Exhibit 99.1 CHOICE AND WYNDHAM CREATE A PREMIER HOSPITALITY COMPANY SERVING THE VALUE CONSCIOUS TRAVELER December 12, 2023

Forward-Looking Statements Information set forth herein includes “forward-looking statements”. Certain, but not necessarily all, of such forward-looking statements can be identified by the use of forward- looking terminology, such as “expect,” “estimate,” “believe,” “anticipate,” “should,” “will,” “forecast,” “plan,” “project,” “assume,” or similar words of futurity. All statements other than historical facts are forward-looking statements. These forward-looking statements are based on management’s current beliefs, assumptions and expectations regarding future events, which in turn are based on information currently available to management. Such statements include, but are not limited to, the ultimate outcome of any possible transaction between Choice and Wyndham (including the possibility that the parties will not agree to pursue a business combination transaction or that the terms of any definitive agreement will be materially different from those described herein); uncertainties as to whether Wyndham will cooperate with Choice regarding the proposed transaction; Choice’s ability to consummate the proposed transaction with Wyndham; the conditions to the completion of the proposed transaction, including the receipt of any required shareholder approvals and any required regulatory approvals; Choice’s ability to finance the proposed transaction with Wyndham; Choice’s indebtedness, including the substantial indebtedness Choice expects to incur in connection with the proposed transaction with Wyndham and the need to generate sufficient cash flows to service and repay such debt; the possibility that Choice may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all and to successfully integrate Wyndham’s operations with those of Choice, including the Choice loyalty program; the possibility that Choice may be unable to achieve the benefits of the proposed transaction for its franchisees, associates, investors and guests within the expected timeframes or at all, including that such integration may be more difficult, time-consuming or costly than expected; that operating costs and business disruption (without limitation, difficulties in maintaining relationships with associates, guests or franchisees) may be greater than expected following the proposed transaction or the public announcement of the proposed transaction; and that the retention of certain key employees may be difficult. Such statements may relate to projections of Choice’s revenue, expenses, adjusted EBITDA, earnings, debt levels, ability to repay outstanding indebtedness, payment of dividends, repurchases of common stock and other financial and operational measures, including occupancy and open hotels, revenue per available room, Choice’s ability to benefit from any rebound in travel demand, and Choice’s liquidity, among other matters. We caution you not to place undue reliance on any such forward-looking statements. Forward-looking statements do not guarantee future performance and involve known and unknown risks, uncertainties and other factors. These and other risk factors that may affect Choice’s operations are discussed in detail in the applicable company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and, as applicable, its or Wyndham’s Quarterly Reports on Form 10-Q. These forward-looking statements speak only as of the date of this presentation or as of the date to which they refer, and Choice assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. 2

Non-GAAP Financial Measurements and Other Definitions Choice evaluates its operations utilizing, among others, the others, to evaluate companies because it excludes certain and media advertising. Franchised and managed property performance metric adjusted EBITDA, which is a non-GAAP items that can vary widely across industries or among owners are required to reimburse Choice for any deficits financial measurement. This measure should not be companies within the same industry. For example, interest generated from these activities and Choice is required to considered as an alternative to any measure of performance expense can be dependent on a company’s capital structure, spend any surpluses generated in future periods. Since these or liquidity as promulgated under or authorized by GAAP, debt levels, and credit ratings, and share based activities will be managed to break-even over time, quarterly such as net income. Choice’s calculation of this compensation expense (benefit) is dependent on the design or annual surpluses and deficits have been excluded from measurement may be different from the calculations used of compensation plans in place and the usage of them. the measurements utilized to assess Choice’s operating by other companies, including Wyndham, and comparability Accordingly, the impact of interest expense and share based performance. may therefore be limited. We discuss management’s reasons compensation expense (benefit) on earnings can vary for reporting this non-GAAP measure and how it is significantly among companies. The tax positions of RevPAR: RevPAR is calculated by dividing hotel room calculated below. companies can also vary because of their differing abilities to revenue by the total number of room nights available to take advantage of tax benefits and because of the tax guests for a given period. Management considers RevPAR to policies of the jurisdictions in which they operate. As a result, In addition to the specific adjustments noted below with be a meaningful indicator of hotel performance and effective tax rates and provision for income taxes can vary respect to adjusted EBITDA, the non-GAAP measures therefore company royalty and system revenues as it considerably among companies. These measures also presented herein also exclude restructuring of Choice’s provides a metric correlated to the two key drivers of exclude depreciation and amortization because companies operations including employee severance benefit, income operations at a hotel: occupancy and ADR. Choice calculates utilize productive assets of different ages and use different taxes and legal costs, acquisition related due diligence, RevPAR based on information as reported by its franchisees. methods of both acquiring and depreciating productive transition and transaction costs, and gains/losses on To accurately reflect RevPAR, Choice may revise its prior assets or amortizing franchise-agreement acquisition costs. sale/disposal and impairment of assets primarily related to years’ operating statistics for the most current information These differences can result in considerable variability in the hotel ownership and development activities to allow for provided. RevPAR is also a useful indicator in measuring relative asset costs and estimated lives and, therefore, the period-over-period comparison of ongoing core operations performance over comparable periods. depreciation and amortization expense among companies. before the impact of these discrete and infrequent charges. Mark-to-market adjustments on non-qualified retirement- Pipeline: Pipeline is defined as hotels awaiting conversion, plan investments recorded in SG&A are excluded from Adjusted Earnings Before Interest, Taxes, Depreciation, and under construction or approved for development, and EBITDA, as Choice accounts for these investments in Amortization: Adjusted EBITDA reflects net income master development agreements committing owners to accordance with accounting for deferred-compensation excluding the impact of interest expense, interest income, future franchise development. arrangements when investments are held in a rabbi trust provision for income taxes, depreciation and amortization, and invested. Changes in the fair value of the investments franchise-agreement acquisition cost amortization, other This presentation includes Wall Street consensus projected are recognized as both compensation expense in SG&A and (gains) and losses, equity in net income (loss) of results for Choice and Wyndham for future periods. Choice is other gains and losses. As a result, the changes in the fair unconsolidated affiliates, mark-to-market adjustments on including these consensus estimates for informational value of the investments do not have a material impact on non-qualified retirement plan investments, share based purposes only, but is not affirming analyst projections or Choice’s net income. Surpluses and deficits generated from compensation expense (benefit) and surplus or deficits separately including guidance on these metrics. Other reimbursable revenues from franchised and managed generated by reimbursable revenue from franchised and information regarding Wyndham has been taken from, or properties are excluded, as Choice’s franchise and managed properties. We consider adjusted EBITDA and based upon, publicly available information. Choice does not management agreements require these revenues to be used adjusted EBITDA margins to be an indicator of operating take any responsibility for the accuracy or completeness of exclusively for expenses associated with providing franchise performance because it measures our ability to service debt, such information. To date, Choice has not had access to any and management services, such as central reservation and fund capital expenditures, and expand our business. We also non-public information of Wyndham. property-management systems, hotel employee and use these measures, as do analysts, lenders, investors, and operating costs, reservation delivery and national marketing 3

Additional Information This communication relates to a proposal that Choice has made for a business combination transaction with Wyndham and the exchange offer which Choice, through WH Acquisition Corp., its wholly owned subsidiary, has made to Wyndham stockholders. The exchange offer is being made pursuant to a tender offer statement on Schedule TO (including the offer to exchange, the letter of election and transmittal and other related offer documents) and a registration statement on Form S-4 filed by Choice on December 12, 2023. These materials, as may be amended from time to time, contain important information, including the terms and conditions of the offer. In furtherance of this proposal and subject to future developments, Choice (and, if applicable, Wyndham) may file one or more registration statements, proxy statements, tender or exchange offers or other documents with the Securities and Exchange Commission (the “SEC”). This communication is not a substitute for any proxy statement, registration statement, tender or exchange offer document, prospectus or other document Choice and/or Wyndham may file with the SEC in connection with the proposed transaction. This communication does not constitute an offer to buy or solicitation of an offer to sell any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Investors and security holders of Choice and Wyndham are urged to read the proxy statement(s), registration statement, tender or exchange offer document (including the offer to exchange, the letter of election and transmittal and other related offer documents), prospectus and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) or prospectus(es) (if and when available) will be mailed to shareholders of Choice and/or Wyndham, as applicable. Investors and security holders may obtain free copies of these documents (if and when available) and other documents filed with the SEC by Choice through the web site maintained by the SEC at www.sec.gov, and by visiting Choice’s investor relations site at www.investor.choicehotels.com. This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, Choice and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. You can find information about Choice’s executive officers and directors in the Annual Report on Form 10-K for the year ended December 31, 2022 filed by Choice with the SEC on March 1, 2023. Additional information regarding the interests of such potential participants will be included in one or more registration statements, proxy statements, tender or exchange offer documents or other documents filed with the SEC if and when they become available. These documents (if and when available) may be obtained free of charge from the SEC’s website at www.sec.gov and by visiting Choice’s investor relations site at www.investor.choicehotels.com. In this communication, we reference information and statistics regarding the Travel Industry. We have obtained this information and statistics from various independent third-party sources, including independent industry publications, reports by market research firms and other independent sources, such as Euromonitor International Limited. Some data and other information contained in this communication are also based on management’s estimates and calculations, which are derived from our review and interpretation of internal surveys and independent sources. Data regarding the industries in which we compete and our market position and market share within these industries are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond our control, but we believe they generally indicate size, position and market share within these industries. While we believe such information is reliable, we have not independently verified any third-party information. While we believe our internal company research and estimates are reliable, such research and estimates have not been verified by any independent source. In addition, assumptions and estimates of our and our industries’ future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause our future performance to differ materially from our assumptions and estimates. As a result, you should be aware that market, ranking and other similar industry data including in this communication, and estimates and beliefs based on that data, may not be reliable. We cannot guarantee the accuracy or completeness of any such information contained in this communication. 4

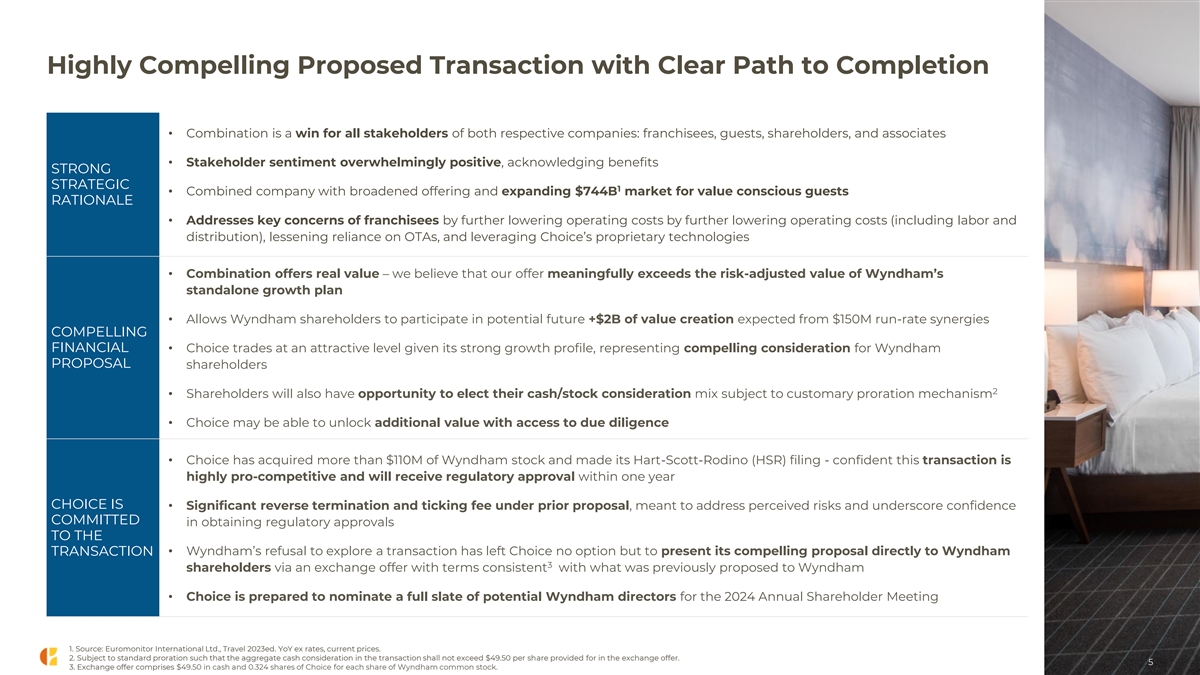

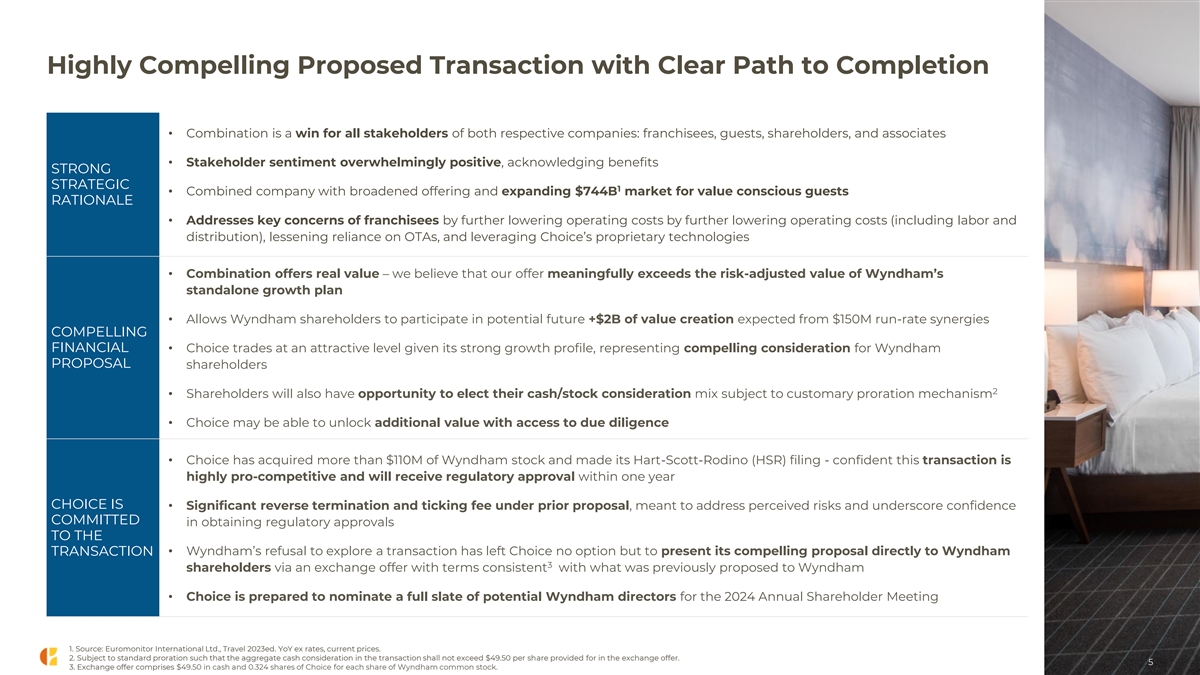

Highly Compelling Proposed Transaction with Clear Path to Completion • Combination is a win for all stakeholders of both respective companies: franchisees, guests, shareholders, and associates • Stakeholder sentiment overwhelmingly positive, acknowledging benefits STRONG STRATEGIC 1 • Combined company with broadened offering and expanding $744B market for value conscious guests RATIONALE • Addresses key concerns of franchisees by further lowering operating costs by further lowering operating costs (including labor and distribution), lessening reliance on OTAs, and leveraging Choice’s proprietary technologies • Combination offers real value – we believe that our offer meaningfully exceeds the risk-adjusted value of Wyndham’s standalone growth plan • Allows Wyndham shareholders to participate in potential future +$2B of value creation expected from $150M run-rate synergies COMPELLING FINANCIAL • Choice trades at an attractive level given its strong growth profile, representing compelling consideration for Wyndham PROPOSAL shareholders 2 • Shareholders will also have opportunity to elect their cash/stock consideration mix subject to customary proration mechanism • Choice may be able to unlock additional value with access to due diligence • Choice has acquired more than $110M of Wyndham stock and made its Hart-Scott-Rodino (HSR) filing - confident this transaction is highly pro-competitive and will receive regulatory approval within one year CHOICE IS • Significant reverse termination and ticking fee under prior proposal, meant to address perceived risks and underscore confidence COMMITTED in obtaining regulatory approvals TO THE • Wyndham’s refusal to explore a transaction has left Choice no option but to present its compelling proposal directly to Wyndham TRANSACTION 3 shareholders via an exchange offer with terms consistent with what was previously proposed to Wyndham • Choice is prepared to nominate a full slate of potential Wyndham directors for the 2024 Annual Shareholder Meeting 1. Source: Euromonitor International Ltd., Travel 2023ed. YoY ex rates, current prices. 2. Subject to standard proration such that the aggregate cash consideration in the transaction shall not exceed $49.50 per share provided for in the exchange offer. 5 3. Exchange offer comprises $49.50 in cash and 0.324 shares of Choice for each share of Wyndham common stock.

SINCE MAKING ITS OFFER PUBLIC ON OCTOBER 17, CHOICE HAS: Choice Is Committed to Completing the Enhanced its offer to the Wyndham Board by offering protections of attractive reverse Proposed termination fee, ticking fee, and strong commitment to take necessary steps to obtain regulatory approvals Transaction Acquired approximately 1.5M Wyndham shares with value exceeding $110M; essentially the maximum allowable amount without obtaining prior regulatory approval Requested the D&O questionnaire and other necessary shareholder documentation to engage in a proxy contest Made necessary regulatory filing under the Hart-Scott-Rodino (HSR) Act Choosing to proactively “start the clock” on the regulatory approval process demonstrates Choice’s focus on, and confidence in, the Choice has launched an Exchange Offer and is prepared to proposed transaction nominate a slate of Directors in connection with Wyndham’s 2024 Annual Meeting 6 6

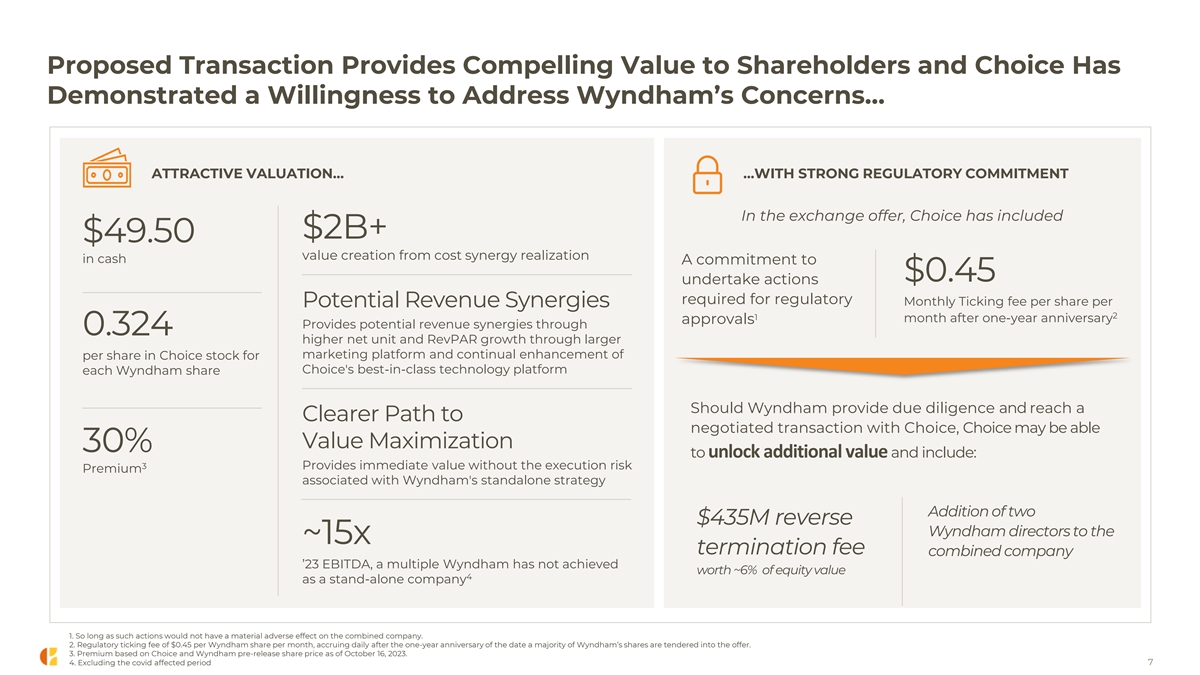

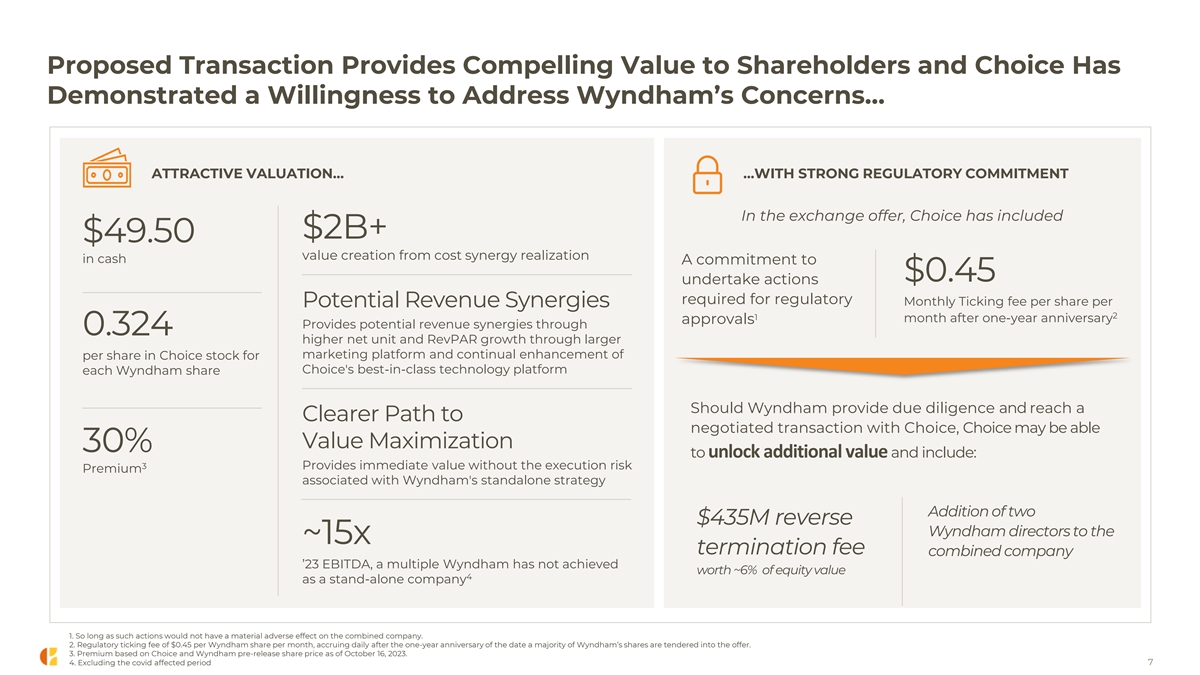

Proposed Transaction Provides Compelling Value to Shareholders and Choice Has Demonstrated a Willingness to Address Wyndham’s Concerns… ATTRACTIVE VALUATION… …WITH STRONG REGULATORY COMMITMENT In the exchange offer, Choice has included $2B+ $49.50 value creation from cost synergy realization in cash A commitment to $0.45 undertake actions required for regulatory Monthly Ticking fee per share per Potential Revenue Synergies 2 1 month after one-year anniversary approvals Provides potential revenue synergies through 0.324 higher net unit and RevPAR growth through larger marketing platform and continual enhancement of per share in Choice stock for Choice's best-in-class technology platform each Wyndham share Should Wyndham provide due diligence and reach a Clearer Path to negotiated transaction with Choice, Choice may be able Value Maximization 30% to unlock additional value and include: 3 Provides immediate value without the execution risk Premium associated with Wyndham's standalone strategy Addition of two $435M reverse Wyndham directors to the ~15x termination fee combined company ’23 EBITDA, a multiple Wyndham has not achieved worth ~6% of equity value 4 as a stand-alone company 1. So long as such actions would not have a material adverse effect on the combined company. 2. Regulatory ticking fee of $0.45 per Wyndham share per month, accruing daily after the one-year anniversary of the date a majority of Wyndham’s shares are tendered into the offer. 3. Premium based on Choice and Wyndham pre-release share price as of October 16, 2023. 4. Excluding the covid affected period 7

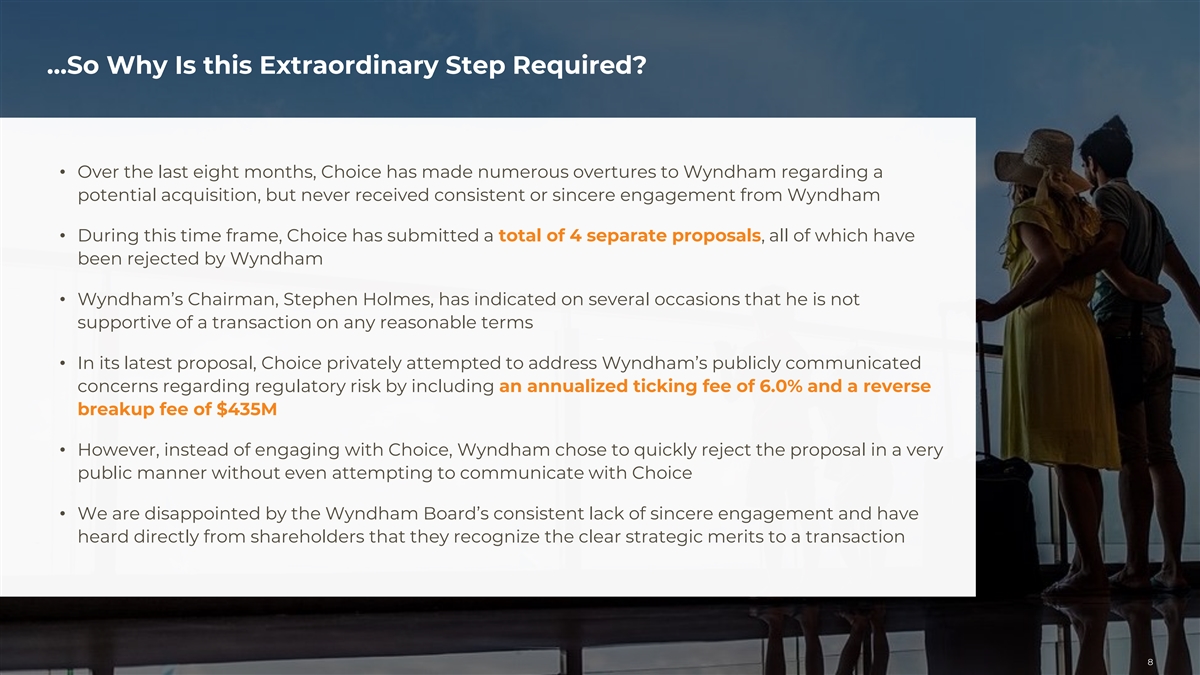

…So Why Is this Extraordinary Step Required? • Over the last eight months, Choice has made numerous overtures to Wyndham regarding a potential acquisition, but never received consistent or sincere engagement from Wyndham • During this time frame, Choice has submitted a total of 4 separate proposals, all of which have been rejected by Wyndham • Wyndham’s Chairman, Stephen Holmes, has indicated on several occasions that he is not supportive of a transaction on any reasonable terms - • In its latest proposal, Choice privately attempted to address Wyndham’s publicly communicated concerns regarding regulatory risk by including an annualized ticking fee of 6.0% and a reverse breakup fee of $435M • However, instead of engaging with Choice, Wyndham chose to quickly reject the proposal in a very public manner without even attempting to communicate with Choice • We are disappointed by the Wyndham Board’s consistent lack of sincere engagement and have heard directly from shareholders that they recognize the clear strategic merits to a transaction 8

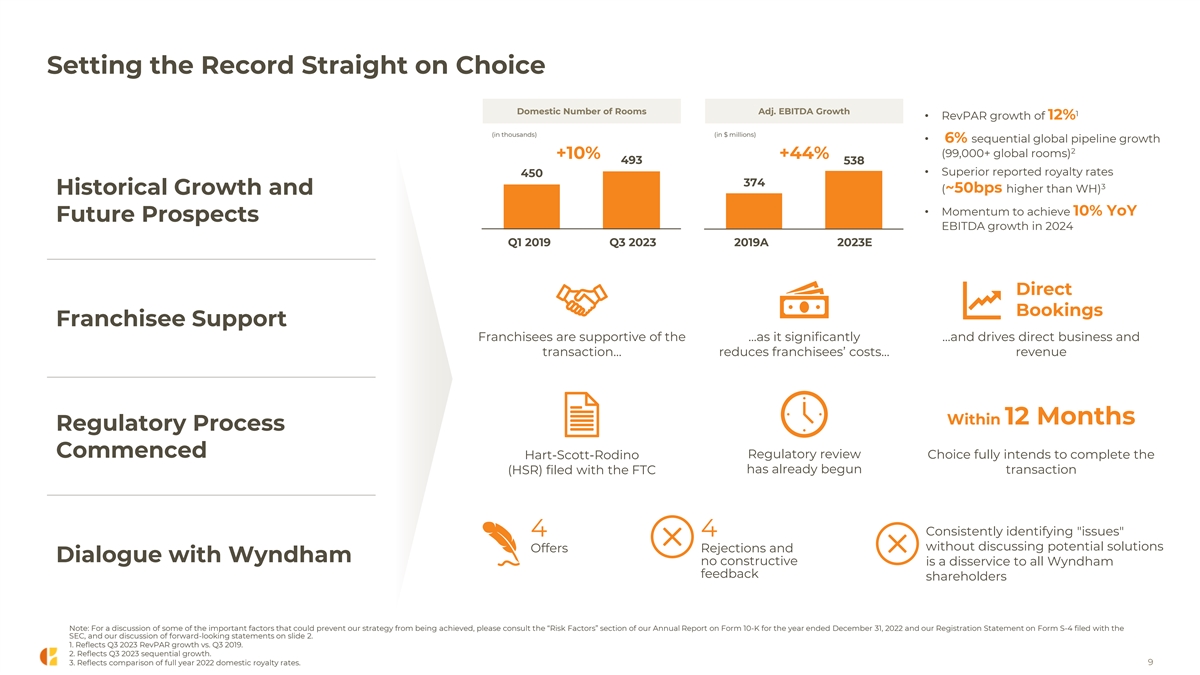

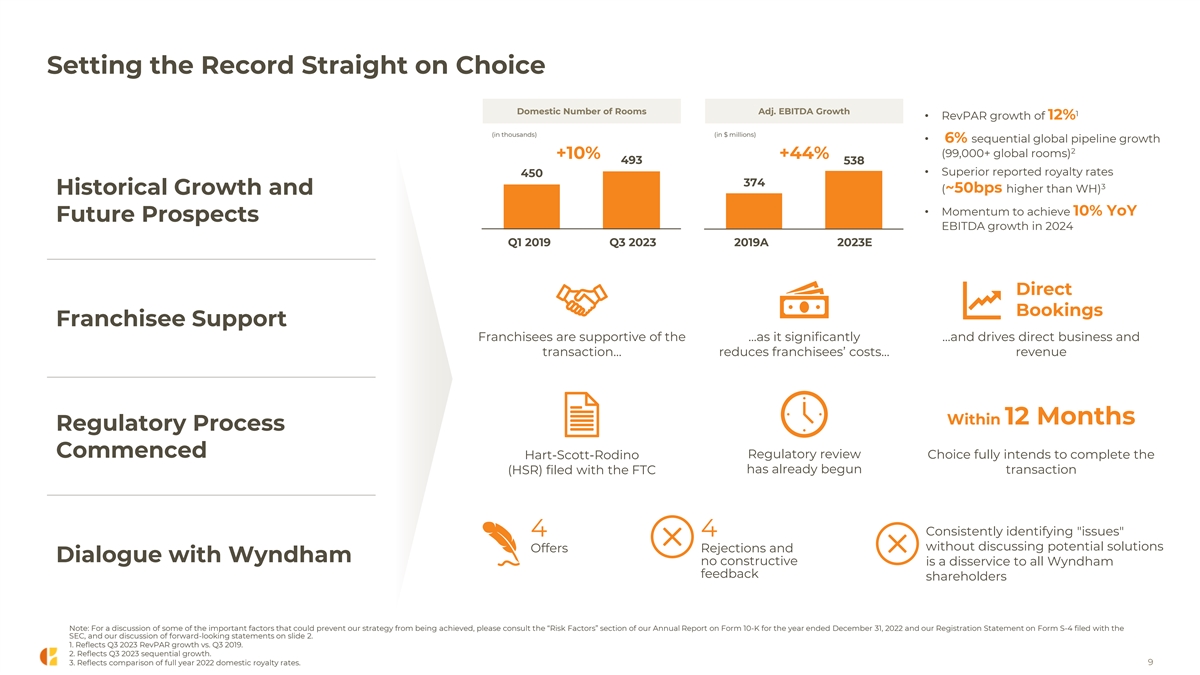

Setting the Record Straight on Choice Domestic Number of Rooms Adj. EBITDA Growth 1 • RevPAR growth of 12% (in thousands) (in $ millions) • 6% sequential global pipeline growth 2 (99,000+ global rooms) +10% +44% 493 538 • Superior reported royalty rates 450 374 3 (~50bps higher than WH) Historical Growth and • Momentum to achieve 10% YoY Future Prospects EBITDA growth in 2024 Q1 2019 Q3 2023 2019A 2023E Direct Bookings Franchisee Support Franchisees are supportive of the …as it significantly …and drives direct business and transaction… reduces franchisees’ costs… revenue Within 12 Months Regulatory Process Commenced Regulatory review Choice fully intends to complete the Hart-Scott-Rodino has already begun transaction (HSR) filed with the FTC 4 4 Consistently identifying issues without discussing potential solutions Offers Rejections and Dialogue with Wyndham no constructive is a disservice to all Wyndham feedback shareholders Note: For a discussion of some of the important factors that could prevent our strategy from being achieved, please consult the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2022 and our Registration Statement on Form S-4 filed with the SEC, and our discussion of forward-looking statements on slide 2. 1. Reflects Q3 2023 RevPAR growth vs. Q3 2019. 2. Reflects Q3 2023 sequential growth. 3. Reflects comparison of full year 2022 domestic royalty rates. 9

Strong Strategic Rationale

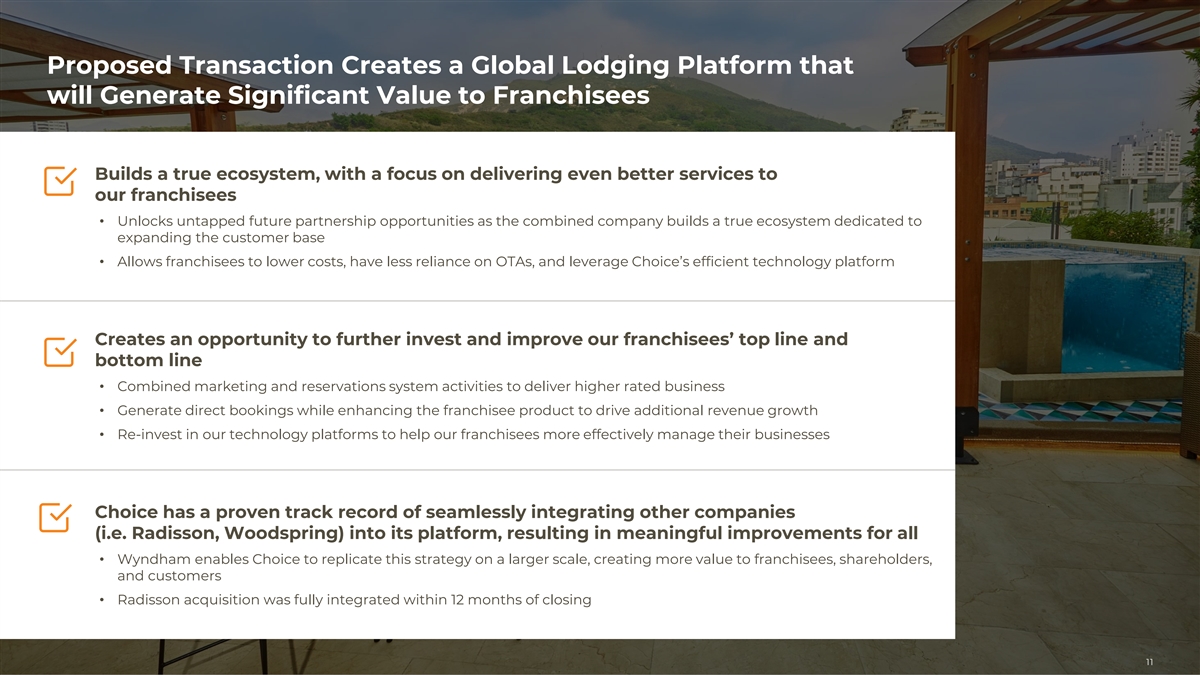

Proposed Transaction Creates a Global Lodging Platform that will Generate Significant Value to Franchisees Builds a true ecosystem, with a focus on delivering even better services to our franchisees • Unlocks untapped future partnership opportunities as the combined company builds a true ecosystem dedicated to expanding the customer base • Allows franchisees to lower costs, have less reliance on OTAs, and leverage Choice’s efficient technology platform - Creates an opportunity to further invest and improve our franchisees’ top line and bottom line • Combined marketing and reservations system activities to deliver higher rated business • Generate direct bookings while enhancing the franchisee product to drive additional revenue growth • Re-invest in our technology platforms to help our franchisees more effectively manage their businesses Choice has a proven track record of seamlessly integrating other companies (i.e. Radisson, Woodspring) into its platform, resulting in meaningful improvements for all • Wyndham enables Choice to replicate this strategy on a larger scale, creating more value to franchisees, shareholders, and customers • Radisson acquisition was fully integrated within 12 months of closing 11

Combination Addresses Key Franchisee Concerns: Operating Costs, Reliance on OTAs, and Continual Investment in Our Proprietary Technology… FRANCHISEE OPERATING COST UNDER PRESSURE PROVEN PATH TO FURTHER IMPROVE PROFITABILITY THROUGH COMBINATION 82% of hotels are experiencing Case Study 1 staffing shortages REDUCED COSTS… INCREASED TOPLINE DELIVERY, Negotiated new terms THROUGH LOWER COST CHANNELS… As of April 2023, national hotel wages with key third-party Increased Traffic and Booked Revenue on 1 distribution partner, were at an all-time high ChoiceHotels.com and the Mobile App versus Radisson lowering distribution costs 4 and Choice combined stand-alone for both legacy Choice and Radisson franchisees 2 Per CBRE , “hotel construction costs Radisson Brands Digital Bookings Post +26% 4 Migration YoY have increased 10%-20% in most Drove savings of up to 20% markets recently” Radisson Brands Conversion Post from targeted solutions +23% 4 Migration YoY under the “Your Key to Profit” brand program 3 Skift reported that hotels will spend Portfolio Wide Bookings on Digital +5% 4 Channels YoY upwards of ~$50B in 2023 in OTA Realized 10% more commissions and markups synergies than originally Integrated Radisson in 11 months, 2 years faster than anticipated Marriott-Starwood integration 1. AHLA’s Front Desk Feedback survey of 474 hoteliers was conducted May 3-9, 2023. 2. CBRE June 2023 report. 3. Skift Report dated October 12, 2023. 12 12 4. Reflects US figures only.

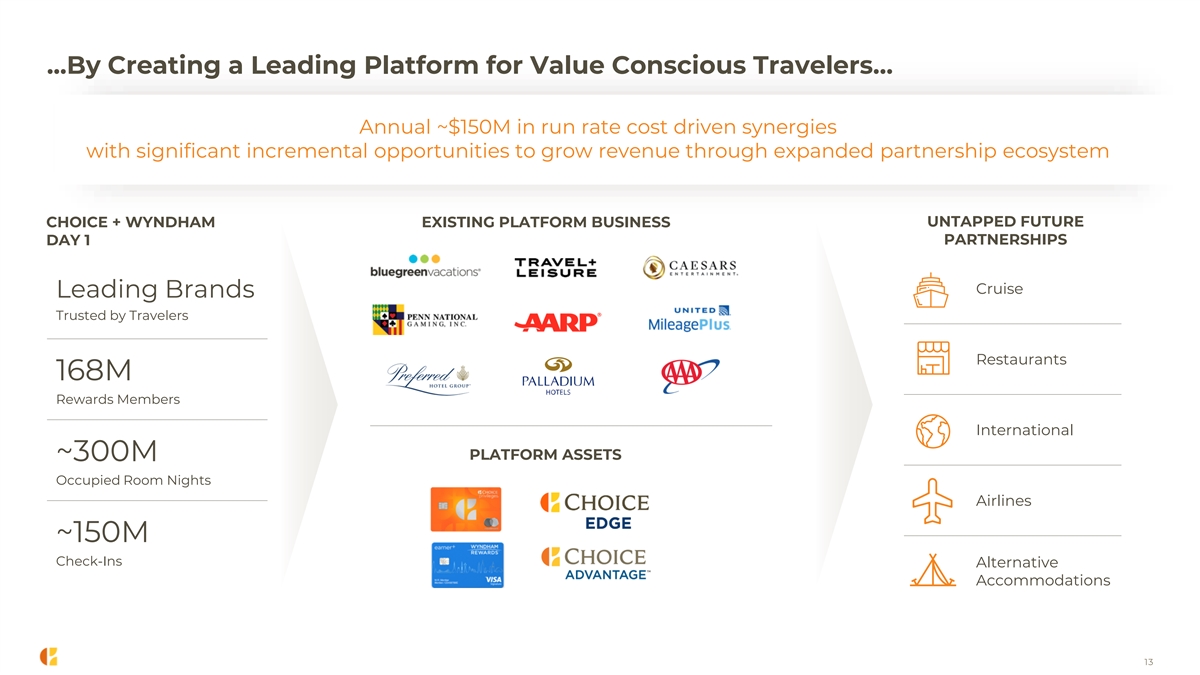

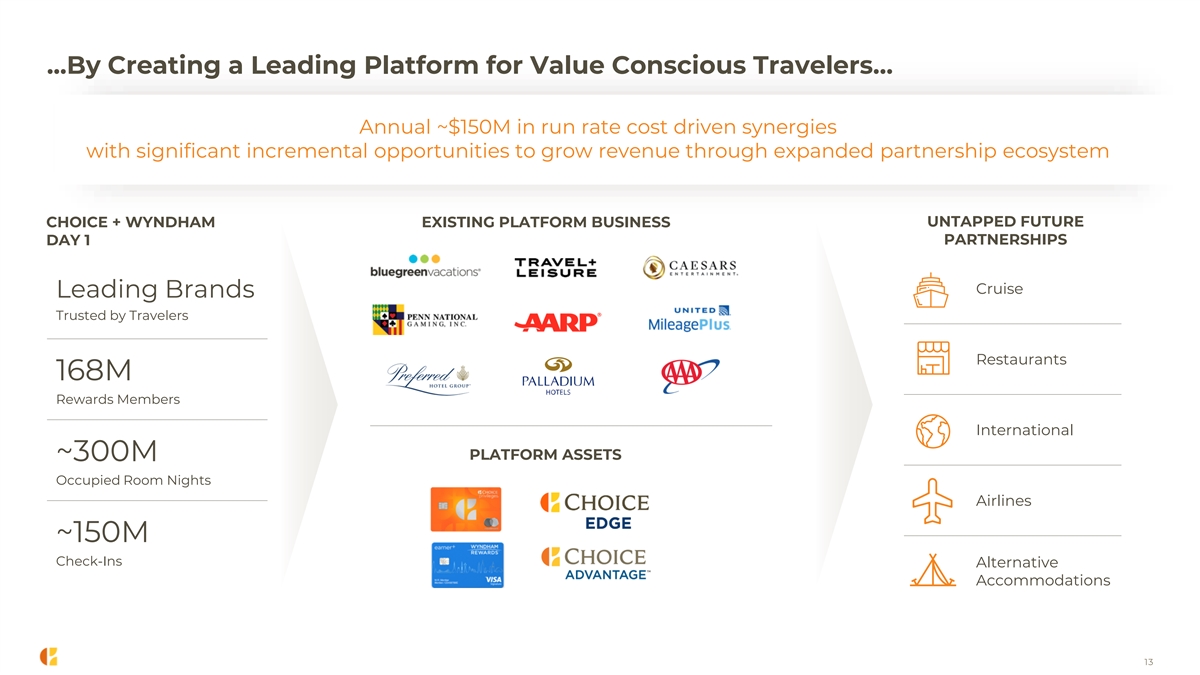

...By Creating a Leading Platform for Value Conscious Travelers… Annual ~$150M in run rate cost driven synergies with significant incremental opportunities to grow revenue through expanded partnership ecosystem UNTAPPED FUTURE CHOICE + WYNDHAM EXISTING PLATFORM BUSINESS DAY 1 PARTNERSHIPS Cruise Leading Brands Trusted by Travelers Restaurants 168M Rewards Members International PLATFORM ASSETS ~300M Occupied Room Nights Airlines ~150M Check-Ins Alternative Accommodations 13

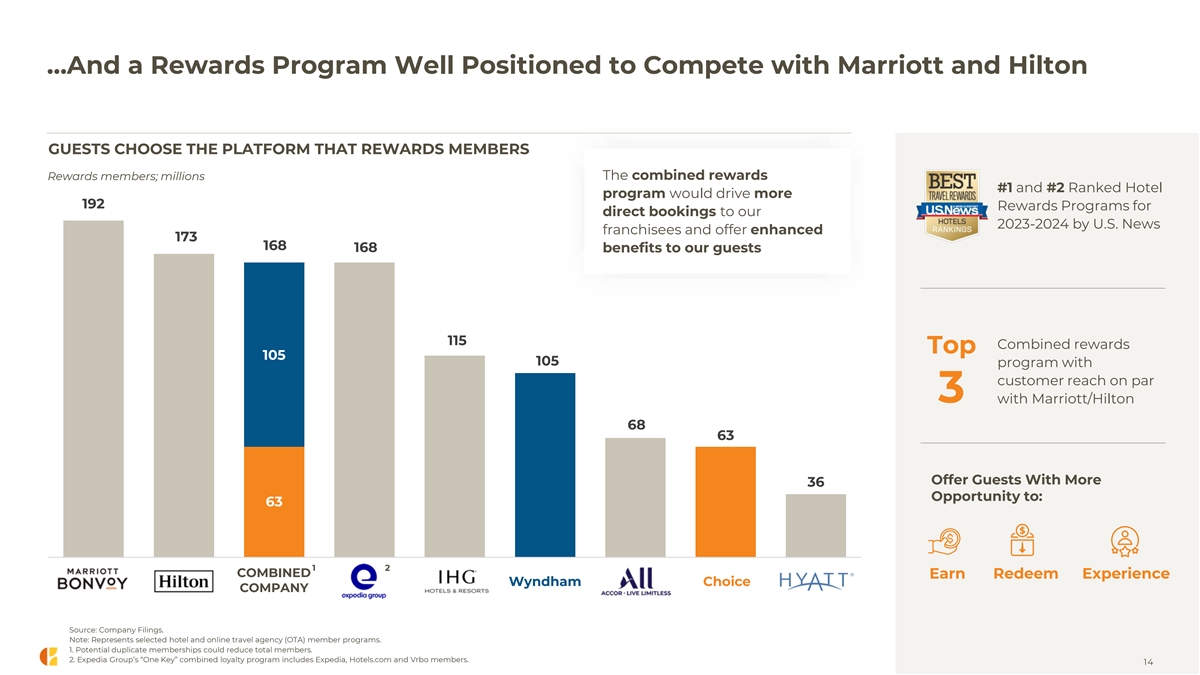

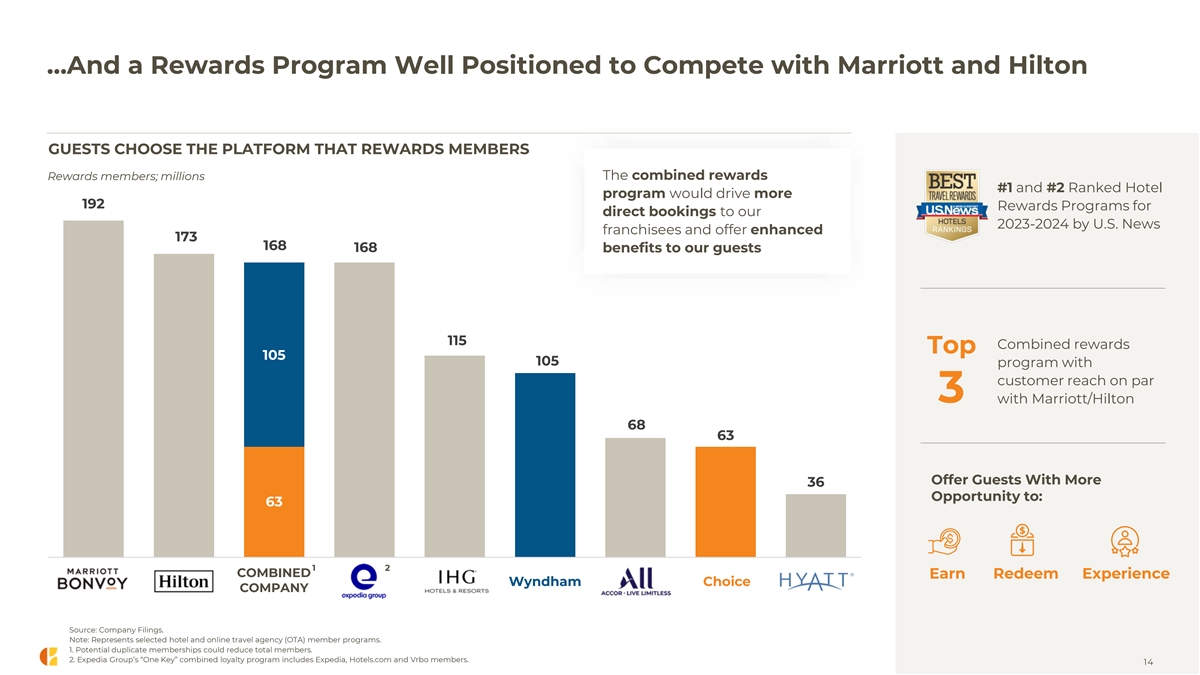

…And a Rewards Program Well Positioned to Compete with Marriott and Hilton GUESTS CHOOSE THE PLATFORM THAT REWARDS MEMBERS Rewards members; millions The combined rewards #1 and #2 Ranked Hotel program would drive more 192 Rewards Programs for direct bookings to our 2023-2024 by U.S. News franchisees and offer enhanced 173 168 168 benefits to our guests 115 Combined rewards Top 105 105 program with customer reach on par 3 with Marriott/Hilton 68 63 Offer Guests With More 36 Opportunity to: 63 1 2 COMBINED Earn Redeem Experience Wyndham Choice COMPANY Source: Company Filings. Note: Represents selected hotel and online travel agency (OTA) member programs. 1. Potential duplicate memberships could reduce total members. 2. Expedia Group’s “One Key” combined loyalty program includes Expedia, Hotels.com and Vrbo members. 14

The Combined Company Would Be Even Better Positioned to Compete and Create Long-term Value 16,360 1,430,000+ ~$25B $1.4B Hotels Globally Rooms Globally Gross Rooms Revenue Annual EBITDA Upper Upscale to $1.2B ~100% 97% Marketing & Economy Franchised Select Service Reservations Spend Top 3 ~150M ~300M 168M Combined Loyalty Check-Ins Annually Occupied Rooms Rewards Members Program in Hospitality Builds on Choice’s revenue Positioned to continue 600+ strong Choice technology intense strategy, driving capturing large and growing team will continue to enhance and value-creation, stability, and market, supported by long- develop our robust proprietary resiliency term industry tailwinds technology platform for the benefit of all franchisees Note: Figures based on publicly available information and reasonable extrapolations of the Wyndham system. For a discussion of some of the important factors that could prevent our strategy from being achieved, please consult the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2022 and our Registration Statement on Form S-4 to 15 15 be filed with the SEC, and our discussion of forward-looking statements on slide 2.

Compelling Financial Proposal

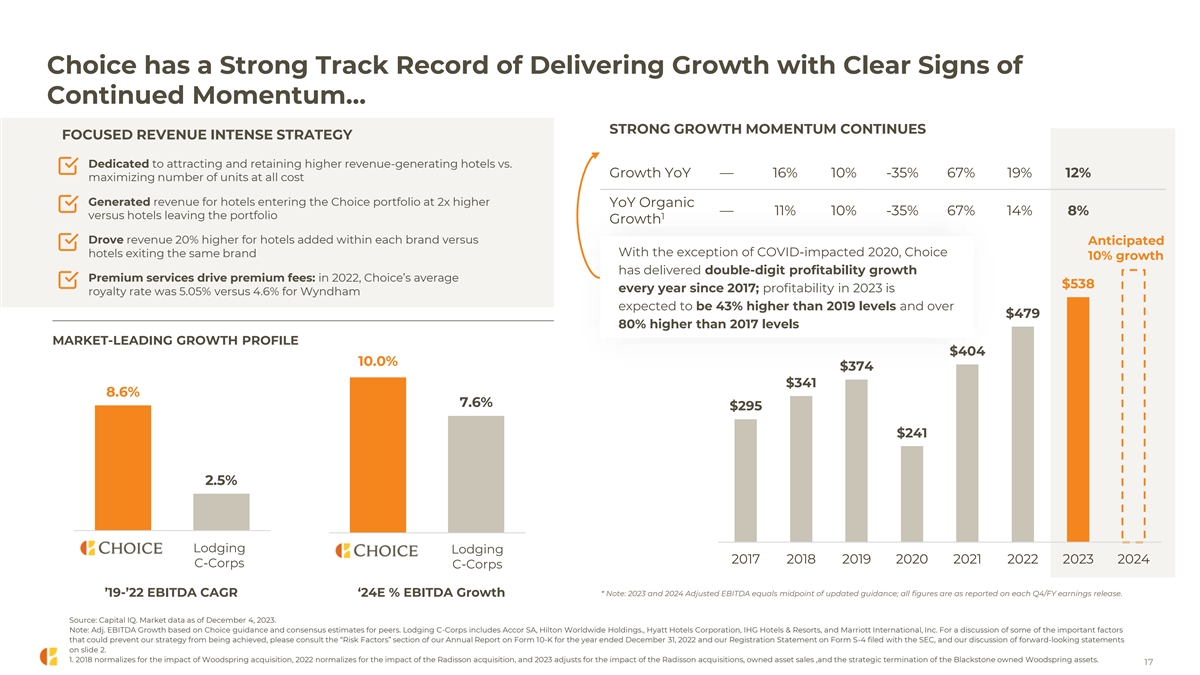

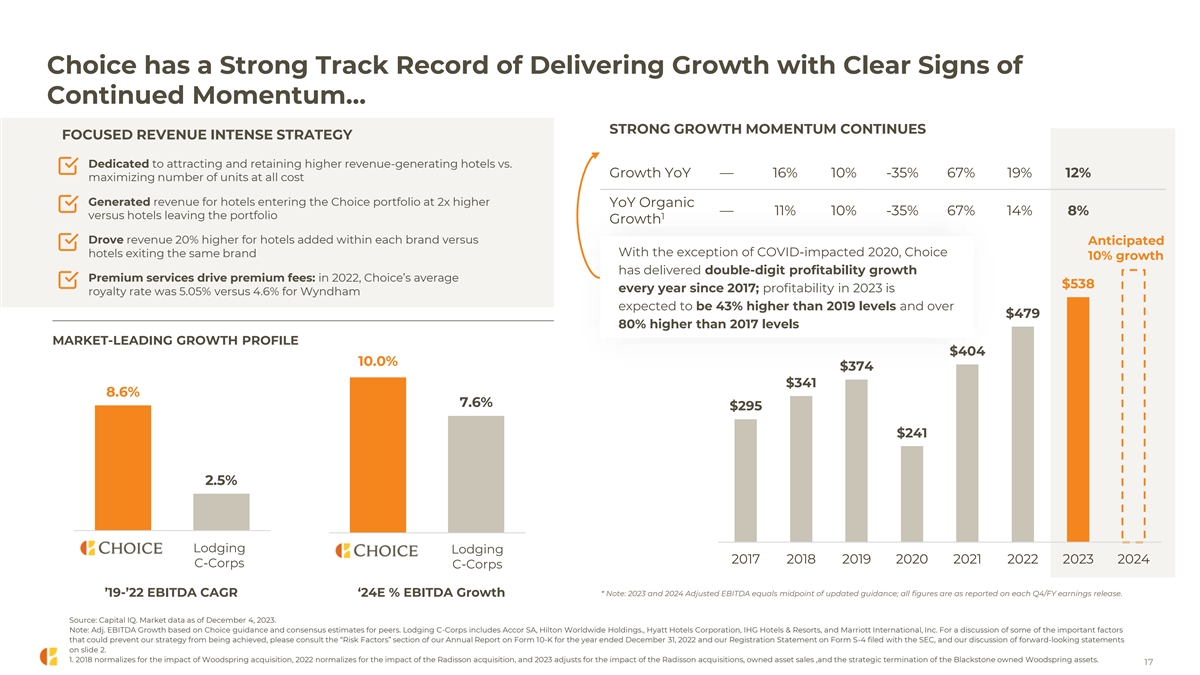

Choice has a Strong Track Record of Delivering Growth with Clear Signs of Continued Momentum… STRONG GROWTH MOMENTUM CONTINUES FOCUSED REVENUE INTENSE STRATEGY Dedicated to attracting and retaining higher revenue-generating hotels vs. Growth YoY — 16% 10% -35% 67% 19% 12% maximizing number of units at all cost Generated revenue for hotels entering the Choice portfolio at 2x higher YoY Organic — 11% 10% -35% 67% 14% 8% versus hotels leaving the portfolio 1 Growth Drove revenue 20% higher for hotels added within each brand versus Anticipated With the exception of COVID-impacted 2020, Choice hotels exiting the same brand 10% growth has delivered double-digit profitability growth Premium services drive premium fees: in 2022, Choice’s average $538 every year since 2017; profitability in 2023 is royalty rate was 5.05% versus 4.6% for Wyndham expected to be 43% higher than 2019 levels and over $479 80% higher than 2017 levels MARKET-LEADING GROWTH PROFILE $404 10.0% $374 $341 8.6% 7.6% $295 $241 2.5% Lodging Lodging 2017 2018 2019 2020 2021 2022 2023 2024 C-Corps C-Corps * Note: 2023 and 2024 Adjusted EBITDA equals midpoint of updated guidance; all figures are as reported on each Q4/FY earnings release. ’19-’22 EBITDA CAGR ‘24E % EBITDA Growth Source: Capital IQ. Market data as of December 4, 2023. Note: Adj. EBITDA Growth based on Choice guidance and consensus estimates for peers. Lodging C-Corps includes Accor SA, Hilton Worldwide Holdings., Hyatt Hotels Corporation, IHG Hotels & Resorts, and Marriott International, Inc. For a discussion of some of the important factors that could prevent our strategy from being achieved, please consult the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2022 and our Registration Statement on Form S-4 filed with the SEC, and our discussion of forward-looking statements on slide 2. 1. 2018 normalizes for the impact of Woodspring acquisition, 2022 normalizes for the impact of the Radisson acquisition, and 2023 adjusts for the impact of the Radisson acquisitions, owned asset sales ,and the strategic termination of the Blackstone owned Woodspring assets. 17

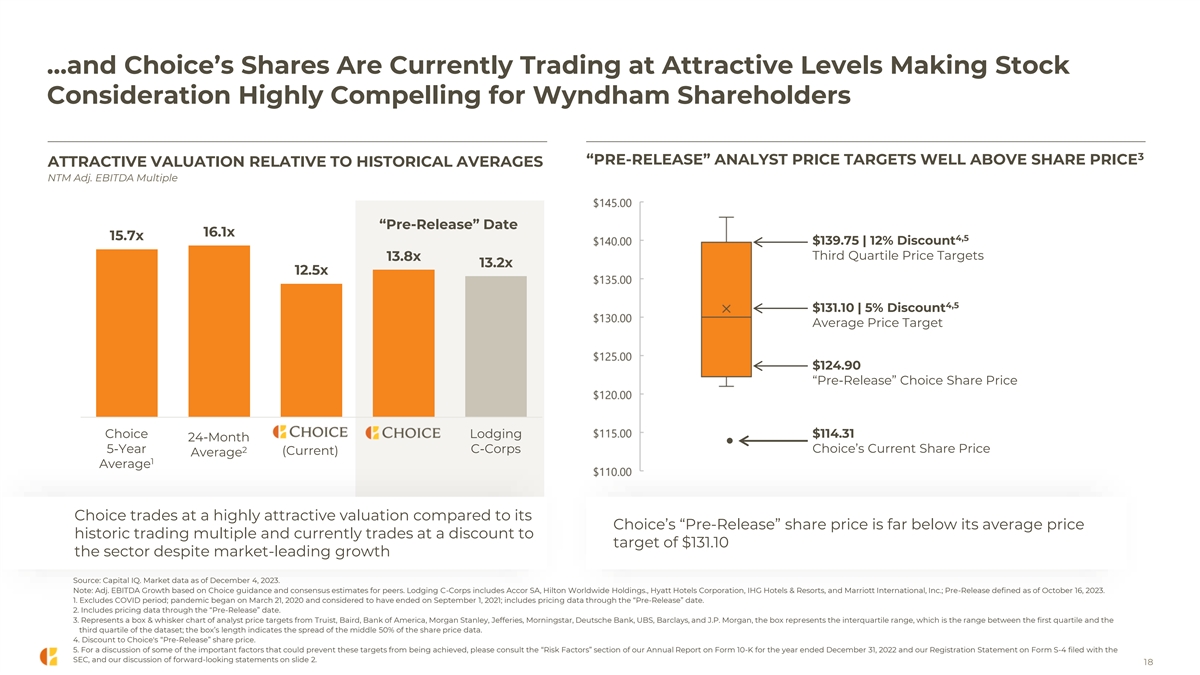

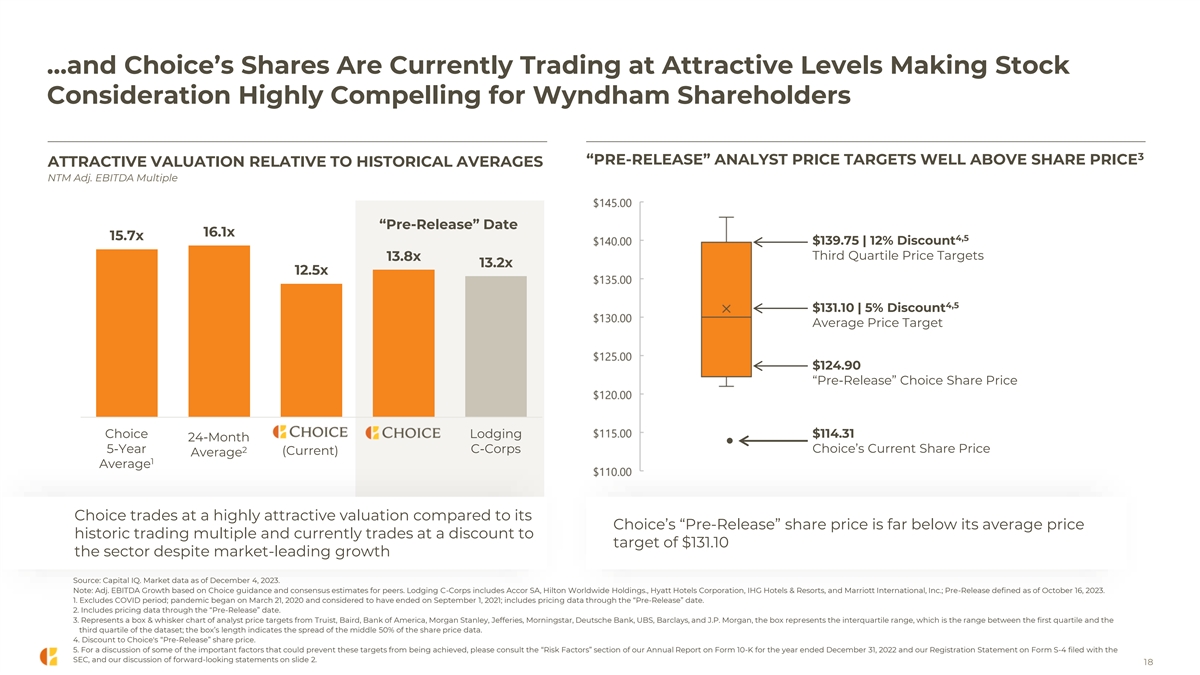

…and Choice’s Shares Are Currently Trading at Attractive Levels Making Stock Consideration Highly Compelling for Wyndham Shareholders 3 “PRE-RELEASE” ANALYST PRICE TARGETS WELL ABOVE SHARE PRICE ATTRACTIVE VALUATION RELATIVE TO HISTORICAL AVERAGES NTM Adj. EBITDA Multiple “Pre-Release” Date 16.1x 15.7x 4,5 $139.75 | 12% Discount Third Quartile Price Targets 13.8x 13.2x 12.5x 4,5 $131.10 | 5% Discount Average Price Target $124.90 “Pre-Release” Choice Share Price $114.31 Choice Lodging 24-Month 2 Choice’s Current Share Price 5-Year C-Corps (Current) Average 1 Average Choice trades at a highly attractive valuation compared to its Choice’s “Pre-Release” share price is far below its average price historic trading multiple and currently trades at a discount to target of $131.10 the sector despite market-leading growth Source: Capital IQ. Market data as of December 4, 2023. Note: Adj. EBITDA Growth based on Choice guidance and consensus estimates for peers. Lodging C-Corps includes Accor SA, Hilton Worldwide Holdings., Hyatt Hotels Corporation, IHG Hotels & Resorts, and Marriott International, Inc.; Pre-Release defined as of October 16, 2023. 1. Excludes COVID period; pandemic began on March 21, 2020 and considered to have ended on September 1, 2021; includes pricing data through the “Pre-Release” date. 2. Includes pricing data through the “Pre-Release” date. 3. Represents a box & whisker chart of analyst price targets from Truist, Baird, Bank of America, Morgan Stanley, Jefferies, Morningstar, Deutsche Bank, UBS, Barclays, and J.P. Morgan, the box represents the interquartile range, which is the range between the first quartile and the third quartile of the dataset; the box’s length indicates the spread of the middle 50% of the share price data. 4. Discount to Choice's “Pre-Release” share price. 5. For a discussion of some of the important factors that could prevent these targets from being achieved, please consult the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2022 and our Registration Statement on Form S-4 filed with the SEC, and our discussion of forward-looking statements on slide 2. 18

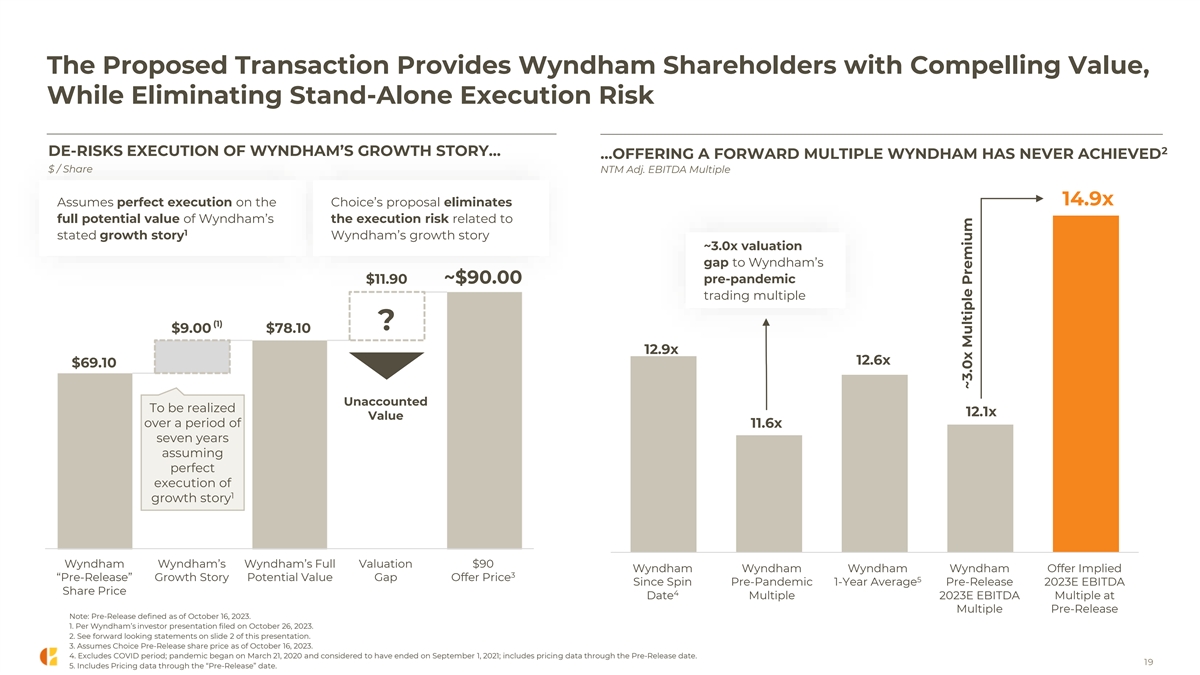

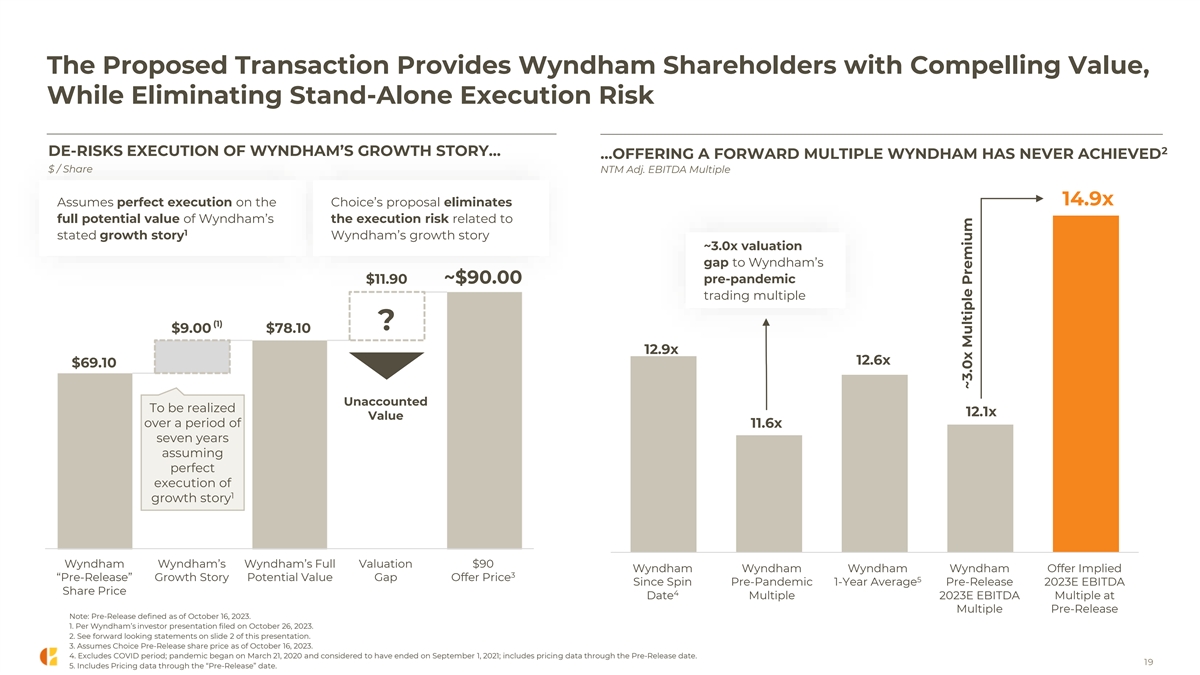

The Proposed Transaction Provides Wyndham Shareholders with Compelling Value, While Eliminating Stand-Alone Execution Risk 2 DE-RISKS EXECUTION OF WYNDHAM’S GROWTH STORY… …OFFERING A FORWARD MULTIPLE WYNDHAM HAS NEVER ACHIEVED $ / Share NTM Adj. EBITDA Multiple Assumes perfect execution on the Choice’s proposal eliminates 14.9x full potential value of Wyndham’s the execution risk related to 1 stated growth story Wyndham’s growth story ~3.0x valuation gap to Wyndham’s $11.90 ~$90.00 pre-pandemic trading multiple (1) ? $9.00 $78.10 12.9x 12.6x $69.10 Unaccounted To be realized 12.1x Value over a period of 11.6x seven years assuming perfect execution of 1 growth story Wyndham Wyndham’s Wyndham’s Full Valuation $90 Wyndham Wyndham Wyndham Wyndham Offer Implied 3 “Pre-Release” Growth Story Potential Value Gap Offer Price 5 Since Spin Pre-Pandemic 1-Year Average Pre-Release 2023E EBITDA Share Price 4 Date Multiple 2023E EBITDA Multiple at Multiple Pre-Release Note: Pre-Release defined as of October 16, 2023. 1. Per Wyndham’s investor presentation filed on October 26, 2023. 2. See forward looking statements on slide 2 of this presentation. 3. Assumes Choice Pre-Release share price as of October 16, 2023. 4. Excludes COVID period; pandemic began on March 21, 2020 and considered to have ended on September 1, 2021; includes pricing data through the Pre-Release date. 19 5. Includes Pricing data through the “Pre-Release” date. ~3.0x Multiple Premium

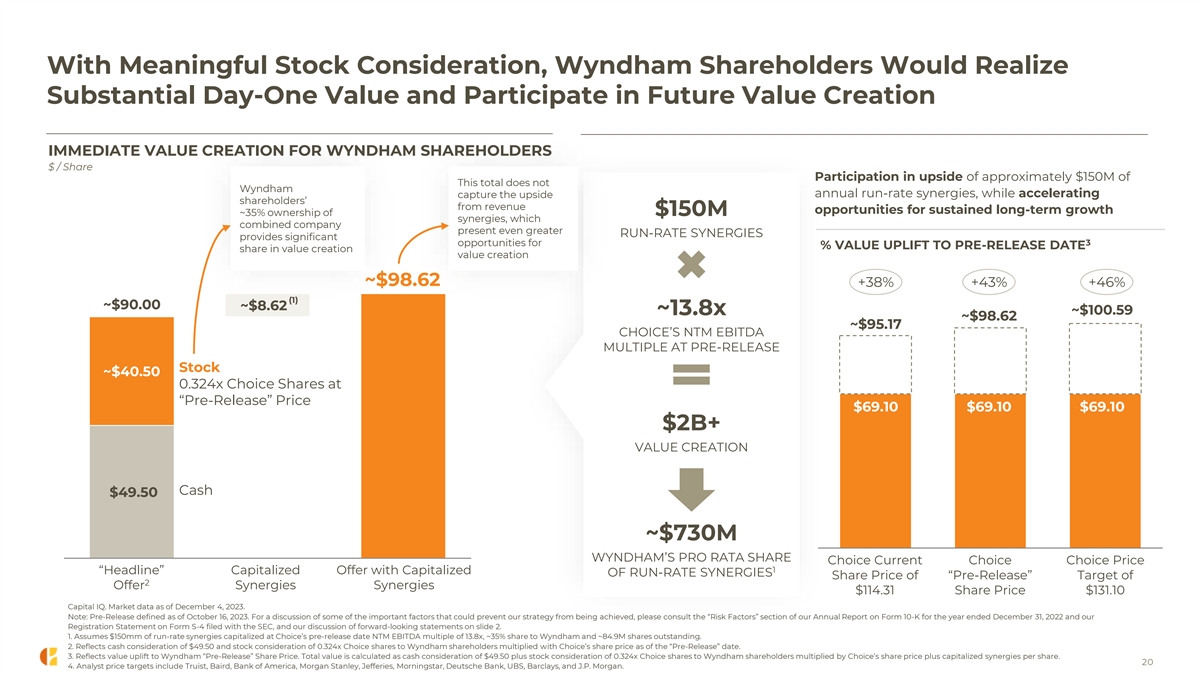

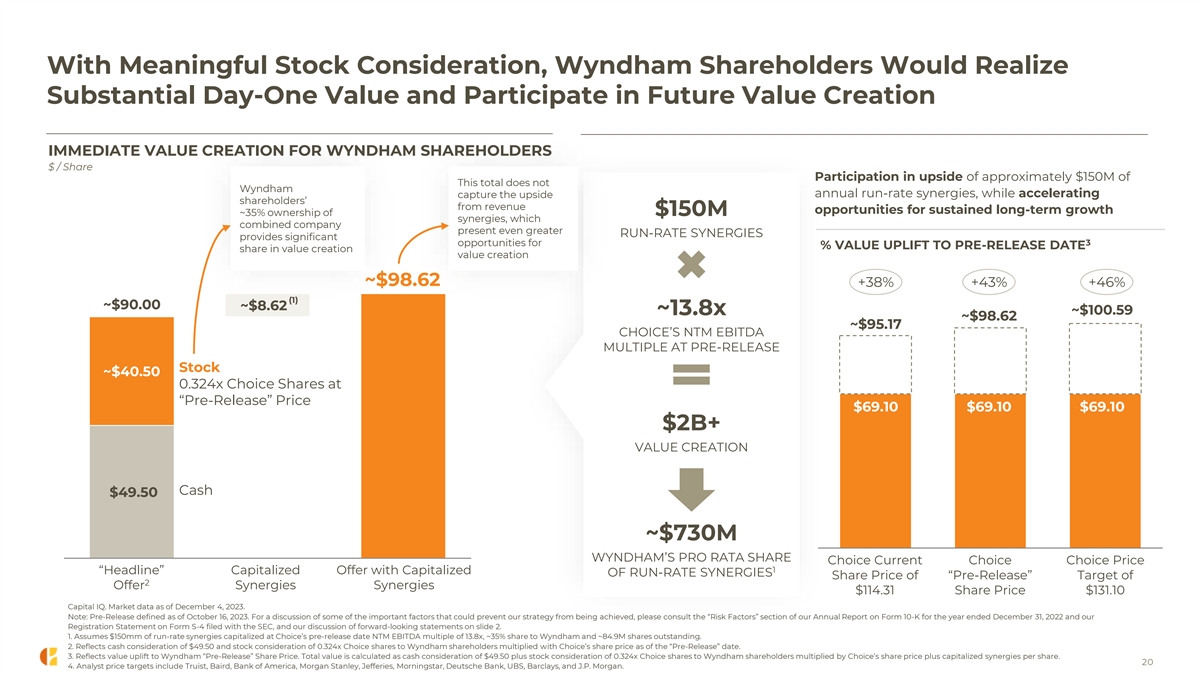

With Meaningful Stock Consideration, Wyndham Shareholders Would Realize Substantial Day-One Value and Participate in Future Value Creation IMMEDIATE VALUE CREATION FOR WYNDHAM SHAREHOLDERS $ / Share Participation in upside of approximately $150M of This total does not Wyndham annual run-rate synergies, while accelerating capture the upside shareholders’ from revenue opportunities for sustained long-term growth ~35% ownership of $150M synergies, which combined company present even greater RUN-RATE SYNERGIES provides significant opportunities for 3 % VALUE UPLIFT TO PRE-RELEASE DATE share in value creation value creation ~$98.62 +38% +43% +46% (1) ~$90.00 ~$8.62 ~13.8x ~$100.59 ~$98.62 ~$95.17 CHOICE’S NTM EBITDA MULTIPLE AT PRE-RELEASE Stock ~$40.50 0.324x Choice Shares at “Pre-Release” Price $69.10 $69.10 $69.10 $2B+ VALUE CREATION Cash $49.50 ~$730M WYNDHAM’S PRO RATA SHARE Choice Current Choice Choice Price 1 “Headline” Capitalized Offer with Capitalized OF RUN-RATE SYNERGIES Share Price of “Pre-Release” Target of 2 Offer Synergies Synergies $114.31 Share Price $131.10 Capital IQ. Market data as of December 4, 2023. Note: Pre-Release defined as of October 16, 2023. For a discussion of some of the important factors that could prevent our strategy from being achieved, please consult the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2022 and our Registration Statement on Form S-4 filed with the SEC, and our discussion of forward-looking statements on slide 2. 1. Assumes $150mm of run-rate synergies capitalized at Choice’s pre-release date NTM EBITDA multiple of 13.8x, ~35% share to Wyndham and ~84.9M shares outstanding. 2. Reflects cash consideration of $49.50 and stock consideration of 0.324x Choice shares to Wyndham shareholders multiplied with Choice’s share price as of the “Pre-Release” date. 3. Reflects value uplift to Wyndham “Pre-Release” Share Price. Total value is calculated as cash consideration of $49.50 plus stock consideration of 0.324x Choice shares to Wyndham shareholders multiplied by Choice’s share price plus capitalized synergies per share. 20 4. Analyst price targets include Truist, Baird, Bank of America, Morgan Stanley, Jefferies, Morningstar, Deutsche Bank, UBS, Barclays, and J.P. Morgan.

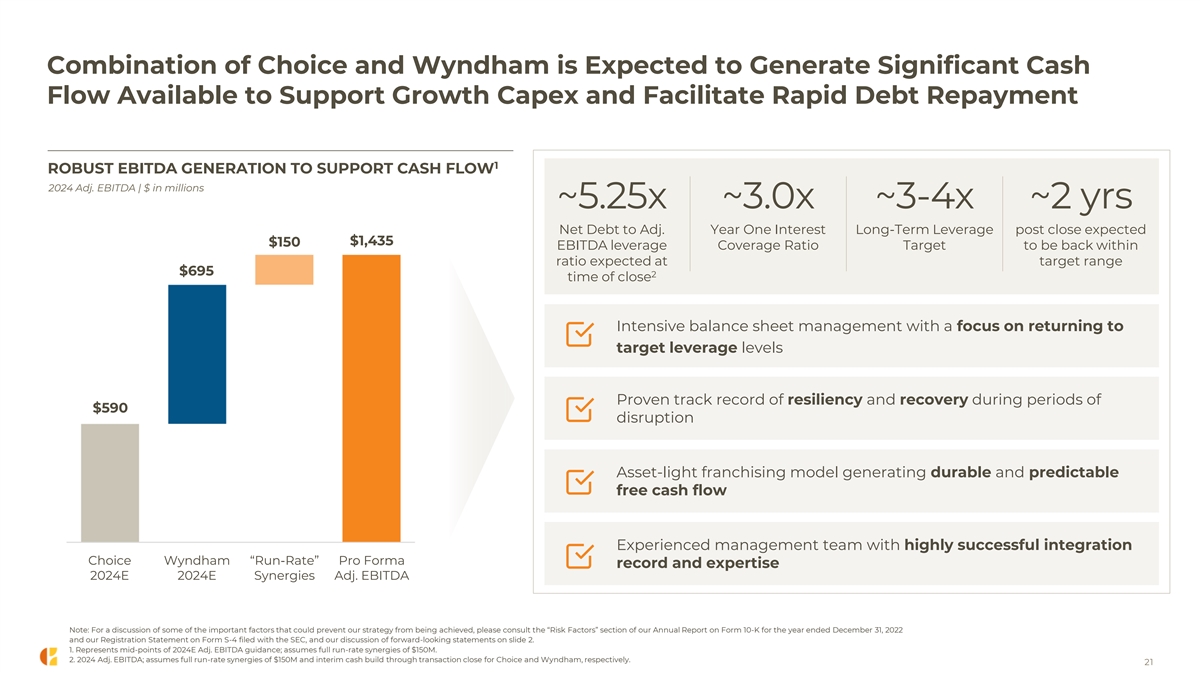

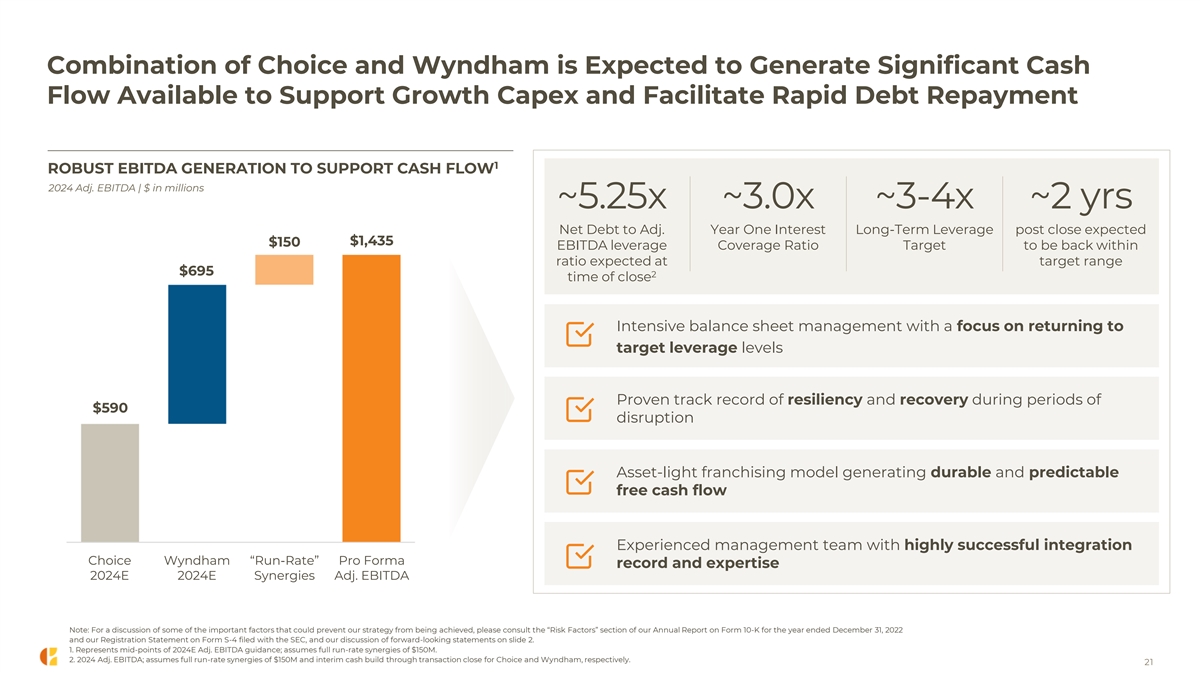

Combination of Choice and Wyndham is Expected to Generate Significant Cash Flow Available to Support Growth Capex and Facilitate Rapid Debt Repayment 1 ROBUST EBITDA GENERATION TO SUPPORT CASH FLOW 2024 Adj. EBITDA | $ in millions ~5.25x ~3.0x ~3-4x ~2 yrs Net Debt to Adj. Year One Interest Long-Term Leverage post close expected $1,435 $150 EBITDA leverage Coverage Ratio Target to be back within ratio expected at target range $695 2 time of close Intensive balance sheet management with a focus on returning to target leverage levels Proven track record of resiliency and recovery during periods of $590 disruption Asset-light franchising model generating durable and predictable free cash flow Experienced management team with highly successful integration Choice Wyndham “Run-Rate” Pro Forma record and expertise 2024E 2024E Synergies Adj. EBITDA Note: For a discussion of some of the important factors that could prevent our strategy from being achieved, please consult the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2022 and our Registration Statement on Form S-4 filed with the SEC, and our discussion of forward-looking statements on slide 2. 1. Represents mid-points of 2024E Adj. EBITDA guidance; assumes full run-rate synergies of $150M. 2. 2024 Adj. EBITDA; assumes full run-rate synergies of $150M and interim cash build through transaction close for Choice and Wyndham, respectively. 21

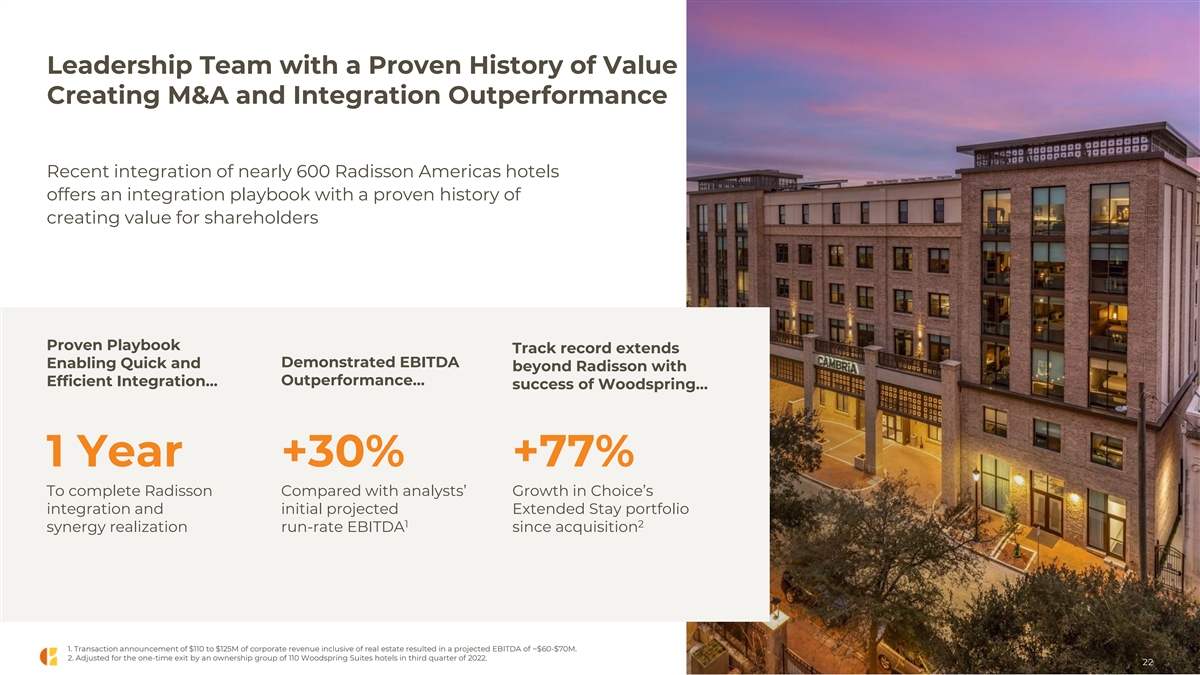

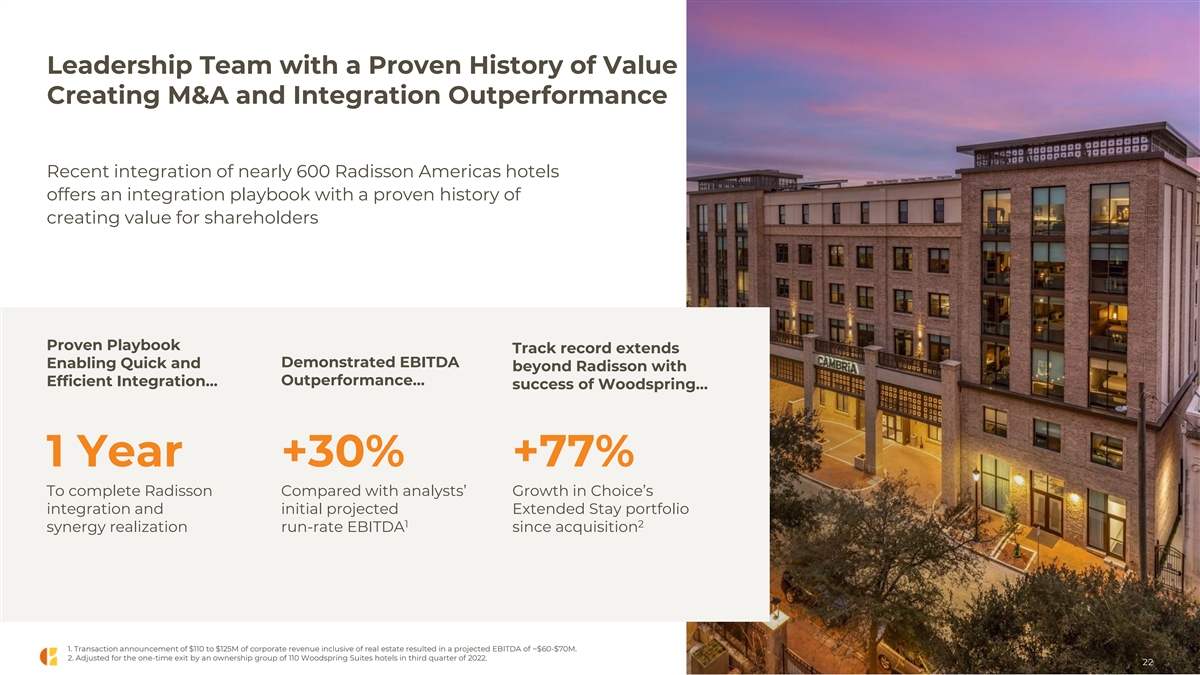

Leadership Team with a Proven History of Value Creating M&A and Integration Outperformance Recent integration of nearly 600 Radisson Americas hotels offers an integration playbook with a proven history of creating value for shareholders Proven Playbook Track record extends Demonstrated EBITDA Enabling Quick and beyond Radisson with Outperformance… Efficient Integration… success of Woodspring… 1 Year +30% +77% To complete Radisson Compared with analysts’ Growth in Choice’s integration and initial projected Extended Stay portfolio 1 2 synergy realization run-rate EBITDA since acquisition 1. Transaction announcement of $110 to $125M of corporate revenue inclusive of real estate resulted in a projected EBITDA of ~$60-$70M. 2. Adjusted for the one-time exit by an ownership group of 110 Woodspring Suites hotels in third quarter of 2022. 22 22

Choice is Committed to the Transaction Comfort Inn & Suites, Boise, ID

OUR COMMITMENT To complete this transaction within the standard one-year timeframe with no material disruption to Choice or Wyndham’s businesses 24

Focused on Obtaining Regulatory Approval • Choice strongly believes that the transaction is pro-competitive and will benefit all stakeholders, including Wyndham and Choice’s franchisees, shareholders, associates, and guests • Choice commenced the process to obtain regulatory approval under the Hart-Scott-Rodino (HSR) Act on December 12, 2023 • By ‘starting the clock’ now on the regulatory approval process, Choice is demonstrating its focus on securing approvals and delivering certainty to stakeholders regarding the timing to complete the transaction • This process may involve requests for additional information from the Federal Trade Commission and Wyndham’s cooperation will make the process more efficient • Commitment to any actions requested by regulators to obtain requisite approvals so long as such actions do not have a material adverse effect on the combined company 25

Franchisees Control Competitive Decision Making and Local Market Pricing… Franchisees control pricing, fostering a Decision-making will always competitive landscape by allowing diverse reside with the franchisees pricing strategies, encouraging ingenuity, and enabling franchisees to tailor offerings to meet specific market demands FRANCHISEES ARE IN CONTROL OF… 1 Setting Pricing Design Operating Staffing 1 Strategy Procedures Decisions Amenities & Location Construction Ability to Reposition Hotels Facilities to New Chain Scales 1. Subject to minimum brand standards. 26 26

…and Maintain Optionality as the Array of Options Keeps Growing …HOSTS MANY CURRENT PLAYERS AND CONTINUES TO THE EVER-EXPANDING GLOBAL LODGING MARKET… (1) WELCOME NEW ENTRANTS GLOBAL ROOMS | Rooms in thousands 6,000 (Hilton) (IHG) Project MidX (Sonesta) (Extended Stay America) (Marriott) (Accor) (Hyatt) 2,000 1,591 1,525 “We’re now entering the midscale tier…And so, we would compete more directly with some of their [Choice and Wyndham] brands.” 1,200 1,127 -- Anthony Capuano, Marriott CEO; November 7, 2023 912 844 817 802 628 “We have every intention to have the best brands in every market to serve mid- market because we think that's where the most money will be made over the 311 304 302 next 10 or 20 or 30 years..” 116 -- Christopher Nassetta, Hilton CEO; July 26, 2023 94 84 84 78 60 58 “Our Essentials and Suites collection consists of mid-scale, upper mid-scale and extended-stay brands[, representing] around 2/3 of our system size and… close to 60% of our pipeline…[Mid-scale segment] is a space ripe for share gains…” -- Elie Maalouf, IHG CEO; August 8, 2023 Source: Capital IQ. Market data as of October 16, 2023. Company Filings, Wall Street research, STR pipeline data as of September 2023. Note: Comparison with select hotels companies, does not represent the full competitive set. Wyndham property counts exclude properties under affiliation arrangements with Wyndham Destinations or other 3rd parties (186 properties as of 12/31/2022). 1. Company data as of year end 2022; non-public companies' units and room counts based on STR Global Census as of December 2022. 2. U.S. independent hotels room count based on STR U.S. Census. 27 U.S. Independent Hotels(2) Wyndham Choice

Choice is Willing to Provide Wyndham Shareholders with Significant Regulatory Protections to Enhance Transaction Certainty While Choice fully intends to complete the transaction within 12 months, Choice’s proposal includes: • Monthly ticking fee of $38 million commencing on the first anniversary from when 1 a majority of Wyndham shares are tendered into the exchange offer 2 • Commitment to undertake any requests from regulators to close the transaction • Flexibility to accommodate market standard timeframe to complete transaction • In addition, as proposed to Wyndham previously, Choice is willing to include a reverse break fee of $435M should Wyndham sign a definitive agreement − Represents ~6% of the total equity purchase price or ~$5.10 / share 3 − Recent transaction comparables have a median reverse break fee of ~4-5% of equity value 1. Regulatory ticking fee of $0.45 per Wyndham share per month, accruing daily after the one-year anniversary of the date a majority of Wyndham’s shares are tendered into the offer. 2. As long as any action would not have a material adverse effect on the combined company. 3. Peer set reflects Kroger-Albertsons, CVS-Signify Health, Broadcom-VMware and Jetblue–Spirit. 28

Choice + Wyndham: Better Together

Choice Franchisees Support Our Proposal “I own three Country Inn & “As an owner of Sleep Inn and Comfort brands, “As a multi-unit hotel owner / Suites and one Comfort Inn we rely on Choice for their best-in-class operator, it’s critical that I property. The transition of franchisee tools, support, and technology. In partner with a company I can Country Inn & Suites over into the hotel business, it is essential to stay ahead trust. I own both Choice and Choice after the Radisson of the market in terms of delivering a top- Wyndham properties, and Americas acquisition has gone quality stay experience to our guests, while while I think both companies smoothly. It is clear that also managing your bottom line. I am able to have good qualities, I believe Choice makes real use Choice’s technology to do just that — that Choice’s combination investments to grow and reduce operating costs, increase my direct with Wyndham will allow uplift brands after they bookings, and boost my profitability. Choice to help elevate the acquire them. For example, Choice has always been a reliable partner Wyndham brands.�� they worked with me to help and I can see how the acquisition of – DON KLAIN, LIGHTHOUSE me build model rooms at my Wyndham will help Choice continue to HOSPITALITY GROUP Country Inn & Suites hotel in decrease my costs of operations and deliver Charlottesville.” more direct business to my hotels.” – VINAY PATEL, CEO, – DAVID BURTON, CHAIRMAN, CHOICE HOTELS FAIRBROOK HOTELS OWNER’S COUNCIL (CHOC), OWNER 30

Delivering Value for Every Stakeholder Franchisees Guests Shareholders Increased More options across stay Immediate value creation investment in the occasions and price and accelerated tools to lower costs points, with an enhanced opportunities for sustained and grow revenue rewards program long-term growth 31

Combined Company Has An Enhanced Ability to Expand Within a Massive Total Addressable Market Choice’s expanded ecosystem and network is better positioned to fulfill long term lodging growth drivers SUPPORTED BY STRONG MACRO AND INDUSTRY TRENDS LARGE TOTAL ADDRESSABLE MARKET… Retirements — 1 in every 5 Americans are expected to be over 65 by 2030 Global Lodging 2028 $744B Rising Wages — The average American salary was 8% higher in February 2023 compared to a year ago +$720B …And Growing Global Lodging 2022 $411B Remote Work — More guests are extending weekend leisure trips to include “shoulder days” (Thursday/Sunday) +$387B US Lodging Road Trips — Two-thirds of all Americans are planned to $133B take a road trip in 2023 Large Addressable Market… +$108B Rebuilding — Industry experts estimate that investments + WH associated with the Infrastructure Investment and Jobs $25B Acts will generate between 50-100M room nights over the next decade $12B Source: Euromonitor International Ltd., Travel 2023ed. YoY ex rates, current prices. 32 Note: Total addressable market reflects upscale, mid-market and budget hotels.

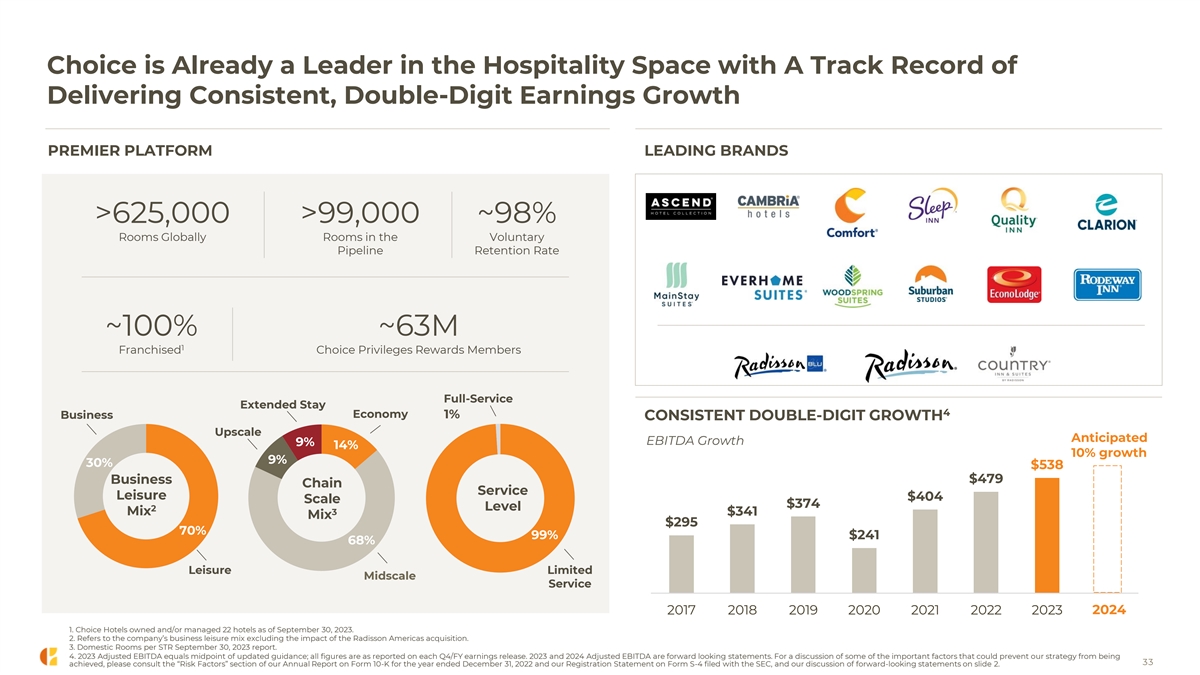

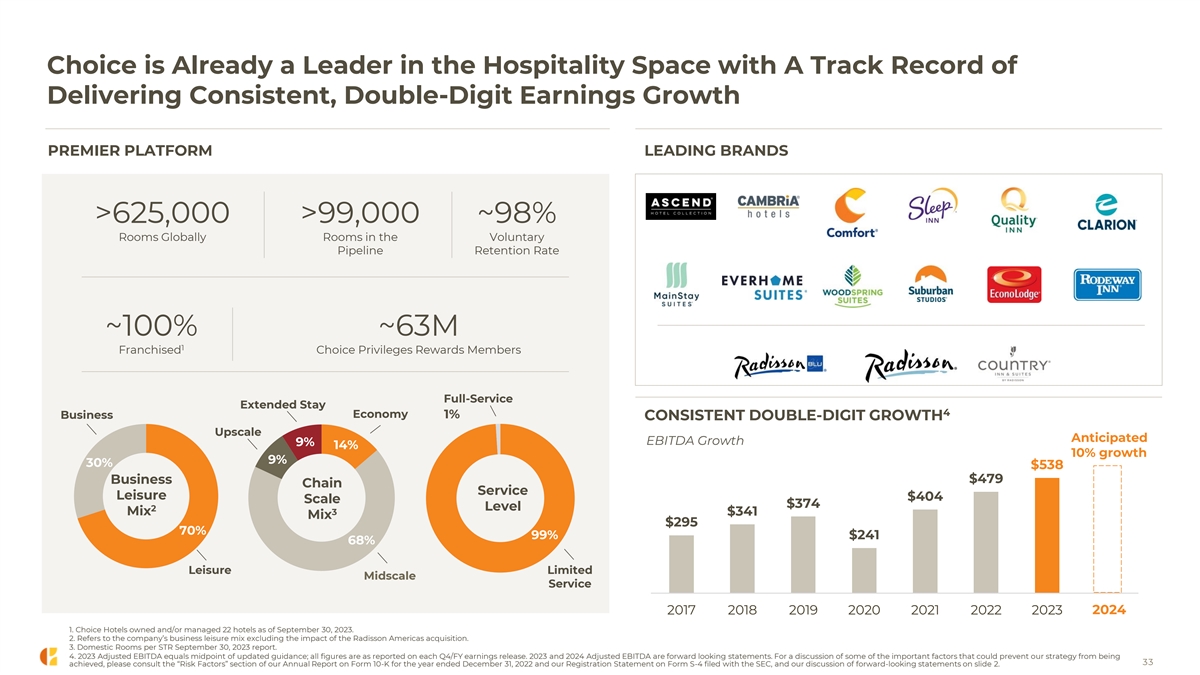

Choice is Already a Leader in the Hospitality Space with A Track Record of Delivering Consistent, Double-Digit Earnings Growth PREMIER PLATFORM LEADING BRANDS >625,000 >99,000 ~98% Rooms Globally Rooms in the Voluntary Pipeline Retention Rate ~100% ~63M 1 Franchised Choice Privileges Rewards Members Full-Service Extended Stay 4 Economy Business 1% CONSISTENT DOUBLE-DIGIT GROWTH Upscale Anticipated EBITDA Growth 9% 14% 10% growth 9% 30% $538 Business $479 Chain Service Leisure $404 Scale $374 2 Level Mix 3 $341 Mix $295 70% 99% $241 68% Leisure Limited Midscale Service 2017 2018 2019 2020 2021 2022 2023 202 2024 4 1. Choice Hotels owned and/or managed 22 hotels as of September 30, 2023. 2. Refers to the company’s business leisure mix excluding the impact of the Radisson Americas acquisition. 3. Domestic Rooms per STR September 30, 2023 report. 4. 2023 Adjusted EBITDA equals midpoint of updated guidance; all figures are as reported on each Q4/FY earnings release. 2023 and 2024 Adjusted EBITDA are forward looking statements. For a discussion of some of the important factors that could prevent our strategy from being 33 achieved, please consult the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2022 and our Registration Statement on Form S-4 filed with the SEC, and our discussion of forward-looking statements on slide 2.

Combined Company Would Realize Faster Growth and Significant Synergies 1 COMBINED COMPANY IS PROJECTED TO GROW RAPIDLY … Adjusted EBITDA | $ in millions 2 ~$150 ~$1,430-1,440 Projected long-term growth of ~$690-700 7-10% on an annualized basis Achieve $150mm of run-rate cost synergies within 24 months ~$590 Additional Revenue Synergies From an Improved Platform Higher Higher Untapped Net Unit RevPAR Partnerships Choice 2024E EBITDA Wyndham 2024E EBITDA Run-Rate Synergies Pro Forma 2024E EBITDA Growth Growth …AND BENEFITS FROM COMPELLING GROWTH DRIVERS RevPAR growth and retention of revenue-intense Enhanced platform offering hotels through brand equity improvement built to serve the value conscious traveler Favorable macroeconomic trends such as Top 3 platform driving improved customer demographic trends, infrastructure investment loyalty and satisfaction and reshoring Continued international expansion 1. These metrics are forward looking statements. For a discussion of some of the important factors that could prevent our strategy from being achieved, please consult the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2022 and our Registration Statement on Form S-4 filed with the SEC, and our discussion of forward-looking statements on slide 2. 2. Choice expects to realize the majority of the $150mm of synergies within 24 months.. 34

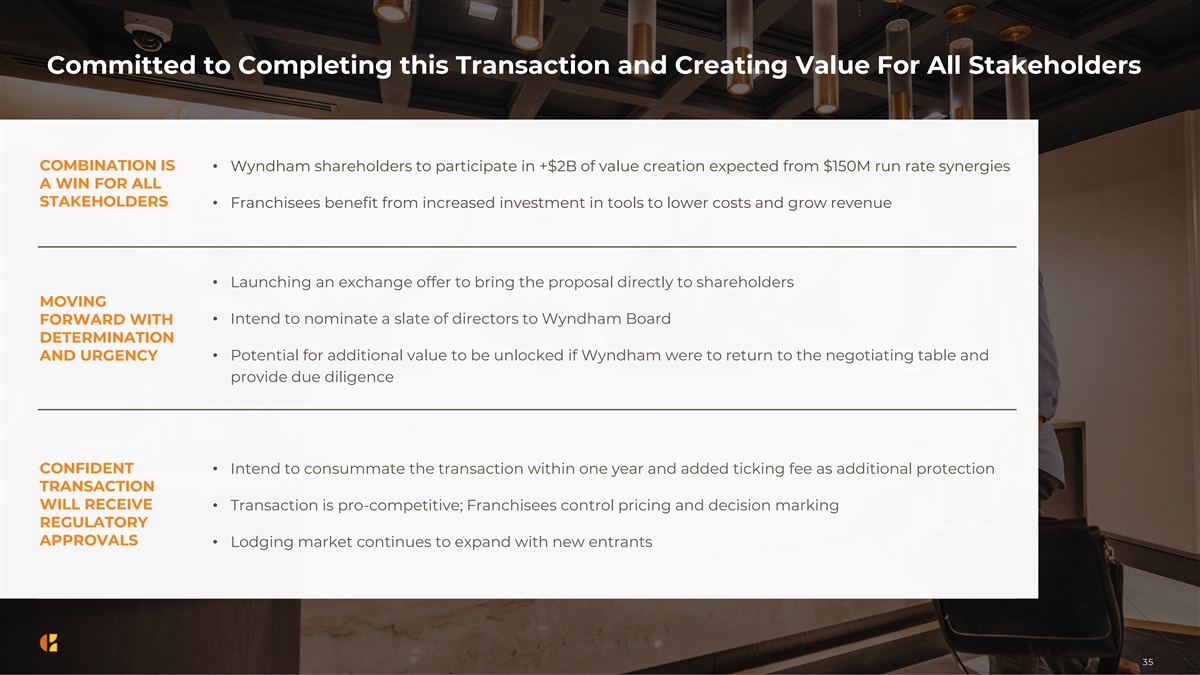

Committed to Completing this Transaction and Creating Value For All Stakeholders COMBINATION IS • Wyndham shareholders to participate in +$2B of value creation expected from $150M run rate synergies A WIN FOR ALL STAKEHOLDERS • Franchisees benefit from increased investment in tools to lower costs and grow revenue • Launching an exchange offer to bring the proposal directly to shareholders MOVING • Intend to nominate a slate of directors to Wyndham Board FORWARD WITH DETERMINATION - AND URGENCY• Potential for additional value to be unlocked if Wyndham were to return to the negotiating table and provide due diligence CONFIDENT • Intend to consummate the transaction within one year and added ticking fee as additional protection TRANSACTION WILL RECEIVE • Transaction is pro-competitive; Franchisees control pricing and decision marking REGULATORY APPROVALS • Lodging market continues to expand with new entrants 35