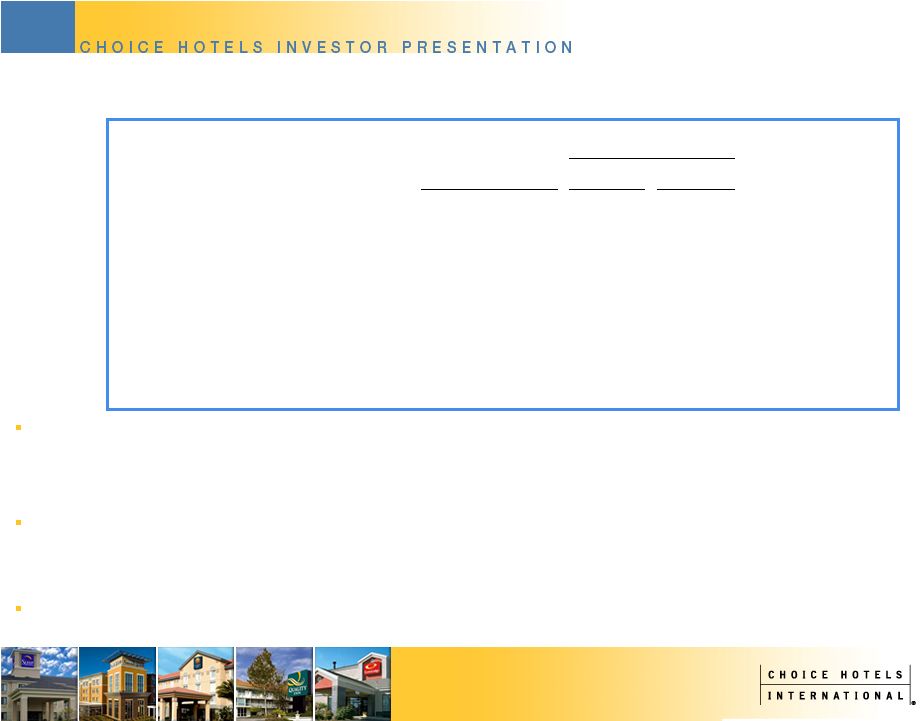

39 ADJUSTED DILUTED EARNINGS PER SHARE Source: Choice Internal Data, December 2009 Note: To improve comparability certain employee severance amounts included in the determination of adjusted diluted earnings per share in this presentation for 2008 and 2007 differ from amounts reported in exhibit 8 of our February 10, 2009 earnings announcement. Outlook Year Ended Year Ended Year Ended Year Ended Year Ended 2% RevPAR December 31, December 31, December 31, December 31, December 31, (In thousands, except per share amounts) Target Sensitivity 2009 2008 2007 2006 2005 Net Income 101,615 $ 99,081 $ 96,760 $ 100,211 $ 111,301 $ 112,787 $ 87,565 $ Adjustments: Loss(Gain) on Extinguishment of Debt, Net of Taxes - - - - - 217 - Acceleration of Management Sucession Plan, Net of Taxes - - - 4,135 - - - Executive Termination Benefits, Net of Taxes - - 2,719 - 2,310 - - Loss on Sublease of Office Space, Net of Taxes - - 944 - - - - Curtailment of SERP, Net of Taxes - - 807 - - - - Loan Reserves Related to Impaired Notes Receivable, Net of Taxes - - - 4,729 - - - Resolution of Provisions for Income Tax Contingencies - - - - - (12,791) (4,855) Income Tax Expense Incurred Due to Foreign Earnings Repatriation - - - - - - 1,192 Loss(Gain) on Sunburst Note Transactions, Net of Taxes - - - - - - - Impairment of and Equity Losses in Friendly Hotels PLC Investment, Net of Taxes - - - - - - - Adjusted Net Income 101,615 $ 99,081 $ 101,230 $ 109,075 $ 113,611 $ 100,213 $ 83,902 $ Weighted Average Shares Outstanding-Diluted 59,941 59,941 60,225 62,521 65,331 67,050 66,336 Diluted Earnings Per Share 1.70 $ 1.65 $ 1.61 $ 1.60 $ 1.70 $ 1.68 $ 1.32 $ Adjustments: Loss(Gain) on Extinguishment of Debt, Net of Taxes - - - - - - - Acceleration of Management Sucession Plan, Net of Taxes - - - 0.07 - - - Executive Termination Benefits, Net of Taxes - - 0.05 - 0.04 - - Loss on Sublease of Office Space, Net of Taxes - - 0.01 - - - - Curtailment of SERP, Net of Taxes - - 0.01 - - - - Loan Reserves Related to Impaired Notes Receivable, Net of Taxes - - - 0.08 - - - Resolution of Provisions for Income Tax Contingencies - - - - - (0.19) (0.08) Income Tax Expense Incurred Due to Foreign Earnings Repatriation - - - - - - 0.02 Loss(Gain) on Sunburst Note Transactions, Net of Taxes - - - - - - - Impairment of and Equity Losses in Friendly Hotels PLC Investment, Net of Taxes - - - - - - - Adjusted Diluted Earnings Per Share (EPS) 1.70 $ 1.65 $ 1.68 $ 1.75 $ 1.74 $ 1.49 $ 1.26 $ Projected Year Ended December 31, 2010 |