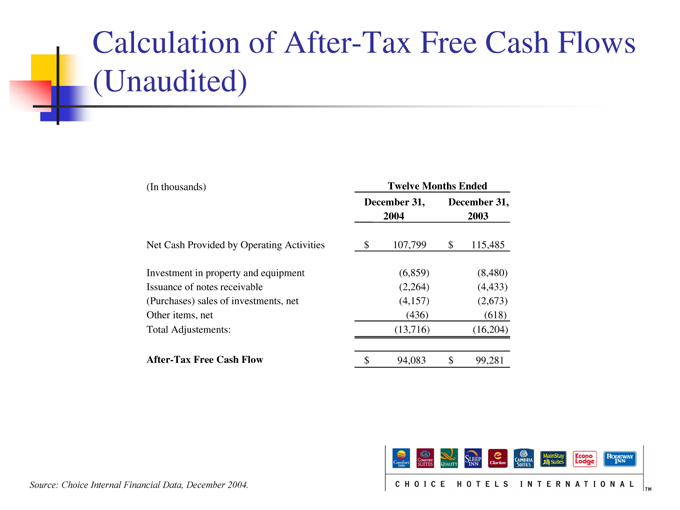

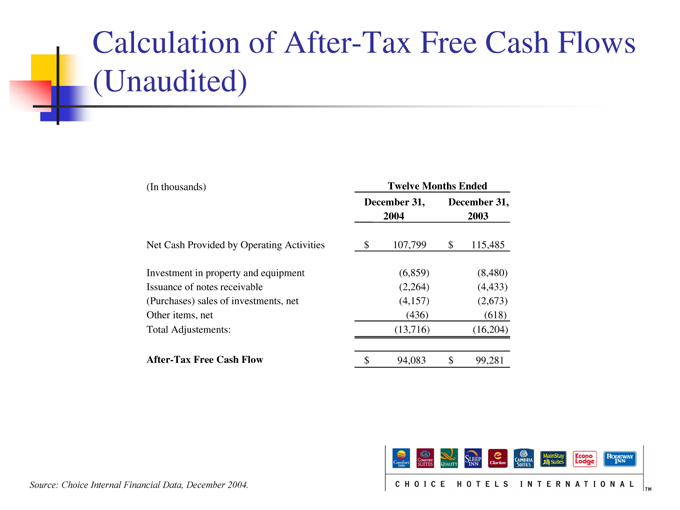

Calculation of After-Tax Free Cash Flows (Unaudited)

(In thousands) Twelve Months Ended

December 31, December 31,

2004 2003

Net Cash Provided by Operating Activities $107,799 $115,485

Investment in property and equipment (6,859) (8,480)

Issuance of notes receivable (2,264) (4,433)

(Purchases) sales of investments, net (4,157) (2,673)

Other items, net (436) (618)

Total Adjustements: (13,716) (16,204)

After-Tax Free Cash Flow $94,083 $99,281

Source: Choice Internal Financial Data, December 2004.

Non-GAAP Financial Measures

Recurring EBITDA, adjusted net income, adjusted diluted earnings per share, franchising revenues and margins, net operating profits after taxes (NOPAT), return on invested capital (ROIC) and after-tax free cash flows are non-GAAP financial measurements. These financial measurements are presented as supplemental disclosures because they are used by management in reviewing and analyzing the company’s performance. This information should not be considered as an alternative to any measure of performance as promulgated under accounting principles generally accepted in the United States (GAAP), such as operating income, net income, diluted earnings per share, total revenues or net cash provided by operating activities. The calculation of these non-GAAP measures may be different from the calculation by other companies and therefore comparability may be limited. The company has included the preceding exhibits which reconcile these measures to the comparable GAAP measurement.