Investor Presentation July 8th, 2020 Cambria Hotel North Scottsdale Desert Ridge Cambria Philadelphia, Pennsylvania Exhibit 99.1

Certain matters discussed in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, our use of words such as "expect," "estimate," "believe," "anticipate," "should," "will," "forecast," "plan," "project," "assume," or similar words of futurity identify such forward-looking statements. These forward-looking statements are based on management's current beliefs, assumptions, and expectations regarding future events, which, in turn, are based on information currently available to management. Such statements may relate to projections of the company's revenue, expenses, earnings, debt levels, ability to repay outstanding indebtedness, payment of dividends, repurchases of common stock, and other financial and operational measures, including occupancy and open hotels, the company's ability to benefit from any rebound in travel demand, our liquidity, our ability to assist franchisees through relief or other financial measures, our ability to minimize or manage disruptions posed by COVID-19, our ability to achieve cost savings and reduce discretionary spending and investments, and the impact of COVID-19 and economic conditions on our future operations, among other matters. We caution you not to place undue reliance on any such forward-looking statements. Forward-looking statements do not guarantee future performance and involve known and unknown risks, uncertainties, and other factors. Forward-looking Statements Several factors could cause actual results, performance, or achievements of the company to differ materially from those expressed in or contemplated by the forward-looking statements. Such risks include, but are not limited to, continuation, resurgence, or worsening of the COVID-19 pandemic, including quarantines, "shelter-in-place" orders, or other travel restrictions; new information which may emerge concerning the severity or impact of the COVID-19 pandemic and the development of vaccines and treatments for COVID-19; changes in consumer demand and confidence, including the impact of the COVID-19 pandemic on unemployment rates, consumer discretionary spending, and the demand for travel, transient, and group business; the impact of COVID-19 on the global hospitality industry, particularly but not exclusively in the U.S. travel market; the success of our mitigation efforts in response to the COVID-19 pandemic; the performance of our brands and categories in any recovery from the COVID-19 pandemic disruption; the timing and amount of future dividends and share repurchases; changes to general, domestic, and foreign economic conditions, including access to liquidity and capital as a result of COVID-19; future domestic or global outbreaks of COVID-19 or other epidemics, pandemics, or contagious diseases, or fear of such outbreaks; changes in law and regulation applicable to the travel, lodging, or franchising industries; foreign currency fluctuations; impairments or declines in the value of the company's assets; operating risks common in the travel, lodging, or franchising industries; changes to the desirability of our brands as viewed by hotel operators and customers; changes to the terms or termination of our contracts with franchisees and our relationships with our franchisees; our ability to keep pace with improvements in technology utilized for marketing and reservations systems and other operating systems; the commercial acceptance of our software as a service technology solutions division's products and services; our ability to grow our franchise system; exposure to risks related to our hotel development, financing, and ownership activities; exposures to risks associated with our investments in new businesses; fluctuations in the supply and demand for hotel rooms; our ability to realize anticipated benefits from acquired businesses; impairments or losses relating to acquired businesses; the level of acceptance of alternative growth strategies we may implement; cyber security and data breach risks; ownership and financing activities; hotel closures or financial difficulties of our franchisees; operating risks associated with our international operations, especially in areas currently most affected by COVID-19; the outcome of litigation; our ability to effectively manage our indebtedness and secure our indebtedness; and any future resurgence of COVID-19. These and other risk factors are discussed in detail in the company's filings with the Securities and Exchange Commission, including our annual report on Form 10-K and our quarterly reports filed on Form 10-Q. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law.

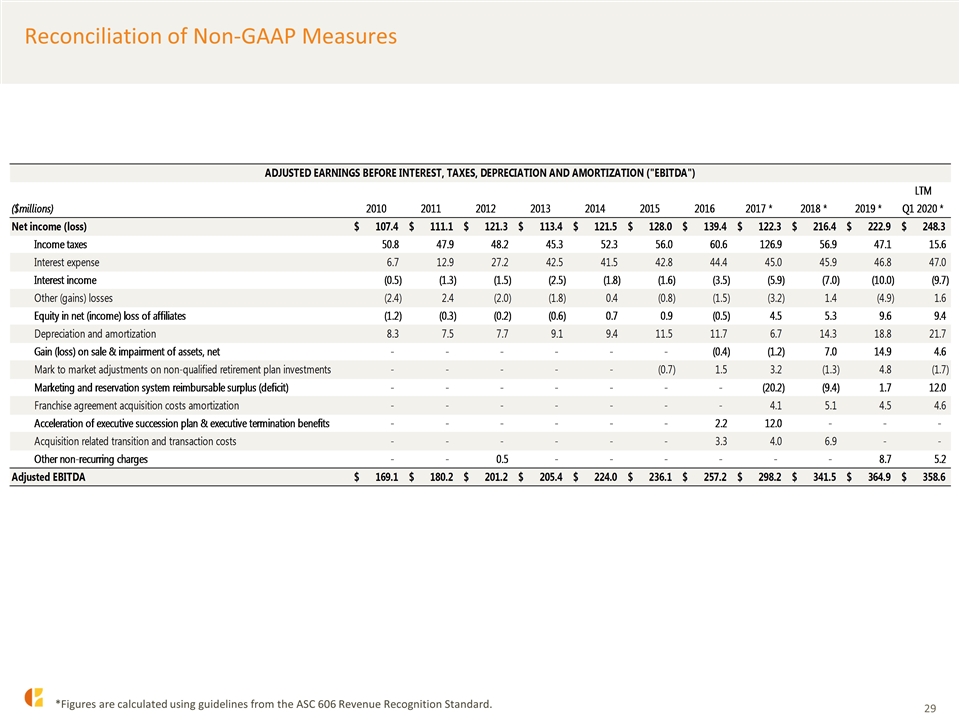

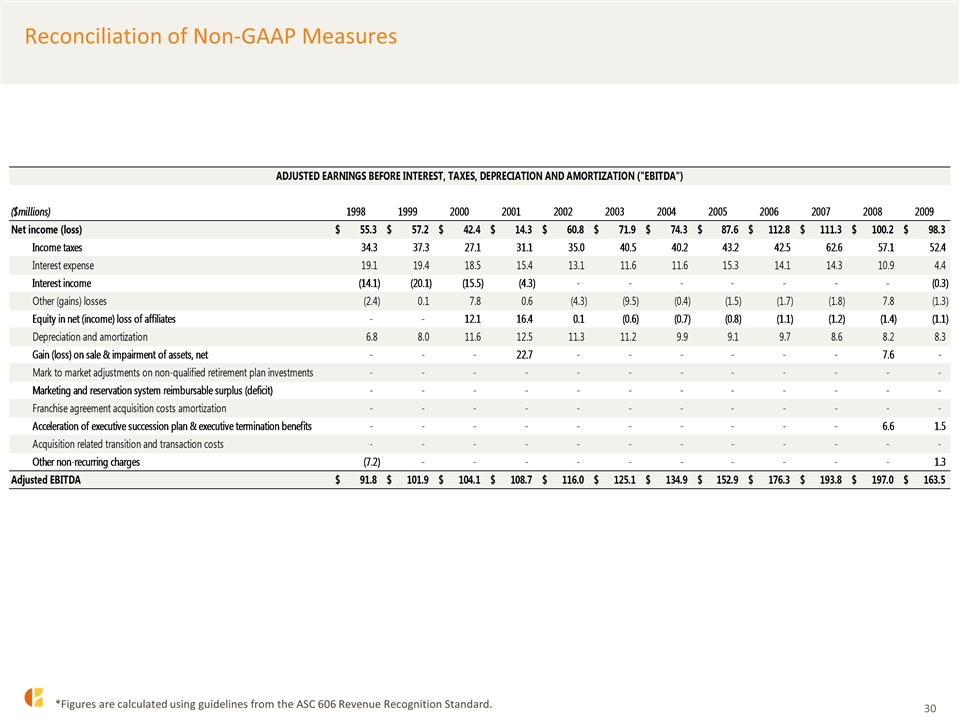

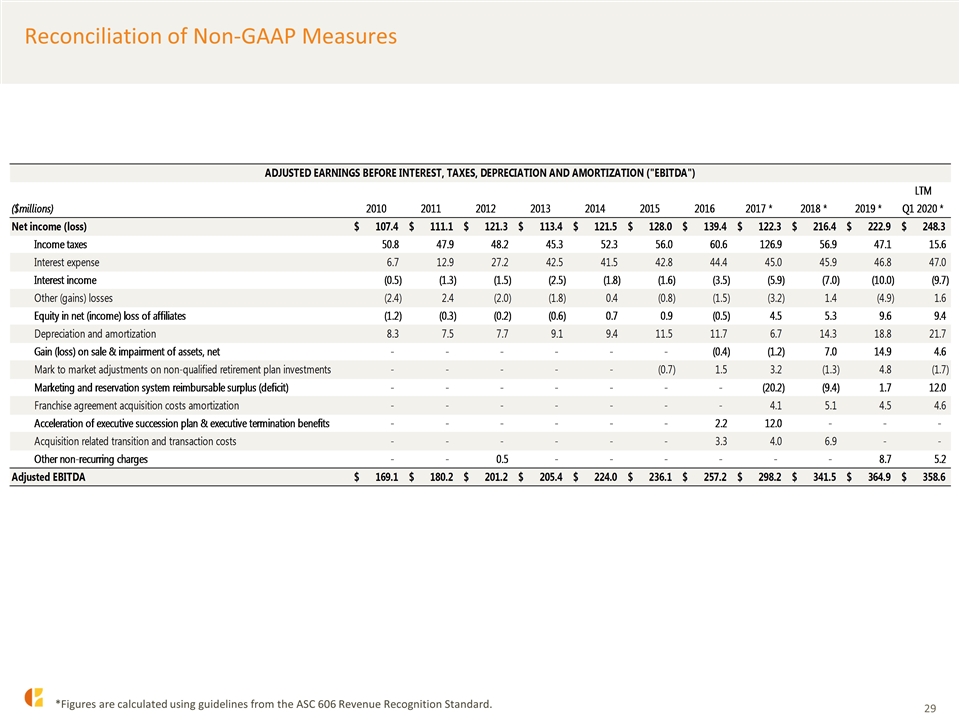

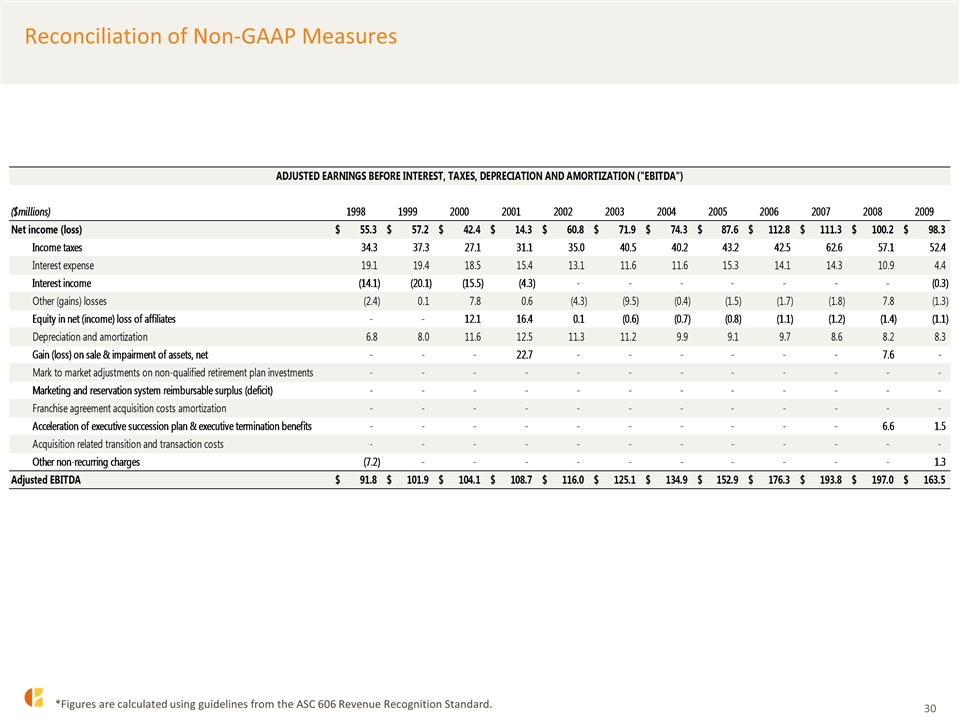

Non-GAAP Financial Measurements The company evaluates its operations utilizing the performance metrics of adjusted EBITDA, revenues excluding marketing and reservation system activities, adjusted net income, and adjusted EPS, which are all non-GAAP financial measurements. These measures, which are reconciled to the comparable GAAP measures in Exhibit 6, should not be considered as an alternative to any measure of performance or liquidity as promulgated under or authorized by GAAP, such as net income, EPS, and total revenues. The company's calculation of these measurements may be different from the calculations used by other companies and comparability may therefore be limited. We discuss management's reasons for reporting these non-GAAP measures and how each non-GAAP measure is calculated below. In addition to the specific adjustments noted below with respect to each measure, the non-GAAP measures presented herein also exclude acquisition-related transition and transaction costs, restructuring of the company’s international operations including employee severance benefit and legal costs, estimated one-time transition taxes on tax legislation enacted into law on December 22, 2017, debt-restructuring costs, federal tax credits related to the rehabilitation and re-use of historic office buildings and gains and losses on sale and impairment of assets primarily related to the company's operations that provide Software as a Service ("SaaS") technology solutions to vacation-rental management companies and the sale of an equity stake in a joint venture to allow for period-over-period comparison of ongoing core operations before the impact of these discrete and infrequent charges. Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization: Adjusted EBITDA reflects net income excluding the impact of interest expense, interest income, provision for income taxes, depreciation and amortization, franchise-agreement acquisition cost amortization, other (gains) and losses, equity in net income (loss) of unconsolidated affiliates, mark-to-market adjustments on non-qualified retirement plan investments and surplus or deficits generated by marketing and reservation-system activities. We consider adjusted EBITDA to be an indicator of operating performance because it measures our ability to service debt, fund capital expenditures, and expand our business. We also use adjusted EBITDA, as do analysts, lenders, investors, and others, to evaluate companies because it excludes certain items that can vary widely across industries or among companies within the same industry. For example, interest expense can be dependent on a company's capital structure, debt levels, and credit ratings. Accordingly, the impact of interest expense on earnings can vary significantly among companies. The tax positions of companies can also vary because of their differing abilities to take advantage of tax benefits and because of the tax policies of the jurisdictions in which they operate. As a result, effective tax rates and provision for income taxes can vary considerably among companies. Adjusted EBITDA also excludes depreciation and amortization because companies utilize productive assets of different ages and use different methods of both acquiring and depreciating productive assets or amortizing franchise-agreement acquisition costs. These differences can result in considerable variability in the relative asset costs and estimated lives and, therefore, the depreciation and amortization expense among companies. Mark-to-market adjustments on non-qualified retirement-plan investments recorded in SG&A are excluded from EBITDA, as the company accounts for these investments in accordance with accounting for deferred-compensation arrangements when investments are held in a rabbi trust and invested. Changes in the fair value of the investments are recognized as both compensation expense in SG&A and other gains and losses. As a result, the changes in the fair value of the investments do not have a material impact on the company's net income. Surpluses and deficits generated from marketing and reservation activities are excluded, as the company's franchise agreements require the marketing and reservation-system revenues to be used exclusively for expenses associated with providing franchise services, such as central reservation and property-management systems, reservation delivery, and national marketing and media advertising. Franchisees are required to reimburse the company for any deficits generated from these marketing and reservation-system activities and the company is required to spend any surpluses generated in future periods. Since these activities will be managed to break-even over time, quarterly or annual surpluses and deficits have been excluded from the measurements utilized to assess the company's operating performance. Adjusted Net Income and Adjusted Earnings Per Share: Adjusted net income and EPS exclude the impact of surpluses or deficits generated from marketing and reservation-system activities. Surpluses and deficits generated from marketing and reservation activities are excluded, as the company's franchise agreements require the marketing and reservation system revenues to be used exclusively for expenses associated with providing franchise services, such as central reservation and property-management systems, reservation delivery, and national marketing and media advertising. Franchisees are required to reimburse the company for any deficits generated from these marketing and reservation-system activities and the company is required to spend any surpluses generated in future periods. Since these activities will be managed to break-even over time, quarterly or annual surpluses and deficits have been excluded from the measurements utilized to assess the company's operating performance. We consider adjusted net income and adjusted EPS to be indicators of operating performance because excluding these items allow for period-over-period comparisons of our ongoing operations. Revenues, Excluding Marketing and Reservation System Activities: The company reports revenues, excluding marketing and reservation-system activities. These non-GAAP measures we present are commonly used measures of performance in our industry and facilitate comparisons between the company and its competitors. Marketing and reservation-system activities are excluded, as the company's franchise agreements require the marketing and reservation-system revenues to be used exclusively for expenses associated with providing franchise services, such as central reservation and property-management systems, reservation delivery, and national marketing and media advertising. Franchisees are required to reimburse the company for any deficits generated from these marketing and reservation-system activities and the company is required to spend any surpluses generated in future periods. Since these activities will be managed to break-even over time, quarterly or annual surpluses and deficits have been excluded from the measurements utilized to assess the company's operating performance.

Speaker Biography Dominic Dragisich is Chief Financial Officer for Choice Hotels International, Inc. (NYSE: CHH), one of the world’s leading hotel companies. In this role, he leads Choice’s overall financial and corporate growth initiatives to drive ongoing expansion across major markets and maximize stakeholder value. Mr. Dragisich also heads the company’s Corporate Development team, overseeing strategic corporate investments, joint ventures, acquisitions, and business alliances, as well as the company’s Corporate Strategy team. Mr. Dragisich joined Choice Hotels in 2017 in his current executive position. During his tenure, he successfully streamlined the company’s budgeting, forecasting and capital allocation processes, and has led several initiatives to support the company’s continued growth in the upscale hotel segment. Most notably, Mr. Dragisich established a strategic finance organization within the company to help define and support long-term business objectives, including those for Choice’s upscale brands. Prior to joining Choice Hotels, Mr. Dragisich served as chief financial officer at XO Communications, a national provider of advanced telecommunications services. There, he oversaw all aspects of the company’s financial operations, including accounting, financial planning and analysis, revenue assurance, real estate, treasury, billing and credit and collections. In addition, he successfully returned the company to revenue growth, increased profitability and played a lead role in the company’s eventual sale to Verizon Communications, Inc. Earlier in his career, Mr. Dragisich held senior finance and operational positions at Marriott International, NII Holdings and Deloitte Consulting. Mr. Dragisich earned his bachelor’s degree in finance and accounting from the University of Virginia’s McIntire School of Commerce and his MBA from Harvard Business School.

Business Overview Comfort Boise, Idaho

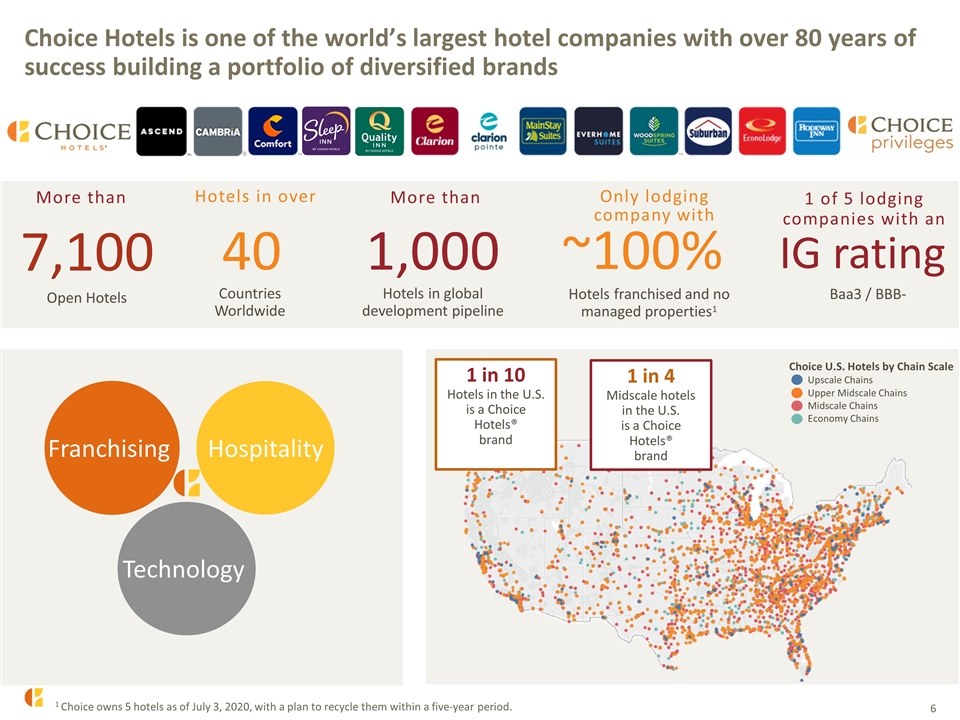

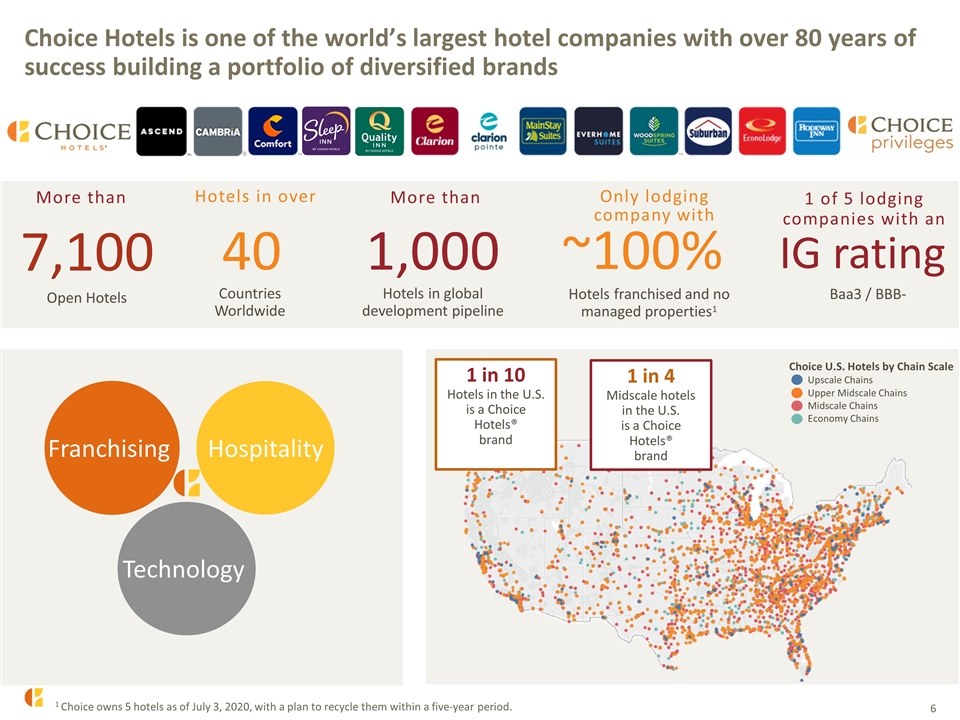

1 Choice owns 5 hotels as of July 3, 2020, with a plan to recycle them within a five-year period. 7,100 40 Choice U.S. Hotels by Chain Scale Upscale Chains Upper Midscale Chains Midscale Chains Economy Chains IG rating 1 of 5 lodging companies with an Franchising Choice Hotels is one of the world’s largest hotel companies with over 80 years of success building a portfolio of diversified brands Countries Worldwide Open Hotels Hotels in global development pipeline 1,000 More than Hotels in over More than Baa3 / BBB- Hospitality ~100% Hotels franchised and no managed properties1 Only lodging company with 1 in 10 Hotels in the U.S. is a Choice Hotels® brand 1 in 4 Midscale hotels in the U.S. is a Choice Hotels® brand Technology

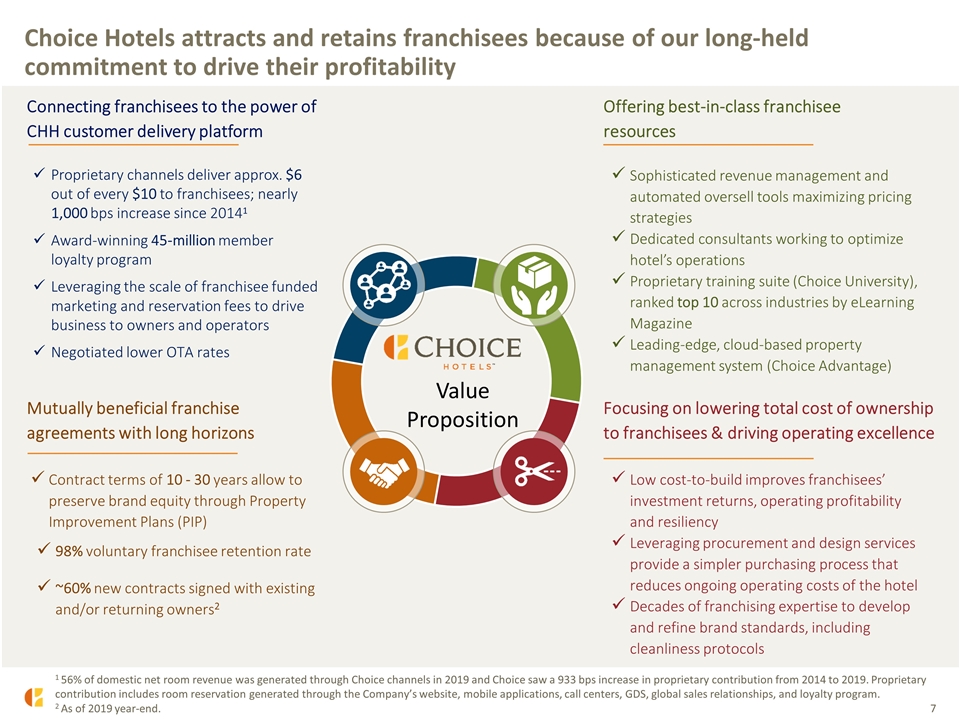

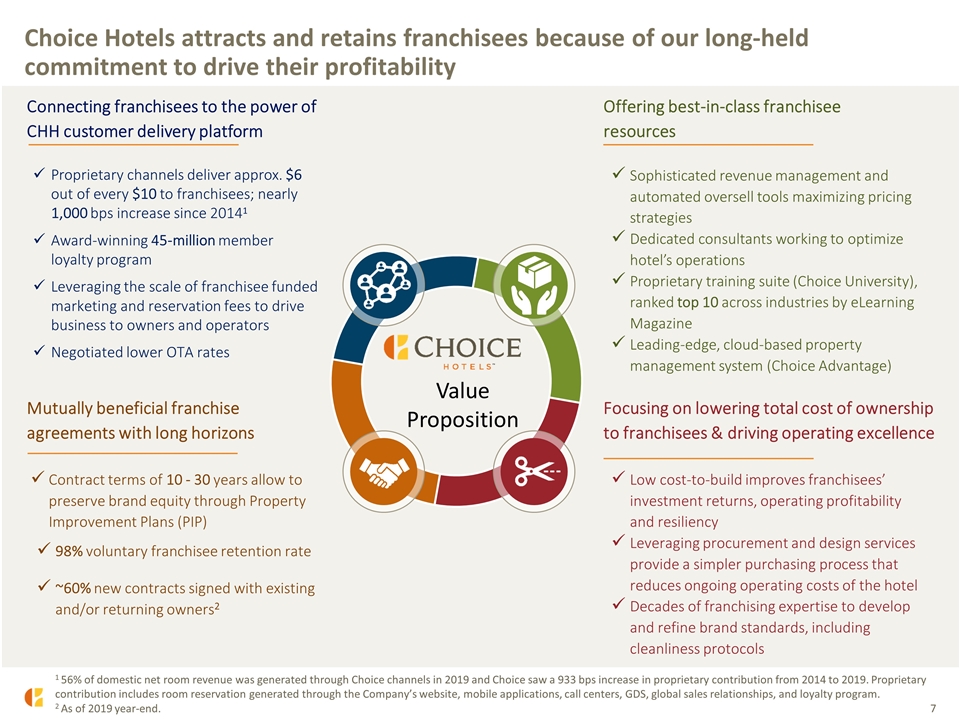

Choice Hotels attracts and retains franchisees because of our long-held commitment to drive their profitability Focusing on lowering total cost of ownership to franchisees & driving operating excellence Proprietary channels deliver approx. $6 out of every $10 to franchisees; nearly 1,000 bps increase since 20141 Award-winning 45-million member loyalty program Leveraging the scale of franchisee funded marketing and reservation fees to drive business to owners and operators Negotiated lower OTA rates Sophisticated revenue management and automated oversell tools maximizing pricing strategies Dedicated consultants working to optimize hotel’s operations Proprietary training suite (Choice University), ranked top 10 across industries by eLearning Magazine Leading-edge, cloud-based property management system (Choice Advantage) Contract terms of 10 - 30 years allow to preserve brand equity through Property Improvement Plans (PIP) 98% voluntary franchisee retention rate ~60% new contracts signed with existing and/or returning owners2 Value Proposition Offering best-in-class franchisee resources Connecting franchisees to the power of CHH customer delivery platform Mutually beneficial franchise agreements with long horizons Low cost-to-build improves franchisees’ investment returns, operating profitability and resiliency Leveraging procurement and design services provide a simpler purchasing process that reduces ongoing operating costs of the hotel Decades of franchising expertise to develop and refine brand standards, including cleanliness protocols 1 56% of domestic net room revenue was generated through Choice channels in 2019 and Choice saw a 933 bps increase in proprietary contribution from 2014 to 2019. Proprietary contribution includes room reservation generated through the Company’s website, mobile applications, call centers, GDS, global sales relationships, and loyalty program. 2 As of 2019 year-end.

Uniquely Positioned to Outperform Margarita European Inn, Ascend, Chicago

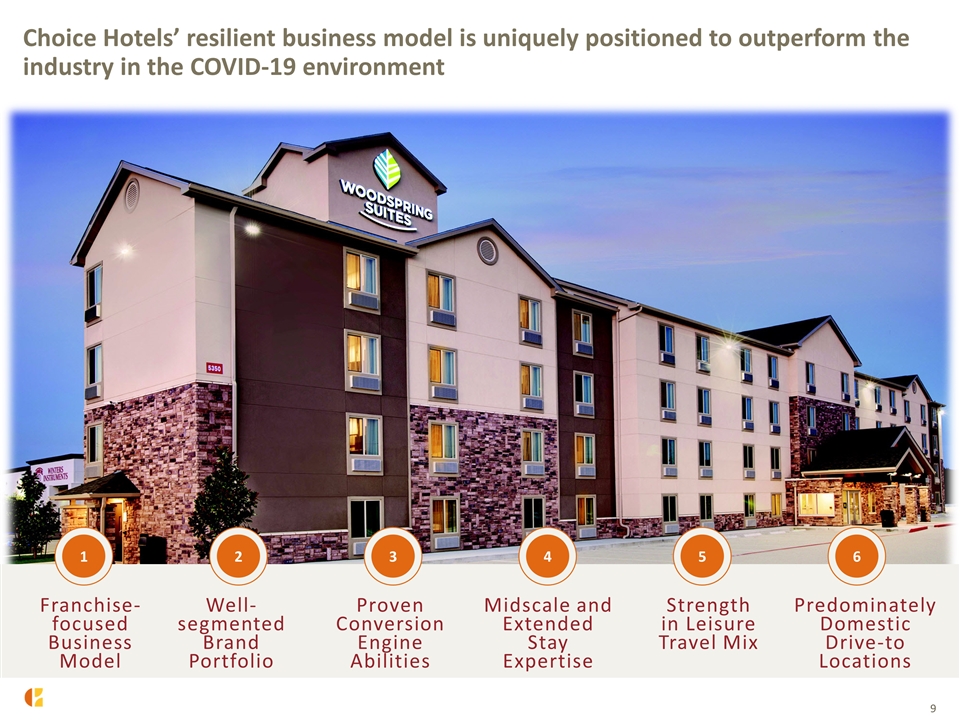

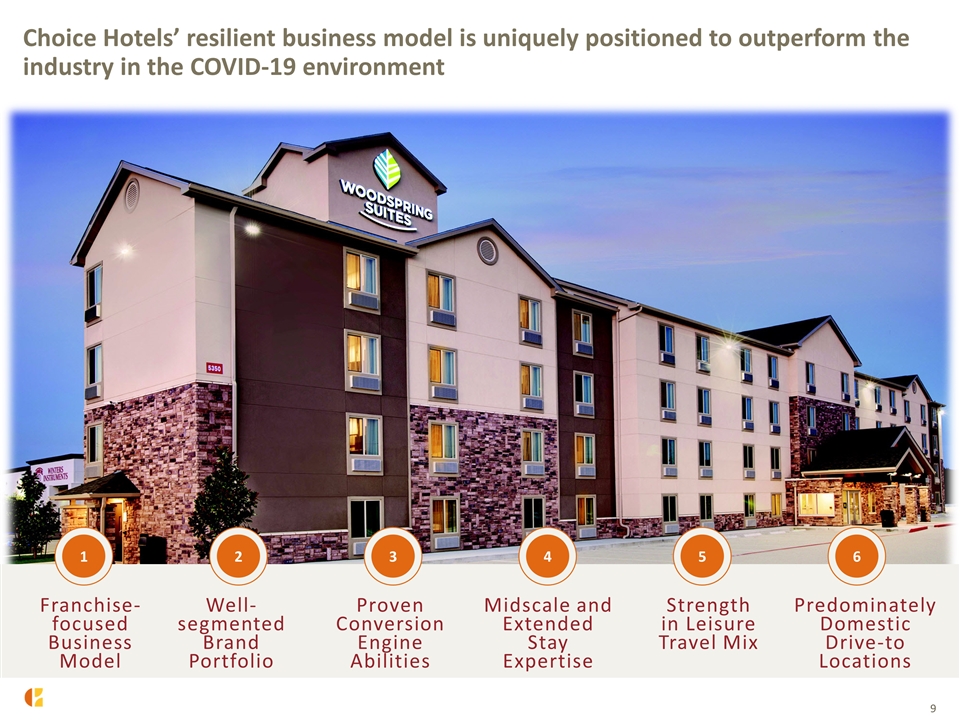

Choice Hotels’ resilient business model is uniquely positioned to outperform the industry in the COVID-19 environment 1 Strength in Leisure Travel Mix Well-segmented Brand Portfolio Predominately Domestic Drive-to Locations Franchise-focused Business Model Proven Conversion Engine Abilities Midscale and Extended Stay Expertise 2 3 4 5 6

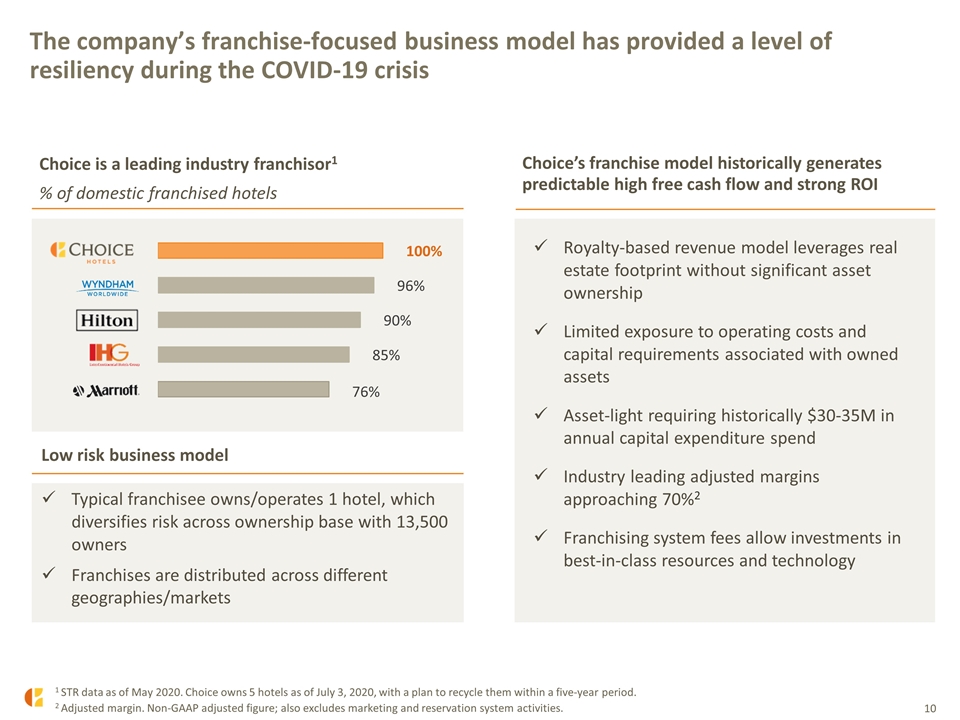

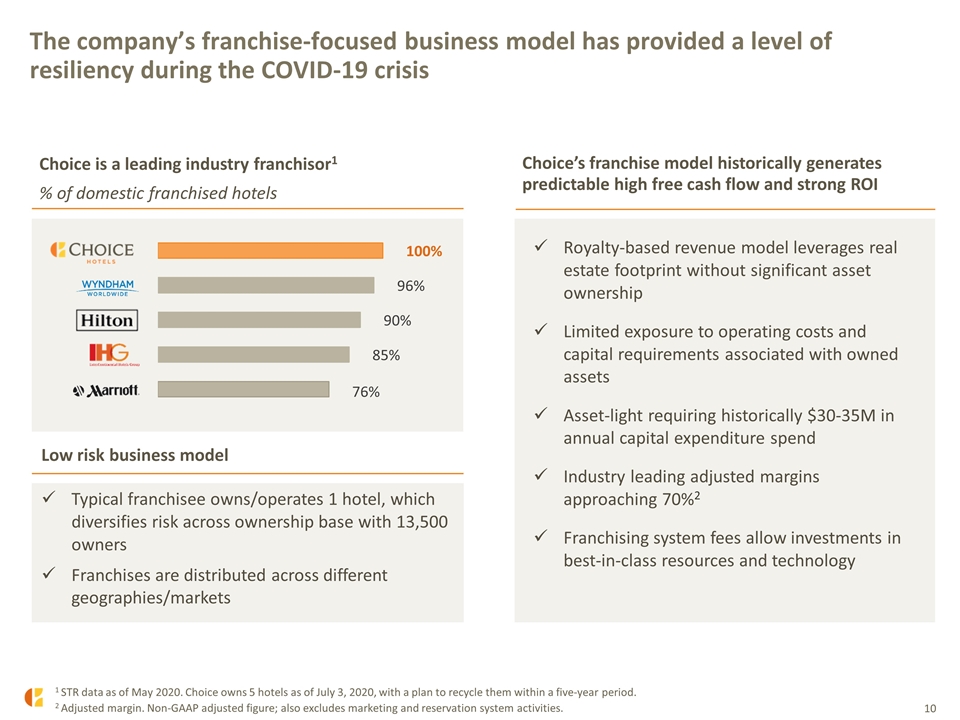

The company’s franchise-focused business model has provided a level of resiliency during the COVID-19 crisis Choice’s franchise model historically generates predictable high free cash flow and strong ROI Royalty-based revenue model leverages real estate footprint without significant asset ownership Limited exposure to operating costs and capital requirements associated with owned assets Asset-light requiring historically $30-35M in annual capital expenditure spend Industry leading adjusted margins approaching 70%2 Franchising system fees allow investments in best-in-class resources and technology Choice is a leading industry franchisor1 % of domestic franchised hotels Typical franchisee owns/operates 1 hotel, which diversifies risk across ownership base with 13,500 owners Franchises are distributed across different geographies/markets Low risk business model 1 STR data as of May 2020. Choice owns 5 hotels as of July 3, 2020, with a plan to recycle them within a five-year period. 2 Adjusted margin. Non-GAAP adjusted figure; also excludes marketing and reservation system activities.

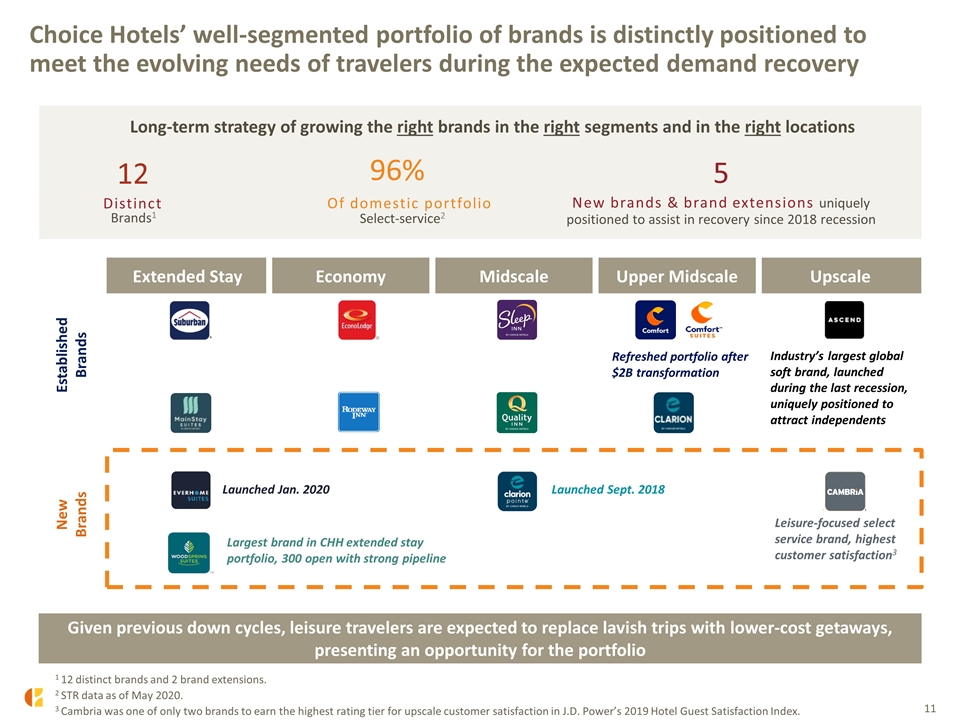

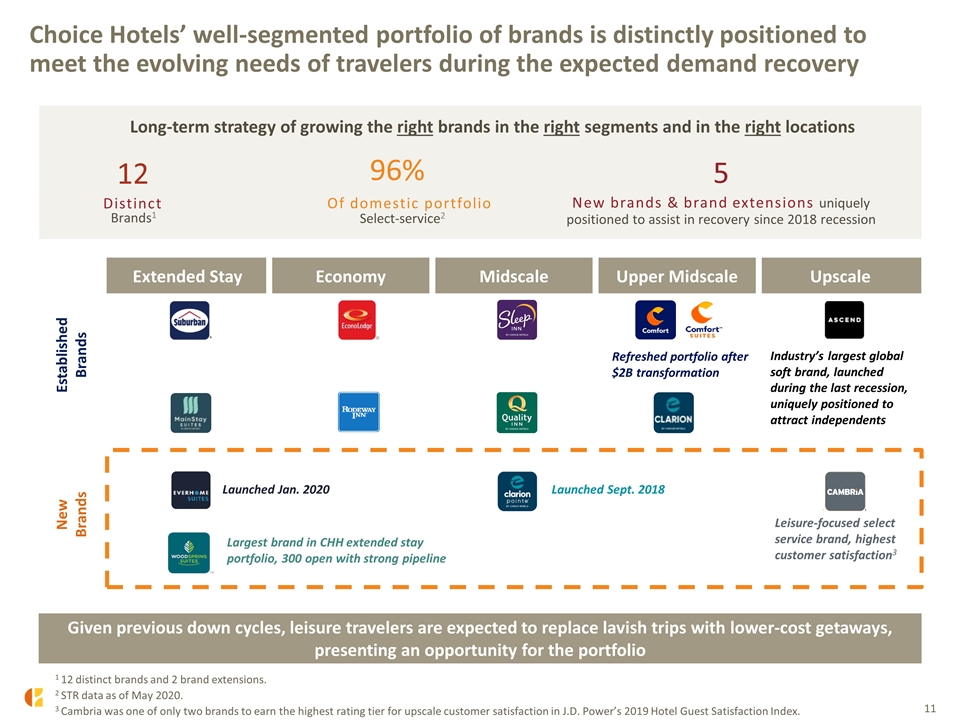

Choice Hotels’ well-segmented portfolio of brands is distinctly positioned to meet the evolving needs of travelers during the expected demand recovery Extended Stay Economy Midscale Upper Midscale Upscale Long-term strategy of growing the right brands in the right segments and in the right locations Given previous down cycles, leisure travelers are expected to replace lavish trips with lower-cost getaways, presenting an opportunity for the portfolio Refreshed portfolio after $2B transformation Industry’s largest global soft brand, launched during the last recession, uniquely positioned to attract independents Leisure-focused select service brand, highest customer satisfaction3 Largest brand in CHH extended stay portfolio, 300 open with strong pipeline 12 96% Select-service2 Brands1 New brands & brand extensions uniquely positioned to assist in recovery since 2018 recession 5 Of domestic portfolio Distinct 1 12 distinct brands and 2 brand extensions. 2 STR data as of May 2020. 3 Cambria was one of only two brands to earn the highest rating tier for upscale customer satisfaction in J.D. Power’s 2019 Hotel Guest Satisfaction Index. Established Brands New Brands Launched Jan. 2020 Launched Sept. 2018

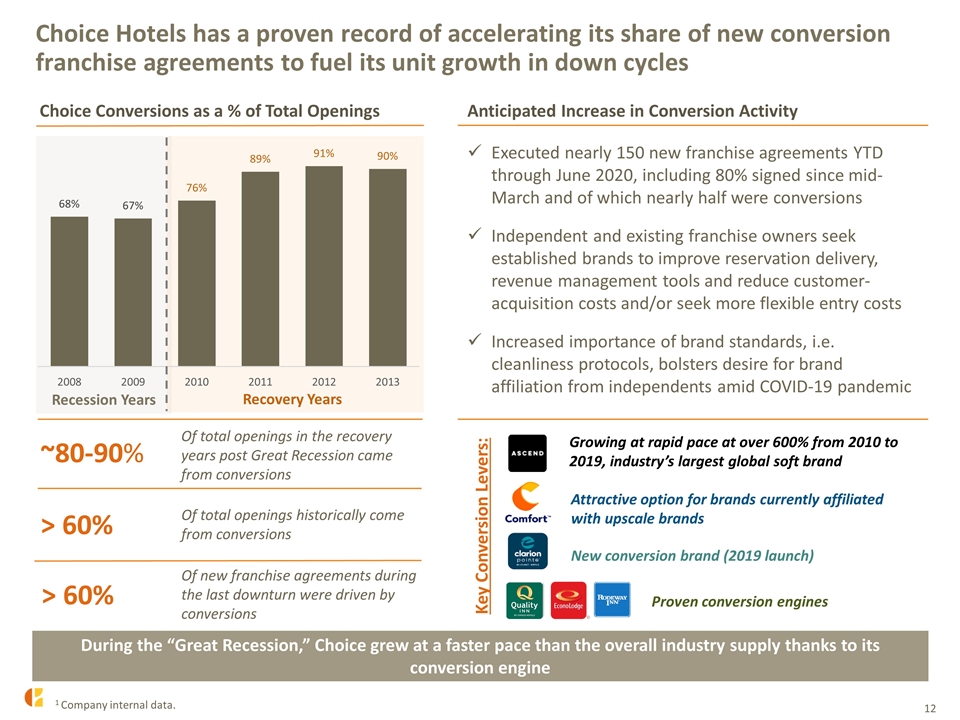

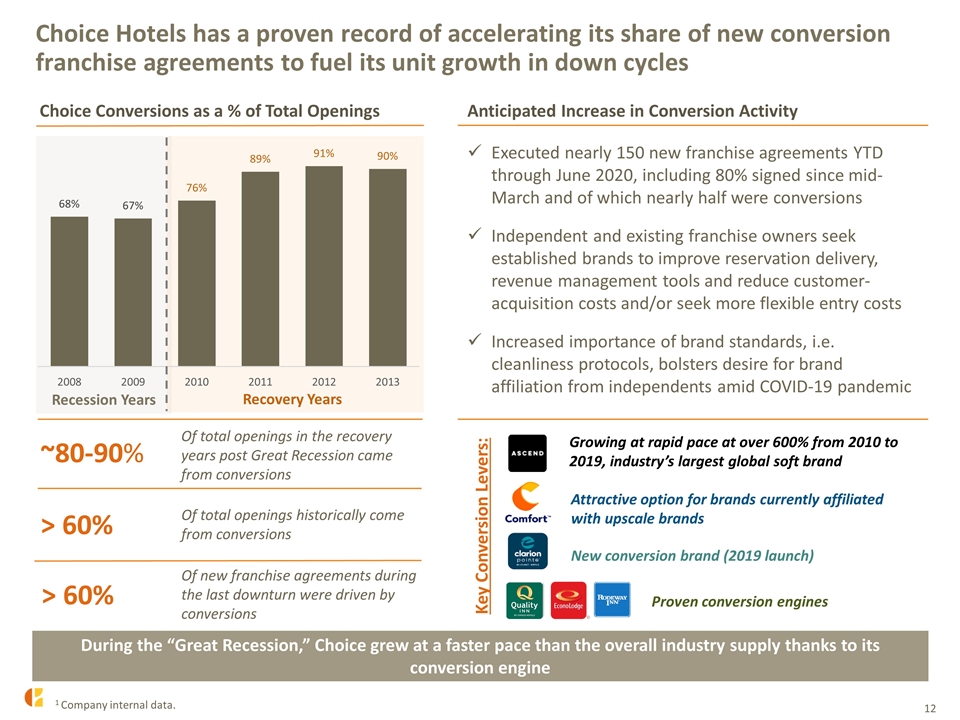

Recovery Years Recession Years Choice Hotels has a proven record of accelerating its share of new conversion franchise agreements to fuel its unit growth in down cycles Executed nearly 150 new franchise agreements YTD through June 2020, including 80% signed since mid-March and of which nearly half were conversions Independent and existing franchise owners seek established brands to improve reservation delivery, revenue management tools and reduce customer-acquisition costs and/or seek more flexible entry costs Increased importance of brand standards, i.e. cleanliness protocols, bolsters desire for brand affiliation from independents amid COVID-19 pandemic Growing at rapid pace at over 600% from 2010 to 2019, industry’s largest global soft brand During the “Great Recession,” Choice grew at a faster pace than the overall industry supply thanks to its conversion engine Of total openings historically come from conversions > 60% Choice Conversions as a % of Total Openings Anticipated Increase in Conversion Activity Key Conversion Levers: Proven conversion engines Attractive option for brands currently affiliated with upscale brands New conversion brand (2019 launch) ~80-90% Of total openings in the recovery years post Great Recession came from conversions Of new franchise agreements during the last downturn were driven by conversions > 60% 1 Company internal data.

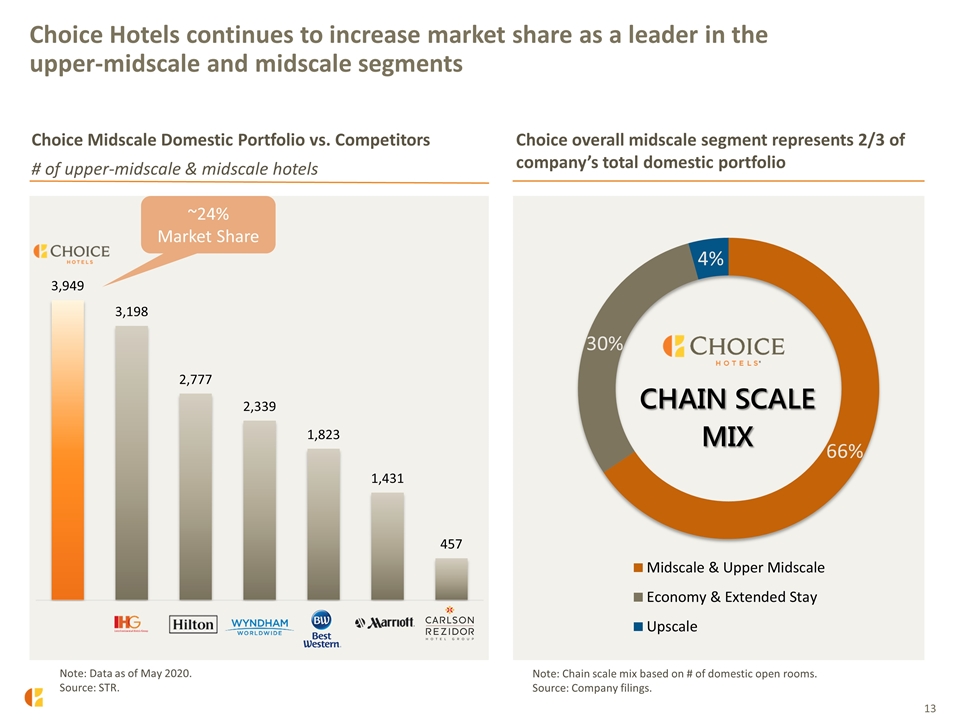

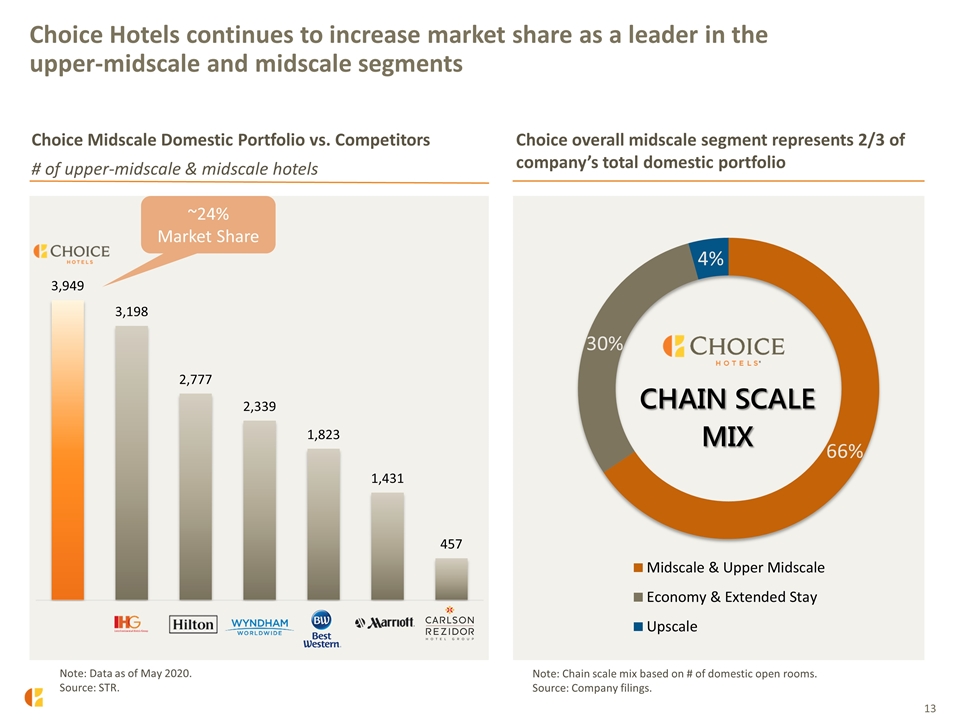

Choice Hotels continues to increase market share as a leader in the upper-midscale and midscale segments Note: Data as of May 2020. Source: STR. Choice Midscale Domestic Portfolio vs. Competitors # of upper-midscale & midscale hotels Choice overall midscale segment represents 2/3 of company’s total domestic portfolio ~24% Market Share Note: Chain scale mix based on # of domestic open rooms. Source: Company filings.

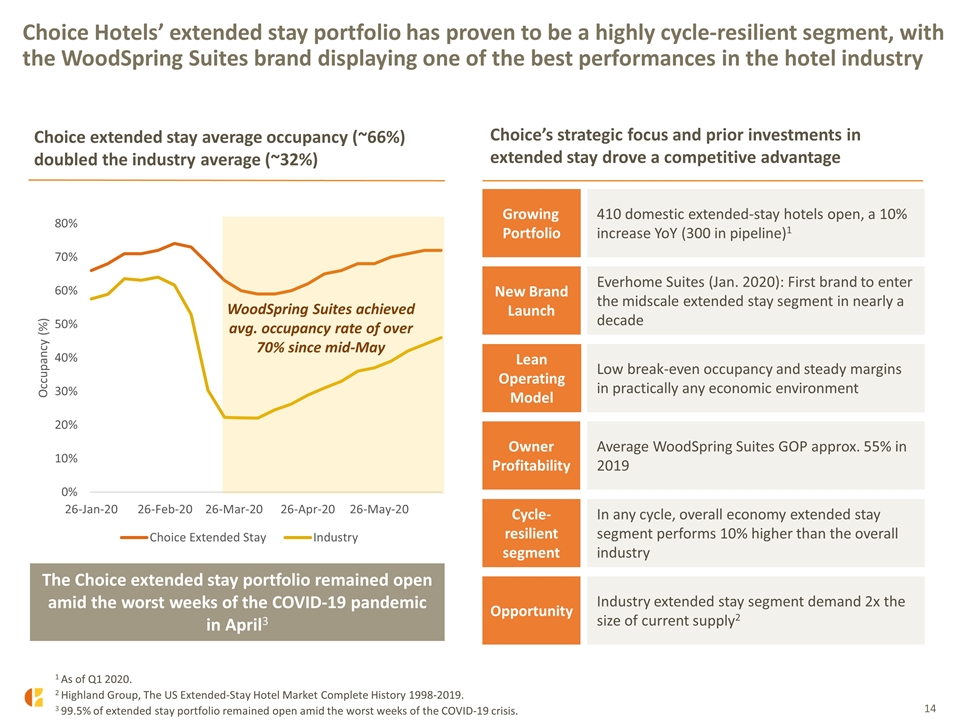

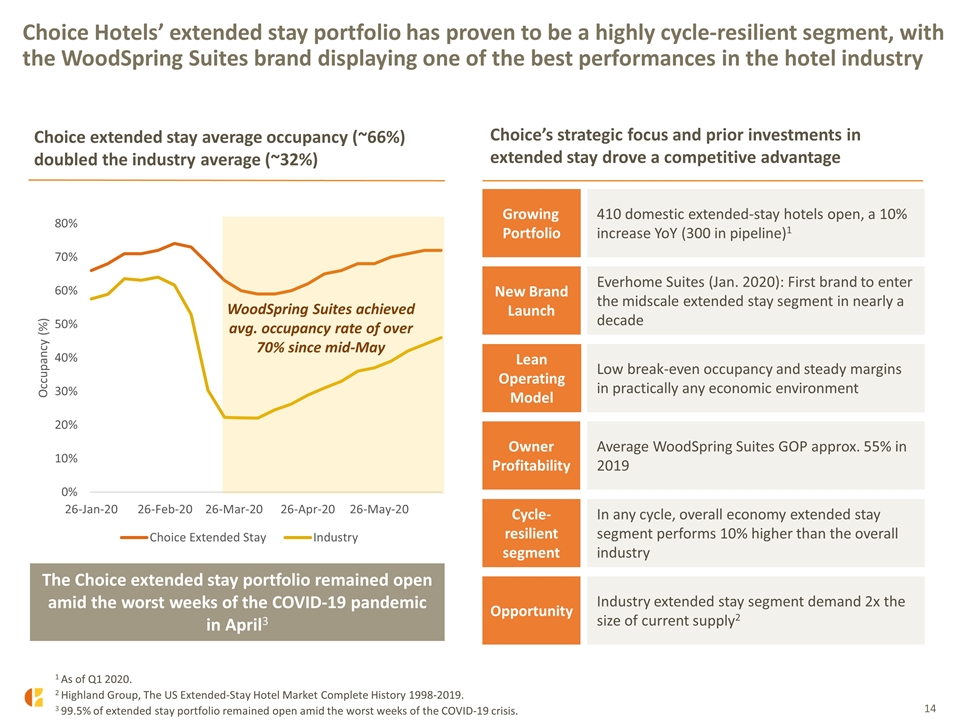

Choice Hotels’ extended stay portfolio has proven to be a highly cycle-resilient segment, with the WoodSpring Suites brand displaying one of the best performances in the hotel industry 410 domestic extended-stay hotels open, a 10% increase YoY (300 in pipeline)1 WoodSpring Suites achieved avg. occupancy rate of over 70% since mid-May The Choice extended stay portfolio remained open amid the worst weeks of the COVID-19 pandemic in April3 1 As of Q1 2020. 2 Highland Group, The US Extended-Stay Hotel Market Complete History 1998-2019. 3 99.5% of extended stay portfolio remained open amid the worst weeks of the COVID-19 crisis. Choice’s strategic focus and prior investments in extended stay drove a competitive advantage Choice extended stay average occupancy (~66%) doubled the industry average (~32%) Growing Portfolio New Brand Launch Lean Operating Model Opportunity Everhome Suites (Jan. 2020): First brand to enter the midscale extended stay segment in nearly a decade Low break-even occupancy and steady margins in practically any economic environment Industry extended stay segment demand 2x the size of current supply2 Cycle-resilient segment In any cycle, overall economy extended stay segment performs 10% higher than the overall industry Owner Profitability Average WoodSpring Suites GOP approx. 55% in 2019

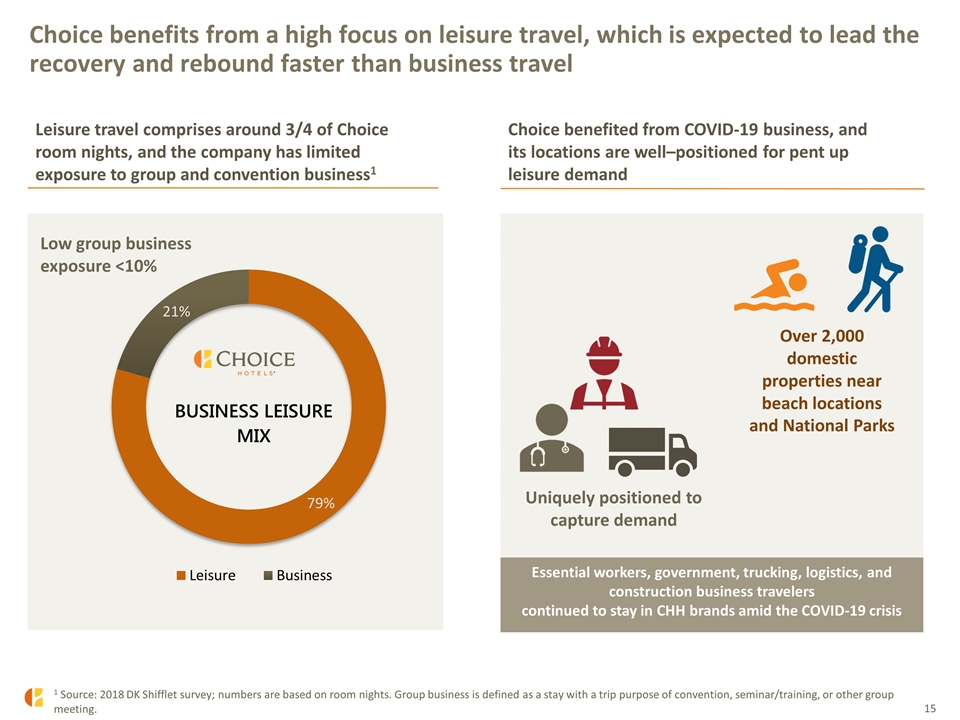

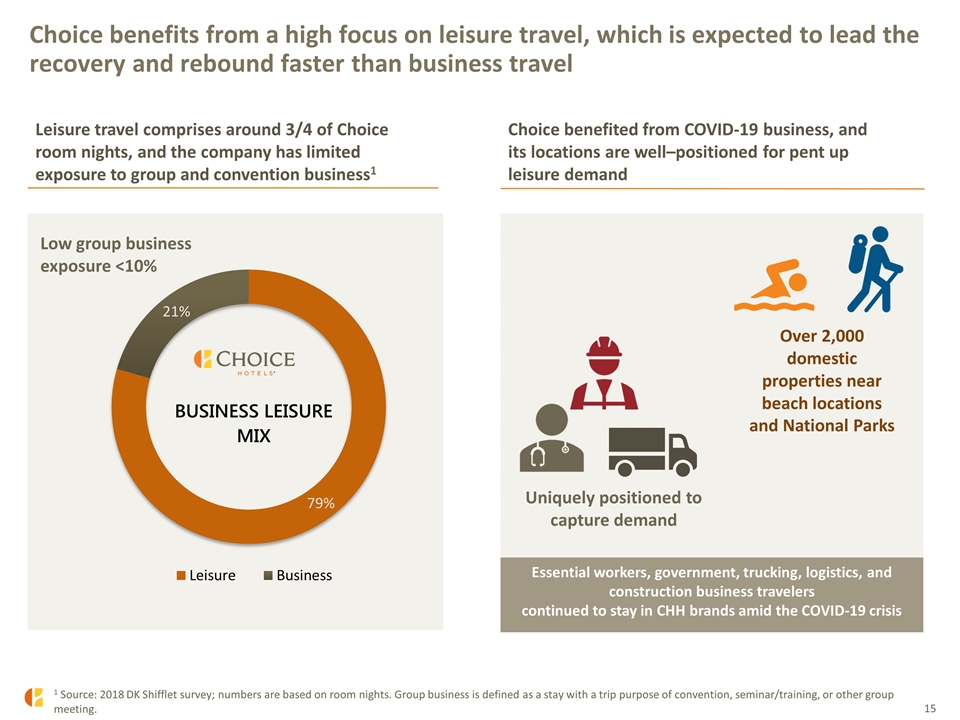

Choice benefits from a high focus on leisure travel, which is expected to lead the recovery and rebound faster than business travel Low group business exposure <10% Over 2,000 domestic properties near beach locations and National Parks Uniquely positioned to capture demand Leisure travel comprises around 3/4 of Choice room nights, and the company has limited exposure to group and convention business1 Choice benefited from COVID-19 business, and its locations are well–positioned for pent up leisure demand Essential workers, government, trucking, logistics, and construction business travelers continued to stay in CHH brands amid the COVID-19 crisis 1 Source: 2018 DK Shifflet survey; numbers are based on room nights. Group business is defined as a stay with a trip purpose of convention, seminar/training, or other group meeting.

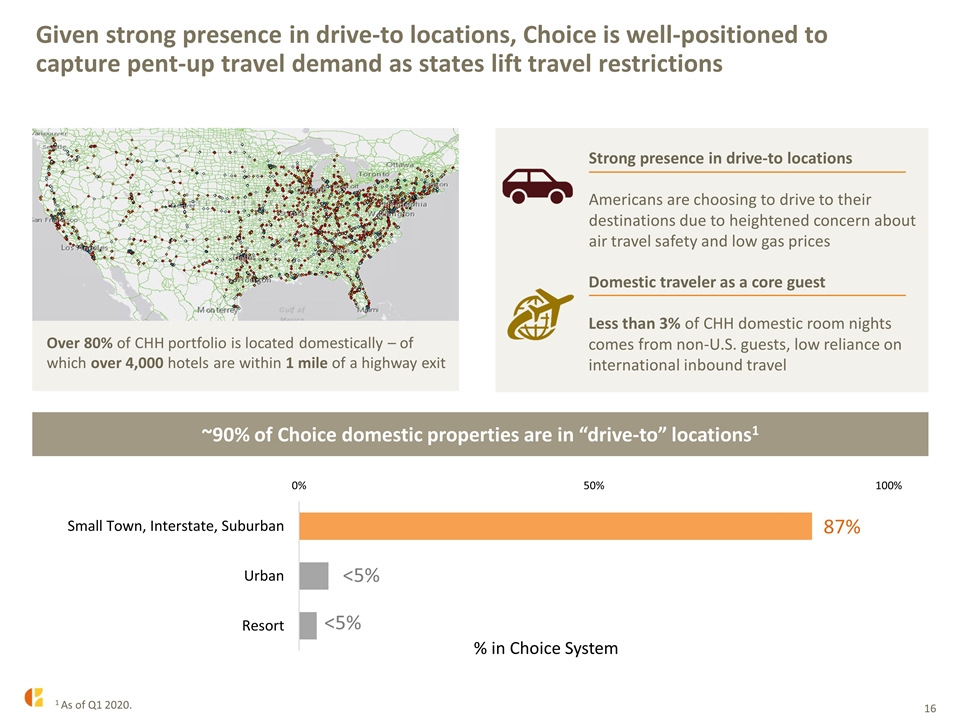

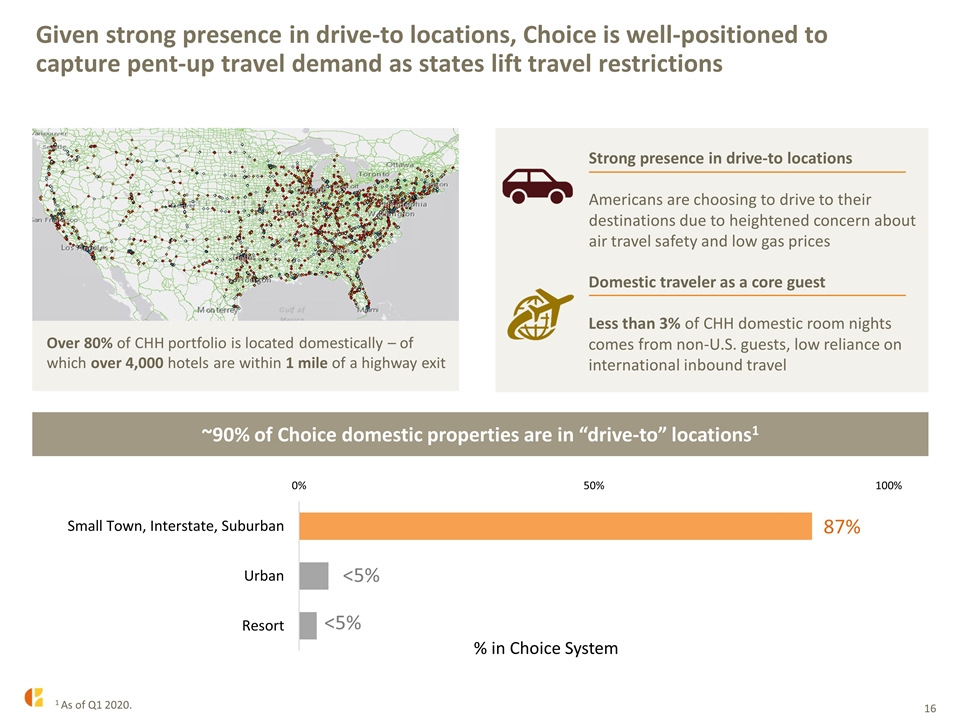

Given strong presence in drive-to locations, Choice is well-positioned to capture pent-up travel demand as states lift travel restrictions ~90% of Choice domestic properties are in “drive-to” locations1 Strong presence in drive-to locations Americans are choosing to drive to their destinations due to heightened concern about air travel safety and low gas prices Domestic traveler as a core guest Less than 3% of CHH domestic room nights comes from non-U.S. guests, low reliance on international inbound travel 87% 1 As of Q1 2020. Over 80% of CHH portfolio is located domestically – of which over 4,000 hotels are within 1 mile of a highway exit <5% <5%

Mitigating the Impacts of COVID-19 Clarion Pointe, Rochester, NY

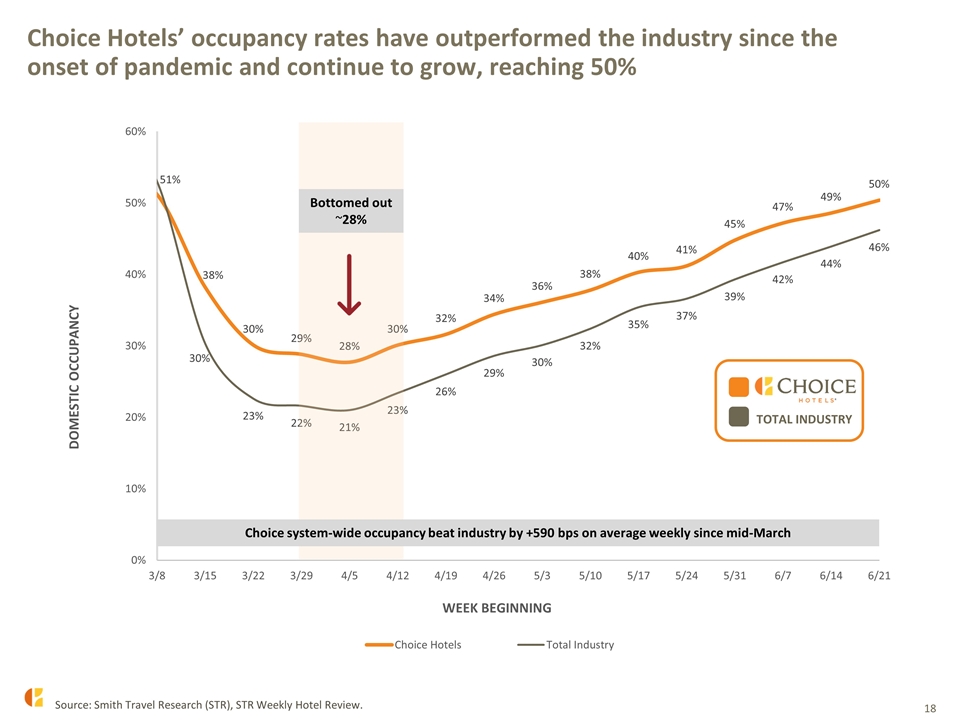

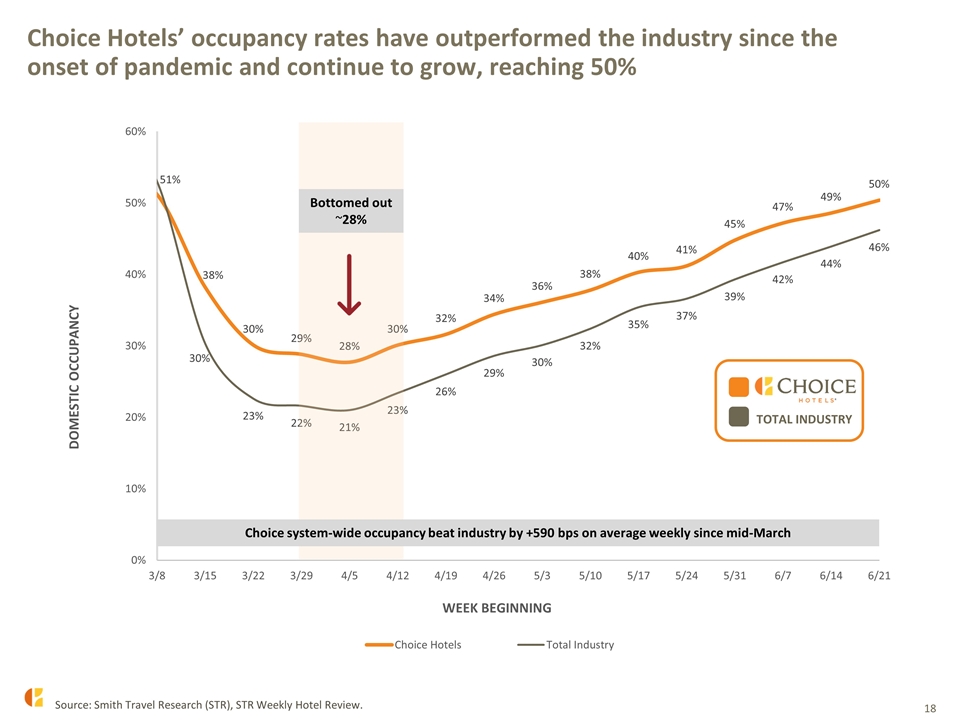

Choice Hotels’ occupancy rates have outperformed the industry since the onset of pandemic and continue to grow, reaching 50% Bottomed out ~28% Choice system-wide occupancy beat industry by +590 bps on average weekly since mid-March TOTAL INDUSTRY Source: Smith Travel Research (STR), STR Weekly Hotel Review.

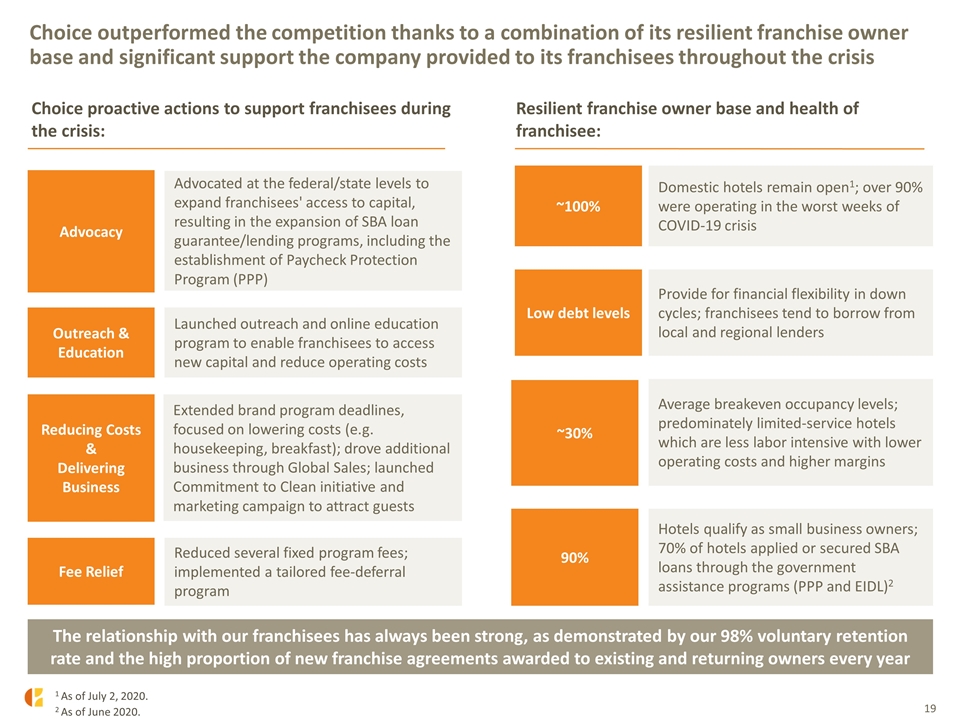

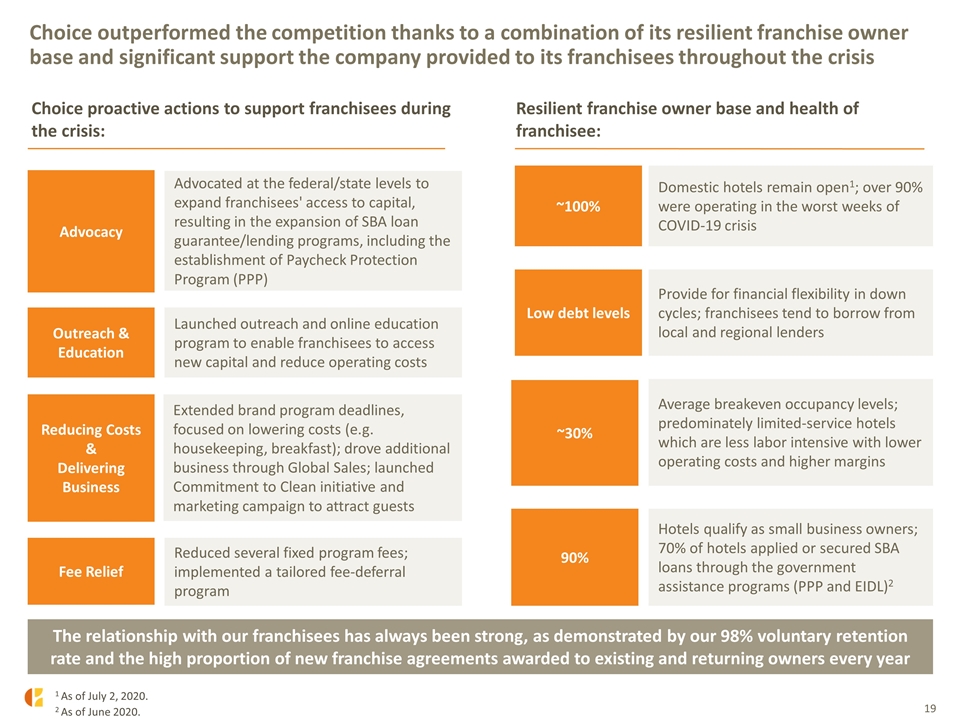

Choice outperformed the competition thanks to a combination of its resilient franchise owner base and significant support the company provided to its franchisees throughout the crisis Choice proactive actions to support franchisees during the crisis: Resilient franchise owner base and health of franchisee: Advocacy Outreach & Education Reducing Costs & Delivering Business Extended brand program deadlines, focused on lowering costs (e.g. housekeeping, breakfast); drove additional business through Global Sales; launched Commitment to Clean initiative and marketing campaign to attract guests Launched outreach and online education program to enable franchisees to access new capital and reduce operating costs Advocated at the federal/state levels to expand franchisees' access to capital, resulting in the expansion of SBA loan guarantee/lending programs, including the establishment of Paycheck Protection Program (PPP) The relationship with our franchisees has always been strong, as demonstrated by our 98% voluntary retention rate and the high proportion of new franchise agreements awarded to existing and returning owners every year ~30% Average breakeven occupancy levels; predominately limited-service hotels which are less labor intensive with lower operating costs and higher margins Low debt levels Provide for financial flexibility in down cycles; franchisees tend to borrow from local and regional lenders ~100% Domestic hotels remain open1; over 90% were operating in the worst weeks of COVID-19 crisis 90% Hotels qualify as small business owners; 70% of hotels applied or secured SBA loans through the government assistance programs (PPP and EIDL)2 1 As of July 2, 2020. 2 As of June 2020. Fee Relief Reduced several fixed program fees; implemented a tailored fee-deferral program

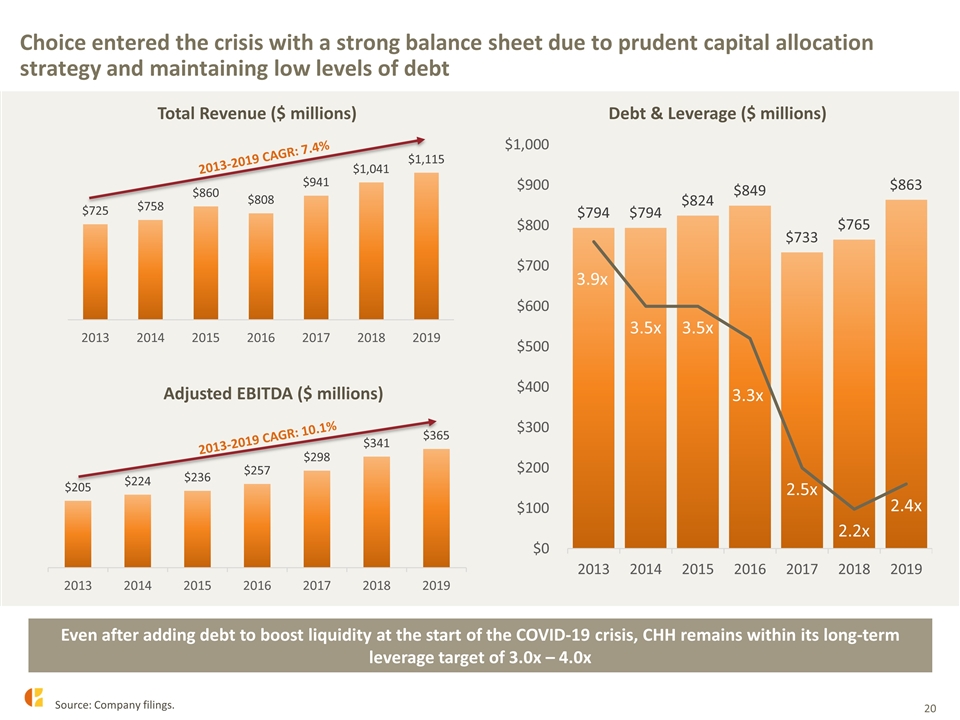

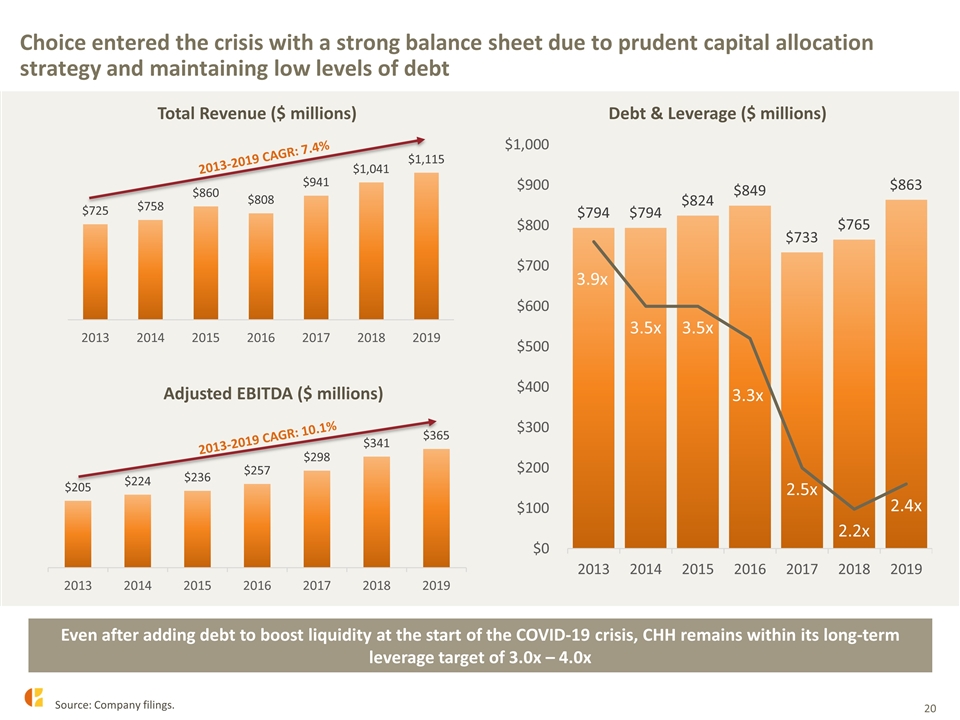

Choice entered the crisis with a strong balance sheet due to prudent capital allocation strategy and maintaining low levels of debt Even after adding debt to boost liquidity at the start of the COVID-19 crisis, CHH remains within its long-term leverage target of 3.0x – 4.0x 2013-2019 CAGR: 10.1% 2013-2019 CAGR: 7.4% Source: Company filings.

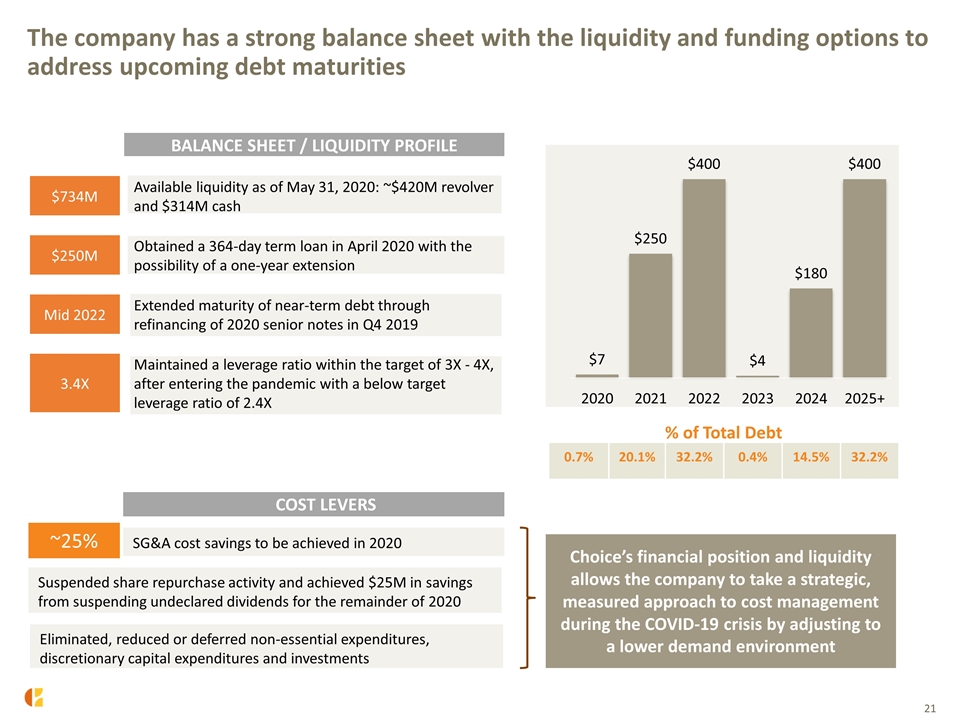

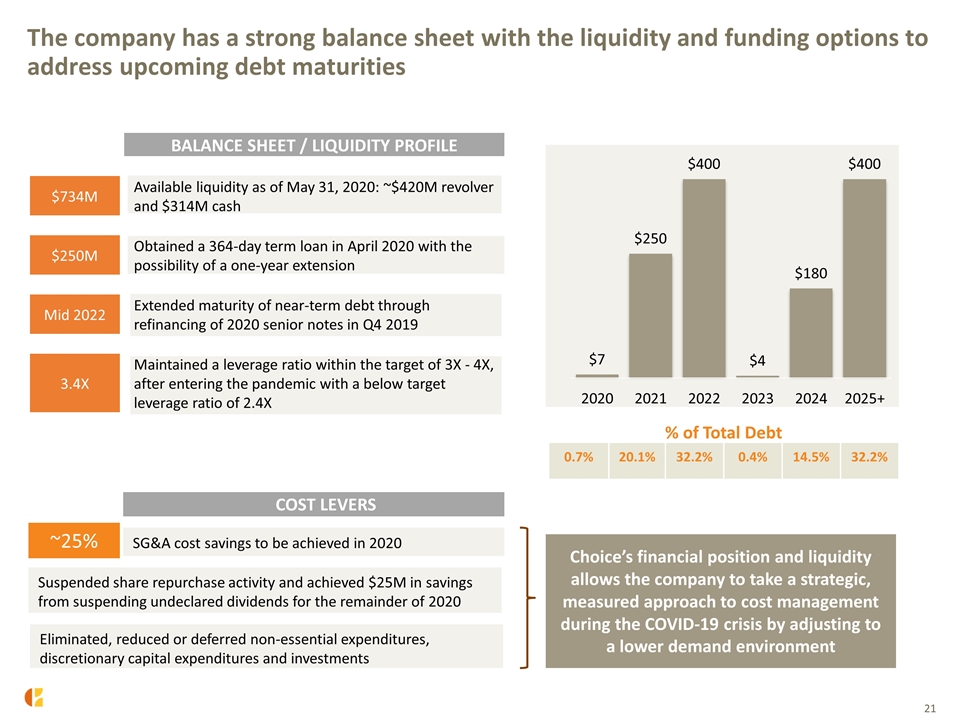

The company has a strong balance sheet with the liquidity and funding options to address upcoming debt maturities % of Total Debt BALANCE SHEET / LIQUIDITY PROFILE $734M Available liquidity as of May 31, 2020: ~$420M revolver and $314M cash $250M Obtained a 364-day term loan in April 2020 with the possibility of a one-year extension Mid 2022 Extended maturity of near-term debt through refinancing of 2020 senior notes in Q4 2019 3.4X Maintained a leverage ratio within the target of 3X - 4X, after entering the pandemic with a below target leverage ratio of 2.4X 0.7% 20.1% 32.2% 0.4% 14.5% 32.2% COST LEVERS SG&A cost savings to be achieved in 2020 Suspended share repurchase activity and achieved $25M in savings from suspending undeclared dividends for the remainder of 2020 Eliminated, reduced or deferred non-essential expenditures, discretionary capital expenditures and investments ~25% Choice’s financial position and liquidity allows the company to take a strategic, measured approach to cost management during the COVID-19 crisis by adjusting to a lower demand environment

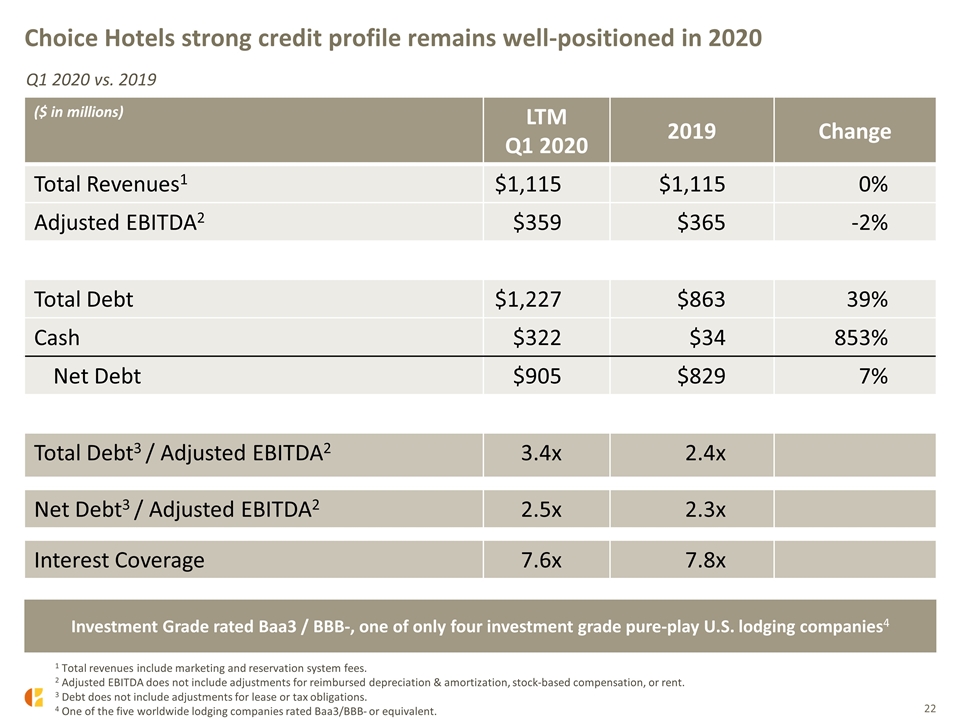

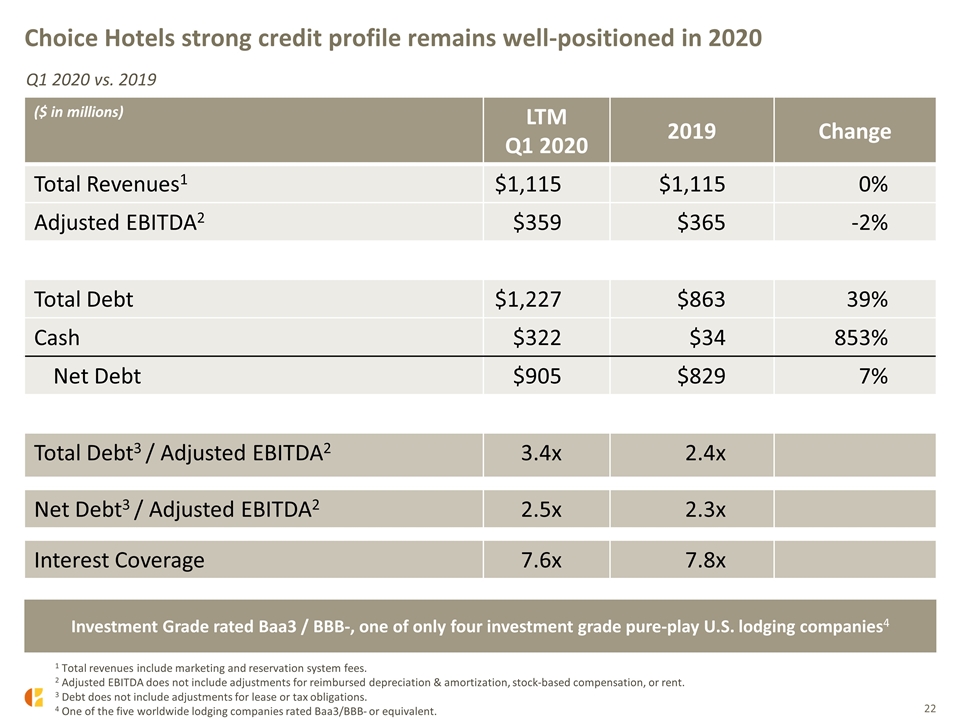

Choice Hotels strong credit profile remains well-positioned in 2020 ($ in millions) LTM Q1 2020 2019 Change Total Revenues1 $1,115 $1,115 0% Adjusted EBITDA2 $359 $365 -2% Total Debt $1,227 $863 39% Cash $322 $34 853% Net Debt $905 $829 7% Total Debt3 / Adjusted EBITDA2 3.4x 2.4x Net Debt3 / Adjusted EBITDA2 2.5x 2.3x Interest Coverage 7.6x 7.8x 1 Total revenues include marketing and reservation system fees. 2 Adjusted EBITDA does not include adjustments for reimbursed depreciation & amortization, stock-based compensation, or rent. 3 Debt does not include adjustments for lease or tax obligations. 4 One of the five worldwide lodging companies rated Baa3/BBB- or equivalent. Investment Grade rated Baa3 / BBB-, one of only four investment grade pure-play U.S. lodging companies4 Q1 2020 vs. 2019

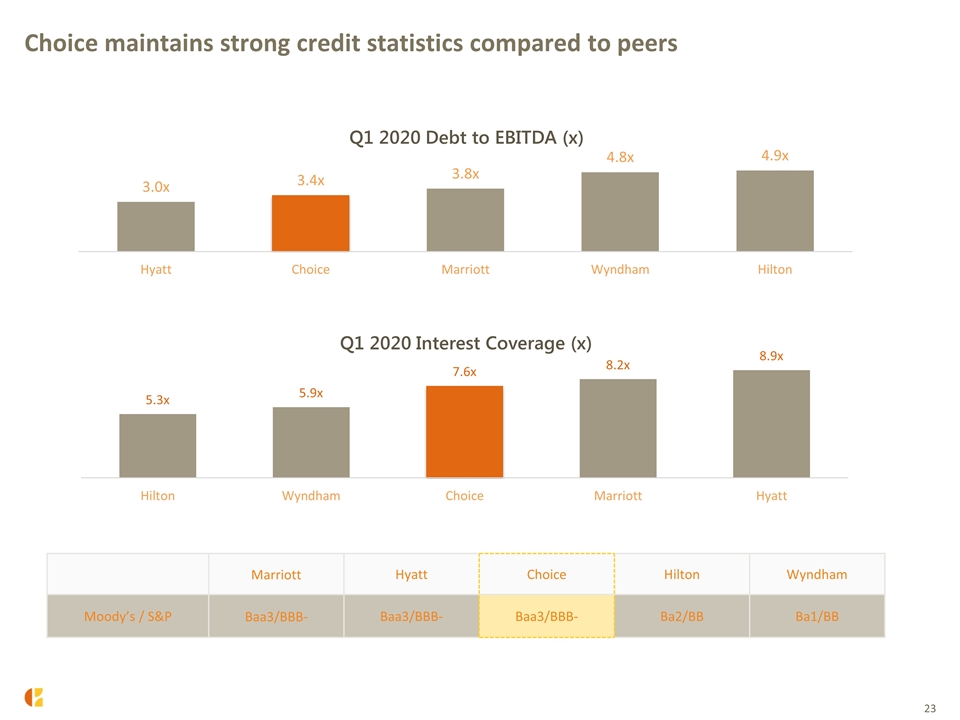

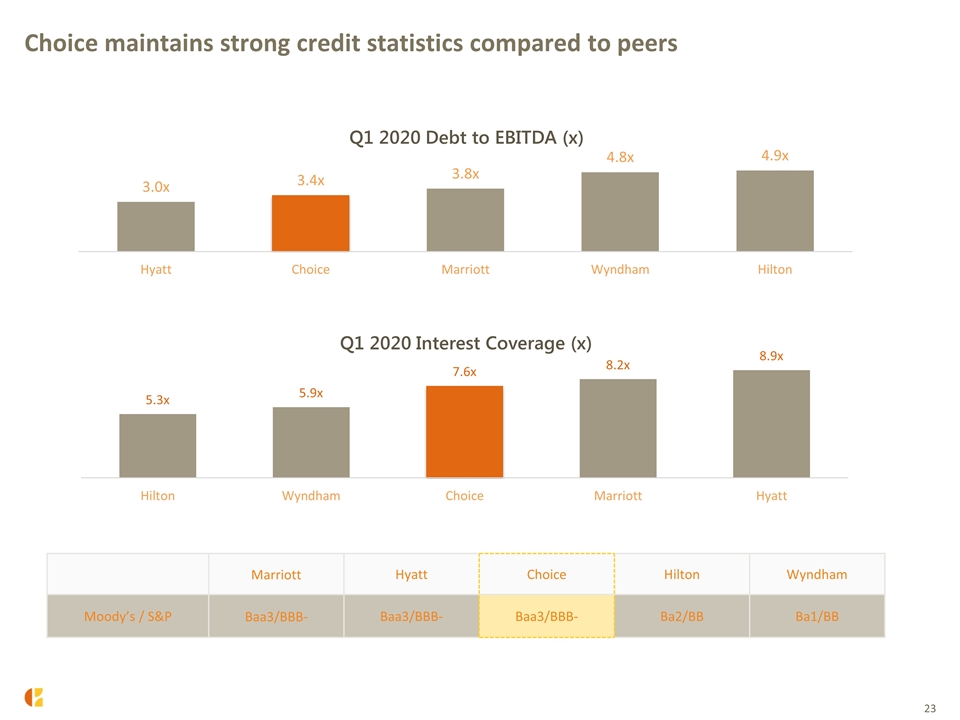

Choice maintains strong credit statistics compared to peers Marriott Hyatt Choice Hilton Wyndham Moody’s / S&P Baa3/BBB- Baa3/BBB- Baa3/BBB- Ba2/BB Ba1/BB

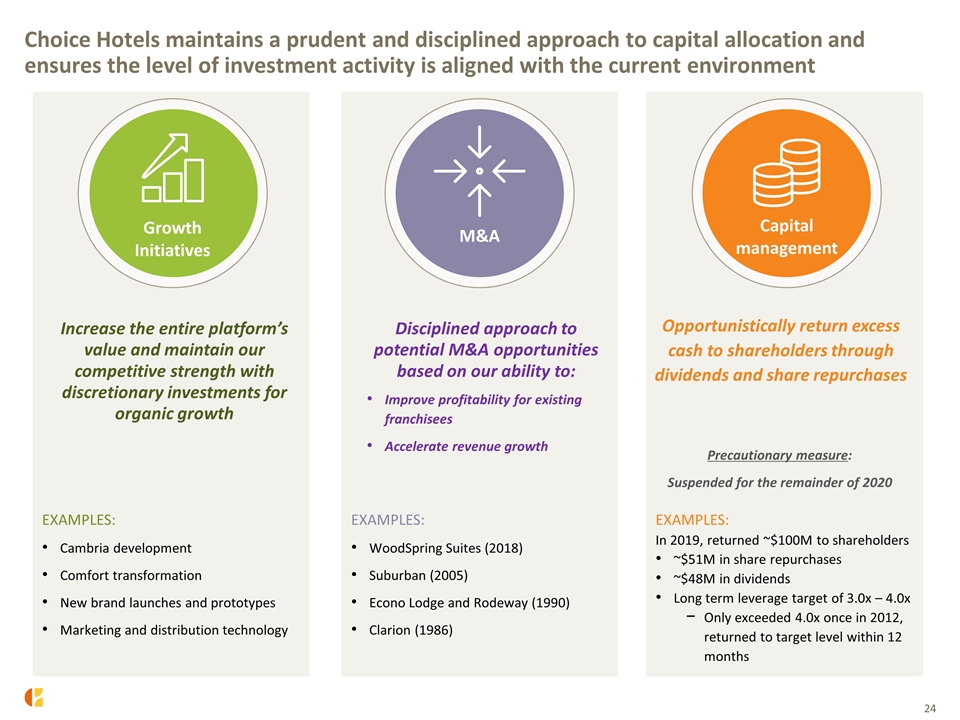

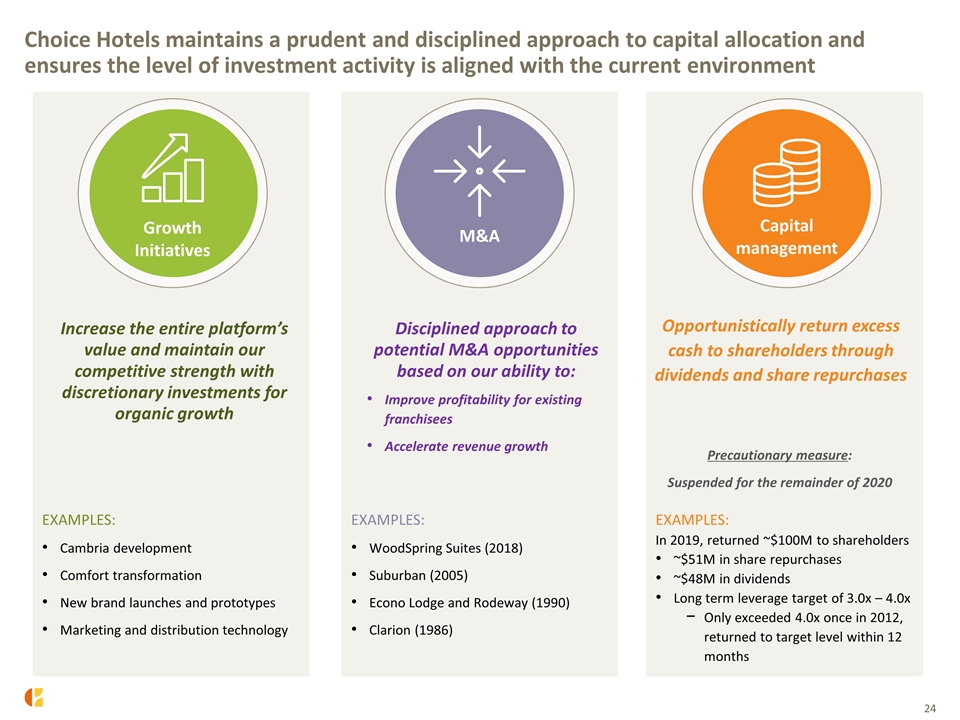

Choice Hotels maintains a prudent and disciplined approach to capital allocation and ensures the level of investment activity is aligned with the current environment Growth Initiatives M&A Capital management Increase the entire platform’s value and maintain our competitive strength with discretionary investments for organic growth Disciplined approach to potential M&A opportunities based on our ability to: Improve profitability for existing franchisees Accelerate revenue growth EXAMPLES: Cambria development Comfort transformation New brand launches and prototypes Marketing and distribution technology Precautionary measure: Suspended for the remainder of 2020 EXAMPLES: In 2019, returned ~$100M to shareholders ~$51M in share repurchases ~$48M in dividends Long term leverage target of 3.0x – 4.0x Only exceeded 4.0x once in 2012, returned to target level within 12 months EXAMPLES: WoodSpring Suites (2018) Suburban (2005) Econo Lodge and Rodeway (1990) Clarion (1986) Opportunistically return excess cash to shareholders through dividends and share repurchases

Asset-light franchising model generates predictable high free cash flow and strong returns on investment 2 Premium brand recognition and North America’s midscale/upper midscale segment leader Investment thesis Recurring fee-for-service business model produces stable cash flows, resilient through cycles, with multiple levers to drive future growth and minimize volatility driven by future business cycles Disciplined and experienced management team focused on fueling long-term growth Conservative balance sheet, record of financial discipline, and significant liquidity 1 3 4 5

Appendix Hotel Petaluma, Ascend, CA

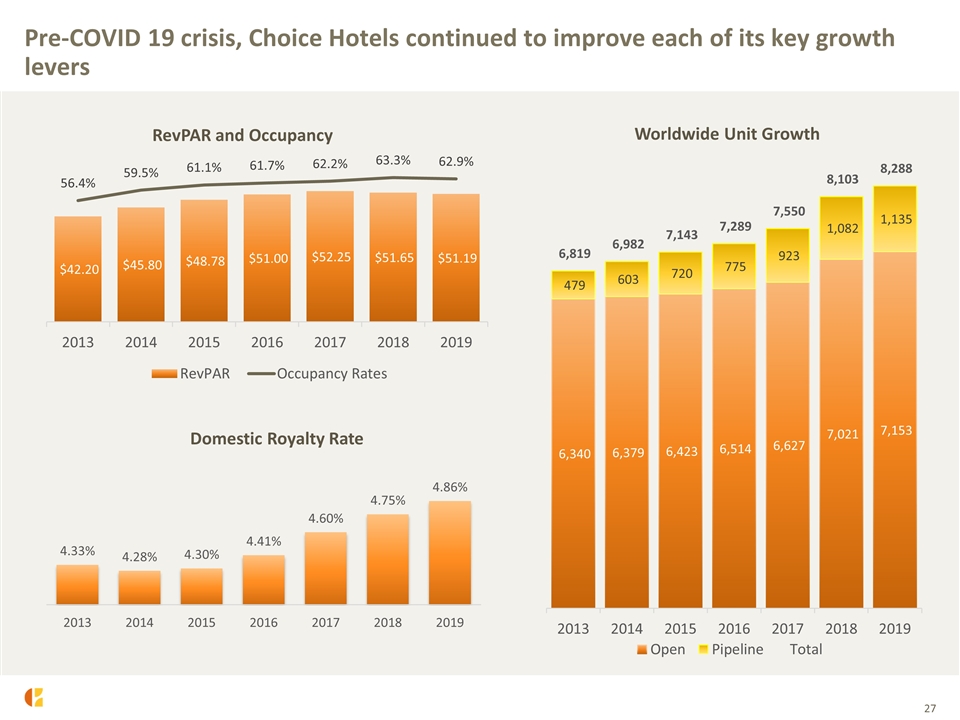

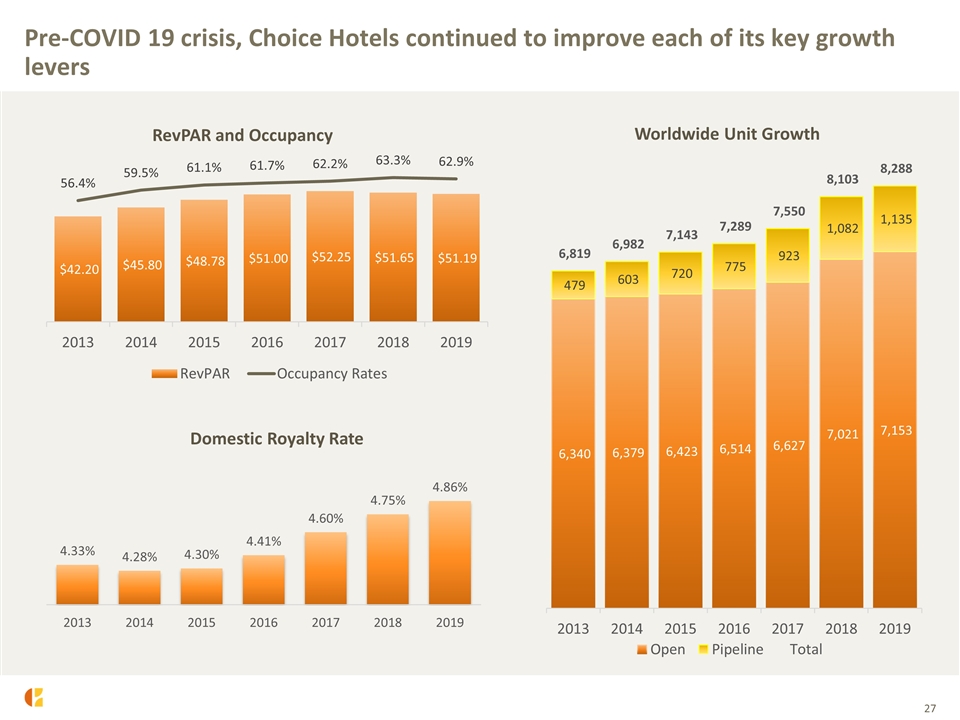

Pre-COVID 19 crisis, Choice Hotels continued to improve each of its key growth levers Domestic Royalty Rate

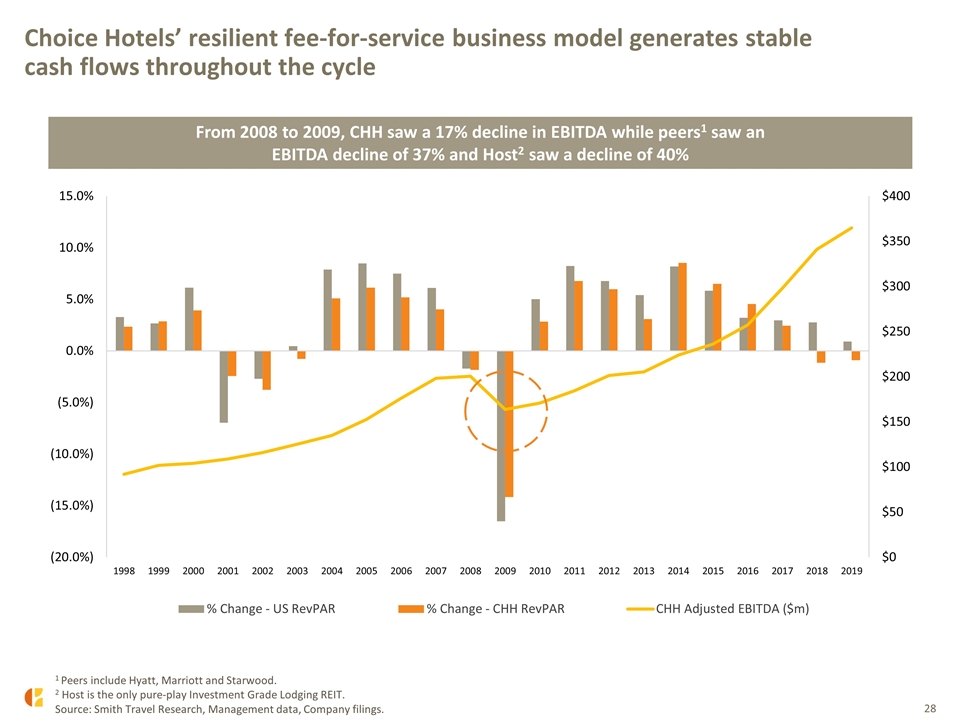

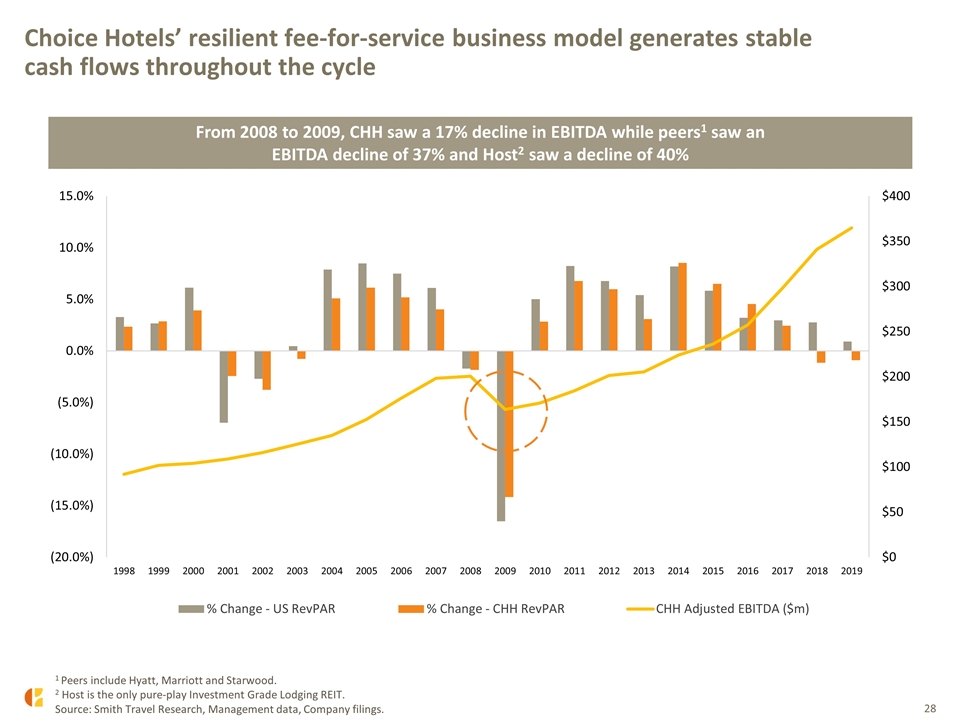

Choice Hotels’ resilient fee-for-service business model generates stable cash flows throughout the cycle 1 Peers include Hyatt, Marriott and Starwood. 2 Host is the only pure-play Investment Grade Lodging REIT. Source: Smith Travel Research, Management data, Company filings. From 2008 to 2009, CHH saw a 17% decline in EBITDA while peers1 saw an EBITDA decline of 37% and Host2 saw a decline of 40%

Reconciliation of Non-GAAP Measures *Figures are calculated using guidelines from the ASC 606 Revenue Recognition Standard.

Reconciliation of Non-GAAP Measures *Figures are calculated using guidelines from the ASC 606 Revenue Recognition Standard. ADJUSTED EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND AMORTIZATION ("EBITDA") ($millions) 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2011 2012 2013 2014 2015 2016 2017 * 2018 * 2019 * LTMQ1 2020 * 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Net income (loss) $55.3 $57.155000000000001 $42.445 $14.3 $60.8 $71.900000000000006 $74.3 $87.6 $112.8 $111.3 $100.2 $98.3 $111.1 $121.3 $113.4 $121.5 $128 $139.4 $122.3 $216.4 $222.9 $248.3 $60.8 $71.900000000000006 $74.3 $87.6 $112.8 $111.3 $100.2 $98.3 $107.4 $111.1 $121.6 Income taxes 34.299999999999997 37.316000000000003 27.137 31.1 35 40.5 40.200000000000003 43.2 42.5 62.6 57.1 52.4 47.9 48.2 45.3 52.3 56 60.6 126.9 56.9 47.1 15.6 35 40.5 40.200000000000003 43.2 42.5 62.6 57.1 52.4 50.8 47.9 48.2 Interest expense 19.100000000000001 19.387 18.489999999999998 15.445 13.1 11.6 11.6 15.3 14.1 14.3 10.9 4.4000000000000004 12.9 27.2 42.5 41.5 42.8 44.4 45 45.9 46.8 47 13.1 11.6 11.6 15.3 14.1 14.3 10.9 4.4000000000000004 6.7 12.9 27.2 Interest income -14.1 -20.091999999999999 -15.534000000000001 -4.3289999999999997 0 0 0 0 0 0 0 -0.3 -1.3 -1.5 -2.5 -1.8 -1.6 -3.5 -5.9 -7 -10 -9.6999999999999993 0 0 0 0 0 0 0 -0.3 -0.5 -1.3 -1.5 Other (gains) losses -2.4 0.1 7.8180000000000005 0.60799999999999998 -4.3 -9.5 -0.4 -1.5 -1.7 -1.8 7.8 -1.2999999999999998 2.4 -2 -1.8 0.4 -0.8 -1.5 -3.2 1.4 -4.9000000000000004 1.6 -4.3 -9.5 -0.4 -1.5 -1.7 -1.8 7.8 -5.6 -2.4 2.4 -1.5 Equity in net (income) loss of affiliates 0 0 12.071 16.436 0.1 -0.6 -0.7 -0.8 -1.1000000000000001 -1.2 -1.4 -1.1000000000000001 -0.3 -0.2 -0.6 0.7 0.9 -0.5 4.5 5.3 9.5760000000000005 9.4 0.1 -0.6 -0.7 -0.8 -1.1000000000000001 -1.2 -1.4 -1.1000000000000001 -1.2 -0.3 -0.2 Depreciation and amortization 6.8 8.0229999999999997 11.622999999999999 12.452 11.3 11.2 9.9 9.1 9.6999999999999993 8.6 8.1999999999999993 8.3000000000000007 7.5 7.7 9.1 9.4 11.5 11.7 6.7 14.3 18.8 21.7 11.3 11.2 9.9 9.1 9.6999999999999993 8.6 8.1999999999999993 8.3000000000000007 8.3000000000000007 7.5 7.7 Gain (loss) on sale & impairment of assets, net 0 0 0 22.713000000000001 0 0 0 0 0 0 7.5549999999999997 0 0 0 0 0 0 -0.4 -1.2 7 14.9 4.5999999999999996 0 0 0 0 0 0 0 0 0 0 0 Mark to market adjustments on non-qualified retirement plan investments 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 -0.7 1.5 3.2 -1.3 4.798 -1.7 0 0 0 0 0 0 0 0 0 0 0 Marketing and reservation system reimbursable surplus (deficit) 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 -20.2 -9.4 1.7 12 0 0 0 0 0 0 0 0 0 0 0 Franchise agreement acquisition costs amortization 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 4.0999999999999996 5.0999999999999996 4.5 4.5999999999999996 0 0 0 0 0 0 0 0 0 0 0 Acceleration of executive succession plan & executive termination benefits 0 0 0 0 0 0 0 0 0 0 6.6050000000000004 1.5 0 0 0 0 0 2.2000000000000002 12 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Acquisition related transition and transaction costs 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 3.3 4 6.9 0 0 0 0 0 0 0 0 0 0 0 0 0 Other non-recurring charges -7.2 0 0 0 0 0 0 0 0 0 0 1.3 0 0.5 0 0 0 0 0 0 8.6999999999999993 5.2 0 0 0 0 0 0 0 0 0 0 0 Adjusted EBITDA $91.799999999999983 $101.889 $104.04999999999998 $108.72499999999999 $115.99999999999999 $125.10000000000001 $134.89999999999998 $152.9 $176.3 $193.8 $196.96 $163.5 $180.2 $201.2 $205.39999999999998 $224 $236.10000000000002 $257.2 $298.20000000000005 $341.5 $364.87400000000002 $358.60000000000008 $115.99999999999999 $125.10000000000001 $134.89999999999998 $152.9 $176.3 $193.8 $182.8 $156.4 $169.1 $180.2 $201.5 358.6 $0