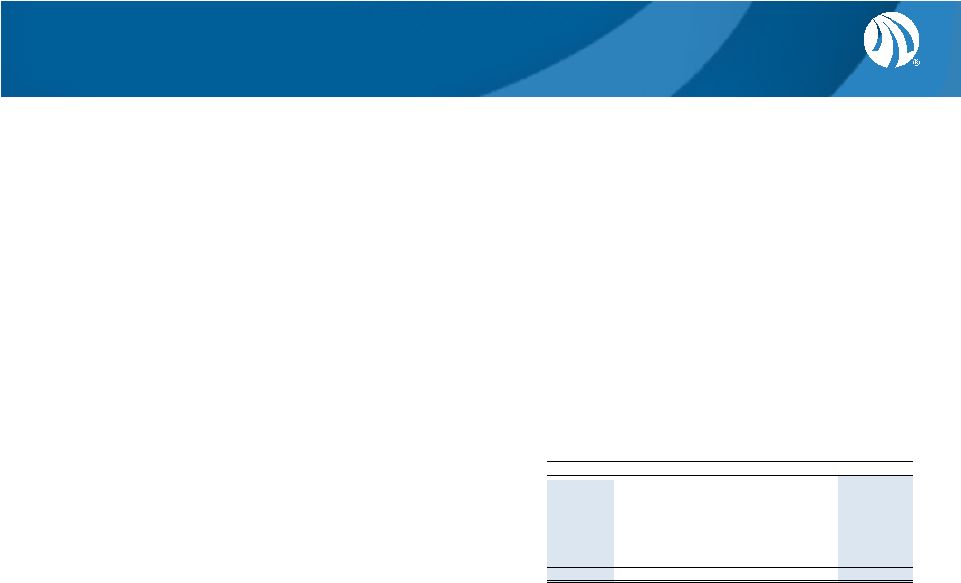

18 Reconciliation of GAAP to Non-GAAP Items – Reconciliation of GAAP to Non-GAAP Items – con’t con’t (1) (2) (3) Quarterly amounts relate to the University Group and Corporate. (4) The Company announced the Culinary Arts segment as held for sale during the fourth quarter of 2014 and it is therefore now reported within discontinued operations. Quarterly adjusted EBITDA amounts for Culinary Arts include: Q1 2015 Q4 2014 Q3 2014 Q2 2014 Q1 2014 Pre-tax income (loss) 250 $ (15,927) $ (12,602) $ (19,771) $ (18,021) $ Depreciation and amortization - 4,504 4,282 4,310 4,268 Legal settlements 775 - - 2,000 3,000 Asset impairments - 10,320 1,523 7,400 - Unused space charges (377) 65 213 (467) (178) Cumulative adjustment related to revenue recognition 54 514 - - - Total 702 $ (524) $ (6,584) $ (6,528) $ (10,931) $ (5) Legal settlement amounts are net of insurance recoveries. (6) (7) (8) The Company believes it is useful to present non-GAAP financial measures which exclude certain significant items as a means to understand the performance of its operations. As a general matter, the company uses non-GAAP financial measures in conjunction with results presented in accordance with GAAP to help analyze the performance of its operations, assist with preparing the annual operating plan, and measure performance for some forms of compensation. In addition, the company believes that non-GAAP financial information is used by analysts and others in the investment community to analyze the company's historical results and to provide estimates of future performance and that failure to report non-GAAP measures could result in a misplaced perception that the company's results have underperformed or exceeded expectations. Unused space charges represent the net present value of remaining lease obligations less an estimated amount for sublease income as well as the subsequent accretion of these charges. Revenue recognition adjustment relates to the accounting for students who withdraw from one of our institutions prior to completion of their program. This adjustment now reflects revenue earned on a cash-basis of accounting beginning in the fourth quarter of 2014 for these students. Quarterly amounts relate to Career Colleges, the Transitional Group and discontinued operations. We believe adjusted EBITDA allows us to compare our current operating results with corresponding historical periods and with the operational performance of other companies in our industry because it does not give effect to potential differences caused by items we do not consider reflective of underlying operating performance. We also present adjusted EBITDA because we believe it is frequently used by securities analysts, investors and other interested parties as a measure of performance. In evaluating adjusted EBITDA, investors should be aware that in the future we may incur expenses similar to the adjustments presented above. Our presentation of adjusted EBITDA should not be construed as an inference that our future results will be unaffected by expenses that are unusual, non-routine or non-recurring. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for net income (loss), operating income (loss), or any other performance measure derived in accordance and reported under GAAP or as an alternative to cash flow from operating activities or as a measure of our liquidity. Non-GAAP financial measures, when viewed in a reconciliation to corresponding GAAP financial measures, provide an additional way of viewing the company's results of operations and the factors and trends affecting the company's business. Non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, the corresponding financial results presented in accordance with GAAP. Management assesses results of operations for the University Group and Corporate separately from Career Colleges and the Transitional Group. As a result, management views adjusted EBITDA from the University Group and Corporate separately from the remainder of the organization, to assess results and make decisions. Accordingly, the Career Colleges and Transitional Group operating losses are added back to pre-tax loss from continuing operations and subtracted from pre-tax loss from discontinued operations. |