UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-08371

| T. Rowe Price Real Estate Fund, Inc. |

|

| (Exact name of registrant as specified in charter) |

| |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Address of principal executive offices) |

| |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2017

Item 1. Report to Shareholders

| Real Estate Fund | December 31, 2017 |

The views and opinions in this report were current as of December 31, 2017. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our Email Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

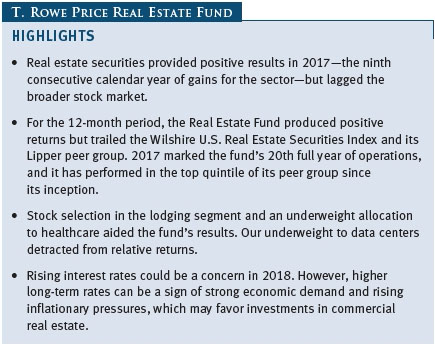

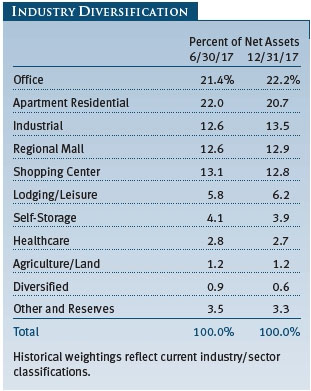

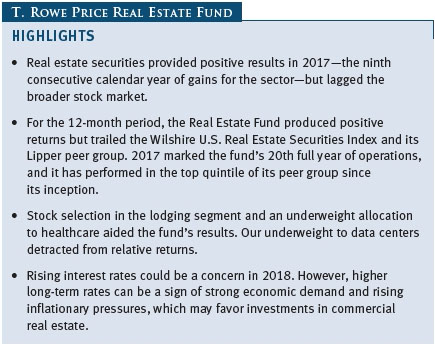

A stronger second half of the year resulted in modest gains for the fund’s real estate securities in 2017, marking the ninth consecutive year of positive total returns for Real Estate Fund investors. However, returns were stronger across broader market indices, such as the S&P 500 Index, due in part to tax reforms that were viewed as more beneficial to corporations than real estate investment trusts (REITs) that already benefit from a low tax structure.

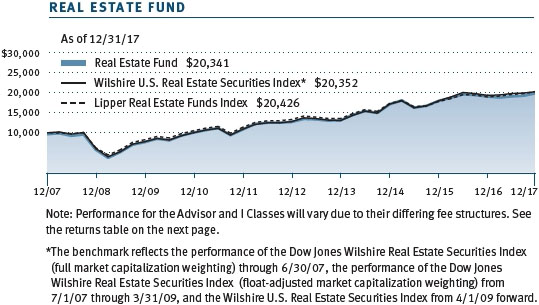

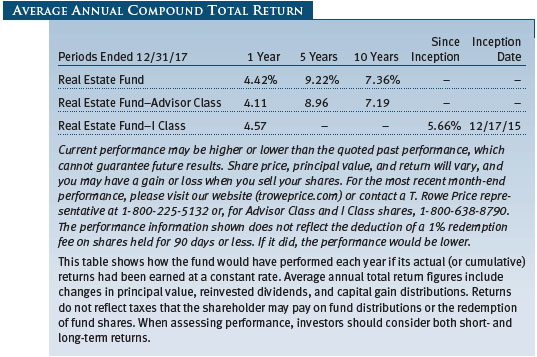

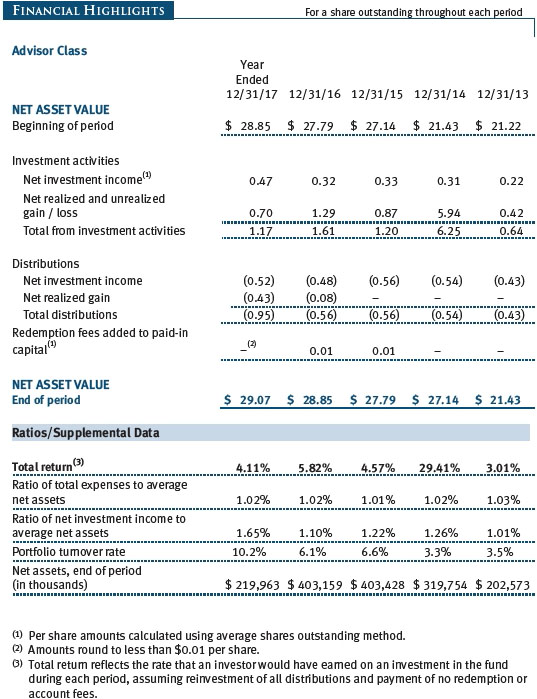

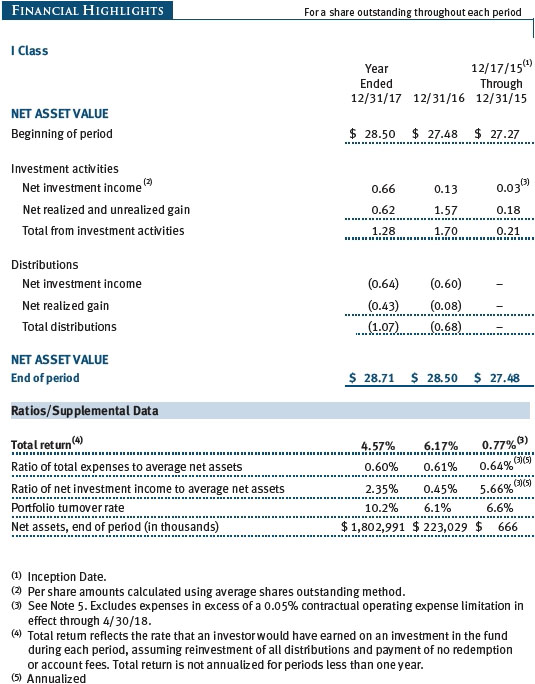

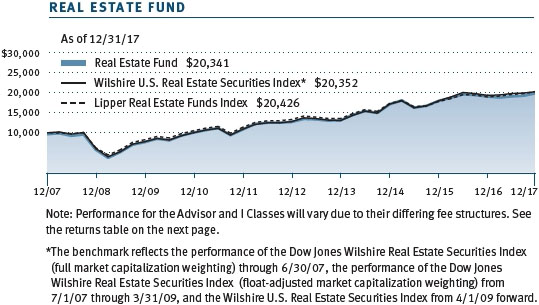

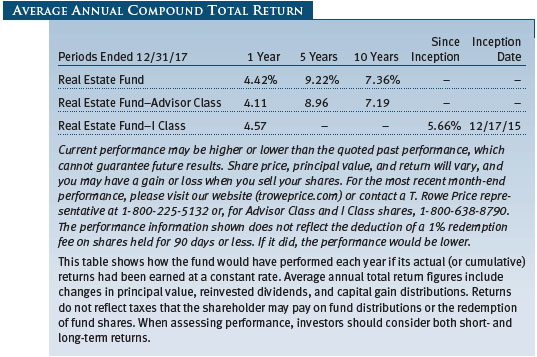

For the 12-month period ended December 31, 2017, the Real Estate Fund returned 4.42% and trailed the Wilshire U.S. Real Estate Securities Index and its Lipper peer group. The fund’s results were more competitive over the second half of the calendar year, and it outperformed its benchmark and peer group for the most recent six-month period. (The returns for the Advisor and I Class shares vary, reflecting their different fee structures.)

Your fund compared favorably versus its peer group during longer time periods. Lipper ranked the Real Estate Fund in the top quartile among real estate funds for the five-year period ended December 31, 2017, and in the top quintile for the since-inception period, which now spans more than 20 years. (Based on cumulative total return, Lipper ranked the fund 158 of 260, 100 of 230, 43 of 200, 44 of 141, and 4 of 28 funds for the 1-, 3-, 5-, and 10-year and since-inception (October 31, 1997) periods ended December 31, 2017, respectively. Past performance cannot guarantee future results.)

DIVIDEND DISTRIBUTION

On December 12, 2017, your fund’s Board of Directors declared a fourth-quarter dividend of $0.29 per share to shareholders of record on that day, which was paid on December 14. You should have received your check or statement reflecting this distribution. This brings total distributions for the year to $0.78 per share; however, a portion of this amount has been reclassified as capital gains for tax purposes. Please remember to use your IRS Form 1099-DIV, not your year-end T. Rowe Price account statement, for tax-filing purposes, in order to accurately reflect the reclassification of a portion of the fund’s income distribution. (Advisor Class distributions were $0.27 per share in the fourth quarter and $0.69 for the year while I Class shares totaled $0.30 and $0.81 for the respective periods.)

MARKET ENVIRONMENT AND STRATEGY

Real estate securities managed modest gains within an environment that seemed to offer recurring challenges throughout the year. Specifically, REITs battled to overcome adverse sentiment related to rising interest rates, the challenges facing traditional retailers, devastating hurricanes, and the uncertain effects of tax reform. Overall, REITs managed to provide positive total returns for the ninth consecutive calendar year.

Despite the inability of Congress to enact sweeping legislation for much of the year, especially regarding broad healthcare reforms, business sentiment and confidence remained high with a new president and one-party control of the White House, Senate, and House of Representatives. The economy continued to expand, and unemployment remained at low levels. The business environment was perceived as friendlier with less regulatory burden. Though uncertainty surrounded the future of free trade, there were few actual actions in this area despite some threatening rhetoric.

The continued economic expansion and tight labor markets led the Federal Reserve to increase short-term interest rates three times during the year in an effort to normalize policy. Higher interest rates also offer the Fed a potential easing tool in the event of weaker economic conditions in the future. While shorter-maturity interest rates increased markedly during the year, longer-term rates were little changed.

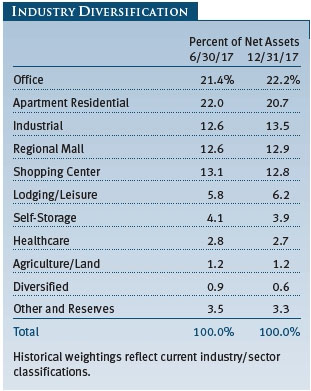

Stronger economic expectations appeared to propel lodging stocks higher during the period, while the prospect of rising rates weighed on the relative performance of subsectors often viewed as more bond-like, including triple net REITs and healthcare REITs. Additionally, deteriorating fundamental concerns further weighed on the results of healthcare REITs.

Despite positive business sentiment and healthy consumer confidence, retailer results were volatile as online sales continued to gain share at the expense of traditional brick-and-mortar sales. Still, traditional retailers continued to work to adapt to online sales, while many online retailers expanded to incorporate physical locations into their omnichannel strategy. The growing shift to online sales with the associated growth of home delivery has bolstered demand for key distribution facilities within the industrial subsector. Meanwhile, within the traditional brick-and-mortar retail space, we continued to observe a stark bifurcation in the valuations between prime locations and secondary locations. Retailers continued to rationalize their store networks, closing secondary locations and seeking rent reductions, but primary locations still held appeal and pricing power in many cases.

During the second half of 2017, three historically devastating hurricanes impacted regions where we have investments. These three hurricanes each ranked within the top five most devastating in terms of economic destruction. First, Hurricane Harvey hit the Gulf Coast, notably impacting the areas around Houston. Hurricane Irma affected much of Florida including Miami and the Keys, and Hurricane Maria took a devastating toll on many Caribbean islands including Puerto Rico. While the property destruction was visible and extensive, the economic consequences of these storms were actually less predictable, and, in some cases, contrary to expectations. For example, many REITs own properties with high-quality construction that weathered the storms relatively well and were soon operating again, while other competitive properties were rendered unusable. Displacements led to a surge in demand for surviving properties that included apartments, hotels, shopping centers, and self-storage facilities. For the REIT properties that were substantially damaged, insurance largely covered the physical damages and business interruption insurance helped ease the negative near-term impact.

While the Republican Congress was unsuccessful in attempts to enact extensive healthcare reform, it did succeed in passing broad tax reform legislation late in the year. This resulted in lower federal tax rates for individuals and a deep reduction in tax rates for C-corporations (a tax designation that includes most major publicly traded companies but does not include REITs). As tax reform prospects grew increasingly likely, C-corporations with much to gain from lower rates rallied on the news, while REITs, which are already exempt from most corporate taxes, were deemed to have little to gain directly and indeed were pressured by fears they might lose some key tax benefits. Ultimately, while the rate reductions were viewed as more positive for C-corporations, REITs were able to retain many beneficial tax provisions.

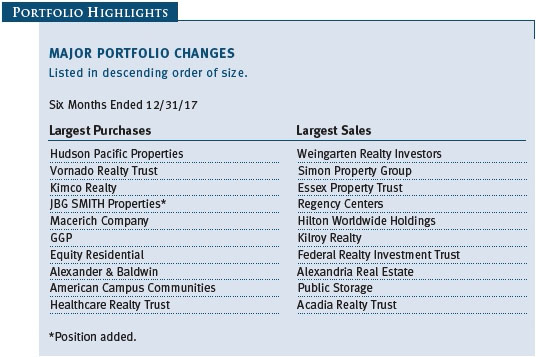

PORTFOLIO REVIEW

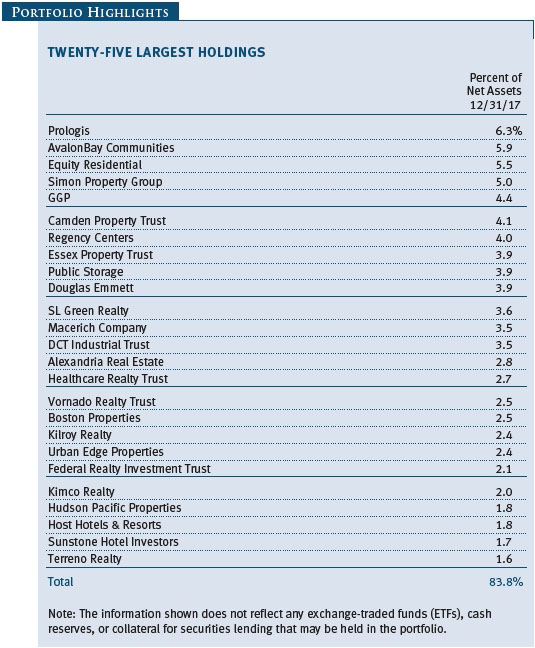

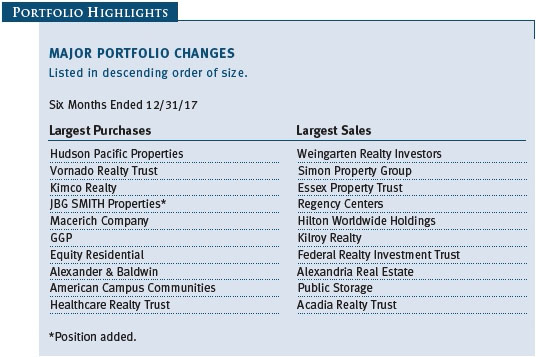

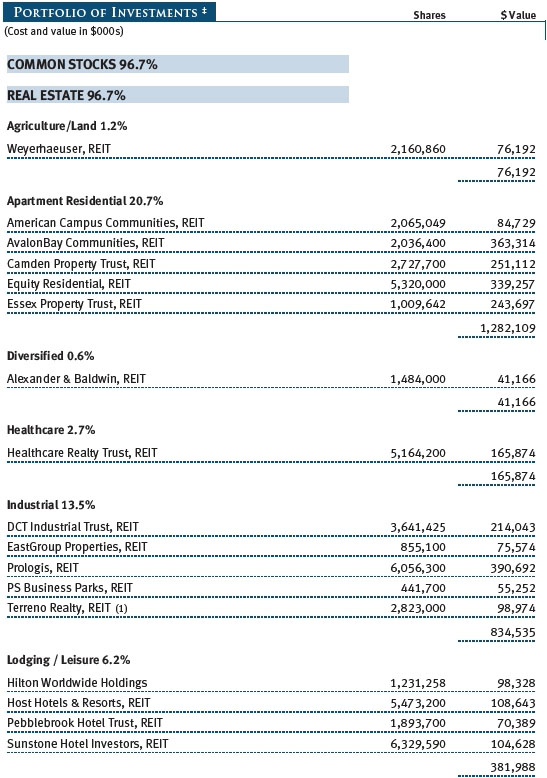

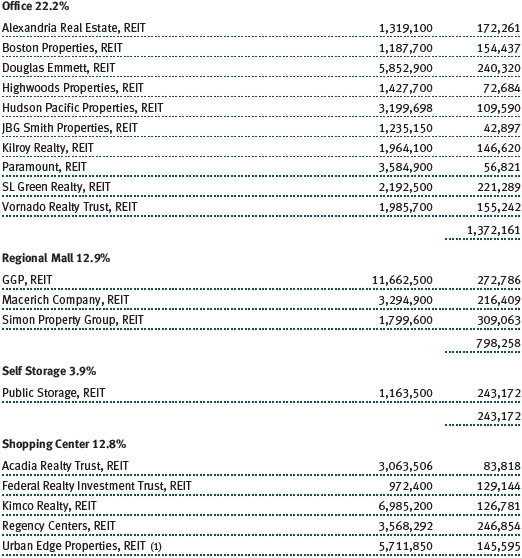

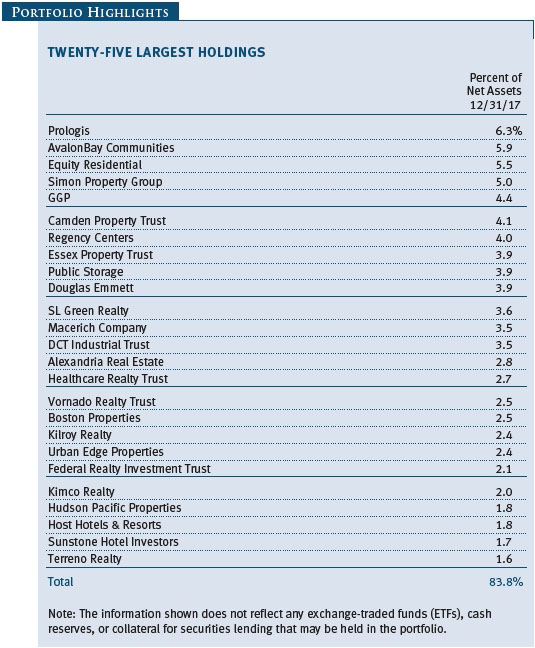

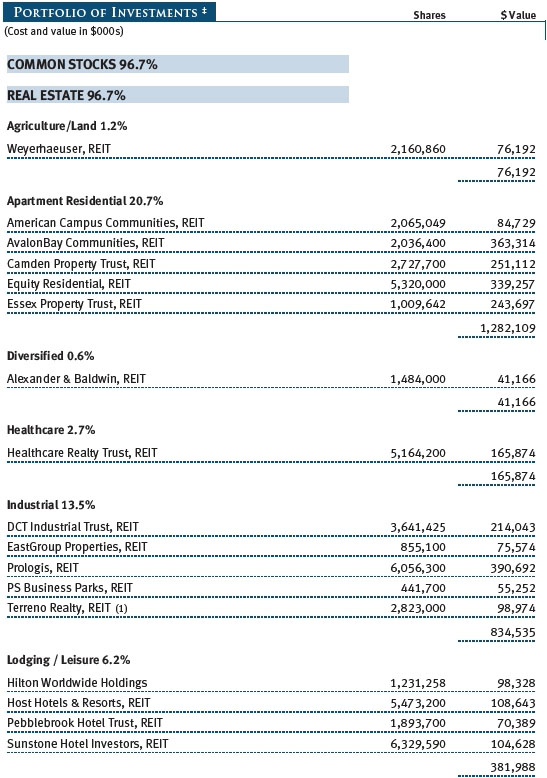

Our stock selection in the lodging segment was a significant contributor to relative results since our last letter. Hilton Worldwide Holdings delivered stellar returns, and its structure as a C-corporation raised expectations that it would benefit from tax reform. Among lodging REITs, Pebblebrook Hotel Trust performed nicely. Pebblebrook has significant exposure to the San Francisco market, and investors became increasingly optimistic about future results with continued construction progress at the Moscone Center, the city’s key convention facility. Room demand has been dampened during disruptive renovation work on the Moscone Center, but that work is closer to completion and forward room bookings are very encouraging. Host Hotels & Resorts also outperformed as investors continued to support the messaging of the new management team. (Please refer to the fund’s portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

Rumors of the death of malls again proved premature as they performed well during the period. While retailers continued to rationalize their networks, they largely agreed that maintaining a presence in popular retail locations was worth the rent. Secondary locations, however, were the target of many store closings and rent concessions. Secondary locations were also challenging because buyers and lenders have become more cautious. Thus, companies with many secondary locations have little choice but to manage through these difficult times.

Meanwhile, prime retail assets continued to hold appeal and value as evidenced by several strategic stakes disclosed during the period by some well-respected investors. GGP received an unsolicited buyout offer from Brookfield Property Partners, which already owns a sizable stake in the company. The GGP board rejected the initial offer but remained open to further negotiations. Macerich Company rebounded on the GGP news as well as news that Third Point LLC, a noted activist firm, had built a sizable stake in the company. Real estate investors may also recall that Macerich was the target of an unsuccessful premium bid by Simon Property Group in 2015. Meanwhile, Simon Property Group continued to deliver solid results and generated positive total returns during the second half and for the full year. Though shopping center returns were pressured across the full calendar year, they did manage a modest rebound during the second half of the year. Shopping centers with a strong grocery component tended to perform well during this period, including our holdings in Regency Centers and Weingarten Realty Investors.

Industrial distribution centers and warehouses continued to benefit from the growth in e-commerce, and positive fundamental results continued to bolster investor enthusiasm. Our industrial holdings all delivered positive total returns during both halves of 2017. Strong returns were achieved in Prologis, DCT Industrial Trust, Eastgroup Property, and Terreno Realty.

Returns in office properties were largely unspectacular. In Manhattan, Paramount Group, Vornado Realty Trust, and SL Green Realty were pressured due to fears of oncoming new supply despite their robust leasing achievements. Manhattan apartment supply also pressured one of our holdings, Equity Residential. We remain bullish on the long-term value of Manhattan assets despite the current weakness.

West Coast apartment markets experienced slower rental growth after the torrid pace that had been experienced there. This pause led to softness in Essex Property Trust and AvalonBay Communities, yet we maintain a positive long-term view on infill markets along the West Coast. That said, tax reform is less favorable to New York and California residents due to the limited deductibility of state and local taxes. We will need to monitor the long-term impact of this effect on demand for office and residential properties in higher tax jurisdictions.

We would like to reflect on data centers, an area that detracted from the fund’s relative performance in the 6- and 12-month periods due to our lack of exposure. There is no doubt that data centers have seen an increase in demand as a result of increased use of technology and cloud computing. That said, we have seen a strong supply response to this demand and note that substantial capital expenditures are spent equipping these data centers relative to the amount spent on the actual land and building construction. Therefore, we are not yet comfortable with the margin of safety for the real estate in these investments as we have seen large write-offs taken on some unsuccessful projects.

Lastly, our shareholders may recall that we have also been uncomfortable with certain aspects of investing in the healthcare subsector, and we would note that our underweight to that sector was a significant contributor to the fund’s relative performance, as several risk factors we have identified appeared to weigh upon that segment.

OUTLOOK

Stock markets are forward looking, and so far they appear to applaud the pro-business actions of the Trump administration. That being said, policy risks remain. Conflicts in the Middle East and with North Korea continue to be a concern, and approaching midterm elections add uncertainty to the political outlook. Moreover, to be successful, tax reform will require an uptick in economic growth to offset tax cuts or else it projects to add to the already burgeoning deficit. However, the market has climbed this “wall of worry” to new heights and may continue to do so.

We will also be watching monetary policy moves this year. The Fed is expected to continue its gradual pace of rate hikes, and REITs seem to routinely battle negative sentiment when rising interest rates are discussed. However, we believe the impact on real estate securities is more pronounced when there are moves in long-term rates. Hence, REITs could provide positive returns despite multiple Fed increases in short-term rates. Indeed, even when long-term interest rates rise, we believe it is the pace of the increase and the conditions under which yields rise that has the strongest influence on returns. Higher long-term rates can be a sign of strong economic demand and rising inflationary pressures, which may favor investments in commercial real estate.

With this shareholder letter we mark the fund’s 20th calendar year since its inception on October 31, 1997, and we are pleased to report that the cumulative returns over that period have been rewarding. While past performance is not indicative of future results, we will strive to maintain your confidence and support with a disciplined approach toward real estate investing.

Respectfully submitted,

David M. Lee

President of the fund and chairman of its Investment Advisory Committee

January 26, 2018

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF INVESTING

The fund’s share price can fall because of weakness in the stock market, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets.

Funds that invest only in specific industries will experience greater volatility than funds investing in a broad range of industries. Due to its concentration in the real estate industry, the fund’s share price could be more volatile than that of a fund with a broader investment mandate. Trends perceived to be unfavorable to real estate, such as changes in the tax laws or rising interest rates, could cause a decline in share prices.

GLOSSARY

Lipper indexes: Fund benchmarks that consist of a small number of the largest mutual funds in a particular category as tracked by Lipper Inc.

Price/earnings ratio (or multiple): A valuation measure calculated by dividing the price of a stock by its current or projected earnings per share. This ratio gives investors an idea of how much they are paying for current or future earnings power.

Real estate investment trusts (REITs): Publicly traded companies that own, develop, and operate apartment complexes, hotels, office buildings, and other commercial properties.

Triple net: A type of lease that requires tenants to pay for taxes, insurance, and maintenance in addition to rent.

Wilshire U.S. Real Estate Securities Index: A float-adjusted, market capitalization-weighted index composed of publicly traded REITs and real estate operating companies.

Performance and Expenses

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

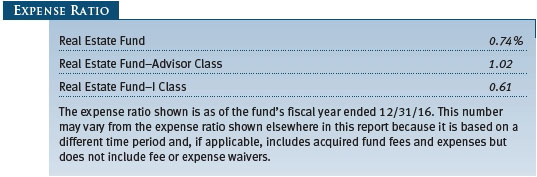

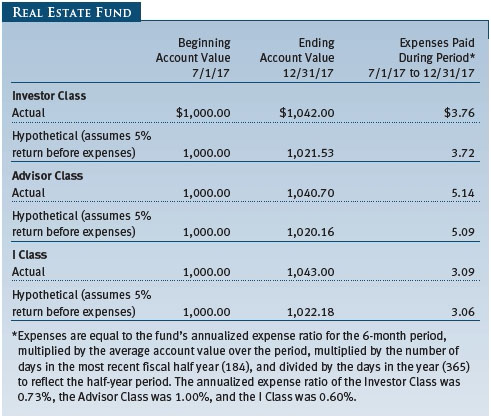

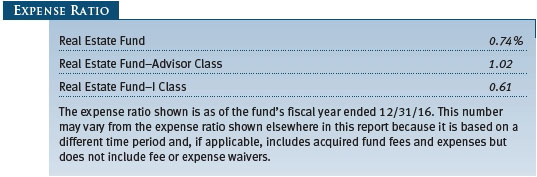

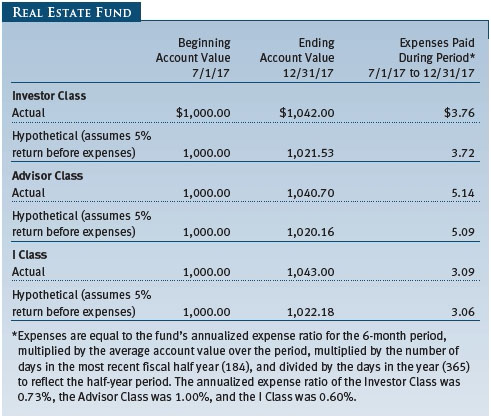

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

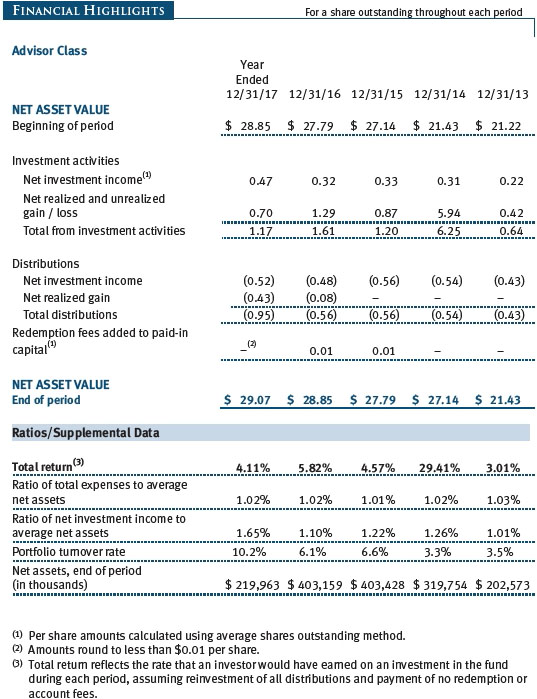

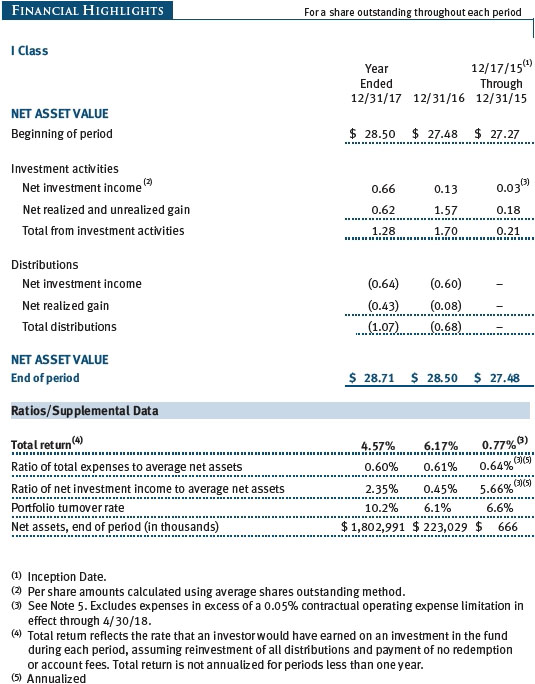

Please note that the fund has three share classes: The original share class (Investor Class) charges no distribution and service (12b-1) fee, the Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee, and I Class shares are available to institutionally oriented clients and impose no 12b-1 or administrative fee payment. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000. The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; or accounts of an investor who is a T. Rowe Price Personal Services or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $250,000). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

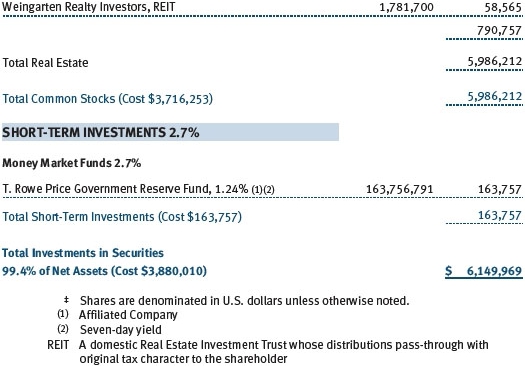

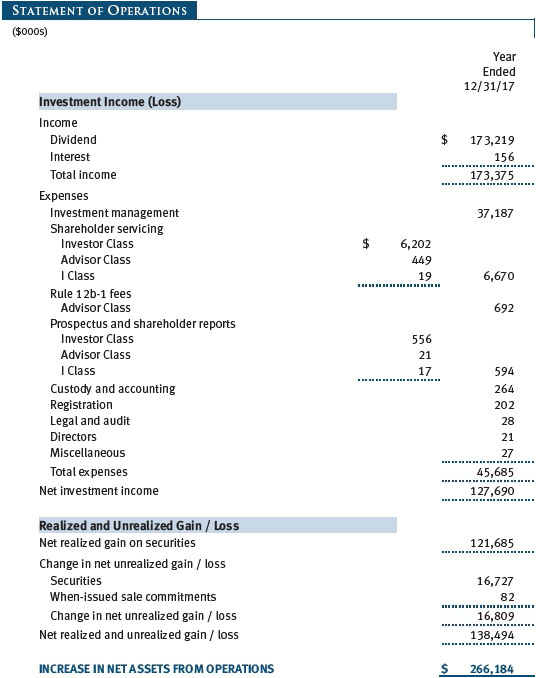

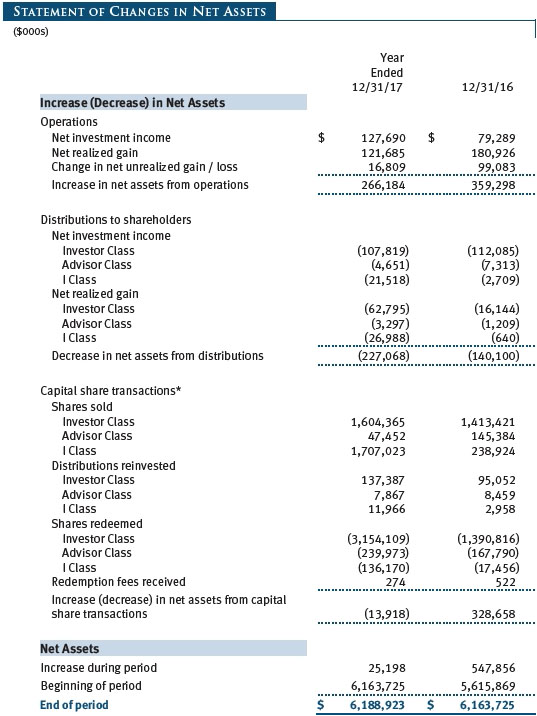

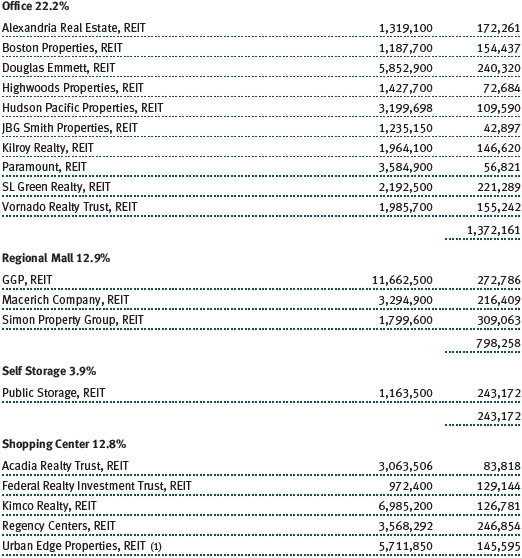

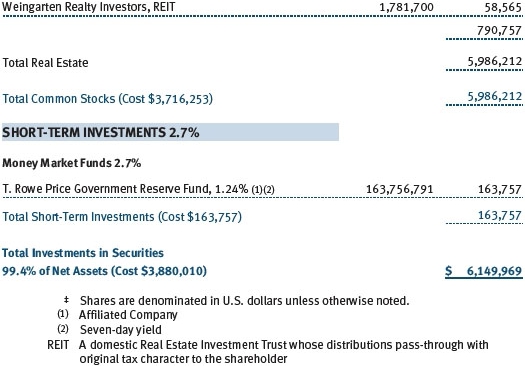

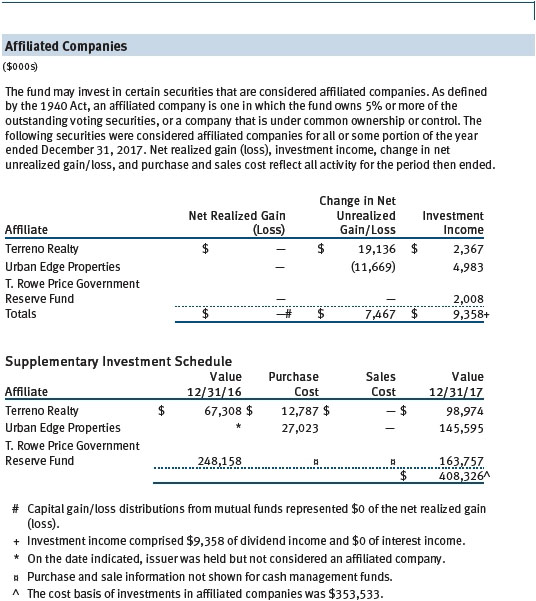

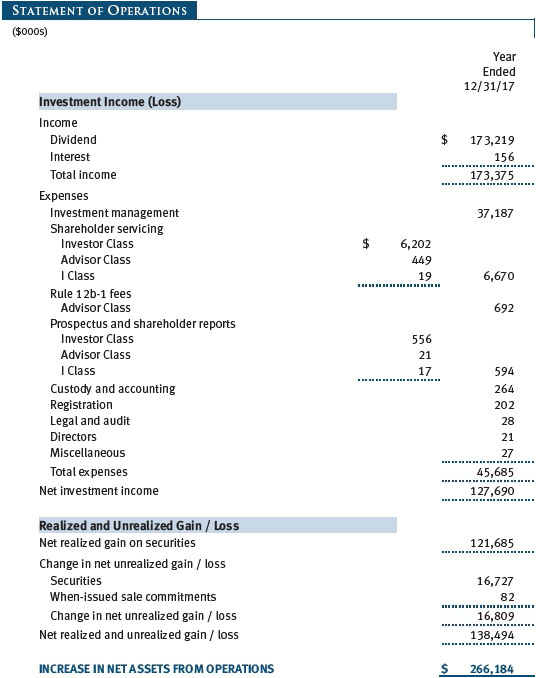

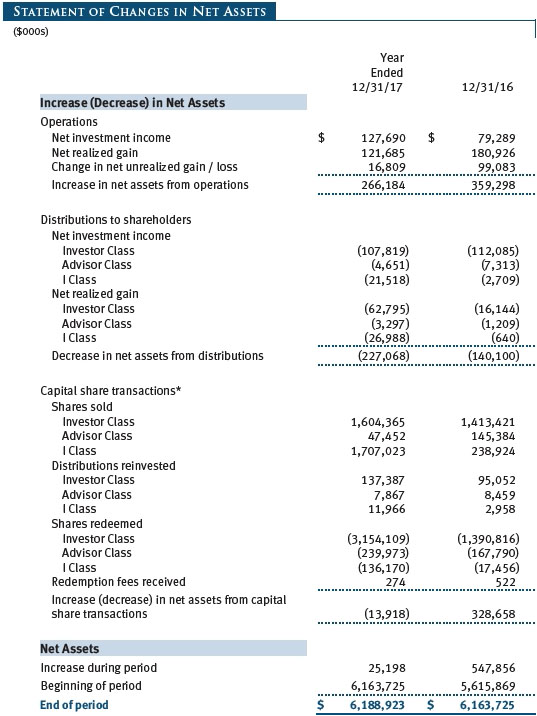

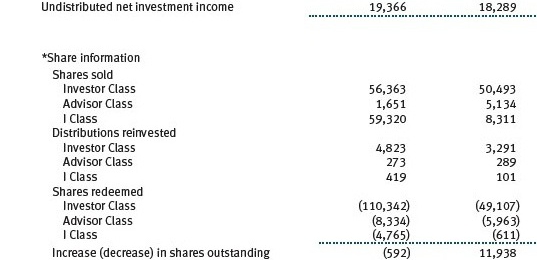

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| Notes to Financial Statements |

T. Rowe Price Real Estate Fund, Inc. (the fund) is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks to provide long-term growth through a combination of capital appreciation and current income. The fund has three classes of shares: the Real Estate Fund (Investor Class), the Real Estate Fund–Advisor Class (Advisor Class), and the Real Estate Fund–I Class (I Class). Advisor Class shares are sold only through unaffiliated brokers and other unaffiliated financial intermediaries. I Class shares generally are available only to investors meeting a $1,000,000 minimum investment or certain other criteria. The Advisor Class operates under a Board-approved Rule 12b-1 plan pursuant to which the class compensates financial intermediaries for distribution, shareholder servicing, and/or certain administrative services; the Investor and I Classes do not pay Rule 12b-1 fees. Each class has exclusive voting rights on matters related solely to that class; separate voting rights on matters that relate to all classes; and, in all other respects, the same rights and obligations as the other classes.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Investment transactions are accounted for on the trade date basis. Income and expenses are recorded on the accrual basis. Realized gains and losses are reported on the identified cost basis. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, are recorded as income tax expense. Distributions from REITs are initially recorded as dividend income and, to the extent such represent a return of capital or capital gain for tax purposes, are reclassified when such information becomes available. Income distributions are declared and paid by each class quarterly. Distributions to shareholders are recorded on the ex-dividend date. A capital gain distribution may also be declared and paid by the fund annually.

Class Accounting Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to all classes, investment income, and realized and unrealized gains and losses are allocated to the classes based upon the relative daily net assets of each class. To the extent any expenses are waived or reimbursed in accordance with an expense limitation (see Note 5), the waiver or reimbursement is charged to the applicable class or allocated across the classes in the same manner as the related expense. The Advisor Class pays Rule 12b-1 fees, in an amount not exceeding 0.25% of the class’s average daily net assets.

Rebates Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements and totaled $27,000 for the year ended December 31, 2017.

Redemption Fees A 1% fee is assessed on redemptions of fund shares held for 90 days or less to deter short-term trading and to protect the interests of long-term shareholders. Redemption fees are withheld from proceeds that shareholders receive from the sale or exchange of fund shares. The fees are paid to the fund and are recorded as an increase to paid-in capital. The fees may cause the redemption price per share to differ from the net asset value per share.

New Accounting Guidance In March 2017, the FASB issued amended guidance to shorten the amortization period for certain callable debt securities, held at a premium. The guidance is effective for fiscal years and interim periods beginning after December 15, 2018. Adoption will have no effect on the fund’s net assets or results of operations.

On August 1, 2017, the fund implemented amendments to Regulation S-X, issued by the Securities and Exchange Commission, which require standardized, enhanced disclosures, particularly related to derivatives, in investment company financial statements. Adoption had no effect on the fund’s net assets or results of operations.

Indemnification In the normal course of business, the fund may provide indemnification in connection with its officers and directors, service providers, and/or private company investments. The fund’s maximum exposure under these arrangements is unknown; however, the risk of material loss is currently considered to be remote.

NOTE 2 - VALUATION

The fund’s financial instruments are valued and each class’s net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business. However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC.

Fair Value The fund’s financial instruments are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The T. Rowe Price Valuation Committee (the Valuation Committee) is an internal committee that has been delegated certain responsibilities by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures and approves all fair value determinations. Specifically, the Valuation Committee establishes procedures to value securities; determines pricing techniques, sources, and persons eligible to effect fair value pricing actions; oversees the selection, services, and performance of pricing vendors; oversees valuation-related business continuity practices; and provides guidance on internal controls and valuation-related matters. The Valuation Committee reports to the Board and has representation from legal, portfolio management and trading, operations, risk management, and the fund’s treasurer.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made. OTC Bulletin Board securities are valued at the mean of the closing bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the closing bid and asked prices. Actively traded equity securities listed on a domestic exchange generally are categorized in Level 1 of the fair value hierarchy. OTC Bulletin Board securities, certain preferred securities, and equity securities traded in inactive markets generally are categorized in Level 2 of the fair value hierarchy.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation and are categorized in Level 1 of the fair value hierarchy. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value.

Thinly traded financial instruments and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded.

Subject to oversight by the Board, the Valuation Committee regularly makes good faith judgments to establish and adjust the fair valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of an equity investment with limited market activity, such as a private placement or a thinly traded public company stock, the Valuation Committee considers a variety of factors, which may include, but are not limited to, the issuer’s business prospects, its financial standing and performance, recent investment transactions in the issuer, new rounds of financing, negotiated transactions of significant size between other investors in the company, relevant market valuations of peer companies, strategic events affecting the company, market liquidity for the issuer, and general economic conditions and events. In consultation with the investment and pricing teams, the Valuation Committee will determine an appropriate valuation technique based on available information, which may include both observable and unobservable inputs. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants, transaction information can be reliably obtained, and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the issue. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants. Depending on the relative significance of unobservable inputs, including the valuation technique(s) used, fair valued securities may be categorized in Level 2 or 3 of the fair value hierarchy.

Valuation Inputs On December 31, 2017, all of the fund’s financial instruments were classified as Level 1, based on the inputs used to determine their fair values. There were no material transfers between Levels 1 and 2 during the year ended December 31, 2017.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

When-Issued Securities The fund may enter into when-issued purchase or sale commitments, pursuant to which it agrees to purchase or sell, respectively, an authorized but not yet issued security for a fixed unit price, with payment and delivery not due until issuance of the security on a scheduled future date. When-issued securities may be new securities or securities issued through a corporate action, such as a reorganization or restructuring. Until settlement, the fund maintains liquid assets sufficient to settle its commitment to purchase a when-issued security or, in the case of a sale commitment, the fund maintains an entitlement to the security to be sold. Amounts realized on when-issued transactions are included in realized gain/loss on securities in the accompanying financial statements.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $638,466,000 and $615,448,000, respectively, for the year ended December 31, 2017.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

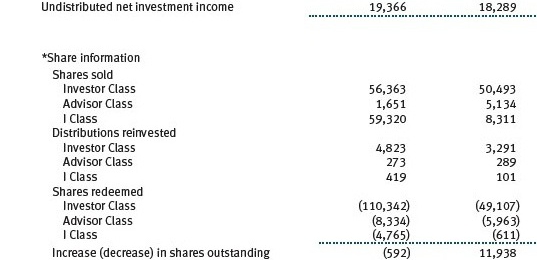

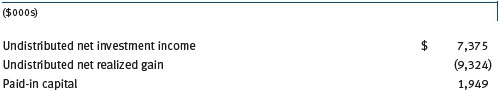

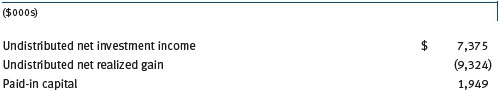

Reclassifications to paid-in capital relate primarily to a tax practice that treats a portion of the proceeds from each redemption of capital shares as a distribution of taxable net investment income or realized capital gain. Reclassifications between income and gain relate primarily to the character of dividends received from real estate investment trusts (REITs). For the year ended December 31, 2017, the following reclassifications were recorded to reflect tax character (there was no impact on results of operations or net assets):

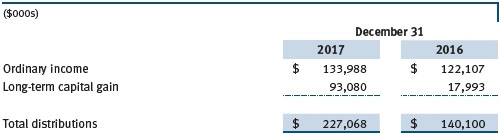

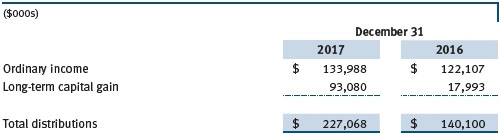

Distributions during the years ended December 31, 2017 and December 31, 2016, were characterized for tax purposes as follows:

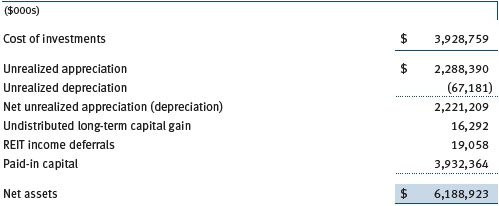

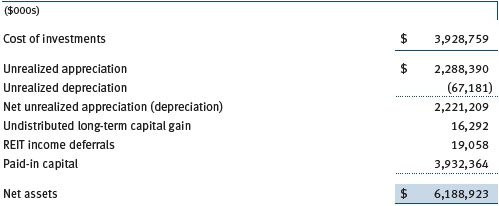

At December 31, 2017, the tax-basis cost of investments and components of net assets were as follows:

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the deferral of losses from wash sales for tax purposes. The fund intends to retain realized gains to the extent of available capital loss carryforwards. Net realized capital losses may be carried forward indefinitely to offset future realized capital gains. During the year ended December 31, 2017, the fund utilized $1,858,000 of capital loss carryforwards. Certain dividends declared by REITs in December and paid the following January are recognized for tax purposes in the subsequent year (REIT income deferrals) but, for financial reporting purposes, are included in the fund’s dividend income on ex-date.

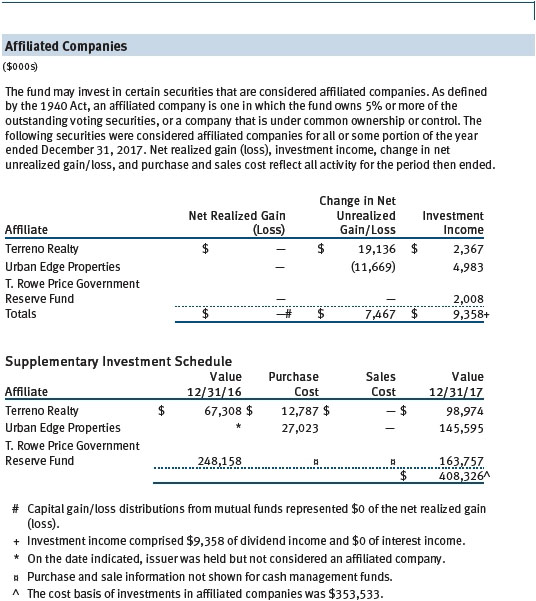

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management agreement between the fund and Price Associates provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.30% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.265% for assets in excess of $650 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At December 31, 2017, the effective annual group fee rate was 0.29%.

The I Class is subject to an operating expense limitation (I Class limit) pursuant to which Price Associates is contractually required to pay all operating expenses of the I Class, excluding management fees, interest, expenses related to borrowings, taxes, brokerage, and other non-recurring expenses permitted by the investment management agreement, to the extent such operating expenses, on an annualized basis, exceed 0.05% of average net assets. This agreement will continue until April 30, 2018, and may be renewed, revised, or revoked only with approval of the fund’s Board. The I Class is required to repay Price Associates for expenses previously paid to the extent the class’s net assets grow or expenses decline sufficiently to allow repayment without causing the class’s operating expenses (after the repayment is taken into account) to exceed both: (1) the expense limitation in place at the time such amounts were paid; and (2) the class’s current expense limitation. However, no repayment will be made more than three years after the date of a payment or waiver. For the year ended December 31, 2017, the I Class operated below its expense limitation.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates provides certain accounting and administrative services to the fund. T. Rowe Price Services, Inc. provides shareholder and administrative services in its capacity as the fund’s transfer and dividend-disbursing agent. T. Rowe Price Retirement Plan Services, Inc. provides subaccounting and recordkeeping services for certain retirement accounts invested in the Investor Class and I Class. For the year ended December 31, 2017, expenses incurred pursuant to these service agreements were $86,000 for Price Associates; $1,243,000 for T. Rowe Price Services, Inc.; and $459,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

The fund may invest its cash reserves in certain open-end management investment companies managed by Price Associates and considered affiliates of the fund: the T. Rowe Price Government Reserve Fund or the T. Rowe Price Treasury Reserve Fund, organized as money market funds, or the T. Rowe Price Short-Term Fund, a short-term bond fund (collectively, the Price Reserve Funds). The Price Reserve Funds are offered as short-term investment options to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and are not available for direct purchase by members of the public. Cash collateral from securities lending is invested in the T. Rowe Price Short-Term Fund. The Price Reserve Funds pay no investment management fees.

The fund may participate in securities purchase and sale transactions with other funds or accounts advised by Price Associates (cross trades), in accordance with procedures adopted by the fund’s Board and Securities and Exchange Commission rules, which require, among other things, that such purchase and sale cross trades be effected at the independent current market price of the security. During the year ended December 31, 2017, the aggregate value of purchases and sales cross trades with other funds or accounts advised by Price Associates was less than 1% of the fund’s net assets as of December 31, 2017.

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of

T. Rowe Price Real Estate Fund, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the portfolio of investments, of T. Rowe Price Real Estate Fund, Inc. (the “Fund”) as of December 31, 2017, the related statement of operations for the year ended December 31, 2017, the statement of changes in net assets for each of the two years in the period ended December 31, 2017, including the related notes, and the financial highlights for each of the periods indicated therein (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2017, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended December 31, 2017 and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits of these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2017 by correspondence with the custodian and transfer agent. We believe that our audits provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 20, 2018

We have served as the auditor of one or more investment companies in the T. Rowe Price group of investment companies since 1973.

| Tax Information (Unaudited) for the Tax Year Ended 12/31/17 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

The fund’s distributions to shareholders included:

| ● | $7,375,000 from short-term capital gains

|

| ● | $95,029,000 from long-term capital gains, of which $85,427,000 was subject to a long-term capital gains tax rate of not greater than 20% and $9,602,000 to a long-term capital gains tax rate of not greater than 25%. |

For taxable non-corporate shareholders, $23,433,000 of the fund’s income represents qualified dividend income subject to a long-term capital gains tax rate of not greater than 20%.

For corporate shareholders, $912,000 of the fund’s income qualifies for the dividends-received deduction.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www3.troweprice.com/usis/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 100 F St. N.E., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| About the Fund’s Directors and Officers |

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting or potentially affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and business and regulatory affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of the Board’s members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

| Independent Directors |

| | |

| Name | | |

| (Year of Birth) | | |

| Year Elected* | | |

| [Number of T. Rowe Price | | Principal Occupation(s) and Directorships of Public Companies and |

| Portfolios Overseen] | | Other Investment Companies During the Past Five Years |

| | | |

| Bruce W. Duncan | | Chief Executive Officer and Director (2009 to December 2016), |

| (1951) | | Chairman of the Board (January 2016 to present), and President |

| 2013 | | (2009 to September 2016), First Industrial Realty Trust, an owner |

| [191] | | and operator of industrial properties; Chairman of the Board |

| | (2005 to September 2016) and Director (1999 to September |

| | 2016), Starwood Hotels & Resorts, a hotel and leisure company; |

| | Director, Boston Properties (May 2016 to present); Director, |

| | Marriott International, Inc. (September 2016 to present) |

| | | |

| Robert J. Gerrard, Jr. | | Advisory Board Member, Pipeline Crisis/Winning Strategies, a |

| (1952) | | collaborative working to improve opportunities for young African |

| 2012 | | Americans (1997 to present) |

| [191] | | |

| | | |

| Paul F. McBride | | Advisory Board Member, Vizzia Technologies (2015 to present) |

| (1956) | | |

| 2013 | | |

| [191] | | |

| | | |

| Cecilia E. Rouse, Ph.D. | | Dean, Woodrow Wilson School (2012 to present); Professor and |

| (1963) | | Researcher, Princeton University (1992 to present); Member of |

| 2012 | | National Academy of Education (2010 to present); Director, MDRC, |

| [191] | | a nonprofit education and social policy research organization |

| | (2011 to present); Research Associate of Labor Studies Program |

| | (2011 to 2015) and Board Member (2015 to present), National |

| | Bureau of Economic Research (2011 to present); Chair of Committee |

| | on the Status of Minority Groups in the Economic Profession |

| | (2012 to present); Vice President (2015 to present), American |

| | Economic Association |

| | | |

| John G. Schreiber | | Owner/President, Centaur Capital Partners, Inc., a real estate |

| (1946) | | investment company (1991 to present); Cofounder, Partner, and |

| 2001 | | Cochairman of the Investment Committee, Blackstone Real Estate |

| [191] | | Advisors, L.P. (1992 to 2015); Director, General Growth Properties, |

| | Inc. (2010 to 2013); Director, Blackstone Mortgage Trust, a real |

| | estate finance company (2012 to 2016); Director and Chairman of |

| | the Board, Brixmor Property Group, Inc. (2013 to present); Director, |

| | Hilton Worldwide (2013 to present); Director, Hudson Pacific |

| | Properties (2014 to 2016) |

| | | |

| Mark R. Tercek | | President and Chief Executive Officer, The Nature Conservancy |

| (1957) | | (2008 to present) |

| 2009 | | |

| [191] | | |

| |

| *Each independent director serves until retirement, resignation, or election of a successor. |

| Inside Directors | | |

| | |

| Name | | |

| (Year of Birth) | | |

| Year Elected* | | |

| [Number of T. Rowe Price | | Principal Occupation(s) and Directorships of Public Companies and |

| Portfolios Overseen] | | Other Investment Companies During the Past Five Years |

| | | |

| Edward C. Bernard | | Director and Vice President, T. Rowe Price; Vice Chairman of the |

| (1956) | | Board, Director, and Vice President, T. Rowe Price Group, Inc.; |

| 2006 | | Chairman of the Board, Director, and Vice President, T. Rowe Price |

| [191] | | Investment Services, Inc., and T. Rowe Price Services, Inc.; Chairman |

| | of the Board and Director, T. Rowe Price Retirement Plan Services, |

| | Inc.; Chairman of the Board, Chief Executive Officer, Director, and |

| | President, T. Rowe Price International and T. Rowe Price Trust |

| | Company; Chairman of the Board, all funds |

| | | |

| Robert W. Sharps, CFA, | | Vice President, T. Rowe Price, T. Rowe Price Group, Inc., and T. Rowe |

| CPA** | | Price Trust Company |

| (1971) | | |

| 2017 | | |

| [135] | | |

| |

| *Each inside director serves until retirement, resignation, or election of a successor. |

| **Effective April 1, 2017, Brian C. Rogers was replaced by Robert W. Sharps as an inside director of certain Price Funds. |

| Officers | | |

| | |

| Name (Year of Birth) | | |

| Position Held With Real Estate Fund | | Principal Occupation(s) |

| | | |

| Darrell N. Braman (1963) | | Vice President, Price Hong Kong, Price |

| Vice President and Secretary | | Singapore, T. Rowe Price, T. Rowe Price Group, |

| | Inc., T. Rowe Price International, T. Rowe Price |

| | Investment Services, Inc., and T. Rowe Price |

| | Services, Inc. |

| | | |

| John R. Gilner (1961) | | Chief Compliance Officer and Vice President, |

| Chief Compliance Officer | | T. Rowe Price; Vice President, T. Rowe Price |

| | Group, Inc., and T. Rowe Price Investment |

| | Services, Inc. |

| | | |

| Thomas J. Huber, CFA (1966) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Nina P. Jones, CPA (1980) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Paul J. Krug, CPA (1964) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| David M. Lee, CFA (1962) | | Vice President, T. Rowe Price, T. Rowe Price |

| President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Catherine D. Mathews (1963) | | Vice President, T. Rowe Price, T. Rowe Price |

| Treasurer and Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Daniel A. McCulley (1987) | | Vice President, T. Rowe Price; formerly, summer |

| Vice President | | intern, Clearbridge Investments (to 2015); |

| | formerly, Associate Research Analyst, T. Rowe |

| | Price (to 2013) |

| | | |

| Philip A. Nestico (1976) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| David Oestreicher (1967) | | Director, Vice President, and Secretary, T. Rowe |

| Vice President | | Price Investment Services, Inc., T. Rowe Price |

| | Retirement Plan Services, Inc., T. Rowe |

| | Price Services, Inc., and T. Rowe Price Trust |

| | Company; Chief Legal Officer, Vice President, |

| | and Secretary, T. Rowe Price Group, Inc.; Vice |

| | President and Secretary, T. Rowe Price and |

| | T. Rowe Price International; Vice President, |

| | Price Hong Kong and Price Singapore |

| | | |

| Preeta Ragavan (1987) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc.; formerly, summer intern, T. Rowe |

| | Price (to 2013) |

| | | |

| John W. Ratzesberger (1975) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company; |

| | formerly, North American Head of Listed |

| | Derivatives Operation, Morgan Stanley |

| | (to 2013) |

| | | |

| Shannon H. Rauser (1987) | | Employee, T. Rowe Price |

| Assistant Secretary | | |

| | | |

| Theodore E. Robson, CFA (1965) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., and T. Rowe Price Trust Company |

| | | |

| Weijie Si (1983) | | Vice President, T. Rowe Price and T. Rowe Price |

| Vice President | | Group, Inc. |

| | | |

| Megan Warren (1968) | | Vice President, T. Rowe Price, T. Rowe Price |

| Vice President | | Group, Inc., T. Rowe Price Retirement Plan |

| | Services, Inc., T. Rowe Price Services, Inc., |

| | and T. Rowe Price Trust Company; formerly, |

| | Executive Director, JP Morgan Chase (to 2017) |

| |

| Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at least 5 years. |

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Bruce W. Duncan qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Duncan is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

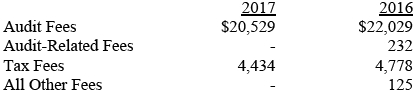

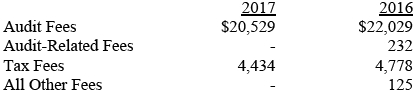

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $2,169,000 and $2,146,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Real Estate Fund, Inc.

| By | | /s/ Edward C. Bernard |

| | | Edward C. Bernard |

| | | Principal Executive Officer |

| |

| Date | | February 20, 2018 | | | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | | /s/ Edward C. Bernard |

| | | Edward C. Bernard |

| | | Principal Executive Officer |

| |

| Date | | February 20, 2018 | | | | |

| |

| |

| By | | /s/ Catherine D. Mathews |

| | | Catherine D. Mathews |

| | | Principal Financial Officer |

| |

| Date | | February 20, 2018 | | | | |