Exhibit 99.1

Exhibit 99.1

Career Education Corporation

2010 Analyst and Investor Day

February 18, 2010

Copyright Career Education Corporation 2010

John Springer

Senior Vice President, Finance and Investor Relations

Copyright Career Education Corporation 2010 2010 Analyst and Investor Day

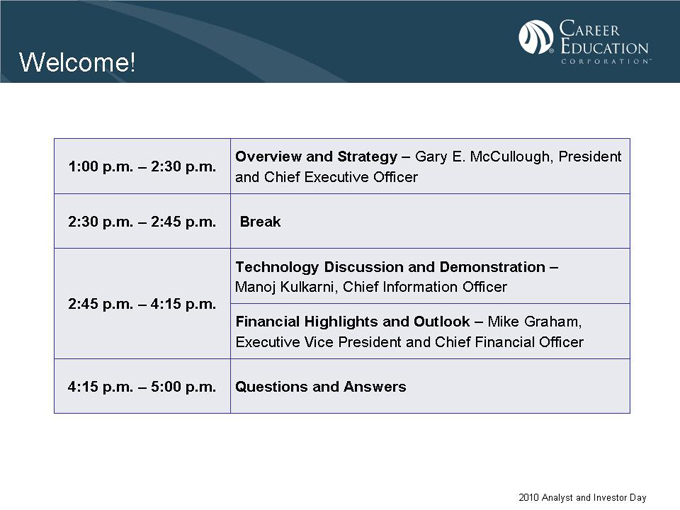

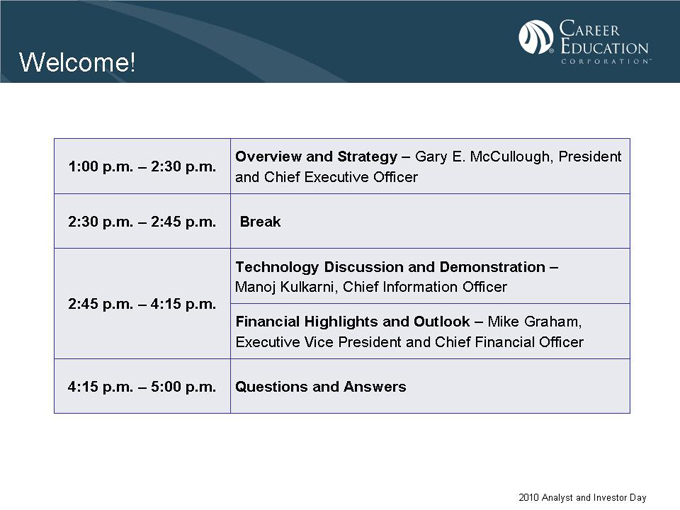

Welcome!

1:00 p.m. – 2:30 p.m. Overview and Strategy – Gary E. McCullough, President and Chief Executive Officer

2:30 p.m. – 2:45 p.m. Break

Technology Discussion and Demonstration – Manoj Kulkarni, Chief Information Officer

2:45 p.m. – 4:15 p.m.

Financial Highlights and Outlook – Mike Graham, Executive Vice President and Chief Financial Officer

4:15 p.m. – 5:00 p.m. Questions and Answers

2010 Analyst and Investor Day

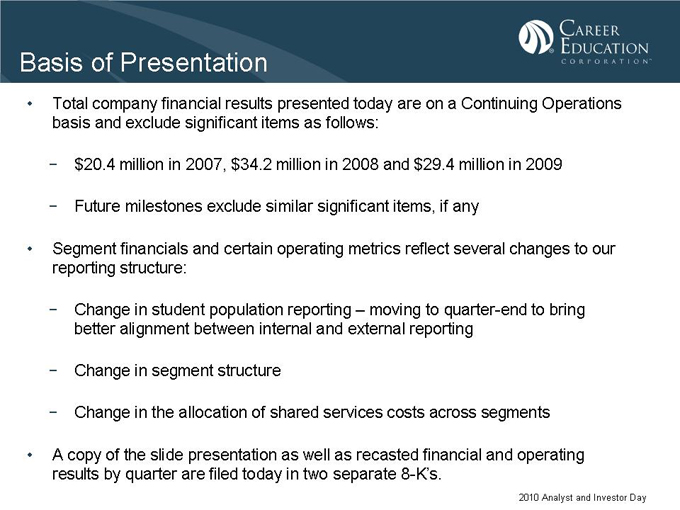

Basis of Presentation

Total company financial results presented today are on a Continuing Operations basis and exclude significant items as follows:

$20.4 million in 2007, $34.2 million in 2008 and $29.4 million in 2009

Future milestones exclude similar significant items, if any

Segment financials and certain operating metrics reflect several changes to our reporting structure:

Change in student population reporting – moving to quarter-end to bring better alignment between internal and external reporting

Change in segment structure

Change in the allocation of shared services costs across segments

A copy of the slide presentation as well as recasted financial and operating results by quarter are filed today in two separate 8-K’s.

2010 Analyst and Investor Day

Safe Harbor

During this presentation, we will make forward-looking statements subject to known and unknown risks and uncertainties that could cause actual performance to differ materially from that expressed or implied by the statements. These statements are based on information currently available to us. Some factors that could cause actual results and performance to differ are: •Our ability to comply with the extensive regulatory requirements and accreditation requirements for school operations •Changes and uncertainties in student lending markets and federal and state student financial aid programs •Financial and operating results, including new student starts •Our ability to manage and grow our business in current and changing economic, political, regulatory and competitive environments •Litigation, claims and administrative proceedings involving the company •Other risks described from time to time in our press releases and our filings with the Securities and Exchange Commission We undertake no obligation to publicly release any revisions to forward-looking statements to reflect events or expectations after the date of this presentation. We provide a detailed discussion of risk factors in our SEC filings and encourage you to review the filings.

2010 Analyst and Investor Day

Non-GAAP Financial Measures

The Company has included some non-GAAP financial measures in this presentation to discuss the Company’s financial results and outlook. As a general matter, the Company uses these non-GAAP measures in addition to and in conjunction with results presented in accordance with GAAP. Among other things, the Company may use such non-GAAP financial measures in addition to and in conjunction with corresponding GAAP measures, to help analyze the performance of its core business, in connection with the preparation of annual budgets, and in measuring performance for some forms of compensation. In addition, the Company believes that non-GAAP financial measures are used by analysts and others in the investment community to analyze the Company’s historical results and in providing estimates of future performance and that failure to report these non-GAAP measures could result in confusion among analysts and others and a misplaced perception that the Company’s results have underperformed or exceeded expectations.

These non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s operations that, when viewed with the GAAP results and the reconciliations to corresponding GAAP financial measures, provide a more complete understanding of the Company’s results of operations and the factors and trends affecting the Company’s business. However, these non-GAAP measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding measures calculated in accordance with GAAP.

2010 Analyst and Investor Day

Gary E. McCullough

President and Chief Executive Officer

Copyright Career Education Corporation 2010 2010 Analyst and Investor Day

Our Approach to Analyst & Investor Day

• We have worked to be transparent during the past three years

• Messages today are intended to be aligned with expressed investor and analyst needs

• Goal is to have you see the company through a different lens

Commitment to changing lives through education

Completed major transformation ahead of expectations

Strength & momentum of a diversified model

• We will answer as many questions as possible today

2010 Analyst and Investor Day

Summary

• Transformed company and achieved 2010 milestones

• Strong momentum entering 2010

• Well positioned in key market segments

• Focused strategies to deliver next level of growth

2010 Analyst and Investor Day

Statement of Purpose

To change lives through education.

2010 Analyst and Investor Day

Vision Statement

Transform the company into a progressive, proprietary education leader that delivers life-changing education for generations of students.

“Progressive, Proprietary Education Leader” – We aspire to educate with schools that rapidly evolve our academic offerings to meet both student and employer demands

“Life-changing Education “ – This is consistent with our Purpose

“Generations of Students “ – This reflects our desire to create an enduring company

2010 Analyst and Investor Day

Core Values

Integrity

Respect

Diversity

Social responsibility

Excellence

Students Employees

2010 Analyst and Investor Day

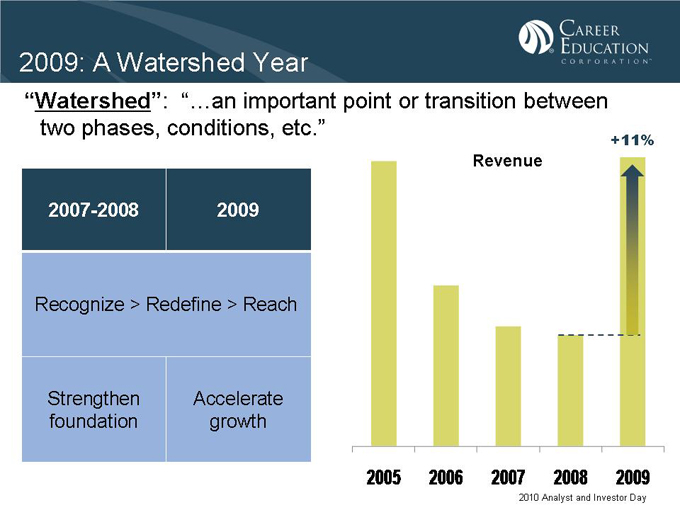

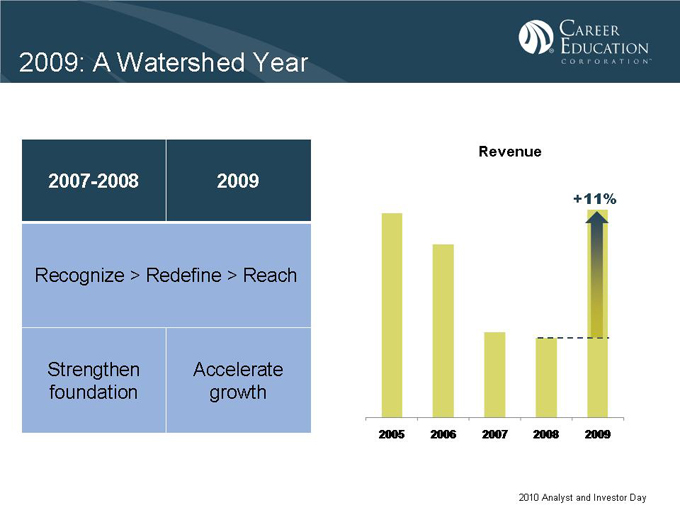

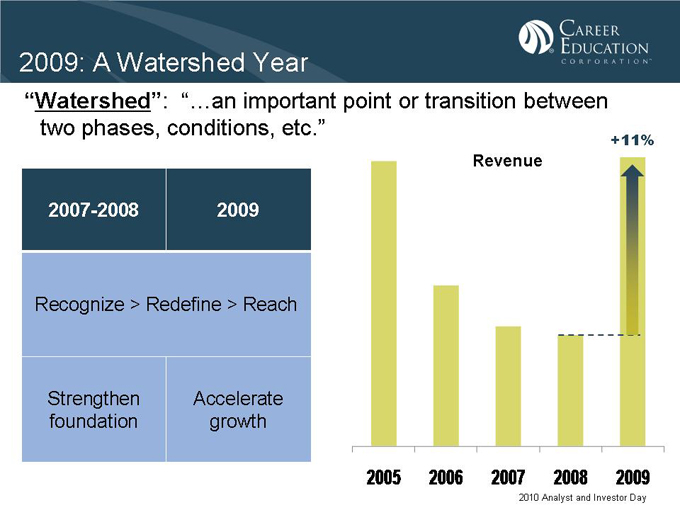

2009: A Watershed Year

“Watershed”: “…an important point or transition between two phases, conditions, etc.”

2007-2008 2009

Recognize > Redefine > Reach

Strengthen foundation

Accelerate growth

Revenue

+11%

2005 2006 2007 2008 2009

2010 Analyst and Investor Day

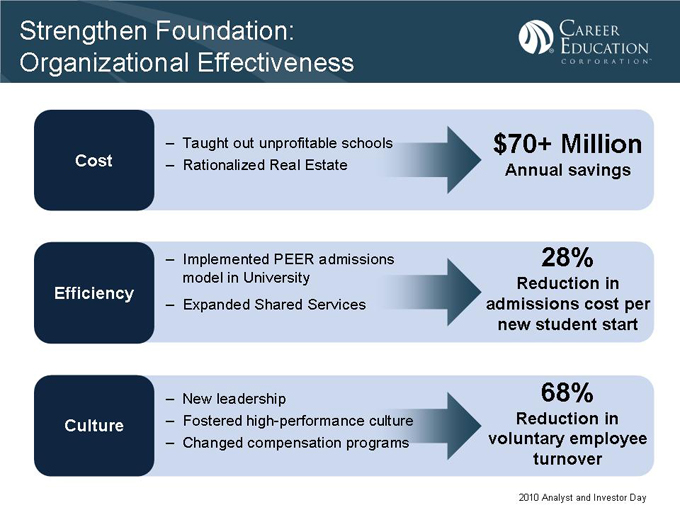

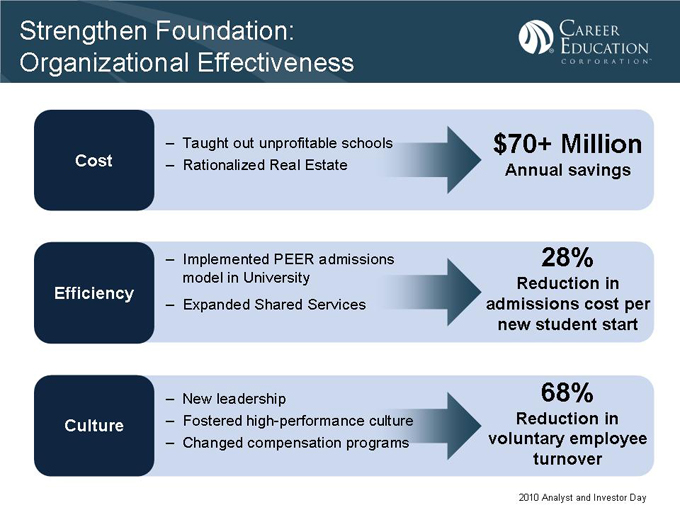

Strengthen Foundation: Organizational Effectiveness

Cost

Taught out unprofitable schools Rationalized Real Estate

$70+ Million

Annual savings

Efficiency

Implemented PEER admissions model in University Expanded Shared Services

28%

Reduction in admissions cost per new student start

Culture

New leadership

Fostered high-performance culture Changed compensation programs

68%

Reduction in voluntary employee turnover

2010 Analyst and Investor Day

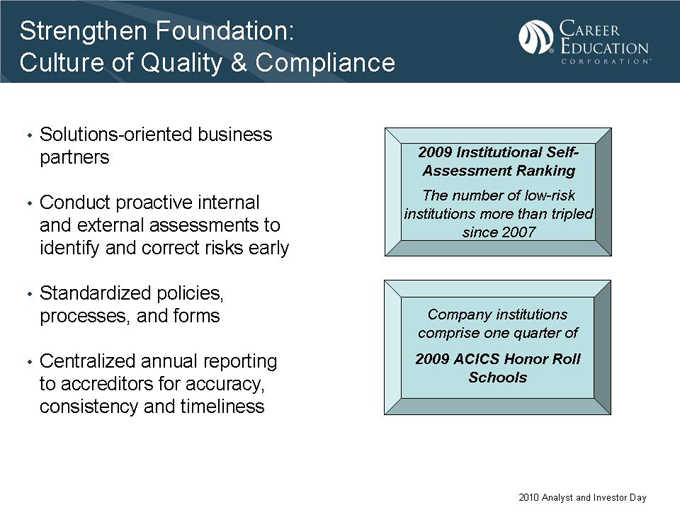

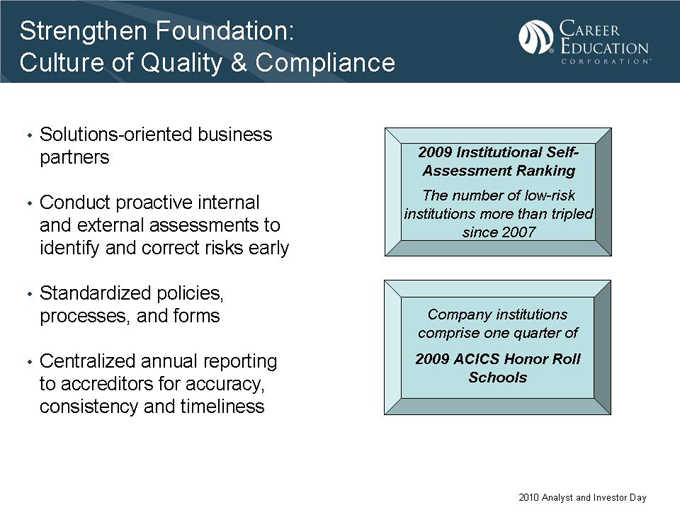

Strengthen Foundation: Culture of Quality & Compliance

• Solutions-oriented business partners

• Conduct proactive internal and external assessments to identify and correct risks early

• Standardized policies, processes, and forms

• Centralized annual reporting to accreditors for accuracy, consistency and timeliness

2009 Institutional Self-Assessment Ranking

The number of low-risk institutions more than tripled since 2007

Company institutions comprise one quarter of

2009 ACICS Honor Roll Schools

2010 Analyst and Investor Day

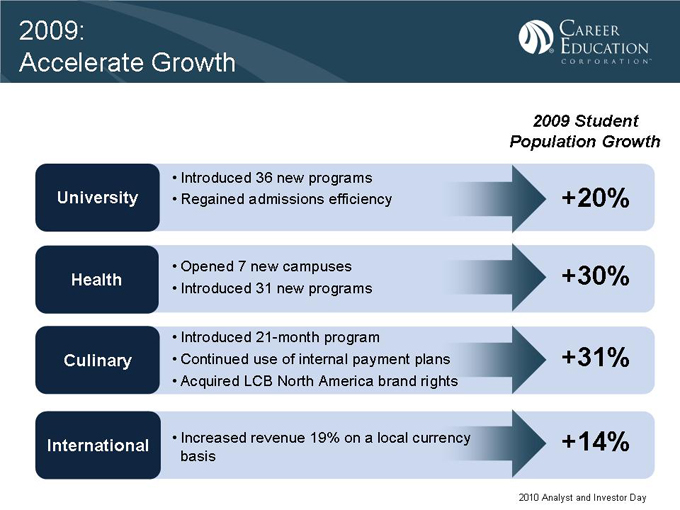

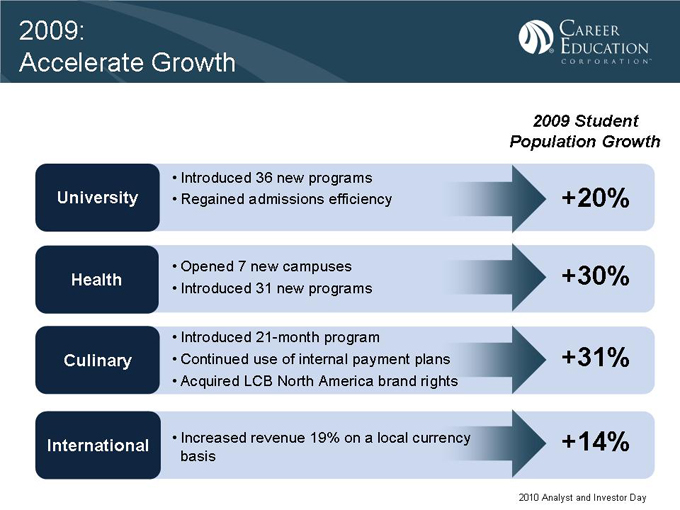

2009: Accelerate Growth

University

Introduced 36 new programs Regained admissions efficiency

+20%

Health

• Opened 7 new campuses

• Introduced 31 new programs

+30%

Culinary

• Introduced 21-month program

• Continued use of internal payment plans

• Acquired LCB North America brand rights

+31%

International

Increased revenue 19% on a local currency basis

+14%

2010 Analyst and Investor Day

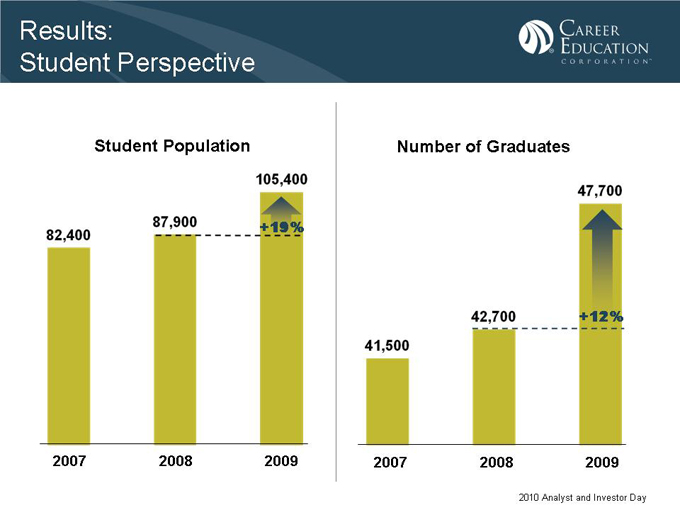

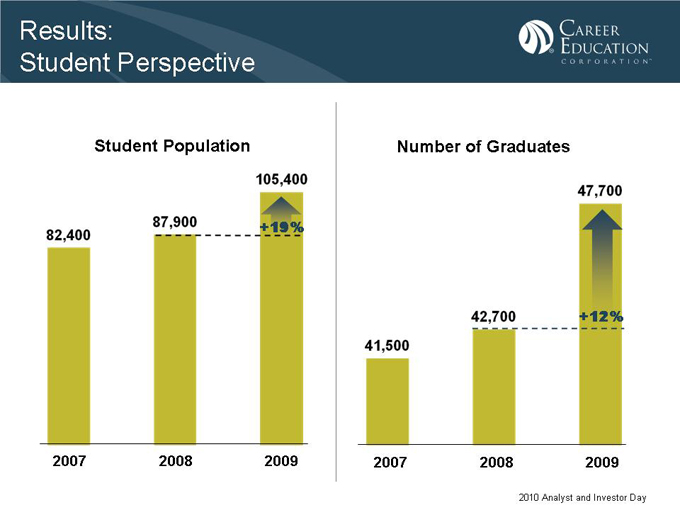

Results: Student Perspective

Student Population

+19% 82,400 87,900 105,400

2007 2008 2009

Number of Graduates

+12% 41,500 42,700 47,700

2007 2008 2009

2010 Analyst and Investor Day

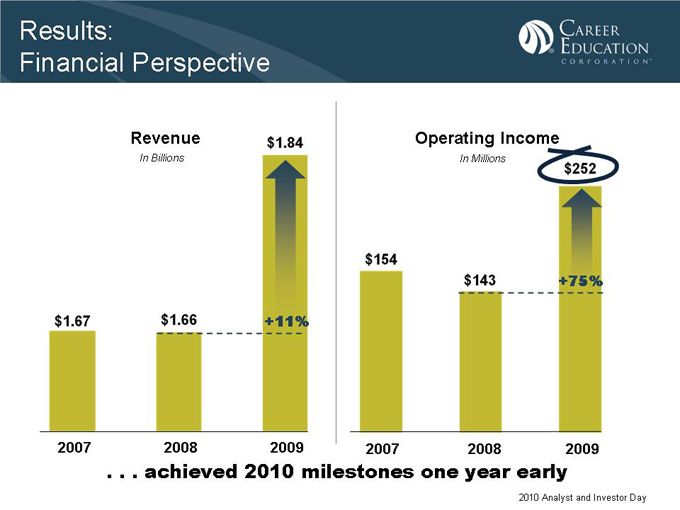

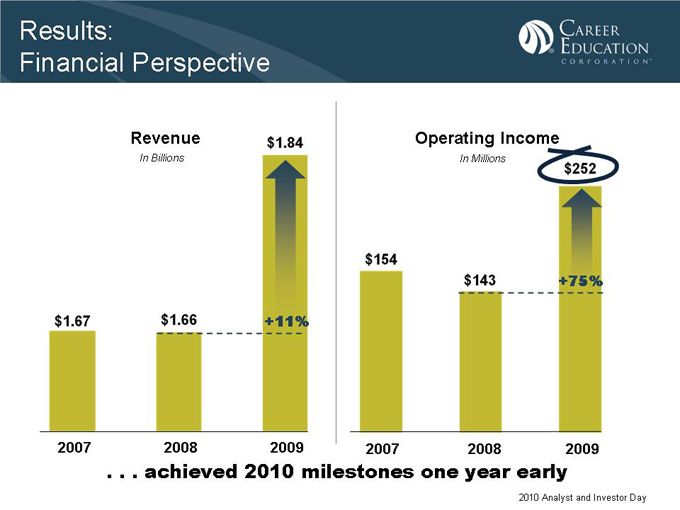

Results:

Financial Perspective

Revenue

In Billions

+11% $1.67 $1.66 $1.84

2007 2008 2009

Operating Income

In Millions

+75% $154 $143 $252

2007 2008 2009

. . . achieved 2010 milestones one year early

2010 Analyst and Investor Day

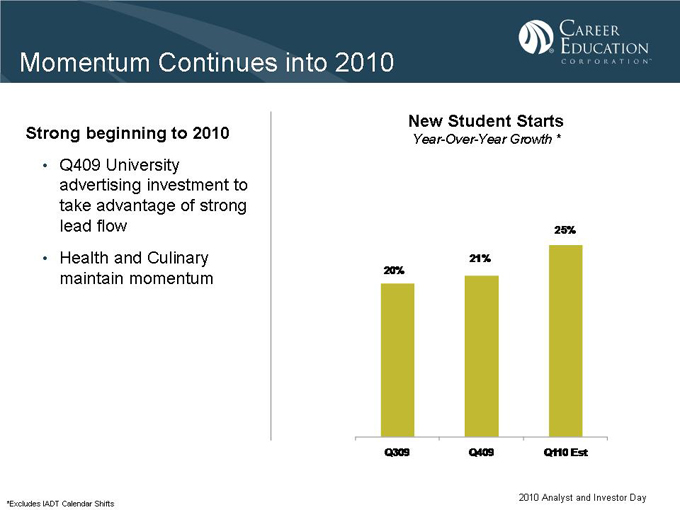

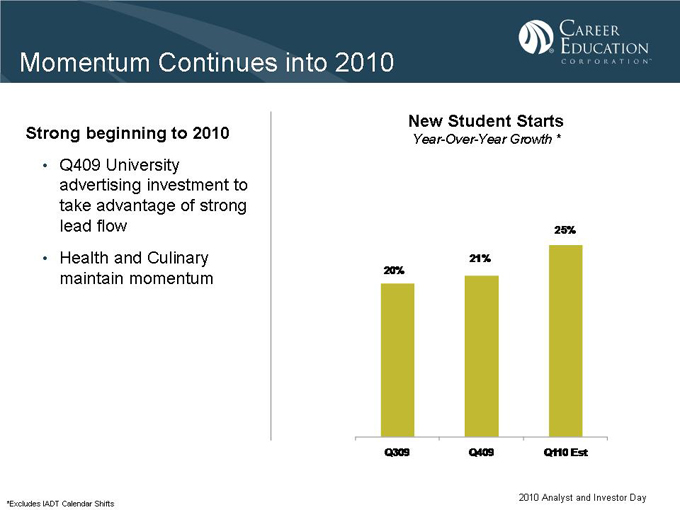

Momentum Continues into 2010

Strong beginning to 2010

• Q409 University advertising investment to take advantage of strong lead flow

• Health and Culinary maintain momentum

New Student Starts

Year-Over-Year Growth *

25%

21% 20%

Q309 Q409 Q110 Est

*Excludes IADT Calendar Shifts

2010 Analyst and Investor Day

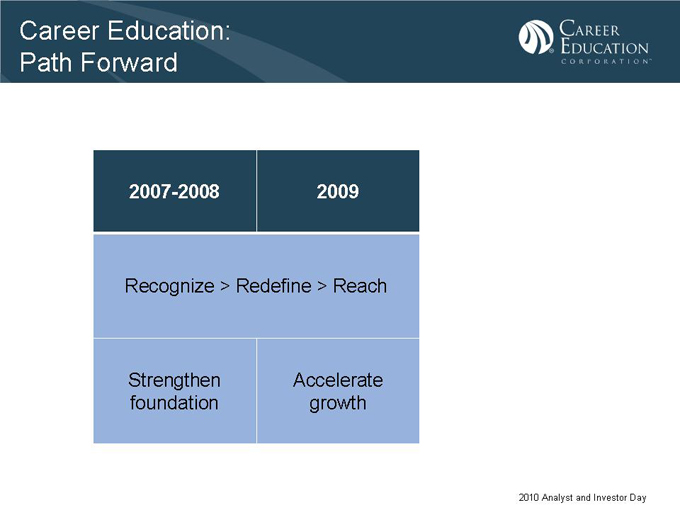

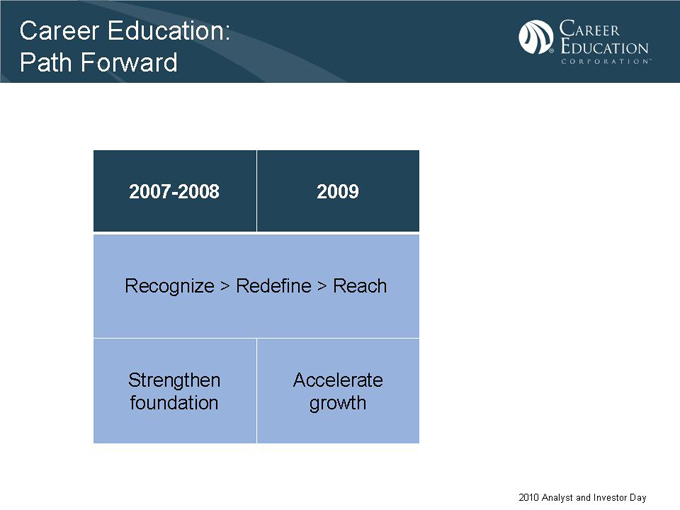

Career Education: Path Forward

2007-2008 2009

Recognize > Redefine > Reach

Strengthen foundation

Accelerate growth

2010 Analyst and Investor Day

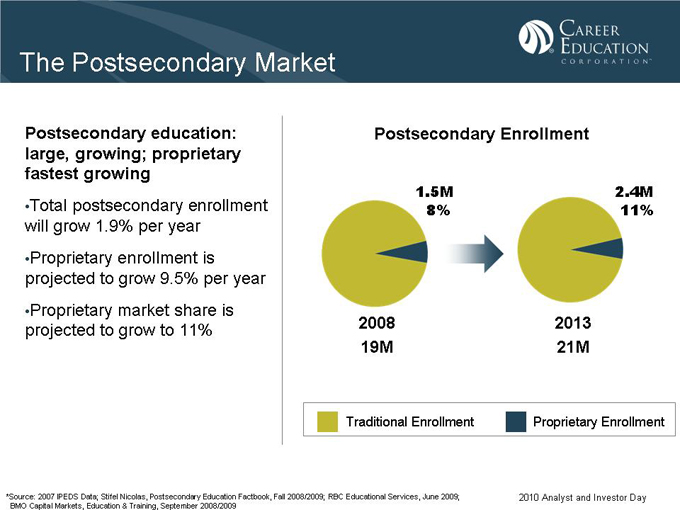

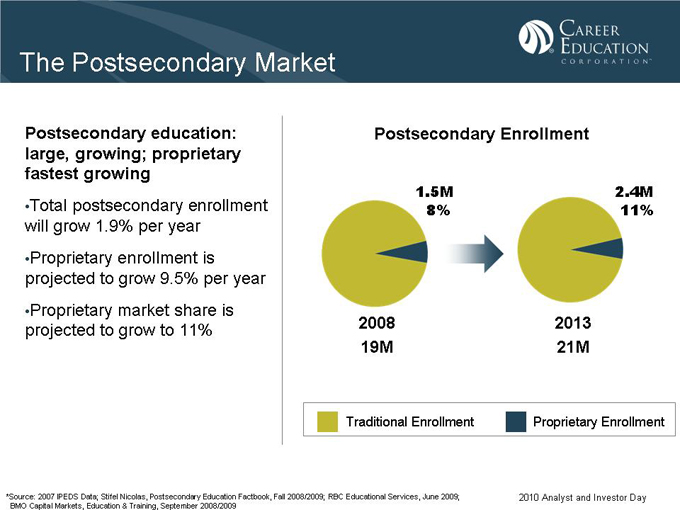

The Postsecondary Market

Postsecondary education: large, growing; proprietary fastest growing

•Total postsecondary enrollment will grow 1.9% per year •Proprietary enrollment is projected to grow 9.5% per year •Proprietary market share is projected to grow to 11%

Postsecondary Enrollment

1.5M

8%

2008 19M

2.4M 11%

2013 21M

Traditional Enrollment

Proprietary Enrollment

*Source: 2007 IPEDS Data; Stifel Nicolas, Postsecondary Education Factbook, Fall 2008/2009; RBC Educational Services, June 2009; BMO Capital Markets, Education & Training, September 2008/2009

2010 Analyst and Investor Day

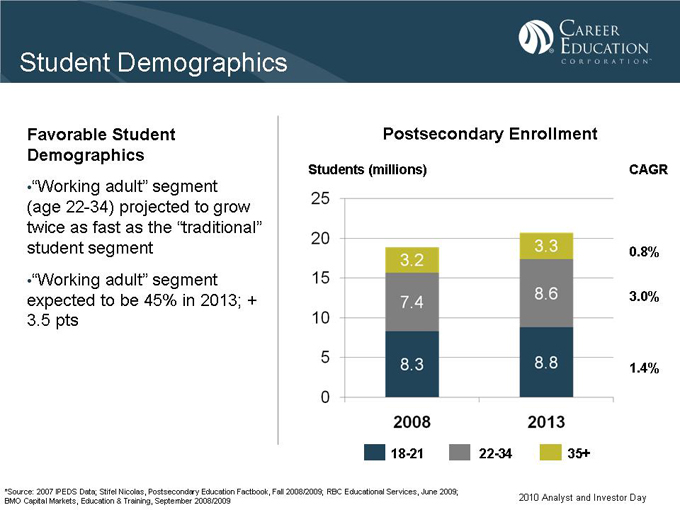

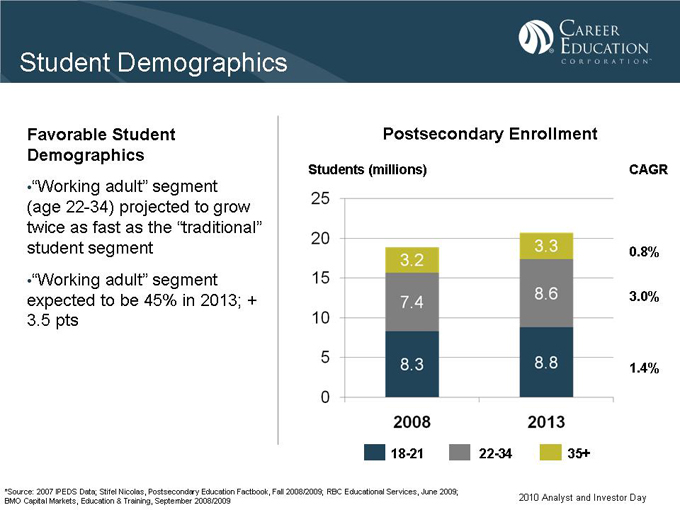

Student Demographics

Favorable Student Demographics

•”Working adult” segment (age 22-34) projected to grow twice as fast as the “traditional” student segment •”Working adult” segment expected to be 45% in 2013; + 3.5 pts

Postsecondary Enrollment

Students (millions)

CAGR

0 5 10 15 20 25

2008 3.2 7.4 8.3

2013 3.3 8.6 8.8

0.8%

3.0%

1.4%

18-21 22-34 35+

*Source: 2007 IPEDS Data; Stifel Nicolas, Postsecondary Education Factbook, Fall 2008/2009; RBC Educational Services, June 2009; BMO Capital Markets, Education & Training, September 2008/2009

2010 Analyst and Investor Day

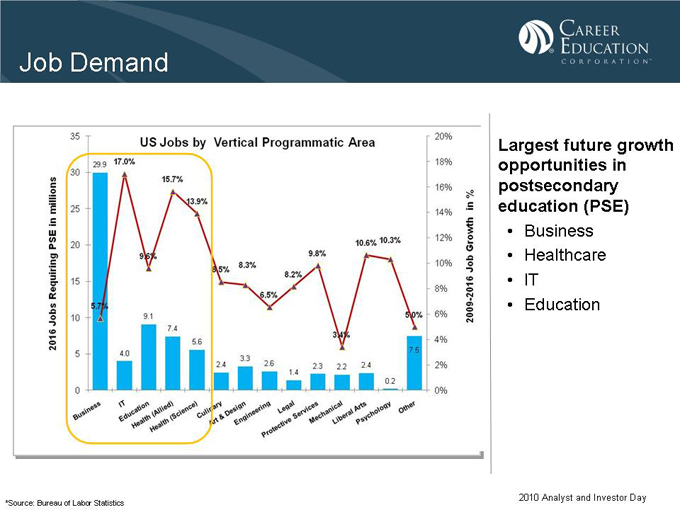

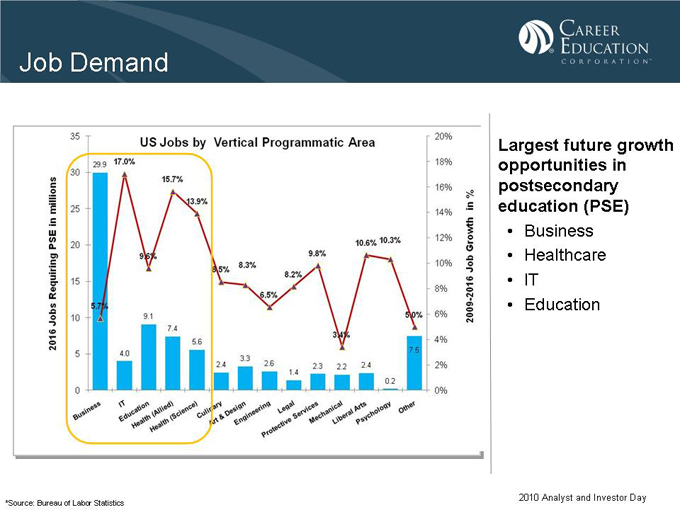

Job Demand

Largest future growth opportunities in postsecondary education (PSE)

• Business

• Healthcare

• IT

• Education

*Source: Bureau of Labor Statistics

2010 Analyst and Investor Day

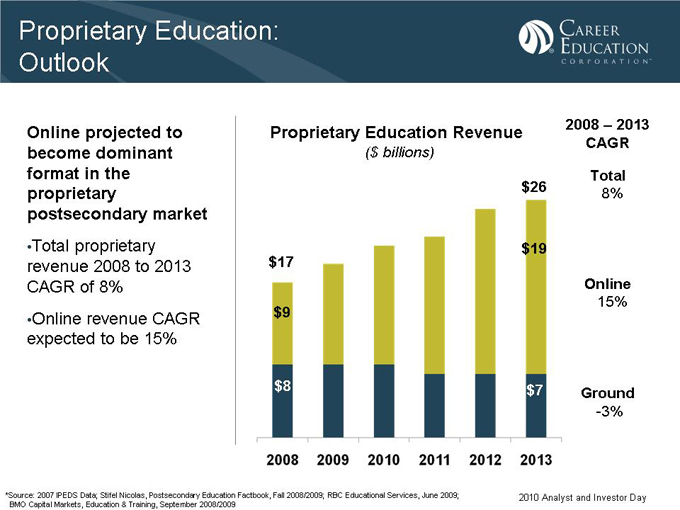

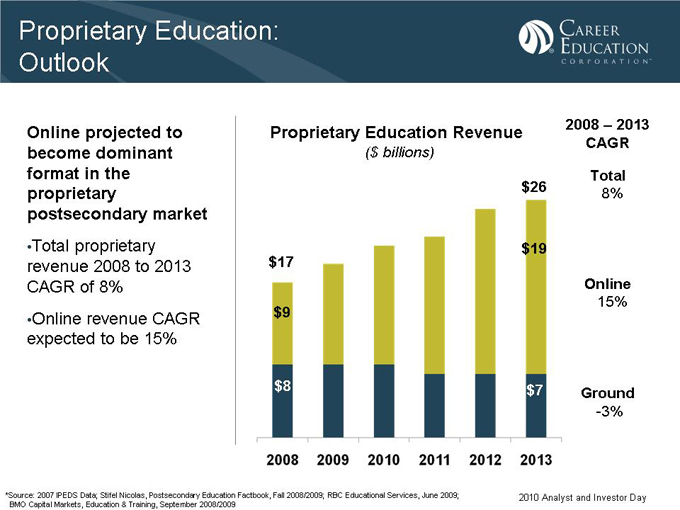

Proprietary Education: Outlook

Online projected to become dominant format in the proprietary postsecondary market

•Total proprietary revenue 2008 to 2013 CAGR of 8% •Online revenue CAGR expected to be 15%

Proprietary Education Revenue

($ billions)

2008 – 2013 CAGR

Total

8%

Online

15%

Ground

-3%

$26

$19 $17

$9

$8 $7

2008 2009 2010 2011 2012 2013

*Source: 2007 IPEDS Data; Stifel Nicolas, Postsecondary Education Factbook, Fall 2008/2009; RBC Educational Services, June 2009; BMO Capital Markets, Education & Training, September 2008/2009

2010 Analyst and Investor Day

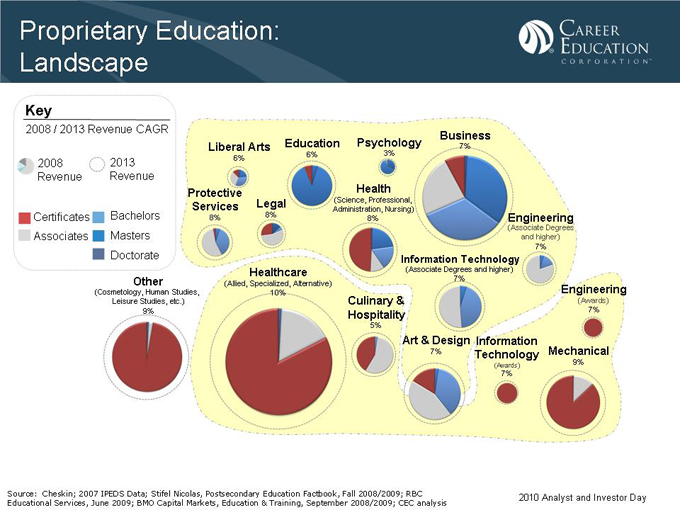

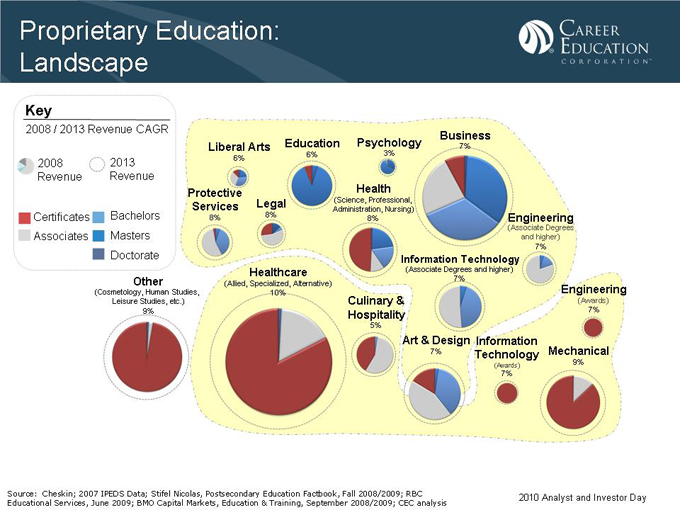

Proprietary Education: Landscape

Key

2008 / 2013 Revenue CAGR

2008 2013 Revenue Revenue

Certificates Bachelors Associates Masters Doctorate

Liberal Arts

6%

Education

6%

Psychology

3%

Business

7%

Protective Services

8%

Legal

8%

Health

(Science, Professional, Administration, Nursing) 8%

Engineering

(Associate Degrees and higher) 7%

Information Technology

(Associate Degrees and higher) 7%

Healthcare

(Allied, Specialized, Alternative) 10%

Culinary & Hospitality

5%

Other

(Cosmetology, Human Studies, Leisure Studies, etc.) 9%

Art & Design

7%

Information Technology

(Awards) 7%

Engineering

(Awards) 7%

Mechanical

9%

Source: Cheskin; 2007 IPEDS Data; Stifel Nicolas, Postsecondary Education Factbook, Fall 2008/2009; RBC Educational Services, June 2009; BMO Capital Markets, Education & Training, September 2008/2009; CEC analysis

2010 Analyst and Investor Day

Proprietary Education: University Landscape

Key

2008 / 2013 Revenue CAGR

2008 Revenue

2013 Revenue

Certificates Associates

Bachelors Masters Doctorate

University -type Curricula

Liberal Arts

6%

Protective Services

8%

Education

6%

Legal

8%

Psychology

3%

Health

(Science, Professional,

Administration, Nursing) 8%

Business

7%

Engineering

(Associate Degrees and higher) 7%

Information Technology

(Associate Degrees and higher) 7%

Art & Design

7%

University segment characteristics:

• Bachelors and higher

• Online focused

• Regional Accreditation

• Diversified offerings

• Largest demand:

Business, Education, Health and IT

Source: Cheskin; 2007 IPEDS Data; Stifel Nicolas, Postsecondary Education Factbook, Fall 2008/2009; RBC Educational Services, June 2009; BMO Capital Markets, Education & Training, September 2008/2009; CEC analysis

2010 Analyst and Investor Day

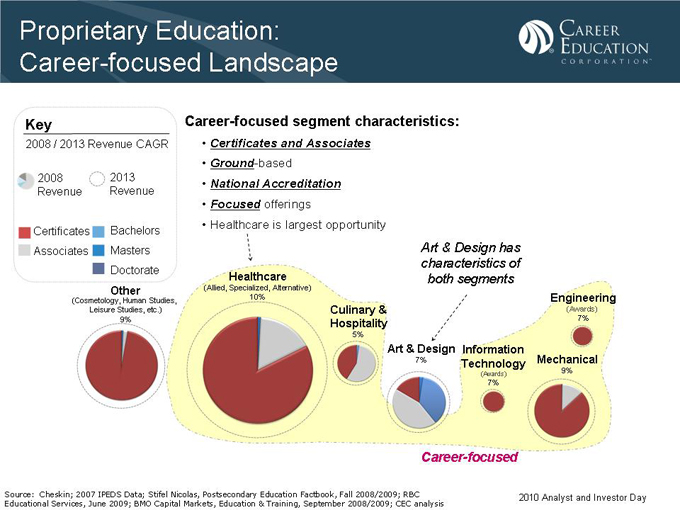

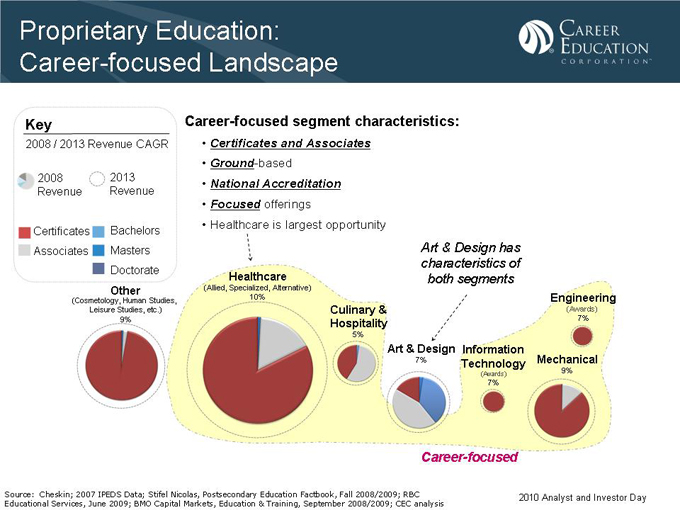

Proprietary Education: Career-focused Landscape

Key

2008 / 2013 Revenue CAGR

2008 Revenue

2013 Revenue

Certificates Associates

Bachelors Masters Doctorate

Career-focused segment characteristics:

• Certificates and Associates

• Ground-based

• National Accreditation

• Focused offerings

• Healthcare is largest opportunity

Other

(Cosmetology, Human Studies, Leisure Studies, etc.) 9%

Healthcare

(Allied, Specialized, Alternative) 10%

Culinary & Hospitality

5%

Art & Design

7%

Information Technology

(Awards) 7%

Mechanical

9%

Engineering

(Awards) 7%

Art & Design has characteristics of both segments

Career-focused

Source: Cheskin; 2007 IPEDS Data; Stifel Nicolas, Postsecondary Education Factbook, Fall 2008/2009; RBC Educational Services, June 2009; BMO Capital Markets, Education & Training, September 2008/2009; CEC analysis

2010 Analyst and Investor Day

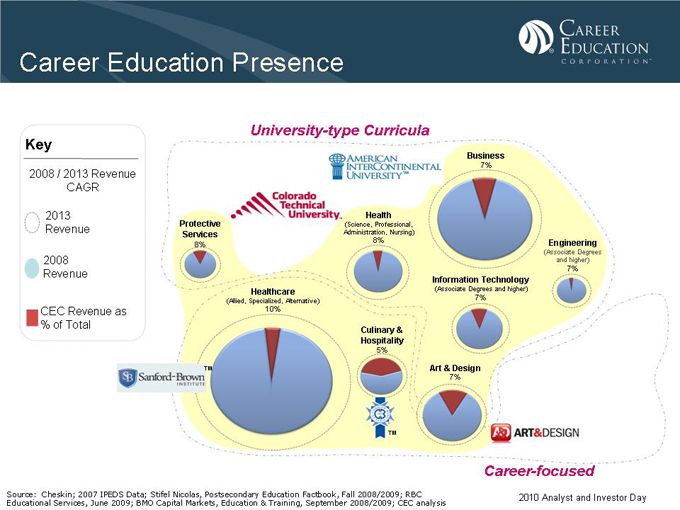

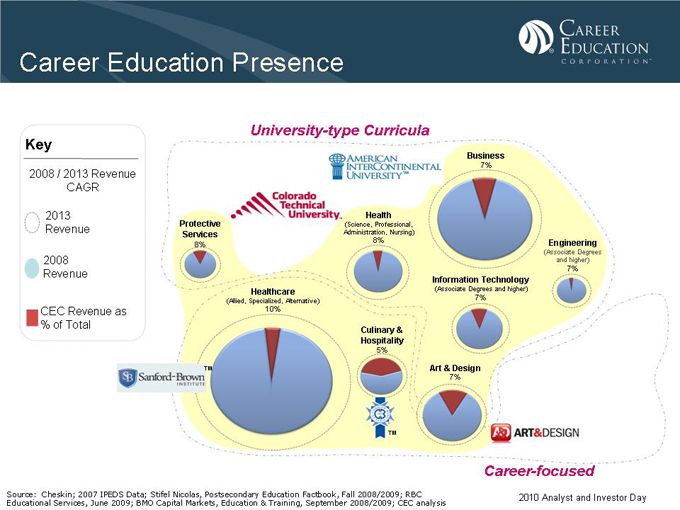

Career Education Presence

Key

2008 / 2013 Revenue CAGR

2013 Revenue

2008 Revenue

CEC Revenue as % of Total

University-type Curricula

Protective Services

8%

Healthcare

(Allied, Specialized, Alternative) 10%

Health

(Science, Professional, Administration, Nursing) 8%

Business

7%

Information Technology

(Associate Degrees and higher) 7%

Engineering

(Associate Degrees and higher) 7%

Culinary & Hospitality

5%

Art & Design

7%

Career-focused

Source: Cheskin; 2007 IPEDS Data; Stifel Nicolas, Postsecondary Education Factbook, Fall 2008/2009; RBC Educational Services, June 2009; BMO Capital Markets, Education & Training, September 2008/2009; CEC analysis

2010 Analyst and Investor Day

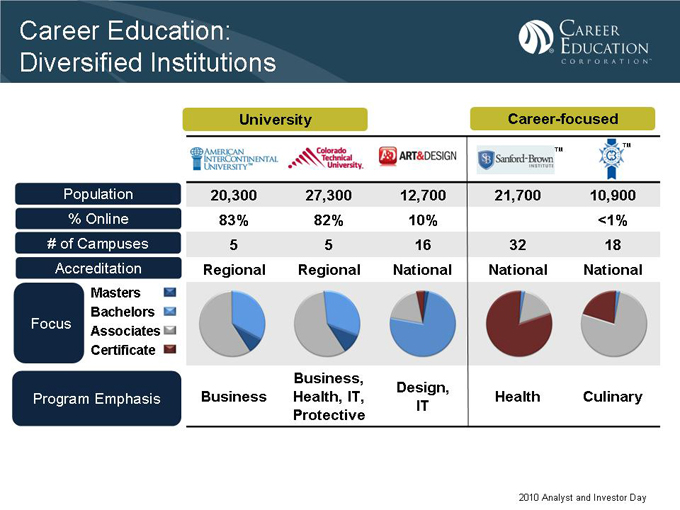

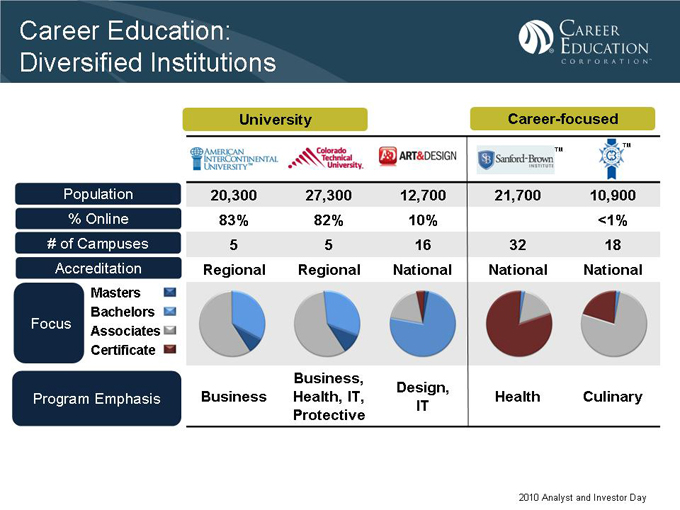

Career Education: Diversified Institutions

University

Career-focused

Population 20,300 27,300 12,700 21,700 10,900

% Online 83% 82% 10% <1%

# of Campuses 5 5 16 32 18

Accreditation Regional Regional National National National

Masters

Bachelors

Focus Associates

Certificate

Program Emphasis Business Business, Health, IT, Protective Design, IT Health Culinary

2010 Analyst and Investor Day

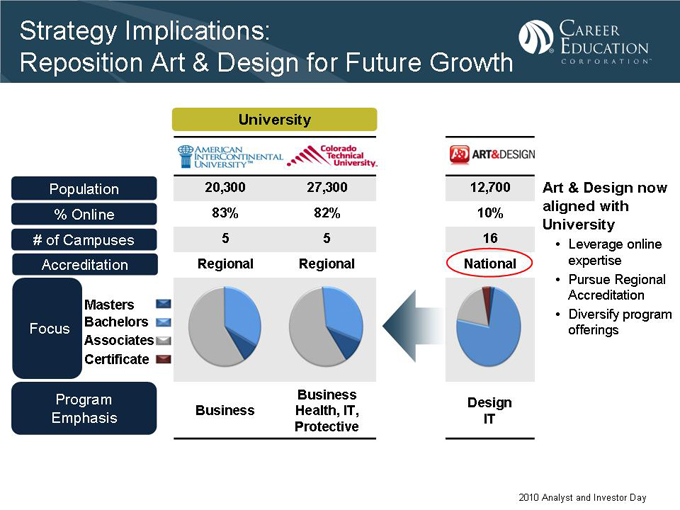

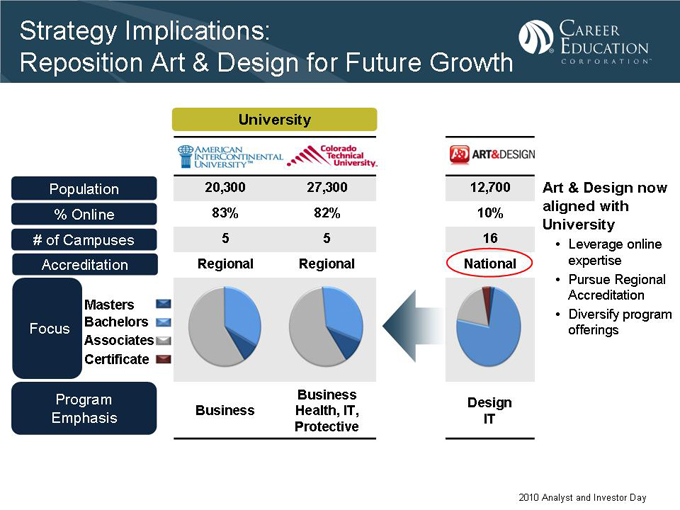

Strategy Implications:

Reposition Art & Design for Future Growth

University

Population 20,300 27,300 12,700

% Online 83% 82% 10%

# of Campuses 5 5 16

Accreditation Regional Regional National

Masters

Focus Bachelors

Associates

Certificate

Program Emphasis Business Business Health, IT, Protective Design IT

Art & Design now aligned with University

• Leverage online expertise

• Pursue Regional Accreditation

• Diversify program offerings

2010 Analyst and Investor Day

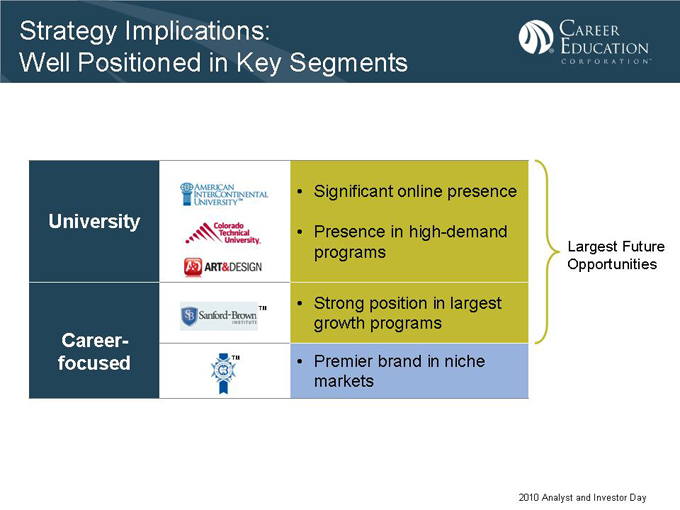

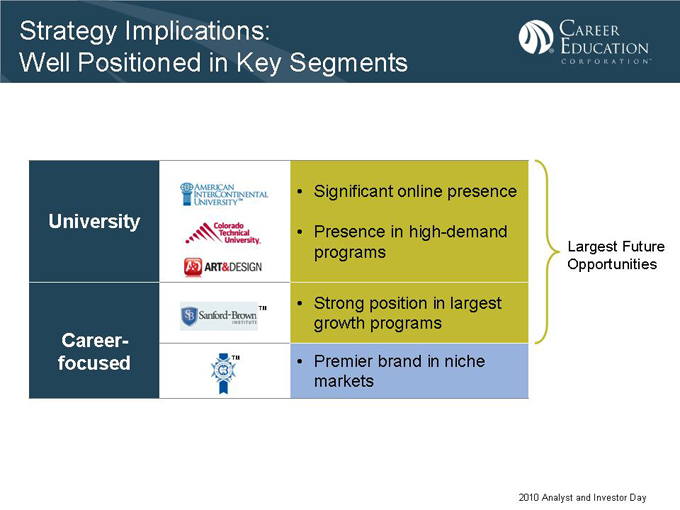

Strategy Implications: Well Positioned in Key Segments

University

Career-focused

• Significant online presence

• Presence in high-demand programs

• Strong position in largest growth programs

• Premier brand in niche markets

Largest Future Opportunities

2010 Analyst and Investor Day

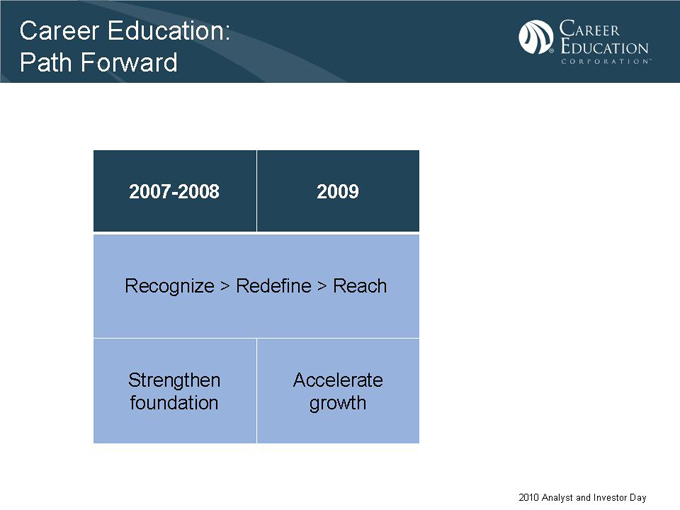

Career Education: Path Forward

2007-2008 2009

Recognize > Redefine > Reach

Strengthen foundation

Accelerate growth

2010 Analyst and Investor Day

Enablers for Growth

• Quality

• Programs

• Technology

• Geographic Expansion

2010 Analyst and Investor Day

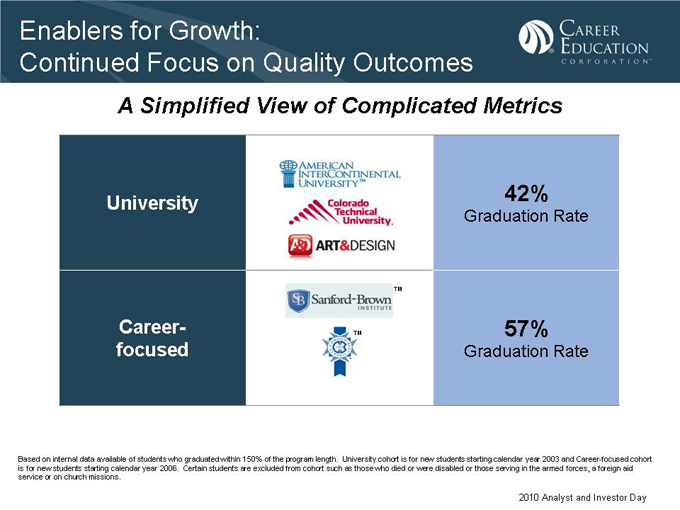

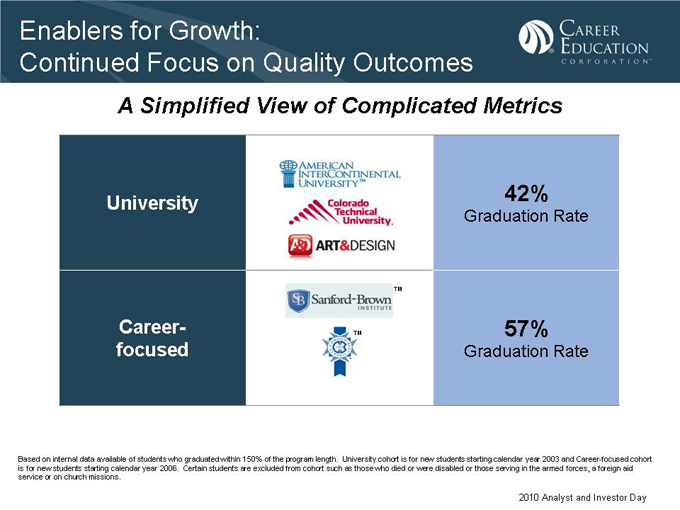

Enablers for Growth:

Continued Focus on Quality Outcomes

A Simplified View of Complicated Metrics

University

Career-focused

42%

Graduation Rate

57%

Graduation Rate

Based on internal data available of students who graduated within 150% of the program length. University cohort is for new students starting calendar year 2003 and Career-focused cohort is for new students starting calendar year 2006. Certain students are excluded from cohort such as those who died or were disabled or those serving in the armed forces, a foreign aid service or on church missions.

2010 Analyst and Investor Day

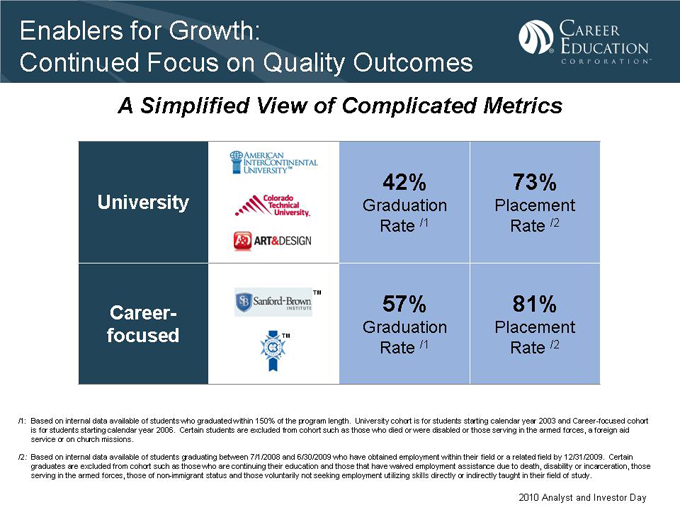

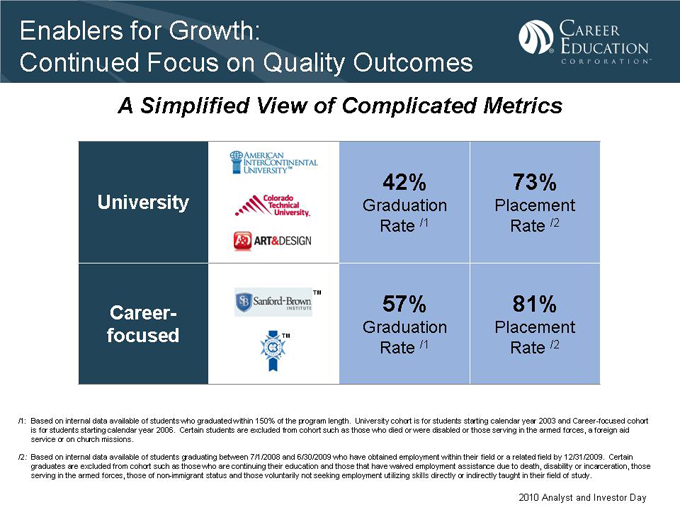

Enablers for Growth:

Continued Focus on Quality Outcomes

A Simplified View of Complicated Metrics

University

Career-focused

42%

Graduation Rate /1

73%

Placement Rate /2

57%

Graduation Rate /1

81%

Placement Rate /2

/1: Based on internal data available of students who graduated within 150% of the program length. University cohort is for students starting calendar year 2003 and Career-focused cohort is for students starting calendar year 2006. Certain students are excluded from cohort such as those who died or were disabled or those serving in the armed forces, a foreign aid service or on church missions.

/2: Based on internal data available of students graduating between 7/1/2008 and 6/30/2009 who have obtained employment within their field or a related field by 12/31/2009. Certain graduates are excluded from cohort such as those who are continuing their education and those that have waived employment assistance due to death, disability or incarceration, those serving in the armed forces, those of non-immigrant status and those voluntarily not seeking employment utilizing skills directly or indirectly taught in their field of study.

2010 Analyst and Investor Day

Enablers for Growth: New Programs

Program Innovation

• Created Centralized Organization

• Research/Opportunity Assessment

• Company-wide perspective enables “Search and reapply”

Research/Collaboration

2010 Analyst and Investor Day

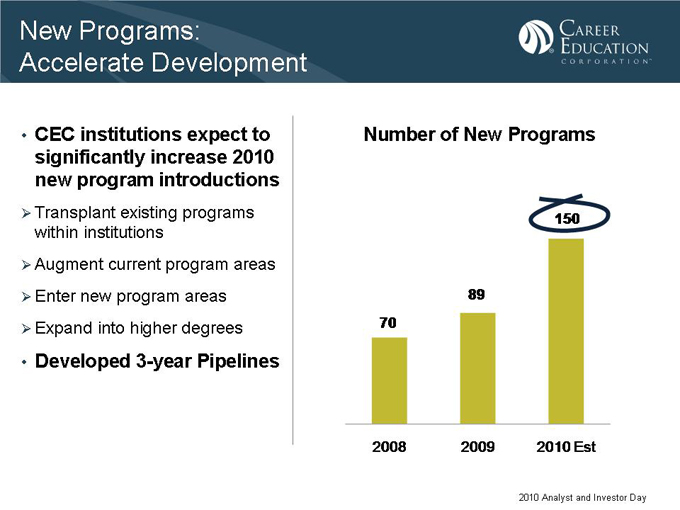

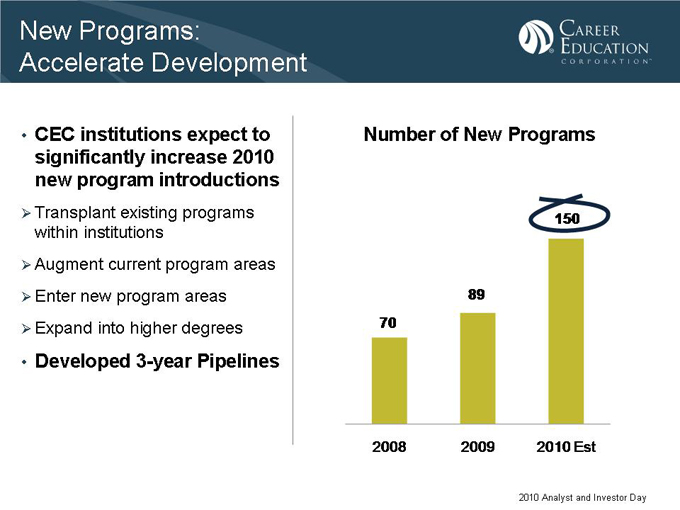

New Programs:

Accelerate Development

• CEC institutions expect to significantly increase 2010 new program introductions

Transplant existing programs within institutions

Augment current program areas

Enter new program areas

Expand into higher degrees

• Developed 3-year Pipelines

Number of New Programs

70

2008

89

2009

150

2010 Est

2010 Analyst and Investor Day

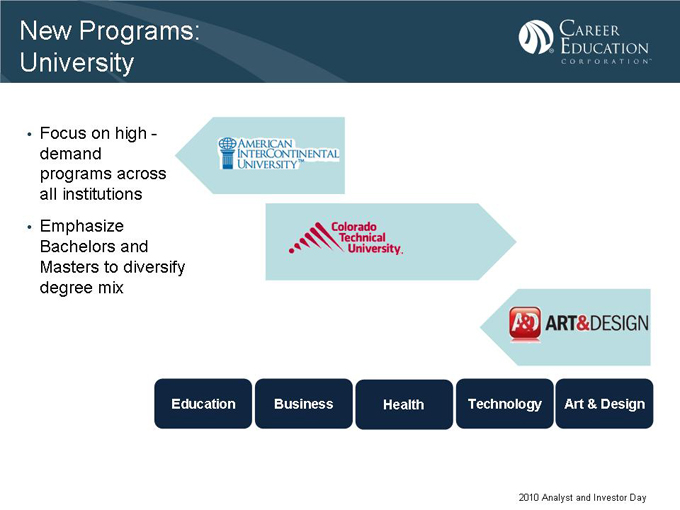

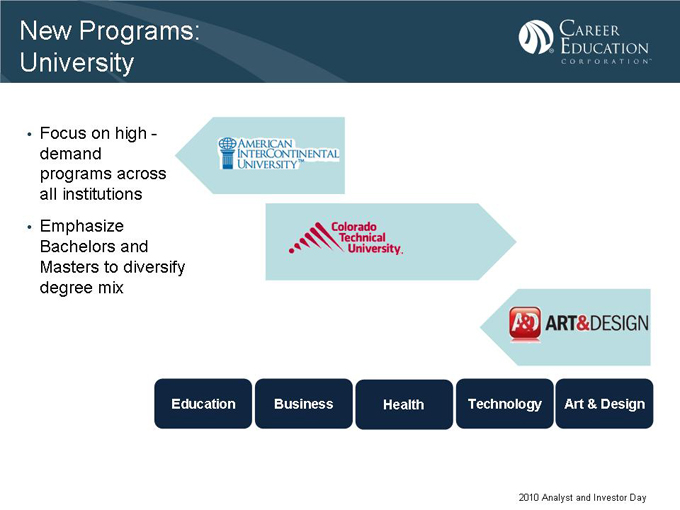

New Programs: University

• Focus on high-demand programs across all institutions

• Emphasize Bachelors and Masters to diversify degree mix

Education Business Health Technology Art & Design

2010 Analyst and Investor Day

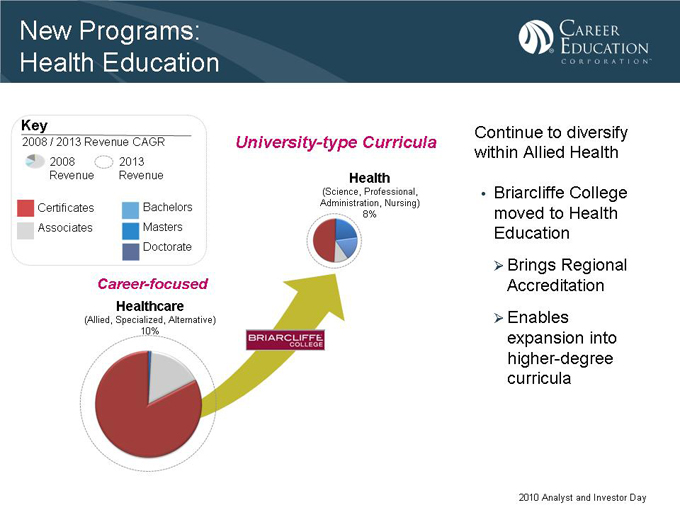

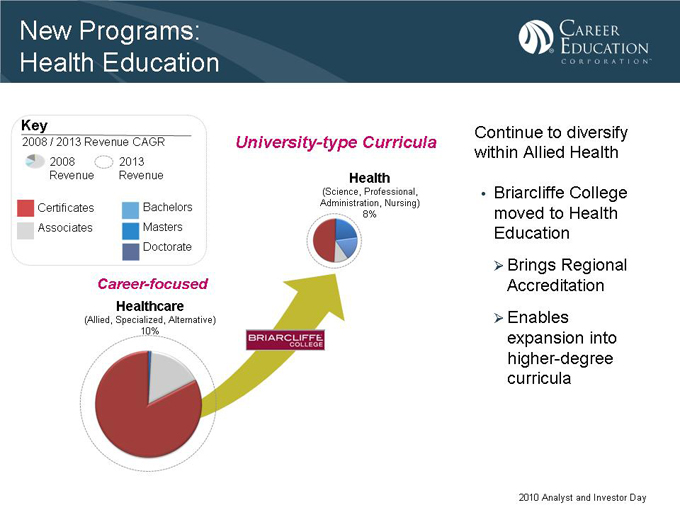

New Programs: Health Education

Key

2008 / 2013 Revenue CAGR

2008 Revenue

2013 Revenue

Certificates Associates

Bachelors Masters Doctorate

Career-focused

Healthcare

(Allied, Specialized, Alternative) 10%

University-type Curricula

Health

(Science, Professional, Administration, Nursing) 8%

Continue to diversify within Allied Health

• Briarcliffe College moved to Health Education

Brings Regional Accreditation

Enables expansion into higher-degree curricula

2010 Analyst and Investor Day

Enablers for Growth: Leveraging Leading Technology

• Proprietary technology

• Integrated platform

• Award-winning architecture

2010 Analyst and Investor Day

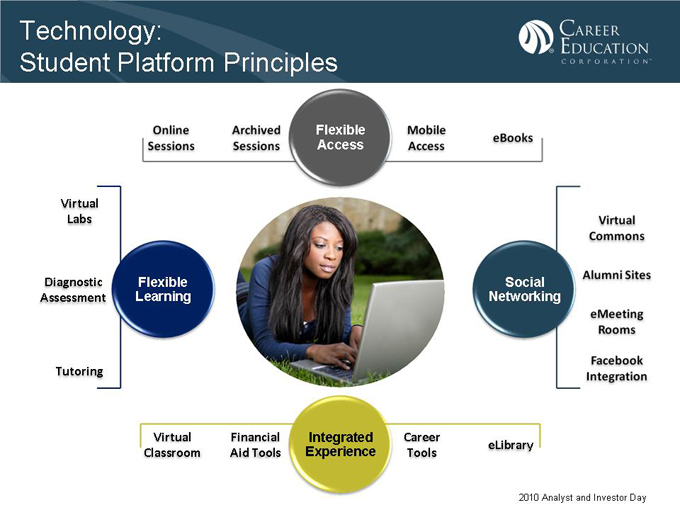

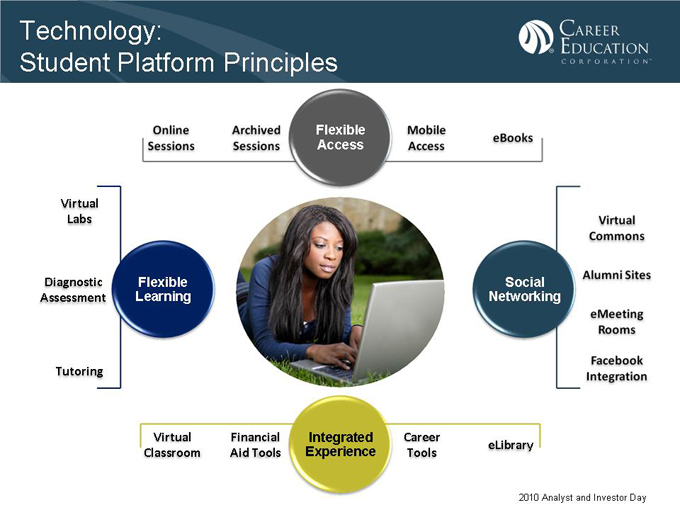

Technology: Student Platform Principles

Flexible Access

Online Sessions

Archived Sessions

Mobile Access

eBooks

Virtual Labs

Diagnostic Assessment

Tutoring

Flexible Learning

Social Networking

Virtual Commons

Alumni Sites

eMeeting Rooms

Facebook Integration

Virtual Classroom

Financial Aid Tools

Integrated Experience

Career Tools

eLibrary

2010 Analyst and Investor Day

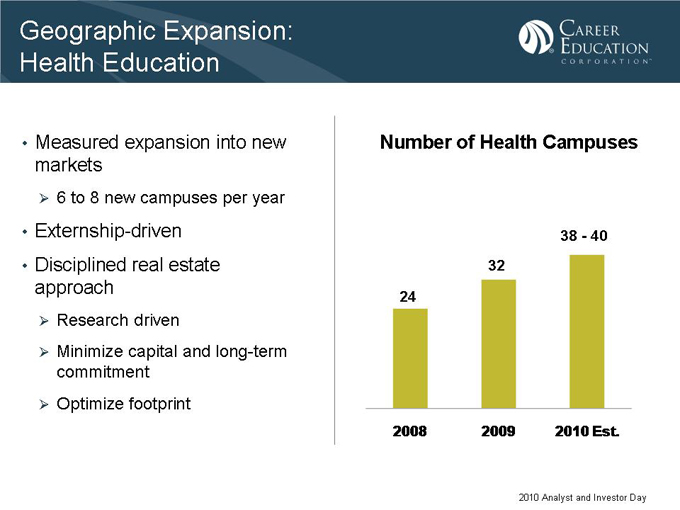

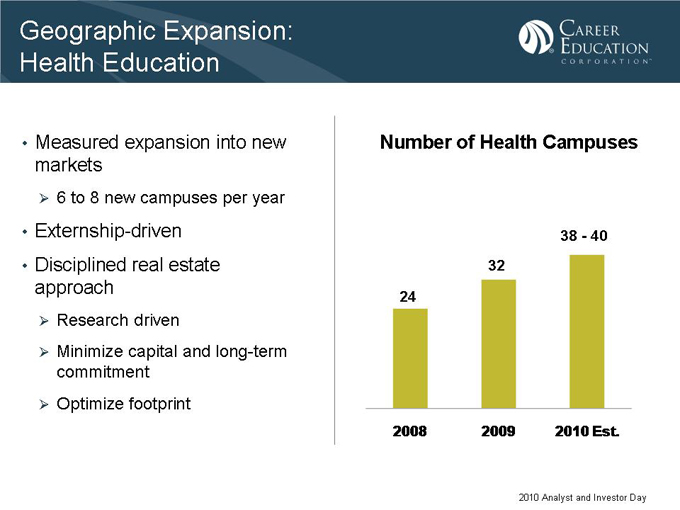

Geographic Expansion: Health Education

• Measured expansion into new markets

6 to 8 new campuses per year

• Externship-driven

• Disciplined real estate approach

Research driven

Minimize capital and long-term commitment

Optimize footprint

Number of Health Campuses

38—40 32

24

2008 2009 2010 Est.

2010 Analyst and Investor Day

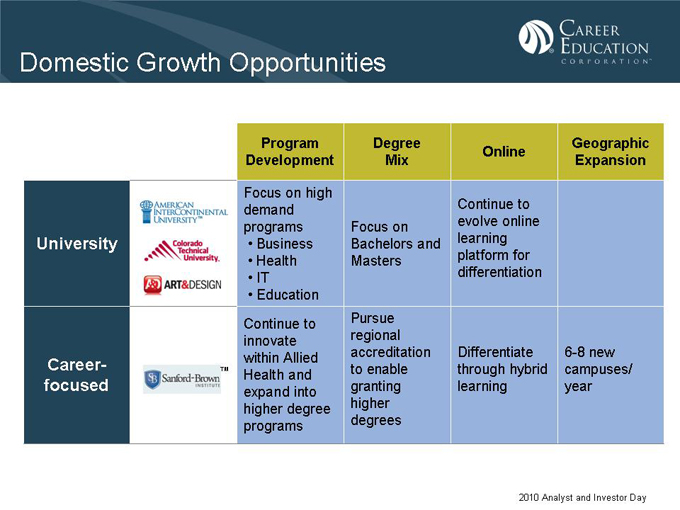

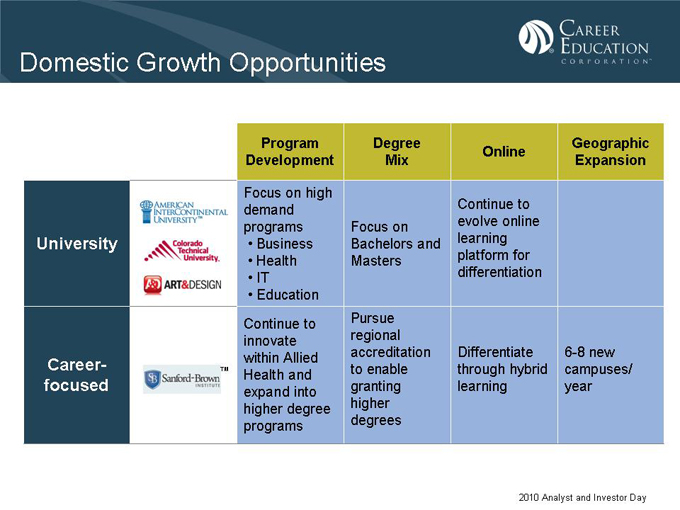

Domestic Growth Opportunities

Program Development Degree Mix Online Geographic Expansion

University

Career-focused

Focus on high demand programs

• Business

• Health

• IT

• Education

Continue to innovate within Allied Health and expand into higher degree programs

Focus on Bachelors and Masters

Pursue regional accreditation to enable granting higher degrees

Continue to evolve online learning platform for differentiation

Differentiate through hybrid learning

6-8 new campuses/year

2010 Analyst and Investor Day

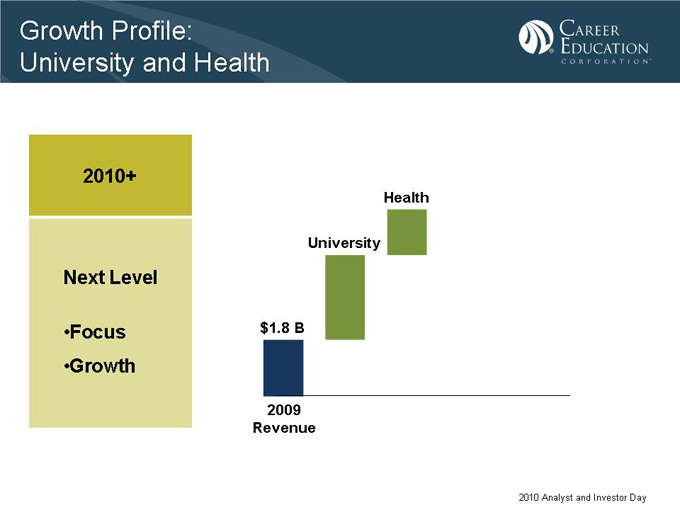

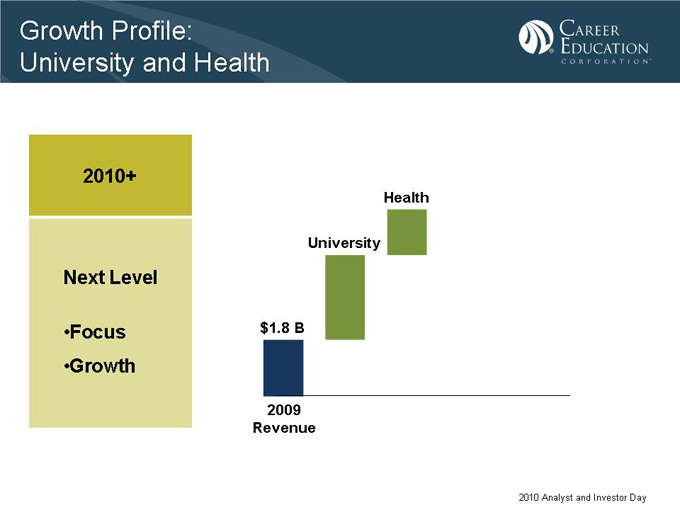

Growth Profile: University and Health

2010+

Next Level

•Focus •Growth

Health

University

$1.8 B

2009 Revenue

2010 Analyst and Investor Day

Targeted Growth Opportunity: Culinary Arts

Population 10,900

% Online <1%

# of Campuses 18

Accreditation National

Masters

Bachelors

Focus Associates

Certificate

Program Emphasis Culinary Arts

Student Population

+30%

2007 2008 2009

Continue to rebuild student population in existing markets

• Premier brand in Culinary

• New programs

• Online bachelor’s degree program

2010 Analyst and Investor Day

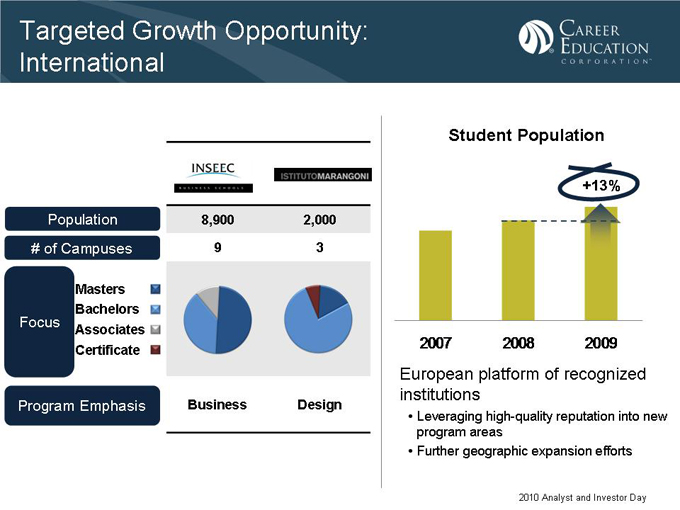

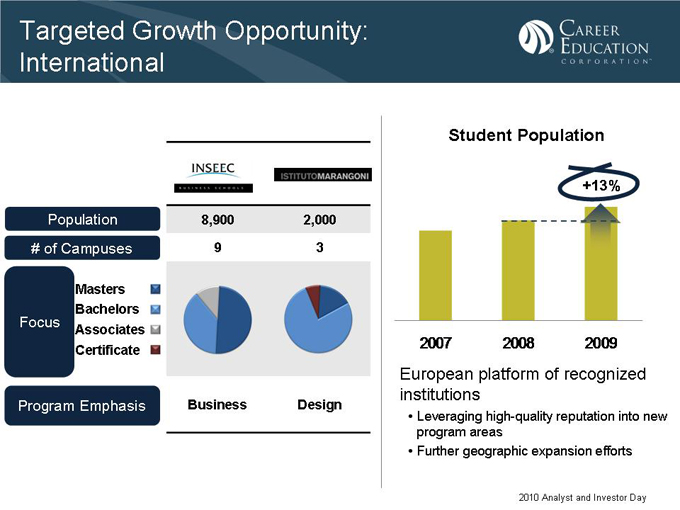

Targeted Growth Opportunity: International

Population 8,900 2,000

# of Campuses 9 3

Masters

Bachelors

Focus Associates

Certificate

Program Emphasis Business Design

Student Population

+13%

2007 2008 2009

European platform of recognized institutions

• Leveraging high-quality reputation into new program areas

• Further geographic expansion efforts

2010 Analyst and Investor Day

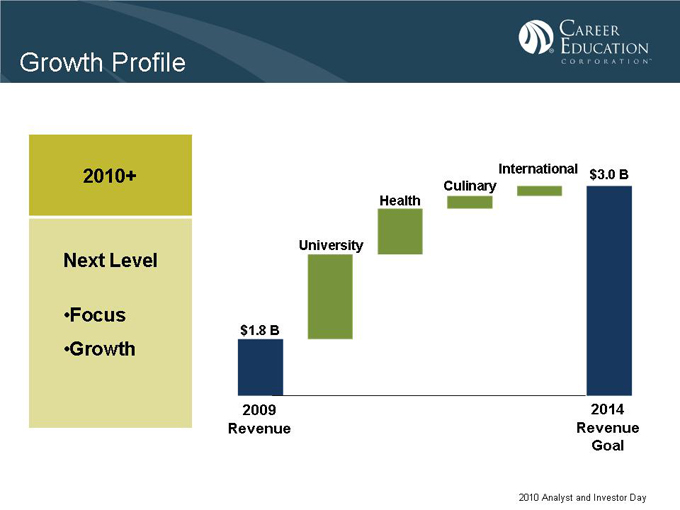

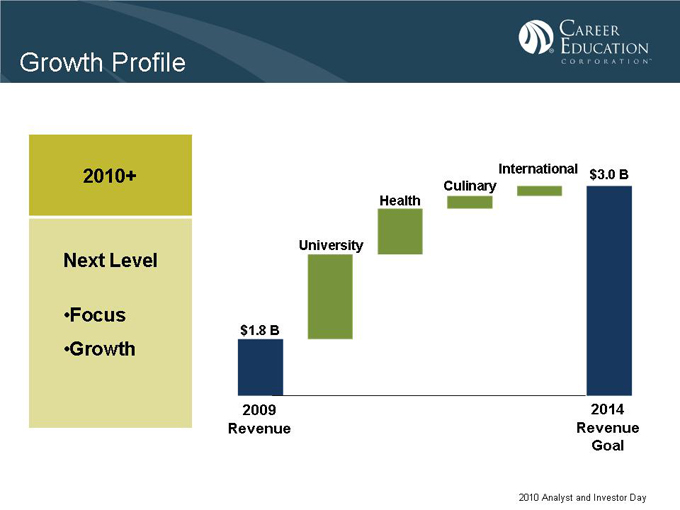

Growth Profile

2010+

Next Level

•Focus •Growth

International $3.0 B Culinary Health

University

$1.8 B

2009 Revenue

2014 Revenue Goal

2010 Analyst and Investor Day

Milestones

Annual Growth

2010+ 2010 2011—2014

Next Level

•Focus •Growth •Value

Student Population Growth 15%+ 8-10%

Revenue Growth 15%+ 8-10%

Operating Income Growth 40%+ 15-20%

2010 Analyst and Investor Day

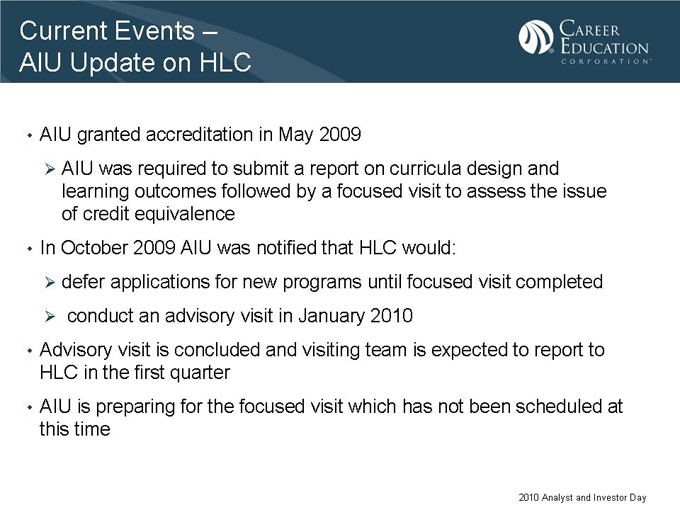

Current Events – AIU Update on HLC

• AIU granted accreditation in May 2009

AIU was required to submit a report on curricula design and learning outcomes followed by a focused visit to assess the issue of credit equivalence

• In October 2009 AIU was notified that HLC would:

defer applications for new programs until focused visit completed conduct an advisory visit in January 2010

• Advisory visit is concluded and visiting team is expected to report to HLC in the first quarter

• AIU is preparing for the focused visit which has not been scheduled at this time

2010 Analyst and Investor Day

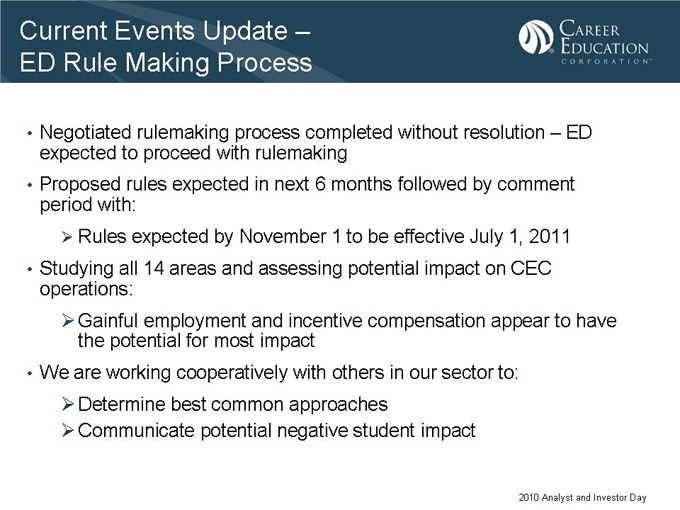

Current Events Update – ED Rule Making Process

• Negotiated rulemaking process completed without resolution – ED expected to proceed with rulemaking

• Proposed rules expected in next 6 months followed by comment period with:

Rules expected by November 1 to be effective July 1, 2011

• Studying all 14 areas and assessing potential impact on CEC operations:

Gainful employment and incentive compensation appear to have the potential for most impact

• We are working cooperatively with others in our sector to:

Determine best common approaches

Communicate potential negative student impact

2010 Analyst and Investor Day

Summary

• Transformed company and achieved 2010 milestones

• Strong momentum entering 2010

• Well positioned in key market segments

• Focused strategies to deliver next level of growth

2010 Analyst and Investor Day

Break

Manoj Kulkarni

Chief Information Officer

Copyright Career Education Corporation 2010 2010 Analyst and Investor Day

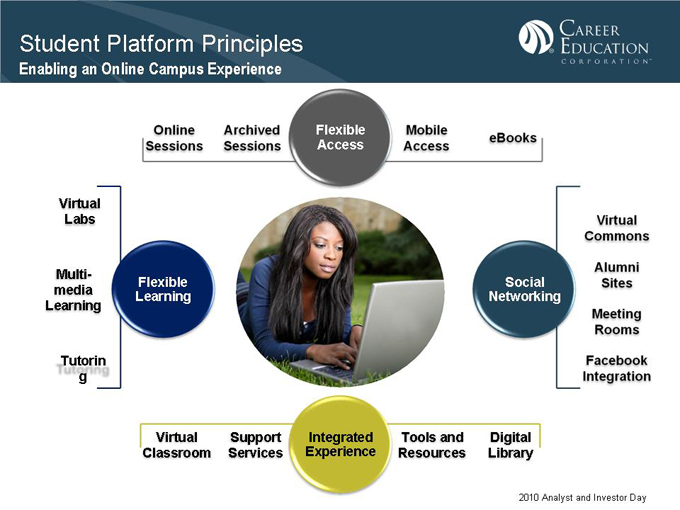

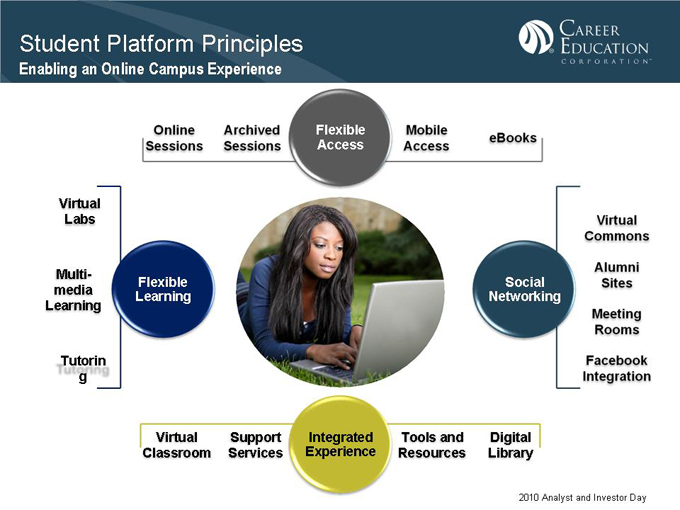

Student Platform Principles

Enabling an Online Campus Experience

Flexible Access

Online Sessions

Archived Sessions

Mobile Access

eBooks

Virtual Labs

Multi-media Learning

Tutoring

Flexible Learning

Social Networking

Virtual Commons

Alumni Sites

Meeting Rooms

Facebook Integration

Virtual Classroom

Support Services

Integrated Experience

Tools and Resources

Digital Library

2010 Analyst and Investor Day

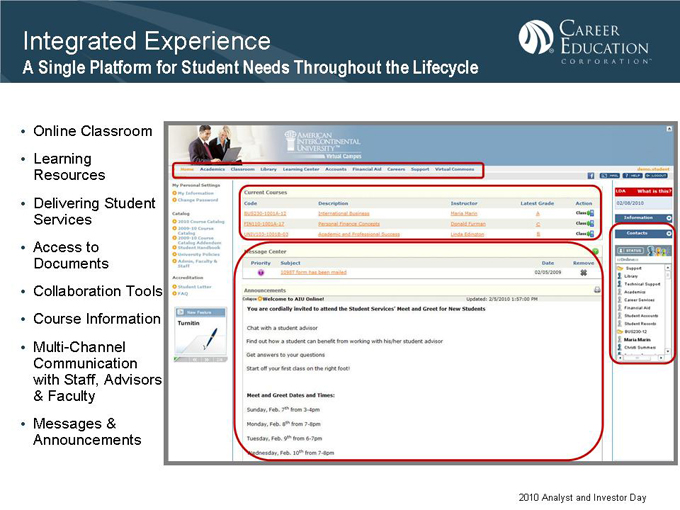

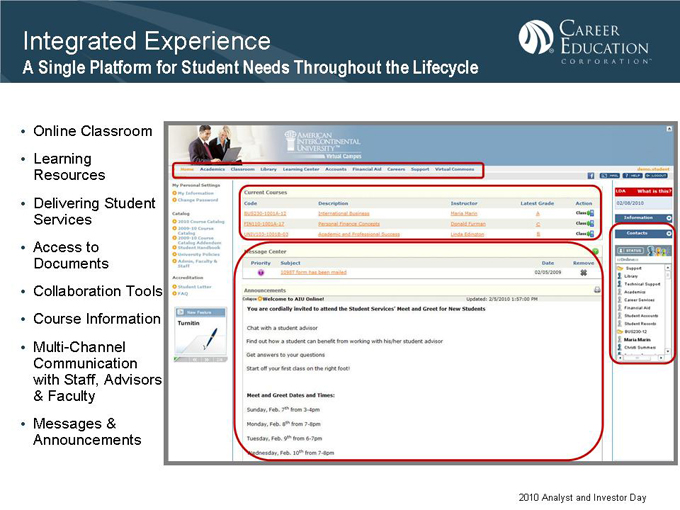

Integrated Experience

A Single Platform for Student Needs Throughout the Lifecycle

• Online Classroom

• Learning Resources

• Delivering Student Services

• Access to Documents

• Collaboration Tools

• Course Information

• Multi-Channel Communication with Staff, Advisors

& Faculty

• Messages & Announcements

2010 Analyst and Investor Day

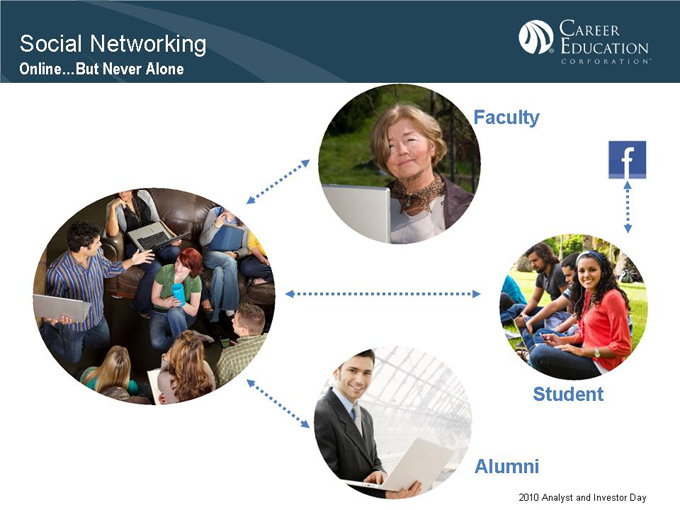

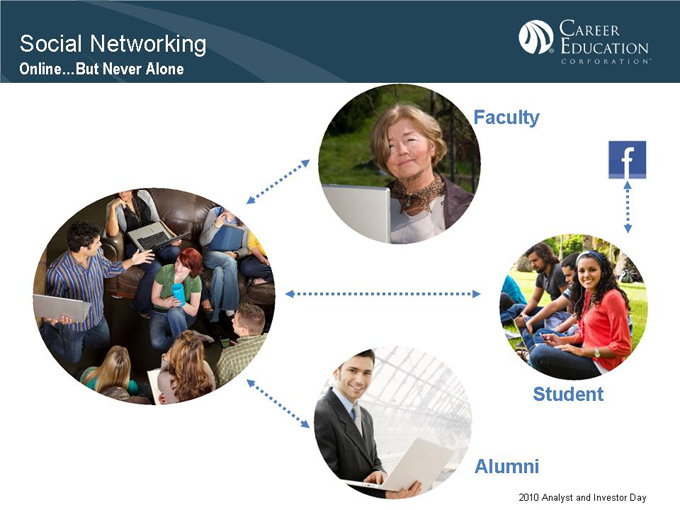

Social Networking

Online…But Never Alone

Faculty

Student

Alumni

2010 Analyst and Investor Day

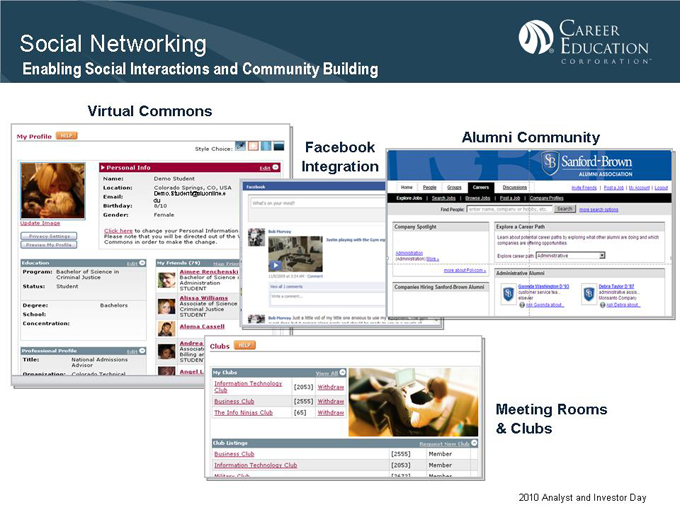

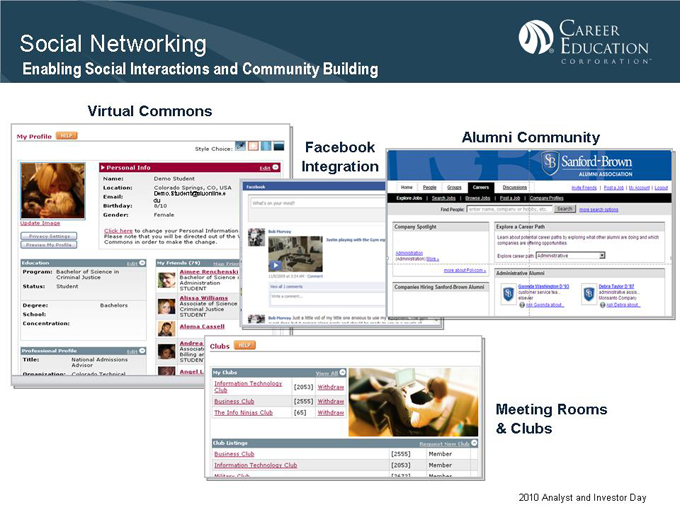

Social Networking

Enabling Social Interactions and Community Building

Virtual Commons

Facebook Integration

Alumni Community

Meeting Rooms & Clubs

2010 Analyst and Investor Day

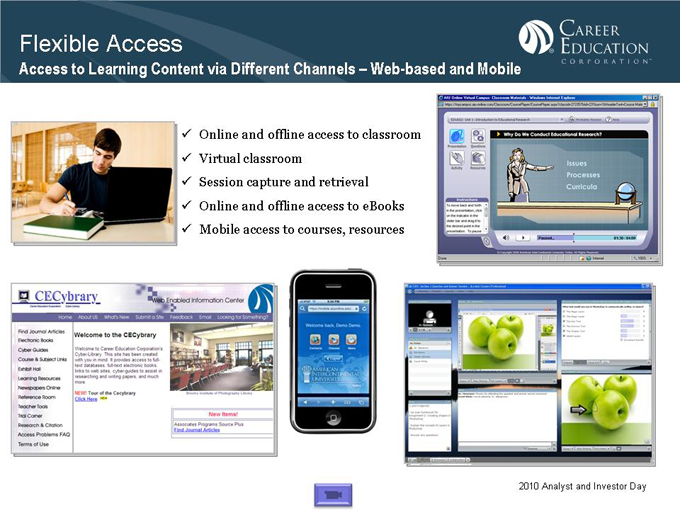

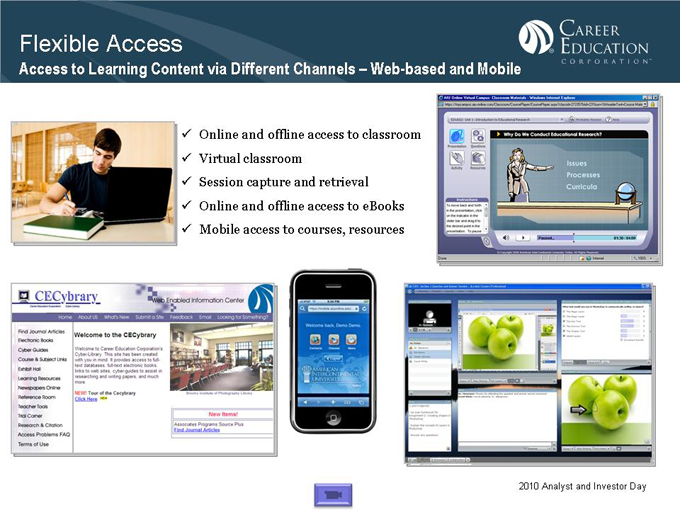

Flexible Access

Access to Learning Content via Different Channels – Web-based and Mobile

Online and offline access to classroom

Virtual classroom

Session capture and retrieval

Online and offline access to eBooks

Mobile access to courses, resources

2010 Analyst and Investor Day

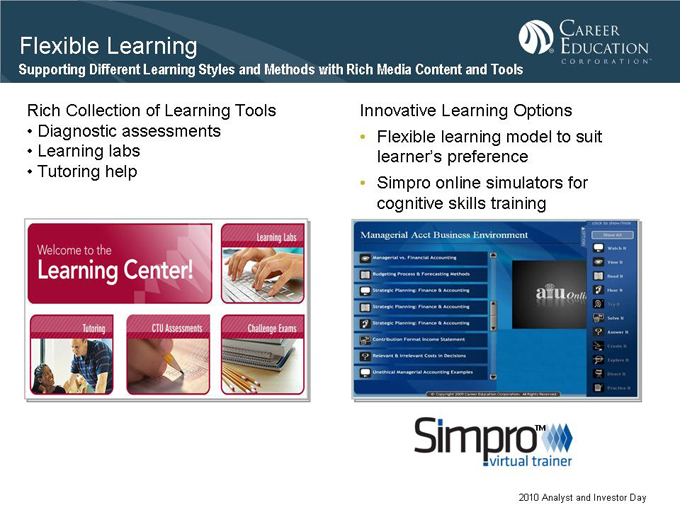

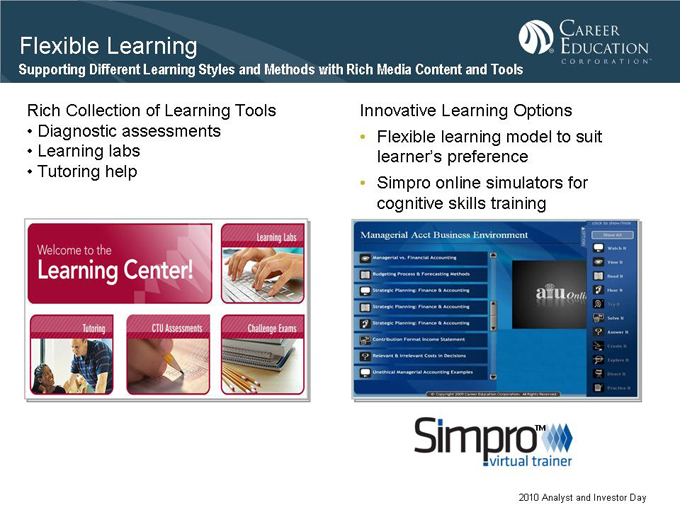

Flexible Learning

Supporting Different Learning Styles and Methods with Rich Media Content and Tools

Rich Collection of Learning Tools

• Diagnostic assessments

• Learning labs

• Tutoring help

Innovative Learning Options

• Flexible learning model to suit learner’s preference

• Simpro online simulators for cognitive skills training

2010 Analyst and Investor Day

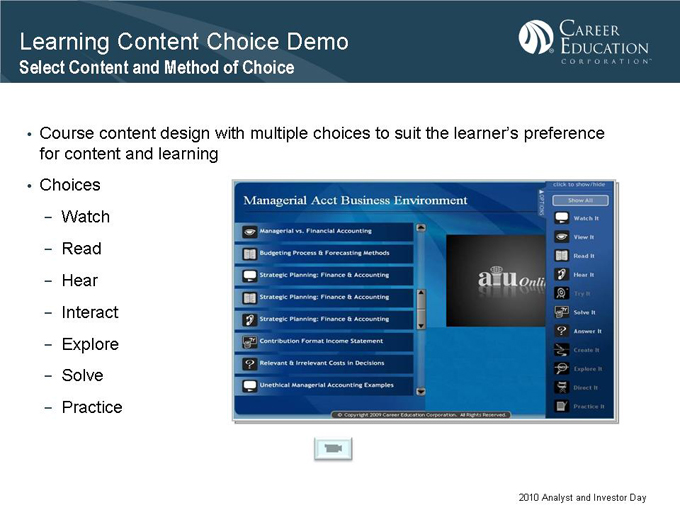

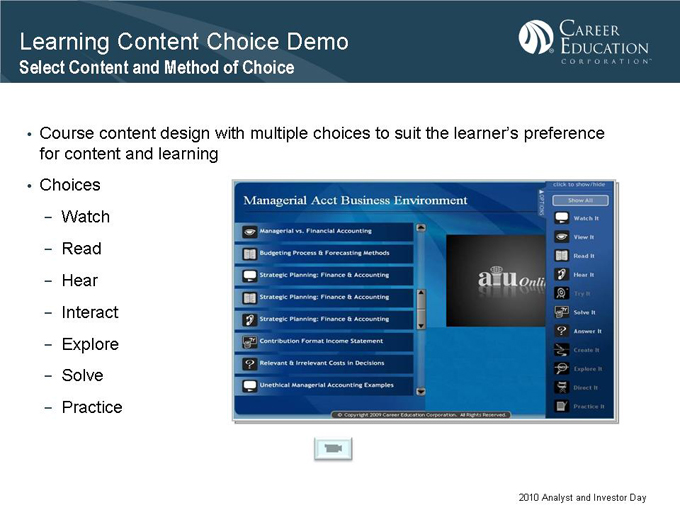

Learning Content Choice Demo

Select Content and Method of Choice

• Course content design with multiple choices to suit the learner’s preference for content and learning

• Choices

Watch

Read

Hear

Interact

Explore

Solve

Practice

2010 Analyst and Investor Day

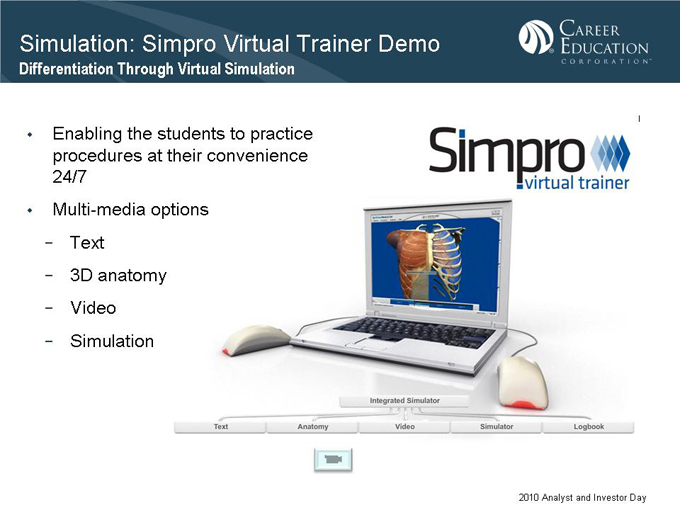

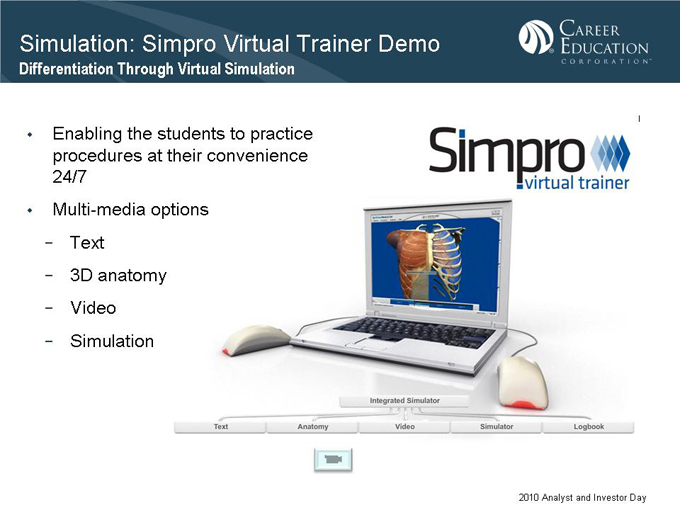

Simulation: Simpro Virtual Trainer Demo

Differentiation Through Virtual Simulation

• Enabling the students to practice procedures at their convenience 24/7

Multi-media options

Text

3D anatomy

Video

Simulation

2010 Analyst and Investor Day

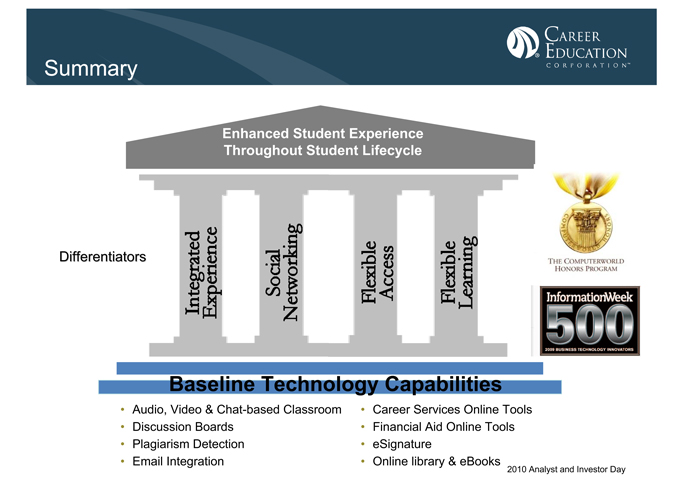

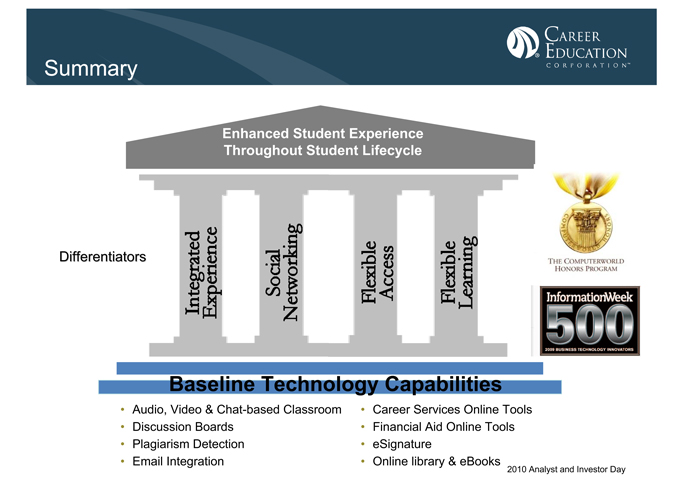

Summary

Enhanced Student Experience Throughout Student Lifecycle

Differentiators

Baseline Technology Capabilities

• Audio, Video & Chat-based Classroom

• Discussion Boards

• Plagiarism Detection

• Email Integration

• Career Services Online Tools

• Financial Aid Online Tools

• eSignature

• Online library & eBooks

2010 Analyst and Investor Day

Student Technology Platform—Conclusions

• Robust, flexible & integrated online learning platform

• Market-competitive standard features for all institutions

• Differentiated learning experiences to enable student success

• Focus on innovative use of online technology and tools

• Ability to leverage scale and manage growth cost-effectively

• Well-positioned to support online, hybrid and campus growth objectives

2010 Analyst and Investor Day

Mike Graham

Executive Vice President and Chief Financial Officer

Copyright Career Education Corporation 2010 2010 Analyst and Investor Day

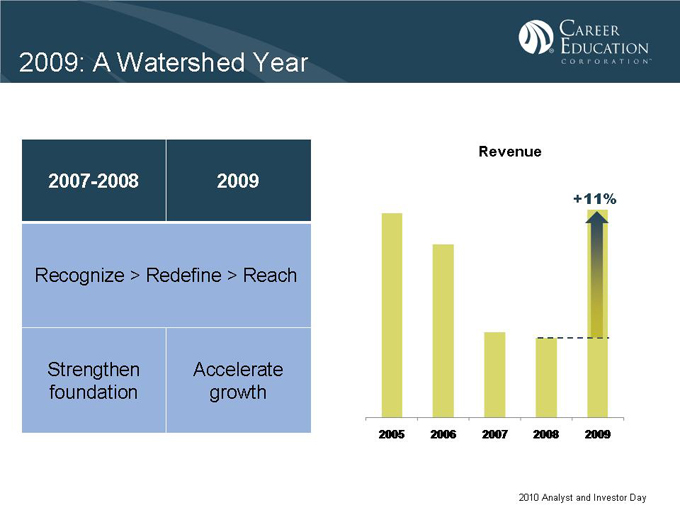

2009: A Watershed Year

2007-2008 2009

Recognize > Redefine > Reach

Strengthen foundation

Accelerate growth

Revenue

+11%

2005 2006 2007 2008 2009

2010 Analyst and Investor Day

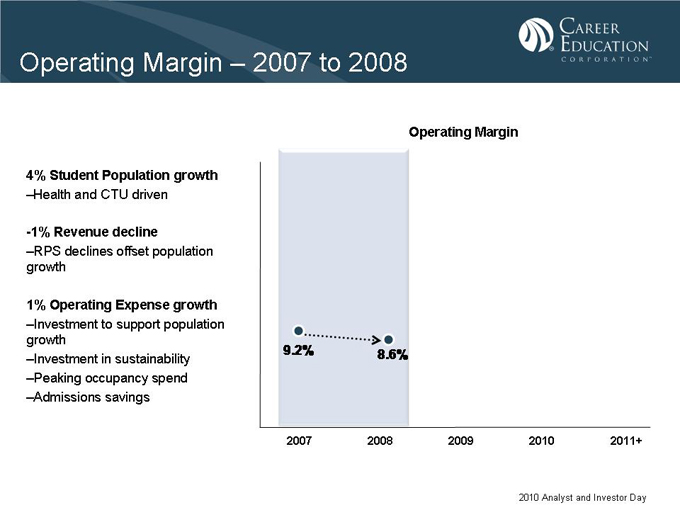

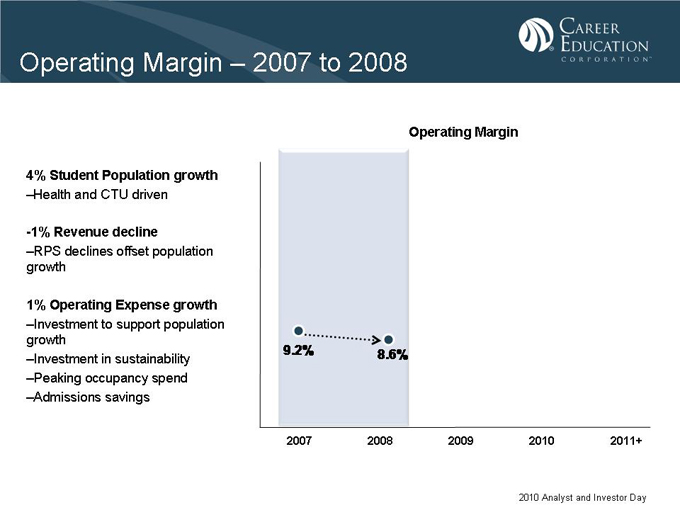

Operating Margin – 2007 to 2008

4% Student Population growth

–Health and CTU driven

-1% Revenue decline

–RPS declines offset population growth

1% Operating Expense growth

–Investment to support population growth

–Investment in sustainability

–Peaking occupancy spend

–Admissions savings

Operating Margin

9.2% 8.6%

2007 2008 2009 2010 2011+

2010 Analyst and Investor Day

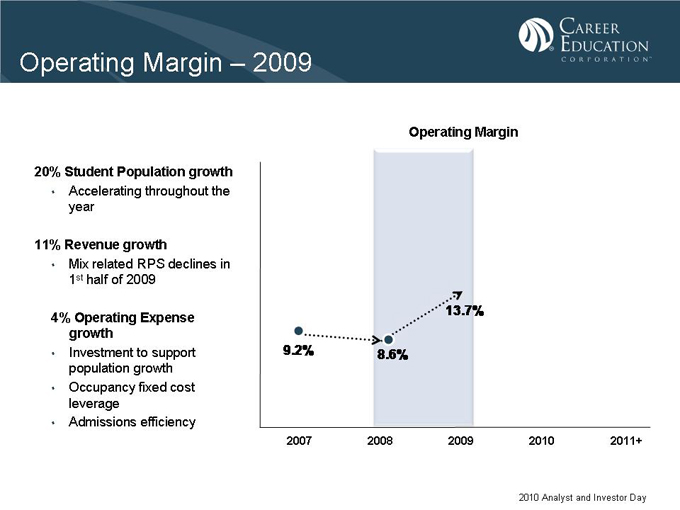

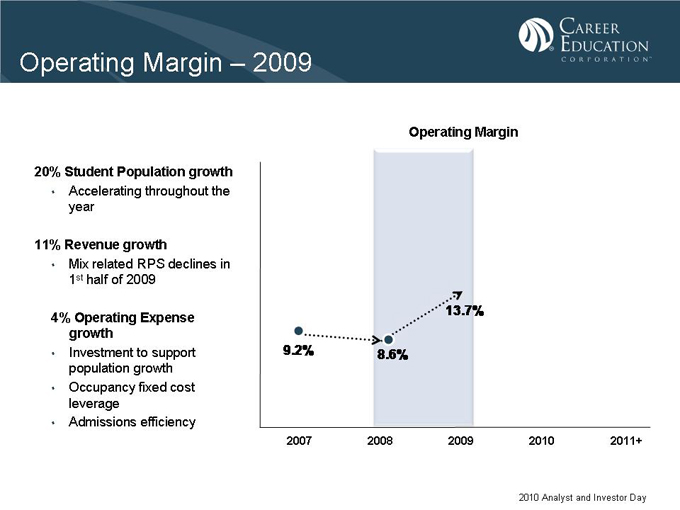

Operating Margin – 2009

20% Student Population growth

• Accelerating throughout the year

11% Revenue growth

• Mix related RPS declines in 1st half of 2009

4% Operating Expense growth

• Investment to support population growth

• Occupancy fixed cost leverage

• Admissions efficiency

Operating Margin

13.7%

9.2% 8.6%

2007 2008 2009 2010 2011+

2010 Analyst and Investor Day

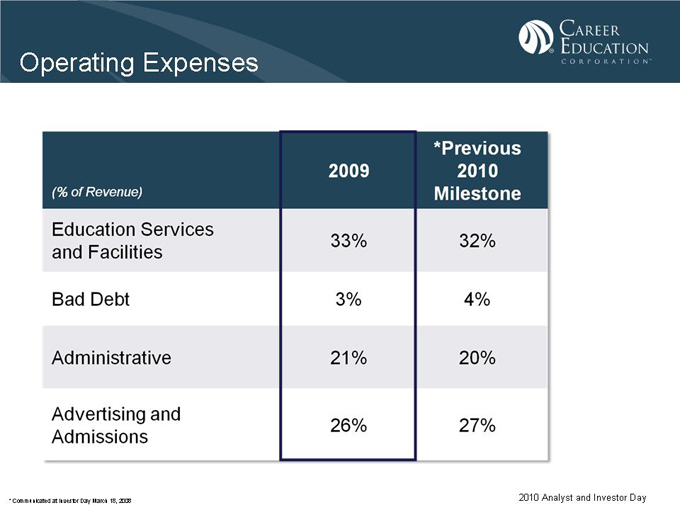

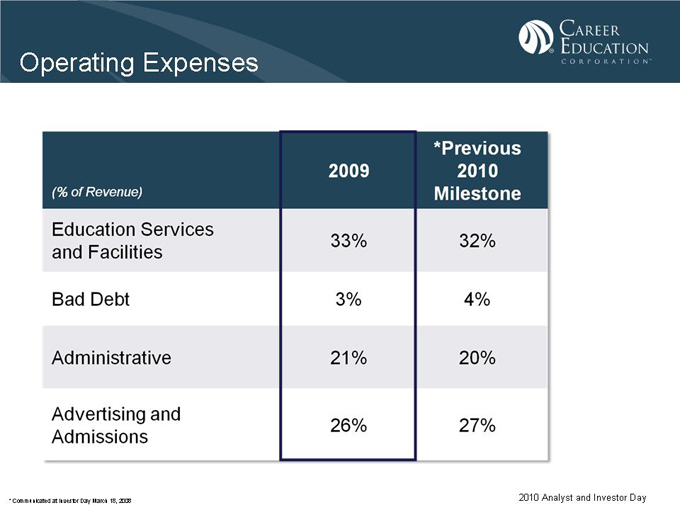

Operating Expenses

(% of Revenue) *Previous 2010 Milestone

2009

Education Services and Facilities 33% 32%

Bad Debt 3% 4%

Administrative 21% 20%

Advertising and Admissions 26% 27%

2010 Analyst and Investor Day

* | | Communicated at Investor Day March 18, 2008 |

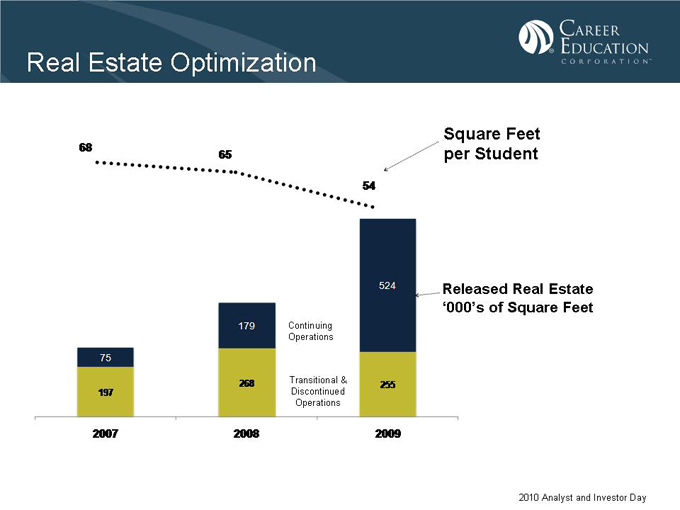

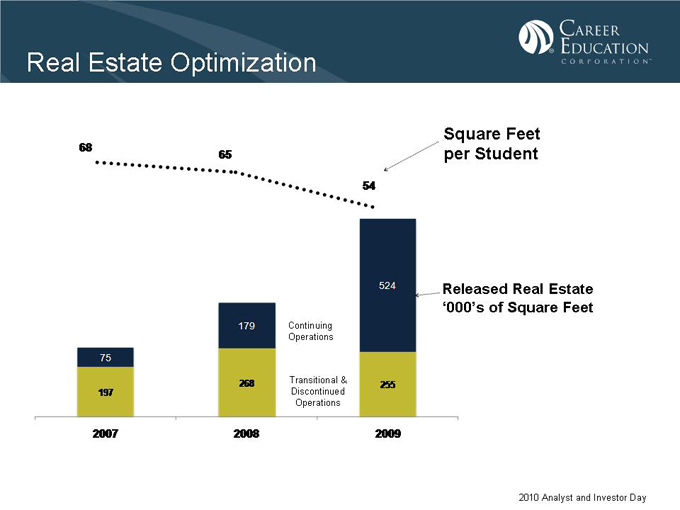

Real Estate Optimization

Square Feet per Student

68

65

54

75

197

2007

179

268

2008

Continuing Operations

Transitional & Discontinued Operations

524

255

2009

Released Real Estate ‘000’s of Square Feet

2010 Analyst and Investor Day

Student Payment Performance

Bad Debt Expense—% of Revenue

Cohort Default Rate*

3.1%

2.6% 2.6%

2007 2008 2009

20.9%

3-Year 19.6% 18.0%

10.6% 10.0% 2-Year 9.1% 8.4%

2005 2006 2007 2008

* | | Total Company, includes transitional schools and discontinued operations |

2010 Analyst and Investor Day

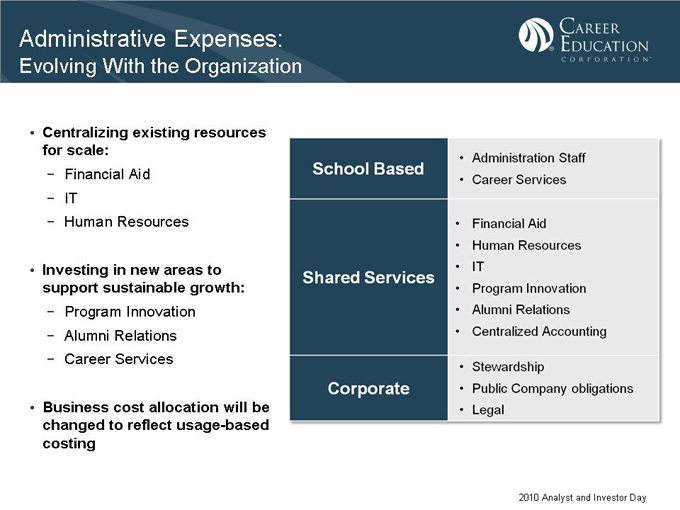

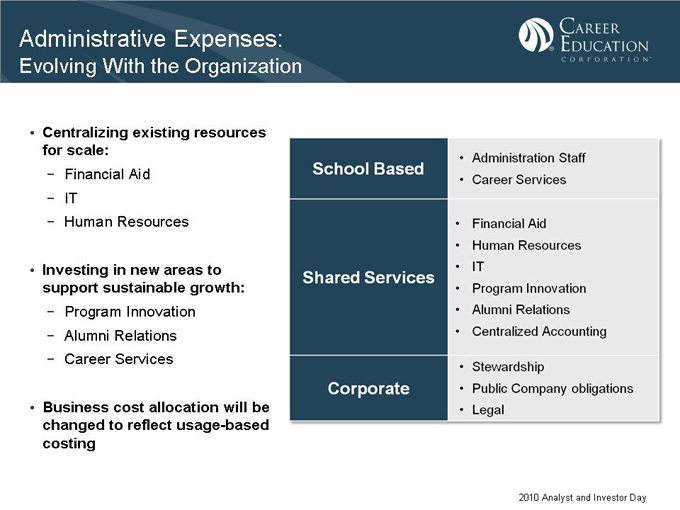

Administrative Expenses:

Evolving With the Organization

• Centralizing existing resources for scale:

Financial Aid

IT

Human Resources

• Investing in new areas to support sustainable growth:

Program Innovation

Alumni Relations

Career Services

• Business cost allocation will be changed to reflect usage-based costing

School Based

• Administration Staff

• Career Services

• Financial Aid

• Human Resources

Shared Services

• IT

• Program Innovation

• Alumni Relations

• Centralized Accounting

• Stewardship

Corporate

• Public Company obligations

• Legal

2010 Analyst and Investor Day

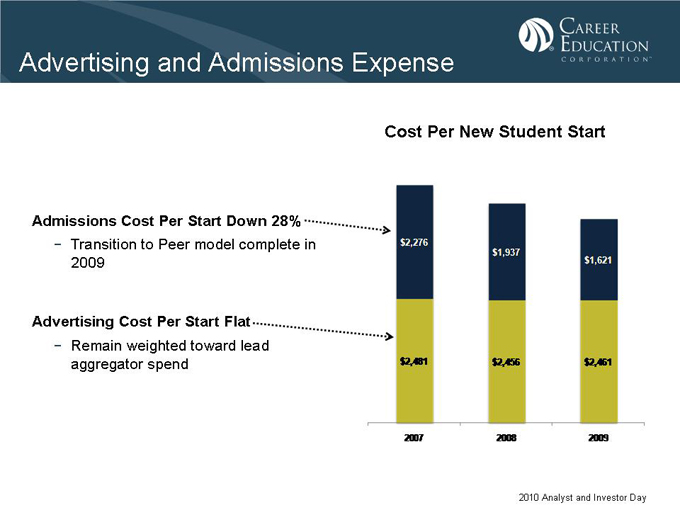

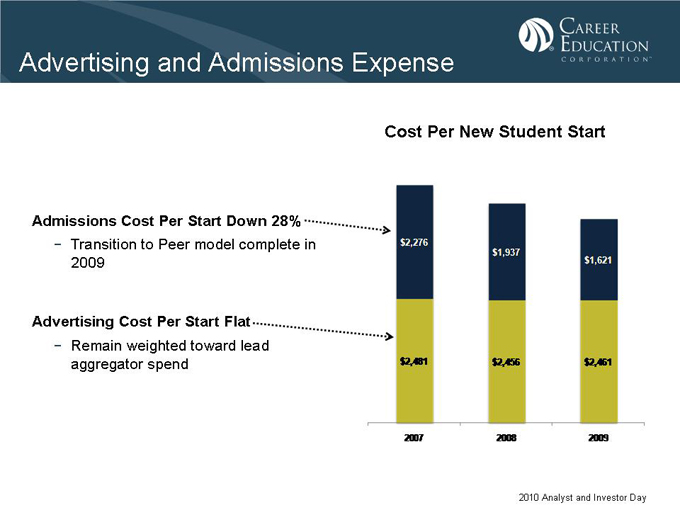

Advertising and Admissions Expense

Cost Per New Student Start

Admissions Cost Per Start Down 28%

Transition to Peer model complete in 2009

Advertising Cost Per Start Flat

Remain weighted toward lead aggregator spend

$2,276 $2,481 2007

$1,937 $2,456 2008

$1,621 $2,461 2009

2010 Analyst and Investor Day

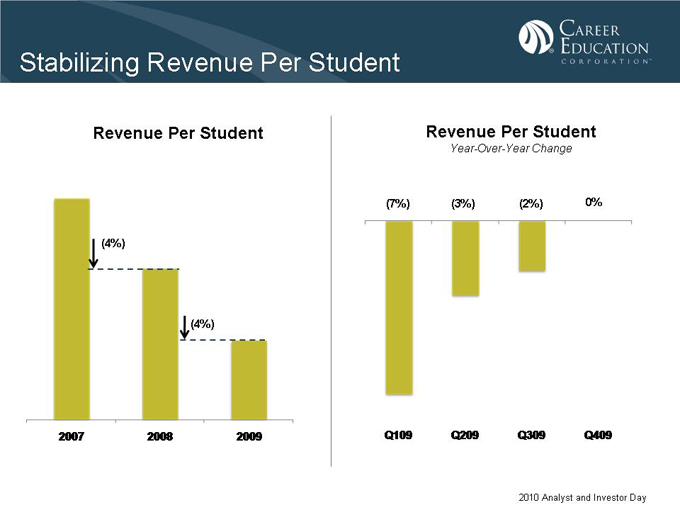

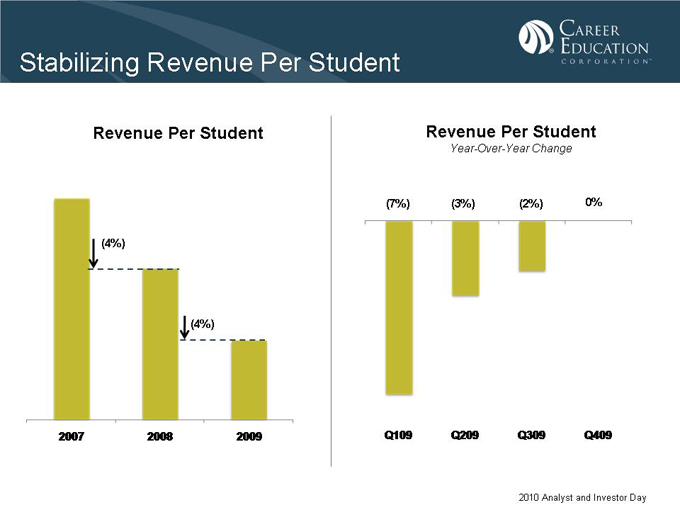

Stabilizing Revenue Per Student

Revenue Per Student

(4%)

(4%)

2007 2008 2009

Revenue Per Student

Year-Over-Year Change

(7%) (3%) (2%) 0%

Q109 Q209 Q309 Q409

2010 Analyst and Investor Day

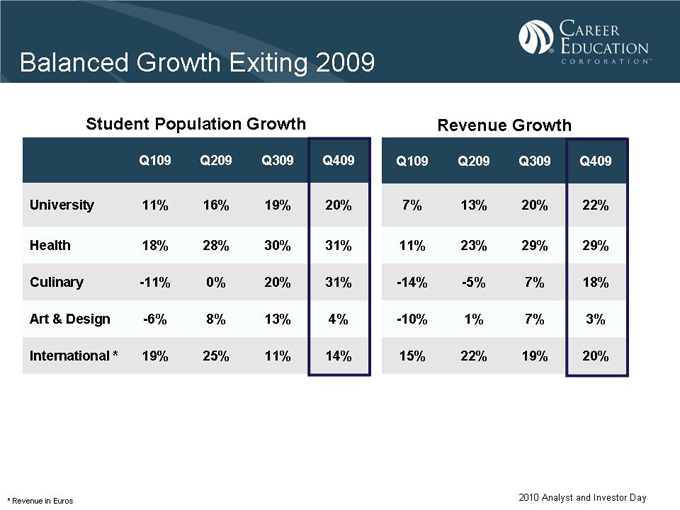

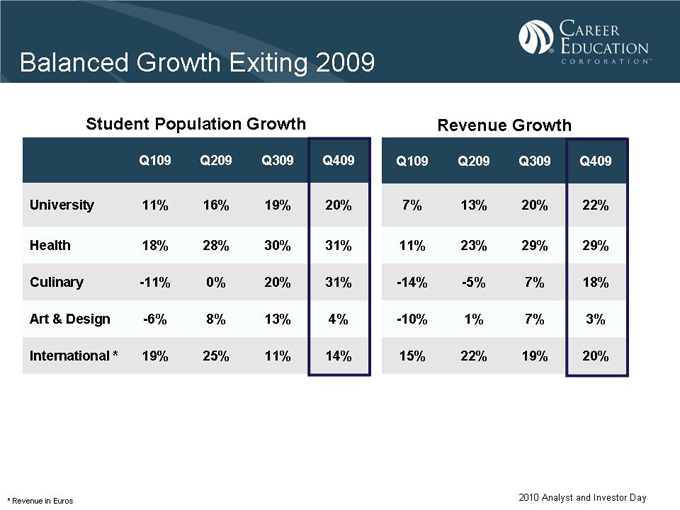

Balanced Growth Exiting 2009

Student Population Growth Revenue Growth

Q109 Q209 Q309 Q409 Q109 Q209 Q309 Q409

University 11% 16% 19% 20% 7% 13% 20% 22%

Health 18% 28% 30% 31% 11% 23% 29% 29%

Culinary -11% 0% 20% 31% -14% -5% 7% 18%

Art & Design -6% 8% 13% 4% -10% 1% 7% 3%

International * 19% 25% 11% 14% 15% 22% 19% 20%

* | | Revenue in Euros 2010 Analyst and Investor Day |

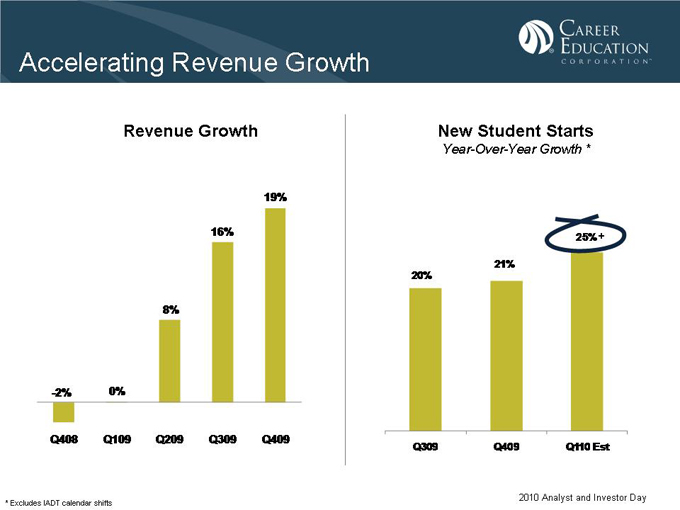

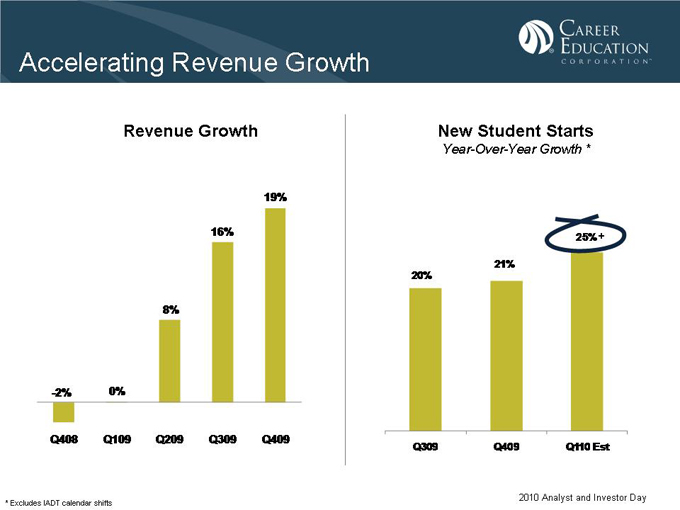

Accelerating Revenue Growth

Revenue Growth

-2%

Q408

0%

Q109

8%

Q209

16%

Q309

19%

Q409

New Student Starts

Year-Over-Year Growth *

20%

Q309

21%

Q409

25%+

Q110 Est

2010 Analyst and Investor Day

* | | Excludes IADT calendar shifts |

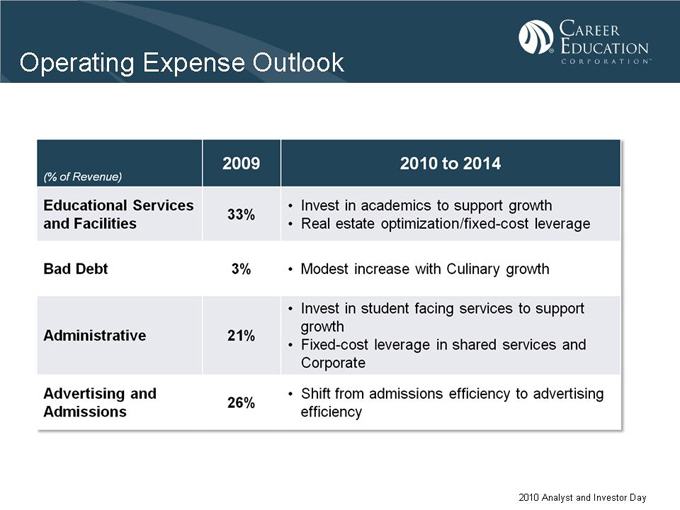

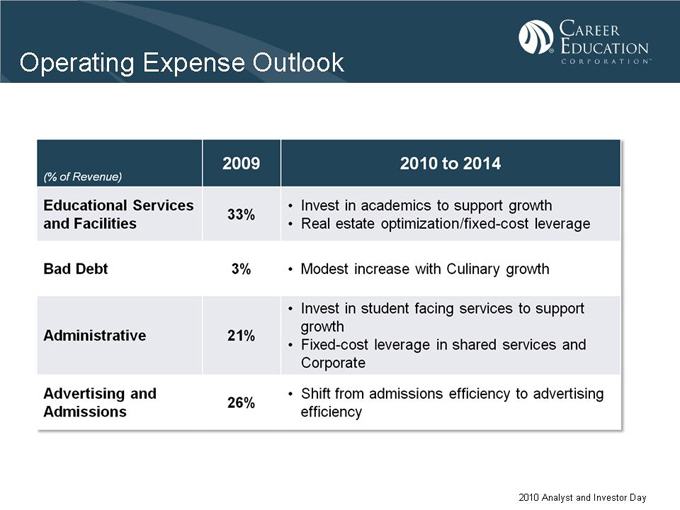

Operating Expense Outlook

(% of Revenue) 2009 2010 to 2014

Educational Services and Facilities 33% • Invest in academics to support growth • Real estate optimization/fixed-cost leverage

Bad Debt 3% • Modest increase with Culinary growth

Administrative 21% • Invest in student facing services to support growth • Fixed-cost leverage in shared services and Corporate

Advertising and Admissions 26% • Shift from admissions efficiency to advertising efficiency

2010 Analyst and Investor Day

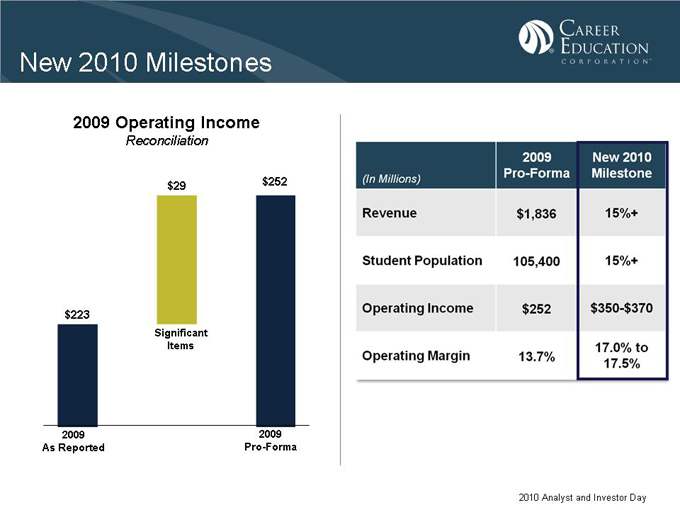

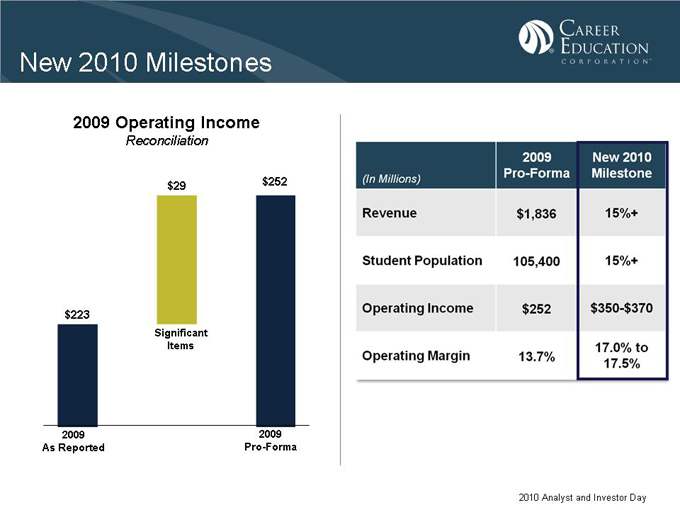

New 2010 Milestones

2009 Operating Income

Reconciliation

$223

2009 As Reported

$29

Significant Items

$252

2009 Pro-Forma

(In Millions) Pro-Forma 2009 New 2010 Milestone

Revenue $1,836 15%+

Student Population 105,400 15%+

Operating Income $252 $350-$370

Operating Margin 13.7% 17.0% to 17.5%

2010 Analyst and Investor Day

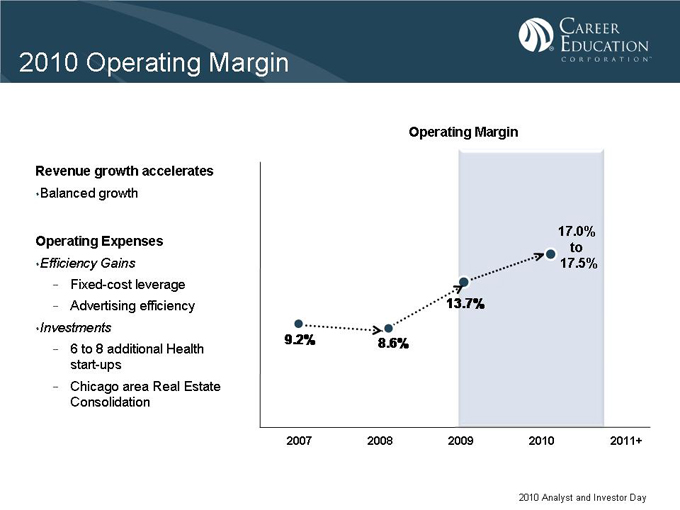

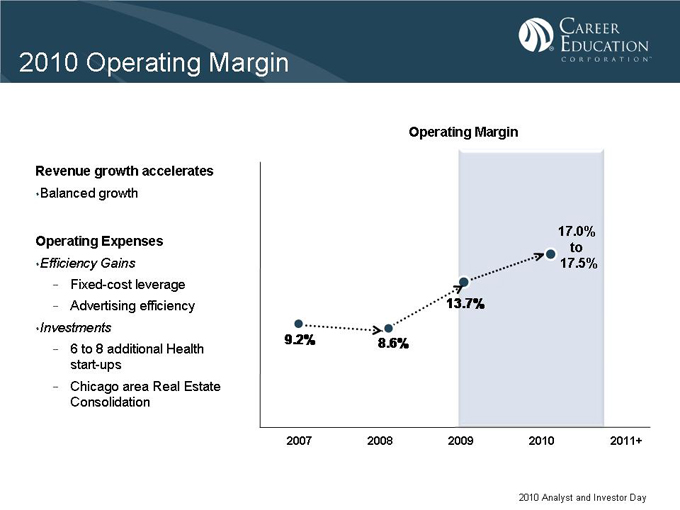

2010 Operating Margin

Revenue growth accelerates

•Balanced growth

Operating Expenses

•Efficiency Gains

Fixed-cost leverage

Advertising efficiency

•Investments

6 | | to 8 additional Health start-ups |

Chicago area Real Estate Consolidation

Operating Margin

13.7%

9.2% 8.6%

17.0% to 17.5%

2007 2008 2009 2010 2011+

2010 Analyst and Investor Day

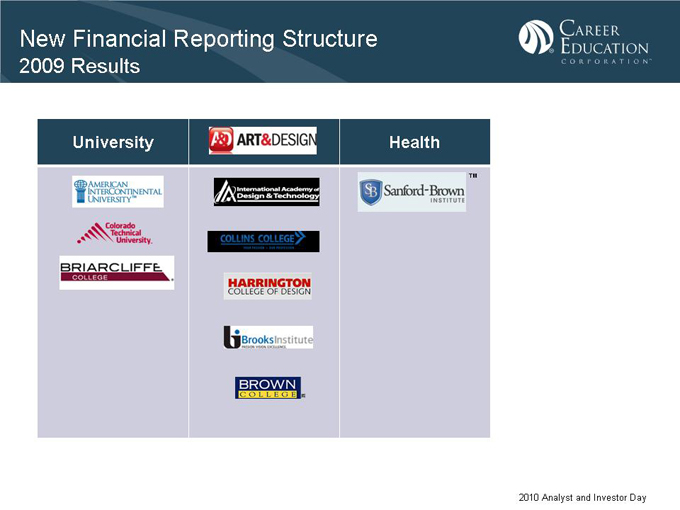

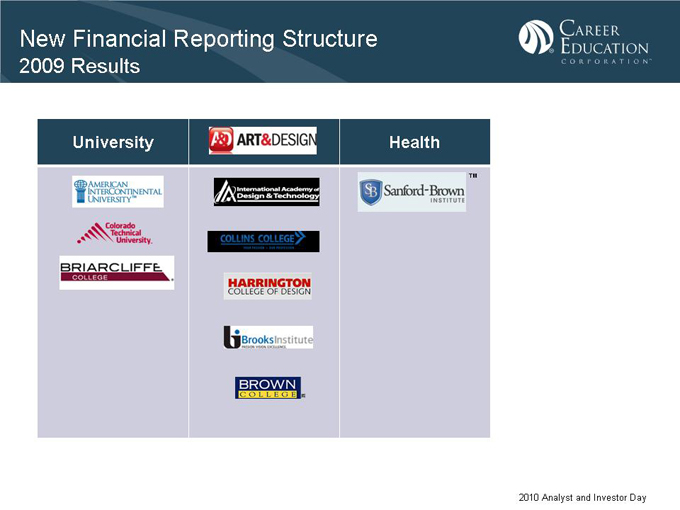

New Financial Reporting Structure

2009 Results

University Health

2010 Analyst and Investor Day

New Financial Reporting Structure

New Segments

University Health

2010 Analyst and Investor Day

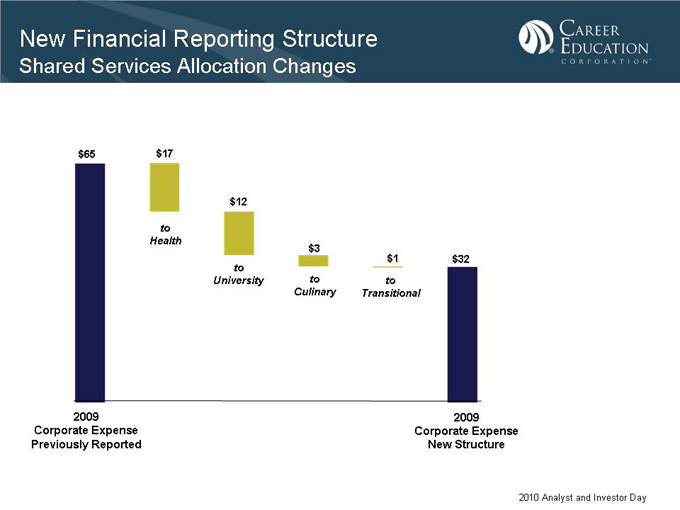

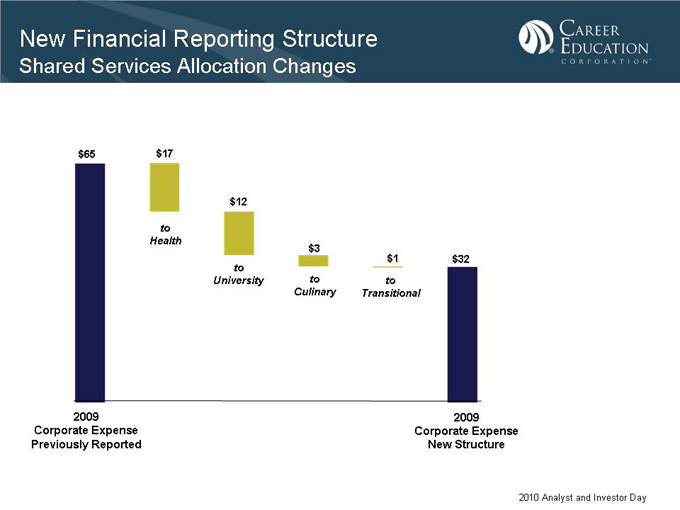

New Financial Reporting Structure

Shared Services Allocation Changes

$65

2009 Corporate Expense Previously Reported

$17

to Health

$12

to University

$3

to

Culinary

$1

to

Transitional

$32

2009 Corporate Expense New Structure

2010 Analyst and Investor Day

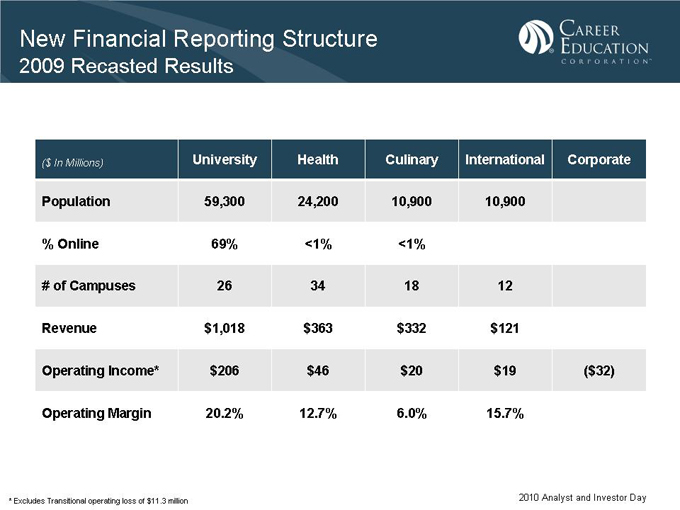

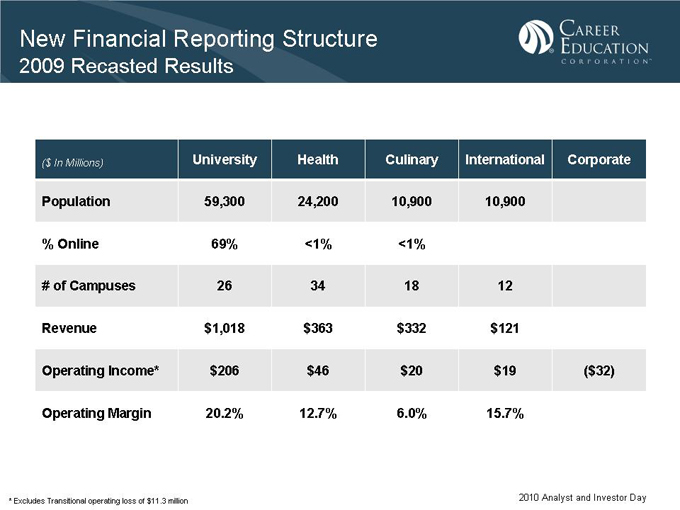

New Financial Reporting Structure

2009 Recasted Results

($ In Millions) University Health Culinary International Corporate

Population 59,300 24,200 10,900 10,900

% Online 69% <1% <1%

# of Campuses 26 34 18 12

Revenue $1,018 $363 $332 $121

Operating Income* $206 $46 $20 $19 ($32)

Operating Margin 20.2% 12.7% 6.0% 15.7%

* | | Excludes Transitional operating loss of $11.3 million 2010 Analyst and Investor Day |

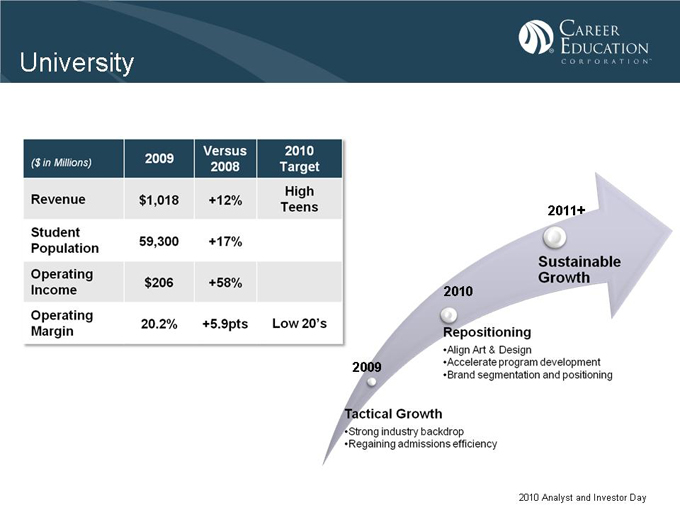

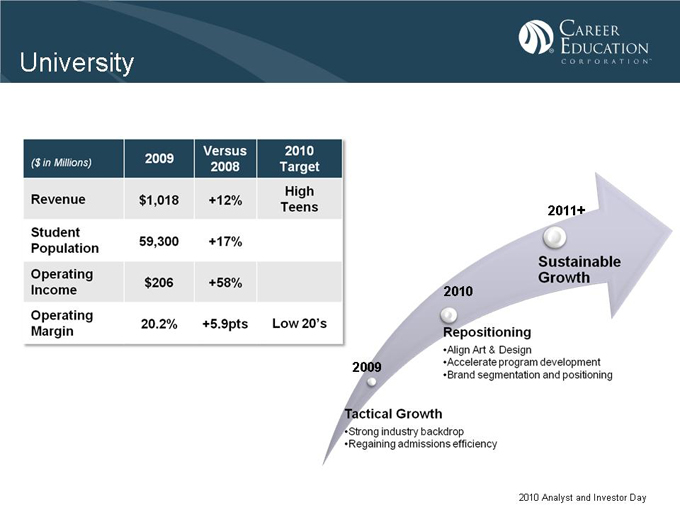

University

($ in Millions) 2009 Versus 2008 2010 Target

Revenue $1,018 +12% High Teens

Student Population 59,300 +17%

Operating Income $206 +58%

Operating Margin 20.2% +5.9pts Low 20’s

2011+

Sustainable Growth

2010

Repositioning

Align Art & Design

Accelerated program development

Brand segementation and positioning

2009

Tactical Growth

Strong industry backdrop

Regaining admissions efficiency

2010 Analyst and Investor Day

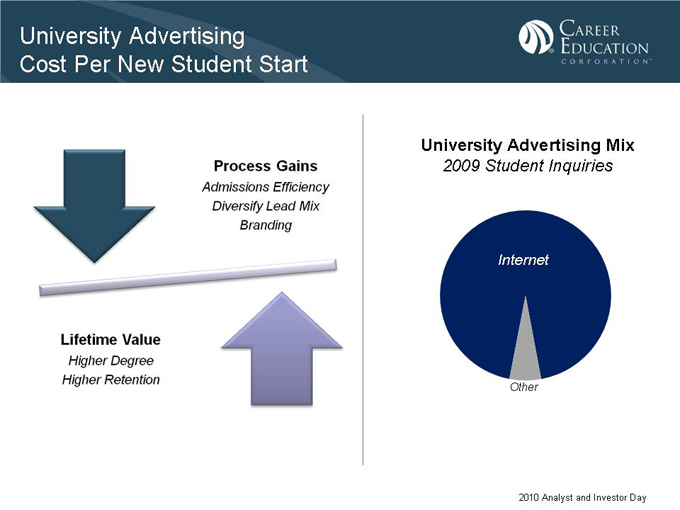

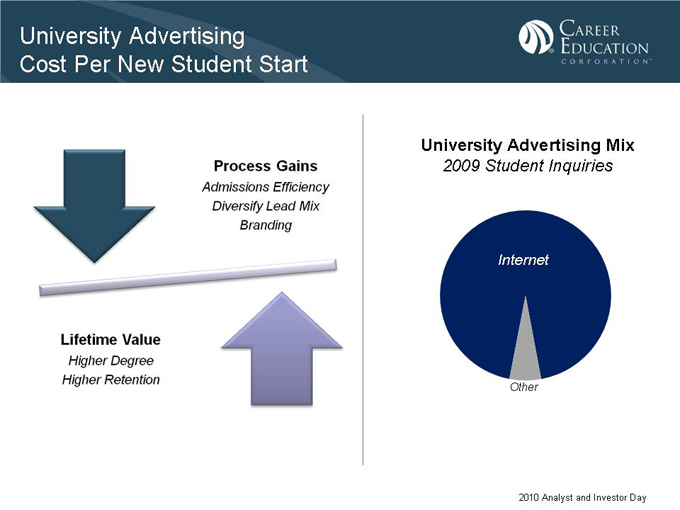

University Advertising Cost Per New Student Start

Process Gains

Admissions Efficiency

Diversify Lead Mix

Branding

Lifetime Value

Higher Degree

Higher Retention

University Advertising Mix

2009 Student Inquiries

Internet

Other

2010 Analyst and Investor Day

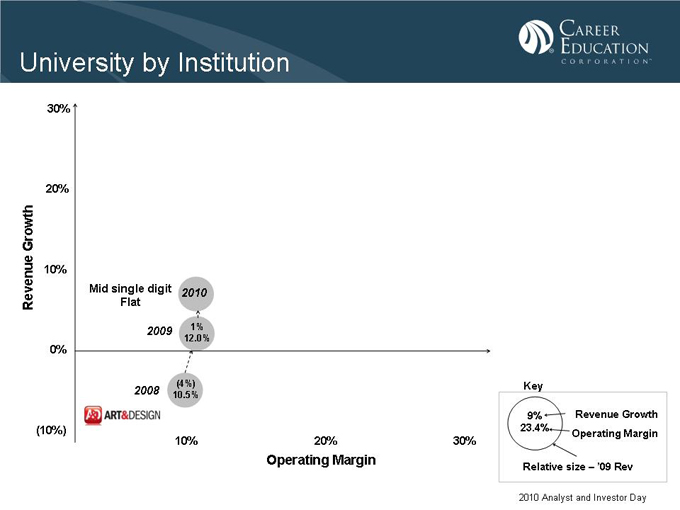

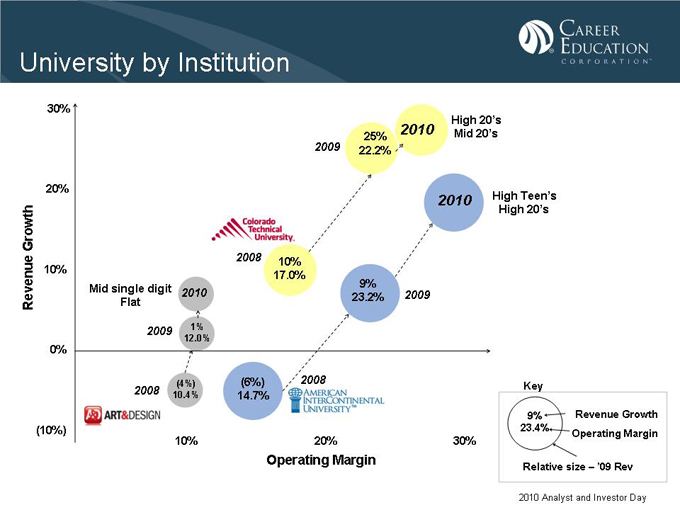

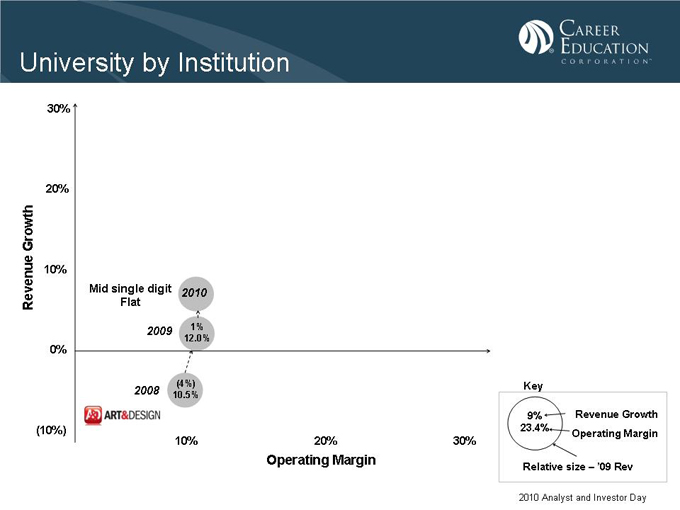

University by Institution

Revenue Growth

30% 20% 10% 0% (10%)

Mid single digit Flat 2010

2009 1% 12.0%

(4%)

2008 10.5%

10%

20% Operating Margin

30%

Key

9% Revenue Growth 23.4% Operating Margin

Relative size – ‘09 Rev

2010 Analyst and Investor Day

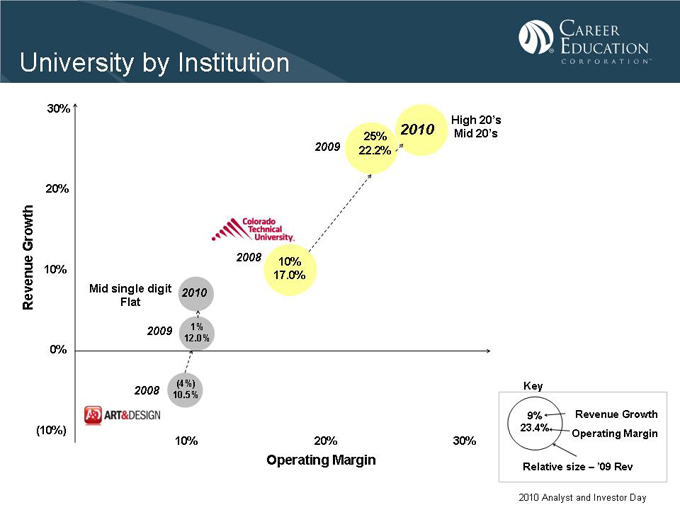

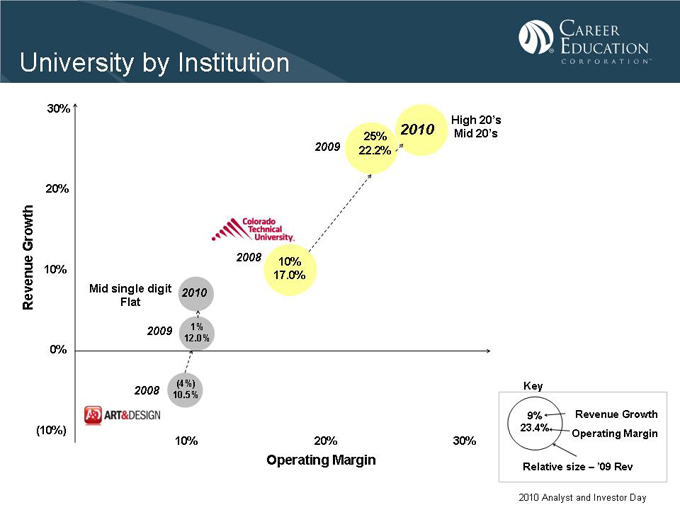

University by Institution

Revenue Growth

30% 20% 10% 0% (10%)

2009

25%

22.2%

2010

High 20’s

Mid 20’s

2008 10%

17.0%

Mid single digit Flat 2010

2009 1% 12.0%

(4%)

2008 10.5%

10%

20% Operating Margin

30%

Key

9% Revenue Growth 23.4% Operating Margin

Relative size – ‘09 Rev

2010 Analyst and Investor Day

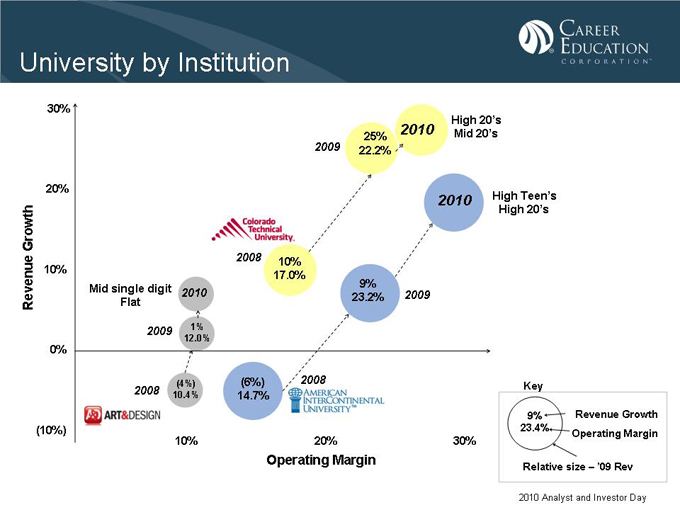

University by Institution

Revenue Growth

30% 20% 10% 0% (10%)

High 20’s Mid 20’s

2010

2009 25% 22.2%

2010 High Teen’s High 20’s

2008 10%

17.0%

9%

23.2% 2009

Mid single digit Flat 2010

2009 1% 12.0%

(4%)

2008 10.4%

(6%) 14.7%

2008

10%

20% Operating Margin

30%

Key

9% Revenue Growth 23.4% Operating Margin

Relative size – ‘09 Rev

2010 Analyst and Investor Day

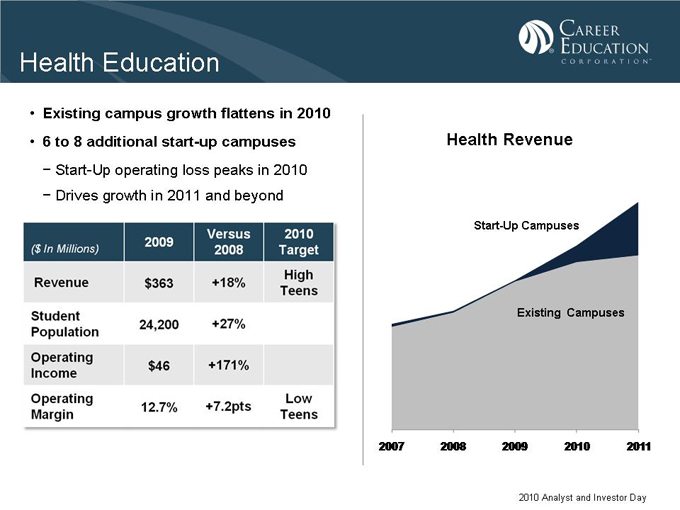

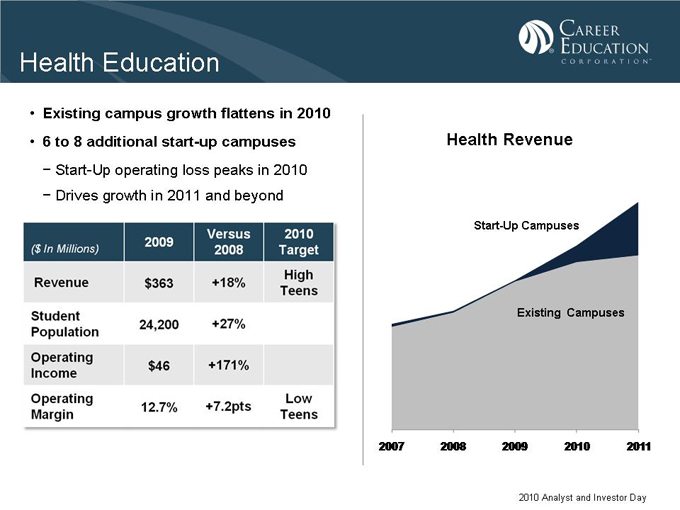

Health Education

• Existing campus growth flattens in 2010

• | | 6 to 8 additional start-up campuses |

Start-Up operating loss peaks in 2010

Drives growth in 2011 and beyond

($ In Millions) 2009 Versus 2008 2010 Target

Revenue $363 +18% High Teens

Student Population 24,200 +27%

Operating Income $46 +171%

Operating Margin 12.7% +7.2pts Low Teens

Health Revenue

Start-Up Campuses

Existing Campuses

2007 2008 2009 2010 2011

2010 Analyst and Investor Day

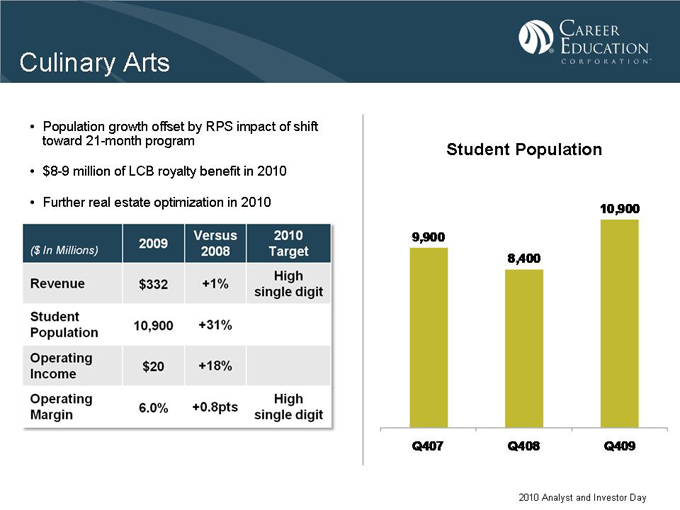

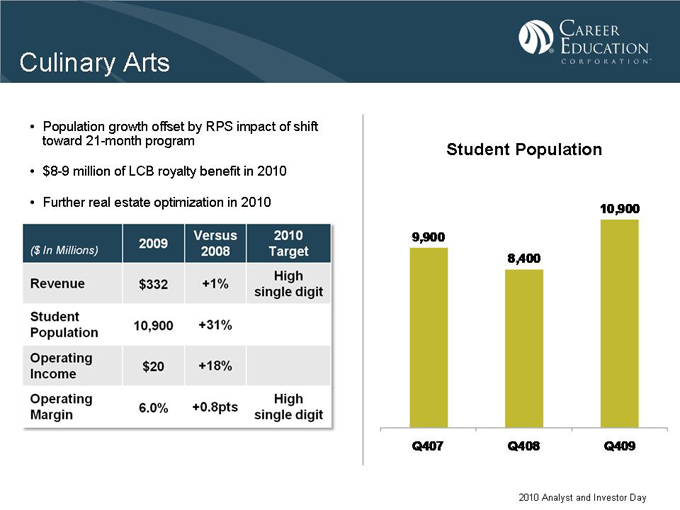

Culinary Arts

• Population growth offset by RPS impact of shift toward 21-month program

• $8-9 million of LCB royalty benefit in 2010

• Further real estate optimization in 2010

($ In Millions) 2009 Versus 2008 2010 Target

Revenue $332 +1% High single digit

Student Population 10,900 +31%

Operating Income $20 +18%

Operating Margin 6.0% +0.8pts High single digit

Student Population

10,900

9,900

8,400

Q407 Q408 Q409

2010 Analyst and Investor Day

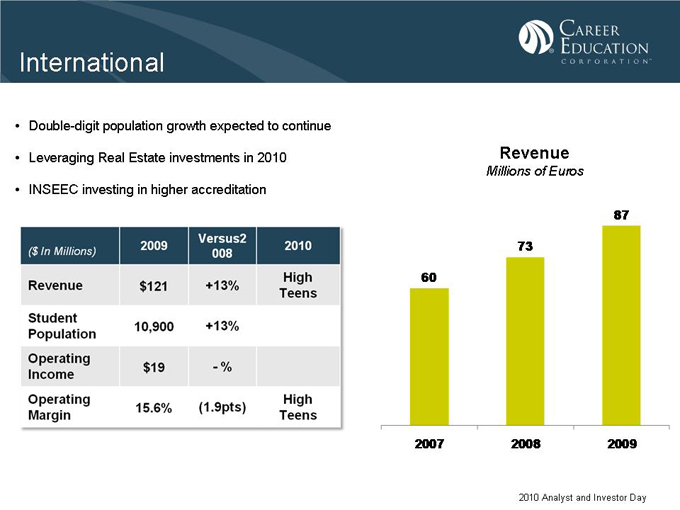

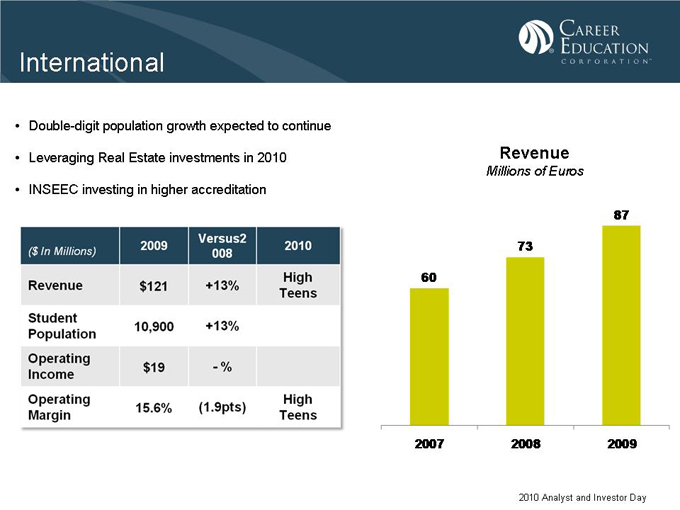

International

• Double-digit population growth expected to continue

• Leveraging Real Estate investments in 2010

• INSEEC investing in higher accreditation

($ In Millions) 2009 Versus2008 2010

Revenue $121 +13% High Teens

Student Population 10,900 +13%

Operating Income $19 -%

Operating Margin 15.6% (1.9pts) High Teens

Revenue

Millions of Euros

87 73 60

2007 2008 2009

2010 Analyst and Investor Day

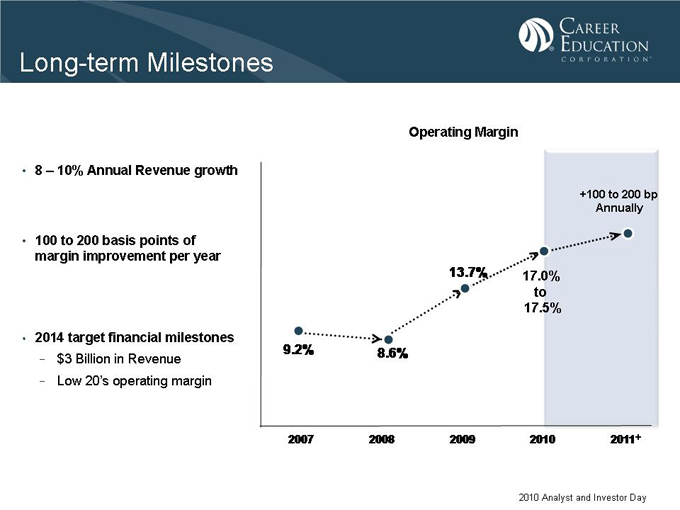

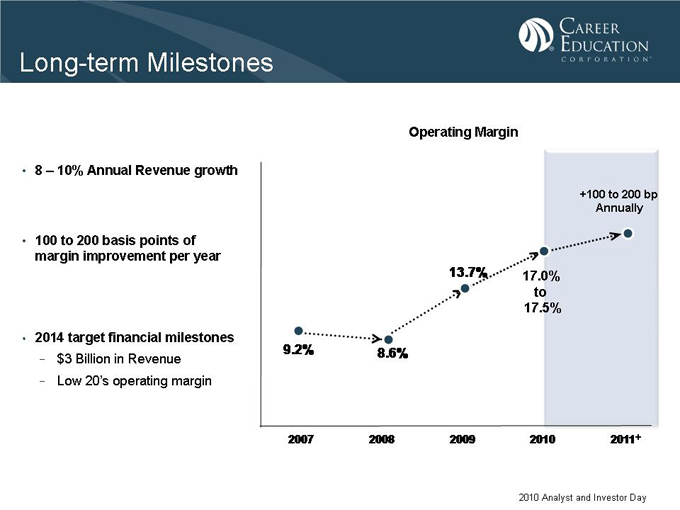

Long-term Milestones

• | | 8 – 10% Annual Revenue growth |

• 100 to 200 basis points of margin improvement per year

• 2014 target financial milestones

$3 Billion in Revenue

Low 20’s operating margin

Operating Margin

+100 to 200 bp Annually

13.7% 17.0% to 17.5%

9.2% 8.6%

2007 2008 2009 2010 2011+

2010 Analyst and Investor Day

Long-term Milestones

Annual Revenue Growth

International

8-10%

Low 20’s%

2014 Target Operating Margin

2010 Analyst and Investor Day

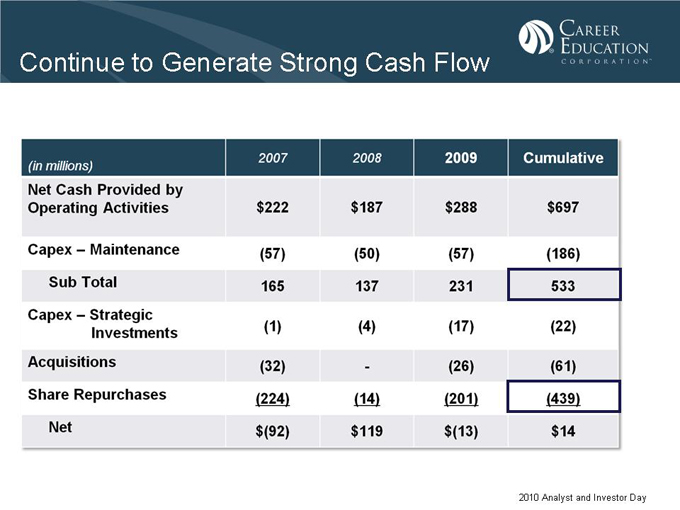

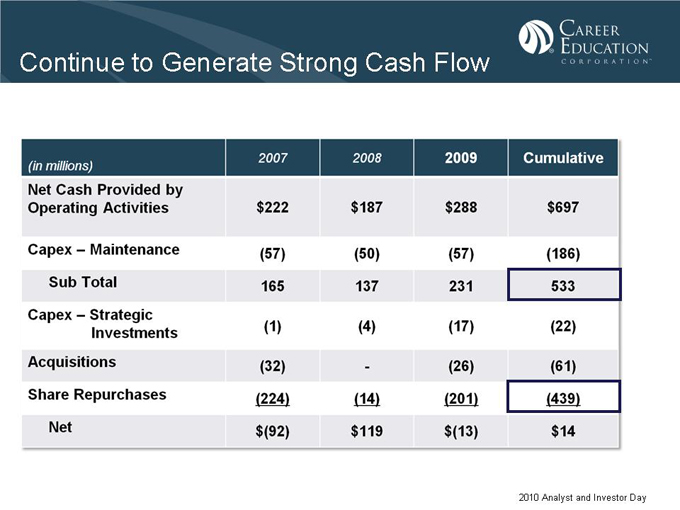

Continue to Generate Strong Cash Flow

(in millions) 2007 2008 2009 Cumulative

Net Cash Provided by Operating Activities $222 $187 $288 $697

Capex—Maintenance (57) (50) (57) (186)

Sub Total 165 137 231 533

Capex—Strategic Investments (1) (4) (17) (22)

Acquisitions (32) — (26) (61)

Share Repurchases (224) (14) (201) (439)

Net $(92) $119 $(13) $14

2010 Analyst and Investor Day

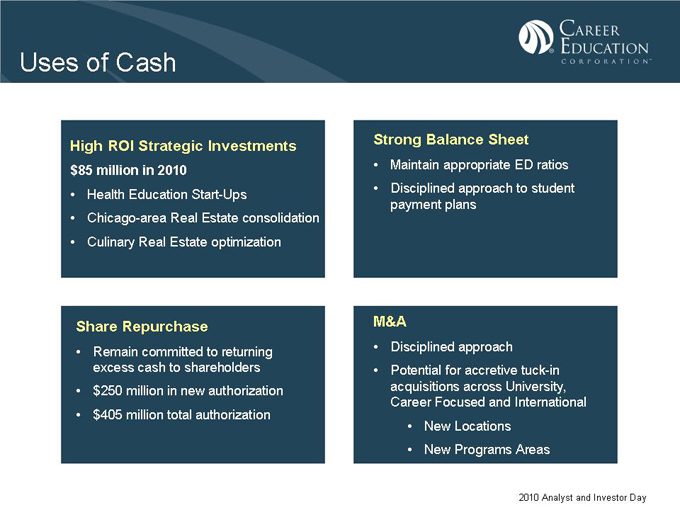

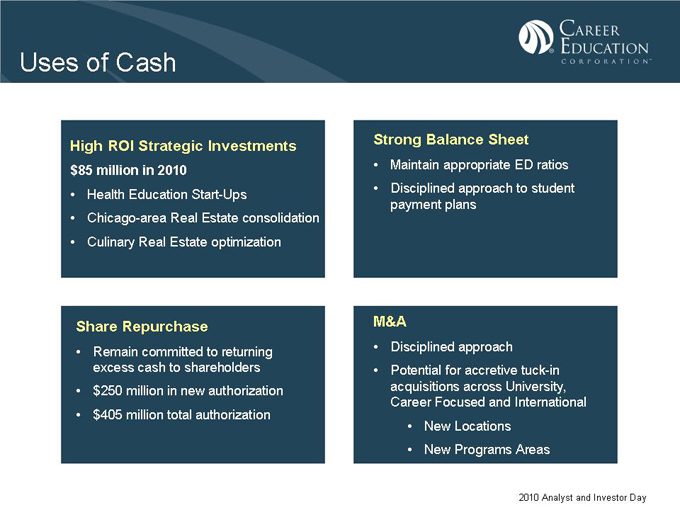

Uses of Cash

High ROI Strategic Investments

$85 million in 2010

• Health Education Start-Ups

• Chicago-area Real Estate consolidation

• Culinary Real Estate optimization

Share Repurchase

• Remain committed to returning excess cash to shareholders • $250 million in new authorization • $405 million total authorization

Strong Balance Sheet

• Maintain appropriate ED ratios

• Disciplined approach to student payment plans

M&A

• Disciplined approach

• Potential for accretive tuck-in acquisitions across University, Career Focused and International

• New Locations

• New Programs Areas

2010 Analyst and Investor Day

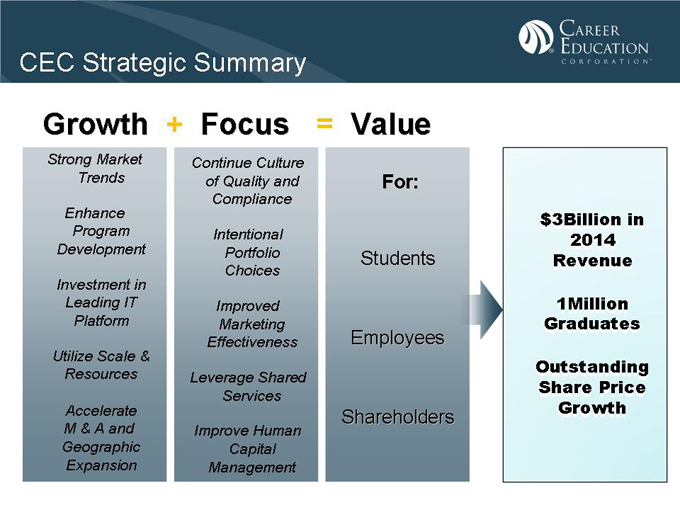

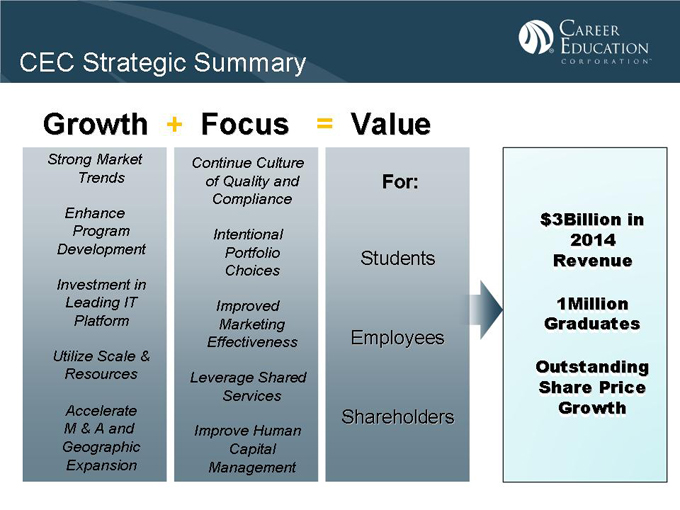

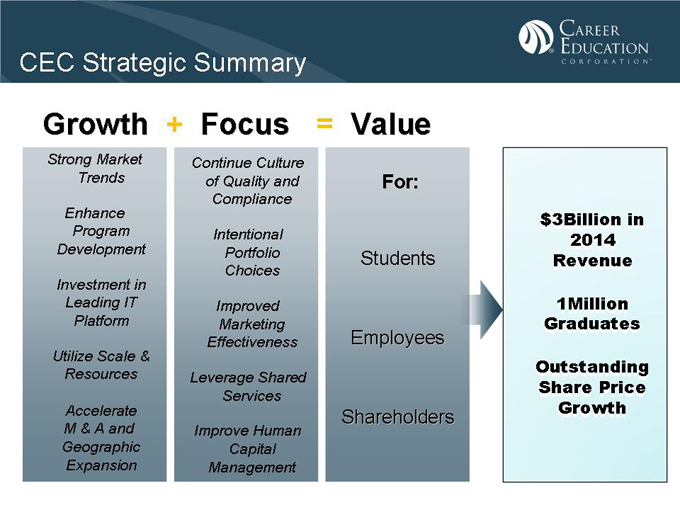

CEC Strategic Summary

Growth + Focus = Value

Strong Market Trends

Enhance Program Development

Investment in Leading IT Platform

Utilize Scale & Resources

Accelerate M & A and Geographic Expansion

Continue Culture of Quality and Compliance

Intentional Portfolio Choices

Improved Marketing Effectiveness

Leverage Shared Services

Improve Human Capital Management

For:

Students Employees Shareholders

$3Billion in 2014 Revenue

1Million Graduates

Outstanding Share Price Growth

Questions and Answers

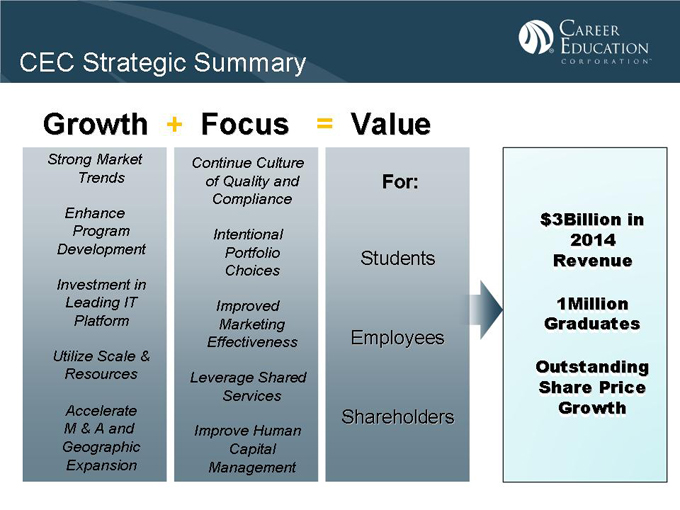

CEC Strategic Summary

Growth + Focus = Value

Strong Market Trends

Enhance Program Development

Investment in Leading IT Platform

Utilize Scale & Resources

Accelerate M & A and Geographic Expansion

Continue Culture of Quality and Compliance

Intentional Portfolio Choices

Improved Marketing Effectiveness

Leverage Shared Services

Improve Human Capital Management

For:

Students Employees Shareholders

$3Billion in 2014 Revenue

1Million Graduates

Outstanding Share Price Growth

Statement of Purpose

To change lives through education.

2010 Analyst and Investor Day

Thank You!

Copyright Career Education Corporation 2010