- PRDO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Perdoceo Education (PRDO) 8-KCareer Education Corporation Reports

Filed: 7 Aug 14, 12:00am

CAREER EDUCATION CORPORATION SECOND QUARTER 2014 INVESTOR CONFERENCE CALL AUGUST 7, 2014 Reid Simpson Senior Vice President & Chief Financial Officer Scott Steffey President & Chief Executive Officer Exhibit 99.2 |

This presentation contains “forward-looking statements,” as defined in Section 21E of the Securities Exchange Act of 1934, as amended, that reflect our current expectations regarding our future growth, results of operations, cash flows, performance and business prospects and opportunities, as well as assumptions made by, and information currently available to, our management. We have tried to identify forward-looking statements by using words such as “believe,” “forecast,” “will,” “expect,” “estimate,” “remain on track” and similar expressions, but these words are not the exclusive means of identifying forward-looking statements. These statements are based on information currently available to us and are subject to various risks, uncertainties, and other factors, including, but not limited to, those discussed in Item 1A,“Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2013 that could cause our actual growth, results of operations, financial condition, cash flows, performance and business prospects and opportunities to differ materially from those expressed in, or implied by, these statements. Except as expressly required by the federal securities laws, we undertake no obligation to update such factors or to publicly announce the results of any of the forward-looking statements contained herein to reflect future events, developments, or changed circumstances or for any other reason. Certain financial information is presented on a non-GAAP basis. The Company believes it is useful to present non-GAAP financial measures which exclude certain significant items as a means to understand the performance of its core business. As a general matter, the Company uses non-GAAP financial measures in conjunction with results presented in accordance with GAAP to help analyze the performance of its core business, assist with preparing the annual operating plan, and measure performance for some forms of compensation. In addition, the Company believes that non-GAAP financial information is used by analysts and others in the investment community to analyze the Company's historical results and to provide estimates of future performance and that failure to report non-GAAP measures could result in a misplaced perception that the Company's results have underperformed or exceeded expectations. The most directly comparable GAAP information and a reconciliation between the non-GAAP and GAAP figures are provided at the end of this presentation, and this presentation (including the reconciliation) has been posted to our website. Cautionary Statements & Disclosures 2 |

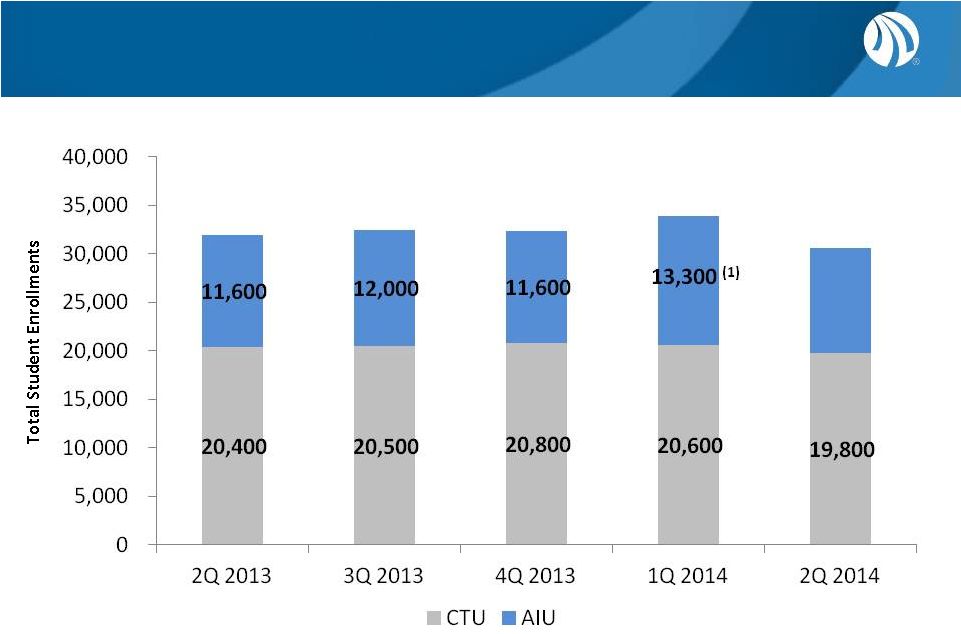

3 Total Student Enrollments - University 32,000 32,500 32,400 33,900 30,600 (1) AIU had two start dates in 2Q 2014 and three start dates in 1Q 2014 which explains why there is a spike in total enrollments in 1Q 2014 and a corresponding decrease in 2Q 2014. 2Q, 3Q and 4Q 2013 each had two AIU start dates. 10,800 (1) |

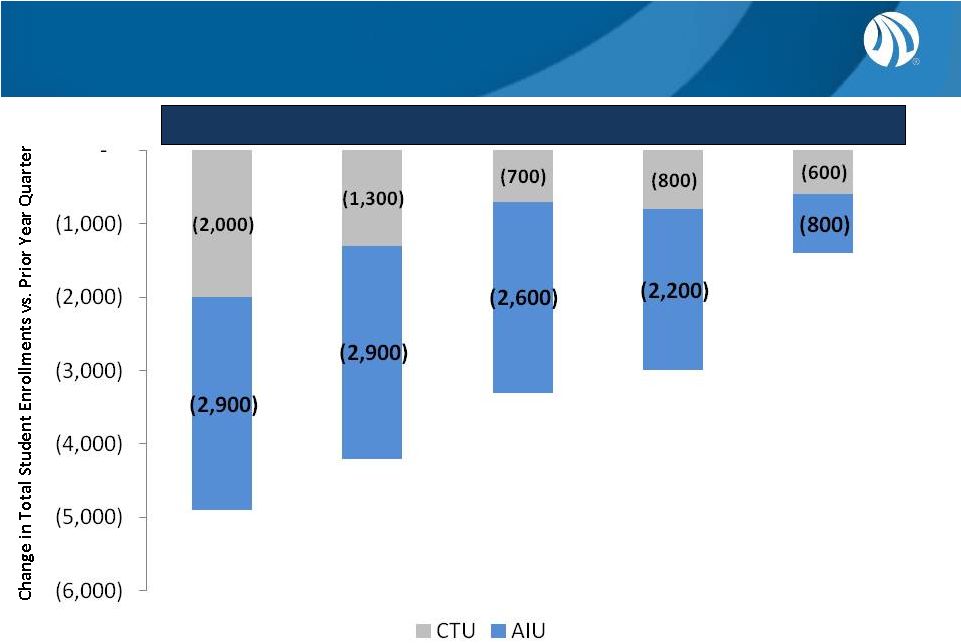

Sequential Improvement in Decline of Total Student Enrollments - University 4 Q2 ‘13 Q3 ‘13 Q4 ‘13 Q1 ’14 Q2 ‘14 (4,900) (4,200) (3,300) (3,000) (1,400) |

5 Total Student Enrollments – Career Schools 18,500 20,300 18,900 20,200 17,500 |

Sequential Improvement in Decline of Total Student Enrollments – Career Schools 6 Q2 ‘13 Q3 ‘13 Q4 ‘13 Q1 ’14 Q2 ‘14 (7,500) (5,400) (1,700) (1,300) (1,000) |

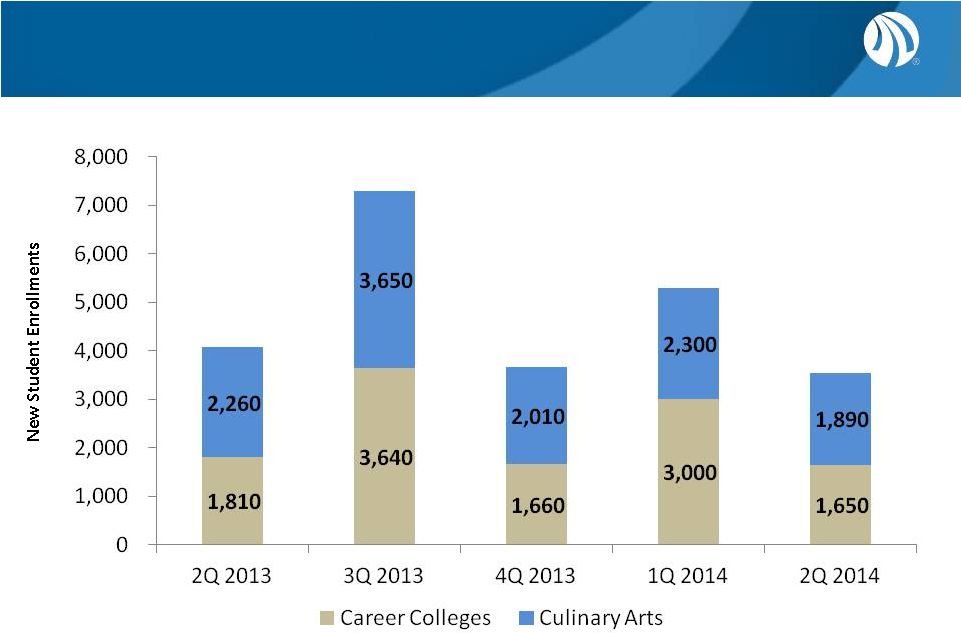

7 New Student Enrollments – Career Schools 4,070 7,290 3,670 5,300 3,540 |

8 Phase Down of Transitional School Campuses |

9 Adjusted EBITDA Q2 ‘13 Q3 ‘13 Q4 ‘13 Q1 ’14 Q2 ‘14 In (000’s) Numbers exclude significant items (including International segment) as disclosed in the Non-GAAP reconciliation at the end of these slides. |

10 Strong Cash Position (1) Balances presented above are quarter end balances and include both Continuing and Discontinued Operations. In (000’s) (2) The increase in 4Q 2013 is attributed to proceeds from the sale of the Company’s International segment. $363,099 (2) |

11 Reconciliation of GAAP to Non-GAAP Items Adjusted EBITDA Q2 2014 Q1 2014 Q4 2013 Q3 2013 Q2 2013 Pre-tax loss from continuing operations (33,746) $ (41,350) $ (45,319) $ (56,411) $ (49,300) $ Transitional Schools operating loss (2) 8,841 7,308 11,227 9,004 9,716 Interest (income) expense, net (177) (25) 65 16 (548) Loss (gain) on sale of business - - (68) 39 222 Depreciation and amortization (3) 12,799 13,305 14,062 14,399 14,749 Stock based compensation (3) 1,020 1,341 1,580 1,713 1,631 Legal settlements (3) (4) 1,600 5,850 17,000 300 8,300 7,403 74 4,516 11,513 3,966 (879) (606) (2,924) 1,184 (612) (3,139) $ (14,103) $ 139 $ (18,243) $ (11,876) $ Adjusted EBITDA per diluted share (0.05) $ (0.21) $ 0.00 $ (0.27) $ (0.18) $ Pre-tax loss from discontinued operations (10,964) $ (16,573) $ 119,133 $ (20,290) $ (16,287) $ Transitional Schools operating loss (2) (8,841) (7,308) (11,227) (9,004) (9,716) Loss (gain) on sale of business 311 - (130,109) - - International Schools operating (income) loss (7) - - (11,434) 7,608 3,659 Interest (income) expense, net - - (51) (22) (14) Depreciation and amortization (8) 1,595 2,126 2,364 2,552 2,818 Legal settlements (8) - - - - 1,700 51 (7) 2,467 72 - 1,436 3,099 5,766 (3,092) (2,611) (16,412) $ (18,663) $ (23,091) $ (22,176) $ (20,451) $ Adjusted EBITDA per diluted share (0.24) $ (0.28) $ (0.35) $ (0.33) $ (0.31) $ CAREER EDUCATION CORPORATION AND SUBSIDIARIES (In thousands, except per share amounts) Asset impairments (3) (5) Unused space charges (3) (6) Asset impairments (8) Unused space charges (6) (8) Adjusted EBITDA–Ongoing Operations Adjusted EBITDA–Transitional and Discontinued Operations (2) (2) UNAUDITED RECONCILIATION OF GAAP TO NON-GAAP ITEMS (1) |

12 Reconciliation of GAAP to Non-GAAP Items – con’t Q2 2014 Q1 2014 Q4 2013 Q3 2013 Q2 2013 CTU - $ (900) $ 1,300 $ - $ - $ Career Colleges - - 200 300 8,300 Culinary Arts 2,000 3,000 15,500 - - Corporate & Other (400) 3,750 - - - Total 1,600 $ 5,850 $ 17,000 $ 300 $ 8,300 $ (1) The Company believes it is useful to present non-GAAP financial measures which exclude certain significant items as a means to understand the performance of its core business. As a general matter, the Company uses non-GAAP financial measures in conjunction with results presented in accordance with GAAP to help analyze the performance of its core business, assist with preparing the annual operating plan, and measure performance for some forms of compensation. In addition, the Company believes that non-GAAP financial information is used by analysts and others in the investment community to analyze the Company's historical results and to provide estimates of future performance and that failure to report non-GAAP measures could result in a misplaced perception that the Company's results have underperformed or exceeded expectations. We believe Adjusted EBITDA allows us to compare our current operating results with corresponding historical periods and with the operational performance of other companies in our industry because it does not give effect to potential differences caused by items we do not consider reflective of underlying operating performance. We also present Adjusted EBITDA because we believe it is frequently used by securities analysts, investors and other interested parties as a measure of performance. In evaluating Adjusted EBITDA, investors should be aware that in the future we may incur expenses similar to the adjustments presented above. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by expenses that are unusual, non-routine or non-recurring. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for net income (loss), operating income (loss), or any other performance measure derived in accordance and reported under GAAP or as an alternative to cash flow from operating activities or as a measure of our liquidity. Non-GAAP financial measures when viewed in a reconciliation to corresponding GAAP financial measures, provides an additional way of viewing the Company's results of operations and the factors and trends affecting the Company's business. Non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding financial results presented in accordance with GAAP. (2) Management assesses results of operations for ongoing operations, which excludes Transitional Schools, separately from Transitional Schools. As schools within the Transitional Schools segment are fully taught-out, these schools will be recast as components of Discontinued Operations. As a result, management views adjusted EBITDA from ongoing operations separately from Transitional Schools and Discontinued Operations to assess results and make decisions. Accordingly, Transitional Schools operating loss is added back to pre-tax loss from continuing operations and subtracted from pre-tax loss from discontinued operations. (3) Quarterly amounts relate to ongoing operations, which excludes Transitional Schools. (4) Legal settlement amounts are net of insurance recoveries and are recorded within the following segments: (5) Asset impairments primarily relate to trade name impairment charges within Culinary Arts of $7.4 million, $10.7 million and $2.3 million which were recorded during the second quarter of 2014, third quarter of 2013 and the second quarter of 2013, respectively, and within Career Colleges of $1.7 million during the second quarter of 2013. (6) Unused space charges represent the net present value of remaining lease obligations less an estimated amount for sublease income as well as the subsequent accretion of these charges. (7) The International Schools segment was sold during the fourth quarter of 2013. As such, management excludes operations from the International Schools when assessing results and trends of Transitional Schools and Discontinued Operations. (8) Quarterly amounts relate to Transitional Schools and Discontinued Operations, excluding International. |

13 End of Presentation |