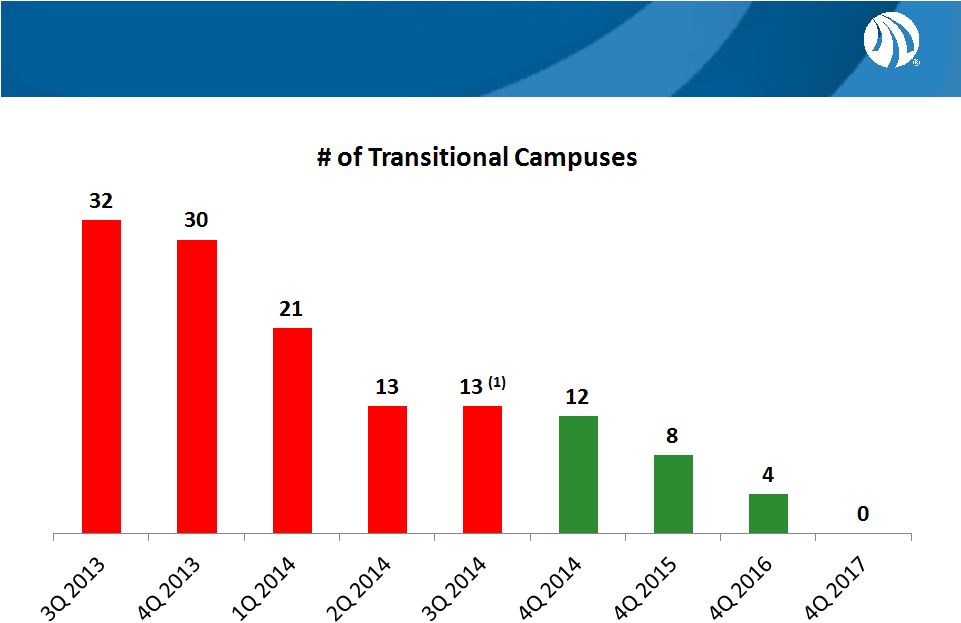

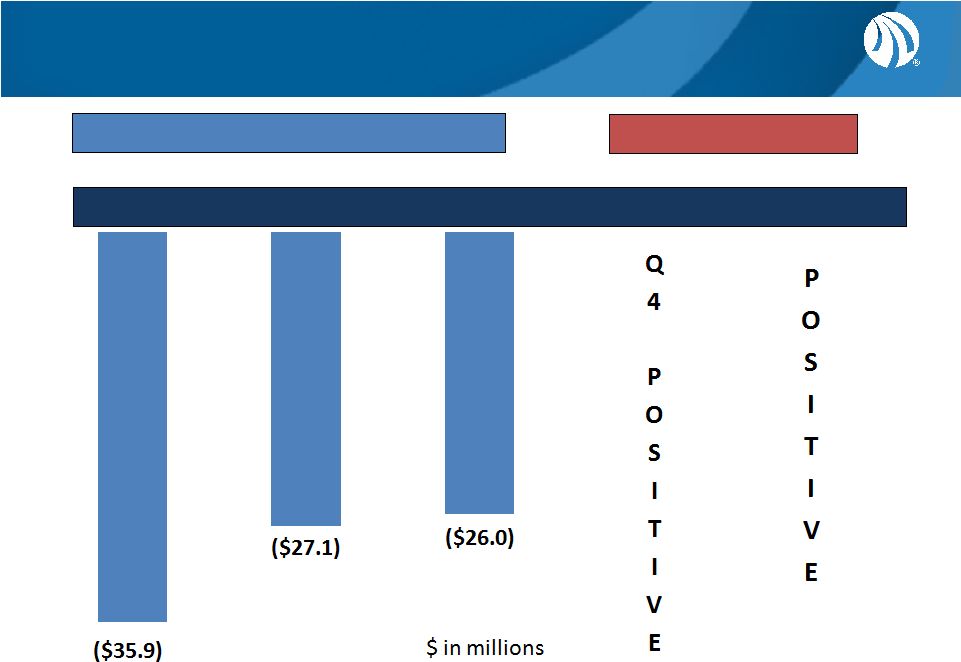

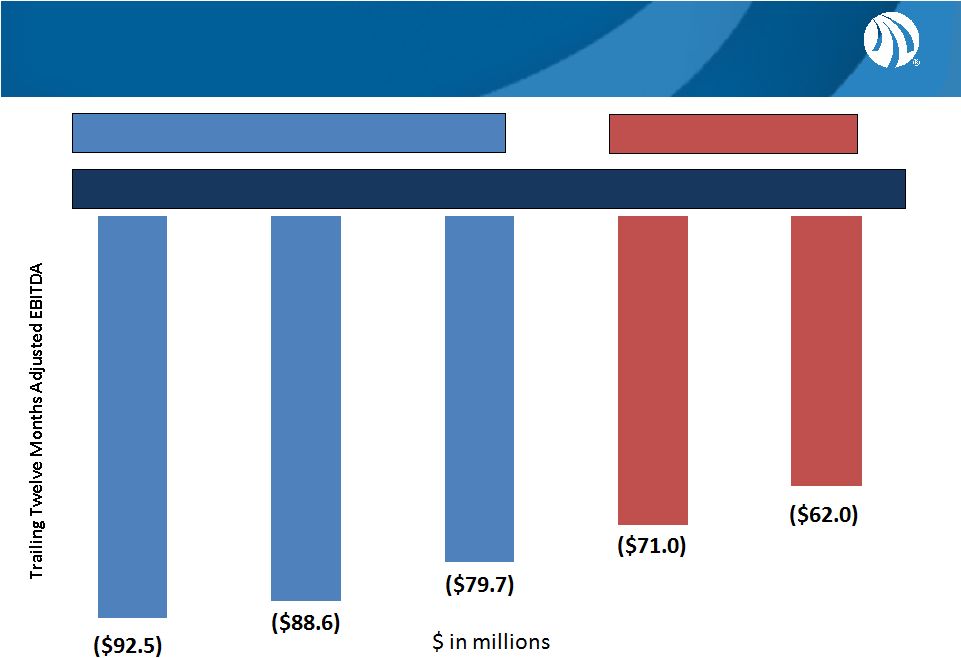

15 Reconciliation of GAAP to Non-GAAP Items – con’t (1) (2) (3) (4) Q3 2014 Q2 2014 Q1 2014 Q4 2013 Q3 2013 CTU - $ - $ (900) $ 1,300 $ - $ Career Colleges - - - 200 300 Culinary Arts - 2,000 3,000 15,500 - Corporate & Other - (400) 3,750 - - Total - $ 1,600 $ 5,850 $ 17,000 $ 300 $ (5) (6) (7) (8) The Company believes it is useful to present non-GAAP financial measures which exclude certain significant items as a means to understand the performance of its ongoing operations. As a general matter, the Company uses non-GAAP financial measures in conjunction with results presented in accordance with GAAP to help analyze the performance of its ongoing operations, assist with preparing the annual operating plan, and measure performance for some forms of compensation. In addition, the Company believes that non-GAAP financial information is used by analysts and others in the investment community to analyze the Company's historical results and to provide estimates of future performance and that failure to report non-GAAP measures could result in a misplaced perception that the Company's results have underperformed or exceeded expectations. We believe Adjusted EBITDA allows us to compare our current operating results with corresponding historical periods and with the operational performance of other companies in our industry because it does not give effect to potential differences caused by items we do not consider reflective of underlying operating performance. We also present Adjusted EBITDA because we believe it is frequently used by securities analysts, investors and other interested parties as a measure of performance. In evaluating Adjusted EBITDA, investors should be aware that in the future we may incur expenses similar to the adjustments presented above. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by expenses that are unusual, non-routine or non-recurring. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for net income (loss), operating income (loss), or any other performance measure derived in accordance and reported under GAAP or as an alternative to cash flow from operating activities or as a measure of our liquidity. Non-GAAP financial measures when viewed in a reconciliation to corresponding GAAP financial measures, provides an additional way of viewing the Company's results of operations and the factors and trends affecting the Company's business. Non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding financial results presented in accordance with GAAP. Management assesses results of operations for ongoing operations, which excludes Transitional Schools, separately from Transitional Schools. As schools within the Transitional Schools segment are fully taught-out, these schools will be recast as components of Discontinued Operations. As a result, management views adjusted EBITDA from ongoing operations separately from Transitional Schools and Discontinued Operations to assess results and make decisions. Accordingly, Transitional Schools operating loss is added back to pre-tax loss from continuing operations and subtracted from pre-tax loss from discontinued operations. Quarterly amounts relate to ongoing operations, which excludes Transitional Schools. Legal settlement amounts are net of insurance recoveries and are recorded within the following segments: Asset impairments primarily relate to impairment charges within Culinary Arts of $1.5 million, $7.4 million and $10.7 million which were recorded during the third quarter of 2014, second quarter of 2014 and third quarter of 2013, respectively, and within Career Colleges of $12.8 million and $2.9 million recorded during the third quarter of 2014 and the fourth quarter of 2013, respectively. Unused space charges represent the net present value of remaining lease obligations less an estimated amount for sublease income as well as the subsequent accretion of these charges. The International Schools segment was sold during the fourth quarter of 2013. As such, management excludes operations from the International Schools when assessing results and trends of Transitional Schools and Discontinued Operations. Quarterly amounts relate to Transitional Schools and Discontinued Operations, excluding International. |