Choice Hotels International Investor Presentation Bear Stearns Retail, Restaurants & Consumer Conference David White, Chief Financial Officer February 28, 2007 Exhibit 99.1 |

2 Disclaimer Certain matters discussed in this presentation may constitute forward-looking statements within the meaning of the federal securities law. Such statements are based on management’s beliefs, assumptions and expectations, which in turn are based on information currently available to management. Actual performance and results could differ from those expressed in or contemplated by the forward-looking statements due to a number of risks, uncertainties and other factors, many of which are beyond Choice’s ability to predict or control. For further information on factors that could impact Choice and the statements contained herein, we refer you to the filings made by Choice with the Securities and Exchange Commission, including our report on Form 10-K for the period ended December 31, 2005. Additional corporate information may be found on the Choice Hotels’ Internet site, which may be accessed at www.choicehotels.com |

3 One of the World’s Largest Hoteliers #2 U.S. Hotel Brand By Hotels Open More than 4,200 hotels open in the U.S. representing over 335,000 rooms Worldwide – more than 5,300 hotels open representing over 435,000 rooms Significant Growth Opportunities Domestic and international unit growth New brands Track Record of Delivering Shareholder Value Over 33% annualized share price return in past five years Dividends and share buybacks Source: Choice Internal Data as of December 2006, Smith Travel Research |

4 Strong, Stable, Growing System Robust Unit Growth Continues 4 percent increase in domestic hotels in 2006 Record 720 new domestic hotel contracts signed in 2006 Strongest pipeline in company’s history 930 hotels under development worldwide, representing more than 72,000 rooms 20-year contracts, barriers to exit Source: Choice Internal Data as of December 2006. |

5 Choice - #2 U.S. Hotel Brand Hilton 5% U.S. Hotel Market Share – Leading Hotel Companies Source: Smith Travel Research, January 2007. 0.0 2.0 4.0 6.0 8.0 10.0 12.0 Market Share - Hotels Open (By Percent) Wyndham Choice IHG Hilton Marriott Best Western Hyatt Starwood |

6 Successful, Proven Business Model Core Competency - Franchising Only pure-play lodging franchisor Highest returning model in the industry Substantial size, scale and distribution Growth in a wide variety of economic conditions and industry cycles High margin, high cash flow model with low capital requirements Difficult to duplicate – significant scale and capital requirements Highly-skilled, experienced in this area |

7 Brand Portfolio Built Over 5 Decades Organic Innovation Acquisitions 1940’s 1980’s 1990’s Scale & Distribution Created By Focus On Core Competency -- Selling Franchises, Selling Hotel Rooms, Servicing Hotel Operators Experience Built On Innovation 2000’s |

8 Well-recognized, Segmented Brands Limited Service Full Service Economy Mid-Scale Upscale |

9 Development Opportunities At Wide Range of Price Points Conversion New Construction $29,000 $36,000 $52,000 $45,500 $68,000 $45 $65 $100+ Targeted Average Daily/Weekly Rate Source: Choice Internal Data as of December 2006. *Excludes cost of land. $43,000 $38,500 $80 |

10 Choice Hotels’ Objectives Achieve Growth in New Market Segments Strategically Grow Existing Brands Improve Brands and Property Performance Improve Brand Recognition and Business Delivery Maximize Financial and Shareholder Returns |

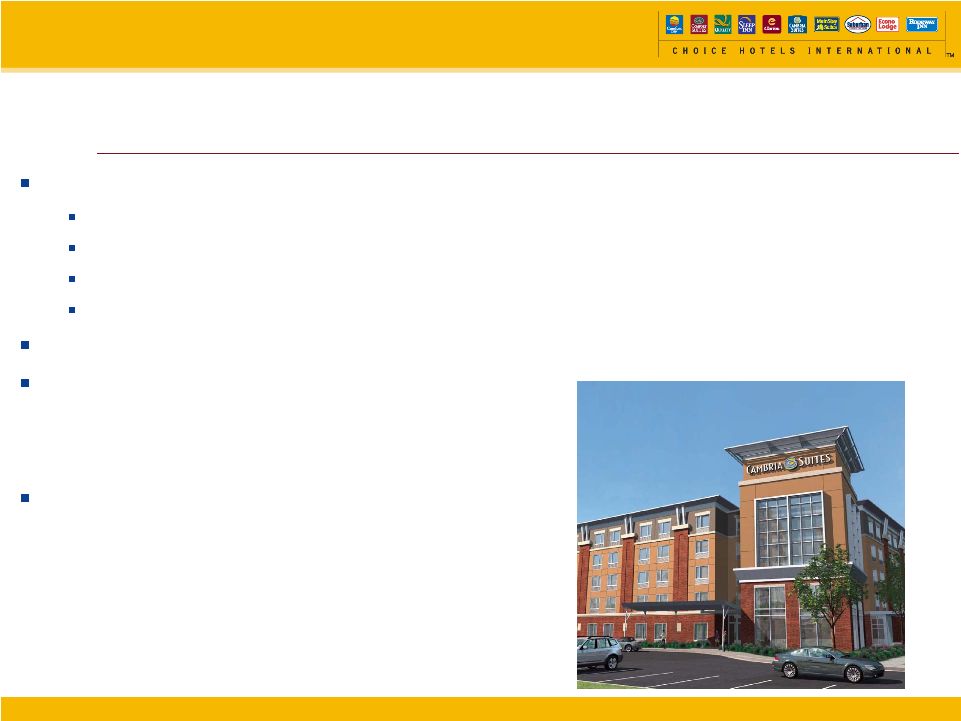

11 Cambria Suites – Upscale, Select Service Market Opportunity All-suites Brand 100% new construction Guest suites 25% larger than standard hotel rooms Very attractive per-key development cost Targeted ADR of $100 - $140 43 Contracts – In 20 States – Signed Since January 2005 Launch Boise Hotel To Open in March – 5 More In 2007 (Appleton, Green Bay, Akron/Canton, Savannah, and Minneapolis) Positioned Favorably Against Established Brands – Courtyard by Marriott and Hilton Garden Inn – and New Market Entrants – aloft, NYLO, Hyatt Place and Hotel Indigo. Source: Choice Internal Data as of December 2006 |

12 Extended Stay Market Opportunity Strong Performing Segment Due to Very Favorable Supply/Demand Equation. Industry Demand Increased 2.5% in 2006 – With Industry Occupancy At 74.5% and Industry RevPAR Up 7.5% Over 2005 Suburban Extended Stay Hotel – 60 Hotels, nearly 8,000 rooms Brand Acquired in 2005 – Serves Economy Market Choice Is Largest Franchisor In the Segment MainStay Suites – 29 Hotels, nearly 2,200 rooms Mid-scale Extended Stay Brand Source: Highland Group, Choice Internal Data as of December 2006 |

13 Brand-Centric Organizational Structure Upscale and Extended Stay Full-Service Mid-Market Economy Modeled on Cambria Suites Successes, New Structure Enables Choice To: Place greater focus on guests and franchisees Optimize brand positioning and segmentation Accelerate innovation Improve agility and remain on top of competitive and industry issues |

14 Growing Existing Brands Via Increased Unit Sales 250 300 350 400 450 500 550 600 650 700 750 2001 2002 2003 2004 2005 2006 $5.0 $7.0 $9.0 $11.0 $13.0 $15.0 $17.0 $19.0 Deals Initial Fee Revenue Franchise Development (New Contracts Sold) $ in millions Executed Contracts Source: Choice Internal Data as of December 2006. 300 deals $7.7 m 304 deals $8.3 m 470 deals $11.3 m 552 deals $13.3 m 639 deals $15.1 m Increased Franchise Contracts = Increased Initial Fees 720 deals $17.9 m |

15 2006: Record 720 New Domestic Hotel Franchise Contracts 0 100 200 300 400 500 600 700 800 900 New Construction Conversion Total 2004 2005 2006 237 182 370 402 639 552 Source: Choice Internal Data December 2006 288 432 Up 22% Over 2005 Up 7% Over 2005 720 Up 13% Over 2005 |

16 Unrelenting Focus on Franchisee ROI Our Vision: To Generate the Highest Return on Investment of Any Hotel Franchise Our Mission: Deliver a Franchise Success System of Strong Brands, Exceptional Services, Vast Consumer Reach, and Size, Scale, and Distribution That Delivers Guests, Satisfies Guests, and Reduces Costs for Our Hotel Owners: Our Passion: Customer Profitability It is Working - Franchisee Satisfaction with Respective Choice Brand(s) at 89%, Up From 79% in 2003 Source: Choice Internal Data as of December 2006. |

17 Franchise Success System Maximizes Owners’ ROI Unmatched Size, Scale, Distribution and Market Reach Lowers Costs and Increases Revenues for Owners Enables Highly-Valued Capabilities Services Technologies Purchasing Assistance Generates more than $13 million in annual revenue and lowers owner costs Source: Choice Internal Data as of December 2006. |

18 Franchise Success System Maximizes Owners’ ROI (cont.) $55+ Million Marketing and Advertising Plan Creates brand awareness and loyalty Drives traffic Enhanced Rewards Program 5 million+ Choice Privileges® members $2.9 billion hotel program revenue to date Delivering Revenue Direct sales - $800 million Intermediary marketing Reservations System $1.6 billion room revenue booked in 2006 – 33% delivery Source: Choice Internal Data as of December 2006. |

19 Business Model Maximizes Financial and Shareholder Returns Capital Allocation – Focus on Returns Capital Structure – Prudent Leverage to Maximize Returns Share Repurchases 66.6 million shares repurchased at an average of $10.69 per share as of 12/31/06 Nearly $712 million since inception of program Dividends Increased quarterly cash dividend by 15% in September 2006 to $0.15/share 2-for-1 Stock Split Effected in October 2005 Source: Choice Internal Data as of December 2006 |

20 Business Model Delivers Superior Returns on Invested Capital 10.4% 27.7% 36.9% 49.5% 69.1% 0% 10% 20% 30% 40% 50% 60% 70% 80% 2001 2002 2003 2004 2005 Source: Bear Stearns 2006 Equity Research – “U.S. Lodging – All Priced In – Our Current Thinking on the Sector.” Disclaimer: Return on invested capital percentages are calculated by Bear Stearns’ lodging industry analysts in accordance with that firms’ methodologies. Please note that any calculations, opinions, estimates or forecasts regarding Choice Hotels International, Inc.'s performance made by Bear Stearns (and therefore the return on invested capital percentages) are theirs alone and do not represent calculations, opinions, forecasts or predictions of Choice Hotels International. |

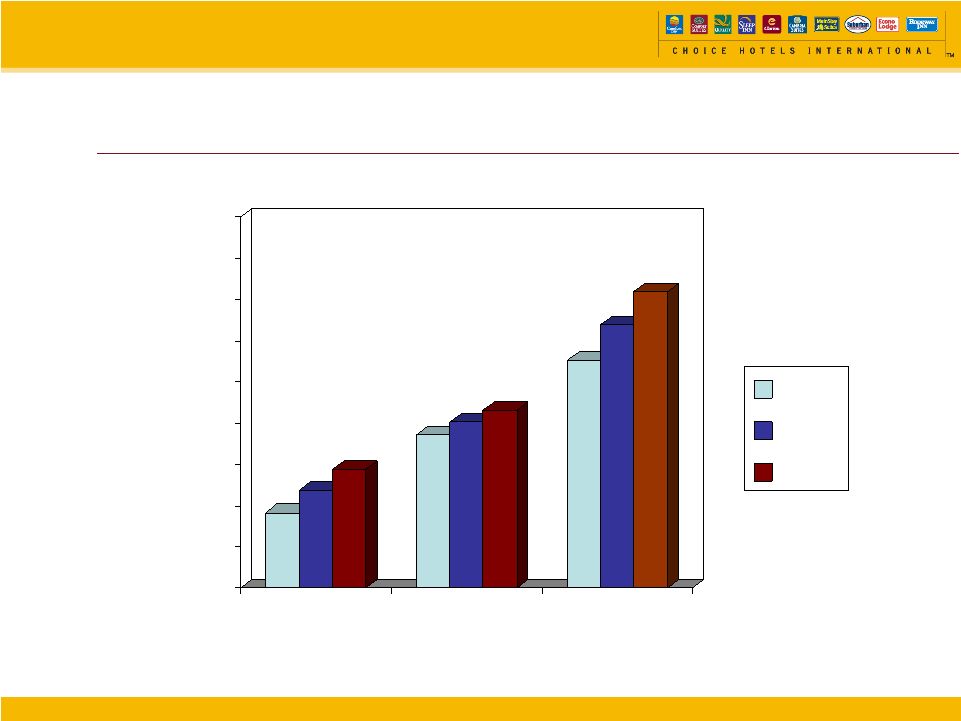

21 Industry-Leading Return on Invested Capital 0 10 20 30 40 50 60 70 2001 2002 2003 2004 2005 Choice Hotels Intl. Hilton Host Hotels Starwood Marriott Intl. Source – Bear Stearns 2006 Equity Research – “U.S. Lodging – All Priced In – Our Current Thinking on the Sector.” Disclaimer: Return on invested capital percentages are calculated by Bear Stearns’ lodging industry analysts in accordance with that firms’ methodologies. Please note that any calculations, opinions, estimates or forecasts regarding Choice Hotels International, Inc.'s performance made by Bear Stearns (and therefore the return on invested capital percentages) are theirs alone and do not represent calculations, opinions, forecasts or predictions of Choice Hotels International, Inc. or its management. Choice Hotels International, Inc. does not by its reference above or distribution imply its endorsement of or concurrence with such information, conclusions or recommendations. |

22 Growing U.S. System Source: Choice Internal Data as of December 2006. 2,500 2,700 2,900 3,100 3,300 3,500 3,700 3,900 4,100 4,300 2002 2003 2004 2005 2006 Domestic System Size CAGR = 3.9% Units Online |

23 Domestic Pipeline – 860 Hotels Source: Choice Internal Data as of December 2006. 602 New Construction Hotels (70%) 258 Conversion Hotels (30%) 0 25 50 75 100 125 150 175 200 225 250 Cambria Suites Comfort Suites Comfort Inn Sleep Inn Quality Clarion Suburban MainStay Suites Econo Lodge Rodeway Inn Midscale w/out F&B Midscale w/F&B Extended Stay Economy Upscale |

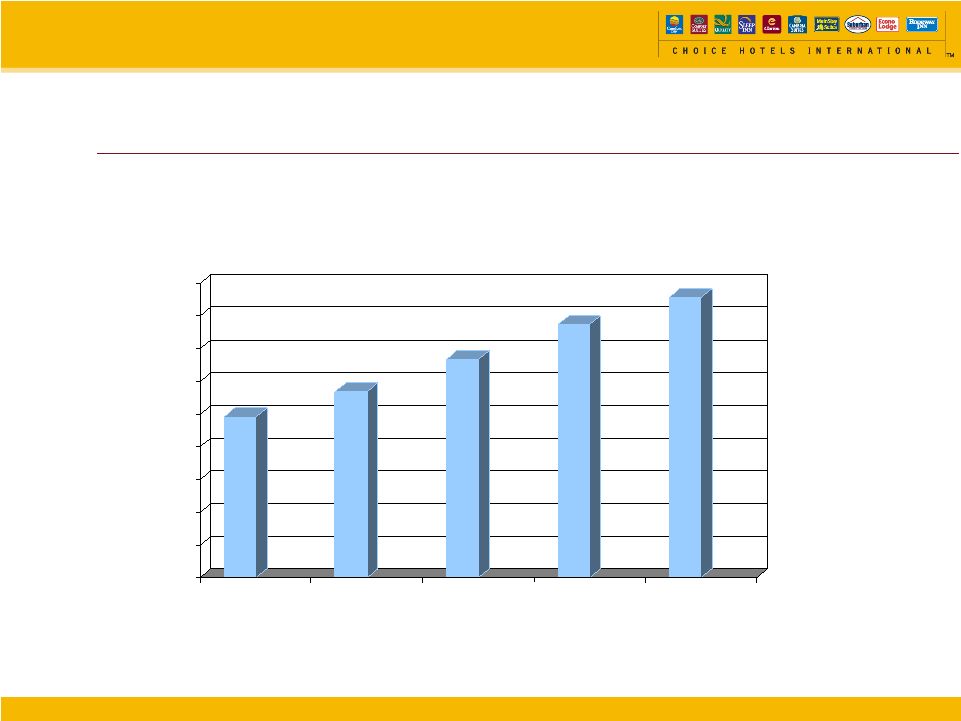

24 Strong Franchising Revenue Growth Source: Choice Internal Data, December 2006. See Appendix. $172.1 $187.1 $203.7 $230.0 $262.1 $160.0 $170.0 $180.0 $190.0 $200.0 $210.0 $220.0 $230.0 $240.0 $250.0 $260.0 $270.0 2002 2003 2004 2005 2006 Franchising Revenues ($ in millions) + 14% CAGR = 8.8% |

25 EBITDA Growth Up Solidly Source: Choice Internal Data, December 2006. See Appendix. $116.0 $125.2 $134.9 $152.8 $176.3 $90 $110 $130 $150 $170 $190 2002 2003 2004 2005 2006 EBITDA ($ in millions) CAGR = 8.7% +15% |

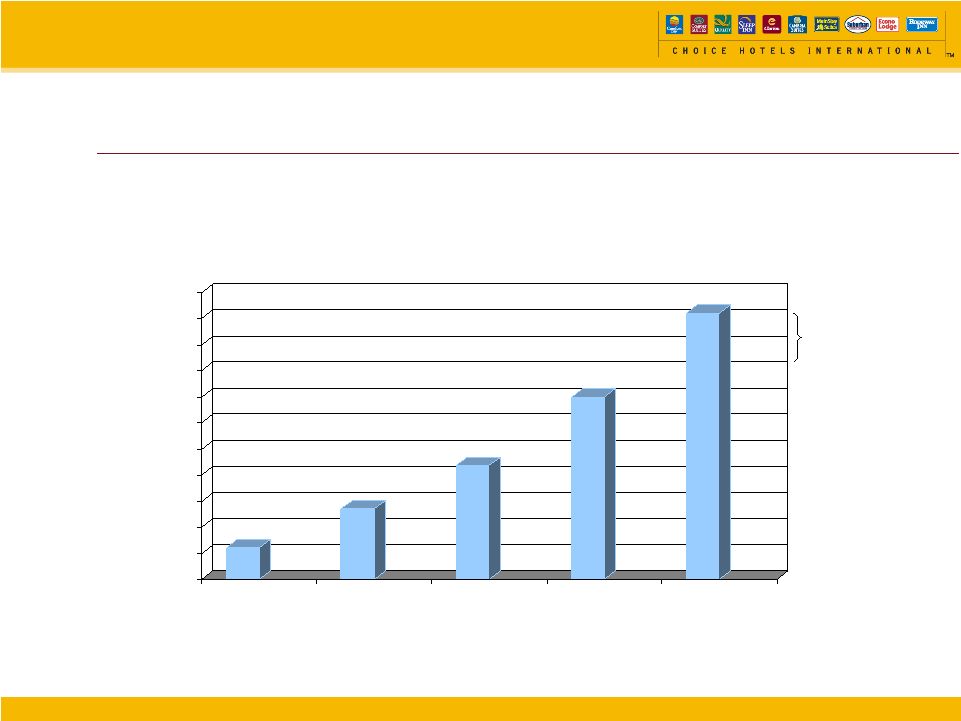

26 Strong EPS Growth Source: Choice Internal Data, December 2006. See Appendix. Per share amounts retroactively adjusted for 2005 stock split. $0.76 $0.93 $1.07 $1.26 $1.49 $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 $1.75 2002 2003 2004 2005 2006 Adjusted Diluted EPS CAGR = 14.4% + 18% |

27 Why Choice Growing System and Favorable Industry Dynamics Strong EPS, EBITDA, and Cash Flow Growth Proven Earnings Stability Even through Industry/Economic Downturns Pure-Play Franchise Focus, Highest Returning Model in the Industry High Operating Margins Significant Free Cash Flow |

Appendix |

29 $2,380,000 $476,000 $10,585,000 $2,117,000 $10,065,000 $2,013,000 Estimated Impact on Royalties $0.02 $0.004 $0.10 $0.02 $0.09 $0.02 Estimated Impact on Diluted EPS 1,2 5 bps increase = 1 bps increase = •Improvement in Royalty Rate 5% (210 units)= 1% (42 units) = 5% = 1% = •New Franchise Growth •RevPAR Improvement Revenue Driver (1) Assumes Outstanding Diluted Shares of 67,049,979 (2) Assumed tax rate of 37.75% Source: Choice Internal Analysis as of December 2006 Continuing Cash Flow Potential Multiple Revenue Levers (Unaudited) |

30 Franchising Revenues and Margins Source: Choice Internal Data as of December 2006. (Dollar amounts in thousands) 2006 2005 2004 2003 2002 Franchising Revenues and Margins Total Revenues 544,662 $ 477,399 $ 428,208 $ 385,866 $ 365,562 $ Adjustments: Marketing and Reservation (1) (278,026) (243,123) (220,732) (195,219) (190,145) Hotel Operations (4,505) (4,293) (3,729) (3,565) (3,331) Franchising Revenues 262,131 $ 229,983 $ 203,747 $ 187,082 $ 172,086 $ Operating Income 166,625 $ 143,750 $ 124,983 $ 113,983 $ 104,700 $ Adjustment: Hotel Operations (1,311) (1,068) (725) (949) (385) Net 165,314 $ 142,682 $ 124,258 $ 113,034 $ 104,315 $ Franchising Margins 63.1% 62.0% 61.0% 60.4% 60.6% Twelve Months Ended December 31, |

31 EBITDA Source: Choice Internal Data as of December 2006. 2006 2005 2004 2003 2002 Operating Income 166,625 $ 143,750 $ 124,983 $ 113,946 $ 104,700 $ Adjustments Depreciation and Amortization 9,705 9,051 9,947 11,225 11,251 EBITDA 176,330 $ 152,801 $ 134,930 $ 125,171 $ 115,951 $ Twelve Months Ended December 31, |

32 Adjusted Net Income Source: Choice Internal Data as of December 2006. (In thousands, except per share amounts) 2006 2005 2004 2003 2002 Net Income 112,787 $ 87,565 $ 74,345 $ 71,863 $ 60,844 $ Adjustments: Debt Extinguishment Costs 217 - 433 - - Resolution of Provisions for Income Tax Contingencies (12,791) (4,855) (1,182) - - Income Tax Expense Incurred Due to Foreign Earnings Repatriation - 1,192 - - - Loss(Gain) on Sunburst Note Transactions - - - (3,383) - Adjusted Net Income 100,213 $ 83,902 $ 73,596 $ 68,480 $ 60,844 $ Weighted Average Shares Outstanding-Diluted 67,050 66,336 69,000 73,349 80,114 Diluted Earnings Per Share 1.68 $ 1.32 $ 1.08 $ 0.98 $ 0.76 $ Adjustments: Debt Extinguishment Costs - - 0.01 - - Resolution of Provisions for Income Tax Contingencies (0.19) (0.08) (0.02) - - Income Tax Expense Incurred Due to Foreign Earnings Repatriation - 0.02 - - - Loss(Gain) on Sunburst Note Transactions - - - (0.05) - Adjusted Diluted Earnings Per Share (EPS) 1.49 $ 1.26 $ 1.07 $ 0.93 $ 0.76 $ Twelve Months Ended December 31, |