SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007

OR

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission file number 001-33192

www.bmhc.com

Building Materials Holding Corporation

Delaware | | 91-1834269 |

| (State of incorporation) | | (IRS Employer Identification No.) |

Four Embarcadero Center, Suite 3200, San Francisco, CA 94111

(415) 627-9100

Securities registered pursuant to Section 12(b) of the Act:

| | Name of each exchange |

Title of each Class | | on which registered |

| | | |

Common Stock, $0.001 par value per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer þ Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No þ

The aggregate market value of common shares held by non-affiliates of the registrant as of June 29, 2007 was $329,429,038. The market value computation excludes 6,173,315 shares held by affiliates such as directors, officers and holders of more than 5% of the common shares outstanding as of June 29, 2007.

The number of common shares outstanding as of March 10, 2008 was 29,381,760.

Documents Incorporated by Reference

| (1) | Portions of the Proxy Statement to be delivered to shareholders in connection with the Annual Meeting of Shareholders on May 6, 2008, are incorporated by reference in Part III of this Form 10-K. |

Building Materials Holding Corporation

FORM 10-K

For the Fiscal Year Ended December 31, 2007

INDEX

| | | | Page |

PART I | | | |

| | | | | 3 |

| | | | | 12 |

| | | | | 16 |

| | | | | 17 |

| | | | | 18 |

| | | | | 19 |

| | | | | |

PART II | | | |

| | | | | 20 |

| | | | | 22 |

| | | | | 23 |

| | | | | 49 |

| | | | | 50 |

| | | | | 93 |

| | | | | 93 |

| | | | | 93 |

| | | | | 94 |

| | | | | |

PART III | | | |

| | | | | 95 |

| | | | | 100 |

| | | | | 101 |

| | | | | 102 |

| | | | | 103 |

| | | | | |

PART IV | | | |

| | | | | 104 |

| | | | | |

| | | | | 111 |

Introduction - Risk Factors and Forward-Looking Statements

There are a number of business risks and uncertainties that affect our operations and therefore could cause future results to differ from past financial performance or expected results and ultimately affect the trading price of our common shares. Information regarding these risks and uncertainties is contained in Item 1A of this Form 10-K under the caption Risk Factors.

Certain statements in this Form 10-K including those related to expectations about homebuilding activity in our markets, demographic trends supporting homebuilding and anticipated sales and operating income are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Statements that are not historical or current facts, including statements about our expectations, anticipated financial results and future business prospects are forward-looking statements. While these statements represent our current judgment on what the future may hold and we believe these judgments are reasonable, these statements involve risks and uncertainties that are important factors that could cause our actual results to differ materially from those in forward-looking statements. These factors include, but are not limited to, the risks and uncertainties cited in Item 1A of this Form 10-K under the caption Risk Factors. Undue reliance should not be placed on such forward-looking statements, as such statements speak only as of the date of the filing of our 2007 Annual Report on Form 10-K. We undertake no obligation to update forward-looking statements.

PART I

General

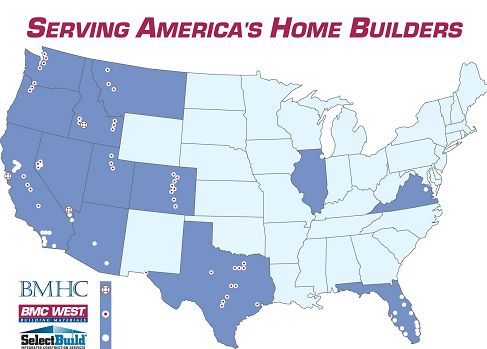

Building Materials Holding Corporation is one of the largest providers of residential building products and construction services in the United States, with a focus in the western and southern states. Our two subsidiaries, BMC West and SelectBuild, provide building products and construction services in 14 of the top 25 single-family construction markets. BMC West markets and sells building materials, manufactures building components and provides construction services to professional builders and contractors through a network of 40 distribution facilities and 59 manufacturing facilities. SelectBuild provides integrated construction services to production homebuilders in key growth markets as well as construction services to commerical and multi-family builders. We have increasingly focused on integrating construction services and manufactured building components to our customers.

Incorporated in the state of Delaware in 1987, Building Materials Holding Corporation trades on the NYSE under the ticker symbol BLG and is headquartered in San Francisco, California.

Periodic and current reports are filed with the Securities and Exchange Commission at www.sec.gov and are also available at our website www.bmhc.com.

Industry Overview

The residential building products and construction services industry is dependent on demand for single-family homes. Housing demand is influenced by many factors including the overall condition of the U.S. economy, mortgage and other interest rates, consumer confidence, job formation and demographic trends as well as other factors. The production of single-family homes is therefore variable and cyclical in nature. The U.S. Census Bureau reported a 29% drop in single-family housing starts to 1.0 million units in 2007 compared to 1.5 million in 2006 and the historic high of 1.7 million units in 2005. As of February 2008, single-family housing starts for 2008 are expected to decline to 0.7 million units according to the National Association of Home Builders. The industry is currently reducing the production of new homes in response to slowing demand and a high inventory of unsold homes.

Although the industry remains fragmented, consolidation is expected to continue to occur among homebuilders, building material distributors and construction service providers. We believe this continued consolidation will favor production homebuilders as well as larger established building material distributors and construction service providers.

At BMC West, we market and sell building products, manufacture building components and provide construction services to professional builders and contractors. Products include structural lumber and building materials purchased from manufacturers as well as manufactured building components such as millwork, trusses and wall panels. Construction services include installation of various building products and framing. We serve our customers based on a regional market management approach where strategic locations offer our entire breadth of building products, manufactured building components and construction services to a market area. We currently offer these products and services in major metropolitan markets in Texas, Washington, Colorado, Idaho, Utah, Montana, California, Oregon and Nevada.

At BMC West, we market and sell building products, manufacture building components and provide construction services to professional builders and contractors. Products include structural lumber and building materials purchased from manufacturers as well as manufactured building components such as millwork, trusses and wall panels. Construction services include installation of various building products and framing. We serve our customers based on a regional market management approach where strategic locations offer our entire breadth of building products, manufactured building components and construction services to a market area. We currently offer these products and services in major metropolitan markets in Texas, Washington, Colorado, Idaho, Utah, Montana, California, Oregon and Nevada.

At SelectBuild, we offer integrated construction services to production homebuilders as well as commercial and multi-family builders. These builders generally outsource framing and other construction services. Our services include wood framing or concrete block masonry, concrete services, plumbing and other services. Construction services include managing labor and construction schedules as well as sourcing materials. We currently offer these services in major metropolitan markets in California, Arizona, Nevada, Florida and Illinois.

At SelectBuild, we offer integrated construction services to production homebuilders as well as commercial and multi-family builders. These builders generally outsource framing and other construction services. Our services include wood framing or concrete block masonry, concrete services, plumbing and other services. Construction services include managing labor and construction schedules as well as sourcing materials. We currently offer these services in major metropolitan markets in California, Arizona, Nevada, Florida and Illinois.

Acquisition and Expansion Strategy

Our growth over the past several years has been largely due to acquisitions. We have grown our business through acquisitions as well as strategically expanding the breadth of our building products and construction services offered to professional builders, contractors and production homebuilders. In particular, we believe production homebuilders are seeking quality, reliable and cost effective solutions to meet their construction service needs. The fragmented nature of the building products and construction services industry provides acquisition opportunities. Acquisitions have been evaluated based on their anticipated performance, management depth, cultural fit, industry reputation and long-term potential customer base. We have typically entered a market by purchasing all or part of an existing business and then pursue integration of our products and services to capture market share. We have assigned experienced due diligence teams to review potential acquisition candidates and developed integration plans once we have agreed in principle to the general terms of an acquisition. As we manage our business through the current industry downturn, we do not intend to pursue acquisitions and our focus will be on enhancing existing operations.

Over the past few years, SelectBuild acquired businesses providing construction services to production homebuilders as follows:

2007 | | 2006 | | 2005 |

· door and molding installation services in Las Vegas, Nevada · remaining 49% interest in our existing truss manufacturer business in Fort Pierce, Florida · remaining 33% interest in our existing framing business in Delaware, Maryland and Virginia · remaining 27% interest in our existing plumbing business in Phoenix and Tucson, Arizona · concrete services in Fresno, California | | · distribution services in Southern California · remaining 49% interest in our existing concrete business in Arizona · window installation services in Phoenix, Arizona · framing services in Southern California · concrete services in Northern Arizona · wall panel and truss manufacturer in Palm Springs, California · remaining 20% interest in our existing concrete block masonry and concrete business in Florida · framing services in Palm Springs, California and Reno, Nevada | | · framing services in San Diego, California · concrete and plumbing services in Las Vegas, Nevada and Southern California · additional 20% interest in our existing concrete block masonry and concrete business in Florida · 51% interest in concrete services in Arizona · 73% interest in plumbing services in Phoenix and Tucson, Arizona · stucco services in Las Vegas, Nevada · 51% interest in framing services in Chicago, Illinois |

At BMC West, we are expanding our building products, manufactured building components, millwork and construction services to become a full-service provider to homebuilders. To facilitate product and service offerings in key markets, BMC West expanded or acquired operations as follows:

2007 | | 2006 | | 2005 |

· building materials distribution in Terrell, Texas · future expansion and consolidation site for building materials distribution and truss manufacturing in Helena, Montana · future site for building materials distribution in Houston, Texas · building materials distribution in Burlington, Washington · building materials distribution in San Antonio, Texas · expansion in progress for millwork facility in Coppell, Texas | | · expansion and consolidation of millwork facility in Englewood, Colorado · truss manufacturer in El Paso, Texas · future site for building materials distribution, truss and millwork facilities in Caldwell, Idaho · building materials distribution and truss manufacturer in Eastern Idaho · expansion of building materials distribution and truss manufacturing in Hurst, Texas · building materials distribution and millwork facility in Houston, Texas | | · truss manufacturer in McCall, Idaho · truss manufacturer in Missoula, Montana · millwork facility in Austin, Texas |

Both of our business segments customize their mix of building products and construction services to meet customer needs in their respective markets. Our acquisition and expansion strategy has changed our sales mix as follows:

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| Building products | 44% | | 40% | | 45% | | 56% | | 64% |

| Construction services | 56% | | 60% | | 55% | | 44% | | 36% |

Competitive Strengths

Strategically located in growing and diverse markets. Our strategy focuses on offering building products and construction services in large rapidly growing markets. According to single-family housing permit data from the U.S. Census Bureau, in 2007 we had operations in 14 of the top 25 U.S. metropolitan statistical areas. Our operations are geographically diverse and principally located in the western and southern states.

Full offering of manufactured products and other services. We believe we are well known and respected in our markets for the superior quality and breadth of our products and services. Through BMC West, we have increased our sales of manufactured products, which provide us with higher margins and increased opportunities to cross-sell other products to our customers. By supplying professional builders and contractors with manufactured products and other services as well as key building materials, we are able to help them reduce costs and cycle time.

Superior quality turnkey construction services. Through SelectBuild, we provide superior quality, cost effective and reliable construction service solutions to production homebuilders and other builders in our markets. Certifications from the National Association of Home Builders demonstrate our professional credibility, competence, business integrity and solid record of customer satisfaction. Because we provide services to multiple production homebuilders in our markets, we are able to maintain a well-trained workforce to provide our services. We believe our competitively priced services enable homebuilders to increase profitability and reduce cycle time with higher quality construction.

Significant economies of scale. Due to the high volume of materials and other building products we purchase, we may be able to negotiate lower prices on materials and further lower costs to our customers. In addition, we have established strong relationships with our suppliers. These strong relationships provide us significant purchasing advantages, including volume rebate programs and preferred customer status when supplies are limited.

Variable cost structure. Our cost of sales and a portion of our selling, general and administrative expenses are variable. Additionally, we can maximize free cash flow during industry downturns by reducing capital expenditures due to the fact that a significant portion of our capital expenditures are discretionary.

Experienced management team. We have a dedicated and experienced management team that combines extensive industry experience, local knowledge in the market areas we serve and experience managing a large, sophisticated enterprise. Our senior management team averages approximately 17 years of industry experience.

Focus on service. Our focus on service is a key factor that distinguishes us from competitors. We employ experienced, service-oriented individuals. Our product knowledge and construction service skills enable customers to rely on our expertise for project implementation and product recommendations. Our quality assurance initiatives limit callbacks on the services and products we provide. Our dedication to providing superior customer service to builders allows our employees to develop consistent relationships and generate repeat and referral business.

Our Customers

Our customers are professional homebuilders engaged in single-family residential construction. We also offer construction services to commercial and multi-family builders. These builders are generally customers with high-volume material and labor needs that require materials procurement, manufactured building components, construction services and on-time job-site delivery. These products and services are not typically offered by retailers selling to do-it-yourselfers, home improvement contractors and trades people.

BMC West customers are local and regional professional homebuilders as well as contractors. SelectBuild customers are principally production homebuilders.

On a consolidated basis, our largest customer accounted for 6% of sales in 2007, while the top five customers represented approximately 20% of consolidated sales. At our business segments, the top five customers accounted for 10% of sales at BMC West and 35% of sales at SelectBuild.

Competition

Our products and construction services compete with similar offerings in the marketplace and our competitors vary in size, management expertise and financial capabilities. Additionally, the markets in each of our business segments are fragmented and highly competitive. Given the fragmented nature of the industry, consolidation continues to occur among building material distributors and construction service providers.

BMC West competes with local, regional and national building products distributors. Builders generally select suppliers based on competitive pricing, product availability, reliable delivery, service, trade credit and knowledgeable personnel. SelectBuild competitors range from single-crew operations to large well-managed organizations spanning multiple markets. Also, some production homebuilders perform their own framing and other construction services.

Sales and Marketing

Our operations are located in many of the largest markets for single-family home construction. Economic strength as well as historical population and migration trends have generally supported the growth of residential construction in our markets. According to the U.S. Census Bureau, housing starts have favored the western and southern regions, representing 75% of annual starts over the past three years.

BMC West attracts customers by consistently providing quality building products and dependable customer service. Sales personnel are dedicated to sourcing new business and maintaining customer relationships. Marketing consists of industry-wide brand communications along with an array of regional marketing events and activities to enhance customer relationships.

SelectBuild relies on the value and solid reputation of their construction services to secure and maintain national and regional relationships with production homebuilders.

Cyclicality and Seasonality

Our business is dependent on demand for and supply of single-family homes which is influenced by changes in the overall condition of the U.S. economy, including interest rates, consumer confidence, job formation and other important factors. The production of single-family homes is therefore variable and cyclical in nature.

Because of weather conditions in some of our markets, our financial condition, results of operations of cash flows may be adversely affected by slower construction activity during the first and fourth quarters of the year.

Business Segments

The following information is presented for our business segments and should be read in conjunction with the Consolidated Financial Statements and related notes that appear in Item 8 of this Form 10-K.

Sales to external customers for building products and construction services are as follows (thousands):

| | | 2007 | | 2006 | | 2005 | |

BMC West | | | | | | | |

| Building products | | $ | 987,871 | | $ | 1,237,349 | | $ | 1,256,346 | |

| Construction services | | | 189,840 | | | 234,104 | | | 228,176 | |

| | | $ | 1,177,711 | | $ | 1,471,453 | | $ | 1,484,522 | |

| | | | | | | | | | | |

SelectBuild | | | | | | | | | | |

| Building products | | $ | 13,413 | | $ | 39,841 | | $ | 35,553 | |

| Construction services | | | 1,093,847 | | | 1,691,973 | | | 1,358,333 | |

| | | $ | 1,107,260 | | $ | 1,731,814 | | $ | 1,393,886 | |

| | | | | | | | | | | |

Total | | $ | 2,284,971 | | $ | 3,203,267 | | $ | 2,878,408 | |

Selected financial information is as follows (thousands):

| | | Sales | | (Loss) (1) Income from Continuing Operations Before Taxes and | | Depreciation | | | | | |

| | | Total | | Inter- Segment | | Trade | | Minority Interests | | and Amortization | | Capital (2) Expenditures | | Assets | |

Year Ended December 31, 2007 | | | | | | | | | | | | | | | |

| BMC West | | $ | 1,179,097 | | $ | (1,386 | ) | $ | 1,177,711 | | $ | 64,653 | | $ | 11,998 | | $ | 21,302 | | $ | 376,462 | |

| SelectBuild | | | 1,107,501 | | | (241 | ) | | 1,107,260 | | | (335,279 | ) | | 32,172 | | | 8,893 | | | 326,507 | |

| Corporate | | | — | | | — | | | — | | | (51,697 | ) | | 4,471 | | | 2,936 | | | 171,875 | |

Discontinued operations | | | — | | | — | | | — | | | — | | | — | | | 79 | | | — | |

| | | $ | 2,286,598 | | $ | (1,627 | ) | $ | 2,284,971 | | | (322,323 | ) | $ | 48,641 | | $ | 33,210 | | $ | 874,844 | |

| Interest expense | | | | | | | | | | | | 33,800 | | | | | | | | | | |

| | | | | | | | | | | | $ | (356,123 | ) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Year Ended December 31, 2006 | | | | | | | | | | | | | | | | | | | | | | |

| BMC West | | $ | 1,473,219 | | $ | (1,766 | ) | $ | 1,471,453 | | $ | 119,737 | | $ | 11,987 | | $ | 33,107 | | $ | 479,101 | |

| SelectBuild | | | 1,744,092 | | | (12,278 | ) | | 1,731,814 | | | 148,416 | | | 30,002 | | | 33,409 | | | 722,328 | |

| Corporate | | | — | | | — | | | — | | | (75,484 | ) | | 3,104 | | | 6,174 | | | 118,880 | |

Discontinued operations | | | — | | | — | | | — | | | — | | | — | | | 28 | | | 8,602 | |

| | | $ | 3,217,311 | | $ | (14,044 | ) | $ | 3,203,267 | | | 192,669 | | $ | 45,093 | | $ | 72,718 | | $ | 1,328,911 | |

| Interest expense | | | | | | | | | | | | 29,082 | | | | | | | | | | |

| | | | | | | | | | | | $ | 163,587 | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

Year Ended December 31, 2005 | | | | | | | | | | | | | | | | | | | | | | |

| BMC West | | $ | 1,486,152 | | $ | (1,630 | ) | $ | 1,484,522 | | $ | 147,781 | | $ | 11,010 | | $ | 17,293 | | $ | 439,779 | |

| SelectBuild | | | 1,395,182 | | | (1,296 | ) | | 1,393,886 | | | 160,957 | | | 13,695 | | | 62,611 | | | 623,877 | |

| Corporate | | | — | | | — | | | — | | | (72,631 | ) | | 2,450 | | | — | | | 79,029 | |

Discontinued operations | | | — | | | — | | | — | | | — | | | — | | | 42 | | | 7,840 | |

| | | $ | 2,881,334 | | $ | (2,926 | ) | $ | 2,878,408 | | | 236,107 | | $ | 27,155 | | $ | 79,946 | | $ | 1,150,525 | |

| Interest expense | | | | | | | | | | | | 14,420 | | | | | | | | | | |

| | | | | | | | | | | | $ | 221,687 | | | | | | | | | | |

(1) Includes the following impairments for 2007:

| | · | $330.4 million for the carrying amount of certain customer relationships and goodwill at SelectBuild and |

| | · | $6.7 million for the carrying amount of goodwill at BMC West. |

Includes the following impairments for 2006:

| | · | $2.2 million for the carrying amount of certain customer relationships and goodwill at SelectBuild. |

Includes the following impairments for 2005:

| | · | $1.3 million for the carrying amount of certain customer relationships and goodwill at SelectBuild. |

(2) Property and equipment from acquisitions are included as capital expenditures.

Operating Strategy

Our business units operate in specific markets and are organized under the business segments of BMC West and SelectBuild. Each regional manager has substantial autonomy and responsibility to address customer needs specific to their markets. The reputation of a building products distributor or construction services provider is often determined locally, where service, product suitability and knowledgeable customer service are critical. Managers are responsible for optimizing business activities in their markets, including the efficient use of personnel, assessing and maintaining working capital, procuring construction labor and material requirements, identifying potential customers and developing appropriate service and product offerings. Incentive compensation is based on successful growth and operating results tied to specific market areas and regions.

We focus on improving efficiency and productivity at our business units while giving special attention and support to units that are not meeting strategic objectives. When a business unit fails to meet performance criteria, remedies include adjusting the mix of products and services, restructuring management, consolidation or liquidation.

Purchasing

We purchase building products from numerous manufacturers and suppliers. Our largest supplier accounted for approximately 9% of purchases in 2007. Because commodity wood products are available from several manufacturers and suppliers, we believe the loss of any single supplier would not have a material adverse effect on our financial position, results of operations or cash flows.

In order to meet market specific needs and maintain appropriate inventory levels, purchasing decisions are made at the business unit level within the framework of corporate negotiated programs. Large volume purchases are made under company-wide guidelines. In addition, we participate in volume discount and cooperative advertising programs with suppliers.

The prices of commodity wood products, concrete, steel and other building products are volatile and may adversely impact financial condition, results of operations and cash flows when prices rapidly rise or fall. Our information systems allow business unit managers to closely monitor sales and inventory. With this supply and demand information, we generally avoid overstocking commodity wood products. As a result, we turn our commodity wood product inventory on average 13 times per year. Such rapid inventory turnover limits our potential exposure to inventory loss from commodity price fluctuations.

Management Information Systems

We are standardizing software and infrastructure platforms that support the information needs of our organization. Our standardization effort includes job cost and construction information, estimating, inventory management, reporting, project scheduling and human resource management.

We have developed a project methodology that allows us to efficiently deploy these information systems to our business units. Our job cost and construction information systems are fully deployed at SelectBuild business units and we expect our inventory management systems to be upgraded by early 2008. At BMC West, our NxTrend point of sale and inventory management systems are operating in approximately 75% of our business units. As we focus on reducing costs during the sharp contraction in the homebuilding industry, future implementations will be limited.

We continue to research, recommend and implement new technology solutions to improve information for decision-making. Remote information technology functions are being consolidated and moved to Boise, Idaho to lower costs and improve efficiencies. We are also pursuing negotiations with our telecommunication vendors to achieve economies on pricing.

Our network infrastructure consists of data centers in Boise, Idaho and Las Vegas, Nevada. This network infrastructure provides redundant services between data centers and allows for a more seamless disaster recovery capability.

Safety and Risk Management

The construction services industry incurs a higher number of accidents and subsequent costs for workers’ compensation claims than typically experienced at building materials distribution facilities. Consequently, we have several programs to enhance safety and reduce the risks encountered by our employees. These programs include instruction and training for truck drivers, construction safety, behavioral safety as well as on-line and instructor led training programs relating to OSHA compliance matters and safety hazards in the workplace.

We maintain comprehensive insurance coverage to mitigate the potential cost of claims. Our estimated cost for automobile, general liability and workers compensation claims is determined by actuarial methods. Claims in excess of certain amounts are insured with third-party insurance carriers. Reserves for claims are recognized based on the estimated costs of these claims as limited by the deductible of the applicable insurance policies.

Employees

Our success is highly dependent on the quality of our employees. Due to competition in attracting and retaining qualified employees, we maintain competitive compensation and benefit programs to attract, motivate and retain top-performers. We also provide extensive product knowledge, customer service and other supervisory or management training programs to achieve our goal of being both the employer and supplier of choice.

Our business is seasonal and in 2007 we employed an average of approximately 18,000 people. Specifically, BMC West employed 5,000, while SelectBuild employed 13,000 employees. Unions represent approximately 700 or less than 5% of these employees. We have not experienced any strikes or other work interruptions and have maintained generally favorable relations with our employees.

Executive Officers

Name | Age | Position and Business Experience |

| | | |

| Robert E. Mellor | 64 | Chairman of the Board and Chief Executive Officer Mr. Mellor became Chairman of the Board of Directors in 2002 and has been Chief Executive Officer since 1997. He has been a director since 1991. He was previously Of Counsel with the law firm of Gibson, Dunn & Crutcher LLP from 1990 to 1997. He is on the boards of directors of Coeur d’Alene Mines Corporation and The Ryland Group. He is also on the board of councilors of Save-the-Redwoods League. He does not serve on the audit committee or compensation committee of any of these boards. |

| | | |

| William M. Smartt | 65 | Senior Vice President and Chief Financial Officer Mr. Smartt has been a Senior Vice President and Chief Financial Officer since April 2004. Prior to joining the Company, he was an independent consultant from August 2001 to March 2004. From 1992 to 2001, he was Executive Vice President, Chief Financial and Administrative Officer of DHL Express, a leader in international air express services. His previous experience as a Chief Financial Officer included 10 years with Di Giorgio Corporation, a Fortune 500 Company, whose product lines included the distribution of building materials, prefabricated components and framing services. |

| | | |

| Stanley M. Wilson | 63 | President and Chief Operating Officer Mr. Wilson was appointed President and Chief Operating Officer of Building Materials Holding Corporation in February 2008. Mr. Wilson was appointed President and CEO of BMC West in 2004 and was appointed Senior Vice President in 2003. He was appointed Vice President in 2000 and was General Manager of the Pacific Division of BMC West from 1993 to 2003. Mr. Wilson has been with the company since its beginning in 1987. His previous experience includes 20 years with the building materials distribution business of Boise Cascade Corporation. |

| | | |

| Michael D. Mahre | 48 | Senior Vice President and President Mr. Mahre was appointed Senior Vice President of Building Materials Holding Corporation in 2003 and President and Chief Executive Officer of SelectBuild in 2002. He was appointed Vice President of Corporate Development in 2001. He joined the Company in 1999 as Director of Financial Planning and Analysis. Mr. Mahre was a principal of The Cambria Group, a private equity investment firm, from 1997 to 1998. |

| | | |

| Eric R. Beem | 38 | Vice President and Controller Mr. Beem was appointed Vice President in January 2006 and Controller in April 2005. He joined the Company as Accounting Manager in 1996. Mr. Beem is a Certified Public Accountant and his experience includes 3 years with an international public accounting firm. |

| | | |

| Mark R. Kailer | 54 | Vice President, Treasurer and Investor Relations Mr. Kailer has been Vice President and Treasurer since 2003. He joined the Company in 2000 as Assistant Treasurer. He was previously Senior Manager of Treasury Services at Circle International Group, a publicly-traded global logistics company based in San Francisco, from 1997 to 2000. |

| | | |

| Jeffrey F. Lucchesi | 54 | Senior Vice President, Chief Information Officer Mr. Lucchesi joined the Company in August 2004 as Senior Vice President and Chief Information Officer. From 2000 to 2004, he was Senior Vice President of Worldwide Operations for Corio, Inc., an enterprise application service provider. Mr. Lucchesi also served from 1994 to 2000 as Vice President and Chief Information Officer for DHL Express, a leader in international air express services. |

| | | |

| Paul S. Street | 59 | Senior Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary Mr. Street joined the Company in 1999 as Senior Vice President, General Counsel and Corporate Secretary and has been Chief Administrative Officer since 2001. He previously served as our outside General Counsel & Secretary while a partner of the law firm of Moffatt, Thomas, Barrett, Rock & Fields. |

Risks Related to Our Business

There are a number of business risks and uncertainties that affect our operations and therefore could cause future results to differ from past performance or expected results. These risks or uncertainties may include, but are not limited to the following factors:

Our business is dependent on demand for and supply of single-family homes which is influenced by changes in the overall condition of the U.S. economy, including interest rates, consumer confidence, job formation and other important factors.

The residential building products and construction services industry is highly dependent on demand for single-family homes, which is influenced by several factors. These factors include economic changes nationally and locally, mortgage and other interest rates, consumer confidence, job formation, demographic trends, inflation, building permit activity and availability of credit as well as other factors. The construction of new homes may experience decline due to over supply of home inventory levels, lack of availability of credit, the unavailability and unaffordability of land in attractive metropolitan areas, shortages of qualified tradespeople, shortages of materials and regulations that impose restrictive zoning and density requirements. Also, changes to housing patterns may occur, such as an increase in consumer demand for urban living rather than single-family suburban neighborhoods. All of these factors could limit demand for home construction and may adversely impact our financial condition, results of operations or cash flows.

There are risks associated with our business model.

Our business model seeks the strategic growth of construction services and distribution of building products in an effort to provide a comprehensive solution to builders. Providing these services and products includes the risks of availability and cost of qualified labor and claims for construction defects, product liability and workers’ compensation as well as the timely sourcing and availability of building products. Additionally, there is no guarantee that our efforts to offer these comprehensive solutions will continue to be accepted by the marketplace.

An inability to implement and maintain cost structures that align with revenue trends may have an adverse impact on our operating results.

When we experience slower periods of homebuilding activity, acquire new businesses or expand existing operations, we may experience inefficiencies in our cost structures. Our evaluation of and changes to expenses in response to declining sales may not be timely, leading to higher costs and lower returns on sales.

Compliance with credit facility covenants is dependent on operating performance and changes in interest expense may adversely impact our operating results.

Our ability to comply with our credit facility covenants depends on our operating performance. Reduced operating performance, organizational changes and other expenses may result in failure to comply with the financial covenants and adversely affect our ability to finance operations or capital needs and could create a default and cause all amounts borrowed to become due and payable immediately. Additionally, the amended credit facility restricts our ability to incur additional indebtedness, pay dividends, repurchase shares, enter into mergers or acquisitions, use proceeds from equity offerings, make capital expenditures and sell assets.

Increases in interest rates and the credit risk premium assigned to us as well as changes in the amount of debt will increase our interest expense. Higher interest expense may adversely impact our financial position, results of operations or cash flows for operating needs.

Changes in the business models of customers may limit our ability to provide building products and construction services required by our customers.

As the business models of our customers evolve, our existing building products and construction service offerings may not meet the needs of certain homebuilders. Homebuilders may decide to no longer outsource construction services or may purchase construction services and building products from separate suppliers. If we do not timely assess shifts in customer expectations, preferences and demands, our financial condition, results of operations or cash flows could be adversely affected.

The integration of acquired businesses may not result in anticipated cost savings and revenue synergies being fully realized or may take longer to realize than expected.

Our past growth has been largely due to acquisitions. As we manage our business through the current industry downturn, we do not intend to pursue acquisitions and our focus will be on enhancing existing operations. The integration of previously acquired businesses may not result in anticipated cost savings and revenue synergies being fully realized or may take longer to realize than expected. The management and acquisition of businesses involves substantial risks including:

| · | the uncertainty that an acquired business will achieve anticipated operating results; |

| · | significant expenses to integrate; |

| · | diversion of management attention; |

| · | departure of key personnel from the acquired business; |

| · | effectively managing entrepreneurial spirit and decision-making; |

| · | integration of different information systems; |

| · | managing new construction service trades; |

| · | unanticipated costs and exposure to unforeseen liabilities; and |

Losses of and changes in customers may have an adverse impact on our operating results.

We are exposed to the risk of loss arising from the failure of a customer. Although amounts due from our customers are typically secured by liens on their construction projects, in the event a customer cannot meet its payment obligations to us, there is a risk that the value of their underlying project will not be sufficient to recover the amounts owed to us. Estimated credit losses are considered in the valuation of amounts due from our customers, however the entire carrying amount is generally at risk.

While economic and regulatory changes seek to reduce excess unsold home inventory, stabilize housing affordability and eliminate overly negative perceptions of the future of the housing market, we may experience losses of and changes in customers. Our 5 largest customers represent 10% of sales for BMC West and 35% of sales for SelectBuild. Additionally, diversification of our sales mix to more products and services for multi-family and light commercial projects may result in changes to our customer mix. The loss of one or more of our significant customers and changes in customer mix may adversely affect our financial condition, results of operations or cash flows.

Our success is dependent upon the availability of and our ability to attract, train and retain qualified individuals.

Competition for employees is especially intense in both building products distribution and construction services. In markets with strong housing demand, we may experience shortages in qualified labor and key personnel, which may limit our ability to complete contracts as well as obtain additional contracts with builders. Additional employment and eligibility requirements as well as enhanced and perceived enforcement from state and federal authorities could also limit the availability of qualified labor. We cannot guarantee that we will be successful in recruiting and retaining qualified employees in the future.

Our operating results are affected by fluctuations in our costs and the availability of sourcing channels for commodity wood products, concrete, steel and other building products.

Prices of commodity wood products, concrete, steel and other building products are historically volatile and are subject to fluctuations arising from changes in domestic and international supply and demand, labor costs, competition, market speculation, government regulations and periodic delays in delivery. Rapid and significant changes in product prices may affect sales as well as margins due to a limited ability to pass on short-term price changes. We do not use derivative financial instruments to hedge commodity price changes.

We may experience shortages of building products as a result of unexpected demand or production difficulties as well as transportation limitations. Any disruption in our sources of supply for key building products could negatively impact our financial condition, results of operations or cash flows.

Our business is subject to intense competition.

We experience competition across all markets for our building products and construction services. Recently, there has been increased consolidation within the building materials distribution and construction services industry. As the industry consolidates, other building materials distributors, including large retail distributors focused on consumers, may aggressively pursue production homebuilders as well as other professional builders and contractors. These competitive factors may lead to pricing pressures and cause reductions in sales or margins as well as increases in operating costs. Loss of significant market share due to competition could result in the closure of facilities.

Weather conditions, including natural catastrophic events, may cause our operating results to fluctuate each quarter.

Our first and fourth quarters historically have been, and are expected to continue to be, adversely affected by weather conditions in some of our markets, causing decreases in operating results due to slower homebuilding activity. In addition, natural catastrophic events may cause our operating results to fluctuate.

The nature of our business exposes us to construction defect and product liability claims as well as other legal proceedings.

We are involved in construction defect and product liability claims relating to our various construction trades and the products we distribute and manufacture. We also operate a large fleet of trucks and other vehicles and therefore face some risk of accidents. Although we believe we maintain adequate insurance, we may not be able to maintain such insurance on acceptable terms or such insurance may not provide adequate protection against potential liabilities. Current or future claims may adversely affect our financial condition, results of operations or cash flows.

We may be adversely affected by disruptions in our information systems.

Our operations are dependent upon information for decision-making and the related information systems. A substantial disruption in our information systems for a prolonged period could result in delays in our services and products and adversely affect our ability to complete contracts and fulfill customer demands. Such delays, problems or costs may have an adverse effect on our financial condition, results of operations or cash flows.

Actual and perceived vulnerabilities as a result of terrorist activities and armed conflict may adversely impact consumer confidence and our business.

Instability in the economy and financial markets as a result of terrorism or war may impact consumer confidence and result in a decrease in homebuilding in our markets. Terrorist attacks may also directly impact our ability to maintain operations and services and may have an adverse effect on our business.

Federal, state and other regulations could impose substantial costs and/or restrictions on our business.

We are subject to various federal, state, local and other regulations, including among other things, work safety regulations promulgated by the Department of Labor’s Occupational Safety and Health Administration, transportation regulations promulgated by the Department of Transportation, employment regulations promulgated by the Department of Homeland Security and the United States Equal Employment Opportunity Commission and state and local zoning restrictions and building codes. More burdensome regulatory requirements in these or other areas may increase our costs and have an adverse effect on our financial condition, results of operations or cash flows.

Numerous other matters of a local and regional scale, including those of a political, economic, business, competitive or regulatory nature may have an adverse impact on our business.

Many factors shape the homebuilding industry and our business. In addition to the factors previously cited, there are other matters of a local and regional scale, including those of a political, economic, business, competitive or regulatory nature that may have an adverse effect on our business.

Risks Related to Our Shares

Risks related to our shares may include, however are not limited to:

Our share price may fluctuate significantly, which may make it difficult for shareholders to trade our shares when desired or at attractive prices.

The market price of our shares is subject to significant changes as a result of our operating performance and the other factors discussed above as well as perceptions and events that are beyond our control. Price and trading volume fluctuations for our shares may be unrelated or disproportionate to our operating performance. Additionally, our share price could fluctuate based on the expectations and performance of other publicly traded companies in the construction services and building products distribution industry.

Anti-takeover defenses in our governing documents and certain provisions under Delaware law could prevent an acquisition of our company or limit the price that investors might be willing to pay for our shares.

Our governing documents and certain provisions of Delaware law that apply to us could make it difficult for another company to acquire control of our company. For example, our certificate of incorporation allows our Board of Directors to issue, at any time and without shareholder approval, preferred shares with such terms as it may determine. Also, our certificate of incorporation provides that during certain types of transactions that could affect control, including the acquisition of 15% or more of our common shares, affiliates of any party to the transaction and persons having a material financial interest in the transaction may not be elected to the Board of Directors. These provisions and others could delay, prevent or allow our Board of Directors to resist an acquisition of our company, even if a majority of our shareholders favored the proposed transaction.

We have no unresolved comments from the Securities and Exchange Commission.

We lease our headquarters in San Francisco, California and our administrative service center in Boise, Idaho. Principal properties include distribution centers for building products, millwork fabrication and distribution sites, truss manufacturing plants, sales and administrative offices. Properties are located in growing metropolitan areas and emerging housing markets. Properties for BMC West are 66% owned and 34% leased while at SelectBuild 18% are owned and 82% leased. Our properties are in good operating condition and we believe they provide adequate capacity to meet the needs of our customers. Locations operate under the trade names BMHC, BMC West and SelectBuild as well as other brand names or trademarks. Properties by business segment are as follows:

BMC West | | SelectBuild | | Corporate |

Location | | Properties | | Location | | Properties | | Location | | Properties |

| Arizona | | 1 | | Arizona | | 16 | | California | | 1 |

| California | | 6 | | California | | 19 | | Idaho | | 1 |

| Colorado | | 14 | | Florida | | 8 | | Nevada | | 1 |

| Idaho | | 12 | | Illinois | | 1 | | | | |

| Montana | | 7 | | Nevada | | 11 | | | | |

| Nevada | | 3 | | Virginia | | 1 | | | | |

| Oregon | | 2 | | | | | | | | |

| Texas | | 31 | | | | | | | | |

| Utah | | 6 | | | | | | | | |

| Washington | | 6 | | | | | | | | |

We are involved in litigation and other legal matters arising in the normal course of business. In the opinion of management, the recovery or liability, if any, under any of these matters will not have a material effect on our financial position, results of operations or cash flows.

There were no matters submitted to a vote of security holders during the fourth quarter of the fiscal year.

PART II

| Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Common Shares

Our common shares trade on the NYSE market under the symbol BLG. The high and low share prices as well as cash dividends for each period were as follows:

| | | 2007 | | 2006 | |

| | | High | | Low | | Cash Dividends Declared | | High | | Low | | Cash Dividends Declared | |

| | | | | | | | | | | | | | |

| First quarter | | $25 | | $18 | | $0.10 | | $40 | | $32 | | $0.10 | |

| Second quarter | | $18 | | $13 | | $0.10 | | $38 | | $25 | | $0.10 | |

| Third quarter | | $15 | | $11 | | $0.10 | | $28 | | $21 | | $0.10 | |

| Fourth quarter | | $12 | | $ 5 | | $0.10 | | $28 | | $24 | | $0.10 | |

Our credit facility amended in February 2008 prohibits the payment of cash dividends on our common shares. The determination of future dividend payments (cash or shares) will depend on many factors, including credit facility restrictions, financial position, results of operations and cash flows.

As of February 29, 2008, there were approximately 14,100 shareholders of record and the closing price of our shares was $5.78.

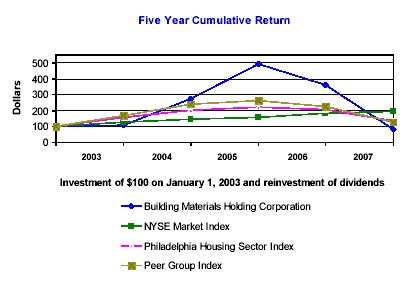

Share Performance Graph

The graph below depicts our cumulative total shareholder returns relative to the performance of:

| · | Philadelphia Housing Sector Index and |

The graph assumes $100 invested at the closing price of our common shares or the applicable index as well as reinvestment of dividends on the date paid. The points of the graph represent year-end index levels based on the last trading day of each year.

Our peer group index is composed of companies that reflect building products and construction services as follows:

· Avatar Holdings Inc. | · Lennar Corp. | · Simpson Manufacturing Co. Inc. |

· Beazer Homes USA Inc. | · Masco Corp. | · Standard Pacific Corp. |

· Brookfield Homes Corp. | · Meritage Homes Corp. | · Toll Brothers Inc. |

· Builders FirstSource Inc. | · MDC Holdings Inc. | · Universal Forest Products, Inc. |

· D.R. Horton Inc. | · NVR Inc. | · USG Corp. |

· KB Home | · Ryland Group Inc. | |

The following selected financial data should be read in conjunction with Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations as well as Item 8 - Financial Statements and Supplementary Data. These items provide further information to understand the comparability of selected financial data.

Selected Financial Data

(thousands, except share data)

| | | Year Ended December 31 | |

| | | 2007 (1) | | 2006 | | 2005 | | 2004 | | 2003 | |

Sales (2) | | | | | | | | | | | |

| Building products | | $ | 1,001,284 | | $ | 1,277,190 | | $ | 1,291,899 | | $ | 1,156,000 | | $ | 892,292 | |

| Construction services | | | 1,283,687 | | | 1,926,077 | | | 1,586,509 | | | 904,362 | | | 498,052 | |

| Total sales | | $ | 2,284,971 | | $ | 3,203,267 | | $ | 2,878,408 | | $ | 2,060,362 | | $ | 1,390,344 | |

| | | | | | | | | | | | | | | | | |

| Impairment of assets | | $ | 337,074 | | $ | 2,237 | | $ | 1,320 | | $ | 2,274 | | $ | 829 | |

| | | | | | | | | | | | | | | | | |

(Loss) income from operations (3) | | $ | (322,323 | ) | $ | 192,669 | | $ | 236,107 | | $ | 105,667 | | $ | 39,020 | |

| | | | | | | | | | | | | | | | | |

Net (loss) income (4) | | $ | (312,713 | ) | $ | 102,074 | | $ | 129,507 | | $ | 53,910 | | $ | 19,929 | |

| | | | | | | | | | | | | | | | | |

| Net (loss) income per diluted share | | $ | (10.86 | ) | $ | 3.45 | | $ | 4.41 | | $ | 1.94 | | $ | 0.74 | |

| | | | | | | | | | | | | | | | | |

| Annual cash dividends declared | | | | | | | | | | | | | | | | |

| per share | | $0.40 | | $0.40 | | $0.24 | | $0.14 | | $0.105 | |

| | | | | | | | | | | | | | | | | |

| Working capital | | $ | 263,180 | | $ | 242,800 | | $ | 304,459 | | $ | 270,437 | | $ | 216,898 | |

| Total assets | | $ | 874,844 | | $ | 1,328,911 | | $ | 1,150,525 | | $ | 743,044 | | $ | 604,199 | |

| Long-term debt, net of current portion | | $ | 344,376 | | $ | 349,161 | | $ | 278,169 | | $ | 206,419 | | $ | 186,773 | |

| Shareholders’ equity | | $ | 253,742 | | $ | 572,629 | | $ | 470,061 | | $ | 327,678 | | $ | 271,010 | |

| | | | | | | | | | | | | | | | | |

| Cash flows provided by operations | | $ | 67,279 | | $ | 273,418 | | $ | 198,294 | | $ | 33,374 | | $ | 12,479 | |

| | | | | | | | | | | | | | | | | |

| Single-family building permits in our markets per U.S. Census Bureau | | | 329,200 | | | 502,311 | | | 632,447 | | | 606,123 | | | 528,838 | |

(1) | As a result of changes in specific markets, the following impairments were recognized in 2007: |

| · | $330.4 million for the carrying amount of goodwill and certain customer relationships at SelectBuild and |

| · | $6.7 million for the carrying amount of goodwill at BMC West. |

| | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |

(2) Sales from acquisitions were: | | $ | 82,088 | | $ | 701,604 | | $ | 403,919 | | $ | 221,407 | | $ | 155,176 | |

(3) Income (loss) from operations of acquisitions was: | | $ | 7,595 | | $ | 55,454 | | $ | 31,588 | | $ | 2,764 | | $ | (3,628 | ) |

(4) | Income from discontinued operations was $14.6 million or $0.50 per share in 2007. Income from discontinued operations was not significant in prior years. |

| Management's Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion should be read in conjunction with the Consolidated Financial Statements and related notes that appear in Item 8 of Form 10-K as well as the caption under this item entitled Business Risks and Forward-Looking Statements.

Our Business

We are one of the largest providers of residential building products and construction services in the United States, with a focus in the western and southern states. We provide building products and construction services in 14 of the top 25 single-family residential construction markets through our two subsidiaries, BMC West and SelectBuild. BMC West markets and sells building products, manufactures building components and provides construction services to professional builders and contractors through a network of 40 distribution facilities and 59 manufacturing facilities. SelectBuild provides integrated construction services to production homebuilders in key growth markets as well as construction services to commercial and multi-family builders. We have increasingly focused on integrating construction services and manufactured building components to our customers.

Our operations are located in metropolitan areas that have historically outpaced U.S. averages for residential building permit activity. With building products and construction services offered in California, Texas, Arizona, Nevada, Washington, Colorado, Idaho, Utah, Florida, Montana, Oregon and Illinois, we believe we are in homebuilding markets supported by positive long-term population growth, household formation and demographic trends.

Business Environment and Executive Overview

Single-Family Housing

(000s)

The U.S. homebuilding industry experienced a sharp contraction in the production of single-family homes in 2007. Following a slowdown in production in 2006, the housing market was negatively impacted by an excess inventory of unsold homes, deteriorating consumer confidence, declining affordability, tightening lending standards and economic concerns. Single-family building permits for the U.S. were down 29% for 2007.

In our markets, we experienced a 35% drop in single-family building permits compared to 2006. The decline in homebuilding was widespread across all our markets for both building products and construction services. Lower sales from weakening buyer demand and increased competition for fewer available contracts led to declines in our gross margins, particularly for construction services. We expect market conditions will continue to be challenging in the foreseeable future and may apply further pressure to our sales, gross margins and operating results.

Our efforts are ongoing to implement and maintain cost structures that align with current revenue trends. During 2007 we have reduced our headcount by 18% and continue to pursue opportunities to reduce costs and improve operating efficiencies. Our growth was principally driven by acquisitions in recent years. As we manage our business through the current industry downturn, we do not intend to purse acquisitions and our focus will be on streamlining and strengthening our existing operations.

Acquisition and Expansion Strategy

Historically, acquisitions have strengthened and broadened our construction services and building product capabilities as well as our presence in attractive markets. In particular, we believe production homebuilders are seeking cost effective and reliable solutions to meet their construction services needs. Our services include framing, concrete, plumbing and other construction services as well as building product distribution and manufactured building components including trusses, millwork and wall panels. As we manage our business through the current industry downturn, we do not intend to pursue acquisitions and our focus will be on enhancing existing operations.

Over the past few years, SelectBuild acquired businesses providing construction services to production homebuilders as follows:

2007 | | 2006 | | 2005 |

· door and molding installation services in Las Vegas, Nevada · remaining 49% interest in our existing truss manufacturer business in Fort Pierce, Florida · remaining 33% interest in our existing framing business in Delaware, Maryland and Virginia · remaining 27% interest in our existing plumbing business in Phoenix and Tucson, Arizona · concrete services in Fresno, California | | · distribution services in Southern California · remaining 49% interest in our existing concrete business in Arizona · window installation services in Phoenix, Arizona · framing services in Southern California · concrete services in Northern Arizona · wall panel and truss manufacturer in Palm Springs, California · remaining 20% interest in our existing concrete block masonry and concrete business in Florida · framing services in Palm Springs, California and Reno, Nevada | | · framing services in San Diego, California · concrete and plumbing services in Las Vegas, Nevada and Southern California · additional 20% interest in our existing concrete block masonry and concrete business in Florida · 51% interest in concrete services in Arizona · 73% interest in plumbing services in Phoenix and Tucson, Arizona · stucco services in Las Vegas, Nevada · 51% interest in framing services in Chicago, Illinois |

At BMC West, we are expanding our building products, manufactured building components, millwork and construction services to become a full-service provider to homebuilders. To facilitate product and service offerings in key markets, BMC West expanded or acquired operations as follows:

2007 | | 2006 | | 2005 |

· building materials distribution in Terrell, Texas · future expansion and consolidation site for building materials distribution and truss manufacturing in Helena, Montana · future site for building materials distribution in Houston, Texas · building materials distribution in Burlington, Washington · building materials distribution in San Antonio, Texas · expansion in progress for millwork facility in Coppell, Texas | | · expansion and consolidation of millwork facility in Englewood, Colorado · truss manufacturer in El Paso, Texas · future site for building materials distribution, truss and millwork facilities in Caldwell, Idaho · building materials distribution and truss manufacturer in Eastern Idaho · expansion of building materials distribution and truss manufacturing in Hurst, Texas · building materials distribution and millwork facility in Houston, Texas | | · truss manufacturer in McCall, Idaho · truss manufacturer in Missoula, Montana · millwork facility in Austin, Texas |

Performance Measurements

We measure our operating performance and financial condition based on several factors including:

| · | Sales | · | Management of working capital |

| · | Income from operations | · | Return on investment |

The discussion of our results of operations and financial condition provides information to assist the reader in understanding our financial statements, changes in key items in those financial statements and the primary factors that accounted for those changes. The discussion of our consolidated financial results is followed by a more detailed review of our business segments.

RESULTS OF OPERATIONS

2007 COMPARED TO 2006

The following table sets forth the amounts and percentage relationship to sales of certain costs, expenses and income items (millions, except per share data):

| | | Year Ended December 31 | |

| | | 2007 | | 2006 | |

Sales | | | | | | | | �� | |

| Building products | | $ | 1,001 | | | 43.8 | % | $ | 1,277 | | | 39.9 | % |

| Construction services | | | 1,284 | | | 56.2 | | | 1,926 | | | 60.1 | |

Total sales | | | 2,285 | | | 100.0 | | | 3,203 | | | 100.0 | |

| | | | | | | | | | | | | | |

Costs and operating expenses | | | | | | | | | | | | | |

| Cost of goods sold | | | | | | | | | | | | | |

| Building products | | | 726 | | | 72.5 | | | 930 | | | 72.8 | |

| Construction services | | | 1,117 | | | 87.0 | | | 1,586 | | | 82.3 | |

| Impairment of assets | | | 337 | | | 14.7 | | | 2 | | | — | |

| Selling, general and administrative expenses | | | 438 | | | 19.2 | | | 496 | | | 15.5 | |

| Other income, net | | | (11 | ) | | (0.5 | ) | | (4 | ) | | (0.1 | ) |

| Total costs and operating expenses | | | 2,607 | | | 114.1 | | | 3,010 | | | 94.0 | |

| | | | | | | | | | | | | | |

(Loss) income from operations | | | (322 | ) | | (14.1 | ) | | 193 | | | 6.0 | |

| | | | | | | | | | | | | | |

| Interest expense | | | 34 | | | 1.5 | | | 29 | | | 0.9 | |

| | | | | | | | | | | | | | |

(Loss) income from continuing operations before income taxes and minority interests | | | (356 | ) | | (15.6 | ) | | 164 | | | 5.1 | |

| | | | | | | | | | | | | | |

| Income tax benefit (expense) | | | 29 | | | 1.2 | | | (56 | ) | | (1.7 | ) |

| Minority interests income, net of income taxes | | | (1 | ) | | — | | | (9 | ) | | (0.3 | ) |

(Loss) income from continuing operations | | | (328 | ) | | (14.4 | ) | | 99 | | | 3.1 | |

| | | | | | | | | | | | | | |

Income from discontinued operations prior to sale | | | 4 | | | 0.2 | | | 5 | | | 0.2 | |

| Gain on sale of discontinued operations | | | 20 | | | 0.9 | | | — | | | — | |

| Income taxes | | | (9 | ) | | (0.4 | ) | | (2 | ) | | (0.1 | ) |

Income from discontinued operations | | | 15 | | | 0.7 | | | 3 | | | 0.1 | |

| | | | | | | | | | | | | | |

Net (loss) income | | $ | (313 | ) | | (13.7 | )% | $ | 102 | | | 3.2 | % |

| | | | | | | | | | | | | | |

Net (loss) income per share: | | | | | | | | | | | | | |

| Continuing operations | | $(11.36 | ) | | | | $3.35 | | | | |

| Discontinued operations | | | 0.50 | | | | | | 0.10 | | | | |

| Diluted | | $(10.86 | ) | | | | $3.45 | | | | |

Consolidated Financial Results

Selected financial results were as follows (millions):

Sales and (Loss) Income from Operations

| | | 2007 | | 2006 | | % Change | |

Sales | | | | | | | |

| Building products | | $1,001 | | $1,277 | | | (22)% | |

| Construction services | | | 1,284 | | | 1,926 | | | (33)% | |

| | | $2,285 | | $3,203 | | | (29)% | |

| | | | | | | | | | | |

(Loss) income from operations | | $(322 | ) | $193 | | | n/m | |

Sales decreased 29% or $918 million to $2.3 billion. A sharp contraction in new home construction consistent with the national downturn in homebuilding was responsible for the decline. Single-family building permits in our markets were down 35% whereas the U.S. overall was down 29% compared to 2006. Weak buyer demand and an excess inventory of unsold homes curtailed new home starts by homebuilders. Sales of construction services were particularly lower since these sales are from production homebuilders who significantly reduced new home construction.

Gross margins declined to 19.4% of sales from 21.4% in the prior year. Bidding for construction contracts was more competitive as fewer opportunities were available for builders. As a result, margins for construction services were sharply lower, while margins for building products improved due to a shift in sales mix to manufactured building components.

Intangibles and Goodwill Impairment

Consistent with the overall housing industry, our operating segments suffered from the effects of the sharp contraction in single-family home construction. The reporting units of our SelectBuild operating segment and the Colorado reporting unit of our BMC West segment demonstrated significant declines in operating performance in the later portion of the fourth quarter of 2007.

During the later portion of the fourth quarter of 2007, the leading sources of economic and housing data forecasted sharper reductions in housing starts. The rapid deterioration in housing forecasts and our operating performance resulted in significant revisions of our operating expectations underpinning the assumptions of recoverability of the carrying amount of customer relationships and goodwill. Additionally, our enterprise value reflected a significant reduction as investors considered overly negative perceptions of the future of the housing market and depressed the share values of housing related companies. For impairment testing, the fair values were determined based on estimates of enterprise value as well as the present value of estimated future operating cash flows. As a result, we determined the carrying amount of certain customer relationships and goodwill exceeded their respective estimated fair values and recognized the following impairments:

| · | $30.0 million for certain customer relationships at SelectBuild, |

| · | $300.2 million for goodwill at SelectBuild, |

| · | $6.7 million for goodwill at BMC West and |

| · | $0.2 million for certain equipment at SelectBuild. |

In addition, the related tax benefit for these impairments was limited to $24 million based on the estimated realization of tax benefits for current and prior periods. To the extent taxable income is generated in future periods, additional tax benefits related to these impairments may be realized and reduce our future effective tax rate.

Continued deterioration in our markets could result in additional impairments of the carrying amount of intangibles and goodwill.

Loss from operations was $322 million compared to income of $193 million in the prior year. Excluding impairments, income from operations was $15 million. Our results from operations declined due to a sharp reduction in sales volume and lower gross margins for construction services.

Selling, general and administrative expenses decreased 12% or $58 million from 2006 due to reductions in the number of employees and related expenses as well as incentive compensation based on operating performance.

As a percent of sales, selling, general and administrative expenses increased 3.7% to 19.2%. These expenses as a percent of sales were higher as a result of the decline in construction services sales volume as well as:

| · | a shift in sales mix to building products from construction services, |

| · | decreases in commodity wood product prices and |

| · | the relatively fixed portion of these expenses. |

Interest Expense

Interest expense of $34 million increased $5 million from the prior year. The increase was due to a rise in interest rates and higher average borrowings. Borrowings were higher to complete payments for acquisitions made in the prior year and fund seasonal working capital requirements.

Income Taxes

The impairment of goodwill and certain customer relationships resulted in a limited income tax benefit of approximately $24 million. To the extent taxable income is generated in future periods, the tax benefit derived from the impairments will be realized and reduce our future effective tax rate. Our combined federal and state income tax rate was a benefit of 6.2% compared to an expense of 33.7% a year ago.

Discontinued Operations

In September 2007, our BMC West business segment sold three building materials distribution businesses in Western Colorado. Gain on the sale of these discontinued operations was $20 million, principally from the December 2007 sale of remaining real estate in Aspen, Colorado. These business units were previously reported as a component of BMC West and were approximately 3% of sales.

Business Segments

Sales and (loss) income from operations by business segment were as follows (millions):

| | | 2007 | | 2006 | |

| | | Sales | | (Loss) Income from Operations | | Sales | | Income from Operations | |

| BMC West | | $ | 1,178 | | $ | 65 | | $ | 1,471 | | $ | 120 | |

| SelectBuild | | | 1,107 | | | (335 | ) | | 1,732 | | | 148 | |

| Corporate | | | — | | | (52 | ) | | ― | | | (75 | ) |

| | | $ | 2,285 | | $ | (322 | ) | $ | 3,203 | | $ | 193 | |

BMC West

Selected financial results were as follows (millions):

| | | 2007 | | 2006 | | % Change | |

Sales | | $ | 1,178 | | $ | 1,471 | | | (20)% | |

| | | | | | | | | | | |

Income from operations | | $ | 65 | | $ | 120 | | | (46)% | |

Sales decreased 20% to $1.2 billion from $1.5 billion in 2006. Consistent with the national downturn in homebuilding, sales were lower in all our regions. Single-family building permits in our markets and the U.S. overall were down 29% compared to 2006. Our commodity wood product prices decreased approximately $93 million relative to a year ago. Adjusting for the impact of commodity wood product prices, our sales declined 14% and were less than the 29% decrease in building permits in our markets.

Income from operations decreased 46% to $65 million from $120 million. Excluding the impairment of $7 million for goodwill at our Colorado operations, income from operations was $72 million or a decrease of 40%. The decrease in income from operations was attributable to lower sales volume. Gross margins improved to 26.3% of sales from 25.9% a year ago. Margins improved due to a shift in sales mix to manufactured building components and improvements in construction services.

Selling, general and administrative expenses decreased 5% or $14 million from a year ago due to reductions in:

| | · | the number of employees and related expenses, |

| | · | incentive compensation based on operating performance as well as |

Due to lower sales and decreases in commodity wood product prices, these expenses as a percent of sales increased to 21.2% from 17.9% a year ago.

SelectBuild

Selected financial results were as follows (millions):

| | | 2007 | | 2006 | | % Change | |

Sales | | $ | 1,107 | | $ | 1,732 | | | (36)% | |

| | | | | | | | | | | |

(Loss) income from operations | | $ | (335 | ) | $ | 148 | | | n/m | |

Sales decreased 36% to $1.1 billion from $1.7 billion a year ago. In response to weak demand for new homes and an excess inventory of unsold homes, production homebuilders sharply curtailed construction. As a consequence, our framing starts declined 35% from the prior year. The Southwest and Pacific regions experienced the largest declines in sales volume. We anticipate market conditions in the near term will remain challenging until excess inventory has been absorbed and buyer demand strengthens.

Loss from operations was $335 million compared to income of $148 million. Excluding the impairments of $330 million for goodwill and certain customer relationships, loss from operations was $5 million. The loss from operations was due to lower sales and a decline in gross margins. With fewer contracts available, competitive pressures lowered margins to 12.0% of sales from 17.8% a year ago, a 33% decline. We anticipate margins will continue to be under pressure during the current industry downturn.

Selling, general and administrative expenses declined 16% or $25 million from a year ago. These expenses were lower due to reductions in:

| · | the number of employees and related expenses, |

| · | incentive compensation based on operating performance and |

| · | an operating performance payment for a recent acquisition. |

These expenses were leveraged against lower sales compared to 2006 and were 12.1% of sales compared to 9.1% a year ago.

Corporate

Corporate represents expenses to support the operations of our business segments, BMC West and SelectBuild. These costs include administrative functions for information systems, reporting, accounts payable and human resources, executive and senior management, professional fees for regulatory compliance and certain incentive compensation as well as actuarial adjustments for insurance and medical claims. These costs are not allocated to our business segments.

Selected financial results are as follows (millions):

| | | 2007 | | 2006 | | % Change |

Operating expenses | | $52 | | $75 | | (31)% |

Corporate expenses decreased 31% to $52 million from $75 million a year ago. The decrease was due to lower incentive compensation based on operating performance. Corporate expenses were consistent with the prior year at 2.3% of sales.

2006 COMPARED TO 2005

The following table sets forth the amounts and percentage relationship to sales of certain costs, expenses and income items (millions, except per share data):

| | | Year Ended December 31 | |

| | | 2006 | | 2005 | |

Sales | | | | | | | | | |

| Building products | | $ | 1,277 | | | 39.9 | % | $ | 1,292 | | | 44.9 | % |