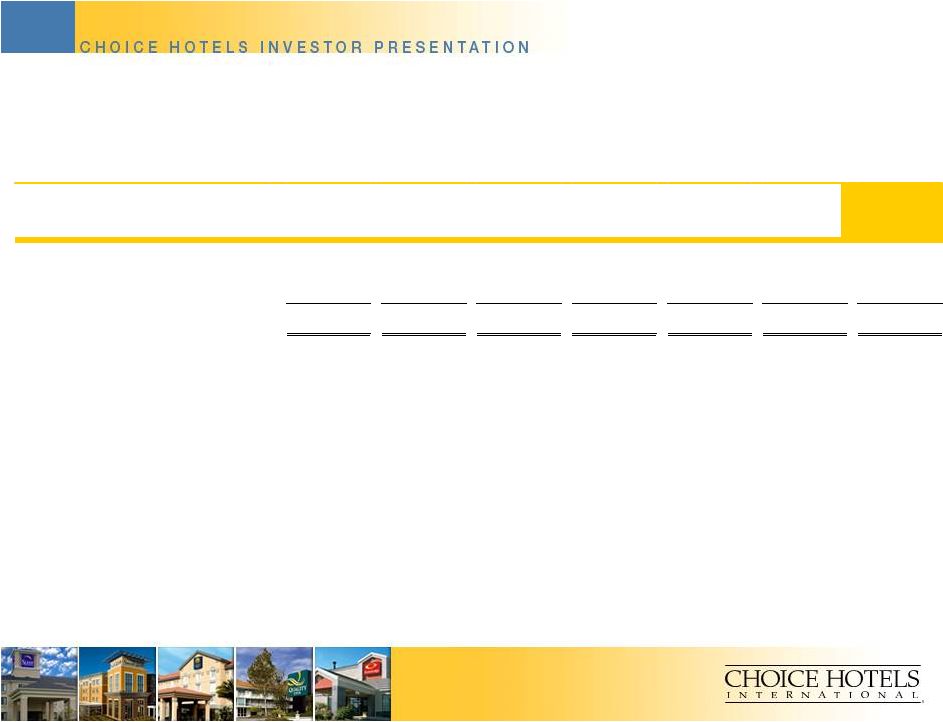

35 35 ADJUSTED DILUTED EARNINGS PER SHARE Note: To improve comparability certain employee severance amounts included in the determination of adjusted franchising margins in this presentation for 2007 through 2011 differ from amounts reported in exhibit 8 of our year-end earnings announcements for those years. Source: Choice Internal Data, December 2011 Year Ended Year Ended Year Ended Year Ended Year Ended Year Ended Year Ended December 31, December 31, December 31, December 31, December 31, December 31, December 31, (In thousands, except per share amounts) 2011 2010 2009 2008 2007 2006 2005 Net Income 110,396 $ 107,441 $ 98,250 $ 100,211 $ 111,301 $ 112,787 $ 87,565 $ Adjustments: Loss(Gain) on Extinguishment of Debt, Net of Taxes - - - - - 217 - Acceleration of Management Sucession Plan, Net of Taxes - - - 4,135 - - - Executive Termination Benefits, Net of Taxes 1,711 762 2,079 - 2,310 - - Loss on Land Held For Sale 1,119 - - - - - - Loss on Sublease of Office Space, Net of Taxes - - 941 - - - - Curtailment of SERP, Net of Taxes - - 757 - - - - Loan Reserves Related to Impaired Notes Receivable, Net of Taxes - - - 4,729 - - - Resolution of Provisions for Income Tax Contingencies - - - - - (12,791) (4,855) Income Tax Expense Incurred Due to Foreign Earnings Repatriation - - - - - - 1,192 Loss(Gain) on Sunburst Note Transactions, Net of Taxes - - - - - - - Impairment of and Equity Losses in Friendly Hotels PLC Investment, Net of Taxes - - - - - - - Adjusted Net Income 113,226 $ 108,203 $ 102,027 $ 109,075 $ 113,611 $ 100,213 $ 83,902 $ Weighted Average Shares Outstanding-Diluted 59,525 59,656 60,224 62,994 65,766 67,490 66,759 Diluted Earnings Per Share 1.85 $ 1.80 $ 1.63 $ 1.59 $ 1.69 $ 1.67 $ 1.31 $ Adjustments: Loss(Gain) on Extinguishment of Debt, Net of Taxes - - - - - - - Acceleration of Management Sucession Plan, Net of Taxes - - - 0.07 - - - Executive Termination Benefits, Net of Taxes 0.03 0.01 0.02 - 0.04 - - Loss on Land Held For Sale 0.02 - - - - - - Loss on Sublease of Office Space, Net of Taxes - - 0.02 - - - - Curtailment of SERP, Net of Taxes - - 0.01 - - - - Loan Reserves Related to Impaired Notes Receivable, Net of Taxes - - - 0.07 - - - Resolution of Provisions for Income Tax Contingencies - - - - - (0.19) (0.08) Income Tax Expense Incurred Due to Foreign Earnings Repatriation - - - - - - 0.02 Loss(Gain) on Sunburst Note Transactions, Net of Taxes - - - - - - - Impairment of and Equity Losses in Friendly Hotels PLC Investment, Net of Taxes - - - - - - - Adjusted Diluted Earnings Per Share (EPS) 1.90 $ 1.81 $ 1.68 $ 1.73 $ 1.73 $ 1.48 $ 1.25 $ |