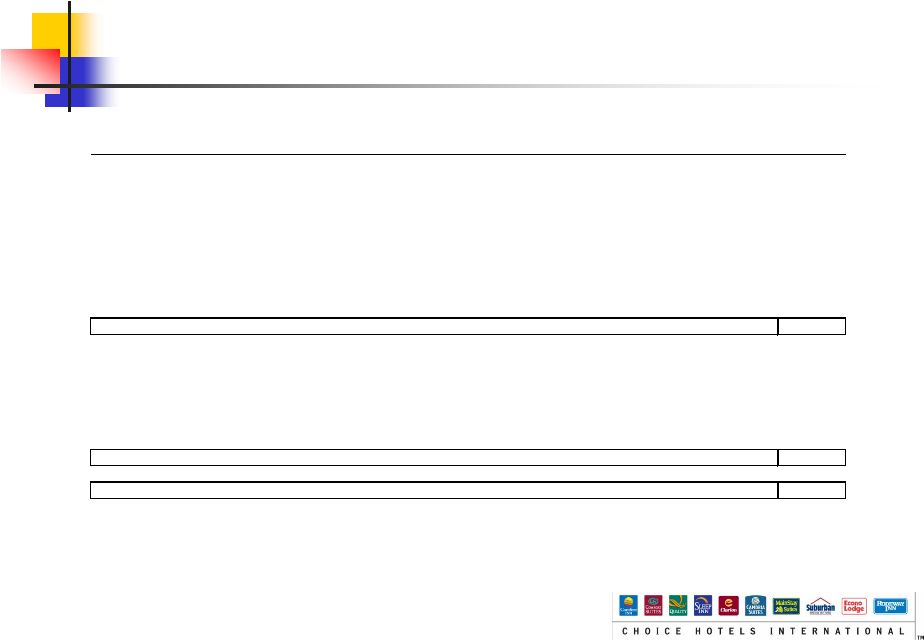

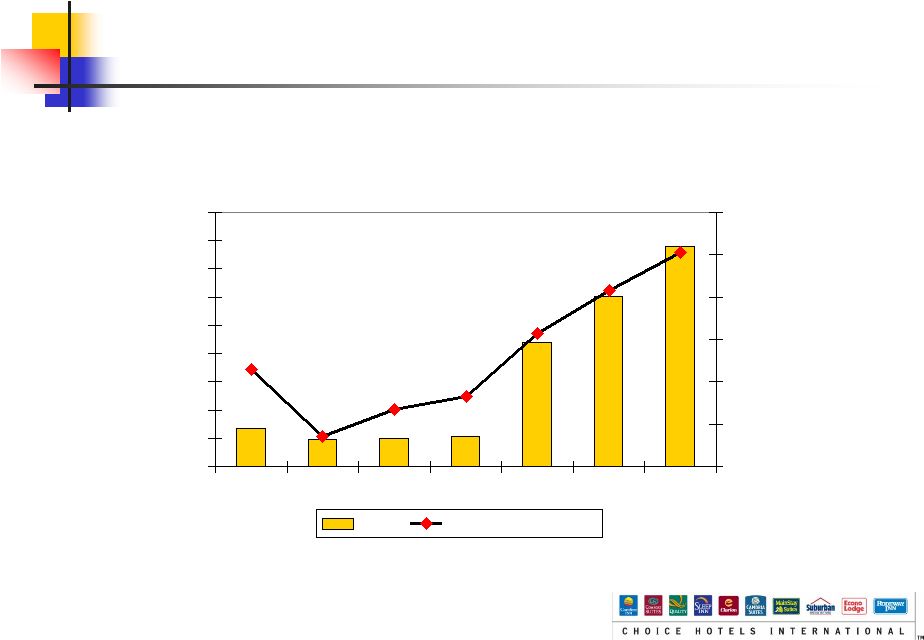

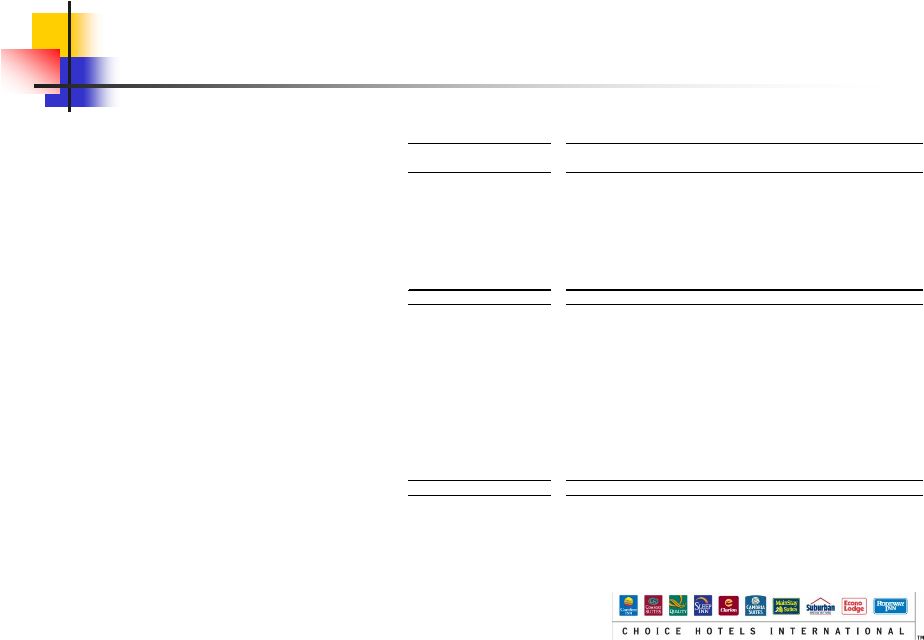

53 Calculation of Adjusted Net Income and Adjusted Diluted Earnings Per Share (EPS) (Unaudited) Source: Choice Internal Data, March 2006 & December 2005. (In thousands, except per share amounts) March 31 March 31 2006 2005 2005 2004 2003 2002 2001 Net Income 17,665 $ 11,999 $ 87,565 $ 74,345 $ 71,863 $ 60,844 $ 14,327 $ Adjustments: Debt Extinguishment Costs - - - 433 - - - Reversal of Provisions for Income Tax Contingencies - - (4,855) (1,182) - - - Income Tax Expense Incurred Due to Foreign Earnings Repatriation - - 1,192 - - - - Loss(Gain) on Sunburst Note Transactions - - - - (3,383) - - Impairment of and Equity Losses in Friendly Hotels PLC Investment - - - - - - 37,166 Adjusted Net Income 17,665 $ 11,999 $ 83,902 $ 73,596 $ 68,480 $ 60,844 $ 51,493 $ Weighted Average Shares Outstanding-Diluted 66,728 66,643 66,336 69,000 73,349 80,114 89,144 Diluted Earnings Per Share 0.26 $ 0.18 $ 1.32 $ 1.08 $ 0.98 $ 0.76 $ 0.16 $ Adjustments: Debt Extinguishment Costs - - - 0.01 - - - Reversal of Provisions for Income Tax Contingencies - - (0.08) (0.02) - - - Income Tax Expense Incurred Due to Foreign Earnings Repatriation - - 0.02 - - - - Loss(Gain) on Sunburst Note Transactions - - - - (0.05) - - Impairment of and Equity Losses in Friendly Hotels PLC Investment - - - - - - 0.42 Adjusted Diluted Earnings Per Share (EPS) 0.26 $ 0.18 $ 1.26 $ 1.07 $ �� 0.93 $ 0.76 $ 0.58 $ Three Months Ended Twelve Months Ended December 31, * |