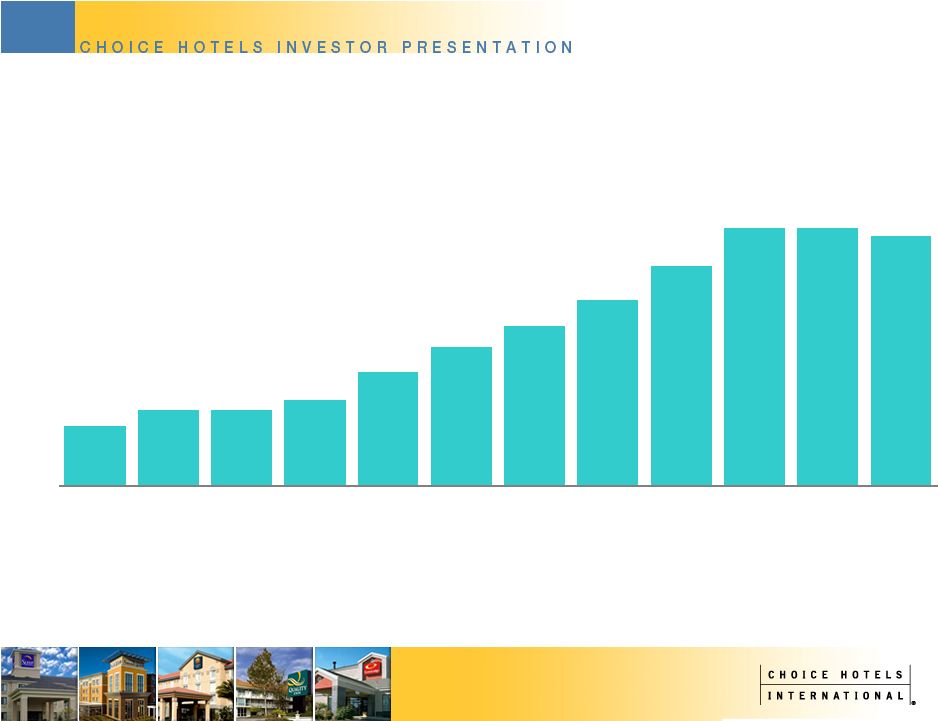

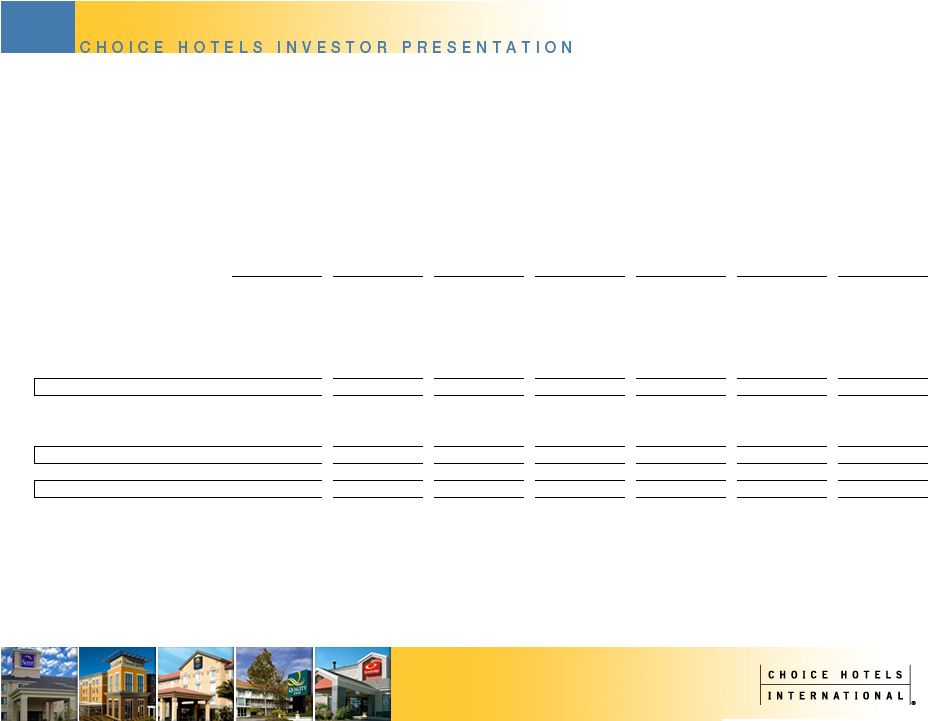

39 ADJUSTED DILUTED EARNINGS PER SHARE (CONTINUED) Source: Choice Internal Data, December 2009 Year Ended Year Ended Year Ended Year Ended Year Ended Year Ended Year Ended December 31, December 31, December 31, December 31, December 31, December 31, December 31, (In thousands, except per share amounts) 2004 2003 2002 2001 2000 1999 1998 Net Income 74,345 $ 71,863 $ 60,844 $ 14,327 $ 42,445 $ 57,155 $ 55,305 $ Adjustments: Loss(Gain) on Extinguishment of Debt, Net of Taxes 433 - - - - - (7,232) Acceleration of Management Sucession Plan, Net of Taxes - - - - - - - Executive Termination Benefits, Net of Taxes - - - - - - - Loss on Sublease of Office Space, Net of Taxes - - - - - - - Curtailment of SERP, Net of Taxes - - - - - - - Loan Reserves Related to Impaired Notes Receivable, Net of Taxes - - - - - - - Resolution of Provisions for Income Tax Contingencies (1,182) - - - - - - Income Tax Expense Incurred Due to Foreign Earnings Repatriation - - - - - - - Loss(Gain) on Sunburst Note Transactions, Net of Taxes - (3,383) - - 4,721 - - Impairment of and Equity Losses in Friendly Hotels PLC Investment, Net of Taxes - - - 37,166 7,532 - - Adjusted Net Income 73,596 $ 68,480 $ 60,844 $ 51,493 $ 54,698 $ 57,155 $ 48,073 $ Weighted Average Shares Outstanding-Diluted 69,000 73,349 80,114 89,144 106,506 111,334 119,096 Diluted Earnings Per Share 1.08 $ 0.98 $ 0.76 $ 0.16 $ 0.40 $ 0.51 $ 0.46 $ Adjustments: Loss(Gain) on Extinguishment of Debt, Net of Taxes 0.01 - - - - - (0.06) Acceleration of Management Sucession Plan, Net of Taxes - - - - - - - Executive Termination Benefits, Net of Taxes - - - - - - - Loss on Sublease of Office Space, Net of Taxes - - - - - - - Curtailment of SERP, Net of Taxes - - - - - - - Loan Reserves Related to Impaired Notes Receivable, Net of Taxes - - - - - - - Resolution of Provisions for Income Tax Contingencies (0.02) - - - - - - Income Tax Expense Incurred Due to Foreign Earnings Repatriation - - - - - - - Loss(Gain) on Sunburst Note Transactions, Net of Taxes - (0.05) - - 0.04 - - Impairment of and Equity Losses in Friendly Hotels PLC Investment, Net of Taxes - - - 0.42 0.07 - - Adjusted Diluted Earnings Per Share (EPS) 1.07 $ 0.93 $ 0.76 $ 0.58 $ 0.51 $ 0.51 $ 0.40 $ |